- CEMI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Chembio Diagnostics (CEMI) DEF 14ADefinitive proxy

Filed: 16 Jun 20, 5:20pm

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

|

| (Name of Registrant as Specified In Its Charter) |

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS and PROXY STATEMENT | ||

2020 Annual Meeting Tuesday, July 28, 2020 10 a.m., Eastern time | Inside CEO’s letter to shareholders Information on four voting proposals: | |

| Election of five directors | |

Virtual-only meeting |  | Approval of reincorporation from Nevada to Delaware |

| Webcast registration access at |  | Ratification of appointment of independent auditor for 2020 |

| viewproxy.com/Chembio/2020 |  | Advisory vote on 2019 executive compensation |

| 555 Wireless Boulevard Hauppauge, New York 11788 |

| NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS |

| • | directions for accessing and reviewing the proxy materials on the Internet and submitting a proxy over the Internet or by telephone; |

| • | instructions for requesting copies of proxy materials in printed form or by email, at no charge; and |

| • | a control number for use in submitting proxies. |

| /s/ Neil A. Goldman | |

| Secretary | June 16, 2020 |

When Tuesday, July 28, 2020 10 a.m., Eastern time Where Webcast only Registration access at viewproxy.com/Chembio/2020 — In order to attend the Annual Meeting, you must register in advance by visiting the website listed above by the registration deadline. Access the Annual Meeting by following the unique link and entering the password that was delivered to you via email following your registration. Registration Deadline Saturday, July 25, 2020 11:59 p.m., Eastern time |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 28, 2020: The Notice of 2020 Annual Meeting of Stockholders, the Proxy Statement, the 2020 Annual Report to Stockholders and instructions for voting via the Internet can be accessed at: www.aalvote.com/CEMI |

How to Vote in Advance Your vote is important. Please vote as soon as possible by one of the methods shown below. Your Notice of Internet Availability, proxy card or voting instruction form should be readily available. Via Internet (Any Web-Enabled Device)  By Telephone (U.S. or Canada only)  By Mail (Pursuant to Printed Materials)  |

| |

555 Wireless Boulevard Hauppauge, New York 11788 |

| Date | Tuesday, July 28, 2020 |

| Time | 10 a.m., Eastern time |

Meeting Registration Address | viewproxy.com/Chembio/2020 |

Registration Deadline | 11:59 p.m., Eastern time, on Saturday, July 25, 2020 |

Meeting Access | Follow the unique link and enter the password that was delivered to you via email following your registration |

Page | |

| 3 | |

| 7 | |

| 12 | |

| 13 | |

| 13 | |

| 13 | |

| 14 | |

| 18 | |

| 38 | |

| 39 | |

| 40 | |

| 40 | |

| 40 | |

| 41 | |

| 41 | |

| 41 | |

| 42 | |

| 42 | |

| 43 | |

| 44 | |

| 45 | |

| 46 | |

| 46 | |

| 46 | |

| 47 | |

| 48 | |

| 49 | |

| 50 | |

| 51 | |

| 51 | |

| 51 | |

| 51 | |

| 52 | |

| 53 | |

| 56 | |

| 57 | |

| 57 | |

| 57 | |

| 57 | |

| 59 | |

| 59 | |

| 59 | |

| Plan of Conversion | Appendix A |

| Certificate of Conversion | Appendix B |

| Delaware Charter | Appendix C |

| Delaware Bylaws | Appendix D |

| Nevada Articles of Conversion | Appendix E |

Time and Date | 10 a.m., Eastern time, on July 28, 2020 |

| Meeting Webcast Registration Address | viewproxy.com/Chembio/2020 |

Record Date | 5 p.m., Eastern time, on June 1, 2020 |

Voting | Stockholders will be entitled to one vote for each outstanding share of common stock they hold of record as of the record date. |

| Total Votes Per Proposal | 20,168,503 votes, based on 20,168,503 shares of common stock outstanding as of the record date. |

| Registration Deadline | 11:59 p.m., Eastern time, on July 25, 2020 |

| Meeting Access | Stockholders that have registered by the registration deadline will be able to access the Annual Meeting by following the unique link and entering the password that was delivered to them via email following their registration. |

| Proposal | Board Recommendation |

Election of directors | FOR each nominee |

Approval of reincorporation in Delaware | FOR |

Ratification of appointment of independent auditor for 2020 | FOR |

Advisory vote on 2019 executive compensation | FOR |

| Until 11:59 p.m., Eastern time, on July 27, 2020 | At the Annual Meeting on July 28, 2020 | |

• Internet: From any web-enabled device at www.aalvote.com/CEMI • Telephone: +1.866.804.9616 • Completed, signed and returned proxy card | • Internet: Joining the Annual Meeting by registering at viewproxy.com/Chembio/2020 prior to the deadline of July 25, 2020 at 11:59 p.m. Eastern time and accessing the unique link and entering the password sent to you via email |

| Election of Directors |

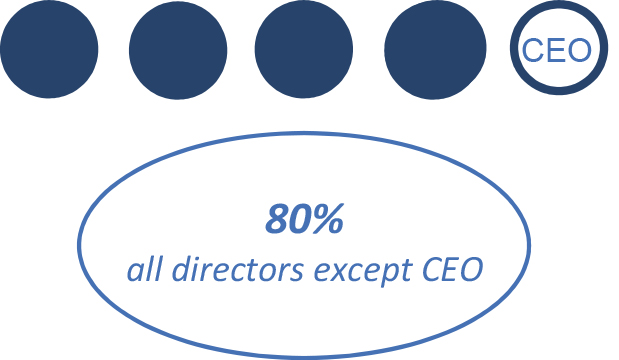

| We are asking stockholders to elect the following five director nominees, each of whom currently serves as a member of the board of directors. |

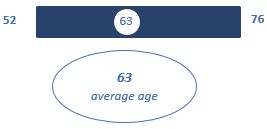

Director Since | Experience/ | Independent | Committee | Other Public | ||||

| Name | Age | Occupation | Qualifications | Yes | No | Memberships | Company Boards | |

| Katherine L. Davis | 63 | 2007 | Owner of Davis Design Group LLC Financial Advisor to Mayor of Indianapolis | • Leadership • Governance • Policy/Government | ✔ | • Nominating and Corporate Governance (Chair) • Audit • Compensation | ||

| Richard L. Eberly | 59 | 2020 | Chief Executive Officer of Chembio Diagnostics, Inc. | • Industry • Leadership • Innovation | ✔ | |||

| Gail S. Page | 64 | 2017 | Executive Chair of the Board Venture Partner at Turret Capital Management, L.P. | • Industry • Leadership • Finance | ✔ | |||

| Mary Lake Polan | 76 | 2018 | Professor of Clinical Obstetrics, Gynecology and Reproductive Sciences at Yale University School of Medicine Chair of Scientific Advisory Board in Women’s Health for Procter and Gamble Company Managing Director of Golden Seeds angel investing group | • Industry • Leadership • Governance | ✔ | • Compensation (Chair) • Audit • Nominating and Corporate Governance | • Motif Bio plc • Quidel Corporation | |

| John G. Potthoff | 52 | 2018 | Chief Executive Officer and Co-founder of Elligo Health Research | • Finance • Industry • Leadership | ✔ | • Audit (Chair) • Compensation • Nominating and Corporate Governance | ||

| Additional Board Governance Practices | ||

| Elections: | Classified Board | No |

Frequency of Director Elections | Annual | |

Voting Standard | Plurality | |

| Mandatory Retirement Age or Tenure | No | |

| Chair: | Separate Chair of the Board and CEO | Yes |

Independent Chair of the Board | Yes | |

| Meetings: | Number of Board Meetings Held in 2019 | 20 |

Directors Attending at Least 95% of Board Meetings in 2019 | All | |

Independent Directors Meet without Management Present | Yes | |

Number of Standing Committee Meetings Held in 2019 | 21 | |

Members Attending at Least 90% of Committee Meetings in 2019 | All | |

| Director Status: | Directors “Overboarded” per ISS or Glass Lewis Voting Guidelines | None |

