QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Magna Entertainment Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

MAGNA ENTERTAINMENT CORP.

2008

NOTICE OF ANNUAL

AND SPECIAL MEETING

AND

PROXY STATEMENT

Tuesday, May 6, 2008

at 11:00 a.m.

Le Royal Meridien King Edward Hotel

Sovereign Ballroom

37 King Street East

Toronto, Ontario, Canada

|

|

Magna Entertainment Corp.

337 Magna Drive

Aurora, Ontario,

Canada L4G 7K1

Tel (905) 726-2462

Fax (905) 726-7448 |

April 4, 2008

Dear Stockholder:

On behalf of our Board of Directors and management, it is my pleasure to invite you to MEC's Annual and Special Meeting of Stockholders (the "Annual Meeting") on Tuesday, May 6, 2008, beginning at 11:00 a.m., in the Sovereign Ballroom at Le Royal Meridien King Edward Hotel in Toronto, Ontario, Canada. The Annual Meeting's business is described in the Notice of Annual and Special Meeting and Proxy Statement accompanying this letter.

In appreciation of your investment in MEC, we are pleased, once again, to offer to you an opportunity to obtain two free passes for general admission to any of our racetracks and off-track betting facilities. The passes are good for an unlimited number of visits over the next year. Please detach, complete and mail the enclosed postcard if you wish to take advantage of this offer.

I look forward to seeing many of our stockholders on May 6th. However, if you are unable to attend in person, you can view a webcast of the Annual Meeting at our websitewww.magnaentertainment.com and you can vote your shares by completing and returning the enclosed proxy form or voting instruction card, as applicable, in the manner described in the Notice of Annual and Special Meeting and Proxy Statement. Your vote is important and we look forward to receiving it.

|

|

Sincerely,

/s/ Frank Stronach |

| | | Frank Stronach

Chairman and Interim Chief Executive Officer |

NOTICE OF ANNUAL AND SPECIAL MEETING

The Annual and Special Meeting of Stockholders (the "Annual Meeting") of Magna Entertainment Corp. ("MEC") will be held on Tuesday, May 6, 2008, beginning at 11:00 a.m. local time, at Le Royal Meridien King Edward Hotel, 37 King Street East, Toronto, Ontario, Canada, to consider and take action upon the following matters described in the accompanying Proxy Statement:

- (1)

- the election of eight directors for terms expiring at the 2009 Annual Meeting of Stockholders of MEC;

- (2)

- the ratification of the appointment, by the Audit Committee of the Board of Directors, of Ernst & Young LLP as MEC's auditors for the fiscal year ending December 31, 2008;

- (3)

- to approve a proposal to authorize the Board of Directors of MEC, in its discretion, to amend MEC's Restated Certificate of Incorporation to effect a reverse stock split for one time only, prior to May 6, 2009, in any whole number consolidation ratio from 1:10 to 1:20;

- (4)

- to approve a proposal to authorize the Board of Directors of MEC, in its discretion, to amend MEC's Restated Certificate of Incorporation to authorize the creation of a class of preferred stock; and

- (5)

- such other matters as may properly come before the meeting.

The Board of Directors has determined that owners of record of MEC's Class A Subordinate Voting Stock and Class B Stock at the close of business on Monday, March 10, 2008 are entitled to notice of and to vote at the Annual Meeting, and at any adjournment(s) thereof.

|

|

By Order of the Board of Directors

/s/ William G. Ford |

| | | William G. Ford

Secretary |

Magna Entertainment Corp.

337 Magna Drive

Aurora, Ontario

Canada L4G 7K1

April 4, 2008 |

|

|

YOUR VOTE IS IMPORTANT

To vote your shares, please complete, sign and date the enclosed proxy form or voting instruction card, as applicable, and return it in the enclosed postage-paid envelope. Please see "GENERAL INFORMATION — Holders of Class A Subordinate Voting Stock and Class B Stock".

TABLE OF CONTENTS

| | Page

|

|---|

| GENERAL INFORMATION | | 1 |

| | Holders of Class A Subordinate Voting Stock and Class B Stock | | 1 |

| ELECTION OF DIRECTORS (Item A on the Proxy Form) | | 2 |

| | Nominees | | 2 |

| | Vote Required | | 4 |

| MANAGEMENT | | 5 |

| | Executive Officers | | 5 |

| SECURITY OWNERSHIP | | 6 |

| THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD | | 8 |

| | Corporate Governance, Human Resources and Compensation Committee | | 9 |

| | Audit Committee | | 9 |

| | Special Committee of Independent Directors | | 9 |

| | Nomination Process | | 9 |

| | Code of Conduct | | 10 |

| | Directors' Compensation | | 10 |

| | Compensation Committee Interlocks and Insider Participation | | 10 |

| | Certain Relationships and Related Transactions | | 11 |

| EXECUTIVE COMPENSATION | | 14 |

| | Compensation Discussion and Analysis | | 14 |

| | Corporate Governance, Human Resources and Compensation Committee Report | | 18 |

| | Summary Compensation Table | | 19 |

| | Grants of Plan-Based Awards | | 19 |

| | Outstanding Equity Awards at Fiscal Year-End | | 20 |

| | Employment Agreements and Termination of Employment Agreements | | 20 |

| | Equity Based Compensation Plan Information | | 21 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 24 |

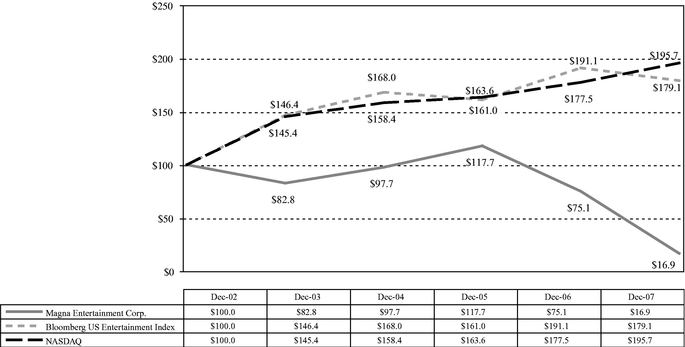

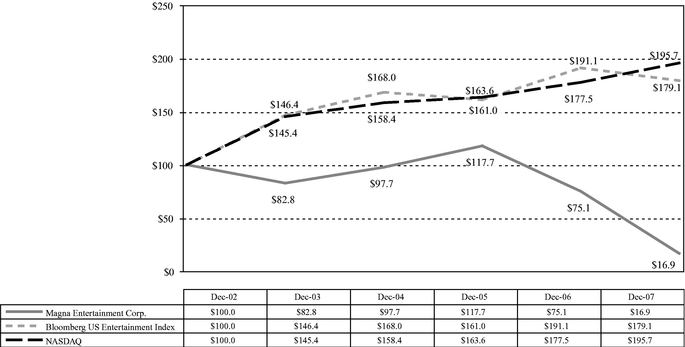

| | Comparative Stock Performance Graph | | 24 |

| AUDIT COMMITTEE REPORT | | 26 |

| RATIFICATION OF APPOINTMENT OF AUDITORS (Item B on the Proxy Form) | | 27 |

| | Principal Accountant Fees and Services | | 27 |

| | Ratification of Appointment of Ernst & Young LLP as Auditors | | 27 |

| | Vote Required | | 28 |

| STOCK CONSOLIDATION (Item C on the Proxy Form) | | 28 |

| | Vote Required | | 34 |

| AUTHORIZATION OF A CLASS OF PREFERRED STOCK (Item D on the Proxy Form) | | 35 |

| | Vote Required | | 36 |

| ADDITIONAL INFORMATION | | 36 |

| | Other Action at the Meeting | | 36 |

| | Cost of Solicitation | | 36 |

| | Stockholder Proposals for Inclusion in Next Year's Proxy Statement | | 36 |

| | Other Stockholder Proposals for Presentation at Next Year's Annual Meeting | | 36 |

| | 2007 Annual Report on Form 10-K and Other Additional Information | | 36 |

| EXHIBIT A — CERTIFICATE OF AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION | | 37 |

| EXHIBIT B — CERTIFICATE OF AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION | | 38 |

i

PROXY STATEMENT

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Magna Entertainment Corp. ("MEC" or the "Company") for use at MEC's Annual and Special Meeting of Stockholders to be held on May 6, 2008 (the "Annual Meeting"), and at any adjournment(s) thereof. The solicitation of proxies provides all stockholders who are entitled to vote on matters that come before the meeting with an opportunity to do so whether or not they attend the meeting in person. This Proxy Statement and the related proxy form are first being mailed to MEC's stockholders on or about April 10, 2008.

