22

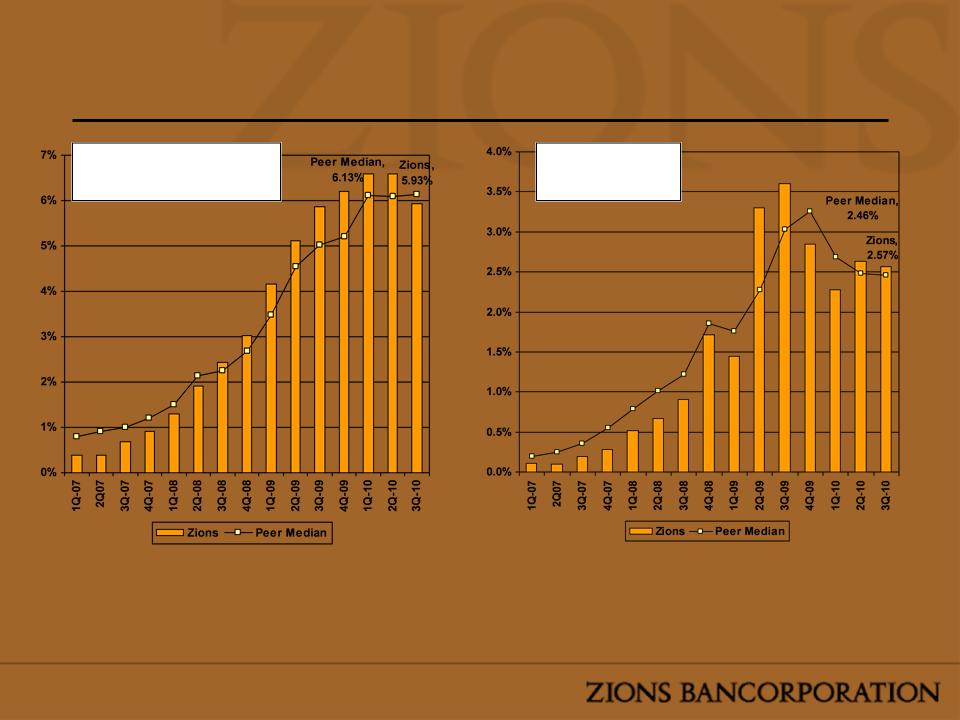

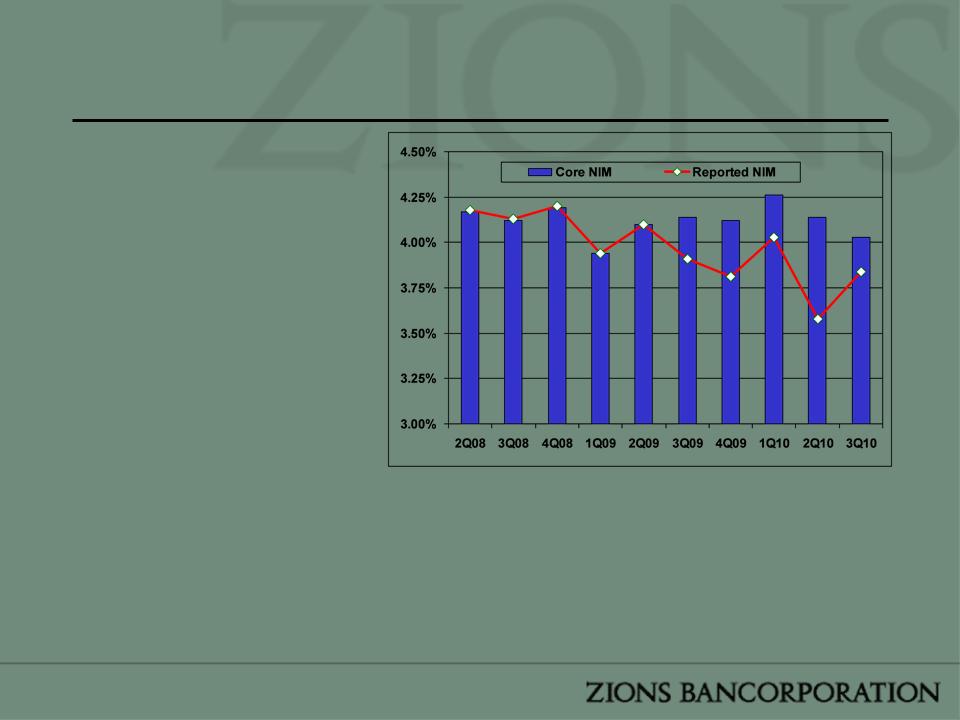

Core NIM Trends

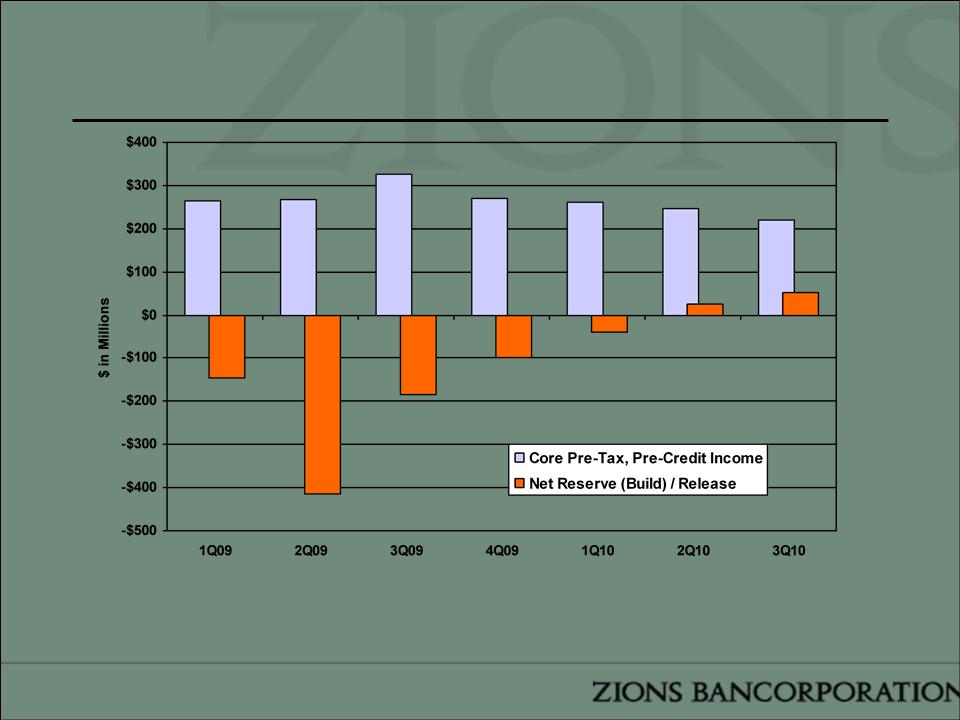

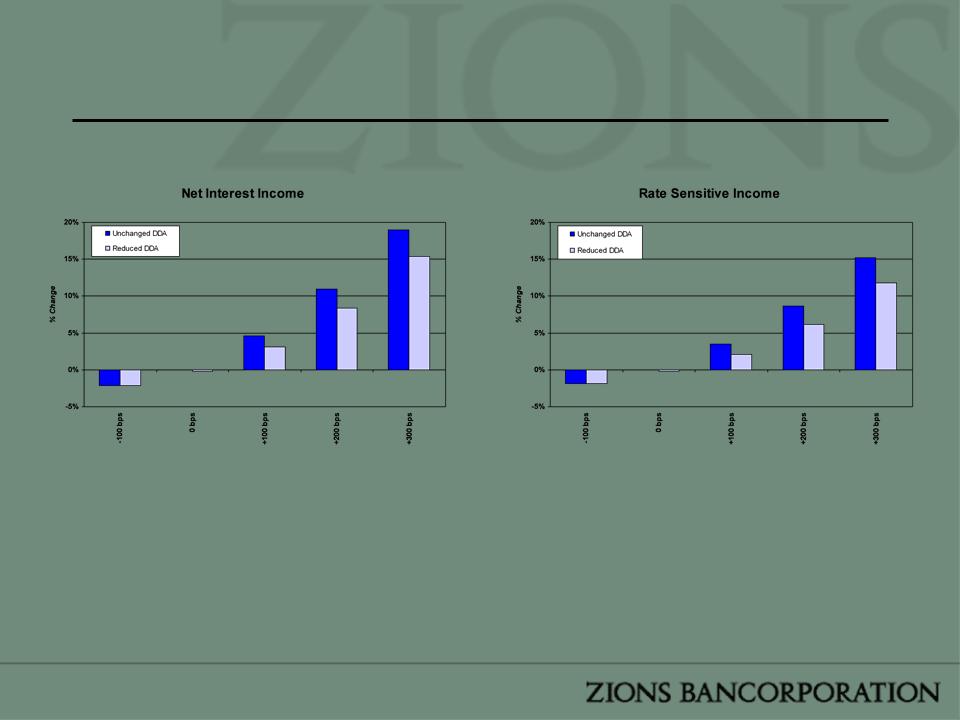

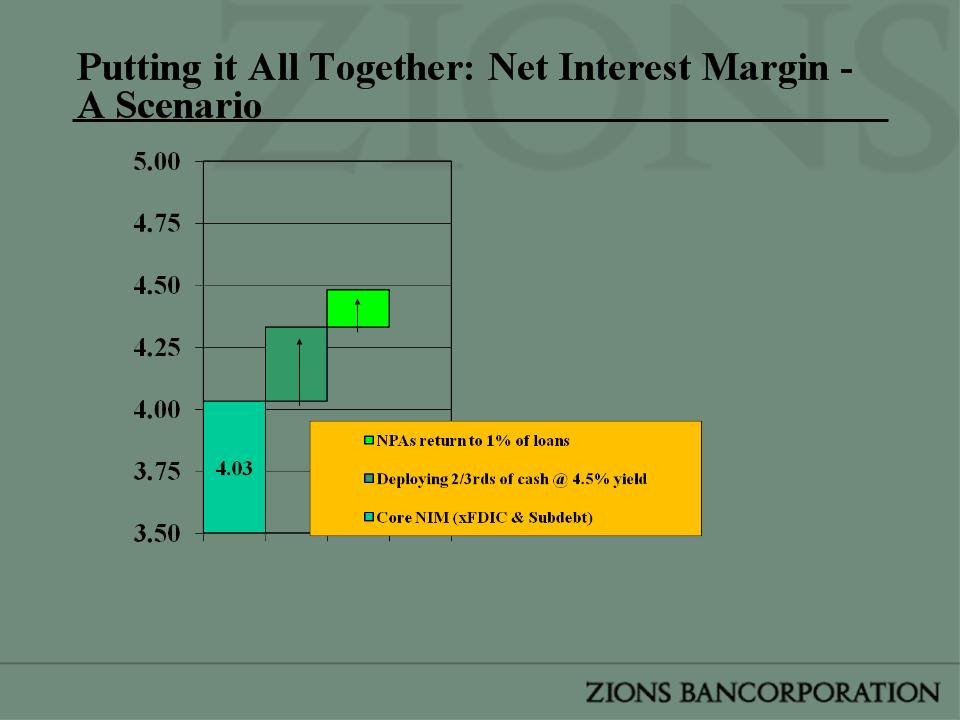

• Zions expects net interest

sensitive income to increase

between an estimated 5.4% and

8.6% if interest rates were to

rise 200 bps*

• Core NIM (excludes discount

accretion) has been generally

stable

– Recent core NIM compression

attributable to a greater drag from

cash balances

– 1Q09 experienced a temporary dip

partially due to an intentional build

-up of excess liquidity during the

