ANNUAL REPORT 2004

ZENITH NATIONAL INSURANCE CORP.

FINANCIAL HIGHLIGHTS

ZENITH NATIONAL INSURANCE CORP. AND SUBSIDIARIES

Year Ended December 31,

| | 2004

| | 2003

| | 2002

| |

|---|

| |

|---|

| RESULTS OF OPERATIONS: | | | (Dollars in thousands, except per share data) | |

| | Total revenues | | $ | 1,044,880 | | $ | 849,335 | | $ | 602,235 | |

| | Net investment income after tax | | | 42,265 | | | 37,966 | | | 32,489 | |

| | Realized gains (losses) on investments after tax | | | 24,726 | | | 12,631 | | | (2,360 | ) |

| |

Income from continuing operations after tax |

|

$ |

117,714 |

|

$ |

65,846 |

|

$ |

1,016 |

|

| | Income from discontinued operations after tax (1) | | | 1,286 | | | 1,154 | | | 9,184 | |

| | |

| |

| |

| |

| | Net income | | $ | 119,000 | | $ | 67,000 | | $ | 10,200 | |

| | |

| |

| |

| |

| PER SHARE DATA: | | | | | | | | | | |

| | Income from continuing operations after tax (2) | | $ | 5.02 | | $ | 3.06 | | $ | 0.05 | |

| | Income from discontinued operations after tax (1)(2) | | | 0.05 | | | 0.05 | | | 0.49 | |

| | |

| |

| |

| |

| | Net income (2) | | $ | 5.07 | | $ | 3.11 | | $ | 0.54 | |

| | |

| |

| |

| |

| | Cash dividends declared per common share | | $ | 1.12 | | $ | 1.00 | | $ | 1.00 | |

KEY STATISTICS: |

|

|

|

|

|

|

|

|

|

|

| | Combined ratios: | | | | | | | | | | |

| | | Workers' compensation | | | 88.5 | % | | 95.9 | % | | 108.7 | % |

| | | Reinsurance | | | 128.2 | % | | 84.3 | % | | 85.6 | % |

| | Stockholders' equity | | $ | 502,147 | | $ | 383,246 | | $ | 317,024 | |

| | Stockholders' equity per share | | | 25.92 | | | 20.27 | | | 16.89 | |

| | Closing common stock price | | | 49.84 | | | 32.55 | | | 23.52 | |

(1) In October 2002, we sold our home-building business and related real estate assets and the results of the discontinued real estate segment are presented as discontinued operations. The gain on the sale in 2002 was $6.3 million after tax, or $0.34 per share. Gains of $2.0 million and $1.8 million before tax ($1.3 million and $1.2 million after tax) were recorded from additional sales proceeds received in 2004 and 2003, respectively, under the earn-out provision of the sale.

(2) Diluted per share amounts for the years ended December 31, 2004 and 2003 reflect the impact of additional shares issuable in connection with Zenith's 5.75% Convertible Senior Notes. Diluted per share amounts for the year ended December 31, 2003 have been restated to include such additional shares (see Note 14 to the Consolidated Financial Statements).

1

TABLE OF CONTENTS

• |

Letter to Stockholders |

|

3 |

• |

Management's Discussion and Analysis of Consolidated

Financial Condition and Results of Operations |

|

28 |

• |

5-Year Summary of Selected Financial Information |

|

56 |

• |

Consolidated Balance Sheets |

|

58 |

• |

Consolidated Statements of Operations |

|

59 |

• |

Consolidated Statements of Cash Flows |

|

60 |

• |

Consolidated Statements of Stockholders' Equity and Consolidated Statements of Comprehensive Income |

|

62 |

• |

Notes to Consolidated Financial Statements |

|

63 |

• |

Report of Independent Registered Public Accounting Firm |

|

92 |

• |

Certifications and Management's Report on Internal Controls over Financial Reporting |

|

94 |

• |

Corporate Directory |

|

|

|

Zenith National Insurance Corp. |

|

98 |

|

Zenith Insurance Company |

|

99 |

|

TheZenith Marketing, Underwriting and Claims Offices |

|

100 |

TheZenith and Zenith are registered U.S. trademarks.

2

TO OUR STOCKHOLDERS

TheZenith generated record revenues, earnings and operating cash flow during 2004.

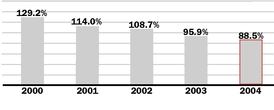

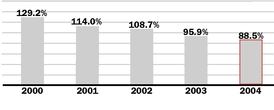

We operate in two insurance business segments: workers' compensation and reinsurance. Workers' compensation trends continued favorable with growth in revenues and income, moderate inflation trends compared to our estimates, and stable indemnity claim frequency resulting in a combined ratio of 88.5%. Reinsurance operations lost money due to the Florida hurricanes.

Zenith's investment portfolio increased from $1.5 billion to $1.9 billion, including cash, treasury bills and United States government securities maturing in two years or less in the amount of approximately $900 million at year-end. We believe that this liquidity will provide opportunities for additional investment income due to the trend of increasing short-term interest rates by the Federal Reserve Board.

We approach the new year with optimism that the combination of our human capital, profit culture, customer service strategy, quality information and financial strength will continue to support favorable results for our insureds, claimants, and shareholders alike. California and Florida, the two states that provide about 86% of our workers' compensation business, are profitable and growing, and operating trends and market conditions are attractive for TheZenith's strategy.

Management's challenge is to continue to outperform the industry under changing conditions as we have accomplished in the past. We are focused on our opportunities with the goal of increasing income while servicing a growing customer base. In a world where diminished expectations of service quality seem to be the norm, our employees are focused on customer-responsive performance and the improvement of our already high service standards. This report will discuss our challenges and opportunities along with current trends.

3

NET INCOME IN 2004 WAS $119.0 MILLION, OR $5.07 PER SHARE, COMPARED TO $67.0 MILLION, OR $3.11 PER SHARE, IN 2003.

FINANCIAL SUMMARY

1. Workers' Compensation Segment:

- •

- Income was $104.1 million compared to $29.3 million in 2003.

- •

- Combined ratio improved to 88.5% from 95.9% in 2003.

- •

- Premiums written increased 27% to $1,079.0 million.

- •

- Premiums in-force increased 20.4% to about $1,042.3 million.

- •

- Rates are adequate with inflation trends moderating.

- •

- Industry combined ratio for 2004 estimated at 106.6% by A.M. Best Company.

2. Additional Financial Stability:

- •

- Cash flow from operating activities was $345.9 million in 2004 compared to $283.8 million the prior year.

- •

- Statutory capital of the insurance business increased by $113.5 million to $573.3 million.

- •

- Shareholders' equity increased by $118.9 million to $502.1 million.

- •

- $125 million of 5.75% Convertible Senior Notes are presently convertible into 5 million shares of Zenith National common stock.

- •

- Market capitalization of TheZenith at year-end was $1,214.6 million, including 5.0 million shares issuable in connection with the Convertible Senior Notes, compared to $778.3 million at December 31, 2003 on the same basis.

3. Net Income:

- •

- Net income was $119.0 million compared to $67.0 million in 2003.

- •

- Net income per diluted share was $5.07 compared to $3.11 the prior year.

- •

- Reinsurance losses due to Florida hurricanes, including Advent, reduced net income by $18.4 million, or $0.75 per share.

- •

- Return on average equity was 27.2% compared to 18.8% the prior year.

4

STOCKHOLDERS' EQUITY PER SHARE

4. Investments:

- •

- Investment income before tax was $61.9 million in 2004 compared with $56.1 million the prior year.

- •

- Reduced average yield was due to lower interest rates.

- •

- Investment portfolio increased from $1.5 billion in 2003 to $1.9 billion in 2004.

- •

- Capital gains before tax in 2004 were $38.6 million compared to $19.4 million the prior year.

- •

- Unrealized portfolio gains were $65.0 million before tax compared to $46.0 million the prior year.

ANALYSIS

The following table summarizes pre-tax workers' compensation and reinsurance results during the past three years.

| |

|---|

Segment Income (Loss)

| | 2004

| | 2003

| | 2002

| |

|---|

| |

|---|

| | | | (Dollars in thousands) | |

| Workers' Compensation | | $ | 104,098 | | $ | 29,260 | | $ | (43,848 | ) |

| Reinsurance | | | (11,956 | ) | | 9,562 | | | 7,644 | |

| Catastrophe losses included in Reinsurance segment* | | | (21,100 | ) | | 0 | | | (400 | ) |

| |

*Additional catastrophe losses in 2004 from Advent Capital were $7.3 million before tax. |

|

2004 results improved significantly:

- •

- 2004 combined ratio for the workers' compensation segment was 88.5% compared to 95.9% in 2003.

- •

- Accident year combined ratios for the workers' compensation operations were 86.3%, 89.1%, and 106.6% for 2004, 2003 and 2002, respectively.

- •

- Combined ratio for the reinsurance segment was 128.2% in 2004 compared to 84.3% in 2003.

5

STOCKHOLDERS' EQUITY INCREASED TO $502.1 MILLION COMPARED TO $383.2 MILLION AT DECEMBER 31, 2003.

- •

- Gross written insurance premiums were $1,119.7 million in 2004 compared to $900.0 million the prior year, an increase of 24.4%. The 10% quota share on our workers' compensation business terminated December 31, 2004.

- •

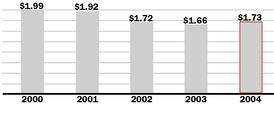

- Investment income after tax was $42.3 million, or $1.73 per share, in 2004 compared to $38.0 million, or $1.66 per share, in 2003.

- •

- Stockholders' equity at December 31, 2004 was $502.1 million compared to $383.2 million at December 31, 2003.

- •

- Net cash flow from operating activities was $345.9 million in 2004 compared to $283.8 million in 2003.

- •

- At December 31, 2004, Zenith had debt of $125 million due to the sale of the 5.75% Convertible Senior Notes in March 2003. These notes are convertible into Zenith common stock until March 31, 2005 with future conversion dependent upon the price of Zenith common stock. There were also $59 million outstanding of our 8.55% Capital Trust Securities issued in July 1998, maturing in 24 years. TheZenith's parent company had $63.9 million of cash and investments and bank lines of credit of $50.0 million available at year-end, which can be utilized to provide statutory capital for our insurance subsidiaries or for general corporate purposes.

- •

- Zenith's subsidiaries are rated A- (Excellent) by A.M. Best Company. Moody's Investors Service and Standard & Poor's have assigned insurance financial strength ratings of Baa1 (Adequate) and BBB+ (Good), respectively.

- •

- Dividends to shareholders were $21.5 million in 2004 compared to $18.8 million in 2003.

6

NET INCOME (LOSS) PER COMMON SHARE

RESERVES

Information in the following table provides estimates of Zenith's net incurred losses and loss adjustment expenses for our workers' compensation and reinsurance segments by accident year, evaluated in the year they were incurred and as they were subsequently evaluated in succeeding years. These data are of critical importance in judging the historical accuracy of our reserve estimates, as well as providing a guide to setting fair prices and rates. The accuracy of reserve estimates is one of our major business risks which we endeavor to manage professionally. Loss reserve estimates are refined continually in an ongoing process as experience develops, new information is obtained and evaluated, and claims are reported and paid. The inflation trend of paid claim costs compared to the inflation assumptions included in the loss reserve estimates is the most important factor in understanding reserve adequacy. Data from 2004 indicate that inflation trends for the current and recent accident years are moderating thereby adding to our confidence in our loss reserve estimates while enhancing current profitability and providing the basis for possible additional rate decreases in the future. Adverse loss development was lower in 2004 than in the prior year. For additional information on reserving and inflation trends, the reader should turn to pages 36 to 41 of this report.

Estimating catastrophe losses in the reinsurance business is highly dependent upon the nature and timing of the event and our ability to obtain timely and accurate information with which to estimate our liability to pay losses. There remains uncertainty as to the nature and amount of monetary losses associated with the Florida hurricanes in 2004, although many of our treaties already are reflecting maximum losses.

7

THEZENITH 2004 RESULTS WERE EXCELLENT DUE TO CONTINUED FAVORABLE TRENDS IN OUR WORKERS' COMPENSATION BUSINESS.

|

|---|

Accident Year Reserve Development from Operations

|

|---|

|

|---|

| | | | Net incurred losses and loss adjustment expenses reported at end of year |

|

|---|

Years in which losses were incurred |

|

|

1998 |

|

|

1999 |

|

|

2000 |

|

|

2001 |

|

|

2002 |

|

|

2003 |

|

|

2004 |

|

|---|

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Prior to 1998 | | $ | 3,616,182 | | $ | 3,648,969 | | $ | 3,643,440 | | $ | 3,623,542 | | $ | 3,633,991 | | $ | 3,628,924 | | $ | 3,652,979 |

| 1998 | | | 250,657 | | | 263,974 | | | 269,425 | | | 276,370 | | | 276,909 | | | 282,469 | | | 284,919 |

| Cumulative | | | 3,866,839 | | | 3,912,943 | | | 3,912,865 | | | 3,899,912 | | | 3,910,900 | | | 3,911,393 | | | 3,937,898 |

| 1999 | | | | | | 262,932 | | | 293,890 | | | 306,462 | | | 298,644 | | | 310,080 | | | 306,654 |

| Cumulative | | | | | | 4,175,875 | | | 4,206,755 | | | 4,206,374 | | | 4,209,544 | | | 4,221,473 | | | 4,244,552 |

| 2000 | | | | | | | | | 289,946 | | | 294,674 | | | 304,251 | | | 311,853 | | | 321,447 |

| Cumulative | | | | | | | | | 4,496,701 | | | 4,501,048 | | | 4,513,795 | | | 4,533,326 | | | 4,565,999 |

| 2001 | | | | | | | | | | | | 409,586 | | | 426,007 | | | 437,452 | | | 447,619 |

| Cumulative | | | | | | | | | | | | 4,910,634 | | | 4,939,802 | | | 4,970,778 | | | 5,013,618 |

| 2002 | | | | | | | | | | | | | | | 391,960 | | | 375,199 | | | 397,817 |

| Cumulative | | | | | | | | | | | | | | | 5,331,762 | | | 5,345,977 | | | 5,411,435 |

| 2003 | | | | | | | | | | | | | | | | | | 523,707 | | | 471,615 |

| Cumulative | | | | | | | | | | | | | | | | | | 5,869,684 | | | 5,883,050 |

| 2004 | | | | | | | | | | | | | | | | | | | | | 615,397 |

| Cumulative | | | | | | | | | | | | | | | | | | | | | 6,498,447 |

| Loss and loss adjustment expense ratios: | | | | | | | | | | | | | | | | | | |

| 1998 | | | 72.6% | | | 76.5% | | | 78.1% | | | 80.1% | | | 80.2% | | | 81.9% | | | 82.6% |

| 1999 | | | | | | 83.4% | | | 93.2% | | | 97.2% | | | 94.7% | | | 98.3% | | | 97.3% |

| 2000 | | | | | | | | | 85.6% | | | 87.0% | | | 89.8% | | | 92.1% | | | 94.9% |

| 2001 | | | | | | | | | | | | 85.9% | | | 89.3% | | | 91.7% | | | 93.9% |

| 2002 | | | | | | | | | | | | | | | 70.4% | | | 67.4% | | | 71.4% |

| 2003 | | | | | | | | | | | | | | | | | | 67.7% | | | 60.9% |

| 2004 | | | | | | | | | | | | | | | | | | | | | 65.2% |

|

This analysis displays the accident year net incurred losses and loss adjustment expenses on a GAAP basis for accident years prior to 1998 and for each of the accident years 1998-2004 for all property-casualty business. The total of net loss and loss adjustment expenses for all claims occurring within each annual period is shown first at the end of that year and then annually thereafter. The total cost includes both payments made and the estimate of future payments as of each year-end. Past development may not be an accurate indicator of future development since trends and conditions change. The data prior to 1999 have been restated to exclude the results of CalFarm Insurance Company, which was sold effective March 31, 1999.

Adverse loss reserve development in recent years has been attributable to higher than expected workers' compensation claim severity, adverse development of catastrophe losses and an increase in the loss reserves assumed in the purchase of RISCORP.

