EXHIBIT 99.1

CIRCOR Reports First-Quarter 2019 Financial Results

Burlington, MA - April 25, 2019 - CIRCOR International, Inc. (NYSE: CIR), a leading provider of flow control solutions and other highly engineered products for the Industrial, Energy and Aerospace & Defense markets, today announced financial results for the first quarter ended March 31, 2019.

First-Quarter 2019 Highlights

| |

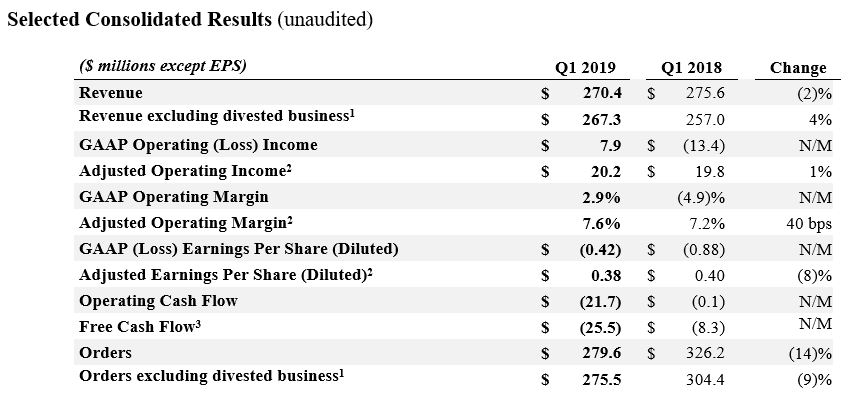

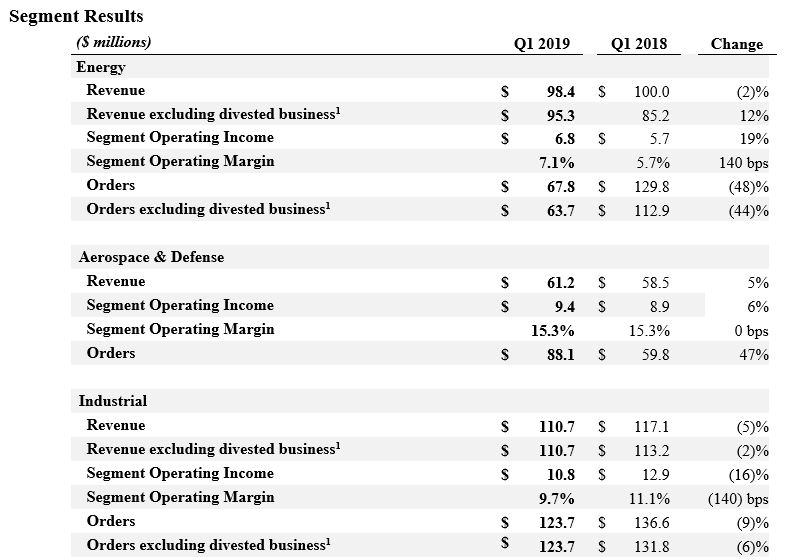

| • | Orders of $280 million, down 14% on a reported basis and down 6% on an organic basis |

| |

| • | Orders in A&D segment grew nearly 50% year over year |

| |

| • | Revenue of $270 million, down 2% on a reported basis and up 8% on an organic basis |

| |

| • | GAAP Operating Margin of 2.9%; GAAP Loss per Share of $(0.42) |

| |

| • | Adjusted Operating Margin of 7.6%; Adjusted Earnings per Share of $0.38 |

| |

| • | Fluid Handling integration remains on track |

| |

| • | Completed sale of Reliability Services business for cash proceeds of $85 million |

| |

| • | Debt pay down of $53 million |

“We reported solid first-quarter 2019 results with 8% organic revenue growth,” said Scott Buckhout, President and Chief Executive Officer. “All three of our business segments grew in the quarter and the outlook for the majority of our end-markets remains positive. We anticipate improving results through the year as we benefit from higher volume, price increases and additional integration savings.

“During the quarter we made significant progress transitioning production to our low-cost manufacturing facilities around the world,” continued Mr. Buckhout. “Our Refinery Valve product line is ramping up in India; several Aerospace platforms were moved to Morocco; and our low-cost facility in Monterrey is now the primary source of production for Distributed Valves in North America.

“De-levering the Company remains a top priority. We reduced our debt by $53 million in the first quarter,” said Mr. Buckhout. “We expect strong free cash flow for the year and we continue to evaluate the sale of non-core businesses to further simplify the Company and accelerate the reduction of outstanding debt.

“Looking ahead, we continue to focus on creating long-term value for shareholders by investing in growth, expanding margins, generating strong free cash flow, and de-levering the Company,” concluded Mr. Buckhout.

