2007 ANNUAL REPORT

ZENITH NATIONAL INSURANCE CORP.

FINANCIAL HIGHLIGHTS

Year Ended December 31,

| | 2007

| | 2006

| | 2005

| |

|

|---|

|

|---|

RESULTS OF OPERATIONS: |

|

|

(Dollars in thousands, except per share data) |

|

|

| Total revenues | | $ | 873,748 | | $ | 1,063,888 | | $ | 1,280,124 | | |

| Net investment income after tax | | | 76,501 | | | 70,926 | | | 53,358 | | |

| Realized gains on investments after tax | | | 13,229 | | | 8,695 | | | 14,446 | | |

| Income from continuing operations after tax | | $ | 233,900 | | $ | 258,700 | | $ | 156,447 | | |

| Gain on sale of discontinued real estate segment after tax (1) | | | | | | | | | 1,253 | | |

| | |

| |

| |

| |

|

| Net income | | $ | 233,900 | | $ | 258,700 | | $ | 157,700 | | |

| | |

| |

| |

| |

|

PER SHARE DATA (2): |

|

|

|

|

|

|

|

|

|

|

|

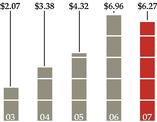

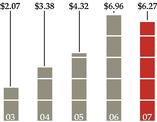

| Income from continuing operations after tax | | $ | 6.27 | | $ | 6.96 | | $ | 4.29 | | |

| Gain on sale of discontinued real estate segment after tax (1) | | | | | | | | | 0.03 | | |

| | |

| |

| |

| |

|

| Net income | | $ | 6.27 | | $ | 6.96 | | $ | 4.32 | | |

| | |

| |

| |

| |

|

| Cash dividends declared per common share (3) | | $ | 2.84 | | $ | 1.26 | | $ | 0.94 | | |

KEY STATISTICS: |

|

|

|

|

|

|

|

|

|

|

|

| Underwriting income (loss) before tax (4): | | | | | | | | | | | |

| Workers' compensation | | $ | 243,832 | | $ | 313,576 | | $ | 213,244 | | |

| Reinsurance (5) | | | (3,661 | ) | | (20,508 | ) | | (56,183 | ) | |

| Combined ratios (6): | | | | | | | | | | | |

| Workers' compensation | | | 67.0% | | | 66.3% | | | 80.9% | | |

| Reinsurance (5) | | | NM | | | 264.4% | | | 187.1% | | |

| Stockholders' equity | | $ | 1,073,357 | | $ | 940,720 | | $ | 712,795 | | |

| Stockholders' equity per share | | | 28.93 | | | 25.41 | | | 19.14 | | |

| Closing common stock price | | | 44.73 | | | 46.91 | | | 46.12 | | |

|

| NM= | | Not Meaningful |

| (1) | | In 2002, we sold our home-building business and related real estate assets. In 2005, the last payment under the earn-out provision of the sale agreement was received resulting in a gain of $1.9 million before tax ($1.3 million after tax). |

| (2) | | Diluted per share amounts reflect the impact of additional shares issuable in connection with our 5.75% Convertible Senior Notes. |

| (3) | | Includes an extra dividend of $1.00 per common share declared and paid in December 2007. |

| (4) | | Underwriting income (loss) before tax from the workers' compensation and reinsurance segments is determined by deducting loss and loss adjustment expenses incurred and underwriting and other operating expenses from net premiums earned. |

| (5) | | In September 2005, we exited the assumed reinsurance business and ceased writing and renewing assumed reinsurance contracts, with all contracts fully expired at the end of 2006. The results of the reinsurance segment in 2007 consist primarily of changes to loss reserve estimates for the 2005 hurricanes. |

| (6) | | The combined ratio, expressed as a percentage, is a key measurement of profitability traditionally used in the property-casualty insurance business. The combined ratio, also referred to as the "calendar year combined ratio," is the sum of the loss and loss adjustment expense ratio and the underwriting and other operating expense ratio. The loss and loss adjustment expense ratio is the percentage of net loss and loss adjustment expenses incurred to net premiums earned. The underwriting and other operating expense ratio is the percentage of underwriting and other operating expenses to net premiums earned. The key operating goal for our workers' compensation segment is to achieve substantial underwriting profits and significantly out-perform the national workers' compensation industry. |

1

TABLE OF CONTENTS

| • | Letter to Stockholders | | 3 | |

• |

Accident Year Reserve Development From Operations |

|

19 |

|

• |

Stock Price Performance |

|

20 |

|

• |

Management's Discussion and Analysis of Consolidated Financial Condition and Results of Operations |

|

21 |

|

• |

5-Year Summary of Selected Financial Information |

|

44 |

|

• |

Consolidated Balance Sheets |

|

46 |

|

• |

Consolidated Statements of Operations |

|

47 |

|

• |

Consolidated Statements of Cash Flows |

|

48 |

|

• |

Consolidated Statements of Stockholders' Equity and Consolidated Statements of Comprehensive Income |

|

50 |

|

• |

Notes to Consolidated Financial Statements |

|

51 |

|

• |

Report of Independent Registered Public Accounting Firm |

|

73 |

|

• |

Management's Report on Internal Controls over Financial Reporting |

|

77 |

|

• |

Corporate Directory |

|

|

|

|

Zenith National Insurance Corp. |

|

78 |

|

|

Zenith Insurance Company |

|

79 |

|

|

Zenith Office Locations |

|

80 |

|

TheZenith and Zenith are registered U.S. trademarks.

2

TO OUR STOCKHOLDERS

It is a pleasure to report that we achieved another year of excellent results in 2007. Workers' compensation underwriting performance was superb with a combined ratio of 67.0%, compared to 66.3% the prior year. TheZenith continues to out-perform the industry's combined ratios of 98.5% and 95.0% for 2007 and 2006, respectively.

Net income was $233.9 million or $6.27 per share compared to $258.7 million or $6.96 per share the prior year. Investment income after tax grew 8% to $76.5 million and our net worth exceeded $1 billion for the first time. Most important, we have a conservative investment portfolio without exposure to sub-prime or other securities which have caused problems for many financial institutions.

Stockholders' dividends were increased twice in 2007 to an annual rate of $2.00 per share. Our financial strength provides the ability to continue to invest in improving our service strategy for all of our policyholders and provides the financial flexibility to operate in the long-term best interests of our stockholders. In this regard, it is possible that we have "excess capital" as some have suggested. If so, it is appropriate to consider this issue gradually over time in order to better evaluate our opportunities and choices. In the meantime, for the first time our Board paid an extra cash dividend of $1.00 per share to all stockholders in December 2007.

Declining claim frequency and modest claim severity have created deflation and/or a sharp slowdown in the level of claim inflation in recent workers' compensation accident years. These favorable short-term trends have been caused by the California and Florida legislative reforms and have resulted in low combined ratios and substantial underwriting profitability. Hindsight indicates that we were conservative in recognizing the full impact of these benefits and therefore favorable reserve development has added significantly to net income during the past two years. Future reserve development, favorable or unfavorable, will be dependent upon new data relating to the frequency of serious claims for prior accident years and long-term inflation/deflation trends. In addition to favorable reserve development, current profit margins from underwriting are substantial.

Pricing is down significantly as a result of the favorable trends and industry earnings, particularly in California and Florida, resulting in reduced premiums. Though we feel very good about our risk management practices, we are not immune to competition. We compete against many firms, both larger and smaller, with diverse game plans regarding profit and service. During the past three years, our policy count is down 12% and our premiums in-force are down 36%, however, our insured payroll increased 2%. In comparison, the number of expensive claims (those involving permanent disability) is down about 13% and severity has also declined. The result is that during this

3

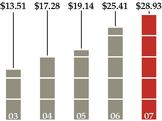

STOCKHOLDERS' EQUITY, PLUS STOCKHOLDERS' DIVIDENDS, HAS GROWN AT AN ANNUAL RATE OF 32.6% FOR FIVE YEARS.

period our claim costs have declined to a greater extent than premiums, resulting in favorable earnings and return on equity.

Our specialist strategy, including our underwriting discipline, has resulted in a long-term record of significantly out-performing our competitors. We intend to continue this focus as we search for opportunities to enhance long-term stockholder value. There is no crystal ball to predict when industry pricing will change, but common sense suggests pricing has reached near bottom and will trend upward in the not too distant future, particularly in California.

Zenith's talented, qualified employees are our greatest asset and the source of our responsive customer service, record low loss ratios, financial stability and future growth. Management appreciates their contribution and supports our employee partners through ongoing training and career development, advancement from within from among the most promising, and competitive compensation and benefits. Likewise, testimony to their confidence in Zenith, 1,085 or 68% of our 1,600 employees own stock in the Company.

