2nd Quarter, 2014 Zions Bancorporation Credit Update

Forward-Looking Statements & Peer Group Abbreviations This presentation contains statements that relate to the projected or modeled performance or condition of Zions Bancorporation and elements of or affecting such performance or condition, including statements with respect to forecasts, opportunities, models, illustrations, scenarios, beliefs, plans, objectives, goals, guidance, expectations, anticipations or estimates, and similar matters. These statements constitute forward-looking information within the meaning of the Private Securities Litigation Reform Act. Actual facts, determinations, results or achievements may differ materially from the statements provided in this presentation since such statements involve significant known and unknown risks and uncertainties. Factors that might cause such differences include, but are not limited to: competitive pressures among financial institutions; economic, market and business conditions, either nationally, internationally, or locally in areas in which Zions Bancorporation conducts its operations, being less favorable than expected; changes in the interest rate environment reducing expected interest margins; changes in debt, equity and securities markets; adverse legislation or regulatory changes; Federal Reserve review of our resubmitted Capital Plan; and other factors described in Zions Bancorporation’s most recent annual and quarterly reports. In addition, the statements contained in this presentation are based on facts and circumstances as understood by management of the company on the date of this presentation, which may change in the future. Except as required by law, Zions Bancorporation disclaims any obligation to update any statements or to publicly announce the result of any revisions to any of the forward-looking statements included herein to reflect future events, developments, determinations or understandings. 2 BAC: Bank of America Corporation BBT: BB&T Corporation CMA: Comerica Incorporated C: Citigroup Inc. HBAN: Huntington Bancshares Incorporated JPM: JPMorgan Chase & Co. KEY: KeyCorp MTB: M&T Bank Corporation PNC: PNC Financial Services Group, Inc. RF: Regions Financial Corporation STI: SunTrust Banks, Inc. UB: UnionBanCal Corporation USB: U.S. Bancorp WFC: Wells Fargo & Company

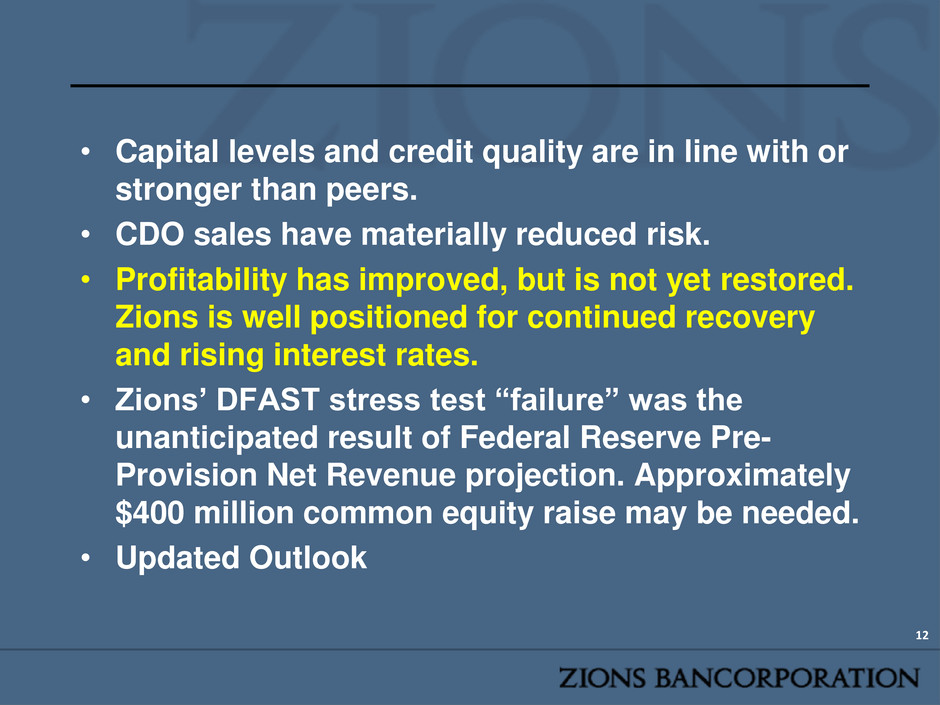

• Capital levels and credit quality are in line with or stronger than peers. • CDO sales have materially reduced risk. • Profitability has improved, but is not yet restored. Zions is well positioned for continued recovery and rising interest rates. • Zions’ DFAST stress test “failure” was the unanticipated result of Federal Reserve Pre- Provision Net Revenue projection. Approximately $400 million common equity raise may be needed. • Updated Outlook 3

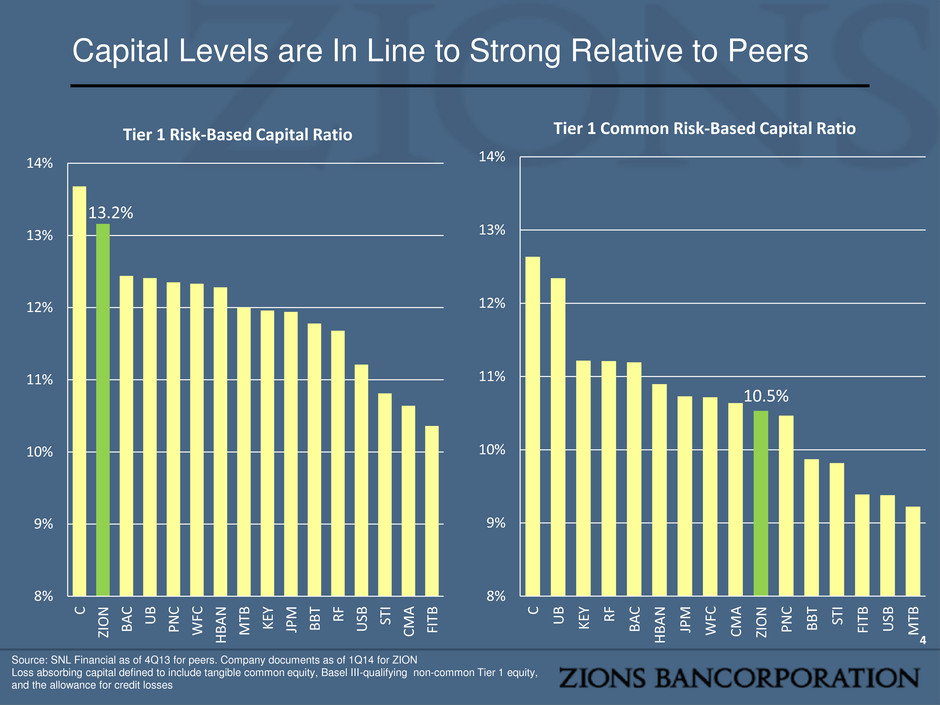

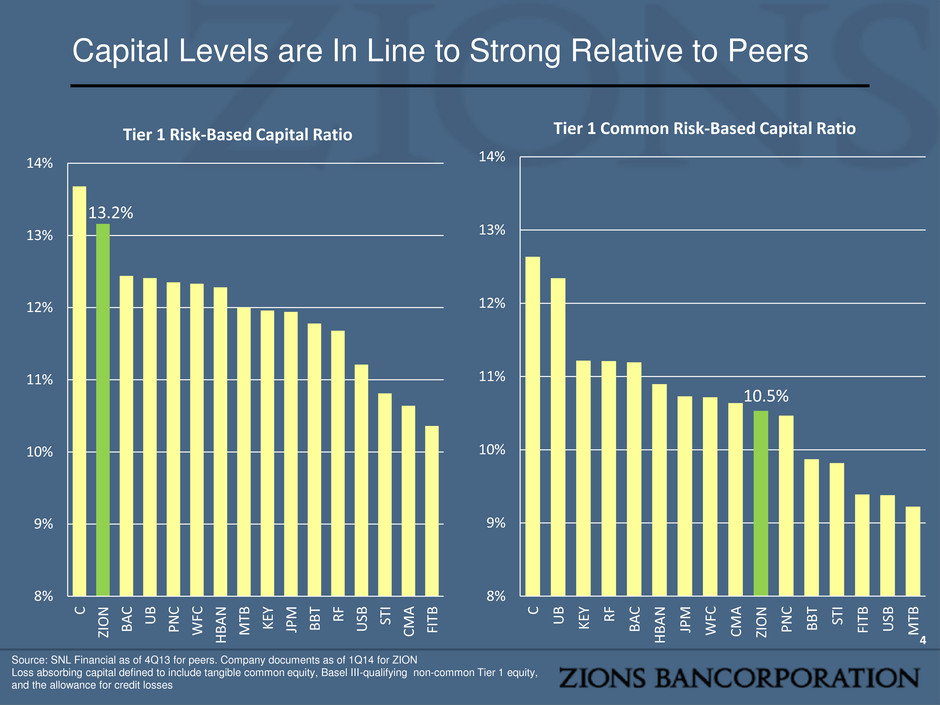

Capital Levels are In Line to Strong Relative to Peers Source: SNL Financial as of 4Q13 for peers. Company documents as of 1Q14 for ZION Loss absorbing capital defined to include tangible common equity, Basel III-qualifying non-common Tier 1 equity, and the allowance for credit losses 4 13.2% 8% 9% 10% 11% 12% 13% 14% C ZIO N B A C U B P N C WF C H B A N M TB KE Y JP M B B T R F US B ST I CM A FIT B Tier 1 Risk-Based Capital Ratio 10.5% 8% 9% 10% 11% 12% 13% 14% C U B KE Y R F B A C H B A N JP M WF C CM A ZIO N P N C B B T ST I FIT B US B M TB Tier 1 Common Risk-Based Capital Ratio

Reserve for Loan Losses is Strong Relative to Peers Source: SNL Financial as of 4Q13 for peers. Company documents as of 1Q14 for ZION Allowance for Credit Losses includes the Allowance for Loan & Lease Losses and the Allowance for Unfunded Commitments 5 2.1% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% C JP M ZIO N FIT B P N C US B R F B A C WF C H B A N ST I B B T KE Y M TB CM A U B Total Allowance for Credit Losses/ Loans

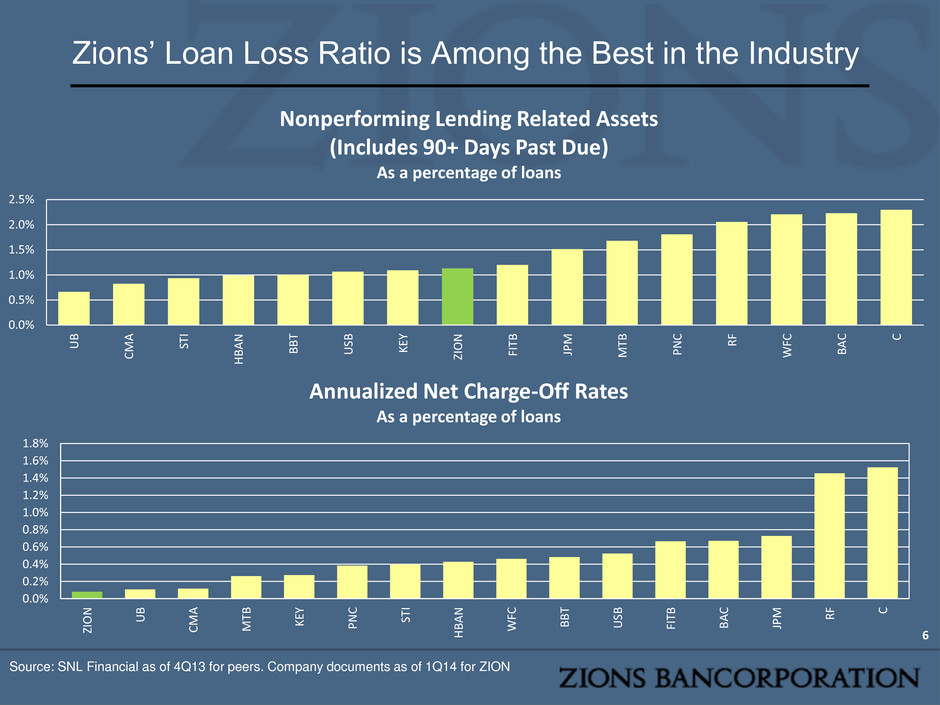

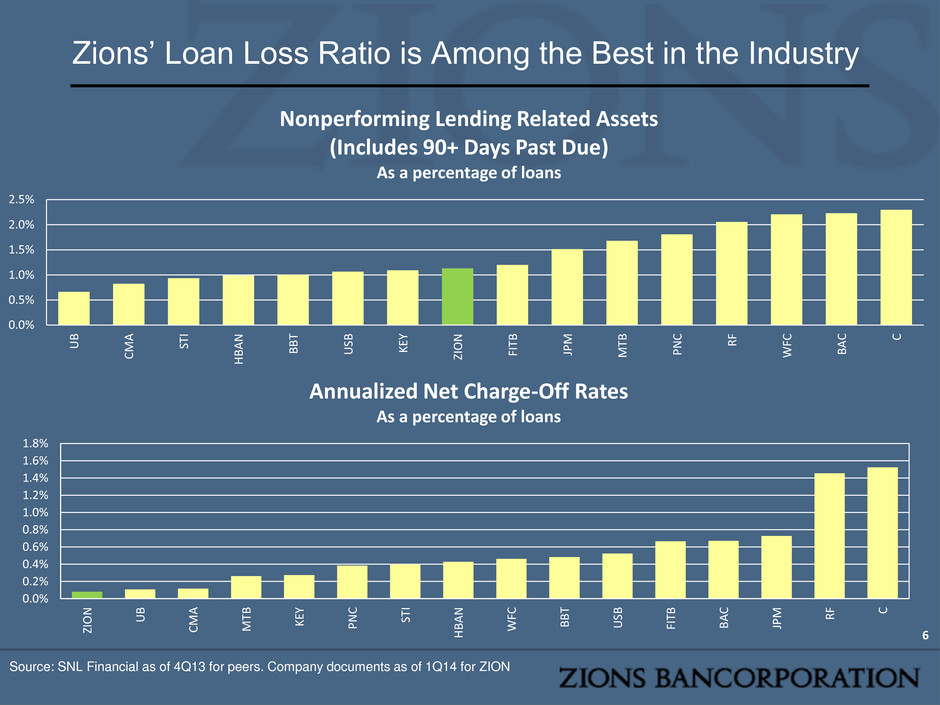

Zions’ Loan Loss Ratio is Among the Best in the Industry 6 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% ZI O N U B C M A M TB K EY P N C ST I H BA N WF C B B T U SB FI TB B A C JP M R F C Annualized Net Charge-Off Rates As a percentage of loans 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% U B C M A ST I H BA N B B T U SB K EY ZI O N FI TB JP M M TB P N C R F WF C B A C C Nonperforming Lending Related Assets (Includes 90+ Days Past Due) As a percentage of loans Source: SNL Financial as of 4Q13 for peers. Company documents as of 1Q14 for ZION

Net Charge Off Rate Compares Favorably with Peers Through the Cycle Net Charge-offs: Through the Cycle, With and Without Construction Loans Source: SNL Financial. Net charge-off ratios annualized. 7 U B M TB CM A P N C ZIO N US B B B T ST I W FC KE Y H B A N R F FIT B JP M B A C C Annualized Average NCO Rate of Overall Portfolio, 2007-2013, With Construction & Land Development 0% 1% 2% 3% 4% 5% 6% U B M TB CM A ZIO N P N C B B T U SB ST I KE Y FIT B W FC R F H B A N JP M B A C C Annualized Average NCO Rate of Overall Portfolio, 2007-2013, Without Construction & Land Development

• Capital levels and credit quality are in line with or stronger than peers. • CDO sales have materially reduced risk. • Profitability has improved, but is not yet restored. Zions is well positioned for continued recovery and rising interest rates. • Zions’ DFAST stress test “failure” was the unanticipated result of Federal Reserve Pre- Provision Net Revenue projection. Approximately $400 million common equity raise may be needed. • Updated guidance 8

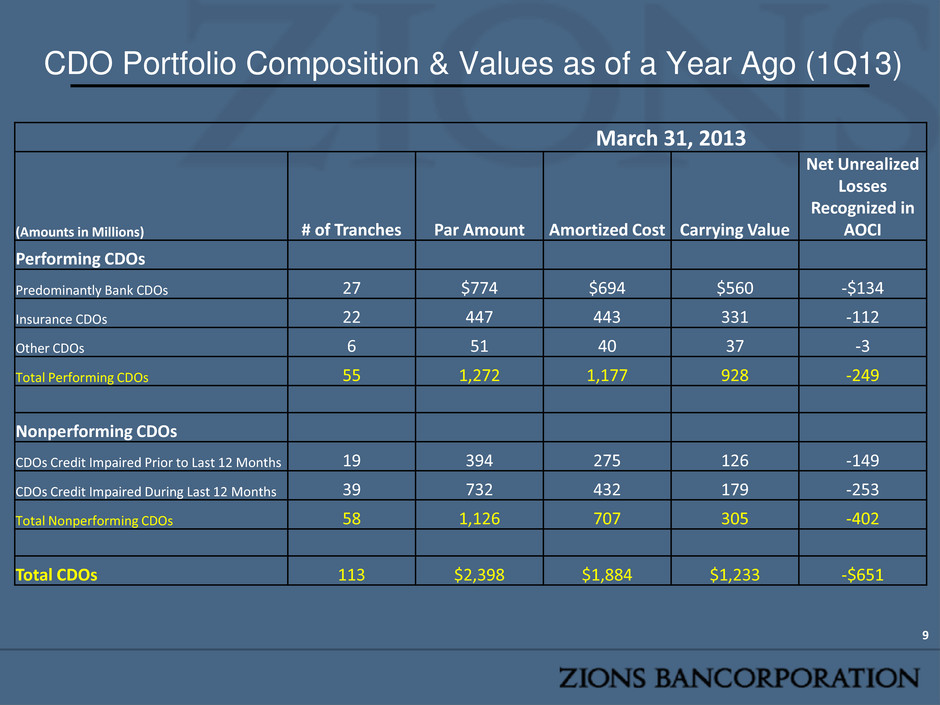

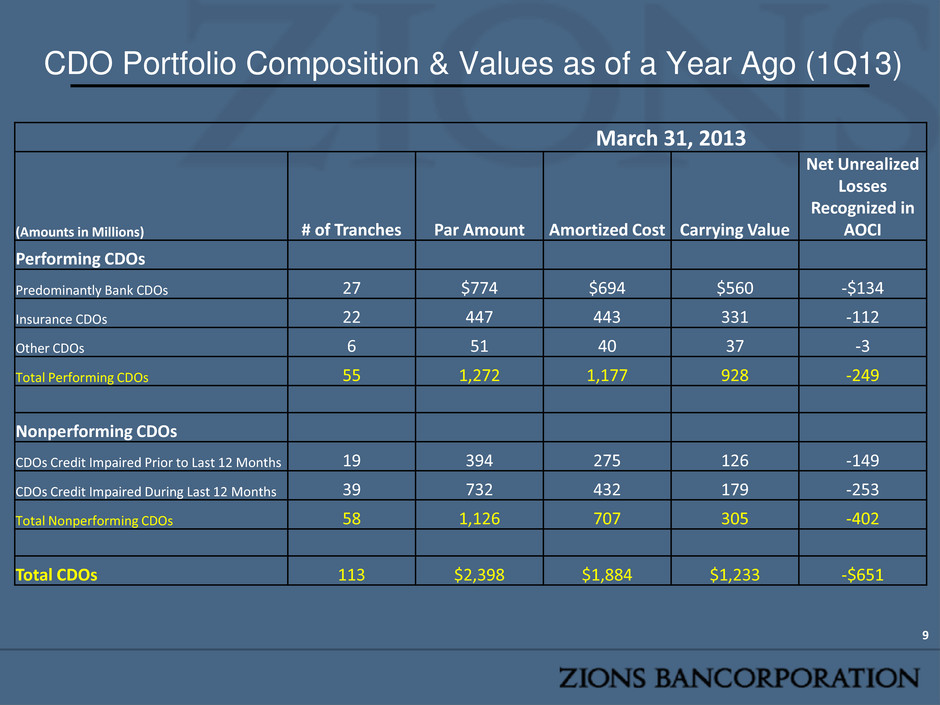

9 CDO Portfolio Composition & Values as of a Year Ago (1Q13) March 31, 2013 (Amounts in Millions) # of Tranches Par Amount Amortized Cost Carrying Value Net Unrealized Losses Recognized in AOCI Performing CDOs Predominantly Bank CDOs 27 $774 $694 $560 -$134 Insurance CDOs 22 447 443 331 -112 Other CDOs 6 51 40 37 -3 Total Performing CDOs 55 1,272 1,177 928 -249 Nonperforming CDOs CDOs Credit Impaired Prior to Last 12 Months 19 394 275 126 -149 CDOs Credit Impaired During Last 12 Months 39 732 432 179 -253 Total Nonperforming CDOs 58 1,126 707 305 -402 Total CDOs 113 $2,398 $1,884 $1,233 -$651

