EXHIBIT 99.1

CIRCOR Reports Fourth-Quarter and Year-End 2016 Financial Results

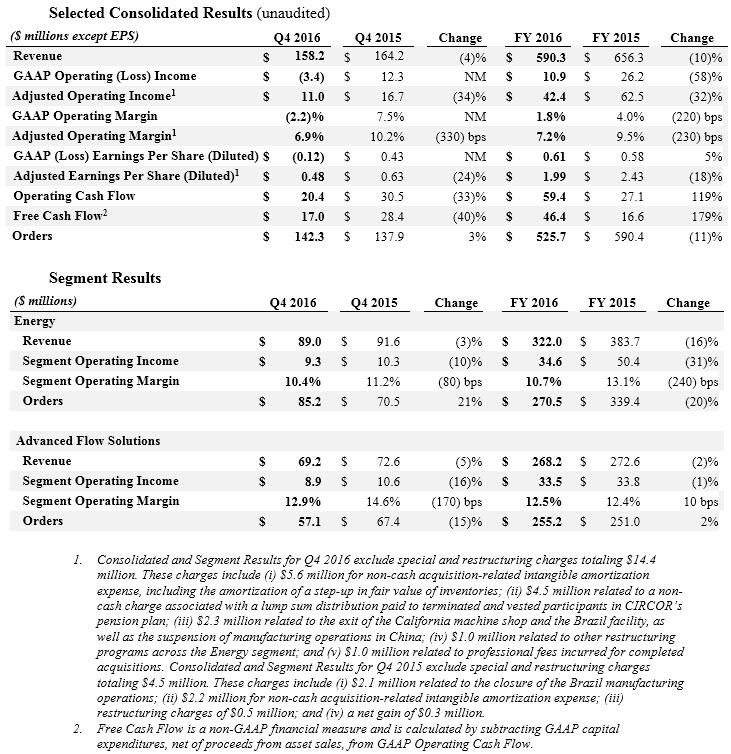

Burlington, MA - February 16, 2017 - CIRCOR International, Inc. (NYSE: CIR), a leading provider of flow control solutions and other highly engineered products for markets including oil & gas, aerospace, power, process and industrial solutions, today announced financial results for the fourth quarter and year ended December 31, 2016.

Fourth-Quarter 2016 Highlights

| |

| • | Revenue of $158 million, GAAP EPS of ($0.12) and Adjusted EPS of $0.48 |

| |

| • | Operating Cash Flow of $20 million and Free Cash Flow of $17 million |

| |

| • | Critical Flow Solutions integration progressing well |

| |

| • | Orders in short-cycle North America market strengthening |

| |

| • | Cost control and restructuring actions continuing to drive bottom-line performance |

“CIRCOR concluded 2016 with solid fourth-quarter performance delivering revenue of $158 million and adjusted earnings per share of $0.48,” said Scott Buckhout, President and Chief Executive Officer. “We were pleased with the quarter, especially the impact of our simplification program and the improvement in our North America short-cycle order trend. In addition, the integration of Critical Flow Solutions is progressing as planned.”

“During the fourth quarter, we formed the Advanced Flow Solutions group to drive better top-line growth by aligning our organization with end markets,” added Buckhout. “AFS serves as a diversified flow technology platform that will expand our penetration into the aerospace, power, process and industrial markets.”

“As we enter 2017, we are optimistic about the market outlook across the majority of our businesses and we anticipate that our simplification and operational excellence actions will continue to benefit the bottom line. We remain focused on building shareholder value through top-line growth, margin expansion, strong cash flow and disciplined capital deployment,” concluded Buckhout.

First-Quarter 2017 Guidance

The Company will provide its guidance for the first quarter of 2017 during the conference call later today.

Press Release

Conference Call Information

CIRCOR International will hold a conference call to review its financial results today, February 16, 2017, at 10:00 a.m. ET. To listen to the conference call and view the accompanying presentation slides, visit “Webcasts & Presentations” in the “Investors” portion of the CIRCOR website. The call also can be accessed by dialing (877) 407-5790 or (201) 689-8328. The webcast will be archived for one year on the Company’s website.

