ZIONS BANCORPORATION

Press Release – Page 1

October 23, 2017

|

| |

Zions Bancorporation

One South Main

Salt Lake City, UT 84133

October 23, 2017 | |

| www.zionsbancorporation.com |

Third Quarter 2017 Financial Results: FOR IMMEDIATE RELEASE

Investor and Media Contact: James Abbott (801) 844-7637

|

|

| Zions Bancorporation Reports: 3Q17 Net Earnings¹ of $152 million, diluted EPS of $0.72 |

compared with 2Q17 Net Earnings¹ of $154 million, diluted EPS of $0.73,

and 3Q16 Net Earnings¹ of $117 million, diluted EPS of $0.57 |

|

THIRD QUARTER RESULTS

|

| | | | | | |

| $0.72 | | $152 million | | 3.45% | | 12.2% |

| Earnings per diluted common share | | Net Earnings 1 | | Net interest margin (“NIM”) | | Common Equity Tier 1 |

|

| | |

| THIRD QUARTER HIGHLIGHTS² |

| | | |

| Net Interest Income and NIM | | Net interest income was $522 million, up 11% |

| NIM was 3.45% compared with 3.36% |

| | | |

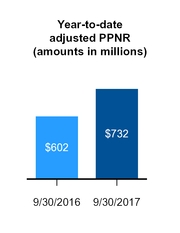

Operating Performance2 | | Pre-provision net revenue ("PPNR") was $257 million, up 18% |

| Adjusted PPNR³ was $251 million, up 20% |

| Noninterest expense was $413 million, compared with $403 million |

| Adjusted noninterest expense³ was $414 million, compared with $404 million |

| Efficiency ratio³ was 62.3%, compared with 65.9% |

| | | |

| Loans and Credit Quality | | Net loans and leases were $44.2 billion, compared with $42.5 billion |

| Provision for credit losses was $1 million, compared with $16 million |

| Net charge-offs were $8 million, compared with $30 million |

| | | |

| Capital Returns | | Tangible return on average tangible common equity³ was 9.8%, compared with 7.9% |

| Common stock repurchases of $115 million, 2.5 million shares, or 1.3% of shares outstanding as of June 30, 2017, during the quarter |

| Common dividend increased to $0.12 per share from $0.08 per share |

| | | |

| Notable Items | | Hurricane Harvey non-credit related impact of $6 million recognized in noninterest expense

|

|

|

| CEO COMMENTARY |

| |

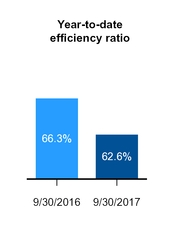

Harris H. Simmons, Chairman and CEO, commented, “Our third quarter earnings reflect moderate loan growth and continued improvement in credit quality. Furthermore, the year-to-date efficiency ratio, at 62.6%, is on track to meet the cost objective we established for 2017. The quarterly results were impacted by Hurricane Harvey, which led us to provide financial relief to affected employees in Texas, and to set aside additional reserves for any credit-related impact from the storm.” Mr. Simmons continued, “We are pleased with the quarterly earnings result, and look forward to continued progress in simplifying our business, meeting our customers’ needs and improving our profitability in the year ahead.”

|

|

|

¹ Net Earnings is net earnings applicable to common shareholders.

² Comparisons noted in the bullet points are calculated for the current quarter versus the same prior-year period, unless otherwise specified.

³ For information on non-GAAP financial measures and why the Company presents these numbers, see pages 16-19. Included in these non-GAAP financial measures are the key metrics to which Zions announced it would hold itself accountable in its June 1, 2015 efficiency initiative, and to which executive compensation is tied. |

ZIONS BANCORPORATION

Press Release – Page 2

October 23, 2017

Comparisons noted in the sections below are calculated for the current quarter versus the same prior-year period, unless otherwise specified.

RESULTS OF OPERATIONS

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income and Margin |

| | | | | | | | 3Q17 - 2Q17 | | 3Q17 - 3Q16 |

| (In millions) | 3Q17 | | 2Q17 | | 3Q16 | | $ | | % | | $ | | % |

| Interest and fees on loans | $ | 468 |

| | $ | 469 |

| | $ | 437 |

| | $ | (1 | ) | | (0.2 | )% | | $ | 31 |

| | 7.1 | % |

| Interest on money market investments | 5 |

| | 5 |

| | 5 |

| | — |

| | — |

| | — |

| | — |

|

| Interest on securities | 84 |

| | 84 |

| | 49 |

| | — |

| | — |

| | 35 |

| | 71.4 |

|

| Total interest income | 557 |

| | 558 |

| | 491 |

| | (1 | ) | | (0.2 | ) | | 66 |

| | 13.4 |

|

| Interest on deposits | 15 |

| | 14 |

| | 13 |

| | 1 |

| | 7.1 |

| | 2 |

| | 15.4 |

|

| Interest on short and long-term borrowings | 20 |

| | 16 |

| | 9 |

| | 4 |

| | 25.0 |

| | 11 |

| | 122.2 |

|

| Total interest expense | 35 |

| | 30 |

| | 22 |

| | 5 |

| | 16.7 |

| | 13 |

| | 59.1 |

|

| Net interest income | $ | 522 |

| | $ | 528 |

| | $ | 469 |

| | $ | (6 | ) | | (1.1 | ) | | $ | 53 |

| | 11.3 |

|

| | | | | | | | bps | | | | bps | | |

| Net interest margin | 3.45 | % | | 3.52 | % | | 3.36 | % | | (0.07 | ) | |

| | 0.09 |

| | |

Net interest income increased to $522 million in the third quarter of 2017 from $469 million. The $53 million, or 11.3%, increase in net interest income was due to a $35 million increase in interest on securities resulting from a 52.5% increase in the average investment securities portfolio and a $31 million increase in interest and fees on loans resulting from loan growth in commercial and consumer loans and increases in short-term interest rates. Interest expense increased $13 million primarily due to an increase in wholesale borrowings.

The net interest margin decreased to 3.45% in the third quarter of 2017, compared with 3.52% in the second quarter of 2017, primarily as a result of $16 million of interest income recoveries on four loans that occurred in the second quarter of 2017 that did not recur in the same magnitude in the current quarter. Excluding that effect, the net interest margin increased slightly from the prior quarter.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Income |

| | | | | | | | 3Q17 - 2Q17 | | 3Q17 - 3Q16 |

| (In millions) | 3Q17 | | 2Q17 | | 3Q16 | | $ | | % | | $ | | % |

| Service charges and fees on deposit accounts | $ | 42 |

| | $ | 43 |

| | $ | 45 |

| | $ | (1 | ) | | (2.3 | )% | | $ | (3 | ) | | (6.7 | )% |

| Other service charges, commissions and fees | 55 |

| | 56 |

| | 54 |

| | (1 | ) | | (1.8 | ) | | 1 |

| | 1.9 |

|

| Wealth management income | 11 |

| | 10 |

| | 10 |

| | 1 |

| | 10.0 |

| | 1 |

| | 10.0 |

|

| Loan sales and servicing income | 6 |

| | 6 |

| | 11 |

| | — |

| | — |

| | (5 | ) | | (45.5 | ) |

| Capital markets and foreign exchange | 8 |

| | 6 |

| | 6 |

| | 2 |

| | 33.3 |

| | 2 |

| | 33.3 |

|

| Customer-related fees | 122 |

| | 121 |

| | 126 |

| | 1 |

| | 0.8 |

| | (4 | ) | | (3.2 | ) |

| Dividends and other investment income | 9 |

| | 10 |

| | 9 |

| | (1 | ) | | (10.0 | ) | | — |

| | — |

|

| Securities gains, net | 5 |

| | 2 |

| | 8 |

| | 3 |

| | 150.0 |

| | (3 | ) | | (37.5 | ) |

| Other | 3 |

| | (1 | ) | | 2 |

| | 4 |

| | 400.0 |

| | 1 |

| | 50.0 |

|

| Total noninterest income | $ | 139 |

| | $ | 132 |

| | $ | 145 |

| | $ | 7 |

| | 5.3 |

| | $ | (6 | ) | | (4.1 | ) |

Total noninterest income for the third quarter of 2017 decreased by 4.1% to $139 million from $145 million. Customer-related fees decreased by $4 million in the third quarter of 2017 due to a $5 million decline in loan sales

