UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| iBASIS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | |

The Global VoIP Company IBAS 12/05 SEPTEMBER 2007

Safe Harbor Statement Various remarks that we may make about future expectations, plans, and prospects for iBasis constitute forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by these forward-looking statements as a result of various important factors, including those discussed in the Company’s Form 10-K for the year ended December 31, 2006, which is on file with the SEC. SHAREHOLDERS OF IBASIS ARE URGED TO READ IBASIS’ DEFINITIVE PROXY STATEMENT (INCLUDING THE SECTIONS CALLED “CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION” AND “REASONS FOR THE TRANSACTION”) WHICH CONTAINS IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONS AND IS AVAILABLE FOR FREE AT THE SEC’S WEB SITE AT WWW.SEC.GOV OR BY CALLING IBASIS INVESTOR RELATIONS AT 781- 505- 7500.

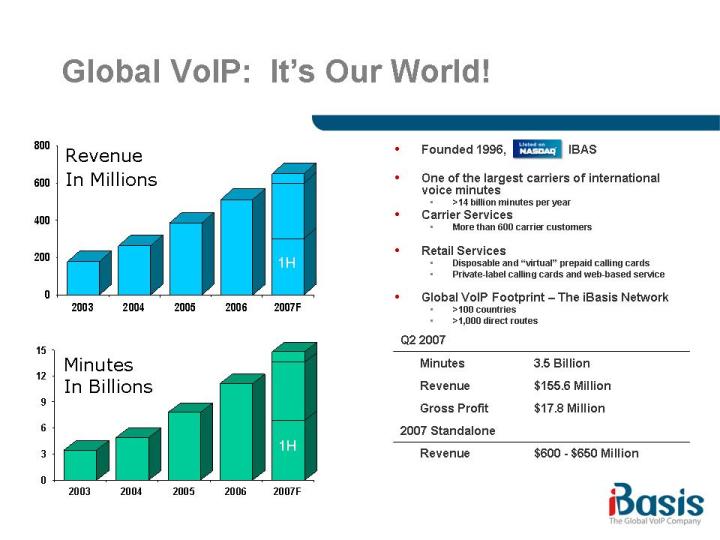

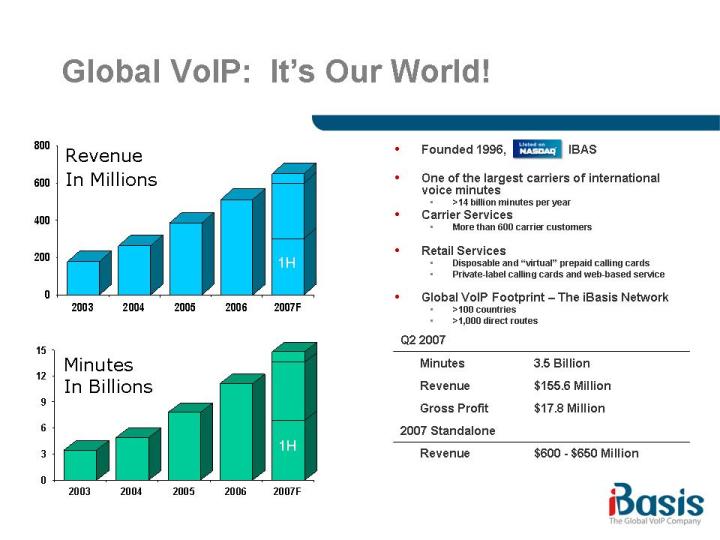

Global VoIP: It’s Our World! Founded 1996, IBAS One of the largest carriers of international voice minutes>14 billion minutes per year Carrier Services More than 600 carrier customers Retail Services Disposable and “virtual” prepaid calling cards Private-label calling cards and web-based service Global VoIP Footprint – The iBasis Network>100 countries>1,000 direct routes Minutes In Billions Revenue In Millions 1H 1H

