Exhibit 99.1

Exhibit 99.1

TransAtlantic

Petroleum Ltd.

Annual Meeting of Shareholders

June 24, 2013

FORWARD LOOKING STATEMENTS

TransAtlantic

Petroleum Ltd.

Outlooks, projections, estimates, targets and business plans in this presentation or any related subsequent discussions are forward-looking statements. Actual future results, including TransAtlantic Petroleum Ltd.’s own production growth and mix; financial results; the amount and mix of capital expenditures; resource additions and recoveries; finding and development costs; project and drilling plans, timing, costs, and capacities; revenue enhancements and cost efficiencies; industry margins; margin enhancements and integration benefits; and the impact of technology could differ materially due to a number of factors. These include market prices for natural gas, natural gas liquids and oil products; estimates of reserves and economic assumptions; the ability to produce and transport natural gas, natural gas liquids and oil; the results of exploration and development drilling and related activities; economic conditions in the countries and provinces in which we carry on business, especially economic slowdowns; actions by governmental authorities, receipt of required approvals, increases in taxes, legislative and regulatory initiatives relating to fracture stimulation activities, changes in environmental and other regulations, and renegotiations of contracts; political uncertainty, including actions by insurgent groups or other conflict; the negotiation and closing of material contracts; shortages of drilling rigs, equipment or oilfield services; and other factors discussed here and under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2012 and our Quarterly Report on Form 10-Q for the three months ended March 31, 2013, which are available on our website at www.transatlanticpetroleum.com and www.sec.gov. See also TransAtlantic’s audited financial statements and the accompanying management discussion and analysis. Forward-looking statements are based on management’s knowledge and reasonable expectations on the date hereof, and we assume no duty to update these statements as of any future date. The information set forth in this presentation does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities of the Company. The information published herein is provided for informational purposes only. The Company makes no representation that the information and opinions expressed herein are accurate, complete or current. The information contained herein is current as of the date hereof, but may become outdated or subsequently may change. Nothing contained herein constitutes financial, legal, tax, or other advice.

The SEC has generally permitted oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We may use the terms “estimated ultimate recovery,” “EUR,” “probable,” “possible,” and “non-proven” reserves, “prospective resources” or “upside” or other descriptions of volumes of resources or reserves potentially recoverable through additional drilling or recovery techniques that the SEC’s guidelines may prohibit us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the Company. There is no certainty that any portion of estimated prospective resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the estimated prospective resources.

Boe (barrel of oil equivalent) is derived by converting natural gas to oil in the ratio of six thousand cubic feet (Mcf) of natural gas to one barrel (bbl) of oil. Boe may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

2

WELCOME

TransAtlantic

Petroleum Ltd.

Agenda

Chairman & CEO:

N. Malone Mitchell 3rd

Introduction

President:

Ian J. Delahunty

Operations

VP, CFO:

Wil F. Saqueton

Finance and Accounting

Chairman & CEO:

N. Malone Mitchell 3rd

President:

Ian J. Delahunty

Q&A

VP, CFO:

Wil F. Saqueton

VP, Legal:

Jeffrey S. Mecom

3

INTRODUCTION

TransAtlantic

Petroleum Ltd.

N. Malone Mitchell 3rd, Chairman & CEO

Current State of the Business

4

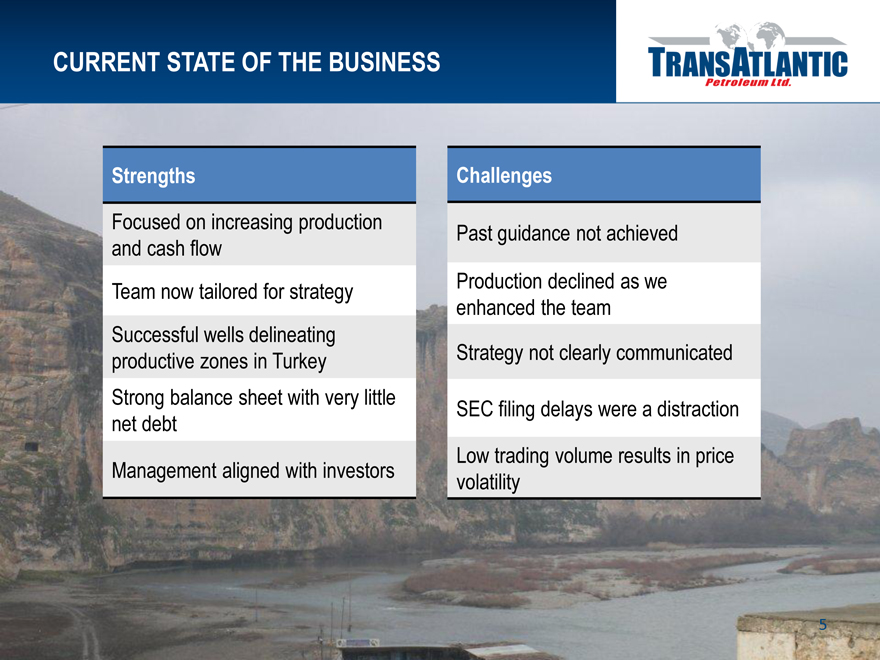

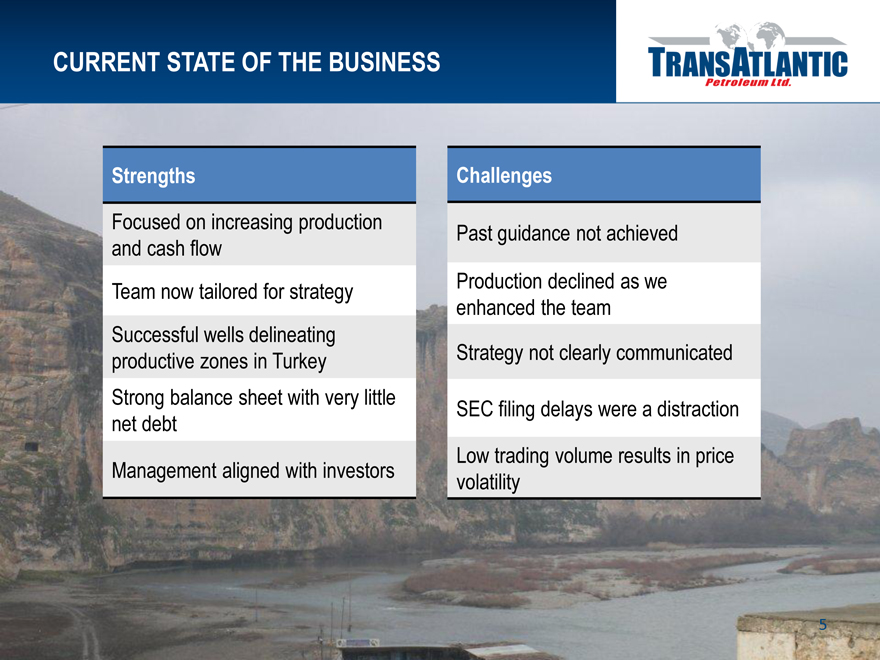

CURRENT STATE OF THE BUSINESS

TransAtlantic

Petroleum Ltd.

Strengths

Focused on increasing production and cash flow

Team now tailored for strategy

Successful wells delineating productive zones in Turkey

Strong balance sheet with very little net debt

Management aligned with investors

Challenges

Past guidance not achieved

Production declined as we enhanced the team

Strategy not clearly communicated

SEC filing delays were a distraction

Low trading volume results in price volatility

5

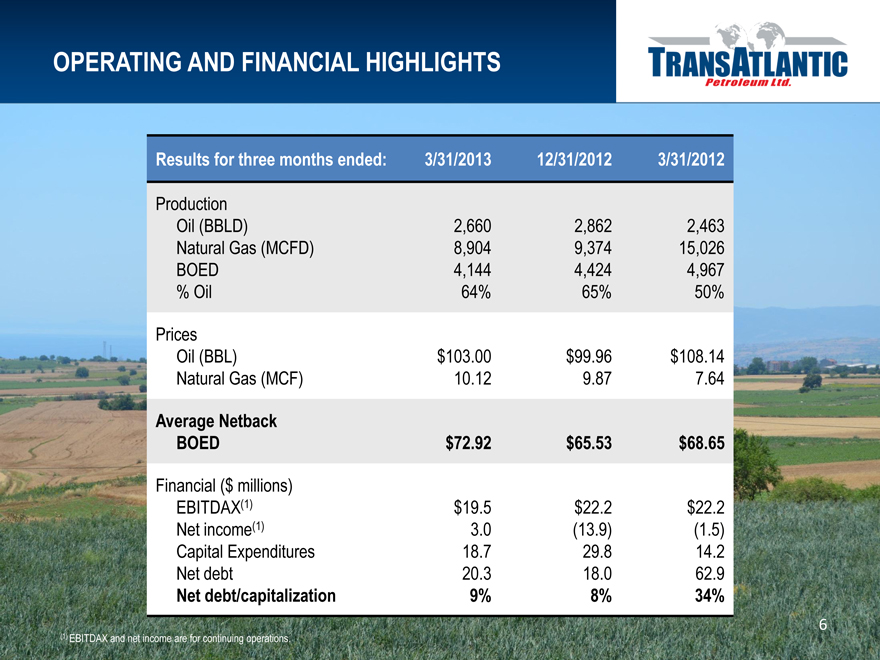

OPERATING AND FINANCIAL HIGHLIGHTS

TransAtlantic

Petroleum Ltd.

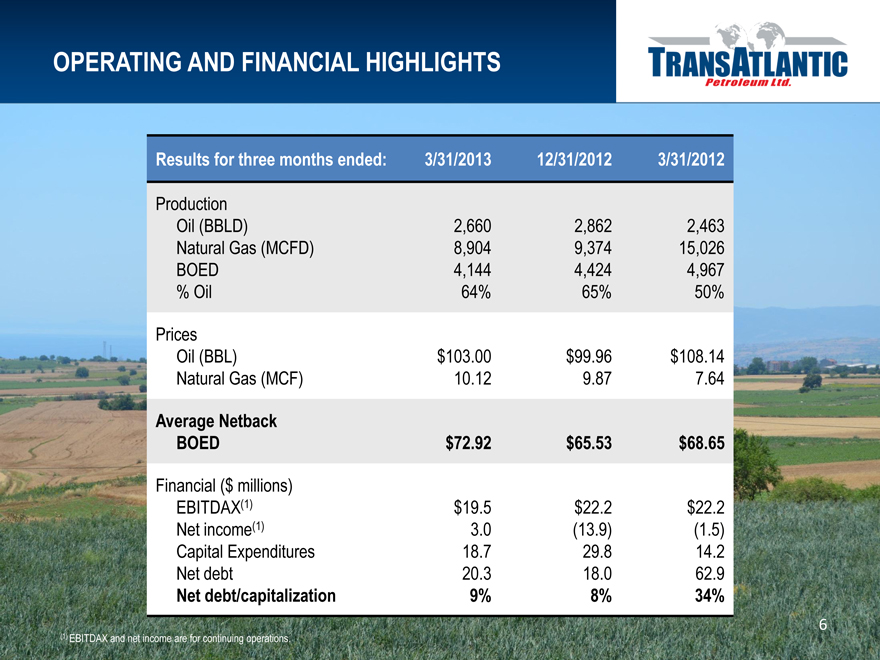

Results for three months ended: 3/31/2013 12/31/2012 3/31/2012

Production

Oil (BBLD) 2,660 2,862 2,463

Natural Gas (MCFD) 8,904 9,374 15,026

BOED 4,144 4,424 4,967

% Oil 64% 65% 50%

Prices

Oil (BBL) $103.00 $99.96 $108.14

Natural Gas (MCF) 10.12 9.87 7.64

Average Netback BOED $72.92 $65.53 $68.65

Financial ($ millions)

EBITDAX(1) $19.5 $22.2 $22.2

Net income(1) 3.0 (13.9) (1.5)

Capital Expenditures 18.7 29.8 14.2

Net debt 20.3 18.0 62.9

Net debt/capitalization 9% 8% 34%

(1) EBITDAX and net income are for continuing operations.

6

OPERATIONS REVIEW

TransAtlantic

Petroleum Ltd.

Ian J. Delahunty, President

1. Objective

2. Team

3. Three-Part Strategy in Turkey

4. Bulgaria Update

5. Outlook

7

OBJECTIVES

TransAtlantic

Petroleum Ltd.

Optimize Assets to Increase Production and Cash Flow

• Utilize North American technology to more efficiently produce assets

- Horizontal drilling, stimulation and 3D seismic

• Manage from Dallas headquarters

• Deploy capital using proven industry expertise and decrease costs

• $130 million capital budget

• Accelerate capital program with consummation of joint venture

8

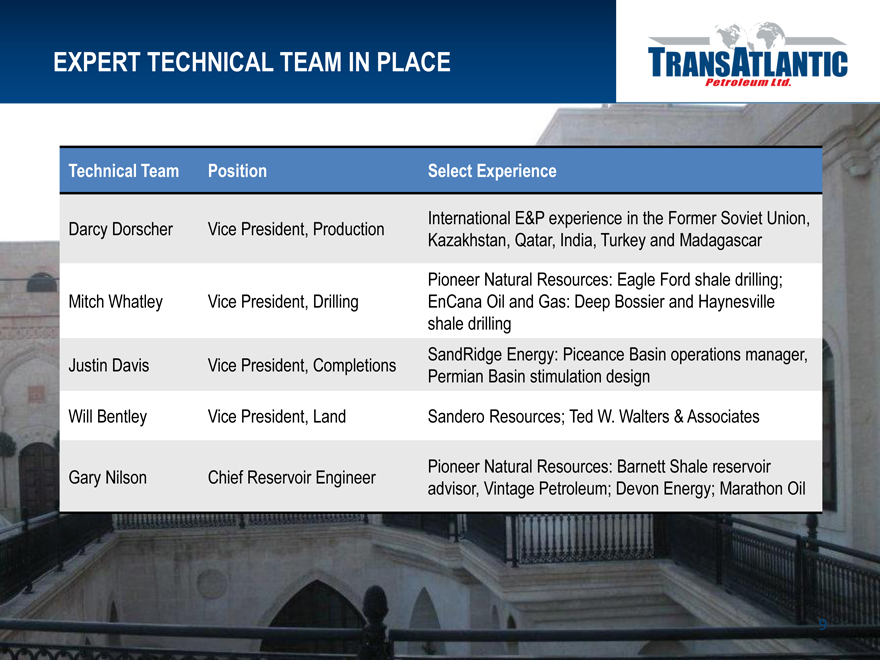

EXPERT TECHNICAL TEAM IN PLACE

TransAtlantic

Petroleum Ltd.

