ANNUAL REPORT

ZENITH NATIONAL INSURANCE CORP.

2001

FINANCIAL HIGHLIGHTS

Years ended December 31,

| | 2001

| | 2000

| | 1999

| |

|---|

Operating Results: |

|

|

(Dollars in thousands, except per share data) |

|

| |

Revenues(1) |

|

$ |

622,046 |

|

$ |

459,569 |

|

$ |

492,108 |

|

|

|

|

|

|

|

|

|

| | Operating loss after tax(2) | | | (29,760 | ) | | (37,739 | ) | | (55,228 | ) |

| |

Realized gains (losses) after tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

On investments |

|

|

5,960 |

|

|

(10,054 |

) |

|

4,993 |

|

|

|

|

|

|

|

|

|

|

|

|

| | |

On sale of CalFarm Insurance Company(1) |

|

|

|

|

|

|

|

|

104,335 |

|

|

|

|

|

|

|

|

|

| | (Loss) income before extraordinary item | | | (23,800 | ) | | (47,793 | ) | | 54,100 | |

| |

Extraordinary item — gain on extinguishment of debt after tax(3) |

|

|

|

|

|

993 |

|

|

|

|

|

|

|

|

|

|

|

|

| | Net (loss) income | | $ | (23,800 | ) | $ | (46,800 | ) | $ | 54,100 | |

|

|

|

|

|

|

|

|

| Per Share Data: | | | | | | | | | | |

| |

Operating loss after tax(2) |

|

$ |

(1.69 |

) |

$ |

(2.19 |

) |

$ |

(3.22 |

) |

| |

Realized gains (losses) after tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

On investments |

|

|

0.34 |

|

|

(0.59 |

) |

|

0.29 |

|

|

|

|

|

|

|

|

|

|

|

|

| | |

On sale of CalFarm Insurance Company(1) |

|

|

|

|

|

|

|

|

6.08 |

|

|

|

|

|

|

|

|

|

| | (Loss) income before extraordinary item | | | (1.35 | ) | | (2.78 | ) | | 3.15 | |

| |

Extraordinary item — gain on extinguishment of debt after tax(3) |

|

|

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

| | Net (loss) income | | $ | (1.35 | ) | $ | (2.72 | ) | $ | 3.15 | |

|

|

|

|

|

|

|

|

| | Stockholders' dividends | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

Key Statistics: |

|

|

|

|

|

|

|

|

|

|

| |

Combined ratio: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

Including catastrophes(2) |

|

|

118.9% |

|

|

130.2% |

|

|

135.2% |

|

|

|

|

|

|

|

|

|

|

|

|

| | |

Excluding catastrophes(2) |

|

|

110.2% |

|

|

123.6% |

|

|

130.0% |

|

| |

Stockholders' equity |

|

$ |

302,611 |

|

$ |

309,776 |

|

$ |

354,559 |

|

| |

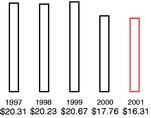

Stockholders' equity per share(4) |

|

|

16.31 |

|

|

17.76 |

|

|

20.67 |

|

| |

Closing common stock price |

|

|

27.94 |

|

|

29.38 |

|

|

20.63 |

|

(1) Zenith completed the sale of CalFarm Insurance Company effective March 31, 1999 for a gain of $104.3 million after tax, or $6.08 per share.

(2) The year ended December 31, 1999 includes $50.0 million before tax ($32.5 million after tax, or $1.89 per share) of net charges associated with an increase in the purchase price of RISCORP. Operating loss excludes realized gains (losses).

(3) In 2000, Zenith repurchased a total of $16.5 million aggregate principal amount of the outstanding 9% Senior Notes due 2002 and $8.0 million aggregate liquidation amount of the outstanding 8.55% Capital Securities.

(4) Excluding the effect of Statement of Financial Accounting Standards No. 115, stockholders' equity per share was $16.36, $18.31, and $21.80 at December 31, 2001, 2000 and 1999, respectively.

1

TABLE OF CONTENTS

| • | Financial Highlights | | 1 |

• |

Letter to Stockholders |

|

3 |

• |

Management's Discussion and Analysis of Consolidated

Financial Condition and Results of Operations |

|

22 |

• |

5-Year Summary of Selected Financial Information |

|

38 |

• |

Property-Casualty Loss Development |

|

40 |

• |

Consolidated Balance Sheet |

|

42 |

• |

Consolidated Statement of Operations |

|

44 |

• |

Consolidated Statement of Cash Flows |

|

45 |

• |

Consolidated Statement of Stockholders' Equity |

|

46 |

• |

Notes to Consolidated Financial Statements |

|

48 |

• |

Report of Independent Accountants |

|

68 |

• |

Corporate Directory |

|

|

|

Zenith National Insurance Corp. |

|

70 |

|

Zenith Insurance Company |

|

71 |

|

TheZenith Marketing, Underwriting and Claims Offices |

|

72 |

|

Perma-Bilt, a Nevada Corporation |

|

72 |

TheZenith and Zenith are registered U.S. trademarks.

2

TO OUR STOCKHOLDERS

Zenith did not return to profitability due to losses incurred in our Reinsurance operations related to the tragic events of September 11th, however 2001 net loss and operating loss improved significantly compared to 2000.

Let us take a moment to acknowledge that monetary and material losses pale in comparison to the human tragedy of the terrorist attack. On behalf of our management and staff, let me extend our heartfelt condolences to the families whose loved ones were lost or injured, some of whom were our colleagues in the financial markets. And let me express our admiration for the courageous actions of the emergency personnel. We pray and hope that this is a one-time occurrence.

Moving forward, there is positive news to report. Zenith's 2001 performance resulted in a 15 percentage point improvement of our combined ratio to 114% in our major business segment, Workers' Compensation. This in tandem with a 38% growth in premium revenues marks a major favorable trend reversal. Prices continue to increase in both our Workers' Compensation and Reinsurance markets. We begin 2002 in a strong financial position to support continuing growth and the restoration of profitability.

9/11 LEGACY FROM AN INSURANCE PERSPECTIVE

Significant underwriting and pricing changes are already underway; new lessons have been learned from the single most devastating property and Workers' Compensation loss in history:

- •

- Prices reinsurers charge have increased, and the terms of contracts offered have been modified.

- •

- Zenith will no longer provide coverage for terrorism in our Reinsurance policies.

- •

- To ensure we properly price our Workers' Compensation business, we will make a modest charge for terrorism exposure where allowed.

- •

- As a purchaser of Reinsurance within our Workers' Compensation business, we are unable to obtain significant terrorism coverage at prices that make economic sense at this time.

3

NEW UNDERWRITING AND PRICING LESSONS HAVE BEEN LEARNED FROM THE SINGLE MOST DEVASTATING PROPERTY AND WORKERS' COMPENSATION LOSS IN HISTORY.

- •

- Close monitoring of our Workers' Compensation segment is underway to make certain we do not write business that will clearly increase our risk and terrorism exposure.

- •

- Submissions have already been rejected where the employer is domiciled in a high-profile structure, and where, in our opinion, security arrangements are inadequate or nonexistent.

- •

- An analysis of our policyholders indicates we do not have large numbers of employers with major employee concentrations in single high profile locations or high-rise buildings.

- •

- Additional capital recently invested in the reinsurance industry will likely dampen the amount and duration of future rate increases in some cases, even though demand for reinsurance coverage is expected to continue.

In summary, the world appears far riskier today than it did prior to September 11th. From our perspective, we believe our rate increases will exceed loss-cost trends, and result in the ongoing improvement of our combined ratios and profitability.

PERFORMANCE SUMMARY

- 1.

- Workers' Compensation:

- •

- Premiums inforce increased 36%.

- •

- Policies inforce increased by 3,000 to 35,500.

- •

- Price increases are continuing.

- •

- Underwriting losses reduced by $29.5 million.

- •

- Combined ratio improved to 114% from 129% in 2000.

- 2.

- Additional financial stability:

- •

- Capital increased by $25 million.

- •

- One million shares sold at 150% of book value.

- •

- Cash flow from operations was $84.6 million in 2001.

4

- 3.

- Net loss and operating loss:

- •

- Net loss was $23.8 million, compared to $46.8 million in 2000.

- •

- Operating loss was $29.8 million, compared to $37.7 million in 2000.

- •

- WTC net loss was $24.4 million after tax, or $1.39 per share.

- 4.

- Investment Income pre-tax:

- •

- Comparable in 2001 and 2000 at about $52 million.

- •

- A favorable result in view of declining interest rates.

- •

- Investment portfolio increased from $852.7 million to $944.7 million.

ANALYSIS

Net loss was $23.8 million, or $1.35 per share in 2001, compared to net loss of $46.8 million, or $2.72 per share the prior year.

The following table summarizes pre-tax underwriting performance during the past three years.

| |

|---|

Underwriting Results

| | 2001

| | 2000

| | 1999

| |

|---|

| |

|---|

| | | | (Dollars in thousands) | |

| Workers' Compensation | | $ | (58,329 | ) | $ | (87,854 | ) | $ | (122,543 | ) |

| Other Property-Casualty | | | | | | | | | (22 | ) |

| Reinsurance | | | (31,918 | ) | | (14,536 | ) | | (7,324 | ) |

| |

| Underwriting loss | | $ | (90,247 | ) | $ | (102,390 | ) | $ | (129,889 | ) |

| |

| Catastrophes | | | (41,700 | ) | | (22,600 | ) | | (18,900 | ) |

| |

2001 results improved significantly, but were adversely affected by the WTC events of September 11, 2001.

- •

- Combined ratio for the Workers' Compensation operations was 114%, comprised of a 65% accident year loss ratio (compared to 68% for the current estimate of last year), a 49% loss adjustment and underwriting expense ratio, and a zero impact from prior years' reserve strengthening. Since the

5

PRICE INCREASES IN BOTH OUR WORKERS' COMPENSATION AND REINSURANCE OPERATIONS POSITION US FAVORABLY FOR THE FUTURE.

beginning of California's open-rating in 1995, our California loss ratio has averaged 69%, compared to 108% for the California industry. Our 39-point advantage is better than TheZenith's comparative results prior to open rating, and demonstrates the discipline of our pricing, underwriting and service strategies during a period of significant market turmoil. Growth in earned premiums of 38% this past year is a result of our underwriting patience.

- •

- 2001 accident year Reinsurance operations were poor due to WTC losses; however, it isn't reasonable to evaluate this business on short-term results.

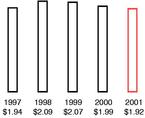

- •

- Investment income after tax was $33.8 million, or $1.92 per share in 2001, compared to $34.2 million, or $1.99 per share in 2000.

- •

- Stockholders' equity at December 31, 2001 was $302.6 million, compared to $309.8 million at December 31, 2000.

- •

- Cash generated from operating activities was $84.6 million in 2001, compared to $47.0 million used in 2000, primarily due to payment of claim liabilities last year. Dividends to shareholders were $17.5 million paid from surplus because of net loss for the year.

- •

- At December 31, 2001, Zenith had long-term debt of $57.2 million, compared to $58.4 million at December 31, 2000. This debt matures on May 1, 2002 and cash exists in the parent Company to repay this obligation. Also outstanding was $65.7 million of 8.55% Capital Trust Securities issued in July 1998, maturing in 27 years. TheZenith's parent Company has $70.0 million of bank lines of credit available at year-end.

- •

- Zenith's subsidiaries are rated A-(Excellent) by A.M. Best Company. Moody's Investor's Service and Standard & Poor's have assigned an insurance financial strength rating of Baa1 (Adequate) and A- (Strong), respectively.

Information in the following table provides estimates of Zenith's net incurred losses and loss adjustment expenses for our Workers' Compensation and Reinsurance business by accident year,

6

LOSS RESERVE ADEQUACY IS ESSENTIAL FOR PRICING AND BALANCE SHEET STRENGTH.

evaluated in the year they were incurred and as they were subsequently evaluated in succeeding years. These data are of critical importance in judging the accuracy of our reserve estimates, as well as providing a guide to the setting of fair prices and rates. Our long-term reserve estimates for 1995 and prior have developed favorably based on our analysis of the data at the end of 2001. However, two significant trends in our insurance operations should be discussed relative to our loss reserve estimates for more recent years such as 1996, 1998 and 1999. First, the trend of increasing claims severity in the Workers' Compensation business caused us to increase our loss reserve estimates last year, principally for the 1999 accident year. We continually analyze our Workers' Compensation data and make every effort to price and reserve for this phenomena. Our analysis at year-end 2001 indicates we have adequately reserved for prior years, and that we are entering 2002 with appropriate rates. However, any unanticipated changes in claims severity and/or frequency may be reflected in future loss reserve estimates, and may require appropriate pricing adjustments.

Second, estimating catastrophe losses in the Reinsurance business is highly dependent upon the nature and timing of the event and our ability to obtain timely and accurate information with which to estimate our liability to pay losses. Loss reserve estimates for catastrophes in recent years, notably 1998 and 1999, have developed unfavorably, mainly attributable to Hurricane Georges in 1998 and the major European storms at the end of 1999. Older year loss reserves for casualty Reinsurance business prior to 1995 developed favorably in 2001. At the end of 2001 with respect to our WTC loss estimate, approximately 70% of the loss is attributable to our contractual maximum loss payable under our excess of loss reinsurance contracts; the remainder of the estimated loss is an estimate of the expected loss incurred on assumed quota share reinsurance contracts. There is considerable uncertainty as to the nature and amount of monetary losses associated with the attack on the World Trade Center, however, we believe we have reserved adequately at year end.

7

LOSS RESERVE ADEQUACY IS AN INHERENT RISK OF THE BUSINESS WHICH WE ENDEAVOR TO MINIMIZE THROUGH PROFESSIONAL CLAIM HANDLING AND

ESTIMATING TECHNIQUES.

|

|---|

Accident Year Reserve Development From Operations

|

|---|

|

|---|

| | | | Net incurred losses and loss adjustment expenses reported at end of year |

|

|---|

| Years in which losses were incurred | | | 1995 | | | 1996 | | | 1997 | | | 1998 | | | 1999 | | | 2000 | | | 2001 |

|

|---|

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Prior to 1995 | | $ | 2,043,207 | | $ | 2,031,870 | | $ | 2,023,559 | | $ | 2,601,752 | | $ | 2,604,758 | | $ | 2,610,441 | | $ | 2,592,458 |

| 1995 | | | 180,170 | | | 187,517 | | | 196,335 | | | 341,708 | | | 351,292 | | | 342,839 | | | 339,602 |

| Cumulative | | | 2,223,377 | | | 2,219,387 | | | 2,219,894 | | | 2,943,460 | | | 2,956,050 | | | 2,953,280 | | | 2,932,060 |

| 1996 | | | | | | 181,844 | | | 238,635 | | | 429,335 | | | 443,443 | | | 434,315 | | | 437,821 |

| Cumulative | | | | | | 2,401,231 | | | 2,458,529 | | | 3,372,795 | | | 3,399,493 | | | 3,387,595 | | | 3,369,881 |

| 1997 | | | | | | | | | 204,502 | | | 333,818 | | | 339,907 | | | 346,276 | | | 344,092 |

| Cumulative | | | | | | | | | 2,663,031 | | | 3,706,613 | | | 3,739,400 | | | 3,733,871 | | | 3,713,973 |

| 1998 | | | | | | | | | | | | 258,000 | | | 271,317 | | | 276,768 | | | 283,713 |

| Cumulative | | | | | | | | | | | | 3,964,613 | | | 4,010,717 | | | 4,010,639 | | | 3,997,686 |

| 1999 | | | | | | | | | | | | | | | 278,054 | | | 309,012 | | | 321,584 |

| Cumulative | | | | | | | | | | | | | | | 4,288,771 | | | 4,319,651 | | | 4,319,270 |

| 2000 | | | | | | | | | | | | | | | | | | 306,082 | | | 310,810 |

| Cumulative | | | | | | | | | | | | | | | | | | 4,625,733 | | | 4,630,080 |

| 2001 | | | | | | | | | | | | | | | | | | | | | 427,943 |

| Ratios: | | | | | | | | | | | | | | | | | | | | | |

| 1995 | | | 73.12% | | | 76.10% | | | 79.68% | | | 73.11% | | | 75.16% | | | 73.35% | | | 72.66% |

| 1996 | | | | | | 73.36% | | | 79.35% | | | 80.08% | | | 82.71% | | | 81.01% | | | 81.66% |

| 1997 | | | | | | | | | 75.04% | | | 72.56% | | | 73.88% | | | 75.26% | | | 74.79% |

| 1998 | | | | | | | | | | | | 74.76% | | | 78.62% | | | 80.20% | | | 82.21% |

| 1999 | | | | | | | | | | | | | | | 86.91% | | | 96.58% | | | 100.51% |

| 2000 | | | | | | | | | | | | | | | | | | 88.76% | | | 90.13% |

| 2001 | | | | | | | | | | | | | | | | | | | | | 89.74% |

|

-This analysis displays the development of accident year net incurred losses and loss adjustment expenses on a GAAP basis for accident years 1995-2001 for all property-casualty business. The total of net loss and loss adjustment expenses for all claims occurring within each annual period is shown first at the end of that year and then annually thereafter. The total cost includes both payments made and the estimate of future payments as of each year-end. Past development may not be an accurate indicator of future development since trends and conditions change.

-The data prior to 1999 have been restated to exclude the results of CalFarm Insurance Company, which was sold effective March 31, 1999. Incurred amounts for RISCORP are reported in 1998 and subsequent years but not in 1995-1997.

8

CAPITAL INCREASED BY $25 MILLION WITH THE SALE OF ONE MILLION SHARES

AT 150% OF BOOK VALUE.

INVESTMENTS

Investment activities are a major part of our revenues and earnings; we believe our portfolio is diversified to achieve a reasonable balance of risk and a stable source of earnings. Zenith primarily invests in debt securities, as compared to equities, and our largest holdings are U.S. Government securities. In comparison to other insurers, we believe our portfolio contains a smaller percentage of equities to total assets, and a larger percentage of cash or short-term securities.

- •

- Consolidated investment income after tax and after interest expense was $28.9 million, or $1.64 per share in 2001, compared to $30.6 million, or $1.78 per share in 2000. Average yields on this portfolio in 2001 were 5.6% before tax and 3.7% after tax, respectively, compared to 5.9% and 3.9%, respectively, in 2000.

- •

- During 2001, Zenith recorded net profits before tax from our investment portfolio of $9.2 million, compared to losses of $15.5 million the prior year. The gains were primarily from trading debt securities offset, in part, by writedowns or losses incurred on certain bonds due to declining credit quality or insolvencies.

- •

- Pre-tax income during 2001 from our real estate activities was $5.8 million, compared to $5.5 million the prior year.

- •

- Zenith's investment portfolio increased $92.0 million, or 10.8% in 2001.

- •

- Unrealized losses in our portfolio of fixed maturity investments were $0.6 million before tax in 2001, compared to $14.5 million, before tax the prior year.

Zenith's investment portfolio is recorded in the financial statements primarily at market value. Average life of the bond portfolio was 6.3 years at December 31, 2001, compared to 5.3 years at December 31, 2000. Portfolio quality is high with 95%, 94% and 95% rated investment grade at December 31, 2001, 2000 and 1999, respectively.

9

2001 WORKERS' COMPENSATION PERFORMANCE RESULTED IN A 15 PERCENTAGE POINT IMPROVEMENT IN OUR COMBINED RATIO TO 114%.

The major developments in the U.S. bond markets were continued low inflation and declining interest rates. Since we are capable of holding bonds to maturity, and the average maturities are relatively short, fluctuations in bond values do not significantly impact our operations.

Short-term investments and liquidity remained high as we searched for intelligent investment opportunities and maintained cash to repay our maturing debt in 2002. We have invested only a small amount of our capital in common stocks, since we believed the equity market was overpriced and would not provide a reasonable return. Management will continue to monitor conditions and at an appropriate time may reconsider our strategy.

|

|---|

Securities Portfolio

| At December 31, 2001

| | At December 31, 2000

|

|---|

|

| | | Amortized Cost* | | Market Value | | | Amortized Cost* | | Market Value |

|

| | | (Dollars in Thousands) |

| Short-Term Investments | $ | 119,066 | $ | 119,066 | | $ | 158,438 | $ | 158,438 |

| U.S. Government Bonds | | 176,371 | | 176,275 | | | 161,796 | | 162,262 |

| Taxable Bonds: | | | | | | | | | |

| Investment grade | | 490,183 | | 493,314 | | | 392,218 | | 385,044 |

| Non-investment grade | | 34,983 | | 31,655 | | | 42,216 | | 35,284 |

| Redeemable Preferred Stocks | | 27,023 | | 26,706 | | | 13,644 | | 12,752 |

| Other Preferred Stocks* | | 12,287 | | 11,888 | | | 10,532 | | 9,090 |

| Common Stocks* | | 29,411 | | 28,394 | | | 23,630 | | 27,301 |

|

*Equity securities at cost

| | | | | |

In 1993, we started a home-building operation in order to participate in the growth of the Las Vegas, Nevada housing market. During 2001, we closed and delivered 413 homes at an average selling price of $202,000, compared to 469 homes at an average selling price of $177,000 the prior year. Sales of $84.8 million and $5.8 million of pre-tax income were recorded during 2001, compared to sales of

10

INVESTMENT INCOME AFTER TAX PER SHARE

$84.5 million and $5.5 million of pre-tax income the previous year. Land presently owned at a cost of $30.0 million will support the construction of an estimated 1,300 homes over the next several years.

Changes in interest rates or other factors could affect future home sales (we have not seen any impact so far); we believe the land we have acquired is strategically located and has long-term value.

WORKERS' COMPENSATION

TheZenith is a specialty insurer with primary operations in California, Florida, Texas and 42 other states. Premiums written in 2001 were $423.8 million, an increase of 38% from the prior year. Underwriting losses pre-tax, were reduced to $58.3 million in 2001 compared to $87.9 million in the prior year. Included in underwriting losses were $5.8 million of pre-tax charges for Guaranty Fund assessments and a provision for the Reliance insolvency.

Growth of 38% is caused by the interaction of an increase in number of policies and a change in net rates, experience modifications and payrolls. At year-end 2001, there were 35,500 policies in force, up about 10% from the prior year.

TheZenith's book of business comprises primarily small employers and a few insureds in high-rise buildings. Therefore, we are in position to look for opportunities in this area, but we must charge for the terrorism exposure. With respect to bio-terrorism or travels by our insureds' employees to high profile areas, we are exposed on a more random basis.

We acknowledge TheZenith's underwriting losses are significant and unacceptable. However, they are declining as a result of higher prices, disciplined underwriting and additional revenues. Continued higher average claim costs (health care increases are significant) plus additional exposure to terrorism, necessitate rate increases. Our accident year loss ratios remain substantially below industry averages, as set forth in the table which is on the top of the next page.

11

LOSS RATIOS OUTPERFORM THE WORKERS' COMPENSATION INDUSTRY DUE TO CORE UNDERWRITING, PRICING, CLAIMS AND SERVICE DISCIPLINES.

|

|---|

| | California

| | Outside of California

|

|---|

Accident Year

Loss Ratios

|

|---|

| | Zenith

| | Industry

| | Zenith

| | Industry

|

|---|

|

|---|

| 1996 | | 64% | | 99% | | 51% | | 62% |

| 1997 | | 70% | | 107% | | 53% | | 70% |

| 1998 | | 70% | | 121% | | 56% | | 77% |

| 1999 | | 80% | | 126% | | 61% | | 81% |

| 2000 | | 72% | | 110% | | 64% | | 81% |

| 2001 | | 67% | | — | | 63% | | —

|

TheZenith's loss ratios outperform the industry due to a number of factors: adequate rates, reasonable reserving accuracy, disciplined underwriting and a commitment to quality services. At present, adverse industry results and estimates of large reserve shortfalls are causing many competitors to increase rates significantly. And apparently in some cases, to become more selective in their underwriting creating opportunities for our business.