ZIONS BANCORPORATION

Press Release – Page 3

October 23, 2017

and servicing income primarily resulting from lower sales of consumer mortgages and a $2 million valuation adjustment on a loan held for sale. Additionally, service charges and fees on deposit accounts declined $3 million. Income from net securities gains was $5 million representing a decrease of $3 million the third quarter of 2016 as a result of a smaller increase in the market values of the Company’s Small Business Investment Company (“SBIC”) investments in the third quarter of 2017. Other noninterest income included a gain of $1 million related to the sale of three branch properties.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Expense |

| | | | | | | | 3Q17 - 2Q17 | | 3Q17 - 3Q16 |

| (In millions) | 3Q17 | | 2Q17 | | 3Q16 | | $ | | % | | $ | | % |

| Salaries and employee benefits | $ | 253 |

| | $ | 242 |

| | $ | 242 |

| | $ | 11 |

| | 4.5 | % | | $ | 11 |

| | 4.5 | % |

| Occupancy, net | 35 |

| | 32 |

| | 33 |

| | 3 |

| | 9.4 |

| | 2 |

| | 6.1 |

|

| Furniture, equipment and software, net | 32 |

| | 32 |

| | 29 |

| | — |

| | — |

| | 3 |

| | 10.3 |

|

| Other real estate expense, net | (1 | ) | | — |

| | — |

| | (1 | ) | | NM | | (1 | ) | | NM |

| Credit-related expense | 7 |

| | 8 |

| | 7 |

| | (1 | ) | | (12.5 | ) | | — |

| | — |

|

| Provision for unfunded lending commitments | (4 | ) | | 3 |

| | (3 | ) | | (7 | ) | | (233.3 | ) | | (1 | ) | | (33.3 | ) |

| Professional and legal services | 14 |

| | 13 |

| | 14 |

| | 1 |

| | 7.7 |

| | — |

| | — |

|

| Advertising | 6 |

| | 6 |

| | 6 |

| | — |

| | — |

| | — |

| | — |

|

| FDIC premiums | 15 |

| | 13 |

| | 12 |

| | 2 |

| | 15.4 |

| | 3 |

| | 25.0 |

|

| Amortization of core deposit and other intangibles | 2 |

| | 2 |

| | 2 |

| | — |

| | — |

| | — |

| | — |

|

| Other | 54 |

| | 54 |

| | 61 |

| | — |

| | — |

| | (7 | ) | | (11.5 | ) |

| Total noninterest expense | $ | 413 |

| | $ | 405 |

| | $ | 403 |

| | $ | 8 |

| | 2.0 |

| | $ | 10 |

| | 2.5 |

|

Adjusted noninterest expense 1 | $ | 414 |

| | $ | 399 |

| | $ | 404 |

| | $ | 15 |

| | 3.8 | % | | $ | 10 |

| | 2.5 | % |

| |

1 | For information on non-GAAP financial measures, see pages 16-19. |

Noninterest expense for the third quarter of 2017 was $413 million, which included $6 million of noninterest expense related to property damage and community and employee support as a result of Hurricane Harvey, compared with $403 million for the third quarter of 2016. The Company has provided approximately $1.5 million of support, primarily in the form of grants and donations, to its employees and the local community affected by Hurricane Harvey. Additionally, the Company has made over 300 interest-free loans totaling more than $5 million to employees impacted by the natural disaster.

Adjusted noninterest expense for the third quarter of 2017 was $414 million compared with $404 million for the same prior year period. The $10 million, or 2.5%, increase in total and adjusted noninterest expense from the third quarter of 2016 was primarily driven by the expense associated with Hurricane Harvey and an increase in salaries and employee benefits, partially offset by a $7 million decrease in other noninterest expense primarily due to legal accruals that occurred in the third quarter of 2016.

The $11 million increase in salaries and employee benefits during the third quarter was primarily due to an increase in incentive compensation accruals. Additionally, healthcare costs increased $3 million from the same prior year period and are expected to remain consistent with the current quarter.

ZIONS BANCORPORATION

Press Release – Page 4

October 23, 2017

The Company is committed to its expense and efficiency ratio goals for 2017, which are to hold adjusted noninterest expense growth to 2-3% in 2017, and to achieve an efficiency ratio in the low 60% range. For information on non-GAAP financial measures, see pages 16-19.

BALANCE SHEET ANALYSIS

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset Quality |

| | | | | | | | 3Q17 - 2Q17 | | 3Q17 - 3Q16 |

| (In millions) | 3Q17 | | 2Q17 | | 3Q16 | | bps | | | | bps | | |

| Ratio of nonperforming assets to loans and leases and other real estate owned | 1.06 | % | | 1.12 | % | | 1.37 | % | | (6 | ) | | | | (31 | ) | | |

| Annualized ratio of net loan and lease charge-offs to average loans | 0.07 | % | | 0.06 | % | | 0.28 | % | | 1 |

| | | | (21 | ) | | |

| Ratio of total allowance for credit losses to loans and leases outstanding | 1.36 | % | | 1.39 | % | | 1.55 | % | | (3 | ) | | | | (19 | ) | | |

| | | | | | | | $ | | % | | $ | | % |

| Classified loans | $ | 1,248 |

| | $ | 1,317 |

| | $ | 1,615 |

| | $ | (69 | ) | | (5.2 | )% | | $ | (367 | ) | | (22.7 | )% |

| Nonperforming assets | 468 |

| | 490 |

| | 587 |

| | (22 | ) | | (4.5 | )% | | (119 | ) | | (20.3 | )% |

| Net loan and lease charge-offs | 8 |

| | 7 |

| | 30 |

| | 1 |

| | 14.3 | % | | (22 | ) | | (73.3 | )% |

| Provision for credit losses | 1 |

| | 10 |

| | 16 |

| | (9 | ) | | (90.0 | )% | | (15 | ) | | (93.8 | )% |

Asset quality improved for the entire loan portfolio when compared with the prior quarter and the same prior year period, primarily due to an improvement in the oil and gas-related portfolio, highlighted by decreases in classified and nonperforming assets. Classified loans and nonperforming assets for the oil and gas-related portfolio decreased $274 million and $137 million, respectively, from the third quarter of 2016.

The Company provided $1 million for credit losses during the third quarter of 2017 ($5 million provision for the allowance for loan and lease losses and a reserve reduction of $4 million for unfunded lending commitments), compared with $10 million during the second quarter of 2017 and $16 million for the third quarter of 2016. The $1 million provision is the result of a $34 million qualitative increase in the allowance for credit losses due to potential losses caused by Hurricane Harvey, offset by decreasing default and loss rates, in addition to improving credit quality metrics in the oil and gas-related portfolio. The allowance for credit losses was $600 million at September 30, 2017, compared with $659 million at September 30, 2016, or 1.36% and 1.55% of loans and leases, respectively. The allowance for credit losses for oil and gas-related loans remains above 7% of the portfolio.

ZIONS BANCORPORATION

Press Release – Page 5

October 23, 2017

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans and Leases |

| | | | | | | | 3Q17 - 2Q17 | | 3Q17 - 3Q16 |

| (In millions) | 3Q17 | | 2Q17 | | 3Q16 | | $ | | % | | $ | | % |

| Loans held for sale | $ | 71 |

| | $ | 53 |

| | $ | 160 |

| | $ | 18 |

| | 34.0 | % | | $ | (89 | ) | | (55.6 | ) |

| Loans and leases: | | | | | | | | | | | | | |

| Commercial | 22,539 |

| | 22,203 |

| | 21,624 |

| | 336 |

| | 1.5 |

| | 915 |

| | 4.2 |

|

| Commercial real estate | 11,114 |

| | 11,198 |

| | 11,450 |

| | (84 | ) | | (0.8 | ) | | (336 | ) | | (2.9 | ) |

| Consumer | 10,503 |

| | 10,282 |

| | 9,466 |

| | 221 |

| | 2.1 |

| | 1,037 |

| | 11.0 |

|

| Loans and leases, net of unearned income and fees | 44,156 |

| | 43,683 |

| | 42,540 |

| | 473 |

| | 1.1 |

| | 1,616 |

| | 3.8 |

|

| Less allowance for loan losses | 541 |

| | 544 |

| | 597 |

| | (3 | ) | | (0.6 | ) | | (56 | ) | | (9.4 | ) |

| Loans held for investment, net of allowance | $ | 43,615 |

| | $ | 43,139 |

| | $ | 41,943 |

| | $ | 476 |

| | 1.1 |

| | $ | 1,672 |

| | 4.0 |

|

Loans and leases, net of unearned income and fees, increased $1.6 billion, or 3.8%, to $44.2 billion at September 30, 2017 from $42.5 billion at September 30, 2016. When compared with the same prior year period, commercial loans increased $915 million and consumer loans increased $1.0 billion, predominantly in 1-4 family residential loans. Commercial real estate loans declined slightly from the same prior year period, primarily due to active management of credit risk concentrations. Unfunded lending commitments increased to $19.8 billion at September 30, 2017, compared with $19.1 billion at September 30, 2016.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits |

| | | | | | | | 3Q17 - 2Q17 | | 3Q17 - 3Q16 |

| (In millions) | 3Q17 | | 2Q17 | | 3Q16 | | $ | | % | | $ | | % |

| Noninterest-bearing demand | $ | 24,011 |

| | $ | 24,172 |

| | $ | 22,711 |

| | $ | (161 | ) | | (0.7 | )% | | $ | 1,300 |

| | 5.7 | % |

| Interest-bearing: | | | | | | | | | | | | | |

| Savings and money market | 25,179 |

| | 25,165 |

| | 25,503 |

| | 14 |

| | 0.1 |

| | (324 | ) | | (1.3 | ) |

| Time | 2,909 |

| | 3,041 |

| | 2,516 |

| | (132 | ) | | (4.3 | ) | | 393 |

| | 15.6 |

|

| Foreign | — |

| | — |

| | 119 |

| | — |

| | NM |

| | (119 | ) | | (100.0 | ) |

| Total deposits | $ | 52,099 |

| | $ | 52,378 |

| | $ | 50,849 |

| | $ | (279 | ) | | (0.5 | ) | | $ | 1,250 |

| | 2.5 |

|

Total deposits increased by $1.3 billion, or 2.5%, from $50.8 billion at September 30, 2016. Average total deposits increased to $51.9 billion for the third quarter of 2017 compared with $50.7 billion for the third quarter of 2016. Average noninterest bearing deposits increased to $23.8 billion for the third quarter of 2017, compared with $22.5 billion for the third quarter of 2016, and were 46% of average total deposits compared with 44% for the same prior year period.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders’ Equity |

| | | | | | | | 3Q17 - 2Q17 | | 3Q17 - 3Q16 |

| (In millions) | 3Q17 | | 2Q17 | | 3Q16 | | $ | | % | | $ | | % |

| Shareholders’ equity: | | | | | | | | | | | | | |

| Preferred Stock | $ | 566 |

| | $ | 566 |

| | $ | 710 |

| | $ | — |

| | — | % | | $ | (144 | ) | | (20.3 | )% |

| Common Stock | 4,552 |

| | 4,660 |

| | 4,748 |

| | (108 | ) | | (2.3 | ) | | (196 | ) | | (4.1 | ) |

| Retained earnings | 2,700 |

| | 2,572 |

| | 2,212 |

| | 128 |

| | 5.0 |

| | 488 |

| | 22.1 |

|

| Accumulated other comprehensive income (loss) | (57 | ) | | (49 | ) | | 9 |

| | (8 | ) | | (16.3 | ) | | (66 | ) | | (733.3 | ) |

| Total shareholders' equity | $ | 7,761 |

| | $ | 7,749 |

| | $ | 7,679 |

| | $ | 12 |

| | 0.2 |

| | $ | 82 |

| | 1.1 |

|

ZIONS BANCORPORATION

Press Release – Page 6

October 23, 2017

During the third quarter of 2017, the Company increased its common stock dividend to $0.12 cents per share from $0.08 cents per share in second quarter of 2017. Common stock repurchases during the current quarter totaled $115 million, or 2.5 million shares, which is equivalent to 1.3% of common stock as of June 30, 2017, at an average price of $45.45 per share. The Company has repurchased $250 million, or 6.1 million shares, of common stock during the last four quarters at an average price of $40.92 per share. The Company has $350 million of buyback capacity remaining in its 2017 capital plan, which spans the timeframe of July 2017 to June 2018. Weighted average diluted shares increased by 4.4 million compared with the third quarter of 2016 primarily due to the dilutive impact of warrants that have been outstanding since 2008 (“TARP” warrants - NASDAQ: ZIONZ) and 2010 (NASDAQ: ZIONW).

Preferred stock decreased by $144 million from September 30, 2016 to September 30, 2017 as a result of the Company redeeming all outstanding shares of its 7.90% Series F Non-Cumulative Perpetual Preferred Stock during the second quarter of 2017. Preferred dividends are expected to be $9.6 million for the fourth quarter of 2017 and second quarter of 2018 and $7.5 million for the first and third quarters of 2018.

Tangible book value per common share increased to $30.93 at September 30, 2017, compared with $29.16. The estimated Basel III common equity tier 1 (“CET1”) capital ratio was 12.2% at September 30, 2017 compared with 12.0%. Basel III capital ratios are based on the applicable phase-in periods; however, the fully phased-in ratio is not substantially different. For information on non-GAAP financial measures, see pages 16-19.

ZIONS BANCORPORATION

Press Release – Page 7

October 23, 2017

Supplemental Presentation and Conference Call

Zions has posted a supplemental presentation to its website, which will be used to discuss these third quarter results at 5:30 p.m. ET this afternoon (October 23, 2017). Media representatives, analysts, investors, and the public are invited to join this discussion by calling 253-237-1247 (domestic and international) and entering the passcode 82373635, or via on-demand webcast. A link to the webcast will be available on the Zions Bancorporation website at zionsbancorporation.com. The webcast of the conference call will also be archived and available for 30 days. About Zions Bancorporation

Zions Bancorporation is one of the nation's premier financial services companies with total assets exceeding $65 billion. Zions operates under local management teams and distinct brands in 11 western states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington and Wyoming. The company is a national leader in Small Business Administration lending and public finance advisory services. In addition, Zions is included in the S&P 500 and NASDAQ Financial 100 indices. Investor information and links to local banking brands can be accessed at zionsbancorporation.com. Forward-Looking Information

Statements in this press release that are based on other than historical data or that express the Company’s expectations regarding future events or determinations are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Statements based on historical data are not intended and should not be understood to indicate the Company’s expectations regarding future events. Forward-looking statements provide current expectations or forecasts or intentions regarding future events or determinations. These forward-looking statements are not guarantees of future performance or determinations, nor should they be relied upon as representing management’s views as of any subsequent date.

Forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those presented, either expressed or implied, in this presentation. Factors that could cause actual results to differ materially from those expressed in the forward-looking statements include the actual amount and duration of declines in the price of oil and gas, our ability to meet our efficiency and noninterest expense goals, the rate of change of interest sensitive assets and liabilities relative to changes in benchmark interest rates as well as other factors discussed in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”) and available at the SEC’s Internet site (http://www.sec.gov). Except as required by law, the Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments.

ZIONS BANCORPORATION

Press Release – Page 8

October 23, 2017

FINANCIAL HIGHLIGHTS

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions, except share, per share, and ratio data) | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

BALANCE SHEET 1 | | | | | | | | | |

| Loans held for investment, net of allowance | $ | 43,615 |

| | $ | 43,139 |

| | $ | 42,198 |

| | $ | 42,082 |

| | $ | 41,943 |

|

| Total assets | 65,564 |

| | 65,446 |

| | 65,463 |

| | 63,239 |

| | 61,039 |

|

| Deposits | 52,099 |

| | 52,378 |

| | 53,475 |

| | 53,236 |

| | 50,849 |

|

| Total shareholders’ equity | 7,761 |

| | 7,749 |

| | 7,730 |

| | 7,634 |

| | 7,679 |

|

| STATEMENT OF INCOME | | | | | | | | | |

| Net earnings applicable to common shareholders | $ | 152 |

| | $ | 154 |

| | $ | 129 |

| | $ | 125 |

| | $ | 117 |

|

| Net interest income | 522 |

| | 528 |

| | 489 |

| | 480 |

| | 469 |

|

Taxable-equivalent net interest income 2 | 531 |

| | 537 |

| | 497 |

| | 488 |

| | 476 |

|

| Total noninterest income | 139 |

| | 132 |

| | 132 |

| | 128 |

| | 145 |

|

| Total noninterest expense | 413 |

| | 405 |

| | 414 |

| | 404 |

| | 403 |

|

Adjusted pre-provision net revenue 2 | 251 |

| | 268 |

| | 213 |

| | 217 |

| | 209 |

|

| Provision for loan losses | 5 |

| | 7 |

| | 23 |

| | (3 | ) | | 19 |

|

| Provision for unfunded lending commitments | (4 | ) | | 3 |

| | (5 | ) | | 3 |

| | (3 | ) |

| Provision for credit losses | 1 |

| | 10 |

| | 18 |

| | — |

| | 16 |

|

| PER COMMON SHARE | | | | | | | | | |

| Net earnings per diluted common share | $ | 0.72 |

| | $ | 0.73 |

| | $ | 0.61 |

| | $ | 0.60 |

| | $ | 0.57 |

|

| Dividends | 0.12 |

| | 0.08 |

| | 0.08 |

| | 0.08 |

| | 0.08 |

|

Book value per common share 1 | 36.03 |

| | 35.54 |

| | 34.65 |

| | 34.09 |

| | 34.19 |

|

Tangible book value per common share 1, 2 | 30.93 |

| | 30.50 |

| | 29.61 |

| | 29.06 |

| | 29.16 |

|

| SELECTED RATIOS AND OTHER DATA | | | | | | | | | |

| Return on average assets | 0.97 | % | | 1.03 | % | | 0.88 | % | | 0.88 | % | | 0.84 | % |

| Return on average common equity | 8.3 | % | | 8.6 | % | | 7.5 | % | | 7.1 | % | | 6.7 | % |