8

INVESTMENT INCOME AFTER TAX PER SHARE

INVESTMENTS

Investment activities are a major part of our revenues and earnings; we believe our portfolio is diversified to achieve a reasonable balance of risk and a stable source of earnings. Zenith primarily invests in debt securities, as compared to equity securities, and our largest holdings are cash and short-term U.S. Government securities. In comparison to other insurers, we believe our portfolio contains a smaller percentage of equity securities to total assets, a larger percentage of cash or short-term securities, and no derivative securities or credit enhancement exposure.

- •

- Consolidated investment income after tax and after interest expense was $33.8 million, or $1.59 per share, in 2004 compared to $29.9 million, or $1.49 per share, in 2003. Average yields on this portfolio in 2004 were 3.8% before tax and 2.5% after tax compared to 4.4% and 2.9%, respectively, in 2003.

- •

- During 2004, Zenith recorded capital gains before tax of $38.6 million compared to $19.4 million the prior year.

- •

- Zenith's investment portfolio increased $369.5 million, or 24.1%, in 2004 to $1.9 billion.

- •

- Net unrealized gains in our portfolio were $65.0 million before tax in 2004 compared to $46.0 million before tax the prior year.

- •

- Zenith's investment portfolio is recorded in the financial statements primarily at market value. Average life of the portfolio was 4.6 years at December 31, 2004 compared to 5.7 years at December 31, 2003. The portfolio quality is high, with 95% and 94% of fixed maturity securities rated investment grade at December 31, 2004 and 2003, respectively.

The major developments affecting the U.S. bond markets were continued low inflation and fluctuating interest rates with the Federal Reserve Board increasing short rates. Long rates ended the year about unchanged from the prior year. Since we are capable of holding bonds to maturity, and the

9

CAPITAL GAINS IN 2004 WERE SIGNIFICANT — $24.7 MILLION, OR $1.01 PER SHARE, COMPARED TO $12.6 MILLION, OR $0.55 PER SHARE, IN 2003.

average maturities are relatively short, fluctuations in bond values do not significantly impact our operations.

Short-term investments and liquidity remained high as we searched for investment opportunities. We have invested only a small amount of our capital in common stocks, since we believe the volatility in the market could impact our ability to expand our insurance business. Our largest common stock holding, Wynn Resorts, of which I am a Director, has performed well since our purchase of one million shares at $13.00 in October, 2002. We realized a gain of $14.1 million before tax in 2004 and retain 750,000 shares with an unrealized gain of $40.4 million at year-end. We believe Wynn Resorts has excellent opportunities in Las Vegas and Macao, however, we sold some shares to prevent an over concentration in one security due to the substantial increase in market value.

|

|---|

Securities Portfolio

| At December 31, 2004

| | At December 31, 2003

|

|---|

|

| | Amortized Cost* | Market Value | | Amortized Cost* | Market Value |

|

| | (Dollars in Thousands) |

Short-term investments,

U.S. Govt. and other securities

maturing within 2 years | $ 901,820 | $ 901,296 | | $ 418,058 | $ 420,405 |

| Other fixed maturity securities: | | | | | |

| Taxable, investment grade | 621,014 | 638,927 | | 748,543 | 770,215 |

| Taxable, non-investment grade | 46,886 | 48,711 | | 27,739 | 28,925 |

| Municipal bonds | 127,378 | 127,242 | | 123,510 | 122,827 |

| Redeemable preferred stocks | 24,741 | 27,553 | | 21,752 | 24,750 |

| Mortgage loans* | 12,645 | 12,645 | | 39,123 | 39,123 |

| Other preferred stocks* | 4,732 | 4,857 | | 10,241 | 10,772 |

| Common stocks* | 58,230 | 101,205 | | 34,211 | 52,189 |

| Other* | 40,146 | 40,146 | | 63,100 | 63,100 |

|

| Total | $1,837,592 | $1,902,582 | | $1,486,277 | $1,532,306 |

|

*Equity securities and other investments at cost. Mortgage loans at unpaid principal balance. |

10

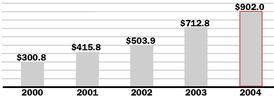

WORKERS' COMPENSATION PREMIUM EARNED (000)

From time to time, on a selective basis, we find excellent real estate investment opportunities. During 2003 we pursued two investments, as follows:

- •

- Development of a 3.2 acre site near our Sarasota, Florida office with a partner: The project includes a Whole Foods Market, a parking structure, 23,000 square feet of commercial property and 95 condominium residences. Whole Foods opened in December 2004 and the balance of the project will be completed in the summer of 2005. The condominiums have been sold and we expect a good return on our investment.

- •

- Land development financing in California on a first mortgage basis with a bonus interest based on the profitable sale of the development: The loan was for $15.0 million for two years with interest and a profit participation. The land development is fully entitled for 494 family homes and 231 condominiums, and a contract was entered into in the fourth quarter of 2004 to sell the property. The sale was consummated in January 2005 and we have received the repayment of our loan and $2.7 million of bonus interest.

During 2004, we received distributions from real estate investment partnerships entered into several years ago, recording capital gains from these partnerships in the amount of $15.6 million. Zenith also received $2.0 million additional proceeds from the sale of our Las Vegas home-building business which is recorded as discontinued operations. At present, except for the above-mentioned Sarasota development where we have $2.8 million invested, we are not involved in any commercial real estate investments.

11

OUR WORKERS' COMPENSATION PREMIUMS EXCEEDED $1.0 BILLION AND THE COMBINED RATIO WAS 88.5% IN 2004.

WORKERS' COMPENSATION

TheZenith is a workers' compensation specialist with primary operations in California and Florida and 43 other states. We believe TheZenith ranks among the top five underwriters in California and Florida, the two states in which we write 86% of our business. We do not have any planned goals as to size, market share or ranking, but are focused on providing quality services to our insureds and a fair return to our shareholders.

Gross premiums written in 2004 were $1,079.0 million, an increase of 27.1% from the prior year. California premiums were 69% of the total. Profits before tax in this segment were a record $104.1 million in 2004 compared to $29.3 million in the prior year. During the past five years, our loss from this segment was $56.7 million, or 2.0% of earned premium. We are focused on improving our five-year average in the current year.

TheZenith's combined ratio improved to 88.5% in 2004 from 95.9% the prior year. Industry combined ratios for workers' compensation are estimated at 106.6% and 108.2%, respectively, for 2004 and 2003. We are pleased with our strategy and culture which have produced results substantially better than industry averages over a long period of time. These results provide the financial strength to continue and enhance our customer service strategy, to support capital for growth, and enhance our ability to assume risk.

Premium growth of about 27% and 46% these past two years was a result of the interaction of an increase in the number of policies and a change in net rates, experience modifications and payrolls. We estimate that the majority of the growth in premiums was due to rate changes and the balance is from our growth in payroll and policies. At year-end 2004, there were 43,400 policies in-force, up 4.6% from the prior year. We have a very diversified group of policies; by size, geography and classes of

12

WORKERS' COMPENSATION COMBINED RATIO

business, including charities and not-for-profit employers. TheZenith offers guaranteed cost (the vast majority of our policies), deductible, dividend and retro plans. Restaurants represent the largest premium class of insureds.

Rates are estimated to have increased 2.3% in 2004 and are expected to decrease in 2005 due to reductions in cost trends primarily related to reform legislation discussed later in this report. California increases were larger and amounted to about 3.7% in 2004. California 2005 rates are expected to be lower than in the past two years due to the recently enacted reform legislation and favorable inflation trends, but at amounts still sufficient to cover the estimated loss cost trends and to provide a reasonable underwriting profit. Specifically, policyholders in the first half of the year will receive rate decreases instituted in July 2004 and January 2005 which approximate 12%. The precise rate may be more or less than 12% depending upon individual risk characteristics. Additional rate changes may be advisable depending on developments, including specific trends caused by the new benefit and reform legislation, healthcare inflation, interest rate levels and loss development. These decisions will be made as new data are available.

