UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2010 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Transition Period From ________ to _________ |

Commission File Number 000-33215

CASPIAN SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 87-0617371 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

| 257 East 200 South, Suite 490 | | |

| Salt Lake City, Utah | | 84111 |

| (Address of principal executive offices) | | (Zip Code) |

(801) 746-3700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to 12(g) of the Exchange Act: Common, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes ¨ No

Indicate by check mark if whether the registrant has submitted electronically and posted in its corporate Web site, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant is required to submit and post such files).

¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filed, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller reporting company þ

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.)

¨ Yes þ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $7,103,657.

As of December 25, 2010, the registrant had 52,213,757 shares of common stock, par value $0.001, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

2

| | | Page |

| | PART I | |

| | | |

| | | |

| Item 1. | Business | 5 |

| | | |

| Item 1A. | Risk Factors | 21 |

| | | |

| Item 1B. | Unresolved Staff Comments | 29 |

| | | |

| Item 2. | Properties | 29 |

| | | |

| Item 3. | Legal Proceedings | 30 |

| | | |

| Item 4. | Removed and Reserved | 30 |

| | | |

| | PART II | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 30 |

| | | |

| Item 6. | Selected Financial Data | 32 |

| | | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 32 |

| | | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 47 |

| | | |

| Item 8. | Financial Statements and Supplementary Data | 47 |

| | | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 47 |

| | | |

| Item 9A. | Controls and Procedures | 47 |

| | | |

| Item 9B. | Other Information | 48 |

| | | |

| | PART III | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 49 |

| | | |

| Item 11. | Executive Compensation | 57 |

| | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 70 |

| | | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 75 |

| | | |

| Item 14. | Principal Accounting Fees and Services | 75 |

| | | |

| Item 15. | Exhibits and Financial Statement Schedules | 76 |

| | | |

| | SIGNATURES | 83 |

3

CASPIAN SERVICES, INC.

Unless otherwise indicated by the context, references herein to the “Company”, “CSI”, “we”, our” or “us” means Caspian Services, Inc, a Nevada corporation, and its corporate subsidiaries and predecessors.

Unless otherwise indicated by the context, all dollar amounts stated in this annual report on Form 10-K are presented in thousands.

Forward Looking Statements

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are based on management’s beliefs and assumptions and on information currently available to our management. For this purpose any statement contained in this annual report on Form 10-K that is not a statement of historical fact may be deemed to be forward-looking, including, but not limited to those relating to future demand for the products and services we offer, changes in the composition of the products and services we offer, future revenues, expenses, results of operations, liquidity and capital resources or cash flows, the commodity price environment, managing our asset base, our ability to res tructure our existing credit facilities or to obtain additional debt or equity financing, management’s assessment of internal control over financial reporting, financial results, opportunities, growth, business plans, strategies and objectives. Without limiting the foregoing, words such as “believe,” “expect,” “project,” “intend,” “estimate,” “budget,” “plan,” “forecast,” “predict,” “may,” “will,” “could,” “should,” or “anticipate” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance or achievements or the industry to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, market factors, market prices and marketing activity, future revenues and costs, unsettled political conditions, civil unrest and governmental actions, foreign curre ncy fluctuations, and environmental and labor laws and other factors detailed herein and in our other filings with the U.S. Securities and Exchange Commission (“SEC”) filings.

Forward-looking statements are predictions and not guarantees of future performance or events. The forward-looking statements are based on current industry, financial and economic information, which we have assessed but which by their nature are dynamic and subject to rapid and possibly abrupt changes. Our actual results could differ materially from those stated or implied by such forward-looking statements due to risks and uncertainties associated with our business. We hereby qualify all our forward-looking statements by these cautionary statements.

These forward-looking statements speak only as of their dates and should not be unduly relied upon. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

4

Item 1. Business

Company History

Caspian Services, Inc. was incorporated under the laws of the state of Nevada on July 14, 1998. On February 28, 2002 we entered into an Agreement and Plan of Reorganization whereby we acquired all of the issued and outstanding shares of Caspian Services Group Limited, (“Caspian”) in exchange for 27,089,700 restricted common shares of the Company. Caspian became our wholly owned subsidiary and the Caspian shareholders assumed controlling interest of the Company. The shareholders of both companies approved the Agreement. Since our acquisition of Caspian, we have concentrated our business efforts to provide diversified oilfield services to the oil and gas industry in western Kazakhstan.

In July 2005 the Company’s name was changed from EMPS Corporation to Caspian Services, Inc., to better reflect the nature of our business in providing oilfield services in the Caspian Sea region of western Kazakhstan.

To enhance the range of oilfield services we provide to our clients, in May 2004 we acquired 100% of the outstanding interests in Tat-Arka LLP (“TatArka”) and a 50% non-controlling interest in Kazmorgeophysica CJSC (“Kazmorgeophysica”). In September 2005 we increased our ownership interest in Kazmorgeophysica to 51% and in September 2008 to 80%. Through TatArka and Kazmorgeophysica, we are able to offer onshore, transition zone and marine seismic data acquisition and processing services to oil and gas exploration companies.

In connection with our plans to build a major marine supply and support base in the port of Bautino, in Bautino Bay, Kazakhstan, in November 2005, through our wholly owned subsidiary Caspian Real Estate Limited, we acquired a five hectare (approximately 12 acre) parcel of undeveloped real property located in the port of Bautino, through the acquisition of a 100% ownership interest in Balykshi LLP, the entity in which the property was held by its previous owners. Construction of the marine base commenced in the first fiscal quarter 2008. The first phase of the project was commissioned in November 2009 and the base is currently partially operational. The official opening of the base occurred in July 2010, after successful commissioning of the second phase; however some dredging works need to be completed by June 2011.

Recent Developments

As discussed in greater detail in Note 7 – Notes Payable of our Consolidated Financial Statements and under the heading “Liquidity and Capital Resources” in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this annual report on Form 10-K, at the end of July 2010 we received written notice from one of our creditors, Altima Central Asia Master Fund Ltd. (“Altima”) that it believed we had violated at least two of the financial covenants contained in the Facility agreement between

5

Altima and the Company. At that time, two other creditors, Great Circle Energy Services L.L.C. (“Great Circle”) and the European Bank for Reconstruction and Development (“EBRD”) verbally notified us that they too believed we were in violation of at least some of the financial covenants of their respective Facility agreement or financing agreements. At the end of November 2010 Great Circle delivered written notice to us stating that we remain in breach of some covenants under their Facility agreement and that such constitutes an event of default. Altima and EBRD verbally notified us of the same at the end of November 2010.