All dollar amounts in this document are in United States dollars unless otherwise stated.

Holders of Class A Subordinate Voting Stock and Class B Stock

Owners of record of MEC's Class A Subordinate Voting Stock and Class B Stock at the close of business on March 10, 2008 are entitled to notice of and to vote at the Annual Meeting. Such owners of the Class A Subordinate Voting Stock are entitled to one (1) vote for each share held and such owners of the Class B Stock are entitled to twenty (20) votes for each share held.

As of March 24, 2008, MEC had authorized 310 million shares of Class A Subordinate Voting Stock, par value $0.01 per share, of which 58,158,887 were issued and outstanding, and 90 million shares of Class B Stock, par value $0.01 per share, of which 58,466,056 were issued and outstanding. The owners of a majority of such issued and outstanding shares, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

If your shares are registered in your name with MEC's transfer agent, you are considered to be the owner of record of those shares and these proxy materials are being sent to you directly.If you wish to give your proxy to someone other than the two persons named as proxies on the enclosed form, you must strike out both names appearing on the enclosed proxy form and insert the name of another person or persons (not more than three). The signed proxy form must be presented at the Annual Meeting by the person or persons representing you.

If your shares are held in a brokerage account or in the name of another nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote your shares. Since a beneficial owner is not the owner of record, you may not vote these shares in person at the meeting unless you obtain a "legal proxy" from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

The shares represented by a properly signed and returned proxy form or voting instruction card, as applicable, will be voted as specified by the stockholder on such form. If a proxy form or voting instruction card, as applicable, is signed and returned but no specification is made, the shares will be voted "FOR" the election of all nominees for director (Item A), "FOR" the ratification of the appointment of Ernst & Young LLP as MEC's independent auditors (Item B), "FOR" the proposed stock consolidation (Item C) and "FOR" the proposed authorization of the creation of a class of preferred stock (Item D). If you are a share owner of record, a proxy may be revoked at any time before it is voted by providing notice of such revocation in writing to the Secretary's Office (at MEC's address set forth in the Notice of Annual and Special Meeting accompanying this Proxy Statement), by submission of another proxy properly signed by such stockholder and bearing a later date, or by voting in person at the Annual Meeting. For shares you hold beneficially in street name, please see the instructions accompanying your voting instruction card regarding how to revoke or change your vote.

Abstentions, where applicable, are not counted as votes "FOR" or "AGAINST" a proposal, but are counted in determining a quorum.

It is the policy of MEC that any proxy, ballot or other voting material that identifies the particular vote of a stockholder will be kept confidential, except in the event of a contested proxy solicitation or as may be required by law. Such documents are available for examination only by the scrutineers, or inspectors of election, and

1

certain persons associated with processing proxy forms and tabulating the vote, although MEC may be informed whether or not a particular stockholder has voted and will have access to each proxy, ballot or other voting material.

ELECTION OF DIRECTORS

(Item A on the Proxy Form)

The MEC Restated Certificate of Incorporation provides that, unless otherwise approved by ordinary resolution by the holders of the Class A Subordinate Voting Stock and the holders of the Class B Stock, each voting separately as a class, (i) a majority of the directors of MEC shall be individuals who are not officers or employees of MEC or persons related to such officers or employees and (ii) at least two of the directors of MEC shall be individuals who are not directors, officers or employees of MEC or its affiliates, including Magna International Inc. ("Magna International") and MI Developments Inc. ("MI Developments"), or persons related to such officers, employees or directors. MEC's bylaws provide that the number of directors of MEC shall be not less than one and not more than fifteen, and that the number of directors and the number of directors to be elected at the Annual Meeting each shall be determined from time to time by resolution of the Board of Directors. The Board of Directors has fixed eight as the number of directors of MEC to be elected at the Annual Meeting. Each director elected at the Annual Meeting will serve for a term expiring at the 2009 Annual Meeting of Stockholders, expected to be held in April or May 2009, or until his or her successor has been duly elected and qualified or his or her earlier resignation or removal.

Nominees

All eight individuals nominated for election to the Board of Directors at the Annual Meeting are incumbent directors. Certain information regarding each nominee is set forth below.

Each nominee for director has consented to being named in this Proxy Statement and to serve if elected. It is the intention of the persons named in the enclosed proxy to vote for the election of the nominees listed on the following pages unless otherwise instructed on the proxy form. If you do not wish your shares to be voted for particular nominees, please strike out the name(s) of the person(s) for whom you do not wish to vote in Item A on the proxy form.

2

If at the time of the Annual Meeting any nominee is no longer available or able to serve, shares represented by the proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Board of Directors or, if none, the size of the Board of Directors will be reduced. The Board of Directors knows of no reason why any of the nominees would be unavailable or unable to serve. The persons nominated for election to the Board of Directors are as follows:

Name

| | Age

| | Residence

| | Position

|

|---|

| Frank Stronach (1)(2) | | 75 | | Lower Austria, Austria | | Interim Chief Executive Officer,

Chairman and Director (since November 1999) |

| Anthony R. Campbell (3)(5) | | 60 | | New York, USA | | Director (since September 2007) |

| Jerry D. Campbell (3)(4)(5)(6) | | 67 | | Michigan, USA | | Lead Director (appointed Lead Director in March 2006; Director since March 2000) |

| Ron Charles | | 60 | | Shadow Hills, California | | Chief Operating Officer and Director (since August 2007) |

| Jennifer Jackson | | 59 | | Ontario, Canada | | Director (since May 2007) |

| William J. Menear (3)(4)(5)(6) | | 62 | | Ontario, Canada | | Director (since October 2002) |

| Frank Vasilkioti (6) | | 71 | | Ontario, Canada | | Director (since May 2007) |

| Charlie J. Williams (3)(4) | | 60 | | Michigan, USA | | Director (since February 2007) |

- (1)

- Currently a director of Magna International.

- (2)

- Currently a director of MI Developments.

- (3)

- Messrs. A.R. Campbell, J. Campbell, Menear and Williams are independent directors.

- (4)

- Member of Audit Committee.

- (5)

- Member of Special Committee of Independent Directors.

- (6)

- Member of Corporate Governance, Human Resources and Compensation Committee.

Frank Stronach serves as Chairman of MEC and has served as Interim Chief Executive Officer of MEC since late June 2007, a position he also held from March 31, 2006 until February 27, 2007. Mr. Stronach has been a director since November 1999. Since 1971, Mr. Stronach has been the Chairman of Magna International, a supplier of automotive systems and components, which he founded over 50 years ago. He is also the founder and Chairman of MI Developments, a real estate operating company and the parent company of MEC. Mr. Stronach is actively involved in racing and breeding thoroughbred horses in California, Florida, Kentucky, New York, Ontario and elsewhere.

Anthony R. Campbell has been a director since his September 2007 appointment by the Board. Mr. Campbell has been a portfolio manager and senior analyst for Dorset Management Corporation since January of 2000 and a partner of Knott Partners Management, LLC, one of MEC's largest institutional shareholders, since 2004. Previously, Mr. Campbell founded Windsor Partners, LP in 1986. Mr. Campbell was a Principal and Managing Director of Berg Capital Corporation, a registered investment advisor, from 1984 through 1985 and also served as general partner of Chelsea Partners, a private investment partnership, during that time.

Jerry D. Campbell has been a director since March 2000 and was President and Chief Executive Officer of MEC from March to August 2000 and Vice-Chairman of MEC from August 2000 to April 2002. Prior to joining MEC, Mr. Campbell served as Chairman of the Board and Chief Executive Officer of Republic Bancorp Inc., a bank holding company, from its establishment in April 1986 to December 1999. He continued to serve as its Chairman of the Board until 2006. In 2006, Republic Bancorp merged with Citizens Banking Corp. to form Citizens Republic Bancorp. Mr. Campbell served as the Chairman of the Board of the merged company, Citizens Republic Bancorp until January 2008. Mr. Campbell was appointed as Lead Director of the MEC Board of Directors in March 2006. Mr. Campbell is the Chairman and Chief Executive Officer of CNBS Financial Group in Orlando, Florida.

