UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

SYCAMORE NETWORKS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

SYCAMORE NETWORKS, INC.

220 Mill Road

Chelmsford, Massachusetts 01824

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 19, 2005

To the Stockholders of Sycamore Networks, Inc.:

The Annual Meeting of Stockholders of Sycamore Networks, Inc., a Delaware corporation (the “Corporation”), will be held on Monday, December 19, 2005 at 9:00 A.M., local time, at the Radisson Hotel, 10 Independence Drive, Chelmsford, Massachusetts 01824 to consider and act upon the following matters:

| | 1. | To elect two (2) members of the Board of Directors to serve for three-year terms as Class III Directors and until their respective successors are elected and qualified. |

| | 2. | To ratify the selection of PricewaterhouseCoopers LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending July 31, 2006. |

| | 3. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

Stockholders entitled to notice of and to vote at the meeting shall be determined as of October 21, 2005, the record date fixed by the Board of Directors for such purpose.

By Order of the Board of Directors,

Richard J. Gaynor

Secretary

Mail Date: November 17, 2005

In order to assure your representation at the Annual Meeting, you are requested to complete, sign, and date the enclosed proxy as promptly as possible and return it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Alternative voting methods are also available via the Internet or by telephone. Please reference the enclosed proxy card or voting card for additional information.

TABLE OF CONTENTS

SYCAMORE NETWORKS, INC.

220 Mill Road

Chelmsford, Massachusetts 01824

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

November 17, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Sycamore Networks, Inc. (the “Corporation”) for use at the Annual Meeting of Stockholders to be held on Monday, December 19, 2005 (the “Annual Meeting”) at 9:00 A.M., local time, at the Radisson Hotel, 10 Independence Drive, Chelmsford, Massachusetts 01824, and any adjournments thereof. This Proxy Statement and the form of proxy were first mailed to stockholders on or about November 17, 2005.

Only stockholders of record as of October 21, 2005 (the “Record Date”) will be entitled to vote at the Annual Meeting and any adjournments thereof. As of that date, 276,566,702 shares of common stock, $.001 par value (the “Common Stock”), of the Corporation were outstanding and eligible to be voted. The holders of Common Stock are entitled to one vote per share on any proposal presented at the Annual Meeting. Stockholders may vote in person or by proxy. Execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote in person. Any proxy may be revoked by a stockholder at any time before it is exercised by delivery of a written revocation or a later executed proxy to the Secretary of the Corporation or by attending the Annual Meeting and voting in person.

VOTING SECURITIES AND VOTES REQUIRED

The representation in person or by proxy of at least a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business. Each share of Common Stock outstanding on the Record Date is entitled to one vote. For purposes of determining the presence of a quorum, abstentions and broker non-votes will be counted as present at the Annual Meeting.

In the election of directors, the two nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to vote at the Annual Meeting shall be elected as directors. Abstentions and broker non-votes will have no effect on the voting outcome with respect to the election of directors.

The affirmative vote of the holders of a majority of the shares of Common Stock present or represented and voting on the matter at the Annual Meeting is necessary to ratify the selection of PricewaterhouseCoopers LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending July 31, 2006. Abstentions and broker non-votes will have no effect upon the outcome of voting with respect to the ratification of the selection of the independent registered public accounting firm.

The persons named as proxies are officers of the Corporation.All properly executed proxies returned in time to be counted at the Annual Meeting will be voted in accordance with the instructions contained therein, and if no choice is specified, such proxies will be voted in favor of the matters set forth in the accompanying Notice of Annual Meeting.

The Board of Directors of the Corporation knows of no other matters to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote properly may be taken, shares represented by all proxies received by the Board of Directors will be voted with respect thereto in accordance with the judgment of the persons named as proxies.

Voting Shares Registered Directly in the Name of the Stockholder

Stockholders with shares registered directly in their name in the Corporation’s stock records maintained by the Corporation’s transfer agent, EquiServe Trust Company, N.A., may vote their shares (1) through the Internet, (2) by making a toll-free telephone call from the U.S. and Canada to EquiServe or (3) by mailing their signed proxy card. Specific voting instructions are set forth on the enclosed proxy card. Votes submitted through the Internet or by telephone through EquiServe must be received by 11:59 P.M. on December 18, 2005.

Voting Shares Registered in the Name of a Brokerage Firm or Bank

Stockholders with shares registered in the name of a brokerage firm or bank participating in the ADP Investor Communication Services program may vote their shares (1) through the Internet, (2) by telephone in accordance with the instructions set forth on the voting card or (3) by mailing their signed voting card. Votes submitted through the Internet or by telephone through the ADP program must be received by ADP Investor Communication Services by 11:59 P.M. on December 18, 2005.

Revocation of Proxies Previously Submitted

To revoke a proxy previously submitted electronically through the Internet or by telephone, a stockholder may simply vote again at a later date, using the same procedures, in which case the later submitted vote will be recorded and the earlier vote revoked. A stockholder may revoke a proxy previously submitted by mail by notifying the Secretary of the Corporation in writing that the proxy has been revoked or by voting in person at the Annual Meeting.

Delivery of Proxy Materials and Annual Report to Households

The rules promulgated by the Securities and Exchange Commission (the “Commission”) permit companies, brokers, banks or other intermediaries to deliver a single copy of an annual report and proxy statement to households at which two or more stockholders reside (“Householding”). Stockholders sharing an address who have been previously notified by their broker, bank or other intermediary and have consented to Householding, either affirmatively or implicitly by not objecting to Householding, will receive only one copy of the Corporation’s annual report and this Proxy Statement. A stockholder who wishes to participate in Householding in the future must contact his or her broker, bank or other intermediary directly to make such request. Alternatively, a stockholder who wishes to revoke his or her consent to Householding and receive separate annual reports and proxy statements for each stockholder sharing the same address must contact his or her broker, bank or other intermediary to revoke such consent. Stockholders may also obtain a separate annual report and/or proxy statement without charge by sending a written request to Sycamore Networks, Inc., 220 Mill Road, Chelmsford, Massachusetts 01824, Attention: Investor Relations, or by calling the Corporation at (978) 250-2900. The Corporation will promptly deliver an annual report and/or proxy statement upon request. Householding does not apply to stockholders with shares registered directly in their name.

Expenses and Solicitation

The cost of soliciting proxies will be borne by the Corporation. Proxies may be solicited by certain of the Corporation’s directors, officers and regular employees, without additional compensation, in person or by telephone or facsimile. In addition, the Corporation has retained Georgeson Shareholder Communications, Inc. (“Georgeson”) to act as proxy solicitor in conjunction with the Annual Meeting. The Corporation has agreed to pay Georgeson a fee of approximately $7,000 plus reimbursement of reasonable out-of-pocket expenses. The Corporation may also reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

In accordance with the Corporation’s Amended and Restated Certificate of Incorporation, the Corporation’s Board of Directors is divided into three classes, each of whose members serve for a staggered three-year term. Upon the expiration of the term of a class of directors, directors in such class will be elected for three-year terms at the annual meeting of stockholders in the year in which such term expires.

The terms for two Class III Directors, Daniel E. Smith and Paul W. Chisholm, will expire at this annual meeting. Messrs. Smith and Chisholm have been nominated for election by the Board of Directors upon the recommendation of the Nominating Committee and have indicated their willingness to serve, if elected. However, if any of the nominees should be unable or unwilling to serve, the proxies will be voted for a substitute nominee designated by the Board of Directors or for fixing the number of directors at a lesser number. If elected, Messrs. Smith and Chisholm will hold office until the Annual Meeting of Stockholders to be held in 2008 and until their respective successors are duly elected and qualified.

The following table sets forth for each nominee to be elected at the Annual Meeting and for each director whose term of office will extend beyond the Annual Meeting, the year each such nominee or director was first elected a director, the age of each nominee or director, the positions currently held by each nominee or director with the Corporation, the year each nominee’s or director’s current term will expire and the class of director of each nominee or director.

| | | | | | | | |

Nominee or Director’s Name

and Year Nominee or Director

First Became a Director

| | Age

| | Position(s) Held

| | Year

Current Term

Will Expire

| | Class of

Director

|

Gururaj Deshpande (1998) | | 54 | | Chairman of the Board of

Directors | | 2007 | | II |

Daniel E. Smith (1998) | | 56 | | President, Chief Executive

Officer and Director | | 2005 | | III |

Timothy A. Barrows (1998) | | 48 | | Director | | 2006 | | I |

Paul W. Chisholm (2002) | | 56 | | Director | | 2005 | | III |

Paul J. Ferri (1998) | | 66 | | Director | | 2007 | | II |

John W. Gerdelman (1999) | | 53 | | Director | | 2006 | | I |

Business Experience of Nominees

The Nominees to serve for three-year terms as Class III Directors and until their respective successors are elected and qualified are:

Daniel E. Smith has served as the Corporation’s President, Chief Executive Officer and as a member of the Corporation’s Board of Directors since October 1998. From June 1997 to July 1998, Mr. Smith was Executive Vice President and General Manager of the Core Switching Division of Ascend Communications, Inc., a provider of wide area network switches and access data networking equipment. Mr. Smith was also a member of the board of directors of Ascend Communications, Inc. during that time. From April 1992 to June 1997, Mr. Smith served as President and Chief Executive Officer and a member of the board of directors of Cascade Communications Corp., a provider of wide area network switches.

Paul W. Chisholm has served as a director since October 2002. Mr. Chisholm has been Chairman and Chief Executive Officer of mindSHIFT Technologies, a provider of managed information technology infrastructure services, since September 2003. Since March 2001, Mr. Chisholm has been President of Paul Chisholm Inc., providing business and telecommunications consulting services to venture capital firms. From December 1996 to

3

January 2001, Mr. Chisholm was President and Chief Executive Officer and a member of the board of directors of COLT Telecom Group plc, a European-based provider of business communication services. From February 1995 to December 1996, Mr. Chisholm served as President of COLT and from July 1992 to February 1995 he served as Managing Director.

Business Experience of Other Directors

Timothy A. Barrows has served as a director since February 1998. Mr. Barrows has been a General Partner of Matrix Partners, a venture capital firm, since September 1985.

John W. Gerdelmanhas served as a director since September 1999. Since January 2004, Mr. Gerdelman has been the Executive Chairman of Intelliden Corporation, a company which he co-founded that provides software solutions to automate network change management and enforce business policy in network operations. From April 2002 through December 2003, Mr. Gerdelman took on the bankruptcy reorganization of Metromedia Fiber Networks, a provider of digital communications infrastructure, as President and Chief Executive Officer. Metromedia Fiber Networks successfully emerged from Chapter 11 bankruptcy in September 2003 as AboveNet, Inc. From January 2000 through March 2002, Mr. Gerdelman was a Managing Member of mortonsgroup, LLC, a partnership investing in early stage companies. From April 1999 through December 1999, Mr. Gerdelman was President and Chief Executive Officer of USA.Net Inc., a web-based electronic messaging services provider. Previously, Mr. Gerdelman had served as an Executive Vice President at MCI Corporation. Mr. Gerdelman also serves on the boards of directors of McDATA Corporation, a storage area network company, APAC Customer Services, Inc., a call center company, and Terabeam Corporation, a designer and manufacturer of broadband wireless equipment and systems.

Gururaj Deshpandehas served as Chairman of the Corporation’s Board of Directors since its inception in February 1998. Mr. Deshpande served as the Corporation’s Treasurer and Secretary from February 1998 to June 1999 and as the Corporation’s President from February 1998 to October 1998. Before co-founding the Corporation, Mr. Deshpande co-founded Cascade Communications Corp., a provider of wide area network switches. From October 1990 to April 1992, Mr. Deshpande served as President of Cascade and from April 1992 to June 1997, he served as Cascade’s Executive Vice President of Marketing and Customer Service. Mr. Deshpande was a member of the board of directors of Cascade since its inception and was chairman of the board of directors of Cascade from 1996 to 1997.

Paul J. Ferrihas served as a director since February 1998. Mr. Ferri has been a General Partner of Matrix Partners, a venture capital firm, since February 1982.

There are no family relationships among any of the directors or executive officers of the Corporation. None of the corporations or other organizations referred to above with which a director has been employed or otherwise associated is a parent, subsidiary or other affiliate of the Corporation.

Board of Director Meetings and Committees

During fiscal year 2005, the Board of Directors held sixteen meetings. No director serving on the Board of Directors in fiscal 2005 attended fewer than 75% of such meetings of the Board of Directors and the Committees on which he serves. The Board of Directors has established a Compensation Committee, Nominating Committee, Audit Committee and Special Litigation Committee.

Compensation Committee

The Compensation Committee consists of Messrs. Barrows and Ferri, each of whom is independent, as defined by the applicable listing requirements of the Nasdaq Stock Market, Inc. (“Nasdaq”). The Compensation Committee is responsible for establishing and monitoring policies governing compensation of executive officers.