Although they are under no obligation to do so, to date neither Altima nor Great Circle have taken action to increase or accelerate the debt obligations we owe them. Similarly, to date, EBRD has taken no action to increase or accelerate the debt obligations we owe them or to accelerate their put right. Should any one of these parties, however, determine to exercise their acceleration or other rights, we would not have sufficient funds to repay any of the loans individually or collectively or to satisfy the EBRD put right and would be forced to seek sources of funding to satisfy these obligations. Given the difficult equity and credit markets and our current financial condition, we believe it would be very difficult, if not impossible, to obtain such funding. If we were unable to obtain funding to repay the loans, we anticipate the above-discussed creditors could seek any legal remedies available to them to obtain repayment of their loans. These remedies could include forcing the Company into bankruptcy. As the financing provided to us by EBRD is secured by mortgages on the real property, assets and bank accounts of Balykshi and Caspian Real Estate Limited, and guaranteed by the Company, EBRD could also pursue remedies under those security agreements, including foreclosing on the marine base and other assets.

We are engaged in ongoing negotiations with Altima, Great Circle and EBRD about the possibility of restructuring our debt obligations to them and to reorganize our business operations. In connection with these discussions, we are investigating many potential solutions, including the availability of other funding sources to refinance our debt obligations, restructuring the repayment terms and obligations under the existing Facility agreements and financing agreements, and the sale of Company assets and subsidiaries. At this time, the Company has not reached a definitive agreement with Altima, Great Circle or EBRD on any potential restructuring.

As noted above, we are continuing with development of our marine base in Bautino Bay. The initial phase of the marine base, including dredging, breakwater, wharf front and general site area was commissioned in November 2009. The official opening of the base occurred in July 2010, after successful commissioning of the second phase. Currently, we are assessing the range of services to be provided at the base. Certain dredging works need to be completed by June 2011 as agreed with local authorities. We are currently negotiating with potential contractors to complete this work. We anticipate the cost to be approximately $2,500 to $5,000. Currently, we have insufficient funds to complete the dredging works. If

6

we do not complete the dredging project by June 2011 we could be subject to certain penalties, including the possible cancelation of our permits and termination of operational activities at the marine base until the dredging work is completed. The failure to provide the funding to timely complete the dredging works may also give rise to an event of default under the EBRD financing agreements.

During our fourth fiscal quarter 2010, our board of directors approved an operational management restructuring plan. In connection with the restructuring plan, the board appointed general managers over each of the Company’s three operational segments – Vessel Operations, Geophysical Services and Marine Base Services. Each general manager is responsible for overseeing the day-to-day operations of the respective business segment. To assist and advise in the management of daily operations, the board of directors also created an Executive Committee. The Executive Committee acts solely as an advisory body on day-to-day operations. For additional information regarding the Executive Committee please see “Committees of the Board of Directors” in Item 10. Directors, Executive Officers and Corporate Governance of this annual report on Form 10-K.

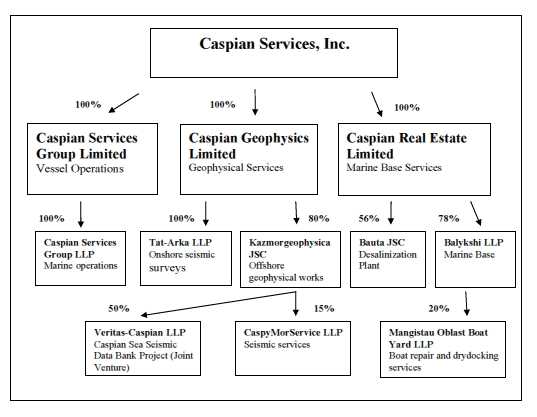

Our Business

We provide a broad range of oilfield services in western Kazakhstan and the Kazakhstan sector of the Caspian Sea. Our business focuses on three principal areas – Vessel Operations which are provided by our fleet of vessels; Geophysical Services and Marine Base Services (formerly entitled “Infrastructure Development”), including water desalinization. We manage our business through three wholly-owned British Virgin Island companies, Caspian Services Group Limited, Caspian Geophysics Limited and Caspian Real Estate Limited. Each of these companies undertakes its operation through various subsidiaries and joint venture entities. Caspian Services Group Limited represents the vessel operations business provided by our vessel flee t. Through Caspian Geophysics we manage our geophysical services operations. Caspian Real Estate is our marine base services company. The following diagram sets forth our subsidiaries and our percentage ownership interest in each entity:

7

Offshore Marine Services Industry

Our fleet customers employ our vessels to provide services to support their oil and gas exploration activities, particularly in connection with seismic work and in the construction of necessary infrastructure to pursue development and production of successful exploration projects. This industry employs various types of vessels, referred to broadly as offshore support vessels that are used to transport materials, supplies and personnel.

The offshore marine services industry is directly impacted by the level of activity in offshore oil and natural gas exploration, development and production, which, in turn, is impacted by trends in oil and natural gas prices. Oil and natural gas prices are affected by a host of geopolitical and economic forces, including the fundamental principles of supply and demand. Each of the major worldwide geophysical offshore oil and gas production regions has unique characteristics that influence the economics of exploration and production

8

and consequently the market for vessels in support of these activities. While there is some vessel interchangeability between geographic regions, barriers such as mobilization costs, environmental sensitivity, seasonality and vessel design suitability restrict migration of vessels between regions. The effect of these restrictions on vessel migration has segmented various regions into separate markets.

In addition to the factors that impact the offshore marine services industry set forth above, our operations are also directly and indirectly affected by exploration and development activities in the north Caspian Sea, in particular, development of the Kashagan oil field. At the time of its discovery in 2000, the Kashagan oil field was one of the largest discoveries in the last 30 years. Initially, the field was scheduled to start commercial production in 2005. Development of the field, however, has been much slower and more difficult than anticipated for various reasons, including harsh weather conditions, with temperatures ranging from 40 degrees Celsius in the summer to -40 degrees Celsius in the winter, high hydrogen sulphide content, high reservoir pr essure, the shallow depth of the Caspian Sea at the field and disagreements with the government of Kazakhstan. As a result, the anticipated commencement of first production has been delayed several times from 2005 to 2008 to 2010 and most recently to late 2013. Development of the second phase of the Kashagan field has also been delayed several times from 2008 to 2009 to 2012 to 2015 and most recently to 2018 or 2019.

In connection with the latest round of delays, North Caspian Operating Company BV (“NCOC”) (formerly Agip KCO), the operator of the Kashagan field reduced its 2010 operating budget from $10 billion to $7 billion. As subcontractors of NCOC are the largest customers for our vessel fleet and anticipated marine base customers, our operations are significantly impacted by development of the Kashagan field.

Vessel Fleet

Our vessel fleet includes fifteen specialized shallow draft vessels designed for use in the shallow waters of the north Caspian Sea. We operate our fleet through our subsidiary, Caspian Services Group Limited. Of the fifteen vessels in our fleet, we own nine. We operate the other six vessels pursuant to agreement with Actamarine, formerly Rederij Waterweg bv, the Dutch shipping company that owns the vessels.

Our fleet is time chartered to oil and natural gas exploration and production companies working primarily in the Kazakhstan sector of the Caspian Sea. Our customers charter our vessels and hire us to provide all necessary staffing and support for safe and efficient operation. Vessel operating expenses are typically our responsibility except that the customer generally provides for port fees and consumables such as water, fuel, lubricants and anti-freeze. In return for providing time-chartered services, in most instances we are paid a daily rate of hire. We also provide additional support services for our accommodations vessels where we are able to charge fees for the accommodating and catering to the client’s personnel.