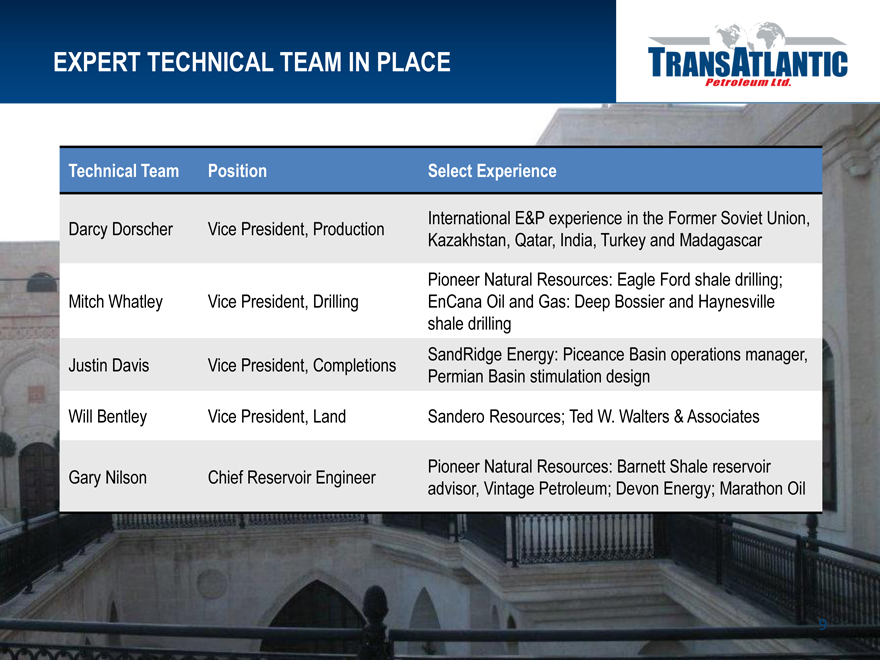

Technical Team Position Select Experience

Darcy Dorscher

Vice President, Production

International E&P experience in the Former Soviet Union, Kazakhstan, Qatar, India, Turkey and Madagascar

Mitch Whatley

Vice President, Drilling

Pioneer Natural Resources: Eagle Ford shale drilling; EnCana Oil and Gas: Deep Bossier and Haynesville shale drilling

Justin Davis

Vice President, Completions

SandRidge Energy: Piceance Basin operations manager, Permian Basin stimulation design

Will Bentley

Vice President, Land

Sandero Resources; Ted W. Walters & Associates

Gary Nilson

Chief Reservoir Engineer

Pioneer Natural Resources: Barnett Shale reservoir advisor, Vintage Petroleum; Devon Energy; Marathon Oil

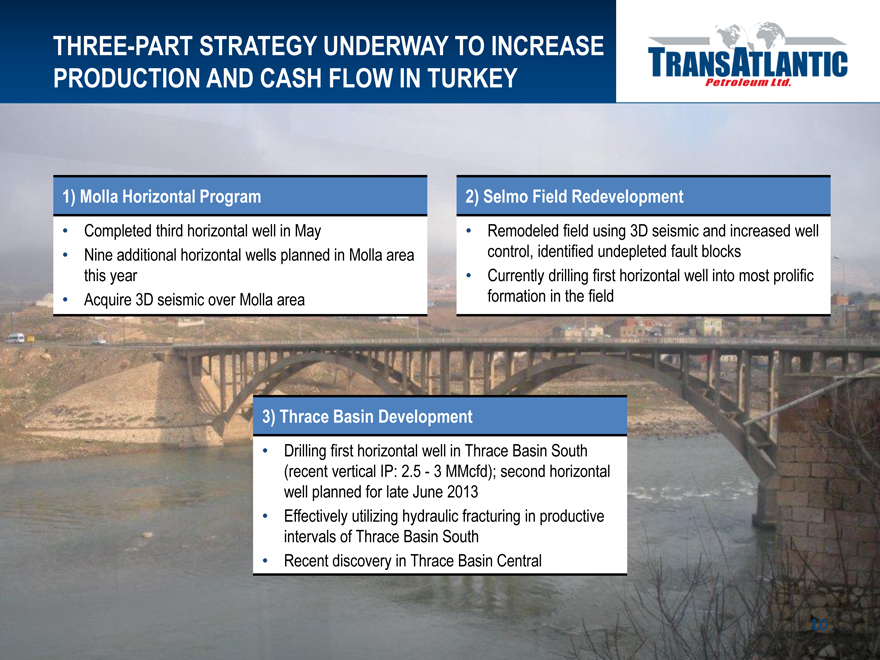

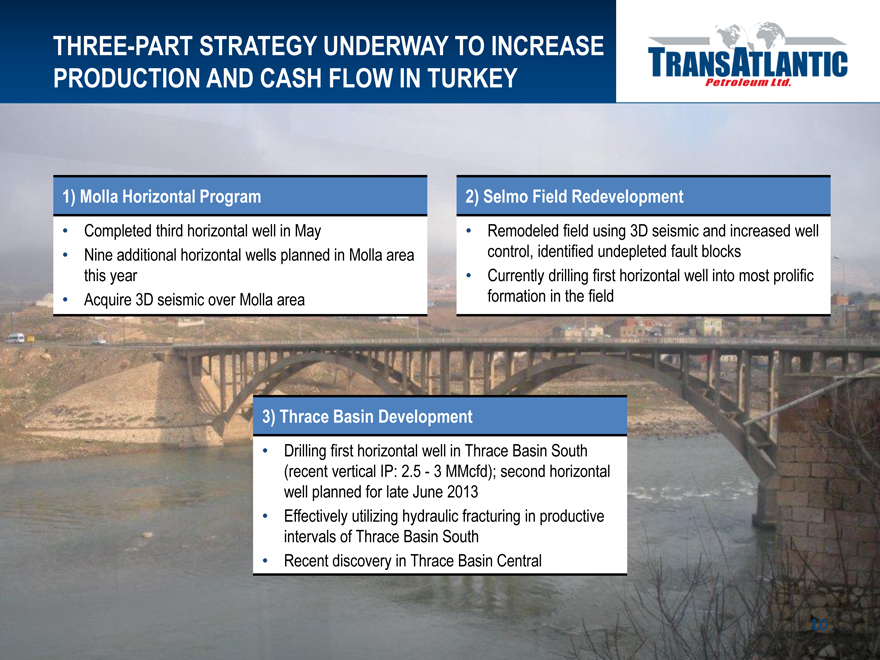

THREE-PART STRATEGY UNDERWAY TO INCREASE PRODUCTION AND CASH FLOW IN TURKEY

TransAtlantic

Petroleum Ltd.

1) Molla Horizontal Program

• Completed third horizontal well in May

• Nine additional horizontal wells planned in Molla area this year

• Acquire 3D seismic over Molla area

2) Selmo Field Redevelopment

• Remodeled field using 3D seismic and increased well control, identified undepleted fault blocks

• Currently drilling first horizontal well into most prolific formation in the field

3) Thrace Basin Development

• Drilling first horizontal well in Thrace Basin South (recent vertical IP: 2.5 - 3 MMcfd); second horizontal well planned for late June 2013

• Effectively utilizing hydraulic fracturing in productive intervals of Thrace Basin South

• Recent discovery in Thrace Basin Central

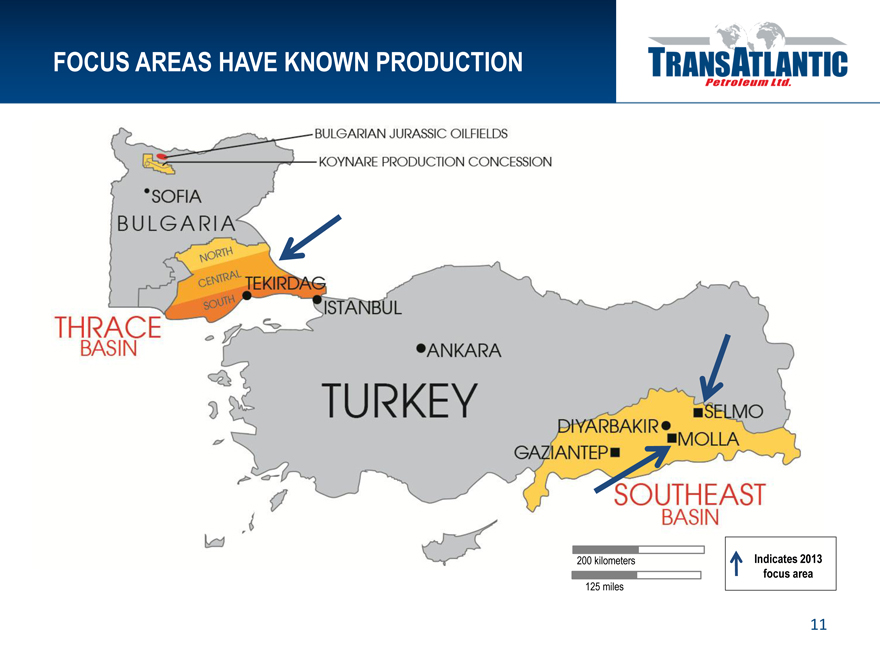

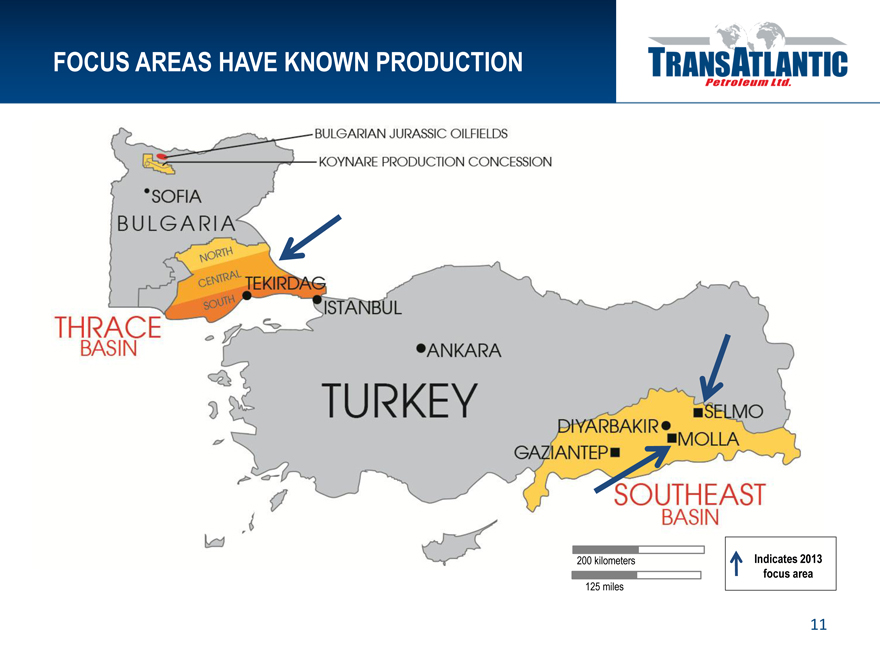

FOCUS AREAS HAVE KNOWN PRODUCTION

TransAtlantic

Petroleum Ltd.

BULGARIAN JURASSIC OILFIELDS

KOYNARE PRODUCTION CONCESSION

SOFIA

BULGARIA

NORTH

CENTRAL

SOUTH

TEKIRDAG

THRACE

BASIN

ISTANBUL

ANKARA

TURKEY

DIYARBAKIR

SELMO

MOLLA

GAZIANTEP

SOUTHEAST

BASIN

200 kilometers

125 miles

Indicates 2013

focus area

11

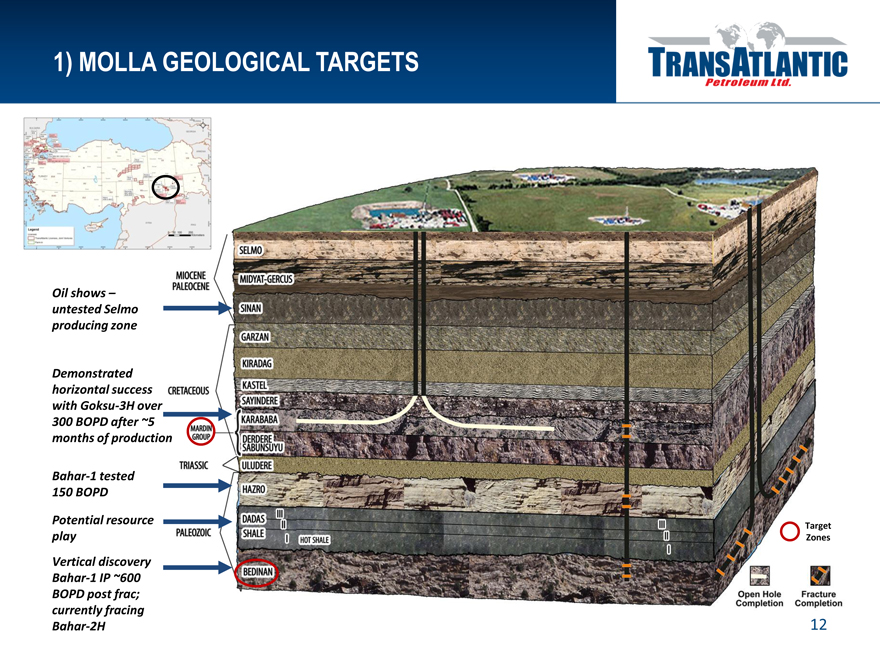

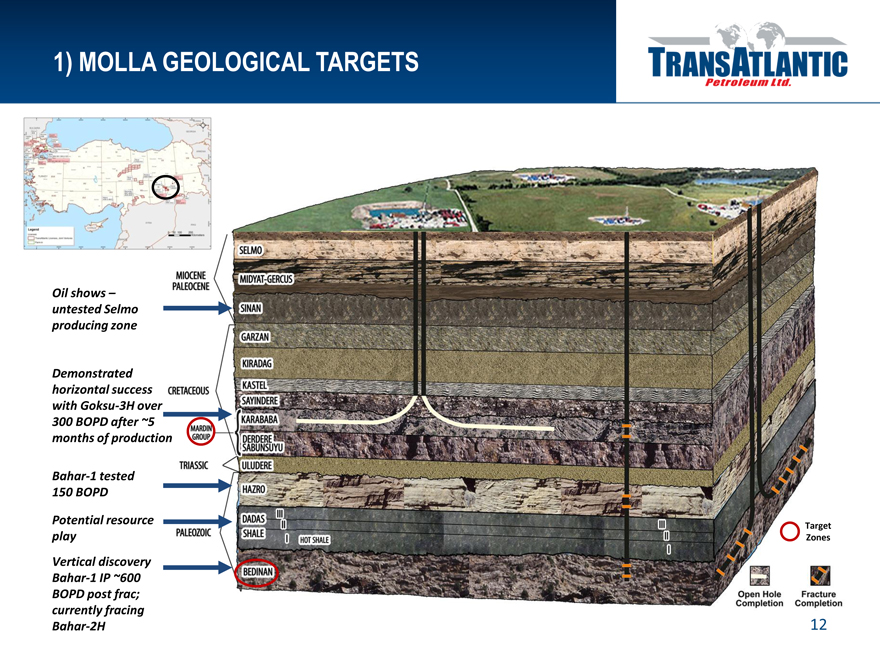

1) MOLLA GEOLOGICAL TARGETS

TransAtlantic

Petroleum Ltd.