Use of Non-GAAP Financial Measures

Adjusted operating income, Adjusted operating margin, Adjusted net income, Adjusted earnings per share (diluted), EBITDA, Adjusted EBITDA, net debt and free cash flow are non-GAAP financial measures. These non-GAAP financial measures are used by management in our financial and operating decision making because we believe they better reflect our ongoing business and allow for meaningful period-to-period comparisons. We believe these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating the Company’s current operating performance and future prospects in the same manner as management does, if they so choose. These non-GAAP financial measures also allow investors and others to compare the Company’s current financial results with the Company’s past financial results in a consistent manner. For example:

| |

| • | We exclude costs and tax effects associated with restructuring activities, such as reducing overhead and consolidating facilities. We believe that the costs related to these restructuring activities are not indicative of our normal operating costs. |

| |

| • | We exclude certain acquisition-related costs, including significant transaction costs and amortization of inventory step-ups and the related tax effects. We exclude these costs because we do not believe they are indicative of our normal operating costs. |

| |

| • | We exclude the expense and tax effects associated with the non-cash amortization of acquisition-related intangible assets because a significant portion of the purchase price for acquisitions may be allocated to intangible assets that have lives of 5 to 20 years. Exclusion of the non-cash amortization expense allows comparisons of operating results that are consistent over time for both our newly acquired and long-held businesses and with both acquisitive and non-acquisitive peer companies. |

| |

| • | We also exclude certain gains/losses and related tax effects, which are either isolated or cannot be expected to occur again with any predictability, and that we believe are not indicative of our normal operating gains and losses. For example, we exclude gains/losses from items such as the sale of a business, significant litigation-related matters and lump-sum pension plan settlements. |

CIRCOR’s management uses these non-GAAP measures, in addition to GAAP financial measures, as the basis for measuring the Company’s operating performance and comparing such performance to that of prior periods and to the performance of our competitors. We use such measures when publicly providing our business outlook, assessing future earnings potential, evaluating potential acquisitions and dispositions and in our financial and operating decision-making process, including for compensation purposes.

Investors should recognize that these non-GAAP measures might not be comparable to similarly titled measures of other companies. These measures should be considered in addition and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with accounting principles generally accepted in the United States. A reconciliation of the non-GAAP financial measures to the most directly comparable GAAP measures is available in this news release.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Reliance should not be placed on forward-looking statements because they involve unknown risks, uncertainties and other factors, which are, in some cases, beyond the control of CIRCOR. Any statements in this press release that are not statements of historical fact are forward-looking statements, including, but not limited to, those relating to CIRCOR’s future performance, including the realization of cost reductions from restructuring activities. Actual events, performance or results could differ materially from the anticipated events, performance or results expressed or implied by such

forward-looking statements. BEFORE MAKING ANY INVESTMENT DECISIONS REGARDING OUR COMPANY, WE STRONGLY ADVISE YOU TO READ THE SECTION ENTITLED "RISK FACTORS" IN OUR MOST RECENT ANNUAL REPORT ON FORM 10-K AND SUBSEQUENT REPORTS ON FORMS 10-Q, WHICH CAN BE ACCESSED UNDER THE "INVESTORS" LINK OF OUR WEBSITE AT WWW.CIRCOR.COM. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

About CIRCOR International, Inc.

CIRCOR International, Inc. designs, manufactures and markets flow control solutions and other highly engineered products and sub-systems for markets including oil & gas, aerospace, power, process and industrial solutions. CIRCOR has a diversified product portfolio with recognized, market-leading brands that fulfill its customers’ unique application needs. The Company’s strategy is to grow organically and through complementary acquisitions; simplify CIRCOR’s operations; achieve world class operational excellence; and attract and retain top industry talent. For more information, visit the Company’s investor relations website at http://investors.circor.com.

Contact:

Rajeev Bhalla

Executive Vice President & Chief Financial Officer

CIRCOR International

(781) 270-1200

CIRCOR INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF (LOSS) INCOME (in thousands, except per share data) UNAUDITED |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, 2016 | | December 31, 2015 | | December 31, 2016 | | December 31, 2015 |

