Filed by MI Developments Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14d-2 of the Securities Exchange Act of 1934, as amended.

Subject Company: Magna Entertainment Corp.

Commission File No. 000-30578

Dated: July 16, 2004

Where to Find Additional Information About the Transaction

This document is neither an offer to purchase securities nor a solicitation of an offer to sell securities of Magna Entertainment Corp. ("MEC"). At the time the expected offer is commenced, MI Developments Inc. ("MID") will file an offer to purchase/prospectus with the United States Securities and Exchange Commission and Canadian securities regulatory authorities and MEC will file a solicitation/recommendation statement with respect to the offer. Investors and stockholders are strongly advised to read the offer to purchase/prospectus (including the offer to purchase, letter of transmittal and related tender documents) and the related solicitation/recommendation statement when they become available because they will contain important information. At that time, investors and stockholders may obtain a free copy of the offer to purchase/prospectus, the related letter of transmittal and certain other offer documents, as well as the solicitation/recommendation statement from the Securities and Exchange Commission's website at www.sec.gov or at www.sedar.com. Free copies of these documents can also be obtained from MID by directing a request to MID, Attention: General Counsel, 455 Magna Drive, Aurora, Ontario, Canada L4G 7A9, (905) 713-6322. YOU SHOULD READ THE OFFER TO PURCHASE/PROSPECTUS CAREFULLY BEFORE MAKING A DECISION CONCERNING THE OFFER.

On July 14, 2004, MID presented the following management presentation:

Creating Value for Shareholders

| | + | |

MAGNA ENTERTAINMENT |

All currency amounts in U.S. dollars

Forward-Looking Statements

The contents of this presentation may contain "forward-looking statements" within the meaning of Section 27A of the United States Securities Act of 1933 and Section 21E of the United States Securities Exchange Act of 1934. Forward-looking statements may include, among others, statements regarding MID's future plans, costs, objectives or economic performance, or the assumptions underlying any of the foregoing. In this presentation we use words such as "may", "would", "could", "will", "likely", "believe", "expect", "anticipate", "intend", "plan", "forecast", "project", "estimate" and similar words to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or the times at or by which such future performance will be achieved. Forward-looking statements are based on information available at the time and/or management's good faith belief with respect to future events and are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond MID's control. MID expressly disclaims any intention and undertakes no obligation to update or revise any forward-looking statements to reflect subsequent information, events or circumstances or otherwise.

