Prospectus

QUINCY GOLD CORP.

7,081,920 Shares of Common Stock

($0.001 par value per share)

We are registering 5,531,920 shares of our common stock for resale by the selling stockholders, and 1,550,000 shares of our common stock issuable upon the exercise of warrants issued to certain shareholders identified in this prospectus. We are filing the registration statement, of which this prospectus is a part, primarily to fulfill a contractual obligation to do so.

We will not receive any of the proceeds from the sale of shares by the selling stockholders, other than payment of the exercise price of the warrants. We will pay all expenses in connection with this offering, other than commissions and discounts of underwriters, dealers or agents.

The selling shareholders will sell their shares at prevailing market prices or privately negotiated prices.

Our shares of common stock are listed on the Over-the-Counter Bulletin Board operated by NASDR, Inc. under the symbol "QCYG".

Investing in our common stock involves a high degree of risk. See "Risk Factors," beginning on page 2.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is August 19, 2004.

We have not authorized any person to give any information or to make any representation not contained in this prospectus in connection with any offering of these shares of common stock. This prospectus is not an offer to sell any security other than these shares of common stock and it is not soliciting an offer to buy any security other than these shares of common stock. This prospectus is not an offer to sell these shares of common stock to any person and it is not soliciting an offer from any person to buy these shares of common stock in any jurisdiction where the offer or sale to that person is not permitted. You should not assume that the information contained in this prospectus is correct on any date after the date of this prospectus, even though this prospectus is delivered or these shares of common stock are offered or sold on a later date.

TABLE OF CONTENTS

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, proxy statements and other information with the Securities Exchange Commission (the "SEC"). You may read and copy any document we file at the SEC's public reference room located 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of such public reference room. You may also request copies of such documents, upon payment of a duplicating fee, by writing to the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549 or obtain copies of such documents from the SEC's web site at http://www.sec.gov.

FORWARD LOOKING STATEMENTS

The statements included in this Prospectus regarding future financial performance and results and the other statements that are not historical facts are forward-looking statements. You can identify forward-looking statements by terminology including "could," "may," "will," "should," "except," "plan," "expect," "project," "estimate," "predict," "anticipate," "believes", "intends", and the negative of these terms or other comparable terminology. Such statements are based upon our current expectations and involve a number of risks and uncertainties and should not be considered as guarantees of future performance. These statements include, without limitation, statements about our market opportunity, our growth strategy, competition, expected activities and future acquisitions and investments and the adequacy of our available cash resources. These statements may be found in the sections of this prospectus entitled "Prospectus Summary," "Risk Factors," "Use of Proceeds," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business." Investors are cautioned that matters subject to forward-looking statements involve risks and uncertainties, including economic, regulatory, competitive and other factors that may affect our business. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions. Readers are cautioned not to place undue reliance on these forward looking statements.

SUMMARY

This summary provides an overview of selected information and does not contain all the information you should consider before investing in our securities. To fully understand this offering and its consequences to you, you should read the entire prospectus carefully, including the "Risks Factors" section and the remainder of the prospectus, before making an investment decision. In this prospectus we refer to Quincy Gold Corp. as "Quincy," "we," "our" and "us."

Quincy Gold Corp.

Quincy Gold is a Nevada corporation engaged in the exploration of mineral properties.

We were organized for the purpose of acquiring and developing mineral natural resource properties. We own interests in seven sets of mineral claims, with unknown mineralization: the Silver Bow Property, the AG Property, the Lantern Property, the Quartz Mountain Property, the Empire Property, the Miller Property and the Seven Troughs Property.

We have also acquired a natural resource mineral database known as the Atlas Database which contains information developed by Atlas Minerals Inc. during the period 1982 through 1987 relating to mineralized material in the western United States. We intend to utilize the Atlas Database to further our stated business objective of acquiring and developing mineral natural resources properties.

Since commencing operations in 1999, we have not generated any revenue from mining operations, and we have funded our operations primarily through the private sale of equity securities, and the proceeds of loans. We will need to raise additional funds in the future to continue our operations.

Our corporate office is located at 309 Center Street, Hancock, MI 49930, telephone number (906) 370-4695. Our administrative office is located at 120 Adelaide Street West, Suite 512, Toronto, Ontario, Canada, M5H 1T1, telephone number (416) 366-7871. Our fiscal year end is April 30.

The Offering

The selling stockholders are offering for resale 5,531,920 shares of our common stock that they currently own, together with warrants to purchase 1,550,000 shares of common stock and common stock acquirable upon exercise of such warrants, all of which were sold at various prices pursuant to the exemptions from registration provided by Regulation D and Regulation S promulgated under the Securities Act of 1933.

We agreed to register the common stock, the warrants, and stock underlying the warrants, for resale by the selling stockholders. This prospectus is part of the registration statement filed to meet our obligations under the registration rights. We will not be involved in the offer and sale of these shares other than registering such shares and warrants pursuant to this prospectus.

1

Our shares of common stock are quoted on the Over-the-Counter Bulletin Board operated by NASDR, Inc. under the symbol "QCYG".

SUMMARY FINANCIAL DATA

| | Date of |

| | Inception |

| | May 5,1999 to |

| | April 30, 2004 |

| | (Audited) $ |

| Statement of Expenses Data: | |

| | |

| Revenue | Nil |

| Net Losses | 1,222,992 |

| Total Operating Expenses | 1,222,992 |

| Staking and Exploration Costs | 387,193 |

| General and Administrative | 673,455 |

| | |

| | As of |

| | April 30, 2004 |

| | (Audited) |

| | |

| Balance Sheet Data: | |

| | |

| Cash | 1,965,159 |

| Total Assets | 1,976,732 |

| Total Liabilities | 145,872 |

| Stockholders Equity (deficit) | 1,830,860 |

RISK FACTORS

An investment in our shares being offered in this prospectus involves a high degree of risk. In deciding whether to purchase shares of our common stock, you should carefully consider the following risk factors, in addition to other information contained in this prospectus. This prospectus also contains forward-looking statements that involve risks and uncertainties, such as:

– metals prices and price volatility;

– amount of metals production;

– costs of production;

– remediation, reclamation, and environmental costs;

– regulatory matters;

– cash flow;

– revenue calculations;

– the nature and availability of financing; and

– exploration risks.

If any of the events or circumstances described in the following risks actually occurs, our business, financial condition, or results of operations could be materially adversely affected and the price of our common stock could decline.

We expect to continue to incur future operating losses and may never achieve profitability.

We have never generated revenue from mining operations, and we have incurred significant net losses in each year since inception. Our net loss since inception to April 30, 2004 was $1,222,992. We expect to continue to incur substantial additional losses for the foreseeable future, and we may never become profitable. Our ability to achieve and maintain profitability and

2

positive cash flow is dependent upon our ability to locate a profitable mineral property, our ability to generate revenues and our ability to reduce exploration stage costs.

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. We cannot guarantee that we will be successful in generating revenues in the future. Failure to generate revenues will cause us to go out of business.

Our audited consolidated financial statements for the year ended April 30, 2004 were prepared on a going concern basis in accordance with United States generally accepted accounting principles. The going concern basis of presentation assumes that we will continue in operation for the foreseeable future and will be able to realize our assets and discharge our liabilities and commitments in the normal course of business. However, our auditor has indicated that our inability to generate sufficient revenue raises substantial doubt as to our ability to continue as a going concern.

We must raise capital to continue our operations, and if we fail to obtain the capital necessary to fund our operations,we will be unable to continue our exploration efforts and may have to cease operations.

At April 30, 2004, we had cash of $1,965,159. We believe this cash will be sufficient to meet our current operating and capital requirements for at least the next 12 months. However, we have based this estimate on assumptions that may prove to be wrong, and we cannot assure that estimates and assumptions will remain unchanged. For example, we are currently assuming that we will have undertaken further exploration efforts over the next 12 months without any significant staff or other resources expansion. To the extent we pursue further exploration efforts or acquire additional mining properties, we will need to raise additional capital to fund development costs. For the year ended April 30, 2004 net cash used for operating activities was $907,105. Our future liquidity and capital requirements will depend on many factors, including timing, cost and progress of our exploration efforts, our evaluation of, and decisions with respect to, our strategic alternatives, and costs associated with the regulatory approvals. If it turns out that we do not have enough money to complete our exploration programs, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money, and can't raise it, we will have to suspend or cease operations.

We believe that additional financing will be required in the future to fund our operations. We do not know whether additional financing will be available when needed or on acceptable terms, if at all. If we are unable to raise additional financing when necessary, we may have to delay our exploration efforts or any property acquisitions or be forced to cease operations. Collaborative arrangements may require us to relinquish our rights to certain of our mining claims.

Our exploration efforts may be adversely affected by metals price volatility causing us to cease exploration efforts.

We have no earnings. However, the success of any exploration efforts is derived from the price of silver, gold, lead and zinc. Silver, gold, lead and zinc prices fluctuate widely and are affected by numerous factors including:

| – expectations for inflation; |

| |

| – speculative activities; |

| |

| – relative exchange rate of the U.S. dollar; |

| |

| – global and regional demand and production; |

| |

| – political and economic conditions; and |

| |

| – production costs in major producing regions. |

These factors are beyond our control and are impossible for us to predict.

For much of 2002 and into 2003, the market prices for gold, silver, lead and zinc, were at their lowest levels since 1995 and were below production costs. The market price of those metals has since increased. The following table discloses the prices of gold, silver, lead and zinc as at April 30, 2003 and 2004.

| | April 30, 2003 | April 30, 2004 | |

| | | | |

| Gold / troy ounce (1) | $336.00 | $387.30 | |

| Silver / troy ounce (1) | $4.61 | $5.95 | |

| Lead / tonne (2) | $450.50 | $735.00 | |

| Zinc / tonne (2) | $763.50 | $1,028.50 | |

| (1) | Source: London Bullion Market Association (www.lbma.org.uk) |

| (2) | Source: London Metals Exchange (www.lme.co.uk) |

3

The above prices may decline in the future. Factors that are generally understood to have contributed to the low prices for silver, gold, lead and zinc in 2002 and into 2003 included sales by private and government holders, the emergence of China as a large net seller and a general global economic slowdown. Since 2003 market prices for gold, silver, lead and zinc have increased substantially. There is no guarantee that these price increases will be sustained.