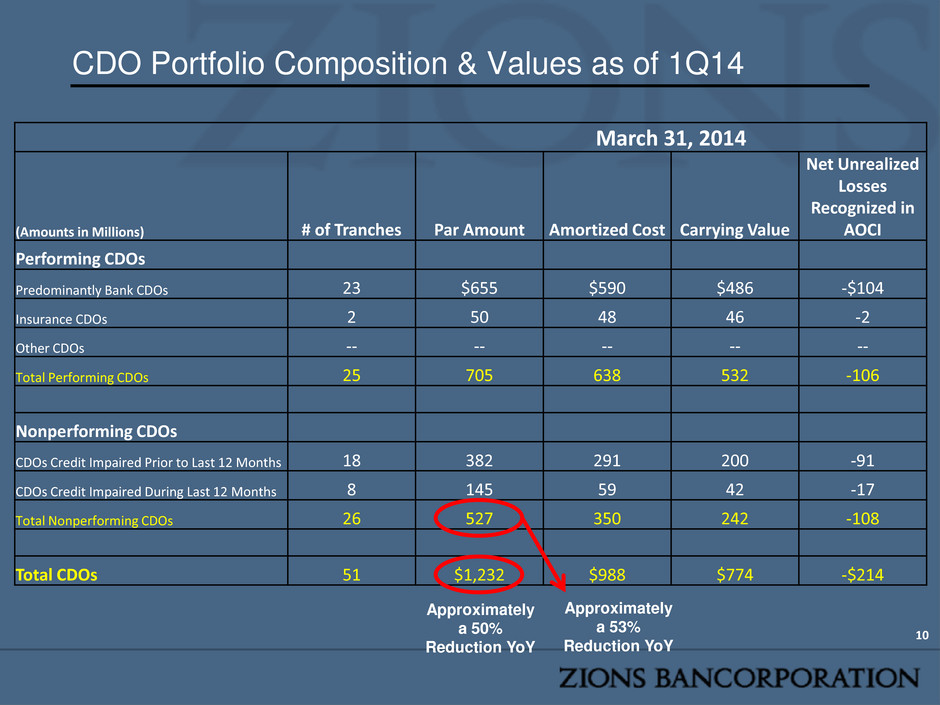

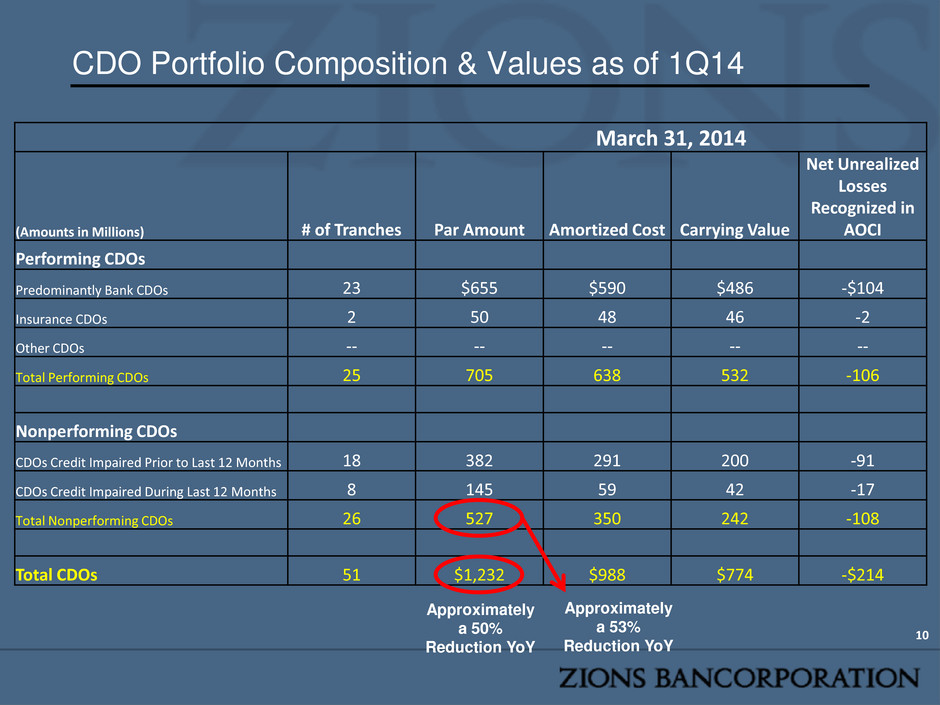

CDO Portfolio Composition & Values as of 1Q14 10 March 31, 2014 (Amounts in Millions) # of Tranches Par Amount Amortized Cost Carrying Value Net Unrealized Losses Recognized in AOCI Performing CDOs Predominantly Bank CDOs 23 $655 $590 $486 -$104 Insurance CDOs 2 50 48 46 -2 Other CDOs -- -- -- -- -- Total Performing CDOs 25 705 638 532 -106 Nonperforming CDOs CDOs Credit Impaired Prior to Last 12 Months 18 382 291 200 -91 CDOs Credit Impaired During Last 12 Months 8 145 59 42 -17 Total Nonperforming CDOs 26 527 350 242 -108 Total CDOs 51 $1,232 $988 $774 -$214 Approximately a 50% Reduction YoY Approximately a 53% Reduction YoY

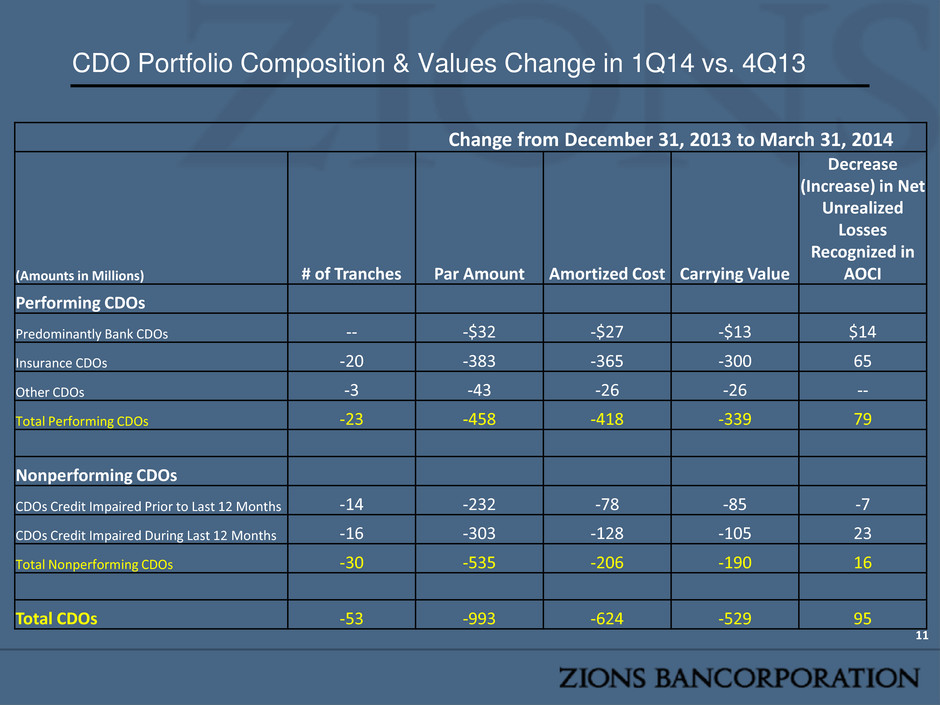

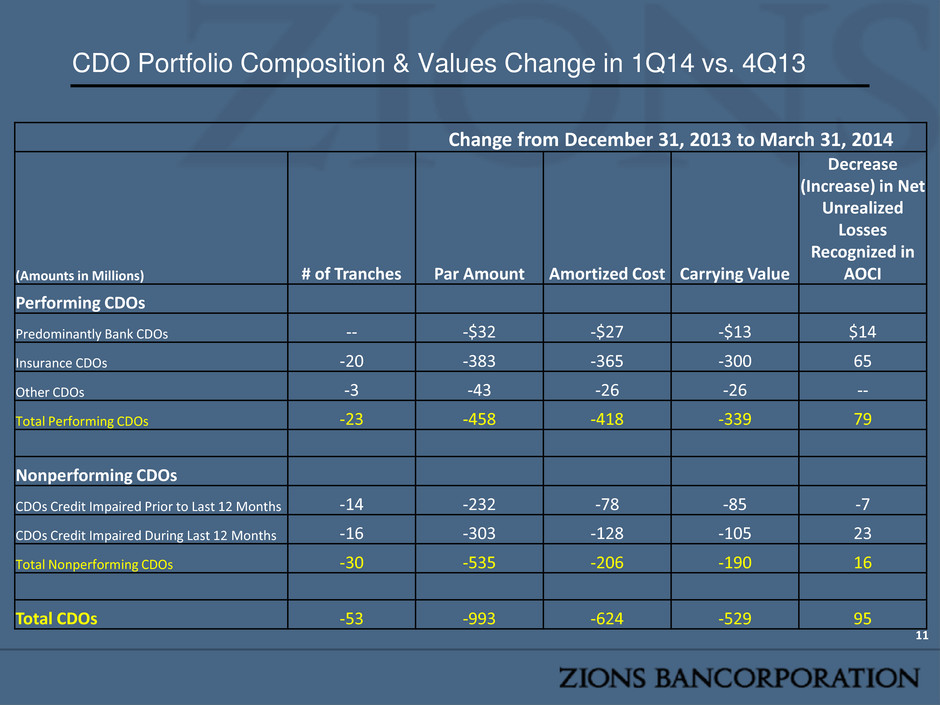

CDO Portfolio Composition & Values Change in 1Q14 vs. 4Q13 11 Change from December 31, 2013 to March 31, 2014 (Amounts in Millions) # of Tranches Par Amount Amortized Cost Carrying Value Decrease (Increase) in Net Unrealized Losses Recognized in AOCI Performing CDOs Predominantly Bank CDOs -- -$32 -$27 -$13 $14 Insurance CDOs -20 -383 -365 -300 65 Other CDOs -3 -43 -26 -26 -- Total Performing CDOs -23 -458 -418 -339 79 Nonperforming CDOs CDOs Credit Impaired Prior to Last 12 Months -14 -232 -78 -85 -7 CDOs Credit Impaired During Last 12 Months -16 -303 -128 -105 23 Total Nonperforming CDOs -30 -535 -206 -190 16 Total CDOs -53 -993 -624 -529 95

• Capital levels and credit quality are in line with or stronger than peers. • CDO sales have materially reduced risk. • Profitability has improved, but is not yet restored. Zions is well positioned for continued recovery and rising interest rates. • Zions’ DFAST stress test “failure” was the unanticipated result of Federal Reserve Pre- Provision Net Revenue projection. Approximately $400 million common equity raise may be needed. • Updated Outlook 12

Profitability Improvement in 2013 Driven by Capital Actions, Partially Offset by a Decline in Net Interest Income 13 (In millions) 1. ROAA and reserve release adjusted ROAA based on net income available to common. Source: SNL Financial and Company documents. * Net Income normalized for one-time debt extinguishment expense in 2Q13, preferred stock redemption in 3Q13, OTTI and debt extinguishment cost in 4Q13, Gain on Sale of CDOs in 1Q14 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 -$200 -$100 $0 $100 $200 $300 $400 Annualized Net Income Available to Common* NIAC, Annualized NIAC, Less Reserve Release -0.50% -0.25% 0.00% 0.25% 0.50% 0.75% 1.00% 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 ROAA and Reserve Release Adjusted ROAA ROAA ROAA, Less Reserve Release

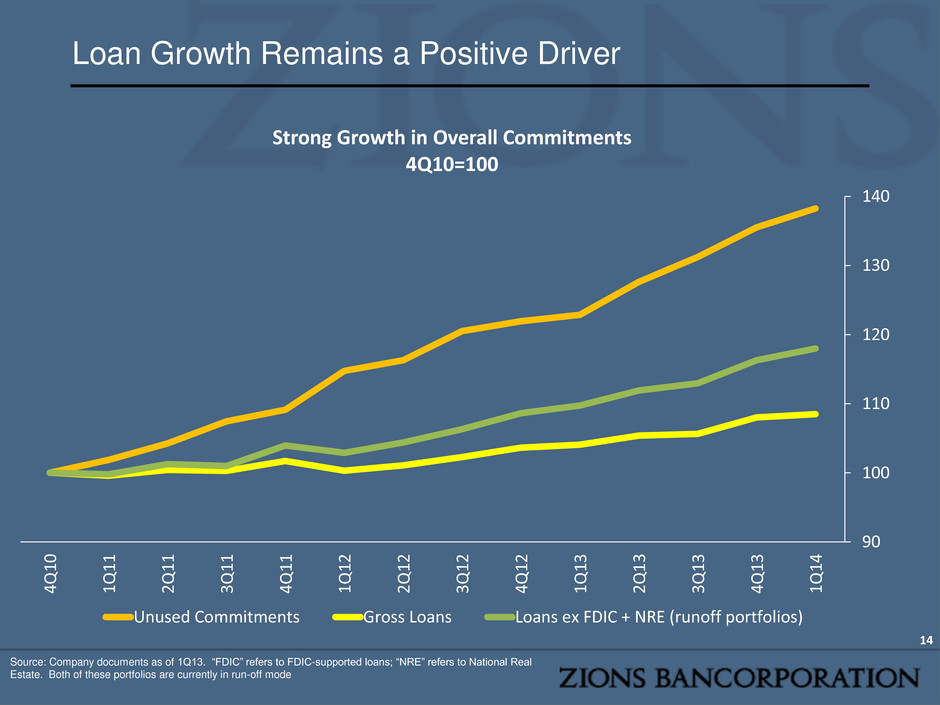

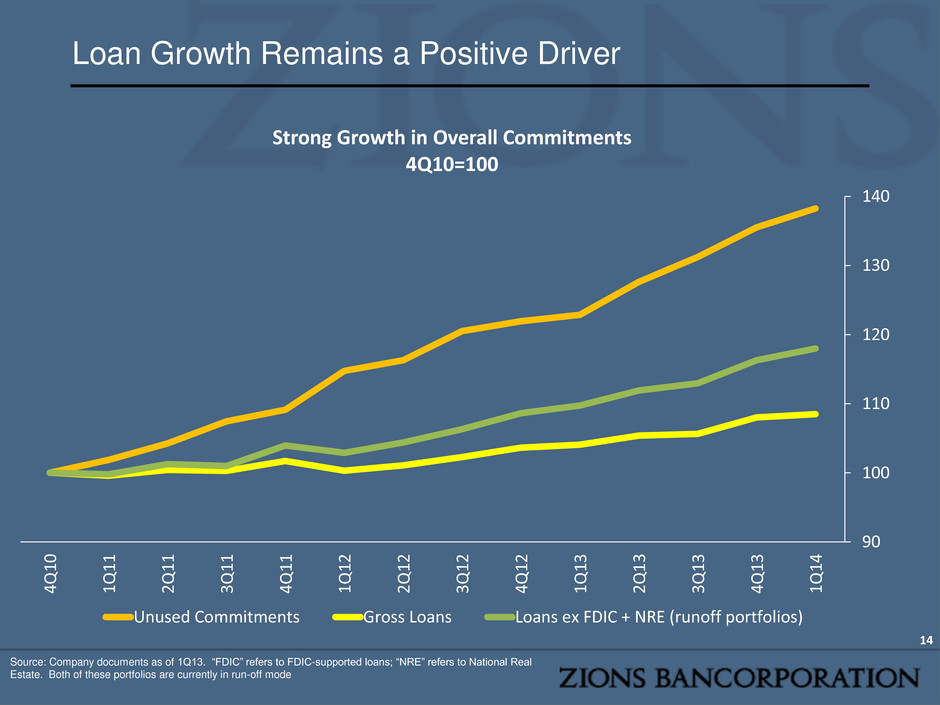

90 100 110 120 130 140 4Q 1 0 1Q 1 1 2Q 1 1 3Q 1 1 4Q 1 1 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2 Q1 3 3Q 1 3 4Q 1 3 1Q 1 4 Strong Growth in Overall Commitments 4Q10=100 Unused Commitments Gross Loans Loans ex FDIC + NRE (runoff portfolios) Loan Growth Remains a Positive Driver 14 Source: Company documents as of 1Q13. “FDIC” refers to FDIC-supported loans; “NRE” refers to National Real Estate. Both of these portfolios are currently in run-off mode