| Net revenues | $ | 158,236 |

| | $ | 164,243 |

| | $ | 590,259 |

| | $ | 656,267 |

|

| Cost of revenues | 109,139 |

| | 113,747 |

| | 407,144 |

| | 456,935 |

|

| GROSS PROFIT | 49,097 |

| | 50,496 |

| | 183,115 |

| | 199,332 |

|

| Selling, general and administrative expenses | 44,528 |

| | 36,959 |

| | 154,818 |

| | 156,302 |

|

| Impairment charges | — |

| | — |

| | 208 |

| | 2,502 |

|

| Special and restructuring charges, net | 8,006 |

| | 1,256 |

| | 17,171 |

| | 14,354 |

|

| OPERATING (LOSS) INCOME | (3,437 | ) | | 12,281 |

| | 10,918 |

| | 26,174 |

|

| Other expense (income): | | | | | | | |

| Interest expense, net | 1,468 |

| | 570 |

| | 3,310 |

| | 2,844 |

|

| Other (income) expense, net | (1,157 | ) | | 2,099 |

| | (2,072 | ) | | 902 |

|

| TOTAL OTHER EXPENSE, NET | 311 |

| | 2,669 |

| | 1,238 |

| | 3,746 |

|

| (LOSS) INCOME BEFORE INCOME TAXES | (3,748 | ) | | 9,612 |

| | 9,680 |

| | 22,428 |

|

| (Benefit from) Provision for income taxes | (1,746 | ) | | 2,456 |

| | (421 | ) | | 12,565 |

|

| NET (LOSS) INCOME | $ | (2,002 | ) | | $ | 7,156 |

| | $ | 10,101 |

| | $ | 9,863 |

|

| (Loss) Earnings per common share: | | | | | | | |

| Basic | $ | (0.12 | ) | | $ | 0.44 |

| | $ | 0.62 |

| | $ | 0.59 |

|

| Diluted | $ | (0.12 | ) | | $ | 0.43 |

| | $ | 0.61 |

| | $ | 0.58 |

|

| Weighted average number of common shares outstanding: | | | | | | | |

| Basic | 16,439 |

| | 16,425 |

| | 16,418 |

| | 16,850 |

|

| Diluted | 16,439 |

| | 16,555 |

| | 16,536 |

| | 16,913 |

|

| Dividends declared per common share | $ | 0.0375 |

| | $ | 0.0375 |

| | $ | 0.1500 |

| | $ | 0.1500 |

|

CIRCOR INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) UNAUDITED |

| | | | | | | |

| | Twelve Months Ended |

| | December 31, 2016 | | December 31, 2015 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 10,101 |

|

| $ | 9,863 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation | 13,304 |

| | 14,254 |

|

| Amortization | 12,316 |

| | 9,681 |

|

| Bad debt expense | 2,330 |

| | 2,561 |

|

| Loss on write down of inventory | 9,297 |

| | 15,404 |

|

| Compensation expense of share-based plans | 5,545 |

| | 6,579 |

|

| Tax effect of share-based plan compensation | 145 |

| | (134 | ) |

| Pension settlement charge | 4,457 |

| | — |

|

| Deferred income tax (benefit) expense | (10,737 | ) | | 781 |

|

| Loss on sale or write down of property, plant and equipment | 3,708 |

| | 305 |

|

| Impairment charges | 208 |

| | 2,502 |

|

| Gain on sale of business | — |

| | (1,044 | ) |

| Changes in operating assets and liabilities, net of effects of acquisition and disposition: | | | |

| Trade accounts receivable | 29,322 |

| | 20,393 |

|

| Inventories | 36,092 |

| | (14,446 | ) |

| Prepaid expenses and other assets | (8,332 | ) | | (4,786 | ) |

| Accounts payable, accrued expenses and other liabilities | (48,357 | ) | | (34,771 | ) |

| Net cash provided by operating activities | 59,399 |

| | 27,142 |

|

| INVESTING ACTIVITIES | | | |

| Purchases of property, plant and equipment | (14,692 | ) | | (12,711 | ) |

| Proceeds from the sale of property, plant and equipment | 1,700 |

| | 2,209 |

|

| Proceeds from divestitures | — |

| | 2,759 |

|

| Business acquisition, net of cash acquired | (197,489 | ) | | (79,983 | ) |

| Net cash used in investing activities | (210,481 | ) | | (87,726 | ) |

| FINANCING ACTIVITIES | | | |

| Proceeds from long-term debt | 323,200 |

| | 261,394 |

|

| Payments of long-term debt | (162,540 | ) | | (182,004 | ) |

| Dividends paid | (2,497 | ) | | (2,559 | ) |

| Proceeds from the exercise of stock options | 246 |

| | 258 |

|

| Tax effect of share-based plan compensation | (145 | ) | | 134 |

|

| Sales (purchases) of common stock | 500 |

| | (74,972 | ) |

| Net cash provided by financing activities | 158,764 |

| | 2,251 |

|

| Effect of exchange rate changes on cash and cash equivalents | (3,944 | ) | | (8,498 | ) |