FIVE YEAR SUMMARY — 2003 TO 2007

|

|---|

December 31

| | Total Assets

| | Stockholders'

Equity

| | Stockholders'

Equity Per Share

| | Return on Average

Equity

|

|

|---|

|

|---|

| |

| | (Dollars in thousands, except per share)

| |

|

|

|---|

| 2003 | | $ | 2,023,704 | | $ | 383,246 | | $ | 13.51 | | 18.8% | |

2004 |

|

|

2,414,655 |

|

|

502,147 |

|

|

17.28 |

|

27.2 |

|

2005 |

|

|

2,717,456 |

|

|

712,795 |

|

|

19.14 |

|

26.3 |

|

2006 |

|

|

2,767,553 |

|

|

940,720 |

|

|

25.41 |

|

31.8 |

|

2007 |

|

|

2,772,980 |

|

|

1,073,357 |

|

|

28.93 |

|

22.9 |

|

|

FINANCIAL PERFORMANCE — 2007 & 2006

- •

- Net Income Per Share: $6.27 v. $6.96

- •

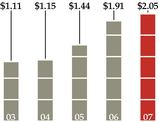

- Net Investment Income: +8.1%

- •

- Workers' Compensation Underwriting Income: $243.8 million v. $313.6 million

- •

- Workers' Compensation Combined Ratio: 67.0% v. 66.3%

- •

- Stockholders' Equity: +14.1%

- •

- Return on Average Equity: 22.9% v. 31.8%

- •

- Stockholders' Dividends Declared: +125.4%

4

STOCKHOLDERS' EQUITY PER SHARE

FINANCIAL SUMMARY

The following table summarizes pre-tax workers' compensation segment income and reinsurance segment loss during the past three years:

|

|---|

Segment Income (Loss)

| | 2007

| | 2006

| | 2005

| |

|

|---|

|

|---|

| | (Dollars in thousands)

|

|---|

| Workers' Compensation | | $ | 243,832 | | $ | 313,576 | | $ | 213,244 | | |

Reinsurance* |

|

|

(3,661 |

) |

|

(20,508 |

) |

|

(56,183 |

) |

|

|

*We exited the reinsurance business in 2005.

2007 results compared to 2006 in several key areas were as follows:

1. Net Income:

- •

- Net income decreased by $24.8 million in 2007 to $233.9 million, but was our second most profitable year. Only 2006 was higher at $258.7 million.

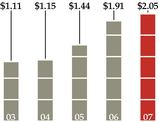

2. Investments:

- •

- Consolidated net investment income after tax and after interest expense was $73.1 million, or $1.96 per share, in 2007 compared to $67.5 million, or $1.82 per share, in 2006. Average yields on our investment portfolio in 2007 were 5.2% before tax and 3.4% after tax compared to 4.8% and 3.2%, respectively, in 2006.

- •

- During 2007, Zenith recognized capital gains before tax of $20.4 million compared to $13.4 million the prior year.

- •

- Net unrealized gains in our investment portfolio were $22.2 million before tax at year-end 2007 compared to $19.1 million before tax at year-end 2006.

- •

- Zenith's investment portfolio is recorded in the financial statements primarily at fair value and was $2.2 billion at year-end. Average maturity of the fixed maturity portfolio was 3.9 years at December 31, 2007 compared to 3.7 years at December 31, 2006. The portfolio quality is high, with 94% and 93% of fixed maturity securities rated investment grade at December 31, 2007 and 2006, respectively.

- •

- Investment income before tax increased by $8.6 million in 2007 to $114.9 million.

5

OUR SPECIALIST STRATEGY, INCLUDING OUR UNDERWRITING DISCIPLINE, HAS RESULTED IN A LONG-TERM RECORD OF SIGNIFICANTLY OUT-PERFORMING OUR COMPETITORS.

3. Workers' Compensation:

- •

- Workers' compensation underwriting results decreased by $69.7 million in 2007, but continued at a very profitable level of $243.8 million.

- •

- Workers' compensation 2007 calendar year combined ratio was 67.0% compared to 66.3% the prior year, significantly out-performing the industry.

- •

- Favorable workers' compensation prior accident year loss reserve development was $113.4 million in 2007 compared to $161.3 million the prior year.

- •

- Workers' compensation accident year combined ratio was 84.4% in 2007 compared to 80.0% the prior year (excludes reserve development and changes in policyholders' dividends for prior accident years).

4. Financial Strength:

- •

- Zenith has a very low level of debt compared to the industry.

- •

- Stockholders' equity at December 31, 2007 was $1.1 billion compared to $940.7 million at December 31, 2006, a 14.1% increase.

- •

- Stockholders' equity, plus stockholders' dividends, has grown at an annual rate of 25.4% for one year, 35.9% for three years and 32.6% for five years.

- •

- Stockholders' equity per share was $28.93 at December 31, 2007 compared to $25.41 at December 31, 2006.

- •

- Dividends declared to stockholders, including a year-end extra cash dividend of $1.00 per share, were $106.4 million in 2007 compared to $47.0 million for the prior year. Our payout ratio as a percentage of net income is among the highest in the property-casualty industry.

RESERVES

Information in the table on page 19 provides estimates of Zenith's net incurred loss and loss adjustment expenses for our workers' compensation and reinsurance segments by accident year, evaluated in the year they were incurred and as they were subsequently evaluated in succeeding years. These data are of critical importance in judging the historical accuracy of our reserve estimates as well as providing a guide to setting fair prices and rates. The accuracy of reserve estimates is one of our major business risks which we endeavor to manage professionally. It is not realistic to believe that 100% accuracy is achievable when forecasting the future. As a result, loss reserve estimates are refined continually in an ongoing process as experience develops, new information is obtained and evaluated, and claims are reported and paid.

6

NET INCOME PER COMMON SHARE

Inflation or deflation trends of paid claim costs in recent years, compared to the assumptions included in the workers' compensation loss reserves estimates for each accident year, are important factors at this time in understanding our reserve situation. Paid loss data for 2003, 2004 and 2005 indicate deflation compared to substantial inflation in years prior to 2002. The primary causes of these developments are the California legislative reforms enacted in 2003 and 2004, the Florida reforms enacted in 2003, and the trend of declining frequency of costly claims. Due to the long period of time over which costly claims are settled and paid, we continue to carry ultimate inflation factors in excess of the paid loss trends for accident years prior to 2005 to allow for the late emergence of long-term health care cost inflation on open expensive claims. As a result of a change in the California permanent disability rating system effective January 1, 2005, we are seeing a reduction in California expensive claims, as discussed further on pages 14 and 15. We are also seeing a faster rate of settlement of these expensive claims for the 2006 accident year, which we believe will favorably impact the ultimate loss costs. Therefore, we ultimately expect deflationary trends to continue for the 2005, 2006 and 2007 accident years in estimating our workers' compensation loss reserves.

During the past three years we have reduced workers' compensation loss reserves for favorable development of prior accident years and increased pre-tax earnings by $300.9 million, compared to the preceding three-year period where we increased loss reserves for unfavorable development of prior accident years and decreased pre-tax earnings by $63.5 million. Future reserve changes will be dependent on new data as more cases are settled for the 2003-2007 period. Due to the long-tail nature of the business, we continue to be conservative in predicting the long-term consequences of recent years based upon the short-term data that is available. At this time, we cannot predict the amount or timing of future reserve changes. For additional information about reserving and inflation trends, please turn to pages 28 to 34 of this report.

As previously announced, we are no longer engaged in the assumed reinsurance business, however we will be paying our assumed reinsurance claims for several years. As of December 31, 2007, we held $62.6 million of reserves to pay our estimated liabilities compared to $106.1 million at year-end 2006.

7

OUR INVESTMENT PORTFOLIO HAS NO EXPOSURE TO SUB-PRIME OR OTHER SECURITIES WHICH HAVE CAUSED PROBLEMS FOR MANY FINANCIAL INSTITUTIONS.

INVESTMENTS

Investment activities are a major part of our revenues and earnings. We believe our portfolio is diversified to achieve a reasonable balance of risk and a stable source of earnings. Regulations require Zenith to primarily invest its reserves in high quality debt securities, as compared to equity securities, and our largest holdings are cash and short-term U.S. Government securities. Compared to other insurers we believe our portfolio consists of a smaller percentage of equity securities to total assets and a larger percentage of cash or short-term securities, with no derivative securities or credit enhancement exposure. Our strategy helped us avoid the large losses recognized by other financial firms from mortgages, sub-prime and other derivative securities this past year.

The major developments affecting the U.S. bond markets were liquidity issues related to sub-prime and non-U.S. Government securities, wider spreads between corporate and government bonds and fluctuating interest rates with the Federal Reserve Board lowering short-term rates with concerns about the U.S. economy. Long-term rates ended the year at a 4.45% yield for 30-year U.S. Government bonds compared to 4.81% the prior year. Since we are capable of holding bonds to maturity, and the average maturities are relatively short, fluctuations in bond values do not significantly impact our operations.

Short-term investments and liquidity remain high as we search for investment opportunities and continue to study the issue of "excess capital." Even though the returns on cash are low, they result in a better outcome than the alternative of risk-taking with an uncertain and volatile outcome. Most of our cash is held by our insurance subsidiaries and is not available to our holding company (the parent), except under the rules relating to dividends for insurance companies. Concerns about the economy, tight lending policy by banks, domestic politics, inflation pressures, the overhang of an unknown amount of securities with large unrealized losses held by financial institutions, and geopolitical issues suggest a continuation of higher cash holdings than would otherwise be the case. The value of the dollar is a concern, along with high oil prices and the unprecedented decline in home prices. We have invested only a small amount of our capital in common stocks since we believe the volatility in the market could impact our capital and our ability to expand our insurance business when desirable. We believe that opportunities to invest at attractive returns will take place in the future, and, therefore holding above-average amounts of cash is temporary. In this regard, it should be obvious that "excess capital" allows us to pursue a more diversified and opportunistic investment approach.

8

INVESTMENT INCOME AFTER TAX PER SHARE

|

|---|

Securities Portfolio

| At December 31, 2007

| | At December 31, 2006

|

|

|---|

|

|---|

| Amortized Cost*

| Market Value

| | Amortized Cost*

| Market Value

|

|

|---|

|

|---|

| (Dollars in thousands)

|

|---|

Short-term investments:

U.S. Govt. and other

securities maturing within

2 years | $708,496 | $710,525 | | $944,796 | $943,720 | |

| Other fixed maturity securities: | | | | | | |

| Taxable, investment grade | 1,108,529 | 1,119,360 | | 915,888 | 909,468 | |

Taxable, non-investment

grade | 141,005 | 132,958 | | 156,619 | 154,749 | |

| Municipal bonds | 128,361 | 128,960 | | 133,887 | 132,414 | |

| Redeemable preferred stocks | 5,600 | 4,946 | | 26,094 | 26,727 | |

| Equity securities | 60,226 | 77,669 | | 69,014 | 98,318 | |

| Other | 19,688 | 19,688 | | 7,616 | 7,616 | |

|

| Total | $2,171,905 | $2,194,106 | | $2,253,914 | $2,273,012 | |

|

*Equity securities and other investments at cost.

9

WORKERS' COMPENSATION UNDERWRITING INCOME WAS 20.6% OF NET PREMIUMS EARNED THE PAST FIVE YEARS.

WORKERS' COMPENSATION

Zenith is a workers' compensation specialist with 57 years of experience and has primary operations in California and Florida, with business in 43 additional states. We estimate that Zenith ranks among the top five underwriters in California and Florida, the two states in which we conduct approximately 81% of our business. Our philosophy does not include any planned goals as to size, market share or ranking, but is focused entirely on providing quality services to our insureds and claimants, generating underwriting profits and delivering an above-average return to our stockholders over time.

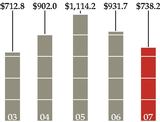

Gross premiums written in 2007 were $740.2 million, a decrease of 21.2% from the prior year, with California premiums representing 54.6% of the total. The decrease in premiums is due primarily to rate reductions in California and Florida, and our pricing and underwriting strategy compared to our competition. Underwriting income before tax in this segment was $243.8 million in 2007 compared to $313.6 million in 2006. During the past five years, our underwriting income from this segment was $904.0 million or 20.6% of net premiums earned.

Zenith's combined ratios (ratios of losses and expenses incurred to total net premiums earned) on a calendar year and accident year basis as recorded in our financial statements for the past five years were as follows:

|

|---|

Combined Ratios

| | Calendar Year

| | Accident Year

| |

|

|---|

|

|---|

| 2003 | | 95.9 | % | 93.9 | % | |

| 2004 | | 88.5 | | 86.3 | | |

| 2005 | | 80.9 | | 81.8 | | |

| 2006 | | 66.3 | | 80.0 | | |

| 2007 | | 67.0 | | 84.4 | | |

|

10

WORKERS' COMPENSATION PREMIUM EARNED

(in millions)

The primary difference between calendar and accident year is the impact of prior accident year reserve adjustments recorded in the calendar year figures. Prior year pre-tax workers' compensation reserve adjustments, favorable (unfavorable), during the past five years were as follows:

|

|---|

Loss Reserve Adjustments

| |

| |

|

|---|

|

|---|

(Dollars in thousands)

|

|---|

| 2003 | | $ | (13,923 | ) | |

| 2004 | | | (20,249 | ) | |

| 2005 | | | 26,289 | | |

| 2006 | | | 161,252 | | |

| 2007 | | | 113,355 | | |

|

As a result of the loss reserve adjustments, the following is the comparison of accident year loss ratios and combined ratios as originally reported and as estimated at December 31, 2007:

|

|---|

| | Loss Ratios

| | Combined Ratios

| |

|

|---|

|

|---|

Accident Year

| | Originally Reported

| | As of

December 31, 2007

| | Originally Reported

| | As of

December 31, 2007

| |

|

|---|

| |

| |

| |

|

|---|

| 2003 | | 53.5 | % | 41.9 | % | 93.9 | % | 84.1 | % | |

| 2004 | | 46.0 | | 31.4 | | 86.3 | | 69.0 | | |

| 2005 | | 39.8 | | 27.5 | | 81.8 | | 66.5 | | |

| 2006 | | 33.6 | | 30.6 | | 80.0 | | 76.2 | | |

| 2007 | | 33.9 | | 33.9 | | 84.4 | | 84.4 | | |

|

Improved profitability has been shared with our customers in California and Florida as indicated by the rate reductions in the following table:

|

|---|

Effective Date of Rate Reductions

| | California

| | Florida

| |

|

|---|

|

|---|

| January 1, 2004 | | 0.0 | % | 0.0 | % | |

| July 1, 2004 | | (10.0 | ) | | | |

| January 1, 2005 | | (2.0 | ) | (4.0 | ) | |

| July 1, 2005 | | (12.0 | ) | | | |

| January 1, 2006 | | (13.0 | ) | (13.4 | ) | |

| July 1, 2006 | | (5.0 | ) | | | |

| January 1, 2007 | | (4.4 | ) | (12.5 | ) | |

| July 1, 2007 | | 0.0 | | | | |

| January 1, 2008 | | 0.0 | | (18.4 | ) | |

|

11

DECLINING CLAIM FREQUENCY AND SEVERITY, REDUCED RATES TO OUR CUSTOMERS AND IMPROVED PROFITABILITY ARE THE MAJOR BUSINESS TRENDS DURING THE PAST FEW YEARS.

In addition to the data in the prior table, further price reductions have resulted from lower experience modifications and individual pricing adjustments which are measured retroactively, and therefore, changes in filed rates alone do not provide a complete picture. We have also paid dividends to our policyholders of $16.5 million, $24.9 million and $4.4 million in 2007, 2006 and 2005, respectively.

Declining claim frequency and severity, reduced rates to our customers and improved profitability are the major business trends during the past few years. These factors have resulted in lower accident year combined ratios, strengthened reserve performance, increased stockholder dividends and improved financial strength. Deflation relating to claim costs is clearly evident in the schedule on page 31 as are the assumptions used to establish loss reserves in our financial statements. Our California rate changes have lagged short-term cost decreases and our competitors' pricing, consistent with our long-term strategy of maintaining underwriting and pricing discipline.

Workers' compensation accident year loss ratios, both within and outside California, compared to rating bureau estimated loss ratios as estimated at December 31, 2007, are set forth in the following table:

|

|---|

| |

| |

| | Outside

California

|

|

|---|

| | California

|

|

|---|

Accident Year

Loss Ratios

|

|

|---|

| | Zenith

| | Industry

| | Zenith

| | Industry

|

|

|---|

|

|---|

| 2001 | | 78% | | 106% | | 58% | | 78% | |

| 2002 | | 61 | | 82 | | 53 | | 70 | |

| 2003 | | 42 | | 52 | | 42 | | 63 | |

| 2004 | | 28 | | 32 | | 38 | | 61 | |

| 2005 | | 25 | | 29 | | 33 | | 58 | |

| 2006 | | 28 | | 36 | | 34 | | 59 | |

| 2007 | | 33 | | — | | 35 | | — | |

|

The table above indicates that during 2001 to 2006 we have loss ratios substantially below industry averages. As you may recall in prior years' Annual Reports, our results appeared to be not as favorable in 2004 and 2005 in relation to the industry as they do at present. This change is due to the favorable reserve development we have reflected during the past two years. In other words, we were more conservative in our reserving during earlier years, primarily due to the uncertainties of how the reforms would develop.

