Exhibit 99.1

ITEM 1. BUSINESS

This combined report is being filed by Spectrum Brands Holdings, Inc. (“SBH”) and SB/RH Holdings, LLC (“SB/RH”) (collectively, the “Company”). SB/RH is a wholly-owned subsidiary of SBH and represents a majority of its assets, liabilities, revenues, expenses and operations. Thus, all information contained in this report relates to, and is filed by, SBH. Information that is specifically identified in this report as relating solely to SBH, such as its financial statements and its common stock, does not relate to and is not filed by SB/RH. SB/RH makes no representation as to that information. The terms “the Company,” “we,” and “our” as used in this report, refer to both SBH and its consolidated subsidiaries and SB/RH and its consolidated subsidiaries, unless otherwise indicated. The terms “SBH” and “SB/RH” refer to Spectrum Brands Holdings, Inc. and SB/RH Holdings, LLC, respectively.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available free of charge through our website at www.spectrumbrands.com as soon as reasonably practicable after such reports are filed with, or furnished to the SEC. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains our reports, proxy statements and other information at www.sec.gov. In addition, copies of our (i) Corporate Governance Guidelines, (ii) charters for the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, (iii) Code of Business Conduct and Ethics and (iv) Code of Ethics for the Principal Executive Officer and Senior Financial Officers are available on our website at www.spectrumbrands.com under “Investor Relations—Corporate Governance.” Copies will also be provided to any stockholder upon written request to the Vice President, Investor Relations & Corporate Communications, Spectrum Brands, Inc. at 3001 Deming Way, Middleton, Wisconsin 53562 or via electronic mail at investorrelations@spectrumbrands.com, or by contacting the Vice President, Investor Relations & Corporate Communications by telephone at (608) 275-3340.

General

Overview

On July 13, 2018, the Company completed the planned Spectrum Merger, as further discussed in Note 4 – Acquisitions to the Consolidated Financial Statements, included elsewhere in this report. Prior to the Spectrum Merger, SBH was a holding company, doing business as HRG Group, Inc. (“HRG”) and conducting its operations principally through its majority owned subsidiaries. Effective the date of the Spectrum Merger, management of the organization was assumed by management of its majority owned subsidiary, Spectrum Brands Holdings, Inc. (subsequently renamed Spectrum Brands Legacy, Inc.) (“Spectrum”); resulting in HRG changing its name to SBH and changing the ticker of common stock traded on the New York Stock Exchange (“NYSE”) from the symbol “HRG” to “SPB”.

Prior to the Spectrum Merger, the reportable segments consisted of (i) Consumer Products, which represented HRG’s 62.0% controlling interest in Spectrum, and (ii) Corporate and Other, which represented the holding company at HRG and other subsidiaries of HRG. Effective the date of the Spectrum Merger, the manner in which management views its business activities changed to reflect the reporting segments of Spectrum. Refer to Note 19 – Segment Information, included in the Notes to the Consolidated financial statements, included elsewhere in this Annual Report, for further discussion of our reporting segments.

SB/RH is a wholly owned subsidiary of Spectrum and ultimately, SBH. Spectrum Brands, Inc., a wholly-owned subsidiary of SB/RH (“SBI”) incurred certain debt guaranteed by SB.RH and domestic subsidiaries of SBI. The reportable segments of SB/RH are consistent with the segments of SBH.

Spectrum

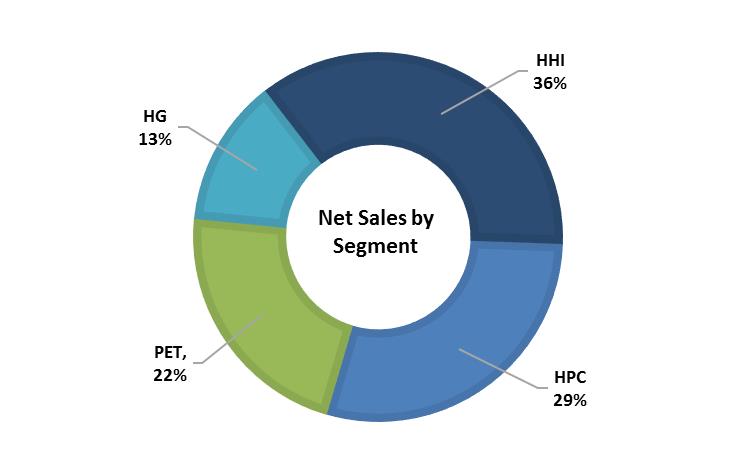

We are a diversified global branded consumer products company. We manage the business in four vertically integrated, product focused segments: (i) Hardware & Home Improvement (“HHI”), (ii) Home and Personal Care (“HPC”), (iii) Global Pet Supplies (“PET”), and (iv) Home and Garden (“H&G”). The Company manufactures, markets and/or distributes its products globally in the North America (“NA”); Europe, Middle East & Africa (“EMEA”); Latin America (“LATAM”) and Asia-Pacific (“APAC”) regions through a variety of trade channels, including retailers, wholesalers and distributors, original equipment manufacturers (“OEMs”) and construction companies. We enjoy strong name recognition in our regions under our various brands and patented technologies across multiple product categories. Geographic strategic initiatives and financial objectives are determined at the corporate level. Each segment is responsible for implementing defined strategic initiatives and achieving certain financial objectives and has a president or general manager responsible for sales and marketing initiatives and the financial results for all product lines within that segment. The following is an overview of the consolidated business showing the net sales by segment and geographic region sold (based upon destination) as a percentage of consolidated net sales for the year ended September 30, 2018.

