Finance Townhall 4Q17 Financial Review January 31, 2018 Janua y 22, 2018 Fourth Quarter 2017 Financial Review

2 Forward-Looking Statements; Use of Non-GAAP Financial Measures Forward Looking Information The attached presentation includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Statements in the attached presentation that are based on other than historical information or that express Zions Bancorporation’s expectations regarding future events or determinations are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect, among other things, our current expectations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, industry results or regulatory outcomes to differ materially from those expressed or implied by such forward-looking statements. Without limiting the foregoing, the words “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “projects,” “should,” “would,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about future financial and operating results, the potential timing or consummation of the proposed transaction described in the presentation and receipt of regulatory approvals or determinations, or the anticipated benefits thereof, including, without limitation, future financial and operating results. Actual results and outcomes may differ materially from those presented, either expressed or implied, in the presentation. Important risk factors that may cause such material differences include, but are not limited to, the rate of change of interest sensitive assets and liabilities relative to changes in benchmark interest rates; growth rates of revenue or expense; risks and uncertainties related to the ability to obtain shareholder and regulatory approvals or determinations for various matters, including the proposed merger of the holding company with and into the operating bank, or the possibility that such approvals or determinations may be delayed; the imposition by regulators of conditions or requirements that are not favorable to Zions; the ability of Zions Bancorporation to achieve anticipated benefits from the consolidation and regulatory determinations; and legislative, regulatory and economic developments that may diminish or eliminate the anticipated benefits of the consolidation. These risks, as well as other factors, are discussed in Zions Bancorporation’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (SEC) and available at the SEC’s Internet site (http://www.sec.gov), and other risks associated with the proposed transaction will be more fully discussed in the proxy statement that will be filed with the Securities and Exchange Commission in connection with the proposed transaction. Use of Non-GAAP Financial Measures: This document contains several references to non-GAAP measures, including pre-provision net revenue and the “efficiency ratio,” which are common industry terms used by investors and financial services analysts. Certain of these non-GAAP measures are key inputs into Zions’ management compensation and are used in Zions’ strategic goals that have been and may continue to be articulated to investors. Therefore, the use of such non-GAAP measures are believed by management to be of substantial interest to the consumers of these financial disclosures and are used prominently throughout the disclosures. A full reconciliation of the difference between such measures and GAAP financials is provided within the document, and users of this document are encouraged to carefully review this reconciliation.

EPS: Diluted earnings per share decreased from the year-ago period, to $0.54 in 4Q17 from $0.60 • Diluted EPS was $0.80 per share when excluding two unique items which are not expected to recur with regular frequency: 1. the revaluation of the deferred tax asset as a result of the Tax Cut and Jobs Act ($0.22/share) 2. the larger contribution to the Company’s charitable foundation in the amount of $12 million ($0.04/share) Adjusted pre-provision net revenue (1): Strong growth of 19% over year-ago period • A 10% year-over-year increase in adjusted revenue (1) • A 5% year-over-year increase in adjusted noninterest expense (1) Efficiency initiative: • Efficiency ratio equaled 61.6% in 4Q17, an improvement from 64.5% in the year ago period • Excluding the charitable contribution referenced above, the efficiency ratio was 59.8% • Achieved low 60 percent range for 2017 with the full year efficiency ratio equaling 62.3%, compared to 65.8% for the full year 2016 • Noninterest expense (NIE) increased over 3% from the year ago period; adjusted NIE increased slightly over 5% • Excluding the charitable contribution referenced above, the adjusted NIE increased 2% over the prior year Loans & Deposits: • Period-end loan balances increased $624 million from the prior quarter, an increase of over 1%; average loan balances increased over 1%; increases in commercial and consumer loans, while commercial real estate loans were generally stable • Average deposits increased about 1% from the prior quarter • Cost of total deposits increased slightly compared to the prior quarter, to 13 basis points from 12 Credit quality: Classified loans declined $115 million (9%, not annualized) from prior quarter Return on Tangible Common Equity was 7.4%; adjusted for items noted above, it was 10.9% 3 Fourth Quarter 2017 Key Performance Indicators Continued PPNR growth and improved profitability (1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation tables.

Pre-Provision Net Revenue Adjusted Pre-Provision Net Revenue (1) 4 Strong year-over-year improvement driven by active balance sheet management, loan growth, expense control, and the benefit of higher benchmark interest rates (1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation table. 2Q17 results included $16 million of interest recovery income related to four loans. ($mm) $0 $50 $100 $150 $200 $250 4Q16 1Q17 2Q17 3Q17 4Q17 Adjusted pre-provision net revenue has strengthened measurably, up 19% over the past year, and up 76% from 4Q14 Excluding $12 million contribution to the Company’s charitable foundation, adjusted pre-provision net revenue increased 25% over the prior year Persistent improvement driven by success on multiple fronts: Loan growth Improved return on liquid assets Customer-related fee income growth Solid expense control Increases in benchmark interest rates Expect stable investment portfolio size over the near term

The efficiency ratio in the quarter was 61.6% (4Q17), declining about 3 percentage points from 64.5% in the year-ago period Excluding the charitable contribution previously referenced, the efficiency ratio was 59.8% Achieved low 60 percent range of 62.3% for 2017 Committed to continuous improvement to the efficiency ratio, moderating from the trailing three year pace 74.1% 69.6% 64.5% 61.6% 55% 60% 65% 70% 75% 4Q14 4Q15 4Q16 4Q17 Efficiency Ratio Efficiency Ratio (1) 5 Substantial improvement driven by both revenue growth and expense control (1) Defined as noninterest expenses as a percentage of net revenue, adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation table.

