C O M B I N E D F I N A N C I A L S T A T E M E N T S Colfax Fluid Handling December 31, 2016, 2015, and 2014 With Report of Independent Auditors

1 INDEX TO THE COMBINED FINANCIAL STATEMENTS Page Report of Independent Auditors 2 Combined Statements of Operations 3 Combined Statements of Comprehensive Income (Loss) 4 Combined Balance Sheets 5 Combined Statements of Changes in Equity 6 Combined Statements of Cash Flows 7 Notes to Combined Financial Statements 8 Note 1. Organization and Nature of Operations 8 Note 2. Summary of Significant Accounting Policies 8 Note 3. Recently Issued Accounting Pronouncements 13 Note 4. Income Taxes 14 Note 5. Goodwill and Intangible Assets 17 Note 6. Property, Plant and Equipment, Net 18 Note 7. Inventories, Net 18 Note 8. Accrued Liabilities 19 Note 9. Defined Benefit Plans 20 Note 10. Financial Instruments and Fair Value Measurements 23 Note 11. Commitments and Contingencies 25 Note 12. Components of Accumulated Other Comprehensive Income 28 Note 13. Related Party Transactions 29 Note 14. Subsequent Events - Divestiture Transaction 29

A member firm of Ernst & Young Global Limited Ernst & Young LLP 621 East Pratt Street Baltimore, MD 21202 Tel: +1 410 539 7940 Fax: +1 410 783 3832 ey.com 2 Report of Independent Auditors The Management of Colfax Corporation We have audited the accompanying combined financial statements of Colfax Fluid Handling (a division of Colfax Corporation), which comprise the combined balance sheets as of December 31, 2016 and 2015, and the related combined statements of operations, comprehensive income (loss), changes in equity and cash flows for each of the three years in the period ended December 31, 2016, and the related notes to the combined financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in conformity with U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the combined financial position of Colfax Fluid Handling at December 31, 2016 and 2015, and the combined results of its operations and its cash flows for each of the three years in the period ended December 31, 2016 in conformity with U.S. generally accepted accounting principles. October 31, 2017

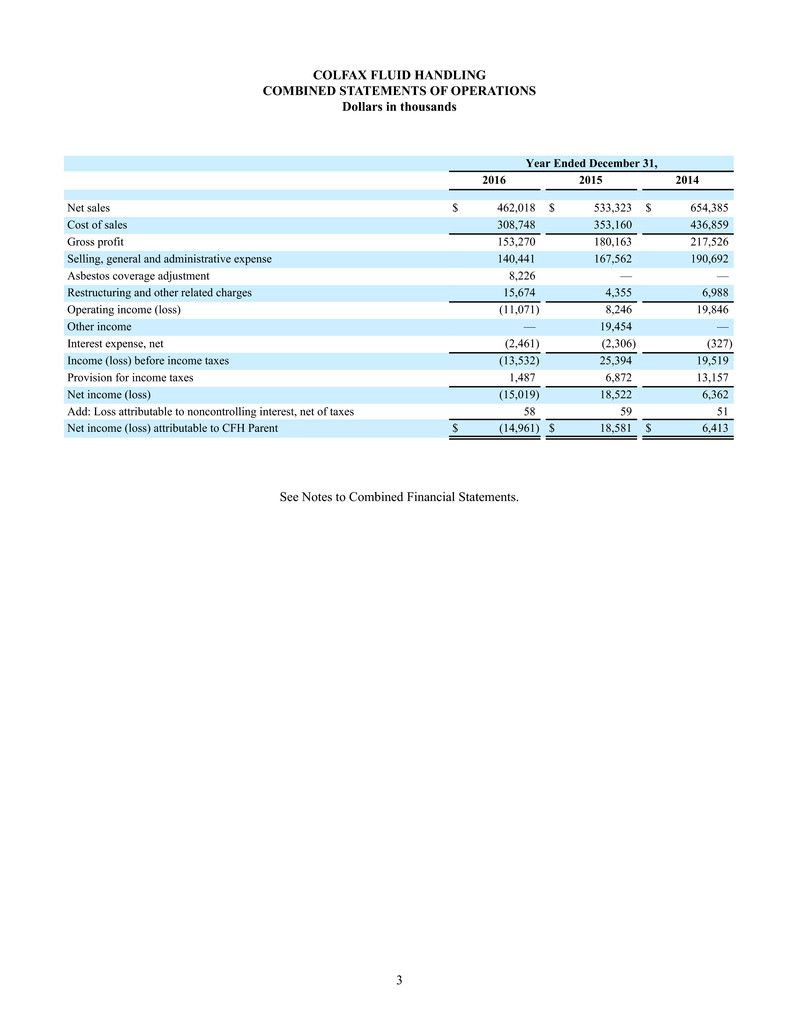

3 COLFAX FLUID HANDLING COMBINED STATEMENTS OF OPERATIONS Dollars in thousands Year Ended December 31, 2016 2015 2014 Net sales $ 462,018 $ 533,323 $ 654,385 Cost of sales 308,748 353,160 436,859 Gross profit 153,270 180,163 217,526 Selling, general and administrative expense 140,441 167,562 190,692 Asbestos coverage adjustment 8,226 — — Restructuring and other related charges 15,674 4,355 6,988 Operating income (loss) (11,071) 8,246 19,846 Other income — 19,454 — Interest expense, net (2,461) (2,306) (327) Income (loss) before income taxes (13,532) 25,394 19,519 Provision for income taxes 1,487 6,872 13,157 Net income (loss) (15,019) 18,522 6,362 Add: Loss attributable to noncontrolling interest, net of taxes 58 59 51 Net income (loss) attributable to CFH Parent $ (14,961) $ 18,581 $ 6,413 See Notes to Combined Financial Statements.

4 COLFAX FLUID HANDLING COMBINED STATEMENTS OF OTHER COMPREHENSIVE INCOME (LOSS) Dollars in thousands Year Ended December 31, 2016 2015 2014 Net income (loss) $ (15,019) $ 18,522 $ 6,362 Other comprehensive income (loss): Changes in unrecognized pension and other post-retirement benefit costs (11,560) 12,104 42,202 Changes in foreign currency translation adjustment (16,497) (16,206) (8,850) Other comprehensive income (loss) (28,057) (4,102) 33,352 Comprehensive income (loss) $ (43,076) $ 14,420 $ 39,714 See Notes to Combined Financial Statements.

5 COLFAX FLUID HANDLING COMBINED BALANCE SHEETS Dollars in thousands December 31, 2016 2015 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 12,916 $ 18,292 Trade receivables, less allowance for doubtful accounts of $12,506 and $11,922 75,392 82,522 Inventories, net 38,885 44,751 Short-term asbestos receivable 27,259 28,872 Other current assets 23,422 24,809 Total current assets 177,874 199,246 Property, plant and equipment, net 66,474 77,244 Goodwill 212,330 219,512 Intangible assets, net 15,302 20,639 Long-term asbestos receivable 358,299 380,102 Notes due from affiliates 138,992 146,574 Other assets 39,075 36,200 Total assets $ 1,008,346 $ 1,079,517 LIABILITIES AND EQUITY CURRENT LIABILITIES: Accounts payable $ 51,998 $ 53,328 Accrued asbestos litigation reserve 48,031 48,095 Accrued liabilities 44,480 54,294 Total current liabilities 144,509 155,717 Long-term asbestos litigation reserve 330,194 347,933 Notes due to affiliates 141,343 149,456 Retirement benefits obligation 109,586 98,006 Other long-term liabilities 2,177 4,595 Total liabilities 727,809 755,707 Equity: Net parent investment 425,985 441,164 Accumulated other comprehensive loss (144,970) (116,913) Total parent equity 281,015 324,251 Noncontrolling interest (478) (441) Total equity 280,537 323,810 Total liabilities and equity $ 1,008,346 $ 1,079,517 See Notes to Combined Financial Statements.

6 COLFAX FLUID HANDLING COMBINED STATEMENTS OF CHANGES IN EQUITY Dollars in thousands Net Parent Investment Accumulated Other Comprehensive Loss Non Controlling Interest Total Equity Balance at January 1, 2014 $ 500,143 $ (146,164) $ (432) $ 353,547 Net income 6,413 — (51) 6,362 Foreign exchange loss — (8,850) — (8,850) Pension gain — 42,203 — 42,203 Net transfers from (to) Parent (75,723) — 30 (75,693) Balance at December 31, 2014 430,833 (112,811) (453) 317,569 Net income (loss) 18,581 — (59) 18,522 Foreign exchange loss — (16,206) — (16,206) Pension gain — 12,104 — 12,104 Net transfers from (to) Parent (8,250) — 71 (8,179) Balance at December 31, 2015 441,164 (116,913) (441) 323,810 Net income (loss) (14,961) — (58) (15,019) Foreign exchange loss — (16,497) — (16,497) Pension loss — (11,560) — (11,560) Net transfers from (to) Parent (218) — 21 (197) Balance at December 31, 2016 $ 425,985 $ (144,970) $ (478) $ 280,537 See Notes to Combined Financial Statements.

7 COLFAX FLUID HANDLING COMBINED STATEMENTS OF CASH FLOWS Dollars in thousands Year Ended December 31, 2016 2015 2014 Cash flows from operating activities: Net income (loss) $ (15,019) $ 18,522 $ 6,362 Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation, amortization and impairment charges 14,193 16,015 31,817 Stock-based compensation expense 2,023 1,672 1,350 Non-cash portion of Parent management fees 7,817 4,321 7,052 Deferred income tax benefit (2,355) (7,804) (6,189) Non-cash pension/OPEB expense 7,733 10,100 7,191 Changes in operating assets and liabilities: Trade receivables, net 3,738 26,607 14,490 Inventories, net 4,461 1,970 920 Accounts payable (52) (10,008) (4,157) Changes in other operating assets and liabilities 559 3,264 (51,338) Net cash provided by operating activities 23,098 64,659 7,498 Cash flows from investing activities: Purchases of fixed assets (8,210) (7,490) (9,331) Proceeds from sale of fixed assets 4,102 776 456 Cash paid for acquisitions — — (6,176) Proceeds from disposition of business — — 3,953 Other, net 162 1,610 1,345 Net cash used in investing activities (3,946) (5,104) (9,753) Cash flows from financing activities: Net transfers to affiliates and parent (23,795) (63,087) (7,252) Net cash used in financing activities (23,795) (63,087) (7,252) Effect of foreign exchange rates on cash and cash equivalents (733) (2,247) (309) Decrease in cash and cash equivalents (5,376) (5,779) (9,816) Cash and cash equivalents, beginning of period 18,292 24,071 33,887 Cash and cash equivalents, end of period $ 12,916 $ 18,292 $ 24,071 See Notes to Combined Financial Statements.

