TRANSATLANTIC petroleum ltd. ANNUAL SHAREHOLDERS’ MEETING MAY 2017 Bahar Field Exhibit 99.1

FORWARD LOOKING STATEMENTS; non-gaap Outlooks, projections, estimates, targets and business plans in this presentation or any related subsequent discussions are forward-looking statements. Actual future results, including TransAtlantic Petroleum Ltd.’s own production growth and mix; financial results; the amount and mix of capital expenditures; resource additions and recoveries; finding and development costs; project and drilling plans, timing, costs, and capacities; revenue enhancements and cost efficiencies; industry margins; margin enhancements and integration benefits; and the impact of technology could differ materially due to a number of factors. These include market prices for natural gas, natural gas liquids and oil products; estimates of reserves and economic assumptions; the ability to produce and transport natural gas, natural gas liquids and oil; the results of exploration and development drilling and related activities; economic conditions in the countries and provinces in which we carry on business, especially economic slowdowns; actions by governmental authorities, receipt of required approvals, increases in taxes, legislative and regulatory initiatives relating to fracture stimulation activities, changes in environmental and other regulations, and renegotiations of contracts; political uncertainty, including actions by insurgent groups or other conflict; the negotiation and closing of material contracts; shortages of drilling rigs, equipment or oilfield services; and other factors discussed here and under the heading “Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2016, which is available on our website at www.transatlanticpetroleum.com and at www.sec.gov. See also TransAtlantic’s audited financial statements and the accompanying management discussion and analysis. Forward-looking statements are based on management’s knowledge and reasonable expectations on the date hereof, and we assume no duty to update these statements contained in our Form 10-K as of any future date, except as required by law. The information set forth in this presentation does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities of the Company. The information published herein is provided for informational purposes only. The Company makes no representation that the information and opinions expressed herein are accurate, complete or current. The information contained herein is current as of the date hereof, but may become outdated or subsequently may change. Nothing contained herein constitutes financial, legal, tax, or other advice. The SEC requires oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We may use the terms “estimated ultimate recovery,” “EUR,” “probable,” “possible,” and “non-proven” reserves, “prospective resources” or “upside” or other descriptions of volumes of resources or reserves potentially recoverable through additional drilling or recovery techniques. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the Company. There is no certainty that any portion of estimated prospective resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the estimated prospective resources. This presentation includes certain non-GAAP financial measures, including Adjusted EBITDAX and Adjusted Book Value. While the Company believes Adjusted EBITDAX and Adjusted Book Value are useful measures for investors, they are not presented in accordance with GAAP. You should not consider non-GAAP measures in isolation or as a substitute for items calculated in accordance with GAAP. In addition, Adjusted EBITDAX has inherent material limitations as a performance measure because it adds back certain expenses to net income (loss) from continuing operations, resulting in those expenses not being taken into account in the applicable financial measure. Because not all companies use identical calculations, the presentation herein of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Note on PV-10: The present value of estimated future net revenues or PV-10 is an estimate of future net revenues from a property at the date indicated, without giving effect to derivative financial instrument activities, after deducting production and ad valorem taxes, future capital costs, abandonment costs and operating expenses, but before deducting future federal income taxes. The future net revenues have been discounted at an annual rate of 10% to determine their “present value.” The present value is shown to indicate the effect of time on the value of the net revenue stream and should not be construed as being the fair market value of the properties or the oil and natural gas reserves we own. Estimates have been made using constant oil and natural gas prices and operating and capital costs at the date indicated, at its acquisition date, or as otherwise indicated. We believe that the present value of estimated future net revenues before income taxes, while not a financial measure in accordance with GAAP, is an important financial measure used by investors and independent oil and natural gas producers for evaluating the relative significance of oil and natural gas properties and acquisitions because the tax characteristics of comparable companies can differ materially. PV-10 is not a measure of financial or operating performance under GAAP. PV-10 should not be considered as an alternative to the Standardized Measure as defined under GAAP. The Standardized Measure represents the PV-10 after giving effect to income taxes. Note on BOE: BOE (barrel of oil equivalent) is derived by converting natural gas to oil in the ratio of six thousand cubic feet (MCF) of natural gas to one barrel (bbl) of oil. BOE may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

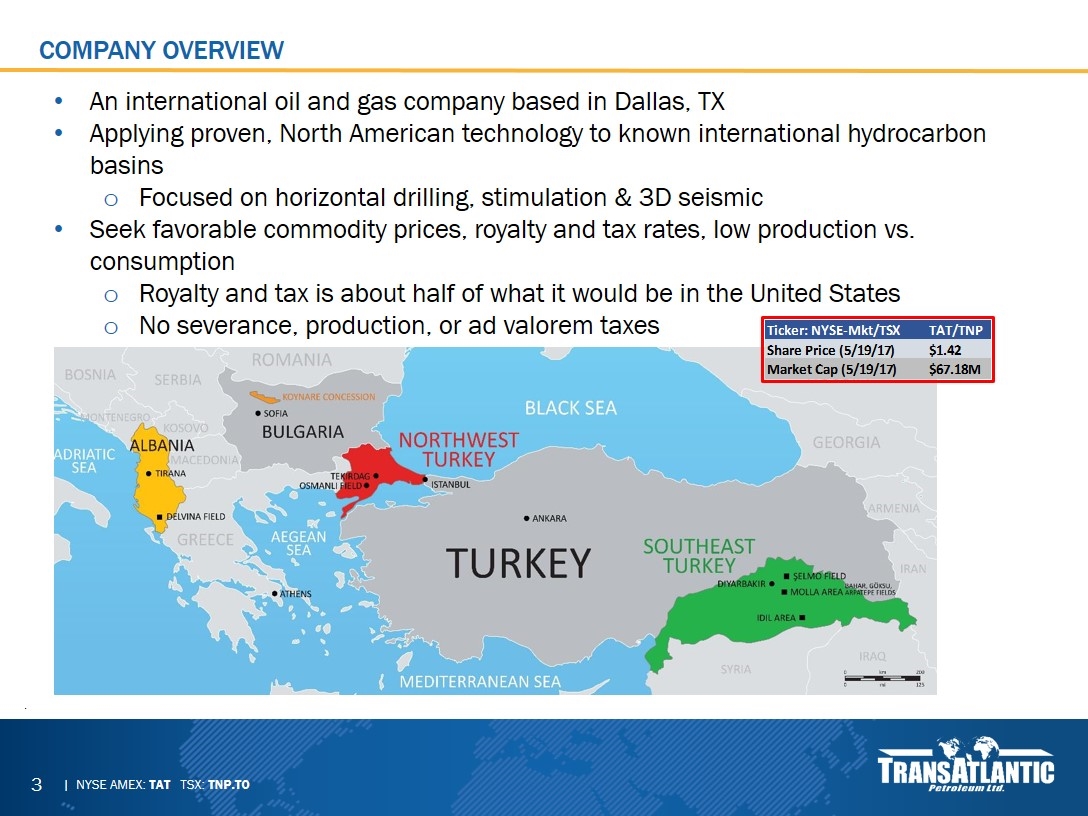

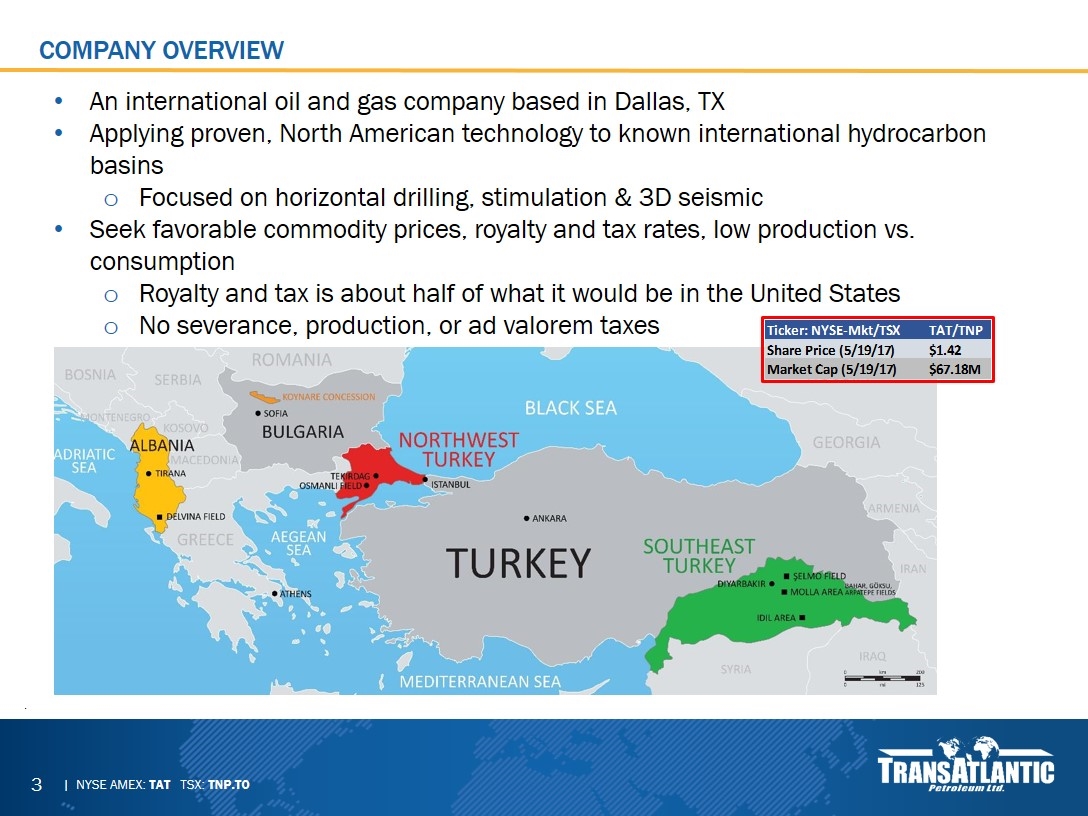

An international oil and gas company based in Dallas, TX Applying proven, North American technology to known international hydrocarbon basins Focused on horizontal drilling, stimulation & 3D seismic Seek favorable commodity prices, royalty and tax rates, low production vs. consumption Royalty and tax is about half of what it would be in the United States No severance, production, or ad valorem taxes Company overview .

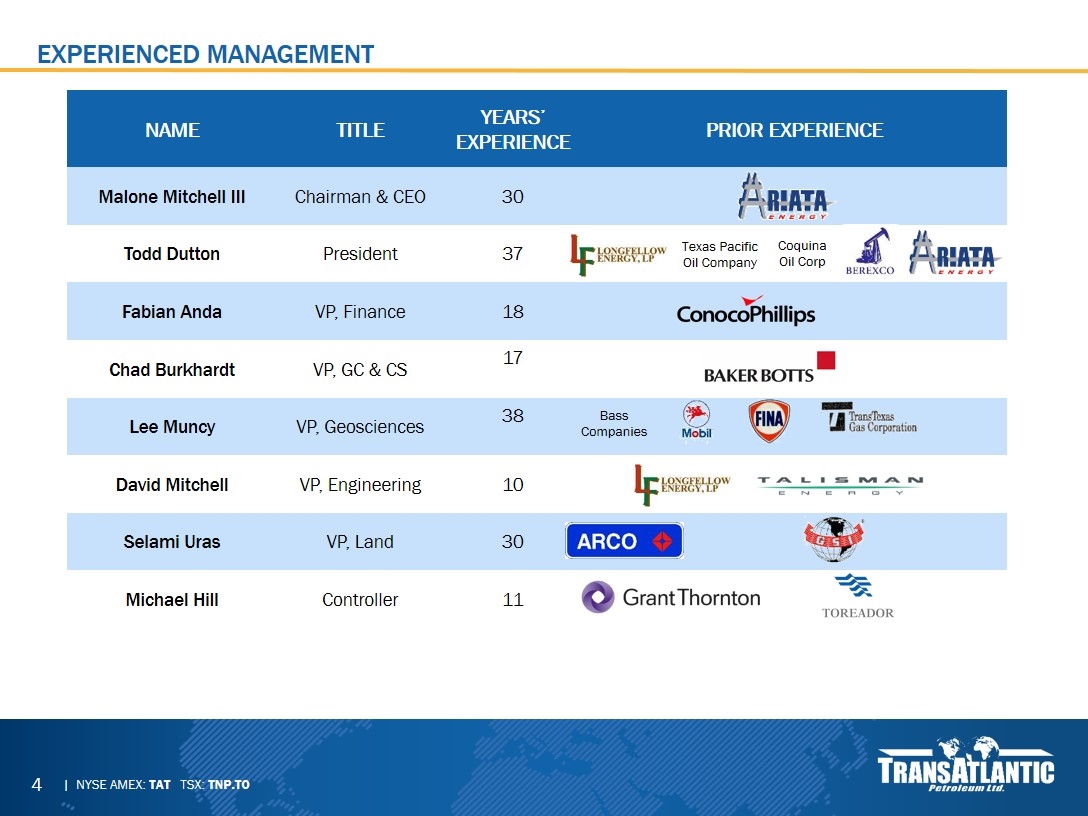

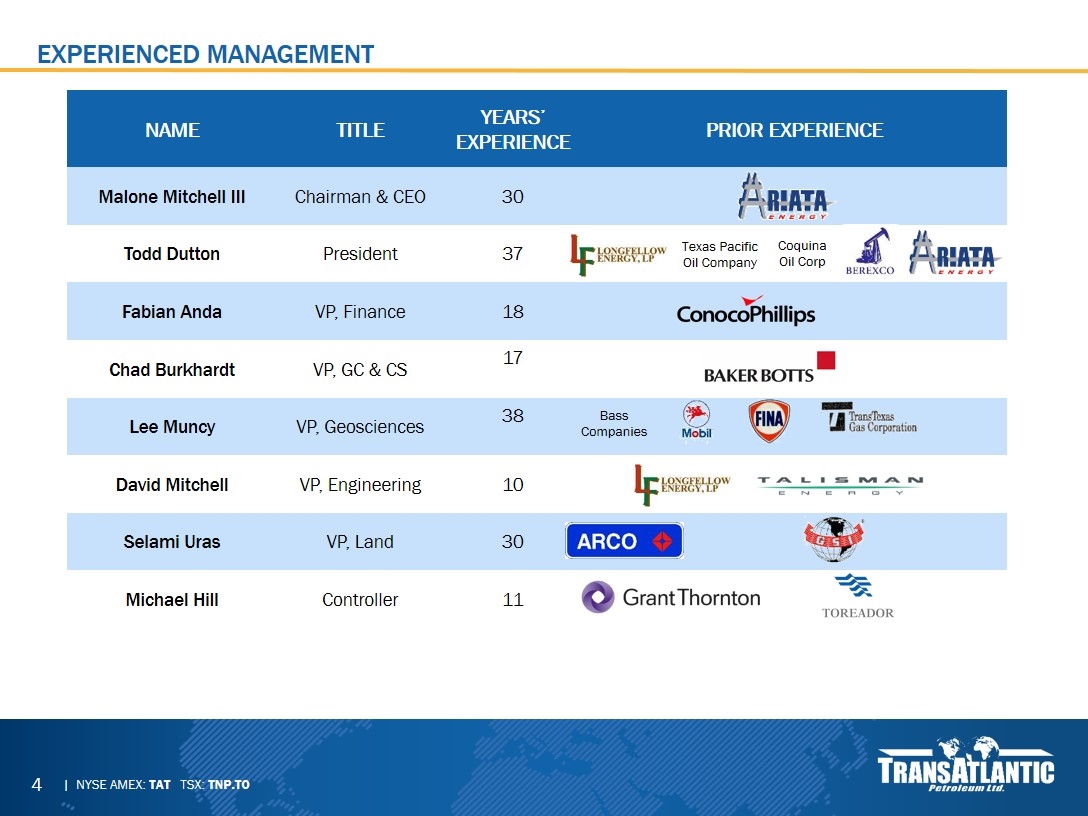

EXPERIENCED MANAGEMENT NAME TITLE YEARS’ EXPERIENCE PRIOR EXPERIENCE Malone Mitchell III Chairman & CEO 30 Todd Dutton President 37 Fabian Anda VP, Finance 18 Chad Burkhardt VP, GC & CS 17 Lee Muncy VP, Geosciences 38 David Mitchell VP, Engineering 10 Selami Uras VP, Land 30 Michael Hill Controller 11 Texas Pacific Oil Company Coquina Oil Corp Bass Companies

Board of directors NAME TITLE Director Since Committee EXPERIENCE Malone Mitchell III Chairman 2008 Bob G. Alexander Director 2010 2 Brian E. Bayley Director 2001 1, 2, & 3 Charles J. Campise Director 2012 1 & 3 Marlan W. Downey Director 2013 3 Gregory K. Renwick Director 2014 Mel G. Riggs Director 2009 1, 2, & 3 Jonathan Fite Director 2016 2 Randall Rochman Director 2016 1 Roxanna Oil Company West Family Investments, Inc. Ionic Management Corp. Alexander Energy Reserve Energy (1) Audit. (2) Compensation, (3) Governance

FINANCIAL REVIEW Selmo Production Facility

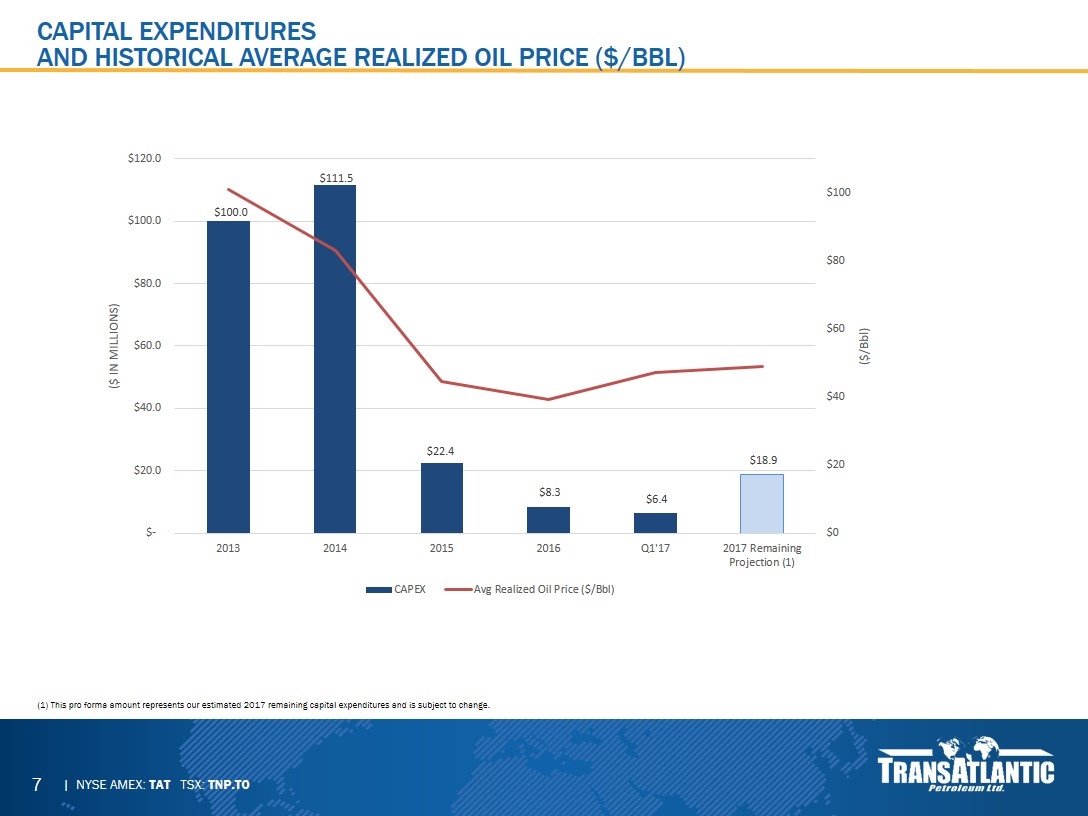

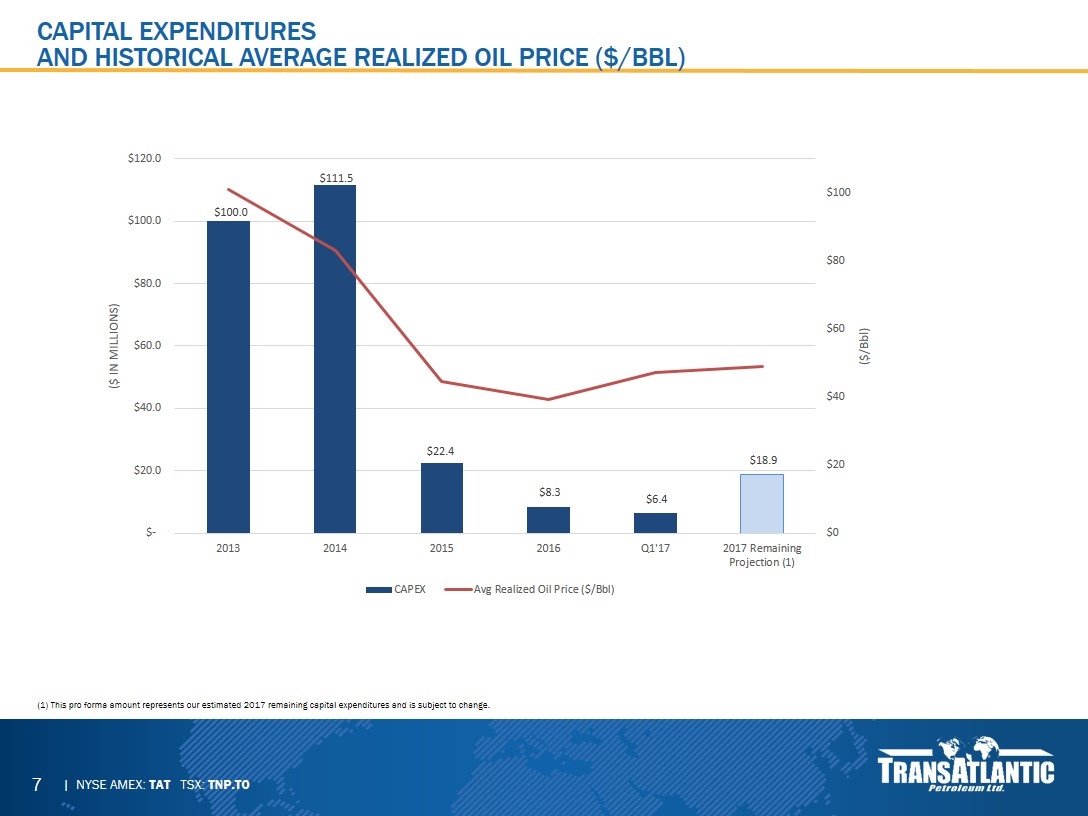

Capital expenditures and historical average realized oil price ($/bbl) (1) This pro forma amount represents our estimated 2017 remaining capital expenditures and is subject to change.