If the market prices for these metals fall below our costs for a sustained period of time, we will experience additional losses and we would have to temporarily suspend or cease exploration efforts at one or more of our properties.

Our mineral exploration efforts may not be successful.

Mineral exploration, particularly for silver and gold, is highly speculative. It involves many risks and is often nonproductive. Even if we find a valuable deposit of minerals, it may be several years before production is possible.

During that time, it may become economically unfeasible to produce those minerals. Establishing ore reserves requires us to make substantial capital expenditures and, in the case of new properties, to construct mining and processing facilities. As a result of these costs and uncertainties, given our current financing, we will not be able to develop any mineralized areas.

We have no known mineral reserves and if we cannot find any we will have to cease operations.

We have no mineral reserves. If we do not find a mineral reserve containing gold or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we will have to cease operations and you will lose your investment.

We face strong competition from other mining companies for the acquisition of new properties.

Mines have limited lives and as a result, we continually seek to find new properties. In addition, there is a limited supply of desirable mineral lands available in the United States where we would consider conducting exploration activities. Because we face strong competition for new properties from other mining companies, some of whom have greater financial resources than we do, we may be unable to acquire attractive new mining properties on terms that we consider acceptable.

Because we only hold titleto the AG Property and we hold only leasehold interests in the other properties, other mining businesses could claim ownership.

We hold unpatented mining claims in the AG property and leasehold interests in our other properties. The validity of these unpatented mining claims or our leasehold interests is often uncertain and may be contested. Our interest in the Lantern Property has been and is the subject of litigation involving the title to the property. In accordance with mining industry practice, we do not obtain title opinions, whether unpatented claims or leasehold interests. Therefore, while we have attempted to acquire satisfactory title or leases to our undeveloped properties, some titles or leases may be defective. If our titles or leases to mining properties are defective, other persons or businesses could claim ownership of our mining properties and we would not be able to explore or develop all or a portion of our properties We would then cease operations and you could lose your investment.

Our operations may be adversely affected by risks and hazards associated with the mining industry.

Our business is subject to a number of risks and hazards including:

– environmental hazards;

– political and country risks;

– industrial accidents;

– labor disputes;

– unusual or unexpected geologic formations;

– cave-ins;

– explosive rock failures; and

– flooding and periodic interruptions due to inclement or hazardous weather conditions.

Such risks could result in:

– damage to or destruction of mineral properties or producing facilities;

– personal injury;

4

– environmental damage;

– delays in exploration efforts;

– monetary losses; and

– legal liability.

We have no insurance against any of these risks. To the extent we are subject to environmental liabilities, we would have to pay for these liabilities. Moreover, in the event that we are unable to fully pay for the cost of remedying an environmental problem, we might be required to suspend operations or enter into other interim compliance measures.

Because we are small and do not have much capital, we must limit our exploration. This may prevent us from realizing any revenues and you may lose your investment as a result.

Because we are small and do not have much capital, we must limit the time and money we expend on exploration of interests in our properties. In particular, we will not:

– devote the time we would like to exploring our properties;

– spend as much money as we would like to exploring our properties.

– rent the quality of equipment we would like to have for exploration; and

– have the number of people working on our properties that we would like to have.

By limiting our operations, it will take longer to explore our properties. There are other larger exploration companies that could and probably would spend more time and money exploring the properties that we have acquired.

We will have to suspend our exploration plans if we do not have access to all our supplies and materials we need.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, like dynamite, and equipment like bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after we have conducted preliminary exploration activities on our properties. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

We face substantial governmental regulation and environmental risks, which could prevent us from exploring or developing our properties.

Our business is subject to extensive federal, state and local laws and regulations governing development, production, labor standards, occupational health, waste disposal, use of toxic substances, environmental regulations, mine safety and other matters. New legislation and regulations may be adopted at any time that results in additional operating expense, capital expenditures or restrictions and delays in the exploration, mining, production or development of our properties.

We maintain no reserves for environmental costs. Various laws and permits require that financial assurances be in place for certain environmental and reclamation obligations and other potential liabilities. Once we undertake any trenching or drilling activities, a reclamation bond and a permit will be required under applicable laws. Currently, we have no financial assurances of any kind. The result is that we would not be in compliance with applicable laws. We also would be unable to undertake any trenching, drilling, or development on any of our properties until we obtain financial assurances to cover potential liabilities.

We may not be able to adequately protect or preserve our rights in the Atlas Database

Our success in the future will be dependent on maintaining a proprietary interest in the information in the Atlas Database. We view our interest in the Atlas Database as proprietary, and rely, and will be relying, on a combination of nondisclosure agreements and other contractual provisions to protect our proprietary rights. When we acquired the Atlas Database, an unrelated company, Atlas Minerals Inc., was granted the right to use and access the Atlas Database. Atlas Database can:

– use the information in the database in a manner adverse to our interests

– sell or give the information in the database to any third parties, including our competitors, without getting our approval and without paying us any money.

The result is that competitors can obtain and exploit information in the Atlas Database. There can be no assurance that the steps taken by us to protect (or defend) our proprietary rights will be adequate or that our competitors will not independently develop information that is substantially equivalent or superior to the information contained in the Atlas Database.

5

Three of our officers and directors have conflicts of interest in that they are officers and directors of other mining companies.

Three of our officers and directors have conflicts of interests in that they are officers and directors of other mining companies. See "Directors, Officers, Promoters and Control Persons". In the future, if we decide to acquire a mining property, which is also sought by one of the companies which Messrs. Skimming, Utterback or Cullen are officers or directors of, a direct conflict of interest could result. Our Articles of Incorporation provide that any conflict must be disclosed, but Messrs. Skimming, Utterback or Cullen would be allowed to vote on any transaction in which they were interested.

We may conduct further offerings in the future in which case your shareholdings will be diluted.

We may conduct further equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. The result of this could reduce the value of your stock. If we issue additional stock, your percentage interest in us will be lower. This condition is often referred to as "dilution".

You may not be able to sell the stock you purchase in this offering on terms you consider reasonable.

On November 24, 2003 the shares of our common stock were approved for listing on the Over-the-Counter Bulletin Board operated by NASDR, Inc. ("OTCBB") under the symbol "QCYR". On July 7, 2004 we changed our name to "Quincy Gold Corp" and were issued a new symbol, "QCYG". We currently have thirteen market makers. The development of a public trading market depends upon the existence of willing buyers and sellers, the presence of which is not within our control or the control of any market maker. Even with a market maker, factors such as the limited size of the offering means that there can be no assurance of an active and liquid market for the common stock developing in the foreseeable future. Even if a market develops, there can be no assurance that a market will continue or that shareholders will be able to sell their shares at or above the price at which these shares are being offered to the public. Purchasers of common stock should carefully consider the limited liquidity of their investment in the shares being offered hereby.

Our stock price is likely to be volatile and could result in substantial losses for investors purchasing shares in this offering.

The stock market has experienced extreme volatility in recent years and may continue to do so in the future. See "Market for Common Stock and Related Stockholder Matters". We cannot be sure that an active public market for our stock will develop or if an active market should develop that it would continue after this offering. Investors may not be able to sell their stock at or above our initial public offering price, if at all. The price for our stock following this offering will be determined in the marketplace and may be influenced by many factors, including the following:

– variations in our financial results or those of companies that are perceived to be similar to ours;

– changes in earnings estimates by industry research analysts for our company or for similar companies in the same industry;

– investors or other market participants' perceptions of us; and

– general or regional economic, industry and market conditions.

In the past, companies that have experienced volatility in the market price of their stock have been the objects of securities class action litigation. If we were the object of securities class action litigation, it could result in substantial costs and a diversion of our management's attention and resources and may therefore have a material adverse effect on our business, financial condition and results of operations.

We may not be able to obtain or maintain the quotation of our common stock on the Over-the-Counter Bulletin Board, which would make it more difficult to dispose of our common stock.

On November 24, 2003 the shares of our common stock were approved for listing on the OTCBB under the symbol "QCYR". On July 7, 2004 we changed our name to "Quincy Gold Corp" and were issued a new symbol, "QCYG". However, we cannot guarantee that our shares will always be available for OTCBB quotations. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements per se, to be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time. If our common stock were not quoted on the OTCBB, trading in our common stock would be conducted, if at all, in the over-the-counter market. This would make it more difficult for stockholders to dispose of their common stock and more difficult to obtain accurate quotations on our common stock. This could have an adverse effect on the price of the common stock.

6

We have applied for listing on the TSX Venture Exchange.

We have applied for listing of our shares of common stock on the TSX Venture Exchange. However, there is no guarantee that out listing application will be accepted.

Our stock price is likely to be below $5.00 per share and treated as a "Penny Stock" which will place restrictions on broker-dealers recommending the stock for purchase.

Our common stock is defined as "penny stock" under the Securities Exchange Act of 1934, and its rules. The SEC has adopted regulations that define"penny stock" to include common stock that has a market price of less than $5.00 per share, subject to certain exceptions. These rules include the following requirements:

| – | broker-dealers must deliver, prior to the transaction, a disclosure schedule prepared by the SEC relating to the penny stock market; |

| | |

| – | broker-dealers must disclose the commissions payable to the broker-dealer and its registered representative; |

| | |

| – | broker-dealers must disclose current quotations for the securities; |

| | |

| – | if a broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market; and |

| | |

| – | a broker-dealer must furnish its customers with monthly statements disclosing recent price information for all penny stocks held in the customers account and information on the limited market in penny stocks. |

Additional sales practice requirements are imposed on broker-dealers who sell penny stocks to persons other than established customers and accredited investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and must have received the purchaser's written consent to the transaction prior to sale. If our common stock becomes subject to these penny stock rules these disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for our common stock, if such trading market should occur. As a result, fewer broker-dealers may be willing to make a market in our stock. You would then be unable to resell our shares.

Our two largest stockholders own a controlling interest in the company allowing them to determine our future direction.

Our President, Secretary, and Chief Financial Officer, namely Daniel T. Farrell, one of our directors, namely John Cullen, and one other shareholder, namely William M. Sheriff, together own over 10,364,000 shares, being over 45% of our outstanding common stock. Consequently, these individuals may be in a position to control or influence the election of a majority of our directors and other matters subject to stockholder vote. Additionally, if they do decide to sell their stock into the market, their sales may cause the market price of the stock to drop.