Second-Quarter 2019 Guidance

For the second quarter of 2019, CIRCOR expects revenue in the range of $270 million to $280 million, and GAAP loss per share in the range of $(0.13) to $(0.03), which reflects acquisition-related amortization expense of $(0.49) and other special and restructuring charges of $(0.04) to $(0.02). Excluding the impact of amortization, special and restructuring (charges) gains, adjusted EPS is expected to be in the range of $0.40 to $0.48 per share. Presentation slides that provide supporting information to this guidance and first-quarter results are posted on the “Investors” section of the Company’s website, http://investors.circor.com, and will be discussed during the conference call at 9:00 a.m. ET tomorrow, April 26, 2019.

| |

| 1. | Orders and revenue excluding divested businesses is a non-GAAP measure and is calculated by subtracting the orders and revenues generated by the divested businesses during the periods prior to their divestiture from the reported orders and revenues. |

| |

| 2. | Adjusted Consolidated and Segment Results for Q1 2019 exclude non-cash acquisition-related intangible amortization, special and restructuring charges totaling $12.3 million ($16.0 million, net of tax). These charges include: (i) $13.2 million charge for non-cash acquisition-related intangible amortization and depreciation expense (ii) $2.8 million for restructuring-related inventory charges (iii) $1.8 million loss from the business divested in January (iv) $1.1 million of other special and restructuring charges, and (v) a gain of $6.6 million in the quarter related to the sale of businesses. Adjusted Consolidated and Segment Results for Q1 2018 exclude non-cash acquisition-related intangible amortization, special and restructuring charges totaling $33.2 million ($25.5 million, net of tax). These charges include: (i) $20.2 million charge for non-cash acquisition-related intangible amortization expense, including the amortization of a step-up in fair value of inventories ($6.6 million); (ii) $10.5 million charge related to restructuring activities, primarily severance, related to our Engineered Valves, Reliability Services and Germany-based Pumps business; and (iii) $2.5 million related to the separation of Fluid Handling business from Colfax Corporation. |

| |

| 3. | Free Cash Flow is a non-GAAP financial measure and is calculated by subtracting GAAP capital expenditures, net of proceeds from asset sales, from GAAP Operating Cash Flow. |

Conference Call Information

CIRCOR International will hold a conference call to review its financial results at 9:00 a.m. ET tomorrow, April 26, 2019. To listen to the live conference call and view the accompanying presentation slides, please visit “Webcasts & Presentations” in the “Investors” portion of CIRCOR’s website. The live call also can be accessed by dialing (877) 407-5790 or (201) 689-8328. The webcast will be archived on the Company’s website for one year.

Use of Non-GAAP Financial Measures

Adjusted operating income, Adjusted operating margin, Adjusted net income, Adjusted earnings per share (diluted), EBITDA, Adjusted EBITDA, net debt, free cash flow, organic growth, pro forma combined amounts and pro forma organic growth are non-GAAP financial measures. These non-GAAP financial measures are used by management in our financial and operating decision making because we believe they reflect our ongoing business and facilitate period-to-period comparisons. We believe these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating the Company’s current operating performance and future prospects in the same manner as management does, if they so choose. These non-GAAP financial measures also allow investors and others to compare the Company’s current financial results with the Company’s past financial results in a consistent manner.

For example:

| |

| • | We exclude costs and tax effects associated with restructuring activities, such as reducing overhead and consolidating facilities. We believe that the costs related to these restructuring activities are not indicative of our normal operating costs. |

| |

| • | We exclude certain acquisition-related costs, including significant transaction costs and amortization of inventory and fixed-asset step-ups and the related tax effects. We exclude these costs because we do not believe they are indicative of our normal operating costs. |

| |

| • | We exclude the expense and tax effects associated with the non-cash amortization of acquisition-related intangible assets because a significant portion of the purchase price for acquisitions may be allocated to intangible assets that have lives up to 25 years. Exclusion of the non-cash amortization expense allows comparisons of operating results that are consistent over time for both our newly acquired and long-held businesses and with both acquisitive and non-acquisitive peer companies. |

| |

| • | We also exclude certain gains/losses and related tax effects, which are either isolated or cannot be expected to occur again with any predictability, and that we believe are not indicative of our normal operating gains and losses. For example, we exclude gains/losses from items such as the sale of a business, significant litigation-related matters and lump-sum pension plan settlements. |

| |

| • | Due to the significance of recently sold businesses and to provide a comparison of changes in our orders and revenue, we also discuss these changes on an “organic” basis. Organic is calculated assuming the divestures were completed on January 1, 2018 and excluding the impact of changes in foreign currency exchange rates. |

CIRCOR’s management uses these non-GAAP measures, in addition to GAAP financial measures, as the basis for measuring the Company’s operating performance and comparing such performance to that of prior periods and to the performance of our competitors. We use such measures when publicly providing our business outlook, assessing future earnings potential, evaluating potential acquisitions

and dispositions and in our financial and operating decision-making process, including for compensation purposes.