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS 8 1. Organization and Nature of Operations The accompanying combined carve-out financial statements include the historical accounts of the Target Business (“Colfax Fluid Handling Business”, “CFH” or the “Business”), a division of Colfax Corporation (“Colfax” or the “Parent”). CFH is a global organization that designs, manufactures, distributes and supports pumps and systems in five primary market segments: Commercial Marine; Defense; Industrial and Power; Oil and Gas; and Reliability Services. CFH is headquartered in the United States in Monroe, North Carolina. Products are marketed to customers under a portfolio of brands. The Parent is a leading diversified industrial technology company that provides gas- and fluid-handling and fabrication technology products and services to customers around the world under the Howden, ESAB and Colfax Fluid Handling brands. On September 24, 2017, the Parent entered into a definitive purchase agreement to sell the Colfax Fluid Handling business to a third party for estimated aggregate consideration of approximately $860 million. The sale is expected to close during the three months ending December 31, 2017, subject to regulatory approval and other customary conditions. 2. Summary of Significant Accounting Policies Basis of Presentation The accompanying combined financial statements have been prepared in accordance with accounting principles generally accepted in the United States (U.S. GAAP) from the Consolidated financial statements and accounting records of Colfax using the historical results of operations and historical cost basis of the assets and liabilities of Colfax that comprise CFH. These financial statements have been prepared solely to demonstrate its historical results of operations, financial position, and cash flows for the indicated periods under Colfax’s management. All intercompany balances and transactions within CFH have been eliminated. Transactions and balances between or among CFH and Colfax and its subsidiaries are reflected as related-party transactions within these financial statements. The Business has historically operated as part of Colfax and not as a stand-alone Company and has no separate legal status or existence. The financial statements have been derived from Colfax’s historical accounting records and are presented on a carve- out basis.The accompanying combined financial statements include the assets, liabilities, revenues, and expenses that are directly attributable to CFH. In addition, certain costs related to the Business as well as allocations deemed reasonable by management have been included to present the combined financial position, results of operations, changes in equity and cash flows of the Business on a stand-alone basis. The allocation methodologies have been described within the notes to the combined financial statements where appropriate. These methodologies were primarily based on proportionate time and effort, headcount, or direct labor costs incurred by CFH compared to Colfax’s other business units. These allocated costs are primarily related to corporate administrative expenses, employee-related costs including benefits for corporate and shared employees, and fees for other corporate and support services. Income taxes have been accounted for in these financial statements as described in Note 4, “Income Taxes.” Pension expenses have been accounted for in these financial statements as described in Note 9, “Defined Benefit Plans.” The financial information included herein may not necessarily reflect the combined financial position, results of operations, changes in equity and cash flows of CFH in the future or what they would have been had the Business been a separate, stand-alone entity during the periods presented. The Business utilizes the Parent’s centralized processes and systems for cash management, payroll, purchasing, and distribution. The net results of these cash transactions between the Business and the Parent are reflected within Equity in the accompanying balance sheets. In addition, the equity represents the Parent’s interest in the recorded net assets of CFH and represents the cumulative net investment by the Parent in CFH through the dates presented, inclusive of cumulative operating results. During the year ended December 31, 2016, the Parent determined that an other-than-temporary lack of exchangeability between the Venezuelan bolivar and U.S. dollar, due to government controls, had restricted CFH’s Venezuelan operation’s ability to pay dividends and satisfy other obligations denominated in U.S. dollars. In addition, other government-imposed restrictions affecting labor, production, and distribution were prohibiting the Business from controlling key operating decisions. These circumstances caused the Business to no longer meet the accounting criteria for control in order to continue consolidating its Venezuelan operations. As a result, the Business deconsolidated its Venezuelan operations as of September 30, 2016 for accounting and reporting purposes. As a result of the deconsolidation, the CFH recorded a charge of $1.9 million in Selling, general and administrative expense for the year ended December 31, 2016, substantially all of which related to accumulated foreign currency translation charges previously

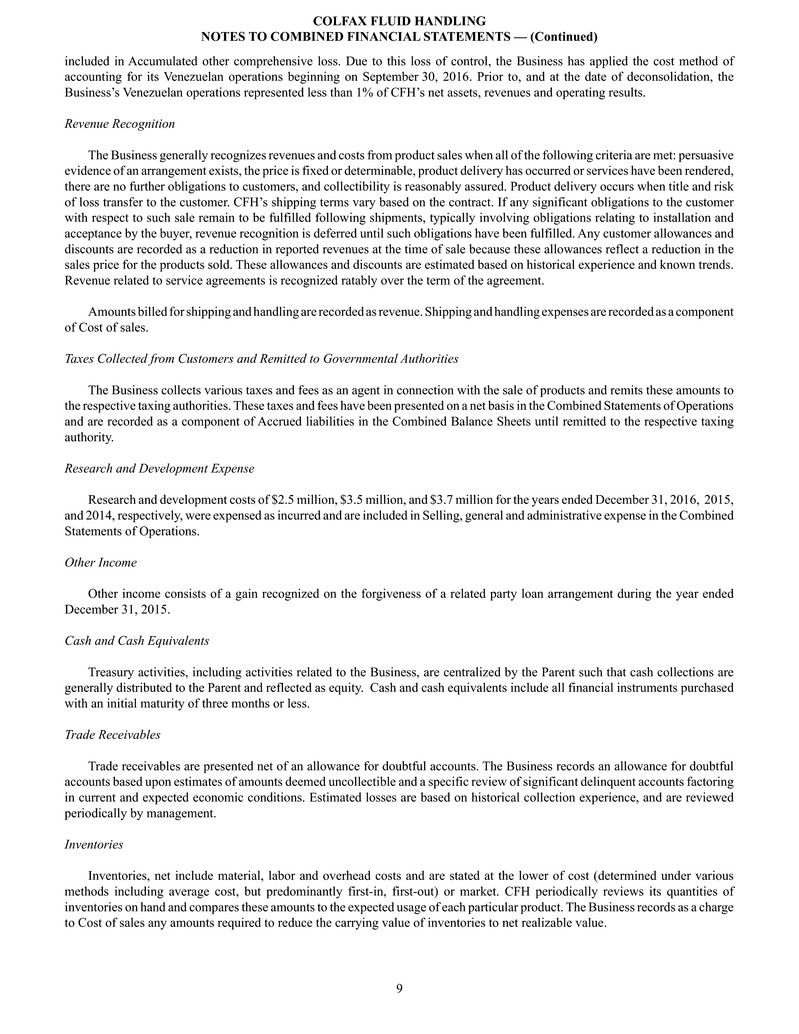

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 9 included in Accumulated other comprehensive loss. Due to this loss of control, the Business has applied the cost method of accounting for its Venezuelan operations beginning on September 30, 2016. Prior to, and at the date of deconsolidation, the Business’s Venezuelan operations represented less than 1% of CFH’s net assets, revenues and operating results. Revenue Recognition The Business generally recognizes revenues and costs from product sales when all of the following criteria are met: persuasive evidence of an arrangement exists, the price is fixed or determinable, product delivery has occurred or services have been rendered, there are no further obligations to customers, and collectibility is reasonably assured. Product delivery occurs when title and risk of loss transfer to the customer. CFH’s shipping terms vary based on the contract. If any significant obligations to the customer with respect to such sale remain to be fulfilled following shipments, typically involving obligations relating to installation and acceptance by the buyer, revenue recognition is deferred until such obligations have been fulfilled. Any customer allowances and discounts are recorded as a reduction in reported revenues at the time of sale because these allowances reflect a reduction in the sales price for the products sold. These allowances and discounts are estimated based on historical experience and known trends. Revenue related to service agreements is recognized ratably over the term of the agreement. Amounts billed for shipping and handling are recorded as revenue. Shipping and handling expenses are recorded as a component of Cost of sales. Taxes Collected from Customers and Remitted to Governmental Authorities The Business collects various taxes and fees as an agent in connection with the sale of products and remits these amounts to the respective taxing authorities. These taxes and fees have been presented on a net basis in the Combined Statements of Operations and are recorded as a component of Accrued liabilities in the Combined Balance Sheets until remitted to the respective taxing authority. Research and Development Expense Research and development costs of $2.5 million, $3.5 million, and $3.7 million for the years ended December 31, 2016, 2015, and 2014, respectively, were expensed as incurred and are included in Selling, general and administrative expense in the Combined Statements of Operations. Other Income Other income consists of a gain recognized on the forgiveness of a related party loan arrangement during the year ended December 31, 2015. Cash and Cash Equivalents Treasury activities, including activities related to the Business, are centralized by the Parent such that cash collections are generally distributed to the Parent and reflected as equity. Cash and cash equivalents include all financial instruments purchased with an initial maturity of three months or less. Trade Receivables Trade receivables are presented net of an allowance for doubtful accounts. The Business records an allowance for doubtful accounts based upon estimates of amounts deemed uncollectible and a specific review of significant delinquent accounts factoring in current and expected economic conditions. Estimated losses are based on historical collection experience, and are reviewed periodically by management. Inventories Inventories, net include material, labor and overhead costs and are stated at the lower of cost (determined under various methods including average cost, but predominantly first-in, first-out) or market. CFH periodically reviews its quantities of inventories on hand and compares these amounts to the expected usage of each particular product. The Business records as a charge to Cost of sales any amounts required to reduce the carrying value of inventories to net realizable value.

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 10 Property, Plant and Equipment Property, plant and equipment, net are stated at historical cost, which includes the fair values of such assets acquired in prior business combinations. Depreciation of property, plant and equipment is recorded on a straight-line basis over estimated useful lives. Assets recorded under capital leases are amortized over the shorter of their estimated useful lives or the lease terms, which range from three to fifteen years. Repair and maintenance expenditures are expensed as incurred unless the repair extends the useful life of the asset. Goodwill and Indefinite-Lived Intangible Assets Goodwill represents the costs in excess of the fair value of net assets acquired associated with acquired businesses of the Parent. Indefinite-lived intangible assets consist of trade names. The Business evaluates the recoverability of goodwill and indefinite-lived intangible assets annually or more frequently if an event occurs or circumstances change in the interim that would more likely than not reduce the fair value of the asset below its carrying amount. In the evaluation of goodwill for impairment, CFH assesses qualitative factors to determine whether it is more likely than not that the fair value of the reporting unit is less than its carrying value. If the Business determines that it is not more likely than not for the reporting unit’s fair value to be less than its carrying value, a calculation of the fair value is not performed. If the Business determines that it is more likely than not for the reporting unit’s fair value to be less than its carrying value, a calculation of the reporting unit’s fair value is performed and compared to the carrying value of that reporting unit. In certain instances, CFH may elect to forgo the qualitative assessment and proceed directly to the first step of the quantitative impairment test. If the carrying value of the reporting unit exceeds its fair value, step two of the impairment analysis is performed. In step two of the analysis, an impairment loss is recorded equal to the excess of the carrying value of the reporting unit’s goodwill over its implied fair value. Generally, the Business measures the fair value of its reporting unit using an income approach, which entails among other things calculating the present value of future discounted cash flows. The discounted cash flow model indicates the fair value of the reporting unit based on the present value of the cash flows that the reporting unit is expected to generate in the future. Significant estimates in the discounted cash flows model include: the weighted average cost of capital; long-term rate of growth and profitability of our business; and working capital effects. CFH has experienced a concurrent decline in numerous end markets and geographic markets that has had a negative impact on the levels of capital invested and maintenance expenditures by certain of its customers which in turn has reduced the demand for its products and services, affecting operating results. Given the above, the Parent elected not to perform qualitative assessments of goodwill and instead proceeded directly to performing the first step of the two-step quantitative goodwill impairment test for its 2016 annual impairment test. The quantitative impairment assessment of goodwill for the CFH reporting unit, based on the methodologies identified above, resulted in a calculated fair value that exceeded the carrying values of the reporting unit, resulting in no impairment charges to goodwill. In the evaluation of indefinite-lived intangible assets for impairment, CFH first assesses qualitative factors to determine whether it is more likely than not that the fair value of the indefinite-lived intangible asset is less than its carrying value. If the Business determines that it is not more likely than not for the indefinite-lived intangible asset’s fair value to be less than its carrying value, a calculation of the fair value is not performed. If CFH determines that it is more likely than not that the indefinite-lived intangible asset’s fair value is less than its carrying value, the fair value is measured and compared to the carrying value of the asset. If the carrying amount of the indefinite-lived intangible asset exceeds its fair value, an impairment loss is recognized in an amount equal to that excess. The Business measures the fair value of its indefinite-lived intangible assets using the “relief-from- royalty” method. Significant estimates in this approach include projected revenues and royalty and discount rates for each trade name evaluated. From time to time, CFH has identified certain indefinite-lived intangible assets that, due to indicators present at the specific operation associated with the indefinite-lived intangible asset, required testing for impairment prior to the annual impairment evaluation. Analyses performed in 2014, 2015 and the most recent analysis performed as of October 1, 2016, resulted in no impairment charges to indefinite-lived assets.