9

Generally we charter our vessels under time charter contracts or on a “spot” basis. Time charter contracts typically cover a specific term, typically one work season or longer. The base rate of hire under such a term contract is generally a fixed rate, though some charter arrangements may include escalation clauses to recover specific additional costs. In contract, vessel chartered on a “spot” basis are typically chartered for a short-term basis ranging anywhere from one day to several weeks or months. There are no material differences in the cost structure of our contracts based on whether the contracts are spot or time charters because our fixed operating costs, including but not limited to, payroll, insurance and maintenance costs, are generally the same without regard to the le ngth of the contract.

Listed below are the six vessel classes we operate along with a description of the type of vessels categorized in each class, the services the respective vessels perform and the number of vessels in each class we operate.

Supply Vessels. Included in this class are towing supply vessels and supply vessels. This vessel class is chartered to customers for use in transporting supplies and equipment from shore bases to offshore projects. Supply vessels have large cargo handling capabilities and are used to serve drilling and production facilities and support offshore construction and maintenance work. We have one supply vessel in our fleet.

Seismic Source and Survey/UtilityVessels. Seismic source and survey/utility vessels are chartered to customers for use in performing offshore geological and seismic studies. Our seismic source vessel is equipped with specialized seismic source and related equipment capable of emitting a large air-gun energy source at high pressure. These vessels may also have accommodations and multiple day endurance. We currently have one seismic source vessel and two survey/utility vessels.

Anchor Handling Multicats and Support Vessel Tugs. This is our largest category of vessels, with seven such vessels in our fleet. These vessels are used to tow floating drilling rigs; assist in the docking of tankers; tow barges; assist pipe laying, cable laying and construction barges; setting anchors for positioning and mooring drilling rigs and are used in a variety of other commercial towing operations, including towing barges, carrying a variety of bulk cargoes and containerized cargo.

Cable Laying Barges. In 2008 we acquired our own six-point anchoring cable laying barge. These vessels are used to lay down communications infrastructure between offshore drilling islands. These vessels typically do not have their own power source as the cable could be damaged by any propulsion mechanism. Therefore, these vessels are normally assisted by utility vessels, such as anchor handling tugs.

Accommodations Vessels. We currently have one accommodations barge and one accommodations vessel in our fleet. These vessels are chartered to customers to provide offshore living quarters to personnel. These vessels also offer food services, laundry and related services. One of our vessels also has a heli-deck. Our accommodations vessels have combined capacity to house up to 123 client personnel and 32 crew members.

10

Crewboats. Crewboats are chartered to customers for use in transporting personnel and small quantities of supplies from shore bases to offshore drilling rigs, platforms and other installations more quickly than other vessels. We currently have one crewboat in our fleet.

As future demand and funding justify, we may expand our fleet. However, there is no assurance that there will be sufficient demand in the market to justify expanding our fleet or the services we offer. Similarly, even if there is sufficient demand, there is no guarantee that we will have sufficient funds or be able to obtain sufficient funding to finance such expansion.

During fiscal 2010 85% of our vessel revenue came from three clients: Saipem Kazakhstan Branch – 58%, Fugro KazProject LLP – 17% and Enka Insaat ve Sanayi A.S. – 10%. During fiscal 2010 we had eight vessels on charter to Saipem Kazakhstan Branch.

Our competition varies from small regional companies to large international corporations and competition is intense. Currently, we have only one local Kazakh competitor. We also compete with many larger foreign companies operating in the Kazakh sector of the Caspian Sea. Despite our smaller size relative to some of our competition, we believe we have an advantage because of our extensive experience operating vessels in the Caspian Sea and conducting business within and complying with the laws and regulations of the Republic of Kazakhstan. In addition, we have developed strong relationships with marine port operators and other local companies. Based on our local regulatory compliance and business reputation, we believe we have been able to differentiate ourselves from our competitors. All of our vessels maintain the Kazakhstan flag while operating in the Caspian Sea.

Geophysical Services

Through our subsidiary Caspian Geophysics we provide onshore, transition zone and marine seismic data acquisition services to independent oil and gas exploration and development companies operating in Kazakhstan and the Caspian Sea and to the national oil company. Geophysical seismic surveys have been the primary tool or method of oil and gas exploration for over fifty years. Geophysical seismic surveying refers to the making, processing and interpreting of measurements of the physical properties of the earth for the purpose of gathering data.

Oil companies utilize geophysical services in the following ways:

| · | to identify new areas of potential sources of hydrocarbons termed “reservoirs;” |

| · | to determine the size and structure of reservoirs; and |

| · | to characterize reservoirs and optimize their development. |

The aim of a 2D seismic survey is to provide a series of vertical inline and crossline graphical slices of the earth that are used to identify and determine the size of a hydrocarbon reservoir. A 3D survey, utilizing a very dense grid of data, provides a continuous volume (100% coverage) of high-quality subsurface data. In a 3D survey, both the structural and stratigraphic elements are continuously represented at a resolution not attainable in 2D surveys.

11

Oil and gas exploration companies typically contract for geophysical services in one of two ways. First, they contract directly with the geophysical service provider. Under this format, once the survey is completed the client owns the data that is recorded. In the industry, this is termed “proprietary” work. Contracts for this type of work are structured in one of two ways. The most widely used are production contracts where the geophysical service provider is paid for the amount of data recorded, usually counted and charged by the number of source points acquired. For any period of time that the service provider is unable to acquire data due to circumstances outside its control, (weather for example), a standby-r ate is charged to the client. The other method of contracting is based on time, where the crew charges the time-rate for any period that the crew is technically capable and available for work.

“Non-proprietary”, “multi-client”, or “speculative” seismic surveys are the second contracting method geophysical service companies may offer. When performing services on this basis, the data is acquired by the geophysical service company for its own account. The geophysical service company then licenses that data to a number of clients. The high cost involved in obtaining geophysical data on a proprietary basis has prompted many clients to license data on a multi-client basis.

The geophysical industry is highly technical and the requirements and demands on acquisition and processing are continually evolving as clients seek to answer questions and understand more about their reservoirs using seismic data sets.

As funding allows, we intend to invest in the latest available technology to allow us to offer the kinds of solutions our clients require, both in terms of capacity; as the area develops its licensing of new acreage, and in terms of technology; as the reservoirs themselves develop and require more detailed data acquisition and analysis.

Caspian Geophysics provides geophysical services through its two subsidiaries: Tat-Arka LLP, a wholly-owned subsidiary; and Kazmorgeophysica, JSC, an 80% owned subsidiary. During fiscal 2010 67% of total geophysical revenue was attributable to Tat-Arka, 30% to Kazmorgeophysica and 3% was attributable to revenues received by Caspian Services Group LLP, our vessel division subsidiary for services rendered in connection with the CMOC project.