Our workers' compensation segment profits are a result of premium growth, moderate indemnity frequency trends and high severity trends on certain types of claims coupled with our consistently focused customer service strategy. Specifically, rate levels continue to exceed short-term estimated loss costs. Our current pricing will continue until we receive additional data as to the comparison of estimated loss cost trends to actual experience. These data are received and analyzed thoroughly after each quarter. Reserve adequacy continues and we have a high degree of comfort that we are dealing prudently with the comparison of inflation trends in paid claim costs compared to the estimated impact of those trends on our reserves and rates. This is crucial with respect to the recent accident

13

OPERATING CASH FLOW INCREASED TO $345.9 MILLION COMPARED TO $283.8 MILLION IN THE PRIOR YEAR.

years where data are more speculative and estimates are more significant. Our accident year loss ratios remain substantially below industry averages, as set forth in the following table:

|

|---|

| | California

| | Outside of California

|

|---|

Accident Year

Loss Ratios

|

|---|

| | Zenith

| | Industry

| | Zenith

| | Industry

|

|---|

|

|---|

| 1998 | | 80% | | 130% | | 50% | | 81% |

| 1999 | | 91% | | 138% | | 55% | | 88% |

| 2000 | | 87% | | 124% | | 56% | | 90% |

| 2001 | | 81% | | 107% | | 53% | | 80% |

| 2002 | | 65% | | 86% | | 50% | | 71% |

| 2003 | | 48% | | 57% | | 48% | | 67% |

| 2004 | | 43% | | — | | 53% | | — |

The favorable comparisons set forth above are due to a number of factors: actuarial rates, agency relationships, reasonable (not perfect) reserving accuracy, disciplined underwriting, reform legislation and our commitment to quality customer services. Most importantly, the excellent performance of our people makes the difference. At present, continuing improved industry results in California compared to the U.S. workers' compensation results, and favorable reform legislation, are providing a more positive operating environment. As a result, there is healthy competition in the California marketplace, including employers' increased appetite for retaining insurance risk. We also expect a few new specialty competitors in the market actively pursuing business. Plus, Berkshire Hathaway who made a deal to take over another insurer's book of business. And, national multi-line companies that have been relatively inactive in California are now testing the waters on a selective basis. The need to generate an adequate return on capital in a low interest rate environment prevents some irresponsible competition to some degree. However, from time to time, there always seems to be a few aggressive

14

OUR COST-BASED PRICING IS TRENDING DOWNWARD, CONSISTENT WITH THE DECLINE IN INFLATION TRENDS.

discounters in certain areas pursuing selected risks. The California State Fund is reporting improved financial results and is probably reducing its market share. TheZenith is a beneficiary of the State Fund strategy and as a result we are expanding our number of policies in-force and premium volume.

We adhere to disciplined and consistent underwriting and service principles and we are dedicated to pricing strategies anticipated to generate an underwriting profit. Significantly, our agents and brokers offer us numerous opportunities, however, we are successful in writing only a small proportion of the business. Based on current market conditions, we expect California to continue to be our most important state representing more than one half of our volume.

At present, California is about a $24 billion market and our California in-force premium at year-end was $731.3 million compared to $587.9 million at the end of 2003. As reported, our total national in-force premium at year-end was $1,042.3 million, an increase of 20.4% from the prior year. (In-force premiums differ from the accounting statement terminology of written and earned premium and are estimates of the premium to be received on all policies prior to their expirations.) Early 2005 results reflect additional growth in premium and policies primarily in California and Florida. Specifically, California in-force premium and total in-force premium were $769.5 million and $1,094.3 million, respectively, at the end of January 2005.

Claim frequency trends in 2004 remained favorable despite the increase in business and the changing economy; severity trends continue in recent years at reduced levels; and our ultimate estimates reflect history and uncertainty as to the long-term outcome of the reform legislation. Severity trends are caused primarily by significant increases in health care and drug costs, now in excess of 50% of our total loss costs, in the duration and amount of temporary disability, and in benefit levels and disability ratings. The frequency of medical-only cases in California seems to be growing due, perhaps, to the new $10,000 legislated benefit. Disputes relating to utilization guidelines are frequent

15

REFORMS APPEAR FAVORABLE, BUT TIME AND DATA ARE ESSENTIAL TO VALIDATE SHORT-TERM TRENDS.

and it is too early to reach any conclusion as to the financial impact. With this in mind, we continue our efforts to protect our financial strength and our policyholders by establishing adequate rates, by challenging excessive health care services/charges and other questionable aspects of the claim process, and by improving our customer service strategy.

TheZenith is mindful that many of our policyholders are experiencing difficult times due to the economy and increases in insurance costs, including workers' compensation premiums, which are difficult to absorb. This is particularly the case with charities and not-for-profit philanthropic organizations. It is also the case for self-insureds and cities, counties and governmental entities due to the cost drivers in the system. There is no alternative to cost-based pricing designed to achieve reasonable profits. We need not apologize to our customers or anyone else for being in business to make profits, particularly after the long period of losses. During 2004 we witnessed the beginnings of moderation in paid claims cost trends and reduced rates accordingly. We will continue to monitor our data and adjust rates, if appropriate, based upon additional information, but we will also remain focused on supporting our recent underwriting profitability and reserve adequacy. Profitability provides capital for expansion and the confidence to assume risk, including the risks involved in reducing rates. Many of our customers received renewal prices substantially lower than rate changes due to favorable history and lower experience modifications — a good sign that our service strategy and the system are working as intended.

Certain small policyholders who rarely have claims cannot comprehend, however, the reason their insurance costs are at relatively high levels. Although we can appreciate the problem, the basic principle of insurance requires that all policyholders contribute to create a larger pool to pay for the cost trends of all claims, even though each insured's claim history varies from zero claims to one or more in any year. Small policyholders frequently have large claims that cost from hundreds of

16

WORKERS' COMPENSATION RESERVE TRANSPARENCY AND ADEQUACY IS APPARENT BY STUDYING OUR INFLATION TRENDS ON PAGE 38.

thousands of dollars to more than a million dollars. If everyone did not contribute to these costs, insurance would not be available. There is no evidence that loss ratios on small policies as a group are lower than our overall loss ratio and, therefore, lower rates are not justified by the facts.

As a result of large insurance company insolvencies, it is expected the California Insurance Guarantee Association will be required to fund hundreds of millions of dollars in losses. Under current law, each of our policyholders (and all policyholders in the state) will be assessed up to 2% of their premiums annually to cover these losses for the foreseeable future.

Our catastrophe management strategies are designed to mitigate our exposure to earthquakes and terrorism. Through a combination of reinsurance and carefully tracking our exposures with technology, we are focused on controlling our risks.

THEZENITH'S MISSION

Reducing employer loss ratios, experience modifications and ultimately the long-term cost of their insurance is our hallmark and our mission. We have specialized for many years in providing necessary services and information to assist employers and their agents or brokers. TheZenith's value-added services, implemented in partnership with our policyholders, agents and brokers, have an excellent record of reducing the net cost of insurance to many of our customers.

- •

- Expert Safety and Health professionals and programs assist with accident and illness prevention, incident investigation and remediation, and safe work practices education and motivation for management and employees.

- •

- Claims and Medical/Disability Management procedures facilitate prompt injury reporting, the use of recommended physicians (where permitted state-by-state), nurse case management of serious claims, analysis and negotiation of hospital and medical bills, and ongoing communications and reviews to monitor and manage recoveries, costs and reserving. We attempt to minimize claims

17

THEZENITH'S 2004 WORKERS' COMPENSATION COMBINED RATIO WAS 88.5% COMPARED TO INDUSTRY ESTIMATES OF 106.6%.

costs by primarily utilizing the services of our internal claim staff, including claim, health and legal professionals.

- •

- Fraud experts, coupled with healthcare professionals and specialized workers' compensation legal personnel, protect employers from fraud and abuse, cooperate with law enforcement agencies, negotiate settlements where prudent, and represent policyholders and our Company throughout the litigation process as appropriate.

- •

- Return-to-Work programs place recovering employees in transitional duties with physician approval, improving employer morale and productivity, while containing costs. We have intensified our efforts to work with employers in this important area.

- •

- Premium auditors provide proper payroll classifications to assure accuracy and avoid unanticipated retroactive billing.

- •

- E-Commerce on the Internet provides valuable current information to our agents and insureds. Also, some agents obtain quotes and write business through our technology.