3

Ron Charles has been a director since August 2007 and has been Chief Operating Officer of MEC since January 2008. Mr. Charles joined MEC in 2004 as Executive Director of MEC California. From the early 1990's to 2004, Mr. Charles was a consultant for ATAK Management, an international real estate development and consumer financing firm, based in Los Angeles. Mr. Charles is a long-time owner and breeder of thoroughbred race horses and is the past Chairman of the Thoroughbred Owners of California and was a founding member of the organization.

Jennifer Jackson has been a director since May 2007 and has been the President of Berger Jackson Capital Services Inc. since 1998. Prior to 1998, Ms. Jackson was an investment advisor with HSBC James Capel Canada Inc. for approximately 10 years. She has 25 years of experience in the investment community both in Canada and in the United States.

William J. Menear has been a director since October 2002. Mr. Menear was a partner of Canec International Ltd., a transatlantic mergers and acquisitions advisory company, from September 2001 to June 2003. Since 1999, Mr. Menear has been President and Chief Executive Officer of William Menear & Associates Limited, a business advisory firm operating in the area of mergers and acquisitions and strategic financial advice, and from 1995 to 1999, was a Managing Director of Scotia Capital Inc., an investment bank. Prior to joining Scotia Capital Inc., Mr. Menear was a Senior Vice-President, Corporate Banking with Scotiabank from 1970 to 1995. Mr. Menear is a former Chairman of the Board of the Orthopaedic and Arthritic Hospital (now called, The Holland Orthopaedic and Arthritic Centre), Toronto from 1982 to 1992. Mr. Menear is currently a director of Dover Industries Limited and Golden China Resources Corporation.

Frank Vasilkioti is the founder and President of Aegis Corporate Financial Services Limited, an independent investment banking firm established in 1979 which specializes in mergers, acquisitions, divestures and financings. He has been a director since his May 2007 election by the Company's stockholders. Mr. Vasilkioti was a director of MI Developments from May 2006 to May 2007. Prior to 1979, Mr. Vasilkioti worked as a financial/investment analyst for Triarch Corporation (Brascan) from 1972 to 1979 and Harris & Partners Limited from 1965 to 1972. Mr. Vasilkioti has served on various charitable boards and committees, including in the following capacities: Chair of an Allocation Committee for the United Way; member of Premier Davis' Advisory Committee on the Constitution from 1981 to 1982; Founding Trustee and Board Member of the Canadian Merit Scholarship Foundation from 1988 to 1992; and Vice Chairman of the Design Exchange from 1997 to 2004.

Charlie J. Williams, an attorney, was appointed as a director in February 2007. Mr. Williams has been a consultant to the City of Highland Park since March 2006, advising the Emergency Financial Manager regarding financial and administrative matters. He has also been the President and Chief Executive Officer of MPS Group Inc., a facility and industrial management company, since May 2007. Mr. Williams also served as the Deputy County Executive to the incumbent Executive and held other administrative positions in his administration from January 2004 through December 2005. He has held various executive level and Chief of Staff positions with the County of Detroit and Wayne County from 1998 to December 2003. In October 2006, Mr. Williams was appointed to a six-year term as the representative of Wayne County, Michigan to the Wayne County Airport Authority Board. Mr. Williams has been a member of the State Bar of Michigan since 1980.

Vote Required

The affirmative vote of a plurality of the votes cast with respect to the shares of Class A Subordinate Voting Stock and Class B Stock, voting together as a single class, present or represented and entitled to vote at the Annual Meeting is required for the election of each nominee for director.

MI Developments, as the holder, directly or indirectly, of all the outstanding shares of Class B Stock, has indicated that it intends to vote all such shares"FOR" the election of each nominee for director.

The Board of Directors recommends that the stockholders vote "FOR" the election of each nominee for director.

4

MANAGEMENT

Executive Officers

The executive officers and other officers of MEC are as follows:

Name

| | Age

| | Position

|

|---|

| Frank Stronach* | | 75 | | Chairman and Interim Chief Executive Officer |

| Ron Charles* | | 60 | | Chief Operating Officer |

| Blake Tohana | | 41 | | Executive Vice-President and Chief Financial Officer |

| Scott Borgemenke | | 42 | | Executive Vice-President, Racing |

| James Bromby | | 48 | | Senior Vice-President, Operations |

| Brant Latta | | 47 | | Senior Vice-President, Operations |

| Frank DeMarco, Jr. | | 82 | | Vice-President, Regulatory Affairs |

| William G. Ford | | 39 | | Secretary |

| Mary Lyn Seymour | | 39 | | Vice-President and Controller |

- *

- See "Election of Directors — Nominees".

Blake Tohana has served as Executive Vice-President and Chief Financial Officer of MEC since July 2003. Prior to joining MEC in that capacity, Mr. Tohana held various executive positions with Fireworks Entertainment Inc., a subsidiary of CanWest Global Communications Corp., from August 1997 to July 2003. Most recently, he served as Executive Vice-President, Corporate Development of Fireworks Entertainment Inc. from April 2002 to July 2003. Prior to that, he served as Chief Financial Officer of Fireworks Entertainment Inc. from October 1998 to April 2002 and Vice-President, Finance from August 1997 to October 1998.

Scott Borgemenke has served as Executive Vice-President, Racing of MEC since January 2008. Prior to joining MEC, Mr. Borgemenke served as chief of staff to Ohio House Speaker, Jon Husted. Previously, Mr. Borgemenke served as chief of staff in the Ohio Senate and as chief policy advisor and director of cabinet affairs for Ohio Governor Bob Taft. Additionally, he served a stint as executive director of the Cincinnati Business Committee and headed his own public affairs, government relations and campaign consulting firm. Mr. Borgemenke served as a member and chairman of the Ohio State Racing Commission from 2002 to 2004.

James Bromby has served as Senior Vice-President, Operations of MEC, along with Brant Latta, since October 2006. Prior to that appointment, he was Vice-President of Operational Finance from March 2006 to October 2006, from August 2003 to March 2006 he was Senior Manager, Continuous Improvement Team and, prior to that, served in various senior level capacities within MEC since its inception.

Brant Latta has served as Senior Vice-President, Operations of MEC, along with James Bromby, since October 2006. Prior to that appointment, he was Vice-President of Operations from March 2006 to October 2006, from August 2003 to March 2006 he was Senior Manager, Continuous Improvement Team and, prior to that, served in various senior level capacities within MEC since its inception.

Frank DeMarco, Jr. has served as Vice-President, Regulatory Affairs of MEC since March 2000. He has also served as Executive Director, General Counsel and Secretary of Los Angeles Turf Club, Incorporated (an indirect, wholly-owned subsidiary of MEC) since April 1998. Mr. DeMarco has been a practicing attorney in Los Angeles County since 1951.

William G. Ford has served as Secretary of MEC since March 2006 and has been Legal Counsel of MEC since May 2003. Prior to joining MEC, Mr. Ford was an associate lawyer with the law firm of McCarthy Tétrault LLP from April 1999 to April 2003.

Mary Lyn Seymour has served as Vice-President and Controller of MEC since October 2006 and as Controller since September 2004. Prior to becoming Controller, Ms. Seymour served as Director of Finance at MEC from May 2001 to September 2004. Prior to joining MEC, Ms. Seymour held various accounting positions with PricewaterhouseCoopers LLP from September 1990 to May 2001, including Principal/Senior Manager from 1998 through 2001.

5

SECURITY OWNERSHIP

The following tables set forth certain information as of March 24, 2008 with respect to beneficial ownership of MEC by: (a) any entity or person known by MEC to be the beneficial owner of more than 5% of the outstanding shares of MEC's Class A Subordinate Voting Stock and Class B Stock; and (b) each director, nominee for director and executive officer (including those officers listed below in the Summary Compensation Table) and all executive officers and directors of MEC as a group.