This strategy causes our premium volume to fluctuate depending on our competitors' pricing strategies and appetites for unprofitable growth. At the same time, it allows us to maintain our discipline and record of producing low loss ratios and outperforming the industry on a consistent basis. Significantly, agents and brokers appreciate the value of our services and want to do business with us, even after long intervals, as long as our pricing is within the competitive "ballpark." Based on current market conditions, we expect California premium to grow faster than in other states.

Along with pricing changes and estimates of large industry reserve shortages, the most significant development last year was the terrorist attacks. Workers' Compensation losses are estimated between $1-$6 billion, the largest in history. (Fortunately, TheZenith did not experience a loss.) Losses will result in price increases adequate to restore the industry's financial health. Individual companies will

12

CLOSE MONITORING OF POLICYHOLDER EMPLOYEES AND LOCATIONS IS ESSENTIAL TO CONTROL OUR TERRORISM RISK.

adjust risk selection strategies and pricing due to the potential of further terrorist acts, lack of reinsurance for terrorism, and concentration of Employers in high profile locations.

2001 claim frequency trends remain favorable despite a weakening economy; on the contrary, severity trends continue to increase in amounts substantially greater than the rate of inflation. These trends are caused primarily by increases in health care costs, now in excess of 50% of our total loss costs. As a result, we must price our new and renewal business accordingly, and establish adequate reserves with the assumption that trends will increase about 15% per year. With this in mind, we are redoubling our efforts to protect ourselves and our insureds from excessive health care charges.

For example, here is a vignette of an unbelievable hospital bill we received this past year. An injured employee had routine back surgery and we were billed $560,000. TheZenith's nurses, claim managers and specialist Workers' Compensation attorneys immediately detected these charges were absurdly excessive. In turn, we prepared to litigate under unfair business practice statutes. Prior to filing the suit, the matter was settled for $20,000 plus an agreement that the hospital would alter its future billing practices to our Company. This story illustrates the required diligence to contain severity trends, and to point out an area of needed attention within the system. Workers' Compensation health care reform must be based on independent professional research because of the complexity of the subject, and the intense political involvement of the participants.

TheZenith is mindful that many of our policyholders are experiencing difficult times due to the economy and price increases. Workers' Compensation coverage, along with other insurance costs, are difficult to absorb. Unfortunately, there is no alternative to price increases due to cost and exposure trends, low levels of interest rates, and the lack of profitability during the past several years. However, employers who instill safe work practices, train their managers in proper Workers' Compensation administration, and cooperate with TheZenith's specialists to reduce loss ratios may well see savings in the ultimate cost of their insurance.

13

OUR TERRORISM RISK IS MINIMIZED BECAUSE WE DO NOT HAVE LARGE CONCENTRATIONS OF POLICYHOLDER EMPLOYEES IN HIGH-PROFILE LOCATIONS OR HIGH-RISE BUILDINGS.

With all due respect, we caution our agents and employers from choosing what may even be a worse choice: self-insurance, either directly or in part through large deductible plans. Why would a business assume Workers' Compensation exposures of uncertain amounts, including terrorism risk, when their basic operations are faced with difficulties of a recessionary environment and low interest rates? Isn't the certainty of fixed costs, with financing available, and access to quality specialist services a better choice? Considering the spread of risk principle of insurance and interest rate environment, the idea an employer or an underwriter can or should risk the Company's bottom line on the outcome of one risk to outperform the averages is simply not prudent.

Last year we wrote: "Incredibly, there are still a number of competitors significantly under-pricing accounts, with managing general agents, reinsurers and not-for-profit companies the major discounters. While their impact will be far less than in recent years, one would think the "message" would have been received by now. Unfortunately, it is easy to predict that the discounters will continue to erode their financial performance, and their ability to provide needed services to assist employers in controlling their costs." While these factors still exist to some degree, we are nevertheless able to find opportunities because of the effectiveness of our service capabilities.

Reinsurance pricing and availability were a possible concern after September 11th, since the Workers' Compensation industry and reinsurers absorbed the largest loss ever. We are pleased to report most of our loyal reinsurers continued to support our program, however at increased rates of about 28%. New reinsurers also expressed the desire to participate. Exclusion of coverage for terrorism excess of a $10 million loss was the major change. The definition of terrorism is quite broad, including, for example, ideological acts and, it is therefore possible future disputes may be anticipated.

14

TERRORISM COVERAGE WILL NOT BE OFFERED IN OUR REINSURANCE POLICIES; WE WILL MAKE A MODEST CHARGE FOR THIS EXPOSURE IN OUR WORKERS' COMPENSATION BUSINESS.

Reducing employer loss ratios, experience modifications, and ultimately the long-term cost of their insurance is our hallmark and our mission. We have specialized for many years in providing these services to employers with a history of high experience modifications. TheZenith's value-added services, implemented in partnership with our policyholders, have an excellent record of delivering against these objectives, and reducing the net cost of insurance to our customers.

- •

- Expert Safety and Health programs assist with accident and illness prevention, incident investigation and remediation, and safe-work practices education for management and employees.

- •

- Claims and Medical/Disability Management procedures facilitate prompt injury reporting, the use of recommended physicians (where permitted state-by-state), nurse case management of serious claims, analysis and negotiation of hospital and medical bills, and continuing communications and reviews to monitor and manage recoveries, costs and reserving.

- •

- Special Investigation Unit and specialized Workers' Compensation legal personnel protect employers from fraud and abuse, negotiate settlements where prudent, and represent policyholders throughout the litigation process as appropriate.

- •

- Return To Work programs place recovering employees in transitional duties with physician approval, improving employer morale and productivity, while containing costs. Recent legislation in California will provide tax credits to stimulate Return To Work involvement by employers.

- •

- Premium Auditors provide proper payroll classifications to assure accuracy and avoid unanticipated retroactive billing.

Quality services require a long-term commitment to the training and development of our Employees, and a stable, motivated work force. We are confident in the abilities of our people to provide above-average results which we witness on a daily basis.

15

AGENTS AND BROKERS APPRECIATE THE VALUE OF OUR SERVICES AND WANT TO DO BUSINESS WITH US, EVEN AFTER LONG INTERVALS, AS LONG AS OUR PRICING IS WITHIN THE COMPETITIVE "BALLPARK."

Regarding the California State Compensation Insurance Fund: its incredible growth, increased market share and decreasing financial strength have significant impacts on California market dynamics. Despite legislative hearings documenting these concerns, the only results are two provisions in the recently adopted legislation adding ex-officio Board members, and requiring a disclaimer of State liability in the Fund's advertising. State Fund officials dismiss these concerns as efforts to restrict their historic competitive role. Our issue is not competing with the State Fund, but rather whether their financial condition is assessed realistically in order to create and maintain a level playing field and not become a contingent financial burden to the State. A new Insurance Commissioner will be elected in California this year, and depending on who is elected, it's possible increased scrutiny and a focus on the facts may occur.

As a result of large insolvencies, it is expected the California Insurance Guarantee Association will be required to fund hundreds of millions of dollars of losses. Each of our policyholders (all policyholders in the State) will be assessed up to 2% of their premiums to cover these losses for several years. Further legislation is anticipated to deal with the needs of the Guaranty Association.

TheZenith further strengthened its financial position in connection with the sale of common stock, by entering into a 10% quota share for three years on new and renewal Workers' Compensation business. This will facilitate our historically conservative financial position while searching for future growth opportunities.

WORKERS' COMPENSATION REGULATION

Politically, significant changes affecting our operations were minimal this past year. Fortunately, the OSHA musculoskeletal regulations did not take effect, but ergonomics issues are a cause for concern and an area where we are increasing our capabilities.

In California, the Governor again vetoed Workers' Compensation legislation, but an improved version of the legislation has been enacted and signed in 2002 to become effective January 1, 2003. Major reform is the elimination of the treating physician presumption (except for pre-designated

16

WORKERS' COMPENSATION LEGISLATION IN CALIFORNIA CONTAINS MANY FAVORABLE REFORMS THAT WILL REDUCE FUTURE LOSS COSTS, DESPITE INCREASED BENEFITS.

personal physicians) which should help control escalating health care costs when it takes effect. Creation of a new management position to supervise the dispute resolution system should improve productivity and costs, and permit the Administrative Director to work more effectively on policy matters. Incentives have been provided to small and medium-sized employers to stimulate early Return To Work programs. And, a medical fee schedule for outpatient services and a pharmaceutical fee schedule will be established. The legislation also mandates an independent study of Workers' Compensation health care costs, since they continue to increase significantly. Benefits will be increased over the next four years by about 16% excluding the impact of reforms and without regard to any change in frequency. We view this as equitable since Workers' Compensation benefits have not changed in California since 1994.