USE OF PROCEEDS

We will not receive any proceeds from the resale of the shares of common stock offered by the selling stockholders.

Upon exercise of all of warrants, the Company would receive proceeds of $1,550,000.

The proceeds from the exercise of the warrants will be used for general working capital purposes.

We estimate we will spend approximately $25,000 in registering the offered shares.

PLAN OF DISTRIBUTION

We are registering on behalf of the selling stockholders 5,531,920 shares of our common stock which they own. We will also register 1,550,000 warrants to purchase our common stock, and 1,550,000 shares underlying the warrants. No warrant solicitation fee will be paid. The selling stockholders may, from time to time, sell all or a portion of the shares of common stock in privately negotiated transactions or otherwise. Such sales will be offered at prevailing market prices or privately negotiated prices.

The shares of common stock may be sold by the selling stockholders by one or more of the following methods, without limitation:

| – | on the over-the-counter market; |

| | |

| – | to purchasers directly; |

| | |

| – | in ordinary brokerage transactions in which the broker solicits purchasers; |

| | |

| – | through underwriters, dealers and agents who may receive compensation in the form of underwriting discounts, |

7

| | concessions or commissions from a seller and/or the purchasers of the shares for whom they may act as agent; |

| | |

| – | through the pledge of shares as security for any loan or obligation, including pledges to brokers or dealers who may from time to time effect distributions of the shares or other interests in the shares; |

| | |

| – | through purchases by a broker or dealer as principal and resale by such broker or dealer for its own account pursuant to this prospectus; |

| | |

| – | through block trades in which the broker or dealer so engaged will attempt to sell the shares as agent or as riskless principal but may position and resell a portion of the block as principal to facilitate the transaction; |

| | |

| – | in any combination of one or more of these methods; or |

| | |

| – | in any other lawful manner. |

Brokers or dealers may receive commissions or discounts from the selling stockholders or, if any of the broker-dealers act as an agent for the purchaser of said shares, from the purchaser in amounts to be negotiated which are not expected to exceed those customary in the types of transactions involved. Broker-dealers may agree with the selling stockholders to sell a specified number of the shares of common stock at a stipulated price per share. In connection with such resales, the broker-dealer may pay to or receive from the purchasers of the shares, commissions as described above. The selling stockholders may also sell the shares of common stock in accordance with Rule 144 under the Securities Act, rather than pursuant to this prospectus.

The selling stockholders and any broker-dealers or agents that participate with the selling stockholders in the sale of the shares of common stock may be deemed to be "underwriters" within the meaning of the Securities Act in connection with these sales. In that event, any commissions received by the broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Furthermore, selling stockholders are subject to Regulation M of the Exchange Act. Regulation M prohibits any activities that could artificially influence the market for our common stock during the period when shares are being sold pursuant to this prospectus. Consequently, selling stockholders, particularly those who are also our officers and directors, must refrain from directly or indirectly attempting to induce any person to bid for or purchase the common stock being offered with any information not contained in this prospectus. Regulation M also prohibits any bids or purchases made in order to stabilize the price of our common stock in connection with the stock offered pursuant to this prospectus.

A selling stockholder may enter into hedging transactions with broker-dealers and the broker-dealers may engage in short sales of our common stock in the course of hedging the positions they assume with such selling stockholder, including, without limitation, in connection with the distribution of our common stock by such broker-dealers or pursuant to exemption from such registration. A selling stockholder may also enter into option or other transactions with broker-dealers that involve the delivery of the common stock to the broker-dealers, who may then resell or otherwise transfer such common stock. A selling stockholder may also loan or pledge the common stock to a broker-dealer and the broker-dealer may sell the common stock so loaned or upon default may sell or otherwise transfer the pledged common stock.

We have not registered or qualified offers and sales of shares of the common stock under the laws of any country, other than the United States. To comply with certain states' securities laws, if applicable, the selling shareholders will offer and sell their shares of common stock in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the selling shareholders may not offer or sell shares of common stock unless we have registered or qualified such shares for sale in such states or we have complied with an available exemption from registration or qualification.

All expenses of the registration statement estimated to be $25,000 including but not limited to, legal, accounting, printing and mailing fees are and will be paid by us. We have agreed to pay costs of registering the selling stockholders' shares in this prospectus. However, any selling costs or brokerage commissions incurred by each selling stockholder relating to the sale of his/her shares will be paid by the selling stockholder.

Any broker or dealer participating in any distribution of the shares may be required to deliver a copy of this prospectus, including any prospectus supplement, to any individual who purchases any shares from or through such a broker-dealer.

DETERMINATION OF OFFERING PRICE

Historically, there has not been any public market for our stock. The Selling Shareholders are expected to sell their shares at market prices.

SELLING STOCKHOLDERS

Set forth below is a list of all stockholders who may sell shares pursuant to this prospectus. The number of shares column represents the number of shares owned by the selling stockholders prior to the offering. The "Common Shares Beneficially Owned Following the Offering" column assumes all shares registered hereby are resold by the selling stockholders. The selling security holders identified in the following table are offering for sale 5,531,920 shares of common stock and

8

1,550,000 shares of common stock upon exercise of the warrants. None of these shares are being offered by directors, officers or principal stockholders.

We will not receive any proceeds from the sale of the shares by the selling stockholders.

For purposes of the column headed "Number of Common Shares Offered Hereby" we have assumed exercise of all of the warrants. Percentage Calculations are based upon our issued share capital as at June 30, 2004 of 22,626,670 shares of common stock.

| | | Common Shares | | | Number of | | | | |

| | | Owned Beneficially | | | Common | | Common Shares Beneficially Owned |

| Name of Shareholder | | Prior to Offering | | | Shares Offered | | Following the Offering |

| | | | | | Hereby | | | | |

| | | No. of Shares | | % | | | No. of Shares | | % |

| | | Owned | | | | | Owned | | |

| | | | | | | | | | |

| 1536815 Ontario Ltd. (1) | | 250,000 | | 1.10% | 50,000 | | 200,000 | | -- (2) |

| | | | | | | | | | |

| Genevest Inc. (3) | | 800,000 | | 3.54% | 800,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Keith W. Foote | | 100,000 | | -- (2) | 100,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Hugh M. Balkam | | 100,000 | | -- (2) | 100,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Mining Financial Services Inc. | | 40,000 | | -- (2) | 40,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Kees Van Winters | | 100,000 | | -- (2) | 100,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Dr. Graeme Hibberd | | 100,000 | | -- (2) | 100,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Angelo P. Comi | | 40,000 | | -- (2) | 40,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Andrew Gemmell | | 20,000 | | -- (2) | 20,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| CAT Finance AG(5) | | 200,000 | | -- (2) | 200,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Bank Sal.Oppenheim jr. & Cie Switzerland Ltd. (6) | | 330,000 | | | 395,000 | | 0 | | 0.00% |

| | | | | 1.46% | | | | | |

| Aumerco Limited (7) | | 136,440 | | -- (2) | 136,440 | | 0 | | 0.00% |

| | | | | | | | | | |

| Myrna Mason | | 45,480 | | -- (2) | 45,480 | | 0 | | 0.00% |

| | | | | | | | | | |

| Michael J. Conlon | | 100,000 | | -- (2) | 100,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| LOM Securities (Cayman) Limited (8) | | 100,000 | | | 100,000 | | 0 | | 0.00% |

| | | | | -- (2) | | | | | |

| Chartwell Investment Services S.A. (9) | | 200,000 | | | 200,000 | | 0 | | 0.00% |

| | | | | -- (2) | | | | | |

| Atlantica, Ltd. (10) | | 100,000 | | -- (2) | 100,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Phillip Kenny | | 25,000 | | -- (2) | 37,500 | | 0 | | 0.00% |

| | | | | | | | | | |

| James Kenny | | 25,000 | | -- (2) | 37,500 | | 0 | | 0.00% |

| | | | | | | | | | |

| William Byrd | | 50,000 | | -- (2) | 75,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Anglo Pacific Group PLC(11) | | 570,000 | | 2.52% | 855,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| Absolute Resource Company LP (12) | | 150,000 | | | 225,000 | | 0 | | 0.00% |

| | | | | -- (2) | | | | | |

| RAB Special Situations(13) | | 2,150,000 | | 9.50% | 3,225,000 | | 0 | | 0.00% |

| | | | | | | | | | |

| TOTAL | | | | | 7,081,920 | | | | |

(1)The ultimate beneficial owner of 1536815 Ontario Ltd. is Michael Wekerle.

(2) Less than one percent.

(3) Genevest Inc. is a publicly traded company based in Toronto, Ontario engaged in the business of funding emerging growth businesses and whose stock is traded on the TSX-Venture Exchange.

(4)The ultimate beneficial owner of Mining Financial Services Inc., is Tor Jensen

(5)CAT Finance AG is a privately held Swiss Financial Institution which is an Associate Participant of the SWX Swiss Exchange.

(6)Bank Sal.Oppenheim jr. & Cie Switzerland Ltd. is a privately held Swiss Financial Institution which is a Participant of the SWX Swiss Exchange.

(7)Aumerco Limited is a private investment fund based in Toronto and managed by David Mason.

(8)LOM Securities (Cayman) Limited is registered securities dealer in the Cayman Islands.

(9)The ultimate beneficial owner of Chartwell Investment Services S.A. is Martin Hubble.

(10)The ultimate beneficial owner of Atlantica, Ltd. is Arthur Jones.

(11)Anglo Pacific Group PLC is a publicly held mining company based in the United Kingdom and whose stock is traded on the London Stock Exchange and the Australian Stock Exchange.

9

(12)The ultimate beneficial owner of Absolute Resource Company LP is J. M. Roberts.

(13)RAB Special Situations LP is an affiliate of RAB Capital plc, a publicly held fund management company based in the United Kingdom whose stock is traded on the London Stock Exchange.

OUR BUSINESS

General

We were incorporated in the State of Nevada on May 5, 1999 with an authorized capital of 200,000,000 shares of common stock, par value $0.001 as “Quincy Resources Inc.” On July 7, 2004 we changed our name to “Quincy Gold Corp.” We own seven mineral properties as well as a natural resource mineral database. Our corporate office is located at 309 Center Street, Hancock, MI 49930, telephone number (906) 370-4695. Our administrative office is located at 120 Adelaide Street West, Suite 512, Toronto, Ontario, Canada, M5H 1T1, telephone number (416) 366-7871.