Our operating performance is influenced by a number of factors including: general economic conditions; foreign exchange fluctuations; trends in consumer markets; consumer confidence and preferences; our overall product line mix, including pricing and gross margin, which vary by product line and geographic market; pricing of certain raw materials and commodities; energy and fuel prices; and our general competitive position, especially as impacted by our competitors’ advertising and promotional activities and pricing strategies. See Management’s Discussion and Analysis of Financial Condition and Results of Operations, included in Item 7 to this Annual Report, for further discussion of the consolidated operating results and segment operating results.

1

Exhibit 99.1

Hardware and Home Improvement (HHI)

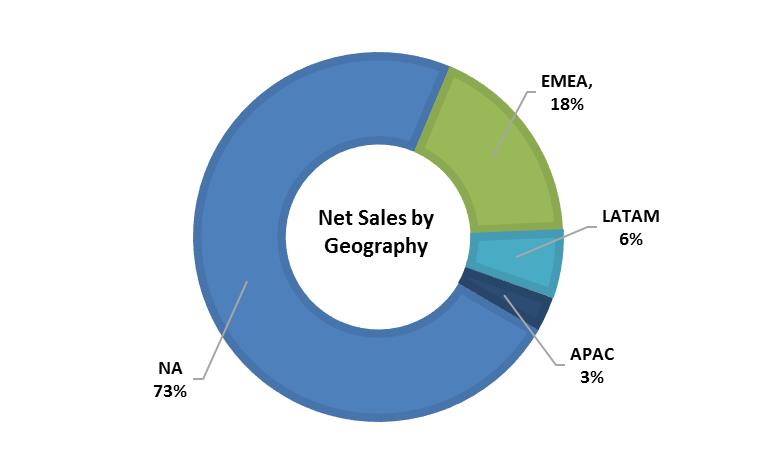

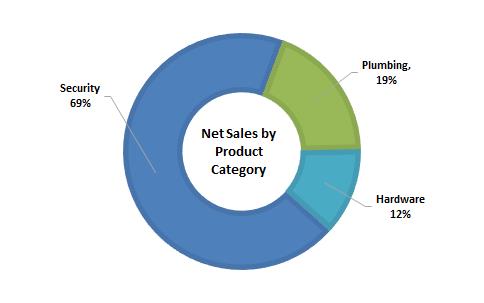

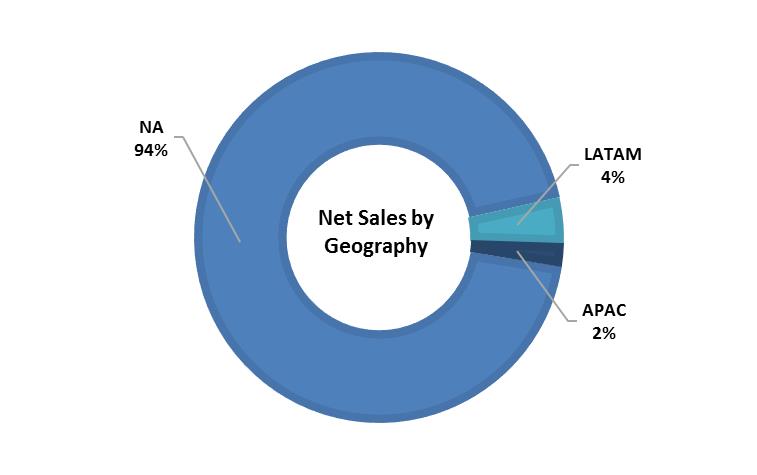

The following is an overview of net sales by product category and geographic region sold (based upon destination) for the year ended September 30, 2018

|

|

|

|

|

Product Category |

| Products |

| Brands |

Residential Locksets |

| Residential locksets and door hardware including knobs, levers, deadbolts, handlesets, and electronic and connected keyless entry locks for residential and commercial applications. |

| Kwikset®, Weiser®, Baldwin®, EZSET®, and Tell Manufacturing® |

Plumbing & Accessories |

| Kitchen, bath and shower faucets and plumbing products. |

| Pfister® |

Builders' Hardware |

| Hinges, metal shapes, security hardware, wire goods, track and sliding door hardware, screen and storm door products, garage door hardware, gate hardware, window hardware and floor protection. |

| National Hardware®, FANAL®, Stanley® and Black and Decker® |

Our residential lockset products incorporate patented SmartKey® technology that provides advanced security and easy rekeying. We also supply product to some customers who have private label offerings. We license the Stanley® and Black & Decker® marks and logos for such products as residential locksets, builder’s hardware, padlocks, and door hardware through a transitional trademark license agreement with Stanley Black & Decker Corporation (“SBD”). Under the agreement we have a royalty-free, fully paid license to use certain trademarks, brand names and logos in marketing our products and services for five years after the completion of the HHI business acquisition in the 2013 fiscal year. The Company amended the license agreement with SBD to extend the license agreement and allow for the continued use of the respective trademarks, brand names and logos through December 2018. During this extension period, Spectrum will pay to SBD royalties based on a percentage of sales.