On balance, this legislation is favorable to all concerned and we applaud the process which, for the first time, is based on many key provisions derived from independent research by the Commission on Health and Safety. Obviously, January 1, 2003 rate increases will be necessary to absorb the net costs of the legislation.

REINSURANCE

Since 1985, TheZenith has been selectively underwriting assumed treaty and facultative Reinsurance. Reinsurance represents 13% of our property-casualty volume, while reserves represent 19% of our total property-casualty reserves. We believe this business will continue to provide long-term profitable diversification to our basic Workers' Compensation operations.

WTC losses of September 11th were the largest insured loss ever, with our estimated net loss before taxes at $37.6 million, resulting in a net loss for the year of $31.9 million. Third quarter reserve estimates indicated an incurred loss of $31.0 million, subsequently revised upward to $37.6 million at year-end. Since the inception of our Reinsurance operation 16 years ago, the combined ratio has averaged 103%. Furthermore, we have benefited from investing the reserves. Although large losses

17

THE REINSURANCE BUSINESS CONTINUES TO PROVIDE LONG-TERM DIVERSIFICATION TO OUR BASIC WORKERS' COMPENSATION OPERATIONS.

from terrorism on U.S. soil were never contemplated, we were certainly aware of the possibility of substantial hurricane losses in Long Island and New York City. Terrorism coverage has been excluded in our future Reinsurance policies, and as indicated, prices and terms have been improved for 2002.

As previously stated, one of our objectives was not to risk more than 5% of our capital as a result of any large catastrophe. As projected, the net loss after tax and applicable property catastrophe premiums from 9/11 events was approximately 5% of our capital, a result consistent with our worst case planning.

Accounting for the property catastrophe Reinsurance business has a different result from our other property-casualty business. At the end of each reporting period, income is recognized without reserves being established if no major catastrophe has occurred. In our other businesses, reserves are mandated based upon actual events as well as expected loss patterns. As a result, there may be large fluctuations (positive or negative) in underwriting results for the property catastrophe Reinsurance business in the short-term since only actual events are considered and estimates are then established. Estimating an unprecedented loss such as 9/11, with significant disputes already pending, is not an exact science.

Unfortunately Congress did not legislate terrorism protection via Reinsurance, or its equivalent, prior to year-end. And, providing loans to the industry would be meaningless. Therefore, we urge Congress to provide a risk-sharing mechanism in conjunction with private market solutions.

401(K) PLAN

All Zenith employees are afforded the opportunity to participate in a tax-deferred savings plan organized under section 401(k) of the Internal Revenue Code. Zenith matches 50% of employee contributions that are 6% or less of their salary; at the close of 2001 approximately 86% of our employees were participating. Assets of the plan at year-end were $33.3 million and were placed among a variety of investment opportunities, with approximately 28% of Plan assets invested in our Company's stock.

18

WE ARE CONFIDENT IN THE ABILITIES OF OUR PEOPLE TO PROVIDE ABOVE-AVERAGE SERVICES WHICH WE WITNESS ON A DAILY BASIS.

Mindful of the possibility our employees might desire greater flexibility diversifying their invested retirement savings, we instituted changes to the plan early in 2002. First, the Company matching contributions are no longer automatically invested in Zenith stock. Rather, matching contributions are directed into the same investments our employees chose for their own contributions, and only into Company stock if the employee so chooses. (Note: we do not allow employees to direct more than 20% of their contributions to Company stock; a policy that will continue.) Second, we will allow employees over 40 years of age, with 10 years of service to redirect Company matching contributions made prior to these changes out of Company stock as desired.

These changes will help our employees make and implement sensible choices about their invested retirement savings in a changing and uncertain environment. The plan provides professional education, independent of our executives, to assist employees in their investment decisions. Hopefully, Congressional legislation will be adopted allowing employees to choose their own investments, including a reasonable investment in Zenith stock if they so choose.

INFORMATION TECHNOLOGY

Improving the functionality of our claims systems and delivering services via the Internet are our two primary objectives. Additionally, we are focused on consolidating our three separate systems into a single national network. Work in all these areas will continue in 2002, and beyond, as we insist on improving productivity.

ACCOUNTING DISCLOSURE

Our financial statements include full disclosure of the accounting policies, estimates and judgements used in their preparation. As we have discussed in previous reports, estimation of loss reserves is a significant component of the preparation of our financial statements. The table on page 8,

19

REDUCING EMPLOYER LOSS RATIOS, EXPERIENCE MODIFICATIONS, AND ULTIMATELY THE LONG-TERM COST OF THEIR INSURANCE IS OUR HALLMARK AND OUR MISSION.

which we have included for many years, clearly shows the history of our loss reserve estimates over the years. Our Workers' Compensation actuaries consider several methods of projecting reserves, the most important of which is trending paid losses. We discuss loss reserve estimates and other important accounting matters on pages 6 and 7 and in the Management's Discussion and Analysis and Notes to the Consolidated Financial Statements sections of this report.

CONCLUSION

We are in the business of managing insurance and investment risk on a profitable basis over the long term. As the recent past has demonstrated, losses take place in the short term based upon a variety of different factors. At present, more favorable trends exist in the Workers' Compensation and Reinsurance businesses.

Our actions over the past years have positioned us for continuing growth, declining combined ratios, enhanced financial strength and the restoration of profitability. I am excited about the opportunities ahead, and our entire management team is focused on improving shareholder value. Returns on equity in recent years have not been adequate or consistent with our long-term objectives; therefore, we are committed to restoring our historically-favorable performance. As always, our people are the key to delivering against these objectives. I believe we are blessed with superb, professional talent, and a disciplined profit and service culture made even stronger by recent events. Teamwork and continuing real-time changes to improve customer services are the key ingredients to our future.

Since the events of September 11th, we strengthened our financial position, and will retire our outstanding debt in May 2002 from existing funds. Future earnings will benefit since the funds to repay debt are invested at rates substantially less than the interest cost. Investment income should also benefit from improved cash flows and reinvestments at higher interest rates.

20

WE THANK OUR AGENTS, BROKERS, REINSURERS, SHAREHOLDERS, DIRECTORS AND EXCELLENT EMPLOYEES WHO HAVE ASSISTED THIS MANAGEMENT TEAM FOR THE PAST 25 YEARS WITH OUTSTANDING SERVICE.

Terrorism exposure has been eliminated from our Reinsurance business, but will continue to be a factor in our Workers' Compensation operations. As a result, we must make a reasonable charge for the exposure (where permitted), and closely monitor concentration of risk and locations most vulnerable to potential terrorist events.

We appreciate the confidence of our agents, brokers, reinsurers and shareholders and the wisdom and judgment of our distinguished Directors. These individuals and firms, along with our excellent employees, have assisted this management team for the past 25 years under my leadership, and I want to acknowledge their contributions to our progress and in positioning us for the future.

Stanley R. Zax

Chairman of the Board and President

Woodland Hills, California, March 2002

21

MANAGEMENT'S DISCUSSION AND ANALYSIS OF CONSOLIDATED FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Information

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements if accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those discussed. Forward-looking statements include those related to the plans and objectives of management for future operations, future economic performance, or projections of revenues, income, earnings per share, capital expenditures, dividends, capital structure, or other financial items. Statements containing words such asexpect, anticipate, believe, or similar words that are used in Management's Discussion and Analysis of Financial Condition and Results of Operations, in other parts of this report or in other written or oral information conveyed by or on behalf of Zenith National Insurance Corp. ("Zenith National") and subsidiaries (collectively, "Zenith") are intended to identify forward-looking statements. Zenith undertakes no obligation to update such forward-looking statements, which are subject to a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include but are not limited to the following: (1) heightened competition, particularly intense price competition; (2) adverse state and federal legislation and regulation; (3) changes in interest rates causing fluctuations of investment income and fair values of investments; (4) changes in the frequency and severity of claims and catastrophes; (5) adequacy of loss reserves; (6) changing environment for controlling medical, legal and rehabilitation costs, as well as fraud and abuse; (7) the terrorist attacks of September 11, 2001, any future terrorist attacks and their aftermath; and (8) other risks detailed herein and from time to time in Zenith's other reports and filings with the Securities and Exchange Commission.