4

The Compensation Committee is responsible for reviewing the performance and compensation levels for executive officers, establishing salary and bonus levels for these individuals and making recommendations to the Board of Directors for restricted stock awards or option grants for these individuals under the Corporation’s stock option plans. The objectives of the Compensation Committee are to correlate executive officer compensation with the Corporation’s business objectives and financial performance, and to enable the Corporation to attract, retain and reward executive officers who contribute to the long-term success of the Corporation. The Compensation Committee will seek to reward executives in a manner consistent with the Corporation’s annual and long-term performance goals and to recognize individual initiative and achievement among executive officers. During fiscal 2005, the Compensation Committee held five meetings. For additional information concerning the Compensation Committee, see “Compensation Committee Report on Executive Compensation.”

Nominating Committee

The Company has a Nominating Committee (the “Nominating Committee”). The functions of the Nominating Committee include the following:

| | • | | identifying and recommending to the Board individuals qualified to serve as directors of the Company; |

| | • | | recommending to the Board directors to serve on committees of the Board; and |

| | • | | advising the Board with respect to matters of Board composition and procedures. |

The Nominating Committee is governed by a charter, a current copy of which is available in the Investor Relations section (under Corporate Governance) of our corporate website atwww.sycamorenet.com. A copy of the charter is also available in print to stockholders upon request, addressed to Sycamore Networks, Inc., Attn: Secretary, 220 Mill Road, Chelmsford, Massachusetts 01824.

The members of the Nominating Committee are Messrs. Chisholm and Gerdelman, each of whom is an independent director under the Nasdaq listing standards. The Nominating Committee met twice during fiscal 2005.

The Nominating Committee will consider director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Nominating Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Nominating Committee may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. To have a candidate considered by the Nominating Committee, a stockholder must submit the recommendation in writing and must include the following information:

| | • | | The name of the stockholder and evidence of that person’s ownership of Company stock, including the number of shares owned and the length of time of ownership; and |

| | • | | The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company and the person’s consent to be named as a director if selected by the Nominating Committee and nominated by the Board. |

The stockholder recommendation and information described above must be sent to the Corporate Secretary and must be received by the Corporate Secretary not less than 120 days prior to the anniversary date of the Company’s most recent annual meeting of stockholders. The Nominating Committee did not receive any stockholder nominee recommendations for the 2005 Annual Meeting.

The Nominating Committee believes that the minimum qualifications for serving as a director of the Company are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company and have an impeccable record and reputation for honest and ethical conduct in both his or her professional and personal

5

activities. In addition, the Nominating Committee examines a candidate’s specific knowledge, experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and the Company.

The Nominating Committee may use any number of methods to identify potential nominees, including personal, management, and industry contacts, recruiting firms and, as described above, candidates recommended by stockholders. The Nominating Committee did not engage any third party recruiting firms to identify nominees in fiscal 2005.

Once a person has been identified by the Nominating Committee as a potential candidate, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Nominating Committee determines that the candidate warrants further consideration, the Chairman or another member of the Committee would contact the person. Generally, if the person expressed a willingness to be considered and to serve on the Board, the Nominating Committee would request information from the candidate, review the person’s accomplishments and qualifications, including in light of any other candidates that the Committee might be considering, and conduct one or more interviews with the candidate. In certain instances, Committee members may contact one or more references provided by the candidate, may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments and may seek management input on the candidate. The Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

Audit Committee

The Audit Committee currently consists of Messrs. Chisholm, Ferri and Gerdelman, each of whom is independent, as defined by the applicable Nasdaq listing requirements and under the Exchange Act. In June 2003, Mr. Chisholm was elected Chairman of the Audit Committee. Mr. Gerdelman, who has served as the president and chief executive officer of a publicly-traded company, currently serves as the Financial Expert of the Audit Committee, as defined by rules of the Commission enacted under Section 407 of the Sarbanes-Oxley Act of 2002. The Audit Committee reviews the professional services provided by the Corporation’s independent registered public accounting firm, the independence of such independent registered public accounting firm from the Corporation’s management and the Corporation’s annual and quarterly financial statements. The Audit Committee also reviews such other matters with respect to the Corporation’s accounting, auditing and financial reporting practices and procedures as it may find appropriate or may be brought to its attention. The Audit Committee is governed by a charter, a current copy of which is available in the Investor Relations section (under Corporate Governance) of our website atwww.sycamorenet.com. During fiscal 2005, the Audit Committee held ten meetings. For additional information concerning the Audit Committee, see “Report of the Audit Committee.”

Special Litigation Committee

The Special Litigation Committee is a temporary committee of the Board of Directors, consisting of Messrs. Chisholm and Gerdelman, each of whom are independent directors who are not defendants in the securities class action litigation pending against the Corporation. The purpose of the committee is to determine whether and on what terms the Corporation should enter into agreements to settle that litigation. During fiscal 2005, the Special Litigation Committee did not hold any meetings.

Board Independence

The Board has affirmatively determined that none of the following directors has a material relationship with the Corporation (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Corporation): Timothy A. Barrows, Paul W. Chisholm, Paul J. Ferri and John W. Gerdelman.

6

Stockholder Communications with Directors

The Board has established a process to receive communications from stockholders. Stockholders may contact any member (or all members) of the Board by mail. To communicate with the Board, any individual director or any group or committee, correspondence should be addressed to the Board of Directors or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary” at Sycamore Networks, Inc., 220 Mill Road, Chelmsford, Massachusetts 01824.

All communications received as set forth in the preceding paragraph will be opened by the office of our Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee, the Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope is addressed.

In addition, although the Company does not have a policy for director attendance at our Annual Meeting, each of our directors is invited and encouraged to attend the Annual Meeting. One of our directors was in attendance at the fiscal 2004 Annual Meeting.

Compensation of Directors

The Corporation reimburses directors for reasonable out-of-pocket expenses incurred in attending meetings of the Board of Directors and committees. Each non-employee director receives an annual retainer of $30,000, which is paid on a quarterly basis. Pursuant to the Corporation’s 1999 Non-Employee Director Stock Option Plan, (the “Director Option Plan”), all non-employee directors of the Corporation are automatically granted non-qualified stock options to purchase 90,000 shares of Common Stock which vests over three years upon their initial appointment to the Board of Directors. Thereafter, on an annual basis immediately following each annual meeting of stockholders, each non-employee director is granted an option to purchase 30,000 shares of Common Stock which vests in one year. Under the plan, options are fully exercisable on the date of grant, however, shares purchased on exercise of such options are subject to repurchase by the Corporation prior to completion of the applicable vesting period. The exercise price per share of all options granted under the Director Option Plan is equal to the fair market value of the Corporation’s Common Stock on the date of grant, and such options expire on the date which is ten years from the date of option grant. At the annual meeting of stockholders held on December 20, 2004, each of the following non-employee directors received an option to purchase 30,000 shares of Common Stock with an exercise price of $3.82 per share: Messrs. Barrows, Chisholm, Ferri and Gerdelman.