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 11 Impairment of Long-Lived Assets Other than goodwill and Indefinite-Lived Intangible Assets Intangibles primarily represent acquired customer relationships, acquired order backlog, acquired technology and software license agreements. A portion of the CFH’s acquired customer relationships is being amortized on an accelerated basis over periods ranging from seven to 30 years based on the present value of the future cash flows expected to be generated from the acquired customers. All other intangibles are being amortized on a straight-line basis over their estimated useful lives, generally ranging from two to fifteen years. The Business assesses its long-lived assets other than goodwill and indefinite-lived intangible assets for impairment whenever facts and circumstances indicate that the carrying amounts may not be fully recoverable. To analyze recoverability, the Business projects undiscounted net future cash flows over the remaining lives of such assets. If these projected cash flows are less than the carrying amounts, an impairment loss would be recognized, resulting in a write-down of the assets with a corresponding charge to earnings. The impairment loss is measured based upon the difference between the carrying amounts and the fair values of the assets. Assets to be disposed of are reported at the lower of the carrying amounts or fair value less cost to sell. Management determines fair value using the discounted cash flow method or other accepted valuation techniques. The Business recorded asset impairment losses related to facility closures totaling $2.0 million during the year ended December 31, 2016 as a component of Restructuring and other related charges in the Combined Statements of Operations. The aggregate carrying value of these assets subsequent to impairment was $0. In addition, analyses were performed during the year ended December 31, 2014 to evaluate certain long-lived intangible assets related to a specific operation within the Business due to projected cash flow declines. The analysis determined certain long-lived intangible assets, primarily consisting of acquired customer relationships and acquired technology, were either impaired or no longer recoverable based upon projected undiscounted net cash flows. The impairment was calculated as the difference between the fair value of the remaining expected future cash flows to be generated from the asset or asset group and the respective carrying value as of the measurement date. The Business recorded $10.5 million of intangible asset impairment loss as a component of Selling, general and administrative expense in the Combined Statement of Operations for the year ended December 31, 2014. The total fair value of these assets of $3.3 million as of December 31, 2014 is included in Level Three of the fair value hierarchy. Warranty Costs Estimated expenses related to product warranties are accrued as the revenue is recognized on products sold to customers and included in Cost of sales in the Combined Statements of Operations. Estimates are established using historical information as to the nature, frequency, and average costs of warranty claims. The activity in the Business’s warranty liability, which is included in Accrued liabilities and Other long-term liabilities in CFH’s combined Balance Sheets, consisted of the following: Year Ended December 31, 2016 2015 (In thousands) Warranty liability, beginning of period $ 1,772 $ 1,684 Accrued warranty expense 2,305 2,961 Changes in estimates related to pre-existing warranties 51 (232) Cost of warranty service work performed (2,576) (2,511) Foreign exchange translation effect (53) (130) Warranty liability, end of period $ 1,499 $ 1,772 Income Taxes The results of operations have historically been included in the consolidated federal income tax returns of Colfax Corporation and the state income tax returns of Colfax Corporation and its US Subsidiaries, including but not limited to CFH. The income tax amounts reflected in the accompanying combined carve-out financial statements have been allocated based on taxable income directly attributable to the CFH Business, resulting in a stand-alone presentation. Management believes the assumptions underlying the allocation of income taxes are reasonable. However, the amounts allocated for income taxes in the accompanying combined carve-out financial statements are not necessarily indicative of the amount of income taxes that would have been recorded had the combined operations been operated as a separate, stand-alone entity.

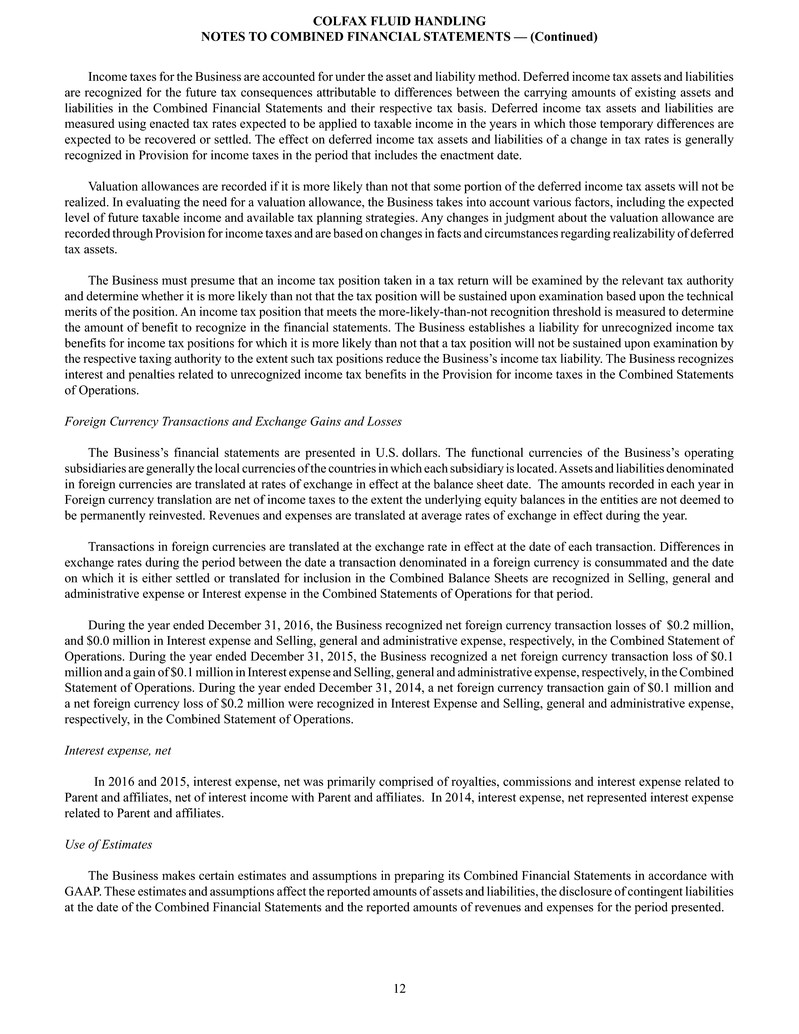

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 12 Income taxes for the Business are accounted for under the asset and liability method. Deferred income tax assets and liabilities are recognized for the future tax consequences attributable to differences between the carrying amounts of existing assets and liabilities in the Combined Financial Statements and their respective tax basis. Deferred income tax assets and liabilities are measured using enacted tax rates expected to be applied to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred income tax assets and liabilities of a change in tax rates is generally recognized in Provision for income taxes in the period that includes the enactment date. Valuation allowances are recorded if it is more likely than not that some portion of the deferred income tax assets will not be realized. In evaluating the need for a valuation allowance, the Business takes into account various factors, including the expected level of future taxable income and available tax planning strategies. Any changes in judgment about the valuation allowance are recorded through Provision for income taxes and are based on changes in facts and circumstances regarding realizability of deferred tax assets. The Business must presume that an income tax position taken in a tax return will be examined by the relevant tax authority and determine whether it is more likely than not that the tax position will be sustained upon examination based upon the technical merits of the position. An income tax position that meets the more-likely-than-not recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Business establishes a liability for unrecognized income tax benefits for income tax positions for which it is more likely than not that a tax position will not be sustained upon examination by the respective taxing authority to the extent such tax positions reduce the Business’s income tax liability. The Business recognizes interest and penalties related to unrecognized income tax benefits in the Provision for income taxes in the Combined Statements of Operations. Foreign Currency Transactions and Exchange Gains and Losses The Business’s financial statements are presented in U.S. dollars. The functional currencies of the Business’s operating subsidiaries are generally the local currencies of the countries in which each subsidiary is located. Assets and liabilities denominated in foreign currencies are translated at rates of exchange in effect at the balance sheet date. The amounts recorded in each year in Foreign currency translation are net of income taxes to the extent the underlying equity balances in the entities are not deemed to be permanently reinvested. Revenues and expenses are translated at average rates of exchange in effect during the year. Transactions in foreign currencies are translated at the exchange rate in effect at the date of each transaction. Differences in exchange rates during the period between the date a transaction denominated in a foreign currency is consummated and the date on which it is either settled or translated for inclusion in the Combined Balance Sheets are recognized in Selling, general and administrative expense or Interest expense in the Combined Statements of Operations for that period. During the year ended December 31, 2016, the Business recognized net foreign currency transaction losses of $0.2 million, and $0.0 million in Interest expense and Selling, general and administrative expense, respectively, in the Combined Statement of Operations. During the year ended December 31, 2015, the Business recognized a net foreign currency transaction loss of $0.1 million and a gain of $0.1 million in Interest expense and Selling, general and administrative expense, respectively, in the Combined Statement of Operations. During the year ended December 31, 2014, a net foreign currency transaction gain of $0.1 million and a net foreign currency loss of $0.2 million were recognized in Interest Expense and Selling, general and administrative expense, respectively, in the Combined Statement of Operations. Interest expense, net In 2016 and 2015, interest expense, net was primarily comprised of royalties, commissions and interest expense related to Parent and affiliates, net of interest income with Parent and affiliates. In 2014, interest expense, net represented interest expense related to Parent and affiliates. Use of Estimates The Business makes certain estimates and assumptions in preparing its Combined Financial Statements in accordance with GAAP. These estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the Combined Financial Statements and the reported amounts of revenues and expenses for the period presented.