The sales force of the HHI business is aligned by brands, customers and geographic regions. We have strong partnerships with a variety of customers including large home improvement centers, wholesale distributors, home builders, plumbers, home automation providers, security/alarm monitoring providers, and commercial contractors. Our sales generally are made through the use of individual purchase orders. A significant percentage of our sales are attributable to a limited group of retailer customers, including Home Depot and Lowe’s, which are customers with more than 10% of Spectrum sales and represent approximately 37% of HHI sales for the fiscal year ended September 30, 2018.

Primary competitors in security and residential locksets include Allegion (Schlage), Assa Abloy (Emtek, Yale) and private label import brands such as Defiant. Primary competitors for plumbing include Masco (Delta), Fortune Brands (Moen), Kohler, American Standard and private label brands such as Glacier Bay. Primary competitors for hardware include The Hillman Group, Hampton Products, Koch (Lehigh) and private labels such as Crown Bolt.

Sales in our HHI segment primarily increase during the spring and summer construction period (the Company’s third and fourth fiscal quarters). Our sales by quarter as a percentage of annual net sales during the years ended September 30, 2018, 2017 and 2016 are as follows:

|

|

|

|

|

|

|

|

|

|

|

| 2018 |

| 2017 |

| 2016 | |||

First Quarter |

|

| 24% |

|

| 23% |

|

| 23% |

Second Quarter |

|

| 23% |

|

| 25% |

|

| 24% |

Third Quarter |

|

| 27% |

|

| 25% |

|

| 27% |

Fourth Quarter |

|

| 26% |

|

| 27% |

|

| 26% |

The principal raw materials used in manufacturing include brass, zinc, and steel that are sourced either on a global or regional basis. The prices of these raw materials are susceptible to fluctuations due to supply and demand trends, energy costs, transportation costs, government regulations and tariffs, changes in currency exchange rates, price controls, general economic conditions and other unforeseen circumstances. We have regularly engaged in forward purchase and hedging derivative transactions in an attempt to effectively manage certain raw material costs we expect to incur over the next 12 to 24 months. Substantially all of our Pfister products are manufactured by third party suppliers that are primarily located in the APAC region. We maintain ownership of most of the tooling and molds used by our suppliers. We continually evaluate our manufacturing facilities’ capacity and related utilization. In general, we believe our existing facilities are adequate for our present and foreseeable needs.

Our research and development strategy is focused on new product development and performance enhancements of our existing products. We plan to continue to use our brand names, customer relationships and research and development efforts to introduce innovative products that offer enhanced value to consumers through new designs and improved functionality.

2

Exhibit 99.1

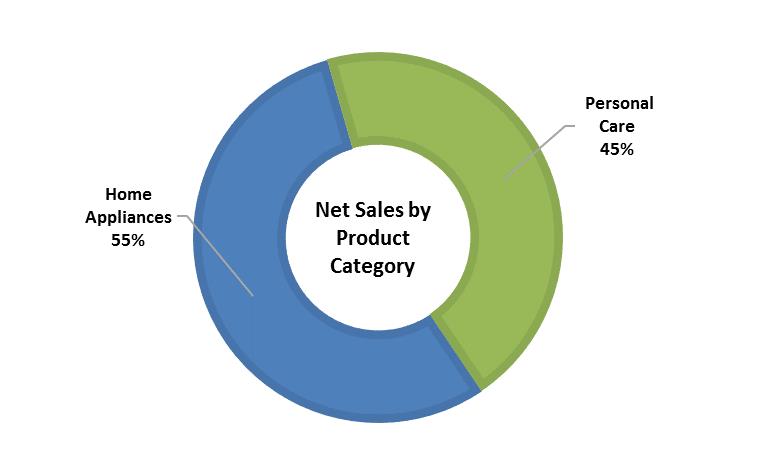

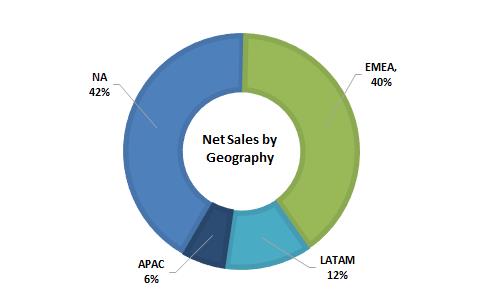

Home and Personal Care (“HPC”)

The following is an overview of net sales by product category and geographic region sold (based upon destination) for the year ended September 30, 2018

Product Category |

| Products |

| Brands |

Home Appliances |

| Small kitchen appliances including toaster ovens, coffeemakers, slow cookers, blenders, hand mixers, grills, food processors, juicers, toasters, breadmakers, and irons. |

| Black & Decker®, Russell Hobbs®, George Foreman®, Toastmaster®, Juiceman®, Farberware®, and Breadman® |

Personal Care |

| Hair dryers, flat irons and straighteners, rotary and foil electric shavers, personal groomers, mustache and beard trimmers, body groomers, nose and ear trimmers, women's shavers, haircut kits and intense pulsed light hair removal systems. |

| Remington®, LumaBella® |

We license the Black & Decker® brand in North America, Latin America (excluding Brazil) and the Caribbean for four core categories of household appliances: beverage products, food preparation products, garment care products and cooking products through a trademark license agreement with BDC through December 2021. Under the agreement, we agree to pay BDC royalties based on a percentage of sales, with minimum annual royalty payments of $15.0 million. The agreement also requires us to comply with maximum annual return rates for products. If BDC does not agree to renew the license agreement, we have 18 months to transition out of the brand name with no minimum royalty payments during such transition period and BDC has agreed to not compete in the four categories for five years after the end of the transition period. Upon request, BDC may elect to extend the license to use the Black & Decker® brand to certain additional product categories. BDC has approved several extensions of the license to additional categories and geographies.