Material Related-Party Transactions with Directors | None | |

Family Relationships with Executive Officers or Other Directors | None | |

Shares Pledged by Directors | None | |

| Approval of Reincorporation from Nevada to Delaware |

| We are asking stockholders to approve our reincorporation from Nevada to Delaware as we believe it is in the best interests of our company and stockholders. As discussed in more detail below, reincorporation in Delaware is intended to, among other things, provide greater predictability and flexibility with respect to our corporate needs through a more highly developed and predictable body of corporate law, enhance our ability to attract and retain qualified directors and executive officers, and provide access to specialized courts where necessary. | |

| Ratification of Appointment of Independent Auditor for 2020 |

| We are asking stockholders to ratify the audit committee’s appointment of Ernst & Young LLP, an independent registered public accounting firm, as our independent auditor to examine and report on our consolidated financial statements for the fiscal year ending December 31, 2020. As discussed in more detail below, the audit committee has selected Ernst & Young LLP to succeed our former independent registered public accounting firm, BDO USA, LLP. | |

| Advisory Vote on 2019 Executive Compensation |

In accordance with rules of the Securities and Exchange Commission or SEC, we are asking stockholders for an advisory vote — known as a “say-on-pay” vote — of the 2019 compensation of our “named executive officers” as set forth in the compensation tables, related narrative discussion and other disclosures under “Executive Compensation” in this Proxy Statement. The following table provides information concerning the compensation paid for 2019 and 2018 to our named executive officers during 2019: |

| Name and Principal Position | Year | Salary($) | Bonus($) | Stock Awards($)(1) | All Other Compensation($) | Total($) |

| John J. Sperzel III(2) | 2019 | 463,846 | — | 2,175,000 | — | 2,638,877 |

| Former Chief Executive Officer and President | 2018 | 416,847 | 89,250 | 950,000 | — | 1,456,097 |

| Neil A. Goldman | 2019 | 319,039 | 23,767 | — | 4,130 | 347,026 |

| Executive Vice President and Chief Financial Officer | 2018 | 294,231 | 50,400 | 300,000 | 2,769 | 647,000 |

| Javan Esfandiari | 2019 | 373,299 | 27,983 | — | 8,697 | 410,009 |

| Executive Vice President and Chief Science and Technology Officer | 2018 | 357,807 | 72,450 | 375,000 | 7,391 | 791,948 |

| (1) | Reflects the aggregate grant date fair value of any restricted common stock granted determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation. Assumptions used in the calculation of this amount are included in Note 10. Equity Incentive to the Consolidated Financial Statements included in our Annual Report. This amount does not reflect the actual economic value realized by each named executive officer. |

| (2) | Mr. Sperzel resigned as our Chief Executive Officer and President and one of our directors effective as of January 3, 2020. For additional information, including severance benefits paid to Mr. Sperzel, see “Executive Compensation—Employment Agreements” below. |

| Q: | Why are we proposing to reincorporate in Delaware? |

| A: | We believe that reincorporating in Delaware will give us a greater measure of flexibility and certainty in corporate governance than is available under Nevada law. Delaware is recognized for adopting comprehensive, modern, and flexible corporate laws, which are revised periodically to respond to the changing legal and business needs of corporations. Delaware’s specialized business judiciary is composed of experts in corporate law matters, and a substantial body of court decisions has developed construing Delaware corporation law. As a result, Delaware law provides greater clarity and predictability with respect to our corporate legal affairs than is currently the case under Nevada law. For these and other reasons, many major U.S. corporations have incorporated in Delaware or have changed their corporate domiciles to Delaware in a manner similar to the manner outlined in Proposal 2. |

| Q: | What is entailed by the reincorporation? |

| A: | We are currently incorporated in Nevada and, as such, governed by Nevada law. As a result of the reincorporation, we will be reincorporated in Delaware and governed by Delaware law. The reincorporation will be effected by a Plan of Conversion that has been adopted by the board of directors. A copy of this plan of domestication is attached as Appendix A. |

| Q: | How will the reincorporation affect my rights as a stockholder? |

| A: | Your rights as a stockholder currently are governed by Nevada law, our Articles of Incorporation, as amended, and our Amended and Restated Bylaws. As a result of the reincorporation, you will remain a stockholder of our company with rights governed by Delaware law and our new certificate of incorporation and bylaws, which differ in various respects from your current rights. These important differences are discussed in this Proxy Statement under “Proposal 2 — Approval of Reincorporation in Delaware — Comparison of Stockholder Rights Before and After the Reincorporation” Forms of our new certificate of incorporation and bylaws after the reincorporation are attached to this Proxy Statement as Appendixes C and D, respectively. |

| Q: | How will the reincorporation affect my ownership percentage in our company? |

| A: | Your proportionate ownership interest in our company will not be affected by the reincorporation. |

| Q: | Are dissenters’ rights available in connection with the reincorporation? |

| A: | No. Nevada law does not afford stockholders dissenters’ rights in connection with a reincorporation. |

| Q: | When and where will the Annual Meeting be held? |

| A: | In light of the public health risks attributable to the COVID-19 pandemic, this year the Annual Meeting of Stockholders of Chembio Diagnostics, Inc., will be held exclusively by webcast, beginning at 10 a.m., Eastern time, on Tuesday, July 28, 2020. In order to attend the Annual Meeting, you must register in advance at viewproxy.com/Chembio/2020 prior to the deadline of 11:59 pm. Eastern time, on July 25, 2020. Upon completing your registration, you will receive further instructions via email, including your unique link and a password that will allow you to access the Annual Meeting. Please be sure to follow the instructions on your proxy card and subsequent instructions that will be delivered to you via email. |

| Q: | Who may join the Annual Meeting? |

| A: | Participation in the Annual Meeting, including voting shares and submitting questions, will be limited to stockholders and proxyholders. To ensure they can participate, stockholders and proxyholders should visit viewproxy.com/Chembio/2020 and register to attend the Annual Meeting prior to the deadline of 11:59 pm. Eastern time, on July 25, 2020. Upon completing your registration, you will receive further instructions via email, including your unique link and a password that will allow you to access the Annual Meeting. Please be sure to follow the instructions on your proxy card and subsequent instructions that will be delivered to you via email. Stockholders and proxyholders that intend to vote at the meeting will need to enter the 11-digit control number included on their Notice of Internet Availability of Proxy Materials or proxy card. |

| Q: | How do I register and attend the Annual Meeting? |

| A: | You must register in advance to attend the Annual Meeting virtually by visiting viewproxy.com/Chembio/2020 prior to the deadline of 11:59 pm. Eastern time, on July 25, 2020. You will need to enter your name, phone number, mailing address as it appears on your proxy card and email address as part of the registration, following which, you will receive an email confirming your registration, as well as the password to attend the Annual Meeting. |