Recommendation of the Board of Directors

The Board of Directors unanimously recommends a vote FOR the election of each of the nominees listed above.

7

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

General

The Board of Directors has selected PricewaterhouseCoopers LLP as its independent registered public accounting firm to audit the financial statements of the Corporation for the year ending July 31, 2006. PricewaterhouseCoopers LLP has acted as the Corporation’s independent registered public accounting firm since the Corporation’s inception. A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions. If the stockholders do not ratify the Board of Directors’ selection of PricewaterhouseCoopers LLP as the Corporation’s independent registered public accounting firm for fiscal year 2006, the Board of Directors will reconsider the matter at its next meeting.

Principal Accountant Fees and Services

The following is a summary of the fees billed to the Corporation by PricewaterhouseCoopers LLP for professional services rendered for the fiscal years ended July 31, 2005 and July 31, 2004:

| | | | | | |

Fee Category

| | Fiscal 2005 Fees

| | Fiscal 2004 Fees

|

Audit Fees | | $ | 546,000 | | $ | 210,000 |

Audit-Related Fees | | | 453,700 | | | 10,000 |

Tax Fees | | | 179,200 | | | 67,700 |

| | |

|

| |

|

|

Total Fees | | $ | 1,178,900 | | $ | 287,700 |

| | |

|

| |

|

|

Audit Fees. Consists of fees billed for professional services rendered for the audit of the Corporation’s financial statements for the fiscal years ended July 31, 2005 and July 31, 2004, and for reviews of the interim financial statements included in the Corporation’s quarterly reports on Form 10-Q. Audit fees for fiscal 2005 include services rendered in connection with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002.

Audit-Related Fees.Consists of fees billed for professional services rendered for audit-related services including consultations on other financial accounting and reporting related matters. Audit-related fees for fiscal 2005 include fees in connection with the independent investigation into stock option accounting conducted under the direction of the Audit Committee during the second half of fiscal 2005.

Tax Fees.Consists of fees billed for professional services relating to tax compliance and other tax services including tax planning and advisory services.

Audit Committee Pre-Approval Policy

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis. All of the audit, audit-related fees and tax fees for Fiscal 2005 and 2004 were pre-approved.

Recommendation of the Board of Directors

The Board of Directors recommends a voteFOR the ratification of the selection of PricewaterhouseCoopers LLP as the Corporation’s independent registered public accounting firm.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of September 30, 2005, with respect to beneficial ownership of Common Stock by: (i) each person who, to the knowledge of the Corporation, beneficially owned more than 5% of the shares of Common Stock outstanding as of such date; (ii) each director of the Corporation; (iii) each executive officer identified in the Summary Compensation Table set forth below under the heading “Compensation and Other Information Concerning Executive Officers”; and (iv) all directors and executive officers as a group.

For purposes of the following table, beneficial ownership is determined in accordance with the rules of the Commission. Except as otherwise noted in the footnotes below, the Corporation believes that each person or entity named in the table has sole voting and investment power with respect to all shares of its Common Stock shown as beneficially owned by them, subject to applicable community property laws. The percentage of shares of Common Stock outstanding is based on 276,309,448 shares of Common Stock outstanding as of September 30, 2005. In computing the number of shares beneficially owned by a person named in the following table and the percentage ownership of that person, shares of Common Stock that are subject to options held by that person that are currently exercisable or exercisable within 60 days of September 30, 2005 are deemed outstanding. These shares are not, however, deemed outstanding for the purpose of computing the percentage ownership of any other person.

| | | | |

Name and Address of Beneficial Owner(1)

| | Amount and Nature of Beneficial Ownership

| | Percentage of Outstanding

|

Gururaj Deshpande (2) | | 45,712,807 | | 16.5 |

Daniel E. Smith (3) | | 42,936,349 | | 15.5 |

John E. Dowling | | 3,000,056 | | 1.1 |

Kevin J. Oye (4) | | 2,148,538 | | * |

Araldo Menegon (5) | | 1,700,000 | | * |

Richard J. Gaynor (6) | | 1,000,000 | | * |

Timothy A. Barrows (7) | | 1,958,663 | | * |

Paul J. Ferri (7) | | 545,553 | | * |

John W. Gerdelman (8) | | 251,850 | | * |

Paul W. Chisholm (9) | | 180,000 | | * |

Platyko Partners, L.P (3) | | 21,775,000 | | 7.9 |

The Gururaj Deshpande Grantor Retained Annuity Trust (2) | | 17,918,400 | | 6.5 |

D.E. Shaw & Co., L.L.C. (10) | | 14,916,311 | | 5.4 |

Third Avenue Management LLC (11) | | 14,508,274 | | 5.3 |

All executive officers and directors as a group (10 persons)(12) | | 99,332,998 | | 35.9 |

| * | Less than 1% of the total number of outstanding shares of Common Stock. |

| (1) | Except as otherwise noted, the address of each person is: c/o Sycamore Networks, Inc., 220 Mill Road, Chelmsford, Massachusetts 01824. |

| (2) | Includes 2,937,500 shares held by the Deshpande Irrevocable Trust and 17,918,400 shares held by the Gururaj Deshpande Grantor Retained Annuity Trust. Mr. Deshpande’s wife serves as a trustee of each of these trusts. Mr. Deshpande disclaims beneficial ownership of these shares. |

| (3) | Includes 21,775,000 shares held by Platyko Partners, L.P., of which Mr. Smith and his wife serve as general partners. |

| (4) | Includes 2,114,457 shares issuable pursuant to options which are immediately exercisable and subject to a repurchase right which lapses as the shares vest. |

| (5) | Consists of 1,700,000 shares issuable pursuant to options which are immediately exercisable and subject to a repurchase right which lapses as the shares vest. |

| (6) | Consists of 1,000,000 shares issuable pursuant to options which are immediately exercisable and subject to a repurchase right which lapses as the shares vest. |

9

| (7) | For each of Messrs. Barrows and Ferri, includes 150,000 shares issuable pursuant to options which are immediately exercisable and subject to a repurchase right which lapses as the shares vest. Also includes 100,818 shares held by Matrix V Entrepreneurs Fund, L.P. Matrix V Management Co., LLC is the general partner of Matrix V Entrepreneurs Fund, L.P. Messrs. Barrows and Ferri, directors of the Corporation, are managing members of Matrix V Management Co., LLC. Messrs. Barrows and Ferri disclaim beneficial ownership of the shares held by Matrix V Entrepreneurs Fund, L.P. except to the extent of their pecuniary interests therein arising from their membership interests in Matrix V Management Co., LLC. |

| (8) | Includes 240,000 shares issuable pursuant to options which are immediately exercisable and subject to a repurchase right which lapses as the shares vest. |

| (9) | Consists of 180,000 shares issuable pursuant to options which are immediately exercisable and subject to a repurchase right which lapses as the shares vest. |

| (10) | According to a Schedule 13G filed on June 17, 2005, D.E. Shaw & Co., L.P. was the beneficial owner of 14,916,311 shares of common stock. The address of D.E. Shaw & Co., L.P. is 120 W. 45th Street, Tower 45, 39th Floor, New York, NY 10036. |

| (11) | According to a Schedule 13G filed on March 10, 2005, Third Avenue Management LLC was the beneficial owner of 14,508,274 shares of common stock. The address of Third Avenue Management LLC is 622 Third Avenue, 32nd Floor, New York, NY 10017. |

| (12) | Includes an aggregate of 5,534,457 shares issuable pursuant to options which are immediately exercisable and subject to a repurchase right which lapses as the shares vest. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act of 1934, as amended, requires the Corporation’s directors, executive officers and holders of more than 10% of the Corporation’s outstanding shares of Common Stock (collectively, “Reporting Persons”) to file with the Commission initial reports of ownership and reports of changes in ownership of the Common Stock of the Corporation. Such persons are required by regulations of the Commission to furnish the Corporation with copies of all such filings. Based solely on its review of the copies of such filings received by it with respect to the fiscal year ended July 31, 2005, the Corporation believes that all Reporting Persons complied with all Section 16(a) filing requirements in the fiscal year ended July 31, 2005.

COMPENSATION AND OTHER INFORMATION CONCERNING EXECUTIVE OFFICERS

Compensation Committee Report on Executive Compensation

The Compensation Committee (the “Committee”) is composed of two independent, non-employee directors of the Board of Directors, neither of whom have interlocking relationships as defined by the Commission. The Committee is responsible for establishing and monitoring policies governing the annual compensation of executive officers. The Committee periodically reviews the approach to executive compensation and makes adjustments as competitive conditions and other circumstances warrant.

Compensation Philosophy

The Corporation operates in the competitive and rapidly changing high technology industry. The Committee believes that executive officer compensation should be determined based on a combination of individual and business objectives and competitive data. The Committee seeks to attract, retain and motivate executive officers through a total compensation package which includes (i) base salary, (ii) variable incentive awards and (iii) long-term, equity-based incentives in the form of restricted stock and stock options. In fiscal 2005, compensation for the Corporation’s executive officers consisted of base salary and performance bonuses for certain individuals and stock options for one individual in conjunction with his initial employment by the Corporation.

10

The Committee reviews market information from published survey data and considers the compensation practices of companies in the Corporation’s industry to determine whether the Corporation’s compensation structure (a) is competitive in the industry; (b) motivates executive officers to achieve the Corporation’s business objectives; and (c) aligns the interests of executive officers with the long-term interests of stockholders. The Committee’s goal is to set the Corporation’s executive officer total compensation at levels that are generally comparable to the market data and typically targets between the fiftieth and the seventy-fifth percentile for total compensation. The Committee also considered certain milestones achieved by the Corporation, including the completion of several new product features and enhancements, individual executive officer duties and contributions and the Corporation’s financial performance in fiscal 2005.

Base Salaries

Base salaries for the Corporation’s executive officers in fiscal 2005 remained below the fiftieth percentile level of comparable positions at other companies in the Corporation’s industry. The below market salaries are consistent with the Committee’s objective to attract, retain and motivate executive officers primarily through long-term, equity-based incentives. The Committee intends to continue to adjust compensation appropriately in order to attract and retain executives who manage the Corporation effectively, and align the interests of its executive officers with the long-term interests of stockholders.

Performance Bonuses

During fiscal 2005, the Corporation’s performance bonus plan was based upon the performance of the Corporation, as well as individual performance. Based on the achievement of certain individual performance objectives in fiscal 2005, the Committee approved the payment of bonuses to Mr. Oye. Mr. Gaynor received bonus payments in fiscal 2005 which he had a contractual right to receive for the first year following his start date. The Committee has implemented a bonus plan for executive officers for the upcoming fiscal year which consists of a percentage of base salary, measured against the performance of the Corporation relative to certain financial goals, and individual performance relative to certain key strategic objectives of the Corporation.

Long-Term Equity Incentives

The Committee’s view in granting long-term equity incentives to the Corporation’s executive officers is to provide each executive officer with compensation opportunities directly aligned with the creation of stockholder value. In determining the amounts of the long-term equity incentives to be awarded to each executive officer, the Committee takes into account the executive officer’s position with the Corporation, the executive officer’s past performance, the number and price of unvested options and restricted stock held by the executive officer and the long-term equity incentive awards made to individuals in similar positions at other companies in the Corporation’s industry. Based upon these factors, the Committee determines the amount of the long-term equity incentives at levels it considers appropriate to create a meaningful opportunity for stock ownership. The weight given to each of these factors varies among individuals at the Committee’s discretion.

During fiscal 2005, options to purchase 1,000,000 shares of common stock, vesting over a five-year period were granted to Mr. Gaynor in conjunction with his initial employment by the Corporation. Such options will allow Mr. Gaynor to acquire shares at a fixed price per share over a specified period of time, contingent upon his continued employment. No other executive officers were granted long-term equity incentives in fiscal 2005.

Chief Executive Officer Compensation

Mr. Smith has served as the Corporation’s Chief Executive Officer since October 1998. Mr. Smith’s base salary for fiscal 2005 remained unchanged and is set below the twenty-fifth percentile of the surveyed data in order to have a substantial portion of his total compensation tied to the Corporation’s performance in the form of long-term equity incentive awards. Upon review of Mr. Smith’s long-term equity incentives, the Committee

11

determined that the stock holdings of Mr. Smith adequately aligned his interests with those of the stockholders and therefore Mr. Smith was not granted any additional restricted stock or stock options in fiscal 2005. Mr. Smith was not paid a performance bonus in fiscal 2005. The Committee may adjust Mr. Smith’s salary in the future, based upon comparative salaries of chief executive officers in the Corporation’s industry, and other factors which may include the financial performance of the Corporation and Mr. Smith’s success in meeting strategic goals.