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 3,738 |

| | (66,831 | ) |

| Cash and cash equivalents at beginning of period | 54,541 |

| | 121,372 |

|

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 58,279 |

| | $ | 54,541 |

|

CIRCOR INTERNATIONAL, INC. CONSOLIDATED BALANCE SHEETS (in thousands) UNAUDITED |

| | | | | | | |

| | December 31, 2016 | | December 31, 2015 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 58,279 |

| | $ | 54,541 |

|

| Trade accounts receivable, less allowance for doubtful accounts of $5,056 and $8,290, respectively | 133,046 |

| | 125,628 |

|

| Inventories | 149,584 |

| | 177,840 |

|

| Prepaid expenses and other current assets | 29,557 |

| | 16,441 |

|

| Total Current Assets | 370,466 |

| | 374,450 |

|

| PROPERTY, PLANT AND EQUIPMENT, NET | 99,713 |

| | 87,029 |

|

| OTHER ASSETS: | | | |

| Goodwill | 206,659 |

| | 115,452 |

|

| Intangibles, net | 135,778 |

| | 48,981 |

|

| Deferred income taxes | 4,824 |

| | 36,799 |

|

| Other assets | 3,316 |

| | 7,204 |

|

| TOTAL ASSETS | $ | 820,756 |

| | $ | 669,915 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 46,767 |

| | $ | 64,284 |

|

| Accrued expenses and other current liabilities | 50,707 |

| | 59,463 |

|

| Accrued compensation and benefits | 20,249 |

| | 18,424 |

|

| Total Current Liabilities | 117,723 |

| | 142,171 |

|

| LONG-TERM DEBT | 251,200 |

| | 90,500 |

|

| DEFERRED INCOME TAXES | 13,657 |

| | 10,424 |

|

| OTHER NON-CURRENT LIABILITIES | 33,766 |

| | 26,043 |

|

| SHAREHOLDERS’ EQUITY: | | | |

| Common stock | 178 |

| | 177 |

|

| Additional paid-in capital | 289,423 |

| | 283,621 |

|

| Retained earnings | 265,543 |

| | 257,939 |

|

| Common treasury stock, at cost | (74,472 | ) | | (74,972 | ) |

| Accumulated other comprehensive loss, net of tax | (76,262 | ) | | (65,988 | ) |

| Total Shareholders’ Equity | 404,410 |

| | 400,777 |

|

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 820,756 |

| | $ | 669,915 |

|

CIRCOR INTERNATIONAL, INC. SUMMARY OF ORDERS AND BACKLOG (in millions) UNAUDITED |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2016 | | December 31,

2015 | | December 31,

2016 | | December 31,

2015 |

ORDERS (1) (3) | | | | | | | |

| Energy | $ | 85.2 |

| | $ | 70.5 |

| | $ | 270.5 |

| | $ | 339.4 |

|

| Advanced Flow Solutions | 57.1 |

| | 67.4 |

| | 255.2 |

| | 251.0 |

|

| Total orders | $ | 142.3 |

| | $ | 137.9 |

| | $ | 525.7 |

| | $ | 590.4 |

|

| | | | | | | | |

BACKLOG (2) (3) | December 31,

2016 | | December 31,

2015 | | | | |

| Energy | $ | 123.1 |

| | $ | 131.6 |

| | | | |

| Advanced Flow Solutions | 119.3 |

| | 137.4 |

| | | | |

| Total backlog | $ | 242.4 |

| | $ | 269.0 |

| | | | |

| | | | | | | | |

| Note 1: Orders do not include the foreign exchange impact due to the re-measurement of customer order backlog amounts denominated in foreign currencies. |

| Note 2: Backlog includes unshipped customer orders, including backlog associated with acquisitions. |

| Note 3: December 31, 2015 segment amounts restated for Q4 2016 organizational realignment. |