Oil shows – untested Selmo producing zone

Demonstrated horizontal success with Goksu-3H over 300 BOPD after ~5 months of production

Bahar-1 tested 150 BOPD

Potential resource play

Vertical discovery Bahar-1 IP ~600 BOPD post frac; currently fracing Bahar-2H

MIOCENE

PALEOCENE

CRETACEOUS

MARDIN GROUP

TRIASSIC

PALEOZOIC

SELMO

MIDYAT-GERCUS

SINAN

GARZAN

KIRADAG

KASTEL

SAYINDERE

KARABABA

DERDERE

SABUNSUYU

ULUDERE

HAZRO

DADAS

SHALE

III II I

HOT SHALE

BEDINAN

III II I

Target Zones

Open Hole Completion

Fracture Completion

12

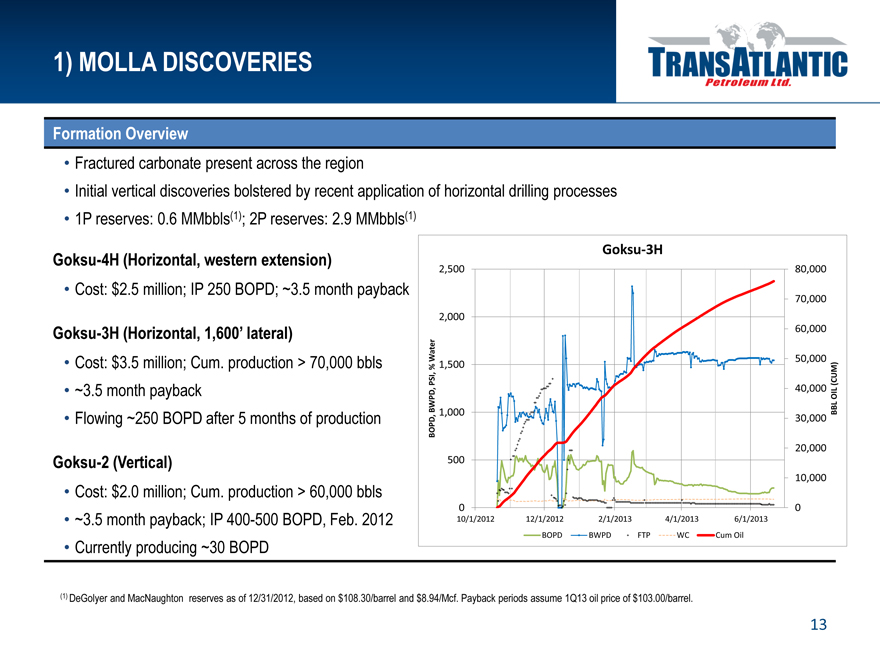

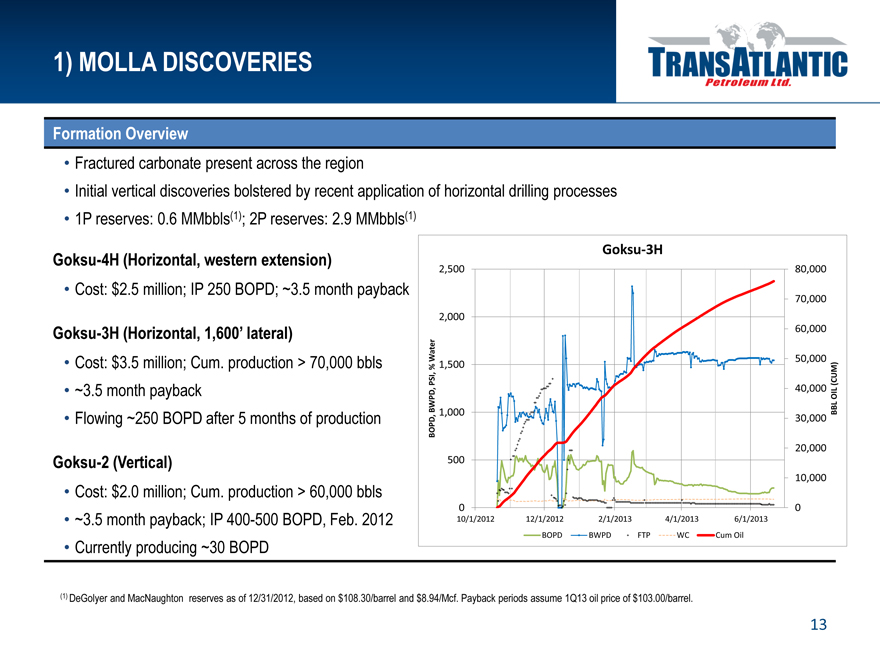

1) MOLLA DISCOVERIES

TransAtlantic

Petroleum Ltd.

Formation Overview

• Fractured carbonate present across the region

• Initial vertical discoveries bolstered by recent application of horizontal drilling processes

• 1P reserves: 0.6 MMbbls(1); 2P reserves: 2.9 MMbbls(1)

Goksu-4H (Horizontal, western extension)

• Cost: $2.5 million; IP 250 BOPD; ~3.5 month payback

Goksu-3H (Horizontal, 1,600’ lateral)

• Cost: $3.5 million; Cum. production > 70,000 bbls

• ~3.5 month payback

• Flowing ~250 BOPD after 5 months of production

Goksu-2 (Vertical)

• Cost: $2.0 million; Cum. production > 60,000 bbls

• ~3.5 month payback; IP 400-500 BOPD, Feb. 2012

• Currently producing ~30 BOPD

Goksu-3H

BOPD, BWPD, PSI, % Water

2,500

2,000

1,500

1,000

500

0

10/1/2012 12/1/2012 2/1/2013 4/1/2013 6/1/2013

BOPD BWPD FTP WC Cum Oil

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

BBL OIL (CUM)

(1) DeGolyer and MacNaughton reserves as of 12/31/2012, based on $108.30/barrel and $8.94/Mcf. Payback periods assume 1Q13 oil price of $103.00/barrel.

13

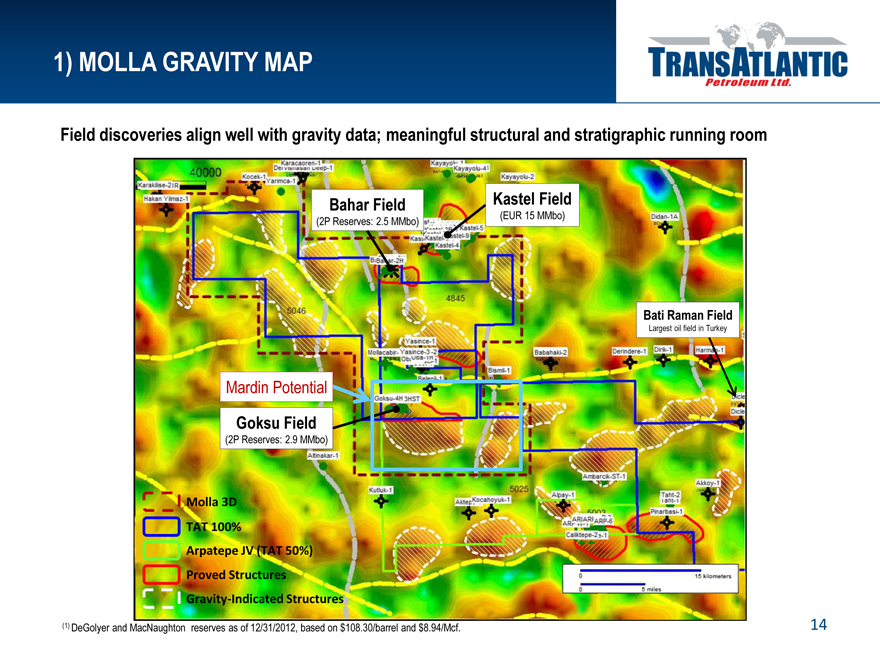

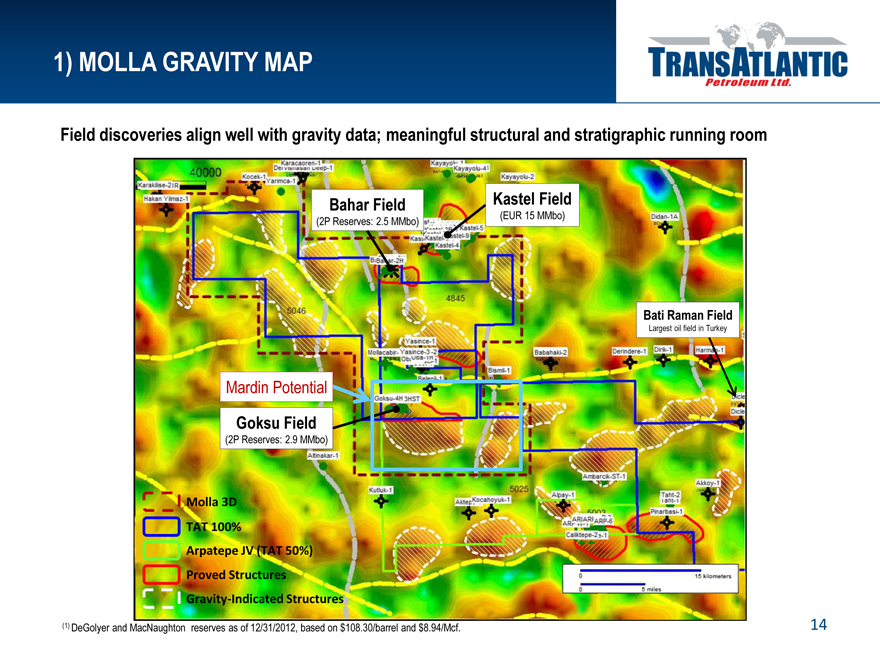

1) MOLLA GRAVITY MAP

TransAtlantic

Petroleum Ltd.

Field discoveries align well with gravity data; meaningful structural and stratigraphic running room

Bahar Field

(2P Reserves: 2.5 MMbo)

Kastel Field

(EUR 15 MMbo)

Bati Raman Field

Largest oil field in Turkey

Mardin Potential

Goksu Field

(2P Reserves: 2.9 MMbo)

Molla 3D

TAT 100%

Arpatepe JV (TAT 50%)

Proved Structures

Gravity-Indicated Structures

(1) DeGolyer and MacNaughton reserves as of 12/31/2012, based on $108.30/barrel and $8.94/Mcf.

14

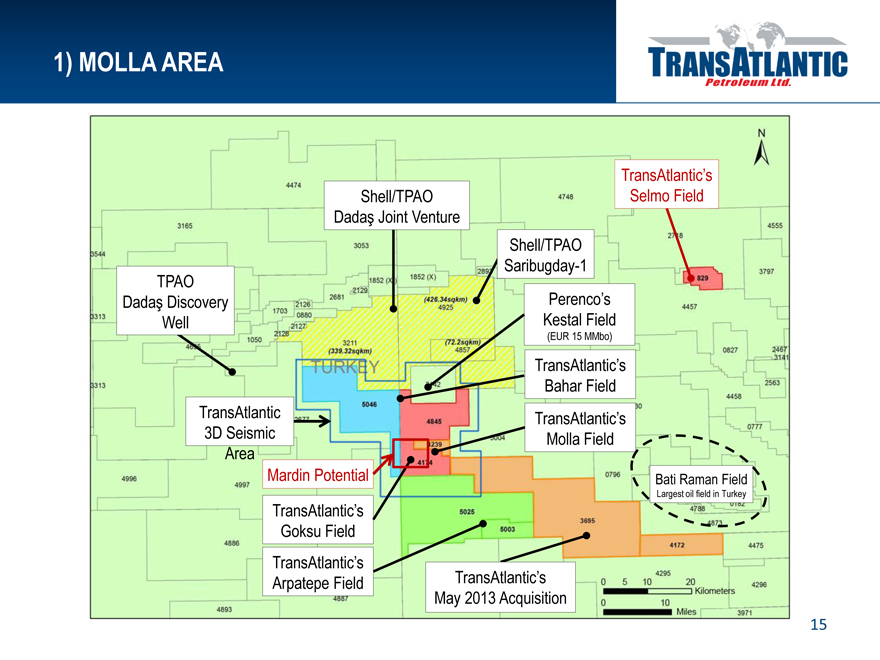

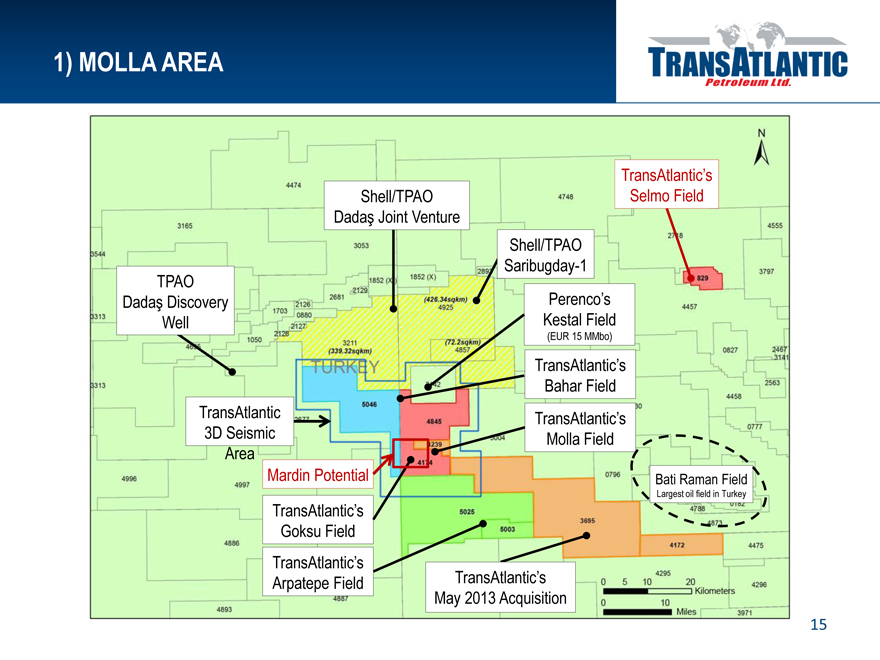

1) MOLLA AREA

TransAtlantic

Petroleum Ltd.