Tangible return on average tangible common equity 2 | 9.8 | % | | 10.2 | % | | 8.8 | % | | 8.4 | % | | 7.9 | % |

| Net interest margin | 3.45 | % | | 3.52 | % | | 3.38 | % | | 3.37 | % | | 3.36 | % |

Efficiency ratio 2 | 62.3 | % | | 59.8 | % | | 65.9 | % | | 64.5 | % | | 65.9 | % |

| Effective tax rate | 34.2 | % | | 32.3 | % | | 24.5 | % | | 33.8 | % | | 33.9 | % |

| Ratio of nonperforming assets to loans and leases and other real estate owned | 1.06 | % | | 1.12 | % | | 1.37 | % | | 1.34 | % | | 1.37 | % |

| Annualized ratio of net loan and lease charge-offs to average loans | 0.07 | % | | 0.06 | % | | 0.43 | % | | 0.25 | % | | 0.28 | % |

Ratio of total allowance for credit losses to loans and leases outstanding 1 | 1.36 | % | | 1.39 | % | | 1.41 | % | | 1.48 | % | | 1.55 | % |

| Full-time equivalent employees | 10,041 |

| | 10,074 |

| | 10,004 |

| | 10,057 |

| | 9,968 |

|

CAPITAL RATIOS 1 | | | | | | | | | |

| Tangible common equity ratio | 9.57 | % | | 9.57 | % | | 9.31 | % | | 9.49 | % | | 9.91 | % |

Basel III: 3 | | | | | | | | | |

| Common equity tier 1 capital | 12.2 | % | | 12.3 | % | | 12.2 | % | | 12.1 | % | | 12.0 | % |

| Tier 1 leverage | 10.6 | % | | 10.5 | % | | 10.8 | % | | 11.1 | % | | 11.3 | % |

| Tier 1 risk-based capital | 13.3 | % | | 13.4 | % | | 13.6 | % | | 13.5 | % | | 13.5 | % |

| Total risk-based capital | 15.0 | % | | 15.1 | % | | 15.3 | % | | 15.2 | % | | 15.3 | % |

| Risk-weighted assets | $ | 51,044 |

| | $ | 50,575 |

| | $ | 50,016 |

| | $ | 49,937 |

| | $ | 49,318 |

|

| Weighted average common and common-equivalent shares outstanding (in thousands) | 209,106 |

| | 208,183 |

| | 210,405 |

| | 205,446 |

| | 204,714 |

|

Common shares outstanding (in thousands) 1 | 199,712 |

| | 202,131 |

| | 202,595 |

| | 203,085 |

| | 203,850 |

|

| |

2 | For information on non-GAAP financial measures, see pages 16-19. |

| |

3 | Basel III capital ratios became effective January 1, 2015 and are based on the applicable phase-in periods. Current period ratios and amounts represent estimates. |

ZIONS BANCORPORATION

Press Release – Page 9

October 23, 2017

CONSOLIDATED BALANCE SHEETS

|

| | | | | | | | | | | | | | | | | | | |

| (In millions, shares in thousands) | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | |

| | (Unaudited) |

| ASSETS | | | | | | | | | |

| Cash and due from banks | $ | 541 |

| | $ | 481 |

| | $ | 566 |

| | $ | 737 |

| | $ | 553 |

|

| Money market investments: | | | | | | | | | |

| Interest-bearing deposits | 765 |

| | 1,167 |

| | 1,761 |

| | 1,411 |

| | 1,489 |

|

| Federal funds sold and security resell agreements | 467 |

| | 427 |

| | 363 |

| | 568 |

| | 1,676 |

|

| Investment securities: | | | | | | | | | |

| Held-to-maturity, at amortized cost (approximate fair value $743, $774, $803, $850 and $718) | 746 |

| | 775 |

| | 815 |

| | 868 |

| | 715 |

|

| Available-for-sale, at fair value | 15,242 |

| | 15,341 |

| | 15,606 |

| | 13,372 |

| | 10,358 |

|

| Trading account, at fair value | 56 |

| | 61 |

| | 40 |

| | 115 |

| | 108 |

|

| Total investment securities | 16,044 |

| | 16,177 |

| | 16,461 |

| | 14,355 |

| | 11,181 |

|

| Loans held for sale | 71 |

| | 53 |

| | 128 |

| | 172 |

| | 160 |

|

| Loans and leases, net of unearned income and fees | 44,156 |

| | 43,683 |

| | 42,742 |

| | 42,649 |

| | 42,540 |

|

| Less allowance for loan losses | 541 |

| | 544 |

| | 544 |

| | 567 |

| | 597 |

|

| Loans held for investment, net of allowance | 43,615 |

| | 43,139 |

| | 42,198 |

| | 42,082 |

| | 41,943 |

|

| Other noninterest-bearing investments | 1,008 |

| | 1,012 |

| | 973 |

| | 884 |

| | 894 |

|

| Premises, equipment and software, net | 1,083 |

| | 1,069 |

| | 1,047 |

| | 1,020 |

| | 987 |

|

| Goodwill | 1,014 |

| | 1,014 |

| | 1,014 |

| | 1,014 |

| | 1,014 |

|

| Core deposit and other intangibles | 3 |

| | 5 |

| | 7 |

| | 8 |

| | 10 |

|

| Other real estate owned | 3 |

| | 4 |

| | 3 |

| | 4 |

| | 8 |

|

| Other assets | 950 |

| | 898 |

| | 942 |

| | 984 |

| | 1,124 |

|

| Total assets | $ | 65,564 |

| | $ | 65,446 |

| | $ | 65,463 |

| | $ | 63,239 |

| | $ | 61,039 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | |

| Deposits: | | | | | | | | | |

| Noninterest-bearing demand | $ | 24,011 |

| | $ | 24,172 |

| | $ | 24,410 |

| | $ | 24,115 |

| | $ | 22,711 |

|

| Interest-bearing: | | | | | | | | | |

| Savings and money market | 25,179 |

| | 25,165 |

| | 26,071 |

| | 26,364 |

| | 25,503 |

|

| Time | 2,909 |

| | 3,041 |

| | 2,994 |

| | 2,757 |

| | 2,516 |

|

| Foreign | — |

| | — |

| | — |

| | — |

| | 119 |

|

| Total deposits | 52,099 |

| | 52,378 |

| | 53,475 |

| | 53,236 |

| | 50,849 |

|

| Federal funds and other short-term borrowings | 4,624 |

| | 4,342 |

| | 3,137 |

| | 827 |

| | 1,116 |

|

| Long-term debt | 383 |

| | 383 |

| | 383 |

| | 535 |

| | 570 |

|

| Reserve for unfunded lending commitments | 59 |

| | 63 |

| | 60 |

| | 65 |

| | 62 |

|

| Other liabilities | 638 |

| | 531 |

| | 678 |

| | 942 |

| | 763 |

|

| Total liabilities | 57,803 |

| | 57,697 |

| | 57,733 |

| | 55,605 |

| | 53,360 |

|

| Shareholders’ equity: | | | | | | | | | |

| Preferred stock, without par value, authorized 4,400 shares | 566 |

| | 566 |

| | 710 |

| | 710 |

| | 710 |

|

| Common stock, without par value; authorized 350,000 shares; issued and outstanding 199,712, 202,131, 202,595, 203,085, and 203,850 shares | 4,552 |

| | 4,660 |

| | 4,696 |

| | 4,725 |

| | 4,748 |

|

| Retained earnings | 2,700 |

| | 2,572 |

| | 2,435 |

| | 2,321 |

| | 2,212 |

|

| Accumulated other comprehensive income (loss) | (57 | ) | | (49 | ) | | (111 | ) | | (122 | ) | | 9 |

|

| Total shareholders’ equity | 7,761 |

| | 7,749 |

| | 7,730 |

| | 7,634 |

| | 7,679 |

|

| Total liabilities and shareholders’ equity | $ | 65,564 |

| | $ | 65,446 |

| | $ | 65,463 |

| | $ | 63,239 |

| | $ | 61,039 |

|

ZIONS BANCORPORATION

Press Release – Page 10

October 23, 2017

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) |

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions, except share and per share amounts) | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| Interest income: | | | | | | | | | |