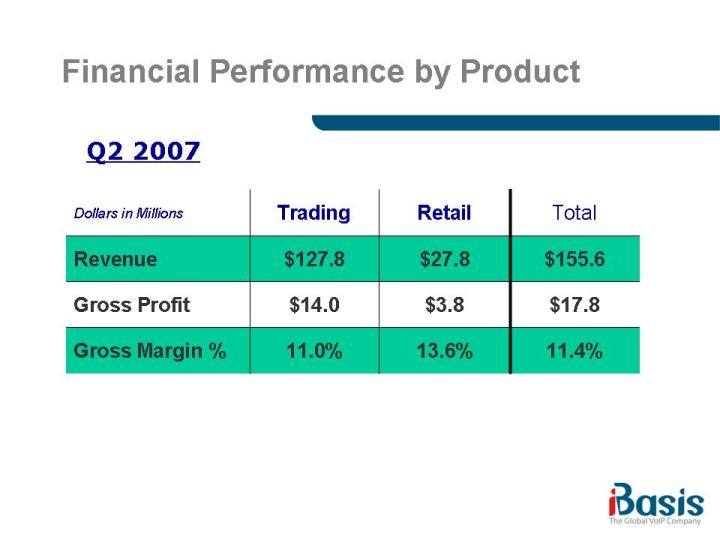

Financial Performance by Product Q2 2007

Q2 Highlights Record Traffic, Revenue, Gross Profit 10th Consecutive Quarter of Positive Cash Flow Strength across the board Wholesale Retail All Regions Concluded Options Related Restatement Regained compliance with NASDAQ Listing Results in-line with guidance

Restatement Restated financials for 2004, 2005 and Q1, Q2 2006 Recorded an additional $10.1 million non-cash stock-based compensation … … of which $9.1 million relates to 3 grants from 2000, 2001, 2002 The amount of the restatement was at the low end of the range previously provided

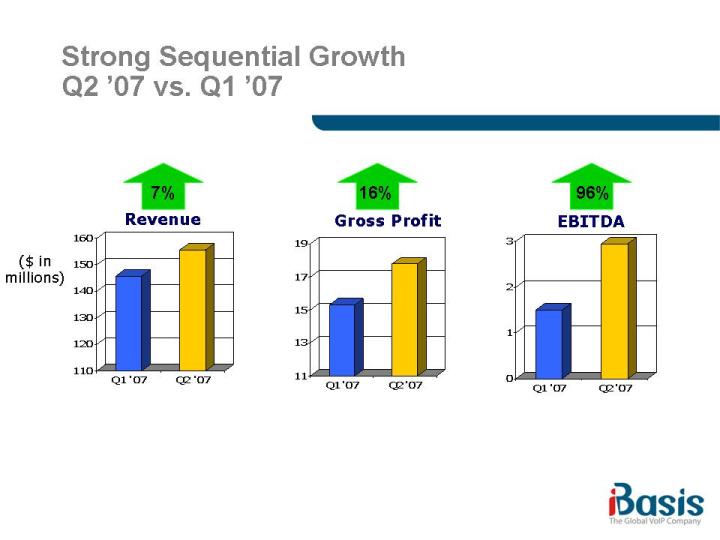

Strong Sequential Growth Q2 ’07 vs. Q1 ’07 Revenue Gross Profit ($ in millions) 7% 16% EBITDA 96%

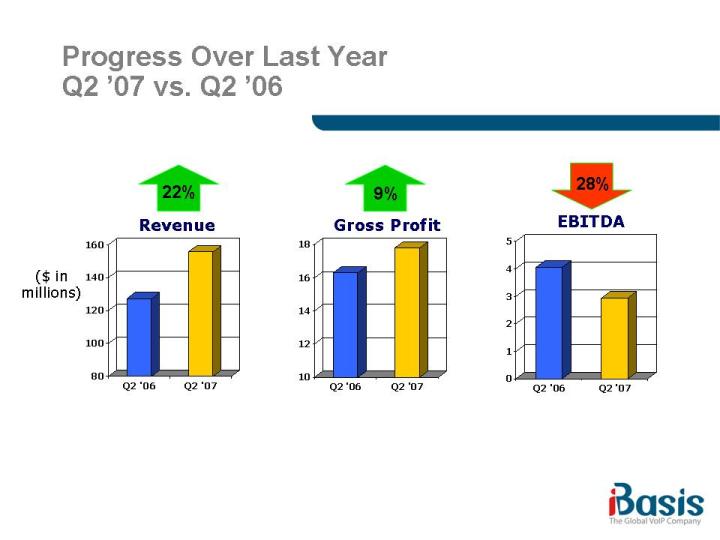

Progress Over Last Year Q2 ’07 vs. Q2 ’06 Revenue Gross Profit ($ in millions) 22% 9% EBITDA 28%