Policy on Deductibility of Executive Compensation

The Committee does not believe Section 162(m) of the Internal Revenue Code of 1986, as amended, which disallows a tax deduction for certain compensation in excess of $1 million, will likely have an effect on the Corporation in the near future. The Committee believes that stock options granted under the Corporation’s stock plans meet the exception for qualified performance-based compensation in accordance with Internal Revenue Code Regulations, so that amounts otherwise deductible with respect to such options will not count toward the $1 million deduction limit. The Committee’s general policy is to take into account the deductibility of compensation in determining the type and amount of compensation payable to executive officers.

Respectfully submitted by the Compensation Committee:

Timothy A. Barrows

Paul J. Ferri

Compensation Committee Interlocks and Insider Participation

Neither of the members of the Committee is currently, or has been, at any time since the Corporation’s formation, an officer or employee of the Corporation. No interlocking relationship exists between any member of the Corporation’s Board of Directors or the Committee and any member of the Board of Directors or compensation committee of any other company.

12

Summary Compensation Table

The table below sets forth, for the fiscal year ended July 31, 2005, the compensation earned by the Corporation’s Chief Executive Officer and the four other most highly compensated individuals who were serving as executive officers at the end of fiscal 2005, or who served as executive officers during fiscal 2005. Collectively, all of these individuals are referred to below as the Named Executive Officers.

In accordance with the rules of the Commission, the compensation set forth in the table below does not include medical, group life or other benefits which are available to all of the Corporation’s salaried employees, and perquisites and other benefits, securities or property which do not exceed the lesser of $50,000 or 10% of the person’s salary and bonus shown in the table. In the table below, columns required by the regulations of the Commission have been omitted where no information was required to be disclosed under those columns.

Summary Compensation Table(1)

| | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long-Term Compensation Awards

|

| | | Year

| | Salary ($)

| | | Bonus ($)

| | | Other Annual Compensation ($)

| | Securities Underlying Options/SARS (#)

| | All Other Compensation ($)

|

Daniel E. Smith | | | | | | | | | | | | | | |

President and Chief Executive | | 2005 | | 100,000 | | | — | | | — | | — | | — |

Officer | | 2004 | | 100,000 | | | — | | | — | | — | | — |

| | | 2003 | | 100,000 | | | — | | | — | | — | | — |

| | | | | | |

Araldo Menegon | | | | | | | | | | | | | | |

Vice President, Worldwide | | 2005 | | 200,000 | | | 156,791 | (2) | | — | | — | | — |

Sales and Support | | 2004 | | 200,000 | | | 162,912 | (2) | | — | | — | | — |

| | | 2003 | | 192,308 | | | 135,294 | (2) | | — | | 1,700,000 | | — |

| | | | | | |

Richard J. Gaynor | | | | | | | | | | | | | | |

Chief Financial Officer, Vice | | 2005 | | 172,800 | (3) | | 66,667 | (3) | | — | | 1,000,000 | | — |

President, Finance and | | 2004 | | — | | | — | | | — | | — | | — |

Administration, Treasurer and | | 2003 | | — | | | — | | | — | | — | | — |

Secretary | | | | | | | | | | | | | | |

| | | | | | |

Kevin J. Oye | | | | | | | | | | | | | | |

Vice President, Systems and | | 2005 | | 210,000 | | | 80,000 | | | — | | — | | — |

Technology | | 2004 | | 205,192 | | | 68,750 | | | — | | — | | — |

| | | 2003 | | 191,707 | | | 20,000 | | | — | | — | | — |

| | | | | | |

John E. Dowling | | | | | | | | | | | | | | |

Vice President, Operations | | 2005 | | 159,000 | | | — | | | — | | — | | — |

| | | 2004 | | 159,000 | | | — | | | — | | — | | — |

| | | 2003 | | 159,000 | | | — | | | — | | — | | — |

| (1) | As of July 31, 2005, the remaining number of shares of restricted Common Stock held by the Named Executive Officers that had not vested and the value of this restricted Common Stock was as follows: Mr. Menegon: 765,000 shares, $589,050 and Mr. Gaynor: 1,000,000 shares, $0. The value is based on the fair market value at July 30, 2005 ($3.56 per share as quoted on the Nasdaq National Market) less the purchase price paid per share. Holders of restricted Common Stock are entitled to receive any dividends the Corporation may pay on its Common Stock. |

| (2) | Consists of sales commissions paid in the fiscal year. |

13

| (3) | Mr. Gaynor joined the Corporation as Chief Financial Officer, Vice President of Finance and Administration, Treasurer and Secretary in October 2004. The data provided in this table reflects amounts earned from that date through July 31, 2005. |

Option Grants in Last Fiscal Year

The following table provides the specified information concerning options granted to the Corporation’s Named Executive Officers during the fiscal year ended July 31, 2005.

OPTION GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | |

Name

| | Number of Securities Underlying Options Granted (1)

| | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise Price

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term (2)

|

| | | | | | 5% ($)

| | 10% ($)

|

Daniel E. Smith | | 0 | | — | | | | — | | — | | | — | | | — |

Araldo Menegon | | 0 | | — | | | | — | | — | | | — | | | — |

Richard J. Gaynor | | 1,000,000 | | 66 | % | | $ | 3.81 | | 10/5/2014 | | $ | 2,396,000 | | $ | 6,072,000 |

Kevin J. Oye | | 0 | | — | | | | — | | — | | | — | | | — |

John E. Dowling | | 0 | | — | | | | — | | — | | | — | | | — |

| (1) | Represents options granted to the Named Executive Officer above under the Corporation’s 1999 Stock Incentive Plan. The options are exercisable immediately, subject to a repurchase right by the Corporation which lapses as the options vest over a five-year vesting period. |

| (2) | Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. The assumed 5% and 10% rates of stock price appreciation are provided in accordance with the rules of the Commission and do not represent the Corporation’s estimate or projection of the future Common Stock price. Potential gains are net of the exercise price but before taxes associated with the exercise. Actual gains, if any, on stock option exercises are dependent on the future financial performance of the Corporation, overall market conditions and the option holder’s continued employment through the vesting period. |

14

Option Exercises and Fiscal Year-End Values

The following table provides the specified information concerning option exercises in the last fiscal year and unexercised options held as of July 31, 2005 by the Corporation’s Named Executive Officers.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| | | | | | | | | | | | |

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-end (#)

| | Value of Unexercised In-the-Money Options at Fiscal Year-end ($) (2)

|

| | | | Exercisable (1)

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Daniel E. Smith | | — | | — | | — | | — | | — | | — |