12

WORKERS' COMPENSATION COMBINED RATIO

Zenith adheres to disciplined and consistent underwriting and customer service principles, and a commitment to pricing strategies based on realistic assumptions anticipated to generate an underwriting profit. Significantly, our agents offer numerous opportunities for business, however, we are selective and successful in writing only a small proportion of the prospective new accounts. We do, however, write a substantial percentage of renewal accounts; testimony to our mission of customer satisfaction. Underwriting profit margins will be primarily dependent upon new data relating to claim cost trends and the frequency of the more costly claims, offset by Florida rate decreases and complicated by an acceleration in the settlement of 2006 cases. In California, rates should stabilize and trend upward as additional industry data are received and as some of the reforms are revised to improve the fairness of the system. In this regard, it is interesting to look at the most recent report of the largest writer of workers' compensation in California, the State Compensation Insurance Fund ("SCIF"). They reported combined ratios for nine months ended September 30, 2007 on an accident year and calendar year basis of 102.5% and 118.6%, respectively. Since SCIF is reporting unfavorable reserve development of 16.1 percentage points, it adds support to the possibility that profits reported for the industry have been overstated and the likelihood of rate increases in the near future.

13

INSURED PAYROLLS GREW 32% IN FIVE YEARS, PRIMARILY FROM MARKETS OUTSIDE OF CALIFORNIA.

We measure our progress based on insured payroll trends which we believe is a more accurate assessment of size and exposure, rather than premiums or policy counts. The following table compares premiums, policy counts and insured payrolls, both within and outside of California.

|

|---|

| | California

| | Outside California

| | Total

|

|---|

December 31,

| | Premiums

In-Force

| | Policies

In-Force(1)

| | Insured

Payrolls(1)

| | Premiums

In-Force

| | Policies

In-Force(1)

| | Insured

Payrolls(1)

| | Premiums

In-Force

| | Policies

In-Force(1)

| | Insured

Payrolls(1)

|

|

|---|

|

|---|

| | (Dollars in millions)

|

|

|---|

| 2002 | | $ | 350.2 | | 22,600 | | $ | 6,860.4 | | $ | 259.2 | | 16,900 | | $ | 8,308.2 | | $ | 609.4 | | 39,500 | | $ | 15,168.6 | |

| 2003 | | | 587.9 | | 25,900 | | | 7,752.2 | | | 277.8 | | 15,600 | | | 8,699.4 | | | 865.7 | | 41,500 | | | 16,451.6 | |

| 2004 | | | 731.3 | | 27,200 | | | 9,701.2 | | | 311.0 | | 16,200 | | | 9,993.5 | | | 1,042.3 | | 43,400 | | | 19,694.7 | |

| 2005 | | | 722.9 | | 27,500 | | | 10,280.9 | | | 326.9 | | 16,900 | | | 10,833.6 | | | 1,049.8 | | 44,400 | | | 21,114.5 | |

| 2006 | | | 501.2 | | 24,600 | | | 9,487.4 | | | 332.8 | | 16,600 | | | 11,744.4 | | | 834.0 | | 41,200 | | | 21,231.8 | |

| 2007 | | | 359.3 | | 22,100 | | | 7,770.8 | | | 310.8 | | 16,200 | | | 12,213.7 | | | 670.1 | | 38,300 | | | 19,984.5 | |

|

- (1)

- Prior period policies in-force and insured payroll amounts have been adjusted as a result of a refinement in our databases and to more accurately align with the premium and policy in-force amounts.

Our five-year growth in insured payrolls was 32%, primarily from outside of California where we have more payrolls than within California. Our payrolls within California grew 13% during the five years, although they did decrease year over year in 2006 and 2007 as a result of our pricing and underwriting strategy compared to our competition.

Our 38,000 policyholders are widely diversified across a number of industries thereby reducing our exposure to an economic downturn. Our largest exposures are to California agriculture, restaurants, dentists, auto dealers, building maintenance and retail stores.

Claim frequency trends in 2007 remained favorable as they have for a number of years. We observed a continued significant drop in the frequency of our highest-cost California claims, and should this trend continue it will bode well for the ongoing deflation of our claim costs.

14

ZENITH IS FOCUSED ON DISCIPLINED AND CONSISTENT UNDERWRITING AND CUSTOMER SERVICE PRINCIPLES.

Unfortunately, we need to be patient for additional data to emerge. The following table shows the trends in the number of California permanent partial disability ("PPD") claims (our highest cost claims) at various dates:

|

|---|

| | Number of California PPD Claims Reported after Number of Months

|

|---|

Accident Year

| | 12

| | 24

| | 36

| | 48

| | 60

| | 72

|

|

|---|

|

|---|

| 2002 | | 3,320 | | 2,820 | | 2,735 | | 2,715 | | 2,683 | | 2,665 | |

| 2003 | | 4,091 | | 3,117 | | 2,912 | | 2,861 | | 2,844 | | | |

| 2004 | | 3,972 | | 2,862 | | 2,668 | | 2,617 | | | | | |

| 2005 | | 3,346 | | 2,641 | | 2,573 | | | | | | | |

| 2006 | | 2,236 | | 2,295 | | | | | | | | | |

| 2007 | | 1,812 | | | | | | | | | | | |

|

We also analyze claim frequency in relation to our exposure, as measured by insured payroll. The following table shows the California PPD claims from the previous table in relation to insured payroll:

|

|---|

| | California PPD Claims per $10 million of Insured Payroll

After Number of Months

|

|---|

Accident Year

| | 12

| | 24

| | 36

| | 48

| | 60

| | 72

|

|

|---|

|

|---|

| 2002 | | 5.08 | | 4.31 | | 4.18 | | 4.15 | | 4.10 | | 4.07 | |

| 2003 | | 5.39 | | 4.11 | | 3.84 | | 3.77 | | 3.75 | | | |

| 2004 | | 4.43 | | 3.19 | | 2.98 | | 2.92 | | | | | |

| 2005 | | 3.16 | | 2.50 | | 2.43 | | | | | | | |

| 2006 | | 2.25 | | 2.30 | | | | | | | | | |

| 2007 | | 2.14 | | | | | | | | | | | |

|

As shown, there is a sharply decreasing trend in the frequency of PPD claims compared to payroll exposure. Even though payroll exposure grew during the five-year period, the number of PPD claims is down producing a nearly 50% reduction in PPD claims per $10 million of payroll. A comparison of the statistics from 2002 - 2003 to subsequent years illustrates the benefits of the reforms. The continuation of the favorable trends each year beginning in 2004 is significant and demonstrates underwriting discipline in a competitive environment and enhances profitability.

Also evident from the two previous tables, the ultimate number of PPD claims is not apparent until about 36 months have elapsed. This is due to the fact that the final assessment of a person's permanent disability cannot be made until they have reached a permanent and stationary medical status. Prior to this, the level of permanent disability is estimated based upon the available medical

15

OUR QUALITY CLAIMS SERVICES ASSIST INJURED WORKERS AND REDUCE COSTS TO EMPLOYERS.

information at the time. The reduction of reported claims for the 2006 and 2007 accident years at 12 and 24 months will be monitored closely. Since the average cost of these types of claims is approximately $75,000, the confirmation over time of the reduction in the frequency will materially affect our ultimate average claim inflation and our financial results.

Our current priorities in the claims operations are on speeding up the claims settlement process and improving the quality of our medical networks. We use technology to assist in these endeavors. These efforts are focused on reducing costs over time and improving medical care to injured workers.

Our catastrophe management strategies are designed to mitigate our exposure to earthquakes, floods and terrorism. Through a combination of reinsurance, underwriting controls and careful tracking of our exposures, supported by technology, we are focused on effectively managing our risks. Since we do not routinely insure employers with large concentrations of employees or companies located in perceived target areas, we are in a good position to minimize the impact of possible terrorist acts.

When we step back from the short-term numbers and look at the long-term trends that exist in our business, we would identify the following:

- 1.

- Lost-time claim frequency has declined significantly over many years.

- 2.

- Medical expenses as a percentage of workers' compensation costs have increased from about 40% to 60% of claim costs.

- 3.

- Legislation, judicial interpretations and medical developments have broadened exposure.

- 4.

- From time to time legislative reforms have improved various state systems, resulting in improved profitability and decreased premiums.

- 5.

- Reserving accuracy and pricing have been made more difficult by these trends and the lengthening of the average claim duration, or tail.

16

68% OF OUR EMPLOYEES OWN STOCK IN THE COMPANY.