Why Customers Partner with iBasis: Leader in International Voice Top ten international voice carrier Proven VoIP leader Broad footprint Financially Strong Positive cash flow Debt-free High quality products Wholesale voice trading Premium voice trading Retail prepaid Source of large, growing volume of international traffic, including retail traffic, for termination

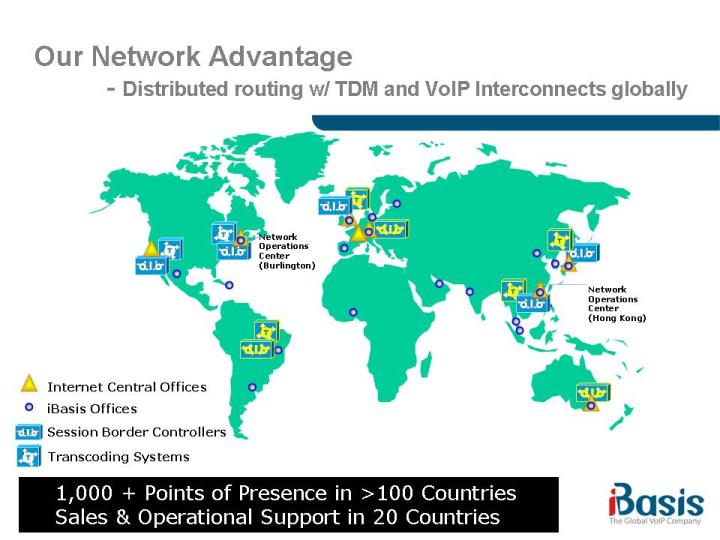

Our Network Advantage Distributed routing w/ TDM and VoIP Interconnects globally Internet Central Offices iBasis Offices Session Border Controllers Transcoding SystemsNetwork Operations Center (Hong Kong) Network Operations Center (Burlington) 1,000 + Points of Presence in>100 Countries Sales & Operational Support in 20 Countries

Industry Developments International wholesale voice business becoming more dependent on scale and efficiency, threatening long-term viability of smaller players and high-overhead incumbents Greater scale is essential to negotiate lower termination prices Sector consolidation already under way Ongoing business combination of companies who want to play a key role in the market Retrenchment from international wholesale of some telecom incumbents Migration to IP technology critical to competitive success Growth in mobile and consumer VoIP expanding wholesale market

The New iBasis In June 2006 iBasis and KPN announced agreement to merge KPN Global Carrier Services into iBasis KPN to own 51% of iBasis stock iBasis pre-close stockholders to receive $113 million cash dividend Proxy filed August 24, 2007 Transaction expected to close by October 1, 2007

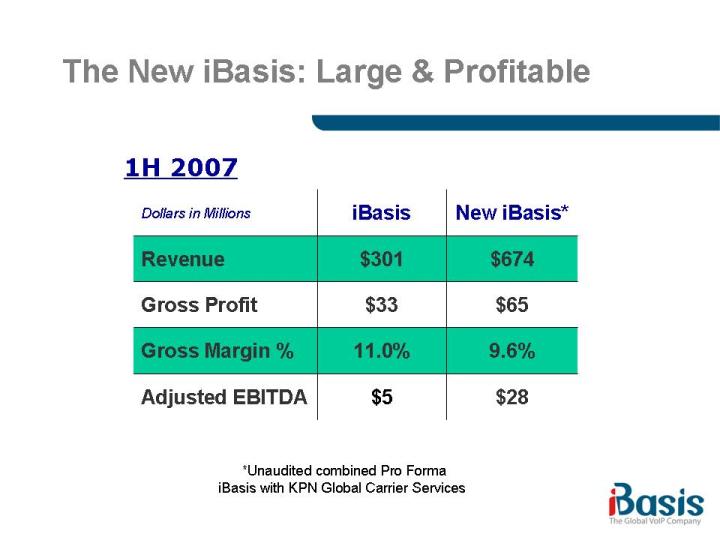

The New iBasis: Large & Profitable 1H 2007 *Unaudited combined Pro Forma iBasis with KPN Global Carrier Services