Araldo Menegon | | — | | — | | 1,700,000 | | — | | 1,309,000 | | — |

Richard J. Gaynor | | — | | — | | 1,000,000 | | — | | — | | — |

Kevin J. Oye | | — | | — | | 2,114,457 | | — | | 220,000 | | — |

John E. Dowling | | — | | — | | — | | — | | — | | — |

| (1) | Options granted under the Corporation’s 1999 Stock Incentive Plan are exercisable immediately, subject to a repurchase right in favor of the Corporation which lapses as the option vests over periods ranging from three to five years. |

| (2) | Value is based on the difference between the option exercise price and the fair market value at July 30, 2005 ($3.56 per share as quoted on the Nasdaq National Market), multiplied by the number of shares underlying the option. |

Employment and Other Arrangements

Richard J. Gaynor joined the Corporation as Chief Financial Officer, Vice President of Finance and Administration, Treasurer and Secretary pursuant to a letter arrangement dated October 5, 2004. Under this arrangement, Mr. Gaynor’s base salary was set at $210,000 and his annual bonus was set at $80,000, payable quarterly. In addition, Mr. Gaynor was granted an option to purchase 1,000,000 shares of Common Stock of the Corporation at an exercise price of $3.81 under the 1999 Stock Incentive Plan. Such options are subject to a five year vesting schedule, vesting 20% one year from the commencement of his employment and 5% per quarter thereafter. Mr. Gaynor’s employment is at will and may be terminated at any time by either party for any reason, with or without cause.

Change in Control Agreements

Each of Messrs. Smith, Menegon, Oye, Dowling and Gaynor, the Corporation’s current executive officers (the “Current Executive Officers”), has entered into a change in control agreement with the Corporation. Under these agreements, each option or restricted stock grant held by the Current Executive Officer which is scheduled to vest within the 12 months after the effectiveness of a change of control of the Corporation will instead vest immediately prior to the change in control. In addition, in the event of a “Subsequent Acquisition” of the Corporation (as defined in these agreements) following a change in control, all options or restricted stock granted by the Corporation to such Current Executive Officers will vest immediately prior to the effectiveness of such acquisition. If a Current Executive Officer is subject to any excise tax on amounts characterized as excess parachute payments, due to the benefits provided under this agreement, the Current Executive Officer shall be entitled to reimbursement of up to $1,000,000 for any excess parachute excise taxes the Current Executive Officer may incur.

In the event of a termination of a Current Executive Officer’s employment following a change in control, either by the surviving entity without cause or by the Current Executive Officer due to a constructive

15

termination, (1) all options and restricted stock of the Current Executive Officer vest, (2) the Current Executive Officer is entitled to continued paid coverage under the Corporation’s group health plans for 18 months after such termination, (3) the Current Executive Officer shall receive a pro rata portion of his performance bonus for the year in which the termination occurred, (4) the Current Executive Officer shall receive an amount equal to 18 months of his base salary and (5) the Current Executive Officer shall receive an amount equal to 150% of his annual performance bonus for the year in which the termination occurred.

Under these agreements, each Current Executive Officer agrees to abide by the Corporation’s confidentiality and proprietary rights agreements and, for a period of one year after such termination, not to solicit the Corporation’s employees or customers.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In July 2000, the Corporation and the Chairman of the Corporation’s Board of Directors (the “Chairman”), entered into an Investor Agreement with Tejas Networks India Private Limited, a private company incorporated in India (“Tejas”), pursuant to which the Corporation and the Chairman each invested $2.2 million in Tejas in exchange for equity shares of Tejas. The Chairman also serves as the Chairman of the Board of Directors of Tejas. An executive officer of the Corporation also attends meetings of the Board of Directors of Tejas for the sole purpose of representing the Corporation’s business interests, if any. The Corporation has entered into various agreements with Tejas under which the Corporation has licensed certain proprietary software development tools to Tejas, and Tejas will assist the Corporation’s business development efforts in India and also provide maintenance and other services to the Corporation’s customers in India, if any. During the years ended July 31, 2005 and 2003, the Corporation recognized revenue relating to transactions with Tejas of $0.1 million and $0.2 million, respectively. During the year ended July 31, 2004, the Corporation did not engage in any material transactions with Tejas.

All transactions involving the Corporation and its officers, directors, principal stockholders and their affiliates, including those since the Corporation’s initial public offering, will be and have been approved by a majority of the Board of Directors, including a majority of the independent and disinterested directors on the Board of Directors, and will be and have been on terms no less favorable to the Corporation than could be obtained from unaffiliated third parties.

16

REPORT OF THE AUDIT COMMITTEE

The Audit Committee’s purpose is to assist the Board of Directors in its oversight of the Corporation’s financial accounting, reporting and internal controls. The Audit Committee operates pursuant to the Audit Committee Charter approved by the Board of Directors.

Management is responsible for the preparation, presentation and integrity of the Corporation’s consolidated financial statements, the selection of appropriate accounting and financial reporting principles, and for the maintenance of internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm, PricewaterhouseCoopers LLP, is responsible for performing an independent audit of the consolidated financial statements and internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board. The Audit Committee periodically meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Corporation’s internal controls and the overall quality of the Corporation’s financial reporting.

In performing its oversight role, the Audit Committee considered and discussed the audited financial statements with management and the Corporation’s independent registered public accounting firm. The Audit Committee also discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended by Statement on Auditing Standards No. 90, Audit Committee Communications, including the quality and acceptability of the Corporation’s accounting principles as applied in its financial reporting. The Audit Committee received the written disclosures and the letter from the Corporation’s independent registered public accounting firm required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees. The Audit Committee also considered whether the provision of non-audit services by the independent registered public accounting firm is compatible with maintaining the independent registered public accounting firm’s independence and has discussed with the independent registered public accounting firm their independence.

Based upon the Audit Committee’s discussions with management and the independent registered public accounting firm and the Audit Committee’s review of the representations of management, and the report of the independent registered public accounting firm to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Corporation’s Annual Report on Form 10-K for the year ended July 31, 2005, as filed with the Securities and Exchange Commission on October 11, 2005.