To MEC's knowledge, except as indicated in the footnotes to these tables or pursuant to applicable community property laws, the persons named in the following tables have sole voting and investment power with respect to the shares of MEC's Class A Subordinate Voting Stock and Class B Stock indicated.

For information regarding MEC's equity compensation plans, please see "Executive Compensation — Equity Based Compensation Plan Information".

(a) Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities

Class of Securities

| | Name and Address

of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | Percentage of Class

|

|---|

| Class B Stock | | MI Developments Inc. (1)(2)

455 Magna Drive

Aurora, Ontario L4G 7A9 | | 58,466,056 | | 100% |

| Class A Subordinate Voting Stock | | Fair Enterprise Limited (3)

1 Seaton Place

St. Helier

Jersey JE4 8YJ

Channel Islands | | 12,571,403 | | 21.6% |

| Class A Subordinate Voting Stock | | MI Developments Inc. (2)

455 Magna Drive

Aurora, Ontario L4G 7A9 | | 4,362,328 | | 7.5% |

| Class A Subordinate Voting Stock | | Cliffwood Partners LLC (4)

11726 San Vicente Boulevard

Suite 600,

Los Angeles CA 90049 | | 3,469,170 | | 6.0% |

| Class A Subordinate Voting Stock | | David M. Knott/Dorset Management Corporation

485 Underhill Boulevard, Suite 205, Syosset, NY 11791 | | 3,416,014 | | 5.9% |

- (1)

- MI Developments directly owns 53,253,145 or 91.1% of these shares of MEC's Class B Stock. The remaining shares of Class B Stock are owned through a wholly-owned subsidiary of MI Developments. MI Developments is entitled to vote approximately 96% of the votes attaching to MEC's outstanding voting securities. Shares of MEC's Class B Stock are convertible, on a one for one basis, into shares of Class A Subordinate Voting Stock. Accordingly, taking into account the Class A Subordinate Voting Stock already held by MI Developments (see Note 2 immediately below), MI Developments beneficially holds 62,828,384 shares of Class A Subordinate Voting Stock on an as converted basis, representing approximately 53.9% of the Class A Subordinate Voting Stock on an as converted basis.

- (2)

- The Stronach Trust controls MI Developments through the right to direct the votes attaching to Class B shares of MI Developments that carry a majority of the votes attaching to the outstanding voting shares of MI Developments. The Class B shares of MI Developments are held by 445327 Ontario Limited, which is controlled by the Stronach Trust. Mr. Frank Stronach is the exclusive representative for voting the shares of MI Developments held by 445327 Ontario Limited solely in the manner directed by the Stronach Trust and is the Chairman of MI Developments and MEC. Mr. Stronach, together with three members of his family, are the trustees of the Stronach Trust. Mr. Stronach is also a member of the class of potential beneficiaries under the Stronach Trust.

- (3)

- Fair Enterprise Limited forms part of an estate planning structure for the Stronach family. Members of the family of Mr. Stronach are among the class of possible indirect beneficiaries of this structure. Neither Mr. Frank Stronach nor members of the Stronach family control or exercise direction over the shares of MEC held by Fair Enterprise Limited.

- (4)

- These securities are held on behalf of Cliffwood Partners LLC, Cliffwood Value Plus Fund L.P., Cliffwood Absolute Return Strategy Ltd, Cliffwood Absolute Return Strategy, L.P., the Common Fund's managed account and Guggenheim Trust Company's managed account. The sole power to dispose of or direct the disposal of the entire shareholding has been delegated to Cliffwood Partners LLC.

6

(b) Security Ownership of Directors and Named Executive Officers

| | Amount and Nature of Beneficial Ownership

| |

| |

|---|

Name of Beneficial Owner

| | Class A Subordinate Voting Stock (1)

|

| | Percentage

of Class

| | Class B Stock

|

| | Percentage of Class

| |

|---|

| Frank Stronach | | 17,952,079 | (2) | | 30.9% | | 58,466,056 | (3) | | 100 | % |

| Anthony R. Campbell | | 36,850 | (4) | | (5) | | — | | | — | |

| Jerry D. Campbell | | 267,832 | (6) | | (5) | | — | | | — | |

| Ron Charles | | 60,711 | (7) | | (5) | | — | | | — | |

| Jennifer Jackson | | 2,000 | | | (5) | | — | | | — | |

| William J. Menear | | 38,436 | (8) | | (5) | | — | | | — | |

| Frank Vasilkioti | | 2,000 | | | (5) | | — | | | — | |

| Charlie J. Williams | | 2,000 | | | (5) | | — | | | — | |

| Blake Tohana | | 116,404 | (9) | | (5) | | — | | | — | |

| Scott Borgemenke | | — | | | — | | — | | | — | |

| James Bromby | | 101,041 | (10) | | (5) | | — | | | — | |

| Brant Latta | | 78,336 | (11) | | (5) | | — | | | — | |

| Michael Neuman* | | — | | | — | | — | | | — | |

| Joseph A. De Francis** | | — | | | — | | — | | | — | |

| All executive officers and directors as a group (15 persons) | | 18,690,841 | | | 32.1% | | 58,466,056 | (3) | | 100 | % |

- *

- Mr. Neuman served as President and Chief Executive Officer during part of 2007. For additional details of his tenure see "Executive Compensation — Summary Compensation Table". The number of shares reported for Mr. Neuman as part of his holdings is based on information in our corporate records and his most recent filings on the Canadian insider reporting system, the System for Electronic Disclosure by Insiders, as at the date of his departure and reports filed pursuant to Section 16(a) of the U.S. Securities Exchange Act of 1934.

- **

- Mr. De Francis ceased to serve as Executive Vice-President in September 2007 and remained as a director until March 3, 2008. The number of shares reported for Mr. De Francis as part of his holdings is based on information in our corporate records and his most recent filings on the Canadian insider reporting system, the System for Electronic Disclosure by Insiders, as at the date of his departure and reports filed pursuant to Section 16(a) of the U.S. Securities Exchange Act of 1934.

- (1)

- Includes the following number of shares of Class A Subordinate Voting Stock issuable upon the exercise of outstanding stock options which may be exercised within 60 days of April 4, 2008: 1,000,000 for Mr. Stronach; 8,000 for Mr. J. Campbell; 40,000 for Mr. Charles; 10,000 for Mr. Menear; 2,000 for each of Messrs. A.R. Campbell, Vasilkioti and Williams and Ms. Jackson; 100,000 for Mr. Tohana; 91,666 for Mr. Bromby; 70,666 for Mr. Latta; and 1,351,332 for all executive officers and directors as a group.

- (2)

- 4,362,328 of these shares are registered in the name of MI Developments. See Note 2 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities". 12,571,403 of these shares are registered in the name of Fair Enterprise Limited. See Note 3 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities". 18,348 of these shares are registered in the name of 865714 Ontario Inc., which is a separate vehicle incorporated for the acquisition of Magna International shares and the sale thereof to the management team of Magna International. Magna International has the right to direct the disposition of these shares. Accordingly, Frank Stronach beneficially holds 76,418,135 shares of Class A Subordinate Voting Stock on an as converted basis representing approximately 65.5% of the Class A Subordinate Voting Stock, on an as converted basis.

- (3)

- MI Developments directly owns 53,253,145 or 91.1% of these shares of MEC's Class B Stock. The remaining shares of Class B Stock are owned through a wholly-owned subsidiary of MI Developments. MI Developments is entitled to vote approximately 96% of the votes attaching to MEC's outstanding voting securities. See Note 2 immediately above and Note 2 above under "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities".

- (4)

- See "Security Ownership of Beneficial Owners of more than 5% of the Company's Voting Securities" for a description of shares of MEC Class A Subordinate Voting Stock held by David M. Knott/Dorset Management Corporation, of which Mr. Campbell is a partner. Mr. Campbell has disclaimed beneficial ownership of the MEC Class A Stock Subordinate Voting Stock held by David M. Knott/Dorset Management Corporation.

- (5)

- These shares represent less than 1% of the class.

- (6)

- Of these holdings, 239,589 shares of Class A Subordinate Voting Stock are owned directly, 11,225 are owned jointly by Mr. Campbell and his wife, 4,009 are owned by Mr. Campbell's wife, and 5,009 are owned indirectly through two wholly-owned corporations, Post It Stables, Inc. and Volar Corp.