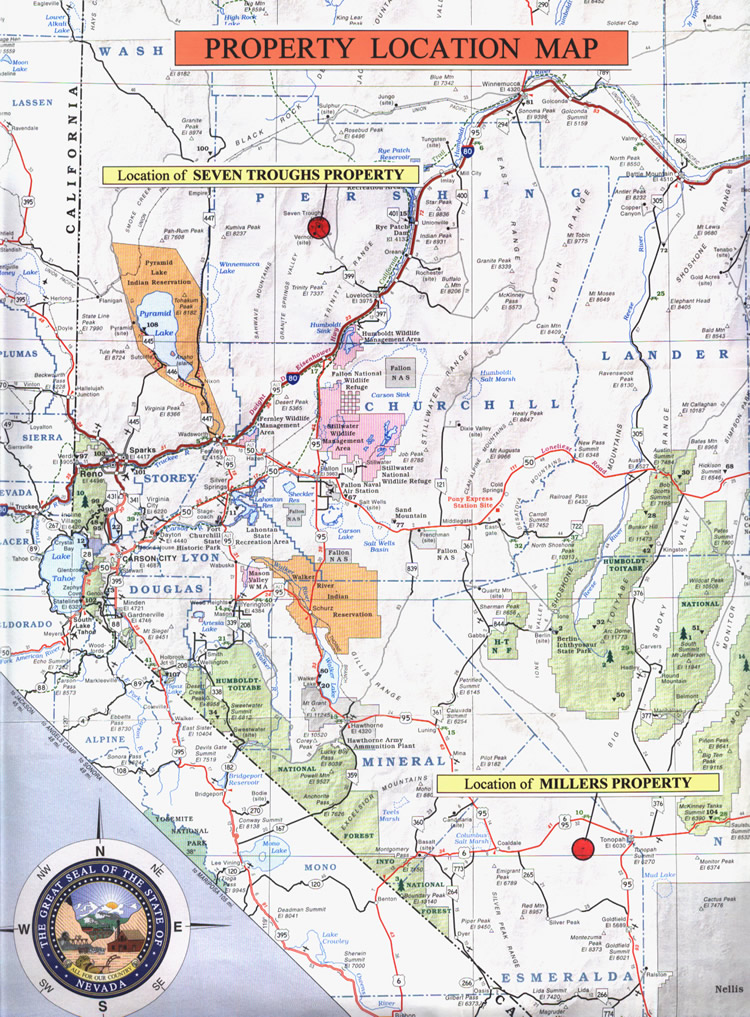

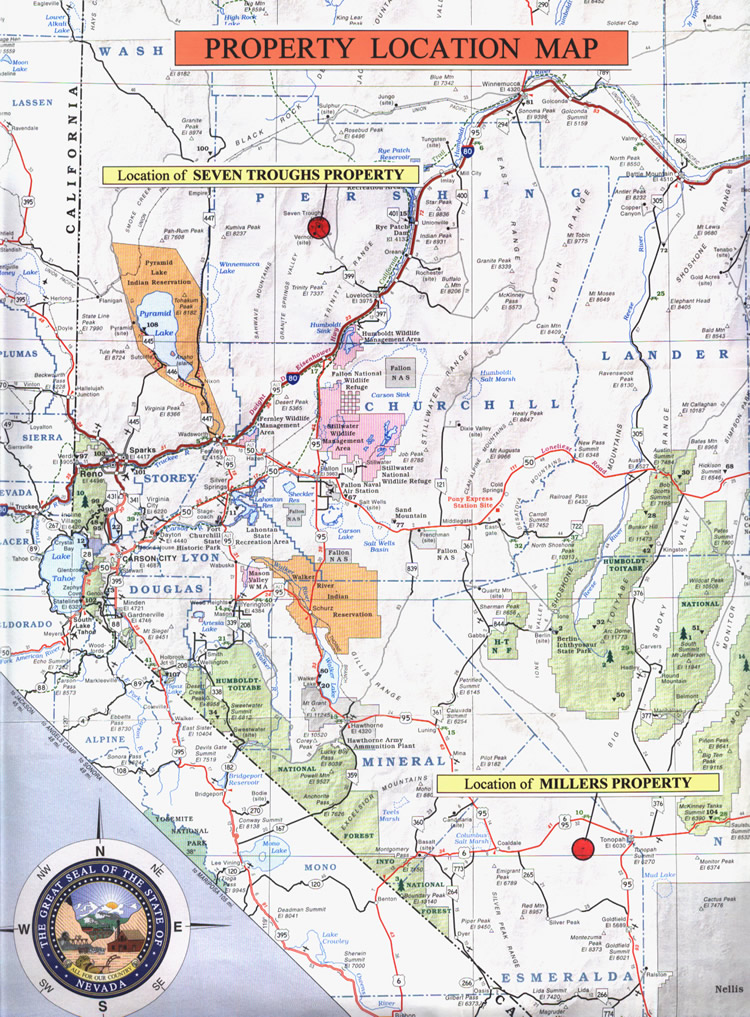

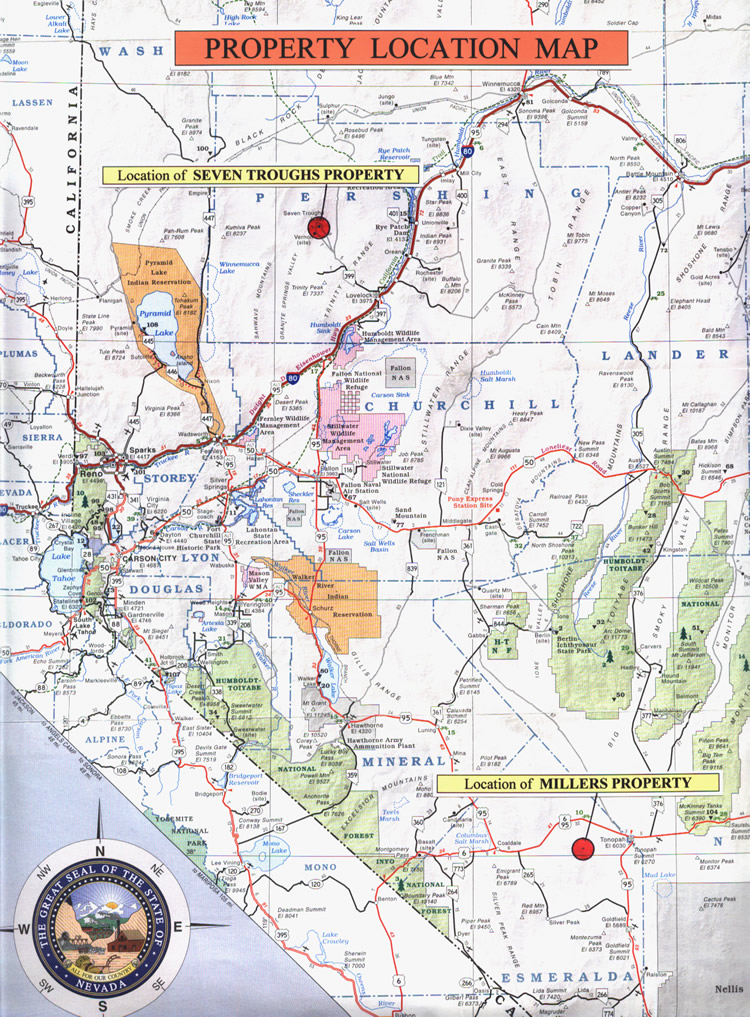

We were organized for the purpose of acquiring and developing mineral properties. We own interests in seven sets of mineral claims: the Silver Bow Property, the AG Property, the Lantern Property, the Quartz Mountain Property, the Empire Property, the Miller Property and the Seven Troughs Property.

We are in the exploration stage and will continue to be in the exploration stage until we achieve significant revenues from operations. In an exploration stage company, management devotes most of its activities in acquiring and developing mineral properties. There is no assurance that a commercially viable mineral deposit exists on any of our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined. Our ability to emerge from the exploration stage with respect to our planned principal business activity is dependent upon our ability to attain profitable operations. There is no guarantee that we will be able to identify, acquire or develop mineral properties that will produce profitability. Moreover, if a potential mineral property is identified which warrants acquisition or participation, additional funds may be required to complete the acquisition or participation, and we may not be able to obtain such financing on terms which are satisfactory to us. There is substantial doubt regarding our ability to continue as a going concern. Our management's plans for our continuation as a going concern include financing our operations through sales of our unregistered common stock. If we are not successful with our plans, investors could then lose all or a substantial portion of their investment.

Principal Product

Our principal product is the exploration, and if warranted, sale of precious minerals. Since our properties have yet to be explored by us there is no guarantee any ore body will ever be found.

Atlas Database

On January 17, 2003 we acquired Atlas Database Corp, the owner of a natural resource exploration database developed by Atlas Minerals Inc. during the period 1982 through 1997. The majority of the information contained in the database relates to research on bulk mineable precious mineralized material in the western United States, particularly sediment hosted disseminated gold deposits and volcanic hosted disseminated hot springs gold mineralized material. Our management intends to utilize this database to further its stated business objective of locating, acquiring and exploring mineral natural resource properties.

Atlas Database Corp. was acquired pursuant to an Agreement and Plan of Merger between ourselves, Atlas Database Acquisition Corp., our wholly owned subsidiary, Atlas Database Corp., Platoro West Incorporated ("Platoro") and William M. Sheriff. Mr. Sheriff is the sole Shareholder of Platoro which was, in turn, the sole shareholder of Atlas Database Corp. Pursuant to the terms of the Agreement and Plan of Merger, 6,000,000 shares of our common stock were issued to Platoro in exchange for all of the issued and outstanding shares of Atlas Database Corp., Atlas Database Acquisition Corp. merged with and into Atlas Database Corp. and its separate existence ceased. As a result of the foregoing, Atlas Database Corp. is now our wholly-owned subsidiary.

The purchase price for the Atlas Database of 6,000,000 shares of our common stock was determined through arm's length negotiations between ourselves and Platoro.

Atlas Database Corp. was formed in January, 2003 and was assigned all of Platoro's right, title and interest in and to the Atlas Database in exchange for $15,000 cash. Prior to the Agreement and Plan of Merger, Platoro was the sole shareholder of Atlas Database Corp. and therefore its parent company.

