EXHIBIT 99.1

CIRCOR Reports First-Quarter 2014 Financial Results

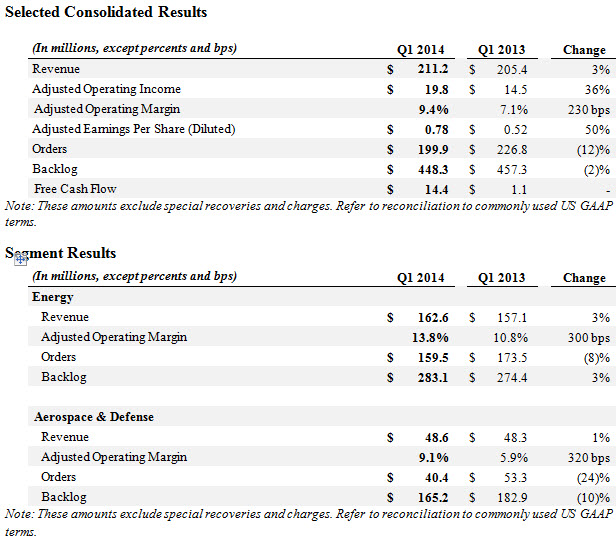

Burlington, MA - April 22, 2014 - CIRCOR International, Inc. (NYSE: CIR), a leading provider of valves and other highly engineered products for markets including oil & gas, power generation and aerospace & defense, today announced financial results for the first quarter ended March 30, 2014.

First-Quarter 2014 Highlights

| |

| • | Adjusted operating margin increased 230 basis points to 9.4% |

| |

| • | Adjusted EPS grew 50% to $0.78 (including $0.03 from foreign currency) |

| |

| • | Free cash flow was $14.4 million, 98% of net income |

| |

| • | Announcing growth investment funded by restructuring G&A |

“CIRCOR began 2014 with strong first-quarter operating results,” said Scott Buckhout, CIRCOR President and Chief Executive Officer. “Our margin expansion initiatives continued to gain traction with adjusted operating margins up year-over-year by 230 basis points to 9.4%. Margins improved across most of our businesses. We had strong sales growth in our upstream markets, particularly in our large international projects business and our instrumentation and sampling business.”

“Q1 order intake was down over last year primarily due to orders from our project businesses, which can vary significantly from quarter to quarter. We remain bullish on our energy end markets and expect solid order intake for the full year,” said Buckhout.

“Today we are announcing an investment program to accelerate organic growth. We intend to invest approximately $7 million to increase the size our sales force in growing markets, open international sales offices in Brazil and Malaysia, and increase our investment in new products. These actions will be entirely funded with a reduction in G&A expenses and the closure of three small facilities,” concluded Buckhout.

Second-Quarter 2014 Guidance

For the second quarter of 2014, the Company expects:

| |

| • | Revenues in the range of $220 million to $230 million; |

| |

| • | Adjusted earnings per share, excluding special charges, in the range of $0.88 to $0.94; and, |

| |

| • | Restructuring related costs of approximately $5 million to $6 million. |

Conference Call Information

CIRCOR International will hold a conference call to review its financial results today, April 22, 2014, at 10:00 a.m. ET. To listen to the conference call and view the accompanying presentation slides, visit “Webcasts & Presentations” in the “Investors” section of the CIRCOR website. The call also can be accessed by dialing (877) 407-5790 or (201) 689-8328. The webcast will be archived for one year on the Company’s website.