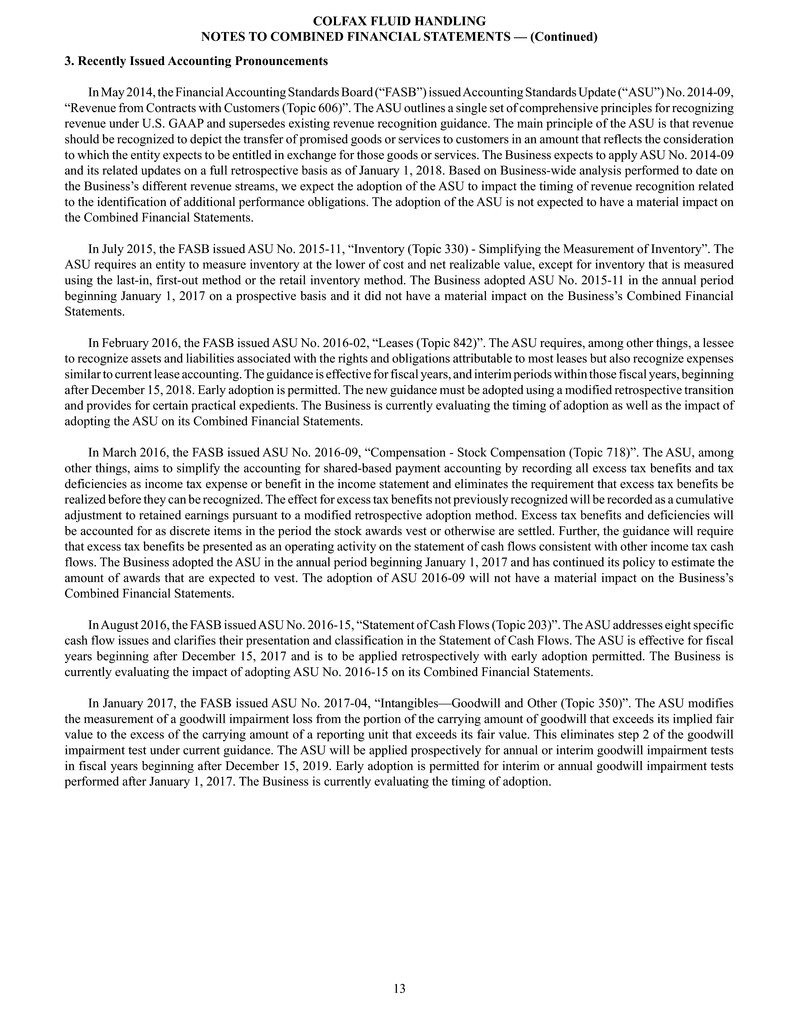

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 13 3. Recently Issued Accounting Pronouncements In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, “Revenue from Contracts with Customers (Topic 606)”. The ASU outlines a single set of comprehensive principles for recognizing revenue under U.S. GAAP and supersedes existing revenue recognition guidance. The main principle of the ASU is that revenue should be recognized to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The Business expects to apply ASU No. 2014-09 and its related updates on a full retrospective basis as of January 1, 2018. Based on Business-wide analysis performed to date on the Business’s different revenue streams, we expect the adoption of the ASU to impact the timing of revenue recognition related to the identification of additional performance obligations. The adoption of the ASU is not expected to have a material impact on the Combined Financial Statements. In July 2015, the FASB issued ASU No. 2015-11, “Inventory (Topic 330) - Simplifying the Measurement of Inventory”. The ASU requires an entity to measure inventory at the lower of cost and net realizable value, except for inventory that is measured using the last-in, first-out method or the retail inventory method. The Business adopted ASU No. 2015-11 in the annual period beginning January 1, 2017 on a prospective basis and it did not have a material impact on the Business’s Combined Financial Statements. In February 2016, the FASB issued ASU No. 2016-02, “Leases (Topic 842)”. The ASU requires, among other things, a lessee to recognize assets and liabilities associated with the rights and obligations attributable to most leases but also recognize expenses similar to current lease accounting. The guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted. The new guidance must be adopted using a modified retrospective transition and provides for certain practical expedients. The Business is currently evaluating the timing of adoption as well as the impact of adopting the ASU on its Combined Financial Statements. In March 2016, the FASB issued ASU No. 2016-09, “Compensation - Stock Compensation (Topic 718)”. The ASU, among other things, aims to simplify the accounting for shared-based payment accounting by recording all excess tax benefits and tax deficiencies as income tax expense or benefit in the income statement and eliminates the requirement that excess tax benefits be realized before they can be recognized. The effect for excess tax benefits not previously recognized will be recorded as a cumulative adjustment to retained earnings pursuant to a modified retrospective adoption method. Excess tax benefits and deficiencies will be accounted for as discrete items in the period the stock awards vest or otherwise are settled. Further, the guidance will require that excess tax benefits be presented as an operating activity on the statement of cash flows consistent with other income tax cash flows. The Business adopted the ASU in the annual period beginning January 1, 2017 and has continued its policy to estimate the amount of awards that are expected to vest. The adoption of ASU 2016-09 will not have a material impact on the Business’s Combined Financial Statements. In August 2016, the FASB issued ASU No. 2016-15, “Statement of Cash Flows (Topic 203)”. The ASU addresses eight specific cash flow issues and clarifies their presentation and classification in the Statement of Cash Flows. The ASU is effective for fiscal years beginning after December 15, 2017 and is to be applied retrospectively with early adoption permitted. The Business is currently evaluating the impact of adopting ASU No. 2016-15 on its Combined Financial Statements. In January 2017, the FASB issued ASU No. 2017-04, “Intangibles—Goodwill and Other (Topic 350)”. The ASU modifies the measurement of a goodwill impairment loss from the portion of the carrying amount of goodwill that exceeds its implied fair value to the excess of the carrying amount of a reporting unit that exceeds its fair value. This eliminates step 2 of the goodwill impairment test under current guidance. The ASU will be applied prospectively for annual or interim goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed after January 1, 2017. The Business is currently evaluating the timing of adoption.

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 14 4. Income Taxes Income before income taxes and Provision for (benefit from) income taxes consisted of the following: Year Ended December 31, 2016 2015 2014 (In thousands) Income (loss) before income taxes: Domestic operations $ (1,728) $ 3,427 $ 10,694 Foreign operations (11,804) 21,967 8,825 $ (13,532) $ 25,394 $ 19,519 Provision for (benefit from) income taxes: Current: Federal $ (1,017) $ 5,139 4,824 State 130 722 696 Foreign 4,729 8,815 13,826 $ 3,842 $ 14,676 $ 19,346 Deferred: Domestic operations $ 908 $ (3,939) $ (1,292) Foreign operations (3,263) (3,865) (4,897) (2,355) (7,804) (6,189) $ 1,487 $ 6,872 $ 13,157 The Provision for (benefit from) income taxes differs from the amount that would be computed by applying the US federal statutory rate as follows: Year Ended December 31, 2016 2015 2014 (In thousands) Taxes calculated at the US federal statutory rate $ (4,736) $ 8,888 $ 6,832 State taxes (164) 450 343 Nondeductible expenses, domestic manufacturing deduction and other 614 (1,739) 814 Effect of tax rates on international operations 1,876 (2,559) 1,670 Changes in valuation allowance and tax reserves 3,897 1,832 3,498 Provision for income taxes $ 1,487 $ 6,872 13,157