| Interest and fees on loans | $ | 468 |

| | $ | 469 |

| | $ | 433 |

| | $ | 438 |

| | $ | 437 |

|

| Interest on money market investments | 5 |

| | 5 |

| | 4 |

| | 4 |

| | 5 |

|

| Interest on securities | 84 |

| | 84 |

| | 78 |

| | 59 |

| | 49 |

|

| Total interest income | 557 |

| | 558 |

| | 515 |

| | 501 |

| | 491 |

|

| Interest expense: | | | | | | | | | |

| Interest on deposits | 15 |

| | 14 |

| | 13 |

| | 13 |

| | 13 |

|

| Interest on short- and long-term borrowings | 20 |

| | 16 |

| | 13 |

| | 8 |

| | 9 |

|

| Total interest expense | 35 |

| | 30 |

| | 26 |

| | 21 |

| | 22 |

|

| Net interest income | 522 |

| | 528 |

| | 489 |

| | 480 |

| | 469 |

|

| Provision for loan losses | 5 |

| | 7 |

| | 23 |

| | (3 | ) | | 19 |

|

| Net interest income after provision for loan losses | 517 |

| | 521 |

| | 466 |

| | 483 |

| | 450 |

|

| Noninterest income: | | | | | | | | | |

| Service charges and fees on deposit accounts | 42 |

| | 43 |

| | 42 |

| | 43 |

| | 45 |

|

| Other service charges, commissions and fees | 55 |

| | 56 |

| | 49 |

| | 52 |

| | 54 |

|

| Wealth management income | 11 |

| | 10 |

| | 10 |

| | 11 |

| | 10 |

|

| Loan sales and servicing income | 6 |

| | 6 |

| | 7 |

| | 6 |

| | 11 |

|

| Capital markets and foreign exchange | 8 |

| | 6 |

| | 7 |

| | 6 |

| | 6 |

|

| Customer-related fees | 122 |

| | 121 |

|

| 115 |

| | 118 |

| | 126 |

|

| Dividends and other investment income | 9 |

| | 10 |

| | 12 |

| | 4 |

| | 9 |

|

| Securities gains (losses), net | 5 |

| | 2 |

| | 5 |

| | (3 | ) | | 8 |

|

| Other | 3 |

| | (1 | ) | | — |

| | 9 |

| | 2 |

|

| Total noninterest income | 139 |

| | 132 |

| | 132 |

| | 128 |

| | 145 |

|

| Noninterest expense: | | | | | | | | | |

| Salaries and employee benefits | 253 |

| | 242 |

| | 262 |

| | 241 |

| | 242 |

|

| Occupancy, net | 35 |

| | 32 |

| | 33 |

| | 32 |

| | 33 |

|

| Furniture, equipment and software, net | 32 |

| | 32 |

| | 32 |

| | 33 |

| | 29 |

|

| Other real estate expense, net | (1 | ) | | — |

| | — |

| | — |

| | — |

|

| Credit-related expense | 7 |

| | 8 |

| | 8 |

| | 7 |

| | 7 |

|

| Provision for unfunded lending commitments | (4 | ) | | 3 |

| | (5 | ) | | 3 |

| | (3 | ) |

| Professional and legal services | 14 |

| | 13 |

| | 14 |

| | 17 |

| | 14 |

|

| Advertising | 6 |

| | 6 |

| | 5 |

| | 5 |

| | 6 |

|

| FDIC premiums | 15 |

| | 13 |

| | 12 |

| | 11 |

| | 12 |

|

| Amortization of core deposit and other intangibles | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

|

| Other | 54 |

| | 54 |

| | 51 |

| | 53 |

| | 61 |

|

| Total noninterest expense | 413 |

| | 405 |

| | 414 |

| | 404 |

| | 403 |

|

| Income before income taxes | 243 |

| | 248 |

| | 184 |

| | 207 |

| | 192 |

|

| Income taxes | 83 |

| | 80 |

| | 45 |

| | 70 |

| | 65 |

|

| Net income | 160 |

| | 168 |

| | 139 |

| | 137 |

| | 127 |

|

| Preferred stock dividends | (8 | ) | | (12 | ) | | (10 | ) | | (12 | ) | | (10 | ) |

| Preferred stock redemption | — |

| | (2 | ) | | — |

| | — |

| | — |

|

| Net earnings applicable to common shareholders | $ | 152 |

| | $ | 154 |

| | $ | 129 |

| | $ | 125 |

| | $ | 117 |

|

| | | | | | | | | | |

| Weighted average common shares outstanding during the period: | | | | | | | | |

| Basic shares (in thousands) | 200,332 |

| | 201,822 |

| | 202,347 |

| | 202,886 |

| | 204,312 |

|

| Diluted shares (in thousands) | 209,106 |

| | 208,183 |

| | 210,405 |

| | 205,446 |

| | 204,714 |

|

| Net earnings per common share: | | | | | | | | | |

| Basic | $ | 0.75 |

| | $ | 0.76 |

| | $ | 0.63 |

| | $ | 0.61 |

| | $ | 0.57 |

|

| Diluted | 0.72 |

| | 0.73 |

| | 0.61 |

| | 0.60 |

| | 0.57 |

|

ZIONS BANCORPORATION

Press Release – Page 11

October 23, 2017

Loan Balances Held for Investment by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| (In millions) | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| Commercial: | | | | | | | | | |

| Commercial and industrial | $ | 14,041 |

| | $ | 13,850 |

| | $ | 13,368 |

| | $ | 13,452 |

| | $ | 13,543 |

|

| Leasing | 343 |

| | 387 |

| | 404 |

| | 423 |

| | 439 |

|

| Owner occupied | 7,082 |

| | 7,095 |

| | 6,973 |

| | 6,962 |

| | 6,889 |

|

| Municipal | 1,073 |

| | 871 |

| | 811 |

| | 778 |

| | 753 |

|

| Total commercial | 22,539 |

| | 22,203 |

| | 21,556 |

| | 21,615 |

| | 21,624 |

|

| Commercial real estate: | | | | | | | | | |

| Construction and land development | 2,170 |

| | 2,186 |

| | 2,123 |

| | 2,019 |

| | 2,147 |

|

| Term | 8,944 |

| | 9,012 |

| | 9,083 |

| | 9,322 |

| | 9,303 |

|

| Total commercial real estate | 11,114 |

| | 11,198 |

| | 11,206 |

| | 11,341 |

| | 11,450 |

|

| Consumer: | | | | | | | | | |

| Home equity credit line | 2,745 |

| | 2,697 |

| | 2,638 |

| | 2,645 |

| | 2,581 |

|

| 1-4 family residential | 6,522 |

| | 6,359 |

| | 6,185 |

| | 5,891 |

| | 5,785 |

|

| Construction and other consumer real estate | 558 |

| | 560 |

| | 517 |

| | 486 |

| | 453 |

|

| Bankcard and other revolving plans | 490 |

| | 478 |

| | 459 |

| | 481 |

| | 458 |

|

| Other | 188 |

| | 188 |

| | 181 |

| | 190 |

| | 189 |

|

| Total consumer | 10,503 |

| | 10,282 |

| | 9,980 |

| | 9,693 |

| | 9,466 |

|

| Loans and leases, net of unearned income and fees | $ | 44,156 |

| | $ | 43,683 |

| | $ | 42,742 |

| | $ | 42,649 |

| | $ | 42,540 |

|

Nonperforming Assets

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| (In millions) | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| | | | | | | | | | |

Nonaccrual loans1 | $ | 465 |

| | $ | 486 |

| | $ | 585 |

| | $ | 569 |

| | $ | 579 |

|

| Other real estate owned | 3 |

| | 4 |

| | 3 |

| | 4 |

| | 8 |

|

| Total nonperforming assets | $ | 468 |

| | $ | 490 |

| | $ | 588 |

| | $ | 573 |

| | $ | 587 |

|

Ratio of nonperforming assets to loans1 and leases and other real estate owned | 1.06 | % | | 1.12 | % | | 1.37 | % | | 1.34 | % | | 1.37 | % |

| Accruing loans past due 90 days or more | $ | 30 |

| | $ | 19 |

| | $ | 30 |

| | $ | 36 |

| | $ | 29 |

|

Ratio of accruing loans past due 90 days or more to loans1 and leases | 0.07 | % | | 0.04 | % | | 0.07 | % | | 0.08 | % | | 0.07 | % |

| Nonaccrual loans and accruing loans past due 90 days or more | $ | 495 |

| | $ | 505 |

| | $ | 615 |

| | $ | 605 |

| | $ | 608 |

|

Ratio of nonaccrual loans and accruing loans past due 90 days or more to loans1 and leases | 1.12 | % | | 1.15 | % | | 1.43 | % | | 1.41 | % | | 1.42 | % |

| Accruing loans past due 30-89 days | $ | 99 |

| | $ | 98 |

| | $ | 137 |

| | $ | 126 |

| | $ | 164 |

|

| Restructured loans included in nonaccrual loans | 115 |

| | 137 |

| | 131 |

| | 100 |

| | 125 |

|

| Restructured loans on accrual | 133 |

| | 167 |

| | 167 |

| | 151 |

| | 170 |

|

| Classified loans | 1,248 |

| | 1,317 |

| | 1,464 |

| | 1,577 |

| | 1,615 |

|

1 Includes loans held for sale.

ZIONS BANCORPORATION

Press Release – Page 12

October 23, 2017

Allowance for Credit Losses

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions) | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| Allowance for Loan Losses | | | | | | | | | |

| Balance at beginning of period | $ | 544 |

| | $ | 544 |

| | $ | 567 |

| | $ | 597 |

| | $ | 608 |

|

| Add: | | | | | | | | | |

| Provision for losses | 5 |

| | 7 |

| | 23 |

| | (3 | ) | | 19 |

|

| Deduct: | | | | | | | | | |

| Gross loan and lease charge-offs | (25 | ) | | (35 | ) | | (57 | ) | | (38 | ) | | (54 | ) |

| Recoveries | 17 |

| | 28 |

| | 11 |

| | 11 |

| | 24 |

|

| Net loan and lease charge-offs | (8 | ) | | (7 | ) | | (46 | ) | | (27 | ) | | (30 | ) |

| Balance at end of period | $ | 541 |

| | $ | 544 |

| | $ | 544 |

| | $ | 567 |

| | $ | 597 |

|

Ratio of allowance for loan losses to loans1 and leases, at period end | 1.23 | % | | 1.25 | % | | 1.27 | % | | 1.33 | % | | 1.40 | % |