Platoro's interest in the Atlas Database was acquired pursuant to a Bill of Sale and Letter Agreement between Platoro and Atlas Minerals Inc. dated June 10, 2000. The purchase price paid by Platoro to Atlas Minerals Inc. was $15,000 cash. As required by the Letter Agreement, we have agreed to comply with the terms thereof. Accordingly, we are required to allow Atlas Minerals Inc. access to the data contained in the Atlas Database for competitive purposes, provided that Atlas Minerals Inc. provides reasonable notice. To date, Atlas Minerals Inc. has not requested access to the data. The Letter Agreement does not provide for sales of any of the data contained in the Atlas Database by Atlas Minerals Inc. to third parties, it only requires that we grant access to the data for competitive purposes. However, it does not specifically prohibit such sales nor would we receive any portion of sales proceeds. We have not obtained a legal opinion on whether or not Atlas Minerals Inc. has the

10

right to sell any of the data contained in the Atlas Database to third parties. However, we are of the view that such sales would be a violation of the terms of the Letter Agreement and would take steps to prevent such sales. We can give no assurance that we would be successful in this regard. Pursuant to the terms of the Letter Agreement, Atlas Minerals Inc. is entitled to access the Atlas Database for the purpose of competing directly with us. Pursuant to the terms of the Letter Agreement, in the event we sell any of the data to a third party we are required to pay Atlas Minerals Inc. 25% of the proceeds of the sale. We do not require Atlas Minerals Inc.'s consent to sell any of the data in the Atlas Database to any third party.

Pursuant to the terms of the Agreement and Plan of Merger we have granted Platoro the option to repurchase from us the Atlas Database on an "as is, where is" basis, provided that (i) during the 365 day period prior to the exercise of the option we have not made commercial use of the Atlas Database and (ii) we have no commercially reasonable plans for use of the Atlas Database. The exercise price of the option is payment by 6,000,000 shares of our common stock. Accordingly, the option exercise price is the same as the purchase price. In the event that we sell the Atlas Database to an arm's length third party the option granted to Platoro will terminate.

Silver Bow Property

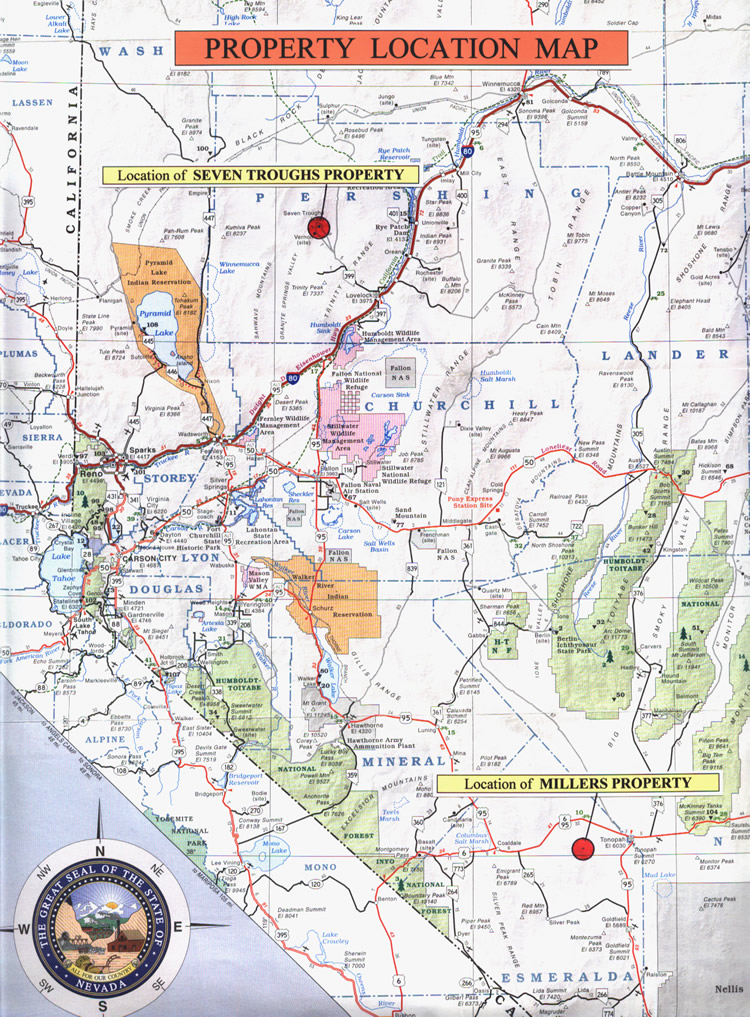

Pursuant to the terms of a Mining Lease and Agreement made the 21st day of February, 2003 between ourselves and Donald K. Jennings and Renegade Exploration (the "Owners"), we acquired the exclusive right to explore and mine ores and minerals of any kind (except oil and gas) on 73 unpatented lode mining claims, located on 1,460 acres, in Nye County, Nevada known as the Silver Bow Property. Its location is shown on the following map.

11

The Silver Bow leased properties are described as follows:

| Name | Date Recorded | NMC Number | Expiry Date |

| | | | |

| Bow 1-3, 14, 15, 32, 33, 18 - 23, & 25 | March 1, 2002 | 828189 – 828202 | August 31, 2004 |

| | | | |

| Bow 4 - 13, 16, 17, 24, 26 - 73 | April 14, 2003 | 8464429- 846487 | August 31, 2004 |

The lease is subject to a 3% Net Smelter Return (NSR) royalty in favor of the Owners. We have the right to purchase two thirds of the NSR for $1,500,000 and the final third for an additional $2,000,000. The lease has a term of 15 years, provided that the following advance royalty payments are made to the Owners:

- $10,000 upon signing (paid);

- $15,000 on February 21 st, 2004 (paid);

- $20,000 on February 21 st, 2005;

- $30,000 on February 21 st, 2006;

- $40,000 on February 21 st, 2007;

- $50,000 on February 21 st, 2008; and

- $50,000 on each February 21 st thereafter.

While as at the date hereof we have sufficient funds to pay the advance royalty payments due on February 21st, 2005, there is no guarantee that we will have sufficient funds to make such payment when it is due. In addition, we may not have the funds to make the advance royalty payments due beginning February 21st, 2006. To have the funds available we will either seek advances from our directors or officers, or engage in additional offerings of our stock. At present, we have made no arrangements to do any of these two methods of fund raising. In the event that we determine that the Silver Bow Property does not merit further exploration, we will not make any further advance royalty payments. If we fail to make the advance royalty payments the Mining Lease and Agreement will terminate and we will lose our interest in the Silver Bow Property. Pursuant to the terms of the Mining Lease and Agreement we have also agreed with the Owners that, in the event that we locate any additional unpatented mining claims within an "Area of Interest" surrounding the Silver Bow Property, such claims will be subject to the Mining Lease and Agreement and, as a result, we will be obligated to pay a 3% NSR royalty referred to above to the Owners in respect of such claims. In the event that any claims we locate are inside the "Area of Interest" and are subject to a royalty payable to a third party, the 3% NSR royalty payable to the Owners will be reduced on a dollar for dollar basis. The "Area of Interest" is defined by specific boundaries and encompasses 1,887 hectares located around the Silver Bow Property.

The claims comprising the Silver Bow Property are numbered Bow 1-73 and are registered in the name of Donald K. Jennings. Maintenance fees on these claims have been paid until September 1, 2004. As a result of the fact that these claims are not registered in our name, other mining companies could claim interests in the 73 unpatented mining claims or challenge our right to conduct exploration activities on the Silver Bow Property.

The acquisition of the Silver Bow Property was based on an examination by two exploration geologists, Thomas Skimming and William Utterback, of: (i) past exploration programs by other companies and individuals; and (ii) the production history of the Silver Bow area and its strategic location within the Midway Structural Trend. The examination led Messrs. Skimming and Utterback to the conclusion that the Silver Bow Property was one of merit, that it exhibited significant gold and silver potential, and warranted further exploration. They then recommended that we negotiate an option agreement for the Silver Bow Property. Messrs. Skimming and Utterback have no interests in the Silver Bow Property. Messrs. Skimming and Utterback are directors with extensive exploration experience in the State of Nevada.

There are no known reserves on the Silver Bow Property and any proposed program by us is exploratory in nature.

The Bow claims are located within the Silverbow Mining District in Nye County, approximately 50 miles east-southeast of the town of Tonopah in south-central Nevada. More precisely, the claims are situated in sections 26 and 32-36 inclusive, T1N, R49E in the central part of the Kawich Mountain Range. The Nellis Air Force Bombing Range borders the area to the south. Access is by paved road east of Tonopah on SR 6 and southeast on the access road to the Nevada Test Site boundary and then approximately 20 miles of poorly maintained single track gravel road.

We have not conducted any significant exploration activities on the Silver Bow Property.

Climate, Local Resources and Physiography

The Silver Bow Property lies at elevations ranging from 6,500 to 7,600 feet above mean sea level within a moderately rugged terrain. The climate is classified as high arid desert. Temperatures vary from 110ºF in the summer to 0ºF in the winter with an average precipitation of only 3.50 inches per year.

12

History

The first discoveries of gold and silver in the Silverbow District were made in the fall of 1904. The first shipments of ore were made in 1906 and by the fall of the same year, the area was abandoned. The area became active again in 1913 and 1920 when small stamp mills were built.

In 1929, a 50-ton flotation mill was constructed at the Blue Horse Mine but operated for only a short time. During 1940 to 1942, lessees shipped about 160 tons of ore from the Silver Glance Mine averaging .05 ounces per ton in gold and 35 ounces per ton in silver. The mines of the Silverbow District were the most consistent gold and silver producers in the area. Ore was shipped annually from the district from 1906 through 1955 with only a few short gaps of no recorded production. Total production from the Silverbow District as calculated by the United States Bureau of Mines (USBM) is 3,246 tons of ore yielding 8,709 ounces of gold and 90,570 ounces of silver. As late as 1964, several of the mines were re-opened but were worked for only a short time.

Since the early 1960s there have been at least four programs of exploratory drilling carried out in the Silverbow District. A total of 17 core and rotary drill holes were completed by the Browne Group in the gulch west of the Silverbow townsite in the 1960s. Amoco Minerals Co. completed 6 rotary drill holes north of the townsite and near the Hillside Mine in 1983-1984. Later in the 1980s, several rotary holes were drilled by NERCO. In late 1993 and early 1994, the Phelps Dodge Mining Co. carried out a program of reverse circulation rotary drilling in the ridge west of the Silverbow townsite. In 1997, Placer Dome Inc. finished the latest round of drilling and concluded that a target meeting their size requirements was unlikely and quitclaimed the property to NevSearch, L.L.C.