Agenda

- •

- Summary of Transaction

- •

- Background to the Offer

- •

- Reasons for the Offer

- •

- Financial Review

- •

- Management Structure and Summary

Creating Value for Shareholders

Summary of Transaction

Transaction Terms

| |

| |

|

|---|

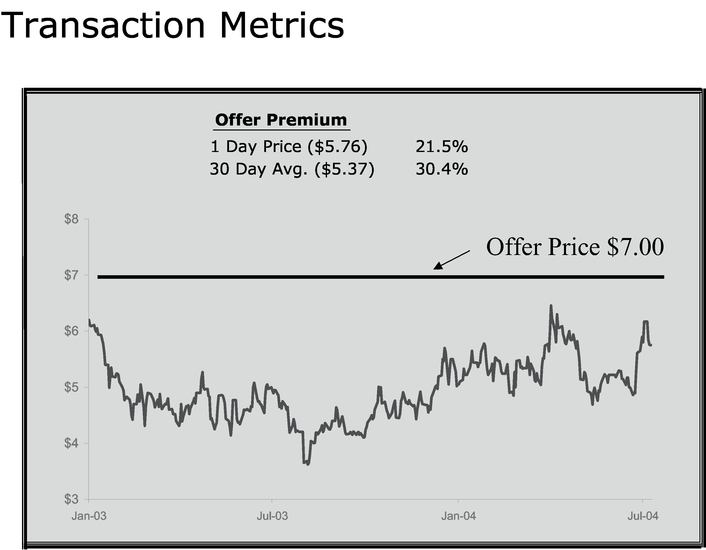

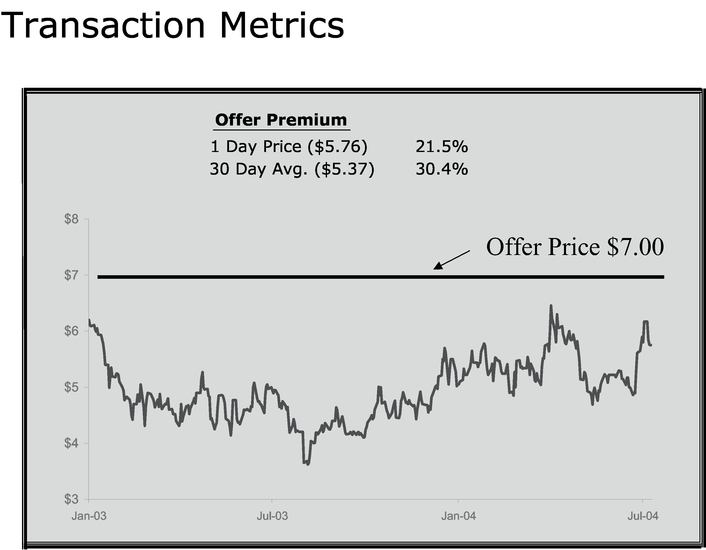

| Offer | | • | | 0.2258 MID A Shares (85%) and $1.05 in cash (15%) for each MEC A Share |

|

|

• |

|

21.5% premium based on July 12 closing price |

Value of Offer |

|

• |

|

$285.8 million (C$376.6 million) |

Transaction Structure |

|

• |

|

Exchange offer |

|

|

• |

|

Second step merger to achieve 100% ownership |

Transaction Terms

| |

| |

|

|---|

| Timing | | • | | Announcement July 13, 2004 |

|

|

• |

|

Circular mailing expected week of August 9 |

|

|

• |

|

Offer expiry expected week of September 13 |

Conditions |

|

• |

|

Majority of MEC A Shares not held by MID and MID related parties tendered to the offer |

|

|

• |

|

MID ownership of at least 90% of the outstanding MEC A Shares (taking into account the conversion of MEC B Shares held by MID into MEC A Shares) |

Creating Value for Shareholders

Background to the Offer

Rationale for Spin-Offs

| |

| |

| |

|

|---|

| |

MAGNA ENTERTAINMENT |

• |

|

Spin-off Sept. 2003 |

|

• |

|

Spin-off Mar. 2000 |

• |

|

Unlock value for Magna shareholders |

|

• |

|

Enable MEC to independently pursue its growth strategy, including developing total entertainment destinations |

• |

|

Allow MID to diversify its portfolio and seek 3rd party development opportunities, including MEC |

|

• |

|

Provide visibility on MEC's financial and operating results |

• |

|

Allow MID to share in the future growth of MEC |

|

|

|

|

Access to capital markets

"Spinco" philosophy benefits

Evolving MID / MEC Relationship

- •

- MEC strategic investment:

- •

- development of under-utilized lands

- •

- redevelopment of existing racing facilities

- •

- development of new racing and slot facilities

- •

- Alternative gaming has significantly increased the scope and size of MEC development opportunities

- •

- MEC investment affects MID value:

- •

- approximately 25% of MID's market cap

- •

- strong vested interest in MEC's success

MEC Since Spin-Off

- •

- Racing acquisitions made

- •

- yet to reach full earnings potential

- •

- Real estate developments have become a higher priority

- •

- Real estate activities requiring more time of both MEC and MID management

- •

- Capital requirements have increased significantly

- •

- Access to capital reduced and cost of financing increased

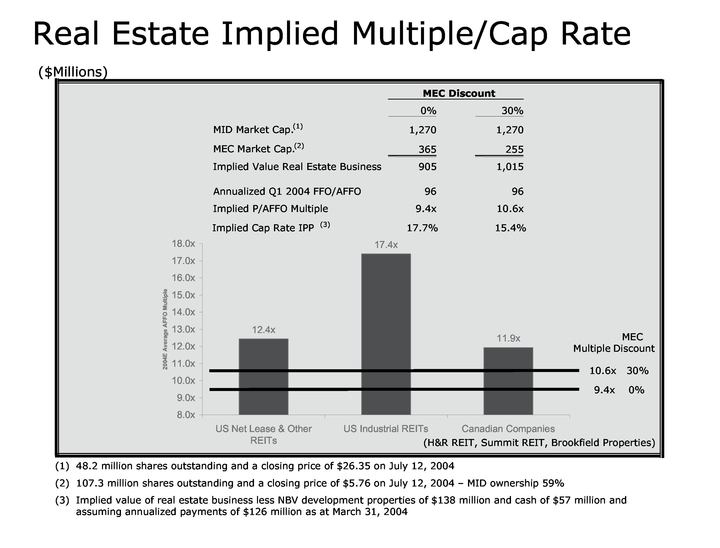

MID Since Spin-Off

- •

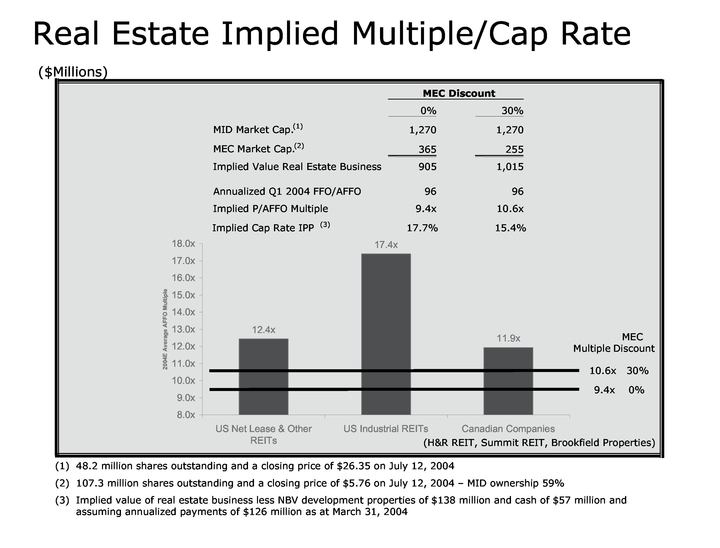

- Shares trade at a discount

- •

- analysts apply discount to value of MEC investment

- •

- implied real estate valuation discount to peers

- •

- Concerns raised by investor community and rating agencies

- •

- increasing capital needs of MEC

- •

- terms of potential MID/MEC real estate transactions

- •

- concentration of income-producing real estate portfolio

- •

- Existing real estate business provides modest returns

- •

- Higher growth and higher return opportunities with MEC developments

MID/MEC Relationship

Separation of MID and MEC

No Longer Optimal

Creating Value for Shareholders

Reasons for the Offer

Reasons

Creating Value for Shareholders

Improves Execution of

MEC Strategy

Improves Flexibility,

Efficiency and Synergies

Improves View of MID

Valuation

Diversifies MID's Real

Estate Assets

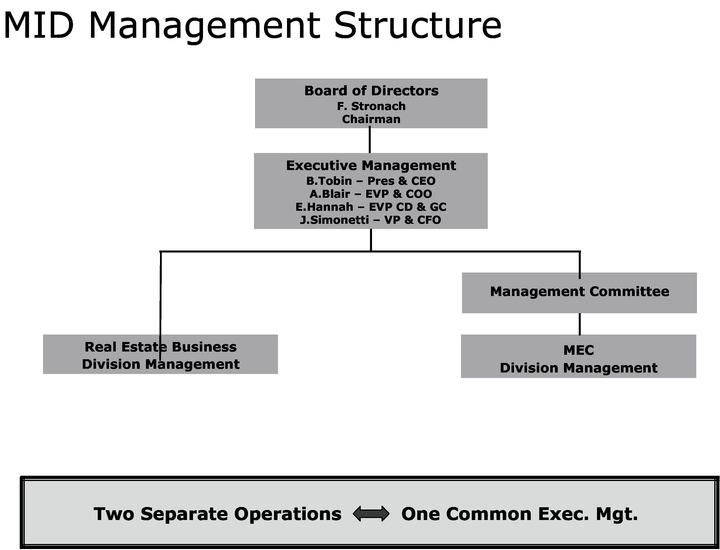

Improves Execution of MEC Strategy

- •

- Direct access to MID construction and development expertise

- •

- Access to capital to finance significant real estate developments and slot expenditures

- •

- MID to have more participation over MEC's day-to-day racing operations, slot initiatives and capital expenditure decisions

Success of MEC Strategy Impacts MID Shareholder Value

Improves Flexibility, Efficiency and Synergies

- •

- Related party developments between two public companies difficult to structure on a project-by-project basis

- •

- Accelerates realization of potentially significant value in MEC

- •

- Eliminates management distractions, time demands and costs of maintaining two public companies

- •

- Overhead savings approximately $10 million annually

- •

- Reduces consolidated after-tax cost of financing MEC projects

Increases Ability to Create Shareholder Value

Improves View of MID Valuation

- •

- Removes holding company structure

- •

- Removes uncertainty around MID's plans for MEC

- •

- Improving MEC's ability to execute its strategy

- •

- Provides MID direct access to potentially higher return business

- •

- Should attract new demand for MID shares

Provides Clarity Regarding

Future MID/MEC Relationship

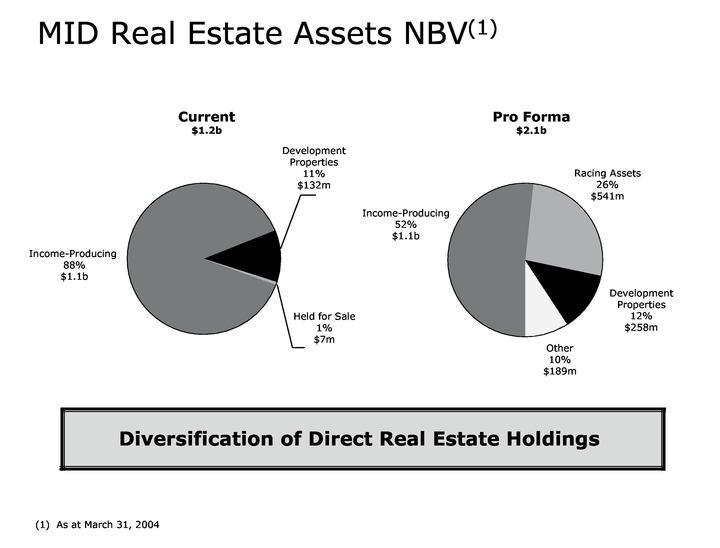

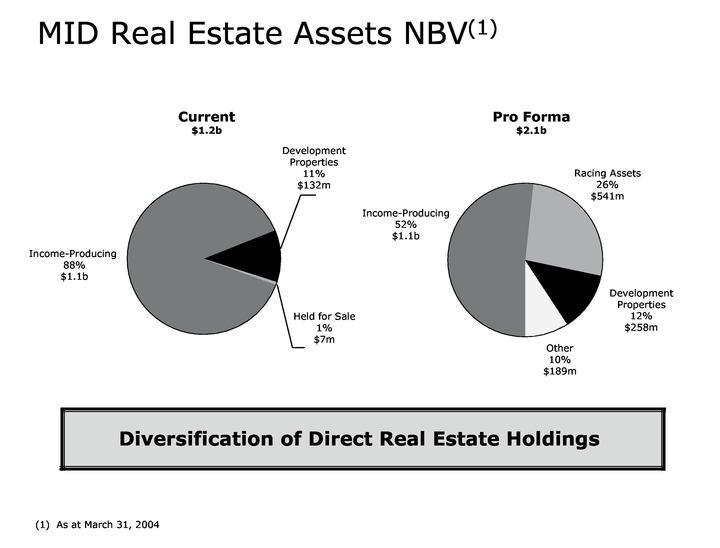

Diversifies MID's Real Estate Assets

- •

- Primary focus on Magna International developments

- •

- MEC provides compelling real estate development opportunities

- •

- Pro forma NBV of MID's income-producing portfolio 52% (versus current 88%) of real estate assets directly owned by MID

Provides Higher Growth

Real Estate Development Opportunities

Creating Value for Shareholders

Financial Review

Financial Reporting Pre-Transaction

| • Focus on MID's Real Estate Business |

| | • segmented reporting of MID's two businesses |

| | • highlight FFO and FFO per share |

| | • provide market value of MEC investment |

| | |

| • MID's financial statements shown on a consolidated basis |

| | |

| • 41% MEC equity stake not owned by MID reflected through Minority Interest |

Financial Reporting Post-Transaction

| • Segmented financial results |

| | • Real Estate Business (FFO) |

| | • MEC (EBITDA) |

| | • allocation of MID corporate costs between two businesses |

| | |

| • Combined net income of Real Estate Business and MEC Operations |

| | |

| • Increase in number of fully diluted MID shares |

| | • MID A Shares issued from transaction |

| | • MEC convertible notes |

| | • MEC options |

Pro Forma Q1 2004 Net Income

($Millions)

| | Consolidated

| | Real Estate

| | MEC

| |

|---|

| Before Minority Interest | | 22.1 | | 11.3 | | 10.8 | |

| Minority Interest(1) | | (4.5 | ) | — | | (4.5 | ) |

| | |

| |

| |

| |

| As Reported(2) | | 17.6 | | 11.3 | | 6.3 | |

| Minority Interest | | 4.5 | | — | | 4.5 | |

| | |

| |

| |

| |

| Pro Forma Q1 2004 Net Income | | 22.1 | | 11.3 | | 10.8 | |

| | |

| |

| |

| |

- (1)

- Represents 41% equity of MEC not owned by MID

- (2)

- As reported by MID pursuant to Canadian GAAP

Pro Forma Fully Diluted MID Shares

| | Millions

|

|---|

| As at March 31, 2004 | | 48.2 |

| Issued from Transaction(1) | | 9.9 |

| | |

|

| | | 58.1 |

| MEC Convertible Notes(2) | | 6.8 |

| MEC Options(3) | | 0.8 |

| | |

|

| | | 65.7 |

| | |

|

- (1)

- Based on 0.2258 MID A Shares issued for every MEC A Share tendered plus 0.7m shares issued to Fair Enterprise

- (2)

- Represents MID A Shares that would be issued upon conversion of MEC convertible notes at exchange offer of 0.2258 MID A Shares issued for every MEC A Share tendered

- (3)

- Represents MID A Shares that would be issued for "in-the-money" MEC options based on 0.2258 MID A Shares issued for every MEC "in-the-money" option

Pro Forma Real Estate Business FFO

($Millions, except per share figures)

| Annualized Q1 2004 FFO(1) | | $ | 96.0 |

| Diluted Annualized Q1 2004 FFO Per Share Pre-Transaction | | $ | 1.99 |

| Pro Forma Annualized Q1 2004 Diluted FFO Per Share | | $ | 1.46 |

- (1)

- Q1 2004 FFO of $24 million (excluding impact of cash retiring allowances) × 4

MEC Contribution in Medium and Long Term Should

Mitigate Dilution Impact

MID Pro Forma Balance Sheet

($Millions)

| | Pro Forma March 31, 2004

|

|---|

| Total Real Estate Assets | | $ | 2,047 |

| Total Assets | | $ | 2,695 |

| Total Debt(1) | | $ | 419 |

Pro Forma Total Debt to Total Capitalization 21%(2)

- (1)

- Includes convertible notes and bank indebtedness

- (2)

- Assuming MID current price of $26.35 per MID share

Creating Value for Shareholders

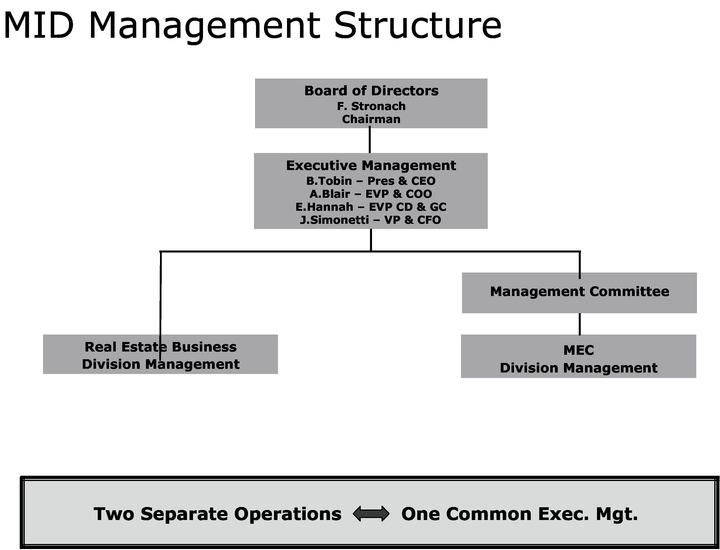

Management Structure

and Summary

Growth Strategy

- •

- Real Estate Business

- •

- focus on Magna International developments

- •

- co-developments of MEC underutilized lands

- •

- development/redevelopment of existing/new racing and slot facilities

- •

- other commercial and residential developments

- •

- 3rd party acquisitions and developments

- •

- MEC

- •

- improve results of core racing operations

- •

- pursue alternative gaming and technology opportunities

- •

- total entertainment destinations

Transaction Highlights

MID Strengths

| | +

| | MEC Potential

|

|---|

| • Geographically diversified high quality assets | | | | • Compelling real estate opportunities |

| • Quality and stability of cash flow | | | | • Improve racing operations |

| • Proven development track record | | | | • Alternative gaming |

| • Experienced management team | | | | • Accelerated growth |

| • Strong balance sheet with financial flexibility | | | | |

| • Established platform for growth | | | | |

Create Shareholder Value