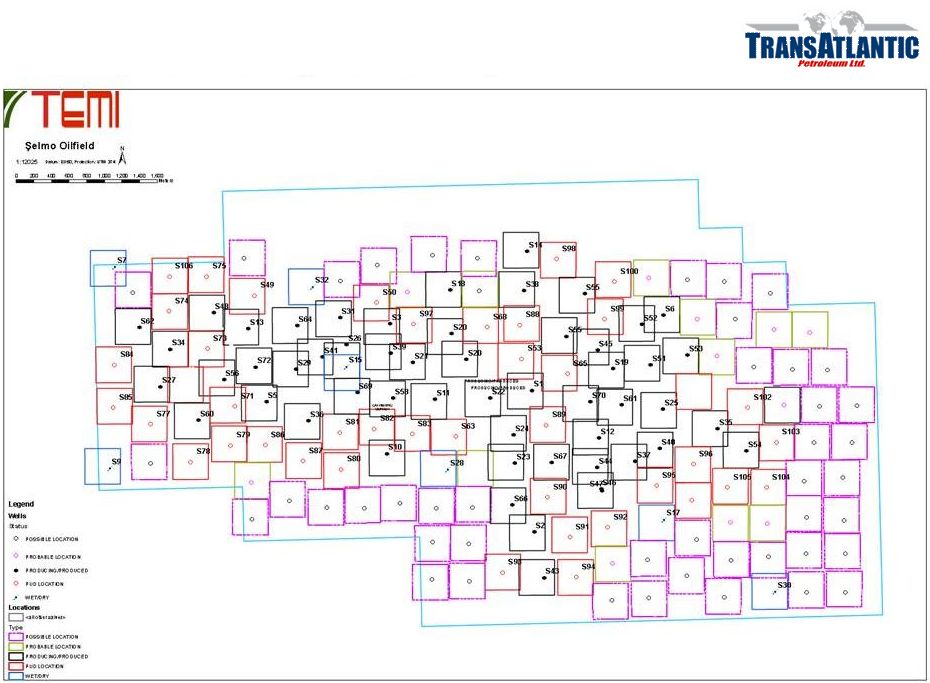

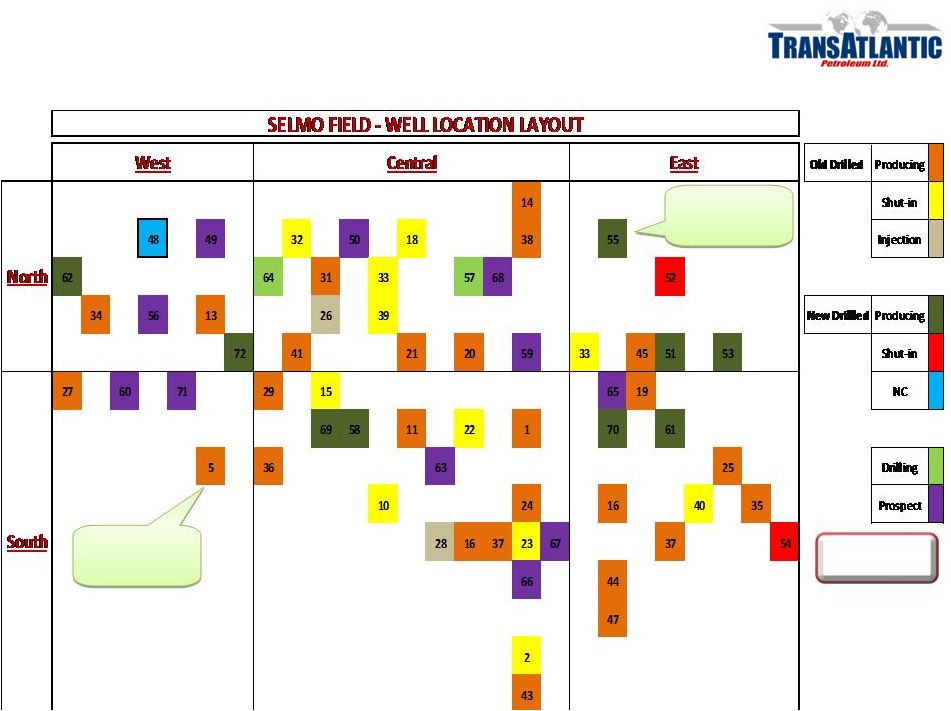

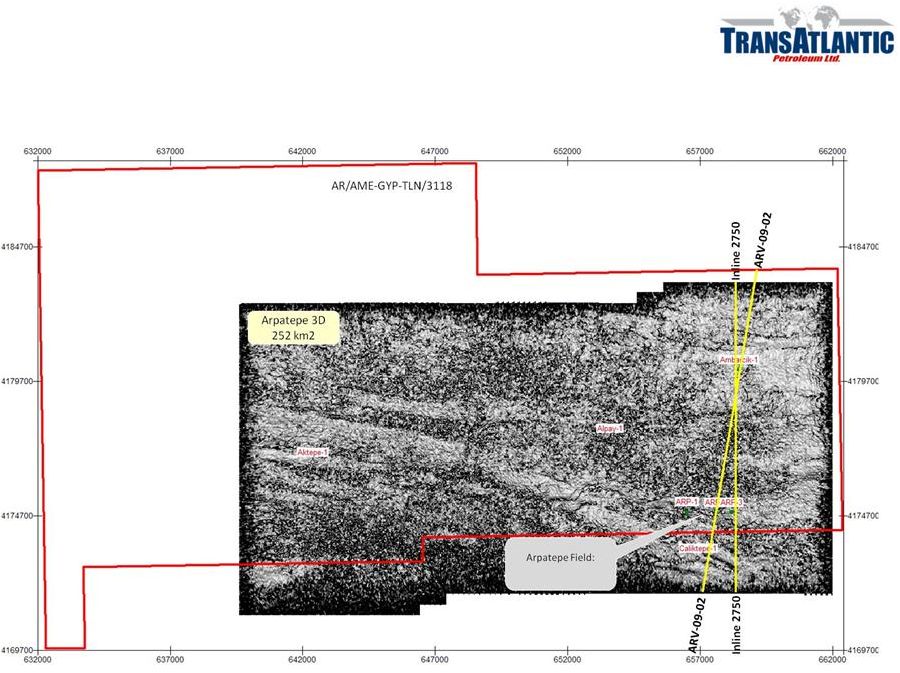

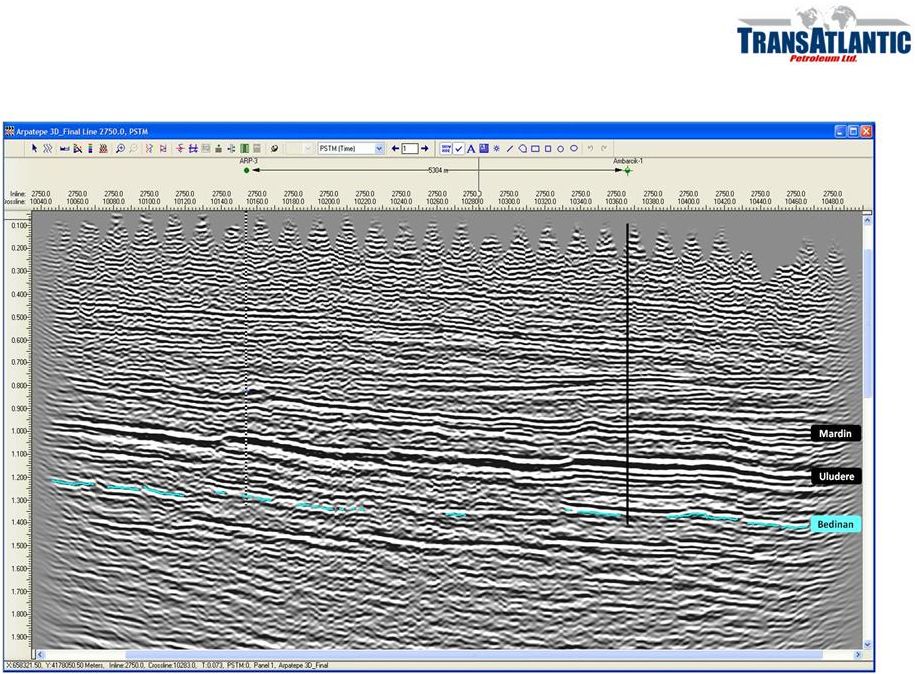

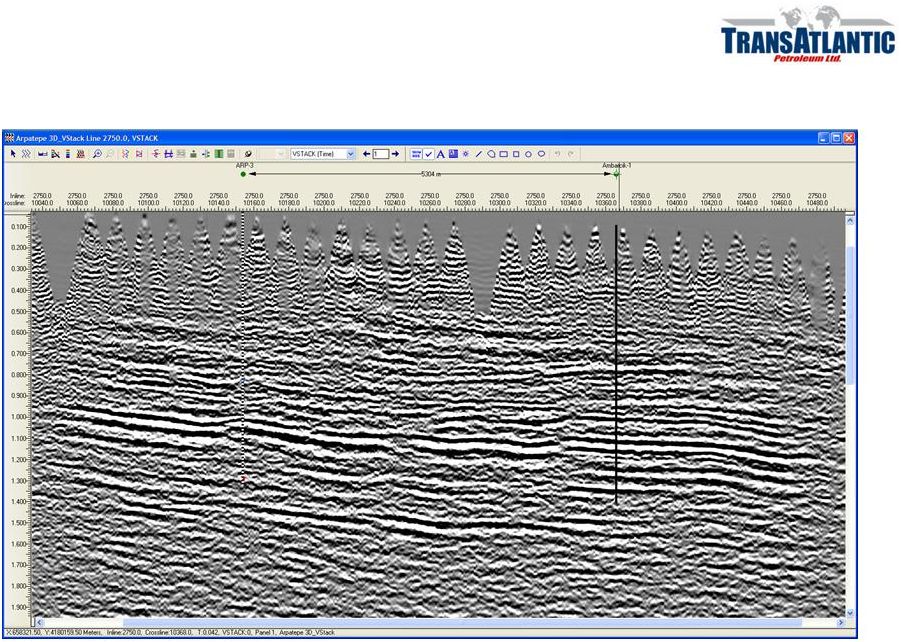

2 Disclaimer Forward-Looking Statements Outlooks, projections, estimates, targets, and business plans in this presentation or any related subsequent discussions are forward-looking statements. Actual future results, including TransAtlantic Petroleum Ltd.’s own production growth and mix; financial results; the amount and mix of capital expenditures; resource additions and recoveries; finding and development costs; project and drilling plans, timing, costs, and capacities; revenue enhancements and cost efficiencies; industry margins; margin enhancements and integration benefits; and the impact of technology could differ materially due to a number of factors. These include changes in long-term oil or gas prices or other market conditions affecting the oil, gas, and petrochemical industries; reservoir performance; timely completion of development projects; war and other political or security disturbances; changes in law or government regulation; the outcome of commercial negotiations; the actions of competitors; unexpected technological developments; the occurrence and duration of economic recessions; unforeseen technical difficulties; and other factors discussed here and under the heading “Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2009 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2010, June 30, 2010 and September 30, 2010 available at our website at www.transatlanticpetroleum.com and www.sec.gov. See also TransAtlantic’s 2009 audited financial statements and the accompanying management discussion and analysis. Forward-looking statements are based on management’s knowledge and reasonable expectations on the date hereof, and we assume no duty to update these statements as of any future date. No Offer, Solicitation or Recommendation