Quality services require a substantial infrastructure investment in experienced employees and technology. Change continues at a rapid pace and, therefore, we have a long-term commitment to invest in the continuous training and development of our people. TheZenith's objective is a stable, self-motivated workforce. Teamwork in concert with technology among the different disciplines provides an above average result. As our business has grown and its complexity increased, we have hired and trained additional employees to support our quality services. At year-end 2004, there were 1,600 employees serving our customers compared to 1,400 at the end of 2003. We are confident in the abilities of our staff and management to build upon, and continue to improve, our services and their effectiveness in a fast changing environment. Our people are our most important asset. Training, teamwork and technology, along with specialization, are providing major improvements in our focus

18

TEAMWORK, TALENTED PEOPLE AND TRAINING FOCUSED ON PERFORMANCE MAKE A DIFFERENCE.

and capabilities resulting in benefits to our customers and shareholders. We strongly believe that this strategy is superior to outsourced services used by competitors.

CALIFORNIA AND FLORIDA REFORMS

California and Florida passed reform legislation in 2003 and California did it again in 2004. The approach to reform was different in each state, but coincidentally the estimated impact reduced rates in 2004 and further in 2005.

In Florida, the primary changes related to compensability of claims, disability benefits and attorney fees. In California, the primary changes related to medical costs and in 2005 the calculation of disability ratings and use of medical networks.

California critics of the reform legislation and the Governor continue to charge that rate reduction has not been meaningful. We disagree. Our rates would be about 30% higher today but for the reforms.

The following is a summary of major items that will impact costs in both states:

FLORIDA

- 1.

- Requires physicians to treat only objective, relevant medical findings.

- 2.

- Clear and convincing evidence needed to prove causation.

- 3.

- Work-related accidents must be more than 50% responsible for injury and subsequent disability.

- 4.

- Permanent disability benefits only available until the beneficiary reaches the age of 75 and if the employee is unable to engage in at least sedentary employment within a 50-mile radius of home.

- 5.

- Hourly fees for employee's attorneys eliminated.

19

OUR SERVICE STRATEGY IS FOCUSED ON REDUCING EMPLOYER LOSS RATIOS, EXPERIENCE MODIFICATIONS AND ULTIMATELY THE LONG-TERM COST OF THEIR INSURANCE.

CALIFORNIA

- 1.

- Vocational rehabilitation benefit eliminated.

- 2.

- Chiropractic and physical therapy benefits limited to 24 visits per injury.

- 3.

- Out-patient fee schedule adopted and set at 120% of Medicare fee schedule.

- 4.

- Treating physician presumption eliminated retroactively (previously eliminated for injuries after January 1, 2003).

- 5.

- Medical treatment utilization guidelines.

- 6.

- Spinal surgery dispute procedure adopted.

- 7.

- Pharmaceutical fee schedule adopted at 100% of the Medi-Cal reimbursement rate.

- 8.

- Medical networks controlling treatments effective January 1, 2005.

- 9.

- Apportionment of disabilities between work-related and non-work related causes.

- 10.

- Limits on temporary disability payments of 104 weeks, with certain exceptions.

- 11.

- Permanent disability ratings to be based on new, more objective factors.

- 12.

- Increased benefits for serious injuries (disability ratings higher than 70%) and up to $10,000 of medical benefits for a denied claim.

Clearly there are opportunities and challenges presented by these reforms. The opportunities are containing costs, reducing inflation trends, improving the predictability of underwriting profitability and adequate reserving, and lowering employer premiums. The challenges are to train our people on the new laws and regulations, implement new systems, measure outcomes, detect changes in trends, identify the most qualified doctors within networks, deal with new types of litigation, and make sure rate changes are related to cost changes on a fair basis. We are optimistic that our seasoned leadership and experienced personnel will respond favorably to the changing conditions.

20

OUR CONSTANTLY EVOLVING INFORMATION TECHNOLOGY IS ESSENTIAL TO SUPPORTING OUR CUSTOMER SERVICE STRATEGY.

As is always the case with complex workers' compensation legislation, it is necessary to study carefully the impact of changes to discern whether there may be unanticipated consequences. With this caution in mind, we believe California and Florida have made favorable changes to their respective systems and the politicians involved should be congratulated for a job well done. In California, there are major changes effective January 1, 2005 which may provide additional benefits in the future, although it will take some time before the financial impact becomes clear. Unfortunately, we think this latter point has been ignored due to political rhetoric desiring to claim immediate credit for the largest amount of short-term savings. It is difficult, if not impossible, to predict the outcome of complex workers' compensation reform legislation. We will change rates based upon our best judgment of actual cost trends and believe that our commercial customers would follow the same approach in their operations. To use a baseball analogy, we are in the early innings and we will not know all the answers as to the effects of the legislation until we get more data and move closer to the ninth inning.

Assuming California claim inflation trends continue to moderate (rate of increase slows), our customers will receive lower rates and our shareholders will receive adequate returns. The major factor impacting claim inflation trends, other than healthcare inflation itself, will be the effect of medical networks on healthcare cost trends and revised permanent disability rules, both of which commenced January 1, 2005. Medical networks, in conjunction with utilization guidelines, are an experiment designed to reduce fraud and over-utilization. The hope is the selected doctors will have a reputation for the best outcomes and injured workers will receive quality medical care permitting a speedy return-to-work without "doctor shopping" or litigation. It should be obvious that until we have sufficient experience to determine whether these changes work as intended, after anticipated legal challenges and/or legislative modifications, we will be unable to estimate their impact on our

21

REINSURANCE CATASTROPHE LOSSES IN 2004, INCLUDING ADVENT, REDUCED NET INCOME BY $18.4 MILLION, OR $0.75 PER SHARE.

operations. The same can be said about new disability guidelines which are based upon American Medical Association guides for evaluating impairment, adjusted for diminished earning capability, age and occupation. Our cautious view of these changes contrasts with the critics who argue that injured workers will receive unintended lower payments thereby benefiting employers and insurers.

REINSURANCE ASSUMED BUSINESS

Since 1985, TheZenith has been selectively underwriting assumed treaty and facultative reinsurance and our combined ratio has averaged 101.9%. Reinsurance represents 4.5% of our property-casualty net premiums earned, while reinsurance loss reserves represent 11.4% of our total property-casualty loss reserves. We believe this business will continue to provide long-term profitable diversification to our basic workers' compensation operations.

The year 2004 was adversely impacted by the Florida hurricanes, offset, in part, by $5.7 million of favorable development from the previously recorded World Trade Center losses.

During 2004, net written premium of this operation was $40.4 million compared to $51.2 million in 2003. Earned premium was $42.4 million compared to $61.0 million the prior year. Losses were $12.0 million in 2004 in this segment compared to profits of $9.6 million the prior year. During the past two years, the majority of written premium was derived from worldwide catastrophe business.

Accounting for the property catastrophe reinsurance business has a different result from our other property-casualty business. At the end of each reporting period, income is recognized without reserves being established if no major catastrophe has occurred. In our other businesses, reserves are mandated based upon actual events as well as expected loss patterns. As a result, there may be large fluctuations (positive or negative) in the results of the reinsurance segment in the short-term since only actual events are considered and estimates are then established.

22

OUR DIRECTORS ARE FOCUSED ON THE HIGHEST STANDARDS OF CORPORATE GOVERNANCE.

As previously reported, we now own 20.9% of Advent Capital (Holdings) PLC, a Lloyd's reinsurance vehicle, which operates Lloyd's Syndicate 780. Our investment is $28.1 million and we are accounting for it under the equity method with a quarter lag. Although the equity method does not record our percentage share of Advent Capital premium in our revenues, from an analytical point of view, our 20.9% ownership of Advent Capital would approximate about $27 million of additional annual reinsurance premium in 2004. Advent Capital specializes in worldwide property catastrophe reinsurance and certain other coverages and our 2004 financial statements include $1.4 million after tax for our proportionate share of Advent Capital's net income. Advent's results were also impacted by the Florida hurricanes.

CORPORATE GOVERNANCE

Our management and Audit Committee spent considerable time and resources during 2004 to comply with Sarbanes-Oxley and Section 404 requirements. Section 404 relates to management's responsibilities to establish and maintain adequate internal controls over financial reporting and the effectiveness of these controls at year-end. We believe that we have always had effective controls, but Sarbanes-Oxley legislation requires that we document these controls in a more formal and professional manner. Our external auditors have attached the requisite opinion certifying the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2004.