The New iBasis: Financially Strong June 30, 2007 *Unaudited combined Pro Forma iBasis with KPN Global Carrier Services

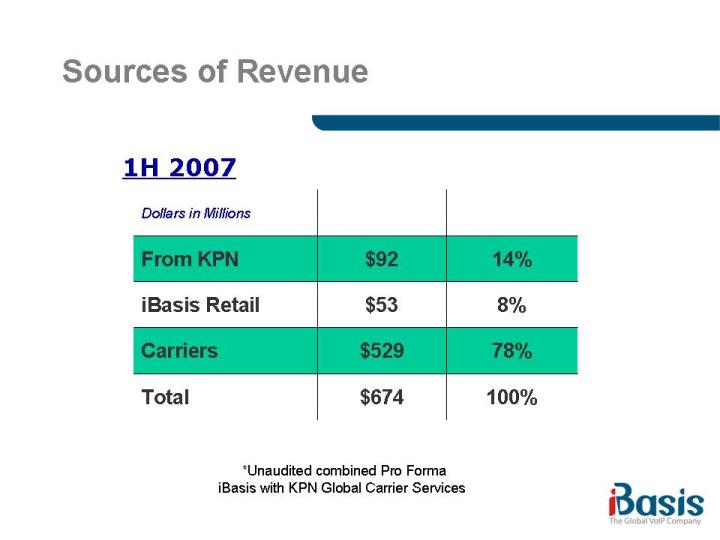

Sources of Revenue 1H 2007 *Unaudited combined Pro Forma iBasis with KPN Global Carrier Services

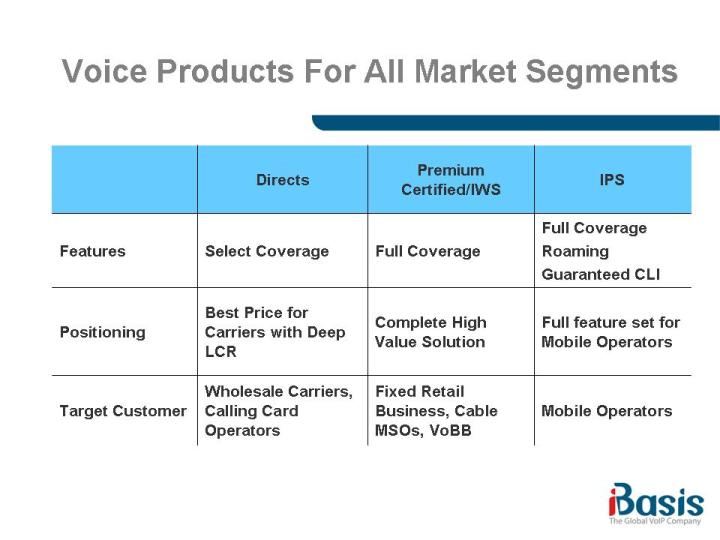

Voice Products For All Market Segments

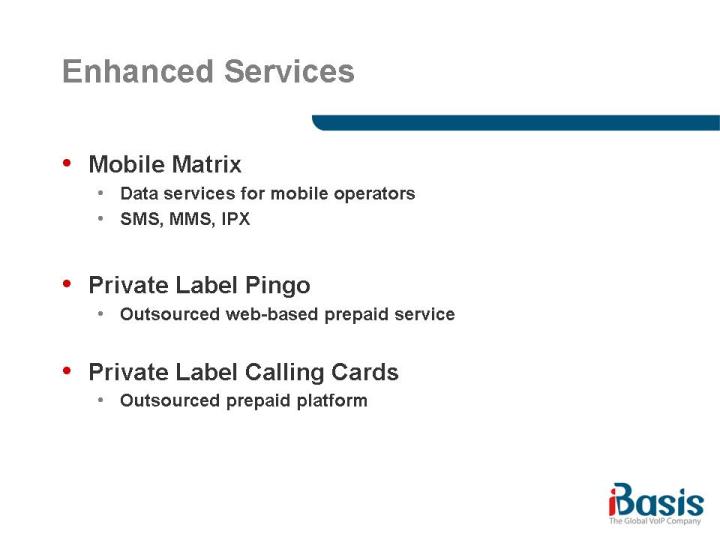

Enhanced Services Mobile Matrix Data services for mobile operators SMS, MMS, IPX Private Label Pingo Outsourced web-based prepaid service Private Label Calling Cards Outsourced prepaid platform