Use of Non-GAAP Financial Measures

Adjusted net income, adjusted earnings per diluted share, adjusted operating income, adjusted operating margin, and free cash flow are non-GAAP financial measures and are intended to serve as a complement to results provided in accordance with accounting principles generally accepted in the United States. CIRCOR believes that such information provides an additional measurement and consistent historical comparison of the Company’s performance. A reconciliation of the non-GAAP financial measures to the most directly comparable GAAP measures is available in this news release.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Reliance should not be placed on forward-looking statements because they involve unknown risks, uncertainties and other factors, which are, in some cases, beyond the control of CIRCOR. Any statements in this press release that are not statements of historical fact are forward-looking statements, including, but not limited to, those relating to CIRCOR’s future performance, including second-quarter revenue and earnings guidance and estimated total annualized pre-tax savings from restructuring actions. Actual events, performance or results could differ materially from the anticipated events, performance or results expressed or implied by such forward-looking statements. BEFORE MAKING ANY INVESTMENT DECISIONS REGARDING OUR COMPANY, WE STRONGLY ADVISE YOU TO READ THE SECTION ENTITLED "RISK FACTORS" IN OUR MOST RECENT ANNUAL REPORT ON FORM 10-K AND SUBSEQUENT REPORTS ON FORMS 10-Q, WHICH CAN BE ACCESSED UNDER THE "INVESTORS" LINK OF OUR WEBSITE AT WWW.CIRCOR.COM. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

About CIRCOR International, Inc.

CIRCOR International, Inc. designs, manufactures and markets highly engineered products and sub-systems for markets including oil & gas, power generation and aerospace & defense. With more than 7,000 customers in over 100 countries, CIRCOR has a diversified product portfolio with recognized, market-leading brands that fulfill its customers’ unique application needs. The Company’s strategy is to grow organically and through complementary acquisitions; simplify CIRCOR’s operations; achieve world class operational excellence; and attract and retain top industry talent. For more information, visit the Company’s investor relations website at http://investors.circor.com.

Contact:

Rajeev Bhalla

Executive Vice President & Chief Financial Officer

CIRCOR International

(781) 270-1200

CIRCOR INTERNATIONAL, INC. CONSOLIDATED STATEMENT OF INCOME (in thousands, except share data) UNAUDITED |