CIRCOR INTERNATIONAL, INC. SEGMENT INFORMATION (in thousands, except percentages) UNAUDITED |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | 2015 | 2016 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL |

| NET REVENUES | | | | | | | | | | |

| Energy | $ | 105,619 |

| $ | 97,753 |

| $ | 88,679 |

| $ | 91,604 |

| $ | 383,655 |

| $ | 83,409 |

| $ | 80,736 |

| $ | 68,901 |

| $ | 89,000 |

| $ | 322,046 |

|

| Advanced Flow Solutions | 60,241 |

| 69,153 |

| 70,579 |

| 72,639 |

| 272,612 |

| 67,389 |

| 65,656 |

| 65,932 |

| 69,236 |

| 268,213 |

|

| Total | $ | 165,860 |

| $ | 166,906 |

| $ | 159,258 |

| $ | 164,243 |

| $ | 656,267 |

| $ | 150,798 |

| $ | 146,392 |

| $ | 134,833 |

| $ | 158,236 |

| $ | 590,259 |

|

| | | | | | | | | | | |

| SEGMENT OPERATING INCOME | | | | | | | | | | |

| Energy | $ | 15,011 |

| $ | 12,926 |

| $ | 12,153 |

| $ | 10,296 |

| $ | 50,386 |

| $ | 9,296 |

| $ | 9,293 |

| $ | 6,755 |

| $ | 9,276 |

| $ | 34,619 |

|

| Advanced Flow Solutions | 5,584 |

| 7,576 |

| 10,077 |

| 10,574 |

| 33,811 |

| 8,452 |

| 8,064 |

| 8,008 |

| 8,939 |

| 33,463 |

|

| Corporate expenses | (6,034 | ) | (5,477 | ) | (6,078 | ) | (4,122 | ) | (21,710 | ) | (6,488 | ) | (5,431 | ) | (6,522 | ) | (7,231 | ) | (25,672 | ) |

| Adjusted Operating Income | $ | 14,561 |

| $ | 15,025 |

| $ | 16,152 |

| $ | 16,748 |

| $ | 62,487 |

| $ | 11,260 |

| $ | 11,926 |

| $ | 8,240 |

| $ | 10,984 |

| $ | 42,410 |

|

| | | | | | | | | | | |

| SEGMENT OPERATING MARGIN % | | | | | | | | | | |

| Energy | 14.2 | % | 13.2 | % | 13.7 | % | 11.2 | % | 13.1 | % | 11.1 | % | 11.5 | % | 9.8 | % | 10.4 | % | 10.7 | % |

| Advanced Flow Solutions | 9.3 | % | 11.0 | % | 14.3 | % | 14.6 | % | 12.4 | % | 12.5 | % | 12.3 | % | 12.1 | % | 12.9 | % | 12.5 | % |

| Adjusted Operating Margin | 8.8 | % | 9.0 | % | 10.1 | % | 10.2 | % | 9.5 | % | 7.5 | % | 8.1 | % | 6.1 | % | 6.9 | % | 7.2 | % |

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS (in thousands, except percentages) UNAUDITED |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL |

| NET CASH (USED IN) PROVIDED BY OPERATING ACTIVITIES | $ | (16,432 | ) | $ | 8,067 |

| $ | 5,006 |

| $ | 30,501 |

| $ | 27,142 |

| $ | 7,654 |

| $ | 10,100 |

| $ | 21,196 |

| $ | 20,449 |

| $ | 59,399 |

|

| LESS: | | | | | | | | | | |

| Capital expenditures, net of sale proceeds | 1,983 |

| 3,584 |

| 2,837 |

| 2,098 |

| 10,502 |

| 3,934 |

| 1,926 |

| 3,730 |

| 3,402 |

| 12,992 |

|

| FREE CASH FLOW | $ | (18,415 | ) | $ | 4,483 |

| $ | 2,169 |

| $ | 28,403 |

| $ | 16,640 |

| $ | 3,720 |

| $ | 8,174 |

| $ | 17,466 |

| $ | 17,047 |

| $ | 46,407 |

|

| TOTAL DEBT | $ | 37,546 |

| $ | 114,078 |

| $ | 111,099 |

| $ | 90,500 |

| $ | 90,500 |

| $ | 97,800 |

| $ | 97,600 |

| $ | 92,400 |

| $ | 251,200 |

| $ | 251,200 |

|

| LESS: | | | | | | | | | |

|

|

| Cash & cash equivalents | 103,883 |

| 55,027 |

| 53,822 |

| 54,541 |

| 54,541 |

| 66,580 |

| 72,970 |

| 84,929 |

| 58,279 |

| 58,279 |

|

| NET (CASH) DEBT | $ | (66,337 | ) | $ | 59,051 |

| $ | 57,277 |

| $ | 35,959 |

| $ | 35,959 |

| $ | 31,220 |

| $ | 24,630 |

| $ | 7,471 |

| $ | 192,921 |

| $ | 192,921 |

|

| TOTAL SHAREHOLDERS' EQUITY | $ | 462,384 |

| $ | 421,070 |

| $ | 407,979 |

| $ | 400,777 |

| $ | 400,777 |

| $ | 414,107 |

| $ | 411,367 |

| $ | 416,598 |

| $ | 404,410 |

| $ | 404,410 |

|

| | | | | | | | | | | |

| TOTAL DEBT AS % OF EQUITY | 8 | % | 27 | % | 27 | % | 23 | % | 23 | % | 24 | % | 24 | % | 22 | % | 62 | % | 62 | % |

| NET DEBT AS % OF EQUITY | (14 | )% | 14 | % | 14 | % | 9 | % | 9 | % | 8 | % | 6 | % | 2 | % | 48 | % | 48 | % |

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS (in thousands, except per share data) UNAUDITED |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL |

| NET INCOME (LOSS) | $ | 8,913 |

| $ | 1,872 |

| $ | (8,078 | ) | $ | 7,156 |

| $ | 9,863 |

| $ | 3,872 |

| $ | 3,813 |

| $ | 4,418 |

| $ | (2,002 | ) | $ | 10,101 |

|

| LESS: | |

|

|

|

| |

|

| | | | | |

| Restructuring related inventory charges | — |

| 2,005 |

| 6,412 |

| 974 |

| 9,391 |

| 1,958 |

| 75 |

| — |

| 813 |

| 2,846 |

|

| Amortization of inventory step-up | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| 1,366 |

| 1,366 |

|

| Impairment charges | — |

| — |

| 2,502 |

| — |

| 2,502 |

| — |

| — |

| 208 |

| — |

| 208 |

|

| Restructuring charges, net | 1,512 |

| 3,127 |

| 342 |

| (347 | ) | 4,634 |

| 1,163 |

| 3,259 |

| 2,252 |

| 2,301 |

| 8,975 |

|

| Acquisition intangible amortization | — |

| 2,110 |

| 2,490 |

| 2,238 |

| 6,838 |

| 1,868 |

| 1,911 |

| 1,888 |

| 4,234 |

| 9,901 |

|

| Special charges, net | (1 | ) | 183 |

| 7,935 |

| 1,603 |

| 9,720 |

| 776 |

| 1,334 |

| 379 |

| 5,707 |

| 8,196 |

|

| Brazil restatement impact | 719 |

| 2,509 |

| — |

| — |

| 3,228 |

| — |

| — |

| — |

| — |

| — |

|

| Income tax impact | (579 | ) | (2,449 | ) | (968 | ) | (1,112 | ) | (5,108 | ) | (954 | ) | (1,611 | ) | (1,519 | ) | (4,487 | ) | (8,571 | ) |

| ADJUSTED NET INCOME | $ | 10,564 |

| $ | 9,357 |

| $ | 10,635 |

| $ | 10,512 |

| $ | 41,068 |

| $ | 8,683 |

| $ | 8,781 |

| $ | 7,626 |

| $ | 7,932 |

| $ | 33,022 |

|

| | | | | | | | | | | |

| EARNINGS (LOSS) PER COMMON SHARE (Diluted) | $ | 0.50 |

| $ | 0.11 |

| $ | (0.49 | ) | $ | 0.43 |

| $ | 0.58 |

| $ | 0.23 |

| $ | 0.23 |

| $ | 0.27 |

| $ | (0.12 | ) | $ | 0.61 |

|

| LESS: | | | | | | | | | | |

| Restructuring related inventory charges | — |

| 0.12 |

| 0.39 |

| 0.06 |

| 0.57 |

| 0.12 |

| — |

| — |

| 0.05 |

| 0.17 |

|

| Amortization of inventory step-up | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| 0.08 |