CONCLUSION

Workers' compensation profitability during the past few years has been substantially above average primarily due to the short-term impact of legislative reforms in Florida and California. It is clear that competitive pricing pressures will reduce growth and profitability in all aspects of the property and casualty business, including workers' compensation. The sub-prime debacle clearly indicates what happens when underwriting standards and risk management are ignored. Our financial strength is our best ever and we intend to continue our high underwriting standards irrespective of the impact on our volume or profits. Our service strategy provides long-term benefits to our policyholders and our profitability over time should continue to outperform the competition.

Common sense indicates that large reserve releases adding substantially to earnings in 2006 and 2007 cannot continue indefinitely. Despite the downward long-term trend in the number of the more expensive claims in California and due to the long-tail nature of this business, we must await additional data from the settlement of claims and the ultimate number of expensive claims before the precise impact becomes clear. We cannot predict the timing or magnitude of future reserve releases, but we do believe the possibility exists for such releases on a more irregular basis than in the past two years as the data emerges. Remember, reserving involves estimates based upon data and judgment.

Our business model operates well despite the ups and downs of the economic and competitive cycles provided that we maintain underwriting discipline and continue to improve our services to claimants, policyholders and agents. The 2007 results indicate substantial underwriting profit margins without reserve releases, and a strong balance sheet with a conservative investment portfolio, including large amounts of cash available for investment opportunities. These factors, along with our investment income, provide an encouraging starting point to continue building additional long-term stockholder value.

17

FINANCIAL STRENGTH IS OUR BEST EVER.

Stockholder dividends were increased again this year to an annual rate of $2.00 per share. Also, due to our financial strength, we declared and paid an extra cash dividend at year-end of $1.00 per share. This extra cash dividend benefits all stockholders equally (which may not necessarily be the case with share repurchases). We continue to study the subject of "excess capital" and to evaluate our opportunities and choices. Consideration must be given to short-term premium, reserve and profitability trends and the possibility of acquisitions, among other factors.

Our success would not be possible without the long-term relationships established with our agents and the leadership demonstrated by our employees. We are deeply indebted to the wisdom and guidance provided by our distinguished Board of Directors and our stockholders.

Stanley R. Zax

Chairman of the Board and President

Woodland Hills, California, February 2008

18

ACCIDENT YEAR RESERVE DEVELOPMENT FROM OPERATIONS

|

|---|

| | Net incurred loss and loss adjustment expenses reported at end of year

|

|---|

Years in which losses were incurred

|

|---|

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

| | 2006

| | 2007

| |

|

|---|

|

|---|

| | (Dollars in thousands)

|

|---|

| Prior to 2002 | | $ | 4,910,634 | | $ | 4,939,802 | | $ | 4,970,778 | | $ | 5,013,618 | | $ | 5,075,133 | | $ | 5,085,430 | | $ | 5,102,346 | | |

| 2002 | | | | | | 391,960 | | | 375,199 | | | 397,817 | | | 413,764 | | | 419,553 | | | 421,279 | | |

| 2003 | | | | | | | | | 523,707 | | | 471,615 | | | 443,744 | | | 440,190 | | | 423,524 | | |

| 2004 | | | | | | | | | | | | 615,397 | | | 538,906 | | | 490,530 | | | 455,377 | | |

| 2005 | | | | | | | | | | | | | | | 730,770 | | | 625,292 | | | 593,668 | | |

| 2006 | | | | | | | | | | | | | | | | | | 464,106 | | | 419,106 | | |

| 2007 | | | | | | | | | | | | | | | | | | | | | 362,645 | | |

Calendar Year (Unfavorable) Favorable Prior Period Development |

|

|

|

|

|

(29,168 |

) |

|

(14,215 |

) |

|

(13,366 |

) |

|

26,900 |

|

|

141,322 |

|

|

109,801 |

|

|

Loss and loss adjustment expense ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2001 | | | 85.9 | % | | 89.3 | % | | 91.7 | % | | 93.9 | % | | 95.3 | % | | 96.0 | % | | 97.1 | % | |

| 2002 | | | | | | 70.4 | | | 67.4 | | | 71.4 | | | 74.3 | | | 75.3 | | | 75.6 | | |

| 2003 | | | | | | | | | 67.7 | | | 60.9 | | | 57.3 | | | 56.9 | | | 54.7 | | |

| 2004 | | | | | | | | | | | | 65.2 | | | 57.1 | | | 51.9 | | | 48.2 | | |

| 2005 | | | | | | | | | | | | | | | 62.0 | | | 53.0 | | | 50.4 | | |

| 2006 | | | | | | | | | | | | | | | | | | 49.2 | | | 44.4 | | |

| 2007 | | | | | | | | | | | | | | | | | | | | | 49.2 | | |

|

This analysis displays the accident year net incurred loss and loss adjustment expenses on a GAAP basis in total for accident years prior to 2002 and for each of the accident years 2002-2007 for our workers' compensation and reinsurance businesses, together. The total of estimated net loss and loss adjustment expenses for all claims occurring within each annual period is shown first at the end of that year and then annually thereafter. The total cost includes both payments made and the estimate of future payments as of each year-end. Past development may not be an accurate indicator of future development since trends and conditions change.

The total change in our incurred loss estimates for all prior accident years in 2007 was a net decrease, or favorable development, of approximately $109.8 million, comprised of $113.4 million for our workers' compensation loss reserves, partially offset by an increase, or unfavorable development, of $3.6 million for our reinsurance loss reserves. The favorable development of our workers' compensation loss reserves during 2007 reflects a reduction of estimated losses for the 2003 through 2006 accident years.

19

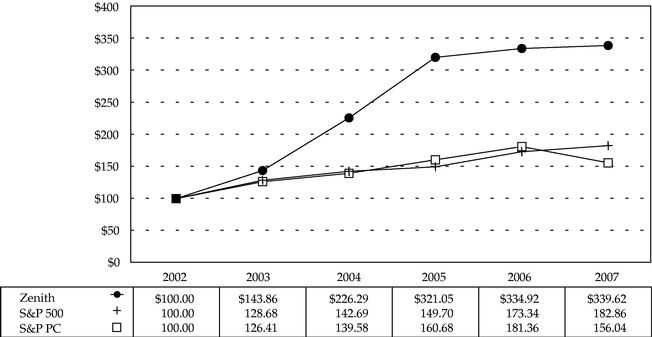

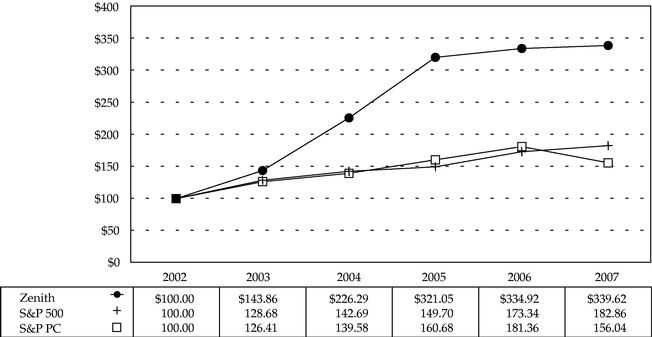

STOCK PRICE PERFORMANCE

The Stock Price Performance Graph below compares the cumulative total returns of the Common Stock, par value $1.00 per share, of Zenith National Insurance Corp., ticker symbol ZNT ("Zenith"), the Standard and Poor's 500 Stock Index ("S&P") and the Standard and Poor's 500 Property-Casualty Insurance Index ("S&P PC") for a five year period. Stock price performance is based on historical results and is not necessarily indicative of future stock price performance. The following graph assumes $100 was invested at the close of trading on the last trading day preceding the first day of the fifth preceding year in Zenith, the S&P 500 and the S&P PC. The calculation of cumulative total return assumes the reinvestment of dividends. The graph was prepared by Standard and Poor's Investment Services, which obtained factual materials from sources believed by it to be reliable, but which disclaims responsibility for any errors or omissions contained in such data.

Comparative Five-Year Total Returns

Zenith, S&P 500, and S&P PC

(Performance Results Through December 31, 2007)

20

MANAGEMENT'S DISCUSSION AND ANALYSIS OF CONSOLIDATED FINANCIAL CONDITION AND RESULTS OF OPERATIONS

ZENITH NATIONAL INSURANCE CORP. AND SUBSIDIARIES

Zenith National Insurance Corp. ("Zenith National") is a holding company engaged, through its wholly-owned subsidiaries (primarily Zenith Insurance Company ("Zenith Insurance")), in the workers' compensation insurance business, nationally. Unless otherwise indicated, all references to "Zenith," "we," "us," "our," the "Company" or similar terms refer to Zenith National together with its subsidiaries.