| | | | | | | |

| | Three Months Ended |

| | March 30, 2014 | | March 31, 2013 |

| Net revenues | $ | 211,186 |

| | $ | 205,398 |

|

| Cost of revenues | 146,548 |

| | 145,549 |

|

| GROSS PROFIT | 64,638 |

| | 59,849 |

|

| Selling, general and administrative expenses | 44,888 |

| | 45,571 |

|

| Special (recoveries) charges, net | (1,157 | ) | | 1,378 |

|

| OPERATING INCOME | 20,907 |

| | 12,900 |

|

| Other (income) expense: | | | |

| Interest expense, net | 918 |

| | 787 |

|

| Other (income) expense, net | (468 | ) | | 612 |

|

| TOTAL OTHER EXPENSE, NET | 450 |

| | 1,399 |

|

| INCOME BEFORE INCOME TAXES | 20,457 |

| | 11,501 |

|

| Provision for income taxes | 5,825 |

| | 3,592 |

|

| NET INCOME | $ | 14,632 |

| | $ | 7,908 |

|

| Earnings per common share: | | | |

| Basic | $ | 0.83 |

| | $ | 0.45 |

|

| Diluted | $ | 0.82 |

| | $ | 0.45 |

|

| Weighted average number of common shares outstanding: | | | |

| Basic | 17,620 |

| | 17,511 |

|

| Diluted | 17,741 |

| | 17,529 |

|

| Dividends paid per common share | $ | 0.0375 |

| | $ | 0.0375 |

|

CIRCOR INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (UNAUDITED) |

| | | | | | | |

| | Three Months Ended |

| | March 30, 2014 | | March 31,

2013 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 14,632 |

|

| $ | 7,908 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation | 4,069 |

| | 4,009 |

|

| Amortization | 786 |

| | 758 |

|

| Compensation expense of share-based plans | 1,830 |

| | 1,028 |

|

| Tax effect of share-based plan compensation | (571 | ) | | (285 | ) |

| (Gain) loss on disposal of property, plant and equipment | 34 |

| | (66 | ) |

| Changes in operating assets and liabilities: | | | |

| Trade accounts receivable, net | (9,952 | ) | | (2,455 | ) |

| Inventories, net | 234 |

| | (6,461 | ) |

| Prepaid expenses and other assets | (859 | ) | | (827 | ) |

| Accounts payable, accrued expenses and other liabilities | 6,854 |

| | 2,198 |

|

| Net cash provided by operating activities | 17,057 |

| | 5,807 |

|

| INVESTING ACTIVITIES | | | |

| Additions to property, plant and equipment | (2,670 | ) | | (4,707 | ) |

| Proceeds from the sale of property, plant and equipment | 13 |

| | 75 |

|

| Net cash used in investing activities | (2,657 | ) | | (4,632 | ) |

| FINANCING ACTIVITIES | | | |

| Proceeds from long-term debt | 48,029 |

| | 33,598 |

|

| Payments of long-term debt | (41,781 | ) | | (37,655 | ) |

| Dividends paid | (670 | ) | | (670 | ) |

| Proceeds from the exercise of stock options | 192 |

| | 1,368 |

|

| Tax effect of share-based compensation | 571 |

| | 285 |

|

| Net cash (used in) provided by financing activities | 6,341 |

| | (3,074 | ) |

| Effect of exchange rate changes on cash and cash equivalents | (824 | ) | | (2,207 | ) |

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 19,917 |

| | (4,106 | ) |

| Cash and cash equivalents at beginning of year | 102,180 |

| | 61,738 |

|

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 122,097 |

| | $ | 57,632 |

|

| Cash paid during the year for: | | | |

| Income taxes | $ | 2,913 |

| | $ | 1,462 |

|

| Interest | $ | 677 |

| | $ | 655 |

|

CIRCOR INTERNATIONAL, INC. CONSOLIDATED BALANCE SHEETS (in thousands) UNAUDITED |

| | | | | | | |

| | March 30,

2014 | | December 31,

2013 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 122,097 |

| | $ | 102,180 |

|

| Short-term investments | 92 |

| | 95 |

|

| Trade accounts receivable, less allowance for doubtful accounts of $2,543 and $2,449, respectively | 154,821 |