Ratio of allowance for loan losses to nonaccrual loans1 at period end | 120 | % | | 115 | % | | 99 | % | | 107 | % | | 109 | % |

| Annualized ratio of net loan and lease charge-offs to average loans | 0.07 | % | | 0.06 | % | | 0.43 | % | | 0.25 | % | | 0.28 | % |

| Reserve for Unfunded Lending Commitments | | | | | | | | | |

| Balance at beginning of period | $ | 63 |

| | $ | 60 |

| | $ | 65 |

| | $ | 62 |

| | $ | 65 |

|

| Provision charged (credited) to earnings | (4 | ) | | 3 |

| | (5 | ) | | 3 |

| | (3 | ) |

| Balance at end of period | $ | 59 |

| | $ | 63 |

| | $ | 60 |

| | $ | 65 |

| | $ | 62 |

|

| Total Allowance for Credit Losses | | | | | | | | | |

| Allowance for loan losses | $ | 541 |

| | $ | 544 |

| | $ | 544 |

| | $ | 567 |

| | $ | 597 |

|

| Reserve for unfunded lending commitments | 59 |

| | 63 |

| | 60 |

| | 65 |

| | 62 |

|

| Total allowance for credit losses | $ | 600 |

| | $ | 607 |

| | $ | 604 |

| | $ | 632 |

| | $ | 659 |

|

Ratio of total allowance for credit losses to loans1 and leases outstanding, at period end | 1.36 | % | | 1.39 | % | | 1.41 | % | | 1.48 | % | | 1.55 | % |

1 Does not include loans held for sale.

ZIONS BANCORPORATION

Press Release – Page 13

October 23, 2017

Nonaccrual Loans by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| (In millions) | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| | | | | | | | | | |

| Loans held for sale | $ | 13 |

| | $ | 12 |

| | $ | 34 |

| | $ | 40 |

| | $ | 29 |

|

| Commercial: | | | | | | | | | |

| Commercial and industrial | $ | 257 |

| | $ | 278 |

| | $ | 358 |

| | $ | 354 |

| | $ | 387 |

|

| Leasing | 8 |

| | 10 |

| | 13 |

| | 14 |

| | 14 |

|

| Owner occupied | 85 |

| | 86 |

| | 89 |

| | 74 |

| | 66 |

|

| Municipal | 1 |

| | 1 |

| | 1 |

| | 1 |

| | 1 |

|

| Total commercial | 351 |

| | 375 |

| | 461 |

| | 443 |

| | 468 |

|

| Commercial real estate: | | | | | | | | | |

| Construction and land development | 6 |

| | 6 |

| | 7 |

| | 7 |

| | 4 |

|

| Term | 41 |

| | 37 |

| | 38 |

| | 29 |

| | 28 |

|

| Total commercial real estate | 47 |

| | 43 |

| | 45 |

| | 36 |

| | 32 |

|

| Consumer: | | | | | | | | | |

| Home equity credit line | 11 |

| | 11 |

| | 9 |

| | 11 |

| | 11 |

|

| 1-4 family residential | 40 |

| | 43 |

| | 35 |

| | 36 |

| | 36 |

|

| Construction and other consumer real estate | 1 |

| | 1 |

| | 1 |

| | 2 |

| | 1 |

|

| Bankcard and other revolving plans | 1 |

| | — |

| | — |

| | 1 |

| | 2 |

|

| Other | 1 |

| | 1 |

| | — |

| | — |

| | — |

|

| Total consumer | 54 |

| | 56 |

| | 45 |

| | 50 |

| | 50 |

|

| Total nonaccrual loans | $ | 465 |

| | $ | 486 |

| | $ | 585 |

| | $ | 569 |

| | $ | 579 |

|

Net Charge-Offs by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| | |

| (In millions) | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| Commercial: | | | | | | | | | |

| Commercial and industrial | $ | 4 |

| | $ | 11 |

| | $ | 45 |

| | $ | 25 |

| | $ | 33 |

|

| Leasing | — |

| | — |

| | — |

| | — |

| | — |

|

| Owner occupied | — |

| | 2 |

| | 1 |

| | (1 | ) | | — |

|

| Municipal | — |

| | — |

| | — |

| | — |

| | — |

|

| Total commercial | 4 |

| | 13 |

| | 46 |

| | 24 |

| | 33 |

|

| Commercial real estate: | | | | | | | | | |

| Construction and land development | — |

| | (8 | ) | | (2 | ) | | — |

| | (1 | ) |

| Term | 2 |

| | — |

| | 1 |

| | 1 |

| | (5 | ) |

| Total commercial real estate | 2 |

| | (8 | ) | | (1 | ) | | 1 |

| | (6 | ) |

| Consumer: | | | | | | | | | |

| Home equity credit line | — |

| | 1 |

| | (1 | ) | | — |

| | 1 |

|

| 1-4 family residential | 1 |

| | — |

| | (1 | ) | | — |

| | — |

|

| Construction and other consumer real estate | — |

| | — |

| | — |

| | — |

| | — |

|

| Bankcard and other revolving plans | — |

| | 1 |

| | 3 |

| | 2 |

| | 2 |

|

| Other | 1 |

| | — |

| | — |

| | — |

| | — |

|

| Total consumer loans | 2 |

| | 2 |

| | 1 |

| | 2 |

| | 3 |

|

| Total net charge-offs | $ | 8 |

| | $ | 7 |

| | $ | 46 |

| | $ | 27 |

| | $ | 30 |

|

ZIONS BANCORPORATION

Press Release – Page 14

October 23, 2017

Oil and Gas Related Exposure1

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30,

2017 | | June 30,

2017 | | September 30,

2016 | | 3Q17 - 2Q17 | | 3Q17 - 3Q16 |

| (In millions) | | | | $ | | % | | $ | | % |

| Loans and leases | | | | | | | | | | | | | |

| Upstream – exploration and production | $ | 784 |

| | $ | 709 |

| | $ | 752 |

| | $ | 75 |

| | 10.6 | % | | $ | 32 |

| | 4.3 | % |

| Midstream – marketing and transportation | 601 |

| | 622 |

| | 623 |

| | (21 | ) | | (3.4 | ) | | (22 | ) | | (3.5 | ) |

| Downstream – refining | 100 |

| | 103 |

| | 123 |

| | (3 | ) | | (2.9 | ) | | (23 | ) | | (18.7 | ) |

| Other non-services | 40 |

| | 37 |

| | 44 |

| | 3 |

| | 8.1 |

| | (4 | ) | | (9.1 | ) |

| Oilfield services | 412 |

| | 455 |

| | 596 |

| | (43 | ) | | (9.5 | ) | | (184 | ) | | (30.9 | ) |

| Oil and gas service manufacturing | 109 |

| | 136 |

| | 176 |

| | (27 | ) | | (19.9 | ) | | (67 | ) | | (38.1 | ) |

Total loan and lease balances 2 | 2,046 |

| | 2,062 |

| | 2,314 |

| | (16 | ) | | (0.8 | ) | | (268 | ) | | (11.6 | ) |

| Unfunded lending commitments | 1,799 |

| | 1,855 |

| | 1,784 |

| | (56 | ) | | (3.0 | ) | | 15 |

| | 0.8 |

|

| Total oil and gas credit exposure | $ | 3,845 |

| | $ | 3,917 |

| | $ | 4,098 |

| | $ | (72 | ) | | (1.8 | ) | | $ | (253 | ) | | (6.2 | ) |

| Private equity investments | $ | 4 |

| | $ | 4 |

| | $ | 6 |

| | $ | — |

| | — |

| | $ | (2 | ) | | (33.3 | ) |

Credit quality measures 2 | | | | | | | | | | | | | |

| Criticized loan ratio | 29.8 | % | | 33.1 | % | | 41.8 | % | | | | | | | | |

| Classified loan ratio | 24.0 | % | | 27.2 | % | | 33.1 | % | | | | | | | | |

| Nonaccrual loan ratio | 10.2 | % | | 12.1 | % | | 15.0 | % | | | | | | | | |

| Ratio of nonaccrual loans that are current | 67.9 | % | | 84.7 | % | | 87.3 | % | | | | | | | | |