Investors should recognize that these non-GAAP measures might not be comparable to similarly titled measures of other companies. These measures should be considered in addition and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with accounting principles generally accepted in the United States. A reconciliation of the non-GAAP financial measures to the most directly comparable GAAP measures is included in this news release.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27 A of the Securities Act of 1933, as amended, and Section 21 E of the Securities Exchange Act of 1934, as amended. Reliance should not be placed on forward-looking statements because they involve unknown risks, uncertainties and other factors, which are, in some cases, beyond the control of CIRCOR. Any statements in this press release that are not statements of historical fact are forward-looking statements, including, but not limited to, those relating to CIRCOR's second-quarter 2019 guidance, our future performance, including realization of cost reductions from restructuring activities and expected synergies, plans to reduce our outstanding debt and our corporate priorities. Actual events, performance or results could differ materially from the anticipated events, performance or results expressed or implied by such forward-looking statements. Important factors that could cause actual results to vary from expectations include, but are not limited to: our ability to respond to competitive developments and to grow our business, both domestically and internationally; changes in the cost, quality or supply of raw materials; our ability to comply with our debt obligations; our ability to successfully implement our acquisition, divesture or restructuring strategies, including our integration of the Fluid Handling business; changes in industry standards, trade policies or government regulations, both in the United States and internationally; and our ability to operate our manufacturing facilities at current or higher levels and respond to increases in manufacturing costs. BEFORE MAKING ANY INVESTMENT DECISIONS REGARDING OUR COMPANY, WE STRONGLY ADVISE YOU TO READ THE SECTION ENTITLED "RISK FACTORS" IN OUR MOST RECENT ANNUAL REPORT ON FORM 10-K AND SUBSEQUENT REPORTS ON FORMS 10-Q, WHICH CAN BE ACCESSED UNDER THE "INVESTORS" LINK OF OUR WEBSITE AT WWW.CIRCOR.COM. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

About CIRCOR International, Inc.

CIRCOR International, Inc. designs, manufactures and markets differentiated technology products and sub-systems for markets including oil & gas, industrial, aerospace & defense and commercial marine. CIRCOR has a diversified flow and motion control product portfolio with recognized, market-leading brands that fulfill its customers’ mission critical needs. The Company’s strategy is to grow organically and through complementary acquisitions; simplify CIRCOR’s operations; achieve world class operational excellence; and attract and retain top talent. For more information, visit the Company’s investor relations website at http://investors.circor.com.

Contact:

David F. Mullen

Senior Vice President Finance

CIRCOR International

(781) 270-1200

CIRCOR INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF LOSS

(in thousands, except per share data)

(UNAUDITED)

|

| | | | | | | |

| | Three Months Ended |

| | March 31, 2019 | | April 1, 2018 |

| Net revenues | $ | 270,395 |

| | $ | 275,580 |

|

| Cost of revenues | 196,526 |

| | 199,276 |

|

| GROSS PROFIT | 73,869 |

| | 76,304 |

|

| Selling, general and administrative expenses | 69,719 |

| | 77,238 |

|

| Special and restructuring (recoveries) charges, net | (3,779 | ) | | 12,446 |

|

| OPERATING INCOME | 7,929 |

| | (13,380 | ) |

| Other expense (income): | | | |

| Interest expense, net | 13,179 |

| | 11,801 |

|

| Other income expense, net | (1,913 | ) | | (1,861 | ) |

| TOTAL OTHER EXPENSE, NET | 11,266 |

| | 9,940 |

|

| LOSS BEFORE INCOME TAXES | (3,337 | ) | | (23,320 | ) |

| Provision for (benefit from) income taxes | 5,095 |

| | (5,879 | ) |

| NET LOSS | $ | (8,432 | ) | | $ | (17,441 | ) |

| Loss per common share: | | | |

| Basic | $ | (0.42 | ) | | $ | (0.88 | ) |

| Diluted | $ | (0.42 | ) | | $ | (0.88 | ) |

| Weighted average number of common shares outstanding: | | | |

| Basic | 20,195 |

| | 19,806 |

|

| Diluted | 20,195 |

| | 19,806 |

|

CIRCOR INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(UNAUDITED)

|

| | | | | | | |

| | Three Months Ended |

| OPERATING ACTIVITIES | March 31, 2019 | | April 1, 2018 |

| Net Loss | $ | (8,432 | ) | | $ | (17,441 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation | 5,944 |

| | 7,334 |

|

| Amortization | 12,906 |

| | 12,329 |

|

| Bad debt expense | 109 |

| | 261 |

|

| Loss on write down of inventory | 3,043 |

| | 963 |

|

| Amortization of inventory fair value step-up | — |

| | 6,600 |

|

| Compensation expense for share-based plans | 1,422 |

| | 1,365 |

|

| Amortization of inventory fair value step-up | — |

| | 881 |

|

| Loss on sale or write-down of property, plant and equipment | — |

| | 1,284 |

|

| Gain on sale of business | (6,569 | ) | | — |

|

| Changes in operating assets and liabilities, net of effects of acquisition and divestitures: | | | |