| | 144,742 |

|

| Inventories, net | 199,200 |

| | 199,404 |

|

| Prepaid expenses and other current assets | 20,496 |

| | 19,815 |

|

| Deferred income tax asset | 17,566 |

| | 17,686 |

|

| Total Current Assets | 514,272 |

| | 483,922 |

|

| PROPERTY, PLANT AND EQUIPMENT, NET | 106,455 |

| | 107,724 |

|

| OTHER ASSETS: | | | |

| Goodwill | 75,999 |

| | 75,876 |

|

| Intangibles, net | 34,924 |

| | 35,656 |

|

| Deferred income tax asset | 17,167 |

| | 18,579 |

|

| Other assets | 5,140 |

| | 4,893 |

|

| TOTAL ASSETS | $ | 753,957 |

| | $ | 726,650 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 83,391 |

| | $ | 70,589 |

|

| Accrued expenses and other current liabilities | 56,710 |

| | 57,507 |

|

| Accrued compensation and benefits | 25,191 |

| | 31,289 |

|

| Income taxes payable | 4,946 |

| | 3,965 |

|

| Notes payable and current portion of long-term debt | 10,519 |

| | 7,203 |

|

| Total Current Liabilities | 180,757 |

| | 170,553 |

|

| LONG-TERM DEBT, NET OF CURRENT PORTION | 45,614 |

| | 42,435 |

|

| DEFERRED INCOME TAXES | 9,217 |

| | 9,666 |

|

| OTHER NON-CURRENT LIABILITIES | 25,768 |

| | 27,109 |

|

| CONTINGENCIES AND COMMITMENTS | | | |

| SHAREHOLDERS’ EQUITY: | | | |

| Common stock | 176 |

| | 176 |

|

| Additional paid-in capital | 272,202 |

| | 269,884 |

|

| Retained earnings | 217,045 |

| | 202,930 |

|

| Accumulated other comprehensive gain, net of taxes | 3,178 |

| | 3,897 |

|

| Total Shareholders’ Equity | 492,601 |

| | 476,887 |

|

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 753,957 |

| | $ | 726,650 |

|

CIRCOR INTERNATIONAL, INC. SUMMARY OF ORDERS AND BACKLOG (in millions) UNAUDITED |

| | | | | | | |

| | Three Months Ended |

| | March 30,

2014 | | March 31,

2013 |

ORDERS (1) | | | |

| Energy | $ | 159.5 |

| | $ | 173.5 |

|

| Aerospace & Defense | 40.4 |

| | 53.3 |

|

| Total orders | $ | 199.9 |

| | $ | 226.8 |

|

| | | | |

BACKLOG (2) | March 30,

2014 | | March 31,

2013 |

| Energy | $ | 283.1 |

| | $ | 274.4 |

|

| Aerospace & Defense | 165.2 |

| | 182.9 |

|

| Total backlog | $ | 448.3 |

| | $ | 457.3 |

|

| | | | |

| Note 1: Orders do not include the foreign exchange impact due to the re-measurement of customer order backlog amounts denominated in foreign currencies. |

| Note 2: Backlog includes all unshipped customer orders. |

CIRCOR INTERNATIONAL, INC. SUMMARY REPORT BY SEGMENT (in thousands, except earnings per share) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | 2013 | 2014 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| NET REVENUES | | | | | | |

| Energy | $ | 157,104 |

| $ | 173,557 |

| $ | 167,660 |

| $ | 162,649 |

| $ | 660,970 |

| $ | 162,587 |

|

| Aerospace & Defense | 48,294 |

| 50,087 |

| 47,071 |

| 51,386 |

| 196,838 |

| 48,599 |

|

| Total | $ | 205,398 |

| $ | 223,644 |

| $ | 214,731 |

| $ | 214,035 |

| $ | 857,808 |

| $ | 211,186 |

|

| ADJUSTED OPERATING MARGIN | | | | | | |

| Energy | 10.8 | % | 13.3 | % | 15.2 | % | 17.1 | % | 14.1 | % | 13.8 | % |

| Aerospace & Defense | 5.9 | % | 11.4 | % | 12.1 | % | 8.4 | % | 9.5 | % | 9.1 | % |

| Segment operating margin | 9.6 | % | 12.9 | % | 14.5 | % | 15.0 | % | 13.0 | % | 12.7 | % |

| Corporate expenses | (2.6 | )% | (2.9 | )% | (3.4 | )% | (3.5 | )% | (3.1 | )% | (3.4 | )% |

| Adjusted operating margin | 7.1 | % | 10.0 | % | 11.1 | % | 11.6 | % | 9.9 | % | 9.4 | % |

| Restructuring inventory charges | 0.1 | % | (0.1 | )% | — | % | 0.3 | % | 0.1 | % | — | % |

| Impairment charges | — | % | — | % | — | % | 3.2 | % | 0.8 | % | — | % |

| Special (recoveries) | — | % | — | % | (1.5 | )% | — | % | (0.4 | )% | (1.1 | )% |

| Special charges | 0.7 | % | 1.0 | % | 1.4 | % | 2.4 | % | 1.4 | % | 0.5 | % |

| Total GAAP operating margin | 6.3 | % | 9.1 | % | 11.1 | % | 5.6 | % | 8.1 | % | 9.9 | % |

| | | | | | | |

| | | | | | | |

CIRCOR INTERNATIONAL, INC. SUMMARY REPORT BY SEGMENT (in thousands, except earnings per share) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | 2013 | 2014 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| ADJUSTED OPERATING INCOME | | | | | | |