During the year, we scrutinized all of our business practices relating to the Spitzer investigations and allegations with the assistance of outside experts. Contingent commissions and their required disclosure, if any, appear at the center of the matter coupled with charges of price-fixing and market-rigging. Price-fixing and market-rigging are clearly improper. Contingent commissions have long been part of industry practice and should be considered separately. Our business model has been built

23

OUR INTERNAL FINANCIAL CONTROLS ARE EFFECTIVE AND CONSISTENT WITH SARBANES-OXLEY.

around services and not contingent commissions. We have very few "contingent commission" arrangements (ten involving the payment of 0.1% of our earned premiums in 2004). We are unaware of any legal requirements that apply to us relating to such agreements or marketing practices which may present problems. We believe in transparency and have requested our agents or brokers to review their disclosure obligations, if any, relating to contingent commissions. We have received an inquiry from the California Insurance Department relating to our marketing practices and commission arrangements and we have responded fully to all information requested. We anticipate new rules, regulations or statutes in this area, but do not believe that based upon various proposals being discussed, they will have a material impact on our business.

Our Audit, Compensation, and Corporate Governance Committees have conducted numerous meetings and reviews to make certain our Corporation is in the forefront of compliance with the highest standards of corporate governance. Our Directors should be complimented for their service and commitment to continuing education to assure we are among the leaders in this important area.

INFORMATION TECHNOLOGY

Improving the functionality of our claims systems and delivering services via web-based technologies remain our two priorities. We have continued to build our systems around an architecture that will support rapid changes in our business environment, including the ability to interface with multiple business partners, as well as provide streamlined "real time" critical information and the standardization of workflows around best practices. An important priority has been our focus on consolidating our three separate systems into a single national platform. Significant progress toward that end was accomplished in 2004. All of our policies are now issued from one single system and we are currently in the process of moving all claims to that system as well.

24

OUR RETURN ON AVERAGE EQUITY WAS 27.2% IN 2004 COMPARED TO 18.8% THE PRIOR YEAR.

A significant effort was put forth this year to ensure that our IT security and controls are effective and consistent with Sarbanes-Oxley. To accomplish this, we employed the services of Science Application International Corporation ("SAIC"), a highly regarded expert in the area of IT systems security.

We continued to expand our E-commerce operations beyond our California and Florida offices. In addition, we have begun the process of upgrading our E-commerce technology to the next generation that is designed to improve efficiencies and lower costs.

We continue to be pleased with the interest in, and access to, our website: www.thezenith.com. During 2004, there were in excess of 500,000 visits and we anticipate more in the coming year as we embed new and valuable content that has been recommended by our customers.

ACCOUNTING DISCLOSURE

Regular readers of our Annual Report will notice a change in some of the terminology we are using to report the results of our insurance businesses this year. Throughout this report we are using the terms "income or (loss) from the workers' compensation segment" or "income or (loss) from the reinsurance segment" instead of the term "underwriting income or loss." We have made the change to be in strict compliance with the accounting rules that govern the reporting of business segments. These rules also require that we not add the income or loss of these two segments together and report the result as single item of income or loss as we have done in previous reports, or report an item entitled either "operating income" or "underwriting income."

We continue to report the combined ratio for the workers' compensation and reinsurance segments but, in accordance with the rules, we have discontinued the practice of presenting a single combined ratio to describe the result of our insurance operations. A comprehensive description of our business segment reporting is on pages 83 and 84.

25

STRONG REVENUE AND EARNINGS FLOWS, COUPLED WITH FAVORABLE SHORT-TERM CLAIM INFLATION TRENDS, HAVE IMPROVED OUR BALANCE SHEET.

Our financial statements include full disclosure of the accounting policies, estimates and assumptions used in their preparation. As we have discussed earlier in this report, estimating our workers' compensation loss costs is one of our major business risks. Our loss costs or cost of goods sold are not quantifiable with a high degree of certainty for several years until a large percentage of the claims for a given year are resolved.

TheZenith's actuaries perform a comprehensive actuarial analysis of our loss reserves every quarter. Assumptions are required to make estimates of loss costs and loss reserves and the key assumption, presently, is the rate of inflation in the most recent accident years of our workers' compensation loss reserves. In the table on page 38, we show the available data concerning paid loss inflation rates for the past several accident years and the inflation rates that we have assumed in our loss reserve estimates. We also provide a discussion of the long-term uncertainty surrounding the inflation trends of our workers' compensation loss costs.

CONCLUSION

Our improved operating performance provides the financial strength and optimism to believe that we can continue to produce excellent results for our agents, insureds and shareholders.

California, our largest market representing 69% of our business, has legislated numerous reforms during the past two years, the most significant of which take effect in 2005. The reforms are designed to reduce claim costs and make the system more fair. Preliminary data are favorable, but it will take time, training and investment to understand and achieve the intended impact. In the meantime, political critics argue that insurers are pocketing savings at the expense of injured workers and rate regulation is the answer. We disagree. Profits are essential to provide capital and to continue to assume risk especially after a long period of poor results. Most important, the uncertainties

26

OUR SPECIALIST BUSINESS MODEL, CUSTOMER SERVICE STRATEGY AND TALENTED EMPLOYEES PRODUCE ABOVE-AVERAGE RESULTS.

surrounding the long-term outcome of the reform legislation are not knowable at this time. Competition and favorable cost trends without rate regulation will provide the best outcomes for all participants.

TheZenith is motivated to take advantage of the opportunities and to meet the challenges ahead. Furthermore, we believe that our business model as a specialist focused on our customer service strategy will continue to provide above-average results. Our goal is to treat all of our constituencies with fairness, at all times with quality and transparency.

We appreciate the confidence and support of our agents, brokers, policyholders, reinsurers, investors, lenders and shareholders. The contributions of our distinguished Board of Directors serve as an inspiration to us all. We also would be remiss in not acknowledging the contributions to our current success from many of our friends and partners who are no longer involved in our business, but whose advice and guidance continues to influence our current activities.

In conclusion, we are financially and operationally strong and are well positioned to pursue future opportunities and enhance shareholder value.

Stanley R. Zax

Chairman of the Board and President

Woodland Hills, California, February 2005

27

MANAGEMENT'S DISCUSSION AND ANALYSIS OF CONSOLIDATED FINANCIAL CONDITION AND RESULTS OF OPERATIONS

ZENITH NATIONAL INSURANCE CORP. AND SUBSIDIARIES

Zenith National Insurance Corp. ("Zenith National") is a holding company engaged, through its wholly-owned subsidiaries (primarily Zenith Insurance Company ("Zenith Insurance")), in the property and casualty insurance business. Unless otherwise indicated, all references to "Zenith," "we," "us," "our," the "Company" or similar terms refer to Zenith National together with its subsidiaries.

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements if accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those discussed. Forward-looking statements include those related to the plans and objectives of management for future operations, future economic performance, or projections of revenues, income, earnings per share, capital expenditures, dividends, capital structure, or other financial items. Statements containing words such asexpect, anticipate, believe, estimate, or similar words that are used in this Management's Discussion and Analysis of Consolidated Financial Condition and Results of Operations ("MD&A"), in other parts of this report or in other written or oral information conveyed by or on behalf of Zenith, are intended to identify forward-looking statements. The Company undertakes no obligation to update such forward-looking statements, which are subject to a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, the following: (1) competition; (2) adverse state and federal legislation and regulation; (3) changes in interest rates causing fluctuations of investment income and fair values of investments; (4) changes in the frequency and severity of claims and catastrophes; (5) adequacy of loss reserves; (6) changing environment for controlling medical, legal and rehabilitation costs, as well as fraud and abuse; (7) losses associated with any terrorist attacks that impact our workers' compensation business in excess of our reinsurance protection; and (8) other risks detailed herein and from time to time in Zenith's other reports and filings with the Securities and Exchange Commission ("SEC").