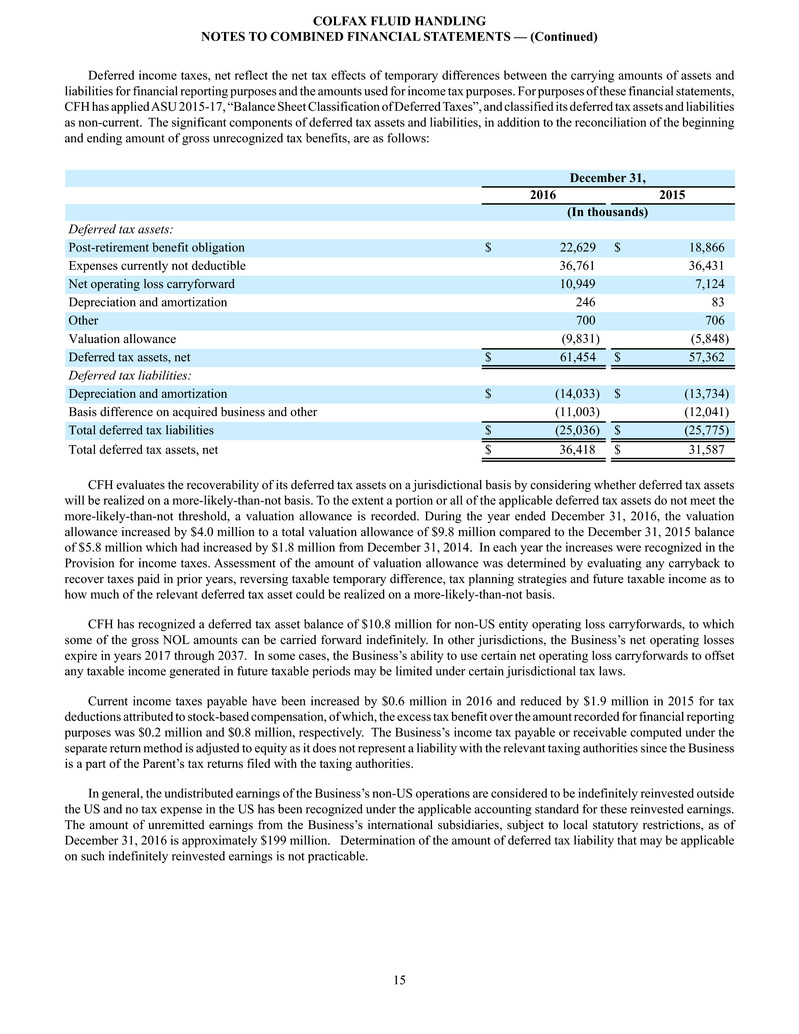

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 15 Deferred income taxes, net reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. For purposes of these financial statements, CFH has applied ASU 2015-17, “Balance Sheet Classification of Deferred Taxes”, and classified its deferred tax assets and liabilities as non-current. The significant components of deferred tax assets and liabilities, in addition to the reconciliation of the beginning and ending amount of gross unrecognized tax benefits, are as follows: December 31, 2016 2015 (In thousands) Deferred tax assets: Post-retirement benefit obligation $ 22,629 $ 18,866 Expenses currently not deductible 36,761 36,431 Net operating loss carryforward 10,949 7,124 Depreciation and amortization 246 83 Other 700 706 Valuation allowance (9,831) (5,848) Deferred tax assets, net $ 61,454 $ 57,362 Deferred tax liabilities: Depreciation and amortization $ (14,033) $ (13,734) Basis difference on acquired business and other (11,003) (12,041) Total deferred tax liabilities $ (25,036) $ (25,775) Total deferred tax assets, net $ 36,418 $ 31,587 CFH evaluates the recoverability of its deferred tax assets on a jurisdictional basis by considering whether deferred tax assets will be realized on a more-likely-than-not basis. To the extent a portion or all of the applicable deferred tax assets do not meet the more-likely-than-not threshold, a valuation allowance is recorded. During the year ended December 31, 2016, the valuation allowance increased by $4.0 million to a total valuation allowance of $9.8 million compared to the December 31, 2015 balance of $5.8 million which had increased by $1.8 million from December 31, 2014. In each year the increases were recognized in the Provision for income taxes. Assessment of the amount of valuation allowance was determined by evaluating any carryback to recover taxes paid in prior years, reversing taxable temporary difference, tax planning strategies and future taxable income as to how much of the relevant deferred tax asset could be realized on a more-likely-than-not basis. CFH has recognized a deferred tax asset balance of $10.8 million for non-US entity operating loss carryforwards, to which some of the gross NOL amounts can be carried forward indefinitely. In other jurisdictions, the Business’s net operating losses expire in years 2017 through 2037. In some cases, the Business’s ability to use certain net operating loss carryforwards to offset any taxable income generated in future taxable periods may be limited under certain jurisdictional tax laws. Current income taxes payable have been increased by $0.6 million in 2016 and reduced by $1.9 million in 2015 for tax deductions attributed to stock-based compensation, of which, the excess tax benefit over the amount recorded for financial reporting purposes was $0.2 million and $0.8 million, respectively. The Business’s income tax payable or receivable computed under the separate return method is adjusted to equity as it does not represent a liability with the relevant taxing authorities since the Business is a part of the Parent’s tax returns filed with the taxing authorities. In general, the undistributed earnings of the Business’s non-US operations are considered to be indefinitely reinvested outside the US and no tax expense in the US has been recognized under the applicable accounting standard for these reinvested earnings. The amount of unremitted earnings from the Business’s international subsidiaries, subject to local statutory restrictions, as of December 31, 2016 is approximately $199 million. Determination of the amount of deferred tax liability that may be applicable on such indefinitely reinvested earnings is not practicable.

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 16 The Business records a liability for unrecognized income tax benefits for the amount of benefit included in its previously filed income tax returns and in its financial results expected to be included in income tax returns to be filed for periods through the date of its Consolidated Financial Statements for income tax positions for which it is more likely than not that a tax position will not be sustained upon examination by the respective taxing authority. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows (inclusive of associated interest and penalties): (In thousands) Balance, December 31, 2013 $ 2,238 Addition for tax positions taken in prior periods 137 Addition for tax positions taken in the current period — Reduction for tax positions taken in prior periods (1) (112) Other, including the impact of foreign currency translation (221) Balance, December 31, 2014 2,042 Addition for tax positions taken in prior periods 65 Addition for tax positions taken in the current period (125) Reduction for tax positions taken in prior periods (1) — Other, including the impact of foreign currency translation (134) Balance, December 31, 2015 $ 1,848 Addition for tax positions taken in prior periods 354 Addition for tax positions taken in the current period 337 Reduction for tax positions taken in prior periods (1) (446) Other, including the impact of foreign currency translation (47) Balance, December 31, 2016 $ 2,046 (1) Includes reductions for lapses in statute of limitations. CFH conducts its business on a global basis and the Parent files income tax returns in the US federal, state and non-US jurisdictions on a combined basis where permitted by the tax law. The Parent and its subsidiaries (including the Business) are routinely examined by tax authorities around the world. Tax examinations remain in process in multiple countries and various US state taxing jurisdictions. In the US, the Parent and its subsidiaries (including the Business) remain subject to examination or adjustment of its carryover tax attributes from tax year 2003. With some exceptions, other major tax jurisdictions generally are not subject to tax examinations for years beginning before 2010. The Business’s total unrecognized tax benefits were $2.0 million, $1.8 million and $2.0 million as of December 31, 2016 and 2015 and 2014, respectively, inclusive of $0.5 million in each year of interest and penalties. The net liabilities for uncertain tax positions as of December 31, 2016, 2015 and 2014 were $2.0 million, $1.8 million and $2.2 million, respectively, and, if recognized, would favorably impact the effective tax rate. The Business records interest and penalties on uncertain tax positions as a component of Provision for (benefit from) income taxes. Due to the difficulty in predicting with reasonable certainty when tax audits will be fully resolved and closed, the range of reasonably possible significant increases or decreases in the liability for unrecognized tax benefits that may occur within the next 12 months is difficult to ascertain. Currently, the Business estimates that it is reasonably possible that the expiration of various statutes of limitations, resolution of tax audits and court decisions may reduce its tax expense in the next 12 months by less than $1.0 million.

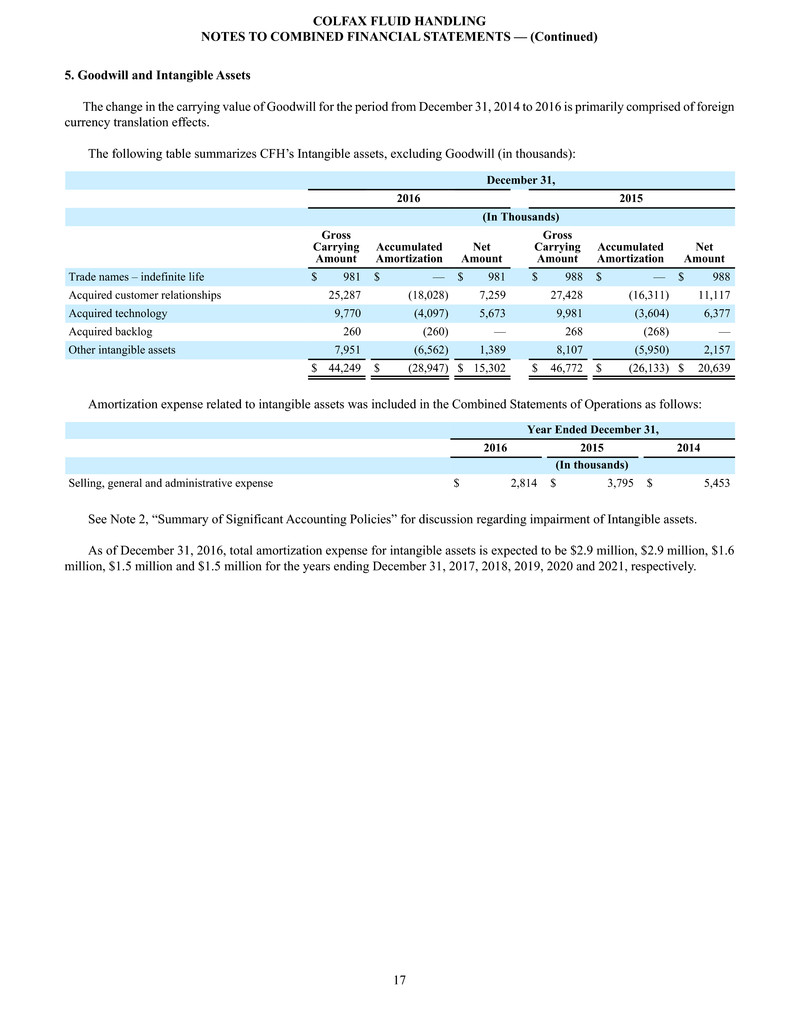

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 17 5. Goodwill and Intangible Assets The change in the carrying value of Goodwill for the period from December 31, 2014 to 2016 is primarily comprised of foreign currency translation effects. The following table summarizes CFH’s Intangible assets, excluding Goodwill (in thousands): December 31, 2016 2015 (In Thousands) Gross Carrying Amount Accumulated Amortization Net Amount Gross Carrying Amount Accumulated Amortization Net Amount Trade names – indefinite life $ 981 $ — $ 981 $ 988 $ — $ 988 Acquired customer relationships 25,287 (18,028) 7,259 27,428 (16,311) 11,117 Acquired technology 9,770 (4,097) 5,673 9,981 (3,604) 6,377 Acquired backlog 260 (260) — 268 (268) — Other intangible assets 7,951 (6,562) 1,389 8,107 (5,950) 2,157 $ 44,249 $ (28,947) $ 15,302 $ 46,772 $ (26,133) $ 20,639 Amortization expense related to intangible assets was included in the Combined Statements of Operations as follows: Year Ended December 31, 2016 2015 2014 (In thousands) Selling, general and administrative expense $ 2,814 $ 3,795 $ 5,453 See Note 2, “Summary of Significant Accounting Policies” for discussion regarding impairment of Intangible assets. As of December 31, 2016, total amortization expense for intangible assets is expected to be $2.9 million, $2.9 million, $1.6 million, $1.5 million and $1.5 million for the years ending December 31, 2017, 2018, 2019, 2020 and 2021, respectively.

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 18 6. Property, Plant and Equipment, Net December 31, Depreciable Life 2016 2015 (In years) (In thousands) Land n/a $ 10,924 $ 12,210 Buildings and improvements 5-40 30,831 36,588 Machinery and equipment 3-15 134,091 146,327 Software 3-5 13,693 15,243 189,539 210,368 Accumulated depreciation (123,065) (133,124) Property, plant and equipment, net $ 66,474 $ 77,244 Depreciation expense, including the amortization of assets recorded under capital leases, for the years ended December 31, 2016, 2015 and 2014, was $9.5 million, $10.5 million and $13.1 million, respectively. Depreciation expense for the years ended December 31, 2016, 2015, and 2014 includes $2.0 million, $0 and $0 of non-cash impairment of fixed assets, respectively. These amounts also include depreciation expense related to software for the years ended December 31, 2016, 2015 and 2014 of $0.6 million, $0.8 million and $1.5 million, respectively. 7. Inventories, Net Inventories, net consisted of the following: December 31, 2016 2015 (In thousands) Raw materials $ 26,628 $ 29,961 Work in process 19,487 20,089 Finished goods 15,640 18,353 61,755 68,403 Less: customer progress payments (14,624) (15,876) Less: allowance for excess, slow-moving and obsolete inventory (8,246) (7,776) Inventories, net $ 38,885 $ 44,751

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 19 8. Accrued Liabilities Accrued liabilities in the Combined Balance Sheets consisted of the following: December 31, 2016 2015 (In thousands) Accrued payroll $ 14,658 $ 16,079 Accrued taxes 3,138 5,521 Warranty liability - current portion 1,477 1,764 Accrued restructuring liability - current portion 2,401 85 Accrued third-party commissions 2,556 3,591 Customer advances & other 20,250 27,254 Accrued liabilities $ 44,480 $ 54,294 Accrued Restructuring Liability The CFH’s restructuring programs include a series of restructuring actions to reduce the structural costs of the Business. A summary of the activity in CFH’s restructuring liability included in Accrued liabilities in the Combined Balance Sheets follows: Year Ended December 31, 2016 Balance at Beginning of Period Provisions Payments Foreign Currency Translation Balance at End of Period (In thousands) Restructuring and other related charges: Termination benefits(1) $ 71 $ 8,776 $ (6,623) $ (302) $ 1,922 Facility closure costs(2) 14 4,621 (4,134) (22) 479 85 13,397 (10,757) (324) 2,401 Non-cash charges 2,277 $ 15,674 (1) Includes severance and other termination benefits, including outplacement services. CFH recognizes the cost of involuntary termination benefits at the communication date or ratably over any remaining expected future service period. Voluntary termination benefits are recognized as a liability and an expense when employees accept the offer and the amount can be reasonably estimated. (2) Includes the cost of relocating associates, relocating equipment and lease termination expense in connection with the closure of facilities. Year Ended December 31, 2015 Balance at Beginning of Period Provisions Payments Foreign Currency Translation Balance at End of Period(3) (In thousands) Restructuring and other related charges: Termination benefits(1) $ 2,699 $ 705 $ (3,216) $ (117) $ 71 Facility closure costs(2) (1,762) 3,650 (1,831) (43) 14 $ 4,355 (1) Includes severance and other termination benefits, including outplacement services. The Business recognizes the cost of involuntary termination benefits at the communication date or ratably over any remaining expected future service period. Voluntary termination benefits are recognized as a liability and an expense when employees accept the offer and the amount can be reasonably estimated. (2) Includes the cost of relocating associates, relocating equipment and lease termination expense in connection with the closure of facilities. (3) As of December 31, 2015, $0.1 million of CFH’s restructuring liability was included in Accrued liabilities. CFH expects to incur Restructuring and other related charges of approximately $5 million during the year ending December 31, 2017 related to its restructuring activities.

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 20 9. Defined Benefit Plans Outside of the U.S., the Business sponsors certain defined benefit pension plans for its employees in Germany, Norway and Sweden. The pension disclosures presented in the table below include these non-U.S pension plans only. The related expenses for these plans are included in Selling, general and administrative expense in the accompanying combined statements of operations. Years Ended December 31, 2016 2015 Pension Benefits-Non U.S. Plans: Service cost $ 2,206 $ 2,366 Interest cost 2,289 2,058 Expected return on plan assets (99) (159) Amortization 1,724 2,451 Net periodic benefit cost $ 6,120 $ 6,716 Other Post-Retirement Benefits: Service cost $ — $ — Interest cost 436 475 Amortization (32) 495 Net periodic benefit cost $ 404 $ 970 In the US, CFH’s salaried employees participate in defined benefit pension plans sponsored by the Parent. These plans include other Parent employees that are not employees of CFH. The Parent also sponsors certain defined contribution plans and provides other post-retirement benefits, including health and life insurance, for certain eligible employees and eligible former employees who have retired from the Business. For the years ended December 31, 2016, 2015 and 2014, respectively, the Parent allocated to CFH approximately $0, $0.9 million and $0.5 million of net pension and other post-retirement benefit expenses, which have been reflected within Selling, general and administrative expense in the accompanying combined statements of operations. The related U.S. pension assets and liabilities have not been allocated to the Business and have not been presented on the accompanying balance sheet since these are assets and liabilities of the Parent. The Business’s other accrued post-retirement benefit obligations as of December 31, 2016 and December 31, 2015 were $11.0 million and $12.0 million, respectively. These obligations are actuarially determined. These balances are accrued within Retirement benefits obligation and Accrued liabilities on the balance sheet. The Business used a weighted-average discount rate of 3.9% and 4.0% to compute its post-retirement benefit obligation at December 31, 2016 and 2015, respectively. The net periodic benefit cost for the Business’s other post-retirement benefit plan was $0.4 million, $1.0 million and $1.0 million for the years ended December 31, 2016, 2015 and 2014, respectively. The Business used a weighted-average discount rate of 4.0%, 3.6% and 4.4% to compute its net periodic benefit cost for its post-retirement benefit obligation for the years ended December 31, 2016, 2015 and 2014, respectively. For measurement purposes, a weighted-average annual rate of increase in the per capita cost of covered health care benefits of approximately 6.2% was assumed. The rate was assumed to decrease gradually to 5.25% by 2021 for one the Company’s plans and to 4.5% by 2027 for the remaining plans and remain at those levels thereafter for benefits covered under the plans.

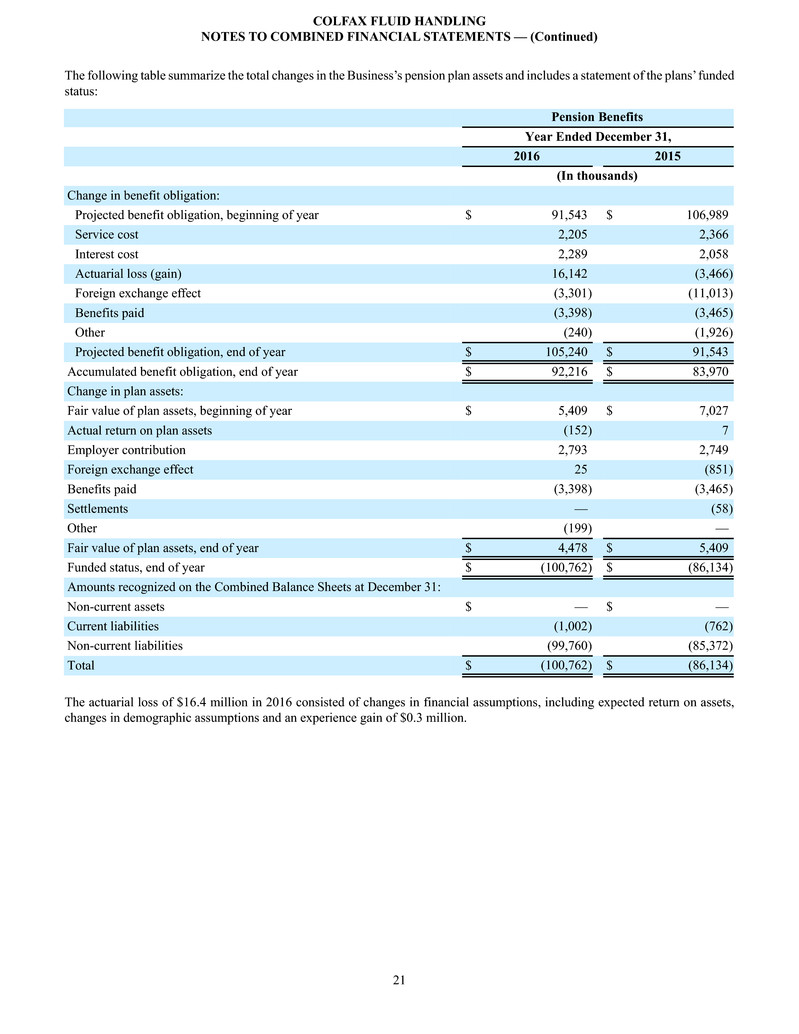

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 21 The following table summarize the total changes in the Business’s pension plan assets and includes a statement of the plans’ funded status: Pension Benefits Year Ended December 31, 2016 2015 (In thousands) Change in benefit obligation: Projected benefit obligation, beginning of year $ 91,543 $ 106,989 Service cost 2,205 2,366 Interest cost 2,289 2,058 Actuarial loss (gain) 16,142 (3,466) Foreign exchange effect (3,301) (11,013) Benefits paid (3,398) (3,465) Other (240) (1,926) Projected benefit obligation, end of year $ 105,240 $ 91,543 Accumulated benefit obligation, end of year $ 92,216 $ 83,970 Change in plan assets: Fair value of plan assets, beginning of year $ 5,409 $ 7,027 Actual return on plan assets (152) 7 Employer contribution 2,793 2,749 Foreign exchange effect 25 (851) Benefits paid (3,398) (3,465) Settlements — (58) Other (199) — Fair value of plan assets, end of year $ 4,478 $ 5,409 Funded status, end of year $ (100,762) $ (86,134) Amounts recognized on the Combined Balance Sheets at December 31: Non-current assets $ — $ — Current liabilities (1,002) (762) Non-current liabilities (99,760) (85,372) Total $ (100,762) $ (86,134) The actuarial loss of $16.4 million in 2016 consisted of changes in financial assumptions, including expected return on assets, changes in demographic assumptions and an experience gain of $0.3 million.

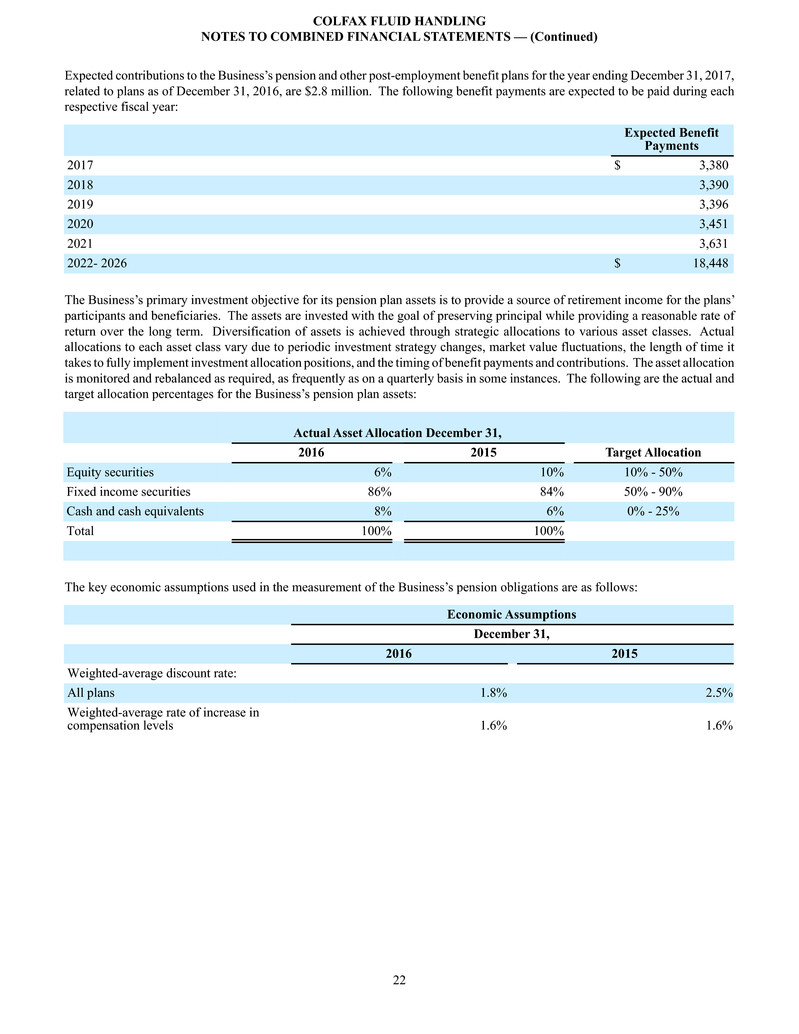

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 22 Expected contributions to the Business’s pension and other post-employment benefit plans for the year ending December 31, 2017, related to plans as of December 31, 2016, are $2.8 million. The following benefit payments are expected to be paid during each respective fiscal year: Expected Benefit Payments 2017 $ 3,380 2018 3,390 2019 3,396 2020 3,451 2021 3,631 2022- 2026 $ 18,448 The Business’s primary investment objective for its pension plan assets is to provide a source of retirement income for the plans’ participants and beneficiaries. The assets are invested with the goal of preserving principal while providing a reasonable rate of return over the long term. Diversification of assets is achieved through strategic allocations to various asset classes. Actual allocations to each asset class vary due to periodic investment strategy changes, market value fluctuations, the length of time it takes to fully implement investment allocation positions, and the timing of benefit payments and contributions. The asset allocation is monitored and rebalanced as required, as frequently as on a quarterly basis in some instances. The following are the actual and target allocation percentages for the Business’s pension plan assets: Actual Asset Allocation December 31, 2016 2015 Target Allocation Equity securities 6% 10% 10% - 50% Fixed income securities 86% 84% 50% - 90% Cash and cash equivalents 8% 6% 0% - 25% Total 100% 100% The key economic assumptions used in the measurement of the Business’s pension obligations are as follows: Economic Assumptions December 31, 2016 2015 Weighted-average discount rate: All plans 1.8% 2.5% Weighted-average rate of increase in compensation levels 1.6% 1.6%