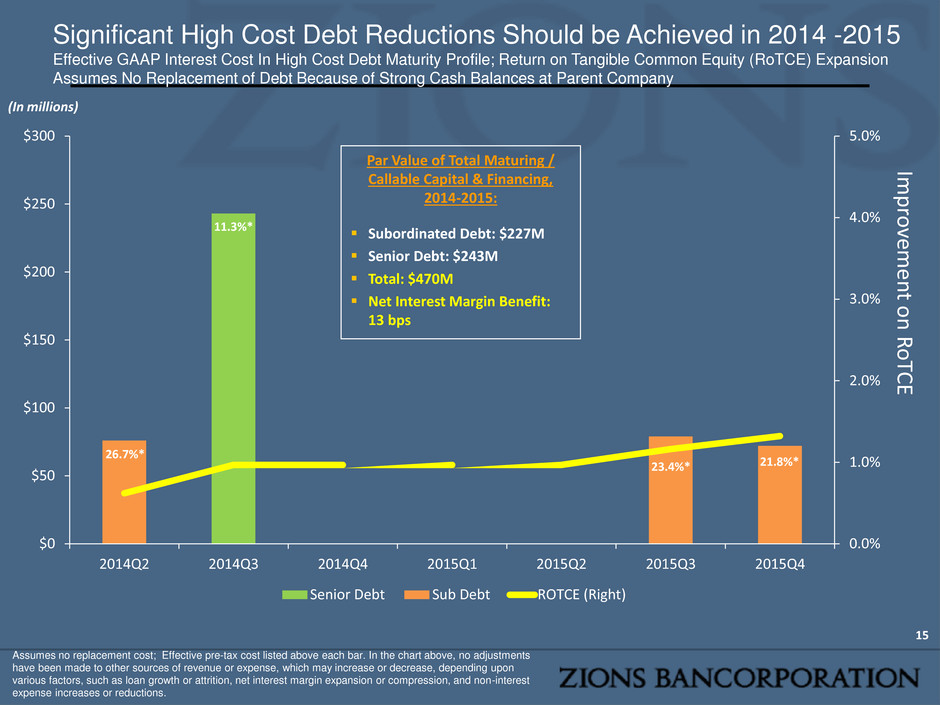

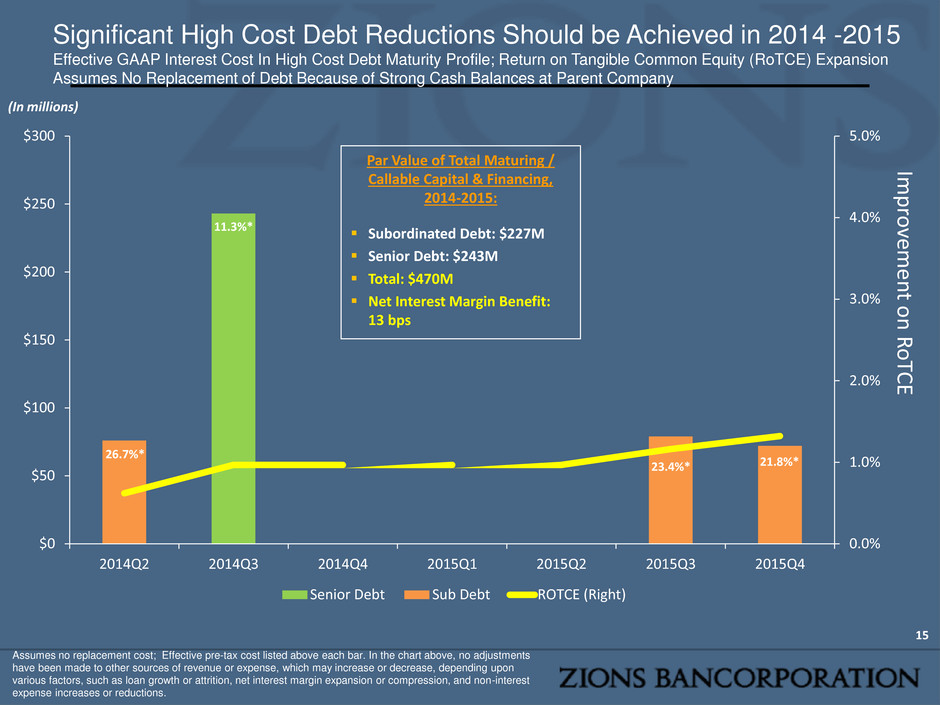

0.0% 1.0% 2.0% 3.0% 4.0% 5.0% $0 $50 $100 $150 $200 $250 $300 2014Q2 2014Q3 2014Q4 2015Q1 2015Q2 2015Q3 2015Q4 Senior Debt Sub Debt ROTCE (Right) Significant High Cost Debt Reductions Should be Achieved in 2014 -2015 Effective GAAP Interest Cost In High Cost Debt Maturity Profile; Return on Tangible Common Equity (RoTCE) Expansion Assumes No Replacement of Debt Because of Strong Cash Balances at Parent Company 15 (In millions) Par Value of Total Maturing / Callable Capital & Financing, 2014-2015: Subordinated Debt: $227M Senior Debt: $243M Total: $470M Net Interest Margin Benefit: 13 bps Im p ro vem e n t on R o TC E Assumes no replacement cost; Effective pre-tax cost listed above each bar. In the chart above, no adjustments have been made to other sources of revenue or expense, which may increase or decrease, depending upon various factors, such as loan growth or attrition, net interest margin expansion or compression, and non-interest expense increases or reductions. 26.7%* 11.3%* 23.4%* 21.8%*

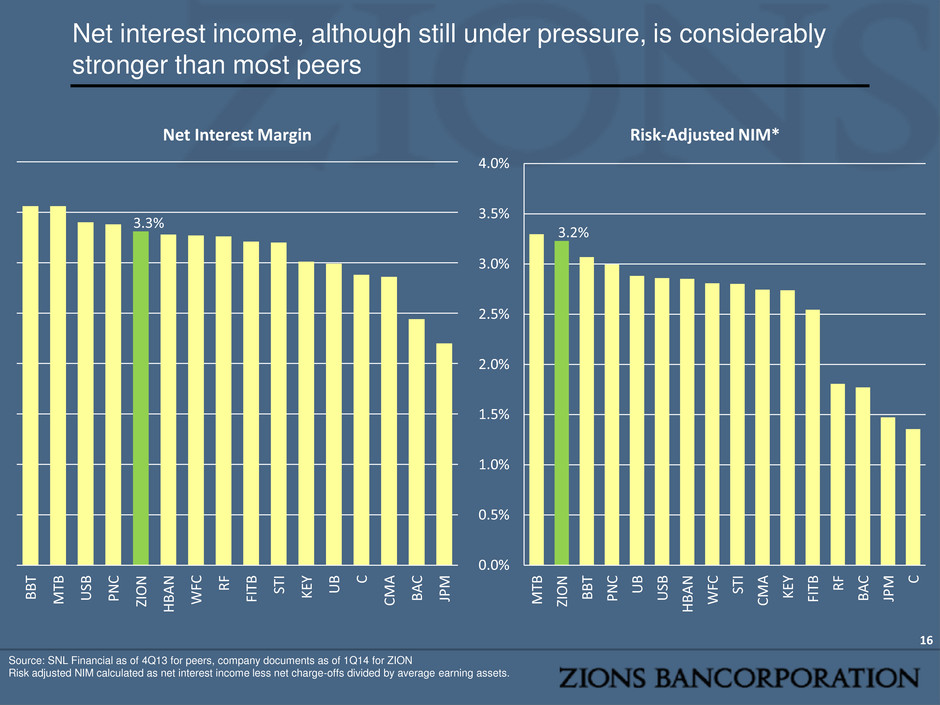

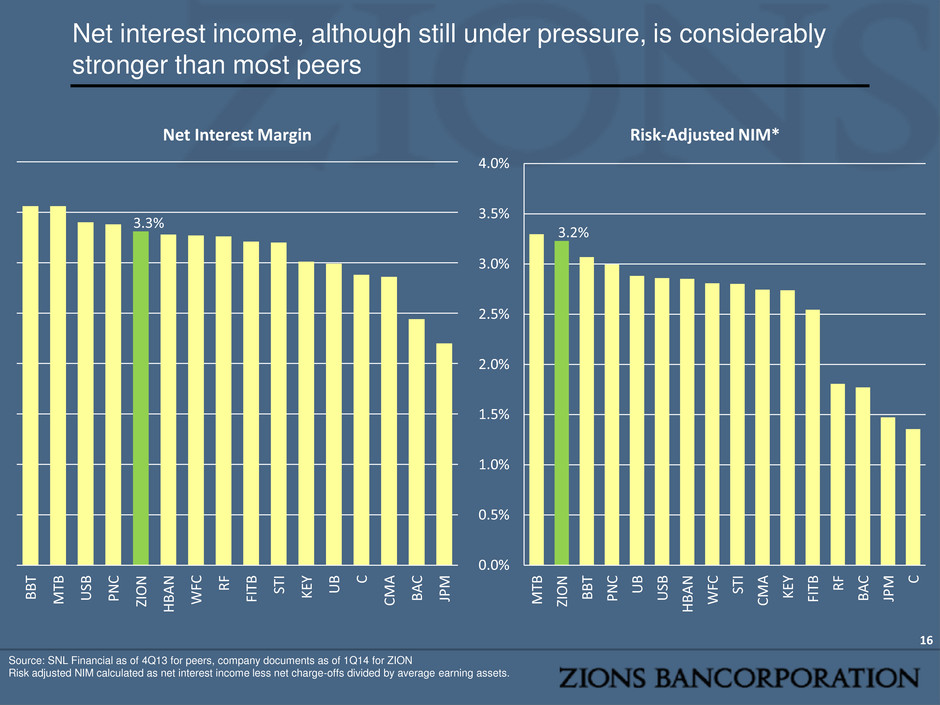

Source: SNL Financial as of 4Q13 for peers, company documents as of 1Q14 for ZION Risk adjusted NIM calculated as net interest income less net charge-offs divided by average earning assets. 16 Net interest income, although still under pressure, is considerably stronger than most peers 3.3% B B T M TB US B P N C ZIO N H B A N WF C R F FIT B ST I KE Y U B C CM A B A C JP M Net Interest Margin 3.2% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% M TB ZIO N B B T P N C U B US B H B A N WF C ST I CM A KE Y FIT B R F B A C JP M C Risk-Adjusted NIM*

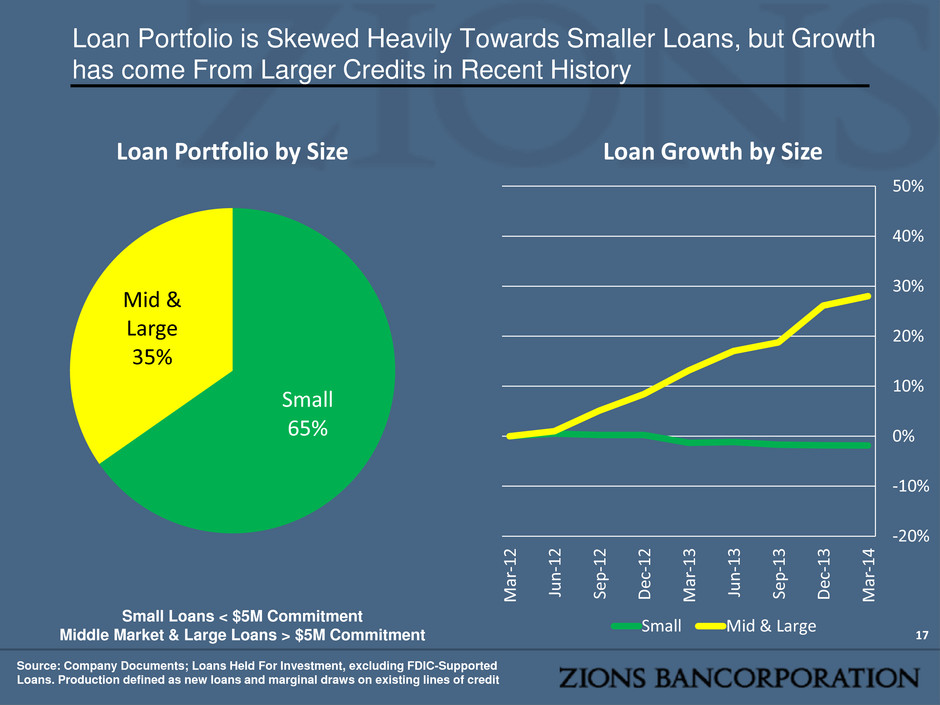

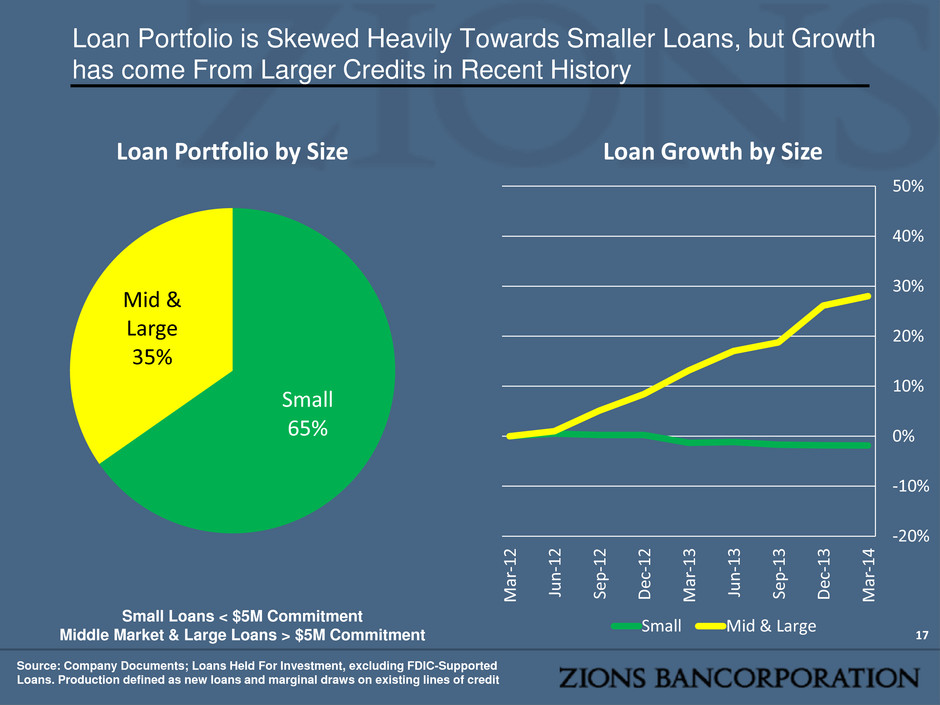

Loan Portfolio is Skewed Heavily Towards Smaller Loans, but Growth has come From Larger Credits in Recent History 17 Small Loans < $5M Commitment Middle Market & Large Loans > $5M Commitment Source: Company Documents; Loans Held For Investment, excluding FDIC-Supported Loans. Production defined as new loans and marginal draws on existing lines of credit Small 65% Mid & Large 35% Loan Portfolio by Size -20% -10% 0% 10% 20% 30% 40% 50% Ma r-1 2 Jun-1 2 Se p -1 2 D ec -1 2 Ma r-1 3 Jun-1 3 Se p -1 3 De c-1 3 Ma r-1 4 Loan Growth by Size Small Mid & Large

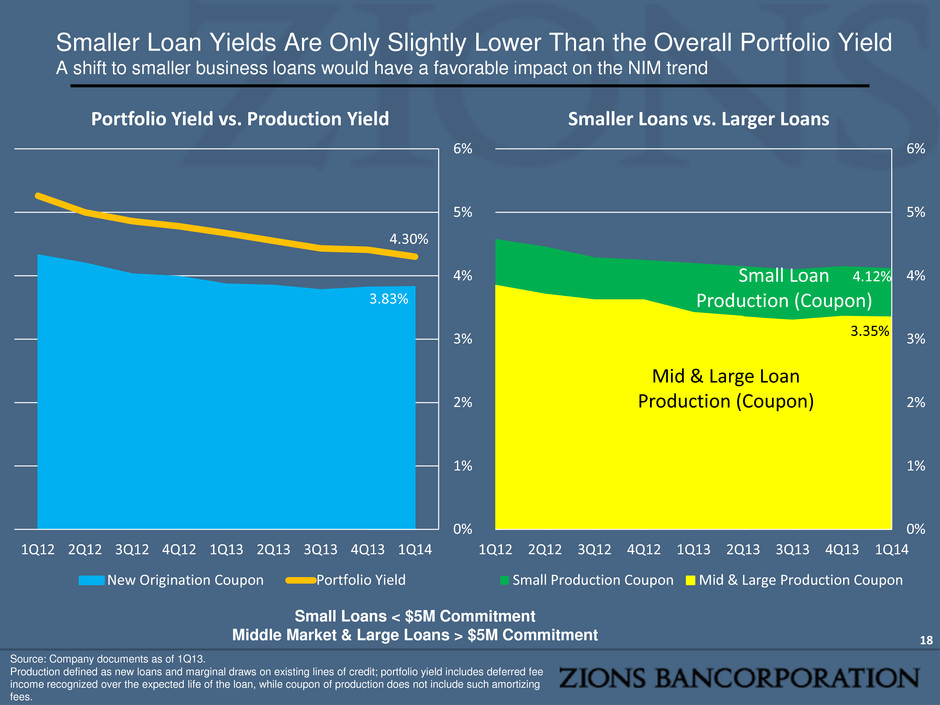

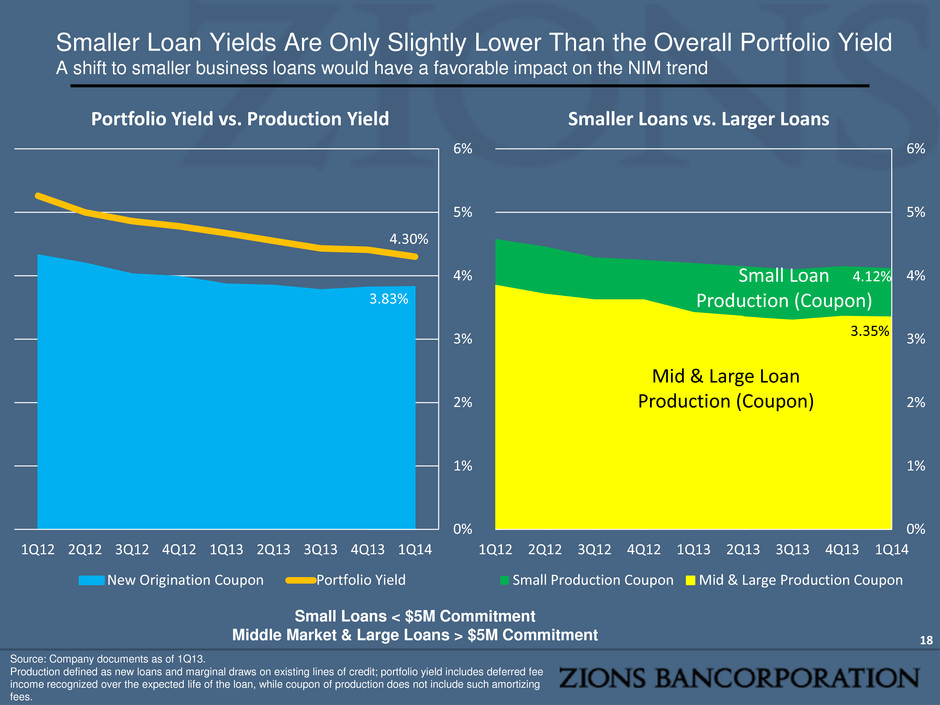

4.12% 3.35% 0% 1% 2% 3% 4% 5% 6% 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Smaller Loans vs. Larger Loans Small Production Coupon Mid & Large Production Coupon Smaller Loan Yields Are Only Slightly Lower Than the Overall Portfolio Yield A shift to smaller business loans would have a favorable impact on the NIM trend 18 Source: Company documents as of 1Q13. Production defined as new loans and marginal draws on existing lines of credit; portfolio yield includes deferred fee income recognized over the expected life of the loan, while coupon of production does not include such amortizing fees. Small Loans < $5M Commitment Middle Market & Large Loans > $5M Commitment Small Loan Production (Coupon) Mid & Large Loan Production (Coupon) 3.83% 4.30% 0% 1% 2% 3% 4% 5% 6% 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Portfolio Yield vs. Production Yield New Origination Coupon Portfolio Yield