We estimate that an initial exploration program on the Silver Bow Property will cost approximately $125,000. This amount provides for a complete review and assessment of the results from all the previous exploration carried out on the property for which information is available or can be obtained ($10,000); mapping and sampling of the existing and accessible underground workings ($15,000) and approximately 10,000 feet of drilling, which would include geological supervision, logging, sampling and assaying ($100,000).

Subject to obtaining sufficient financing we plan to review these mineral claims and, if warranted, undertake further exploration activities.

AG Property

In March 2003, we staked 43 lode mining claims in Humboldt County, Nevada known as the AG Property. The claims are registered in our name.

The AG mining claims are described as follows:

| Name | Date Recorded | NMC Number | Expiry Date |

| AG 11-53 | March 3, 2003 | 844139-844181 | August 31, 2004 |

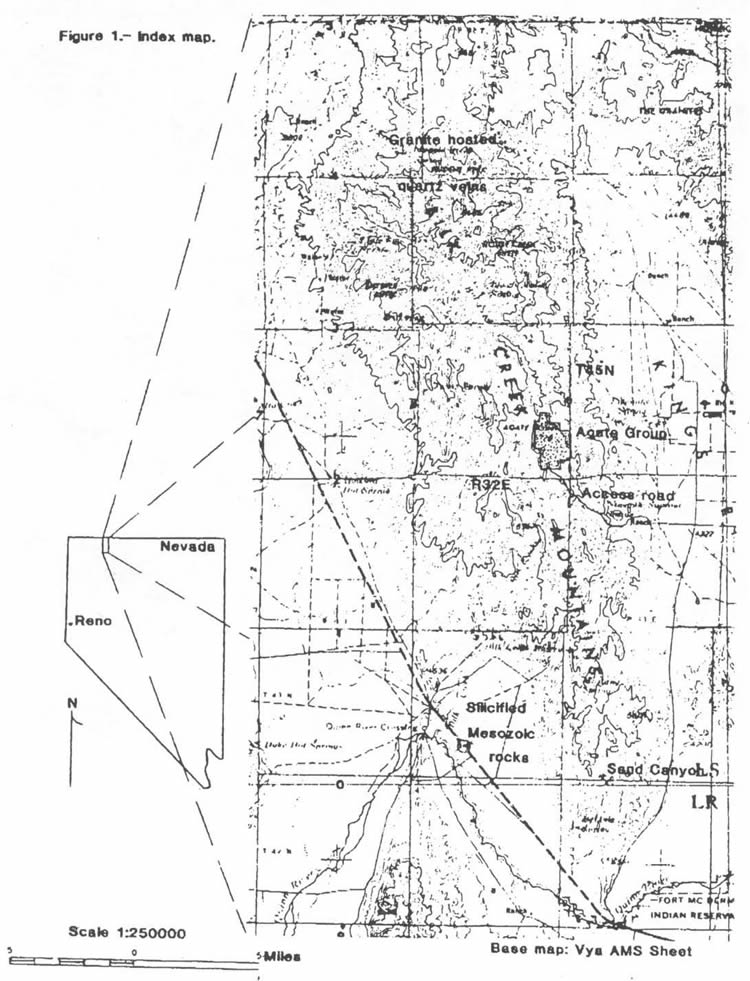

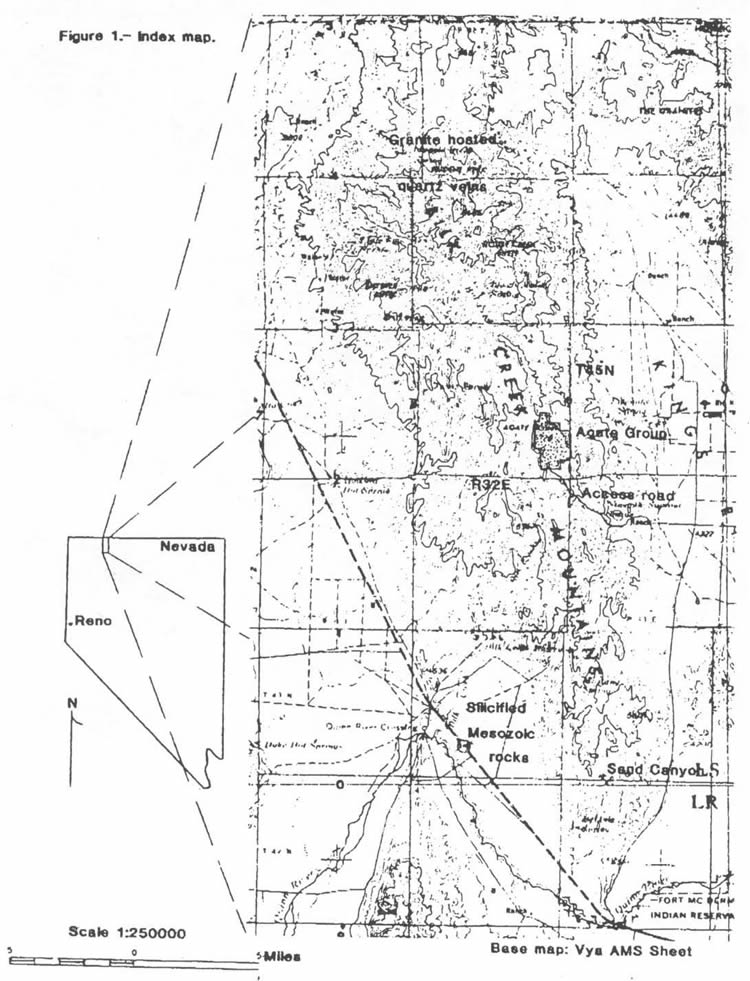

The AG Property is located approximately 32 miles northwest of the town of Orovada in Humboldt County, Nevada. The Property lies within the Bilk Creek Mountains, as shown on the following map, and encompasses a small hill.

13

Access to the Property is from the town of Winnemucca located in northern Nevada on Interstate Route 80, north on U.S. Route 95, then northwesterly on Nevada State Route 140 to the Fort McDermott Indian Reservation, then along an unimproved dirt road running north through Sand Canyon for approximately 22 miles to the Property.

The acquisition of the AG Property was based on the results of an exploration program previously carried out by Noranda Exploration, Inc. in 1983 on ground presently encompassed by the AG Property. Thomas Skimming and William Utterback, exploration geologists, also conducted a field examination. They identified evidence of banded, epithermal, quartz-adularia veins on the property which exhibited "angel wing" textures characteristic of many of the epithermal quartz veins that have been developed as gold mines in the state of Nevada. Messrs. Skimming and Utterback have no interest in the AG Property.

We have not conducted any exploration activities on the AG property. Subject to obtaining sufficient financing we plan to review these mineral claims and, if warranted, undertake further exploration activities. We are presently in the exploration stage and there is no assurance that a commercially viable mineral deposit, a reserve, exists in the AG Property until further exploration is done and a comprehensive evaluation concludes economic and legal feasibility.

There are no known reserves on the AG Property and any proposed program by us is exploratory in nature.

Climate, Local Resources and Physiography

The AG Property lies at elevations ranging from 6,000 to 6,700 feet above mean sea level within a moderately rugged terrain. Agate Point, the most prominent topographic feature on the Property, has an elevation of 6728 feet above mean sea level. The climate is classified as high arid to semi-arid desert. Temperatures vary from 100ºF in the summer to -10ºF in the winter with an average precipitation of approximately 5 inches per year which is mainly in the form of snow during the winter months.

History

During a routine field investigation in 1983 in Sand Canyon at the south end of the Bilk Creek Mountain Range, geologists of Noranda Exploration Inc. noticed a north trending structure extending to Agate Point which suggested an extensive area of silica alteration.

Preliminary sampling indicated anomalous gold, arsenic, antimony and mercury in brecciated and stockwork veined volcanic rocks. During the following year, geological mapping was carried out to identify the volcanic stratigraphy, structure and the distribution and type of alteration exhibited in the rocks. Geochemical sampling was done to identify areas with anomalous concentrations of precious metals and pathfinder elements. This data was examined and preliminary models were constructed. As a result of their findings, Noranda concluded that the Agate Point area has low potential for a large tonnage, economic precious metal deposit (open pit, heap leach-type of deposit) but noted the potential for a structurally controlled, high grade-type deposit in the area.

Around 1990, Geomex Minerals Inc. acquired the AG Property and drilled two shallow holes approximately 2000 feet apart in the central area near Agate Point. One of these was collared near the granite contact. The results of their drilling are not available but it is known that they were looking for a bulk tonnage deposit.

It is estimated initial exploration program on the AG Property will cost approximately $75,000. This amount provides for additional sampling of the vein system in the central portion of the Property together with sample analyses ($15,000), test geophysical surveys and the construction of a control grid ($10,000) and approximately 5,000 feet of reverse-circulation drilling at an all inclusive cost of $10 per foot, which would include geological supervision, logging, sampling and assaying of drill samples ($50,000).

Lantern Property

On July 31, 2003, we entered into a mining lease with Newmont Mining Corporation for patented fee land totaling 1,123 acres, and also received a quit claim deed for 340 acres consisting of 22 unpatented mining claims. The property is known as the Lantern Property. Platoro West Incorporated, a corporation controlled by one of our shareholders, namely William Sheriff, is also a party to the Mining Lease. Specifically excluded from the agreement are 22 unpatented mining claims under lease to Romios Gold Resources, Inc. a Canadian corporation.

Platoro West Incorporated began negotiating with Newmont in 2002 to acquire the Lantern Property and made certain maintenance fee payments in respect of the claims comprising the Lantern Property in contemplation of a definitive agreement being reached with Newmont. In 2003, as part of these negotiations, Platoro proposed to Newmont that Platoro would lease the Lantern Property from Newmont and, in turn, sublease the Lantern property to us. Newmont requested instead that both Platoro and ourselves be party to the mining lease agreement. We have agreed with Platoro that we will reimburse Platoro for all out-of-pocket costs incurred by it in respect of maintaining the Lantern Property prior to the date of the mining lease agreement and that, in the event that we do not elect to conduct exploration work on the Lantern Property, we will transfer the Lantern Property to Platoro, subject to the terms of the mining lease agreement. We are of the view that this arrangement does not give rise to a conflict of interest as neither William Sheriff nor Platoro are directors of ours.