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 23 The key economic assumptions used in the computation of net periodic benefit cost are as follows: Net Benefit Cost Assumptions Year Ended December 31, 2016 2015 Weighted-average discount rate: 2.5% 2.1% Weighted-average expected return on plan assets: 2.6% 2.7% Weighted-average rate of increase in compensation levels 2.2% 2.0% The components of net unrecognized pension cost included in Accumulated other comprehensive loss in the Combined Balance Sheets that have not been recognized as a component of net periodic benefit cost are as follows: December 31, 2016 2015 (In thousands) Amortization of loss $ 2,381 $ 1,690 The Business maintains defined contribution plans covering certain union and non-union employees. CFH’s expense relating to these plans for the years ended December 31, 2016, 2015 and 2014 was $2.8 million, $3.3 million and $3.2 million, respectively. 10. Financial Instruments and Fair Value Measurements CFH utilizes fair value measurement guidance prescribed by accounting standards to value its financial instruments. The guidance establishes a fair value hierarchy based on the inputs used to measure fair value. This hierarchy prioritizes the inputs into three broad levels as follows: Level One: Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets. Level Two: Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in inactive markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. Level Three: Inputs to the valuation methodology are unobservable and significant to the fair value measurement. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. A summary of the Business’s assets and liabilities that are measured at fair value on a recurring basis for each fair value hierarchy level for the periods presented is as follows: December 31, 2016 Level One Level Two Level Three Total (In thousands) Assets: Cash equivalents $ 12,916 $ — $ — $ 12,916 Foreign currency contracts related to sales - not designated as hedges — 137 — 137 $ 12,916 $ 137 $ — $ 13,053

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 24 December 31, 2015 Level One Level Two Level Three Total (In thousands) Assets: Cash equivalents $ 18,292 $ — $ — $ 18,292 Foreign currency contracts related to sales - not designated as hedges — 140 — 140 $ 18,292 $ 140 $ — $ 18,432 Liabilities: Foreign currency contracts related to sales - not designated as hedges — 10 — 10 $ — $ 10 $ — $ 10 There were no transfers in or out of Level One, Two or Three during the years ended December 31, 2016 and 2015. Cash Equivalents The Business’s cash equivalents consist of investments in interest-bearing deposit accounts and money market mutual funds which are valued based on quoted market prices. The fair value of these investments approximate cost due to their short-term maturities and the high credit quality of the issuers of the underlying securities. Derivatives The Business periodically enters into foreign currency, interest rate swap and commodity derivative contracts. The Business uses interest-rate swaps to manage exposure to interest-rate fluctuations. Foreign currency contracts are used to manage exchange rate fluctuations. Commodity futures contracts are used to manage costs of raw materials used in CFH’s production processes. The Business does not enter into derivative contracts for trading purposes. During the periods presented there were no changes in CFH’s valuation techniques used to measure asset and liability fair values on a recurring basis. Foreign Currency Contracts Foreign currency contracts are measured using broker quotations or observable market transactions in either listed or over- the-counter markets. The Business primarily uses foreign currency contracts to mitigate the risk associated with customer forward sale agreements denominated in currencies other than the applicable local currency, and to match costs and expected revenues where production facilities have a different currency than the selling currency. As of December 31, 2016 and 2015, the Business had foreign currency contracts with the following notional values: December 31, 2016 2015 (In thousands) Foreign currency contracts sold - not designated as hedges $ 1,630 $ 7,931 Total foreign currency derivatives $ 1,630 $ 7,931 The Business recognized the following in its Combined Financial Statements related to its derivative instruments Realized gains and losses are included in Interest expense, net and unrealized gains and losses are included in Other comprehensive income (loss).

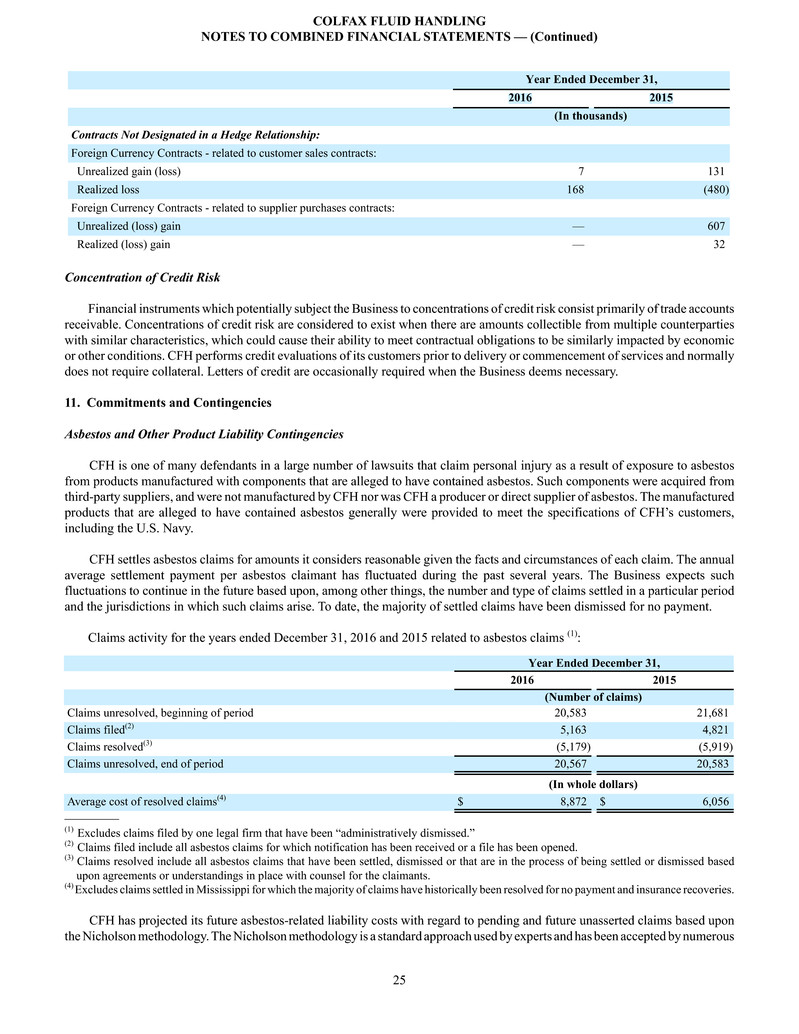

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 25 Year Ended December 31, 2016 2015 (In thousands) Contracts Not Designated in a Hedge Relationship: Foreign Currency Contracts - related to customer sales contracts: Unrealized gain (loss) 7 131 Realized loss 168 (480) Foreign Currency Contracts - related to supplier purchases contracts: Unrealized (loss) gain — 607 Realized (loss) gain — 32 Concentration of Credit Risk Financial instruments which potentially subject the Business to concentrations of credit risk consist primarily of trade accounts receivable. Concentrations of credit risk are considered to exist when there are amounts collectible from multiple counterparties with similar characteristics, which could cause their ability to meet contractual obligations to be similarly impacted by economic or other conditions. CFH performs credit evaluations of its customers prior to delivery or commencement of services and normally does not require collateral. Letters of credit are occasionally required when the Business deems necessary. 11. Commitments and Contingencies Asbestos and Other Product Liability Contingencies CFH is one of many defendants in a large number of lawsuits that claim personal injury as a result of exposure to asbestos from products manufactured with components that are alleged to have contained asbestos. Such components were acquired from third-party suppliers, and were not manufactured by CFH nor was CFH a producer or direct supplier of asbestos. The manufactured products that are alleged to have contained asbestos generally were provided to meet the specifications of CFH’s customers, including the U.S. Navy. CFH settles asbestos claims for amounts it considers reasonable given the facts and circumstances of each claim. The annual average settlement payment per asbestos claimant has fluctuated during the past several years. The Business expects such fluctuations to continue in the future based upon, among other things, the number and type of claims settled in a particular period and the jurisdictions in which such claims arise. To date, the majority of settled claims have been dismissed for no payment. Claims activity for the years ended December 31, 2016 and 2015 related to asbestos claims (1): Year Ended December 31, 2016 2015 (Number of claims) Claims unresolved, beginning of period 20,583 21,681 Claims filed(2) 5,163 4,821 Claims resolved(3) (5,179) (5,919) Claims unresolved, end of period 20,567 20,583 (In whole dollars) Average cost of resolved claims(4) $ 8,872 $ 6,056 (1) Excludes claims filed by one legal firm that have been “administratively dismissed.” (2) Claims filed include all asbestos claims for which notification has been received or a file has been opened. (3) Claims resolved include all asbestos claims that have been settled, dismissed or that are in the process of being settled or dismissed based upon agreements or understandings in place with counsel for the claimants. (4) Excludes claims settled in Mississippi for which the majority of claims have historically been resolved for no payment and insurance recoveries. CFH has projected its future asbestos-related liability costs with regard to pending and future unasserted claims based upon the Nicholson methodology. The Nicholson methodology is a standard approach used by experts and has been accepted by numerous