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements if accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those discussed. Forward-looking statements include those related to the plans and objectives of management for future operations, future economic performance, or projections of revenues, income, earnings per share, capital expenditures, dividends, capital structure, or other financial items. Statements containing words such asexpect, anticipate, believe, estimate, or similar words that are used in this Management's Discussion and Analysis of Consolidated Financial Condition and Results of Operations ("MD&A"), in other parts of this report or in other written or oral information conveyed by or on behalf of Zenith, are intended to identify forward-looking statements. The Company undertakes no obligation to update such forward-looking statements, which are subject to a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, the following: (1) competition; (2) payroll levels of our customers; (3) weakening economy; (4) adverse state and federal legislation and regulation; (5) changes in interest rates causing fluctuations of investment income and fair values of investments; (6) changes in the frequency and severity of claims and catastrophes; (7) adequacy of loss reserves; (8) changing environment for controlling medical, legal and rehabilitation costs, as well as fraud and abuse; (9) losses associated with any terrorist attacks that impact our workers' compensation business in excess of our reinsurance protection; (10) losses caused by nuclear, biological, chemical or radiological events whether or not there is any applicable reinsurance protection; and (11) other risks detailed herein and from time to time in Zenith's reports and filings with the Securities and Exchange Commission ("SEC").

OVERVIEW

We are in the business of managing insurance and investment risk with the major risk factors set forth in the preceding paragraph. Our main business activity is the workers' compensation insurance business. We measure our performance by our ability to increase stockholders' equity over the long-term. Following is a summary of our recent business performance and how we expect the trends to continue for the foreseeable future.

Revenues. Our revenues are comprised of the net premiums earned from our workers' compensation and reinsurance segments and the net investment income and realized gains from our investments segment. Total revenues in the year ended December 31, 2007 decreased compared to the corresponding period of 2006 principally because of decreased workers' compensation premium revenues in California, partially offset by increases in net investment income and realized gains on investments. The 2007 decline in California workers' compensation premiums principally reflects rate decreases as a result of favorable loss costs trends originating from the 2003 and 2004 legislative reforms combined with a decline in insured payrolls and policies in-force as a result of our pricing and underwriting strategy compared to our competition.

Our operating goals do not include objectives for revenues or market share but rather emphasize pricing and underwriting discipline to maintain profitability. We expect that workers' compensation rates in California should stabilize and possibly trend higher during 2008, however, our actual premium trend

21

in 2008 will be principally determined by competition. Our workers' compensation premiums are discussed further under "Results of Operations — Workers' Compensation Segment" on pages 23 to 26.

Income (Loss) from Workers' Compensation and Reinsurance Segments.

(a) Workers' Compensation. Income before tax from our workers' compensation segment for the three years ended December 31 was as follows (dollars in thousands):

|

| 2007 | | $ | 243,832 |

| 2006 | | | 313,576 |

| 2005 | | | 213,244 |

|

Workers' compensation underwriting income decreased in 2007 compared to 2006 because of decreased premium revenue and lower favorable development of prior accident year loss reserve estimates. Workers' compensation underwriting income increased in 2006 compared to 2005 due to higher favorable development on prior accident year loss reserve estimates, partially offset by decreased premium revenue.

(b) Reinsurance. Losses before tax from our reinsurance segment for the three years ended December 31 were as follows (dollars in thousands):

| |

| 2007 | | $ | (3,661 | ) |

| 2006 | | | (20,508 | ) |

| 2005 | | | (56,183 | ) |

| |

In both 2007 and 2006, we recognized additional estimated losses attributable to the 2005 hurricanes (Rita and Wilma) of $3.0 million and $19.9 million, respectively. In 2005, we recognized catastrophe losses of $69.2 million attributable to the 2005 hurricanes (Katrina, Rita and Wilma). We exited the reinsurance business in September 2005.

Loss Reserves. We recognized pre-tax favorable development on prior accident year workers' compensation loss reserve estimates for the three years ended December 31 as follows (dollars in thousands):

|

| 2007 | | $ | 113,355 |

| 2006 | | | 161,252 |

| 2005 | | | 26,289 |

|

The favorable development is a result of our estimates of loss reserves following the 2003 and 2004 legislative reforms in California and the 2003 legislative reforms in Florida. With the passage of time, more claims for the 2003 - 2006 accident years have been paid and closed and, with the benefit of this data, our estimates of prior year reserves have proven to be redundant. At this time, we do not currently expect the magnitude of favorable development that occurred over the past two years to continue and we cannot predict the amount or timing of future reserve changes, whether favorable or unfavorable.

Investments Segment. Investment income before tax for the three years ended December 31 was as follows (dollars in thousands):

|

| 2007 | | $ | 114,863 |

| 2006 | | | 106,294 |

| 2005 | | | 79,200 |

|

The increase in investment income in 2007 compared to 2006 principally reflects a $7.3 million cash dividend received from a common stock investment and higher interest rates on fixed maturity investments. The increase in investment income in 2006 compared to 2005 reflects the increase in our investment portfolio from the favorable net cash flow from operations and higher interest rates on fixed maturity investments. We expect that investment income in 2008 will be affected by declining interest rates.

At December 31, 2007, $0.7 billion of the investment portfolio was in fixed maturities of two years or less compared to $0.9 billion at December 31, 2006.

We recorded realized gains from investments in each of the last three years, but we cannot predict future realized gains from investments.

22

Stockholders' Equity. Consolidated stockholders' equity per share increased each of the three years ended December 31 as follows:

|

| 2007 | | $ | 28.93 |

| 2006 | | | 25.41 |

| 2005 | | | 19.14 |

|

Stockholders' equity will primarily depend upon the future level of net income, payment of dividends and any fluctuations in the fair values of our investments. We will continue to evaluate whether we have excess capital, including consideration over time of the level of dividends.

More information about the key elements of our performance follows below.

RESULTS OF OPERATIONS

Summary Results by Segment. Our business is classified into the following segments: investments, workers' compensation, reinsurance, and parent. Income from operations of the investments segment includes investment income and realized gains and losses on investments, and we do not allocate investment income to the results of our workers' compensation and reinsurance segments. Income (loss) from operations of the workers' compensation and reinsurance segments is determined by deducting net loss and loss adjustment expenses incurred and underwriting and other operating expenses from net premiums earned. In September 2005, we exited the assumed reinsurance business and ceased writing and renewing assumed reinsurance contracts, with all contracts fully expired at the end of 2006. The loss from operations of the parent segment includes interest expense and the general operating expenses of Zenith National. The comparative components of net income are set forth in the following table:

| |

|---|

| | Year Ended December 31,

| |

|---|

(Dollars in thousands)

| | 2007

| | 2006

| | 2005

| |

|---|

| |

|---|

| Net investment income | | $ | 114,863 | | $ | 106,294 | | $ | 79,200 | |

| Realized gains on investments | | | 20,353 | | | 13,377 | | | 22,224 | |

| |

| Income before tax from investments segment | | | 135,216 | | | 119,671 | | | 101,424 | |

| Income (loss) before tax from: | | | | | | | | | | |

| | Workers' compensation segment | | | 243,832 | | | 313,576 | | | 213,244 | |

| | Reinsurance segment | | | (3,661 | ) | | (20,508 | ) | | (56,183 | ) |

| | Parent segment | | | (12,506 | ) | | (11,927 | ) | | (20,938 | ) |

| |

| Income from continuing operations before tax and equity in earnings of investee | | | 362,881 | | | 400,812 | | | 237,547 | |

| Income tax expense | | | 128,981 | | | 142,112 | | | 81,894 | |

| |

| Income from continuing operations after tax and before equity in earnings of investee | | | 233,900 | | | 258,700 | | | 155,653 | |

| Equity in earnings of investee after tax | | | | | | | | | 794 | |

| |

| Income from continuing operations after tax | | | 233,900 | | | 258,700 | | | 156,447 | |

| Gain on sale of discontinued real estate segment after tax | | | | | | | | | 1,253 | |

| |

| Net income | | $ | 233,900 | | $ | 258,700 | | $ | 157,700 | |

| |

Net premiums earned in the workers' compensation and reinsurance segments were as follows:

|

|---|

| | Year Ended December 31,

|

|---|

(Dollars in thousands)

| | 2007

| | 2006

| | 2005

|

|---|

|

|---|

| Workers' compensation: | | | | | | | | | |

| | California | | $ | 407,105 | | $ | 582,282 | | $ | 762,095 |

| | Outside California | | | 331,091 | | | 349,457 | | | 352,099 |

|

| Total workers' compensation | | | 738,196 | | | 931,739 | | | 1,114,194 |

| Reinsurance | | | 336 | | | 12,478 | | | 64,506 |

|

| Net premiums earned | | $ | 738,532 | | $ | 944,217 | | $ | 1,178,700 |

|

Workers' Compensation Segment. In the workers' compensation segment, we provide insurance coverage for the statutorily prescribed benefits that employers are required to provide to their employees who may be injured in the course of employment. Except in those states, primarily Florida, where we are required by regulation to use mandated rates, we set our own rates based upon actuarial analysis of current and anticipated cost trends with the goal

23

of achieving underwriting profits. We continually analyze data and use our best judgment about loss cost trends, particularly claim inflation, to set adequate premium rates and loss reserves.