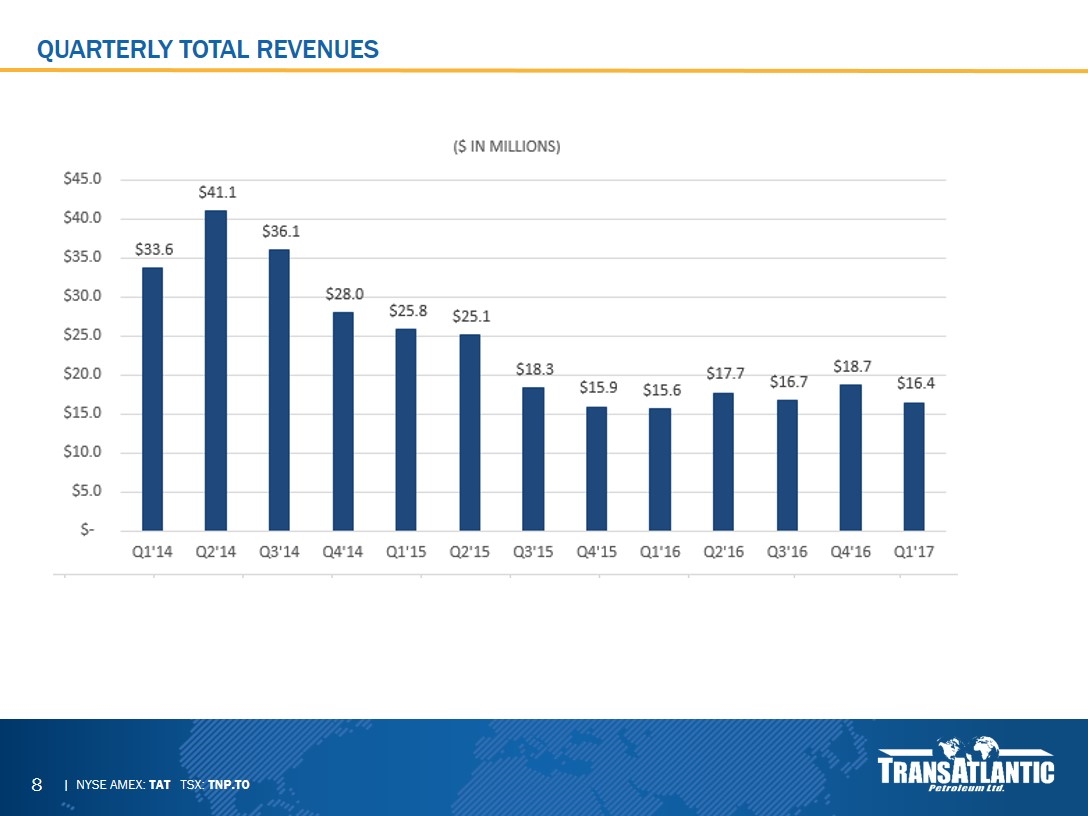

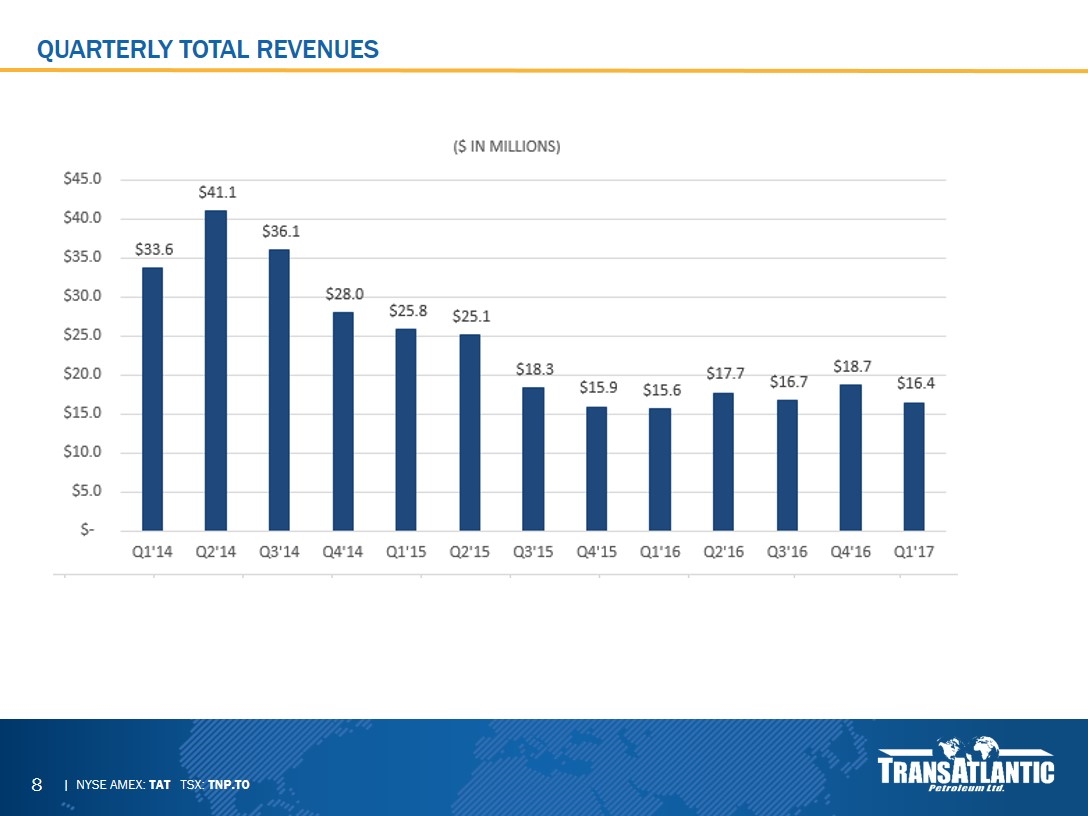

QUARTERLY TOTAL REVENUES

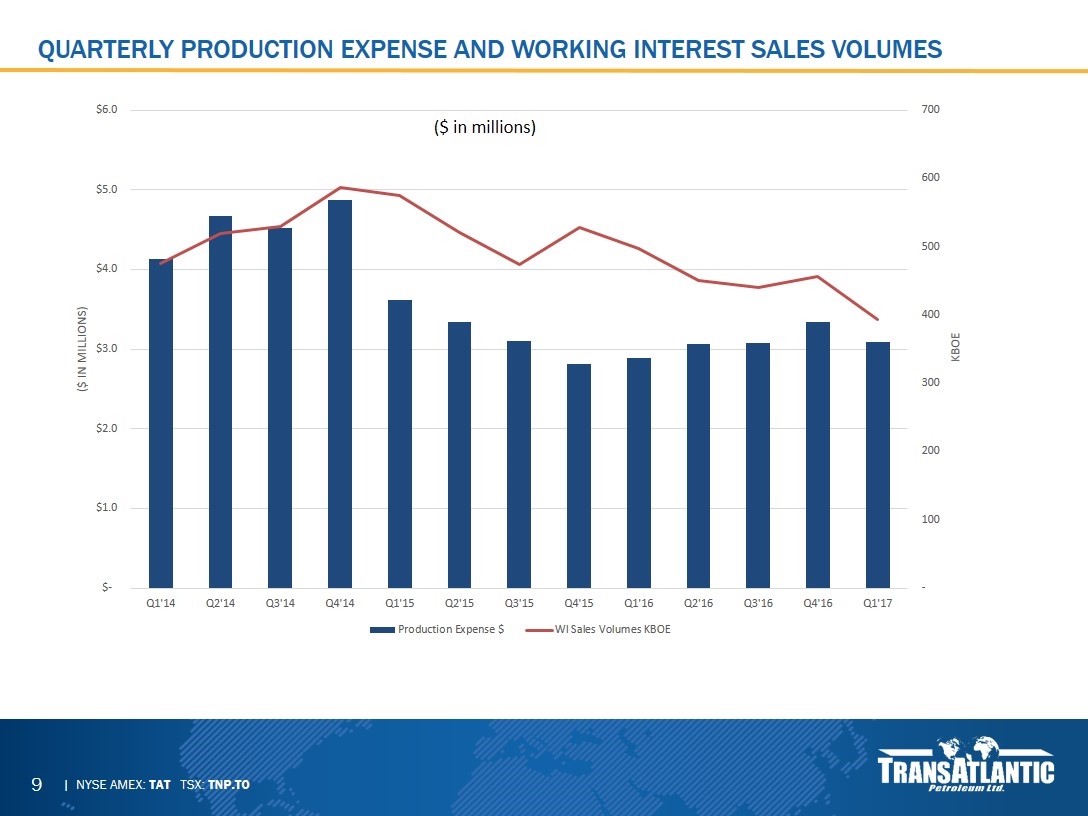

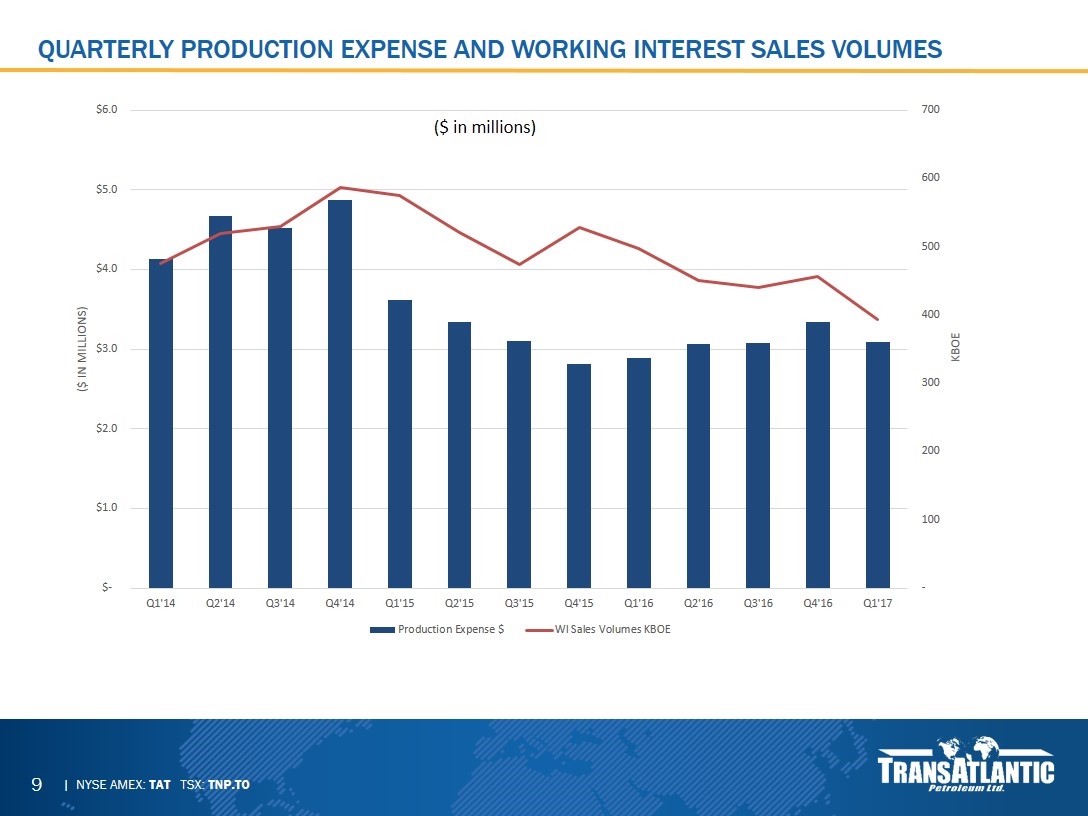

Quarterly PRODUCTION EXPENSE and working interest sales volumes ($ in millions)

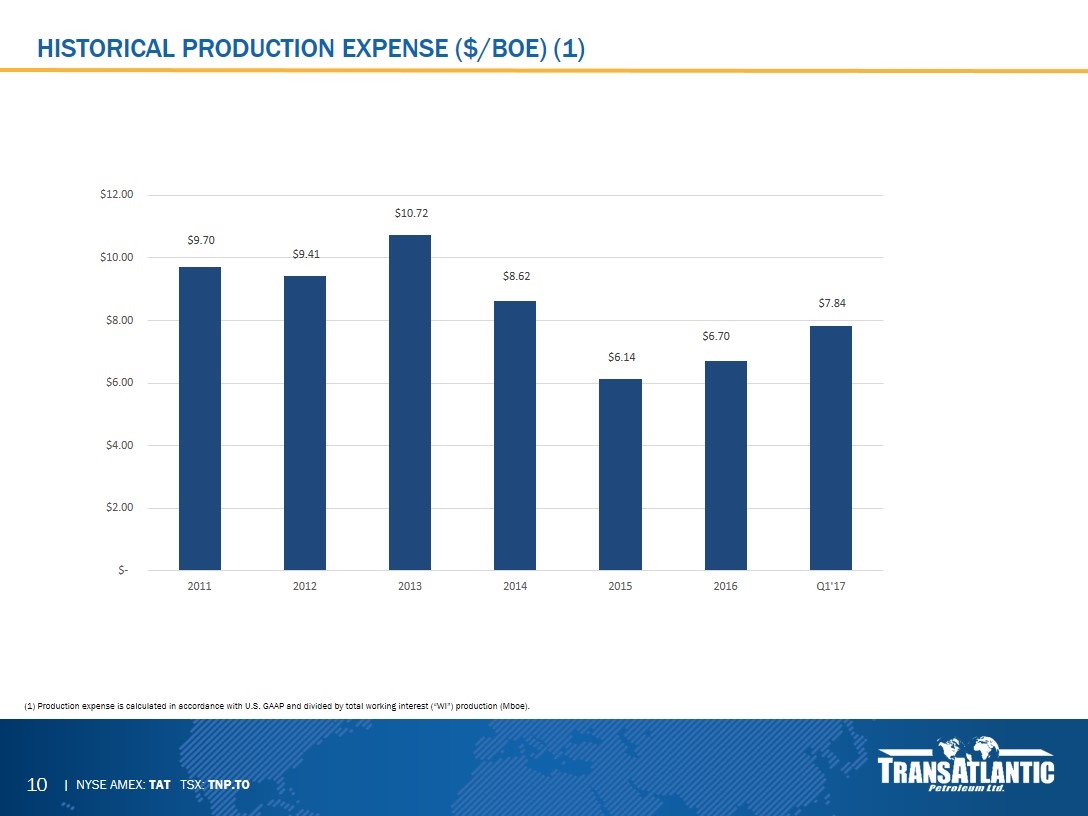

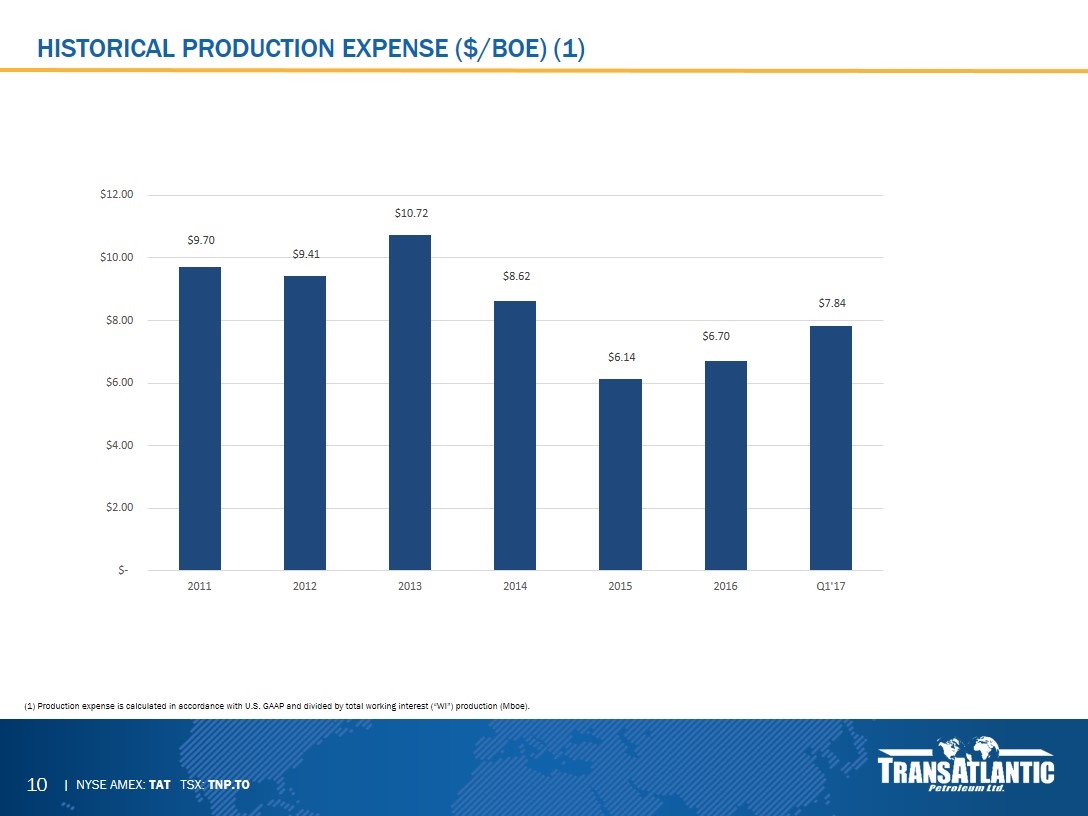

Historical production expense ($/boe) (1) (1) Production expense is calculated in accordance with U.S. GAAP and divided by total working interest (“WI”) production (Mboe).

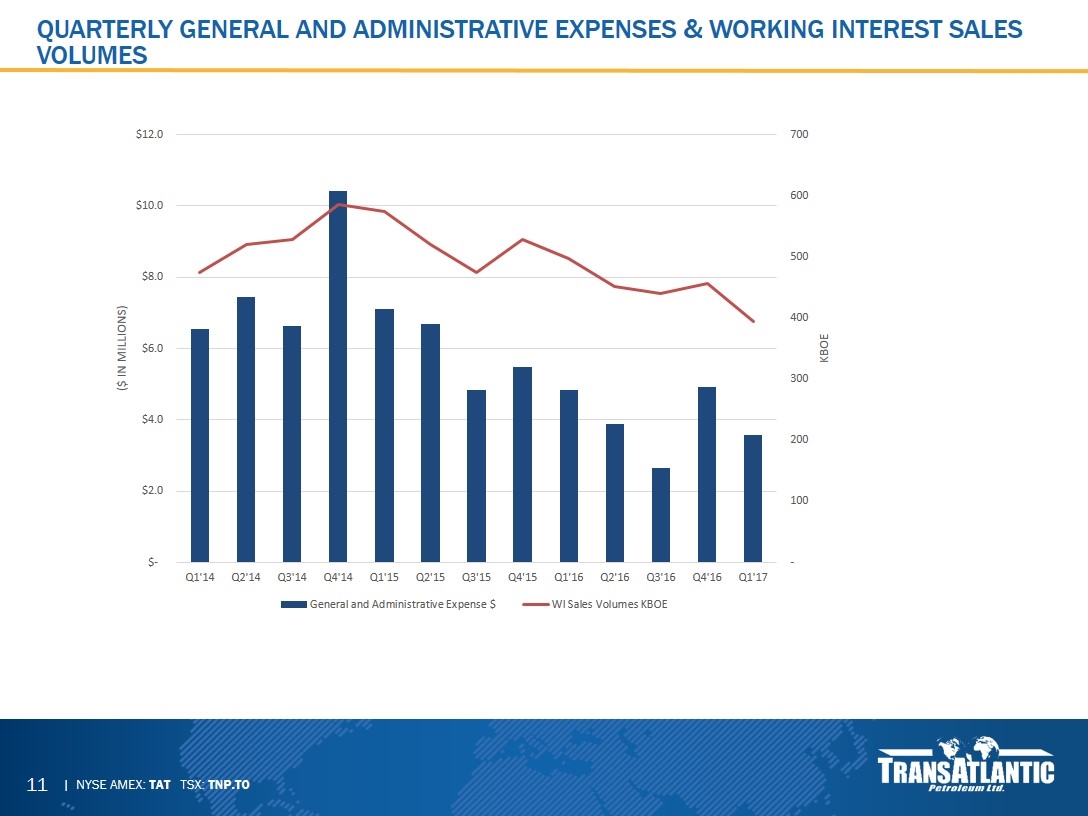

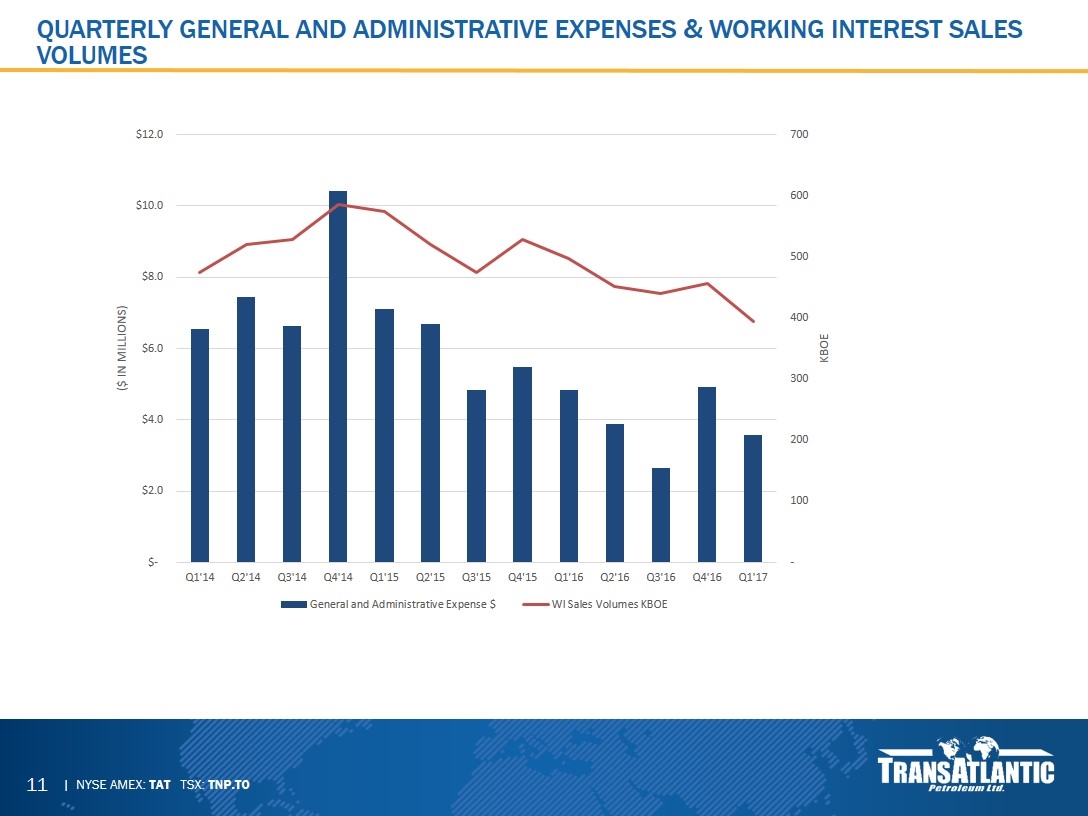

QUARTERLY General and administrative expenses & Working interest SALES VOLUMES

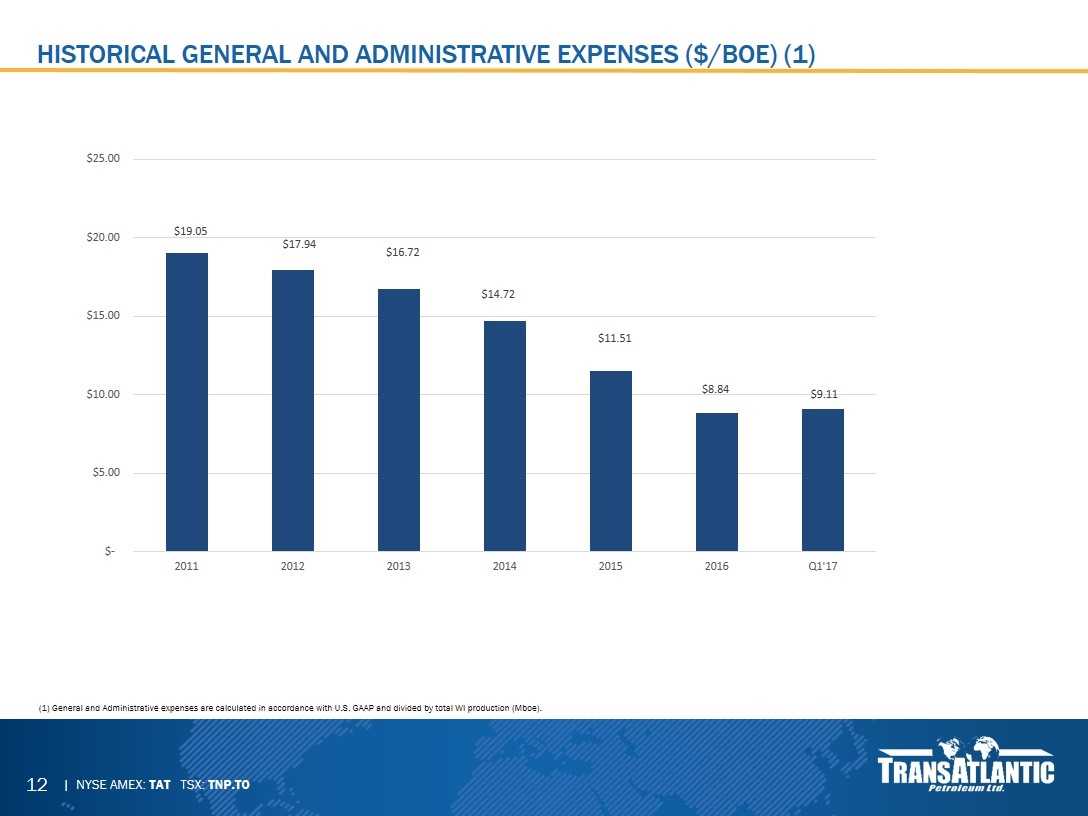

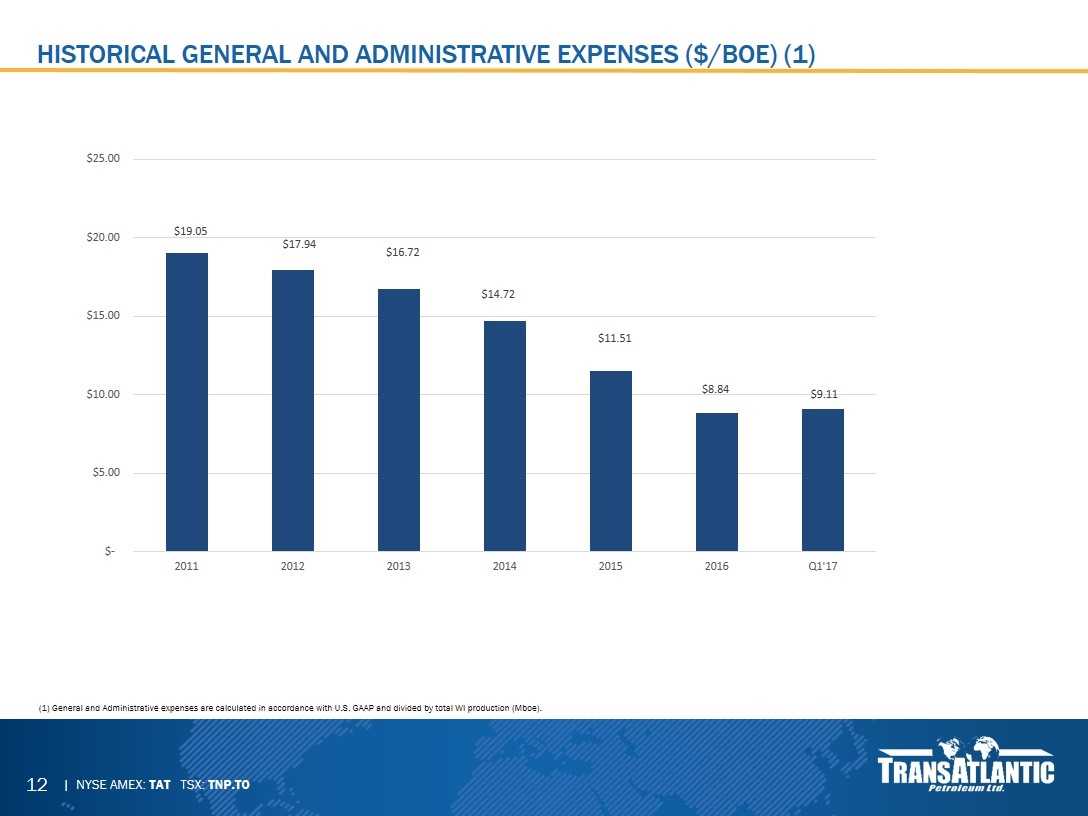

Historical general and administrative expenses ($/boe) (1) (1) General and Administrative expenses are calculated in accordance with U.S. GAAP and divided by total WI production (Mboe).