| Energy | $ | 16,940 |

| $ | 23,114 |

| $ | 25,441 |

| $ | 27,809 |

| $ | 93,304 |

| $ | 22,462 |

|

| Aerospace & Defense | 2,864 |

| 5,724 |

| 5,705 |

| 4,342 |

| 18,635 |

| 4,426 |

|

| Segment operating income | 19,804 |

| 28,838 |

| 31,146 |

| 32,151 |

| 111,939 |

| 26,888 |

|

| Corporate expenses | (5,277 | ) | (6,570 | ) | (7,400 | ) | (7,400 | ) | (26,646 | ) | (7,137 | ) |

| Adjusted operating income | 14,528 |

| 22,268 |

| 23,746 |

| 24,751 |

| 85,293 |

| 19,750 |

|

| Restructuring inventory charges | 250 |

| (242 | ) | — |

| 638 |

| 646 |

| — |

|

| Impairment charges | — |

| — |

| — |

| 6,872 |

| 6,872 |

| — |

|

| Special (recoveries) | — |

| — |

| (3,151 | ) | — |

| (3,151 | ) | (2,243 | ) |

| Special charges | 1,378 |

| 2,254 |

| 2,961 |

| 5,160 |

| 11,752 |

| 1,086 |

|

| Total GAAP operating income | 12,900 |

| 20,256 |

| 23,936 |

| 12,081 |

| 69,174 |

| 20,907 |

|

| INTEREST EXPENSE, NET | (787 | ) | (838 | ) | (745 | ) | (792 | ) | (3,162 | ) | (918 | ) |

| OTHER (EXPENSE) INCOME, NET | (612 | ) | (626 | ) | (568 | ) | (167 | ) | (1,974 | ) | 468 |

|

| PRETAX INCOME | 11,501 |

| 18,792 |

| 22,623 |

| 11,122 |

| 64,038 |

| 20,457 |

|

| PROVISION FOR INCOME TAXES | (3,592 | ) | (6,124 | ) | (4,903 | ) | (2,297 | ) | (16,916 | ) | (5,825 | ) |

| EFFECTIVE TAX RATE | 31.2 | % | 32.6 | % | 21.7 | % | 20.7 | % | 26.4 | % | 28.5 | % |

| NET INCOME | $ | 7,908 |

| $ | 12,668 |

| $ | 17,720 |

| $ | 8,825 |

| $ | 47,121 |

| $ | 14,632 |

|

| Weighted Average Common Shares Outstanding (Diluted) | 17,529 |

| 17,607 |

| 17,667 |

| 17,710 |

| 17,629 |

| 17,741 |

|

| EARNINGS PER COMMON SHARE (Diluted) | $ | 0.45 |

| $ | 0.72 |

| $ | 1.00 |

| $ | 0.50 |

| $ | 2.67 |

| $ | 0.82 |

|

| ADJUSTED EBITDA | $ | 18,682 |

| $ | 26,419 |

| $ | 27,850 |

| $ | 29,441 |

| $ | 102,392 |

| $ | 27,387 |

|

| ADJUSTED EBITDA AS A % OF SALES | 9.1 | % | 11.8 | % | 13.0 | % | 13.8 | % | 11.9 | % | 13.0 | % |

| CAPITAL EXPENDITURES | $ | 4,707 |

| $ | 4,100 |

| $ | 4,772 |

| $ | 3,749 |

| $ | 17,328 |

| $ | 2,670 |

|

| | | | | | | |

| | |

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLES TERMS (in thousands, except earnings per share) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | 2013 | 2014 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| FREE CASH FLOW AS % OF NET INCOME | 14 | % | 75 | % | 167 | % | 167 | % | 116 | % | 98 | % |