The combined ratio, expressed as a percentage, is a key measurement of profitability traditionally used in the property-casualty insurance business. The combined ratio, also referred to as the "calendar year combined ratio," is the sum of the loss and loss adjustment expense ratio and the underwriting and other operating expense ratio. The loss and loss adjustment expense ratio is the percentage of loss and loss adjustment expenses incurred to net premiums earned. The underwriting and other operating expense ratio is the percentage of underwriting and other operating expenses to net premiums earned. When the calendar year combined ratio is adjusted to exclude prior period items, such as loss reserve development and policyholders' dividends, it becomes the "accident year combined ratio," a non-GAAP financial measure.

The key operating goal for our workers' compensation segment is to achieve substantial underwriting profits and significantly out-perform the national workers' compensation industry. Historically, a combined ratio of 100% or lower was considered an excellent result, however in recent years we have achieved combined ratios significantly better than this target.

Workers' compensation calendar year combined ratios, along with a reconciliation to the accident year combined ratios, were as follows:

| |

|---|

| | Year Ended December 31,

| |

|---|

| | 2007

| | 2006

| | 2005

| |

|---|

| |

|---|

| Calendar Year Combined Ratios | | 67.0 | % | 66.3 | % | 80.9 | % |

| Prior Accident Year Items: | | | | | | | |

| | Favorable loss reserve development | | 15.4 | | 17.3 | | 2.4 | |

| | Decrease (increase) in policyholders' dividends | | 2.0 | | (3.6 | ) | (1.5 | ) |

| |

| Total Prior Accident Year | | 17.4 | | 13.7 | | 0.9 | |

| |

| Accident Year Combined Ratios | | 84.4 | % | 80.0 | % | 81.8 | % |

| |

Income before tax from the workers' compensation segment decreased by $69.7 million to $243.8 million for year ended December 31, 2007, compared to the same period in 2006 due to the following:

- •

- Net premiums earned decreased 20.8%, primarily as a result of the 30.1% decrease in California.

- •

- Favorable prior accident year loss development in 2007 was $113.4 million, but $47.9 million less than in 2006.

- •

- Policy acquisition costs are generally variable to net earned premiums. However, underwriting and other operating expenses are more fixed in nature and, although lower in 2007 compared to 2006, are a larger percent of net earned premiums.

Offset in part by:

- •

- A reduction of $15.1 million in estimated policyholders' dividends for prior accident years, compared to a $34.1 million increase in 2006.

Income before tax from the workers' compensation segment increased by $100.3 million to $313.6 million for the year ended December 31, 2006, compared to the same period in 2005 due to the following:

- •

- Higher favorable prior accident year loss reserve development in 2006 of $161.3 million, compared to $26.3 million in 2005

Offset in part by:

- •

- Net premiums earned decreased 16.4%, primarily as a result of the 23.6% decrease in California.

- •

- Estimated policyholders' dividends for prior accident years increased by $34.1 million, compared to $16.0 million in 2005.

For a discussion of the favorable development of prior accident year loss reserves, see "Loss Reserves" on pages 28 to 34.

24

Workers' compensation premiums in-force, number of policies in-force, and insured payrolls in California and outside of California are shown in the following table. Premiums in-force is a measure of the amount of premiums billed or to be billed on all un-expired policies at the date shown and insured payroll is our best indicator of exposure.

|

|---|

(Dollars in millions)

| | Premiums

in-force

| | Policies

in-force

(1)

| | Insured

Payrolls

(1)

|

|---|

|

|---|

| California | | | | | | | | |

| December 31, 2002 | | $ | 350.2 | | 22,600 | | $ | 6,860.4 |

| December 31, 2003 | | | 587.9 | | 25,900 | | | 7,752.2 |

| December 31, 2004 | | | 731.3 | | 27,200 | | | 9,701.2 |

| December 31, 2005 | | | 722.9 | | 27,500 | | | 10,280.9 |

| December 31, 2006 | | | 501.2 | | 24,600 | | | 9,487.4 |

| December 31, 2007 | | | 359.3 | | 22,100 | | | 7,770.8 |

Outside California |

|

|

|

|

|

|

|

|

| December 31, 2002 | | $ | 259.2 | | 16,900 | | $ | 8,308.2 |

| December 31, 2003 | | | 277.8 | | 15,600 | | | 8,699.4 |

| December 31, 2004 | | | 311.0 | | 16,200 | | | 9,993.5 |

| December 31, 2005 | | | 326.9 | | 16,900 | | | 10,833.6 |

| December 31, 2006 | | | 332.8 | | 16,600 | | | 11,744.4 |

| December 31, 2007 | | | 310.8 | | 16,200 | | | 12,213.7 |

Total |

|

|

|

|

|

|

|

|

| December 31, 2002 | | $ | 609.4 | | 39,500 | | $ | 15,168.6 |

| December 31, 2003 | | | 865.7 | | 41,500 | | | 16,451.6 |

| December 31, 2004 | | | 1,042.3 | | 43,400 | | | 19,694.7 |

| December 31, 2005 | | | 1,049.8 | | 44,400 | | | 21,114.5 |

| December 31, 2006 | | | 834.0 | | 41,200 | | | 21,231.8 |

| December 31, 2007 | | | 670.1 | | 38,300 | | | 19,984.5 |

|

(1) Prior period policies in-force and insured payroll amounts have been adjusted as a result of a refinement in our databases and to more accurately align with the premium and policy in-force amounts.

California premiums in-force decreased in each of the last three years ended December 31, 2007 as a result of premium rate changes due to favorable loss cost trends from the 2003 and 2004 legislative reforms, combined with our pricing and underwriting strategy compared to our competition as reflected in the decline in insured payrolls and policies in-force in 2006 and 2007. Premiums in-force outside California also declined as of December 31, 2007 compared to December 31, 2006 and 2005, however rate decreases were to a large extent offset by growth in insured payrolls.

In California, the state in which the largest amount of our workers' compensation premiums are earned, we set our own rates based upon our actuarial analysis of current and anticipated cost trends. As a result of favorable loss cost trends originating from the 2003 and 2004 legislative reforms, we have reduced our California premium rates in a manner that we believe deals prudently with the uncertainty about the long-term outcome of loss costs trends for recent accident years. These manual rates do not necessarily indicate the rates charged to our policyholders because employers' experience modification factors are subject to revision annually; and our underwriters are given authority to increase (debit) or decrease (credit) rates based upon individual risk characteristics. The following table sets forth the manual rate change percentages in California, as well as the change in the average rates charged in California on renewal business for each period. The change in the average renewal rate takes into consideration changes in manual rates as well as the changes in experience modification factors and net credits or debits applied by our underwriters (decreases are shown in parentheses):

| |

|---|

Effective date of change

| | Manual

Rate

Change

| | Average

Renewal

Charged Rate

Change

| |

|---|

| |

|---|

| January 1, 2004 | | 0.0 | % | (4.0 | )% |

| July 1, 2004 | | (10.0 | ) | (12.0 | ) |

| January 1, 2005 | | (2.0 | ) | 0.0 | |

| July 1, 2005 | | (12.0 | ) | (19.0 | ) |

| January 1, 2006 | | (13.0 | ) | (15.0 | ) |

| July 1, 2006 | | (5.0 | ) | (13.0 | ) |

| January 1, 2007 | | (4.4 | ) | 0.0 | |

| July 1, 2007 | | 0.0 | | (15.0 | ) |

| January 1, 2008 | | 0.0 | | | |

| |

Future California premium rate decisions will be based on data about loss costs trends and upon any modification to the workers' compensation system while maintaining our goal of achieving underwriting profits and out-performing the industry.

In Florida, the state in which the second largest amount of our workers' compensation premium is earned, premium rates for workers' compensation insurance are set by the Florida Department of Insurance ("Florida DOI"). Manual rate change percentages in Florida were as follows:

|

|---|

Effective date of change

| | Manual Rate

Change

|

|---|

|

|---|

| January 1, 2004 | | 0.0% |

| January 1, 2005 | | (4.0) |

| January 1, 2006 | | (13.4) |

| January 1, 2007 | | (12.5) |

| January 1, 2008 | | (18.4) |

|

25

Most of our workers' compensation policies are non-participating, but we issue certain policies for which the policyholder may participate in favorable claims experience through a dividend. An estimated provision for workers' compensation policyholders' dividends is accrued as the related premiums are earned. In addition, Florida statutes require payment of additional policyholders' dividends to Florida policyholders pursuant to a formula based on underwriting results ("Florida Dividends"). We accrued $19.0 million and $34.1 million for estimated Florida Dividends as of December 31, 2007 and 2006, respectively. During 2007, we reduced our accrual for estimated Florida Dividends by $15.1 million, to reflect the impact of changes in our estimated direct loss reserves, as well as the impact of the recently enacted legislation in California (the domiciliary state of our insurance subsidiaries) which eliminates the excess statutory reserves effective January 1, 2008. Our ultimate obligation for Florida Dividends is dependent on our filings with the Florida Department of Insurance and on our prescribed loss reserves included in our annual statutory financial statements.