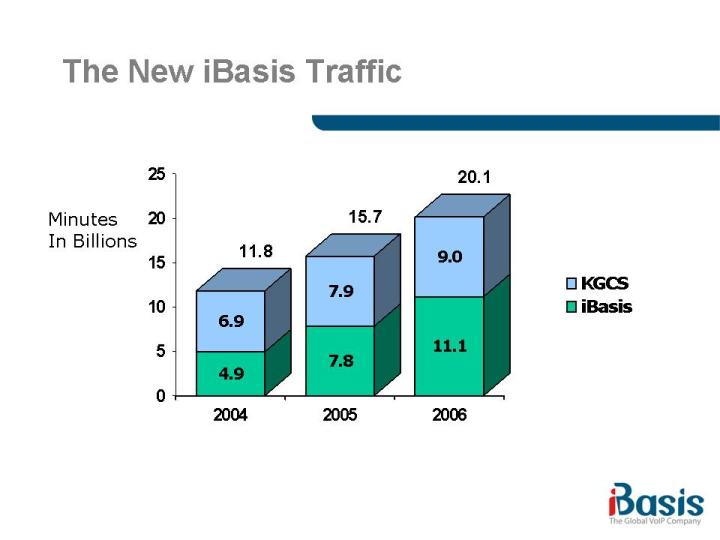

The New iBasis Traffic Minutes In Billions 20.1 11.8 15.7

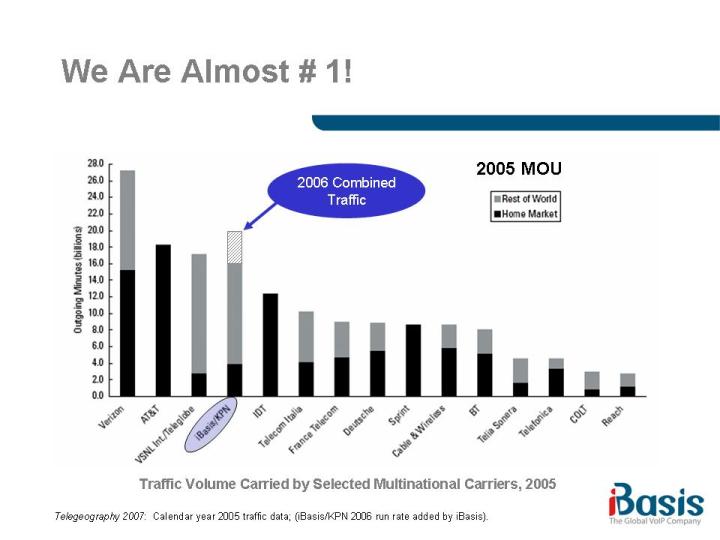

We Are Almost # 1! Telegeography 2007: Calendar year 2005 traffic data; (iBasis/KPN 2006 run rate added by iBasis). Traffic Volume Carried by Selected Multinational Carriers, 2005 (Gp:) 2006 Combined Traffic 2005 MOU