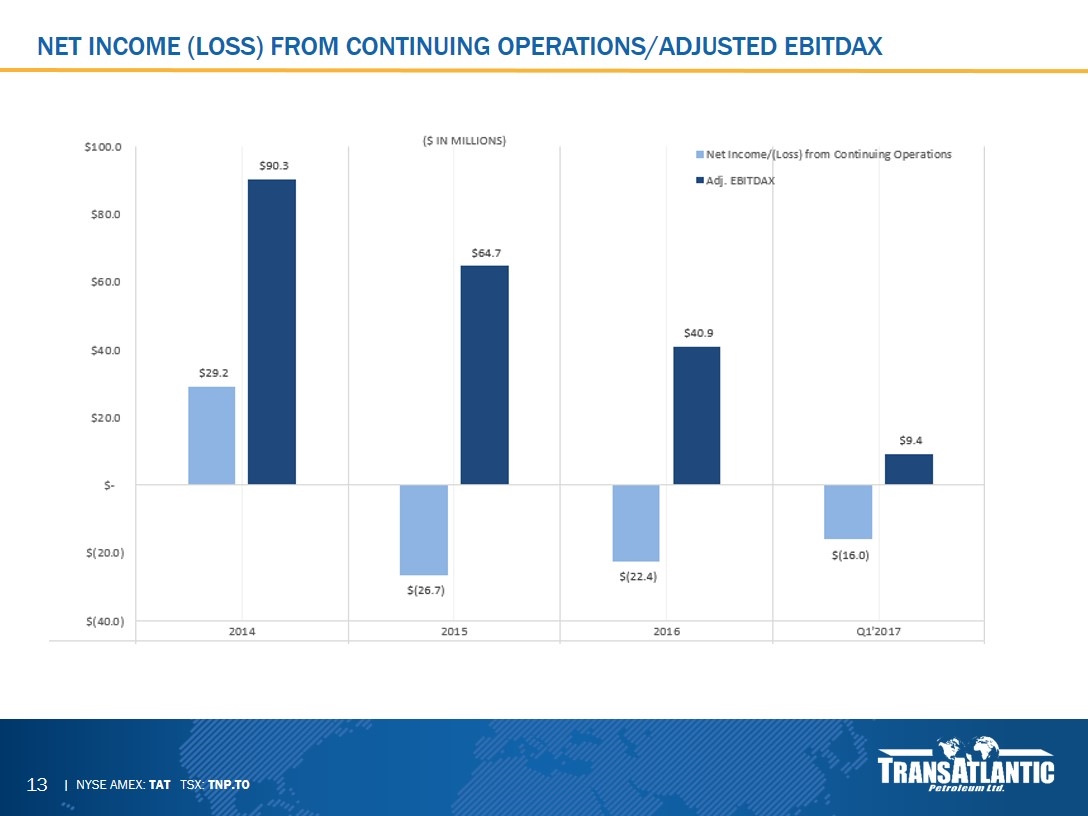

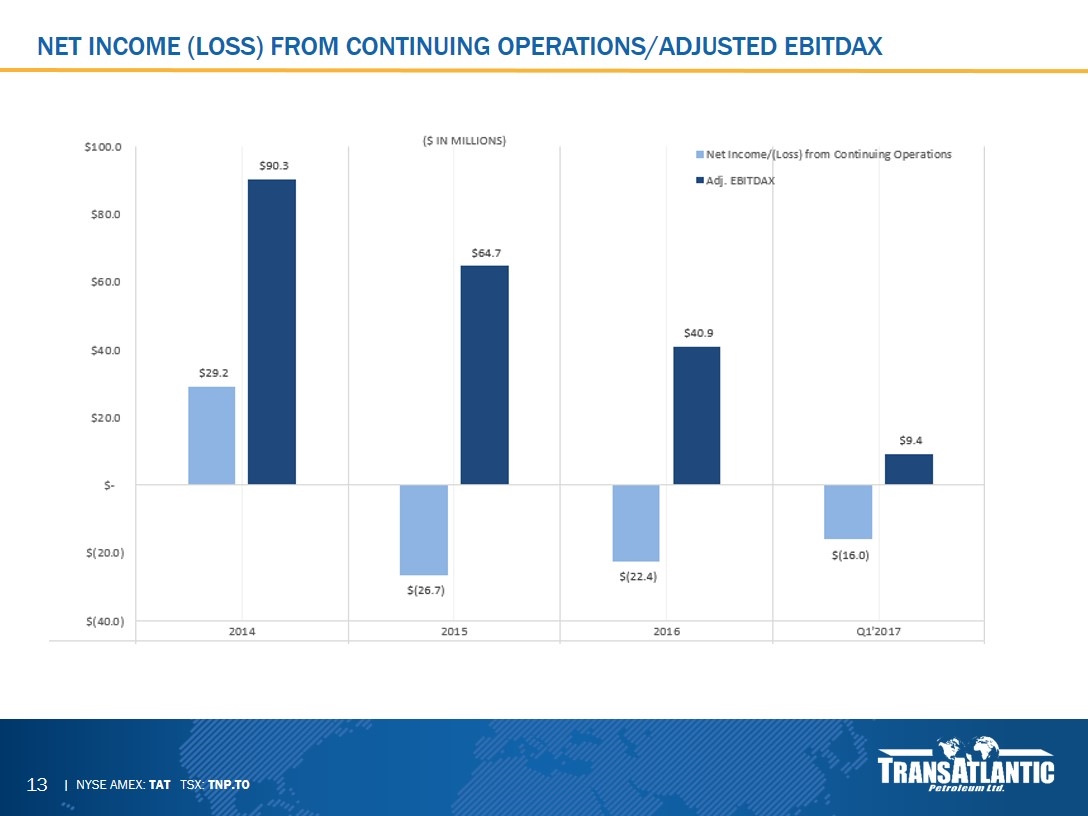

NET INCOME (LOSS) FROM CONTINUING OPERATIONS/ADJUSTED EBITDAX

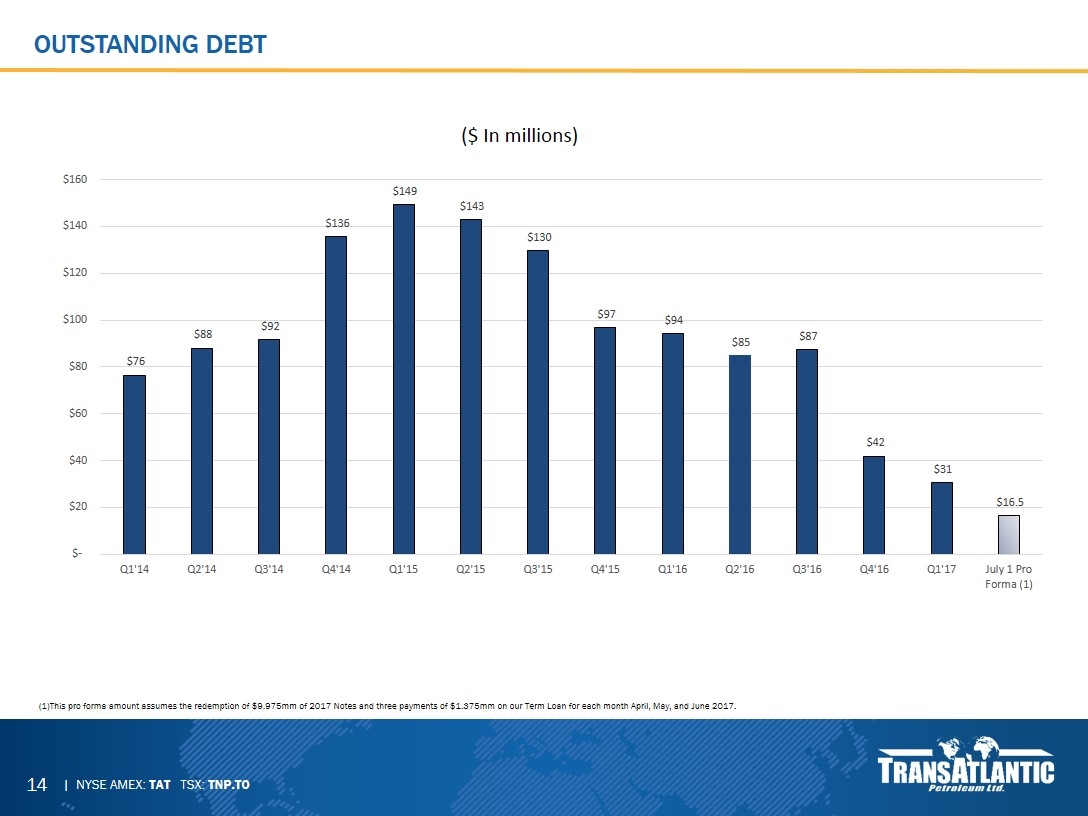

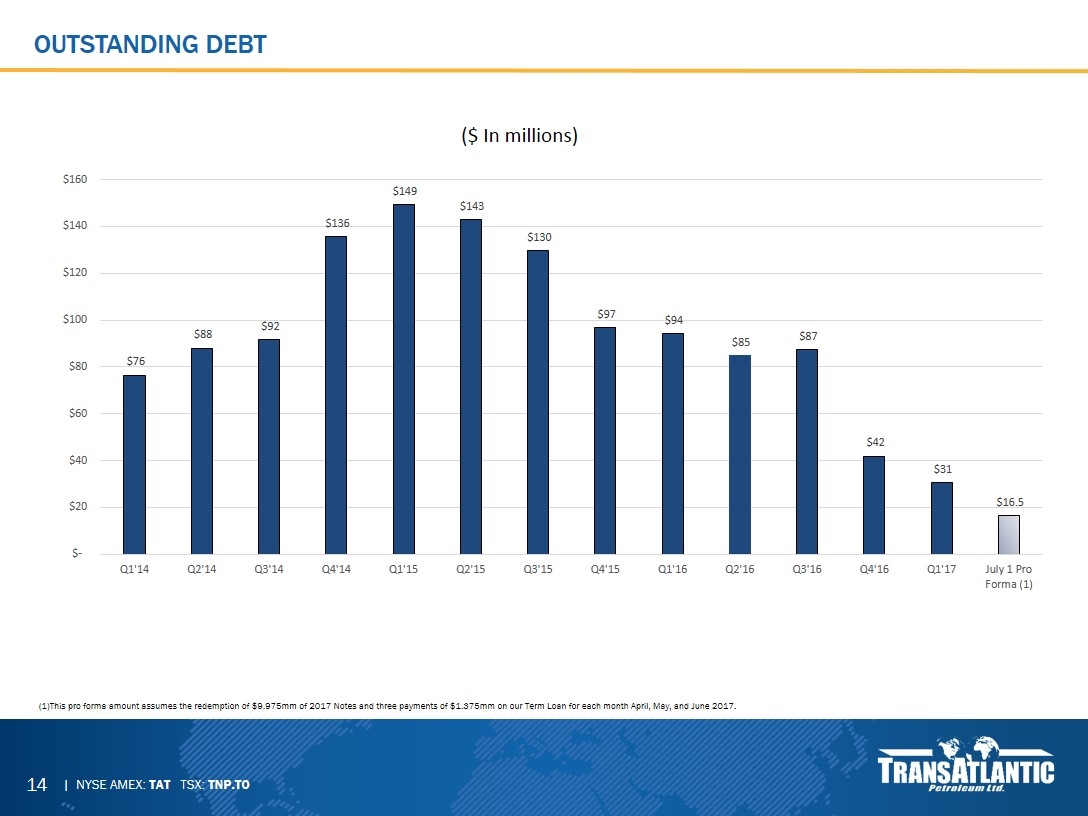

Outstanding debt (1)This pro forma amount assumes the redemption of $9.975mm of 2017 Notes and three payments of $1.375mm on our Term Loan for each month April, May, and June 2017. ($ In millions)

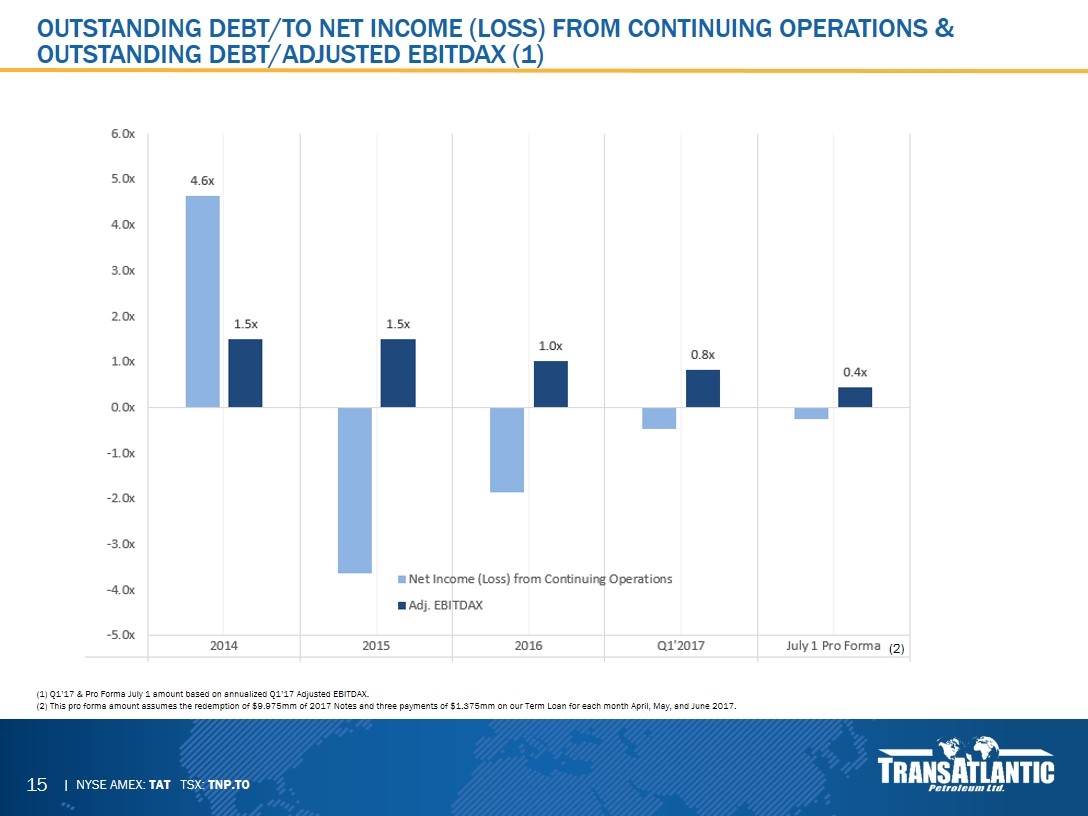

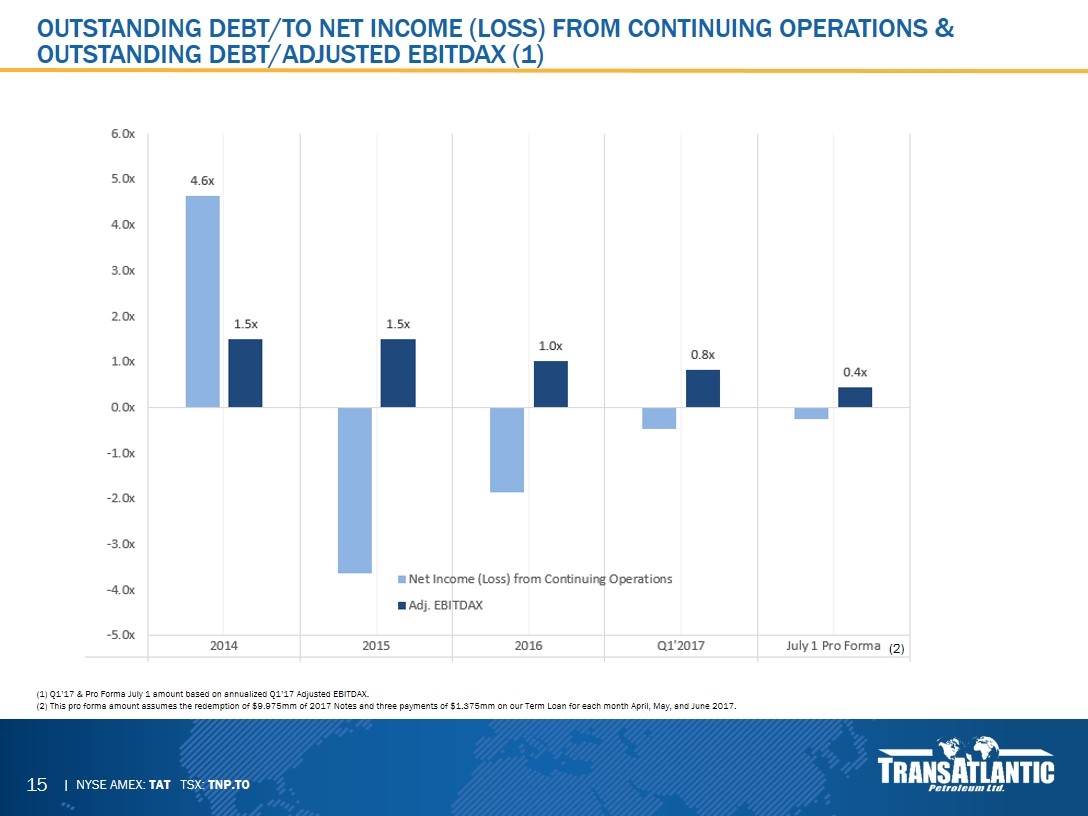

Outstanding debt/to net income (loss) from continuing operations & outstanding debt/adjusted ebitdax (1) (1) Q1’17 & Pro Forma July 1 amount based on annualized Q1’17 Adjusted EBITDAX. (2) This pro forma amount assumes the redemption of $9.975mm of 2017 Notes and three payments of $1.375mm on our Term Loan for each month April, May, and June 2017. (2)

CURRENT VALUE Goksu Production Facility

TRANSATLANTIC TODAY TransAtlantic’s stock is underpriced on an Adjusted Book Value, EBITDAX multiple, and reserves basis Now drilling out of cash flow to resume production growth Over the next few months, we will drill high impact wells to grow reserves and production visibility Board has approved plan to: Recruit and hire an experienced Financial Transaction Manager Work to execute transactions to accelerate activity level Explore various alternatives for maximizing asset value through increasing reserves and share price to make strategic transactions a more likely scenario.