Tat-Arka LLP

TatArka provides 2D and 3D land seismic data acquisition services to companies engaged in onshore oil and gas exploration in the Republic of Kazakhstan. TatArka provides these services under project specific partnerships with other local service providers as required by the Republic of Kazakhstan. TatArka has held a general state license to conduct geophysical works since September 4, 2001.

12

Land seismic data acquisition requires that our surveying crews mark and position with GPS the location for deployment of recording (geophones) and seismic source equipment. The recording crews use either explosives or mechanical vibrators to produce acoustic sound waves (termed “shooting”). The recording system synchronizes the shooting and captures the seismic signal via the geophones.

In comparative terms, the acquisition of onshore seismic data requires considerably less effort, and is less complex, than the acquisition of offshore seismic data. As a result, onshore seismic data acquisition services are far less expensive than offshore services.

The onshore seismic market in Kazakhstan is comparably mature and is dominated by four local companies: Azimut, SIF Dank, TatArka and KazGeodgeco.

Because of the ongoing economic slowdown and accompanying tightening of the credit markets, many of our land seismic clients continue to experience significant difficulty in obtaining financing for land seismic data surveys. To assist the Company in satisfying some of its outstanding liabilities management is currently investigating the market interest for and the feasibility of selling its interest in TatArka.

Kazmorgeophysica JSC

We own an 80% controlling interest in Kazmorgeophysica JSC. Kazmorgeophysica provides 2D and 3D transition zone and marine seismic data acquisition services to oil and gas exploration companies operating in the Kazakhstan sector of the Caspian Sea. Kazmorgeophysica has held a general state license to conduct geophysical works since May 29, 2002.

In contrast to the onshore seismic market, the marine seismic market in Kazakhstan is still developing. To date, only a small number of marine or transition zone surveys have been conducted. We believe this is primarily due to the limited number of entities currently holding exploration licenses in Kazakhstan. We expect that the release of new license blocks by the government of Kazakhstan will attract significant interest from the international oil and gas community, although the government has not given indications of when they may release new license blocks. If and when the government does release new license blocks, we anticipate that a direct result of such will be a significant increase in demand for marine and transition zone seismic data a cquisition services as well as additional demand for our vessel fleet from customers wishing to utilize our vessels for marine seismic data acquisition.

Historically, the complexity of modern marine seismic data collection methods in the environmentally sensitive, shallow waters of the north Caspian Sea, and the associated cost, has meant that only well situated local companies and large international exploration companies with advanced technology and sufficient capital have been capable of providing marine seismic services in Kazakhstan. We believe this trend is changing as more local companies gain access to the technology and methodologies used and as they obtain sufficient capital to acquire the necessary equipment and vessels to provide these services. Additionally, the current laws of Kazakhstan require marine seismic services providers meet the

13

country’s local content requirements, either through local ownership or by partnership. The 20% owner of Kazmorgeophysica is 100% owned by Kazakh interests, which satisfies the local content requirement and gives Kazmorgeophysica an advantage over its international competitors.

Kazmorgeophysica currently competes with two local companies, Kazakhstancaspishelf and Uzhmaorgeologia and three international firms, Westerngeco, CGG Veritas and PGS. As discussed above, in order to satisfy the local content requirements of Kazakhstan, these international firms are required to tender with a local partner.

As oil and gas exploration companies often require both onshore and offshore seismic data acquisition services, TatArka and Kazmorgeophysica often contract with each other to provide services for their respective customers.

Kazmorgeophysica owns a 50% equity interest in Veritas-Caspian LLP (“Veritas-Caspian”). Veritas-Caspian contracted with the Ministry of Energy and Mineral Resources in January 2006 to acquire seismic data, on an exclusive basis, over all the open acreage in Kazakhstan’s sector of the Caspian Sea. This project is referred to herein as the “State Geophysical Survey.”

The combination of existing high quality seismic data packages and licensing rounds has proven very successful in a number of locations around the globe in ensuring maximum revenues from license blocks for the government while providing a transparent and efficient system of tenders for oil companies. When the government of the Republic of Kazakhstan opens licensing rounds Veritas-Caspian will be able to market more of the seismic data collected on behalf of the government, and can begin to realize more revenues generated through the sale of the seismic data it is gathering. Veritas-Caspian has the exclusive right to market and sell the data to prospective bidders on tendered Kazakhstan oil blocks on five-year contracts that are automatically extendable unless term inated by specific action of the parties. The current contract between Veritas-Caspian and the government was scheduled to expire in December 2010. The contract provides for an automatic five year extension unless one of the parties to the contract commenced the termination process prior to the expiration date. To our knowledge, neither party initiated the termination process.

Revenue from the sale of data from the State Geophysical Survey will be split between the Kazakhstan government and Veritas-Caspian at various percentages after Veritas-Caspian has recovered its costs. In turn, revenue will be split between the joint-venture holders after Veritas-Caspian has recovered its costs.

14

Marine Base Services (formerly entitled “Infrastructure Development”)

Atash Marine Base

Balykshi LLP

The official opening of our marine base occurred in July 2010 and the base is currently partially operational subject to completion of certain dredging work. The base is currently about 50% occupied. The base is used not only by our own fleet, but also by other vessel fleet operators in the region such as Saipem Kazakhstan Branch, Er Sai Caspian Contractor LLP and some small operators. We plan to market services to large multi-national oil companies engaged in exploration and construction in the region.

The marine base offers the following facilities and services:

| moorings for winter period; |

| · | wharf front crane pad for vessel loading/offloading; |

| · | boat yard with vessel lifting facilities; |

| · | water storage facilities and vessel bunkering; |

| · | oily and waste water collection and storage facilities; |

| · | weighbridge facilities; |

| · | electrical power supply and distribution system; |

| · | fire-fighting system; and |

| · | open lay-down storage area |

Meanwhile we continue assessing additional services to be provided at the marine base based on customers’ demand. We are also currently discussing additional facilities with a number of interested parties.

In March 2010 we agreed with local authorities to complete the outstanding dredging works by June 2011. The outstanding dredging work includes removal of an obstruction that currently limits the size vessel that can access the base. Completion of dredging will allow larger vessels to access the base and increase the potential customer pool. We are negotiating with potential contractors to complete dredging and anticipate the cost will be approximately $2,500 to $5,000. Currently, we have insufficient funds to complete the dredging project. If we do not complete the dredging by June 2011, we could be subject to certain penalties, including the possible cancelation of our permits and termination of operating activities at the marine base until the dredging work is completed. ;The failure to provide the funding to timely complete dredging works could become an event of default and trigger EBRD’s acceleration rights under its loan and put option agreements.

15

We have funded construction of the marine base through a combination of debt and equity financing. In June 2007, we entered into a series of financing agreements with EBRD, pursuant to which EBRD agreed to provide $32,000 of debt financing and to make an equity investment in the marine base in the amount of $10,000 in exchange for a 22% equity interest in our subsidiary Balykshi. The scope of the base was subsequently revised. This reduced anticipated base construction costs. In response, we returned a portion of the funds borrowed from EBRD to reduce the anticipated total amount of the EBRD loan to $18,600. Funds not raised from EBRD were provided by us. Balykshi’s and CRE’s assets are pledged as collateral under the EBRD financing agreements (including bank accounts and movable and immovable property). Balykshi also executed agreements assigning its interests to insurance, investments and contracts to EBRD. To obtain the financing, EBRD also required the Company to guarantee the financial performance of its subsidiaries under the financing agreements.