| Trade accounts receivable | (5,758 | ) | | 22,038 |

|

| Inventories | (1,108 | ) | | (14,850 | ) |

| Other current assets and liabilities | (23,243 | ) | | (20,909 | ) |

| Net cash used in operating activities | (21,686 | ) | | (145 | ) |

| INVESTING ACTIVITIES | | | |

| Additions to property, plant and equipment | (3,879 | ) | | (8,234 | ) |

| Proceeds from the sale of property, plant and equipment | 28 |

| | 93 |

|

| Proceeds from the sale of business, net | 83,321 |

| | — |

|

| Net cash provided by (used in) investing activities | 79,470 |

| | (8,141 | ) |

| FINANCING ACTIVITIES | | | |

| Proceeds from long-term debt | 87,400 |

| | 71,950 |

|

| Payments of short-term and long-term debt | (140,500 | ) | | (44,106 | ) |

| Proceeds from the exercise of stock options | — |

| | 301 |

|

| Return of cash to Fluid Handling Seller | — |

| | (7,905 | ) |

| Net cash (used in) provided by financing activities | (53,100 | ) | | 20,240 |

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 426 |

| | 956 |

|

| INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | 5,110 |

| | 12,910 |

|

| Cash, cash equivalents, and restricted cash at beginning of period | 69,525 |

| | 112,293 |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH AT END OF PERIOD | $ | 74,635 |

| | $ | 125,203 |

|

CIRCOR INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(UNAUDITED)

|

| | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 73,619 |

| | $ | 68,517 |

|

| Trade accounts receivable, less allowance for doubtful accounts | 188,500 |

| | 183,552 |

|

| Inventories | 217,991 |

| | 217,378 |

|

| Prepaid expenses and other current assets | 89,904 |

| | 90,659 |

|

| Assets held for sale | 4,623 |

| | 87,940 |

|

| Total Current Assets | 574,637 |

| | 648,046 |

|

| PROPERTY, PLANT AND EQUIPMENT, NET | 198,148 |

| | 201,799 |

|

| OTHER ASSETS: | | | |

| Goodwill | 476,562 |

| | 459,205 |

|

| Intangibles, net | 422,302 |

| | 441,302 |

|

| Deferred income taxes | 25,632 |

| | 28,462 |

|

| Other assets | 35,483 |

| | 12,798 |

|

| TOTAL ASSETS | $ | 1,732,764 |

| | $ | 1,791,612 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 122,277 |

| | $ | 123,881 |

|

| Accrued expenses and other current liabilities | 99,771 |

| | 107,312 |

|

| Accrued compensation and benefits | 27,251 |

| | 33,878 |

|

| Liabilities held for sale | — |

| | 11,141 |

|

| Current portion of long-term debt | — |

| | 7,850 |

|

| Total Current Liabilities | 249,299 |

| | 284,062 |

|

| LONG-TERM DEBT | 733,666 |

| | 778,187 |

|

| DEFERRED INCOME TAXES | 33,780 |

| | 33,932 |

|

| PENSION LIABILITY, NET | 146,854 |

| | 150,623 |

|

| OTHER NON-CURRENT LIABILITIES | 37,832 |

| | 15,815 |

|

| SHAREHOLDERS’ EQUITY | 531,333 |

| | 528,993 |

|

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 1,732,764 |

| | $ | 1,791,612 |

|

CIRCOR INTERNATIONAL, INC. SUMMARY OF ORDERS AND BACKLOG (in millions) UNAUDITED |

| | | | | | | |

| | Three Months Ended |

| | March 31, 2019 | | April 1, 2018 |

ORDERS (1) | | | |

| Energy | $ | 67.8 |

| | $ | 129.8 |

|

| Aerospace & Defense | 88.1 |

| | 59.8 |

|

| Industrial | 123.7 |

| | 136.6 |

|

| Total orders | $ | 279.6 |

| | $ | 326.2 |

|

| | | | |

BACKLOG (2) | March 31, 2019 | | April 1, 2018 |

| Energy | $ | 140.3 |

| | $ | 224.1 |

|

| Aerospace & Defense | 206.5 |

| | 165.8 |

|

| Industrial | 174.2 |

| | 170.6 |

|

| Total backlog | $ | 521.0 |

| | $ | 560.5 |

|

| | | | |

| Note 1: Orders do not include the foreign exchange impact due to the re-measurement of customer order backlog amounts denominated in foreign currencies. Q1 2019 and 2018 orders include $4.1 million and $21.7 million, respectively, related to divested businesses. |

| Note 2: Backlog includes unshipped customer orders for which revenue has not been recognized. Backlog at Q1 2018 includes $25.6 million related to divested businesses. |