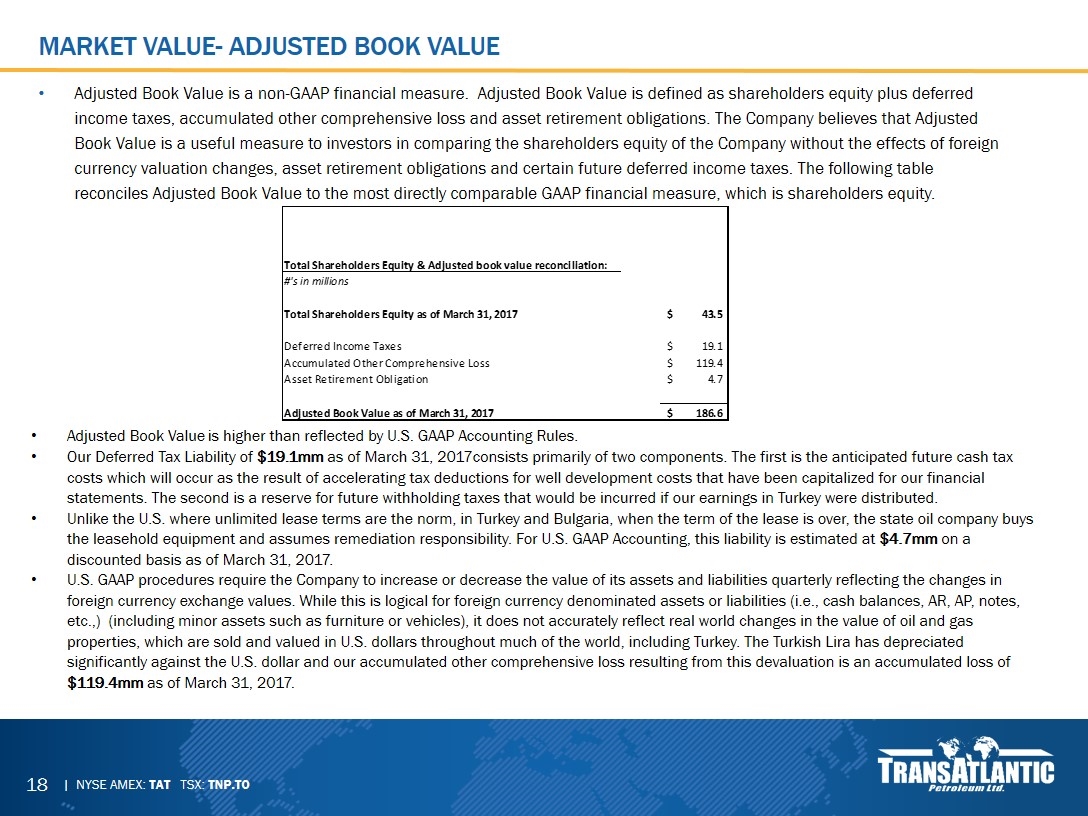

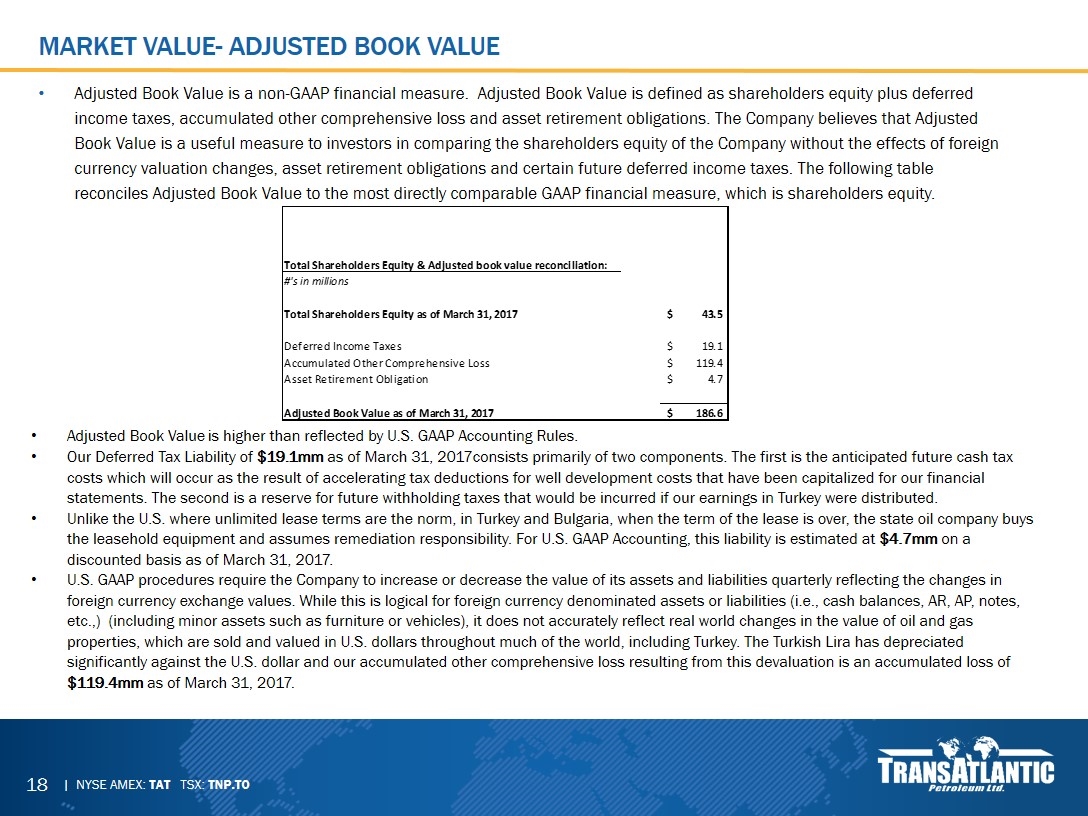

Adjusted Book Value is higher than reflected by U.S. GAAP Accounting Rules. Our Deferred Tax Liability of $19.1mm as of March 31, 2017consists primarily of two components. The first is the anticipated future cash tax costs which will occur as the result of accelerating tax deductions for well development costs that have been capitalized for our financial statements. The second is a reserve for future withholding taxes that would be incurred if our earnings in Turkey were distributed. Unlike the U.S. where unlimited lease terms are the norm, in Turkey and Bulgaria, when the term of the lease is over, the state oil company buys the leasehold equipment and assumes remediation responsibility. For U.S. GAAP Accounting, this liability is estimated at $4.7mm on a discounted basis as of March 31, 2017. U.S. GAAP procedures require the Company to increase or decrease the value of its assets and liabilities quarterly reflecting the changes in foreign currency exchange values. While this is logical for foreign currency denominated assets or liabilities (i.e., cash balances, AR, AP, notes, etc.,) (including minor assets such as furniture or vehicles), it does not accurately reflect real world changes in the value of oil and gas properties, which are sold and valued in U.S. dollars throughout much of the world, including Turkey. The Turkish Lira has depreciated significantly against the U.S. dollar and our accumulated other comprehensive loss resulting from this devaluation is an accumulated loss of $119.4mm as of March 31, 2017. Adjusted Book Value is a non-GAAP financial measure. Adjusted Book Value is defined as shareholders equity plus deferred income taxes, accumulated other comprehensive loss and asset retirement obligations. The Company believes that Adjusted Book Value is a useful measure to investors in comparing the shareholders equity of the Company without the effects of foreign currency valuation changes, asset retirement obligations and certain future deferred income taxes. The following table reconciles Adjusted Book Value to the most directly comparable GAAP financial measure, which is shareholders equity. Market value- adjusted book value

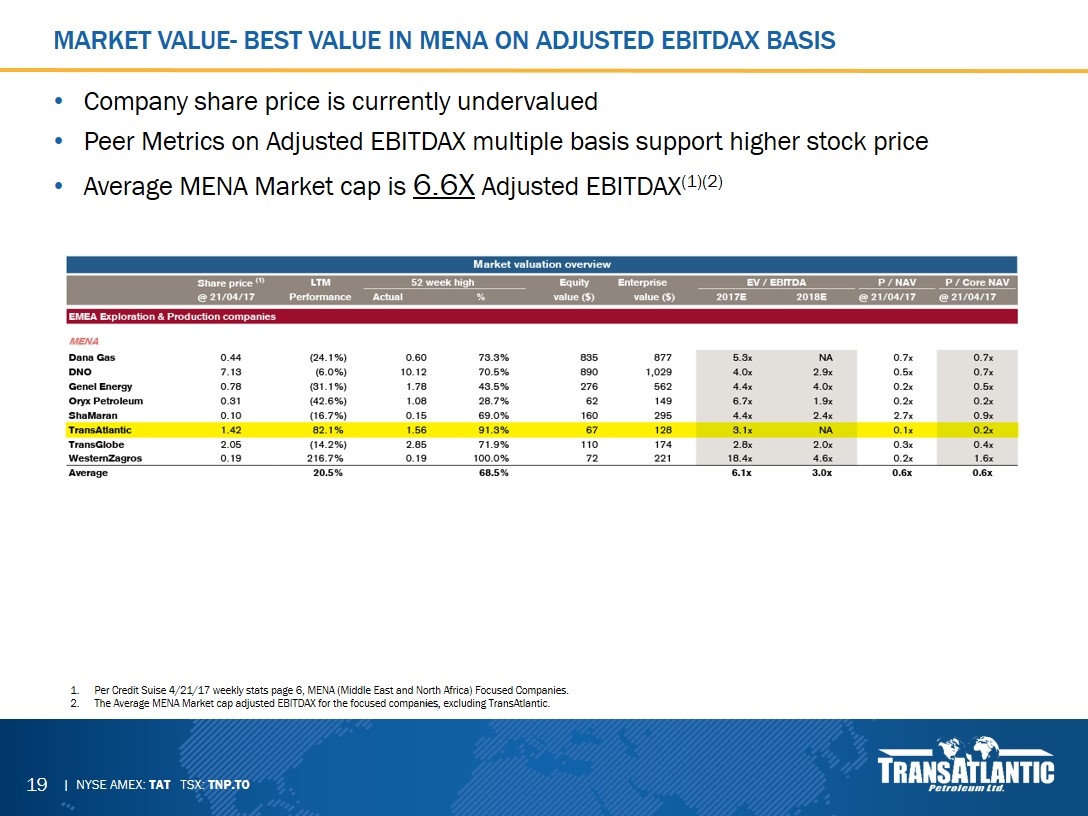

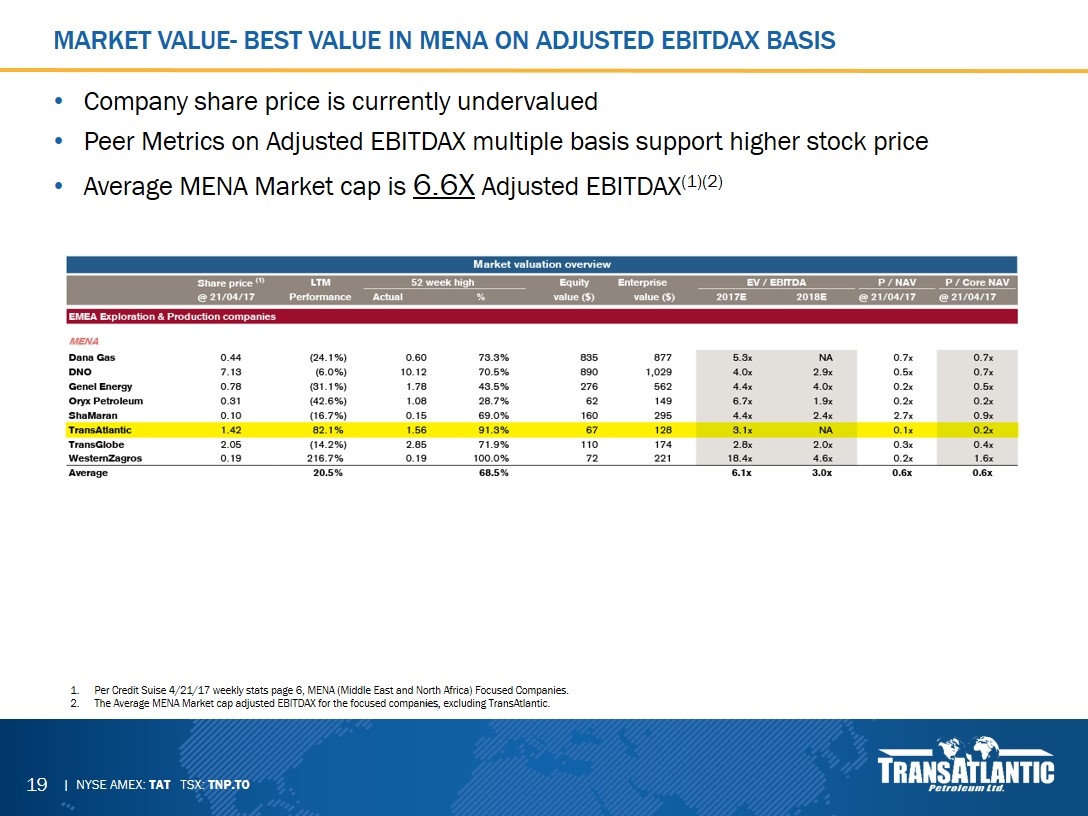

Company share price is currently undervalued Peer Metrics on Adjusted EBITDAX multiple basis support higher stock price Average MENA Market cap is 6.6X Adjusted EBITDAX(1)(2) Market value- Best value in MENA on adjusted EBITDAX basis Per Credit Suise 4/21/17 weekly stats page 6, MENA (Middle East and North Africa) Focused Companies. The Average MENA Market cap adjusted EBITDAX for the focused companies, excluding TransAtlantic.

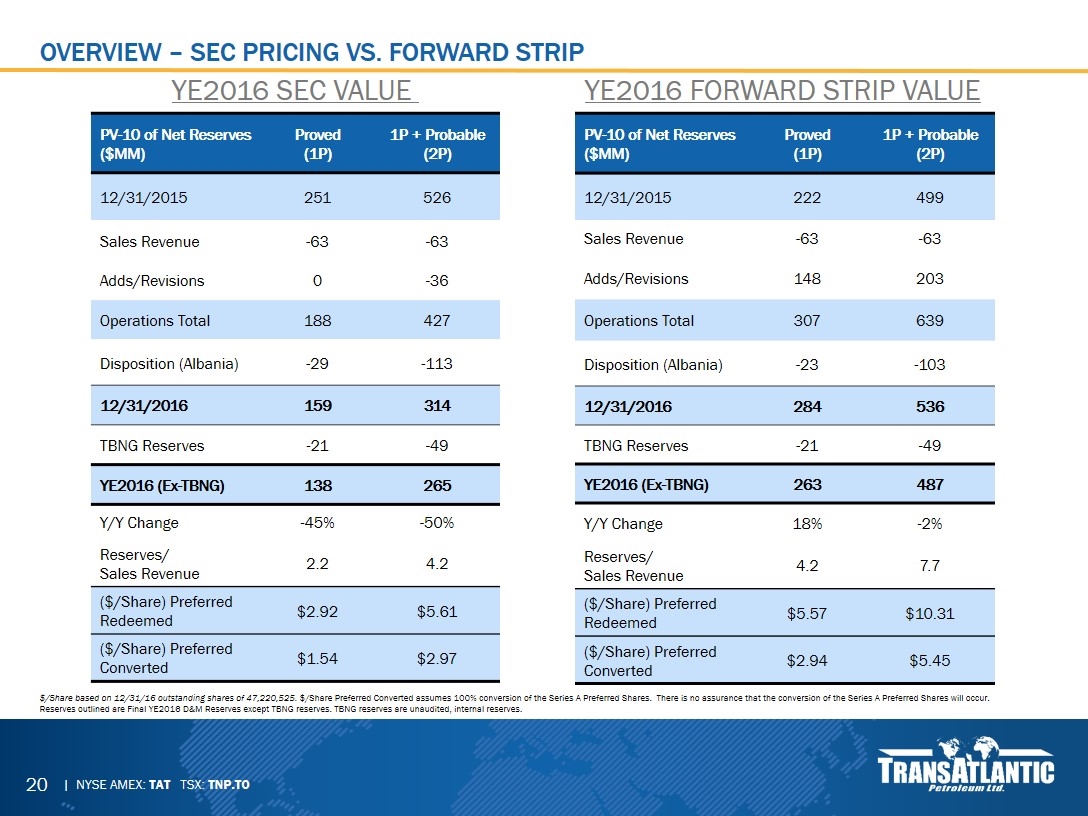

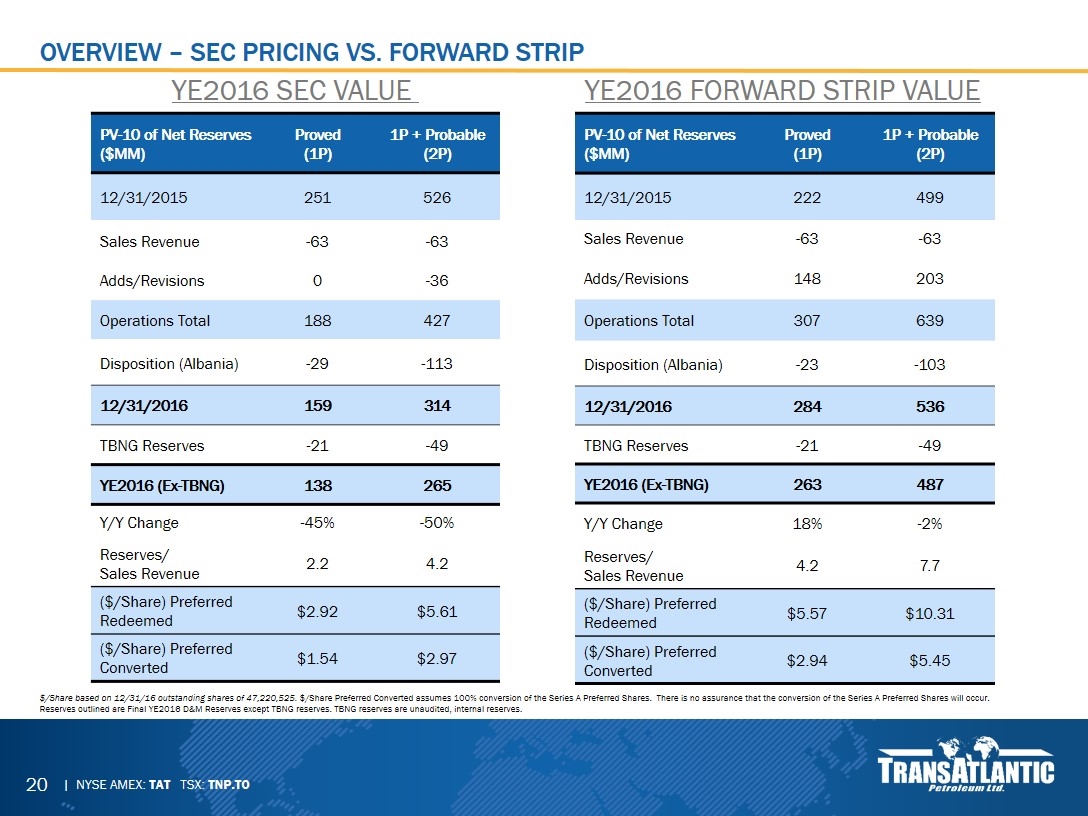

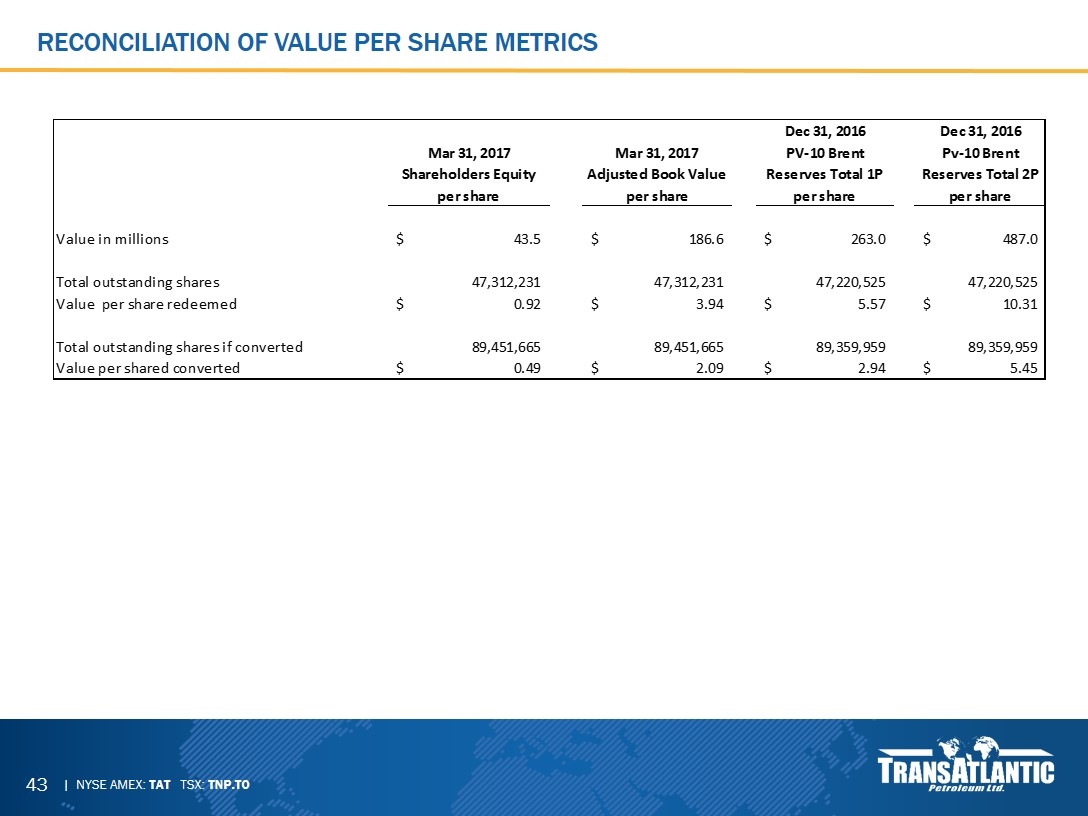

Overview – sec pricing VS. FORWARD STRIP $/Share based on 12/31/16 outstanding shares of 47,220,525. $/Share Preferred Converted assumes 100% conversion of the Series A Preferred Shares. There is no assurance that the conversion of the Series A Preferred Shares will occur. Reserves outlined are Final YE2016 D&M Reserves except TBNG reserves. TBNG reserves are unaudited, internal reserves. ye2016 sec value YE2016 forward strip value PV-10 of Net Reserves ($MM) Proved (1P) 1P + Probable (2P) 12/31/2015 251 526 Sales Revenue -63 -63 Adds/Revisions 0 -36 Operations Total 188 427 Disposition (Albania) -29 -113 12/31/2016 159 314 TBNG Reserves -21 -49 YE2016 (Ex-TBNG) 138 265 Y/Y Change -45% -50% Reserves/ Sales Revenue 2.2 4.2 ($/Share) Preferred Redeemed $2.92 $5.61 ($/Share) Preferred Converted $1.54 $2.97 PV-10 of Net Reserves ($MM) Proved (1P) 1P + Probable (2P) 12/31/2015 222 499 Sales Revenue -63 -63 Adds/Revisions 148 203 Operations Total 307 639 Disposition (Albania) -23 -103 12/31/2016 284 536 TBNG Reserves -21 -49 YE2016 (Ex-TBNG) 263 487 Y/Y Change 18% -2% Reserves/ Sales Revenue 4.2 7.7 ($/Share) Preferred Redeemed $5.57 $10.31 ($/Share) Preferred Converted $2.94 $5.45

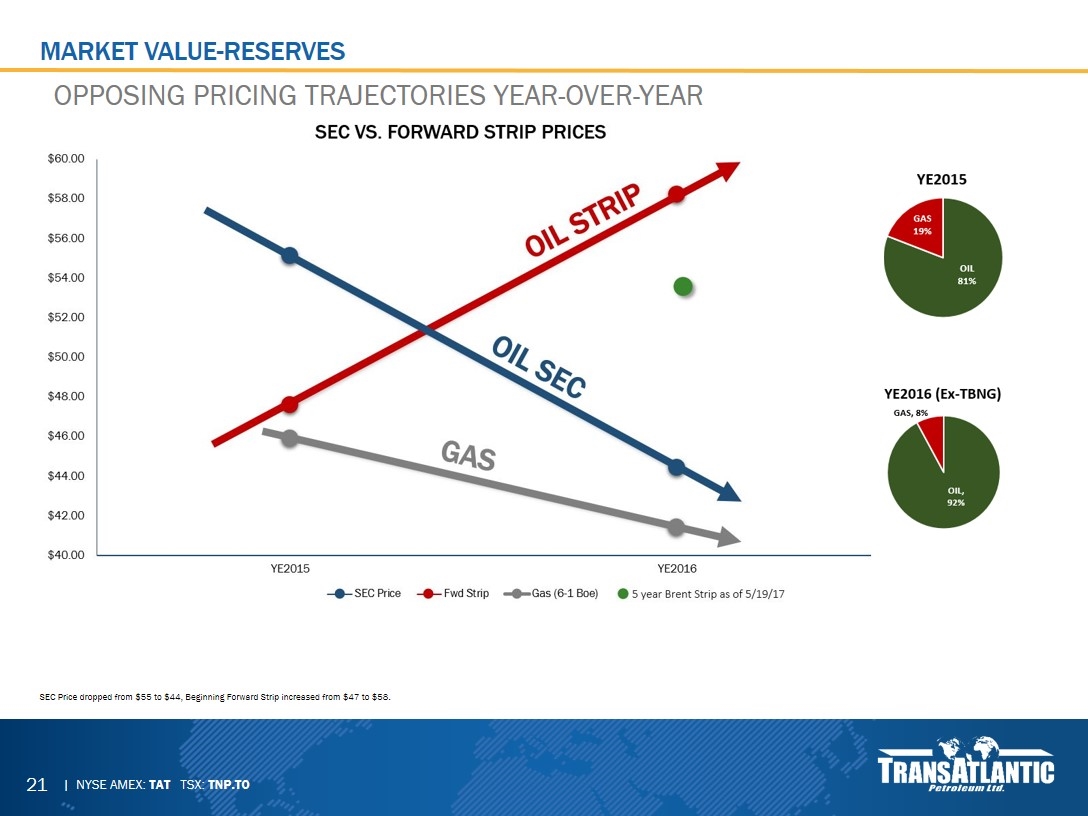

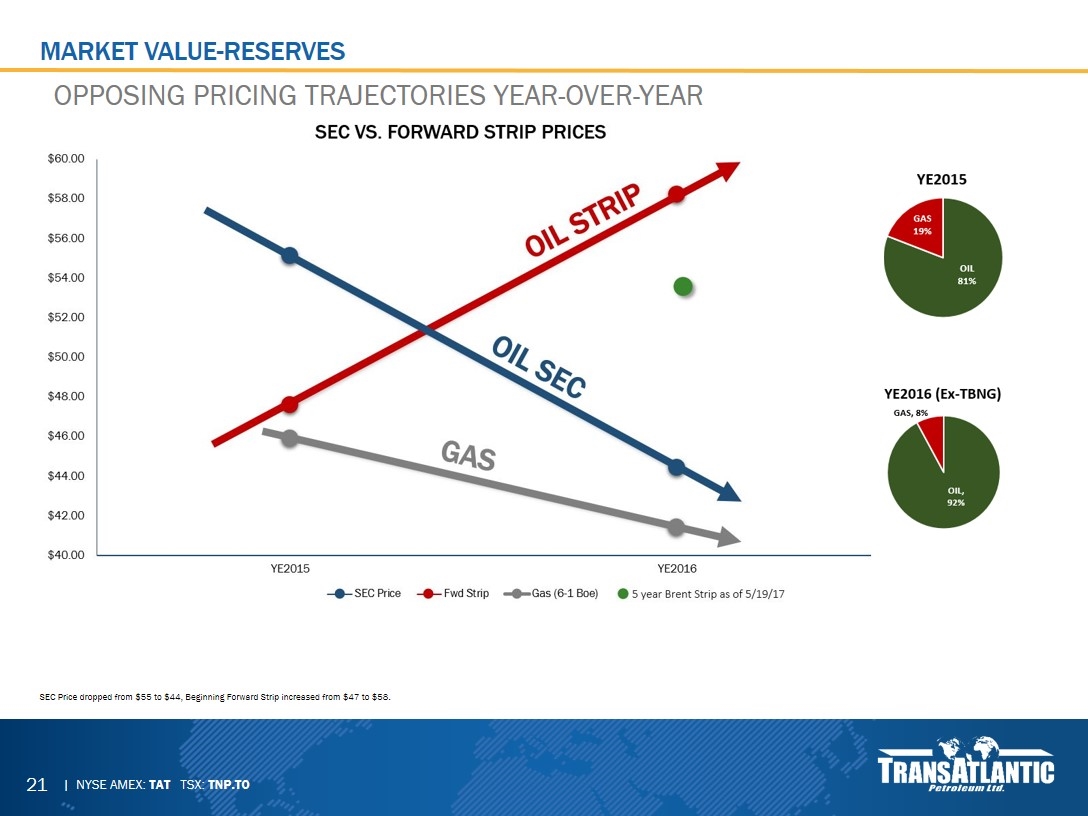

Market value-reserves OPPOSING PRICING TRAJECTORIES YEAR-OVER-YEAR SEC Price dropped from $55 to $44, Beginning Forward Strip increased from $47 to $58.