We own the right to use the Remington® trademark for electric shavers, shaver accessories, grooming products and personal care products; and Remington Arms Company, Inc. (“Remington Arms”) owns the rights to use the trademark for firearms, sporting goods and products for industrial use, including industrial hand tools. The terms of a 1986 agreement between Remington Products, LLC and Remington Arms provides for the shared rights to use the trademark on products which are not considered “principal products of interest” for either company. We retain the trademark for nearly all products which we believe can benefit from the use of the brand name in our distribution channels. Through our acquisition of Shaser, Inc., we have patented technology that is used in our i-Light and i-Light Reveal intense pulsed light hair removal product line.

HPC products are sold primarily to large retailers, online retailers, wholesalers, distributors, warehouse clubs, food and drug chains and specialty trade or retail outlets such as consumer electronics stores, department stores, discounters and other specialty stores. International distribution varies by region and is often executed on a country-by-country basis. Our sales generally are made through the use of individual purchase orders. A significant percentage of our sales are attributable to a limited group of retailer customers, including Wal-Mart, which is a customer having more than 10% of Spectrum sales and represent approximately 21% of HPC net sales for the fiscal year ended September 30, 2018.

Primary competitors for small appliances include Newell Brands (Sunbeam, Mr. Coffee, Crockpot, Oster), De’Longhi America (DeLonghi, Kenwood, Braun), SharkNinja (Shark, Ninja), Hamilton Beach Holding Co. (Hamilton Beach, Proctor Silex), Sensio, Inc. (Bella); SEB S.A.(T-fal, Krups, Rowenta), Whirlpool Corporation (Kitchen Aid), Conair Corporation (Cuisinart, Waring), Koninklijke Philips N.V. (Philips), Glen Dimplex (Morphy Richards) and private label brands for major retailers. Primary competitors in personal care include are Koninklijke Philips Electronics N.V. (Norelco), The Procter & Gamble Company (Braun), Conair Corporation, Wahl Clipper Corporation and Helen of Troy Limited.

Sales from electric personal care product categories tend to increase during the December holiday season (the Company’s first fiscal quarter), while small appliances sales increase from July through December primarily due to the increased demand by customers in the late summer for “back-to-school” sales (the Company’s fourth fiscal quarter) and in December for the holiday season. Our sales by quarter as a percentage of annual net sales during the years ended September 30, 2018, 2017 and 2016 are as follows:

|

|

|

|

|

|

|

|

|

|

|

| 2018 |

| 2017 |

| 2016 | |||

First Quarter |

|

| 31% |

|

| 31% |

|

| 31% |

Second Quarter |

|

| 21% |

|

| 20% |

|

| 21% |

Third Quarter |

|

| 23% |

|

| 23% |

|

| 23% |

Fourth Quarter |

|

| 25% |

|

| 26% |

|

| 25% |

Substantially all of our home appliances and personal care products are manufactured by third party suppliers that are primarily located in the APAC region. We maintain ownership of most of the tooling and molds used by our suppliers.

Our research and development strategy is focused on new product development and performance enhancements of our existing products. We plan to continue to use our brand names, customer relationships and research and development efforts to introduce innovative products that offer enhanced value to consumers through new designs and improved functionality.

3

Exhibit 99.1

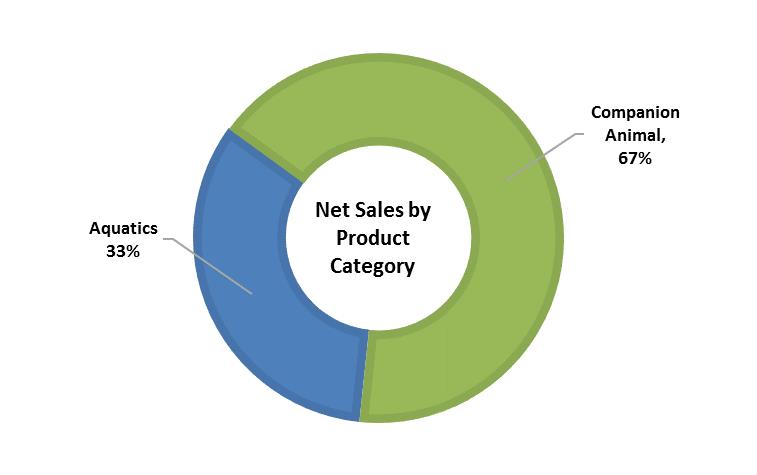

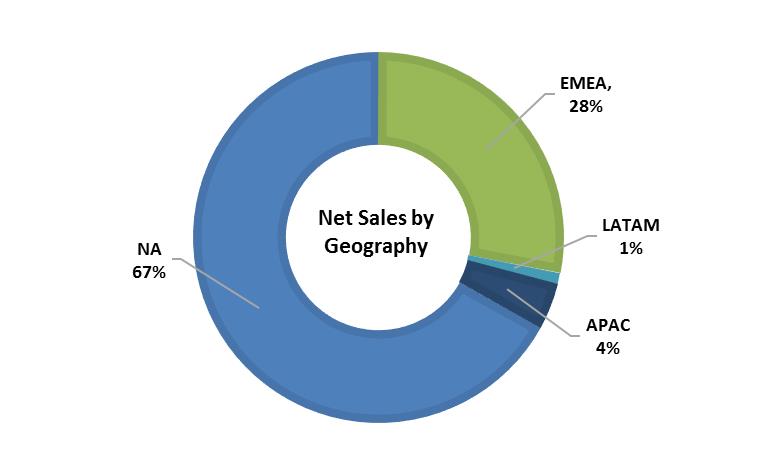

Pet Supplies (PET)