7

- (7)

- Includes 20,711 shares of Class A Subordinate Voting Stock in respect of Performance Share Awards issued in 2006 and 2007 in lieu of an entitlement related to the financial performance of our California operations.

- (8)

- Includes 10,000 shares of Class A Subordinate Voting Stock issued in connection with the Company's current policy to issue 10,000 shares of Class A Subordinate Voting Stock to each individual who completes five years of continuous service as a director.

- (9)

- Includes 16,404 shares of Class A Subordinate Voting Stock in respect of Performance Share Awards issued in 2006 and 2007 in lieu of 50% of Mr. Tohana's 2005 and 2006 guaranteed bonus.

- (10)

- Includes 9,375 shares of Class A Subordinate Voting Stock in respect of Performance Share Awards issued in 2006 and 2007 in lieu of 50% of Mr. Bromby's 2005 and 2006 guaranteed bonus.

- (11)

- Includes 7,670 shares of Class A Subordinate Voting Stock in respect of Performance Share Awards issued in 2006 and 2007 in lieu of 50% of Mr. Latta's 2005 and 2006 guaranteed bonus.

THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

The business of MEC is managed under the direction of the Board of Directors (the "Board"). The Board held 16 meetings during 2007. Of the current directors of MEC, Messrs. J. Campbell and Menear attended at least 75% of the meetings of the Board and Committees of which they were members during fiscal year 2007 and the remaining directors (other than Mr. Stronach) attended at least 75% of the meetings held during the time they served as directors in 2007. The directors had the following attendance rates for Board of Directors meetings held during their time of service in 2007: for Mr. Stronach, 11 of 16 meetings (four of the five meetings for which Mr. Stronach was not in attendance pertained to related party transactions); for Mr. A.R. Campbell, 3 of 3 meetings; for Mr. J. Campbell, 16 of 16 meetings; for Mr. Charles, 5 of 5 meetings; for Ms. Jackson, 7 of 8 meetings; for Mr. Menear, 16 of 16 meetings; for Mr. Vasilkioti, 8 of 8 meetings; and for Mr. Williams, 12 of 12 meetings. See "Election of Directors — Nominees" for information on the commencement of Board service of Ms. Jackson and Messrs. A.R. Campbell, Charles, Vasilkioti and Williams. While MEC does not have a formal, written attendance policy requiring directors to attend its Annual Meeting of Stockholders, the Board encourages directors to attend the Annual Meeting. All then current members of the Board attended the 2007 Annual Meeting.

MEC does not have a formal process for stockholders to send communications to the Board. In view of the infrequency of stockholder communications with the Board, the Board believes that a formal process is not necessary. Any stockholder may submit written communications to the Board by sending them to Magna Entertainment Corp., 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1, Attention: Secretary's Office, whereupon such communications will be forwarded to the Board as a group or to the individual director or directors addressed.

MEC is a "controlled company" as defined in the Nasdaq Marketplace Rules because MI Developments controls a majority of the votes attaching to MEC's outstanding voting stock. As a result, under the Nasdaq Marketplace Rules, MEC is only required to establish and maintain one committee of the Board, the Audit Committee. Pursuant to the Nasdaq Marketplace Rules, MEC's Audit Committee is required to be composed solely of independent directors, but neither the Board nor any other committee of the Board is required to meet the other director independence requirements set forth in the Nasdaq Marketplace Rules, except that the independent directors are required to meet on a regular basis. Commencing in October 2003, the non-management, independent members of the Board have met independently on a quarterly basis.

Because of the number of matters requiring Board consideration, to make the most effective use of individual Board members' capabilities, the Board has established three standing committees to devote attention to specific subjects and to assist it in the discharge of its responsibilities: (i) the Corporate Governance, Human Resources and Compensation Committee, (ii) the Audit Committee, and (iii) the Special Committee of Independent Directors. The functions of these committees, their current members and the number of meetings held during 2007 are described below.

In April 2005, MEC's Board of Directors adopted a resolution requiring the independent directors of MEC to maintain ownership of all shares of the Corporation's Class A Subordinate Voting Stock issued to them as director fees up to a maximum amount of shares with a market value of not less than $100,000; provided that on and after the fifth full year of service as a director of the Corporation, each director is required to own shares of Class A Subordinate Voting Stock of the Corporation with a market value of not less than $100,000.

8

In March 2006, MEC's Board of Directors appointed Jerry Campbell as Lead Director of the Board. Mr. Campbell has served on MEC's Board since March 2000.

Corporate Governance, Human Resources and Compensation Committee

The Corporate Governance, Human Resources and Compensation Committee is composed of Jerry Campbell (Chairman), William Menear and Frank Vasilkioti. The Committee annually reviews and re-affirms its Charter, which was originally adopted in March 2000. The Corporate Governance, Human Resources and Compensation Committee administers MEC's Long-Term Incentive Plan. It also reviews and makes recommendations to the Board with respect to all direct and indirect compensation, benefits and perquisites of MEC's Chief Executive Officer, Chief Operating Officer, Executive Vice-President and Chief Financial Officer, and certain other senior management employees, and MEC's policies regarding management benefits and perquisites. This Committee is also generally responsible for developing MEC's approach to corporate governance issues, including MEC's relationship with MI Developments and Magna International, and assessing the effectiveness of the system of corporate governance employed by MEC as a whole. The Corporate Governance, Human Resources and Compensation Committee held five meetings during year 2007.

Audit Committee

The Audit Committee is composed of William J. Menear (Chairman), Jerry Campbell and Charlie J. Williams. Each member of the Audit Committee is "independent" as currently required by the Nasdaq Marketplace Rules. In addition, the Board of Directors has determined that each of William J. Menear and Jerry Campbell is an "audit committee financial expert" as defined by Item 401 of Regulation S-K.

The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, and is responsible for the appointment, engagement and oversight of the work of the independent auditors of MEC. The Audit Committee has adopted a formal written Audit Committee Charter. In accordance with its Charter, the Audit Committee also has considerable general authority in relation to the oversight of MEC's financial affairs, as well as specific responsibility to review MEC's quarterly and annual financial statements and the related management's discussion and analysis of financial condition and results of operations ("MD&A") and to report thereon to the Board. In addition, the Audit Committee reviews MEC's internal financial and accounting controls and procedures, reviews the selection, use and application of accounting policies and practices, and examines and considers various other matters in relation to the internal and external audits of MEC's accounts and its financial reporting process and system of internal controls. Also, in accordance with its Charter, the Audit Committee conducted an annual review of its Charter in February 2008. The Audit Committee held 10 meetings during fiscal year 2007.

Special Committee of Independent Directors

The Special Committee of Independent Directors was originally established in July 2004 to evaluate a proposed offer by MI Developments to acquire all the outstanding shares of Class A Subordinate Voting Stock of MEC that it did not already own. Ultimately, MI Developments decided not to proceed with the offer. In December 2006, the Board of Directors recast the power and authority of the Special Committee to review and evaluate proposed financing and/or asset sale transactions involving MI Developments and Magna International and to make appropriate recommendation to the Board of Directors of MEC with respect to such proposed financing and/or asset sale transactions. The Special Committee is composed of Jerry Campbell (Chairman), William J. Menear and Anthony R. Campbell. The Special Committee held a total of 22 formal meetings in respect of proposed financing and/or asset sale transactions involving MI Developments and Magna International and members of the Special Committee had informal discussions among themselves and with their separate legal and financial advisors on a number of other occasions. The Special Committee also supervised and provided guidance to members of MEC management engaged in negotiating various financing and/or asset sale transactions involving MI Developments and Magna International. Please refer to the transactions discussed under "Certain Relationships and Related Transactions".

Nomination Process

Because MEC is a "controlled company" (as discussed above), MEC is not required to have, and does not have, a nominating committee or other committee of the Board performing similar functions. Nominees for

9

director of MEC are considered and approved by the full Board and there is no charter applicable to the nominating process (including any policy with respect to consideration of nominees by security holders).