Overview

Zenith's long-term source of consolidated earnings is principally the income and investment income from the operation of its property-casualty insurance businesses ("P&C Operations") and its investment portfolio. The P&C Operations are composed of Workers' Compensation, Reinsurance and Other Property-Casualty (through March 31, 1999). Workers' Compensation represents insurance coverage for the statutorily prescribed benefits that employers are required to pay to their employees injured in the course of employment. During 2001, Zenith wrote workers' compensation insurance in 45 states but the largest concentrations, 49.5% and 22.3% of the Workers' Compensation premiums earned during 2001, were in California and Florida, respectively. Reinsurance principally consists of world-wide, assumed reinsurance of property losses from catastrophes and large property risks. Results of the Reinsurance operations can be adversely impacted in periods that sustain large catastrophe losses. Other Property-Casualty, which was operated by CalFarm Insurance Company ("CalFarm"), formerly a wholly-owned subsidiary of Zenith Insurance Company ("Zenith Insurance"), a wholly-owned subsidiary of Zenith National, represented multiple product line direct insurance other than workers' compensation principally in California. Effective March 31, 1999, Zenith sold CalFarm. Results of the P&C Operations for the three years ended December 31, 2001 are set forth in the table that follows.

The Real Estate operations develop land and primarily construct single-family residences in Las Vegas, Nevada. Investment operations provide income and realized gains on investments, primarily from investments in debt securities. The Parent operations represent Zenith National, a holding company which owns, directly or indirectly, all of the capital

22

stock of the P&C Operations, non-insurance companies and other investment securities.

The net loss in 2001 is mainly attributable to losses in the assumed Reinsurance operations associated with the World Trade Center events of September 11, 2001. See discussion below under "Reinsurance." The Workers' Compensation operations are not expected to incur any losses as a result of the events of September 11, 2001.

The comparability of the results of operations in 1999 compared to 2000 and 2001 is affected by two significant items. First, in the third quarter of 1999, Zenith recorded net charges of $50.0 million before tax ($32.5 million after tax, or $1.89 per share) associated with an increase in the estimated net liabilities for unpaid losses and loss adjustment expenses acquired from RISCORP (the "RISCORP Purchase Adjustment"—for a full description of the RISCORP Acquisition and the RISCORP Purchase Adjustment, see Note 14 to the Consolidated Financial Statements). Second, effective March 31, 1999, Zenith sold CalFarm which had previously operated Zenith's Other Property-Casualty operations. The sale of CalFarm resulted in a gain of $104.3 million after tax (see Note 13 to the Consolidated Financial Statements).

The comparative components of net (loss) income after tax for the three years ended December 31, 2001 are set forth in the following table:

| |

|---|

(Dollars in thousands)

| 2001

| | 2000

| | 1999

| |

|---|

| |

|---|

| Net investment income | $ | 33,841 | | $ | 34,243 | | $ | 35,632 | |

| Realized gains (losses) on investments | | 5,960 | | | (10,054 | ) | | 4,993 | |

| |

| Subtotal | | 39,801 | | | 24,189 | | | 40,625 | |

| Property-casualty underwriting results: | | | | | | | | | |

| | Loss excluding catastrophes and RISCORP Purchase Adjustment | | (32,831 | ) | | (53,251 | ) | | (40,404 | ) |

| | Catastrophe losses | | (27,105 | ) | | (14,690 | ) | | (12,285 | ) |

| | RISCORP Purchase Adjustment | | | | | | | | (32,500 | ) |

| |

| Property-casualty underwriting loss | | (59,936 | ) | | (67,941 | ) | | (85,189 | ) |

| Income from Real Estate operations | | 3,746 | | | 3,552 | | | 2,372 | |

| Interest expense | | (4,924 | ) | | (3,666 | ) | | (5,342 | ) |

| Parent expenses | | (2,487 | ) | | (3,927 | ) | | (2,701 | ) |

| |

| Loss before gain on sale of CalFarm and extraordinary item | | (23,800 | ) | | (47,793 | ) | | (50,235 | ) |

| Gain on sale of CalFarm | | | | | | | | 104,335 | |

| Extraordinary item-gain on extinguishment of debt | | | | | 993 | | | | |

| |

| Net (loss) income | $ | (23,800 | ) | $ | (46,800 | ) | $ | 54,100 | |

| |

23

The comparative results of the P&C Operations before tax and combined ratios for the three years ended December 31, 2001 are set forth in the table below. 1999 is presented both including and excluding the RISCORP Purchase Adjustment.

| |

|---|

(Dollars in thousands)

| | 2001

| | 2000

| | 1999(1)

| | 1999(2)

| |

|---|

| |

|---|

| Premiums earned: | | | | | | | | | | | | | |

| | Workers' Compensation: | | | | | | | | | | | | | |

| | | California | | $ | 205,835 | | $ | 137,497 | | $ | 107,929 | | $ | 107,929 | |

| | | Outside California | | | 210,013 | | | 163,336 | | | 164,325 | | | 170,925 | |

| |

| | Total Workers' Compensation | | | 415,848 | | | 300,833 | | | 272,254 | | | 278,854 | |

| | Reinsurance | | | 61,028 | | | 37,919 | | | 36,441 | | | 36,441 | |

| | Other Property-Casualty(3) | | | | | | | | | 54,108 | | | 54,108 | |

| |

| Total | | $ | 476,876 | | $ | 338,752 | | $ | 362,803 | | $ | 369,403 | |

| |

| Underwriting loss before tax: | | | | | | | | | | | | | |

| | Workers' Compensation | | $ | (58,329 | ) | $ | (87,854 | ) | $ | (72,543 | ) | $ | (122,543 | ) |

| | Reinsurance | | | (31,918 | ) | | (14,536 | ) | | (7,324 | ) | | (7,324 | ) |

| | Other Property-Casualty(3) | | | | | | | | | (22 | ) | | (22 | ) |

| |

| Total | | $ | (90,247 | ) | $ | (102,390 | ) | $ | (79,889 | ) | $ | (129,889 | ) |

| |

| Combined loss and expense ratios: | | | | | | | | | | | | | |

| | Workers' Compensation: | | | | | | | | | | | | | |

| | | Loss and loss adjustment expenses | | | 83.8% | | | 96.4% | | | 89.2% | | | 102.5% | |

| | | Underwriting expenses | | | 30.2 | | | 32.8 | | | 37.4 | | | 41.4 | |

| |

| Combined ratio | | | 114.0% | | | 129.2% | | | 126.6% | | | 143.9% | |

| |

| | Reinsurance: | | | | | | | | | | | | | |

| | | Loss and loss adjustment expenses | | | 136.9% | | | 124.0% | | | 105.0% | | | 105.0% | |

| | | Underwriting expenses | | | 15.4 | | | 14.3 | | | 15.1 | | | 15.1 | |

| |

| Combined ratio | | | 152.3% | | | 138.3% | | | 120.1% | | | 120.1% | |

| |

| | Other Property-Casualty(3): | | | | | | | | | | | | | |

| | | Loss and loss adjustment expenses | | | | | | | | | 66.5% | | | 66.5% | |

| | | Underwriting expenses | | | | | | | | | 33.5 | | | 33.5 | |

| |

| Combined ratio | | | | | | | | | 100.0% | | | 100.0% | |

| |

| Total: | | | | | | | | | | | | | |

| | | Loss and loss adjustment expenses | | | 90.6% | | | 99.4% | | | 87.4% | | | 97.5% | |

| | | Underwriting expenses | | | 28.3 | | | 30.8 | | | 34.6 | | | 37.7 | |

| |

| Combined ratio | | | 118.9% | | | 130.2% | | | 122.0% | | | 135.2% | |

| |

(1) Excluding RISCORP Purchase Adjustment

(2) Including RISCORP Purchase Adjustment

(3) CalFarm was sold effective March 31, 1999

24

Zenith's key operating goal for the P&C Operations is to achieve a combined ratio of 100% or lower. The combined ratio, expressed as a percentage, is the key measure of underwriting profitability traditionally used in the property-casualty insurance business. It is the sum of net incurred loss and loss adjustment expenses, underwriting expenses and policyholders' dividends, expressed as a percentage of net premiums earned.