| Q: | What materials have been prepared for stockholders in connection with the Annual Meeting? |

| A: | We are furnishing you and other stockholders of record with the following proxy materials: |

| • | our 2020 Annual Report to Stockholders, which we refer to as the 2020 Annual Report and which includes our Annual Report on Form 10‑K for the fiscal year ended December 31, 2019, as amended (including our audited consolidated financial statements for 2018 and 2019); |

| • | this Proxy Statement for the 2020 Annual Meeting, which we refer to as this Proxy Statement and which also includes a letter from our Chief Executive Officer and President to stockholders and a Notice of 2020 Annual Meeting of Stockholders; and |

| • | a Notice of Internet Availability of Proxy Materials, which we refer to as the Notice of Internet Availability, which includes a control number for use in submitting proxies. |

| Q: | Why was I mailed a Notice of Internet Availability rather than a printed set of proxy materials? |

| A: | In accordance with rules adopted by the SEC, we are furnishing the proxy materials to stockholders by providing access via the Internet, instead of mailing printed copies. This process expedites the delivery of proxy materials to our stockholders, lowers our costs and reduces the environmental impact of the Annual Meeting. The Notice of Internet Availability tells you how to access and review the proxy materials on the Internet and how to vote on the Internet. It also provides instructions you may follow to request paper or emailed copies of the proxy materials. |

| Q: | Are the proxy materials available via the Internet? |

| A: | You can access and review the proxy materials for the Annual Meeting at www.chembio.com/investors/proxy. In order to submit your proxies, however, you will need to refer to the Notice of Internet Availability sent to you with this Proxy Statement or a proxy card mailed to you upon your request to obtain your control number and other personal information needed to vote by proxy or in person. |

| Q: | What is a proxy? |

| A: | The term “proxy,” when used with respect to stockholder, refers to either a person or persons legally authorized to act on the stockholder’s behalf or a format that allows the stockholder to vote without being physically present at the Annual Meeting. |

| Q: | What matters will the stockholders vote on at the Annual Meeting? |

| A: | Proposal |  | Election of the following five director nominees: | ||||||

| • | Katherine L. Davis | • | Richard L. Eberly | • | Gail S. Page | ||||

| • | Mary Lake Polan | • | John G. Potthoff | ||||||

| Proposal |  | Approval of reincorporation in Delaware | |

| Proposal |  | Ratification of appointment of our independent auditor for 2020 | |

| Proposal |  | Approval, as an advisory vote, of 2019 executive compensation as disclosed in this Proxy Statement |

| Q: | Who can vote at the Annual Meeting? |

| A: | Stockholders of record of common stock at 5 p.m., Eastern time, on June 1, 2020, the record date, will be entitled to vote at the Annual Meeting. As of the record date, there were outstanding a total of 20,168,503 shares of common stock, each of which will be entitled to one vote on each proposal. As a result, up to a total of 20,168,503 votes can be cast on each proposal. |

| Q: | What is a stockholder of record? |

| A: | A stockholder of record is a stockholder whose ownership of common stock is reflected directly on the books and records of our transfer agent, Action Stock Transfer Corporation. |

| Q: | What does it mean for a broker or other nominee to hold shares in “street name”? |

| A: | If you beneficially own shares held in an account with a broker, bank or similar organization, that organization is the stockholder of record and is considered to hold those shares in “street name.” An organization that holds your beneficially owned shares in street name will vote in accordance with the instructions you provide. If you do not provide the organization with specific voting instructions with respect to a proposal, the organization’s authority to vote your shares will, under the rules of the Nasdaq Global Market or Nasdaq, depend upon whether the proposal is considered a “routine” or a non-routine matter. |

| • | The organization generally may vote your beneficially owned shares on routine items for which you have not provided voting instructions to the organization. The only routine matter expected to be voted on at the Annual Meeting is the ratification of the appointment of our independent auditor for 2020 (Proposal 3). |

| • | The organization generally may not vote on non-routine matters, including Proposals 1, 2 and 4. Instead, it will inform the inspector of election that it does not have the authority to vote on those matters. This is referred to as a “broker non-vote.” |

| Q: | How do I vote my shares if I do not attend the Annual Meeting? |

| A: | If you are a stockholder of record, you may vote prior to the Annual Meeting as follows: |

| • | Via the Internet: | You may vote via the Internet by going to www.aalvote.com/CEMI in accordance with the voting instructions on the Notice of Internet Availability and the proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Eastern time, on July 27, 2020. You will be given the opportunity to confirm that your instructions have been recorded properly. |

| • | By Telephone: | You may vote by calling +1.866.804.9616 and following the instructions provided on the telephone line. Telephone voting is available 24 hours a day until 11:59 p.m., Eastern time, on July 27, 2020. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been recorded properly. |

| • | By Mail: | If you obtain a proxy card by mail, you may vote by returning the completed and signed proxy card in a postage-paid return envelope that will be provided with the proxy card. |

| • | Via the Internet: | You may vote via the Internet by going to www.aalvote.com/CEMI in accordance with the voting instructions on the Notice of Internet Availability and the proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Eastern time, on July 27, 2020. You will be given the opportunity to confirm that your instructions have been recorded properly. |

| • | By Telephone: | You may vote by calling +1.866.804.9616 and following the instructions provided on the telephone line. Telephone voting is available 24 hours a day until 11:59 p.m., Eastern time, on July 27, 2020. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been recorded properly. |

| Q: | Can I vote at the Annual Meeting? |

| A: | If you are a stockholder of record, you may vote in person at the Annual Meeting, whether or not you previously voted. If your shares are held in street name, you must obtain a written proxy, executed in your favor, from the stockholder of record to be able to vote at the Annual Meeting. |

| Q: | Can I ask questions at the Annual Meeting? |

| A: | You may submit questions via the Internet during the Annual Meeting by participating in the webcast. In order to participate in the webcast, you will need to register at viewproxy.com/Chembio/2020 prior to 11:59 p.m. Eastern time on July 25, 2020 and follow the instructions delivered to you via email, including accessing the Annual Meeting through your unique link and a password that will allow you to access the Annual Meeting and submit questions. We will answer any timely submitted questions on a matter to be voted on at the Annual Meeting before voting is closed on the matter. Following adjournment of the formal business of the Annual Meeting, we will address appropriate general questions from stockholders regarding our company in the order in which the questions are received. Questions relating to the stockholder proposals or our company may be submitted in the field provided in the web portal at or before the time the questions are to be discussed. All questions received during the Annual Meeting will be presented as submitted, uncensored and unedited, except that we may omit certain personal details for data protection issues and we may edit profanity or other inappropriate language. If we receive substantially similar questions, we will group those questions together and provide a single response to avoid repetition. Additional information regarding the submission of questions during the Annual Meeting can be found in our 2020 Rules of Conduct and Procedure, available at viewproxy.com/Chembio/2020. |

| Q: | Why is the Annual Meeting being conducted as a virtual meeting? |

| A: | The board of directors considers the appropriate format of our annual meeting of stockholders on an annual basis. This year the board chose a virtual meeting format for the Annual Meeting in an effort to facilitate safe stockholder attendance and participation in light of the COVID-19 (Coronavirus) outbreak by enabling stockholders to participate fully, and equally, from any location around the world, at no cost. The virtual meeting format will allow our stockholders to engage with us at the Annual Meeting from any geographic location, using any convenient internet-connected devices, including smart phones and tablet, laptop or desktop computers. |