OVERVIEW

Zenith is in the business of managing insurance and investment risk with the major risk factors set forth in the preceding paragraph. Our main business activity is the workers' compensation insurance business and we also operate a small assumed reinsurance business. We measure our performance by our ability to increase stockholders' equity over the long-term. Following is a summary of our recent business performance and how we expect the trends to continue for the foreseeable future:

1) Revenues. Our revenues are comprised of the net premiums earned from our workers' compensation and reinsurance segments and the investment income and realized gains from our investments segment. The most significant trend in our revenues in the last three years was that our workers' compensation net premiums earned increased in each of the three years ended December 31, 2004 as a result of rate increases and additional policies. Effective January 1, 2005, there will be a favorable impact on our workers' compensation net premiums earned because we will no longer cede 10% of our workers' compensation earned premiums under the quota share reinsurance agreement which reduced net earned premiums in 2002 through 2004. Competition will be the principal factor determining the future trend of our workers' compensation earned premiums.

2) Income (loss) from the workers' compensation and reinsurance segments. The results of our workers' compensation and

28

reinsurance segments may fluctuate from time to time.

- (a)

- Workers' Compensation. Income from our workers' compensation segment increased in each of the three years ended December 31, 2004.

- (b)

- Reinsurance. The results of the reinsurance segment were a loss in 2004 due to the Florida hurricanes, compared to profits in 2003 and 2002.

3) Investments segment. We have increased our investment portfolio and investment income in each of the last three years as a result of favorable net cash flow from operations, but the increases in investment income were moderated by lower interest rates. We expect favorable net cash flow from operations will continue to increase our investment portfolio in 2005. At December 31, 2004, $901.3 million of our investments, including short-term investments, were in maturities of two years or less. Short-term interest rates have recently increased from their historically low levels. Any future increases in short-term rates or reinvestment of our short maturities, in conjunction with favorable cash flow, would result in relative changes in our investment income in the future that are greater than the relative changes of the last three years. In 2004 and 2003, we also generated significant realized net capital gains, but we cannot predict future capital gains with any reasonable certainty.

4) Loss reserves. In 2004, we revised the accident year allocation of our workers' compensation loss reserve estimates as we observed additional information about paid loss inflation data during the year. In 2003 and 2002, we recognized small amounts of additions to prior year loss reserves. As of the end of 2004, we believe our workers' compensation loss reserve estimates have a lower risk of adverse development in the future because of the assumptions we have made in estimating losses in the most recent accident years relative to the current data on paid loss inflation trends.

5) Stockholders' equity. During the last three years, consolidated stockholders' equity increased from $317.0 million ($16.89 per share) at December 31, 2002 to $383.2 million ($20.27 per share) at December 31, 2003 to $502.1 million ($25.92 per share) at December 31, 2004. Stockholders' equity will depend upon the future level of net income and any fluctuations in the values of our investments.

More information about the key elements of our performance follows below.

RESULTS OF OPERATIONS

Summary Results by Segment. Our business is classified into the following segments: investments; workers' compensation; reinsurance; and parent. Our real estate segment was discontinued in 2002. Income from operations of the investments segment includes investment income and realized gains and losses on investments and we do not allocate investment income to the results of our workers' compensation and reinsurance segments. Income (loss) from the workers' compensation and reinsurance segments is determined solely by deducting net losses and loss adjustment expenses incurred and underwriting and other operating expenses incurred from net premiums earned. Loss from operations of the parent segment includes interest expense and the general operating expenses of Zenith National. The comparative components of net income

29

(loss) for the three years ended December 31, 2004 are set forth in the following table:

| |

|---|

| | Year Ended December 31,

| |

|---|

(Dollars in thousands)

| | 2004

| | 2003

| | 2002

| |

|---|

| |

|---|

| Net investment income | | $ | 61,876 | | $ | 56,103 | | $ | 48,811 | |

| Realized gains (losses) on investments | | | 38,579 | | | 19,433 | | | (3,631 | ) |

| |

| Income before tax from investments segment | | | 100,455 | | | 75,536 | | | 45,180 | |

| Income (loss) before tax from: | | | | | | | | | | |

| | Workers' compensation segment | | | 104,098 | | | 29,260 | | | (43,848 | ) |

| | Reinsurance segment | | | (11,956 | ) | | 9,562 | | | 7,644 | |

| | Parent segment | | | (19,051 | ) | | (17,694 | ) | | (10,237 | ) |

| |

| Income (loss) from continuing operations before tax and equity in earnings of investee | | | 173,546 | | | 96,664 | | | (1,261 | ) |

| Income tax expense (benefit) | | | 57,213 | | | 33,664 | | | (914 | ) |

| |

| Income (loss) from continuing operations after tax and before equity in earnings of investee | | | 116,333 | | | 63,000 | | | (347 | ) |

| Equity in earnings of investee after tax | | | 1,381 | | | 2,846 | | | 1,363 | |

| |

| Income from continuing operations after tax | | | 117,714 | | | 65,846 | | | 1,016 | |

| Income from discontinued operations after tax | | | 1,286 | | | 1,154 | | | 9,184 | |

| |

| Net income | | $ | 119,000 | | $ | 67,000 | | $ | 10,200 | |

| |

Net income improved in 2004 compared to 2003, and in 2003 compared to 2002, principally as a result of improved results in the workers' compensation segment and realized gains in the investments segment offset by catastrophe losses in the reinsurance segment in 2004.

The combined ratio, expressed as a percentage, is a key measurement of profitability traditionally used in the property-casualty insurance industry. The combined ratio is the sum of the loss and loss adjustment expense ratio and the underwriting and other operating expense ratio. The loss and loss adjustment expense ratio is the percentage of net incurred loss and loss adjustment expenses to net premiums earned. The underwriting and other operating expense ratio is the percentage of underwriting and other operating expenses to net premiums earned. The key operating goal for our insurance segments is to achieve a combined ratio of 100% or lower. The combined ratios of the workers' compensation and reinsurance segments for the three years ended December 31, 2004 are set forth in the following table:

|

|---|

| | Year Ended December 31,

|

|---|

| | 2004

| | 2003

| | 2002

|

|---|

|

|---|

| Workers' compensation: | | | | | | |

| | Loss and loss adjustment expenses | | 64.6% | | 69.9% | | 76.7% |

| | Underwriting and other operating expenses | | 23.9% | | 26.0% | | 32.0% |

|

| Combined ratio | | 88.5% | | 95.9% | | 108.7% |

|

| Reinsurance: | | | | | | |

| | Loss and loss adjustment expenses | | 107.6% | | 65.5% | | 64.7% |

| | Underwriting and other operating expenses | | 20.6% | | 18.8% | | 20.9% |

|

| Combined ratio | | 128.2% | | 84.3% | | 85.6% |

|

Workers' Compensation Segment. In the workers' compensation segment, we provide insurance coverage for the statutorily prescribed benefits that employers are required to provide to their employees who may be injured in the course of employment. We establish our prices (in those states in which we are not required by regulation to use mandated rates) with the goal of achieving a combined ratio under 100%. We continually analyze data and use our best judgment about loss trends, particularly inflation, to set adequate premium rates and loss reserves. Our underwriters identify and assess risks, determine appropriate policy prices and strive to sell our policies in the face of competition. In regulated states, principally Florida, they seek out opportunities to write policies where the mandated rates (which are based on aggregate loss experience) afford an opportunity for us to provide our services at a

30

profit. Using our claims servicing infrastructure, we strive to control the cost of delivering appropriate benefits in an environment which includes significant regulation, periodic legislative changes, fraud and abuse. We use this claim service strategy as a selling proposition to service-oriented employers.

Rising loss costs in recent years have necessitated significant rate increases, particularly in California. Overall premium rate increases were 35% in 2003 and 19% in 2002, including 46% in California in 2003 and 27% in 2002. However, effective for new and renewal policies on January 1, 2004, we left our California rates unchanged and we reduced our California rates by 10% for new and renewal policies effective July 1, 2004, after a second round of reform legislation (discussed in the "Workers' Compensation Reform Legislation" section following) was enacted in California.

The combined ratio of our workers' compensation segment improved in the year ended December 31, 2004 compared to 2003, and in 2003 compared to 2002, because premium rate increases have exceeded the estimated increases in loss costs leading to a lower loss ratio and the increase in premium revenues lowered the expense ratio.