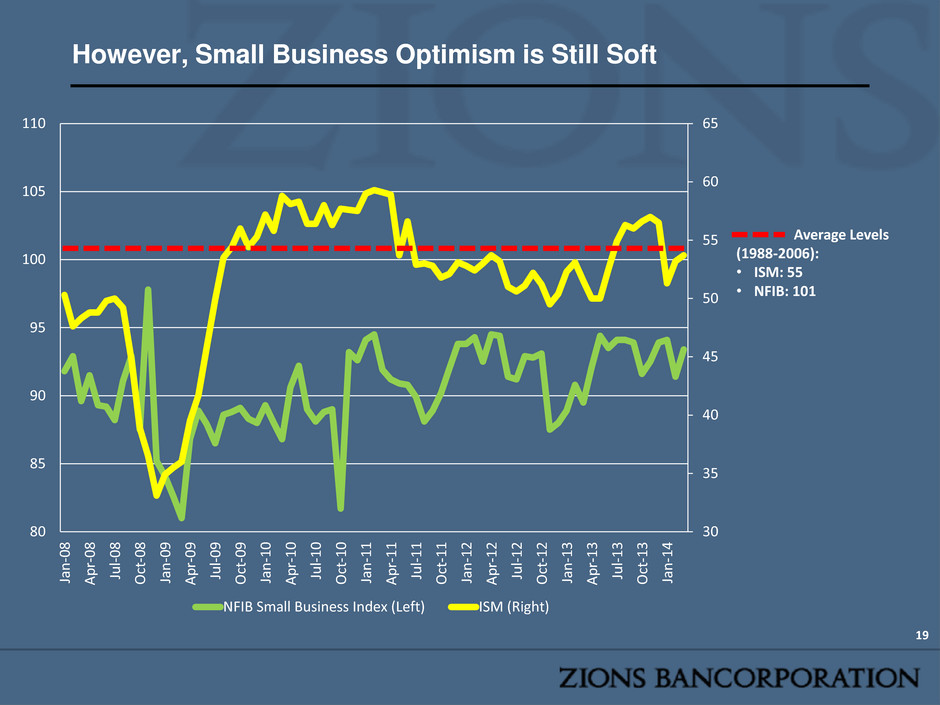

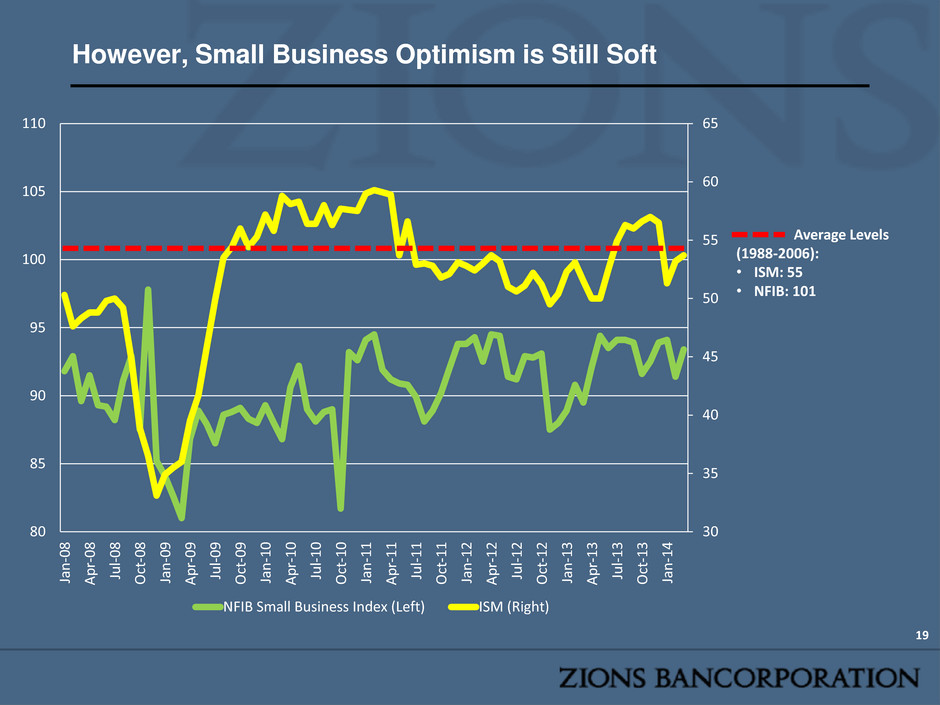

30 35 40 45 50 55 60 65 80 85 90 95 100 105 110 Ja n -0 8 A p r- 0 8 Ju l- 0 8 O ct -0 8 Ja n -0 9 A p r- 0 9 Ju l- 0 9 O ct -0 9 Ja n -1 0 A p r- 1 0 Ju l- 1 0 O ct -1 0 Ja n -1 1 A p r- 1 1 Ju l- 1 1 O ct -1 1 Ja n -1 2 A p r- 1 2 Ju l- 1 2 O ct -1 2 Ja n -1 3 A p r- 1 3 Ju l- 1 3 O ct -1 3 Ja n -1 4 NFIB Small Business Index (Left) ISM (Right) However, Small Business Optimism is Still Soft 19 Average Levels (1988-2006): • ISM: 55 • NFIB: 101

Drivers of Profitability: Fee Income Initiative • Zions has proportionately low fee income relative to peers • Long term fixes through organic growth, not major M&A • Areas Targeted for Growth: • Treasury Management • Business Credit Cards • Wealth Management • Mortgage • Growth focused within Zions’ footprint with relationship customers 20

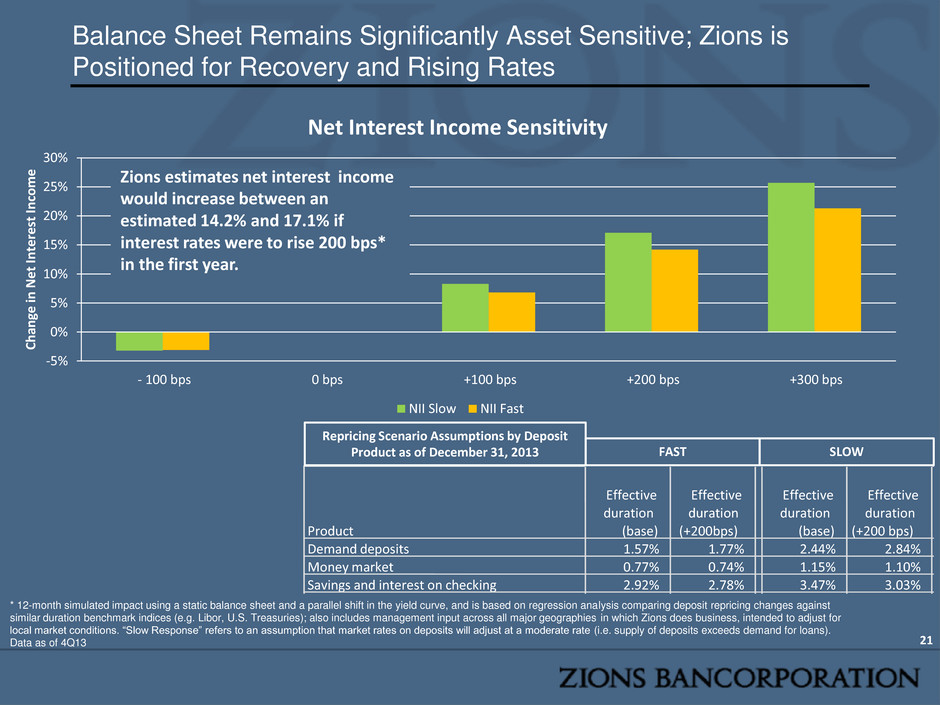

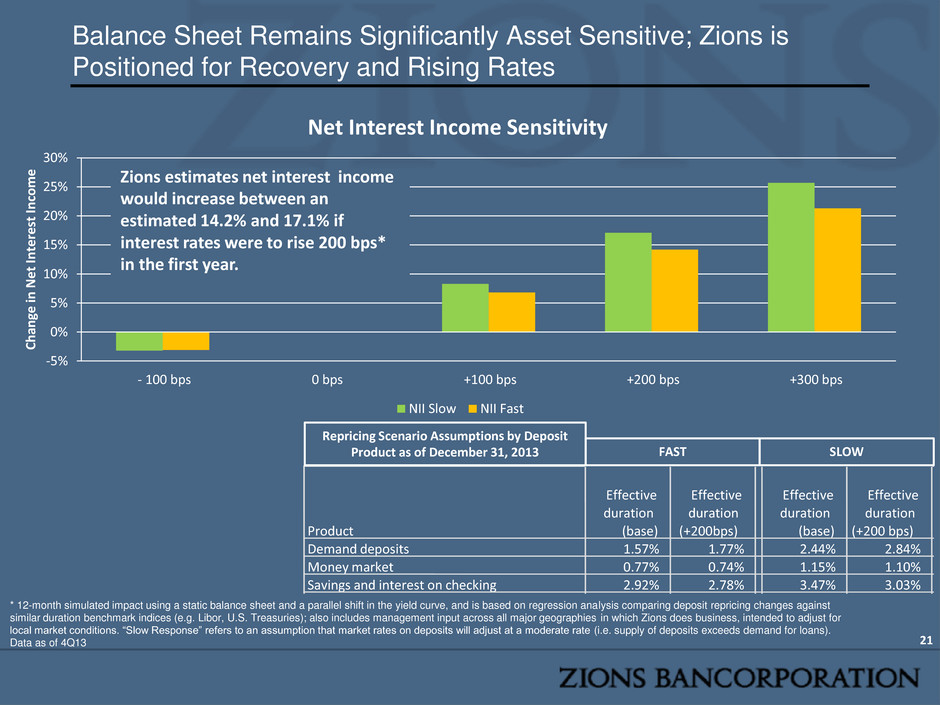

-5% 0% 5% 10% 15% 20% 25% 30% - 100 bps 0 bps +100 bps +200 bps +300 bps C h an ge in N e t In terest In co m e Net Interest Income Sensitivity NII Slow NII Fast Balance Sheet Remains Significantly Asset Sensitive; Zions is Positioned for Recovery and Rising Rates 21 Zions estimates net interest income would increase between an estimated 14.2% and 17.1% if interest rates were to rise 200 bps* in the first year. * 12-month simulated impact using a static balance sheet and a parallel shift in the yield curve, and is based on regression analysis comparing deposit repricing changes against similar duration benchmark indices (e.g. Libor, U.S. Treasuries); also includes management input across all major geographies in which Zions does business, intended to adjust for local market conditions. “Slow Response” refers to an assumption that market rates on deposits will adjust at a moderate rate (i.e. supply of deposits exceeds demand for loans). Data as of 4Q13 Product Effective duration (base) Effective duration (+200bps) Effective duration (base) Effective duration (+200 bps) Demand deposits 1.57% 1.77% 2.44% 2.84% Money market 0.77% 0.74% 1.15% 1.10% Savings and interest on checking 2.92% 2.78% 3.47% 3.03% Repricing Scenario Assumptions by Deposit Product as of December 31, 2013 FAST SLOW

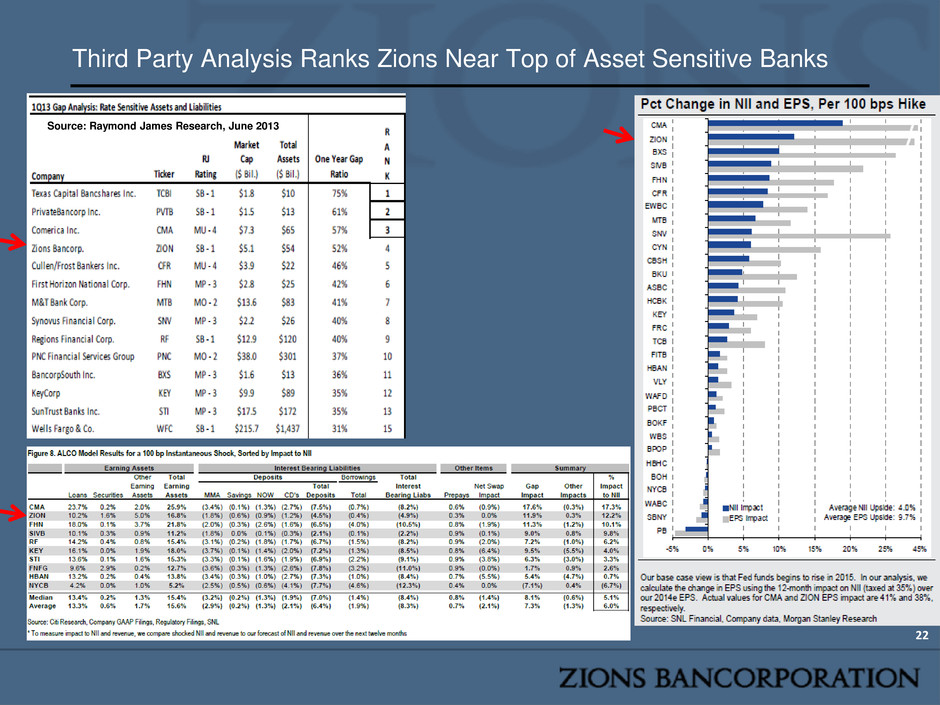

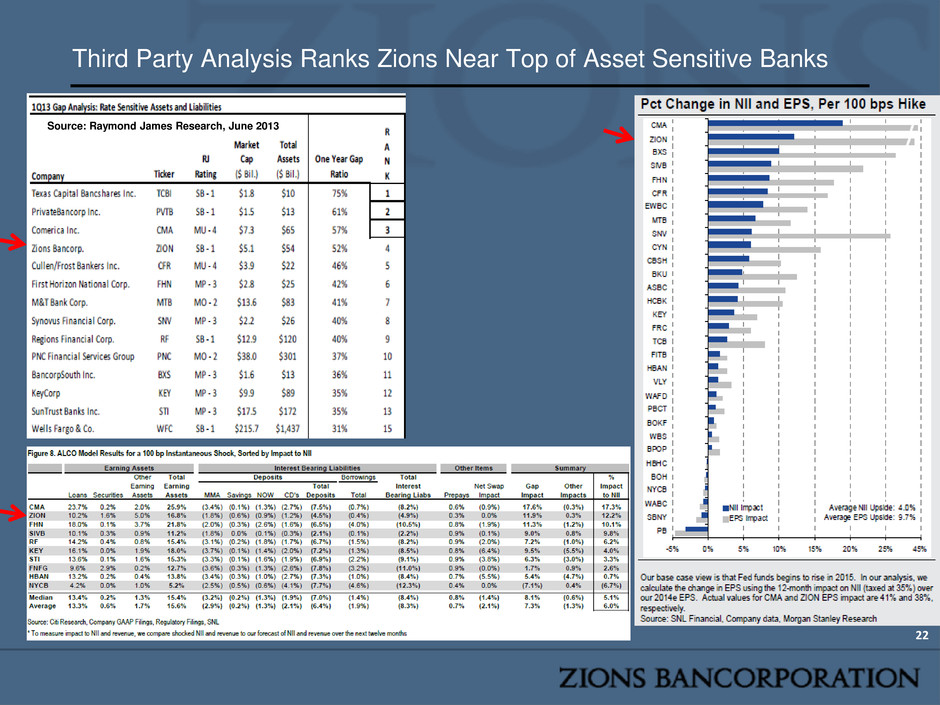

Third Party Analysis Ranks Zions Near Top of Asset Sensitive Banks 22 Source: Raymond James Research, June 2013