14

The Lantern Property is located in Pershing County, Nevada, about 62 miles from Winnemucca, Nevada. Access to the property is from the town of Lovelock located on Interstate Highway No. 80 over Nevada State Route 399 for 15 miles and then an additional 35 miles to the north over unimproved gravel roads.

15

The 17 unpatented mining claims deeded to us as part of the Lantern Property are as follows:

| Name | NMC Number | Expiry Date |

| | | |

| Petal 1-8 | 772574-772581 | August 31, 2004 |

| | | |

| Petal 29-36 | 772602-772609 | August 31, 2004 |

| | | |

| Petal 38 | 772611 | August 31, 2004 |

The leased portions of the Lantern Property are 29-OSP-0001(NLRC 182054) and 29-OSP-0006(182092). Under the lease agreement, we are required to spend the following amounts on exploration and assessment work:

- $25,000 during the 12 month period ended July 31, 2005;

- $25,000 during the 12 month period ended July 31, 2006;

- $50,000 during the 12 month period ended July 31, 2007;

- $50,000 during the 12 month period ended July 31, 2008;

- $50,000 during the 12 month period ended July 31, 2009;

- $50,000 during the 12 month period ended July 31, 2010;

- $50,000 during the 12 month period ended July 31, 2011;

- $50,000 during the 12 month period ended July 31, 2012; and

- $100,000 during the 12 month period ended July 31, 2013 and each July 31 thereafter as long as the agreement is ineffect.

The lease is subject to a maximum 4 % Net Smelter Return (NSR) royalty in favor of Newmont Mining Corporation. Newmont Mining Corporation also retained a preferential ore processing right. We are required to undertake a feasibility study.

While as at the date hereof we have sufficient funds to pay the initial exploration and assessment work due by July 31, 2005, there is no guarantee that we will have sufficient funds to make such payment when due. In the event that we do not have adequate funds available we will either seek advances from our directors or officers, or engage in additional offerings of our stock. At present, we have made no arrangements to do any of these two methods of fund raising. In the event that we determine that the Lantern Property does not merit further exploration, we will not make any further exploration expenditures. If we fail to make the exploration expenditures the mining lease will terminate and we will lose our interest in the Lantern Property.

We are also responsible for all taxes and federal maintenance fees for the property. Newmont also has the option to create a joint venture with us. We can terminate the lease agreement at any time after spending $100,000 on exploration and assessment work.

There are no known reserves on the Lantern Property and any proposed program by us is exploratory in nature.

Newmont has told us that the current owner of the property, Nevada Land and Resource Company LLC, has filed a lawsuit challenging the validity of leases for the Lantern Property. A July 12, 2002, trial court decision rejected Nevada Land and Resource Company claims. That decision is now on appeal to the Nevada Supreme Court.

We have not conducted any exploration activities on the Lantern Property. Subject to obtaining sufficient financing we plan to review these mineral claims and, if warranted, undertake further exploration activities. We are presently in the exploration stage and there is no assurance that a commercially viable mineral deposit, a reserve, exists in the Lantern Property until further exploration is done and a comprehensive evaluation concludes economic and legal feasibility.

Acquisition of our interests in the Lantern Property was based on the professional judgment and evaluation of two exploration geologists, Thomas Skimming and William Utterback. Messrs. Skimming and Utterback are directors with extensive exploration experience in the State of Nevada. Messrs. Skimming and Utterback have no interest in the Lantern Property.

Climate and Physiography

The Lantern Property is situated near the southwestern end of the Antelope Range within a cluster of low hills ranging between 4,800 and 5,200 feet elevation. Vegetation consists essentially of sparse amounts of sage brush and patches of native grasses.

The climate is high arid desert with light snow falls during the winter months that usually melt before March and rarely accumulates to depths that would inhibit travel. The area is dry throughout most of the year.

16

History

Since 1980, several companies, principally Santa Fe Pacific Gold Corporation and Newmont Mining Corporation have conducted comprehensive exploration programs within portions of the boundaries of the existing Lantern Property. This work, consisting largely of geological mapping, soil and rock geochemical surveys, various geophysical surveys and extensive drilling, identified a low-grade resource reported to contain 268,000 gold equivalent ounces. Higher grade intercepts of gold mineralization were encountered in banded, epithermal quartz veins during the drilling but were never evaluated with deeper, systematic drilling. The earlier exploration programs focused on the potential for a low-grade, bulk tonnage-type of gold deposit on the property but did not address the potential of a deeper, high-grade, bonanza-type of gold mineralization.

Budget

We estimate that an initial exploration program on the Lantern Property will cost approximately $100,000. This amount provides for an in-depth review and assessment of the results from all the previous exploration carried out on the Lantern Property for which technical data and general information is available to us and approximately 10,000 feet of reverse circulation drilling which would include geological supervision, logging, sampling, assaying and general administrative costs.

Quartz Mountain Property

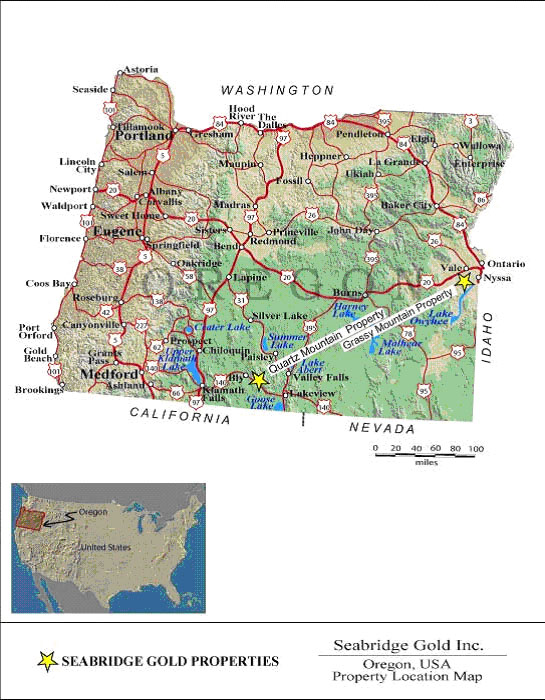

Pursuant to the terms of an Option Agreement made as of October 15, 2003 with Seabridge Gold Corporation (a wholly-owned subsidiary of Seabridge Gold Inc.) ("Seabridge") we acquired an exclusive option to earn a 50% interest in 67 unpatented mining claims located in Lake County, Oregon known as the Quartz Mountain Property, subject to certain exclusions. Our rights pursuant to the Option Agreement specifically exclude a reported 2.7 million ounce low-grade gold resource, discussed below. Our exploration program will focus on other reported grades of mineralization.

Pursuant to the terms of the Option Agreement, in order to maintain our option and earn the 50% interest we must:

• | incur cumulative exploration expenditures of $1,500,000 on or before October 15, 2008 as follows |

| | ° | by October 15, 2004, $100,000, |

| | ° | by October 15, 2005, $250,000, |

| | ° | by October 15, 2006, $500,000, and |

| | ° | by October 15, 2008, $1,500,000; |

• | issue to Seabridge 250,000 shares of our common stock as follows |

| | ° | 50,000 shares on execution of the Option Agreement (which shares have been issued), and |

| | ° | 200,000 shares with 30 days of satisfying the expenditure obligations described above. |

If those conditions are satisfied, we will be deemed to have exercised the option and earned our 50% interest in the Quartz Mountain Property, at which time we will be deemed to have entered into a Joint Venture Agreement with Seabridge. While currently we have sufficient funds to make the cumulative exploration expenditures due by October 15, 2004, there is no guarantee that we will have sufficient funds to make such expenditures when due. In addition, we may not have funds to make the cumulative exploration expenditures due beginning October 15, 2005. In the event we do not have the funds available, we will either seek advances from our directors or officers, or engage in additional offerings of our stock. At present, we have no arrangements to do any of these two methods of fund raising. In the event we determine the Quartz Mountain Property does not merit further exploration, we will not make any further exploration expenditures. If we fail to make the exploration expenditures, the Option Agreement will terminate and we will lose our interest in the Quartz Mountain Property.

We may also increase our interest in the Quartz Mountain Property from 50% to 62.5% by (i) funding 100% of a feasibility study on the Quartz Mountain Property within three years; and (ii) issuing 250,000 shares at the completion of the feasibility study.

We are required to make the first $100,000 of expenditures and to pay all fees required to keep the Quartz Mountain Property in good standing. Once we have made the first $100,000 of expenditures we may terminate the Option Agreement on 60 days written notice to Seabridge.

We have also agreed with Seabridge that, if the parties to the Option Agreement acquire any additional mineral properties within two miles of the outer boundaries of the Quartz Mountain Property, such properties will immediately be subject to the Option Agreement.

The Option Agreement is subject to two Royalty Agreements, the first of which is between Seabridge and William M. Sheriff, our largest shareholder (the “Sheriff Royalty”) pursuant to a Royalty Agreement dated December 18, 2001, and the second of which is between Seabridge and Quartz Mountain Resources Ltd., an arm’s length third party, (the “QMR Royalty”) pursuant to an Asset Purchase and Sale and Royalty Agreement dated December 17, 2001. Pursuant to the Sheriff Royalty, Sheriff is entitled to a 0.5% net smelter returns royalty from all ore mined on the Quartz Mountain Property, and pursuant to the QMR Royalty, Quartz Mountain Resources Ltd. is entitled to a 1% net smelter returns royalty from all ore mined on the Quartz Mountain Property.