The following is an overview of PET net sales by product category and geographic region sold (based upon destination) for the year ended September 30, 2018:

|

|

|

|

|

Product Category |

| Products |

| Brands |

Companion Animal |

| Rawhide chews, dog and cat clean-up, training, health and grooming products, small animal food and care products, rawhide-free dog treats, and wet and dry pet food for dogs and cats. |

| 8IN1® (8-in-1), Dingo®, Nature's Miracle®, Wild Harvest™, Littermaid®, Jungle®, Excel®, FURminator®, IAMS® (Europe only), Eukanuba® (Europe only), Healthy-Hide®, DreamBone®, SmartBones®, GloFish®, ProSense®, Perfect Coat®, eCOTRITION®, Birdola® and Digest-eeze®. |

Aquatics |

| Consumer and commerical aquarium kits, stand-alone tanks; acqustics equipment such as filtration systems, heaters and pumps; and acqutics consumables such as fish food, water managerment and care |

| Tetra®, Marineland®, Whisper® and Instant Ocean®. |

We sell primarily to pet superstores, mass merchandisers, e-tailers, grocery stores and drug chains, warehouse clubs and other specialty retailers. International distribution varies by region and is often executed on a country-by-country basis. Our sales generally are made through the use of individual purchase orders. In addition to product sales, we also perform installation and maintenance services on commercial aquariums. A significant percentage of our sales are attributable to a limited group of retailer customers, including Wal-Mart, which is a customer with more than 10% of Spectrum sales and represent approximately 23% of PET net sales for the fiscal year ended September 30, 2018.

Primary competitors are Mars Corporation, the Hartz Mountain Corporation and Central Garden & Pet Company which all sell a comprehensive line of pet supplies that compete across our product categories. The pet supplies product category is highly fragmented with no competitor holding a substantial market share and consists of small companies with limited product lines.

Sales remain fairly consistent throughout the year with little variation. Our sales by quarter as a percentage of annual net sales during the years ended September 30, 2018, 2017 and 2016 are as follows:

|

|

|

|

|

|

|

|

|

|

|

| 2018 |

| 2017 |

| 2016 | |||

First Quarter |

|

| 25% |

|

| 25% |

|

| 25% |

Second Quarter |

|

| 25% |

|

| 24% |

|

| 25% |

Third Quarter |

|

| 24% |

|

| 24% |

|

| 25% |

Fourth Quarter |

|

| 26% |

|

| 27% |

|

| 25% |

Substantially all of our rawhide alternative products are manufactured by third party suppliers that are primarily located in the Asia-Pacific region and Mexico. We maintain ownership of most of the tooling and molds used by our suppliers. We continually evaluate our manufacturing facilities’ capacity and related utilization. In general, we believe our existing facilities are adequate for our present and foreseeable needs.

Our research and development strategy is focused on new product development and performance enhancements of our existing products. We plan to continue to use our brand names, customer relationships and research and development efforts to introduce innovative products that offer enhanced value to consumers through new designs and improved functionality.

4

Exhibit 99.1

Home and Garden (H&G)

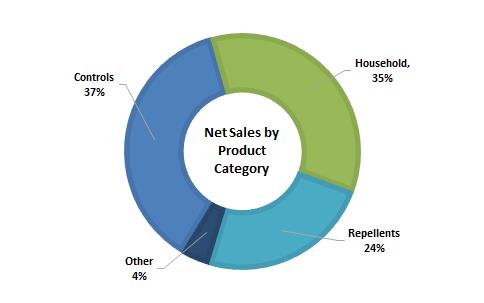

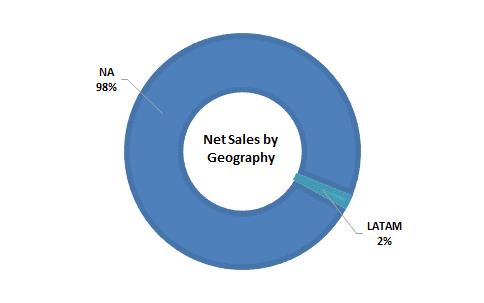

The following is an overview of H&G net sales by product category and geographic region sold (based upon destination) for the year ended September 30, 2018:

|

|

|

|

|

Product Category |

| Products |

| Brands |

Household |

| Household pest control solutions such as spider and scorpion killers; ant and roach killers; flying insect killers; insect foggers; wasp and hornet killers; and bedbug, flea and tick control products. |

| Hot Shot®, Black Flag®, Real-Kill®, Ultra Kill®, The Ant Trap® (TAT), and Rid-A-Bug®. |

Controls |

| Outdoor insect and weed control solutions, and animal repellents such as aerosols, granules, and ready-to-use sprays or hose-end ready-to-sprays. |

| Spectracide®, Garden Safe®, Liquid Fence®, and EcoLogic®. |

Repellents |

| Personal use pesticides and insect repellent products, including aerosols, lotions, pump sprays and wipes, yard sprays and citronella candles. |

| Cutter® and Repel®. |

Other product category consists of products sold to the Global Auto Care business unit that was classified as discontinued operations and subsequently sold to Energizer Holdings, Inc. (“Energizer”) on January 28, 2019. Product sales and distribution will continue under a supply agreement with Energizer subsequent to the completion of the sale. See Note 3 – Divestitures, in Notes to the Consolidated Financial Statements, included elsewhere for additional discussion.