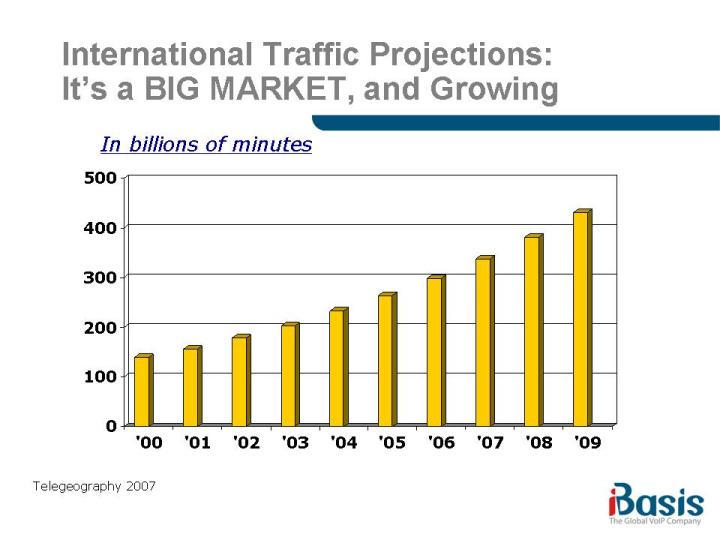

International Traffic Projections: It’s a BIG MARKET, and Growing In billions of minutes Telegeography 2007

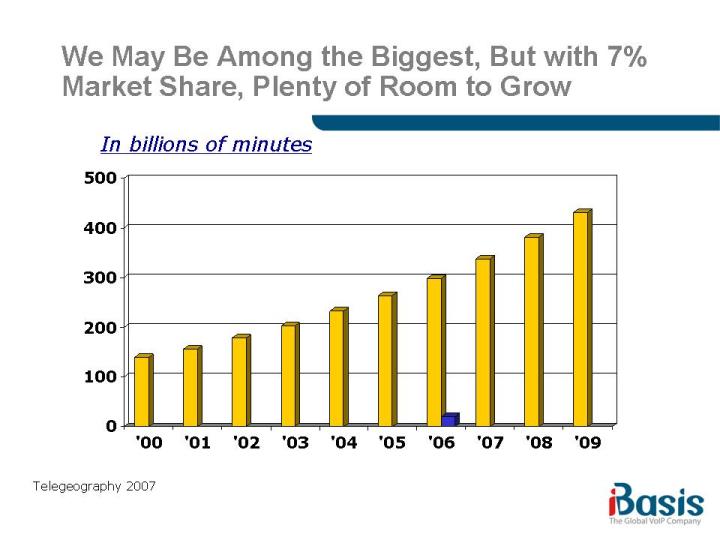

We May Be Among the Biggest, But with 7% Market Share, Plenty of Room to Grow In billions of minutes Telegeography 2007

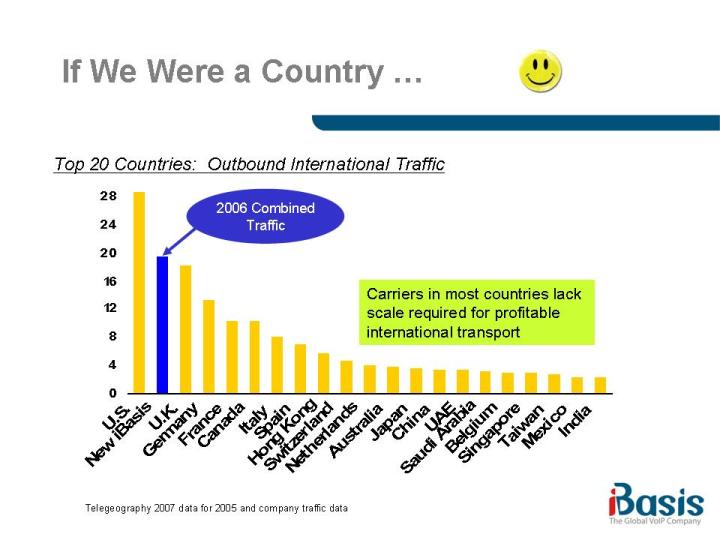

If We Were a Country … 2006 Combined Traffic Top 20 Countries: Outbound International Traffic Telegeography 2007 data for 2005 and company traffic data Carriers in most countries lack scale required for profitable international transport