Net charge-off ratio, annualized 3 | 1.2 | % | | 3.1 | % | | 7.1 | % | | | | | | | | |

| |

1 | Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a borrower as oil and gas-related, including a particular segment of oil and gas-related activity, e.g., upstream or downstream; typically, 50% of revenues coming from the oil and gas sector is used as a guide. |

2 Total loan and lease balances and the credit quality measures do not include oil and gas loans held for sale at period end.

| |

3 | Calculated as the ratio of annualized net charge-offs to the beginning loan balances for each respective period. |

ZIONS BANCORPORATION

Press Release – Page 15

October 23, 2017

CONSOLIDATED AVERAGE BALANCE SHEETS, YIELDS AND RATES

(Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | September 30, 2017 | | June 30, 2017 | | September 30, 2016 |

| (In millions) | Average balance | | Average yield/rate 1 | | Average balance | | Average

yield/rate 1 | | Average balance | | Average

yield/rate 1 |

| ASSETS | | | | | | | | | | | |

| Money market investments | $ | 1,246 |

| | 1.44 | % | | $ | 1,572 |

| | 1.20 | % | | $ | 3,140 |

| | 0.63 | % |

| Securities: | | | | | | | | | | | |

| Held-to-maturity | 750 |

| | 3.96 | % | | 788 |

| | 3.97 | % | | 706 |

| | 4.33 | % |

| Available-for-sale | 15,197 |

| | 2.12 | % | | 15,386 |

| | 2.11 | % | | 9,698 |

| | 1.82 | % |

| Trading account | 43 |

| | 3.73 | % | | 79 |

| | 3.43 | % | | 80 |

| | 3.34 | % |

| Total securities | 15,990 |

| | 2.21 | % | | 16,253 |

| | 2.20 | % | | 10,484 |

| | 2.00 | % |

| Loans held for sale | 52 |

| | 4.29 | % | | 100 |

| | 3.23 | % | | 133 |

| | 3.34 | % |

Loans held for investment 2: | | | | | | | | | | | |

| Commercial | 22,261 |

| | 4.36 | % | | 21,885 |

| | 4.44 | % | | 21,816 |

| | 4.19 | % |

| Commercial real estate | 11,192 |

| | 4.46 | % | | 11,236 |

| | 4.74 | % | | 11,331 |

| | 4.19 | % |

| Consumer | 10,379 |

| | 3.86 | % | | 10,122 |

| | 3.83 | % | | 9,340 |

| | 3.81 | % |

| Total loans held for investment | 43,832 |

| | 4.27 | % | | 43,243 |

| | 4.38 | % | | 42,487 |

| | 4.11 | % |

| Total interest-earning assets | 61,120 |

| | 3.67 | % | | 61,168 |

| | 3.72 | % | | 56,244 |

| | 3.52 | % |

| Cash and due from banks | 767 |

| | | | 795 |

| | | | 556 |

| | |

| Allowance for loan losses | (540 | ) | | | | (546 | ) | | | | (609 | ) | | |

| Goodwill | 1,014 |

| | | | 1,014 |

| | | | 1,014 |

| | |

| Core deposit and other intangibles | 4 |

| | | | 6 |

| | | | 11 |

| | |

| Other assets | 2,974 |

| | | | 2,974 |

| | | | 2,846 |

| | |

| Total assets | $ | 65,339 |

| | | | $ | 65,411 |

| | | | $ | 60,062 |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | |

| Savings and money market | $ | 25,190 |

| | 0.16 | % | | $ | 25,467 |

| | 0.14 | % | | $ | 25,683 |

| | 0.15 | % |

| Time | 2,933 |

| | 0.70 | % | | 3,048 |

| | 0.66 | % | | 2,409 |

| | 0.51 | % |

| Foreign | — |

| | | | — |

| | | | 117 |

| | 0.30 | % |

| Total interest-bearing deposits | 28,123 |

| | 0.21 | % | | 28,515 |

| | 0.20 | % | | 28,209 |

| | 0.18 | % |

| Borrowed funds: | | | | | | | | | | | |

| Federal funds and other short-term borrowings | 4,609 |

| | 1.17 | % | | 4,302 |

| | 0.94 | % | | 343 |

| | 0.22 | % |

| Long-term debt | 383 |

| | 5.71 | % | | 383 |

| | 5.77 | % | | 680 |

| | 5.13 | % |

| Total borrowed funds | 4,992 |

| | 1.52 | % | | 4,685 |

| | 1.34 | % | | 1,023 |

| | 3.48 | % |

| Total interest-bearing liabilities | 33,115 |

| | 0.41 | % | | 33,200 |

| | 0.36 | % | | 29,232 |

| | 0.29 | % |

| Noninterest-bearing deposits | 23,798 |

| | | | 23,819 |

| | | | 22,466 |

| | |

| Other liabilities | 630 |

| | | | 565 |

| | | | 668 |

| | |

| Total liabilities | 57,543 |

| | | | 57,584 |

| | | | 52,366 |

| | |

| Shareholders’ equity: | | | | | | | | | | | |

| Preferred equity | 566 |

| | | | 684 |

| | | | 710 |

| | |

| Common equity | 7,230 |

| | | | 7,143 |

| | | | 6,986 |

| | |

| Total shareholders’ equity | 7,796 |

| | | | 7,827 |

| | | | 7,696 |

| | |

| Total liabilities and shareholders’ equity | $ | 65,339 |

| | | | $ | 65,411 |

| | | | $ | 60,062 |

| | |

| | | | | | | | | | | | |

| Spread on average interest-bearing funds | | | 3.26 | % | | | | 3.36 | % | | | | 3.23 | % |

| Net yield on interest-earning assets | | | 3.45 | % | | | | 3.52 | % | | | | 3.36 | % |

1 Rates are calculated using amounts in thousands and taxable-equivalent rates used where applicable.

2 Net of unearned income and fees, net of related costs. Loans include nonaccrual and restructured loans.

ZIONS BANCORPORATION

Press Release – Page 16

October 23, 2017

GAAP to Non-GAAP Reconciliations

(Unaudited)

This press release presents non-GAAP financial measures, in addition to GAAP financial measures, to provide investors with additional information. The adjustments to reconcile from the applicable GAAP financial measures to the non-GAAP financial measures are presented in the following schedules. The Company considers these adjustments to be relevant to ongoing operating results and provide a meaningful base for period-to-period and company-to-company comparisons. These non-GAAP financial measures are used by management to assess the performance and financial position of the Company and for presentations of Company performance to investors. The Company further believes that presenting these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management.

Non-GAAP financial measures have inherent limitations, and are not required to be uniformly applied by individual entities. Although non-GAAP financial measures are frequently used by stakeholders to evaluate a company, they have limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of results reported under GAAP.

The following are the non-GAAP financial measures presented in this press release and a discussion of why management uses these non-GAAP measures:

Tangible Book Value per Common Share – this schedule also includes “tangible common equity.” Tangible book value per common share is a non-GAAP financial measure that management believes provides additional useful information about the level of tangible equity in relation to outstanding shares of common stock. Management believes the use of ratios that utilize tangible equity provides additional useful information because they present measures of those assets that can generate income.

Tangible Return on Average Tangible Common Equity – this schedule also includes “net earnings applicable to common shareholders, excluding the effects of the adjustments, net of tax” and “average tangible common equity.” Tangible return on average tangible common equity is a non-GAAP financial measure that management believes provides useful information about the Company’s use of shareholders’ equity. Management believes the use of ratios that utilize tangible equity provides additional useful information because they present measures of those assets that can generate income.

Efficiency Ratio – this schedule also includes “adjusted noninterest expense,” “taxable-equivalent net interest income,” “adjusted taxable-equivalent revenue,” and “adjusted pre-provision net revenue (“PPNR”).” The methodology of determining the efficiency ratio may differ among companies. Management makes adjustments to exclude certain items as identified in the subsequent schedule which it believes allows for more consistent comparability among periods. Management believes the efficiency ratio provides useful information regarding the cost of generating revenue. Adjusted noninterest expense provides a measure as to how well the Company is managing its expenses, and adjusted PPNR enables management and others to assess the Company’s ability to generate capital to cover credit losses through a credit cycle. Taxable-equivalent net interest income allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The efficiency ratio and adjusted noninterest expense are the key metrics to which the Company announced it would hold itself accountable in its June 1, 2015 efficiency initiative, and to which executive compensation is tied.

ZIONS BANCORPORATION

Press Release – Page 17

October 23, 2017

GAAP to Non-GAAP Reconciliations

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| (In millions, except shares and per share amounts) | | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| Tangible Book Value per Common Share | | | | | | | | |

| Total shareholders’ equity (GAAP) | | $ | 7,761 |

| | $ | 7,749 |

| | $ | 7,730 |

| | $ | 7,634 |

| | $ | 7,679 |

|

| Preferred stock | | (566 | ) | | (566 | ) | | (710 | ) | | (710 | ) | | (710 | ) |

| Goodwill | | (1,014 | ) | | (1,014 | ) | | (1,014 | ) | | (1,014 | ) | | (1,014 | ) |

| Core deposit and other intangibles | | (3 | ) | | (5 | ) | | (7 | ) | | (8 | ) | | (10 | ) |

| Tangible common equity (non-GAAP) | (a) | $ | 6,178 |

| | $ | 6,164 |

| | $ | 5,999 |

| | $ | 5,902 |

| | $ | 5,945 |

|

| Common shares outstanding (in thousands) | (b) | 199,712 |

| | 202,131 |

| | 202,595 |

| | 203,085 |

| | 203,850 |

|

| Tangible book value per common share (non-GAAP) | (a/b) | $ | 30.93 |

| | $ | 30.50 |

| | $ | 29.61 |

| | $ | 29.06 |

| | $ | 29.16 |

|

| | | | | | | | | | | |

| | | Three Months Ended |

| (Dollar amounts in millions) | | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| Tangible Return on Average Tangible Common Equity | | | | | | | | |

| Net earnings applicable to common shareholders (GAAP) | | $ | 152 |

| | $ | 154 |

| | $ | 129 |

| | $ | 125 |

| | $ | 117 |

|

| Adjustments, net of tax: | | | | | | | | | | |

| Amortization of core deposit and other intangibles | | 1 |

| | 1 |

| | 1 |

| | 1 |

| | 1 |

|

| Net earnings applicable to common shareholders, excluding the effects of the adjustments, net of tax (non-GAAP) | (a) | $ | 153 |

| | $ | 155 |

| | $ | 130 |

| | $ | 126 |

| | $ | 118 |

|

| Average common equity (GAAP) | | $ | 7,230 |

| | $ | 7,143 |

| | $ | 6,996 |

| | $ | 6,998 |

| | $ | 6,986 |

|

| Average goodwill | | (1,014 | ) | | (1,014 | ) | | (1,014 | ) | | (1,014 | ) | | (1,014 | ) |

| Average core deposit and other intangibles | | (4 | ) | | (6 | ) | | (8 | ) | | (10 | ) | | (11 | ) |

| Average tangible common equity (non-GAAP) | (b) | $ | 6,212 |

| | $ | 6,123 |

| | $ | 5,974 |

| | $ | 5,974 |

| | $ | 5,961 |

|

| Number of days in quarter | (c) | 92 |

| | 91 |

| | 90 |

| | 92 |

| | 92 |

|

| Number of days in year | (d) | 365 |

| | 365 |

| | 365 |

| | 366 |

| | 366 |

|

| Tangible return on average tangible common equity (non-GAAP) | (a/b/c)*d | 9.8 | % | | 10.2 | % | | 8.8 | % | | 8.4 | % | | 7.9 | % |

ZIONS BANCORPORATION

Press Release – Page 18

October 23, 2017

GAAP to Non-GAAP Reconciliations

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| (In millions) | | September 30,

2017 | | June 30,

2017 | | March 31,

2017 | | December 31,

2016 | | September 30,

2016 |

| Efficiency Ratio | | | | | | | | | | |

| Noninterest expense (GAAP) | (a) | $ | 413 |

| | $ | 405 |

| | $ | 414 |

| | $ | 404 |

| | $ | 403 |

|

| Adjustments: | | | | | | | | | | |

| Severance costs | | 1 |

| | — |

| | 5 |

| | 1 |

| | — |

|

| Other real estate expense | | (1 | ) | | — |

| | — |

| | — |

| | — |

|

| Provision for unfunded lending commitments | | (4 | ) | | 3 |

| | (5 | ) | | 3 |

| | (3 | ) |

| Amortization of core deposit and other intangibles | | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

|

Restructuring costs 1 | | 1 |

| | 1 |

| | 1 |

| | 3 |

| | — |

|

| Total adjustments | (b) | (1 | ) | | 6 |

| | 3 |

| | 9 |

| | (1 | ) |

| Adjusted noninterest expense (non-GAAP) | (a-b)=(c) | $ | 414 |

| | $ | 399 |

| | $ | 411 |

| | $ | 395 |

| | $ | 404 |

|

| Net interest income (GAAP) | (d) | $ | 522 |

| | $ | 528 |

| | $ | 489 |

| | $ | 480 |

| | $ | 469 |

|

| Fully taxable-equivalent adjustments | (e) | 9 |

| | 9 |

| | 8 |

| | 8 |

| | 7 |

|

| Taxable-equivalent net interest income (non-GAAP) | (d+e)=(f) | 531 |

| | 537 |

| | 497 |

| | 488 |

| | 476 |

|

| Noninterest income (GAAP) | (g) | 139 |

| | 132 |

| | 132 |

| | 128 |

| | 145 |

|

| Combined income (non-GAAP) | (f+g)=(h) | 670 |

| | 669 |

| | 629 |

| | 616 |

| | 621 |

|

| Adjustments: | | | | | | | | | | |

| Fair value and nonhedge derivative income | | — |

| | — |

| | — |

| | 7 |

| | — |

|

| Securities gains (losses), net | | 5 |

| | 2 |

| | 5 |

| | (3 | ) | | 8 |

|

| Total adjustments | (i) | 5 |

| | 2 |

| | 5 |

| | 4 |

| | 8 |

|

| Adjusted taxable-equivalent revenue (non-GAAP) | (h-i)=(j) | $ | 665 |

| | $ | 667 |

| | $ | 624 |

| | $ | 612 |

| | $ | 613 |

|

| Pre-provision net revenue (PPNR) | (h)-(a) | $ | 257 |

| | $ | 264 |

| | $ | 215 |

| | $ | 212 |

| | $ | 218 |

|

| Adjusted PPNR (non-GAAP) | (j-c) | 251 |

| | 268 |

| | 213 |

| | 217 |

| | 209 |

|

| Efficiency ratio (non-GAAP) | (c/j) | 62.3 | % | | 59.8 | % | | 65.9 | % | | 64.5 | % | | 65.9 | % |

1 The restructuring costs in the fourth quarter of 2016 are primarily related to the termination of the Zions Direct auction platform and changes to create a simplified lending approach for our business banking customers.

ZIONS BANCORPORATION

Press Release – Page 19

October 23, 2017

|

| | | | | | | | | |

| | | Nine Months Ended |

| (In millions) | | September 30,

2017 | | September 30,

2016 |

| Efficiency Ratio | | | | |

| Noninterest expense (GAAP) | (a) | $ | 1,232 |

| | $ | 1,181 |

|

| Adjustments: | | | | |

| Severance costs | | 6 |

| 7 |

| 4 |

|

| Other real estate expense | | (1 | ) | | (2 | ) |

| Provision for unfunded lending commitments | | (6 | ) | | (13 | ) |

| Amortization of core deposit and other intangibles | | 5 |

| 4 |

| 6 |

|

| Restructuring costs | | 3 |

| 2 |

| 1 |

|

| Total adjustments | (b) | 7 |

| | (4 | ) |

| Adjusted noninterest expense (non-GAAP) | (a-b)=(c) | $ | 1,225 |

| | $ | 1,185 |

|

| Net interest income (GAAP) | (d) | $ | 1,539 |

| | $ | 1,386 |

|

| Fully taxable-equivalent adjustments | (e) | 26 |

| | 19 |

|

| Taxable-equivalent net interest income (non-GAAP) | (d+e)=(f) | 1,565 |

| | 1,405 |

|

| Noninterest income (GAAP) | (g) | 404 |

| | 388 |

|

| Combined income (non-GAAP) | (f+g)=(h) | 1,969 |

| | 1,793 |

|

| Adjustments: | | | | |

| Fair value and nonhedge derivative loss | | (1 | ) | | (5 | ) |

| Securities gains, net | | 13 |

| | 11 |

|

| Total adjustments | (i) | 12 |

| | 6 |

|

| Adjusted taxable-equivalent revenue (non-GAAP) | (h-i)=(j) | $ | 1,957 |

| | $ | 1,787 |

|

| Pre-provision net revenue (PPNR) | (h)-(a) | $ | 737 |

| | $ | 612 |

|

| Adjusted PPNR (non-GAAP) | (j-c) | 732 |

| | 602 |

|

| Efficiency ratio (non-GAAP) | (c/j) | 62.6 | % | | 66.3 | % |