We sell primarily to home improvement centers, mass merchandisers, dollar stores, hardware stores, home and garden distributors, and food and drug retailers, primarily in the U.S. We also sell certain products in our LATAM markets, primarily in the Caribbean. Our sales generally are made through the use of individual purchase orders. A significant percentage of our sales are attributable to a limited group of retailer customers, including Wal-Mart, Home Depot and Lowe’s, which are customers with more than 10% of Spectrum sales and represent approximately 66% of H&G net sales for the fiscal year ended September 30, 2018.

Primary competitors are The Scotts Miracle-Gro Company (Scotts, Ortho, Roundup, Miracle-Gro, Tomcat); Central Garden & Pet (AMDRO, Sevin), Bayer A.G. (Bayer Advanced), S.C. Johnson & Son, Inc. (Raid, OFF!); and Henkel AG & Co. KGaA (Combat).

Sales typically peak during the first six months of the calendar year (the Company’s second and third fiscal quarters) due to customer seasonal purchasing patterns and timing of promotional activities. Our sales by quarter as a percentage of annual net sales during the years ended September 30, 2018, 2017 and 2016 are as follows

|

|

|

|

|

|

|

|

|

|

|

| 2018 |

| 2017 |

| 2016 | |||

First Quarter |

|

| 10% |

|

| 10% |

|

| 9% |

Second Quarter |

|

| 25% |

|

| 27% |

|

| 30% |

Third Quarter |

|

| 42% |

|

| 39% |

|

| 42% |

Fourth Quarter |

|

| 23% |

|

| 24% |

|

| 19% |

Our research and development strategy is focused on new product development and performance enhancements of our existing products. We plan to continue to use our brand names, customer relationships and research and development efforts to introduce innovative products that offer enhanced value to consumers through new designs and improved functionality.

5

Exhibit 99.1

HRG - Salus

HRG, through its subsidiary, Salus, used variable interest entities (“VIE”) for securitization activities, in which Salus transferred whole loans into a trust or other vehicle such that the assets were legally isolated from the creditors of Salus. Assets held in a trust could only be used to settle obligations of the trust. The creditors of the trusts typically had no recourse to Salus except in accordance with the obligations under standard representations and warranties. When Salus was the servicer of whole loans held in a securitization trust, Salus has the power to direct the most significant activities of the trust. Salus consolidated a whole-loan securitization trust if it had the power to direct the most significant activities and also held securities issued by the trust or has other contractual arrangements, other than standard representations and warranties that could potentially be significant to the trust.

Other Information

Governmental Regulations and Environmental Matters

Due to the nature of our operations, our facilities are subject to a broad range of federal, state, local and foreign legal and regulatory provisions relating to the environment, including those regulating the discharge of materials into the environment, the handling and disposal of solid and hazardous substances and wastes and the remediation of contamination associated with the releases of hazardous substances at our facilities. We believe that compliance with the federal, state, local and foreign laws and regulations to which we are subject will not have a material effect upon our capital expenditures, financial condition, earnings or competitive position.

From time to time, we have been required to address the effect of historic activities on the environmental condition of our properties. We have not conducted invasive testing at all facilities to identify all potential environmental liability risks. Given the age of our facilities and the nature of our operations, it is possible that material liabilities may arise in the future in connection with our current or former facilities. If previously unknown contamination of property underlying or in the vicinity of our manufacturing facilities is discovered, we could incur material unforeseen expenses, which could have a material adverse effect on our financial condition, capital expenditures, earnings and competitive position. Although we are currently engaged in investigative or remedial projects at some of our facilities, we do not expect that such projects, taking into account established accruals, will cause us to incur expenditures that are material to our business, financial condition or results of operations; however, it is possible that our future liability could be material.

We have been, and in the future may be, subject to proceedings related to our disposal of industrial and hazardous material at off-site disposal locations or similar disposals made by other parties for which we are held responsible as a result of our relationships with such other parties. In the U.S., these proceedings are under the Federal Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”) or similar state laws that hold persons who “arranged for” the disposal or treatment of such substances strictly liable for costs incurred in responding to the release or threatened release of hazardous substances from such sites, regardless of fault or the lawfulness of the original disposal. Liability under CERCLA is typically joint and several, meaning that a liable party may be responsible for all costs incurred in investigating and remediating contamination at a site. As a practical matter, liability at CERCLA sites is shared by all of the viable responsible parties. We occasionally are identified by federal or state governmental agencies as being a potentially responsible party for response actions contemplated at an off-site facility. At the existing sites where we have been notified of our status as a potentially responsible party, it is either premature to determine whether our potential liability, if any, will be material or we do not believe that our liability, if any, will be material. We may be named as a potentially responsible party under CERCLA or similar state laws for other sites not currently known to us, and the costs and liabilities associated with these sites may be material.