TransAtlantic’s

Selmo Field

Shell/TPAO Dadaş Joint Venture

Shell/TPAO Saribugday-1

TPAO Dadaş Discovery Well

Perenco’s

Kestal Field

(EUR 15 MMbo)

TransAtlantic’s

Bahar Field

TransAtlantic’s

Molla Field

TransAtlantic

3D Seismic Area

Mardin Potential

TransAtlantic’s

Goksu Field

TransAtlantic’s

Arpatepe Field

TransAtlantic’s

May 2013 Acquisition

Bati Raman Field

Largest oil field in Turkey

15

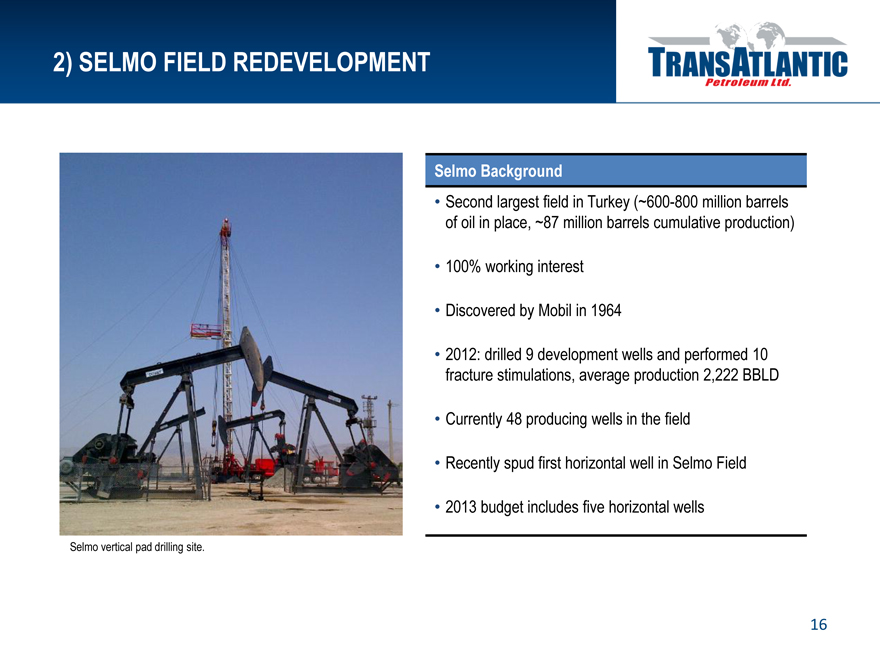

2) SELMO FIELD REDEVELOPMENT

TransAtlantic

Petroleum Ltd.

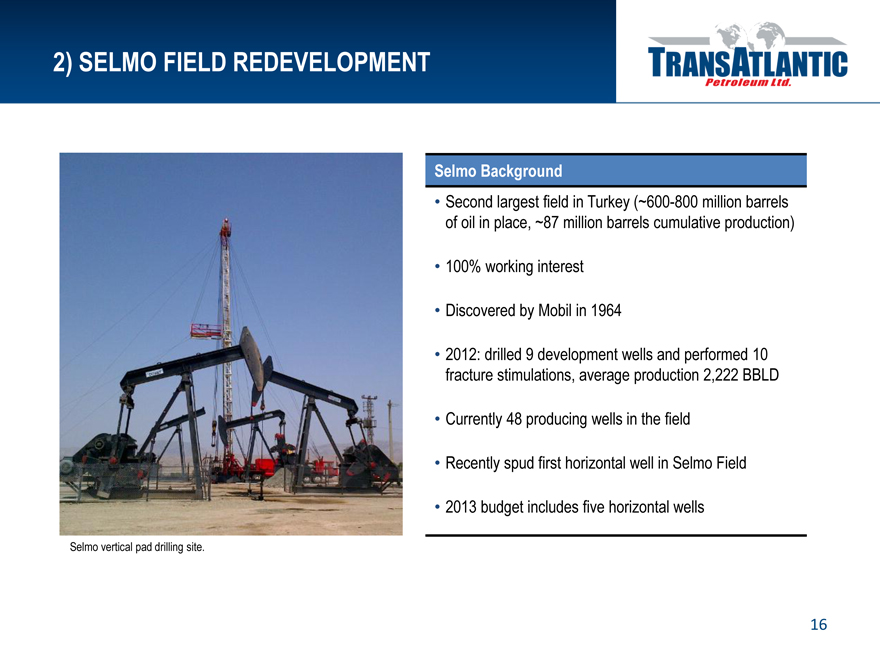

Selmo vertical pad drilling site.

Selmo Background

• Second largest field in Turkey (~600-800 million barrels of oil in place, ~87 million barrels cumulative production)

• 100% working interest

• Discovered by Mobil in 1964

• 2012: drilled 9 development wells and performed 10 fracture stimulations, average production 2,222 BBLD

• Currently 48 producing wells in the field

• Recently spud first horizontal well in Selmo Field

• 2013 budget includes five horizontal wells

16

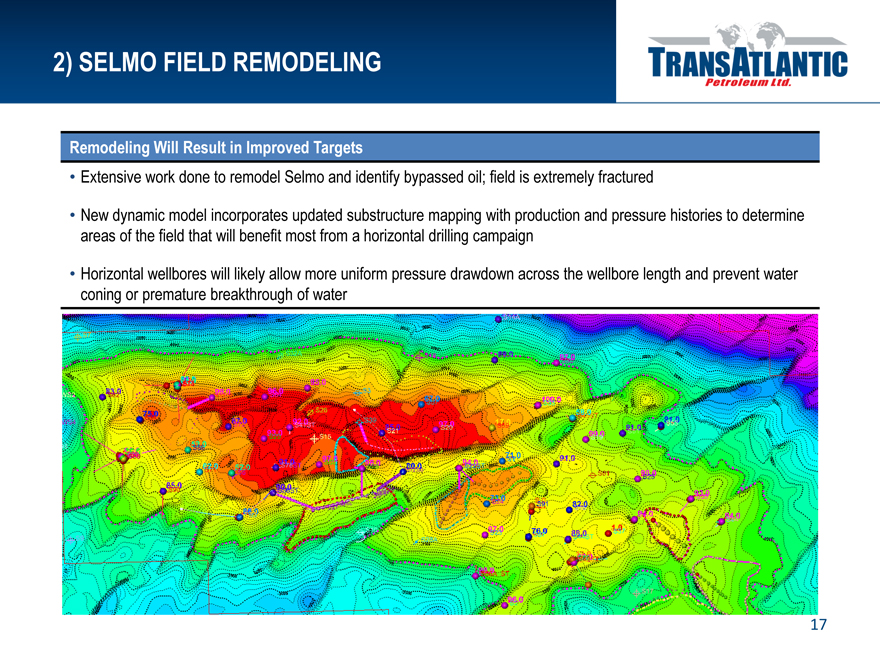

2) SELMO FIELD REMODELING

TransAtlantic Petroleum Ltd.

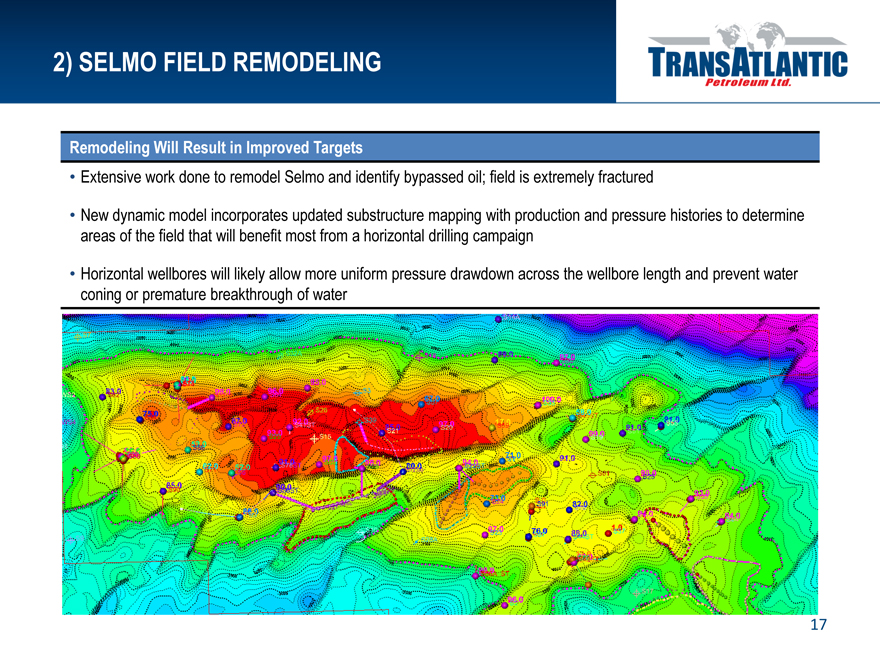

Remodeling Will Result in Improved Targets

• Extensive work done to remodel Selmo and identify bypassed oil; field is extremely fractured

• New dynamic model incorporates updated substructure mapping with production and pressure histories to determine areas of the field that will benefit most from a horizontal drilling campaign

• Horizontal wellbores will likely allow more uniform pressure drawdown across the wellbore length and prevent water coning or premature breakthrough of water

17

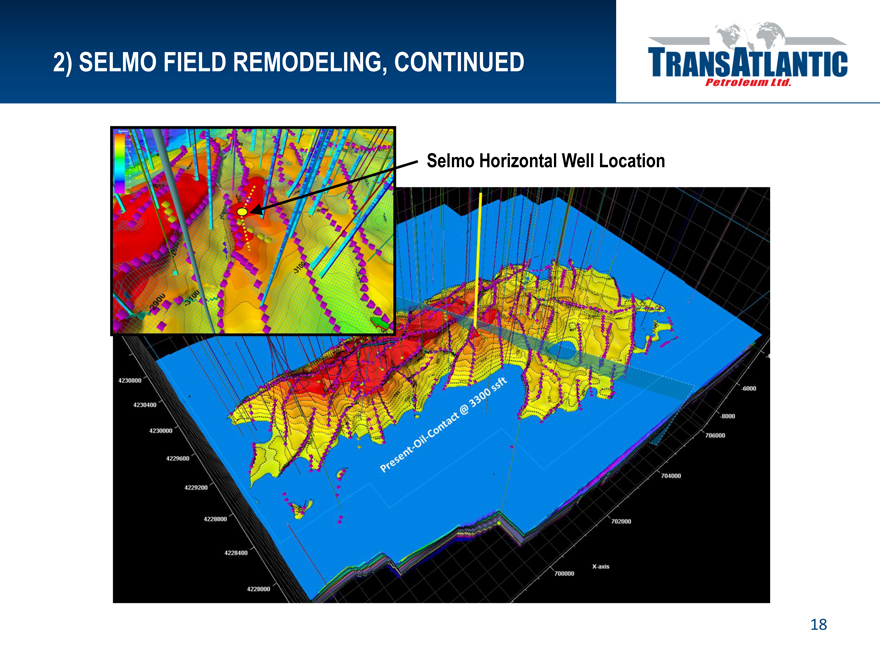

2) SELMO FIELD REMODELING, CONTINUED

TransAtlantic Petroleum Ltd.