Profitability 6 Zions’ profitability continues to improve since announcing the efficiency initiative Return on assets was 0.74% in 4Q17; adjusted for the two items referenced previously, it was up 1.07%, up from 0.88% a year ago Return on tangible common equity was 7.4% in 4Q17; adjusted it was 10.9%, up from 8.4% a year ago Return on Assets 0.57% 0.68% 0.88% 0.88% 1.03% 0.97% 0.74% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 4Q14 4Q15 4Q16 1Q17 2Q17 3Q17 4Q17 Return on Tangible Common Equity 5.0% 6.2% 8.4% 8.8% 10.2% 9.8% 7.4% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 4Q14 4Q15 4Q16 1Q17 2Q17 3Q17 4Q17 10.9% (1) 2Q17 results included $16 million of interest recovery income related to four loans, or approximately nine basis points of ROA and one percentage point of ROTCE. 4Q14 and 4Q15 shown to depict progress since embarking upon the efficiency initiative (1) (1) 1.07%

Average Loan and Deposit Growth Average Total Loans Average Total Deposits 7 Moderate balance sheet growth is expected to be a key driver of Zions’ positive operating leverage Average loans held for investment increased 4% over the year-ago period, and about 5% (annualized) from the prior quarter Average deposits increased 0.3% over the year-ago period, and increased over 3% (annualized) from the prior quarter ($mm) $35,000 $40,000 $45,000 $50,000 $55,000 4Q16 1Q17 2Q17 3Q17 4Q17 $35,000 $40,000 $45,000 $50,000 $55,000 4Q16 1Q17 2Q17 3Q17 4Q17 ($mm) Deposits up 0.3% YoY

Financial Results 8 Solid and improving fundamental performance Three Months Ended (Dollar amounts in millions, except per share data) Dec 31, 2017 Sept 30, 2017 Dec 31, 2016 Earnings Results: Diluted Earnings Per Share $ 0.54 $ 0.72 $ 0.60 Net Earnings Applicable to Common Shareholders 114 152 125 Net Interest Income 526 522 480 Noninterest Income 139 139 128 Noninterest Expense 417 413 404 Pre-Provision Net Revenue (1) 259 251 217 Provision for Credit Losses (12) 1 - Ratios: Return on Assets(2) 0.74 % 0.97 % 0.88 % Return on Common Equity(3) 6.3 % 8.3 % 7.1 % Return on Tangible Common Equity(3) 7.4 % 9.8 % 8.4 % Net Interest Margin 3.45 % 3.45 % 3.37 % Yield on Loans 4.30 % 4.27 % 4.19 % Yield on Securities 2.14 % 2.21 % 2.08 % Average Cost of Total Deposits(4) 0.13 % 0.12 % 0.10 % Efficiency Ratio (1) 61.6 % 62.3 % 64.5 % Effective Tax Rate 52.5 % 34.2 % 33.8 % Ratio of Nonperforming Assets to Loans, Leases and OREO 0.93 % 1.06 % 1.34 % Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.11 % 0.07 % 0.25 % Basel III Common Equity Tier 1 12.1 % 12.2 % 12.1 % (1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation tables. (2) Net Income before Preferred Dividends or redemption costs used in the numerator (3) Net Income Applicable to Common used in the numerator (4) Includes noninterest-bearing deposits

Net interest income increased 10% over the year-ago period Majority of the increase attributable to increases in: Interest and fees on loans due to loan growth in commercial and consumer loans Interest on securities from an increase in the average investment securities portfolio Short-term benchmark interest rates Interest revenue increases were partially offset by modestly higher interest expense on deposits and borrowed funds Net Interest Income Net Interest Income 9 Growth due primarily to loan growth, securities growth and wider net interest margin ($mm) $400 $425 $450 $475 $500 $525 $550 4Q16 1Q17 2Q17 3Q17 4Q17 (1) 2Q17 results included $16 million of interest recovery income related to four loans. (1)

[CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] [CELLRANGE], [Y VALUE] -25% 0% 25% 50% 75% $0 $5 $10 $15 Loan Growth by Type 10 Moderate to strong loan growth achieved in targeted growth categories Year-over-Year Loan Growth Total Loans: +5% Year over year: Loan growth predominantly in Residential Mortgage (1-4 Family), Owner Occupied (ex-NRE), C&I, and Municipal Decline in NRE, Oil and Gas (O&G), and Term CRE (ex-NRE) accounted for nearly $550 million of attrition Over the next four quarters, we expect moderate total loan growth, driven by: Strong growth in 1-4 Family and Municipal Moderate growth in C&I, Owner- Occupied and Commercial Real Estate loans Stable to slightly increasing O&G Continued although moderating attrition in NRE Note: National Real Estate (NRE) is a division of Zions Bank (which is a division of ZB, N.A.) with a focus on small business loans with low LTV ratios, which generally are in line with SBA 504 program parameters. “Other” loans includes certain consumer loans such as credit cards and homeowner construction. Note: circle size indicates relative proportion of loan portfolio as of 4Q17. Gr o wt h R ate: Year o ver Yea r Size of the Portfolio, in billions of dollars

Loans 74% Securities 22% Cash 4% Loans 72% Securities 26% Cash 2% Net Interest Income Drivers 11 Net interest income reflects higher short-term interest rates Net Interest Margin (NIM) Avg Earning Asset Mix Relative to the prior quarter, the 4Q17 NIM was stable at 3.45% Yield on loans increased to 4.30% from 4.27% in the prior quarter Cost of deposits increased slightly to 13 bps from 12 bps 3.37% 3.38% 3.52% 3.45% 3.45% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 4Q16 1Q17 2Q17 3Q17 4Q17 Loan Yield Securities Yield Interest Expense Net Interest Margin Cash Yield 4Q16 4Q17 Short Term Resets or Maturities (loans only) Percent of Loans Hedges (swaps, floors) Net Percentage of Portfolio (1) Prime and 1M Libor 46% -3% 43% 2-3M Libor 4% -- 4% 4-12M Libor 5% -- 5% Other Lns <12 months 10% 1% 11% Longer-term Resets or Maturities 1-5 years 24% -- 24% 5+ years 11% -- 11% (1) Net percentage column sums to less than 100% due primarily to 2% of total loans that have interest rate floors which are in the money (floor rate > index+spread rate); these $1.0 billion of loan balances with floors have a weighted average “in the money” amount of 48 basis points. After giving effect to potential future rate hikes, loans with floors would no longer be subject to the floors and would begin to reset with the relevant indices and therefore the 99% total at December 31, 2017 would increase to/towards 100%. Because the dates at which the floors would no longer be in effect are not certain (subject to future Federal Reserve monetary policy decisions), the timing of such cannot be reflected in the chart.

Much of the reduction in rate sensitivity was due to securities purchases during 2016 and early 2017 The average investment portfolio is $11.4 billion higher than 4Q14; taxable-equivalent interest income from the investment portfolio increased nearly $130 million in FY2017 compared with FY2016 Zions and the peer median experienced a cumulative 44% and 46% deposit beta during 2004-5 rising interest rate period, respectively, although for the first 200 bps the beta for Zions and Peers was 19% and 24%, respectively Interest Rate Sensitivity and Historical Deposit Beta 12 Zions has partially reduced asset sensitivity in exchange for current income Source: Company filings and SNL Financial. Cumulative rate hike cycle beta includes one full year for deposit costs to catch up to the changes in the benchmark rates. Chart begins one quarter preceding the first increase in Fed Funds rate for each cycle. (1) This 12-month simulated impact using a static-sized balance sheet and a parallel shift in the yield curve, does not contemplate changes in fee income that is amortized in interest income (e.g. premiums, discounts, origination points and costs) and is based on statistical analysis relating pricing and deposit migration to benchmark rates (e.g. LIBOR, U.S. Treasuries). Net Interest Income Sensitivity 0.0 1.0 2.0 3.0 4.0 5.0 6.0 Q TR 0 Q TR 1 Q TR 2 Q TR 3 Q TR 4 Q TR 5 Q TR 6 Q TR 7 Q TR 8 Q TR 9 Q TR 1 0 Q TR 1 1 Q TR 1 2 ZION Cost of Total Deposits Peer Median Cost of Total Deposits FF Target Rate 2004-2006 and 2015-2017 Rate Cycles Percent Modeled Annual Change in a +200bps Interest Rate Environment(1) ∆ in NII 5% Assumed Beta of Total Deposits 36% 2004-2006 2015-2017

Customer-related fee income increased approximately 8% from the year ago period, primarily due to: An 8% Increase in non-deposit service charges, which was primarily due to credit card fee income growth A 9% increase from trust and wealth management income An increase capital markets (includes swap and foreign exchange related revenue) fees Fee Income growth remains a major focus for the Company Noninterest Income 13 Continued focus on fee income (1) Reflects total customer-related noninterest income, which excludes items such as fair value and non-hedge derivative income, securities gains (losses), and other items, as detailed in the Noninterest Income table located in the earnings release. Customer-Related Fee Income (1) ($mm) $118 $115 $121 $122 $127 $0 $30 $60 $90 $120 $150 4Q16 1Q17 2Q17 3Q17 4Q17

Noninterest Expense ($ millions) $404 $414 $405 $413 $417 $0 $125 $250 $375 4Q16 1Q17 2Q17 3Q17 4Q17 Noninterest Expense 14 Expense controls have resulted in improved profitability Total noninterest expense increased over 3% from the year-ago period: Included a $12 million contribution to the Company’s charitable foundation, which was largely attributable to the passing of the Tax Cut and Jobs Act. Excluding the effect of the contribution, noninterest expense was $405 million, which is generally stable with the year-ago period Expect adjusted noninterest expense to increase in the low single digit percentage rate for FY18 vs. FY17. Outlook includes expected cost associated with: $1,000 bonuses paid to approximately 8,000 employees Increases in base compensation to about 40% of employees $4051 (1) $405 million reflects the total noninterest expense excluding the $12 million contribution to the Company’s charitable foundation

Credit Quality 15 Key Credit Quality Ratios Credit quality remains healthy and is improving Key Credit Metrics: Classified loans were less than 3% of loans Down 9% from prior quarter Down 28% from the prior year NPAs were 0.9% of loans Down almost 11% from prior quarter Down 27% from the prior year Annualized NCOs were 0.1% of average loans for the quarter Allowance for credit losses remains strong at just over 1% of total loans and leases 1.4x coverage of NPAs Strong coverage of annualized NCOs 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 4Q16 1Q17 2Q17 3Q17 4Q17 Classified / Loans NPAs / Loans NCOs / Loans (ann.) Note: Net Charge-offs/Loans ratio is annualized for all periods shown

Tax Rates 16 The effective tax rate for 2018 is estimated to be between 24% and 25%, down from the adjusted effective tax rate of 34.8% in 2017 2017 adjusted effective tax rate of 34.8% excludes the effect of: DTA adjustment of $47 million One time state tax adjustments in the first half of 2017 Application of ASU 2016-09 which changed the accounting for stock- based compensation The estimated 2018 annual effective tax rate presented is based on 2017 information and does not consider the impact related to stock-based compensation. Further, the tax rate does not reflect any estimated impacts from potential changes to state tax laws during 2018 38.1% 36.8% 24.8% 34.8% [CELLREF] 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% FY2017 FY2018 Estimate St at u to ry St at u to ry Ef fec ti ve ( G AAP ) Ad ju st ed E ff ec ti ve Es ti m at ed E ff ec ti ve

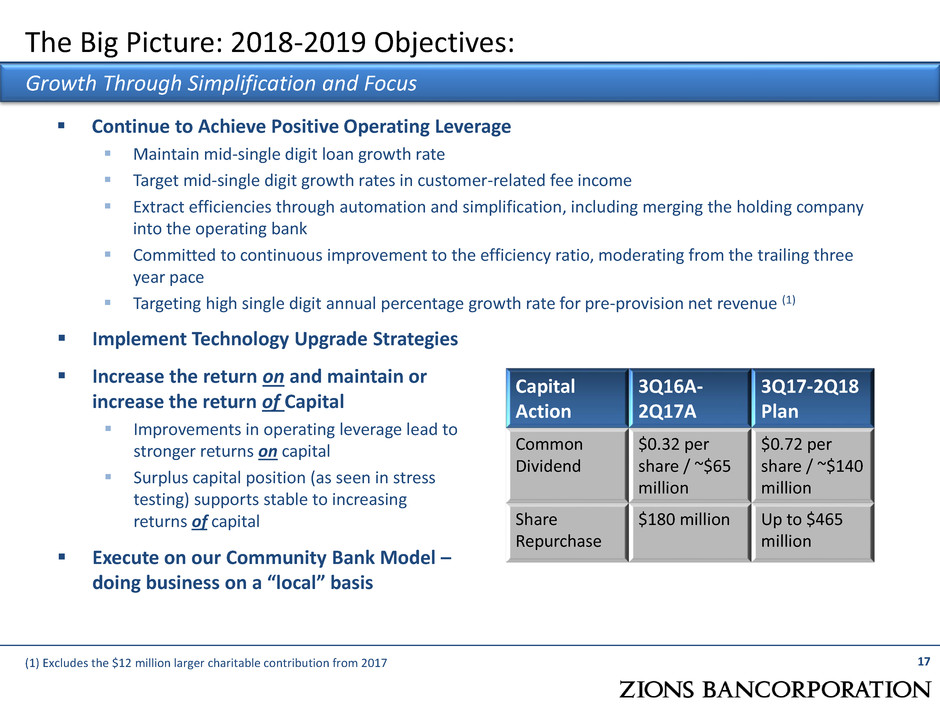

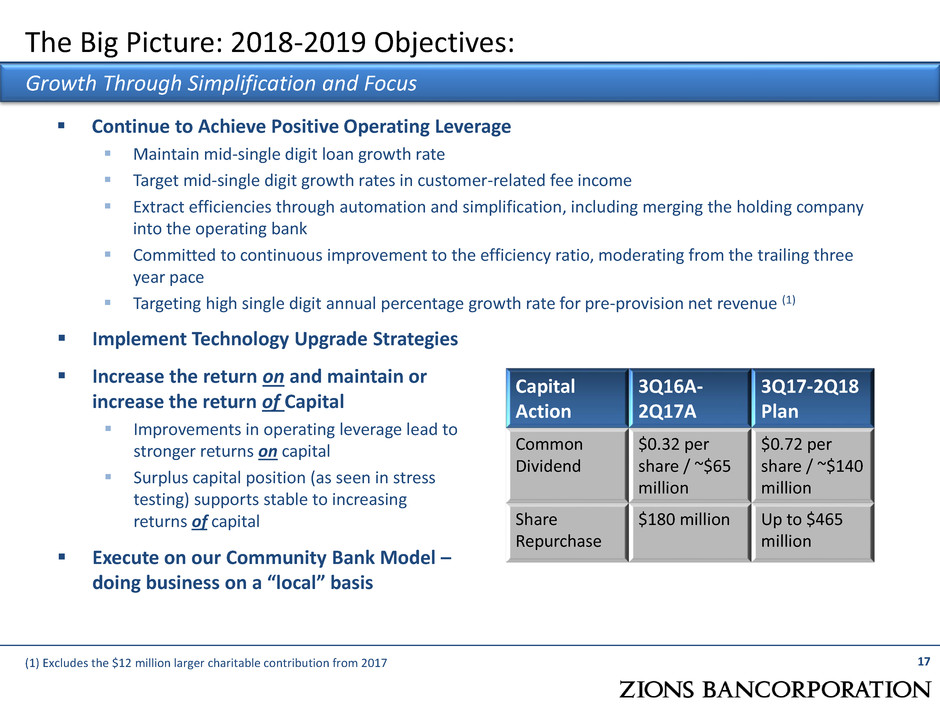

Continue to Achieve Positive Operating Leverage Maintain mid-single digit loan growth rate Target mid-single digit growth rates in customer-related fee income Extract efficiencies through automation and simplification, including merging the holding company into the operating bank Committed to continuous improvement to the efficiency ratio, moderating from the trailing three year pace Targeting high single digit annual percentage growth rate for pre-provision net revenue (1) 17 The Big Picture: 2018-2019 Objectives: Growth Through Simplification and Focus Implement Technology Upgrade Strategies Increase the return on and maintain or increase the return of Capital Improvements in operating leverage lead to stronger returns on capital Surplus capital position (as seen in stress testing) supports stable to increasing returns of capital Execute on our Community Bank Model – doing business on a “local” basis Capital Action 3Q16A- 2Q17A 3Q17-2Q18 Plan Common Dividend $0.32 per share / ~$65 million $0.72 per share / ~$140 million Share Repurchase $180 million Up to $465 million (1) Excludes the $12 million larger charitable contribution from 2017

Next 12-Month Financial Outlook (4Q18E, vs. 4Q17A) 18 Outlook Comments Moderately Increasing • Over the next 12 months, we expect continued strong growth from residential mortgage and municipal loans, moderate growth in C&I and CRE loans Moderately Increasing • Excludes the effects of future interest rate hikes, but includes the expected benefit from the December 2017 fed funds rate hike of 25 basis points. Contemplates continued increases in loans and a moderate increase in funding costs Modest • Expect quarterly loan loss provisions to be modest. May experience reserve releases as credit quality continues to improve, offset by reserves for new loans and net charge-offs Slightly Increasing • Customer-related fees excludes securities gains, dividends Slightly Increasing • Excluding the larger contribution to the Company’s charitable foundation in 4Q17 of $12 million, FY18 adjusted NIE expected to increase slightly (low single digit rate of growth) Decreasing • Excluding stock-based compensation1, the effective tax rate for FY18 is expected to be between 24% and 25% • Expect preferred dividend to be $34 million in FY18 • Diluted shares may experience some volatility due to the effect of outstanding warrants and the average price of ZION shares Customer-Related Fees Loan Balances Net Interest Income Loan Loss Provision Tax Rate Preferred Dividends & Diluted Shares Adjusted Noninterest Expense (1) ASU 2016-09 went into effect January 1, 2017 and now requires the difference between income tax accounting and U.S. GAAP accounting for stock compensation to be recognized in the income statement instead of a direct adjustment to equity.

Impact of Warrants Oil & Gas (O&G) Portfolio Detail Credit Quality Metrics, O&G and Ex-O&G Retail CRE and C&I Loan Portfolio Loan Growth by Bank Brand and Loan Type GAAP to Non-GAAP Reconciliation 19 Appendix

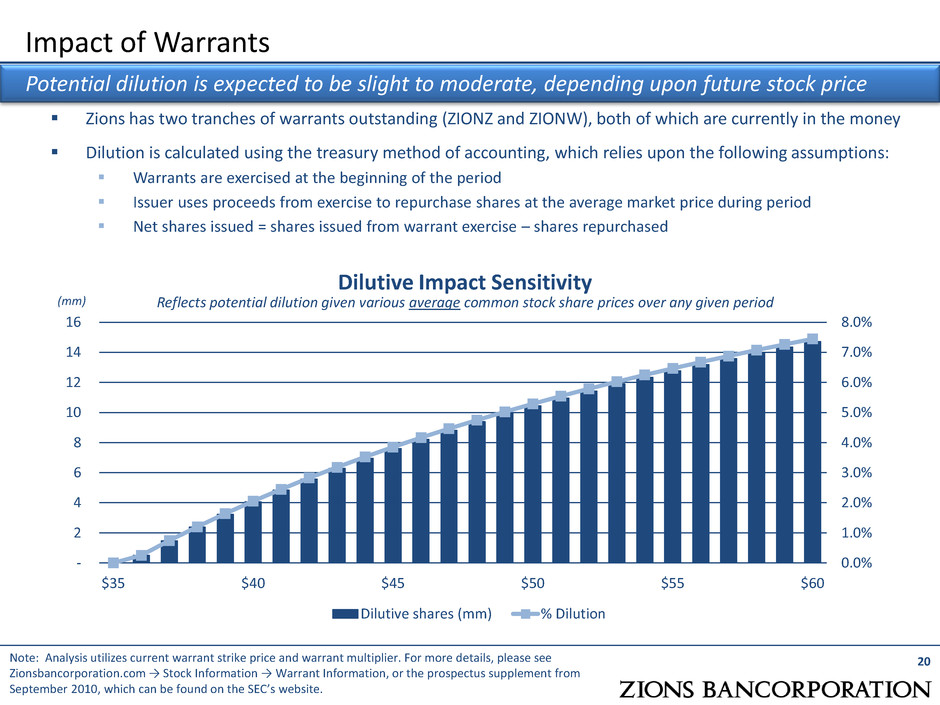

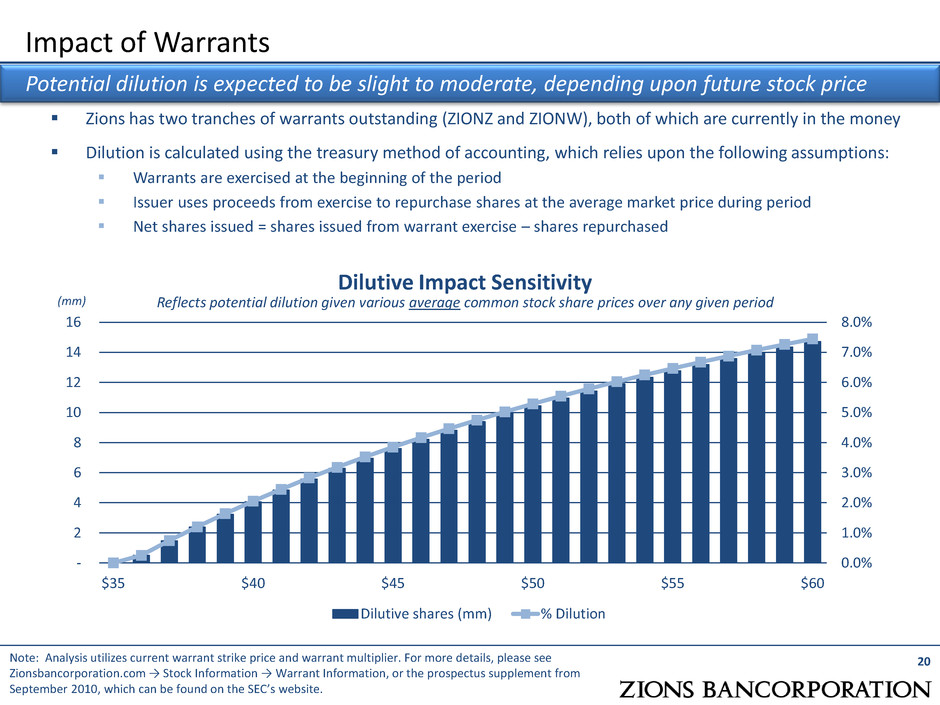

Zions has two tranches of warrants outstanding (ZIONZ and ZIONW), both of which are currently in the money Dilution is calculated using the treasury method of accounting, which relies upon the following assumptions: Warrants are exercised at the beginning of the period Issuer uses proceeds from exercise to repurchase shares at the average market price during period Net shares issued = shares issued from warrant exercise – shares repurchased Impact of Warrants Dilutive Impact Sensitivity Reflects potential dilution given various average common stock share prices over any given period 20 Potential dilution is expected to be slight to moderate, depending upon future stock price (mm) 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% - 2 4 6 8 10 12 14 16 $35 $40 $45 $50 $55 $60 Dilutive shares (mm) % Dilution Note: Analysis utilizes current warrant strike price and warrant multiplier. For more details, please see Zionsbancorporation.com → Stock Information → Warrant Information, or the prospectus supplement from September 2010, which can be found on the SEC’s website.

21 Note: Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a borrower as oil and gas- related, including a particular segment of oil and gas-related activity, e.g., upstream or downstream; typically, 50% of revenues coming from the oil and gas sector is used as a guide. (1) Calculated as the ratio of annualized net charge-offs for each respective period to loan balances at each period end. Oil & Gas (O&G) Portfolio Detail (In millions) 4Q17 3Q17 $ Change % Change 4Q16 Loans and leases: Upstream - exploration and production $ 730 37% $ 784 38% $ (54) -7% $ 733 Midstream – marketing and transportation 617 31% 601 29% 16 3% 598 Downstream – refining 123 6% 100 5% 23 23% 137 Other non-services 34 2% 40 2% (6) -15% 38 Oilfield services 367 19% 412 20% (45) -11% 500 Oil and gas service manufacturing 102 5% 109 5% (7) -6% 152 Total loan and lease balances 1,973 100% 2,046 100% (73) -4% 2,158 Unfunded lending commitments 1,908 1,799 109 6% 1,722 Total oil and gas credit exposure $ 3,881 $ 3,845 $ 36 1% $ 3,880 Private equity investments $ 3 $ 4 $ (1) 0% $ 7 Credit Quality Measures Criticized loan ratio 25.1% 29.8% 37.8% Classified loan ratio 17.9% 24.0% 31.6% Nonaccrual loan ratio 7.7% 10.2% 13.6% Ratio of nonaccrual loans that are current 88.1% 67.9% 81.6% Net charge-offs, annualized(1) 0% 1.2% 3.0% O&G credit quality measures show continued improvement over last quarter and the year ago period