The profitability of the P&C Operations is principally dependent upon the adequacy of rates charged to the insured for insurance protection; the frequency and severity of claims and catastrophes; the ability to accurately estimate and accrue reported and unreported losses in the correct period; and the ability to manage claim costs and keep operating expenses in line with premium volume. Some of the factors that continue to impact the business and economic environment in which Zenith operates include: intense price competition; poor operating results and reports of substantial under estimation of reported loss reserves in the national workers' compensation insurance industry; an uncertain political and regulatory environment, both state and federal; the outlook for economic growth in geographic areas where Zenith operates; the frequency and severity of claims and catastrophes; the changing environment for controlling medical, legal and rehabilitation costs, as well as fraud and abuse; and the terrorist attacks of September 11, 2001, any future attacks and the inability to purchase workers' compensation reinsurance coverage for terrorist acts in adequate amounts or at reasonable rates. Effective January 1, 2002, consistent with industry practice, losses arising from acts of terrorism in the United States were excluded from the coverage by many of the reinsurance companies from which Zenith purchases workers' compensation reinsurance. Zenith has purchased reinsurance protection specifically to cover losses, individually or in the aggregate, in 2002 from acts of terrorism up to $9.0 million in excess of $1.0 million. Effective January 1, 2002, in Zenith's assumed Reinsurance operations losses from acts of terrorism are excluded from the coverage provided by Zenith's assumed reinsurance contracts. Fluctuations in interest rates cause fluctuations in Zenith's investment income and the fair values of its investments. Although management is currently unable to predict the effect of any of the foregoing, these factors, related trends and uncertainties could have a material effect on Zenith's future operations, financial condition and cash flows.

The preparation of financial statements in accordance with Generally Accepted Accounting Principles (GAAP) requires both the use of estimates and judgments relative to the application of appropriate accounting policies. Zenith's accounting policies are described in the Notes to the Consolidated Financial Statements, but three particular matters associated with the application of GAAP and the use of estimates are important to an understanding of Zenith's financial statements. First, accounting for property and casualty insurance operations requires Zenith to estimate its liability for unpaid losses and loss adjustment expenses ("loss reserves") as of the balance sheet date. The amount by which estimated losses, measured subsequently by reference to payments and additional estimates, differ from those originally reported for a period is known as "development." Development is unfavorable when losses ultimately settle for more than the levels at which they were reserved or subsequent estimates indicate a basis for reserve increases on open claims. Development is favorable when losses ultimately settle for less than the amount reserved or subsequent estimates indicate a basis for reducing loss reserves on open claims. Favorable or unfavorable development of loss reserves is reflected currently in earnings. The impact of

25

loss reserve development on results of the P&C operations in each of the three years ended December 31, 2001 is discussed below. A 10-year history of the development of Zenith's loss reserves is set forth in the table on Pages 40 and 41. Zenith's current loss reserve estimates may be subject to development in future years and reserve development may take a very long time to appear because of the uncertainty inherent in currently estimating long term liabilities. Second, in addition to loss reserve estimates, accounting for property and casualty insurance operations requires Zenith to defer and amortize certain direct policy acquisition costs as the underlying policy premiums are earned. At December 31, 2001, deferred policy acquisition costs were $12.7 million related to unearned premiums of $71.3 million. If the expected claims costs and other policy related costs related to the unearned premiums exceeded those unearned premiums a premium deficiency would exist and policy acquisition costs that otherwise were deferred would be expensed. At December 31, 2001 Zenith's estimates indicated that there was no premium deficiency. Third, Zenith makes provision for deferred income taxes based on temporary differences between the tax basis and book basis of assets and liabilities. At December 31, 2001, Zenith recorded a net deferred tax asset of $34.5 million, including an asset of $33.3 million attributable to the fact that Internal Revenue Service regulations require property and casualty insurance companies to discount loss reserves for tax purposes. Zenith does not discount its loss reserves in its financial statements. Zenith's net deferred tax asset is expected to be fully recoverable because all future deductible amounts can be offset by anticipated future taxable income, including investment income or available refunds from prior years.

The following table shows the one-year loss reserve development for loss and loss adjustment expense for the P&C Operations. The one-year loss reserve development is the change recorded in the current year for the estimate of the loss reserves established at the end of the preceding year and reflects a cumulative adjustment to all estimates made in prior years.

|

|---|

(Dollars in thousands)

| | Workers'

Compensation

| | Reinsurance

| | Other

Property-

Casualty(1)

| | Total

|

|---|

|

|---|

| One-year loss development in: | | | | | | | | | | | | |

| | 2001 | | $ | 272 | | $ | 4,075 | | | | | $ | 4,347 |

| | 2000 | | | 8,251 | | | 22,629 | | | | | | 30,880 |

| | 1999(2) | | | 38,767 | | | 7,336 | | $ | (1,279 | ) | | 44,824 |

|

Favorable development is shown in brackets.

(1) CalFarm was sold effective March 31, 1999

(2) Adverse development in 1999 in the Workers' Compensation operation is attributable to the RISCORP Purchase Adjustment.

Zenith continually monitors loss development trends and data to establish adequate premium rates and loss reserves. Two continuing trends in the P&C Operations are significant to Zenith's loss reserve estimates. First, the trend of increasing claims severity in the Workers' Compensation operation has caused some development in prior year reserves. In 2000, Zenith increased its estimate of unpaid Workers' Compensation losses for principally the 1999 accident year by about $8.0 million. In 2001, Zenith's estimates of its prior year Workers' Compensation loss reserves were estimated to be adequate based on the current interpretation of the data, however, estimating the impact of any continuing severity trends is a major risk factor for estimating Zenith's Workers' Compensation loss reserves and for establishing appropriate rates.

Second, estimating catastrophe losses in the Reinsurance business is highly dependent upon the nature and timing of the event and Zenith's ability to obtain timely and accurate information with which to estimate its liability to pay losses. Loss reserve estimates for catastrophe losses in recent years have developed unfavorably as

26

discussed below. In 2001, Zenith incurred a very significant loss in connection with the attack on the World Trade Center on September 11. There is considerable uncertainty as to the nature and amount of monetary losses associated with the attack on the World Trade Center. Zenith has estimated its share of the loss to be approximately $48.0 million by estimating the probable impact to each of its reinsurance contracts based on currently available information. Approximately 70% of the loss is attributable to the contractual maximum loss payable by Zenith under its excess of loss reinsurance contracts; the remainder of the estimated loss is an estimate of its expected loss incurred on assumed quota share reinsurance contracts. Estimates of the impact of the World Trade Center loss and other catastrophes is based on the information that is currently available and such estimates could change based on any new information that becomes available or based upon reinterpretation of existing information.

Additional estimates of the impact of the events in 1999, principally storms in Europe in December of that year, caused unfavorable development in the Reinsurance operation in 2000 and 2001, offset in 2001 by favorable development of loss reserves for older years prior to 1995. Adverse development in the Reinsurance operations in 1999 was principally attributable to increased estimates in 1999 of the loss associated with Hurricane Georges, the principal catastrophe in 1998. The Workers' Compensation reserve strengthening in 1999 is attributable to the RISCORP Purchase Adjustment. In 1999, Zenith re-estimated the reserves acquired from RISCORP in 1998 (see Note 14 to the Consolidated Financial Statements) and the increase in the acquired reserves was recorded as adverse development in 1999 but should be distinguished from adverse development that represents re-estimates of liabilities that originated with Zenith.