| FREE CASH FLOW | $ | 1,100 |

| $ | 9,525 |

| $ | 29,557 |

| $ | 14,696 |

| $ | 54,878 |

| $ | 14,387 |

|

| ADD: | | | | | | |

| Capital Expenditures | 4,707 |

| 4,100 |

| 4,772 |

| 3,749 |

| 17,328 |

| 2,670 |

|

| NET CASH PROVIDED BY OPERATING ACTIVITIES | $ | 5,807 |

| $ | 13,625 |

| $ | 34,329 |

| $ | 18,445 |

| $ | 72,206 |

| $ | 17,057 |

|

| NET DEBT (CASH) | $ | 8,814 |

| $ | (1,376 | ) | $ | (36,466 | ) | $ | (52,637 | ) | $ | (52,637 | ) | $ | (66,056 | ) |

| ADD: |

|

|

|

|

|

|

|

|

|

| |

| Cash & Cash Equivalents | 57,633 |

| 60,831 |

| 86,285 |

| 102,180 |

| 102,180 |

| 122,097 |

|

| Investments | 99 |

| 96 |

| 98 |

| 95 |

| 95 |

| 92 |

|

| TOTAL DEBT | $ | 66,546 |

| $ | 59,551 |

| $ | 49,917 |

| $ | 49,638 |

| $ | 49,638 |

| $ | 56,133 |

|

| DEBT AS % OF EQUITY | 16 | % | 14 | % | 11 | % | 10 | % | 10 | % | 11 | % |

| TOTAL DEBT | 66,546 |

| 59,551 |

| 49,917 |

| 49,638 |

| 49,638 |

| 56,133 |

|

| TOTAL SHAREHOLDERS' EQUITY | 418,819 |

| 432,151 |

| 459,058 |

| 476,887 |

| 476,887 |

| 492,601 |

|

| | | | | | | |

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLES TERMS (in thousands, except earnings per share) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | 2013 | 2014 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| ADJUSTED OPERATING INCOME | $ | 14,528 |