Premiums in-force and number of policies in-force in California and outside of California were as follows (premiums in-force are a measure of the amount of premiums billed or to be billed on all un-expired policies at the date shown):

|

|---|

| | California

| | Outside of California

|

|---|

(Dollars in millions)

| | Premiums

in-force

| | Policies

in-force

| | Premiums

in-force

| | Policies

in-force

|

|---|

|

|---|

| December 31, | | | | | | | | | | |

| 2004 | | $ | 731.3 | | 27,200 | | $ | 311.0 | | 16,200 |

| 2003 | | | 587.9 | | 25,900 | | | 277.8 | | 15,600 |

| 2002 | | | 350.2 | | 22,600 | | | 259.2 | | 16,900 |

|

We believe that the insureds' payroll is our best indicator of exposure. We estimate that the underlying payroll associated with our policies in-force increased during the same periods as follows:

| |

|---|

| | Annual Increase in

Insured Payroll

| |

|---|

Policies in-force at December 31,

| | California Only

| | Total Company

| |

|---|

| |

|---|

| 2004 | | 25 | % | 20 | % |

| 2003 | | 13 | | 9 | |

| 2002 | | 19 | | 17 | |

| |

We increased our workers' compensation net premiums earned in each of the years from 2002 to 2004 as a result of the increases in rates and policies:

|

|---|

| | Year Ended December 31,

|

|---|

(Dollars in thousands)

| | 2004

| | 2003

| | 2002

|

|---|

|

|---|

| Net premiums earned: | | | | | | | | | |

| | Workers' compensation: | | | | | | | | | |

| | | California | | $ | 621,284 | | $ | 458,312 | | $ | 277,120 |

| | | Outside California | | | 280,763 | | | 254,484 | | | 226,739 |

|

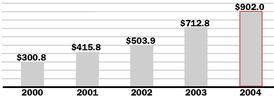

| | Total workers' compensation | | $ | 902,047 | | $ | 712,796 | | $ | 503,859 |

|

Net premiums earned in 2004, 2003 and 2002 are net of $98.7 million, $78.5 million and $36.8 million, respectively, of ceded earned premiums under a 10% quota share reinsurance agreement with Odyssey America Reinsurance Corporation ("Odyssey America"), a subsidiary of Fairfax Financial Holdings Limited ("Fairfax"), a Toronto based financial services holding company, effective for policies written on or after January 1, 2002. This quota share agreement ended on December 31, 2004. The effect of this quota share agreement is discussed further in the "Liquidity and Capital Resources" section following. At December 31, 2004, companies controlled by Fairfax owned approximately 24% of the outstanding common stock of Zenith National (not including shares issuable upon conversion of Zenith's 5.75%

31

Convertible Senior Notes ("Convertible Notes") held by affiliates of Fairfax). Net premiums earned will increase in 2005 as a result of the termination of this quota share contract at December 31, 2004.

So far in 2005, California continues to present profitable opportunities. Although we have increased our workers' compensation net premiums earned in each of the last three years, revenue growth is not an independent objective. We will continue to focus on premium rate adequacy, attractive returns to our stockholders and the delivery of quality services to our policyholders.

Workers' Compensation Reform Legislation. During 2004, Zenith wrote workers' compensation insurance in 45 states, but the largest concentrations, 69% and 17% of the workers' compensation net premiums earned during 2004, were in California and Florida, respectively. The concentration of Zenith's workers' compensation business in these states makes the results of our operations dependent on trends that are characteristic of these states as compared to national trends, for example, state legislation, competition and workers' compensation inflation trends.

In California, workers' compensation reform legislation was enacted in October 2003 and April 2004 with the principal objectives of lowering the trend of increasing costs and improving fairness in the system. The principal changes in the legislation of October 2003 are as follows: 1) a reduction in the reimbursable amount for certain physician fees, outpatient surgeries, pharmaceutical products and certain durable medical equipment; 2) a limitation on the number of chiropractor or physical therapy office visits; 3) the introduction of medical utilization guidelines; 4) a requirement for second opinions on certain spinal surgeries; 5) a repeal of the presumption of correctness afforded to the treating physician, except where the employee has pre-designated a treating physician; and 6) a presumption of correctness is to be afforded to the evidence-based medical utilization guidelines developed by the American College of Occupational and Environmental Medicine.

The principal changes in the legislation of 2004 are as follows: 1) employers and insurers are authorized, beginning in 2005, to establish networks of medical providers within which injured workers are required to be treated (an independent medical review would be allowed if the claimant disputes the treatment recommended in the network only after obtaining the opinions of three network physicians); 2) within one working day of filing a claim form, a claimant must be afforded necessary treatment for up to $10,000 in medical fees (however, employers and insurers still have up to 90 days to investigate the compensability of a claim); 3) a methodology for apportioning disabilities between work-related and non-work related causes was created and employers will only be liable for the portion of permanent disability that is directly work-related; 4) Temporary Disability ("TD") benefits are not to exceed 104 weeks within 2 years of the first TD payment, but cases with certain specified injuries will be allowed up to 240 weeks of TD benefits within 5 years of the date of injury; 5) Permanent Disability ("PD") ratings are based on a new, objective disability rating schedule effective January 1, 2005 (and for some injuries prior to January 1, 2005) as well as upon the injured workers' diminished future earning capacity, rather than their ability to compete in the open labor market (PD benefits were revised to make available higher benefits to more severely injured workers and lower benefits to less severely injured workers); 6) incentives were created to encourage employers to offer return-to-work programs; and 7) new medical-legal processes for resolving disputed medical issues were created.

32

In Florida, legislation was enacted effective October 1, 2003, which provides changes to the workers' compensation system. Such changes are designed to expedite the dispute resolution process, provide greater compliance and enforcement authority to combat fraud, revise certain indemnity benefits and increase medical reimbursement fees for physicians and surgical procedures. One of the intended outcomes of the legislation is a reduction in the overall costs associated with delivering workers' compensation benefits in the state of Florida. The premium rates that we and other insurance companies use for workers' compensation insurance in Florida are set by the Florida Department of Insurance ("Florida DOI"). The Florida DOI decreased premium rates by an average of 14%, effective October 1, 2003, which offsets a previous 13.7% average increase in premium rates as of April 1, 2003. Effective January 1, 2005, the Florida DOI decreased premium rates by an average of 5.1%.

In both California and Florida, the major risk factor associated with these recent legislative changes is the impact the changes will have on the operation of the workers' compensation system, including the trend of loss costs. In California, where we file and use our own premium rates, we believe that a measured and gradualistic response is appropriate to estimating the future impact of the California workers' compensation legislation because there is considerable uncertainty as to how some of the provisions will impact the behavior of the various participants in the California workers' compensation system and because some of the provisions did not become effective until January 1, 2005. Although we expect that, when fully implemented, the legislation should result in a lower trend of cost increases than we had experienced prior to the legislation, we cannot currently estimate the amount or the timing of the effects of such legislation. We reduced our California rates by 10% for new and renewal policies effective July 1, 2004. As provided for by legislation enacted in California in 2002, changes in indemnity benefits increased total costs by 2.8% effective January 1, 2005 (and will further increase total costs by 2.7% on January 1, 2006) and we filed premium rates in California for use on or after January 1, 2005 that reflect an overall decrease of 1.5% from the rates in effect since July 1, 2004. After we have obtained further data about our loss cost trends, we will decide what changes, if any, are appropriate for our California workers' compensation rates.

Our insurance company subsidiaries are subject to taxes on their gross premium revenue in lieu of most state income taxes. In California, the premium tax rate is 2.35%. A proposed ballot initiative has been received by the California Attorney General's Office in California which, among other things, would increase the California premium tax rate to 7.0%. We cannot predict if the proposed initiative will receive the required number of signatures for inclusion on a statewide ballot or, if included on such a ballot, whether the initiative would be approved by the California electorate.

Regulatory investigations in the insurance industry. In 2004, New York State Attorney General Elliot Spitzer announced that he was investigating various alleged inappropriate solicitation practices between insurance companies and agents and brokers, including "contingent commissions" under which brokers receive additional payments from insurance companies for placing with them an increased volume of business. Regulators in various other states have also announced similar investigations into these alleged inappropriate practices. In December 2004, we received a letter of inquiry from the California Department of Insurance ("California DOI") requesting information about Zenith's arrangements and dealings with its agents and brokers. We have

33