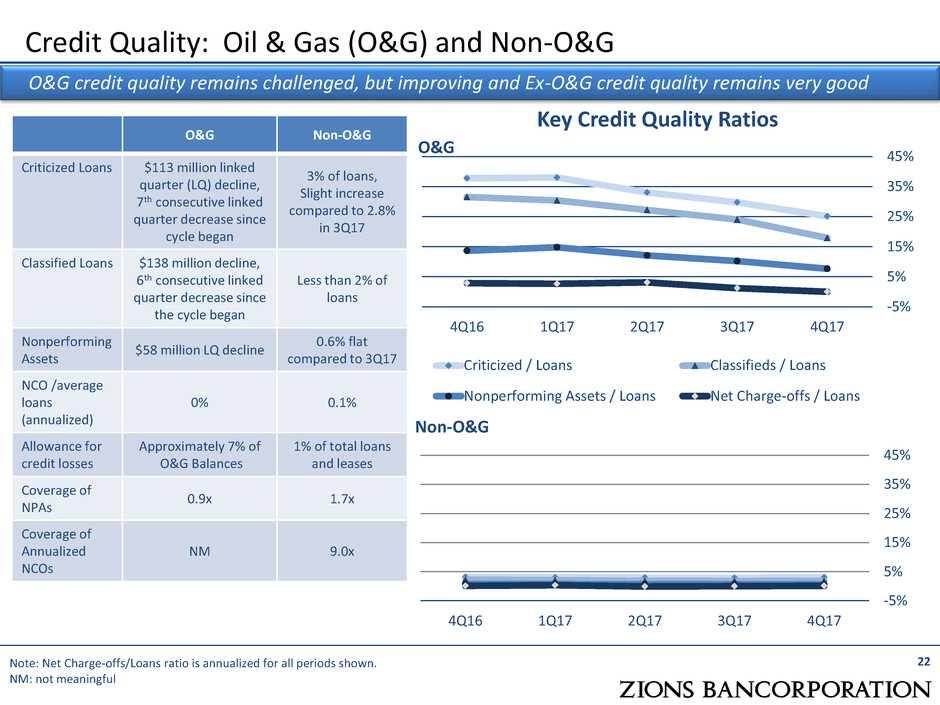

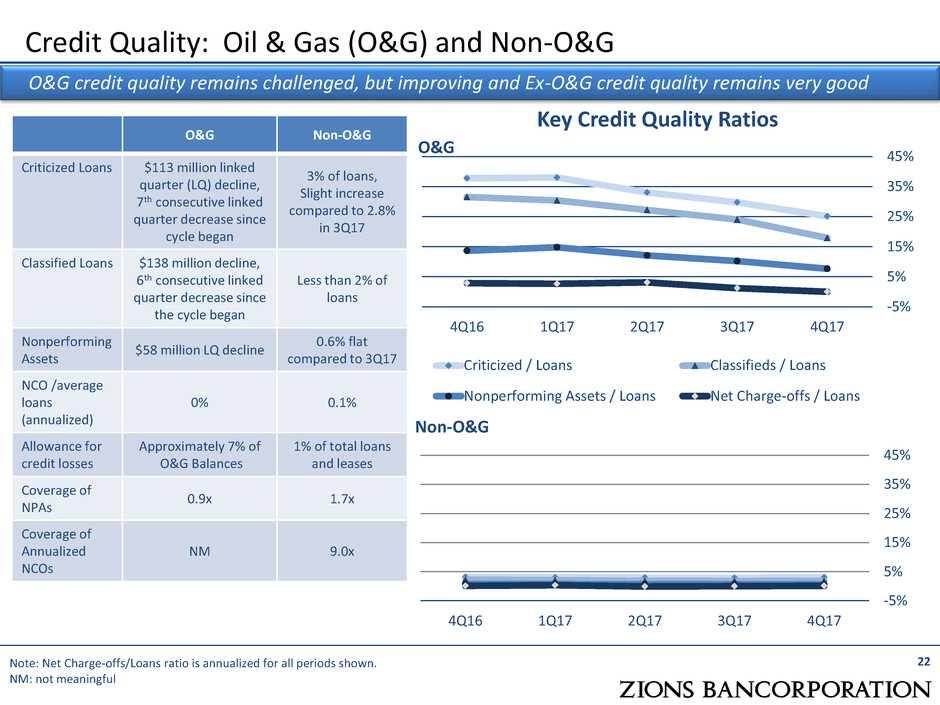

Credit Quality: Oil & Gas (O&G) and Non-O&G 22 Key Credit Quality Ratios O&G credit quality remains challenged, but improving and Ex-O&G credit quality remains very good Note: Net Charge-offs/Loans ratio is annualized for all periods shown. NM: not meaningful -5% 5% 15% 25% 35% 45% 4Q16 1Q17 2Q17 3Q17 4Q17 Criticized / Loans Classifieds / Loans Nonperforming Assets / Loans Net Charge-offs / Loans O&G Non-O&G Criticized Loans $113 million linked quarter (LQ) decline, 7th consecutive linked quarter decrease since cycle began 3% of loans, Slight increase compared to 2.8% in 3Q17 Classified Loans $138 million decline, 6th consecutive linked quarter decrease since the cycle began Less than 2% of loans Nonperforming Assets $58 million LQ decline 0.6% flat compared to 3Q17 NCO /average loans (annualized) 0% 0.1% Allowance for credit losses Approximately 7% of O&G Balances 1% of total loans and leases Coverage of NPAs 0.9x 1.7x Coverage of Annualized NCOs NM 9.0x O&G Non-O&G -5% 5% 15% 25% 35% 45% 4Q16 1Q17 2Q17 3Q17 4Q17

O&G Loan Loss Expectation O&G loan losses are expected to decline substantially over the next 12 months as compared to the last 12 months (1) Most of the expected loss is likely to come from services loans 51% of classified O&G loans are from services loans Approximately three quarters of O&G losses incurred since Sep 30, 2014 are from services loans Healthy sponsor support has resulted in loss levels that were lower than otherwise would have been experienced Improved borrower and sponsor sentiment Strong Reserve Against O&G Loans Zions’ O&G allowance for credit losses is: 7% of O&G loan balances 27% of criticized O&G loan balances 23 Oil & Gas Loss Outlook and Reserve The outlook is improving for the O&G portfolio (1) Assuming oil and gas commodity prices remain relatively stable; LTM O&G NCOs were $36 million.