significant turmoil during late

2008/early 2009

– Large senior note issuance in

September 2009 had about 8 bps

adverse impact on the core NIM in

4Q09

(1) Cash drag refers to the adverse impact on the net interest margin due to the total balance of cash held in interest-bearing accounts. Assumptions

used to compute the cash drag include investing the cash at a rate of 4.5%, similar to the rate achieved on recent loan production. Liquidity targets and

loan demand are factors that may prevent fully deploying such cash; the cash drag is shown for illustrative purposes only.

*Assumes a parallel shift in the yield curve; key assumptions include a slow and a fast deposit repricing response (i.e. if deposit rates are slow to

increase Zions expects a 7.2% increase in interest sensitive income, and if deposits were to reprice quickly Zions expects a 4.2% increase in interest

sensitive income); sensitivity analysis based on 2Q10 data

Due to the extinguishment/ reissuance of subordinated debt in June 2009, Zions experiences non-cash discount accretion, which increases interest

expense, reducing GAAP NIM

| 1Q0

9 | 2Q0

9 | 3Q0

9 | 4Q0

9 | 1Q1

0 | 2Q1

0 | 3Q1

0 |

Cash Drag (1) | | 24

bps | 17

bps | 16

bps | 24

bps | 20

bps | 35

bps | 46

bps |