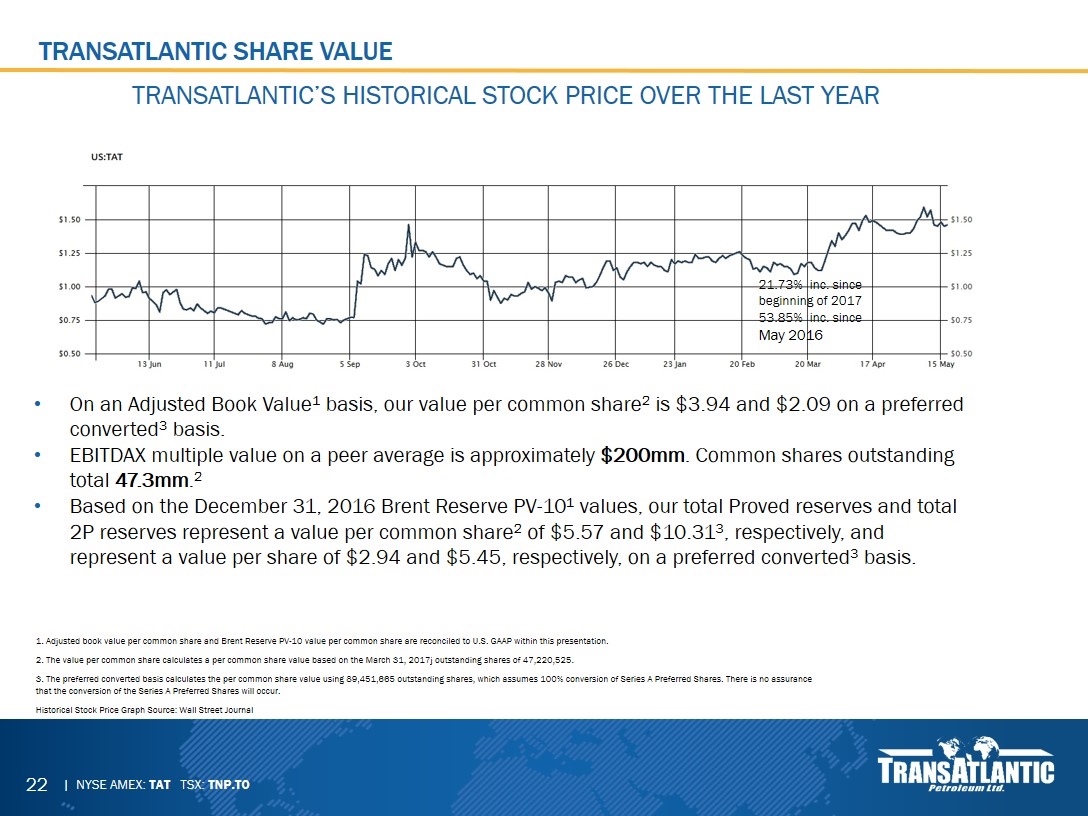

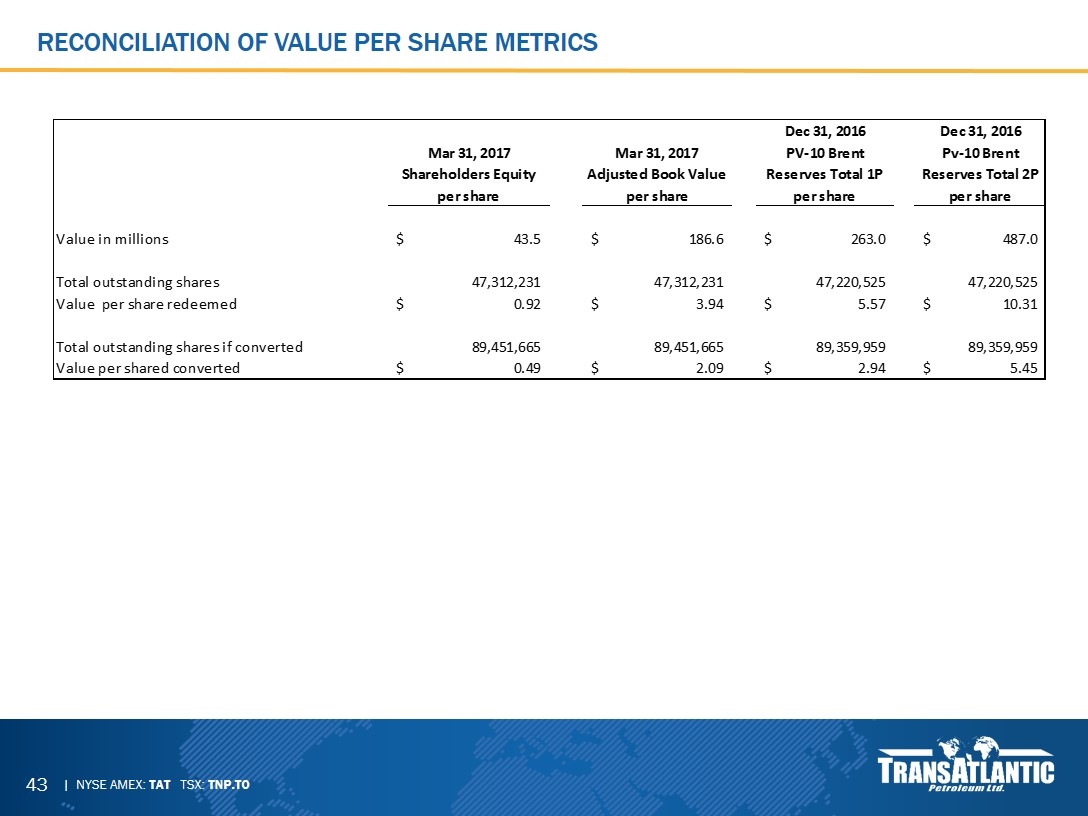

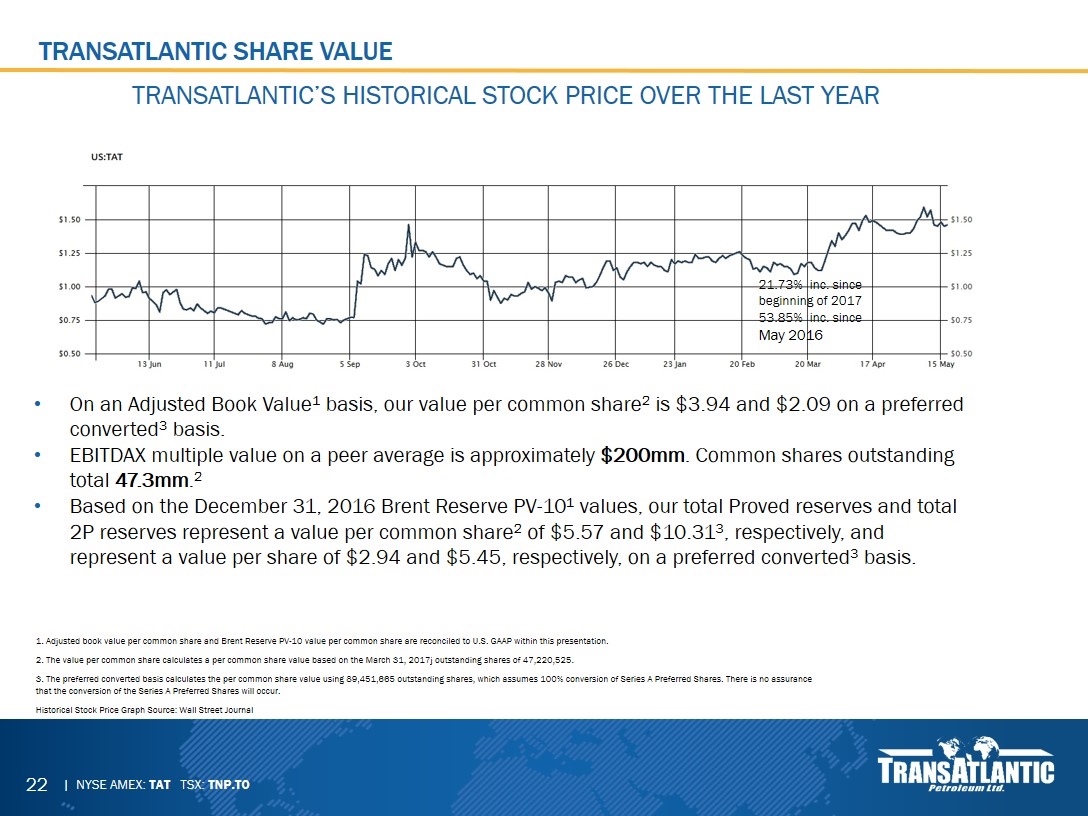

TRANSATLANTIC SHARE VALUE On an Adjusted Book Value1 basis, our value per common share2 is $3.94 and $2.09 on a preferred converted3 basis. EBITDAX multiple value on a peer average is approximately $200mm. Common shares outstanding total 47.3mm.2 Based on the December 31, 2016 Brent Reserve PV-101 values, our total Proved reserves and total 2P reserves represent a value per common share2 of $5.57 and $10.313, respectively, and represent a value per share of $2.94 and $5.45, respectively, on a preferred converted3 basis. 1. Adjusted book value per common share and Brent Reserve PV-10 value per common share are reconciled to U.S. GAAP within this presentation. 2. The value per common share calculates a per common share value based on the March 31, 2017j outstanding shares of 47,220,525. 3. The preferred converted basis calculates the per common share value using 89,451,665 outstanding shares, which assumes 100% conversion of Series A Preferred Shares. There is no assurance that the conversion of the Series A Preferred Shares will occur. Historical Stock Price Graph Source: Wall Street Journal TRANSATLANTIC’S HISTORICAL STOCK PRICE OVER THE LAST YEAR 21.73% inc. since beginning of 2017 53.85% inc. since May 2016

Growth plan

Better fiscal terms than North America Turkey 87.5% NRI* Bulgaria 97.5% NRI until cost recovery and 70% NRI thereafter* Albania 93.0% NRI* Products price premiums Brent indexed oil – dollar based payments $6.00/mcf gas – dollar and local currency payments Unsatisfied local demand Our near term growth projects Expand productive trend in Molla area in Turkey Sidetrack and drill high impact prospect in Bulgaria Return shut in gas wells to production in Albania Opportunity for growth *NRI= Net Revenue Interest which is the percentage of hydrocarbon sales the oil company receives after payment of royalty.

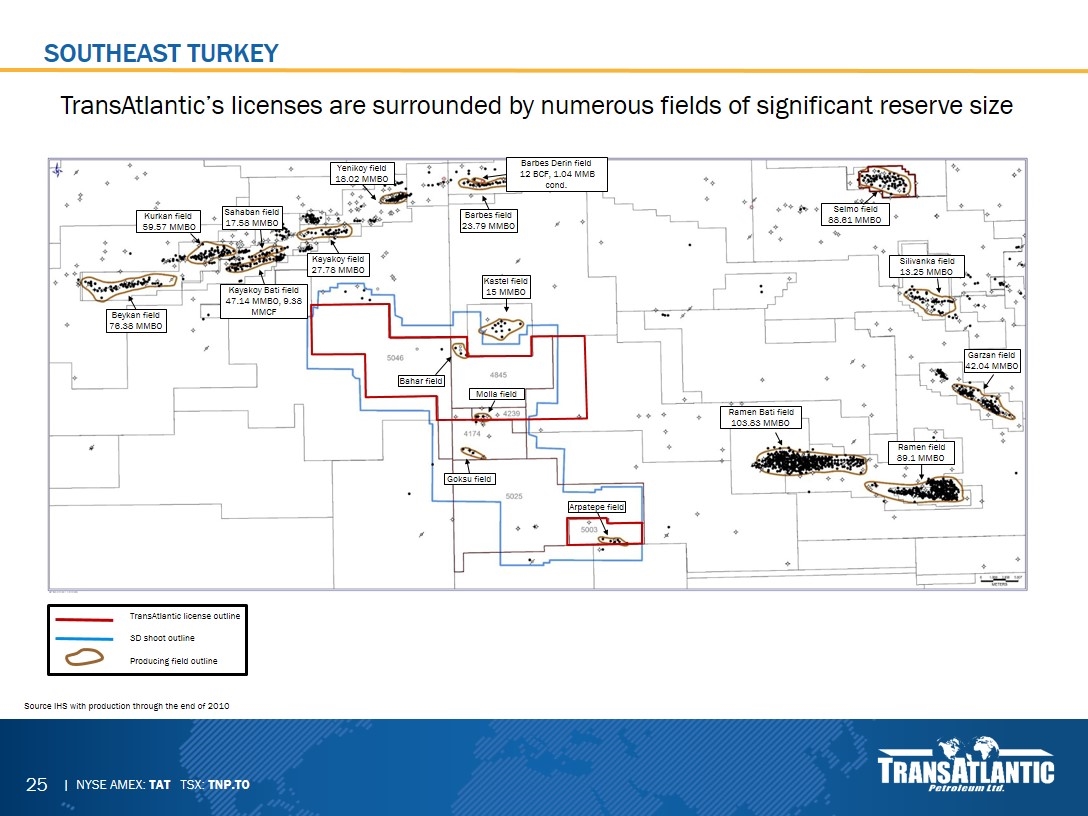

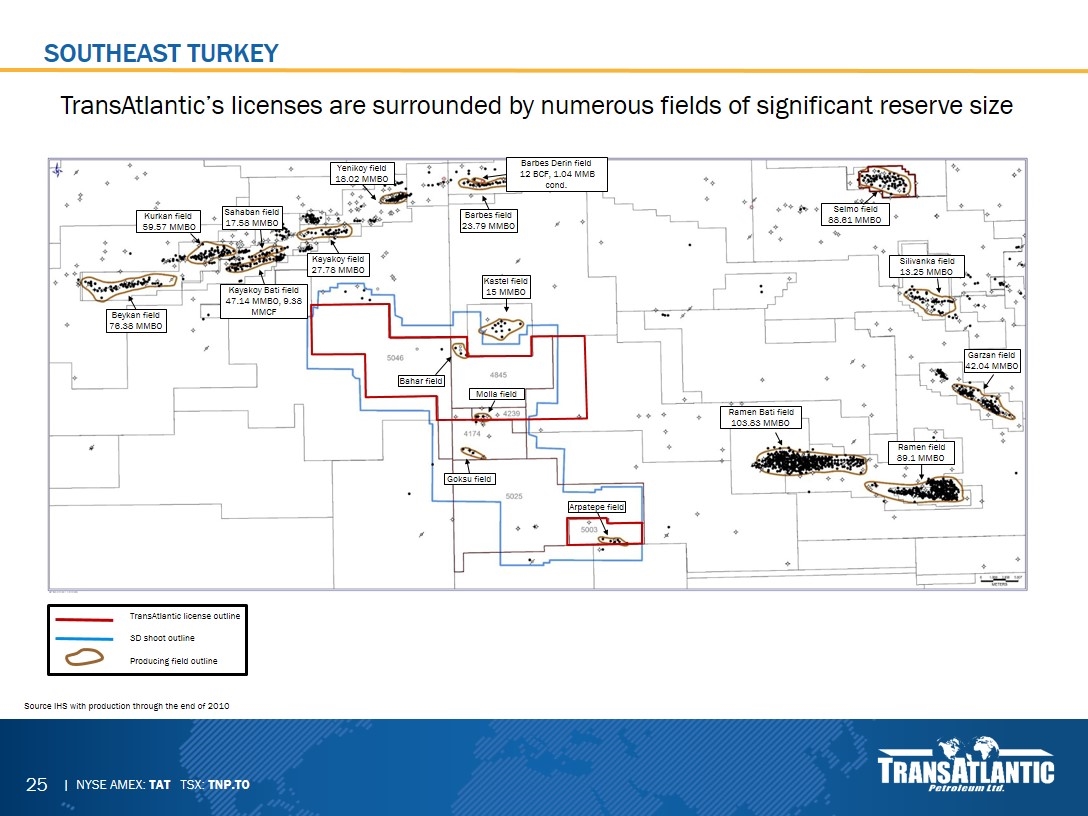

Southeast turkey Source IHS with production through the end of 2010 TransAtlantic’s licenses are surrounded by numerous fields of significant reserve size TransAtlantic license outline 3D shoot outline Producing field outline Barbes field 23.79 MMBO Barbes Derin field 12 BCF, 1.04 MMB cond. Yenikoy field 18.02 MMBO Kayakoy field 27.78 MMBO Kayakoy Bati field 47.14 MMBO, 9.38 MMCF Sahaban field 17.58 MMBO Kurkan field 59.57 MMBO Beykan field 76.38 MMBO Kastel field 15 MMBO Bahar field Molla field Goksu field Arpatepe field Ramen Bati field 103.83 MMBO Ramen field 89.1 MMBO Garzan field 42.04 MMBO Silivanka field 13.25 MMBO Selmo field 88.61 MMBO

SE Turkey – Molla Area (Composite Type Log for the Molla Area) Devonian Silurian Ordovician Cretaceous Dev Bahar 3 Hazro F-3 Hazro F-2 Dadas III Hazro F-1 Bedinan Silts Dadas II Bedinan Repeat Hazro F-4 Bedinan Main Dadas Hot Shale Oil Productive Oil Productive Oil Productive Source Rock Pinar 1ST Mardin Karababa B Derdere Sabunsuyu Hazro Karababa A Major Pay Zones in Basin Bahar Field produces from multiple horizons including the Bedinan Sands, Dadas Sands, Hazro F-3 Sands, and the Hazro F-4 Dolomite. The formations along with the Mardin Formation, which is a major producer throughout the basin, are the primary objectives in the Molla Area. Limestone Dolomite Sandstone

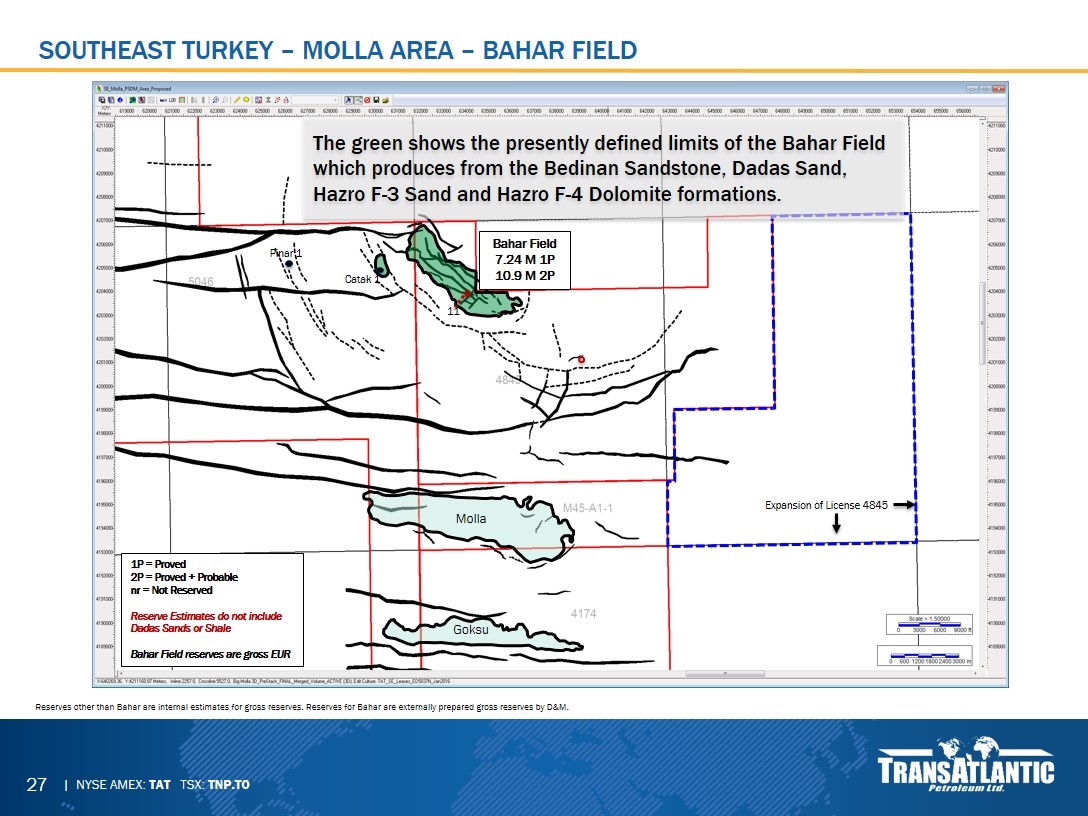

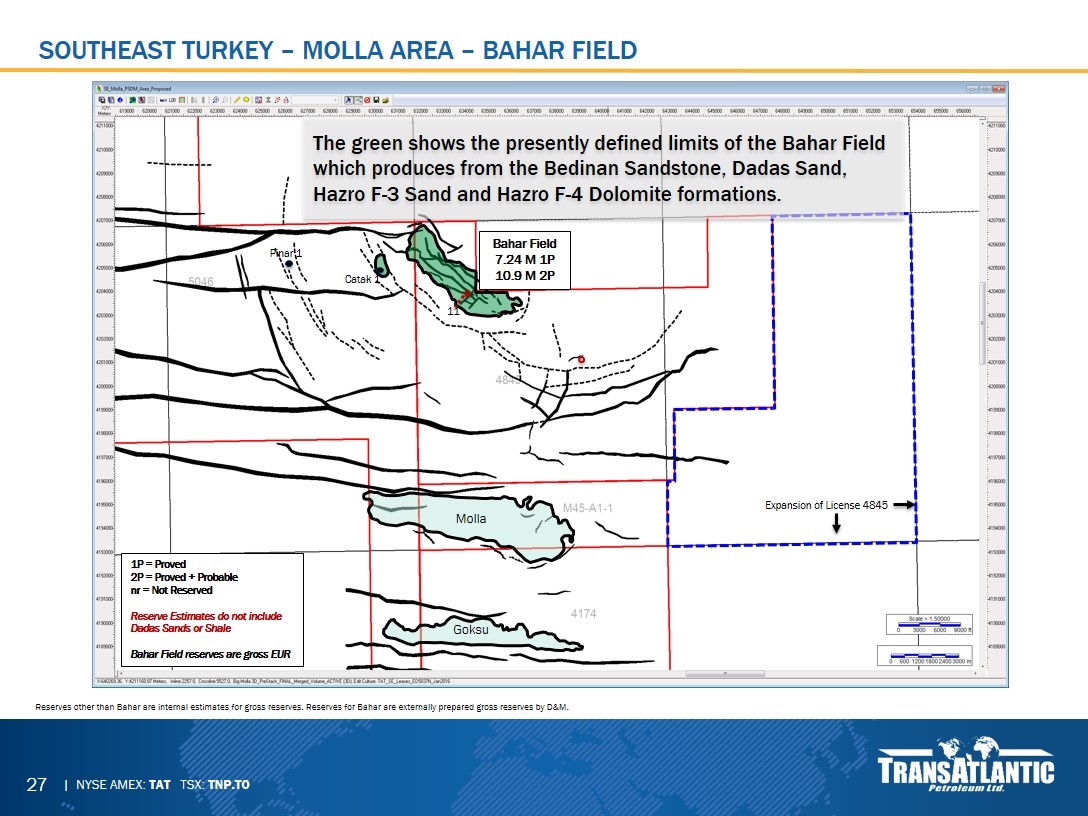

Southeast Turkey – Molla Area – Bahar field Reserves other than Bahar are internal estimates for gross reserves. Reserves for Bahar are externally prepared gross reserves by D&M. Pinar 1 Catak 1 Expansion of License 4845 Molla Goksu 1P = Proved 2P = Proved + Probable nr = Not Reserved Reserve Estimates do not include Dadas Sands or Shale Bahar Field reserves are gross EUR Bahar Field 7.24 M 1P 10.9 M 2P 11 The green shows the presently defined limits of the Bahar Field which produces from the Bedinan Sandstone, Dadas Sand, Hazro F-3 Sand and Hazro F-4 Dolomite formations.