| Q: | If I am unable to participate in the live audio webcast of the Annual Meeting, may I listen at a later date? |

| A: | An audio replay of the Annual Meeting will be posted and publicly available at chembio.com/investors/investor-relations/ following the Annual Meeting and will remain publicly available until our next annual meeting of stockholders in 2021. This audio replay will cover the entire Annual Meeting, including each stockholder question addressed during the Annual Meeting. |

| Q: | May I change my vote or revoke my proxy? |

| A: | If you are a stockholder of record and previously delivered a proxy, you may subsequently change or revoke your proxy at any time before it is exercised by: |

| • | voting via the Internet or telephone at a later time; |

| • | submitting a completed and signed proxy card with a later date; or |

| • | voting at the Annual Meeting. |

| Q: | What happens if I do not give specific voting instructions? |

| A: | If you are a stockholder of record and you return a proxy card without giving specific voting instructions, the Proxy Committee will vote your shares in the manner recommended by the board of directors on all four proposals presented in this Proxy Statement and as the Proxy Committee may determine in its discretion on any other matters properly presented for a vote at the Annual Meeting. |

| Q: | What if other matters are presented at the Annual Meeting? |

| A: | If a stockholder of record provides a proxy by voting in any manner described in this Proxy Statement, the Proxy Committee will have the discretion to vote on any matters, other than the four proposals presented in this Proxy Statement, that are properly presented for consideration at the Annual Meeting. We do not know of any other matters to be presented for consideration at the Annual Meeting. |

| Election of Directors |

| The affirmative vote of a plurality of votes cast by shares entitled to vote and present in person or represented by proxy at the Annual Meeting at which a quorum is present is required to elect each director. Votes to “abstain” will not be counted for the purpose of determining whether a director is elected. Similarly, broker non‑votes will not have any effect on the outcome of the election of directors, since broker non-votes are not counted as “votes cast.” | |

| Approval of Reincorporation from Nevada to Delaware |

| Our reincorporation from Nevada to Delaware must be affirmatively approved by a majority of the votes entitled to be cast and present in person or represented by proxy at the Annual Meeting. Abstentions will count as votes against this proposal because shares with respect to which a stockholder abstains will be deemed present and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal because broker non-votes are not counted as “votes cast.” | |

| Ratification of Appointment of Independent Auditor for 2020 |

| The ratification of Ernst & Young LLP as our independent auditor for the year ending December 31, 2020 must be approved by affirmative votes constituting a majority of the votes entitled to be voted and present in person or represented by proxy at the Annual Meeting. Abstentions will count as votes against this proposal, because shares with respect to which the stockholder abstains will be deemed present and entitled to vote. Because this proposal is considered a routine matter, discretionary votes by brokers will be counted. | |

| Approval of 2019 Executive Compensation on an Advisory Basis |

| The advisory “say-on-pay” vote to approve our 2019 executive compensation must be approved by affirmative votes constituting a majority of the votes entitled to be cast and present in person or represented by proxy at the Annual Meeting. Abstentions will count as votes against this proposal, because shares with respect to which the stockholder abstains will be deemed present and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal, because broker non-votes are not counted as “votes cast.” |

| • | a high standard of personal and professional ethics, integrity and values; |

| • | the training, experience and ability to make and oversee policy in business, government and education sectors; |

| • | the willingness and ability to keep an open mind when considering matters affecting our interests and the interests of its constituents; |

| • | the willingness and ability to devote the required time and effort to effectively fulfill the duties and responsibilities related to board and committee membership; |

| • | the willingness and ability to serve on the board for multiple terms, if nominated and elected, to enable development of a deeper understanding of our business affairs; |

| • | the willingness not to engage in activities or interests that may create a conflict of interest with a director’s responsibilities and duties to us and our constituents; and |

| • | the willingness to act in the best interests of our company and our constituents, and objectively assess board, committee and management performance. |

| • | the nominee’s professional experience for at least the past five years; |

| • | the year in which the nominee first became one of our directors; |

| • | each standing committee of the board of directors on which the nominee currently serves; |

| • | the nominee’s age as of the record date for the Annual Meeting; |

| • | the relevant skills the nominee possesses that qualify him or her for nomination to the board; and |

| • | directorships held by each nominee presently and at any time during the past five years at any public company or registered investment company. |

| Katherine L. Davis | ||

| Chembio Board Service: • Tenure: 13 years • Committees: ○ Audit ○ Compensation ○ Nominating and Corporate Governance (Chair) Age: 63 | |

INDEPENDENT | ||

| • | Director since 2007, and was Chair of the Board from March 2014 until April 2020 |

| • | Owner of Davis Design Group LLC, a provider of analytical and visual tools for public policy design, since 2007 |

| • | Chief Executive Officer of Global Access Point, a start-up company with products for data transport, data processing, and data storage network and hub facilities, from 2005 to 2006 |

| • | Lieutenant Governor of the State of Indiana from 2003 to 2005 |

| • | Controller of the City of Indianapolis from 2000 to 2003 |

| • | Financial Advisor to the Mayor of Indianapolis since January 2016 |

| Richard L. Eberly | ||

| Chembio Board Service: • Tenure: Since May 2020 Age: 59 | |

| • | Chief Executive Office and President since March 16, 2020 and a director since May 2, 2020 |

| • | Managing Director at Solid Rock Principled Capital of Solid Rock Principled Capital LLC, a private equity firm focused on biomedical companies, from March 2018 to March 2020 |

| • | Executive Vice President and President, Chief Commercial Officer at Meridian Bioscience, Inc. from July 2016 to February 2018 |

| • | President of Meridian Life Science from October 2012 to July 2016 |

| • | Chief Commercial Officer of Meridian Life Science from February 2011 to February 2018 |

| • | Executive Vice President from 2005 to 2011, Executive Vice President, General Manager from 2003 to 2005, Executive Vice President from 2000 to 2003 and Vice President of Sales and Marketing from 1997 to 2000, all at Meridian Life Science |

| • | Prior to his appointment to Vice President of Sales and Marketing, he served as Director of Sales for Meridian |

| • | Before joining Meridian, Mr. Eberly held sales and marketing positions at Abbott Diagnostics, Division of Abbott Laboratories |

| • | Masters in Business Administration degree from Harvard Business School |

| • | Bachelor of Science degree in mechanical engineering from the Massachusetts Institute of Technology |

| • | Masters in Business Administration degree from Xavier University |

| • | Bachelor of Science degree in Biochemistry from Juniata College |

| • | Leadership |

| • | Governance |

| • | Policy / Government |

| • | Industry |

| • | Leadership |

| • | Innovation |

| Gail S. Page | ||

| Chembio Board Service • Tenure: 3 years • Executive Chair of the Board Age: 64 | |

INDEPENDENT | ||

| • | Executive Chair of the Board since April 2020, and director since July 2017 |

| • | Interim Chief Executive Officer from January 2020 to March 2020 and then provider of transitional services from March 2020 to June 2020 |

| • | Venture Partner at Turret Capital Management, L.P., an international healthcare-focused investment management fund, since September 2018 |

| • | Managing Partner and founder of Vineyard Investment Advisors, LLC, a firm assisting with new product and services development, from 2014 to November 2018 |

| • | Co-founder and director of Consortia Health Holdings LLC, a rehabilitation services provider focused on pelvic disorders, from 2013 to June 2018 |

| • | President, Chief Executive Officer and director of Vermillion, Inc., a developer and manufacturer of novel diagnostic blood tests, from 2006 to 2012 |

| • | Executive Vice President and Chief Operating Officer of Luminex Corporation, a developer of testing solutions for life science applications, from 2000 to 2003 |

| • | Senior Vice President of Roche Biomedical Laboratories, Inc. / Laboratory Corporation of America, a healthcare diagnostic company, from 1988 to 2000 |

| Mary Lake Polan | ||

| Chembio Board Service: • Tenure: 1 year and 10 months • Committees: ○ Audit ○ Compensation (Chair) ○ Nominating and Corporate Governance Age: 76 | |

INDEPENDENT | ||

| • | Director since August 2018 |

| • | Clinical Professor in the Department of Clinical Obstetrics, Gynecology and Reproductive Sciences at Yale University School of Medicine since 2014 |

| • | Adjunct Professor in Obstetrics and Gynecology department at Columbia University School of Medicine from 2007 to 2014, and a Visiting Professor in the same department from 2005 to 2007 |

| • | Chair of Department of Obstetrics and Gynecology at Stanford University School of Medicine from 1990 to 2005 |

| • | Chair of Scientific Advisory Board in Women’s Health for the Procter and Gamble Company since 1997 |

| • | Managing Director of Golden Seeds, an angel investing group investing in women-led companies, since 2007 |

| • | Author of more than 130 books, articles and chapters in her areas of research |

| • | Bachelor of Science degree in Medical Technology from the University of Florida |

| • | Completed executive management program at the Kellogg School in Chicago |

| • | Master of Public Health (Maternal and Child Health Program) degree from the University of California, Berkeley |

| • | Medical Doctor degree from Yale University School of Medicine |

| • | Doctor of Philosophy degree in Molecular Biophysics and Biochemistry from Yale University School of Medicine |

| • | Bachelor of Arts degree from Connecticut College |

| • | Industry |

| • | Leadership |

| • | Finance |

| • | Industry |

| • | Leadership |

| • | Governance |

| • | Motif Bio plc (AIM/NASDAQ:MTFB), a clinical-stage biopharmaceutical company specializing in developing novel antibiotics, since 2004 |

| • | Quidel Corporation (NASDAQ:QDEL), a developer of point-of-care diagnostic solutions, since 1993 |

| John G. Potthoff | ||

| Chembio Board Service • Tenure: 2 years • Committees: ○ Audit (Chair) ○ Compensation ○ Nominating and Corporate Governance Age: 52 | |

INDEPENDENT | ||

| • | Director since May 2018 |

| • | Chief Executive Officer, co-founder and director of Elligo Health Research, a clinical research company, since March 2016 |

| • | President and Chief Executive Officer of Theorem Clinical Research Inc., a global contract research organization providing comprehensive clinical services, from 2011 until its acquisition by Chiltern International in September 2015 |

| • | Chief Operating Officer of INC Research Holdings, Inc. from its acquisition of Tanistry, Inc. in 2001 until its acquisition by private equity investors in 2010 |

| • | Chief Executive Officer and founder of Tanistry, Inc., a contract research organization focused on the central nervous system, from 2000 to 2001 |

| • | Doctor of Philosophy degree in Psychology from the University of Texas-Austin |

| • | Master of Arts degree in Psychology from the University of Texas-Austin |

| • | Bachelor of Arts degree in Psychology from the University of Texas-Austin |

| • | Finance |

| • | Industry |

| • | Leadership |

| • | The affairs of our company will cease to be governed by the NRS and will become subject to the DGCL. |

| • | The resulting Delaware corporation, which we refer to as CEMI‑Delaware, will be the same entity as the corporation currently incorporated in Nevada, which we refer to as CEMI‑Nevada, and will continue with all of the rights, privileges and powers of CEMI‑Nevada. CEMI‑Delaware will have the same name, will possess all of the properties of CEMI‑Nevada, will continue with all of the debts, liabilities and obligations of CEMI‑Nevada, and will continue with the same officers and directors of CEMI‑Nevada immediately prior to the Reincorporation, as more fully described below. |

| • | Upon effectiveness of the Reincorporation, each issued and outstanding share of common stock of CEMI‑Nevada will be automatically converted into one issued and outstanding share of common stock of CEMI‑Delaware, without any further action on the part of our company or our stockholders. We will continue to file periodic reports and other documents with the SEC. The Reincorporation will not change the respective positions of our company or stockholders under federal securities laws. If shares of common stock of CEMI‑Nevada are freely tradable prior to the Reincorporation, the shares of common stock of CEMI-Delaware received upon conversion will also be freely tradable after the Reincorporation. Similarly, shares of common stock of CEMI‑Delaware received upon conversion in the Reincorporation will be subject to the same transfer restrictions applicable prior to the Reincorporation with respect to the shares of common stock of CEMI‑Nevada that converted into those shares of CEMI‑Delaware. For purposes of computing compliance with the holding period requirement of Rule 144 under the Securities Act of 1933, stockholders will be deemed to have acquired the shares of CEMI‑Delaware common stock on the date they acquired the shares of CEMI‑Nevada common stock that converted into the shares of CEMI‑Delaware. |

| • | Our common stock will continue to be quoted on the Nasdaq Capital Market under the symbol “CEMI” following the Reincorporation. |

| • | Upon effectiveness of the Reincorporation, all of our employee benefit and incentive plans will become CEMI‑Delaware plans, and each option, equity award or other right issued under such plans will automatically be converted into an option, equity award or right to purchase or receive the same number of shares of CEMI‑Delaware common stock, at the same price per share, upon the same terms and subject to the same conditions as before the Reincorporation. In addition, our employment agreements and other employee benefit arrangements also will be continued by CEMI‑Delaware upon the terms and subject to the conditions in effect at the time of the Reincorporation. |

| • | the Delaware General Assembly, which each year considers and adopts statutory amendments that are designed to meet changing business needs; |

| • | the DGCL, which is generally acknowledged to be the most advanced and flexible corporate statute in the country; |

| • | a well-established body of case law construing the DGCL, which has been developed over the last century, will provide a greater measure of predictability than exists in any other jurisdiction; |

| • | the Delaware Court of Chancery, which brings to its handling of complex corporate issues a level of experience, a speed of decision, and a degree of sophistication and understanding unmatched by any other court in the country, as well as the highly regarded Delaware Supreme Court; |

| • | the responsiveness and efficiency of the Division of Corporations of the Delaware Secretary of State; and |

| • | the certainty afforded by the well-established principles of corporate governance under Delaware law, which will, among other benefits, assist our company in continuing to attract and retain outstanding directors and officers. |

| Provision | Nevada | Delaware | ||

Amending Charters | The NRS requires the adoption of a resolution by a corporation’s board of directors followed by the affirmative vote of the majority of shares present in person or represented by proxy and entitled to vote to approve any amendment to the articles of incorporation. If a proposed amendment would adversely alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by, in addition to the affirmative vote otherwise required, the vote of the holders of shares representing a majority of the voting power of each class or series adversely affected by the amendment. NRS 78.390. The Nevada Charter is consistent with the NRS. | The DGCL requires the adoption of a resolution by a corporation’s board of directors followed by the affirmative vote of the majority of shares present in person or represented by proxy and entitled to vote to approve any amendment to the certificate of incorporation, unless a greater percentage vote is required by the certificate of incorporation. Where a separate vote by class or series is required, the affirmative vote of a majority of the shares of such class or series is required unless the certificate of incorporation requires a greater percentage vote. Further, the DGCL states that if an amendment would (a) increase or decrease the aggregate number of authorized shares of a class, (b) increase or decrease the par value of shares of a class, or (c) alter or change the powers, preferences or special rights of a particular class or series of stock so as to affect them adversely, the class or series so affected shall be given the power to vote as a class notwithstanding the absence of any specifically enumerated power in the certificate of incorporation. DGCL §242. The Delaware Charter is consistent with the DGCL. |