Respectfully submitted by the Audit Committee

Paul W. Chisholm (Chairman)

Paul J. Ferri

John W. Gerdelman

17

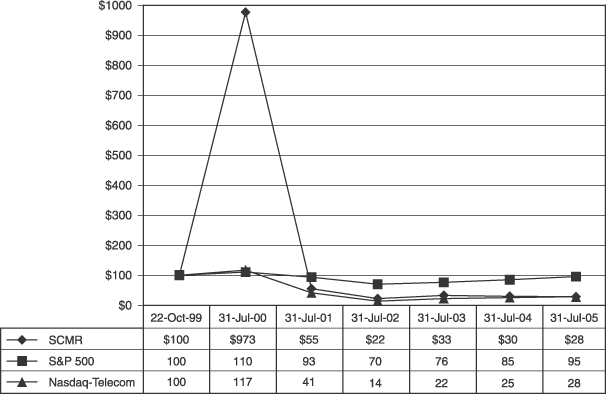

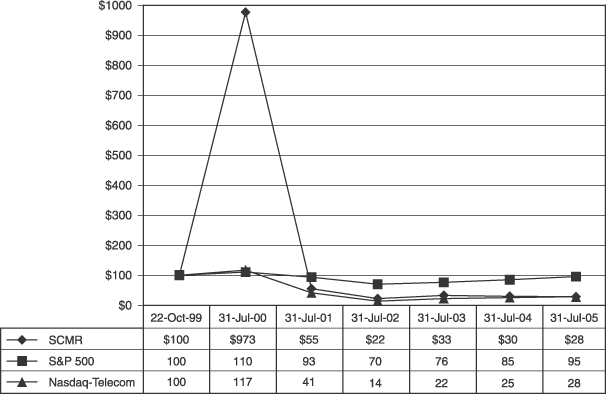

STOCK PERFORMANCE GRAPH

The following graph compares the yearly percentage change in the cumulative total stockholder return on the Corporation’s Common Stock during the period from the Corporation’s initial public offering through July 31, 2005, with the cumulative total return on the S&P 500 and the Nasdaq Telecommunications Index. The comparison assumes $100 was invested on October 22, 1999 (the date of the Corporation’s initial public offering) in the Corporation’s Common Stock and in each of the foregoing indices and assumes reinvestment of dividends, if any. The performance shown is not necessarily indicative of future performance.

Comparison of Cumulative Total Return* Among

Sycamore Networks, Inc.,

The S&P 500 and The Nasdaq Telecommunications Index

| * | Prior to October 22, 1999, the Corporation’s Common Stock was not publicly traded. Comparative data is provided only for the period since that date. |

Notwithstanding anything to the contrary set forth in any of the Corporation’s filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate other filings with the Commission, including this Proxy Statement, in whole or in part, the Compensation Committee Report on Executive Compensation, the Report of the Audit Committee and the Stock Performance Graph shall not be deemed incorporated by reference into any such filings.

18

CODE OF ETHICS

Pursuant to Section 406 of the Sarbanes-Oxley Act of 2002, the Corporation has adopted a business code of ethics and corporate governance that applies to all executive officers, directors and employees of the Corporation. The business code of ethics and corporate governance is available on the Corporation’s website atwww.sycamorenet.com under the Investor Relations section. The Corporation intends to satisfy the disclosure requirement under Item 10 of Form 8-K regarding an amendment to, or waiver from, a provision of the business code of ethics and corporate governance by posting such information on its website, at the address specified above, unless a Form 8-K is otherwise required by applicable rules of the Nasdaq National Market. A copy of the code of ethics can be obtained without charge by written request to Investor Relations, Sycamore Networks, Inc., 220 Mill Road, Chelmsford, Massachusetts 01824.

STOCKHOLDER PROPOSALS

To be eligible for inclusion in the proxy statement to be furnished to all stockholders entitled to vote at the 2006 Annual Meeting of Stockholders of the Corporation, proposals of stockholders must be received at the Corporation’s principal executive offices not later than July 15, 2006 and must otherwise satisfy the conditions established by the Commission for stockholder proposals to be included in the Corporation’s proxy statement for that meeting. In accordance with the Corporation’s Amended and Restated By-Laws, proposals of stockholders intended for presentation at the 2006 Annual Meeting of the Stockholders of the Corporation (but not intended to be included in the proxy statement for that meeting) must be received no earlier than September 20, 2006 and no later than October 10, 2006. In order to curtail any controversy as to the date on which a proposal was received by the Corporation, it is suggested that proponents submit their proposals by Certified Mail, Return Receipt Requested, to the attention of the Corporation’s Secretary.

TRANSACTION OF OTHER BUSINESS

At the date of this Proxy Statement, the only business which the Board of Directors intends to present or knows that others will present at the Annual Meeting is as set forth above. If any other matter or matters are properly brought before the Annual Meeting, or an adjournment or postponement thereof, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their best judgment.

19

| | |

| P | | SYCAMORE NETWORKS, INC. |

| R | | |

| O | | Proxy for Annual Meeting of Stockholders |

| X | | |

| Y | | December 19, 2005 |

| |

| | | SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS |

The undersigned hereby appoints Daniel E. Smith and Richard J. Gaynor, and each of them, proxies, with full power of substitution, to vote all shares of stock of Sycamore Networks, Inc. (the “Corporation”) which the undersigned is entitled to vote at the Annual Meeting of Stockholders of the Corporation to be held on Monday, December 19, 2005 (the “Annual Meeting”) at 9:00 A.M., local time, at the Radisson Hotel, 10 Independence Drive, Chelmsford, Massachusetts 01824, and at any postponements and adjournments thereof, upon the matters set forth in the Notice of Annual Meeting of Stockholders and Proxy Statement dated November 17, 2005, a copy of which has been received by the undersigned. The proxies are further authorized to vote, in their discretion, upon such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

| | |

| |

| | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE |

SYCAMORE NETWORKS, INC.

C/O EQUISERVE TRUST COMPANY, N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

Your vote is important. Please vote immediately.

| | | | | | |

Vote-by-Internet Log on to the Internet and go to http://www.eproxyvote.com/scmr | | OR | | | | Vote-by-Telephone Call toll-free 1-877-PRX-VOTE (1-877-779-8683) |

If you vote over the Internet or by telephone, please do not mail your card.

Please mark votes as in this example

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED “FOR” THE PROPOSALS IN ITEMS 1 AND 2.

1. To elect the following nominees to the Board of Directors to serve for three-year terms as Class III Directors and until their respective successors are elected and qualified:

Nominees:

| (01) | Daniel E. Smith and (02) Paul W. Chisholm |

¨ FOR ¨ WITHHELD

¨

For all nominees except as noted above. To withhold authority to vote for any individual nominee, write the name of the nominee on the above line.

2. To ratify the selection of the firm of PricewaterhouseCoopers LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending July 31, 2006.

¨ FOR ¨ AGAINST ¨ ABSTAIN

3. To transact such other business as may properly come before the meeting and any adjournment thereof.

¨ MARK HERE IF YOU PLAN TO ATTEND THE MEETING

¨ MARK HERE FOR ADDRESS

CHANGE AND NOTE BELOW

If signing as attorney, executor, trustee or guardian, please give your full title as such. If stock is held jointly, each owner should sign.

| | |

|

Signature | | Date |

|

Signature | | Date |