CIRCOR INTERNATIONAL, INC. SEGMENT INFORMATION (in thousands, except percentages) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | 2018 | 2019 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| ORDERS | | | | | | |

| Energy | $ | 129,762 |

| $ | 113,171 |

| $ | 110,987 |

| $ | 97,990 |

| $ | 451,910 |

| $ | 67,770 |

|

| Aerospace & Defense | 59,793 |

| 59,441 |

| 81,533 |

| 76,702 |

| 277,469 |

| 88,107 |

|

| Industrial | 136,607 |

| 136,746 |

| 114,876 |

| 121,886 |

| 510,115 |

| 123,746 |

|

| Total | $ | 326,162 |

| $ | 309,358 |

| $ | 307,396 |

| $ | 296,578 |

| $ | 1,239,494 |

| $ | 279,623 |

|

| | | | | | | |

| NET REVENUES | | | | | | |

| Energy | $ | 99,972 |

| $ | 112,804 |

| $ | 121,023 |

| $ | 117,433 |

| $ | 451,232 |

| $ | 98,417 |

|

| Aerospace & Defense | 58,477 |

| 57,500 |

| 57,757 |

| 63,283 |

| 237,017 |

| 61,240 |

|

| Industrial | 117,131 |

| 131,064 |

| 118,734 |

| 120,647 |

| 487,576 |

| 110,738 |

|

| Total | $ | 275,580 |

| $ | 301,368 |

| $ | 297,514 |

| $ | 301,363 |

| $ | 1,175,825 |

| $ | 270,395 |

|

| | | | | | | |

| SEGMENT OPERATING INCOME | | | | | | |

| Energy | $ | 5,696 |

| $ | 9,242 |

| $ | 9,163 |

| $ | 9,396 |

| $ | 33,497 |

| $ | 6,783 |

|

| Aerospace & Defense | 8,931 |

| 6,992 |

| 8,709 |

| 11,415 |

| 36,047 |

| 9,374 |

|

| Industrial | 12,948 |

| 15,037 |

| 14,609 |

| 14,746 |

| 57,340 |

| 10,787 |

|

| Corporate expenses | (7,802 | ) | (6,448 | ) | (8,034 | ) | (8,015 | ) | (30,299 | ) | (6,705 | ) |

| Adjusted Operating Income | $ | 19,773 |

| $ | 24,823 |

| $ | 24,447 |

| $ | 27,542 |

| $ | 96,585 |

| $ | 20,239 |

|

| | | | | | | |

| SEGMENT OPERATING MARGIN % | | | | | | |

| Energy | 5.7 | % | 8.2 | % | 7.6 | % | 8.0 | % | 7.4 | % | 6.9 | % |

| Aerospace & Defense | 15.3 | % | 12.2 | % | 15.1 | % | 18.0 | % | 15.2 | % | 15.3 | % |

| Industrial | 11.1 | % | 11.5 | % | 12.3 | % | 12.2 | % | 11.8 | % | 9.7 | % |

| CIRCOR Adjusted Operating Margin | 7.2 | % | 8.2 | % | 8.2 | % | 9.1 | % | 8.2 | % | 7.5 | % |

| | | | | | | |

| SEGMENT OPERATING MARGIN % EXCLUDING DIVESTITURES | | | | | | |

| Energy | 6.7 | % | 7.5 | % | 6.0 | % | 7.8 | % | 7.0 | % | 7.1 | % |

| Aerospace & Defense | 15.3 | % | 12.2 | % | 15.1 | % | 18.0 | % | 15.2 | % | 15.3 | % |

| Industrial | 11.4 | % | 11.9 | % | 12.8 | % | 12.7 | % | 12.2 | % | 9.7 | % |

| CIRCOR Adjusted Operating Margin Excluding Divestitures | 7.7 | % | 8.2 | % | 7.9 | % | 9.3 | % | 8.3 | % | 7.6 | % |

|

| | | | | | | | | | | | | | | | | | |

| CIRCOR INTERNATIONAL INC. |

| SUPPLEMENTAL INFORMATION REGARDING DIVESTED BUSINESSES |

| (in thousands) |

| UNAUDITED |

| | | | | | | |

| | 2018 | 2019 |

| DIVESTED BUSINESSES | 1st QTR | 2nd QTR | 3rd QTR | 4th QTR | Total | 1st QTR |