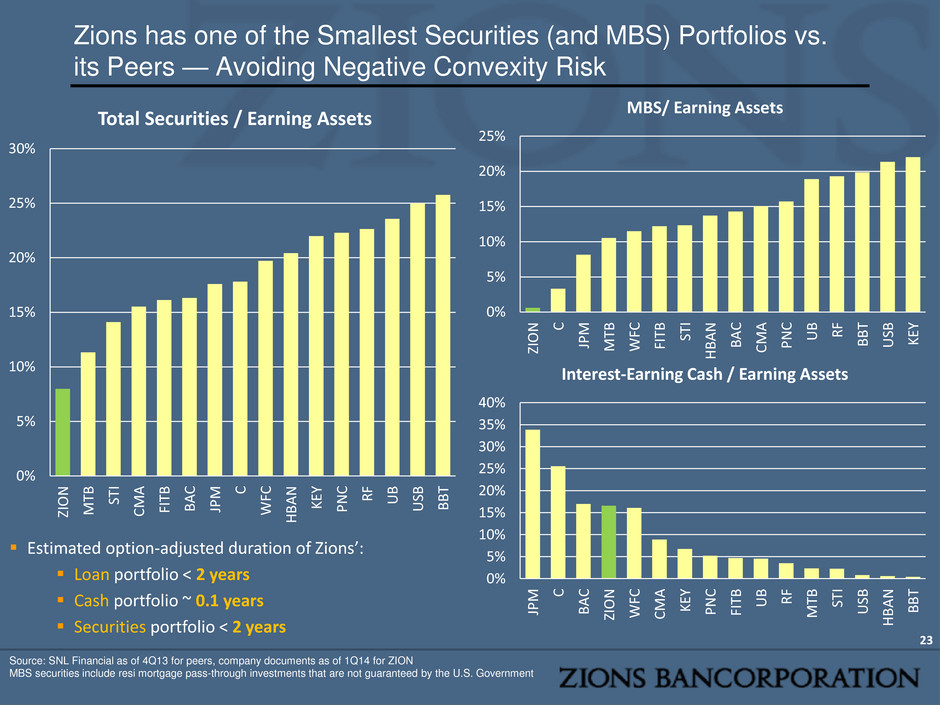

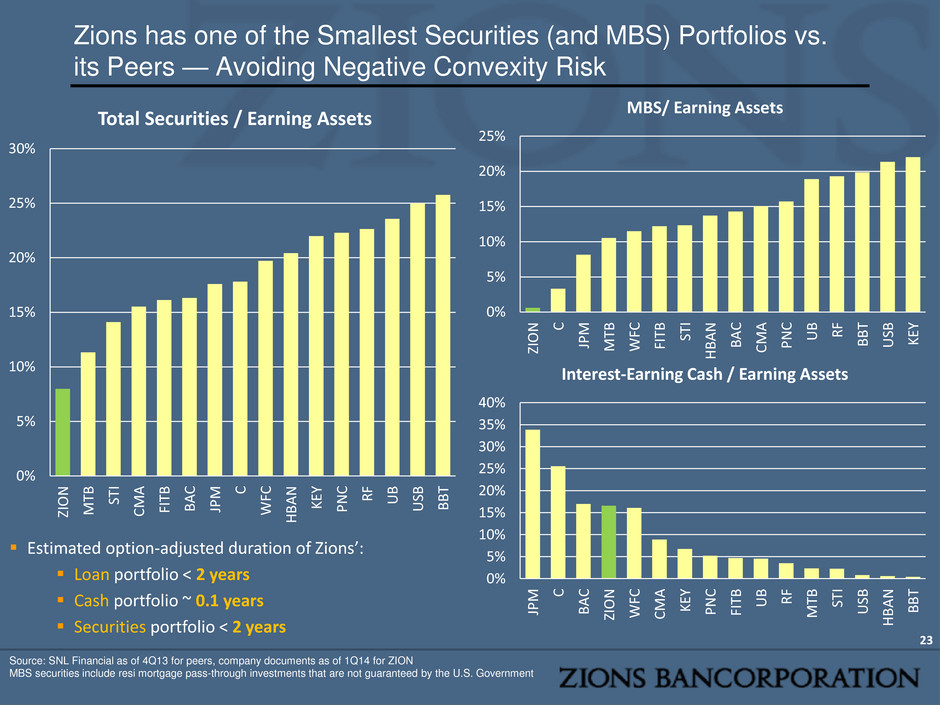

Zions has one of the Smallest Securities (and MBS) Portfolios vs. its Peers — Avoiding Negative Convexity Risk Source: SNL Financial as of 4Q13 for peers, company documents as of 1Q14 for ZION MBS securities include resi mortgage pass-through investments that are not guaranteed by the U.S. Government Estimated option-adjusted duration of Zions’: Loan portfolio < 2 years Cash portfolio ~ 0.1 years Securities portfolio < 2 years 23 0% 5% 10% 15% 20% 25% 30% ZIO N M TB ST I CM A FIT B B A C JP M C WF C H B A N KE Y P N C R F U B US B B B T Total Securities / Earning Assets 0% 5% 10% 15% 20% 25% ZIO N C JP M M TB WF C FIT B ST I H B A N B A C CM A P N C U B R F B B T US B KE Y MBS/ Earning Assets 0% 5% 10% 15% 20% 25% 30% 35% 40% JP M C B A C ZIO N WF C CM A KE Y P N C FIT B U B R F M TB ST I US B H B A N B B T Interest-Earning Cash / Earning Assets

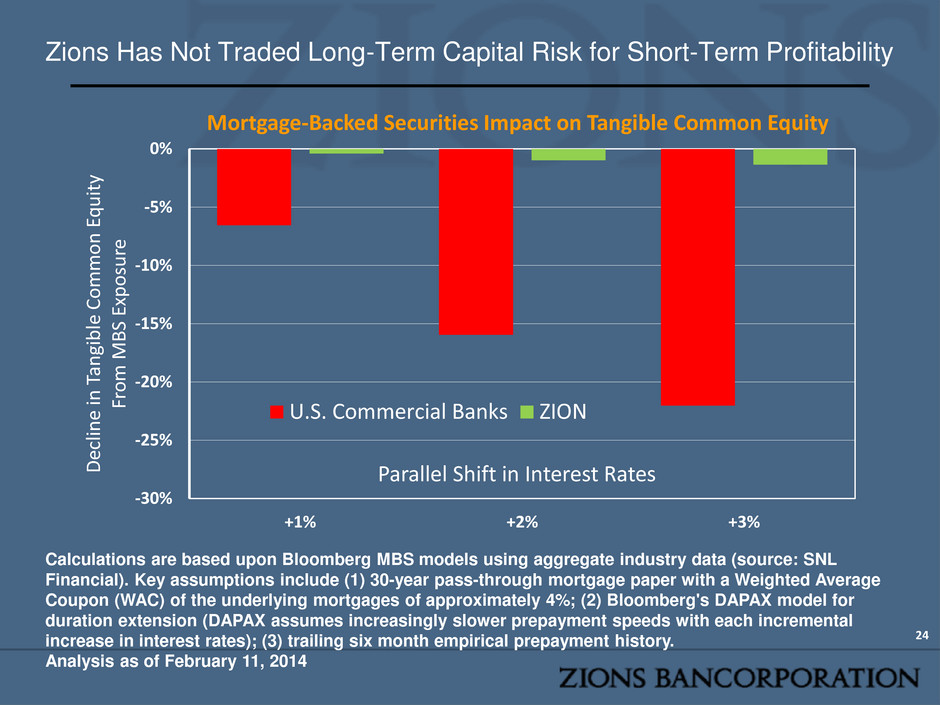

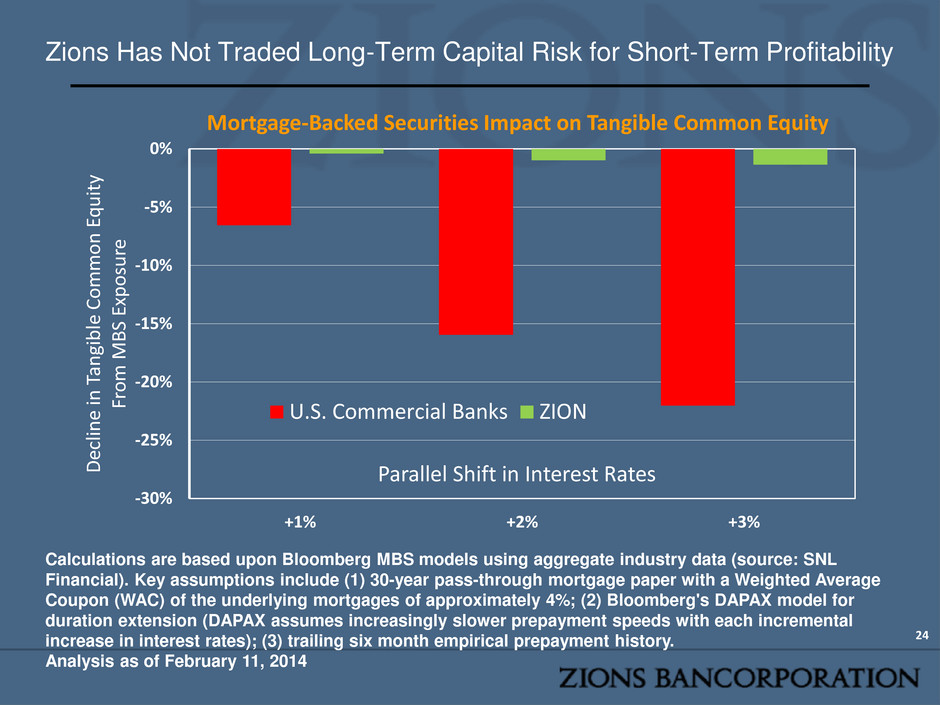

Zions Has Not Traded Long-Term Capital Risk for Short-Term Profitability 24 -30% -25% -20% -15% -10% -5% 0% +1% +2% +3% Decl ine i n T an gi b le Com m on E qu it y Fr om MBS Ex p osu re Parallel Shift in Interest Rates Mortgage-Backed Securities Impact on Tangible Common Equity U.S. Commercial Banks ZION Calculations are based upon Bloomberg MBS models using aggregate industry data (source: SNL Financial). Key assumptions include (1) 30-year pass-through mortgage paper with a Weighted Average Coupon (WAC) of the underlying mortgages of approximately 4%; (2) Bloomberg's DAPAX model for duration extension (DAPAX assumes increasingly slower prepayment speeds with each incremental increase in interest rates); (3) trailing six month empirical prepayment history. Analysis as of February 11, 2014

• Capital levels and credit quality are in line with or stronger than peers. • CDO sales have materially reduced risk. • Profitability has improved, but is not yet restored. Zions is well positioned for continued recovery and rising interest rates. • Zions’ DFAST stress test “failure” was the unanticipated result of Federal Reserve Pre- Provision Net Revenue projection. Approximately $400 million common equity raise may be needed. • Updated Outlook 25

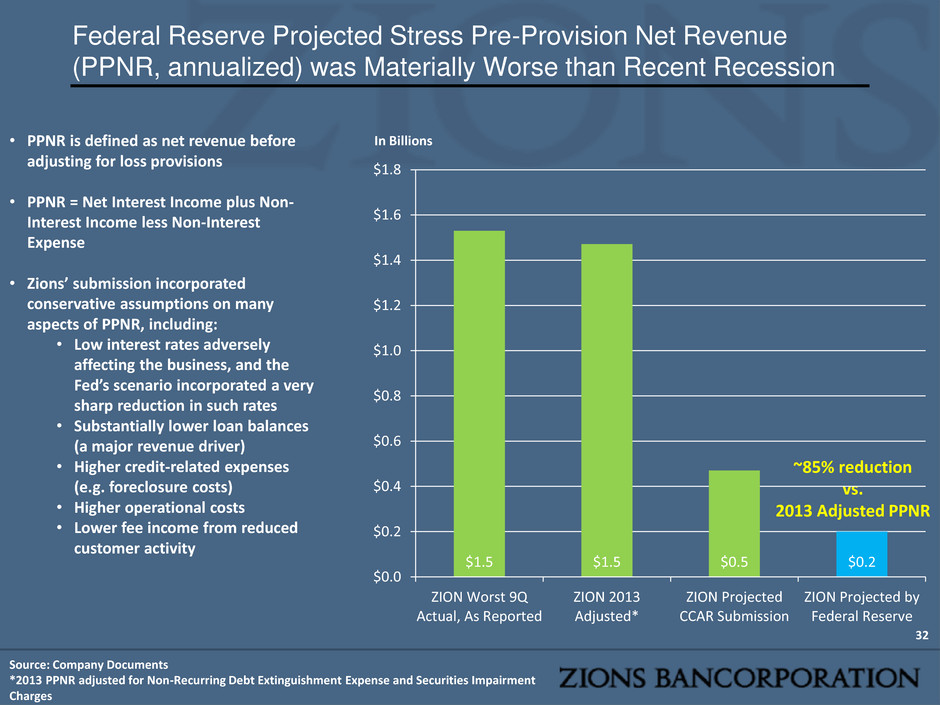

Significant Variances Between Zions and Federal Reserve Models There were two major variances between Zions’ Projections in its 2014 Comprehensive Capital Adequacy and Review (CCAR) Submission and the Federal Reserves’ Projections for Zions in that same hypothetical scenario and when compared to the recent severe recession 1. Loss rates on loans — results were similar to other CCAR banks but significantly greater than actual experience in the recent recession 2. Earnings generated over the hypothetical stress test period — very different than other CCAR banks and significantly lower than Zions’ actual experience in the recent recession 26

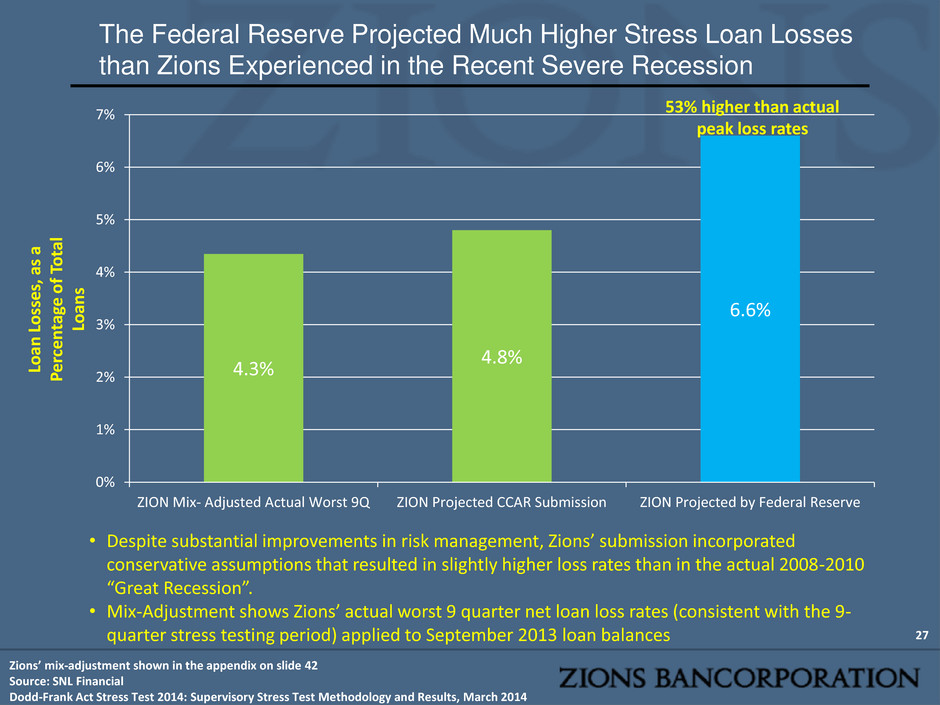

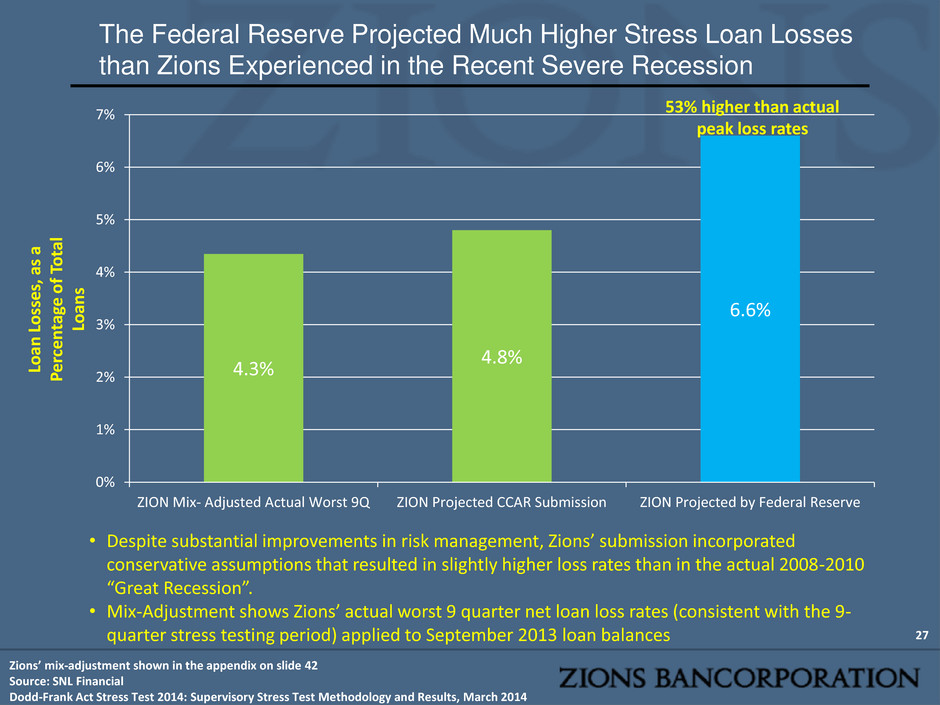

The Federal Reserve Projected Much Higher Stress Loan Losses than Zions Experienced in the Recent Severe Recession 27 4.3% 4.8% 6.6% 0% 1% 2% 3% 4% 5% 6% 7% ZION Mix- Adjusted Actual Worst 9Q ZION Projected CCAR Submission ZION Projected by Federal Reserve Zions’ mix-adjustment shown in the appendix on slide 42 Source: SNL Financial Dodd-Frank Act Stress Test 2014: Supervisory Stress Test Methodology and Results, March 2014 53% higher than actual peak loss rates • Despite substantial improvements in risk management, Zions’ submission incorporated conservative assumptions that resulted in slightly higher loss rates than in the actual 2008-2010 “Great Recession”. • Mix-Adjustment shows Zions’ actual worst 9 quarter net loan loss rates (consistent with the 9- quarter stress testing period) applied to September 2013 loan balances Loa n L o ss e s, a s a P e rce n ta ge of T o ta l Loa n s