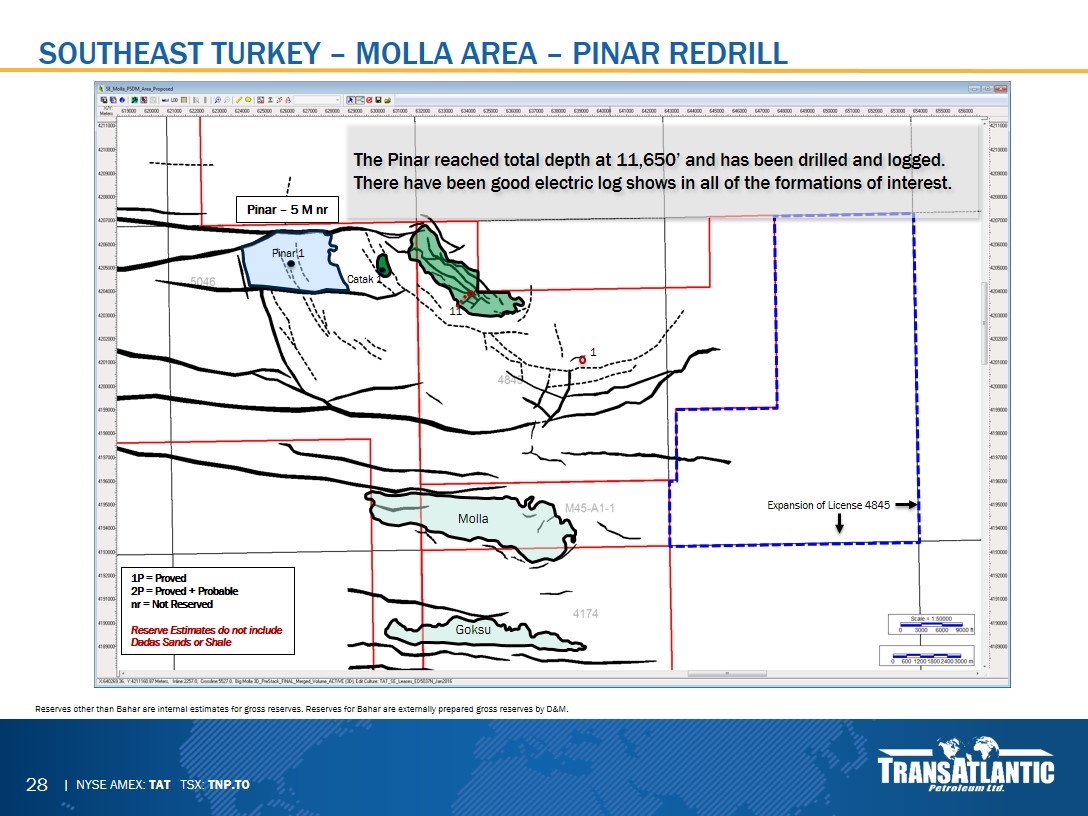

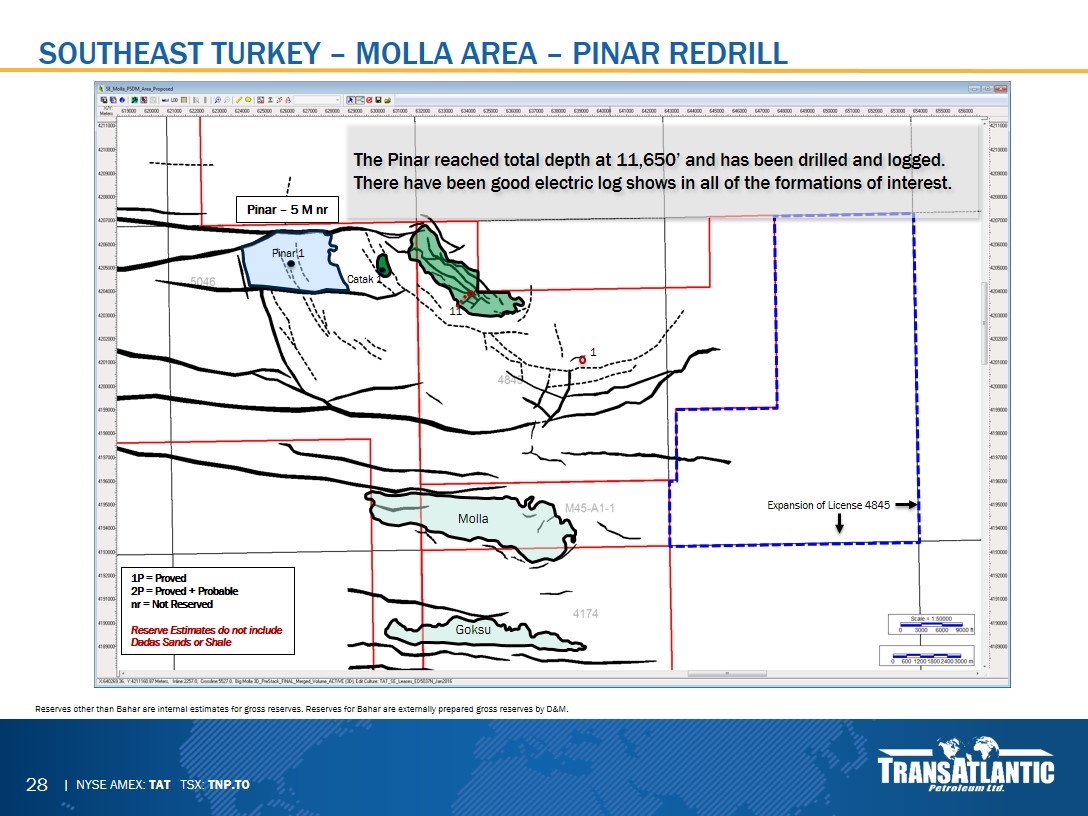

Southeast Turkey – Molla Area – Pinar Redrill Reserves other than Bahar are internal estimates for gross reserves. Reserves for Bahar are externally prepared gross reserves by D&M. Pinar 1 Catak 1 Expansion of License 4845 Molla Goksu 1P = Proved 2P = Proved + Probable nr = Not Reserved Reserve Estimates do not include Dadas Sands or Shale Pinar – 5 M nr 1 11 The Pinar reached total depth at 11,650’ and has been drilled and logged. There have been good electric log shows in all of the formations of interest.

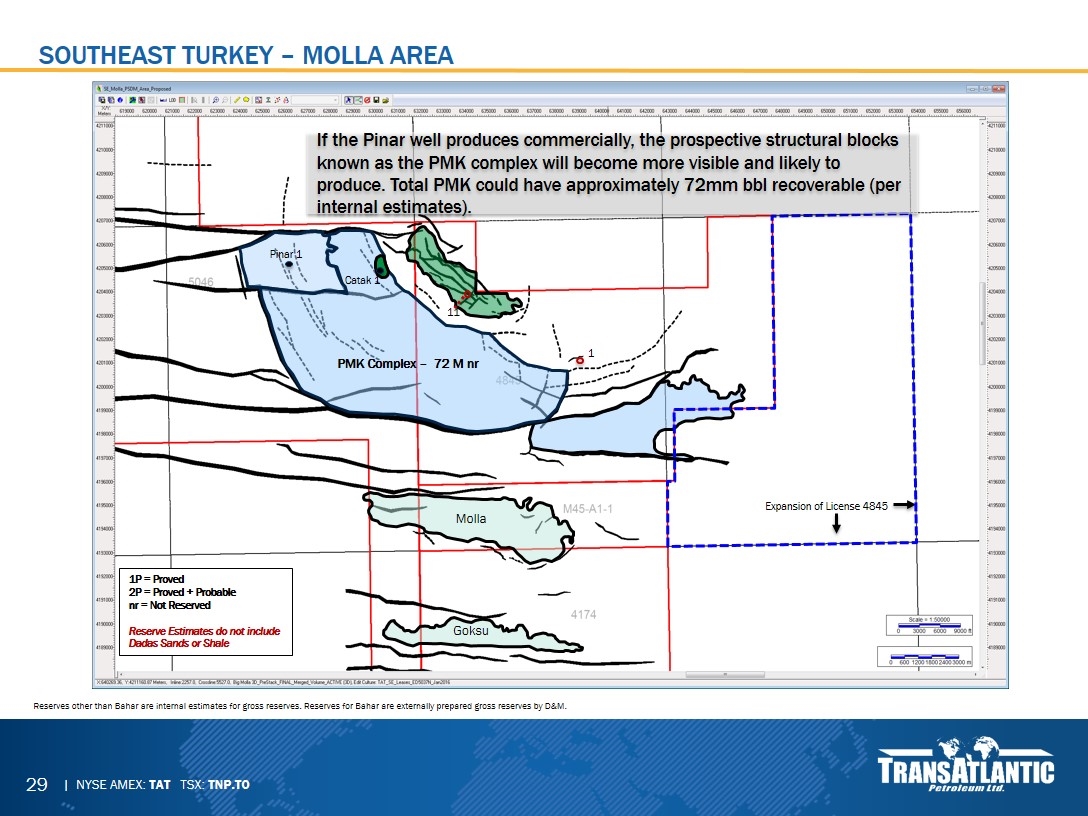

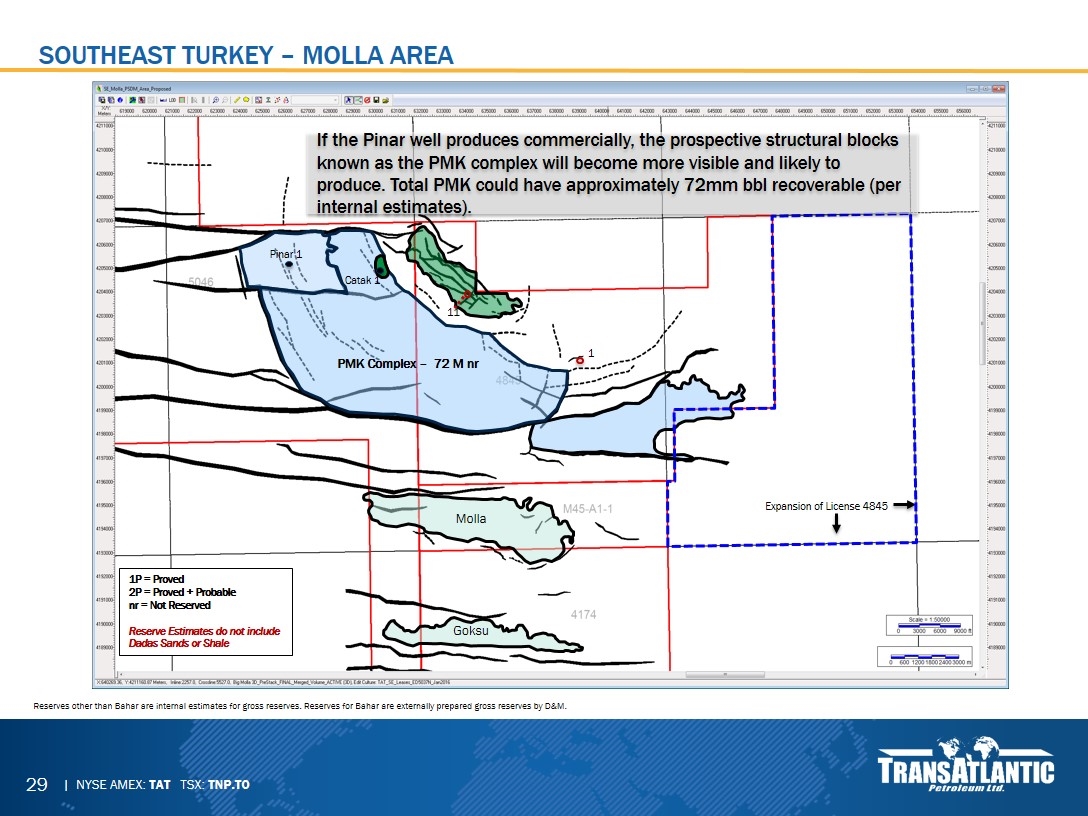

Southeast Turkey – Molla Area Reserves other than Bahar are internal estimates for gross reserves. Reserves for Bahar are externally prepared gross reserves by D&M. Pinar 1 Catak 1 Expansion of License 4845 Molla Goksu 1P = Proved 2P = Proved + Probable nr = Not Reserved Reserve Estimates do not include Dadas Sands or Shale PMK Complex – 72 M nr 1 11 If the Pinar well produces commercially, the prospective structural blocks known as the PMK complex will become more visible and likely to produce. Total PMK could have approximately 72mm bbl recoverable (per internal estimates).

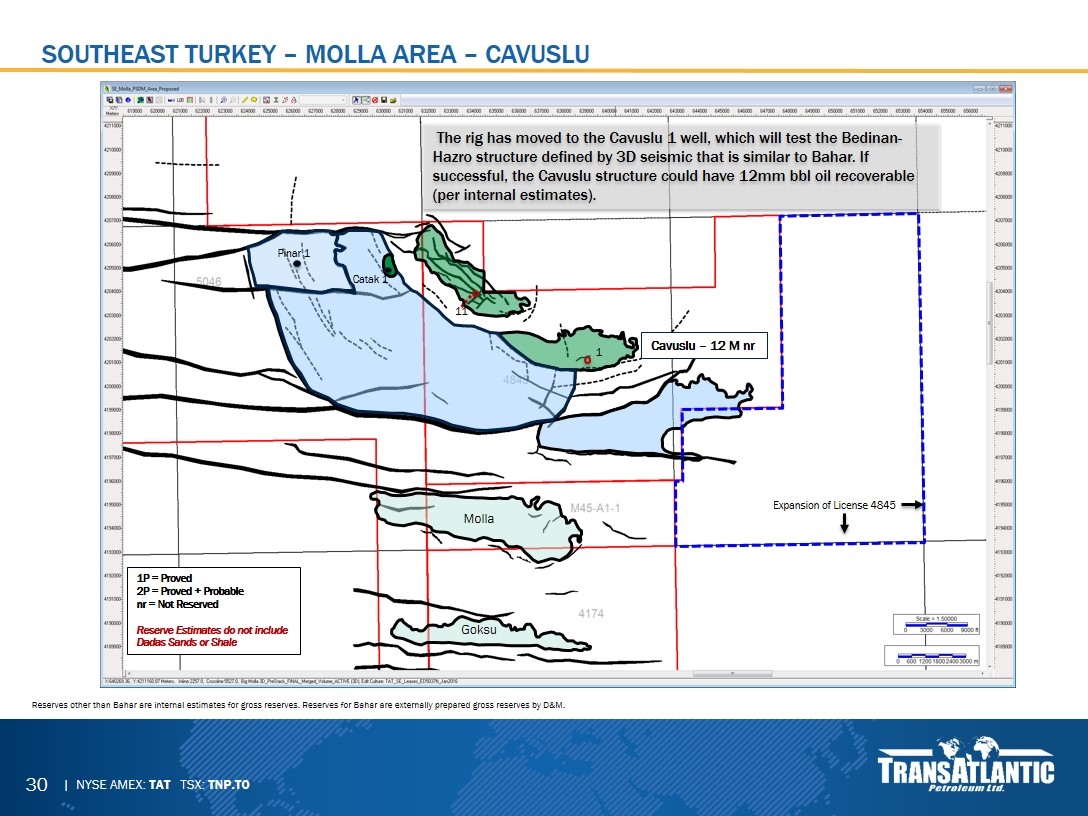

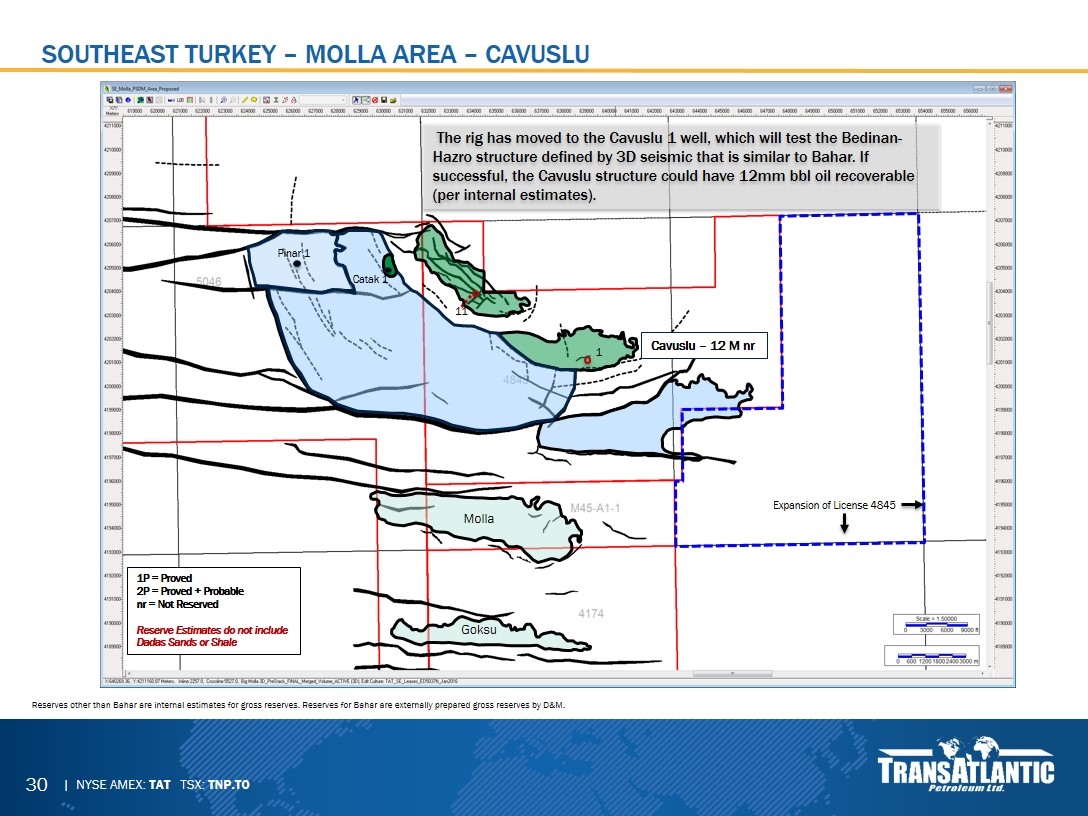

Southeast Turkey – Molla Area – Cavuslu Reserves other than Bahar are internal estimates for gross reserves. Reserves for Bahar are externally prepared gross reserves by D&M. Pinar 1 Catak 1 Expansion of License 4845 Molla Goksu 1P = Proved 2P = Proved + Probable nr = Not Reserved Reserve Estimates do not include Dadas Sands or Shale Cavuslu – 12 M nr 1 11 The rig has moved to the Cavuslu 1 well, which will test the Bedinan-Hazro structure defined by 3D seismic that is similar to Bahar. If successful, the Cavuslu structure could have 12mm bbl oil recoverable (per internal estimates).