| | | | | | | |

| ORDERS | | | | | | |

| Energy | $ | 16,891 |

| $ | 18,389 |

| $ | 19,145 |

| $ | 15,451 |

| $ | 69,875 |

| $ | 4,104 |

|

| Industrial | 4,848 |

| 4,484 |

| 2,302 |

| 4,796 |

| 16,430 |

| — |

|

| CIRCOR | $ | 21,738 |

| $ | 22,873 |

| $ | 21,446 |

| $ | 20,247 |

| $ | 86,305 |

| $ | 4,104 |

|

| | | | | | | |

| NET REVENUES | | | | | | |

| Energy | $ | 14,731 |

| $ | 17,419 |

| $ | 16,579 |

| $ | 16,885 |

| $ | 65,613 |

| $ | 3,106 |

|

| Industrial | 3,897 |

| 1,499 |

| 2,070 |

| 3,846 |

| 11,312 |

| — |

|

| CIRCOR | $ | 18,628 |

| $ | 18,918 |

| $ | 18,649 |

| $ | 20,731 |

| $ | 76,925 |

| $ | 3,106 |

|

| | | | | | | |

| SEGMENT OPERATING INCOME | | | | | | |

| Energy | $ | 8 |

| $ | 2,085 |

| $ | 2,905 |

| $ | 1,597 |

| $ | 6,596 |

| $ | — |

|

| Industrial | 79 |

| (427) |

| (371) |

| (78) |

| (798) |

| — |

|

| CIRCOR | $ | 87 |

| $ | 1,658 |

| $ | 2,534 |

| $ | 1,519 |

| $ | 5,798 |

| $ | — |

|

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS (in thousands, except percentages) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | 2018 | 2019 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| NET CASH (USED IN) PROVIDED BY OPERATING ACTIVITIES | $ | (145 | ) | $ | (465 | ) | $ | 24,073 |

| $ | 30,531 |

| $ | 53,994 |

| $ | (21,686 | ) |

| LESS: | | | | | | |

| Capital expenditures, net of sale proceeds | 8,141 |

| 3,563 |

| 5,119 |

| 6,534 |

| 23,357 |

| 3,851 |

|

| FREE CASH FLOW | $ | (8,286 | ) | $ | (4,028 | ) | $ | 18,954 |

| $ | 23,997 |

| $ | 30,637 |

| $ | (25,537 | ) |

| | | | | | | |

| GROSS DEBT | $ | 823,665 |

| $ | 827,629 |

| $ | 831,613 |

| $ | 807,050 |

| $ | 807,050 |

| $ | 753,950 |

|

| LESS: Cash & cash equivalents | 123,305 |

| 69,030 |

| 71,334 |

| 68,517 |

| 68,517 |

| 73,619 |

|

| GROSS DEBT, NET OF CASH | $ | 700,360 |

| $ | 758,599 |

| $ | 760,279 |

| $ | 738,533 |

| $ | 738,533 |

| $ | 680,331 |

|

| | | | | | | |

| TOTAL SHAREHOLDERS' EQUITY | $ | 592,096 |

| $ | 573,992 |

| $ | 574,171 |

| $ | 528,993 |

| $ | 528,993 |

| $ | 531,333 |

|

| | | | | | | |

| GROSS DEBT AS % OF EQUITY | 139 | % | 144 | % | 145 | % | 153 | % | 153 | % | 142 | % |

| GROSS DEBT, NET OF CASH AS % OF EQUITY | 118 | % | 132 | % | 132 | % | 140 | % | 140 | % | 128 | % |

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS (in thousands, except per share data) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | 2018 | 2019 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| NET INCOME (LOSS) | $ | (17,441 | ) | $ | 5,902 |