| $ | 22,268 |

| $ | 23,746 |

| $ | 24,751 |

| $ | 85,293 |

| $ | 19,750 |

|

| LESS: | | | | | | |

| Inventory restructuring charges | 250 |

| (242 | ) | — |

| 638 |

| 646 |

| — |

|

| Impairment charges | — |

| — |

| — |

| 6,872 |

| 6,872 |

| — |

|

| Special (recoveries) | — |

| — |

| (3,151 | ) | — |

| (3,151 | ) | (2,243 | ) |

| Special charges | 1,378 |

| 2,254 |

| 2,961 |

| 5,160 |

| 11,753 |

| 1,086 |

|

| OPERATING INCOME | $ | 12,900 |

| $ | 20,256 |

| $ | 23,936 |

| $ | 12,081 |

| $ | 69,173 |

| $ | 20,907 |

|

| ADJUSTED NET INCOME | $ | 9,043 |

| $ | 14,044 |

| $ | 16,439 |

| $ | 16,773 |

| $ | 56,299 |

| $ | 13,916 |

|

| LESS: | | | | | | |

| Inventory restructuring charges, net of tax | 174 |

| (165 | ) | — |

| 396 |

| 405 |

| — |

|

| Impairment charges, net of tax | — |

| — |

| — |

| 4,261 |

| 4,261 |

| — |

|

| Special (recoveries), net of tax | — |

| — |

| (3,151 | ) | — |

| (3,151 | ) | (1,391 | ) |

| Special charges, net of tax | 961 |

| 1,541 |

| 1,870 |

| 3,291 |

| 7,663 |

| 675 |

|

| NET INCOME | $ | 7,908 |

| $ | 12,668 |

| $ | 17,720 |

| $ | 8,825 |

| $ | 47,121 |

| $ | 14,632 |

|

| ADJUSTED EARNINGS PER SHARE | $ | 0.52 |

| $ | 0.81 |

| $ | 0.93 |

| $ | 0.95 |

| $ | 3.21 |

| $ | 0.78 |

|

| LESS: | | | | | | |

| Inventory restructuring charges, net of tax | 0.01 |

| (0.01 | ) | — |

| 0.02 |

| 0.02 |

| — |

|

| Impairment charges, net of tax | — |

| — |

| — |

| 0.24 |

| 0.24 |

| — |

|

| Special (recoveries), net of tax | — |

| — |

| (0.18 | ) | — |

| (0.18 | ) | (0.08 | ) |

| Special charges, net of tax | 0.06 |

| 0.10 |

| 0.11 |

| 0.19 |

| 0.46 |

| 0.04 |

|

| EARNINGS PER COMMON SHARE (Diluted) | $ | 0.45 |

| $ | 0.72 |

| $ | 1.00 |

| $ | 0.50 |

| $ | 2.67 |

| $ | 0.82 |

|

| | | | | | | |

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLES TERMS (in thousands, except earnings per share) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | 2013 | 2014 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| EBITDA | $ | 17,054 |

| $ | 24,407 |

| $ | 23,368 |

| $ | 11,914 |

| $ | 86,272 |

| $ | 26,230 |

|

| LESS: | | | | | | |

| Interest expense, net | (787 | ) | (838 | ) | (745 | ) | (792 | ) | (3,162 | ) | (918 | ) |

| Depreciation | (4,009 | ) | (4,026 | ) | (3,908 | ) | (4,091 | ) | (16,034 | ) | (4,069 | ) |

| Amortization | (758 | ) | (751 | ) | (764 | ) | (766 | ) | (3,039 | ) | (786 | ) |

| Provision for income taxes | (3,592 | ) | (6,124 | ) | (4,903 | ) | (2,297 | ) | (16,916 | ) | (5,825 | ) |

| NET INCOME | $ | 7,908 |

| $ | 12,668 |

| $ | 17,720 |

| $ | 8,825 |

| $ | 47,121 |

| $ | 14,632 |

|

| ADJUSTED EBITDA | $ | 18,682 |

| $ | 26,419 |

| $ | 27,850 |

| $ | 29,441 |

| $ | 102,392 |

| $ | 27,387 |

|

| Inventory restructuring charges | (250 | ) | 242 |

| — |

| (638 | ) | (646 | ) | — |

|

| Impairment charges | — |

| — |

| — |

| (6,872 | ) | (6,872 | ) | — |

|

| Special (recoveries) | — |

| — |

| 3,151 |

| — |

| 3,151 |

| (2,243 | ) |

| Special charges | (1,378 | ) | (2,254 | ) | (2,961 | ) | (5,160 | ) | (11,753 | ) | 1,086 |

|

| Interest expense, net | (787 | ) | (838 | ) | (745 | ) | (792 | ) | (3,162 | ) | (918 | ) |

| Depreciation | (4,009 | ) | (4,026 | ) | (3,908 | ) | (4,091 | ) | (16,034 | ) | (4,069 | ) |

| Amortization | (758 | ) | (751 | ) | (764 | ) | (766 | ) | (3,039 | ) | (786 | ) |

| Provision for income taxes | (3,592 | ) | (6,124 | ) | (4,903 | ) | (2,297 | ) | (16,916 | ) | (5,825 | ) |

| NET INCOME | $ | 7,908 |

| $ | 12,668 |

| $ | 17,720 |

| $ | 8,825 |

| $ | 47,121 |

| $ | 14,632 |

|

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF FUTURE PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS UNAUDITED |

| | | | | | | | |

| | | 2nd Quarter 2014 |

| | | Low | | High |

| REVENUE (in millions) | | $ | 220 |

| | $ | 230 |

|

| | | | | |

| EXPECTED ADJUSTED EARNINGS PER SHARE (DILUTIVE) | | $ | 0.88 |

| | $ | 0.94 |

|

| LESS: | | | | |

| Restructuring related charges | } | $ | 0.25 |

| | $ | 0.21 |

|

| Special charges |

| EXPECTED EARNINGS PER COMMON SHARE (Diluted) | | $ | 0.63 |

| | $ | 0.73 |

|

| | | | | |

| Note: Assumes 26% - 27% tax rate and exchange rates at present values. | | | | |