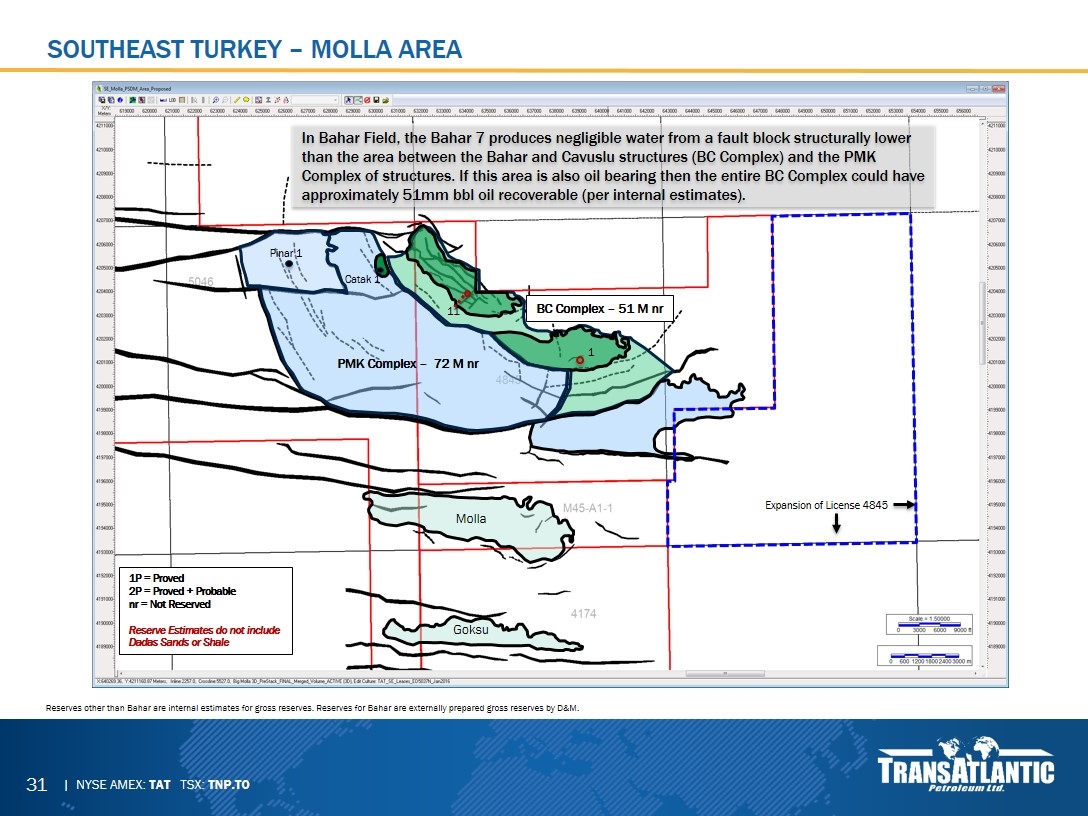

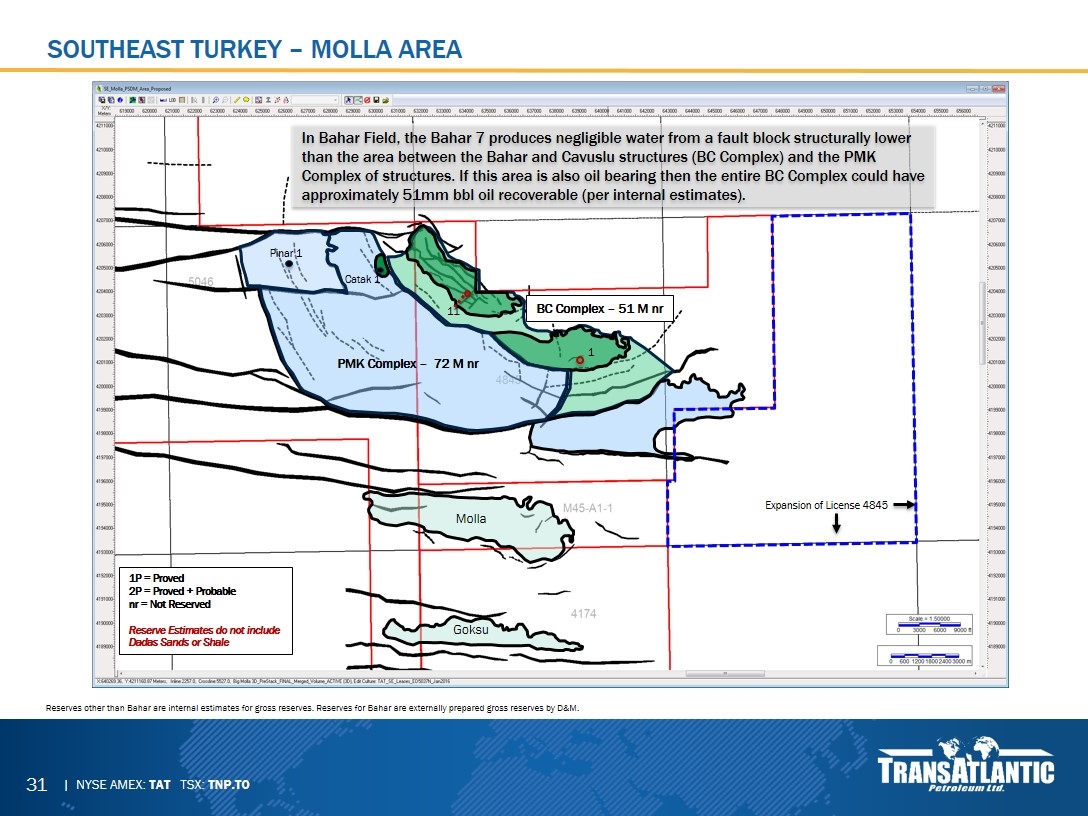

Southeast Turkey – Molla AreA Reserves other than Bahar are internal estimates for gross reserves. Reserves for Bahar are externally prepared gross reserves by D&M. Pinar 1 Catak 1 Expansion of License 4845 Molla Goksu 1P = Proved 2P = Proved + Probable nr = Not Reserved Reserve Estimates do not include Dadas Sands or Shale PMK Complex – 72 M nr BC Complex – 51 M nr 1 11 In Bahar Field, the Bahar 7 produces negligible water from a fault block structurally lower than the area between the Bahar and Cavuslu structures (BC Complex) and the PMK Complex of structures. If this area is also oil bearing then the entire BC Complex could have approximately 51mm bbl oil recoverable (per internal estimates).

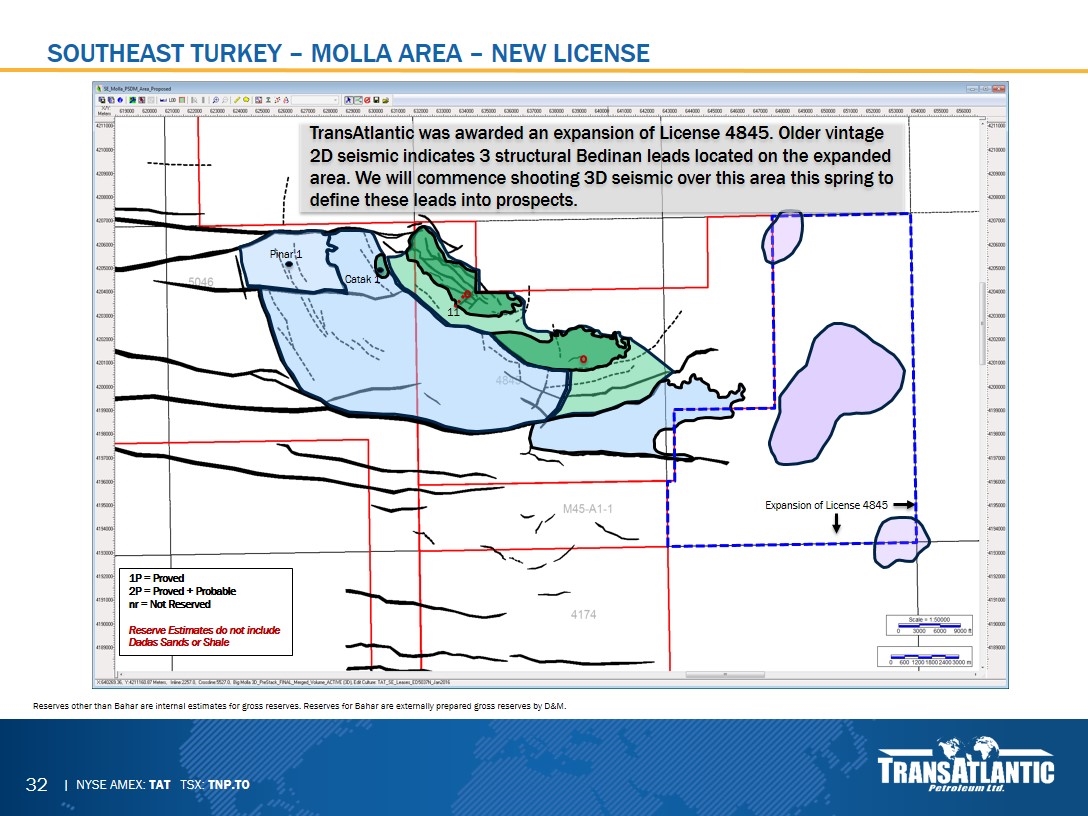

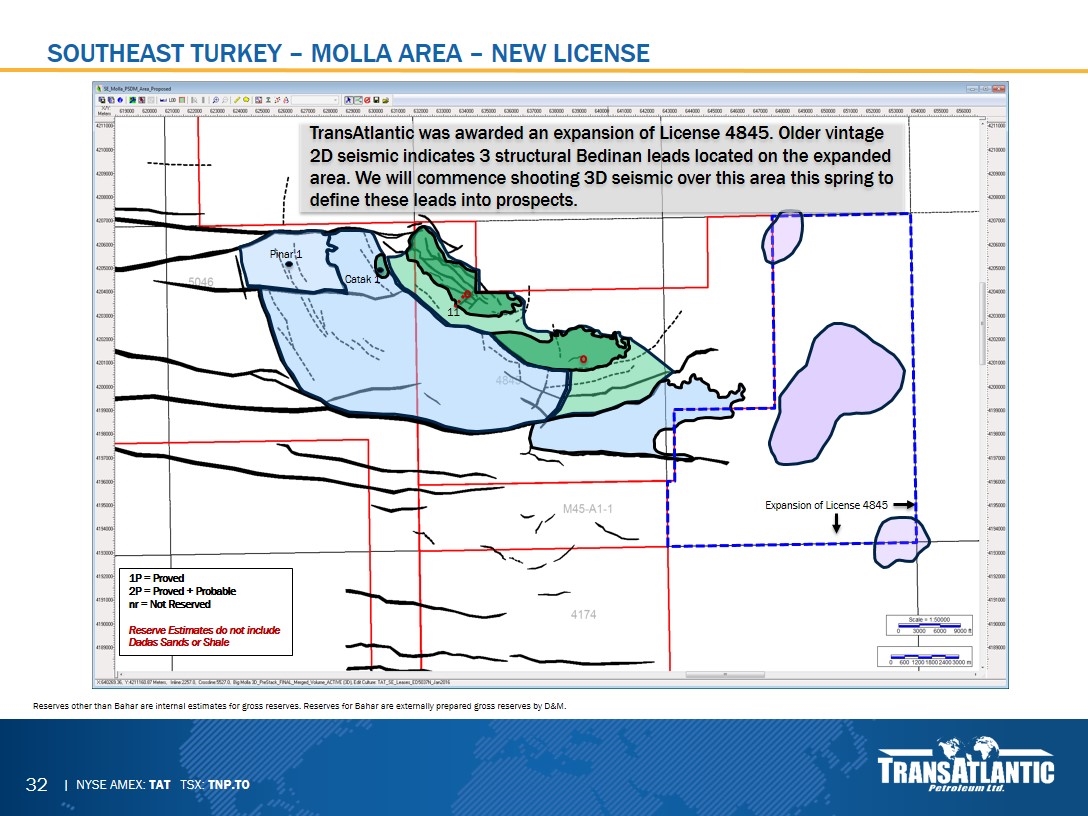

Southeast Turkey – Molla AreA – new license Reserves other than Bahar are internal estimates for gross reserves. Reserves for Bahar are externally prepared gross reserves by D&M. Pinar 1 Catak 1 Expansion of License 4845 1P = Proved 2P = Proved + Probable nr = Not Reserved Reserve Estimates do not include Dadas Sands or Shale 11 TransAtlantic was awarded an expansion of License 4845. Older vintage 2D seismic indicates 3 structural Bedinan leads located on the expanded area. We will commence shooting 3D seismic over this area this spring to define these leads into prospects.

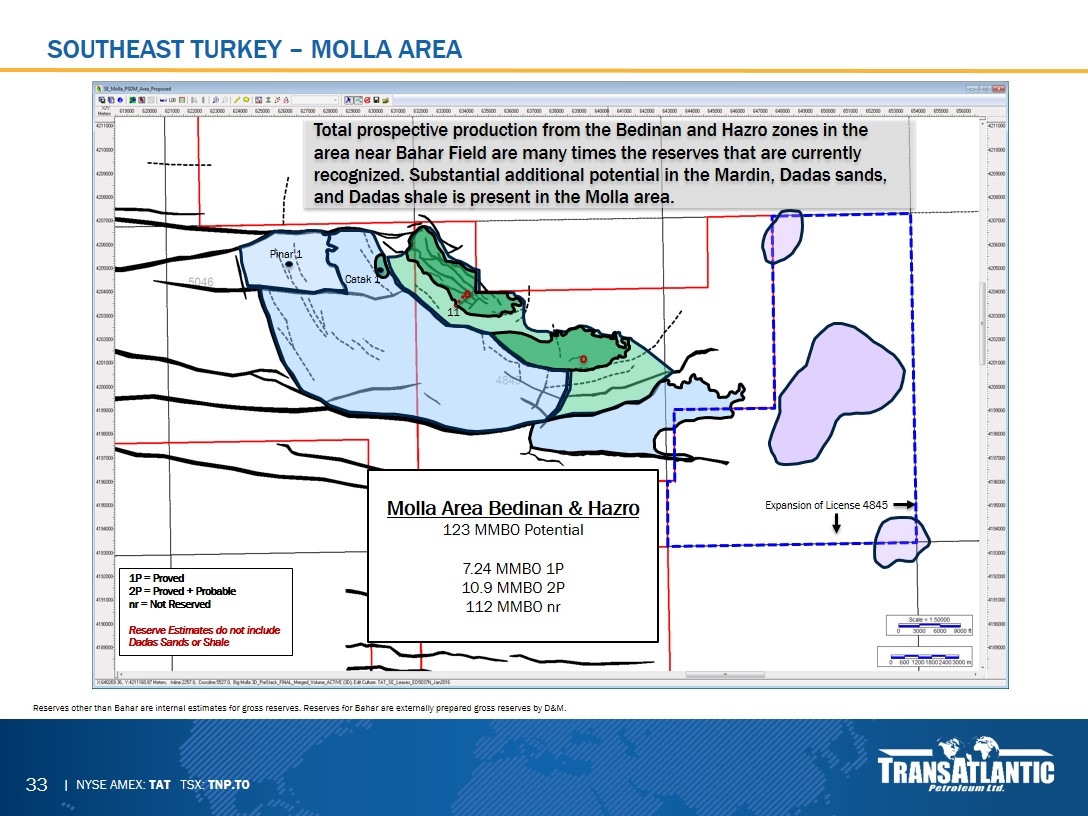

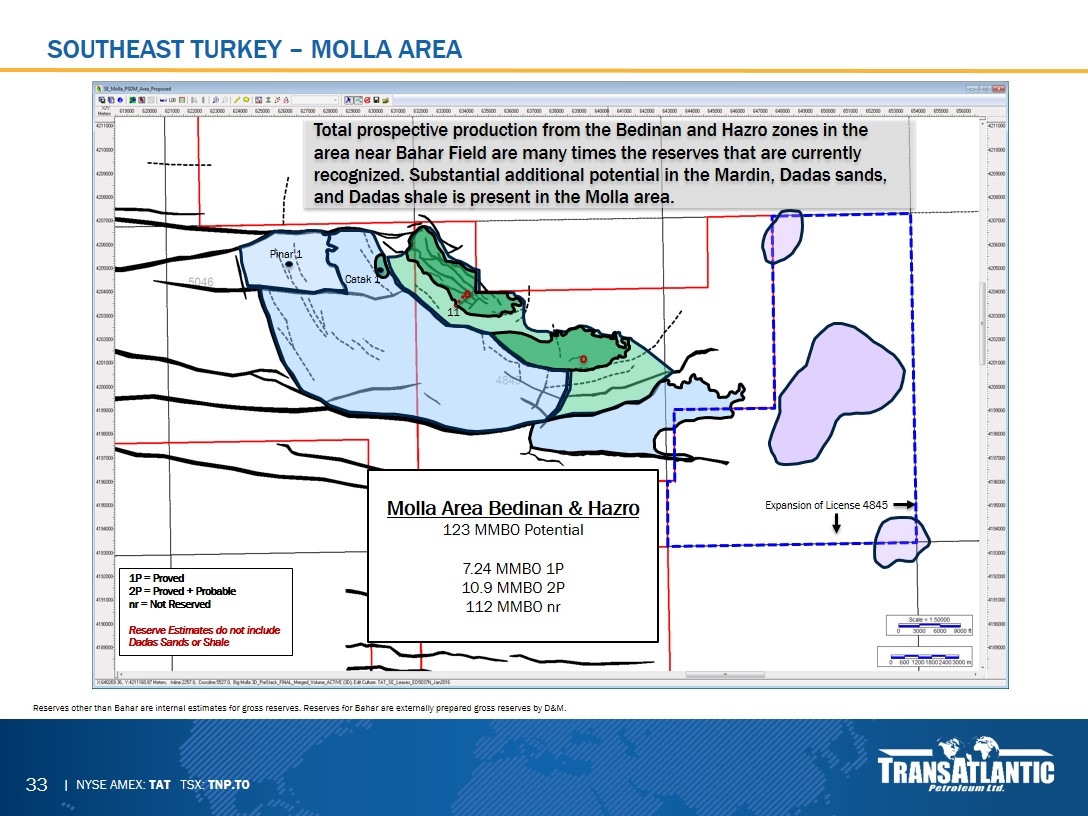

Southeast Turkey – Molla Area Reserves other than Bahar are internal estimates for gross reserves. Reserves for Bahar are externally prepared gross reserves by D&M. Pinar 1 Catak 1 Expansion of License 4845 1P = Proved 2P = Proved + Probable nr = Not Reserved Reserve Estimates do not include Dadas Sands or Shale Molla Area Bedinan & Hazro 123 MMBO Potential 7.24 MMBO 1P 10.9 MMBO 2P 112 MMBO nr 11 Total prospective production from the Bedinan and Hazro zones in the area near Bahar Field are many times the reserves that are currently recognized. Substantial additional potential in the Mardin, Dadas sands, and Dadas shale is present in the Molla area.

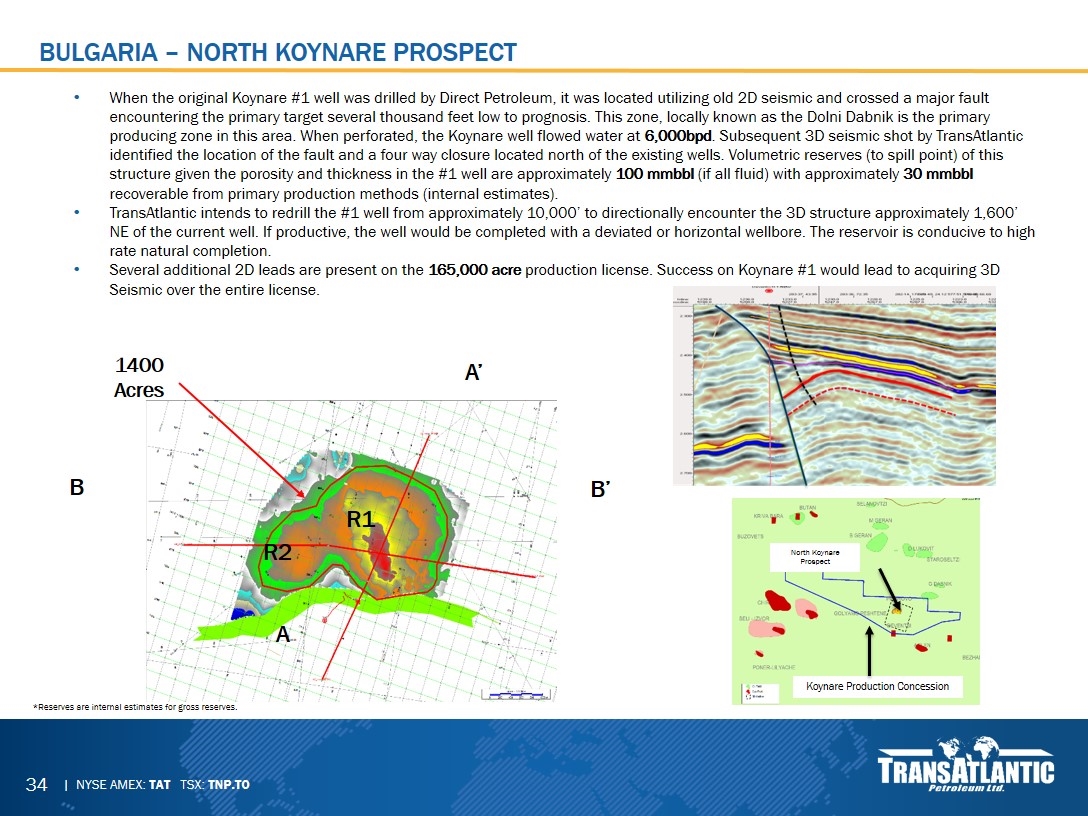

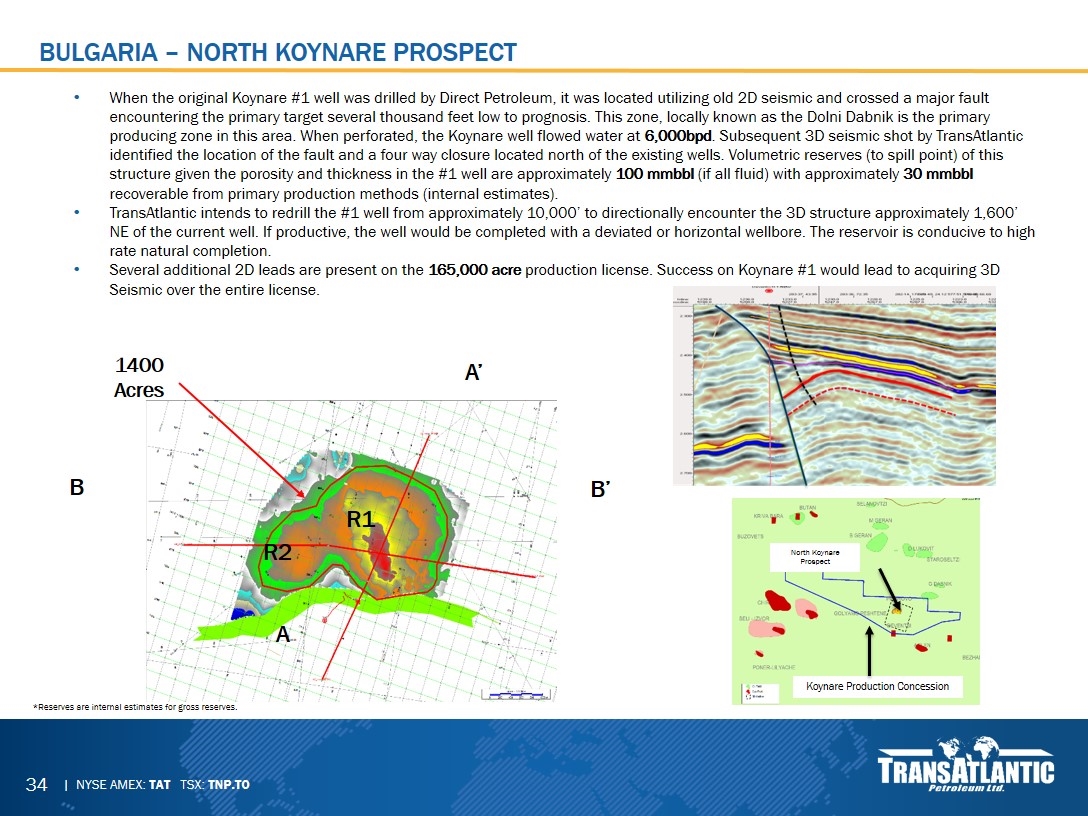

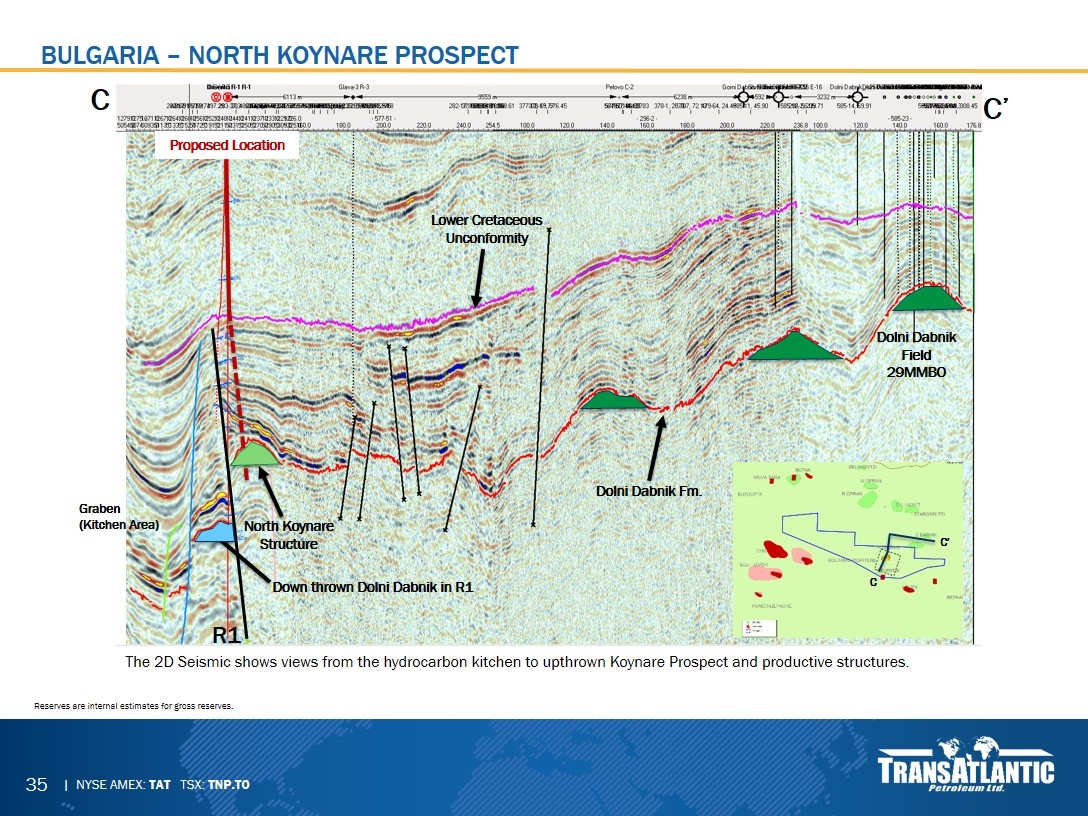

Bulgaria – North Koynare Prospect *Reserves are internal estimates for gross reserves. A A’ B B’ R1 R2 1400 Acres When the original Koynare #1 well was drilled by Direct Petroleum, it was located utilizing old 2D seismic and crossed a major fault encountering the primary target several thousand feet low to prognosis. This zone, locally known as the Dolni Dabnik is the primary producing zone in this area. When perforated, the Koynare well flowed water at 6,000bpd. Subsequent 3D seismic shot by TransAtlantic identified the location of the fault and a four way closure located north of the existing wells. Volumetric reserves (to spill point) of this structure given the porosity and thickness in the #1 well are approximately 100 mmbbl (if all fluid) with approximately 30 mmbbl recoverable from primary production methods (internal estimates). TransAtlantic intends to redrill the #1 well from approximately 10,000’ to directionally encounter the 3D structure approximately 1,600’ NE of the current well. If productive, the well would be completed with a deviated or horizontal wellbore. The reservoir is conducive to high rate natural completion. Several additional 2D leads are present on the 165,000 acre production license. Success on Koynare #1 would lead to acquiring 3D Seismic over the entire license. Koynare Production Concession North Koynare Prospect