17

The claims are registered in the name of Seabridge and are described as follows:

| Name | Date Recorded | NMC Number | Expiry Date |

| | | | |

| 4 Squares 1-8, amended | March 29, 1962 | 22755-22762 | August 31, 2004 |

| | | | |

| Angel 7-8 | October 5, 1956 | 22763-22764 | August 31, 2004 |

| | | | |

| FH 5-12, 21, 23-27, 29-35, 64-65, amended | September 1, 1983 | 45146-45153, 45162, 45164-45168,45170- | August 31, 2004 |

| | | 45176, 45205, 45206 | |

| | | | |

| FH 14, 22, 28, 36, 66, amended | August 16, 1984 | 45155, 45163, 45169, 45177, 45207 | August 31, 2004 |

| | | | |

| NQTZ 108, 110, 143-148 | February 1, 1985 | 81602, 81603, 81627-81632 | August 31, 2004 |

| | | | |

| NQTZ 191, 193 | February 3, 1985 | 81659, 81661 | August 31, 2004 |

| | | | |

| QTZ 31, 32, 34, 41 | June 18, 1983 | 63755, 63756, 63758, 63765 | August 31, 2004 |

| | | | |

| QTZ 43, 67-70, 77, 79 | June 19, 1983 | 63767, 63791-63794, 63801, 63803 | August 31, 2004 |

| | | | |

| TRA 1-8 | September 1, 1983 | 66682-66689 | August 31, 2004 |

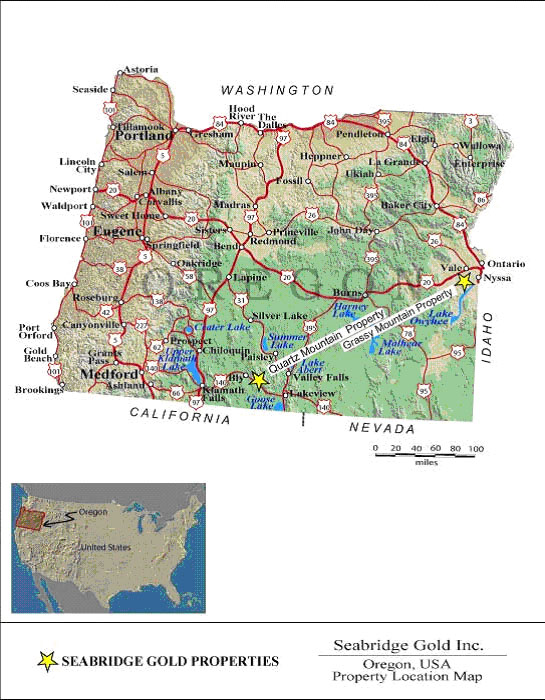

The Quartz Mountain Property is located in the Fremont National Forest in south-central Oregon approximately 30 miles west-northwest of the town of Lakeview on Oregon State Highway 140 as shown on the following map.

18

Access to the Quartz Mountain Property from Highway 140 is via several secondary paved and gravel service access roads to the Fremont National Forest that are maintained by the United States Forest Service.

The acquisition of the Quartz Mountain Property was based on a review of the results of a number of exploration programs that were carried out in the past and on the professional judgment and evaluation of two exploration geologists, Thomas Skimming and George Cole. Messrs. Skimming and Cole are directors with extensive exploration experience in the State of Oregon. Messrs. Skimming and Cole have no interest in the Quartz Mountain Property.

We have not conducted any exploration activities on the Quartz Mountain Property. Subject to obtaining sufficient financing we plan to review these mineral claims and, if warranted, undertake further exploration activities. We are presently in the exploration stage and there is no assurance that a commercially viable mineral deposit, a reserve, exists in the Quartz Mountain Property until further exploration is done and a comprehensive evaluation concludes economic and legal feasibility.

There are no known reserves on the Quartz Mountain Property and any proposed program by us is exploratory in nature.

Climate, Local Resources and Physiography

The Quartz Mountain Property is situated at an elevation of around 6,000 feet above mean sea level in the Basin and Range Province that extends from Nevada into southern Oregon. The annual precipitation in this region averages 20 inches, most of which falls as snow between the months of October and April. Vegetation is characterized by an open, park-like, pine forest with sparse underbrush that consists of low profile shrubs and patches of native grasses.

History

From 1982 to 1996, comprehensive exploration programs were carried out at different time periods by The Anaconda Company, Wavecrest Resources Ltd., Galactic Resources Ltd., Pegasus Gold Corporation and Newmont Exploration Ltd. within the boundaries of the existing Quartz Mountain Property. These programs, which consisted essentially of geological mapping, soil and rock geochemistry, various geophysical surveys and extensive reverse-circulation and core drilling identified a total (measured, indicated and inferred) low-grade resource reported to contain 2.7 million ounces of gold. Higher grade intercepts of gold mineralization were encountered in silica flooded sulphide breccias, multiple quartz veinlets and banded, epithermal quartz veins during the drilling but, excluding a small drill program that was carried out by Quartz Mountain Gold Corporation (a joint venture between Wavecrest Resources Ltd. and Galactic Resources Ltd.) during the fall of 1988, these high grade gold intercepts were never evaluated with deeper, systematic drilling. The earlier exploration programs focused on the potential for a low-grade, bulk tonnage-type of gold deposit but was not seriously pursued.

Little to no work has been performed on the Quartz Mountain Property since 1996.

Budget

An exploration program to assess the significance of the high grade gold intersections encountered in earlier drilling on the Quartz Mountain Property has been recommended by Resource Modeling Incorporated of Tucson, Arizona. The exploration program is budgeted at $1,350,000 and is to include drilling 36 core and reverse circulation holes totaling 33,650 feet on the Quartz Mountain Property. The work program commenced in July, 2004.

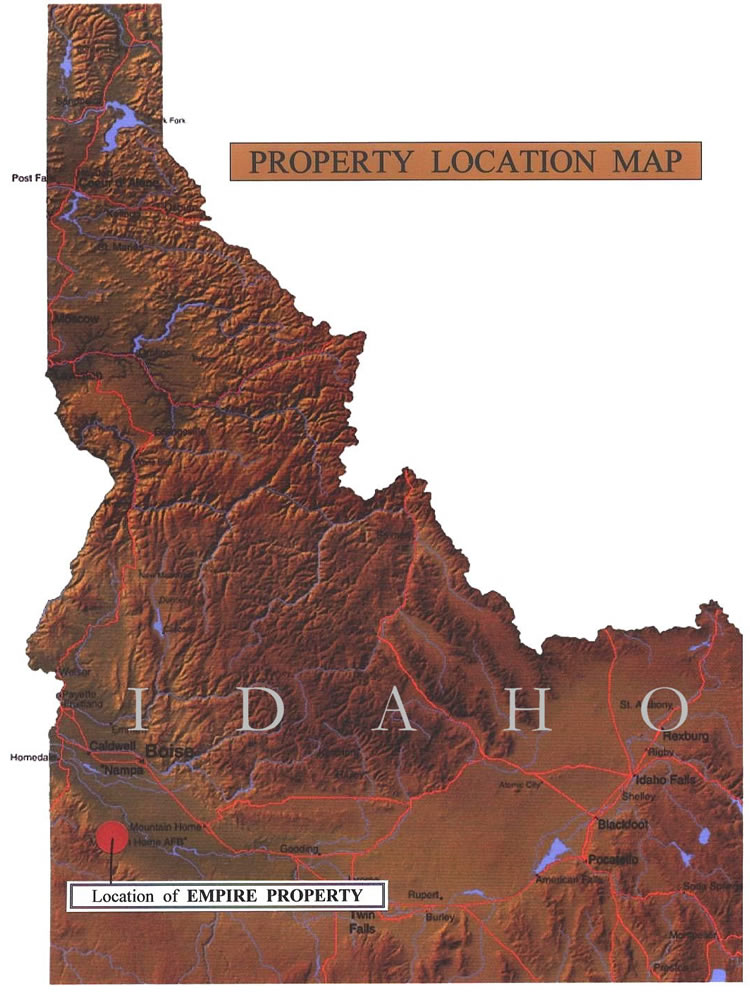

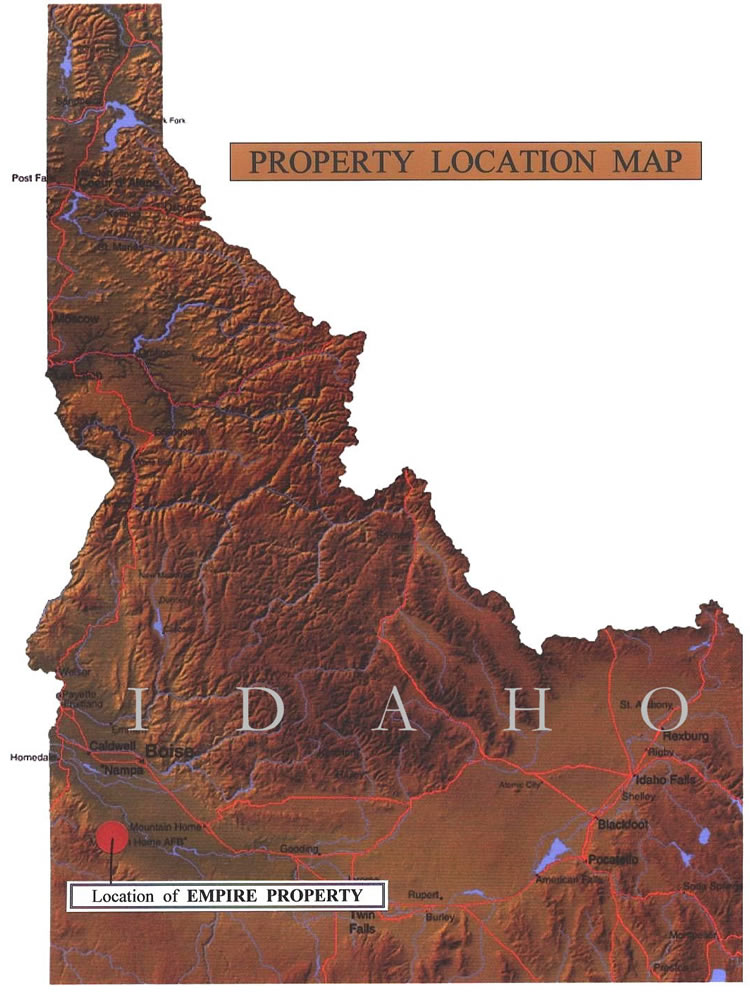

Empire Property

On December 15, 2003 we entered into a Mining Lease and Agreement with Nevada Contact Inc., in respect of 22 unpatented mineral claims (except oil and gas) situated in Owhee County, Idaho (the "Empire Claims") and certain additional lands (except oil and gas) comprising 552 acres, more or less, also located in Owhee County, Idaho pursuant to a State of Idaho Department of Lands Mineral Lease (the "Empire Lease").