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 26 courts. It is CFH’s policy to record a liability for asbestos-related liability costs for the longest period of time that it can reasonably estimate. The Business believes that it can reasonably estimate the asbestos-related liability for pending and future claims that will be resolved in the next 15 years and has recorded that liability as its best estimate. While it is reasonably possible that it will incur costs after this period, the Business does not believe the reasonably possible loss or range of reasonably possible losses is estimable at the current time. Accordingly, no accrual has been recorded for any costs which may be paid after 15 years. Defense costs associated with asbestos-related liabilities, as well as costs incurred related to litigation against CFH’s insurers are expensed as incurred. The Business has evaluated the insurance assets for each subsidiary based upon the applicable policy language and allocation methodologies, and law pertaining to the affected subsidiary’s insurance policies. CFH was notified in 2010 by the primary and umbrella carrier who had been fully defending and indemnifying the Business for 20 years that the limits of liability of its primary and umbrella layer policies had been exhausted. CFH has sought coverage from certain excess layer insurers whose terms and conditions follow form to the umbrella carrier, which parties’ dispute was resolved by the Delaware state courts during 2016. This litigation confirmed that asbestos-related costs should be allocated among excess insurers using an “all sums” allocation (which allows an insured to collect all sums paid in connection with a claim from any insurer whose policy is triggered, up to the policy’s applicable limits), that the entity has rights to excess insurance policies purchased by a former owner of the business, and that, based on the September 12, 2016 ruling by the Delaware Supreme Court, the entity has a right to immediate access to the excess layer policies. Further, the Delaware Supreme Court ruled in the entity’s favor on a “trigger of coverage” issue, holding that every policy in place during or after the date of a claimant’s first significant exposure to asbestos was “triggered” and potentially could be accessed to cover that claimant’s claim. The Court also largely affirmed and reversed in part some of the prior lower court rulings on defense obligations and whether payment of such costs erode policy limits or are payable in addition to policy limits. Based upon these rulings, the Business currently estimates that CFH’s future expected recovery percentage is approximately 92% of asbestos-related costs with CFH expected to be responsible for approximately 8% of its future asbestos-related costs. Since approximately mid-2011, the Parent had funded $94.9 million of CFH’s asbestos-related defense and indemnity costs through December 31, 2016, which it expects to recover from insurers. Based on the above-referenced court rulings, CFH recently requested that its insurers reimburse all of that amount and currently expects to receive substantially all of that amount. In late December 2016, $23.6 million of that amount was reimbursed. Certain of the excess insurers have advised CFH that they are still reviewing costs data relating to the other unreimbursed amounts. CFH also has requested that certain excess insurers provide ongoing coverage for future asbestos-related defense and/or indemnity costs. The insurers to which the vast majority of pending claims have been tendered have not yet responded to this request. To the extent any disagreements concerning excess insurers’ payment obligations under the Delaware Supreme Court’s rulings remain, they are expected to be resolved by Delaware court action, which is still pending and has been remanded to the Delaware Superior Court for any further proceedings. In the interim, and while not impacting the results of operations, CFH’s cash funding for future asbestos-related defense and indemnity costs for which it expects reimbursement from insurers could range up to $10 million per quarter. During the year ended December 31, 2014, CFH recorded a $6.9 million pre-tax charge due to a higher number of asbestos claims settlements and a decline in the insurance recovery rate. The charge was comprised of an increase in asbestos-related liabilities of $14.5 million partially offset by an increase in expected insurance recoveries of $7.6 million. During the year ended December 31, 2015, the Business recorded a $4.1 million pre-tax charge due to an increase in mesothelioma and lung cancer claims and higher settlement values per claim that have occurred and are expected to continue to occur in certain jurisdictions. The pre- tax charge was comprised of an increase in asbestos-related liabilities of $20.2 million partially offset by an increase in expected insurance recoveries of $16.1 million. These pre-tax charges were included in Selling, general and administrative expense in the Combined Statements of Operations. During the year ended December 31, 2016, the Business recorded an $8 million increase in asbestos-related liabilities due to higher settlement values per claim. The related insurance asset was accordingly increased $6.4 million, resulting in a net pre-tax charge to Selling, general, and administrative expense of $1.6 million.

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 27 The Business’s Combined Balance Sheets included the following amounts related to asbestos-related litigation: December 31, 2016 2015 (In thousands) Current asbestos insurance receivable(1) $ 27,259 $ 28,872 Long-term asbestos insurance asset (1) 266,030 284,095 Long-term asbestos insurance receivable 92,269 96,007 Accrued asbestos liability 48,031 48,095 Long-term asbestos liability (2) 330,194 347,933 (1) Included in Asbestos asset receivable in the Combined Balance Sheets. (2) Represents accruals for probable and reasonably estimable asbestos-related liability cost that the Business believes it will pay through the next 15 years, overpayments by certain insurers and unpaid legal costs related to defending itself against asbestos-related liability claims and legal action against the Business’s insurers, which is included in Accrued Asbestos litigation reserve in the Combined Balance Sheets. As discussed above, on September 12, 2016, the Delaware Supreme Court affirmed prior rulings regarding CFH ’s insurance policies and also ruled on other matters including specific determinations of coverage for defense costs under the excess policies. The net result of the ruling is an adjustment to the Business’s expected future recoveries, resulting in an $8.2 million reduction to the net recoverable insurance asset recorded as a pre-tax charge to the Combined Statement of Operations for the year ended December 31, 2016. The estimated future expected recovery rate may change over time as these claims are fully settled, which may result in periodic adjustments impacting our financial condition and results of operations. Certain matters, including potential interest which could be awarded to CFH, are subject to further rulings from the Delaware courts. While the outcome is uncertain, none of these matters is expected to have a material adverse effect on the financial condition, results of operations or cash flows of the Business. The Delaware Supreme Court’s ruling is also expected to result in the receipt from excess insurers of approximately $73 million in unreimbursed costs, as of December 31, 2016, funded by CFH in defense and settlement of asbestos claims, although the timing of cash defense and settlement costs, compared to levels experienced prior to the ruling, remains uncertain. Management’s analyses are based on currently known facts and a number of assumptions. However, projecting future events, such as new claims to be filed each year, the average cost of resolving each claim, coverage issues among layers of insurers, the method in which losses will be allocated to the various insurance policies, interpretation of the effect on coverage of various policy terms and limits and their interrelationships, the continuing solvency of various insurance companies, the amount of remaining insurance available, as well as the numerous uncertainties inherent in asbestos litigation could cause the actual liabilities and insurance recoveries to be higher or lower than those projected or recorded which could materially affect the Business’s financial condition, results of operations or cash flow.

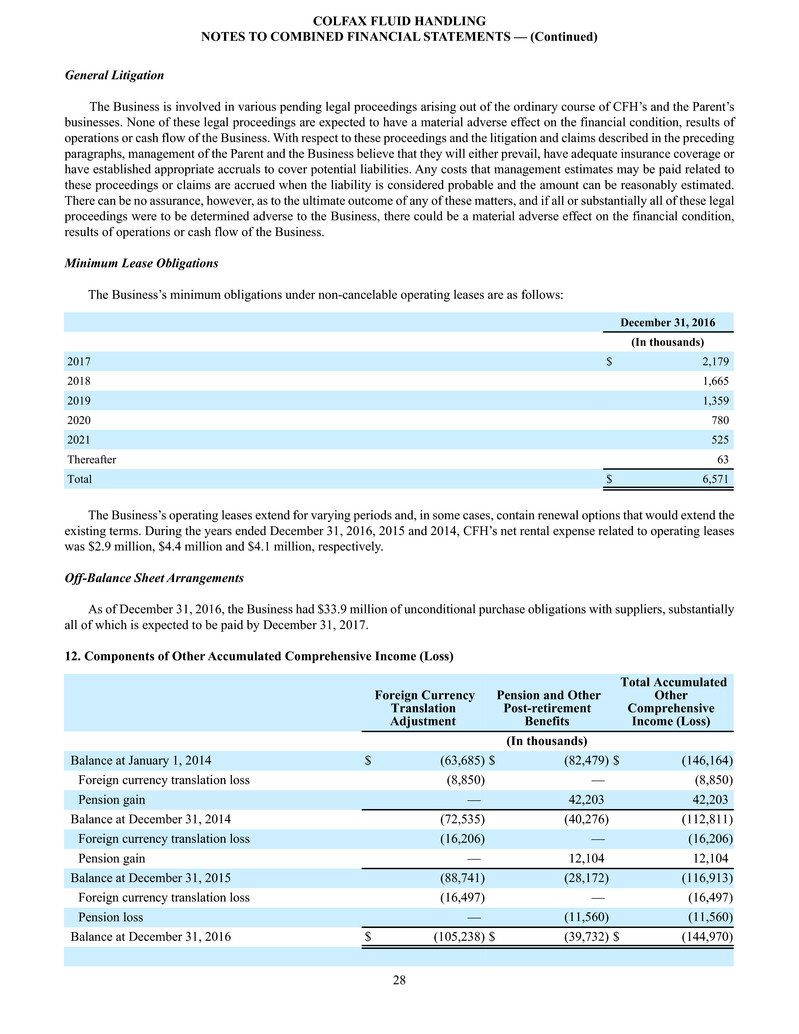

COLFAX FLUID HANDLING NOTES TO COMBINED FINANCIAL STATEMENTS — (Continued) 28 General Litigation The Business is involved in various pending legal proceedings arising out of the ordinary course of CFH’s and the Parent’s businesses. None of these legal proceedings are expected to have a material adverse effect on the financial condition, results of operations or cash flow of the Business. With respect to these proceedings and the litigation and claims described in the preceding paragraphs, management of the Parent and the Business believe that they will either prevail, have adequate insurance coverage or have established appropriate accruals to cover potential liabilities. Any costs that management estimates may be paid related to these proceedings or claims are accrued when the liability is considered probable and the amount can be reasonably estimated. There can be no assurance, however, as to the ultimate outcome of any of these matters, and if all or substantially all of these legal proceedings were to be determined adverse to the Business, there could be a material adverse effect on the financial condition, results of operations or cash flow of the Business. Minimum Lease Obligations The Business’s minimum obligations under non-cancelable operating leases are as follows: December 31, 2016 (In thousands) 2017 $ 2,179 2018 1,665 2019 1,359 2020 780 2021 525 Thereafter 63 Total $ 6,571 The Business’s operating leases extend for varying periods and, in some cases, contain renewal options that would extend the existing terms. During the years ended December 31, 2016, 2015 and 2014, CFH’s net rental expense related to operating leases was $2.9 million, $4.4 million and $4.1 million, respectively. Off-Balance Sheet Arrangements As of December 31, 2016, the Business had $33.9 million of unconditional purchase obligations with suppliers, substantially all of which is expected to be paid by December 31, 2017. 12. Components of Other Accumulated Comprehensive Income (Loss) Foreign Currency Translation Adjustment Pension and Other Post-retirement Benefits Total Accumulated Other Comprehensive Income (Loss) (In thousands) Balance at January 1, 2014 $ (63,685) $ (82,479) $ (146,164) Foreign currency translation loss (8,850) — (8,850) Pension gain — 42,203 42,203 Balance at December 31, 2014 (72,535) (40,276) (112,811) Foreign currency translation loss (16,206) — (16,206) Pension gain — 12,104 12,104 Balance at December 31, 2015 (88,741) (28,172) (116,913) Foreign currency translation loss (16,497) — (16,497) Pension loss — (11,560) (11,560) Balance at December 31, 2016 $ (105,238) $ (39,732) $ (144,970)