| Provision | Nevada | Delaware |

Amending Bylaws | The NRS provides that, unless otherwise prohibited by any bylaw adopted by the stockholders, the directors may adopt, amend or repeal any bylaw, including any bylaw adopted by the stockholders. The articles of incorporation may grant the authority to adopt, amend or repeal bylaws exclusively to the directors. NRS 78.120. The Nevada Charter and Nevada Bylaws are consistent with the NRS. | The power to adopt, amend, or repeal the bylaws of a corporation shall be vested in the stockholders entitled to vote, provided that the corporation in its certificate of incorporation may confer such power on the board of directors, although the power vested in the stockholders is not divested or limited where the board also has such power. DGCL §109. The Delaware Charter expressly authorizes the board to adopt, amend or repeal the Delaware Bylaws without action on the part of the stockholders, provided that any bylaw adopted or amended by the board, and any powers thereby conferred, may be amended, altered or repealed by the stockholders. The Delaware Bylaws also state that the board is expressly empowered to adopt, amend or repeal the bylaw and that the stockholders shall also have the power to adopt, amend or repeal the Bylaws. The statutory rule is altered, however, in that any such action by stockholders shall require the affirmative vote of the holders of at least two-thirds in voting power of the outstanding shares of capital stock entitled to vote thereon. | ||

| Classified Board | The NRS allows a corporation to classify its board of directors. At least one-fourth of the total number of directors must be elected annually. NRS 78.330. The Nevada Charter and Nevada Bylaws do not provide for classification of the board. | The DGCL permits a corporation to classify its board of directors into as many as three classes, divided as equally as possible with staggered terms of office. DGCL Section 141. The Delaware Charter and Delaware Bylaws do not provide for classification of the board. | ||

Number of Directors | The NRS provides that a corporation must have at least one director, and may provide in its articles of incorporation or in its bylaws for a fixed number of directors or a variable number of directors, and for the manner in which the number of directors may be increased or decreased. Unless otherwise provided in the articles of incorporation, directors need not be stockholders. NRS 78.115. The Nevada Bylaws do not change this statutory rule. | The DGCL provides that a corporation must have at least one director and that the number of directors shall be fixed by, or in the manner provided in, the bylaws, unless the certificate of incorporation fixes the number of directors. DGCL §141. The Delaware Charter, which does not fix the number of directors, and Delaware Bylaws do not change this statutory rule and are substantially similar to the Nevada Charter and the Nevada Bylaws with respect to the number of directors. |

| Provision | Nevada | Delaware |

Removing Directors | Any one or all of the directors may be removed by the holders of not less than two-thirds of the voting power of a corporation’s issued and outstanding stock. The NRS does not distinguish between removal of directors with or without cause. NRS 78.335. The Nevada Bylaws state that, except as otherwise provided by the NRS, any director or the entire board of directors may be removed with or without cause by the affirmative vote of the holders of two-thirds of the voting power of the issued and outstanding common stock entitled to vote. | Any director or the entire board of directors may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors, except as follows: (a) in the case of a corporation whose board is classified, stockholders may effect such removal only for cause unless the certificate of incorporation provides otherwise; or (b) in the case of a corporation having cumulative voting, if less than the entire board is to be removed, no director may be removed without cause if the votes cast against such director’s removal would be sufficient to elect such director if then cumulatively voted at an election of the entire board, or, if there be classes of directors, at an election of the class of directors of which such director is a part. DGCL §141. The Delaware Bylaws provide that, except as otherwise provided by the Delaware Charter or the DGCL, any director may be removed, with or without cause, by the holders of two-thirds of the outstanding shares of common stock then entitled to vote at a meeting for the election of directors. | ||

Filling Director Vacancies | All vacancies on the board of directors, including those caused by an increase in the number of directors, may be filled by a majority of the remaining directors, though less than a quorum, unless it is otherwise provided in the articles of incorporation. Unless otherwise provided in the articles of incorporation, upon a resignation by a director, the board may fill the vacancy with each director so appointed to hold office during the remainder of the term of office of the resigning director. NRS 78.335. The Nevada Bylaws are consistent with the NRS. | All vacancies on the board of directors may be filled by a majority of the remaining directors, though less than a quorum, unless the certificate of incorporation provides otherwise. Unless otherwise provided in the certificate of incorporation, the board may fill the vacancies for the remainder of the term of office of resigning director or directors. Further, if, at the time of filling any vacancy, the directors then in office shall constitute less than a majority of the whole board, the Delaware Court of Chancery may, upon application of any stockholder or stockholders holding at least 10% of the total number of the shares at the time outstanding having the right to vote for such directors, summarily order an election to be held to fill any such vacancies or newly created directorships, or to replace the directors chosen by the directors then in office. DGCL §223. The Delaware Bylaws are consistent with the DGCL and are substantially similar to the Nevada Bylaws with respect to filling board vacancies. |

| Provision | Nevada | Delaware |

Board Action by Written Consent | The NRS provides that, unless the articles of incorporation or bylaws provide otherwise, any action required or permitted to be taken at a meeting of the board of directors or a committee thereof may be taken without a meeting if, before or after the action, a written consent thereto is signed by all the members of the board or committee. NRS 78.315. The Nevada Bylaws are consistent with the NRS. | The DGCL provides that, unless the certificate of incorporation or bylaws provide otherwise, any action required or permitted to be taken at a meeting of the board of directors or any committee thereof may be taken without a meeting if all members of the board or such committee consent thereto in writing or by electronic transmission and the writing or writings or electronic transmissions are filed with the minutes of proceedings of the board or such committee. DGCL §141. The Delaware Bylaws are consistent with the DGCL and are substantially similar to the Nevada Bylaws in regard to board and committee action by written consent. | ||

Interested Party Transactions | The NRS provides that no contract or transaction between a corporation and one or more of its directors or officers, or between a corporation and any other entity of which one or more of its directors or officers are directors or officers, or in which one or more of its directors or officers have a financial interest, is void or voidable if one of the following circumstances exists: (a) the director’s or officer’s interest in the contract or transaction is known to the Board, and the transaction is approved or ratified by the Board in good faith by a vote sufficient for the purpose (without counting the vote of the interested director or officer); (b) the director’s or officer’s interest in the contract or transaction is known to the stockholders, and the transaction is approved or ratified by a majority of the stockholders holding a majority of voting power; (c) the fact of the common interest is not known to the director or officer at the time the transaction is brought before the Board; or (d) the contract or transaction is fair to the corporation at the time it is authorized or approved. NRS 78.140. | The DGCL provides that no contract or transaction between a corporation and one or more of its directors or officers, or between a corporation and any other entity of which one or more of its directors or officers are directors or officers, or in which one or more of its directors or officers have a financial interest, is void or voidable if: (a) the material facts as to the director’s or officer’s relationship or interest and as to the contract or transaction are disclosed or known to the board of directors or a committee thereof, which authorizes the contract or transaction in good faith by the affirmative vote of a majority of the disinterested directors, even though the disinterested directors are less than a quorum; (b) the material facts as to the director’s or officer’s relationship or interest and as to the contract or transaction are disclosed or known to the stockholders entitled to vote thereon and the contract or transaction is specifically approved in good faith by the stockholders; or (c) the contract or transaction is fair to the corporation as of the time it is authorized, approved or ratified by the board, a committee thereof or the stockholders. DGCL §144. The NRS and the DGCL are substantially similar with respect to interested party transactions, with the DGCL providing additional provisions for the approval of related-party transactions by stockholders. |

| Provision | Nevada | Delaware |

Quorum for Stockholder Meeting | Unless the articles of incorporation or bylaws provide otherwise, a majority of the voting power, present in person or by proxy at a meeting of stockholders (regardless of whether the proxy has authority to vote on all matters), constitutes a quorum for the transaction of business. NRS 78.320. The Nevada Bylaws are consistent with the NRS. | The certificate of incorporation or bylaws may specify the number of shares (and the amount of other securities having voting power) the holders of which shall be present or represented by proxy at any meeting in order to constitute a quorum for, and the votes that shall be necessary for, the transaction of any business, but a quorum may not consist of less than one-third of the shares entitled to vote at the meeting, except that, where a separate vote by one or more classes or series is required, a quorum may not consist of less than one-third of the shares of each such class or series. In the absence of such a specification: (a) a majority of the shares entitled to vote, present in person or represented by proxy, shall constitute a quorum at a stockholder meeting; (b) in all matters other than the election of directors, the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter shall be the act of the stockholders; (c) directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors; and (d) where a separate vote by one or more classes or series is required, a majority of the outstanding shares of each such class or series, present in person or represented by proxy, shall constitute a quorum entitled to take action with respect to that vote on that matter and, in all matters other than the election of directors, the affirmative vote of the majority of shares of each such class or series present in person or represented by proxy at the meeting shall be the act of each such class or series. A bylaw amendment adopted by stockholders specifying the votes necessary for election of directors may not be further amended or repealed by the board of directors. DGCL §216. | ||

| Consistent with the DGCL, the Delaware Bylaws state that the holders of a majority in voting power of the capital stock issued and outstanding and entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business. The Delaware Bylaws and Nevada Bylaws are substantially similar with respect to quorum requirements. |

| Provision | Nevada | Delaware |

Cumulative Voting for Directors | The NRS permits cumulative voting in the election of directors only if the articles of incorporation provide for cumulative voting and certain procedures for the exercise of cumulative voting are followed. NRS 78.360. The Nevada Charter does not provide for cumulative voting. | Under the DGCL, a corporation may provide for cumulative voting in its certificate of incorporation. DGCL Section 214. The Delaware Charter does not provide for cumulative voting. | ||

Duration of Proxies | A proxy is effective only for a period of six months from the date of its creation, unless it is coupled with an interest or unless otherwise provided by the stockholder in the proxy, which duration may not exceed seven years. A proxy shall be deemed irrevocable if the written authorization states that the proxy is irrevocable, but is irrevocable only for as long as it is coupled with an interest sufficient in law to support an irrevocable power. NRS 78.355. The Nevada Bylaws do not change this statutory rule. | A proxy executed by a stockholder will remain valid for a period of three years, unless the proxy provides for a longer period. A duly executed proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A proxy may be made irrevocable regardless of whether the interest with which it is coupled is an interest in the stock itself or an interest in the corporation generally. DGCL §212 The Delaware Bylaws do not change this statutory rule. The DGCL statutory default provides for proxies to remain valid for a longer duration than the NRS statutory default. | ||

Advance Notice Provisions | The Nevada Bylaws do not contain advance notice requirements for business to be brought by a stockholder before an annual or special meeting of stockholders. | The Delaware Bylaws contain advance notice requirements for business to be brought before an annual or special meeting of stockholders, including nominations of persons for election as directors. As a result, stockholders must satisfy specific timing and information requirements in order to have a proposal considered at or in order to nominate a person for election as a director at an annual or special meeting. Any proposal or nomination that fails to comply with these timing and information requirements may be disqualified. The Delaware Bylaws and the Nevada Bylaws are materially different in this respect. |

| Provision | Nevada | Delaware |

Stockholder Votes for Mergers and Similar Transactions | Under the NRS, the approval of a majority of outstanding shares entitled to vote, as well as the board of directors, is required for a merger or a sale of substantially all of the assets of the corporation. Generally, the NRS does not require a stockholder vote of the surviving corporation in a merger if: (a) the plan of merger does not amend the existing articles of incorporation; (b) each share of stock of the surviving corporation outstanding immediately before the effective date of the merger is an identical outstanding share after the merger; (c) the number of voting shares outstanding immediately after the merger, plus the number of voting shares issued as a result of the merger, either by the conversion of securities issued pursuant to the merger or the exercise of rights and warrants issued pursuant to the merger, will not exceed by more than 20% the total number of voting shares of the surviving domestic corporation outstanding immediately before the merger; and (d) the number of participating shares outstanding immediately after the merger, plus the number of participating shares issuable as a result of the merger, either by the conversion of securities issued pursuant to the merger or the exercise of rights and warrants issued pursuant to the merger, will not exceed by more than 20% the total number of participating shares outstanding immediately before the merger. NRS 92A.130. The Nevada Charter and Nevada Bylaws do not change the statutory rule. | Under the DGCL, the approval of a majority of outstanding shares entitled to vote, as well as the board of directors, is required for a merger or a sale of substantially all of the assets of the corporation. Generally, the DGCL does not require a stockholder vote of the surviving corporation in a merger (unless the corporation provides otherwise in its certificate of incorporation) if: (a) the plan of merger does not amend the existing certificate of incorporation; (b) each share of stock of the surviving corporation outstanding immediately before the effective date of the merger is an identical outstanding share after the effective date of the merger; and (c) either no shares of common stock of the surviving corporation and no shares, securities or obligations convertible into such stock are to be issued or delivered under the plan of merger, or the authorized unissued shares or shares of common stock of the surviving corporation to be issued or delivered under the plan of merger plus those initially issuable upon conversion of any other shares, securities or obligations to be issued or delivered under such plan do not exceed 20% of the shares of common stock of such constituent corporation outstanding immediately prior to the effective date of the merger. DGCL §251. The Delaware Charter and Delaware Bylaws do not change the statutory rule. The NRS and the DGCL are substantially similar in regard to stockholder approval of mergers and other corporate transactions. | ||

Consideration of Non- Stockholder Interests | The NRS authorizes directors, when taking action on behalf of the corporation, to consider the interests of constituencies other than stockholders, including employees, suppliers, creditors, customers and the community and society as a whole. NRS 78.138(4). | Delaware case law limits the ability of the board of directors to consider the interests of non-stockholders when taking action on behalf of the corporation in some circumstances. This aspect of Delaware law could, in some circumstances, limit the discretion of the board in responding to unsolicited takeover proposals or similar events. |

| Provision | Nevada | Delaware |

Special Meetings of Stockholders | The NRS states that, unless otherwise provided in the articles of incorporation or bylaws, the entire board of directors, any two directors or the president may call annual and special meetings of the stockholders and directors. NRS 78.310. The Nevada Bylaws are consistent with the NRS, but also provide that a special meeting of stockholders may be called by the Chief Executive Officer or at the request in writing of stockholders owning a majority in amount of the entire capital stock issued and outstanding and entitled to vote. | The DGCL provides that special meetings of the stockholders may be called by the board of directors or by such persons as may be authorized by the certificate of incorporation or bylaws. DGCL §211. The Delaware Charter and Delaware Bylaws state that special meetings of the stockholders may be called at any time by the board, the Chair of the Board, the Chief Executive Officer or the President (in the absence of the Chief Executive Officer), but may not be called by any other person. The Delaware Charter and Delaware Bylaws thus differ from the Nevada Bylaws in that stockholders cannot request that a special meeting of the stockholders be called. | ||

Stockholder Action by Written Consent | The NRS states that, unless the articles of incorporation or bylaws provide otherwise, any action required or permitted to be taken at a stockholder meeting may be taken without a meeting if the holders of outstanding stock having at least the minimum number of votes that would be necessary to authorize or take such action at a meeting consent to the action in writing. NRS 78.320. The Nevada Bylaws state that any action which may be taken by the vote of the stockholders at a meeting may be taken without a meeting if authorized by the written consent of stockholders holding at least a majority of the outstanding voting power entitled to vote thereon. | The DGCL states that, unless the certificate of incorporation provides otherwise, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if the holders of outstanding stock having at least the minimum number of votes that would be necessary to authorize or take such action at a meeting consents to the action in writing. In addition, The DGCL requires the corporation to give prompt notice of the taking of corporate action without a meeting by less than unanimous written consent to those stockholders who did not consent in writing. DGCL §228. The Delaware Charter and Delaware Bylaws do not allow stockholders to act by written consent, and therefore differ from the Nevada Bylaws. |

| Provision | Nevada | Delaware |

Failure to Hold Annual Stockholder Meeting | Under the NRS, if a corporation fails to hold an annual stockholder meeting to elect directors within 18 months after the last election of directors, a Nevada district court may order an election upon the petition of one or more stockholders holding at least 15% of the corporation’s voting power. NRS 78.345. The Nevada Bylaws do not change this statutory rule. | Under the DGCL, if an annual meeting for election of directors is not held on the date designated or an action by written consent to elect directors in lieu of an annual meeting has not been taken within 30 days after the date designated for the annual meeting, or if no date has been designated, for a period of 13 months after the last annual meeting or the last action by written consent to elect directors in lieu of an annual meeting, the Delaware Court of Chancery may summarily order a meeting to be held upon the application of any stockholder or director. DGCL §211. The Delaware Bylaws do not change this statutory rule. The DGCL provides for a shorter interval between meetings than the NRS (13 months versus 18 months) before a stockholder can apply to a court to order a meeting for the election of directors. The NRS requires that application be made by a stockholder holding at least 15% of the voting power, while the DGCL permits any stockholder or director to make the application. | ||

Adjournment of Stockholder Meetings | Unless the articles of incorporation or bylaws provide otherwise, if a stockholder meeting is adjourned to another date, time or place, notice need not be delivered of the date, time or place of the adjourned meeting if they are announced at the meeting at which the adjournment is taken. If a new record date is fixed for the adjourned meeting, notice of the adjourned meeting must be delivered to each stockholder of record as of the new record date. NRS 78.370. The Nevada Bylaws do not change this statutory rule. | If a meeting of stockholders is adjourned due to lack of a quorum and the adjournment is for more than 30 days, or if after the adjournment a new record date is fixed for the adjourned meeting, notice of the adjourned meeting must be given to each stockholder of record entitled to vote at the meeting. At the adjourned meeting, the corporation may transact any business that might have been transacted at the original meeting. DGCL §222. The Delaware Bylaws do not change this statutory rule. |

| Provision | Nevada | Delaware |

Director Standard of Conduct | Under the NRS, directors and officers must exercise their powers in good faith and with a view to the interests of the corporation. | Under the DGCL, the standards of conduct for directors have developed through written opinions of the Delaware courts. Generally, directors are subject to fiduciary duties of care, loyalty and good faith. | ||

Limitation on Director Liability | Under the NRS, unless the articles of incorporation provide for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that (a) the director’s or officer’s act or failure to act constituted a breach of his or her fiduciary duties as a director or officer and (b) the breach of those duties involved intentional misconduct, fraud, or a knowing violation of law. NRS 78.138. Consistent with this statutory rule, the Nevada Charter provide that the personal liability of the directors of the corporation is eliminated to the fullest extent permitted by the NRS. The Nevada Bylaws do not change this statutory rule. | Under the DGCL, if the certificate of incorporation so provides, the personal liability of a director for breach of fiduciary duty as a director may be eliminated or limited. The certificate of incorporation may not, however, limit or eliminate a director’s personal liability for (a) any breach of the director’s duty of loyalty to the corporation or its stockholders, (b) acts or omissions not in good faith or involving intentional misconduct or a knowing violation of law, (c) payment of unlawful dividends, stock repurchases or redemptions, or (d) any transaction in which the director received an improper personal benefit. DGCL §102. Consistent with this statutory rule, the Delaware Charter and the Delaware Bylaws limit the personal liability of a director for breach of fiduciary duty as permitted under the DGCL. The DGCL is more extensive than the NRS in the enumeration of actions under which we may not eliminate a director’s personal liability |

| Provision | Nevada | Delaware |

| Indemnification | Under the NRS, a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, except an action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with the action, suit or proceeding if the person (a) is not liable pursuant to NRS 78.138 or (b) acted in good faith and in a manner that he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent, does not, of itself, create a presumption that the person is liable pursuant to NRS 78.138 or did not act in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, or that, with respect to any criminal action or proceeding, he or she had reasonable cause to believe that the conduct was unlawful. However, indemnification may not be made for any claim, issue or matter as to which such a person has been adjudged to be liable to the corporation or for amounts paid in settlement, unless and only to the extent that the court determines the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper. NRS 78.7502. The Nevada Charter and the Nevada Bylaws are consistent with the NRS. | Under the DGCL, a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses (including attorneys’ fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person (a) acted in good faith and in a manner that he or she reasonably believed to be in or not opposed to the best interests of the corporation and (b) with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. With respect to actions by or in the right of the corporation, no indemnification shall be made with respect to any claim, issue, or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit is brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnification for such expenses which such court shall deem proper. A director or officer who is successful, on the merits or otherwise in defending any proceeding subject to the DGCL’s indemnification provisions shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith. DGCL §145. The Delaware Charter and the Delaware Bylaws are consistent with the DGCL. The indemnification provisions of the NRS and the DGCL are substantially similar. |

| Provision | Nevada | Delaware |

Advancement of Expenses | The NRS provides that the articles of incorporation, the bylaws or an agreement made by the corporation may provide that the expenses of officers and directors incurred in defending a civil or criminal action, suit, or proceeding must be paid by the corporation as they are incurred and in advance of the final disposition of the action, suit, or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the corporation. NRS 78.751. The Nevada Charter and the Nevada Bylaws do not change this statutory rule. | The DGCL provides that expenses incurred by an officer or director in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it is ultimately determined that he or she is not entitled to be indemnified by the corporation as authorized under the DGCL. Such expenses may be so paid upon such terms and conditions as the corporation deems appropriate. Under the DGCL, unless otherwise provided in its certificate of incorporation or bylaws, a corporation has the discretion whether or not to advance expenses. DGCL §145. The Delaware Charter and the Delaware Bylaws are consistent with the DGCL. The expense advancement provisions of the NRS and the DGCL are substantially similar. | ||