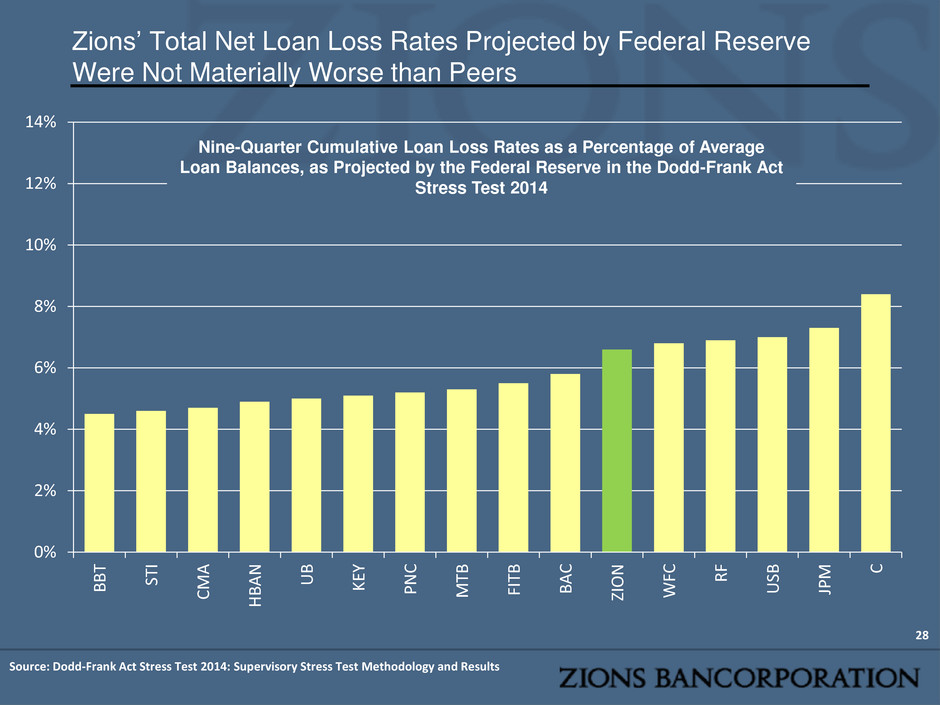

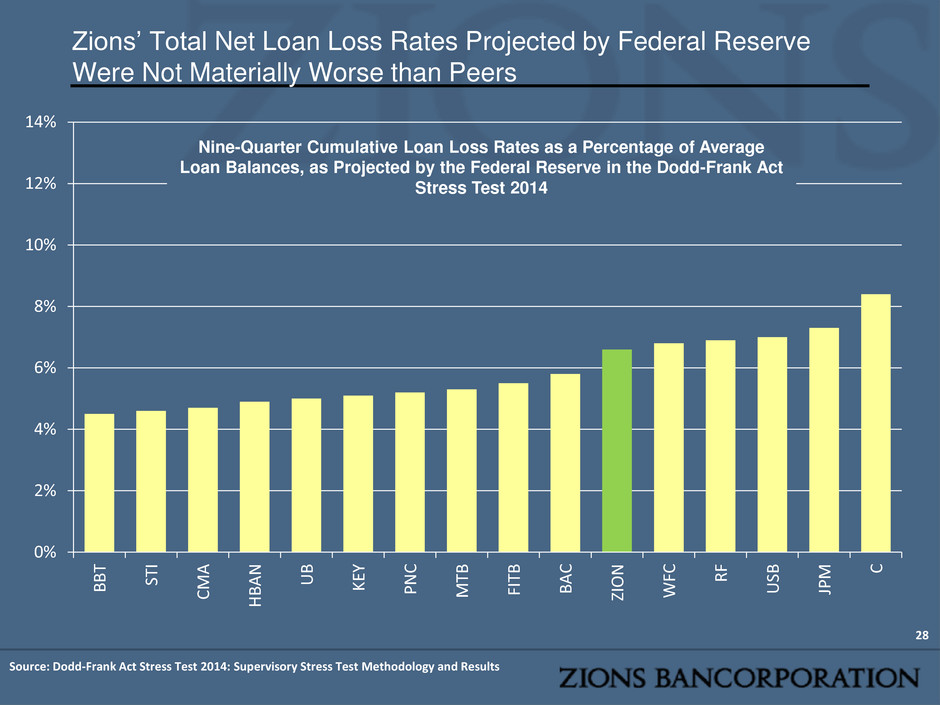

Zions’ Total Net Loan Loss Rates Projected by Federal Reserve Were Not Materially Worse than Peers 28 Source: Dodd-Frank Act Stress Test 2014: Supervisory Stress Test Methodology and Results 0% 2% 4% 6% 8% 10% 12% 14% B B T ST I C M A H B A N U B KE Y P N C M TB FI TB B A C ZI O N W FC R F U SB JP M C Nine-Quarter Cumulative Loan Loss Rates as a Percentage of Average Loan Balances, as Projected by the Federal Reserve in the Dodd-Frank Act Stress Test 2014

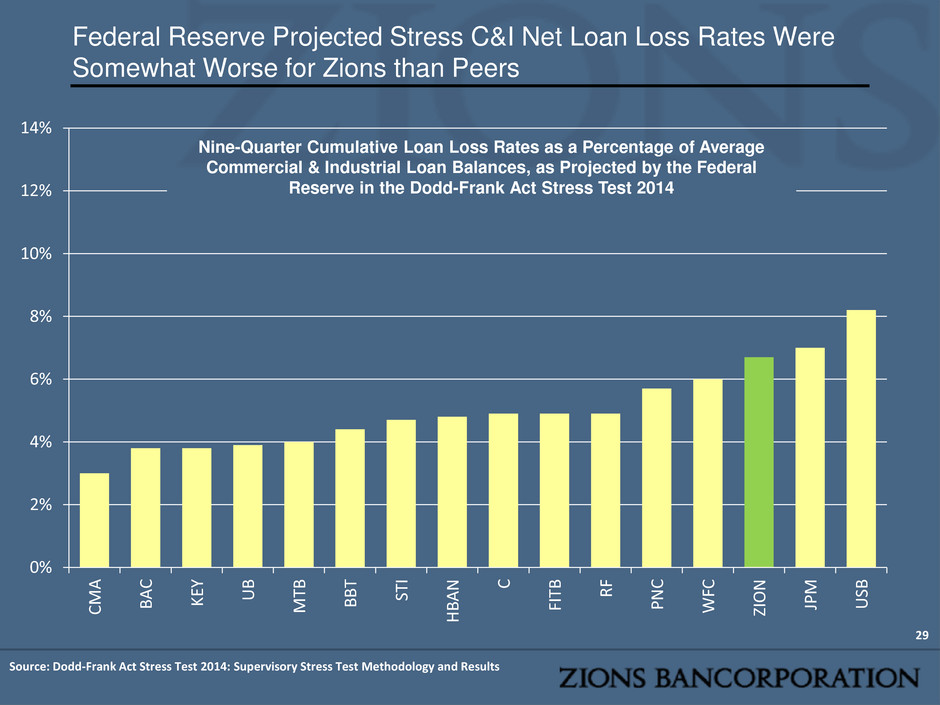

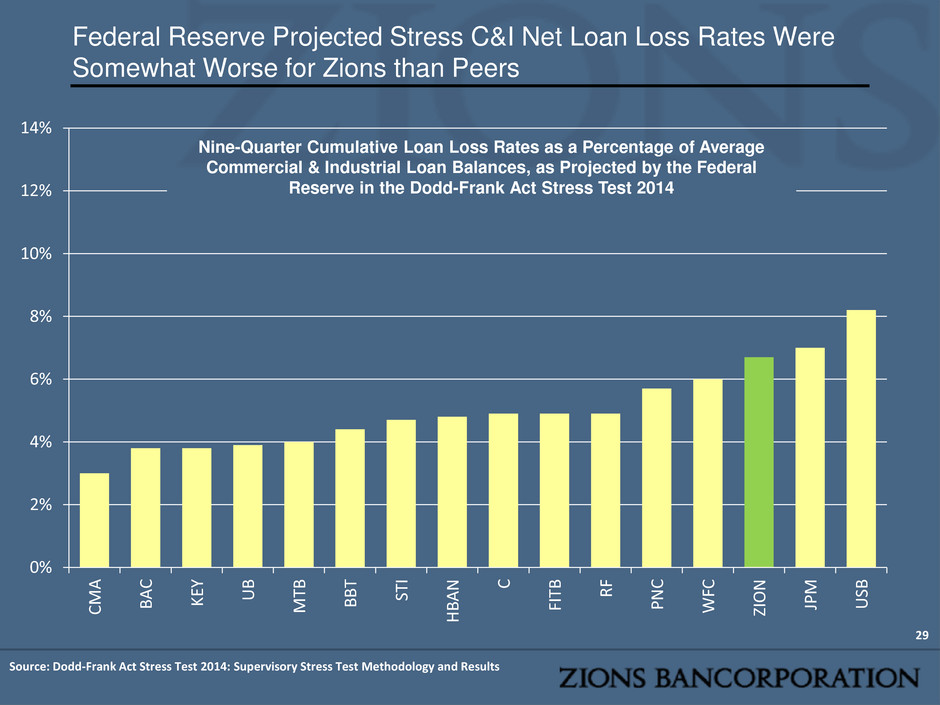

Federal Reserve Projected Stress C&I Net Loan Loss Rates Were Somewhat Worse for Zions than Peers 29 Source: Dodd-Frank Act Stress Test 2014: Supervisory Stress Test Methodology and Results 0% 2% 4% 6% 8% 10% 12% 14% C M A B A C KE Y U B M TB B B T ST I H B A N C FIT B R F P N C W FC ZI O N JP M U SB Nine-Quarter Cumulative Loan Loss Rates as a Percentage of Average Commercial & Industrial Loan Balances, as Projected by the Federal Reserve in the Dodd-Frank Act Stress Test 2014

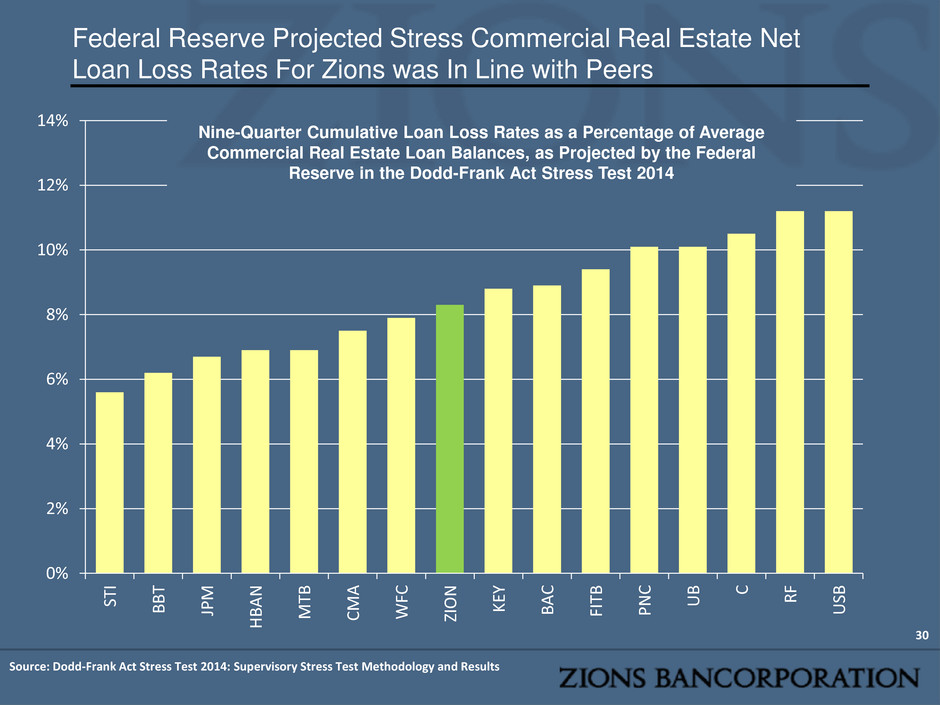

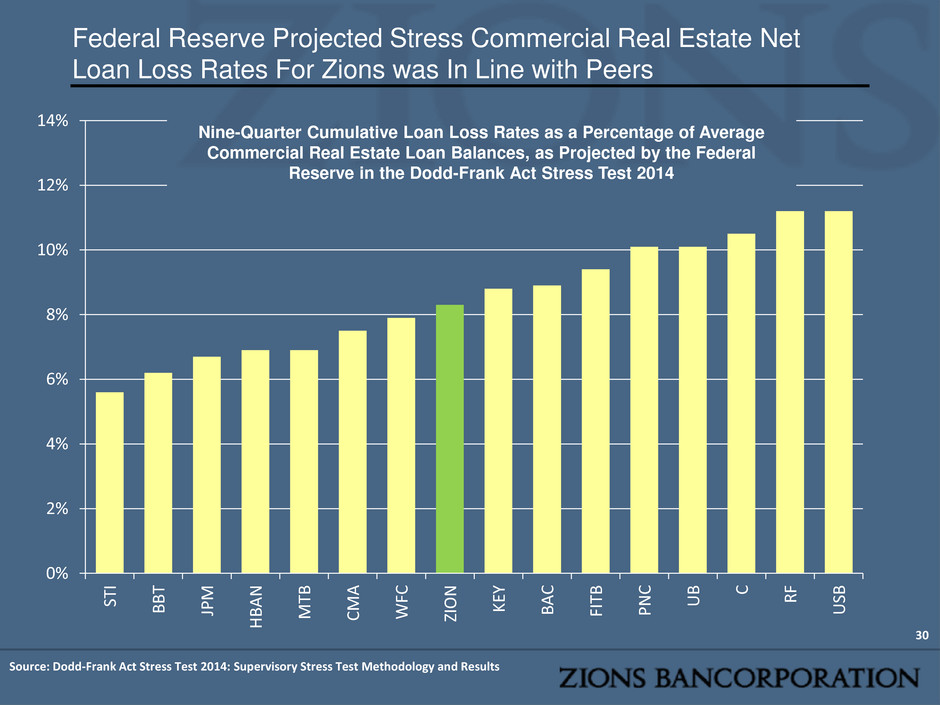

Federal Reserve Projected Stress Commercial Real Estate Net Loan Loss Rates For Zions was In Line with Peers 30 Source: Dodd-Frank Act Stress Test 2014: Supervisory Stress Test Methodology and Results 0% 2% 4% 6% 8% 10% 12% 14% ST I B B T JP M H B A N M TB C M A W FC ZI O N KE Y B A C FIT B P N C U B C R F U SB Nine-Quarter Cumulative Loan Loss Rates as a Percentage of Average Commercial Real Estate Loan Balances, as Projected by the Federal Reserve in the Dodd-Frank Act Stress Test 2014

Federal Reserve Projected Stress Mortgage Net Loan Loss Rates Were Materially Better for Zions than for Peers. 31 Source: Dodd-Frank Act Stress Test 2014: Supervisory Stress Test Methodology and Results 0% 2% 4% 6% 8% 10% 12% 14% ZI O N P N C B B T U SB U B M TB H B A N KE Y C M A ST I B A C FIT B R F JP M W FC C First Lien Mortgages 0% 2% 4% 6% 8% 10% 12% 14% U B B B T P N C ZI O N KE Y C M A H B A N U SB M TB FIT B ST I R F W FC B A C JP M C Junior Liens and HELOCs Nine-Quarter Cumulative Loan Loss Rates as a Percentage of Average First Lien Residential Loan Balances, as Projected by the Federal Reserve in the Dodd-Frank Act Stress Test 2014 Nine-Quarter Cumulative Loan Loss Rates as a Percentage of Average Junior Lien & Home Equity Loan Balances, as Projected by the Federal Reserve in the Dodd-Frank Act Stress Test 2014

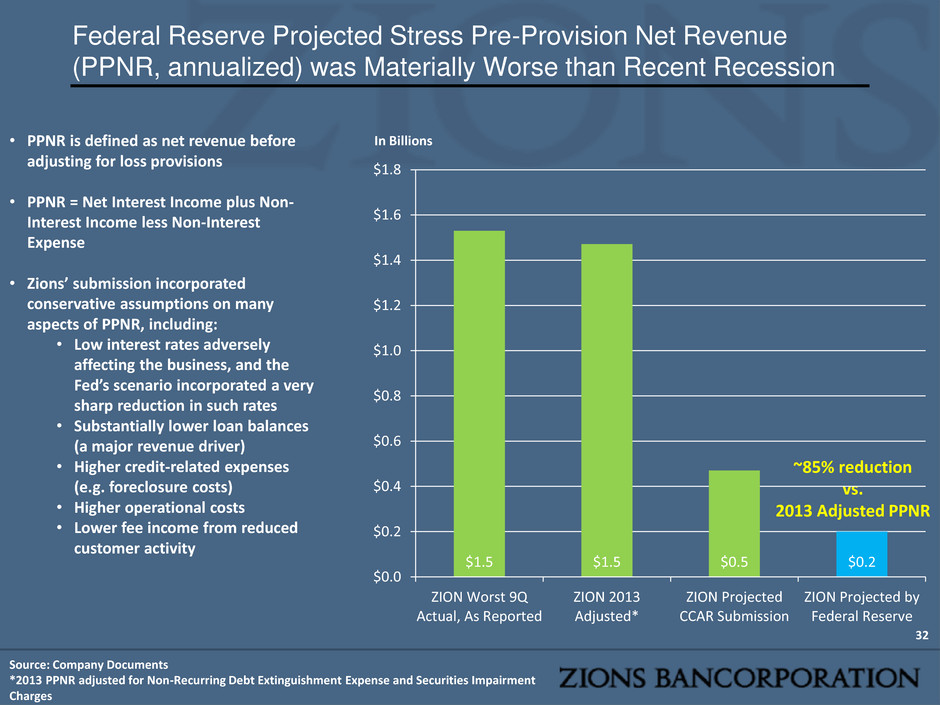

Federal Reserve Projected Stress Pre-Provision Net Revenue (PPNR, annualized) was Materially Worse than Recent Recession 32 In Billions Source: Company Documents *2013 PPNR adjusted for Non-Recurring Debt Extinguishment Expense and Securities Impairment Charges • PPNR is defined as net revenue before adjusting for loss provisions • PPNR = Net Interest Income plus Non- Interest Income less Non-Interest Expense • Zions’ submission incorporated conservative assumptions on many aspects of PPNR, including: • Low interest rates adversely affecting the business, and the Fed’s scenario incorporated a very sharp reduction in such rates • Substantially lower loan balances (a major revenue driver) • Higher credit-related expenses (e.g. foreclosure costs) • Higher operational costs • Lower fee income from reduced customer activity ~85% reduction vs. 2013 Adjusted PPNR $1.5 $1.5 $0.5 $0.2 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 $1.8 ZION Worst 9Q Actual, As Reported ZION 2013 Adjusted* ZION Projected CCAR Submission ZION Projected by Federal Reserve