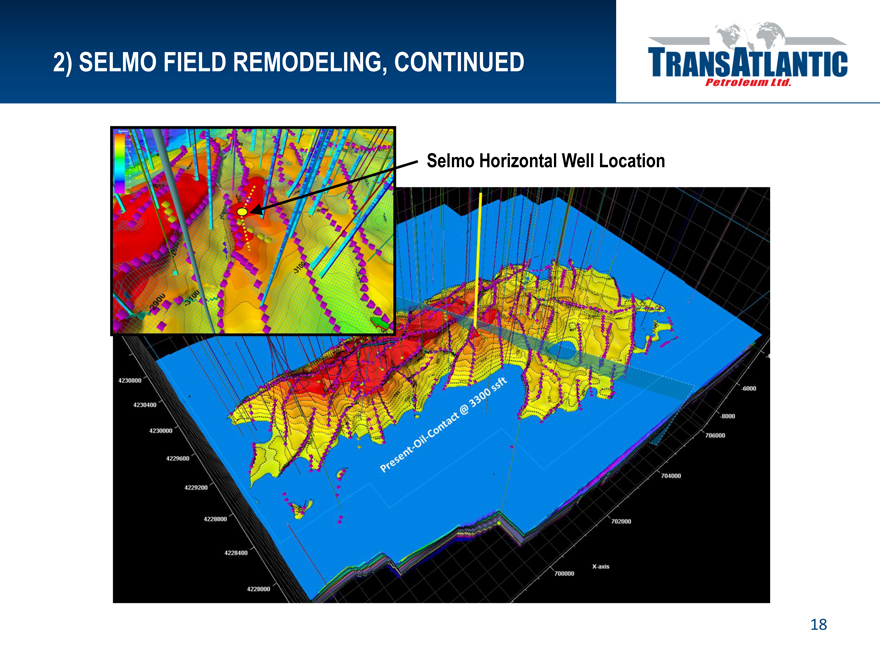

Selmo Horizontal Well Location

Present-Oil-Contact @ 3300 ssft

18

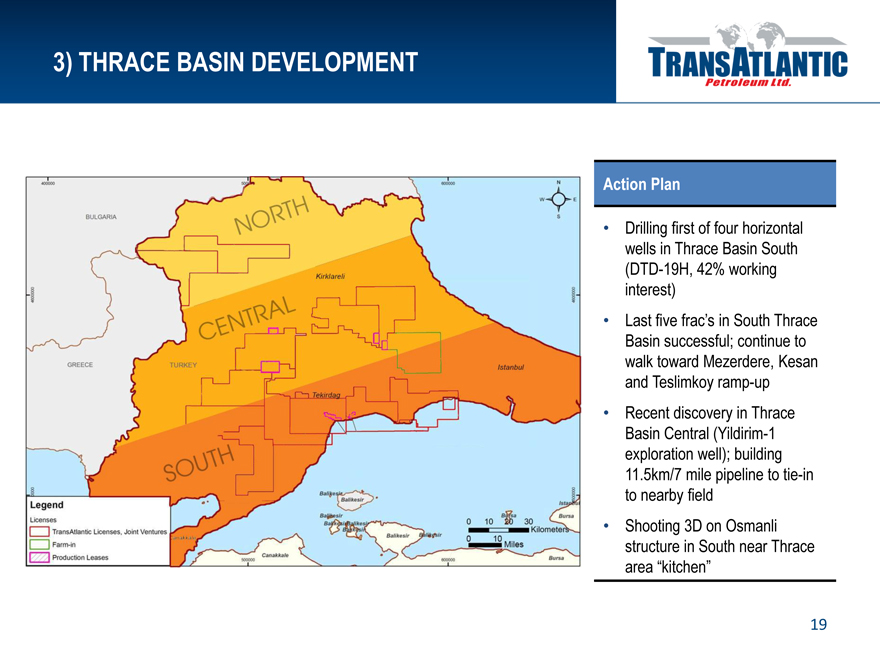

3) THRACE BASIN DEVELOPMENT

TransAtlantic Petroleum Ltd.

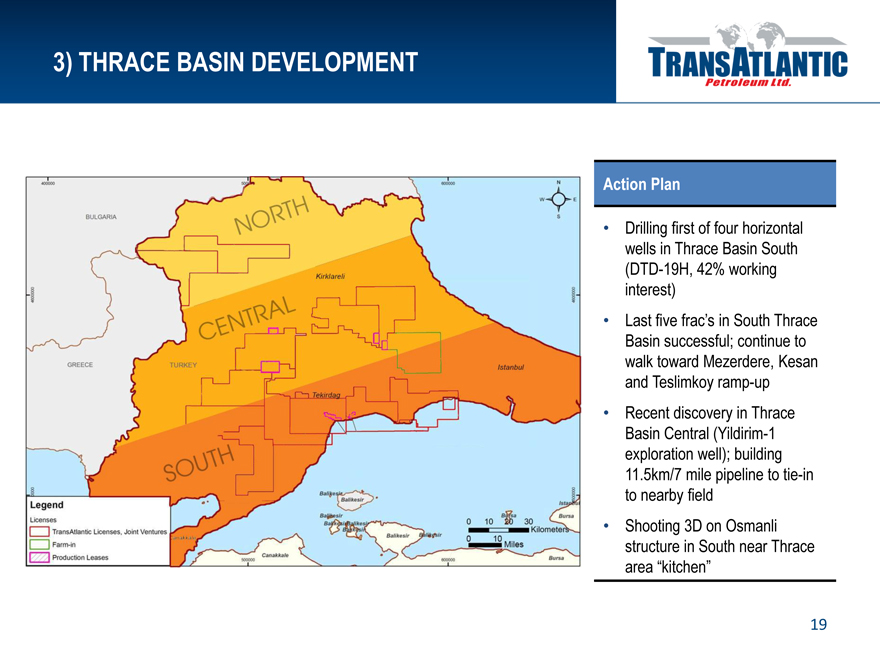

Action Plan

• Drilling first of four horizontal wells in Thrace Basin South (DTD-19H, 42% working interest)

• Last five frac’s in South Thrace Basin successful; continue to walk toward Mezerdere, Kesan and Teslimkoy ramp-up

• Recent discovery in Thrace Basin Central (Yildirim-1 exploration well); building 11.5km/7 mile pipeline to tie-in to nearby field

• Shooting 3D on Osmanli structure in South near Thrace area “kitchen”

NORTH

CENTRAL

SOUTH

N S W E

BULGARIA

GREECE

TURKEY

Kirklareli

Istanbul

Tekirdag

0 10 20 30 Kilometers

0 10 Miles

Bursa

Legend

Licenses

TransAtlantic Licenses, Joint Ventures

Farm-in

Production Leases

19

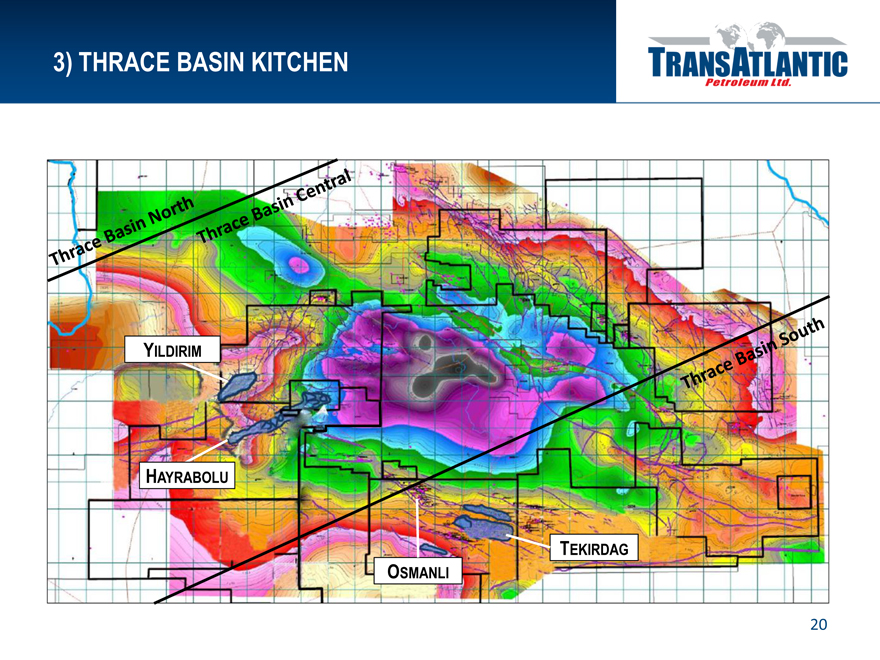

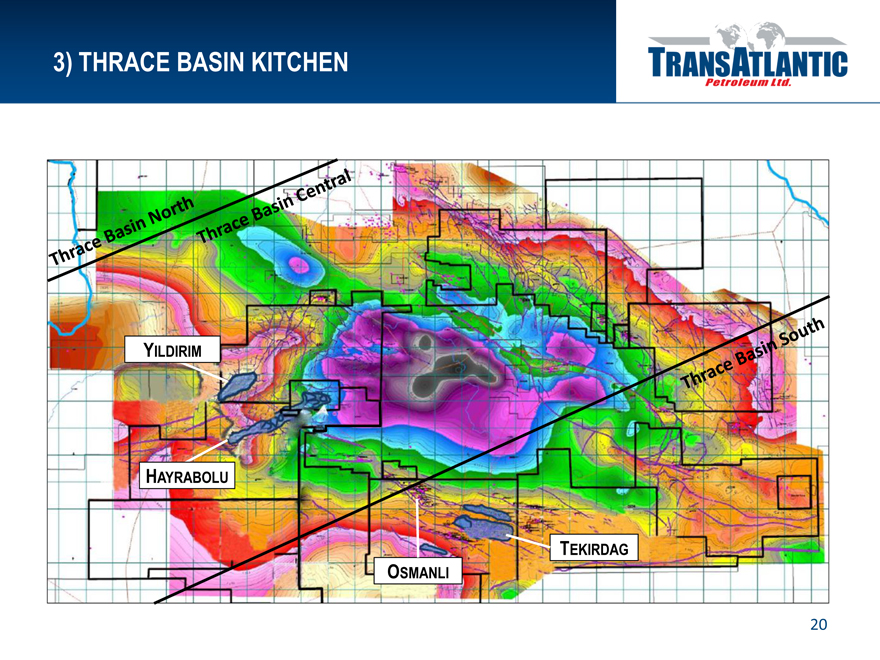

3) THRACE BASIN KITCHEN

TransAtlantic Petroleum Ltd.

Thrace Basin North

Thrace Basin Central

Yildirim

Hayrabolu

Osmanli

Tekirdag

Thrace Basin South

20

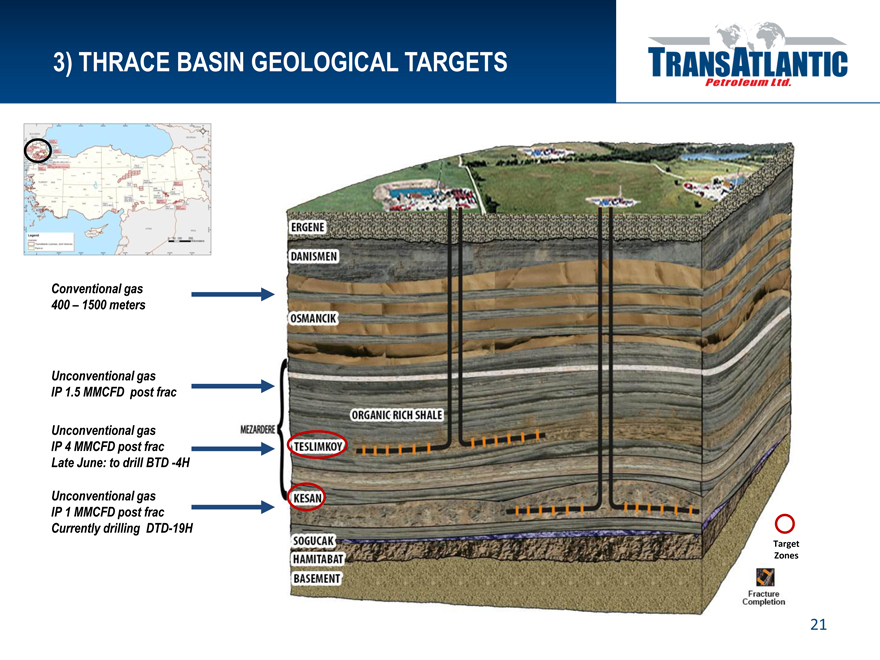

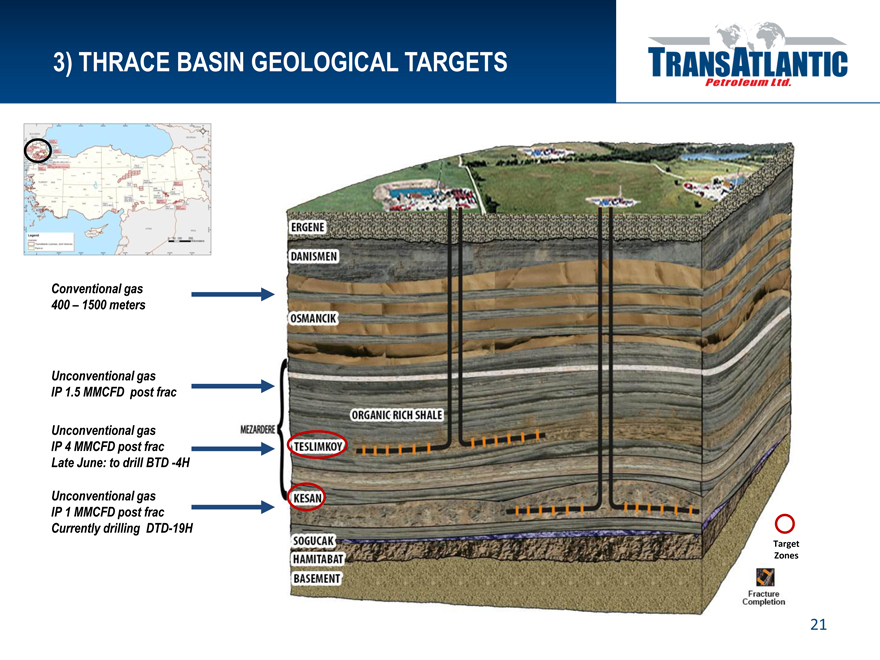

3) THRACE BASIN GEOLOGICAL TARGETS

TransAtlantic

Petroleum Ltd.

Conventional gas 400 – 1500 meters

Unconventional gas IP 1.5 MMCFD post frac

Unconventional gas IP 4 MMCFD post frac Late June: to drill BTD -4H

Unconventional gas IP 1 MMCFD post frac Currently drilling DTD-19H

ERGENE

DANSMEN

OSMANKIK

ORGANIC RICH SHALE

MEZARDERE

TESLIMKOY

KESAN

SOGUCAK

HAMITABAT

BASEMENT

Target Zones

Fracture Completion

21

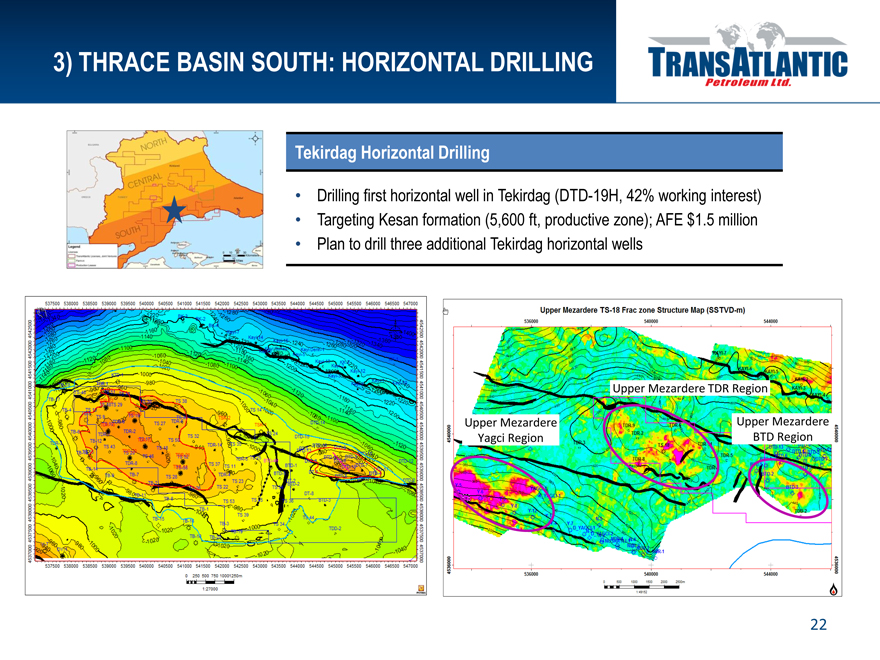

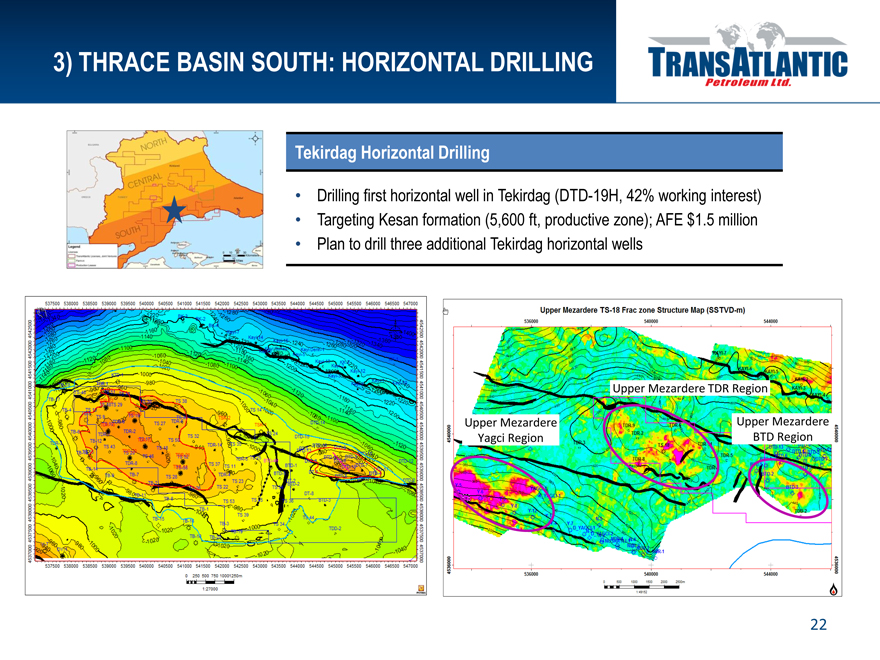

3) THRACE BASIN SOUTH: HORIZONTAL DRILLING

TransAtlantic

Petroleum Ltd.

Tekirdag Horizontal Drilling

Drilling first horizontal well in Tekirdag (DTD-19H, 42% working interest)

Targeting Kesan formation (5,600 ft, productive zone); AFE $1.5 million

Plan to drill three additional Tekirdag horizontal wells

Upper Mezardere TS-18 Frac zone Structure Map (SSTVD-m)

Upper Mezardere TDR Region

Upper Mezardere Yagci Region

Upper Mezardere BTD Region

22

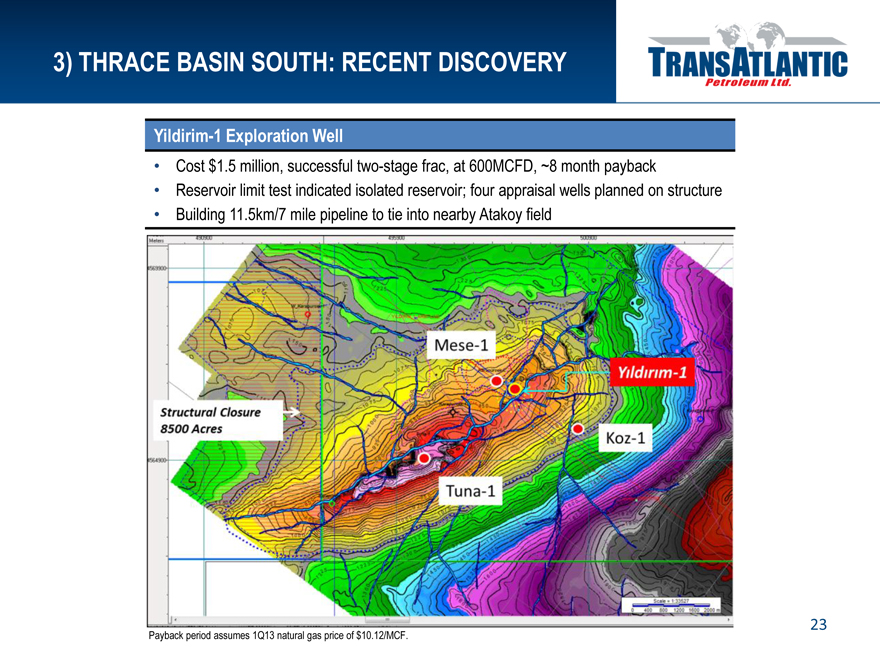

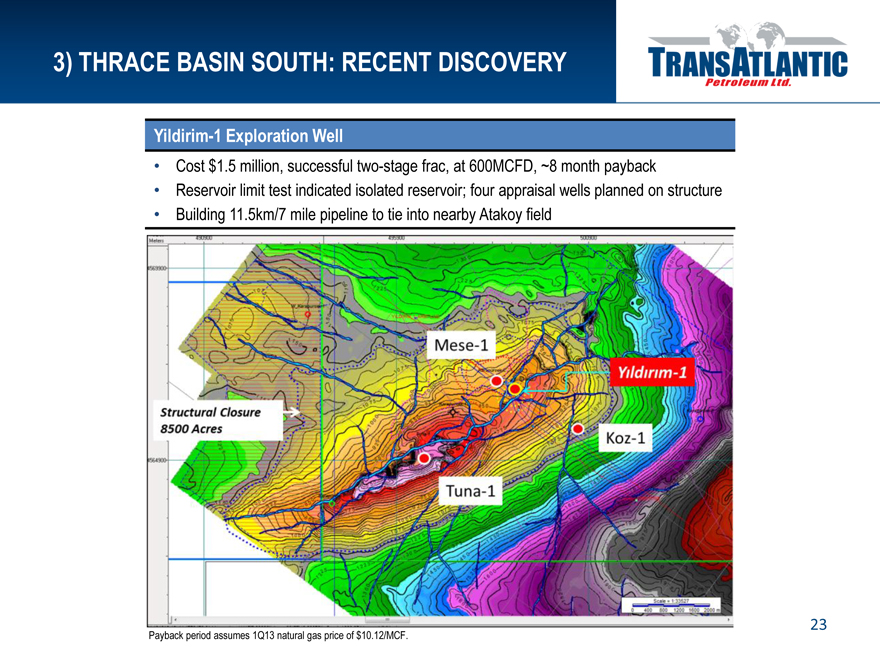

3) THRACE BASIN SOUTH: RECENT DISCOVERY

TransAtlantic

Petroleum Ltd.

Yildirim-1 Exploration Well

Cost $1.5 million, successful two-stage frac, at 600MCFD, ~8 month payback

Reservoir limit test indicated isolated reservoir; four appraisal wells planned on structure

Building 11.5km/7 mile pipeline to tie into nearby Atakoy field

Mese-1

Yildirim-1

Structural Closure

8500 Acres

Koz-1

Tuna-1

Payback period assumes 1Q13 natural gas price of $10.12/MCF.

23

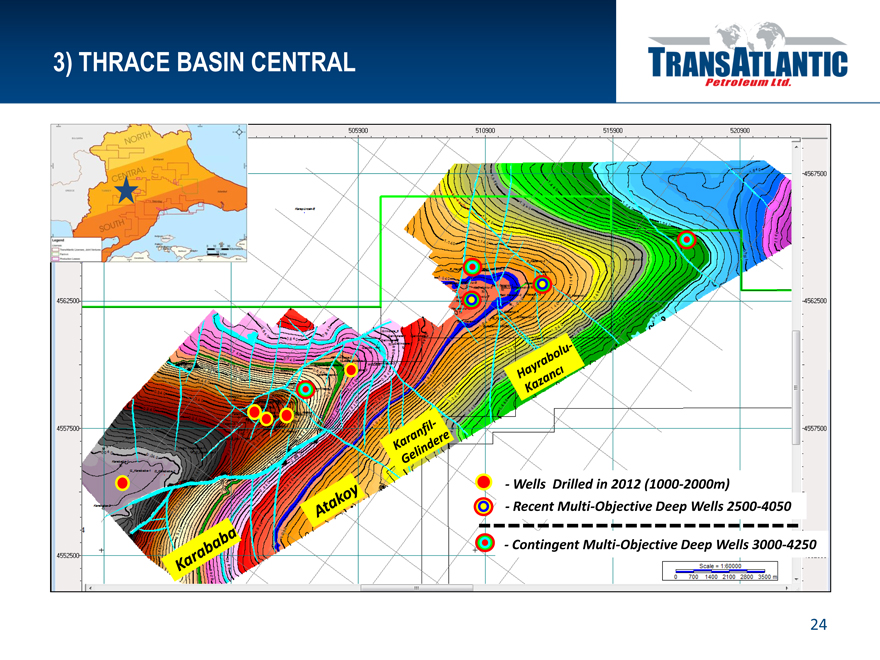

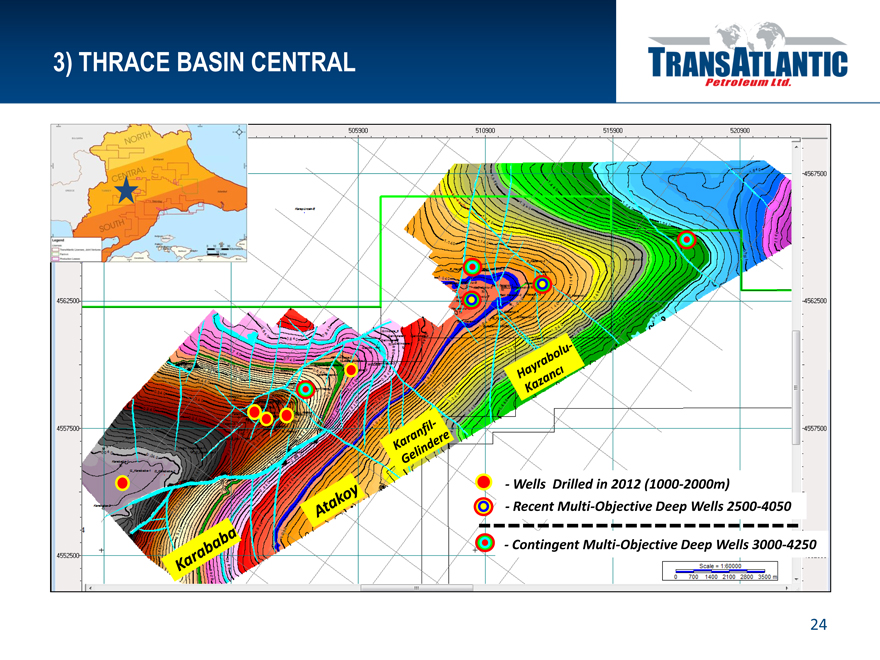

3) THRACE BASIN CENTRAL

TransAtlantic

Petroleum Ltd.

Karababa

Atakoy

Karanfil-

Gelindere

Hayrabolu-

Kazanci

Wells Drilled in 2012 (1000-2000m)

Recent Multi-Objective Deep Wells 2500-4050

Contingent Multi-Objective Deep Wells 3000-4250

24

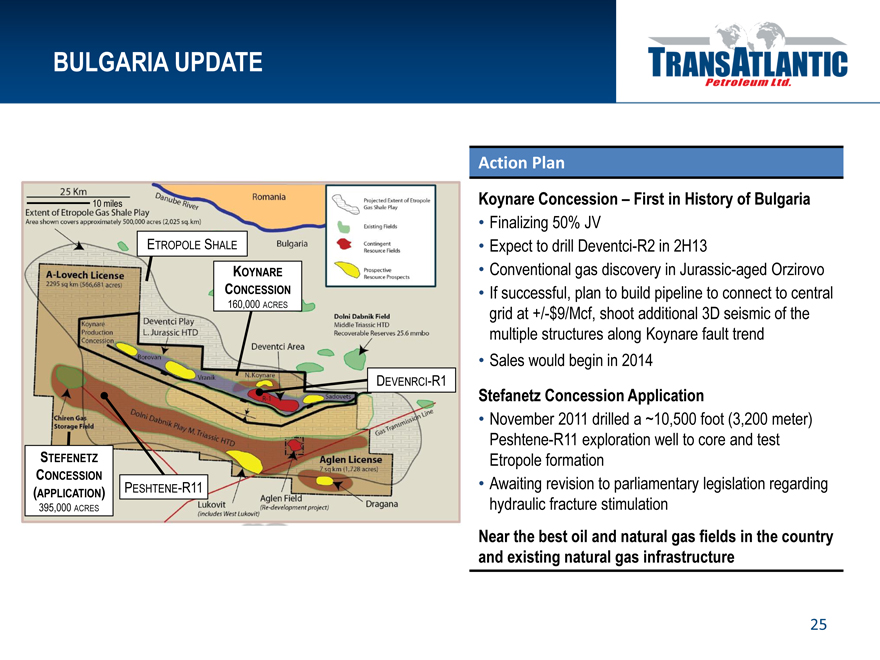

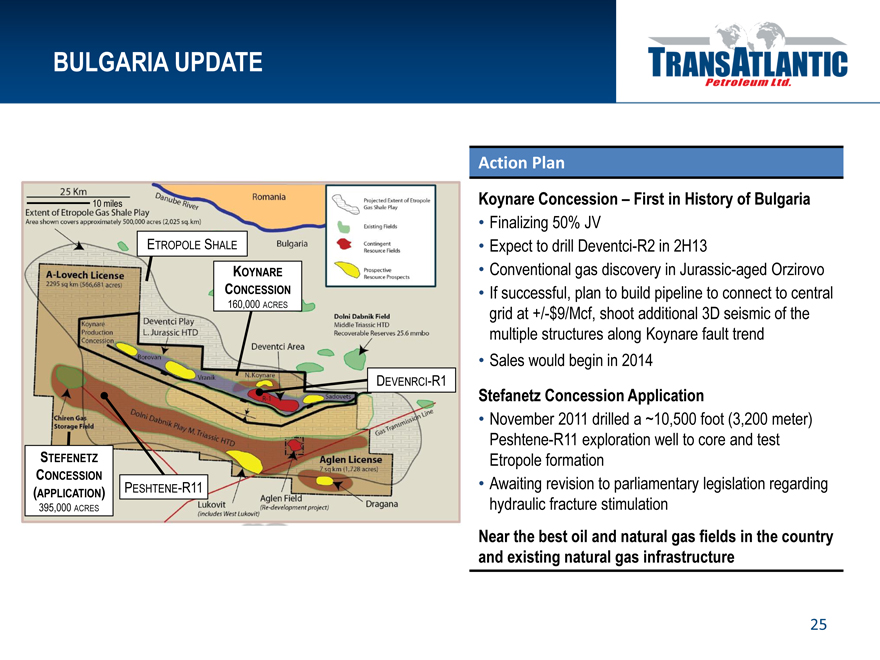

BULGARIA UPDATE

TransAtlantic

Petroleum Ltd.

ETROPOLE SHALE

KOYNARE CONCESSION

160,000 ACRES

DEVENRCI-R1

STEFENETZ CONCESSION (APPLICATION)

395,000 ACRES

PESHTENE-R11

Action Plan

Koynare Concession – First in History of Bulgaria

Finalizing 50% JV

Expect to drill Deventci-R2 in 2H13

Conventional gas discovery in Jurassic-aged Orzirovo

If successful, plan to build pipeline to connect to central grid at +/-$9/Mcf, shoot additional 3D seismic of the multiple structures along Koynare fault trend

Sales would begin in 2014

Stefanetz Concession Application

November 2011 drilled a ~10,500 foot (3,200 meter) Peshtene-R11 exploration well to core and test Etropole formation

Awaiting revision to parliamentary legislation regarding hydraulic fracture stimulation

Near the best oil and natural gas fields in the country and existing natural gas infrastructure

25

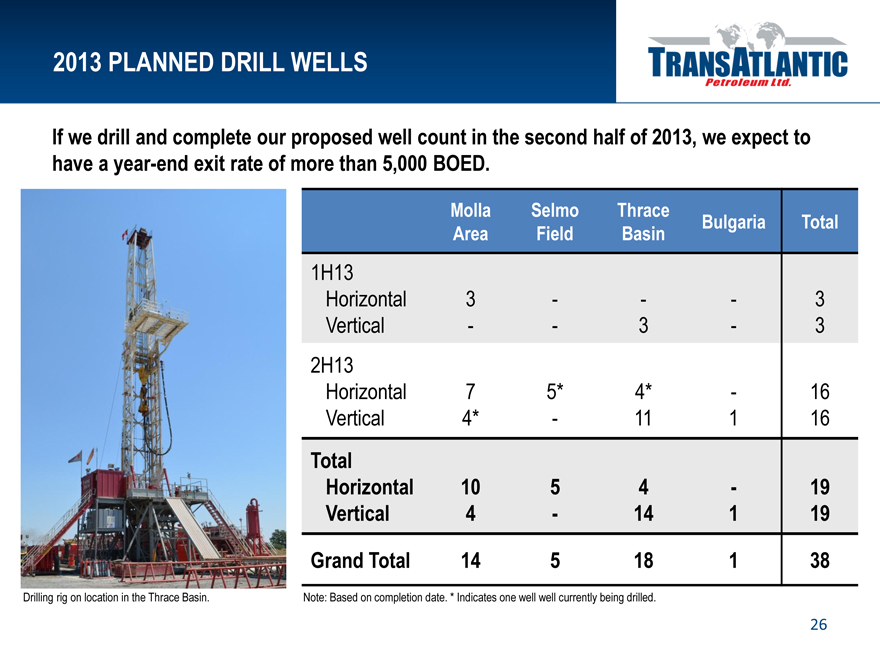

2013 PLANNED DRILL WELLS

If we drill and complete our proposed well count in the second half of 2013, we expect to have a year-end exit rate of more than 5,000 BOED.

Drilling rig on location in the Thrace Basin.

Molla

Selmo

Thrace

Bulgaria

Total

Area

Field

Basin

1H13

Horizontal

3

—

—

—

3

Vertical

—

—

3

—

3

2H13

Horizontal

7

5*

4*

—

16

Vertical

4*

—

11

1

16

Total

Horizontal

10

5

4

—

19

Vertical

4

—

14

1

19

Grand Total

14

5

18

1

38

Note: Based on completion date. * Indicates one well well currently being drilled.

26

OPERATIONS OUTLOOK

TransAtlantic

Petroleum Ltd.

Optimize Assets to Increase Production and Cash Flow

• Utilize North American technology to more efficiently produce assets

• Deploy capital using proven industry expertise and decrease costs

• Accelerate capital program with consummation of joint venture

Three-Part Strategy Underway in Turkey

1) Molla horizontal program; completed three wells

2) Selmo field redevelopment; drilling first horizontal well

3) Thrace Basin development; drilling first horizontal well in Thrace Basin South; recent discovery in Thrace Basin Central

27

FINANCIAL REVIEW

TransAtlantic

Petroleum Ltd.

Wil F. Saqueton, VP, CFO

1. Changes to facilitate accurate and timely SEC filings

2. Plans to reduce external audit fees

3. Status of credit facilities

28

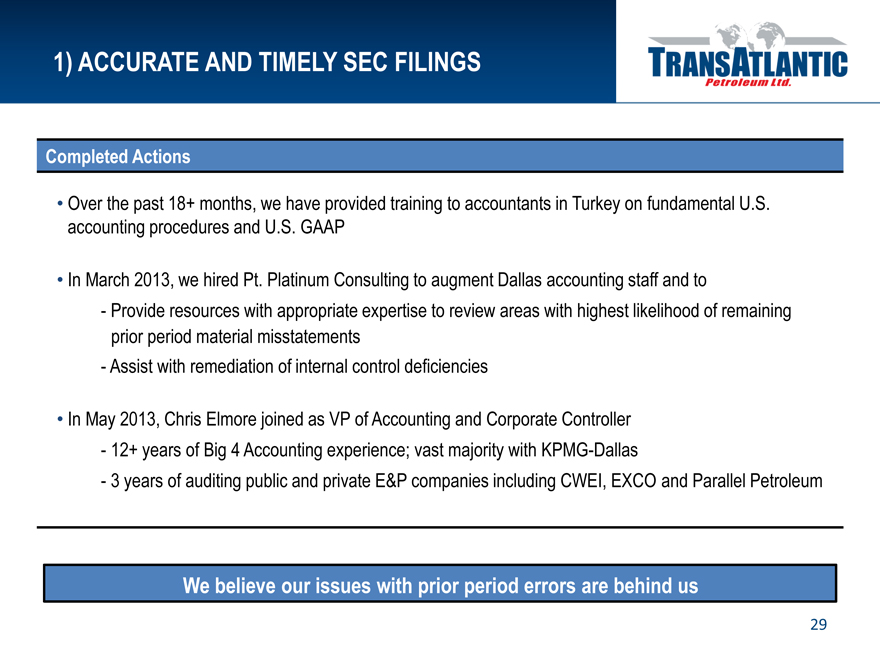

1) ACCURATE AND TIMELY SEC FILINGS

TransAtlantic

Petroleum Ltd.

Completed Actions

• Over the past 18+ months, we have provided training to accountants in Turkey on fundamental U.S. accounting procedures and U.S. GAAP

• In March 2013, we hired Pt. Platinum Consulting to augment Dallas accounting staff and to

- Provide resources with appropriate expertise to review areas with highest likelihood of remaining prior period material misstatements

- Assist with remediation of internal control deficiencies

• In May 2013, Chris Elmore joined as VP of Accounting and Corporate Controller

- 12+ years of Big 4 Accounting experience; vast majority with KPMG-Dallas

- 3 years of auditing public and private E&P companies including CWEI, EXCO and Parallel Petroleum

We believe our issues with prior period errors are behind us

29

1) ACCURATE AND TIMELY SEC FILINGS

Items in Process

• Relocate and staff accounting resources to support operational shift to Dallas

• Phase 1

- AFE support

- Joint Interest Billings and (some) partners support

- Viking invoice approvals and upload

Bringing two current Turkish

accountants to Dallas on trial basis

starting with July close

- Consolidations and financial reporting accountant

- Internal controls management

Working to staff locally (Dallas,

Houston, Oklahoma City)

• Phase 2

• Will explore bringing an international tax resource in-house

• Will explore moving more general accounting functions from Turkey to Dallas

30

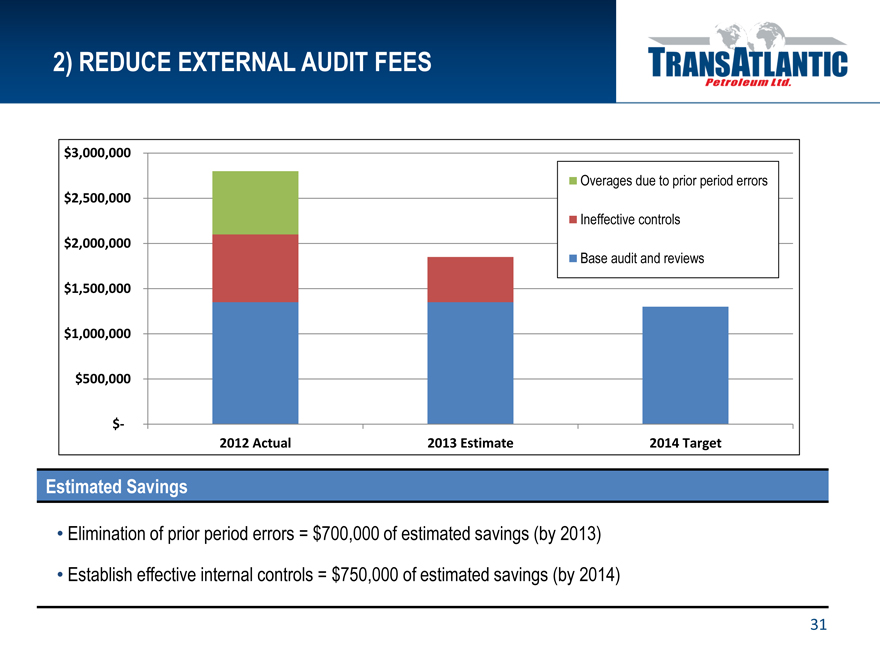

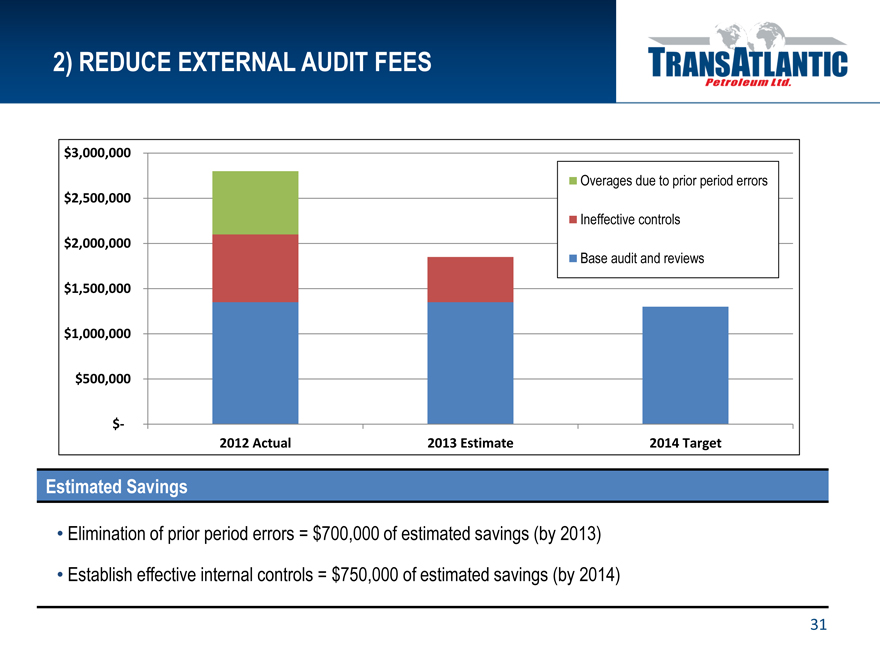

2) REDUCE EXTERNAL AUDIT FEES

TransAtlantic

Petroleum Ltd.