| 0.08 |

|

| Impairment charges | — |

| — |

| 0.15 |

| — |

| 0.15 |

| — |

| — |

| 0.01 |

| — |

| 0.01 |

|

| Restructuring charges, net | 0.09 |

| 0.19 |

| 0.02 |

| (0.02 | ) | 0.28 |

| 0.07 |

| 0.20 |

| 0.14 |

| 0.14 |

| 0.54 |

|

| Acquisition intangible amortization | — |

| 0.12 |

| 0.15 |

| 0.14 |

| 0.41 |

| 0.11 |

| 0.12 |

| 0.11 |

| 0.26 |

| 0.60 |

|

| Special charges, net | — |

| 0.01 |

| 0.48 |

| 0.10 |

| 0.59 |

| 0.05 |

| 0.08 |

| 0.02 |

| 0.35 |

| 0.50 |

|

| Brazil restatement impact | 0.04 |

| 0.15 |

| — |

| — |

| 0.19 |

| — |

| — |

| — |

| — |

| — |

|

| Income tax impact | (0.03 | ) | (0.15 | ) | (0.06 | ) | (0.07 | ) | (0.31 | ) | (0.06 | ) | (0.10 | ) | (0.09 | ) | (0.27 | ) | (0.52 | ) |

| ADJUSTED EARNINGS PER SHARE (Diluted) | $ | 0.60 |

| $ | 0.55 |

| $ | 0.64 |

| $ | 0.63 |

| $ | 2.43 |

| $ | 0.52 |

| $ | 0.53 |

| $ | 0.46 |

| $ | 0.48 |

| $ | 1.99 |

|

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS (in thousands) UNAUDITED |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL |

| NET INCOME (LOSS) | $ | 8,913 |

| $ | 1,872 |

| $ | (8,078 | ) | $ | 7,156 |

| $ | 9,863 |

| $ | 3,872 |

| $ | 3,813 |

| $ | 4,418 |

| $ | (2,002 | ) | $ | 10,101 |

|

| LESS: | | | | | | | | | | |

| Interest expense, net | (641 | ) | (805 | ) | (828 | ) | (570 | ) | (2,844 | ) | (631 | ) | (605 | ) | (605 | ) | (1,468 | ) | (3,310 | ) |

| Depreciation | (3,521 | ) | (3,629 | ) | (3,526 | ) | (3,578 | ) | (14,254 | ) | (3,263 | ) | (3,213 | ) | (3,138 | ) | (3,690 | ) | (13,304 | ) |

| Amortization | (710 | ) | (2,827 | ) | (3,205 | ) | (2,939 | ) | (9,681 | ) | (2,529 | ) | (2,569 | ) | (2,488 | ) | (4,730 | ) | (12,316 | ) |

| (Provision for) benefit from income taxes | (3,284 | ) | (2,517 | ) | (4,308 | ) | (2,456 | ) | (12,565 | ) | (1,520 | ) | (1,478 | ) | 1,673 |

| 1,746 |

| 421 |

|

| EBITDA | $ | 17,068 |

| $ | 11,650 |

| $ | 3,789 |

| $ | 16,698 |

| $ | 49,206 |

| $ | 11,815 |

| $ | 11,678 |

| $ | 8,976 |

| $ | 6,140 |

| $ | 38,610 |

|

| LESS: | | | | | | | | | | |

| Restructuring related inventory charges | — |

| (2,005 | ) | (6,412 | ) | (974 | ) | (9,391 | ) | (1,958 | ) | (75 | ) | — |

| (813 | ) | (2,846 | ) |

| Amortization of inventory step-up | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| (1,366 | ) | (1,366 | ) |

| Impairment charges | — |

| — |

| (2,502 | ) | — |

| (2,502 | ) | — |

| — |

| (208 | ) | — |

| (208 | ) |

| Restructuring charges, net | (1,512 | ) | (3,127 | ) | (342 | ) | 347 |

| (4,634 | ) | (1,163 | ) | (3,259 | ) | (2,252 | ) | (2,301 | ) | (8,975 | ) |

| Special charges, net | 1 |

| (183 | ) | (7,935 | ) | (1,603 | ) | (9,720 | ) | (776 | ) | (1,334 | ) | (379 | ) | (5,707 | ) | (8,196 | ) |