The information set forth in this presentation does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities of the Company. The information published herein is provided for informational purposes only. The Company makes no representation that the information and opinions expressed herein are accurate, complete or current. The information contained herein is current as of the date hereof, but may become outdated or subsequently may change. Nothing contained herein constitutes financial, legal, tax, or other advice. Notes Regarding SEC Reserves Data and Other Oil and Gas Information The Company uses in this presentation the terms proved, probable and possible reserves. Proved reserves are reserves which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs and under existing economic conditions, operating methods and government regulations prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced, or the operator must be reasonably certain that it will commence the project within a reasonable time. Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. Estimates of probable and possible reserves which may potentially be recoverable through additional drilling or recovery techniques are by nature more uncertain than estimates of proved reserves and accordingly are subject to substantially greater risk of not actually being realized by the Company. In addition, in this presentation the Company uses certain broader terms such as “contingent resource estimate,” or “potential” or “upside” or other descriptions of volumes of resources potentially recoverable through additional drilling or recovery techniques that may include probable and possible reserves as defined by the SEC’s guidelines. The Company has not attempted to distinguish probable and possible reserves from these broader classifications. The SEC’s rules prohibit us from including in filings with the SEC these broader classifications of reserves. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. Contingent resource estimate refers to the Company’s internal estimates of hydrocarbon quantities that may be potentially discovered through exploratory drilling or recovered with additional drilling or recovery techniques and have not been reviewed by independent reserves evaluators. Contingent resource estimates do not constitute reserves and do not include proved reserves. Area wide unproven, unrisked resource potential has not been fully risked by our management. Actual quantities that may be ultimately recovered from the Company’s interests will differ substantially. Factors affecting ultimate recovery include the scope of the Company’s drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, drilling results, license expirations, transportation constraints, regulatory approvals, field spacing rules, recoveries of gas in place, length of horizontal laterals, actual drilling results, including geological and mechanical factors affecting recovery rates and other factors. Estimates of resource potential may change significantly as development of our resource plays provides additional data. DeGolyer and MacNaughton evaluated the Company’s reserves as of December 31, 2010 in accordance with the reserves definitions of Rule 4-10(a) (1)-(32) of Regulation S-X of the Securities and Exchange Commission (“SEC”) and in accordance with National Instrument 51-101 (“NI 51-101”) and the Canadian Oil and Gas Evaluators Handbook (“COGEH”). DeGoyler and MacNaughton evaluated reserves at the Company’s Selmo oil field, Arpatepe oil field, Bakuk license, and Thrace Basin gas fields, all of which are located in Turkey. In this presentation, the Company uses the term “barrels of oil equivalent” (“Boe”). Boe is not included in the DeGolyer and MacNaughton report and is derived by the Company by converting natural gas to oil in the ratio of six thousand cubic feet (mcf) of natural gas to one barrel (bbl) of oil. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |