Exhibit 99.2

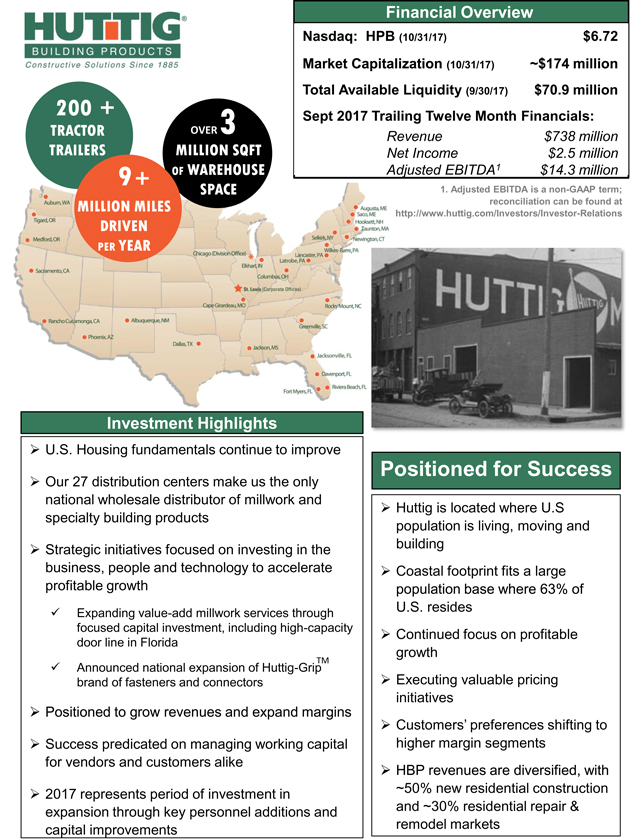

Financial Overview Nasdaq: HPB (10/31/17) $6.72 Market Capitalization (10/31/17) ~$174 million 200 + Total Available Liquidity (9/30/17) $70.9 million Sept 2017 Trailing Twelve Month Financials: TRACTOR OVER3 Revenue $738 million TRAILERS MILLION SQFT Net Income $2.5 million 9 + OF WAREHOUSE Adjusted EBITDA1 $14.3 million SPACE 1. Adjusted EBITDA is a non-GAAP term; MILLION MILES reconciliation can be found DRIVEN http://www.huttig.com/Investors/Investor-Relations PER YEAR Investment Highlights U.S. Housing fundamentals continue to improve Positioned for Success Our 27 distribution centers make us the only national wholesale distributor of millwork and Huttig is located where U.S specialty building products population is living, moving and Strategic initiatives focused on investing in the building business, people and technology to accelerate Coastal footprint fits a large profitable growth population base where 63% of U.S. resides Expanding value-add millwork services through focused capital investment, including high-capacity Continued focus on profitable door line in Florida growth TM Announced national expansion of Huttig-Grip Executing valuable pricing brand of fasteners and connectors initiatives Positioned to grow revenues and expand margins Customers’ preferences shifting to Success predicated on managing working capital higher margin segments for vendors and customers alike HBP revenues are diversified, with 2017 represents period of investment in ~50% new residential construction expansion through key personnel additions and and ~30% residential repair & capital improvements remodel markets

Representing the brands that our customers prefer Representative Vendors Representative Customers Huttig-Grip is a NEW division of Huttig Building Products created to expand its private label construction fastener and specialty building products line into a NATIONAL brand Expect $175 to $250 million in annual incremental revenue over the next 36 months Expansion of existing service proposition leverages infrastructure Standard operating leverage of 7% to 10% equates to $12 to $25 million upon maturity of line Forward-looking projected financial information is based on current estimates and forecasts. Actual results could differ materially. We therefore caution against placing substantial reliance on the forward-looking statements contained in this presentation. Further information about the Company, including information about factors that could materially affect its results of operations and financial condition, is contained in the Company’s most recently filed Annual Report on Form 10-K and quarterly reports on Form 10-Q that you can find on our website at http://www.huttig.com/Investors/Investor-Relations.