| Brazil restatement impact | (719 | ) | (2,509 | ) | — |

| — |

| (3,228 | ) | — |

| — |

| — |

| — |

| — |

|

| ADJUSTED EBITDA | $ | 19,298 |

| $ | 19,474 |

| $ | 20,980 |

| $ | 18,928 |

| $ | 78,681 |

| $ | 15,712 |

| $ | 16,346 |

| $ | 11,815 |

| $ | 16,327 |

| $ | 60,201 |

|

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS (in thousands, except percentages) UNAUDITED |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL |

| GAAP OPERATING INCOME (LOSS) | $ | 12,331 |

| $ | 5,090 |

| $ | (3,529 | ) | $ | 12,281 |

| $ | 26,174 |

| $ | 5,495 |

| $ | 5,347 |

| $ | 3,513 |

| $ | (3,437 | ) | $ | 10,918 |

|

| LESS: | | | | | | | | | | |

| Restructuring related inventory charges | — |

| 2,005 |

| 6,412 |

| 974 |

| 9,391 |

| 1,958 |

| 75 |

| — |

| 813 |

| 2,846 |

|

| Amortization of inventory step-up | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| 1,366 |

| 1,366 |

|

| Impairment charges | — |

| — |

| 2,502 |

| — |

| 2,502 |

| — |

| — |

| 208 |

| — |

| 208 |

|

| Restructuring charges, net | 1,512 |

| 3,127 |

| 342 |

| (347 | ) | 4,634 |

| 1,163 |

| 3,259 |

| 2,252 |

| 2,301 |

| 8,975 |

|

| Acquisition intangible amortization | — |

| 2,110 |

| 2,490 |

| 2,238 |

| 6,838 |

| 1,868 |

| 1,911 |

| 1,888 |

| 4,234 |

| 9,901 |

|

| Special charges, net | (1 | ) | 183 |

| 7,935 |

| 1,603 |

| 9,720 |

| 776 |

| 1,334 |

| 379 |

| 5,707 |

| 8,196 |

|

| Brazil restatement impact | 719 |

| 2,509 |

| — |

| — |

| 3,228 |

| — |

| — |

| — |

| — |

| — |

|

| ADJUSTED OPERATING INCOME | $ | 14,561 |

| $ | 15,025 |

| $ | 16,152 |

| $ | 16,748 |

| $ | 62,487 |

| $ | 11,260 |

| $ | 11,926 |

| $ | 8,240 |

| $ | 10,984 |

| $ | 42,410 |

|

| | | | | | | | | | | |

| GAAP OPERATING MARGIN | 7.4 | % | 3.0 | % | (2.2 | )% | 7.5 | % | 4.0 | % | 3.6 | % | 3.7 | % | 2.6 | % | (2.2 | )% | 1.8 | % |

| LESS: | | | | | | | | | | |

| Restructuring related inventory charges | —% |

| 1.2 | % | 4.0 | % | 0.6 | % | 1.4 | % | 1.3 | % | 0.1 | % | —% |

| 0.5 | % | 0.5 | % |

| Amortization of inventory step-up | —% |

| —% |

| —% |

| —% |

| —% |

| —% |

| —% |

| —% |

| 0.9 | % | 0.2 | % |

| Impairment charges | —% |

| —% |

| 1.6 | % | —% |

| 0.4 | % | —% |

| —% |

| 0.2 | % | — | % | — | % |

| Restructuring charges, net | 0.9 | % | 1.9 | % | 0.2 | % | (0.2 | )% | 0.7 | % | 0.8 | % | 2.2 | % | 1.7 | % | 1.5 | % | 1.5 | % |

| Acquisition intangible amortization | —% |

| 1.3 | % | 1.6 | % | 1.4 | % | 1.0 | % | 1.2 | % | 1.3 | % | 1.4 | % | 2.7 | % | 1.7 | % |

| Special charges, net | —% |

| 0.1 | % | 5.0 | % | 1.0 | % | 1.5 | % | 0.5 | % | 0.9 | % | 0.3 | % | 3.6 | % | 1.4 | % |

| Brazil restatement impact | 0.4 | % | 1.5 | % | —% |

| —% |

| 0.5 | % | —% |

| —% |

| —% |

| — | % | — | % |

| ADJUSTED OPERATING MARGIN | 8.8 | % | 9.0 | % | 10.1 | % | 10.2 | % | 9.5 | % | 7.5 | % | 8.1 | % | 6.1 | % | 6.9 | % | 7.2 | % |