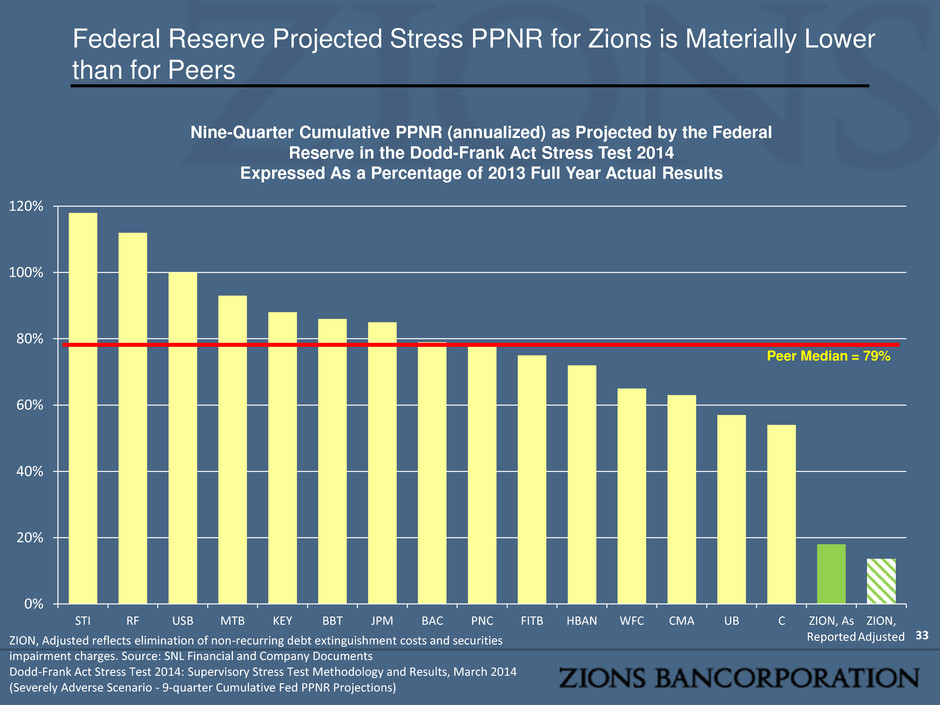

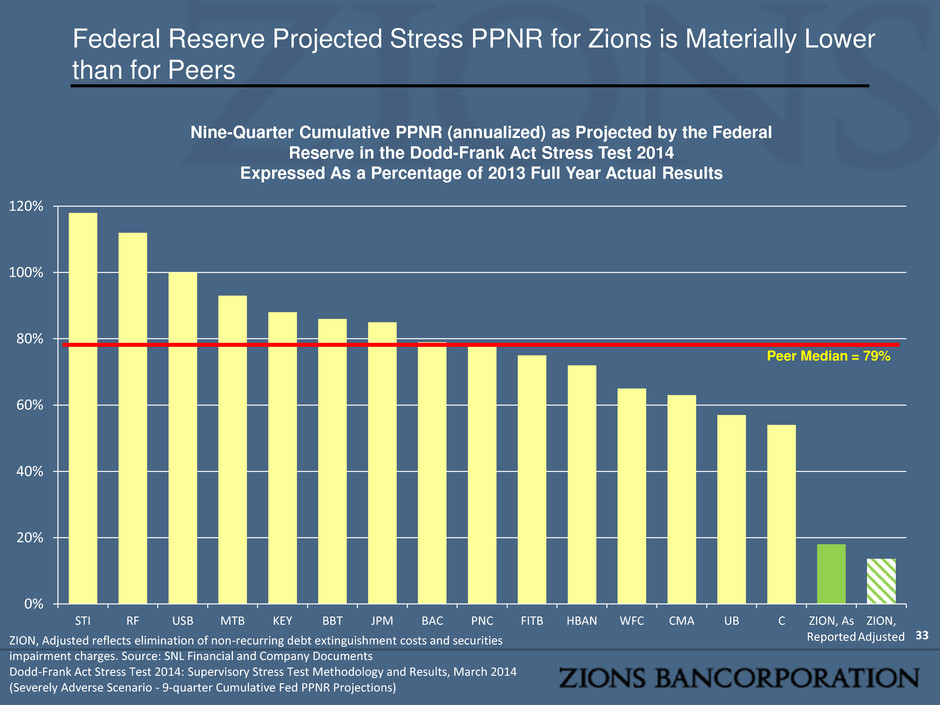

0% 20% 40% 60% 80% 100% 120% STI RF USB MTB KEY BBT JPM BAC PNC FITB HBAN WFC CMA UB C ZION, As Reported ZION, Adjusted Federal Reserve Projected Stress PPNR for Zions is Materially Lower than for Peers 33 ZION, Adjusted reflects elimination of non-recurring debt extinguishment costs and securities impairment charges. Source: SNL Financial and Company Documents Dodd-Frank Act Stress Test 2014: Supervisory Stress Test Methodology and Results, March 2014 (Severely Adverse Scenario - 9-quarter Cumulative Fed PPNR Projections) Peer Median = 79% Nine-Quarter Cumulative PPNR (annualized) as Projected by the Federal Reserve in the Dodd-Frank Act Stress Test 2014 Expressed As a Percentage of 2013 Full Year Actual Results

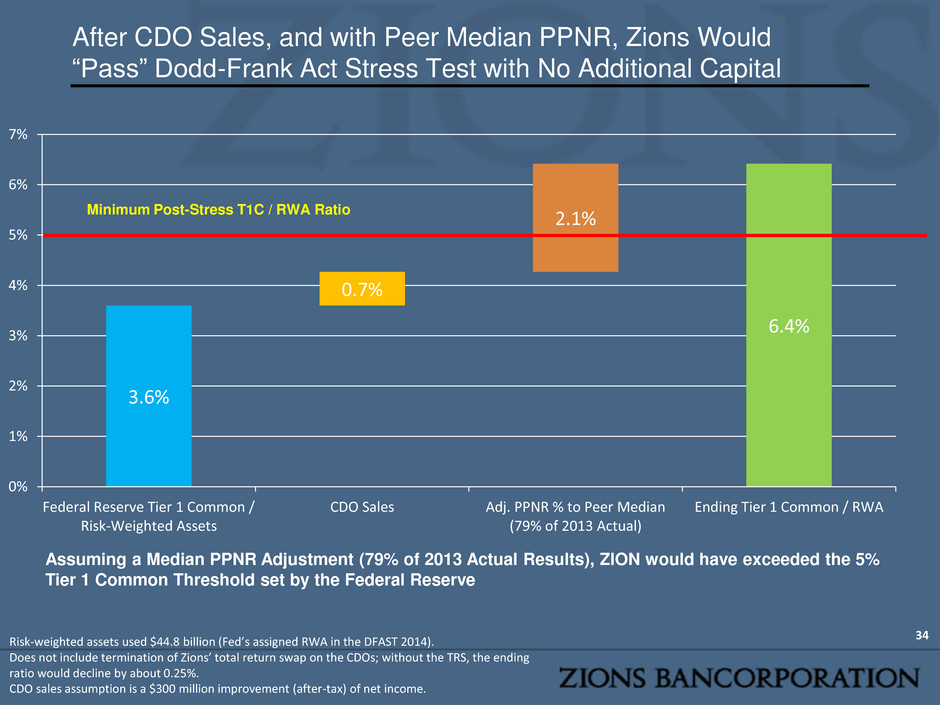

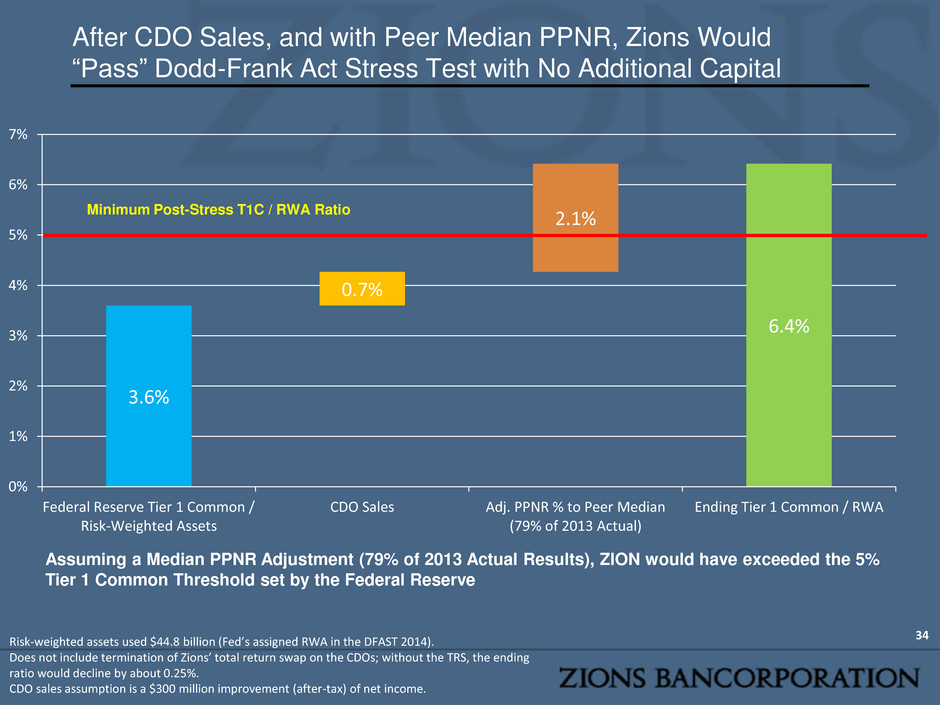

3.6% 0.7% 2.1% 6.4% 0% 1% 2% 3% 4% 5% 6% 7% Federal Reserve Tier 1 Common / Risk-Weighted Assets CDO Sales Adj. PPNR % to Peer Median (79% of 2013 Actual) Ending Tier 1 Common / RWA After CDO Sales, and with Peer Median PPNR, Zions Would “Pass” Dodd-Frank Act Stress Test with No Additional Capital 34 Minimum Post-Stress T1C / RWA Ratio Risk-weighted assets used $44.8 billion (Fed’s assigned RWA in the DFAST 2014). Does not include termination of Zions’ total return swap on the CDOs; without the TRS, the ending ratio would decline by about 0.25%. CDO sales assumption is a $300 million improvement (after-tax) of net income. Assuming a Median PPNR Adjustment (79% of 2013 Actual Results), ZION would have exceeded the 5% Tier 1 Common Threshold set by the Federal Reserve

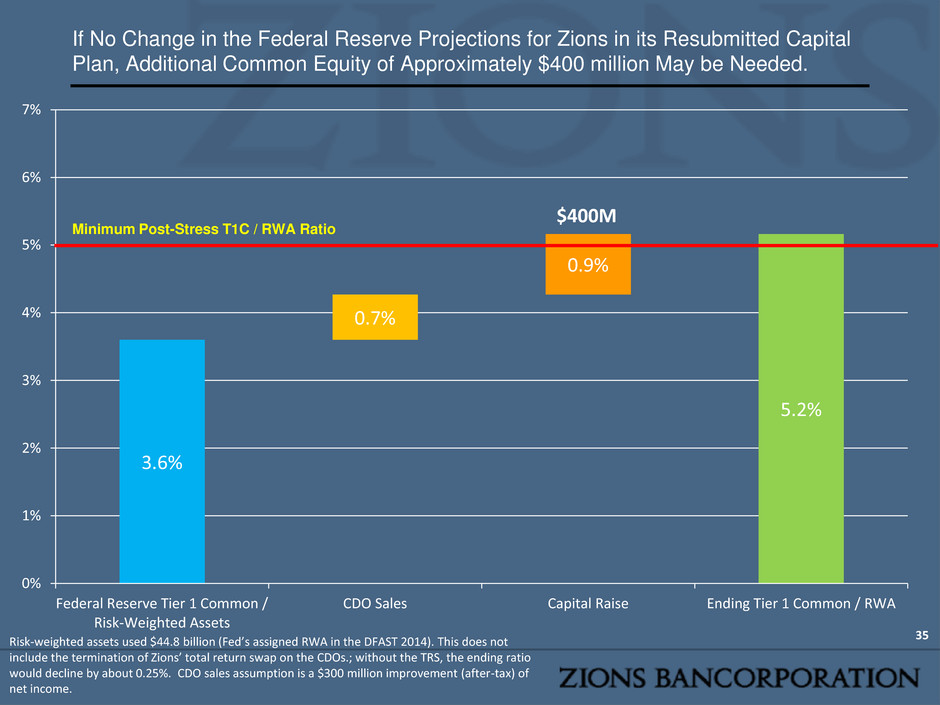

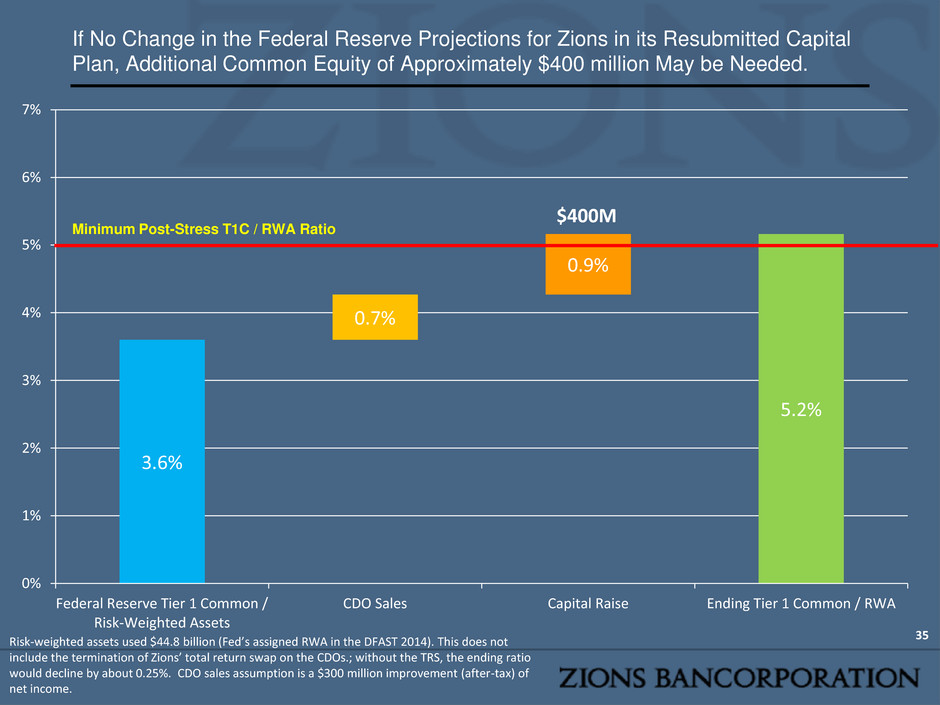

3.6% 0.7% 0.9% 5.2% 0% 1% 2% 3% 4% 5% 6% 7% Federal Reserve Tier 1 Common / Risk-Weighted Assets CDO Sales Capital Raise Ending Tier 1 Common / RWA If No Change in the Federal Reserve Projections for Zions in its Resubmitted Capital Plan, Additional Common Equity of Approximately $400 million May be Needed. 35 Minimum Post-Stress T1C / RWA Ratio $400M Risk-weighted assets used $44.8 billion (Fed’s assigned RWA in the DFAST 2014). This does not include the termination of Zions’ total return swap on the CDOs.; without the TRS, the ending ratio would decline by about 0.25%. CDO sales assumption is a $300 million improvement (after-tax) of net income.

• Capital levels and credit quality are in line with or stronger than peers. • CDO sales have materially reduced risk. • Profitability has improved, but is not yet restored. Zions is well positioned for continued recovery and rising interest rates. • Zions’ DFAST stress test “failure” was the unanticipated result of Federal Reserve Pre- Provision Net Revenue projection. Approximately $400 million common equity raise may be needed. • Updated Outlook 36

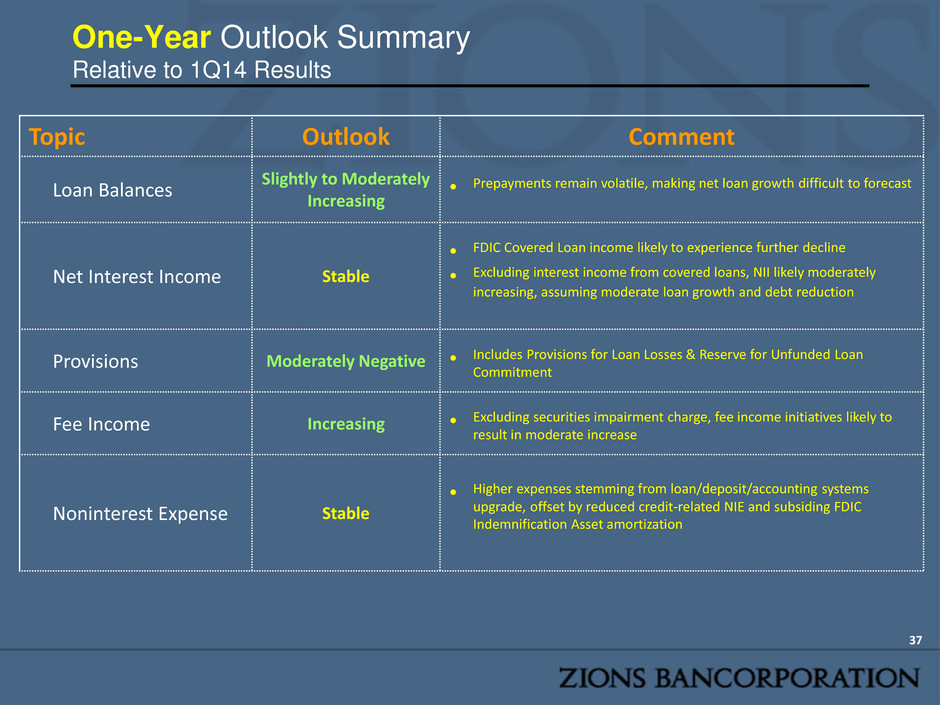

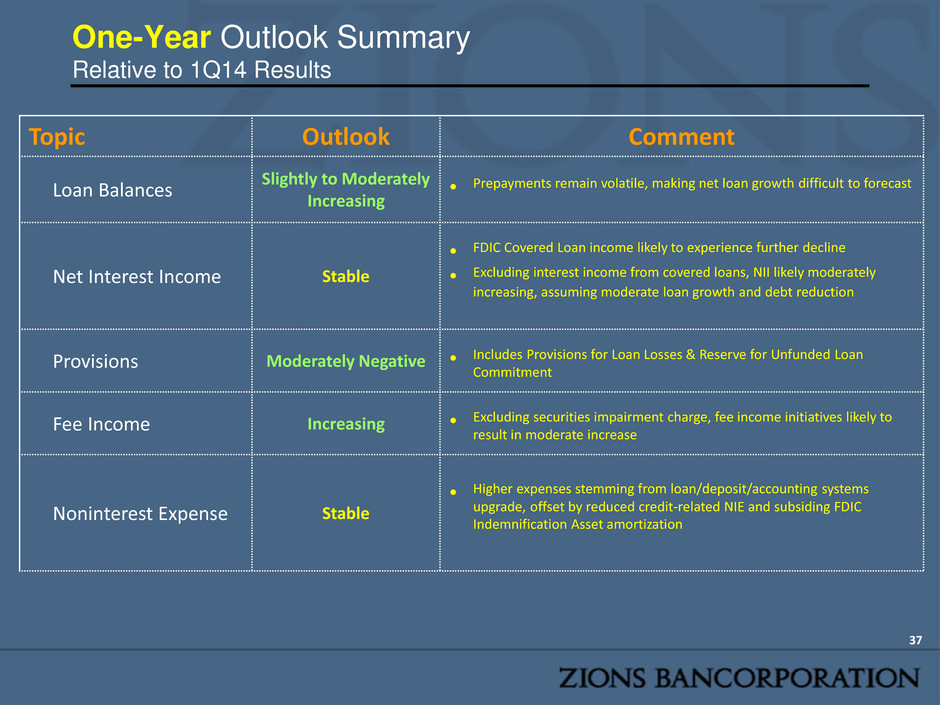

Topic Outlook Comment Loan Balances Slightly to Moderately Increasing • Prepayments remain volatile, making net loan growth difficult to forecast Net Interest Income Stable • FDIC Covered Loan income likely to experience further decline • Excluding interest income from covered loans, NII likely moderately increasing, assuming moderate loan growth and debt reduction Provisions Moderately Negative • Includes Provisions for Loan Losses & Reserve for Unfunded Loan Commitment Fee Income Increasing • Excluding securities impairment charge, fee income initiatives likely to result in moderate increase Noninterest Expense Stable • Higher expenses stemming from loan/deposit/accounting systems upgrade, offset by reduced credit-related NIE and subsiding FDIC Indemnification Asset amortization One-Year Outlook Summary Relative to 1Q14 Results 37