In connection with EBRD’s $10 million equity investment to purchase a 22% equity interest in Balykshi, we entered into a Put Option Agreement granting EBRD the right to require the Company to repurchase the 22% equity interest. The put is exercisable from June 2013 through June 2017. The put price is determined based on the fair market value of Balykshi as mutually agreed by the parties. If the put price together with any dividend received by EBRD generates an annual internal rate of return for EBRD in excess of 30% per annum rate (the “put price excess”), the put price shall be reduced by an amount representing half of the put price excess. If the parties are unable to agree upon a fair market valuation, the parties agree to hire a third party expert to determine the put pric e on the basis of the fair market value of Balykshi, as set forth in the Put Option Agreement. In the event there is a change in control of the Company, EBRD has the right to require the repurchase of the equity interest at its fair market value.

The Put Option Agreement contains an acceleration feature. Should Balykshi: (i) default on $1 million or more of debt; (ii) fail to meet the obligations of any of the agreements between Balykshi, the Company and EBRD; (iii) be found to have made false representations to EBRD; or (iv) be declared insolvent, EBRD has the right to accelerate the put option. If the put option is accelerated, EBRD can require us to repurchase the $10 million equity investment plus a 20% per annum rate of return, taking into account any dividend or other distributions received by EBRD, at any time following one of the events mentioned above. The acceleration feature of the Put Option Agreement is a conditional obligation and is recognized as an adjustment to the carrying value of the put opt ion liability when an event of default occurs. At September 30, 2010 we concluded the value of the put option was $13,644 including $3,644 to reflect the possible right EBRD has to accelerate the put option.

Given the Company’s current financial difficulties, coupled with anticipated delays in demand for the marine base as a result of the delayed development of the Kashagan oil field, the Company is currently investigating the possibility of selling its interest in the marine base.

16

Mangistau Oblast Boat Yard, LLP

Balykshi and two unrelated third parties formed Mangistau Oblast Boat Yard LLP (“MOBY”) for the purpose of constructing and operating a boat repair and dry-docking services yard to be located within our marine base. Balykshi holds a 20% equity interest in MOBY.

In August 2008 MOBY entered into a loan agreement with EBRD in the amount of $12.3 million (the “MOBY Loan”). In June 2009 in connection with the MOBY Loan, EBRD required certain parties, including the Company, to execute a Deed of Guarantee and Indemnity (the “Guarantee”) guaranteeing repayment of the MOBY Loan. The MOBY Loan funded and the Company became liable for the obligations under the Guarantee as of September 3, 2009. For additional information regarding the MOBY Loan, the Guarantee and our obligations under the Guarantee please see “Off-balance Sheet Financing Arrangements” in Item 7. Management’s Disc ussion and Analysis of Financial Condition and Results of Operations of this annual report on Form 10-K.

During October 2008, we entered into a lease agreement with MOBY for the lease of three hectares of space at our marine base to operate the vessel repair and drydock facility. The lease agreement is for 20 years and calls for a fixed rent payment of $290 per annum. In November 2009, according to the agreement term, MOBY made a partial advance payment of $3,347, which is being recognized over the 20 year lease term starting from May 2010.

As of June 30, 2010 and September 30, 2010 MOBY was in violation of certain financial covenants under MOBY Loan. EBRD had provided MOBY a written waiver of these violations. In addition EBRD has agreed to reduce the financial ratios until March 31, 2011 contained in the MOBY Loan.

As with the marine base, the Company is currently investigating the possibility of restructuring its participation in MOBY and has approached its MOBY partners about a possible sale of the Company’s 20% interest in MOBY.

Water Desalinization

Bauta JSC

Through our subsidiary Caspian Real Estate Ltd. we own a 56% interest in Bauta JSC (“Bauta”), a joint venture that operates a water desalinization plant in the Port of Bautino. At the desalinization plant, Bauta purifies drinking water for sale in bulk and in bottles. Bauta provides bulk water to the local community at cost under an infrastructure agreement with the local government and provides water to oilfield camps in the region. NCOC is the largest buyer of bulk water from the plant. Bauta bottles and sells water in five liter and one-and-a half liter bottles. As much of the demand for drinking water comes from oilfield camps, water sales, like vessel operations, are seasonal, with most sales occurring during the work s eason. The bottled water is primarily sold to the surrounding oil field camps, the local municipality and other businesses in the region.

17

Safety and Risk Management

Kazakhstan is a member of the International Maritime Organization (“IMO”) and is a signatory to most of the IMO conventions regulating safety and navigation. We are committed to ensuring the safety of our operations. Management regularly communicates with our personnel to promote safety and instill safe work habits through media and safety review sessions. We also regularly conduct safety training meetings for our seaman and staff personnel. We dedicate personnel and resources to ensure safe operations and regulatory compliance. We employ safety personnel who are responsible for administering our safety programs.

The operation of any marine vessel involves an inherent risk of catastrophic marine disaster, adverse weather conditions, mechanical failure, collisions, and property losses to the vessel and business interruption due to political action. Any such event may result in a reduction in revenues or increased costs.

The worldwide threat of terrorist activity and other acts of war, or hostility, impact the risk of political, economic and social instability. It is possible that acts of terrorism may be directed against the United States domestically or abroad and such acts of terrorism could be directed against properties and personnel of U.S.-owned companies such as ours. The resulting economic, political and social uncertainties, including the potential for future terrorist acts and war, could cause the premiums charged for our insurance coverage to increase. To date, we have not experienced any property losses as a result of terrorism, political instability or war.

Management believes that the Company’s insurance coverage is adequate. We have not experienced a loss in excess of insurance policy limits; however, there is no assurance that our liability coverage will be adequate to cover all potential claims that may arise. While we believe that we should be able to maintain adequate insurance in the future at rates considered commercially acceptable, we cannot guarantee such with the current level of uncertainty in the insurance market.

Industry Conditions, Competition and Customers

Our operations are materially dependent upon the levels of activity in offshore crude oil and natural gas exploration, development and production in the north Caspian Sea. Such activity levels are affected by the trends in worldwide crude oil and natural gas prices that are ultimately influenced by the supply and demand relationship for these natural resources.

In recent years, consolidation of exploration, field development and production companies has occurred and this trend may continue in the future. Consolidation reduces the number of potential customers for our services and may negatively affect exploration, field development and production activity as consolidated companies generally focus on increasing efficiency and reducing costs and delay or abandon exploration activities with less promise. Such activity could adversely affect demand for our services and reduce our

18

revenues. In addition, consolidation could result in the absorption of an oil and gas company with whom we have a strong commercial relationship into another company with which we do not, or vice-versa.

The principal competitive factors for the offshore marine services industry are suitability and availability of equipment, price and quality of service. In addition, the ability to demonstrate a good safety record and attract and retain qualified and skilled personnel are also important competitive factors. As noted above, we have numerous competitors in all areas in which we operate, so the business environment is highly competitive.

Our principal customers are major oil and natural gas exploration, development and production companies or subcontractors of such companies. As noted above, our three largest customers accounted for 85% of our vessel revenues during the fiscal year ended September 30, 2010. We consider our operations to be dependent on NCOC (formerly Agip KCO) and its subcontractors.

Environmental Compliance

During the ordinary course of business our operations are subject to a wide variety of environmental laws and regulations. Violations of these laws may result in civil and criminal penalties, fines, injunctions and other sanctions. Compliance with existing governmental regulations that have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, has not had, nor is expected to have, a material effect on the Company. We are proactive in establishing policies and operating procedures for safeguarding the environment against any environmentally hazardous material aboard our vessels and at shore base locations. In addition, we have established operating policies that are intended to increase awareness of actions that may harm the environment. However, environmental laws and regulations are subject to change and may impose increasingly strict requirements and, as such, we cannot estimate the ultimate cost of complying with such laws and regulations.

Foreign Operations

In recent years, the Republic of Kazakhstan has undergone substantial political and economic change. As an emerging market, Kazakhstan is still developing the business infrastructure that generally exists in more mature free market economies. As a result, operations carried out in Kazakhstan can involve risks that are not typically associated with developed markets. Instability in the market reform process could subject us to unpredictable changes in the basic business environment in which we currently operate. Therefore, we face risks inherent in conducting business internationally, such as:

| · | foreign currency exchange fluctuations or imposition of currency exchange controls; |

| · | legal and governmental regulatory requirements; |

19

| · | disruption of tenders resulting from disputes with governmental authorities; |

| · | potential vessel seizure or nationalization of assets; |

| · | import-export quotas or other trade barriers; |

| · | difficulties in collecting accounts receivable and longer collection periods; |

| · | political and economic instability; |

| · | difficulties and costs of staffing and managing international operations; and |

| · | language and cultural differences. |

Any of these factors could adversely affect our operations and consequently their operating results and financial condition. At this time, management is unable to estimate what, if any, changes may occur or the resulting effect of any such changes on our financial condition or future results of operations.

We also face the potential risk of changing and potentially unfavorable tax treatment and currency law violations. Legislation and regulations regarding taxation, foreign currency transactions and licensing of foreign currency loans in the Republic of Kazakhstan continue to evolve as the central government manages the transformation from a command to a market-oriented economy. The legislation and regulations are not always clearly written and their interpretation is subject to the opinions of local tax inspectors. Instances of inconsistent opinions between local, regional and national tax authorities are not unusual.

The current regime of penalties and interest related to reported and discovered violations of Kazakhstan’s laws, decrees and related regulations can be severe. Penalties include confiscation of the amounts at issue for currency law violations, as well as fines of generally 100% of the taxes unpaid. Interest is assessable at rates of generally 0.06% per day. As a result, penalties and interest can result in amounts that are multiples of any unreported taxes.

Despite the relative political stability in Kazakhstan, our operations and financial condition may be adversely affected by Kazakh political developments, including the application of existing and future legislation and tax regulations.

Seasonality

Due to weather conditions in the north Caspian Sea, demand for our vessel fleet, desalinized water and transition zone and marine seismic data acquisition services is seasonal and is subject to prevailing weather conditions in the region. Typically, significant demand for these services begins in late March or early April and continues until late November. Our business volume, however, is more dependent on oil and natural gas prices and the global supply and demand conditions for our services than any seasonal variations.

Employees

The Company and its subsidiaries currently employ approximately 870 employees. We hire our employees under local labor contracts complying with the governing law of the Republic of Kazakhstan.

20

Under local labor laws, all labor contracts that do not expire or are not terminated before one year are automatically (by law) extended for an undefined period. This makes it more difficult to terminate existing employees. We have managed to maintain low turnover of our work force. With ongoing labor market monitoring, we believe that future new labor requirements can be satisfied and there is no significant risk of a labor shortage.

We provide voluntary and mandatory offshore training and support qualification growth of our employees. In addition, there are legislative requirements to provide a certain number of local employees per year with formal outside training. We continue to satisfy these local labor market protective measures.

We believe we have satisfactory relations with our employees. To date, neither our operations, nor the operations of any of our subsidiaries, have been interrupted by strikes or work stoppages.

Reports to Security Holders

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other filings pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, and amendments to such filings with the United States Securities and Exchange Commission (“SEC”). We provide free access to all of these SEC filings, as soon as reasonably practicable after filing, on our Internet web site located at www.caspianservices inc.com. In addition, the public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains its interne t site www.sec.gov, which contains reports, proxy and information statements and our other SEC filings. Information appearing on the Company’s website is not part of any report that it files with the SEC.

Item 1A. Risk Factors

We operate in challenging and highly competitive markets. Listed below are some of the more critical or unique risk factors that we have identified as affecting or potentially affecting the Company and the marine services industry. You should consider these risks and the risks identified elsewhere in this annual report on Form 10-K and in the Notes to the Consolidated Financial Statements when evaluating our forward-looking statements and our Company. The effect of any one risk factor or a combination of several risk factors could materially affect our results of operations, financial condition and cash flows and the accuracy of any forward-looking statements made in this annual report on Form 10-K.

21

We are in default of certain loan covenants and are unable to satisfy our obligations under our loan agreements.

As discussed in greater detail in Note 7 – Notes Payable of our Consolidated Financial Statements and under the heading “Liquidity and Capital Resources” in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this annual report on Form 10-K, at the end of July 2010 we received written notice from Altima that it believed we had violated at least two of the financial covenants contained in its Facility agreement. At that time, Great C ircle and EBRD verbally notified us that they too believed we were in violation of at least some of the financial covenants of their respective Facility agreement or financing agreements. At the end of November 2010 Great Circle delivered written notice to us stating that we remain in breach of some covenants under their Facility agreement and that such constitutes an event of default. Altima and EBRD verbally notified us of the same at the end of November 2010.

Although they are under no obligation to do so, to date neither Altima nor Great Circle have taken action to increase or accelerate the debt obligations we owe them. Similarly, to date, EBRD has taken no action to increase or accelerate the debt obligations we owe them or to accelerate their put right. Should any one of these parties, however, determine to exercise their acceleration or other rights, we would not have sufficient funds to repay any of the loans individually or collectively or to satisfy the EBRD put right and would be forced to seek sources of funding to satisfy these obligations.

As of September 30, 2010, the outstanding amount due to Altima, Great Circle and EBRD was approximately $19.832 million, $19.177 million and $19.167 million, respectively. In addition were EBRD to accelerate its put option, the accelerated put price would be $10 million plus an internal rate of return of 20% per annum, which is September 30, 2010 was approximately $3.644 million. If Altima, Great Circle and EBRD were each to accelerate repayment of their respective loans and the put option, at September 30, 2010 we would need nearly $72,000 to satisfy these obligations. Given the difficult equity and credit markets and our current financial condition, we believe it would be very difficult, if not impossible, to obtain such funding. If we were unable to obtain funding t o repay the loans or satisfy the put, we anticipate the above-discussed creditors could seek any legal remedies available to them to obtain repayment of their loans. These remedies could include forcing the Company into bankruptcy. As the financing provided to us by EBRD is secured by mortgages on the real property, assets and bank accounts of Balykshi and Caspian Real Estate Limited, and guaranteed by the Company, EBRD could also pursue remedies under those security agreements, including foreclosing on the marine base and other assets.

We are engaged in ongoing negotiations with Altima, Great Circle and EBRD about the possibility of restructuring our debt obligations to them and to reorganize our business operations. In connection with these discussions, we are investigating many potential solutions, including the availability of other funding sources to refinance our debt obligations, restructuring the repayment terms and obligations under the existing Facility agreements and financing agreements, and the sale of Company assets and subsidiaries. At this time, the Company has not reached a definitive agreement with Altima, Great Circle or EBRD on any potential restructuring. There is no guarantee we will be successful in restructuring any of these obligations.

22

Our substantial debt could adversely affect our financial health and prevent us from fulfilling our obligations.

We have a significant amount of debt. As of September 30, 2010, we owed our three primary creditors nearly $60 million. We will not be able to generate sufficient cash to service our debt as it becomes due.

Our substantial debt could have important consequences. In particular, it could:

• increase our vulnerability to general adverse economic and industry conditions;

• require us to dedicate an inordinate portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund capital expenditures and other general corporate purposes;

• limit our flexibility in planning for, or reacting to, changes in our businesses and the industries in which we operate;

• place us at a competitive disadvantage compared to our competitors that have less debt; and

• limit, along with the financial and other restrictive covenants of our indebtedness, among other things, our ability to borrow additional funds.

Our debt agreements will contain restrictive covenants that may limit our ability to respond to changes in market conditions or pursue business opportunities.

Our debt agreements contain restrictive covenants that limit our ability to, among other things:

• incur or guarantee additional debt;

• pay dividends;

• repay subordinated debt prior to its maturity;

• grant additional liens on our assets; and

• merge with another entity or dispose of our assets.

In addition, our debt agreements require us to maintain certain financial ratios and tests. The requirement that we comply with these provisions may materially adversely affect our ability to react to changes in market conditions, take advantage of business opportunities we believe to be desirable, obtain future financing, fund needed capital expenditures or withstand a continuing or future downturn in our business.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

As disclosed in the Report of Independent Registered Public Accounting Firm in our Consolidated Financial Statements we are in violation of certain loan covenants which allow for the lenders to exercise acceleration features and declare the loans and accrued interest immediately due and payable. Should any of the parties determine to exercise acceleration feature and declare the loans and accrued interest immediately due and payable, we would not have sufficient funds to repay any of the loans. And, at September 30,

23

2010, we had negative working capital of $50,339. As a result of these factors, our independent registered public accounting firm has expressed that the uncertainty of the outcome of these factors raises substantial doubt about our ability to continue as a going concern.

We may be unable to complete dredging works at the marine base within the timeline required by the local authorities.

In March 2010 we agreed with local authorities to complete the outstanding dredging works by June 2011. We are currently negotiating with potential contractors to complete this work. We anticipate the cost to be approximately $2,500 to $5,000. Currently, we have insufficient funds to complete the dredging project. If we do not complete the dredging by June 2011, we could be subject to certain penalties, including the possible cancelation of our permits and termination of operational activities at the marine base until the dredging work is completed. Our failure to provide the funding to timely complete the dredging works may also give rise to an event of default under the EBRD financing agreements.

Our business largely depends on levels of exploration and development activity in the oil and natural gas industry.

Our business is substantially dependent upon the condition of the oil and natural gas industry and, in particular, the willingness of E&P companies to make capital expenditures for exploration, development and production operations. The level of capital expenditures generally depends on the prevailing views of future oil and natural gas prices, which are influenced by numerous factors, including but not limited to:

• demand for oil and natural gas;

• the cost of exploration for, and production and transportation of, oil and natural gas;

• the ability of E&P companies to generate funds or otherwise obtain external capital for exploration, development, construction

and production operations;

• the sale and expiration dates of leases in Kazakhstan and the Caspian Sea region;

• weather conditions;

• environmental or other government regulations both domestic and foreign;

• domestic and foreign tax policies; and

• the pace adopted by foreign governments for the exploration, development and production of their oil and gas reserves.

Oil and natural gas prices had been at historically high levels until experiencing a sharp decline during the second half of 2008 and continuing into 2009 and 2010. A worldwide decrease in hydrocarbon demand and a decline in commodity prices have caused many E&P companies to curtail planned capital spending. Historically, demand for our services has been sensitive to the level of exploration spending by oil and gas companies. A sustained period of low drilling and production activity, low commodity prices or reductions in industry budgets could reduce demand for our services and would likely have a material adverse effect on our business, financial condition or results of operations.

24

Slower than anticipated growth of the market may negatively impact our business.

Our revenues are dependent upon demand for our services. If oil and gas exploration and development activities expand at slower than anticipated rates, or if one of our primary clients curtails its activities for any reason, our results of operations and financial condition could be negatively impacted by the reduction in available work and/or a reduction in pricing if supply of services exceeds market demand. Based on the latest available information Kashagan’s second phase will likely be postponed until 2018 or 2019, which we anticipate will delay growth in the market and demand for our services, particularly our marine base services, which in turn may adversely affect the results of our operations.

Difficult economic market conditions may impact our operations.

Uncertainty about economic market conditions makes it challenging for us to forecast operating results and to make decisions about future investments. Our success is both directly and indirectly dependent upon conditions in the financial and commercial markets that are outside our control and difficult to predict. Uncertain economic conditions may lead our customers to postpone spending in response to tighter credit and reductions in income or asset values, which may lead many financial lenders and institutional investors to reduce, and in some cases, cease to provide funding to borrowers, which, in turn, will adversely affect the liquidity and financial condition of our customers. These factors may also adversely affect our liquidity and financial condition. Factors s uch as interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws (including laws relating to taxation), trade barriers, commodity prices, currency exchange rates and controls, and national and international political circumstances (including wars, terrorist acts or security operations) can have a material negative impact on our business and operations, which in turn would reduce our revenues and profitability.

Prolonged material economic downturn in crude oil and natural gas prices can negatively impact the development plans of exploration and production companies. In addition, a prolonged recession may result in a decrease in demand for offshore support vessel services and a reduction in charter rates and/or utilization rates, which would have a material adverse effect on our results of operations, cash flows and financial condition. Prior to mid-2008, oil and gas companies had increased their respective exploration and development activities in response to a very favorable pricing environment for oil and gas that existed at that time. Worldwide demand for oil and gas dropped precipitously and energy prices sharply declined during the last half of calendar 2008 as a result of a global economic r ecession. Over one year later, there are signs that economic improvement is underway; however, the pace of recovery and demand for energy and, in turn, offshore supply vessel services has been slow.

We are subject to all the risks of being dependent upon only a few customers.

Because our vessel fleet is chartered to a limited number of customers, the loss of any one of these customers could adversely impact our financial condition and results of operations. Given the current demand for vessels in the Kazakh sector of the Caspian Sea, the loss of any of our major customers could have a detrimental impact upon our financial condition and results of operations. In addition, if we lose our major customers we will be forced to put out vessels out to the spot market, with all the attendant risks of that market,

25

including uncertain demand, with little ability to offset our significant fixed costs. When a significant percentage of our vessels are chartered under spot charter contracts it typically leads to decreased revenues because of lower utilization, this is more pronounced during winter season because spot charter contracts traditionally do not provide winter standby rates. In such situations, our results of operations typically suffer as well because despite lower utilization, we continue to incur costs for personnel, maintenance, etc.

Oil and natural gas prices are highly volatile.

Commodity prices for crude oil and natural gas are highly volatile. Prices are sensitive to the supply/demand relationship for the respective natural resources. High demand for crude oil and natural gas and/or low inventory levels for the resources as well as any perceptions about future supply interruptions can cause commodity prices for crude oil and natural gas to rise, while generally, low demand for natural resources and/or increases in crude oil and natural gas supplies cause commodity prices for the respective natural resources to decrease.

Factors that affect the supply of crude oil and natural gas include but are not limited to the following: the Organization of Petroleum Exporting Countries’ (“OPEC”) ability to control crude oil production levels and pricing as well as the level of production by non-OPEC countries; political and economic uncertainties; advances in exploration and development technology; worldwide demand for natural resources; and governmental restrictions placed on exploration and production of natural resources.

Changes in the level of capital spending by our customers could negatively impact our results of operations.

Our principal customers are oil and natural gas exploration, development and production companies. Our results of operations are dependent on the level of capital spending by the energy industry. The energy industry’s level of capital spending is substantially related to the prevailing commodity price of natural gas and crude oil. Low commodity prices

26

have the potential to reduce the amount of crude oil and natural gas that our customers can explore for, develop and produce economically. When this market dynamic occurs, our customers generally reduce their capital spending budgets for offshore drilling, exploration and development until commodity prices for natural resources increase to levels that can support increases in production and development and sustain growth.

The offshore marine service and geophysics industries are highly competitive.

We operate in highly competitive industries, which could depress vessel charter rates and utilization and adversely affect our financial performance. We compete for business with our competitors on the basis of price; reputation for quality service; quality, suitability and technical capabilities of vessels; availability of vessels; and safety and efficiency. In addition, competition may be adversely affected by regulations requiring, among other things, the awarding of contracts to local contractors, the employment of local citizens and/or the purchase of supplies from local vendors that favor or require local ownership. In general, declines in the level of offshore drilling and development activity by the energy industry negatively affect the demand for our vessels and result in downward pressure on day rates. Extended periods of low vessel demand and/or low day rates would reduce our revenues.

Potential overcapacity in the marine services industry in the North Caspian Sea region.

Over the past decade, construction of offshore vessels of the types we operate have increased significantly. Excess offshore supply vessel capacity likewise exerts downward pressure on charter rates. Excess capacity can occur when newly constructed vessels enter the market and when vessels are mobilized between market areas.

The offshore supply vessel market has approximately 450 new-build offshore support vessels (platform supply vessels and anchor handlers only) that are currently estimated to be under construction and that are expected to be delivered to the worldwide offshore vessel market over the next four years, according to ODS-Petrodata. The current worldwide fleet of these classes of vessels is estimated at approximately 2,450 vessels. An increase in vessel capacity could result in increased competition in the North Caspian Sea which may have the effect of lowering charter rates and utilization rates, which, in turn, would result in lower revenues.

There are inherent operational hazards to the marine services industry.

The operation of any marine vessel involves inherent risk that could adversely affect our financial performance if we are not adequately insured or indemnified. Our operations are also subject to various operating hazards and risks, including risk of catastrophic marine disaster; adverse sea and weather conditions; mechanical failure; collisions and property losses to the vessel; war, sabotage and terrorism risks; and business interruption due to political action or inaction, including nationalization of asset by foreign governments.

These risks present a threat to the safety of personnel and to our vessels, cargo and other property, as well as the environment. Any such event may result in a reduction in revenues, increased costs, property damage, and additionally, third parties may have significant claims against us for damages due to personal injury, death, property damage, pollution and loss of business. Our vessels are generally insured for their estimated market value against damage or loss, but we do not fully insure for business interruption. Our insurance coverage is subject to deductibles and certain exclusions. We can provide no assurance, however, that our insurance coverage will be available beyond the renewal periods, that we will be able to obtain insurance for all operational risks and that our insurance policies will be adequate to cover future claims that may arise.

27

Failure to meet our legal compliance obligations could result in significant cost to the Company.

We must comply with extensive government regulation in the form of international conventions, federal and state laws and regulations. These conventions, laws and regulations govern matters of environmental protection, worker health and safety, and the manning, construction and operation of vessels. Moreover, the International Maritime Organization recently made the regulations of the International Safety Management (“ISM”) Code mandatory. All of our vessels now comply fully with these international standards. The ISM Code provides an international standard for the safe management and operation of ships, pollution prevention and certain crew and vessel certifications. The risks of incurring substantial compliance costs, liabilities and penalties for non-compliance are inherent in offshore maritime operations. Compliance with environmental, health and safety laws and regulations increases our cost of doing business. Additionally, environmental, health and safety laws change frequently. Therefore, we may be unable to predict the future costs or other future impact of environmental, health and safety laws on our operations. There is no assurance that we can avoid significant costs, liabilities and penalties imposed as a result of environmental regulation in the future.

Compliance with the Foreign Corrupt Practices Act.

As a U.S. corporation, the company is subject to the regulations imposed by the Foreign Corrupt Practices Act (FCPA), which generally prohibits U.S. companies and their intermediaries from making improper payments to foreign officials for the purpose of obtaining or keeping business or obtaining an improper business benefit. We have adopted proactive procedures to promote compliance with the FCPA, but we may be held liable for actions taken by our strategic or local partners or agents even though these partners or agents may not themselves be subject to the FCPA. Any determination that we have violated the FCPA could have a material adverse effect on our business, results of operations, and cash flows.

Compliance with environmental regulations may adversely impact our operations.

A variety of regulatory developments, proposals and requirements have been introduced in the U.S. and various other countries that are focused on restricting the emission of carbon dioxide, methane and other gases. If such legislation is enacted, increased energy, environmental and other costs and capital expenditures could be necessary to comply with the limitations. These developments may curtail production and demand for hydrocarbons such as crude oil and natural gas and thus adversely affect future demand for our vessels, which are highly dependent on the level of activity in offshore oil and natural gas exploration, development and production market. Although it is unlikely that demand for oil and gas will lessen dramatically over the short-term, in the long-term, demand for oil and ga s or increased regulation of environmental regulations may create greater incentives for use of alternative

28