| $ | (6,841 | ) | $ | (21,005 | ) | $ | (39,385 | ) | $ | (8,432 | ) |

| LESS: | | | | | | |

| Restructuring related inventory charges | 473 |

| 1,067 |

| — |

| 864 |

| 2,404 |

| 2,818 |

|

| Amortization of inventory step-up | 6,600 |

| — |

| — |

| — |

| 6,600 |

| — |

|

| Restructuring charges, net | 9,615 |

| 844 |

| 1,348 |

| 944 |

| 12,751 |

| 863 |

|

| Acquisition amortization | 11,797 |

| 11,767 |

| 11,733 |

| 12,012 |

| 47,309 |

| 12,148 |

|

| Acquisition depreciation | 1,837 |

| 1,735 |

| 1,742 |

| 1,735 |

| 7,049 |

| 1,123 |

|

| Special charges (recoveries), net | 2,831 |

| 1,156 |

| 1,408 |

| 5,692 |

| 11,087 |

| (4,641 | ) |

| Income tax impact | (7,687 | ) | (11,056 | ) | 967 |

| 12,124 |

| (5,652 | ) | 3,766 |

|

| ADJUSTED NET INCOME | $ | 8,025 |

| $ | 11,415 |

| $ | 10,357 |

| $ | 12,366 |

| $ | 42,163 |

| $ | 7,645 |

|

| | | | | | | |

| EARNINGS (LOSS) PER COMMON SHARE (Diluted) | $ | (0.88 | ) | $ | 0.30 |

| $ | (0.34 | ) | $ | (1.05 | ) | $ | (1.97 | ) | $ | (0.42 | ) |

| LESS: | | | | | | |

| Restructuring related inventory charges | 0.02 |

| 0.05 |

| — |

| 0.04 |

| 0.12 |

| 0.14 |

|

| Amortization of inventory step-up | 0.33 |

| — |

| — |

| — |

| 0.33 |

| — |

|

| Restructuring charges, net | 0.49 |

| 0.04 |

| 0.07 |

| 0.05 |

| 0.64 |

| 0.04 |

|

| Acquisition amortization | 0.60 |

| 0.59 |

| 0.59 |

| 0.60 |

| 2.37 |

| 0.60 |

|

| Acquisition depreciation | 0.09 |

| 0.09 |

| 0.09 |

| 0.09 |

| 0.35 |

| 0.06 |

|

| Special charges (recoveries), net | 0.14 |

| 0.06 |

| 0.07 |

| 0.29 |

| 0.55 |

| (0.23 | ) |

| Income tax impact | (0.39 | ) | (0.55 | ) | 0.05 |

| 0.61 |

| (0.28 | ) | 0.19 |

|

| ADJUSTED EARNINGS PER SHARE (Diluted) | $ | 0.40 |

| $ | 0.57 |

| $ | 0.52 |

| $ | 0.62 |

| $ | 2.11 |

| $ | 0.38 |

|

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS (in thousands) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | 2018 | 2019 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| NET INCOME (LOSS) | $ | (17,441 | ) | $ | 5,902 |

| $ | (6,841 | ) | $ | (21,005 | ) | $ | (39,384 | ) | $ | (8,432 | ) |

| LESS: | | | | | | |

| Interest expense, net | (11,801 | ) | (13,755 | ) | (14,100 | ) | (13,257 | ) | (52,913 | ) | (13,179 | ) |

| Depreciation | (7,334 | ) | (7,157 | ) | (7,065 | ) | (7,198 | ) | (28,754 | ) | (5,944 | ) |

| Amortization | (12,329 | ) | (12,282 | ) | (12,234 | ) | (12,410 | ) | (49,255 | ) | (12,636 | ) |

| Benefit from (provision for) income taxes | 5,879 |

| 7,646 |

| (2,537 | ) | (14,278 | ) | (3,290 | ) | (5,095 | ) |

| EBITDA | $ | 8,144 |

| $ | 31,450 |

| $ | 29,095 |

| $ | 26,138 |

| $ | 94,828 |

| $ | 28,422 |

|

| LESS: | | | | | | |

| Restructuring related inventory charges | (473 | ) | (1,067 | ) | — |

| (864 | ) | (2,404 | ) | (2,818 | ) |

| Amortization of inventory step-up | (6,600 | ) | — |

| — |

| — |

| (6,600 | ) | — |

|

| Restructuring charges, net | (9,615 | ) | (844 | ) | (1,348 | ) | (944 | ) | (12,751 | ) | (863 | ) |

| Special (charges) recoveries, net | (2,831 | ) | (1,156 | ) | (1,408 | ) | (5,692 | ) | (11,087 | ) | 4,641 |

|

| ADJUSTED EBITDA | $ | 27,663 |

| $ | 34,517 |

| $ | 31,851 |

| $ | 33,638 |

| $ | 127,669 |

| $ | 27,462 |

|

CIRCOR INTERNATIONAL, INC. RECONCILIATION OF KEY PERFORMANCE MEASURES TO COMMONLY USED GENERALLY ACCEPTED ACCOUNTING PRINCIPLE TERMS (in thousands, except percentages) UNAUDITED |

| | | | | | | | | | | | | | | | | | |

| | 2018 | 2019 |

| | 1ST QTR | 2ND QTR | 3RD QTR | 4TH QTR | TOTAL | 1ST QTR |

| GAAP OPERATING INCOME (LOSS) | $ | (13,380 | ) | $ | 8,252 |

| $ | 8,216 |

| $ | 6,296 |

| $ | 9,384 |

| $ | 7,929 |

|

| LESS: | | | | | | |

| Restructuring related inventory charges | 473 |

| 1,067 |

| — |

| 864 |

| 2,404 |

| 2,818 |

|

| Amortization of inventory step-up | 6,600 |

| — |

| — |

| — |

| 6,600 |

| — |

|

| Restructuring charges, net | 9,615 |

| 844 |

| 1,348 |

| 944 |

| 12,751 |

| 863 |

|

| Acquisition amortization | 11,797 |

| 11,767 |

| 11,733 |

| 12,012 |

| 47,309 |

| 12,148 |

|

| Acquisition depreciation | 1,837 |

| 1,735 |

| 1,742 |

| 1,735 |

| 7,049 |

| 1,123 |

|

| Special charges (recoveries), net | 2,831 |

| 1,156 |

| 1,408 |

| 5,692 |

| 11,087 |

| (4,641 | ) |

| ADJUSTED OPERATING INCOME | $ | 19,773 |

| $ | 24,821 |

| $ | 24,447 |

| $ | 27,543 |

| $ | 96,584 |

| $ | 20,240 |

|

| | | | | | | |

| GAAP OPERATING MARGIN | (4.9 | )% | 2.7 | % | 2.8 | % | 2.1 | % | 0.8 | % | 2.9 | % |

| LESS: | | | | | | |

| Restructuring related inventory charges | 0.2 | % | 0.4 | % | — | % | 0.3 | % | 0.2 | % | 1.0 | % |