Zenith has exposure to asbestos losses in its Workers' Compensation operations for medical, indemnity and loss adjustment expenses associated with covered workers' long-term exposure to asbestos or asbestos-containing materials. Most of these claims date back to the 1970's and early 1980's and Zenith's exposure is generally limited to a pro rata share of the workers' compensation-related loss for the period of time coverage was provided. Zenith also has potential exposure to environmental and asbestos losses and loss adjustment expenses beginning in 1985 through its Reinsurance operations but the business reinsured by Zenith in its Reinsurance operations contains exclusion clauses for environmental and asbestos losses. CalFarm (through March 31, 1999) wrote liability coverage under farmowners' and small commercial policies, however any such liabilities associated with CalFarm were retained by CalFarm when it was sold and Zenith retains no exposure to any such liabilities. Environmental and asbestos losses have not been material to Zenith's results of operations or financial condition and Zenith believes that its reserves for environmental and asbestos losses are appropriately established. However, due to the long term nature of these claims, the ultimate exposure may vary from the amounts currently reserved.

Inflation rates may impact the financial statements and operating results in several areas. Fluctuations in inflation rates impact the market value of the investment portfolio and yields on new investments. Inflation also impacts the portion of the loss reserves that relates to hospital and medical expenses and property claims and loss adjustment expenses, but not the portion of loss reserves that relates to workers' compensation indemnity payments for lost wages which are fixed by statute.

27

Adjustments for inflationary impacts are implicitly included as part of the P&C Operations' continual review of property-casualty reserve estimates. Actuarial account of increased costs is considered in setting adequate rates, and this is particularly important in the health care area where hospital and medical inflation rates have exceeded general inflation rates. Operating expenses, including payrolls, are impacted to a certain degree by the inflation rate.

Workers' Compensation

The following is a discussion of results of the Workers' Compensation operations as set forth in the preceding table excluding the impact of the RISCORP Purchase Adjustment in 1999.

For the past several years, national workers' compensation industry results have been extremely unprofitable as intense competition resulted in inadequate levels of premium rates at the same time as the industry experienced a general trend of declining frequency and of increasing claim severity. In addition, there are reports by certain industry organizations of significant under-reserving in the industry's reported results. Zenith's in-force Workers' Compensation premiums decreased consistently in the several years prior to 2000 as a result of Zenith's endeavors to maintain rate adequacy in the face of intense competition in the national workers' compensation insurance industry. Competitive pricing conditions began to improve in California and certain other states in 2000 and continued in 2001. As a result of this improvement and in conjunction with the rate increases described below, Zenith increased its in-force premiums in California from $98.1 million at December 31, 1999 to $146.7 million at December 31, 2000 and to $210.4 million at December 31, 2001. Outside of California, where competition and pricing are improving only in certain states, Zenith's in-force premiums increased from $145.8 million at December 31, 1999 to $162.4 million at December 31, 2000 and to $209.7 million at December 31, 2001. As a result, premiums earned in the Workers' Compensation operations increased in 2000 compared to 1999 and in 2001 compared to 2000.

Zenith continually monitors loss development trends and data to establish adequate premium rates and loss reserves. In 2000 and 2001, Zenith increased its Workers' Compensation premium rates in California as follows: effective January 1, 2000 by about 8%; effective September 1, 2000 by about 9%; effective January 1, 2001 by about 8%; and effective August 1, 2001 by about 5%. At the beginning of 2002, Zenith further increased its rates in California by about 26% including a 5% charge for terrorism. Rate increases in most of the other states in which it does business were implemented at January 1, 2001 and 2002. However, in Florida, rates are set by the Florida Department of Insurance, and were unchanged in 2000 and 2001.

Underwriting losses in the Workers' Compensation operations decreased in 2001 compared to 2000 principally due to a decrease in the loss ratio and because of the favorable impact of increased premium revenues on the claims operating expense and underwriting expense ratios. Underwriting losses in the Workers' Compensation operations increased in 2000 compared to 1999 principally because of a higher loss ratio in 2000. In 2000, Zenith increased its estimate of California losses for prior years, principally for 1999 as a result of higher than expected claims severity, and about $8.0 million of reserve strengthening is included in the loss ratio and underwriting loss in 2000.

Zenith expects that the future operating profitability of its Workers' Compensation operations will be dependent upon the following: 1) general levels of competition; 2) industry pricing; 3) legislative and regulatory actions; 4) the frequency and severity of terrorist acts, if any, similar to the World Trade Center

28

attack or anthrax events; and 5) management's ability to estimate the impact of any continuing adverse claim severity trends, including increases in the cost of healthcare, on the adequacy of loss reserves and premium rates. Also, claim frequency trends continue to decline, but the reasons therefor are not clear and management is unable to predict whether these trends will continue. Zenith is unable to predict when its Workers' Compensation operations will return to underwriting profitability, although it anticipates continued improvement in the short-run with increases in volume and prices.

In January 2002, the Governor of California signed legislation relating to workers' compensation in California which will become effective January 1, 2003. The legislation provides for increases over the next several years in the benefits payable to injured workers. Other changes include measures to help control costs and encourage return to work of injured workers. Zenith cannot quantify the impact of the legislation at this time, but believes that certain provisions will reduce the costs that would otherwise be associated with future benefits. The major risk factor is whether or not the legislation, or the economy or a combination of both, will change the long term favorable trend of reduced claim frequency and whether or not Zenith can estimate and implement on a timely basis appropriate, relevant rate increases.

In Florida, the Special Disability Trust Fund (the "Fund") assesses workers' compensation insurers to pay for what are commonly referred to as "Second Injuries." Historic assessments have been inadequate to completely fund obligations of the Fund. In late 1997, the Florida statute was amended so that the Fund will not be liable for, and will not reimburse employers or carriers for, Second Injuries occurring on or after January 1, 1998. Zenith Insurance has recorded its receivable from the Fund for Second Injuries based on specific claims and historical experience prior to January 1, 1998. At December 31, 2001 and 2000, the receivable from the Fund was $18.1 million and $31.1 million, respectively, related to the pre-January 1, 1998 claims.

On October 3, 2001, the Commonwealth Court of Pennsylvania issued an Order of Liquidation for Reliance Insurance Company ("Reliance") in response to a petition from the Pennsylvania Department of Insurance. At December 31, 2001, Reliance owed Zenith Insurance $6.0 million of reinsurance recoverable on paid and unpaid losses in connection with reinsurance arrangements assumed by Zenith Insurance in the 1996 acquisition of the Associated General Commerce Self-Insurers' Trust Fund. As of December 31, 2001, Zenith Insurance recorded a $3.0 million provision for impairment of the reinsurance recoverable from Reliance. Zenith Insurance cannot currently predict the ultimate outcome of this matter; but it is possible that if the Pennsylvania Department of Insurance increases its estimates of Reliance's unpaid liabilities or uncollectible reinsurance recoverables without considering additional investment income, Zenith Insurance may not recover any of its reinsurance recoverable from Reliance.

State Guarantee Funds ("Guarantee Funds") exist to ensure that policyholders (holders of direct insurance polices but not of reinsurance policies) receive payment of their claims if insurance companies become insolvent. The Guarantee Funds are funded primarily by statutorily prescribed assessments they bill to other insurance companies doing business in their states. Various mechanisms exist in these states for assessed insurance companies to recover these assessments. Upon the Order of Liquidation of Reliance, the Guarantee Funds became primarily liable for the payment of Reliance's policyholder liabilities. The declaration of an insolvency establishes the presumption that assessments by the Guarantee Funds are probable. Zenith writes workers'

29

compensation insurance in many of the states where Reliance has unpaid workers' compensation liabilities and expects to receive Guarantee Fund assessments, some of which may be based on certain of the premiums it has already earned at December 31, 2001. Accordingly, in the year ended December 31, 2001, Zenith recorded an estimate of $2.8 million (net of expected recoveries of $2.3 million recoverable before the end of 2002) for its expected liability at December 31, 2001 for Guarantee Fund assessments. This estimate is based on currently available information and could change based on additional information or reinterpretation of existing information concerning the Order of Liquidation for Reliance and the actions of the Guarantee Funds. Zenith also expects that it will receive continuing Guarantee Fund assessments in connection with the Reliance insolvency in many of the states in which it writes workers' compensation insurance. The ultimate impact of such assessments will depend upon the amount and timing of the assessments and of any recoveries to which Zenith is entitled.

Reinsurance

Results of the Reinsurance operations may be adversely impacted in years when large catastrophes occur. However, since its inception in 1985, the combined ratio of the Reinsurance operations through December 31, 2001 was 103.0%.