Code of Conduct

MEC adopted a Code of Business Conduct (the "Code") effective May 4, 2004 that applies to all of MEC's directors, officers and employees. The Code fulfills the Code of Ethics requirements under Item 406 of Regulation S-K. A copy of the Code was filed with MEC's Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 16, 2006 and is also available on MEC's website atwww.magnaentertainment.com/Investors. A copy of the Code will be provided without charge to any person upon request in writing to the Secretary's Office, Magna Entertainment Corp., 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1.

Directors' Compensation

Directors who are not officers or employees of MEC or any of its affiliates were paid an annual retainer (or pro rata portion for directors who served less than 12 months in 2007) of $10,000 in cash and the equivalent of $30,000 in shares of Class A Subordinate Voting Stock for their service as directors in 2007, together with a fee of $1,500 for attendance at each meeting of the Board. Such directors were also paid an annual committee retainer of $5,000 (Committee Chairmen receive a $15,000 annual retainer) and a fee of $1,500 for attendance at each meeting of each Committee of the Board on which they serve. Compensation for Board and Committee work and travel days ($2,000 per day) and for the execution of written resolutions ($250) was also provided to directors who are not officers or employees. In addition, each director receives certain stock options as set forth below under "Executive Compensation — Equity Based Compensation Plan Information — Nonqualified Stock Options".

The following table shows the amounts, before withholdings, earned by individual non-management directors in respect of service as members of the Board of Directors in 2007.

|

|---|

Name

| | Fees Earned or Paid in Cash

($)

| | Stock Awards

($) (1)

| | Option Awards

($)

| | All Other Compensation

($) (2)

| | Total

($)

|

|---|

|

| Jerry D. Campbell | | 175,750 | | 30,000 | | — | | — | | 205,750 |

|

| Anthony R. Campbell | | 18,000 | | 9,000 | | 14,500 (4) | | — | | 41,500 |

|

| Louis E. Lataif (3) | | 34,000 | | 10,500 | | — | | — | | 44,500 |

|

| William J. Menear | | 129,750 | | 30,000 | | — | | — | | 159,750 |

|

| Jennifer Jackson | | 28,935 | | 19,500 | | 14,500 (4) | | — | | 62,935 |

|

| Frank Vasilkioti | | 30,435 | | 19,500 | | 14,500 (4) | | — | | 64,435 |

|

| Charlie J. Williams | | 50,140 | | 25,200 | | 14,500 (4) | | — | | 89,840 |

|

- (1)

- Stock issued as payment of fees for serving as a director.

- (2)

- The aggregate amount of perquisites and other personal benefits, securities or property did not exceed $10,000 for any of the directors.

- (3)

- Mr. Lataif did not stand for re-election at the 2007 Annual Meeting.

- (4)

- Calculated using the Black-Scholes pricing model. Each of Messrs. A.R. Campbell, Vasilkioti, Williams and Ms. Jackson received 10,000 options with an exercise price of $2.78 in 2007.

Compensation Committee Interlocks and Insider Participation

The members of the Corporate Governance, Human Resources and Compensation Committee for fiscal year 2007 were Jerry Campbell (Chairman), Louis E. Lataif (who ceased to serve in May 2007 by virtue of not standing for re-election to the Board of Directors at the 2007 Annual Meeting), William Menear and Frank Vasilkioti. Mr. Menear is not and has never been an officer or employee of MEC or any of its subsidiaries. Mr. J. Campbell was President and Chief Executive Officer of MEC from March to August 2000 and Vice-Chairman of MEC from August 2000 to April 2002. Mr. Campbell has not held any position with MEC, other than Director, since April 2002. Mr. Vasilkioti was a director of MI Developments from May 2006 to May 2007. In addition,

10

there are no compensation committee interlocks between MEC and other entities involving MEC's executive officers and board members who serve as executive officers of such entities.

Certain Relationships and Related Transactions

We have employment agreements with certain of our officers. See "Executive Compensation — Employment Agreements and Termination of Employment Agreements".

MEC pays for its share of an insurance policy that provides, among other coverage, for executive liability of up to $65.0 million (per occurrence and in the aggregate for all claims made during the policy year) for officers and directors of MI Developments and its subsidiaries (including MEC and its subsidiaries), subject to a $1.0 million deductible for executive indemnification. In addition to this, MEC purchased an additional policy with a limit of $15.0 million, which provides financial protection for the directors and officers of MEC in the event they are sued in conjunction with the performance of their duties.

MEC's bylaws contain provisions that may require MEC to indemnify its directors, and at the option of the Board, any of its officers, employees or agents, against certain liabilities that may arise by reason of their status or service as directors, officers, employees or agents, as permitted by applicable law, and to advance expenses incurred as a result of any proceedings against them that are subject to indemnification under MEC's bylaws. In addition, MEC has entered into agreements with our outside directors, Messrs. A.R. Campbell, J. Campbell, Menear, Vasilkioti, Williams and Ms. Jackson, that provide for the indemnification of these individuals by MEC, to the fullest extent permitted by applicable law, as a result of their role as members of the Board or any action alleged to have been taken or omitted in such capacity, and to advance expenses incurred as a result of any proceedings against them that are subject to indemnification under the agreements.

On August 19, 2003, the shareholders of Magna International approved the spin off of its wholly-owned subsidiary, MI Developments. As a result of the spin off transaction, MI Developments acquired Magna International's controlling interest in MEC. MEC and MI Developments operate as separate public companies, each having its own board of directors and management team.

MI Developments is a real estate operating company engaged in the ownership, development, management, leasing, acquisition and expansion of industrial and commercial real estate properties located in Canada, Europe, the United States and Mexico. Virtually all of MI Developments' income-producing properties are under long-term leases to Magna International and its subsidiaries.

MI Developments was incorporated under the laws of Ontario, Canada. The Class A subordinate voting shares of MI Developments are listed for trading on the New York Stock Exchange and the Toronto Stock Exchange ("TSX"). MI Developments' Class B shares are listed on the TSX. MI Developments is the sole holder of MEC's Class B Stock (directly and indirectly), which means that MI Developments is entitled to exercise approximately 96% of the total votes attached to all MEC's outstanding stock. MI Developments is therefore able to elect all the directors of MEC and to control MEC.

On March 31, 2008, MI Developments announced that it had received a reorganization proposal on behalf of various of its shareholders, including entities affiliated with Mr. Stronach (the "Stronach Group"). Among other things, the proposal contemplates MI Development's controlling equity investment in MEC being sold to an entity to be identified by the Stronach Group. However, there can be no assurance that the transactions contemplated by the reorganization proposal will be completed.

MEC's Corporate Constitution requires that a minimum of two directors be individuals who are not MEC officers or employees, or officers, directors or employees of any of MEC's affiliates, including MI Developments and Magna International, or persons related to any such officers, employees or directors. The Corporate Constitution also requires that a majority of MEC's directors be individuals who are not MEC officers or employees or individuals related to these persons.

Because MI Developments is able to elect all of MEC's directors and controls MEC, MI Developments is able to cause MEC to effect certain corporate transactions without the consent of MEC's minority stockholders, subject to applicable law and the fiduciary duties of MEC's directors and officers. In addition, MI Developments is able to cause or prevent a change in control of MEC. The Stronach Trust controls MI Developments through

11

the right to direct the votes attaching to Class B shares of MI Developments, which carry a majority of the votes attaching to the outstanding voting shares of MI Developments. Mr. Frank Stronach, the Chairman of MEC and MI Developments, together with three members of his family, are the trustees of the Stronach Trust. Mr. Stronach is also a member of the class of potential beneficiaries of the Stronach Trust.

On September 12, 2007, we entered into a non-revolving bridge loan agreement (the "Bridge Loan") with a subsidiary of MI Developments pursuant to which up to $80.0 million of financing will be made available, subject to certain conditions. The Bridge Loan matures on May 31, 2008. The Bridge Loan also required certain amendments to the terms of the outstanding Gulfstream Park and Remington Park project financings with MI Developments. In return for MI Developments agreeing to waive any applicable make-whole payments for repayments made under either of these project financings prior to May 31, 2008, the required amendments provide, among other things, that under the Gulfstream Park project financing arrangement: (i) Gulfstream Park's obligations are now guaranteed by MEC; and (ii) $100.0 million of indebtedness must be repaid by May 31, 2008. As required under the initial funding conditions of the Bridge Loan, we had negotiated an extension of the term of our $40.0 million senior secured revolving bank credit facility with a Canadian financial institution to January 31, 2008. Pursuant to the terms of the Bridge Loan, advances after January 15, 2008 are subject to MI Developments being satisfied that the senior secured revolving credit facility will be further extended to at least April 30, 2008 or that a satisfactory refinancing of that facility has been arranged. As the senior secured revolving credit facility was extended to March 31, 2008, MI Developments waived this condition for advances between January 15, 2008 and March 31, 2008. On March 31, 2008, the maturity date of the senior secured revolving credit facility was further extended to April 30, 2008. As of March 24, 2008, $46.2 million (inclusive of principal and interest) was outstanding.

Also, in connection with our September 2007 adopted plan to eliminate debt by December 31, 2008, we also entered into a September 2007 consulting agreement with MI Developments, pursuant to which MI Developments will provide consulting services to our management and Board of Directors in connection with the debt elimination plan. We are required to reimburse MI Developments for its expenses, but there are no fees payable to MI Developments in connection with the consulting agreement. This consulting arrangement may be terminated by either party under certain circumstances.

On June 7, 2007, we sold San Luis Rey Downs, a thoroughbred training center located on approximately 205 acres in Bonsall, California (approximately 40 miles from San Diego), to a subsidiary of MI Developments, for cash consideration of approximately $24.0 million. Concurrently with this sale transaction, we also entered into a lease agreement whereby one of our subsidiaries has leased the property from MI Developments for a three year period on a triple-net lease basis, which provides for a nominal annual rent in addition to operating costs that arise from the use of the property. The lease is terminable at any time by either party on four months notice.

On March 28, 2007, a subsidiary of MI Developments acquired 157 acres of excess real estate adjacent to MEC's Palm Meadows Training Center, located in Palm Beach County, Florida, in return for cash consideration of $35.0 million. In addition, MEC has been granted a profit participation right in respect of the property under which we are entitled to receive 15% of net proceeds from any sale or development of the property after MI Developments achieves a 15% internal rate of return.

On February 7, 2007, MI Developments acquired all of our interests and rights in two non-core real estate properties, a 34 acre parcel of residential developments land in Aurora, Ontario, Canada and a 64 acre parcel of excess land at Laurel Park in Howard County, Maryland for cash consideration of Cdn. $12.0 million (U.S. $10.1 million) and $20.0 million, respectively. As part of these transactions, we were also granted a profit participation right in respect of each property under which we are entitled to receive 15% of net proceeds from any sale or development of the property after MI Developments achieves a 15% internal rate of return.

In addition to the Bridge Loan, two of our subsidiaries have each entered into a project financing agreement with a subsidiary of MI Developments: one entered into in December 2004 with respect to the reconstruction of facilities at Gulfstream Park (the "Gulfstream Loan") and the second entered into in July 2005 for the build-out of the casino facility at Remington Park (the "Remington Loan").

The Gulfstream Loan agreement, which was amended and restated three times and was further amended in connection with the Bridge Loan transaction, provides for a loan of an aggregate of $162.3 million in three

12

separate tranches, with funds having been advanced to fund the construction of casino facilities as well as track facilities. The $115 million first tranche has a 10 year term from the February 1, 2006 completion date of the initial reconstruction project. Amounts outstanding prior to that completion date under the first tranche bore interest at a floating rate equal to 2.55% per annum above MI Development's notional cost of borrowing under its floating rate credit facility, compounded monthly. Amounts outstanding after the completion date bear interest at a fixed rate of 10.5% per annum, compounded semi-annually. The $25.8 million second tranche is due on July 26, 2011 and the $21.5 million third tranche is due on December 22, 2011. Each of the second and third tranche bear interest at a fixed rate of 10.5% per annum, compounded semi-annually. For both the first and second tranche payment of interest was deferred until January 1, 2007, after which MEC started to make monthly blended payments of principal and interest based on a 25-year amortization period commencing on the respective completion dates. With respect to the third tranche, prior to May 1, 2007, interest was capitalized to the principal balance of the loan, thereafter blended payment of principal and interest based on a 25 year amortization period were required. In connection with the Bridge Loan transaction, the Gulfstream Loan was amended such that a repayment of $100.0 million is due by May 31, 2008. The Gulfstream Loan contains cross-guarantee, cross-default and cross-collateralization provisions such that the loan is guaranteed by MEC's subsidiaries that own and operate Remington Park and the Palm Meadows Training Center and is collateralized principally by security over the lands forming part of the operations at Gulfstream Park, Remington Park and Palm Meadows and over all other assets of Gulfstream Park, Remington Park and Palm Meadows, excluding licenses and permits. As of March 24, 2008, $167.1 million (inclusive of principal and interest) was outstanding ($128.9 million, $24.2 million and $14.0 million with respect to tranches 1, 2 and 3 respectfully).

Funds advanced under the Remington Loan were provided by way of progress draws applied to complete the build out of the casino facility, which opened in November 2005. Advances under the loan funded the capital expenditures relating to the development, design and construction of the casino facility, including the purchase and installation of electronic gaming machines. The loan has a 10 year term from the November 28, 2005 completion date. Amounts outstanding prior to that completion date under the loan bore interest at a floating rate equal to 2.55% per annum above MI Development's notional cost of LIBOR borrowing under its floating rate credit facility, compounded monthly. Amounts outstanding after the completion date bear interest at a fixed rate of 10.5% per annum, compounded semi-annually. Payment of interest was deferred until January 1, 2007, after which MEC started to make monthly blended payments of principal and interest based on a 25-year amortization period commencing on the completion date. Certain cash from the operations of Remington Park must be used to pay deferred interest on the loan plus a portion of the principal under the loan equal to the deferred interest on the Gulfstream Loan. The Remington Loan is secured by all assets of Remington Park, excluding licenses and permits. The Remington Loan is also secured by a charge over the lands owned by Gulfstream Park and a charge over the Palm Meadows Training Center and contains cross-guarantee, cross-default and cross-collateralization provisions. As of March 24, 2008, $27.0 million (inclusive of principal and interest) was outstanding.

On September 12, 2007, certain amendments were made to the Gulfstream Park and Remington Park project financings. In return for the lender agreeing to waive any applicable make-whole payments for repayments made under either of the project financings prior to May 31, 2008, the required amendments provide, among other things, that under the Gulfstream Park project financing arrangement: (i) Gulfstream Park's obligations are now guaranteed by MEC; and (ii) $100.0 million of indebtedness under the Gulfstream Park project financings must be repaid by May 31, 2008.

On December 21, 2007, we entered into an agreement to sell 225 acres of excess real estate located in Ebreichsdorf, Austria to a subsidiary of Magna International, for a purchase price of Euros 20.0 million (approximately $29.4 million), subject to customary closing adjustments. Originally anticipated to close during the first quarter of 2008 following the satisfaction of customary closing conditions including the receipt of all necessary regulatory approvals, it is currently expected that the transaction will close in April 2008.

During the year ended December 31, 2007, MEC incurred costs of $3.7 million for rent of facilities and central shared and other services from Magna International and its subsidiaries.

13

On October 29, 2007, we completed a private placement of MEC Class A Subordinate Voting Stock to Fair Enterprise Limited ("Fair Enterprise"), a company that forms part of an estate planning vehicle for the family of Frank Stronach, MEC's Chairman and Interim Chief Executive Officer, and received proceeds of $19.6 million, net of transaction costs of $0.4 million. Pursuant to the terms of the subscription agreement entered into on September 13, 2007, Fair Enterprise was issued 8.9 million shares of Class A Subordinate Voting Stock at a price of $2.25 per share. The price per share was set at the greater of (i) 90% of the volume weighted average price per share of Class A Subordinate Voting Stock on NASDAQ for the five trading days commencing on September 13, 2007; and (ii) U.S. $1.91, being 100% of the volume weighted average price per share of Class A Subordinate Voting Stock on NASDAQ for the five trading days immediately preceding September 13, 2007 (the date of announcement of the private placement). Prior to this transaction, Fair Enterprise owned approximately 7.5% of the issued and outstanding Class A Subordinate Voting Stock. Upon completion of the private placement, the percentage of Class A Subordinate Voting Stock beneficially owned by Fair Enterprise increased to approximately 21.6% of the issued and outstanding Class A Subordinate Voting Stock, representing approximately 10.8% of the equity of MEC. The shares of Class A Subordinate Voting Stock issued pursuant to the subscription agreement were issued and sold in a private transaction exempt from registration under Section 4(2) of the Securities Act of 1933, as amended.

For more details about MEC's relationship with MI Developments, Magna International and Fair Enterprise and related transactions, please see "Certain Relationships and Related Transactions" in MEC's Form 10-K for the fiscal year ended December 31, 2007, which section is incorporated herein by reference.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Our Corporate Governance, Human Resources and Compensation Committee

The Corporate Governance, Human Resources and Compensation Committee (the "Committee") of the Board was formed on March 4, 2000. For a discussion of the composition and mandate of this Committee, see "The Board of Directors and Committees of the Board — Corporate Governance, Human Resources and Compensation Committee" above.

MEC has adopted many of the organizational and operating policies and principles utilized for many years by its original parent company, Magna International, certain of which have been embodied in MEC's Corporate Constitution. MEC's Corporate Constitution balances the interests of stockholders, employees and management by specifically defining the rights of employees (including management) and investors to participate in MEC's profits and growth, and reflects certain operational and compensation philosophies which align employee (including management) and stockholder interests. These philosophies and MEC's Corporate Constitution assist in maintaining an entrepreneurial environment and culture at MEC. MEC wishes this entrepreneurial culture to flourish, and therefore intends to apply compensation philosophies which will enhance its ability to attract, retain and motivate skilled, entrepreneurial employees at all levels of the MEC organization, while assisting in the alignment of the interests of MEC's stockholders and management.

MEC has had a relatively brief history. In its formative years, its focus was on acquiring racetracks, and other operations related to the horse racing industry. As a result, MEC now owns and operates: horse racetracks and related pari-mutuel wagering operations, including off-track betting facilities; casinos in conjunction with its racetracks where permitted by law; AmTote International, Inc., a provider of totalisator services to the pari-mutuel industry; and XpressBet®, a national Internet and telephone account wagering system, as well as MagnaBet™ internationally. MEC also has a 50% joint venture interest in HRTV®, a 24-hour horse racing television network, and TrackNet Media Group LLC, a racing content management and distribution company. In prior years the Committee based compensation decisions to a significant degree, on the role executive officers played in the pursuit of acquisition strategies. As the Company's strategic focus has shifted, so has the criteria by which the Committee measures performance. Operational efficiencies and financial performance indicators, such as liquidity, profitability, revenue growth and cost reduction, have become increasingly important both to the Company's strategic focus and the Committee's deliberations. In 2007, an increased emphasis on debt reduction also meant the Committee considered the role individuals had in raising proceeds to repay debt, whether those proceeds were raised from the sale of non-core assets or from improved operational efficiencies.

14

This Committee, in accordance with its mandate, is required to consider and apply, among other things, the historical operating philosophies and policies of MEC, including MEC's Corporate Constitution, direct profit participation and use of stock options and other stock rights granted under the Long-Term Incentive Plan, to align the interests of management and stockholders and to create shareholder value.

Under its mandate, the Committee may retain outside legal and other experts at the expense of the Company where reasonably required to do so. In 2007, the Committee did not directly retain any external advisors.

Michael Neuman served as Chief Executive Officer from February 27, 2007 to June 22, 2007. Frank Stronach served as Interim Chief Executive Officer immediately prior to Mr. Neuman's tenure and has also served in such capacity since Mr. Neuman's departure. The Committee commenced a search for a Chief Executive Officer in July 2007. In February 2008, the non-management directors of the Company's Board of Directors established a new search committee comprised of Jerry Campbell, Anthony Campbell, Ron Charles and Tom Hodgson to intensify the search for a new Chief Executive Officer. Any candidates put forth by the search committee for consideration will require the Committee's approval.

In addition to the above noted ongoing search for a Chief Executive Officer, the Committee was actively engaged in 2007 in considering executive officer compensation matters. The Committee, which met five times in 2007, discharged its duties by, among other things:

- •

- Addressing the various components of a compensation package for a Chief Executive Officer. In connection with the ongoing search for a Chief Executive Officer, each proposed item of the Chief Executive Officer's compensation package was determined to be in line with compensation paid to Chief Executive Officers of entities of a similar size and complexity to MEC. In addition, it has also determined that MEC's diverse operations encompassing racetrack operations, broadcasting, totalisator services and account wagering operations, demand someone with a significant track record and previously demonstrated management skills and personal attributes. In addition to the level of cash compensation determined appropriate to entice a qualified individual to join the Company, other aspects of compensation have also been considered, such as the need for a long-term incentive and the ability to increase compensation if the Company's long-term performance improves. While the Committee remains mindful of the significant amount of executive talent needed to successfully face the many challenges of building a company such as MEC and attaining our strategic goals, it is also conscious that the Company's financial performance must be taken into account in setting the incentive compensation of the Chief Executive Officer.

- •

- Considering the compensation levels of MEC's senior management from time-to-time in light of the duties, obligations and performance expectations associated with senior positions. Historically, the Committee has approved an increase in a given executive's compensation after considering whether the individual had a role in certain operational or financial improvements and/or whether there was an increase in responsibility. The Committee determined that there should be no significant increases in any executive officer's compensation during 2007.

- •

- Reviewing the overall compensation packages for executives and other employees to consider the ratio of cash compensation to other forms of compensation.

- •

- Determining the appropriateness of changes in compensation strategies in light of the Company's performance during 2007, and expected future performance.

- •

- Considering peer comparator companies' compensation strategies. Determining relevant comparator companies presents a unique and ongoing challenge as few entities are engaged in such a broad spectrum of activities associated with the horse racing industry. As such, it is not possible to establish one clear peer group of companies, though MEC's financial performance compared against competitors in an industry

15

Compensation levels for our executives are set after due consideration of the input of our most senior management, as well as advice and counsel, or information, from external resources. Internally, it has typically been the case that the Chief Executive Officer, Chief Operating Officer (in 2007, two Senior Vice-Presidents of Operations), Executive Vice-President and Chief Financial Officer and Vice-President and Controller have had input into compensation matters. Internal legal counsel with expertise in compensation matters also provides input as required. As we have not traditionally had a senior officer specifically appointed solely to develop and implement the Company's business plans and strategies for all companywide human resource functions, the Senior Vice-Presidents and Executive Vice-President and Chief Financial Officer have had key roles in that aspect. The Executive Vice-President and Chief Financial Officer has periodically attended Committee meetings and provided senior management's feedback as required. It is expected that the Chief Operating Officer will also assume that role. The Corporate Secretary is also in attendance at each Committee meeting and oversees the legal aspects of the Company's executive compensation plans, updates the Committee regarding changes in laws and regulations affecting the Company's compensation policies, and records the minutes of each Committee meeting.

The Committee chair may communicate directly with the Chief Operating Officer, Executive Vice-President and Chief Financial Officer and Senior Vice-Presidents of Operations regarding external market data, industry data, internal pay information, individual and Company performance results and updates on regulatory issues. The Committee Chair may delegate specific tasks to the certain executives in order to facilitate decision making and to assist in finalizing meeting agendas, documentation, and compensation data for Committee review and approval.

The executive officers of the Company annually review the performance of our senior executives and, based on these reviews, recommends to the Committee compensation for all senior executives, other than their own compensation. The Committee, however, has the discretion to modify the recommendations and makes the final decisions regarding material compensation to senior executives, including base pay, incentive pay (bonus), and equity awards.

In addition to information received from senior management and the consideration of individual performance, the input of Frank Stronach, our Chairman and Interim Chief Executive Officer and the controlling shareholder of our parent company is also considered when the Committee makes compensation decisions for the most senior executive officers.

Objectives of Compensation Programs

The following are the various components of the Company's executive compensation program, which is designed to achieve our strategy of rewarding our executives for performance:

- •

- Base Salaries. Base salaries should not be customarily increased on an annual basis. As a result, fixed compensation costs are contained, with increased financial rewards coming principally from variable incentive compensation.

- •