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$1,000,000

$500,000

$-

Overages due to prior period errors

Ineffective controls

Base audit and reviews

2012 Actual 2013 Estimate 2014 Target

Estimated Savings

• Elimination of prior period errors = $700,000 of estimated savings (by 2013)

• Establish effective internal controls = $750,000 of estimated savings (by 2014)

31

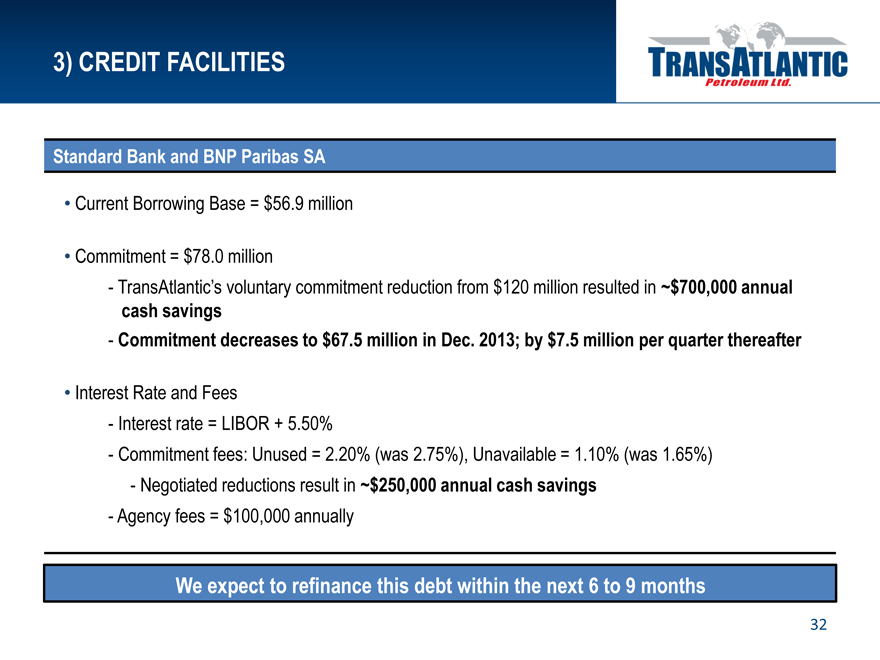

3) CREDIT FACILITIES

TransAtlantic

Petroleum Ltd.

Standard Bank and BNP Paribas SA

• Current Borrowing Base = $56.9 million

• Commitment = $78.0 million

- TransAtlantic’s voluntary commitment reduction from $120 million resulted in ~$700,000 annual cash savings

- Commitment decreases to $67.5 million in Dec. 2013; by $7.5 million per quarter thereafter

• Interest Rate and Fees

- Interest rate = LIBOR + 5.50%

- Commitment fees: Unused = 2.20% (was 2.75%), Unavailable = 1.10% (was 1.65%)

- Negotiated reductions result in ~$250,000 annual cash savings

- Agency fees = $100,000 annually

We expect to refinance this debt within the next 6 to 9 months

32

3) CREDIT FACILITIES

TransAtlantic Petroleum Ltd.

Yapi Kredi (Turkish Bank)

• We have secured an 80 million Turkish Lira (TL)

(US $42.1 million) line of credit for our Thrace Basin Natural Gas (TBNG) subsidiary

- Cash = 60 million TL (US $31.6 million)

- Non-cash = 20 million TL (US $10.5 million)

• Unsecured

- No collateral, no covenants

• No fees

• Two year tenor for each borrowing

• Interest rate negotiated upon each borrowing

Hydraulic fracture stimulation of the Bahar-1 well in the Molla area.

We will utilize YK facility to fund TBNG exploration and development as needed

Note: Based on 6/19/13 conversion rate of US $1 = $1.90 TL.

33

Q&A

TransAtlantic

Petroleum Ltd.

N. Malone Mitchell 3rd, Chairman & CEO

Ian J. Delahunty, President

Wil F. Saqueton, VP, CFO

Jeff S. Mecom, VP Legal

34

INVESTOR CONTACT INFORMATION

TransAtlantic

Petroleum Ltd.

Taylor B. Miele

Director of Investor Relations (214) 265-4746 taylor.miele@tapcor.com

Wil F. Saqueton

VP - Chief Financial Officer (214) 265-4743 wil.saqueton@tapcor.com

Ian J. Delahunty

President (214) 265-4780 ian.delahunty@tapcor.com

35

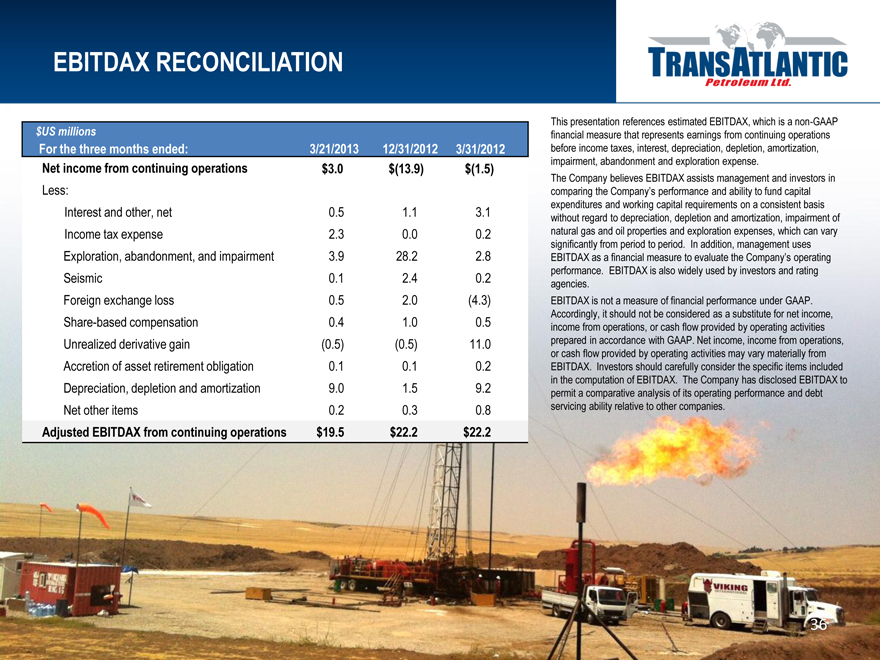

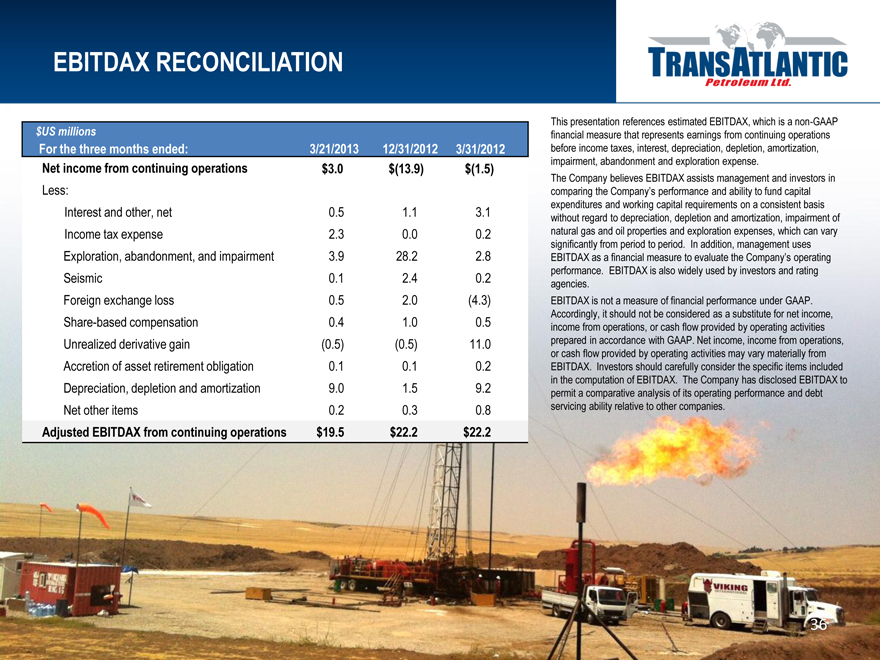

EBITDAX RECONCILIATION

TransAtlantic

Petroleum Ltd.

$US millions

For the three months ended: 3/21/2013 12/31/2012 3/31/2012

Net income from continuing operations $3.0 $(13.9) $(1.5)

Less:

Interest and other, net 0.5 1.1 3.1

Income tax expense 2.3 0.0 0.2

Exploration, abandonment, and impairment 3.9 28.2 2.8

Seismic 0.1 2.4 0.2

Foreign exchange loss 0.5 2.0 (4.3)

Share-based compensation 0.4 1.0 0.5

Unrealized derivative gain (0.5) (0.5) 11.0

Accretion of asset retirement obligation 0.1 0.1 0.2

Depreciation, depletion and amortization 9.0 1.5 9.2

Net other items 0.2 0.3 0.8

Adjusted EBITDAX from continuing operations $19.5 $22.2 $22.2

This presentation references estimated EBITDAX, which is a non-GAAP financial measure that represents earnings from continuing operations before income taxes, interest, depreciation, depletion, amortization, impairment, abandonment and exploration expense.

The Company believes EBITDAX assists management and investors in comparing the Company’s performance and ability to fund capital expenditures and working capital requirements on a consistent basis without regard to depreciation, depletion and amortization, impairment of natural gas and oil properties and exploration expenses, which can vary significantly from period to period. In addition, management uses

EBITDAX as a financial measure to evaluate the Company’s operating performance. EBITDAX is also widely used by investors and rating agencies.

EBITDAX is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net income, income from operations, or cash flow provided by operating activities prepared in accordance with GAAP. Net income, income from operations, or cash flow provided by operating activities may vary materially from EBITDAX. Investors should carefully consider the specific items included in the computation of EBITDAX. The Company has disclosed EBITDAX to permit a comparative analysis of its operating performance and debt servicing ability relative to other companies.

36

TransAtlantic

Petroleum Ltd.

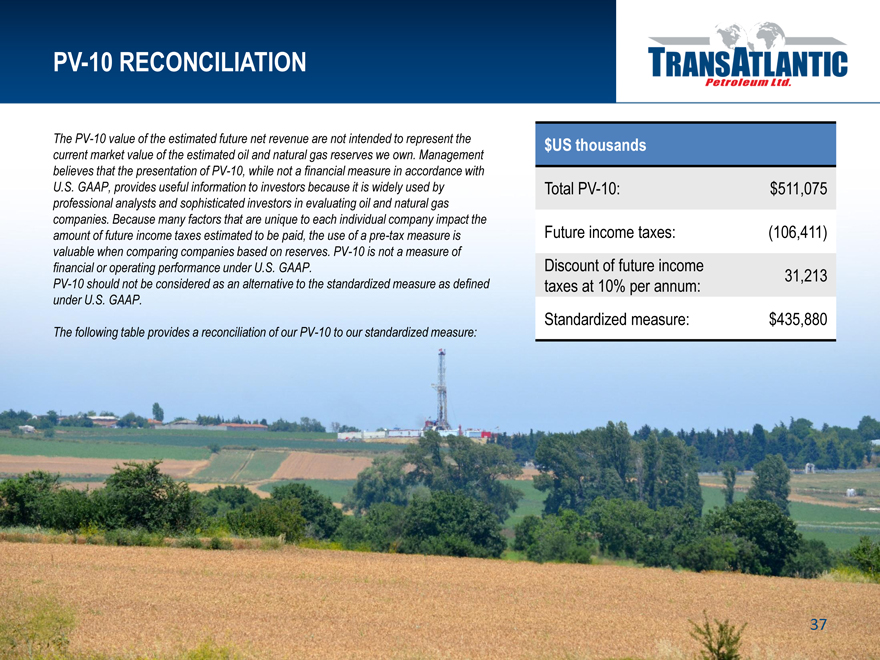

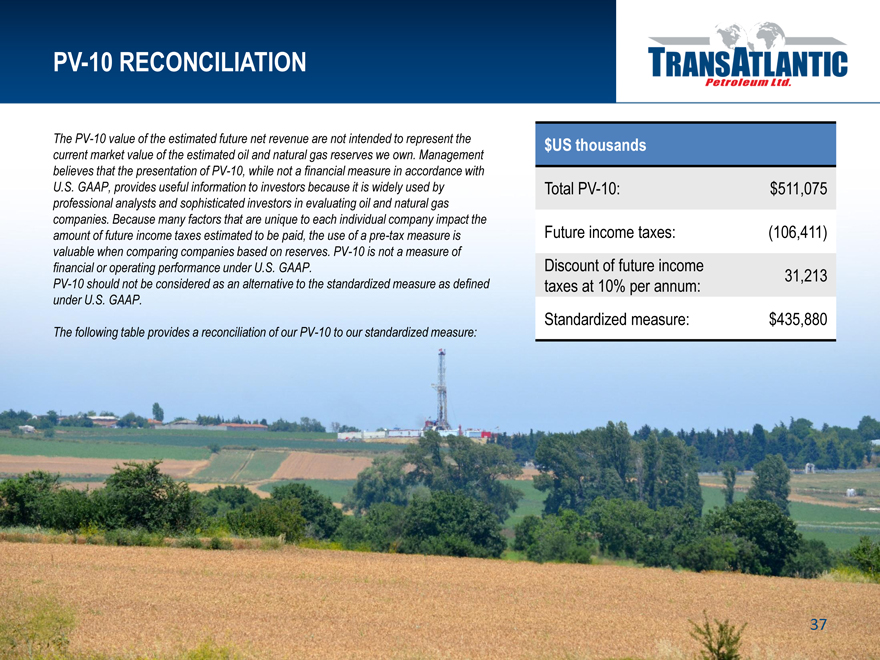

PV-10 RECONCILIATION

The PV-10 value of the estimated future net revenue are not intended to represent the current market value of the estimated oil and natural gas reserves we own. Management believes that the presentation of PV-10, while not a financial measure in accordance with U.S. GAAP, provides useful information to investors because it is widely used by professional analysts and sophisticated investors in evaluating oil and natural gas companies. Because many factors that are unique to each individual company impact the amount of future income taxes estimated to be paid, the use of a pre-tax measure is valuable when comparing companies based on reserves. PV-10 is not a measure of financial or operating performance under U.S. GAAP.

PV-10 should not be considered as an alternative to the standardized measure as defined under U.S. GAAP.

The following table provides a reconciliation of our PV-10 to our standardized measure:

$US thousands

Total PV-10:

$511,075

Future income taxes:

(106,411)

Discount of future income

31,213

taxes at 10% per annum:

Standardized measure:

$435,880

37