It is difficult to quantify with certainty the potential financial impact of actions regarding expenditures for environmental matters, particularly remediation, and future capital expenditures for environmental control equipment. See Note 18 - Commitments and Contingencies in the Notes to the Consolidated Financial Statements included elsewhere within the Annual Report for further discussion on estimated liabilities arising from such environmental matters. Nevertheless, based upon the information currently available, we believe that our ultimate liability arising from such environmental matters should not be material to our business or financial condition.

Electronic and electrical products that depend on electric current to operate (“EEE”) that we sell in Europe are subject to regulation in European Union (“EU”) markets under two key EU directives. Among our brands, this includes a limited range of products, such as aquarium pumps, heaters, and lighting. The first directive is the Restriction of the Use of Hazardous Substances in Electrical and Electronic Equipment (“RoHS”) which took effect in EU member states beginning July 1, 2006. RoHS prohibits companies from selling EEE products which contain certain specified hazardous materials in EU member states. We believe that compliance with RoHS does not have a material effect on our capital expenditures, financial condition, earnings or competitive position. The second directive is entitled the Waste of Electrical and Electronic Equipment (“WEEE”). WEEE makes producers or importers of particular classes of EEE goods financially responsible for specified collection, recycling, treatment and disposal of past and future covered products. WEEE assigns levels of responsibility to companies doing business in EU markets based on their relative market share. WEEE calls on each EU member state to enact enabling legislation to implement the directive. To comply with WEEE requirements, we have partnered with other companies to create a comprehensive collection, treatment, disposal and recycling program as specified within the member countries we conduct business. As EU member states pass enabling legislation we currently expect our compliance system to be sufficient to meet such requirements. Our current estimated costs associated with compliance with WEEE are not significant based on our current market share. However, we continue to evaluate the impact of the WEEE legislation and implementing regulations as EU member states implement guidance and as our market share changes and, as a result, actual costs to our company could differ from our current estimates and may be material to our business, financial condition or results of operations.

Certain of our products and facilities in each of our business segments are regulated by the United States Environmental Protection Agency (the “EPA”), the United States Food and Drug Administration (the “FDA”) and/or other federal consumer protection and product safety agencies and are subject to the regulations such agencies enforce, as well as by similar state, foreign and multinational agencies and regulations. For example, in the U.S., all products containing pesticides are regulated by the EPA and equivalent state agencies. The majority of these products must be registered at a federal and/or state level before they can be sold. Our inability to obtain, delay in our receipt of, or the cancellation of any registration could have an adverse effect on our business, financial condition and results of operations. The severity of the effect would depend on which products were involved, whether another product could be substituted and whether our competitors were similarly affected. We attempt to anticipate regulatory developments and maintain registrations of, and access to, substitute chemicals and other ingredients. We may not always be able to avoid or minimize these risks.

The Food Quality Protection Act (“FQPA”) established a standard for food-use pesticides, which is that a reasonable certainty of no harm will result from the cumulative effect of pesticide exposures. Under the FQPA, the EPA is evaluating the cumulative effects from dietary and non-dietary exposures to pesticides. The pesticides in certain of our products continue to be evaluated by the EPA as part of this program. It is possible that the EPA or a third party active ingredient registrant may decide that a pesticide we use in our products will be limited or made unavailable to us. We cannot predict the outcome or the severity of the effect of the EPA’s continuing evaluations of active ingredients used in our products.

Certain of our products and packaging materials are subject to regulations administered by the FDA. Among other things, the FDA enforces statutory prohibitions against misbranded and adulterated products, establishes ingredients and manufacturing procedures for certain products, establishes standards of identity for certain products, determines the safety of products and establishes labeling standards and requirements. In addition, various states regulate these products by enforcing federal and state standards of identity for selected products, grading products, inspecting production facilities and imposing their own labeling requirements.

6

Exhibit 99.1

The fish sold under the GloFish brand can be classified as an intragenic or transgenic species due to the addition of their bioluminescent genes, which means the FDA has the authority to regulate as the luminescence is caused by intentionally altered genomic DNA. Additional regulatory agencies, including the EPA, as well as agencies in U.S. and foreign states have authority to regulate these types of species. It is possible that the EPA, FDA, another U.S. federal agency, a U.S. state, or a foreign agency could in the future seek to exercise authority over the distribution and/or sale of GloFish brand fish. We will continue to monitor the development of any regulations that might apply to our bioluminescent fish.

Certain of our products may be regulated under programs within the United States, Canada, or in other countries that may require that those products and the associated product packaging be recycled or managed for disposal through a designated recycling program. Some programs are funded through assessment of a fee on the manufacturer and suppliers, including Spectrum Brands. We do not expect that such programs will cause us to incur expenditures that are material to our business, financial condition or results of operations; however, it is possible that our future liability could be material.

The United States Toxic Substances Control Act (“TSCA”) was amended in 2016, and the EPA is currently evaluating additional chemicals for regulation under that amended law. Certain of our products may be manufactured using chemicals or other ingredients that may be subject to regulation under current TSCA regulations, and other chemicals or ingredients may be regulated under the law in the future. We do not expect that compliance with current or future TSCA regulations will cause us to incur expenditures that are material to our business, financial condition or results of operations; however, it is possible that our future liability could be material.

Employees

We have approximately 14,000 full-time employees worldwide as of September 30, 2018 associated with our continuing operations. Approximately 4% of our total labor force is covered by 3 collective bargaining agreements that will expire during our fiscal year ending September 30, 2019. We believe that our overall relationship with our employees is good.

Discontinued Operations

Global Batteries and Lighting (“GBL”)

The Company’s assets and liabilities associated with GBL have been classified as held for sale and the respective operations have been classified as discontinued operations; and reported separately for all periods presented. GBL consists of consumer batteries products including alkaline batteries, zinc carbon batteries, nickel metal hydride (NiMH) rechargeable batteries, hearing aid batteries, battery chargers, battery-powered portable lighting products including flashlights and lanterns, and other specialty battery products primarily under the Rayovac® and VARTA® brand, and other proprietary brand names pursuant to licensing arrangements with third parties.

On January 15, 2018 the Company entered into a definitive acquisition agreement with Energizer Holdings, Inc. (“Energizer”) where Energizer has agreed to acquire from the Company its GBL business for an aggregate purchase price of $2.0 billion in cash, subject to customary purchase price adjustments. The Agreement provides that Energizer will purchase the equity of certain subsidiaries of the Company and acquire certain assets and assume certain liabilities of other subsidiaries used or held for the purpose of the GBL business. On November 15, 2018, subsequent to the year ended September 30, 2018, the Company entered into an amended acquisition agreement to address a proposed remedy submitted by Energizer to the European Commission, which provided for conditional approval from the commission provided the Varta® consumer battery, chargers, portable power and portable lighting business in the EMEA region be divested by Energizer subsequent to the GBL acquisition, including manufacturing and distribution facilities in Germany. Approval from the commission was received on December 11, 2018. The amended acquisition agreement provides for a purchase price adjustment that is contingent upon the completion of the divestiture of Energizer, including a potential downward adjustment equal to 75% of the difference between the divestiture sale price and the target sale price of $600 million, not to exceed $200 million; or a potential upward adjustment equal to 25% of the excess purchase price. Energizer anticipates that it will complete the divestiture in the 2019 fiscal year. On January 2, 2019, the Company completed the sale of GBL to Energizer. Refer to Note 3 – Divestitures and Note 23 – Subsequent Events to the Consolidated Financial Statements, included elsewhere in this Annual Report, for further discussion pertaining to the GBL divestiture.

Global Auto Care (“GAC”)

The Company’s assets and liabilities associated with GAC have been classified as held for sale and the respective operations have been classified as discontinued operations; and reported separately for all periods presented. GAC consists of appearance products, including protectants, wipes, tire and wheel care products, glass cleaners, leather care products, air fresheners and washes designed to clean, shine, refresh and protect interior and exterior automobile surfaces under the Armor All® brand; performance products including STP® branded fuel and oil additives, functional fluids and automotive appearance products; A/C recharge products that consist of do-it-yourself automotive air conditioner recharge products under the A/C Pro® brand, along with other refrigerant and oil recharge kits, sealants and accessories.

On November 15, 2018 the Company entered into a definitive acquisition agreement with Energizer where Energizer agreed to acquire from the Company its GAC business for an aggregate purchase price of $1.25 billion, including $937.5 million in cash plus stock consideration of 5.3 million shares of Energizer common stock with an approximate value of $312.5 million, subject to customary purchase price adjustments. The agreement provides that Energizer will purchase the equity of certain subsidiaries of the Company and acquire certain assets and assume certain liabilities of other subsidiaries used or held for the purpose of the GAC business. On January 28, 2019, the Company completed the sale of GAC to Energizer. Refer to Note 3 – Divestitures and Note 23 – Subsequent Events to the Consolidated Financial Statements, included elsewhere in this Annual Report, for further discussion pertaining to the GAC divestiture.

HRG – Insurance Operations

On November 30, 2017, Fidelity & Guaranty Life (“FGL”), a former majority owned subsidiary of HRG, completed its merger (the “FGL Merger”) with CF Corporation and its related entities (collectively, the “CF Entities”) in accordance with its previously disclosed Agreement and Plan of Merger (the “FGL Merger Agreement”). In addition, pursuant to a share purchase agreement, on November 30, 2017, Front Street Re (Delaware) Ltd., a wholly-owned subsidiary of HRG, sold to the CF Entities (such sale, the “Front Street Sale”) all of the issued and outstanding shares of its former wholly-owned subsidiaries, Front Street Re Cayman Ltd. and Front Street Re Ltd (collectively, “Front Street”, and together with FGL, the “Insurance Operations”). Pursuant to the share purchase agreement, on December 5, 2017, the Company repaid the $92.0 million of notes (such notes, the “HGI Energy Notes”) issued by HGI Energy, which were held directly and indirectly by Front Street and FGL. As a result of the completion of the FGL Merger and the Front Street Sale, HRG no longer has any equity interest in FGL or Front Street and HRG’s former Insurance Operations business is presented as discontinued operations for prior periods. HRG deconsolidated FGL and Front Street as of November 30, 2017. Refer Note 3 – Divestitures, included in the Notes to the Consolidated Financial Statements for more discussion pertaining to the disposition of HRG’s former Insurance Operations business.

7