Appendix 38

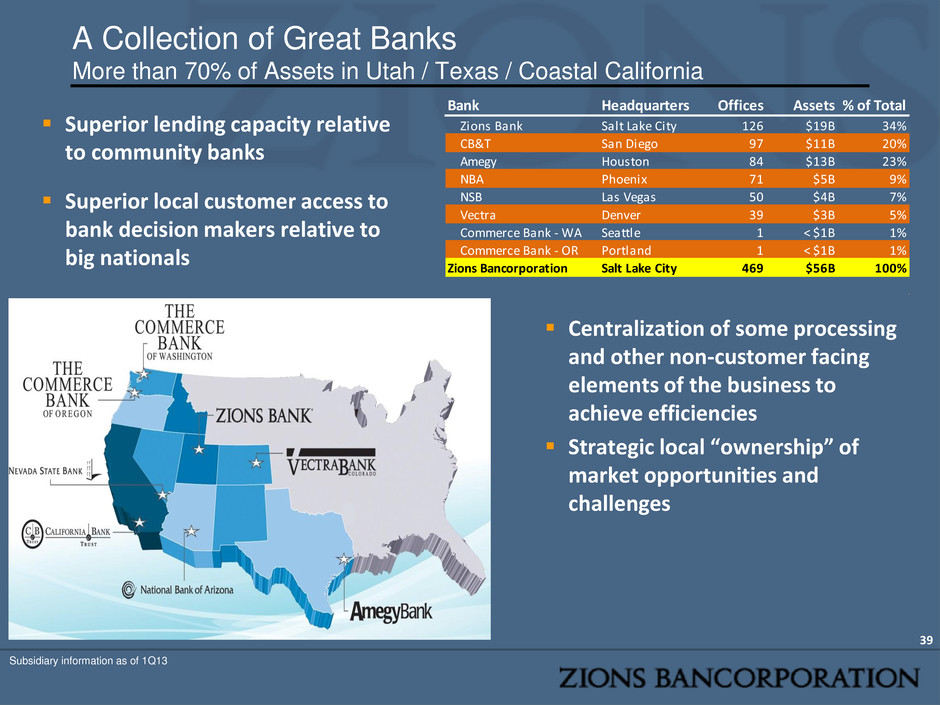

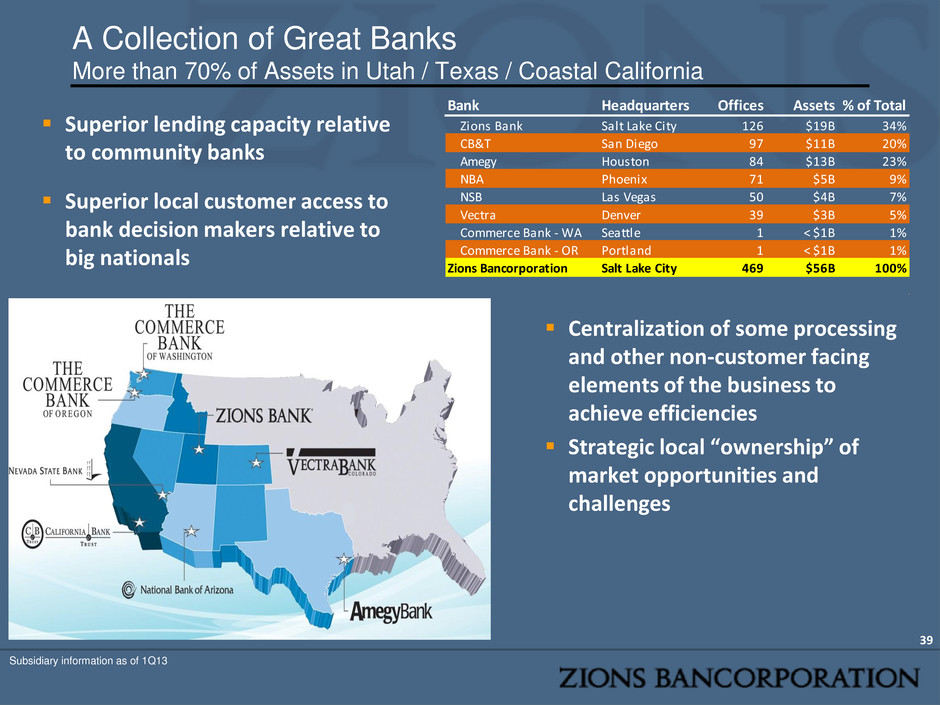

Bank Headquarters Offices Assets % of Total Zions Bank Salt Lake City 126 $19B 34% CB&T San Diego 97 $11B 20% Amegy Houston 84 $13B 23% NBA Phoenix 71 $5B 9% NSB Las Vegas 50 $4B 7% Vectra Denver 39 $3B 5% Commerce Bank - WA Seattle 1 < $1B 1% Commerce Bank - OR Portland 1 < $1B 1% Zions Bancorporation Salt Lake City 469 $56B 100% A Collection of Great Banks More than 70% of Assets in Utah / Texas / Coastal California 39 Subsidiary information as of 1Q13 Superior lending capacity relative to community banks Superior local customer access to bank decision makers relative to big nationals Centralization of some processing and other non-customer facing elements of the business to achieve efficiencies Strategic local “ownership” of market opportunities and challenges

Awards: Nationally Recognized for Excellence • Twelve (12) Greenwich Excellence Awards in Small Business and Middle Market Banking (2013) • Including: Excellence: Overall Satisfaction Excellence: Likelihood to Recommend Excellence: Treasury Management Excellence: Financial Stability Only 11 U.S. banks were awarded more than 10 Excellence awards in 2013; Zions has been consistently awarded more than 10 awards per year for many years in a row. • Nationally Ranked in the Top 10 in Small Business Loan production 1 • Top team of women bankers – American Banker2 • Amegy Bank Named Ex-Im Bank Small Business Lender of the Year3 40 1. Volume and number of loans, SBA fiscal year ended September 30, 2013 2. One of four winning teams, 2013, Zions Bank 3. exim.gov, April 24, 2014

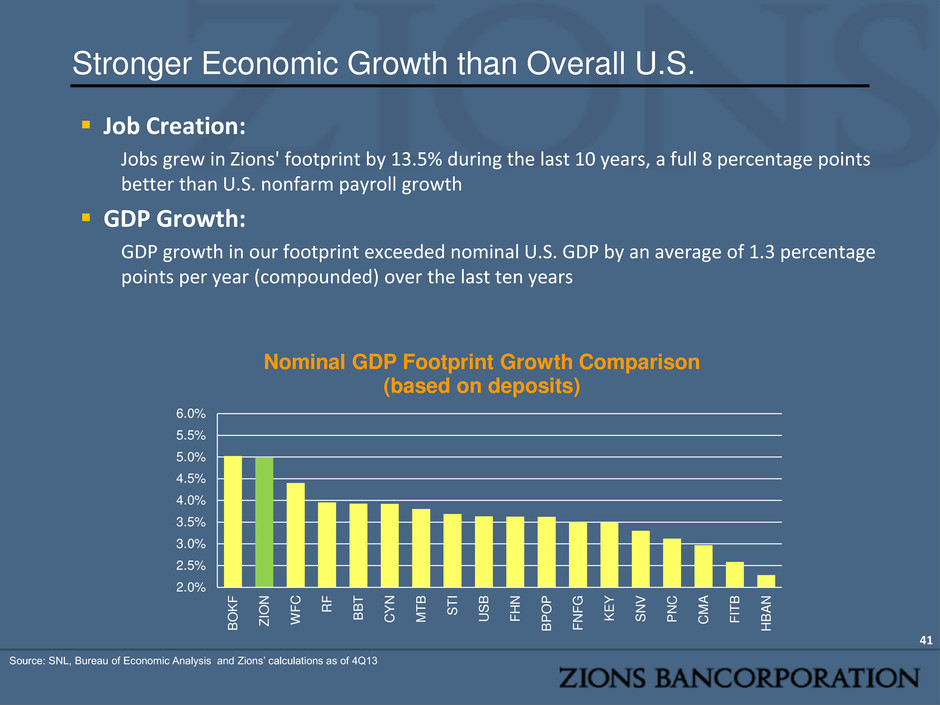

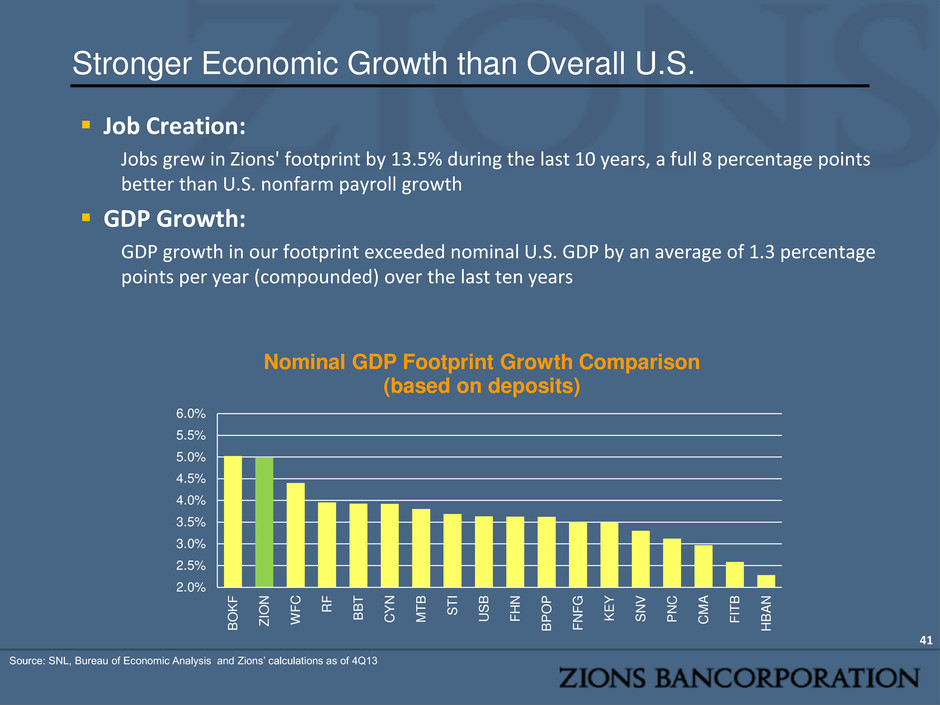

Job Creation: Jobs grew in Zions' footprint by 13.5% during the last 10 years, a full 8 percentage points better than U.S. nonfarm payroll growth GDP Growth: GDP growth in our footprint exceeded nominal U.S. GDP by an average of 1.3 percentage points per year (compounded) over the last ten years Stronger Economic Growth than Overall U.S. 41 Source: SNL, Bureau of Economic Analysis and Zions’ calculations as of 4Q13 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% B O K F Z IO N W F C R F B B T C Y N MT B S T I U S B F H N B P O P F N F G K E Y S N V P N C C M A F IT B H B A N Nominal GDP Footprint Growth Comparison (based on deposits)

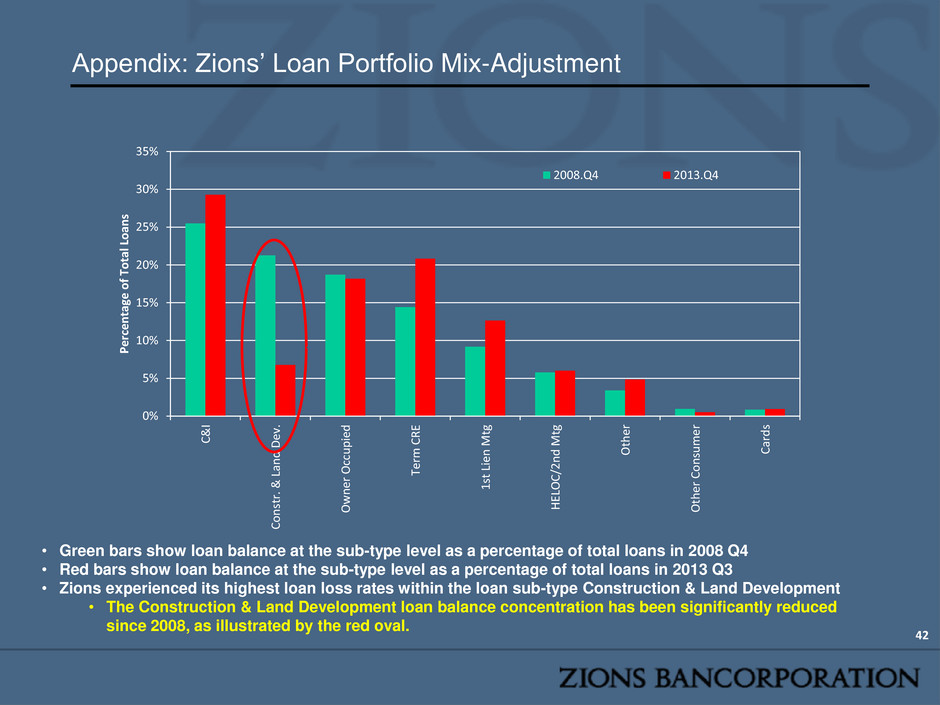

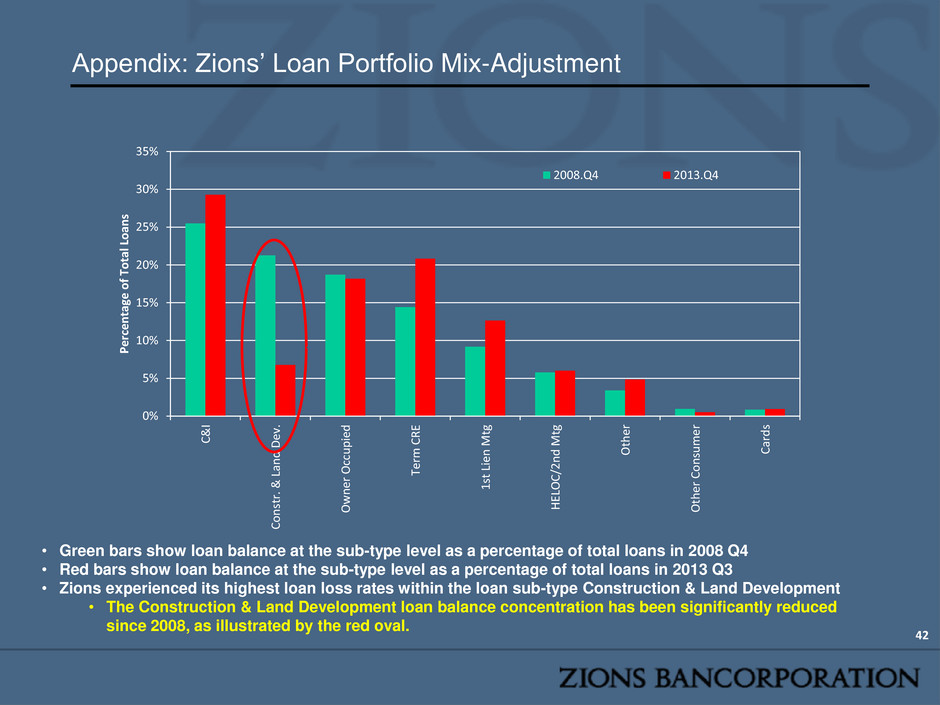

Appendix: Zions’ Loan Portfolio Mix-Adjustment 42 • Green bars show loan balance at the sub-type level as a percentage of total loans in 2008 Q4 • Red bars show loan balance at the sub-type level as a percentage of total loans in 2013 Q3 • Zions experienced its highest loan loss rates within the loan sub-type Construction & Land Development • The Construction & Land Development loan balance concentration has been significantly reduced since 2008, as illustrated by the red oval. 0% 5% 10% 15% 20% 25% 30% 35% C& I Co n str . & L an d De v. O w n er Oc cu p ie d Te rm CR E 1 st Li en M tg H ELOC/ 2 n d M tg O th er O th er C o n su m e r Car d s Pe rc e n tage o f T o tal L o an s 2008.Q4 2013.Q4

4.6% 5.9% 8.3% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% ZION Mix- Adjusted Actual Worst 9Q ZION Projected CCAR Submission ZION Projected by Federal Reserve Commercial Real Estate Net Loan Loss Rates 43 Zions’ mix-adjustment shown in the appendix on slide 42 Source: SNL Financial Dodd-Frank Act Stress Test 2014: Supervisory Stress Test Methodology and Results, March 2014 • Despite substantial improvements in risk management, Zions’ submission incorporated conservative assumptions that resulted in slightly higher loss rates than in the actual 2008-2010 “Great Recession”. • Mix-Adjustment shows Zions’ actual worst 9 quarter net loan loss rates (consistent with the 9- quarter stress testing period) applied to September 2013 loan balances CRE L oa n L o ss e s, a s a P e rce n ta ge of CRE Loa n s 76% higher than actual peak loss rates