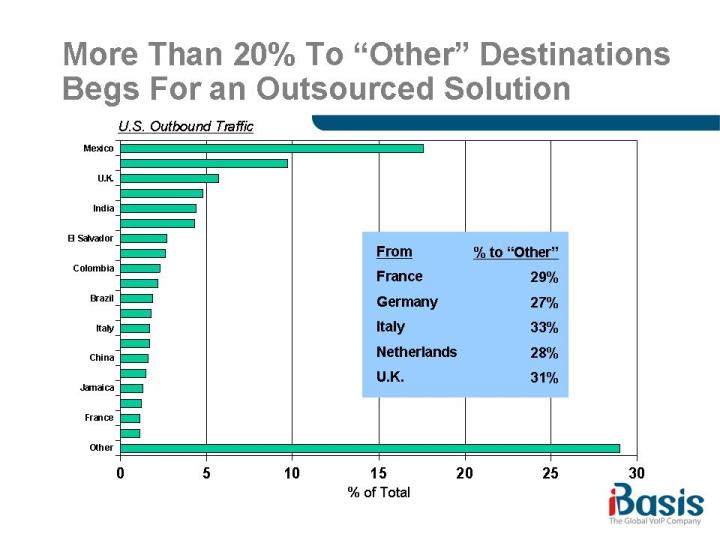

More Than 20% To “Other” Destinations Begs For an Outsourced Solution From France Germany Italy Netherlands U.K. % to “Other” 29% 27% 33% 28% 31% U.S. Outbound Traffic % of Total

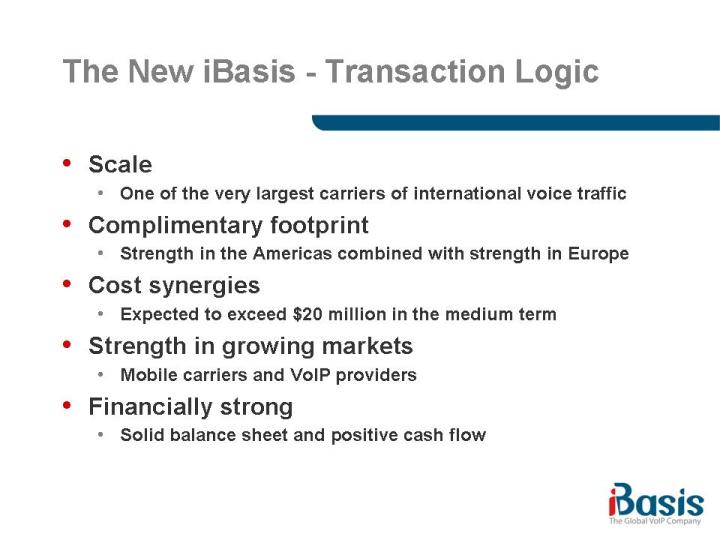

The New iBasis - Transaction Logic Scale One of the very largest carriers of international voice traffic Complimentary footprint Strength in the Americas combined with strength in Europe Cost synergies Expected to exceed $20 million in the medium term Strength in growing markets Mobile carriers and VoIP providers Financially strong Solid balance sheet and positive cash flow

The Next 10 Years International Voice Market Is Growing More Traffic Moving to Wholesale Prices Stabilizing Competitors Are Weakening The World Is Shifting to All-IP Playing To Our Strength

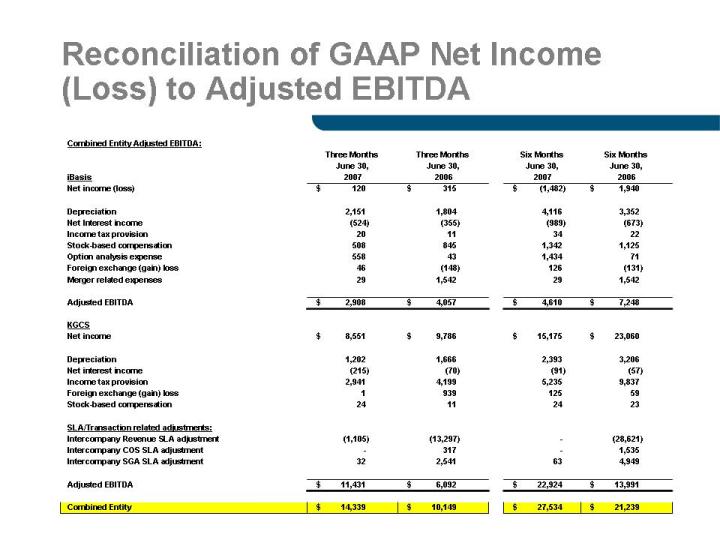

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA