Peoples Bancorp

OF NORTH CAROLINA, INC

OF NORTH CAROLINA, INC

Southeast 2008

Super-Community Bank Conference

February 12, 2008

NASDAQ: PEBK

www.peoplesbanknc.com

Peoples Bancorp has made forward-looking statements in the

accompanying presentation materials that are subject to risks and

uncertainties. These statements are based on the beliefs and

assumptions of the management of Peoples Bancorp, and on the

information available to management at the time the presentation

materials were prepared. These forward-looking statements involve

certain risks and uncertainties, including a variety of factors that may

cause Peoples Bancorp’s actual results to differ materially from the

anticipated results or other expectations expressed in such forward-

looking statements. Readers are cautioned not to place undue reliance

on these forward-looking statements and are advised to carefully review

the risk factors described in other documents that Peoples Bancorp files

from time to time with the Securities and Exchange Commission,

including the Quarterly Reports on Form 10-Q, the Annual Report on

Form 10-K, and other required filings.

accompanying presentation materials that are subject to risks and

uncertainties. These statements are based on the beliefs and

assumptions of the management of Peoples Bancorp, and on the

information available to management at the time the presentation

materials were prepared. These forward-looking statements involve

certain risks and uncertainties, including a variety of factors that may

cause Peoples Bancorp’s actual results to differ materially from the

anticipated results or other expectations expressed in such forward-

looking statements. Readers are cautioned not to place undue reliance

on these forward-looking statements and are advised to carefully review

the risk factors described in other documents that Peoples Bancorp files

from time to time with the Securities and Exchange Commission,

including the Quarterly Reports on Form 10-Q, the Annual Report on

Form 10-K, and other required filings.

Forward-looking Statements

NASDAQ: PEBK

www.peoplesbanknc.com

About Peoples Bank

n 96 year operating history

n Total Assets of $906 million at December 31, 2007

n HQ in Newton, NC (40 miles north of Charlotte)

n 21 offices -- 20 within a 50 mile radius of Charlotte

n Banco de la Gente = Latino Banking Division

n Initiated in 2004

n Opened 4th Banco office in Raleigh in January

2008

2008

NASDAQ: PEBK

www.peoplesbanknc.com

Peoples Bancorp of NC, Inc.

n Formed in 1999 as a one bank HC for Peoples Bank

n Bank Subsidiaries

n Real Estate Advisory Services, Inc.

n Peoples Investment Services, Inc.

NASDAQ: PEBK

www.peoplesbanknc.com

Branch Network:

21 Offices in 7 counties

21 Offices in 7 counties

NASDAQ: PEBK

www.peoplesbanknc.com

Strategic Focus

n Grow Core Deposits

n Growth in Existing Markets

n Expand Banco de la Gente

n Identify expansion opportunities using Store-front or

Traditional Branches

Traditional Branches

n Hire Market Leaders to expand in high growth

markets (LPO’s)

markets (LPO’s)

NASDAQ: PEBK

www.peoplesbanknc.com

Primary Market Area: Catawba and Lincoln Counties | ||||

’07 Rank | Institution (ST) | ’07 # Branches | ‘07 Deposits in Market ($000) | ‘07 Market Share |

1 | BB&T Corp. (NC) | 13 | 759,341 | 23.1% |

2 | Peoples Bancorp of NC Inc. | 15 | 604,205 | 18.4% |

3 | Wachovia Corp. (NC) | 6 | 426,606 | 13.0% |

4 | Bank of Granite Corp. (NC) | 7 | 368,912 | 11.2% |

5 | First Citizens BancShares Inc. (NC) | 8 | 199,494 | 5.5% |

6 | Fifth Third Bancorp (OH) | 5 | 196,423 | 6.1% |

7 | First FSB of Lincolnton (NC) | 3 | 192,764 | 5.8% |

8 | Bank of America Corp. (NC) | 6 | 189,315 | 6.0% |

9 | FNB United Corp. (NC) | 4 | 179,914 | 0.8% |

10 | Carolina Trust Bank (NC) | 5 | 94,010 | 0.7% |

Total For Institutions In Market | 79 | 3,289,069 | ||

Source: SNL Financial

PEBK Deposit Market Share

NASDAQ: PEBK

www.peoplesbanknc.com

PEBK Dep. in | Dep. Market | Proj. Pop. | Med. HH Income | Proj. HH | ||||

No. of | Market | Share | 2007-2012 | 2007 | Income Δ% | |||

County | Rank | Branches | ($000) | (%) | (%) | ($) | (%) | |

Catawba | 2 | 11 | 456,068 | 18.99 | 5.54 | 49,596 | 13.56 | |

Lincoln | 3 | 3 | 148,137 | 16.70 | 9.63 | 49,819 | 11.84 | |

Alexander | 5 | 1 | 44,841 | 13.04 | 5.33 | 45,999 | 11.58 | |

Mecklenburg | 20 | 3 | 12,752 | 0.01 | 15.27 | 65,741 | 19.52 | |

Union | 10 | 1 | 1,186 | 0.08 | 31.78 | 64,184 | 19.01 | |

Iredell | 19 | 1 | 0 | 0.00 | 14.47 | 52,663 | 16.39 | |

Wake | 29 | 1 | 0 | 0.00 | 20.19 | 72,665 | 19.11 | |

NC Totals | 21 | 662,984 | ||||||

Source: SNL Financial | ||||||||

Expanding into Growth Markets

NASDAQ: PEBK

www.peoplesbanknc.com

Banco de la Gente

n Identified an Untapped Market

n 10% of our market (as of 2004)

n 57% of Latinos did not have a bank account

n Latinos need basic transactions and help building credit

n 4 Offices: Charlotte (2), Monroe and Raleigh

n Source of Non-Interest Income and Mortgage loans

NASDAQ: PEBK

www.peoplesbanknc.com

* CAGR = Compound annual growth rate 2002-2007

Consistent Balance Sheet Growth

NASDAQ: PEBK

www.peoplesbanknc.com

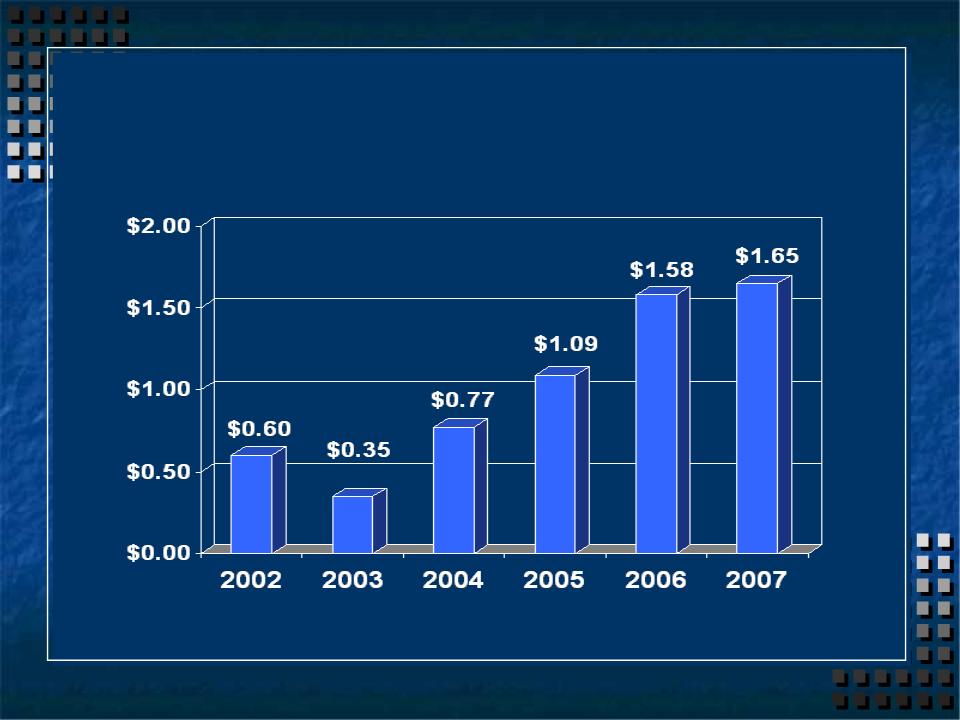

5-Year EPS CAGR* = 29.9%

*CAGR - compound annual growth rate 2002 - 2007

Improved Earnings Growth

NASDAQ: PEBK

www.peoplesbanknc.com

Improved Asset Quality

NASDAQ: PEBK

www.peoplesbanknc.com

1%

CRE is 61%

Owner-occupied

Owner-occupied

Construction =

• 33% Residential

• 13% Commercial

• 54% Land Development

1-4 Res. RE

Construction

CRE

Consumer

HELOC

MultiFam/Land

C&I

Loan Portfolio Composition

at December 31, 2007

at December 31, 2007

NASDAQ: PEBK

www.peoplesbanknc.com

Lower cost = Transaction accounts + MM + savings

CAGR = Compound annual growth rate 2002-2007

millions

5 year CAGR’s:

Deposit Analysis

NASDAQ: PEBK

www.peoplesbanknc.com

$’s in millions

Total Revenue

NASDAQ: PEBK

www.peoplesbanknc.com

Name | Title | Years at Peoples | Years in Banking | Age |

Tony W. Wolfe | President and CEO | 18 | 39 | 61 |

Lance A. Sellers | EVP, Chief Credit Officer | 10 | 24 | 45 |

A. Joseph Lampron | EVP, Chief Financial Officer | 6 | 20 | 53 |

William D. Cable | EVP, Chief Operations Officer | 13 | 18 | 39 |

Joseph F. Beaman, Jr. | EVP, Chief Administrative Officer | 31 | 37 | 58 |

Management Profile

NASDAQ: PEBK

www.peoplesbanknc.com

Company Strengths

n Local bankers: well established in the local markets

n Local decision making authority

n Active and motivated Board

n Effective sales culture

n Commitment to technology and up-to-date delivery

channels

channels

n Active in our communities - local governments along

with civic and charitable organizations

with civic and charitable organizations

NASDAQ: PEBK

www.peoplesbanknc.com

Investment Highlights

n Established Reputation

n Growth initiatives both in and outside of current

markets

markets

n History of strong profitability

n History of stock dividends and increasing cash

dividends; attractive yield

dividends; attractive yield