June 12, 2009

Mr. Terence O’Brien

Branch Chief

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-7010

| Re: | Chemtura Corporation Form 10-K for the fiscal year ended December 31, 2008 Filed March 2, 2009 Form 10-Q for the period ended March 31, 2009 Filed May 8, 2009 |

On behalf of Chemtura Corporation (“Chemtura”, the “Company”, “we” or “our”), this letter is being submitted in response to comments received from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated May 21, 2009 (the “Comment Letter”) with respect to the above captioned Forms 10-K and 10-Q.

Attachment I to this letter has been submitted separately with the Commission subject to a request for confidential treatment pursuant to Rule 83 of the Commission’s Rules on Information Requests (17 CFR 200.83).

For ease of reference, we have set forth below, in boldface type, the text of the Staff’s comment, with the Company’s response following immediately thereafter. Capitalized terms used but not defined herein shall have the meaning ascribed to them in the Forms 10-K and 10-Q.

This response letter (excluding Attachment I) is being provided as a correspondence file on EDGAR.

Form 10-K for the year ended December 31, 2008

General

| | 1. | We note your March 23, 2009 Form 8-K disclosing that you are postponing your annual meeting. Please tell us when you expect to file your amended Form 10-K to include Part III information. |

The Company is in the process of preparing its amended Form 10-K for the fiscal year ended December 31, 2008 to include Part III information (“Form 10-K/A”). The Company intends to file its Form 10-K/A on or before July 31, 2009.

Item 1A. Risk Factors, page 12

| | 2. | In future filings containing risk factor disclosure, please refrain from using qualifying or limiting statements in the introductory paragraph, such as references to other risks that you do not currently deem significant or of which your are currently unaware. Such qualifications and limitations are inappropriate. Your risk factor disclosure should address all of the material risks that you face. If you do not deem risks material, you should not make reference to them. |

The Company will refrain from using such statements in future filings and will include those risk factors that are most significant as required by Item 503 of Regulation S-K.

| | 3. | Given the magnitude of the goodwill impairment charge of $986 million during 2008, it appears this item warranted prominent disclosure in the risk factors section, particularly since you have included a risk factor noting the decline in operations on page 14. Please revise future filings accordingly. |

The Company will include such a risk factor in future filings.

Management’s Discussion and Analysis, page 34

Critical Accounting Estimates, page 51

| | 4. | The $665 million fourth quarter 2008 goodwill impairment charge had 2660% and 216% impacts on fourth quarter and annual 2008 net income, respectively. The disclosure on page 52 attributes the impairment to the changes in financial performance during the fourth quarter 2008 and the outlook in 2009, coupled with continuing adverse equity market conditions. (i) Given the materiality of the charge, this disclosure should be revised to fully identify the changes in estimates that precipitated the impairment. Pursuant to Section 501.14 of the Financial Reporting Codification, please identify the material assumptions and estimates that changed between the September 2008 test and the December 2008 test and quantify the impact of these changes on the impairment calculation. (ii) Quantify the extent to which 2008 results differed from the July 2008 cash flow projections update. (iii) Disclose whether the December 2008 cash flow projections assume any negative future cash flows, and if so, for how long. Note also the requirement to specifically discuss the accuracy of management’s past estimates. Please also provide this disclosure in your letter. |

| | i. | The Company will revise such disclosures in the future to more fully identify the changes in estimates that precipitate impairments. The significant changes in assumptions are described below. |

The Company tests for goodwill impairment at the reporting unit level. In 2008, the Company had five reporting units identified as follows: (a) Polymer Additives; (b) Petroleum Additives; (c) Urethanes; (d) Crop Protection; and (e) Consumer Products.

We assess the impairment of goodwill on an annual basis and whenever events occur or circumstances change that indicate it is more likely than not that the fair value of the reporting unit is less than the carrying amount. Judgment is required in determining whether an event has occurred that may indicate that goodwill may be impaired. Factors that could indicate that an impairment may exist include significant underperformance relative to plan or long-term projections, significant changes in business strategy, significant negative industry or economic trends or a significant decline in our stock price for a sustained period of time.

The first step (defined as “Step 1”) of the goodwill impairment test, used to identify potential impairment, compares the fair value of the reporting unit with its carrying amount, including goodwill. If the fair value of the reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not impaired, and the second step of the impairment test is not required. If the carrying amount of a reporting unit exceeds its fair value, the second step of the goodwill impairment test is performed to quantify the amount of impairment loss, if any. The Company performed a Step 1 goodwill impairment test at its annual testing date of July 31, 2008 and determined that the fair value exceeded the carrying value for all reporting units; therefore, goodwill was not impaired.

Subsequent to July 31, 2008, certain triggering events required the Company to perform an interim Step 1 test for each subsequent quarterly reporting period. These triggering events primarily included the sustained reduction of our market capitalization from September 30, 2008 through December 31, 2008 along with the increased risk related to the timing and realization of our projected cash flows due to the continued deterioration of the economy in the second half of 2008. In addition, on March 18, 2009, the Company filed for relief under Chapter 11 of the United States Bankruptcy Code.

The discounted cash flow (DCF) method was used to measure the fair value of the Company’s reporting units under the income approach at each testing date. Determining the fair value using a discounted cash flow method required the Company to make estimates and assumptions, including long-term projections of cash flows, market conditions and appropriate discount rates. The Company’s judgments were based upon historical experience, current market trends, forecasts for future sales, and other relevant information. In estimating future cash flows, the Company used internally generated projections of sales and operating profits, adjusted for capital expenditures, changes in net working capital, and adjustments for non-cash items to determine the free cash flow available to invested capital. A terminal value utilizing a constant growth rate of cash flows was used to calculate a terminal value after the explicit projection period.

A market capitalization reconciliation is used by the Company to corroborate the Step 1 income approach to measure fair value. The market capitalization reconciliation utilizes the Company’s stock price to calculate the market capitalization of equity which is then reconciled to the aggregate fair value of its reporting units. The Company will also compare revenue and EBITDA multiples to comparable companies in order to analyze the reasonableness of its assumptions.

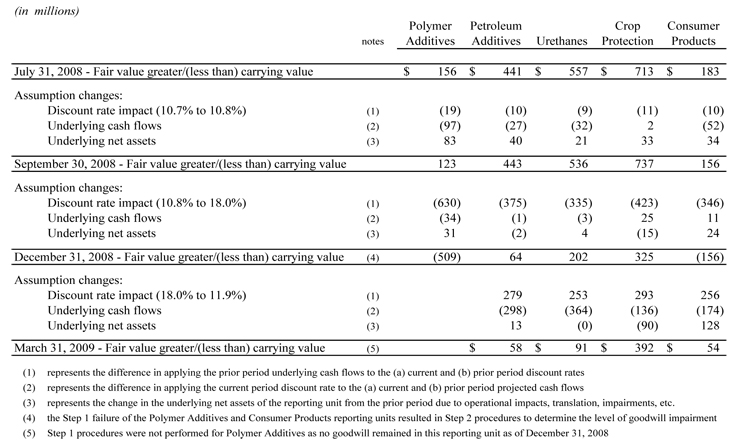

The following table represents a summary of the Company’s Step 1 test as of the annual impairment testing date along with the impact of assumption changes that occurred for each subsequent interim test:

The key assumptions used by the Company in its estimation of reporting unit fair value are the discount rate and the underlying cash flow projections. The changes in these assumptions are described below:

| | · | Discount rates are based on a weighted average cost of capital (“WACC”), which represents the average rate a business pays its providers of debt and equity capital. The WACC used by the Company to test goodwill is derived from a group of comparable companies. The change in discount rate from 10.7% at July 31, 2008 to 10.8% at September 30, 2008 was due primarily to changes in the risk free rate, small company risk premium and Moody’s seasoned Baa Corporate Bond Yield. |

In addition to the increase in the discount rate, the Company also re-evaluated its cash flow projections and determined that it was appropriate to amend the growth rates inherent in its cash flows. In its annual tests as of July 31, 2008, the Company utilized its three year cash flow projections (2009 through 2011) included in its long range plan (“LRP”). As a result of the deterioration and uncertainty in the overall economy, management estimated that its short-term cash flow projections in the LRP would be negatively effected by the economic downturn. In connection with the impairment analysis at September 30, 2008, management believed that the Company’s long range cash flow projections would still be achieved. However, due to the macroeconomic conditions, it would take the Company a longer period of time to achieve those cash flows. Management estimated that the economic downturn would last two years, and therefore, the cash flow targets were extended to a period of five years (2011 through 2013) in its September 30, 2008 test. Generally, this led to a decrease in reporting unit projected cash flows with a resulting decrease in fair value.

| | · | At December 31, 2008, the Company again updated its peer company analysis and determined a market participant discount rate of 12.0%. The Company experienced a sharp decline in customer demand in November and December 2008 resulting in a decline in sales and financial performance. At this time, the Company also reviewed its cash flow projections in light of the significant economic turmoil and the Company's specific liquidity concerns and financial performance. Consistent with other market participants, the Company determined that there was inherent risk as to its ability to achieve the revenue and cost targets included in its cash flow projections. To address this uncertainty, the Company, with the assistance of its external valuation experts, determined that a 600 basis point specific risk premium should be added to the discount rate. In determining this rate, the Company used the Highland Global model which considered a number of factors including revenue growth assumptions, financial risk, operational risk, profitability, industry risk, economic risk and customer concentration. |

| | · | During the first quarter of 2009, the Company filed for bankruptcy protection under Chapter 11 of the United States Bankruptcy Code. At March 31, 2009, the updated peer company analysis identified a market participant discount rate of 11.9%. The Company also recast its 2009 operational forecast and used this as the basis for its cash flow projections. Given the uncertainty surrounding the Company’s bankruptcy reorganization and the economy in general, growth rates in the revised 2009 operational forecast were significantly reduced to less than the estimated GDP growth rate. Based on the reduction in revised forecasts, the Company determined that the 600 basis point specific risk premium was no longer appropriate. Attachment I to this letter contains the Company’s March 31, 2009 impairment analysis which provides additional discussion of the Step 1 analysis at this date. |

| | · | At July 31, September 30 and December 31, 2008, the Company performed a market capitalization reconciliation to corroborate the fair values determined from its discounted cash flow model. This reconciliation demonstrated implied control premiums of 43%, 35% and 43% which were considered reasonable. |

| | · | As a result of the bankruptcy filing, the Company’s stock price was impacted which resulted in the stock being delisted from the NYSE. As of March 31, 2009, the stock was trading on the pink sheets at $0.05 per share. The market capitalization of the Company on this date was $11.5 million compared to $339.6 million at December 31, 2008 indicating that market participants viewed the equity to have little value given its unsecured nature. Consequently, the Company determined that a reconciliation of reporting unit fair values to market capitalization was not an appropriate procedure to corroborate the fair values determined from the discounted cash flow models. To corroborate its fair values, the Company compared the revenue and EBITDA multiples inherent in its March 31, 2009 reporting unit fair values with those of its peer companies and determined that these multiples were reasonable. |

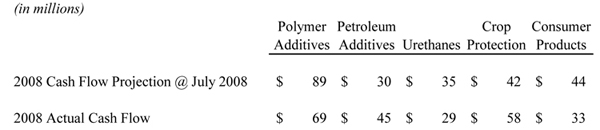

| | ii. | The following table depicts the actual 2008 reporting unit cash flow results compared to the 2008 cash flow projections utilized in the Company’s July 2008 annual impairment test: |

The reporting units whose industry segments were most impacted by the economic uncertainties in the second half 2008 were those that experienced the goodwill impairments in the fourth quarter of 2008 (i.e. Polymer Additives and Consumer Products).

| | iii. | The December 2008 cash flow projections did not assume any negative future cash flows for any of the Company’s five operating reporting units. |

Acquisitions and Divestments, page 73

| | 5. | Please tell us and revise future filings to state why the oleochemical divestiture as described on page 76 does not constitute discontinued operations pursuant to SFAS 144. |

The Company determined that this divestiture did not constitute a component of an entity in accordance with paragraph 41 of SFAS 144. This product line is a part of a larger cash-flow generating asset group (Polymer Additives) and, in the aggregate, does not represent a group that on its own is a component of the entity. Therefore, the Company determined that the conditions in SFAS 144 paragraph 42 for reporting the divestiture in discontinued operations would not be met. The Company will revise the disclosure in future filings to state this fact.

Furthermore, the Company determined that this divestiture constituted a business as defined by EITF 98-3 and, as such, goodwill was allocated to this portion of the Polymer Additives reporting unit in determining the loss calculated in accordance with paragraph 39 of SFAS 142.

Item 9A. Controls and Procedures, page 124

| | 6. | You state the Company did not provide adequate oversight to ensure a timely and effective review of its income tax accounts, which deficiency resulted in a material misstatement in the preliminary financial statements as of December 31, 2008. (i) Please revise future filings to disclose in detail the nature of the material weakness. That is, discuss how the misstatement emerged, quantify the impact it had on the preliminary financial statements, and how it was identified and resolved. Provide this information in your response letter. Also, please tell us whether you assessed the possibility of errors in the prior quarterly filings. (ii) Explain whether the “taxes attributable to prior periods” referenced on page 86 are accounting errors. |

| | i. | As disclosed in Item 9A(c) of the referenced Form 10-K, the Company engaged external tax consultants and added internal resources to assist in the preparation and review of the Company’s 2008 tax provision. In addition, the Company provided training related to the preparation of income tax provisions to its key employees throughout the world. Notwithstanding these actions taken by management, our internal control over financial reporting as of December 31, 2008 did not include effective monitoring to ensure that key review controls in our income tax provision process were performed in a timely manner. In particular, our monitoring activities did not detect that our controls over the intraperiod tax allocation and the balance sheet classification of deferred income taxes were not performed adequately prior to the Company’s earnings release on February 25, 2009. Subsequently, material misstatements in the preliminary financial statements were identified. These misstatements existed in the Company's press release that was furnished in connection with the Company’s February 25, 2009 Form 8-K, but were identified and corrected prior to the March 2, 2009 filing of the Company's 2008 annual report on Form 10-K. The nature of the misstatements related to the following: |

| | · | A $47 million intraperiod allocation of the Company’s valuation allowance between income tax expense and other comprehensive income (OCI). This valuation allowance was required to be classified in OCI against the deferred tax benefit that arose in the fourth quarter from defined employee benefit plan actuarial losses. |

| | · | Balance sheet reclassifications were required to present deferred tax accounts on a net current and a net noncurrent basis by tax jurisdiction. |

| | Because these errors were not identified on a timely basis which was an implication to the effectiveness of our income tax provision monitoring activities, the Company disclosed a material weakness in its 2008 annual report on Form 10-K related to the adequacy of oversight to ensure a timely and effective review of its income tax accounts. |

| | Management analyzed the impact of these misstatements in light of SFAS 109, “Accounting for Income Taxes” and EITF Topic No. D-32, “Intraperiod Tax Allocation of the Tax Effect of Pretax Income from Continuing Operations” and determined that the adjustments that arose as a result of the material weakness would not be applicable for prior quarterly periods. |

| | In addition to disclosing the Company’s remediation plans and efforts, the Company will add the following disclosure to Item 4 in its Form 10Q for the period ending June 30, 2009 regarding the material weakness that existed at December 31, 2008: |

“At December 31, 2008, the Company did not provide adequate oversight to ensure a timely and effective review of its income tax accounts. In particular, the Company did not maintain effective monitoring of key review controls in its income tax process. This deficiency resulted in the failure to detect breakdowns in its review controls over the intraperiod tax allocation process and the appropriate balance sheet classification of deferred income taxes and led to a material misstatement of the Company’s income tax accounts in its preliminary financial statements as of December 31, 2008 that were included in its press released dated February 25, 2009. These misstatements were corrected prior to the release of the 2008 Annual Report on Form 10-K.

As a result of the material weakness described above, management concluded that Chemtura’s internal control over financial reporting was not effective as of December 31, 2008.”

| | ii. | The caption “taxes attributable to prior periods” on page 86 of the 2008 Form 10-K reflects changes in estimates that were finalized by the issuance of the Internal Revenue Service’s revenue agent adjustments report and do not represent accounting errors. |

| | 7. | Please tell us why this material weakness was limited to only one area of the financial statements where an audit adjustment occurred. It appears that the nature of such material weakness, that is, inadequate oversight, could be so pervasive as to appear in other areas of the financial statements. |

The Company conducted an evaluation of the effectiveness of its internal control over financial reporting as of December 31, 2008 based on the framework in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on the Company’s evaluation of internal control over financial reporting, management determined that the material weakness (discussed in Comment 6) was limited to the oversight and timely review of the tax accounts.

Due to the complexity of the Company’s global operating structure, combined with the nature of the tax accounts, the Company completes the preparation of its income tax provision and related tax accounts subsequent to the completion of its non-income tax related accounts. Commencing in 2008, management engaged additional outside tax consultants to assist in the preparation of the income tax provision. However, management did not provide adequate oversight over its tax resources, including its external tax consultants, to ensure that all controls embedded in the process over the preparation of the income tax provision were performed timely. This oversight control resided within the Company’s tax function and, as such, does not impact other areas of the financial statements.

| | 8. | We note the debt agreements listed in Item 2.04 of your March 23, 2009 Form 8-K. Supplementally tell us where the following documents are located in the exhibit index, and if they are not included, explain why or include them in future filings. |

| | · | $400 million of 7% Notes due July 15, 2009 under an Indenture dated as of July 16, 1999; and |

| | · | $150 Million of 6.875% debentures due 2026, under an indenture dated as of February 1, 1993. |

The debt agreements listed in Item 2.04 of the Company’s March 23, 2009 Form 8-K will be included as exhibits in the Company’s Form 10-K/A.

Certifications, Exhibits 31.1 and 31.2

| | 9. | In future filings, please file the certification exactly as set forth in Item 601 (b)(31) and do not replace “report” with “annual report” in paragraphs 2, 3, 4(a) and (c). |

The Company will revise the wording in future filings so that these certifications include the exact language of paragraph 4(b) of Item 601(b)(31) of Regulation S-K.

Form 10-Q for the period ended March 31, 2009

Management’s Discussion and Analysis, page 31

| 10. | We note that despite the significant goodwill impairment charge in 2008, it appears your March 31, 2009 market capitalization is still significantly below the book value of your equity, but no impairment was found to exist as of the end of this quarter. (i) Please provide us with your SFAS 142 fair value analysis so we can better understand the difference between book value and market capitalization. Include your historical cash flow amounts so we can understand the basis for the projected cash flows. (ii)Please tell us what assumptions have changed and the resultant impact on your analysis from those used in your December 2008 test. (iii)Please explain how your assumptions comply with the requirement in paragraphs 23-25 of SFAS 142 that they be market-based. (iv)Tell us if you expect to record a goodwill impairment charge in the second quarter 2009. |

| | |

| | i. | The Company’s impairment analysis is attached to this response letter as Attachment I. The Company has requested confidential treatment for Attachment I pursuant to Rule 83 of the Commission’s Rules on Information Requests. Attachment I was submitted separately to the Commission along with the request for confidential treatment |

| | | |

| | ii. | Please refer to the response to Comment 4 (pages 3 through 6) for a discussion of the Step 1 assumption changes from December 2008 to March 2009. |

| | iii. | Paragraph 23 of SFAS 142 states that quoted market prices in active markets are the best evidence of fair value of a reporting unit and should be used as the basis for measurement, if available. While the Company is publicly-traded, its individual reporting units are not. Therefore, the Company believes it is not possible to use quoted market prices as the primary measurement basis of fair values for individual reporting units. SFAS 142 also acknowledges that quoted market prices in active markets do not necessarily represent fair value (for example, because of control premiums) and therefore, need not be the sole measurement basis of the fair value of the reporting unit. |

The Company determined the fair value of each of the reporting units by using the DCF method. The indicated fair value of each of the reporting units was then compared with the reporting unit’s carrying value to determine whether there was an indication of impairment.

We believe that the use of the DCF method was applied in accordance with paragraph 25 of SFAS 142 which states, “In estimating the fair value of a reporting unit, a valuation technique based on multiples of earnings or revenue or a similar performance measure may be used if that technique is consistent with the objective of measuring fair value.” Paragraph 47 of SFAS 142 further clarifies that acceptable valuation methods for determining a reporting unit’s fair value include the use of a present value technique.

To determine the indicated fair value of the reporting units under the DCF method, the projected stream of cash flows was converted to present value by using an estimated discount rate. The discount rate was determined based on the weighted average cost of capital of comparable companies plus any risks inherent in the individual reporting units.

In order to validate that the fair values determined under the DCF method were reasonable in the current market environment, the Company reviewed the implied EBITDA and revenue multiples to those observed within selected publicly traded guideline companies used in the calculation of the discount rate. Each of the reporting unit’s implied EBITDA and revenue multiples fell within the minimum and maximum multiples for the selected publicly traded guideline companies.

| | iv. | The Company continually monitors and evaluates business and competitive conditions that affect its operations to determine if, in accordance with Paragraph 28 of SFAS 142, an event or change in circumstances has occurred that would more likely than not reduce the fair value of a reporting unit below its carrying amount, thus requiring an interim test for goodwill impairment. Circumstances that could trigger an interim impairment test include but are not limited to: negative current events or long-term outlooks for specific industries impacting the company as a whole or specific reporting units; a significant adverse change in the business climate or legal factors; an adverse action or assessment by a regulator; unanticipated competition; loss of key personnel; and the likelihood that a reporting unit or significant portion of a reporting unit will be sold or otherwise disposed. |

We have concluded that, as of the date of this letter, no event or change in circumstance has occurred that would require the Company to perform an interim goodwill impairment test. The second quarter of 2009 typically represents a peak season for certain reporting units (i.e. Consumer Products) and, as such, an analysis of performance versus projections will provide additional evidence to determine whether an interim goodwill impairment test is required. The Company will continue to monitor events and circumstances through June 30, 2009.

* * * *

Chemtura further acknowledges that:

| | · | Chemtura is responsible for the adequacy and accuracy of the disclosures in its filings; |

| | · | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | · | Chemtura may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions regarding the responses set forth above, please do not hesitate to contact the undersigned at (203) 573-2214.

Very truly yours,

/s/ Stephen C. Forsyth

Stephen C. Forsyth

Executive Vice President and Chief

Financial Officer