Workers' Compensation Reform Legislation. During 2007, we wrote workers' compensation insurance in 45 states, but the largest concentrations, 55.1% and 26.1% of our workers' compensation net premiums earned during 2007, were in California and Florida, respectively. The concentration of our workers' compensation business in these states makes the results of our operations dependent on trends that are characteristic of these states as compared to national trends, e.g., state legislation, competition, and workers' compensation loss costs inflation or deflation trends.

In California, workers' compensation reform legislation was enacted in October 2003 and April 2004 with the principal objectives of lowering the trend of increasing costs and improving fairness in the system. The principal changes in the legislation of 2003 included: 1) a reduction in the reimbursable amount for certain physician fees, outpatient surgeries, pharmaceutical products and certain durable medical equipment; 2) a limitation on the number of chiropractor or physical therapy office visits; 3) the introduction of medical utilization guidelines; 4) a requirement for second opinions on certain spinal surgeries; 5) a repeal of the presumption of correctness afforded to the treating physician, except where the employee has pre-designated a treating physician; and 6) a presumption of correctness is to be afforded to the evidence-based medical utilization guidelines developed by the American College of Occupational and Environmental Medicine.

The principal changes in the legislation of 2004 included: 1) employers and insurers are authorized, beginning in 2005, to establish networks of medical providers within which injured workers are required to be treated (an independent medical review would be allowed if the claimant disputes the treatment recommended in the network only after obtaining the opinions of three network physicians); 2) within one working day of filing a claim form, a claimant must be afforded necessary treatment for up to $10,000 in medical fees (however, employers and insurers still have up to 90 days to investigate the compensability of a claim); 3) a methodology for apportioning disabilities between covered, work-related and prior causes was created such that employers are only liable for the portion of permanent disability that accrues from a covered, work-related injury; 4) Temporary Disability ("TD") benefits are not to exceed 104 weeks within 2 years of the first TD payment, but cases with certain specified injuries will be allowed up to 240 weeks of TD benefits within 5 years of the date of injury; 5) Permanent Disability ("PD") ratings are based on a new, objective disability rating schedule effective January 1, 2005 (and for some injuries prior to January 1, 2005) as well as upon the injured workers' diminished future earning capacity, rather than their ability to compete in the open labor market (PD benefits were revised to make available higher benefits to more severely injured workers and lower benefits to less severely injured workers); 6) incentives were created to encourage employers to offer return-to-work programs; and 7) new medical-legal processes for resolving disputed medical issues were created.

In Florida, legislation was enacted effective October 1, 2003, which provides changes to the workers' compensation system. Such changes were designed to expedite the dispute resolution process, provide greater compliance and

26

enforcement authority to combat fraud, revise certain indemnity benefits and increase medical reimbursement fees for physicians and surgical procedures. One of the intended outcomes of the legislation is a reduction in the overall cost associated with delivering workers' compensation benefits in the state of Florida.

There have been no subsequent legislative changes which have materially impacted our workers' compensation business. However, California legislative changes during 2007 extended the time period for which the 104 weeks of temporary disability payments may be taken.

During 2008, we anticipate on-going legislative and judicial consideration of the determination of disability and the level of benefits for injured workers with permanent disability. In addition, there are renewed discussions in California around integrating workers' compensation and group health benefits into "24-hour" coverage. We cannot currently predict if substantial changes will occur.

Reinsurance Segment. In September 2005, we exited the assumed reinsurance business and ceased writing and renewing assumed reinsurance contracts. All contracts fully expired at the end of 2006; however, we will be paying our assumed reinsurance claims for several years. The results of the reinsurance segment will continue to be included in the results of continuing operations, primarily consisting of changes to loss reserve estimates.

In assumed reinsurance, we provided coverage that protected other insurance and reinsurance companies from the accumulation of large losses from major loss events, known in the insurance industry as "catastrophes." Results of the reinsurance segment were favorable in the absence of catastrophes and unfavorable in periods when they occurred and, consequently, the results of this segment fluctuated. Results of the reinsurance segment for the year ended December 31, 2007 were reduced by catastrophe losses of $3.0 million ($2.0 million after tax, or $0.05 per share) compared to catastrophe losses of $19.9 million ($12.9 million after tax, or $0.35 per share) for the year ended December 31, 2006. The catastrophe losses are primarily attributable to loss development on Hurricanes Wilma and Rita, which occurred in 2005.

The $56.2 million loss before tax in the reinsurance segment for the year ended December 31, 2005 was due to estimated catastrophe losses of $69.2 million ($45.0 million after tax, or $1.21 per share) net of additional premiums earned from reinstatement premiums. Catastrophe losses in 2005 were attributable to Hurricanes Katrina, Rita, and Wilma.

Estimating catastrophe losses in the reinsurance business is highly dependent upon the nature and timing of the event and our ability to obtain timely and accurate information with which to estimate our liability to pay losses. Estimates of the impact of catastrophes on the reinsurance segment are based on the information that is currently available and such estimates could change based on new information that becomes available or based upon reinterpretation of existing information. We describe in more detail the uncertainty surrounding catastrophe loss reserve estimates in the "Loss Reserves" section below.

Investments Segment. Investment income and realized gains and losses are discussed in the "Investments" section below.

Parent Segment. The parent segment loss reflects the holding company activities of Zenith National, as follows:

|

|---|

| | Year Ended December 31,

|

|---|

(Dollars in thousands)

| | 2007

| | 2006

| | 2005

|

|---|

|

|---|

| Interest expense | | $ | 5,245 | | $ | 5,275 | | $ | 8,757 |

| Parent expenses | | | 7,261 | | | 6,652 | | | 12,181 |

|

| Parent segment loss | | $ | 12,506 | | $ | 11,927 | | $ | 20,938 |

|

Interest expense was less in 2007 and 2006 compared to 2005 because $123.8 million aggregate principal amount of our 5.75% Convertible Senior Notes due March 30, 2023 ("Convertible Notes") was converted into our common stock during 2005. Interest expense on the Convertible Notes is added back to net income in the computation of diluted earnings per share (see Note 14 to the Consolidated Financial Statements).

Parent expenses in 2005 include $4.7 million related to the conversion of certain of the Convertible Notes in 2005 (see Note 9 to the Consolidated Financial Statements).

27

LOSS RESERVES

Accounting for the workers' compensation and reinsurance segments requires us to estimate the liability for the expected ultimate cost of unpaid losses and loss adjustment expenses as of the balance sheet date ("loss reserves"). Our loss reserves were as follows:

|

|---|

| | December 31,

|

|---|

(Dollars in millions)

| | 2007

| | 2006

|

|---|

|

|---|

| Workers' compensation segment: | | | | | | |

| | Unpaid losses and loss adjustment expenses | | $ | 1,390 | | $ | 1,416 |

| | Less: Receivable from reinsurers for unpaid losses | | | 326 | | | 221 |

|

| Unpaid losses and loss adjustment expenses, net of reinsurance | | $ | 1,064 | | $ | 1,195 |

|

| Reinsurance segment: | | | | | | |

| | Unpaid losses and loss adjustment expenses gross and net of reinsurance receivable | | $ | 63 | | $ | 106 |

|

| Total: | | | | | | |

| | Unpaid losses and loss adjustment expenses | | $ | 1,453 | | $ | 1,522 |

| | Less: Receivable from reinsurers for unpaid losses | | | 326 | | | 221 |

|

| Unpaid losses and loss adjustment expenses, net of reinsurance | | $ | 1,127 | | $ | 1,301 |

|

Loss reserves are estimates and are inherently uncertain; they do not and cannot represent an exact measure of ultimate liability. Accordingly, as we receive new information and update our assumptions over time regarding the ultimate liability, our loss reserves may prove to be inadequate to cover our actual losses or they may prove to exceed the ultimate amount of our actual losses. The amount by which estimated losses, measured subsequently by reference to payments and additional estimates, differ from those originally reported for a period is known as "development." Development is favorable when losses ultimately settle for less than the amount reserved or subsequent estimates indicate a basis for reducing loss reserves on open claims. Development is unfavorable when losses ultimately settle for more than the levels at which they were reserved or subsequent estimates indicate a basis for reserve increases on open claims. Favorable or unfavorable development of loss reserves is reflected in our Consolidated Statements of Operations in the period the change is made.