| Amortization of inventory step-up | 2.4 | % | — | % | — | % | — | % | 0.6 | % | — | % |

| Restructuring charges, net | 3.5 | % | 0.3 | % | 0.5 | % | 0.3 | % | 1.1 | % | 0.3 | % |

| Acquisition amortization | 4.3 | % | 3.9 | % | 3.9 | % | 4.0 | % | 4.0 | % | 4.5 | % |

| Acquisition depreciation | 0.7 | % | 0.6 | % | 0.6 | % | 0.6 | % | 0.6 | % | 0.4 | % |

| Special charges (recoveries), net | 1.0 | % | 0.4 | % | 0.5 | % | 1.9 | % | 0.9 | % | (1.7 | )% |

| ADJUSTED OPERATING MARGIN | 7.2 | % | 8.2 | % | 8.2 | % | 9.1 | % | 8.2 | % | 7.5 | % |

| Impact of Divestitures | 0.5 | % | — | % | (0.3 | )% | 0.2 | % | 0.1 | % | 0.1 | % |

| ADJUSTED OPERATING MARGIN EXCLUDING DIVESTITURES | 7.7 | % | 8.2 | % | 7.9 | % | 9.3 | % | 8.3 | % | 7.6 | % |

|

| | | | | | | | | | | | | |

| CIRCOR INTERNATIONAL, INC. |

| Q1 2019 Organic Growth Calculations |

| (in thousands, except percentages) |

| UNAUDITED |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Industrial | | Energy | | Aerospace & Defense | | CIRCOR |

| ORDERS | $ | | % | | $ | | % | | $ | | % | | $ | | % |

| | | | | | | | | | | | | | | | |

| Q1 2018 | $ | 136.6 |

| | | | $ | 129.8 |

| | | | $ | 59.8 |

| | | | $ | 326.2 |

| | |

| Divestitures | (4.8) |

| | | | (16.9) |

| | | | 0 |

| | | | (21.7) |

| | |

| Q1 2018 Excluding Divestitures | 131.8 |

| | | | 112.9 |

| | | | 59.8 |

| | | | 304.4 |

| | |

| | | | | | | | | | | | | | | | |

| Organic | (1.3) |

| | -1% | | (48.0) |

| | -42% |

| | 29.7 |

| | 50% | | (19.5) |

| | -6% |

|

| Acquisition / Divestiture | 0 |

| | 0% | | 4.1 |

| | 4% |

| | 0 |

| | 0% | | 4.1 |

| | 1% |

|

| FX | (6.8) |

| | -5% | | (1.3) |

| | -1% |

| | (1.4) |

| | -2% | | (9.4) |

| | -3% |

|

| Total Change Excluding Divestitures | (8.0) |

| | -6% | | (45.1) |

| | -40% |

| | 28.3 |

| | 47% | | (24.8) |

| | -8% |

|

| | | | | | | | | | | | | | | | |

| Q1 2019 | $ | 123.7 |

| | | | $ | 67.8 |

| | | | $ | 88.1 |

| | | | $ | 279.6 |

| | |

| | | | | | | | | | | | | | | | |

| | Industrial | | Energy | | Aerospace & Defense | | CIRCOR |

| NET REVENUE | $ | | % | | $ | | % | | $ | | % | | $ | | % |

| | | | | | | | | | | | | | | | |

| Q1 2018 | $ | 117.1 |

| | | | $ | 100.0 |

| | | | $ | 58.5 |

| | | | $ | 275.6 |

| | |

| Divestitures | (3.9) |

| | | | (14.7) |

| | | | 0 |

| | | | (18.6) |

| | |

| Q1 2018 Excluding Divestitures | 113.2 |

| | | | 85.2 |

| | | | 58.5 |

| | | | 257.0 |

| | |

| | | | | | | | | | | | | | | | |

| Organic | 3.8 |

| | 3% | | 12.1 |

| | 14 | % | | 4.0 |

| | 7% | | 20.0 |

| | 8 | % |

| Acquisition / Divestiture | 0 |

| | 0% | | 3.1 |

| | 4 | % | | 0 |

| | 0% | | 3.1 |

| | 1% |

|

| FX | (6.3) |

| | -6% | | (2.1) |

| | -2% |

| | (1.3) |

| | -2% | | (9.6) |

| | -4% |

|

| Total Change Excluding Divestitures | (2.5) |

| | -2% | | 13.2 |

| | 15% |

| | 2.7 |

| | 5% | | 13.5 |

| | 5% |

|

| | | | | | | | | | | | | | | | |

| Q1 2019 | $ | 110.7 |

| | | | $ | 98.4 |

| | | | $ | 61.2 |

| | | | $ | 270.4 |

| | |