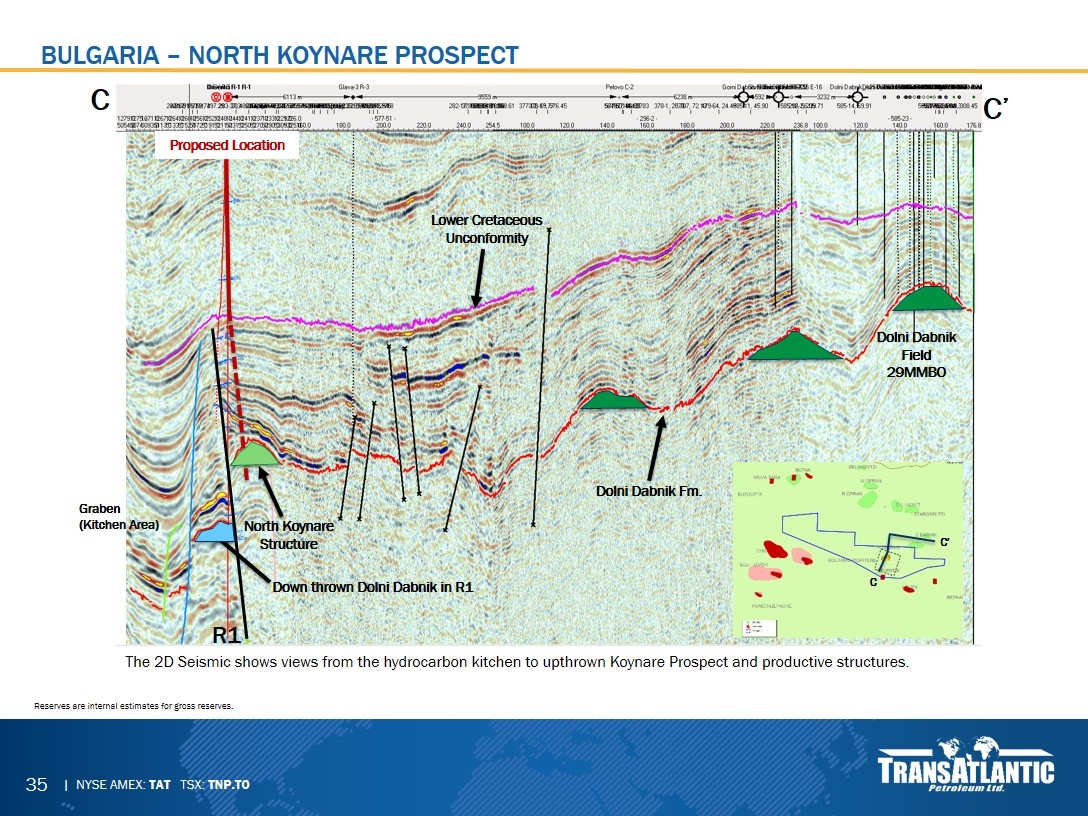

Bulgaria – North Koynare Prospect Reserves are internal estimates for gross reserves. North Koynare Structure Dolni Dabnik Field 29MMBO Dolni Dabnik Fm. Lower Cretaceous Unconformity C C’ Proposed Location Graben (Kitchen Area) R1 Down thrown Dolni Dabnik in R1 The 2D Seismic shows views from the hydrocarbon kitchen to upthrown Koynare Prospect and productive structures. C C’

Delvina gas field 25% Operated Interest Reserves are internal estimates from Chevron report. Plan to workover two existing wells and install a gas treatment facility in 2017 Delvina Field Estimated net TAT recoverable reserves in Delvina range from 61 BCF (10 Mboe) to 279 BCF (46 Mboe) (per prior Chevron analysis)

Strengthened balance sheet. No longer a “going concern.” Back to drilling from cash flow Using NAV (Adjusted Book Value), Adjusted EBITDAX multiple, or reserves the company is the best value in the MENA region. Near term plan for reserve growth and production visibility 14 Mboe 1P reserves now 160 Mboe (140 Mboe Net) reservoir tests in 2017 Explore various alternatives for maximizing asset value through increasing reserves and share price to make strategic transactions a more likely scenario. Summary

CONTACT EMILEE UPSON INVESTOR RELATIONS ADMINISTRATIVE COORDINATOR 972.590.9912 emilee.upson@tapcor.com Selmo Field

appendix Diyarbakir

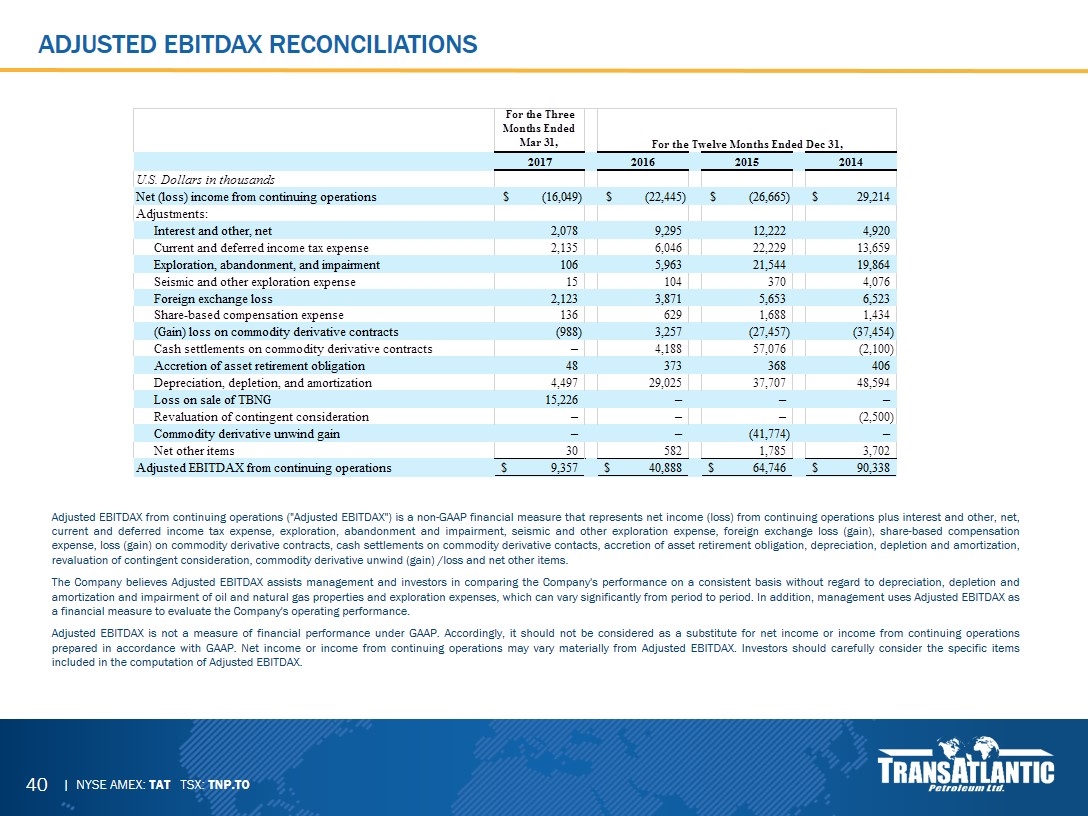

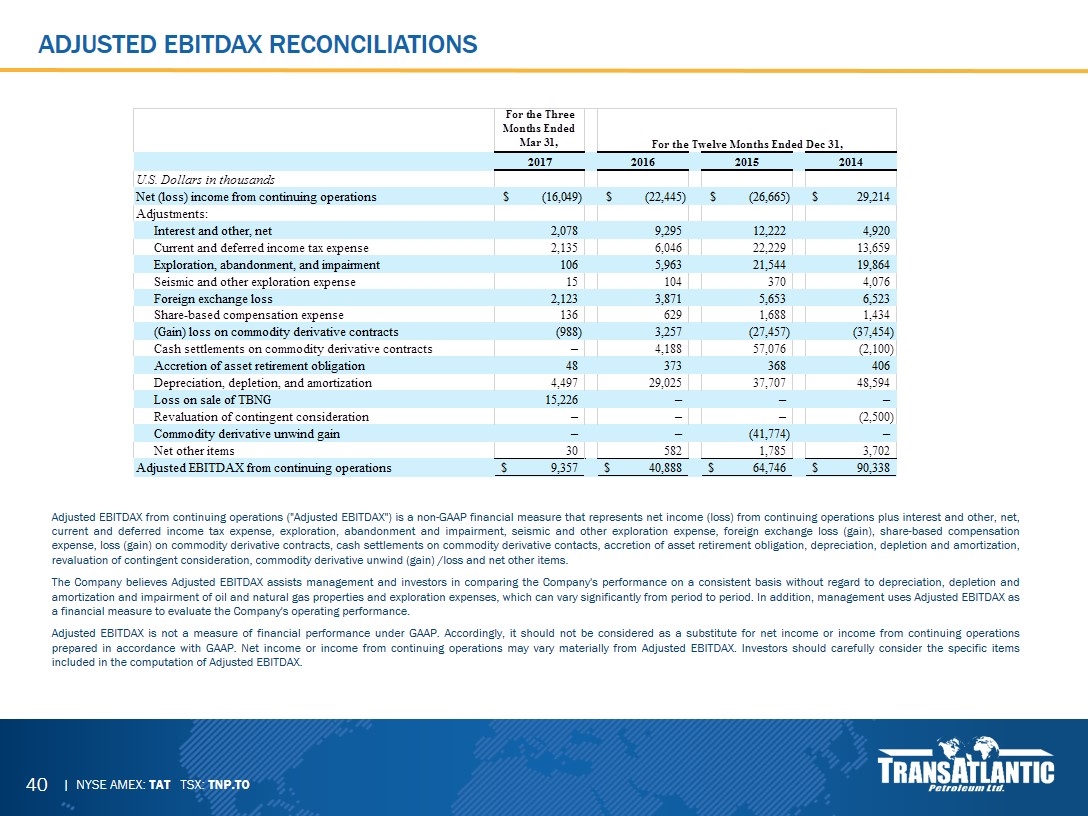

Adjusted ebitdax reconciliations Adjusted EBITDAX from continuing operations ("Adjusted EBITDAX") is a non-GAAP financial measure that represents net income (loss) from continuing operations plus interest and other, net, current and deferred income tax expense, exploration, abandonment and impairment, seismic and other exploration expense, foreign exchange loss (gain), share-based compensation expense, loss (gain) on commodity derivative contracts, cash settlements on commodity derivative contacts, accretion of asset retirement obligation, depreciation, depletion and amortization, revaluation of contingent consideration, commodity derivative unwind (gain) /loss and net other items. The Company believes Adjusted EBITDAX assists management and investors in comparing the Company's performance on a consistent basis without regard to depreciation, depletion and amortization and impairment of oil and natural gas properties and exploration expenses, which can vary significantly from period to period. In addition, management uses Adjusted EBITDAX as a financial measure to evaluate the Company's operating performance. Adjusted EBITDAX is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net income or income from continuing operations prepared in accordance with GAAP. Net income or income from continuing operations may vary materially from Adjusted EBITDAX. Investors should carefully consider the specific items included in the computation of Adjusted EBITDAX.

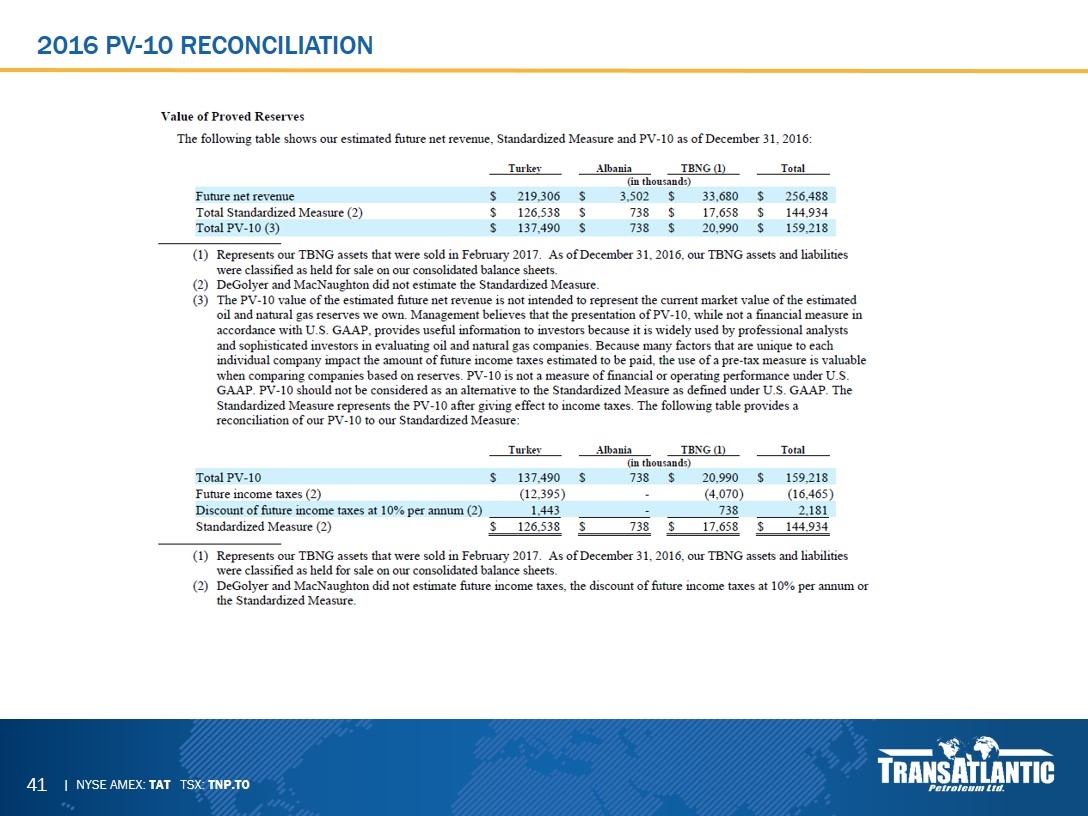

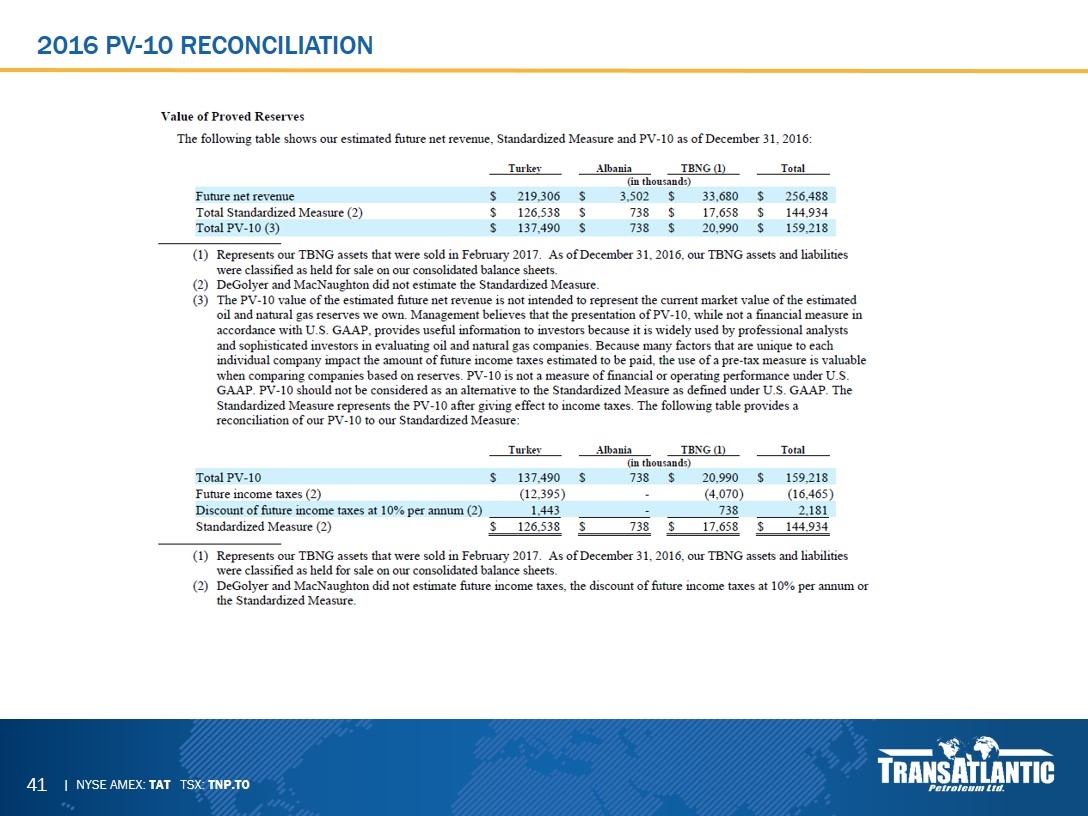

2016 PV-10 Reconciliation

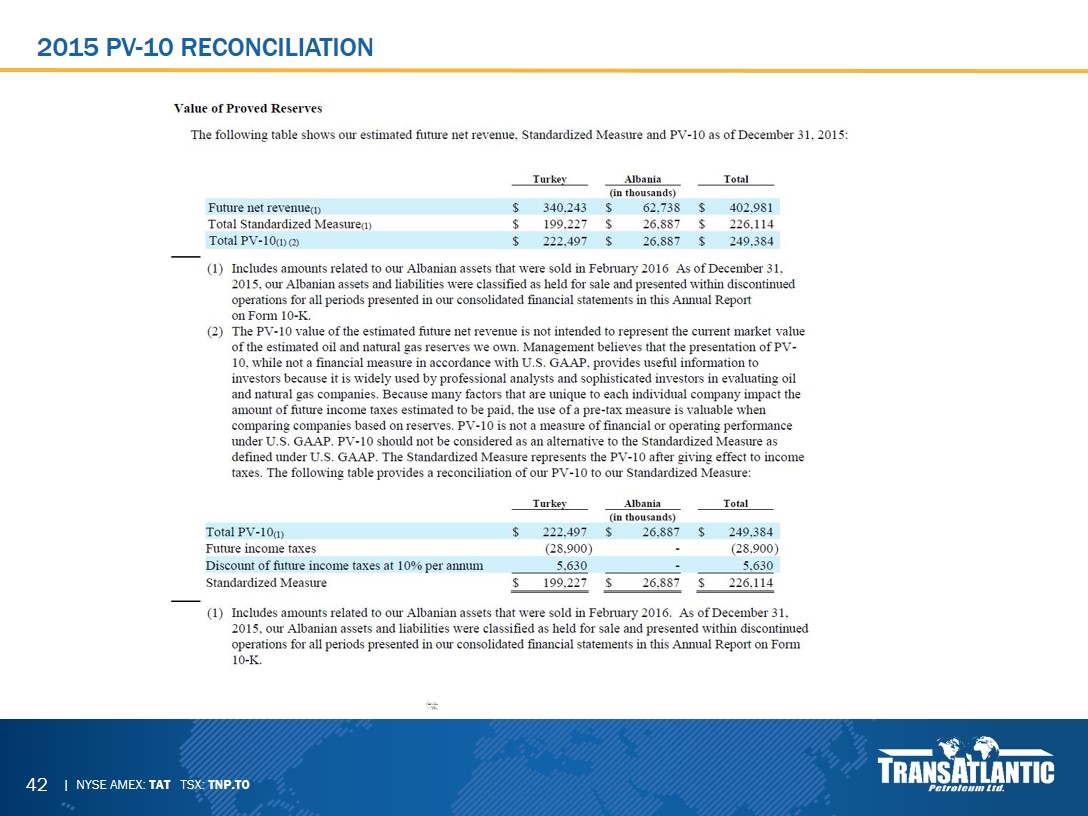

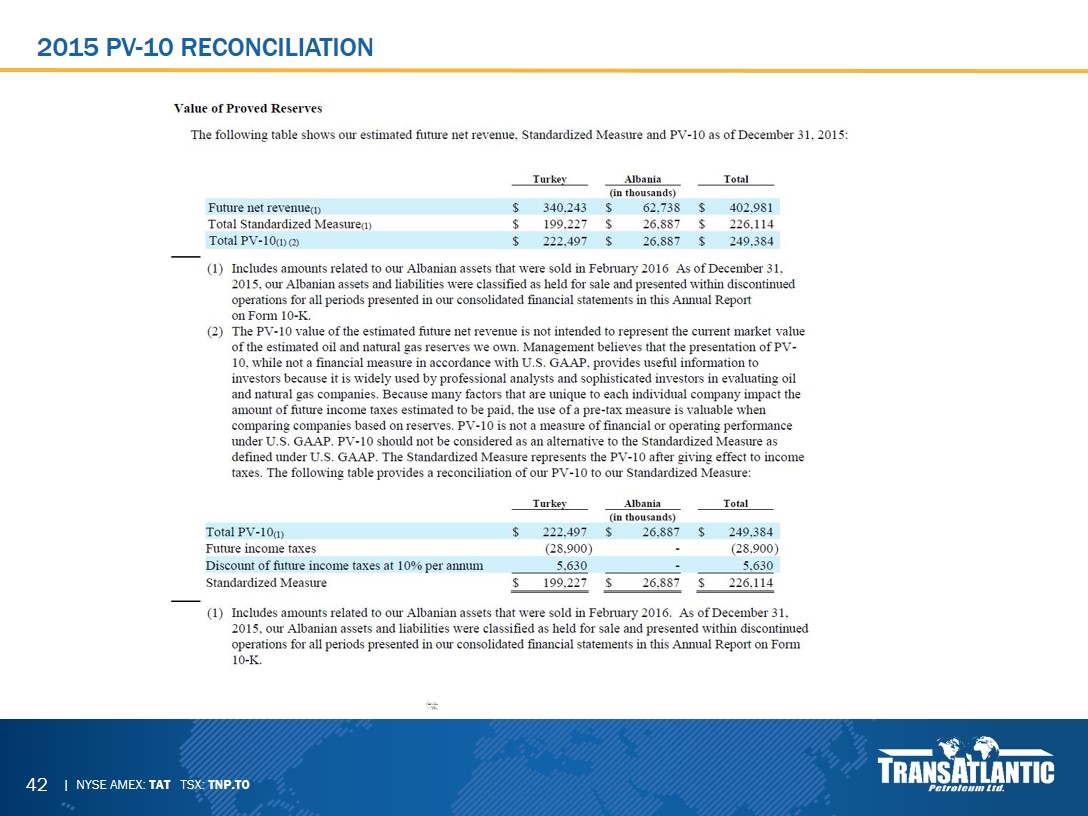

2015 Pv-10 reconciliation

Reconciliation of value per share metrics