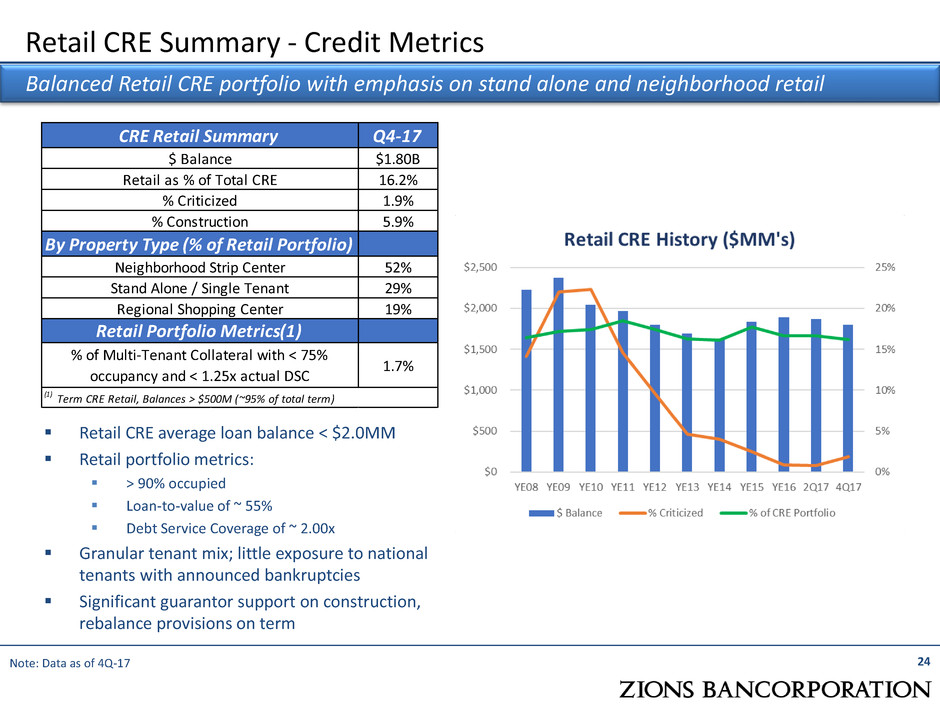

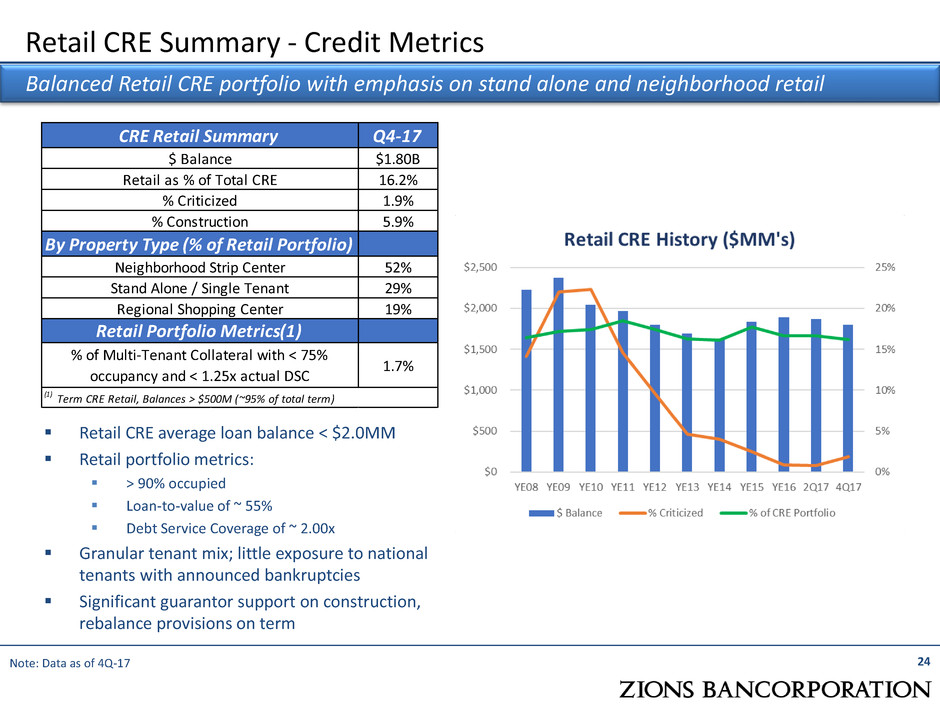

Retail CRE Summary - Credit Metrics 24 Balanced Retail CRE portfolio with emphasis on stand alone and neighborhood retail Note: Data as of 4Q-17 Retail CRE average loan balance < $2.0MM Retail portfolio metrics: > 90% occupied Loan-to-value of ~ 55% Debt Service Coverage of ~ 2.00x Granular tenant mix; little exposure to national tenants with announced bankruptcies Significant guarantor support on construction, rebalance provisions on term Q4-17 $1.80B 16.2% 1.9% 5.9% 52% 29% 19% 1.7% (1) Term CRE Retail, Balances > $500M (~95% of total term) CRE Retail Summary $ Balance Retail as % of Total CRE % Criticized % Construction By Property Type (% of Retail Portfolio) Neighborhood Strip Center Stand Alone / Single Tenant Regional Shopping Center Retail Portfolio Metrics(1) % of Multi-Tenant Collateral with < 75% occupancy and < 1.25x actual DSC

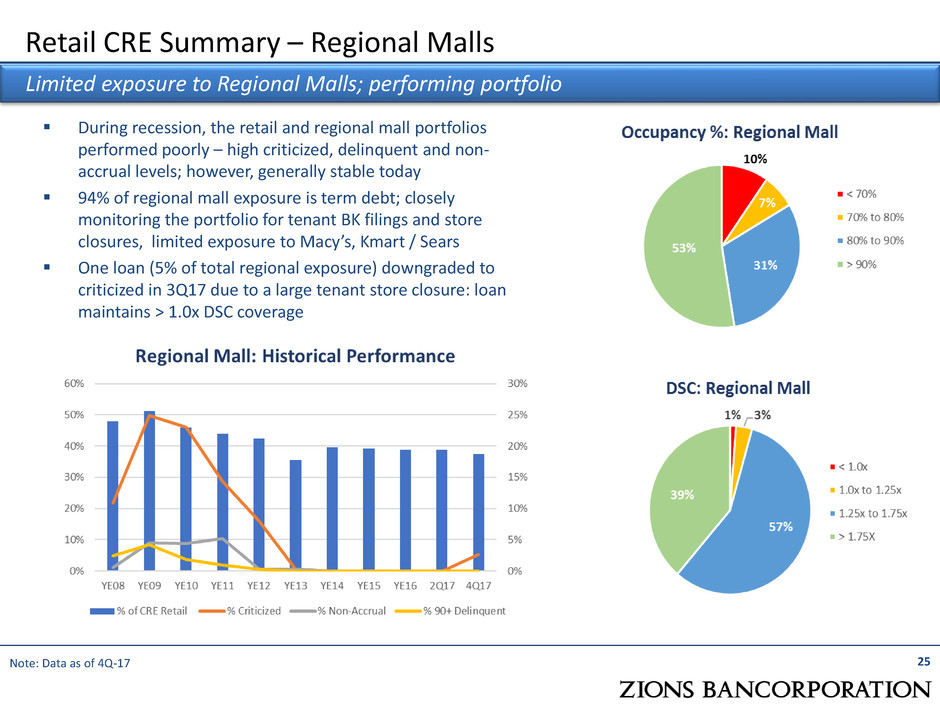

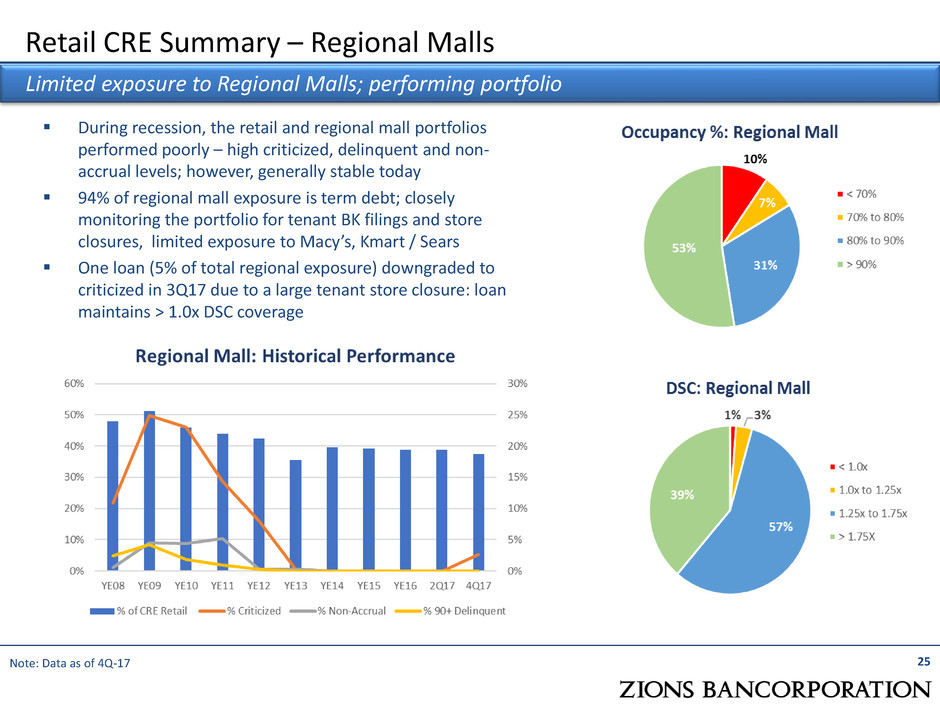

Retail CRE Summary – Regional Malls 25 Limited exposure to Regional Malls; performing portfolio Note: Data as of 4Q-17 During recession, the retail and regional mall portfolios performed poorly – high criticized, delinquent and non- accrual levels; however, generally stable today 94% of regional mall exposure is term debt; closely monitoring the portfolio for tenant BK filings and store closures, limited exposure to Macy’s, Kmart / Sears One loan (5% of total regional exposure) downgraded to criticized in 3Q17 due to a large tenant store closure: loan maintains > 1.0x DSC coverage

Retail CRE Summary - Location and Collateral Type 26 Footprint based lending with term loan emphasis Note: Data as of 4Q-17 93% of portfolio is in the Bank’s footprint states Since 2008-9 recession, Zions identified specific retail types as a concern, thus limiting exposure to shadow anchor retail and regional malls Community bank model results in < 20% of the bank’s CRE retail loans secured by regional malls Retail CRE bank clients provide significant guarantor strength, many who maintain national and regional tenant relationships No speculative retail construction

Retail C&I Summary 27 The portfolio is stable, with limited exposure to national brick and mortar retailers Retail C&I loans (defined by NAICS codes) total $2.3B and represent exposure to the overall retail industry; More insulated (84%) includes auto dealers, gas stations, grocery stores, building material suppliers, and similar companies Less insulated (16%) includes those providing products widely available both on-line and through traditional brick and mortal channels Limited exposure to national, legacy brick and mortar retailers Majority of borrowers defined as less insulated are smaller, niche companies, with on-line and other non-brick-and-mortar distribution channels Over the past year, total exposure increased 5%; More Insulated loans accounted for 88% of the increase Less Insulated loans accounted for 12% of the increase After generally improving then remaining stable, credit quality deteriorated slightly largely due to a single credit with non-systemic issues C&I Retail Loan by Segment Retail C&I History Note: Data as of 4Q-17

Retail C&I Summary - Total 28 Total Retail C&I is dominated by Term Debt secured by Real Estate or Dealer Flooring Approximately half of the Total Retail C&I balances are secured by real estate, primarily auto dealers, gas stations and grocery stores Flooring lines of credit (those secured by new and used autos) account for another 19% of balances Unsecured exposure accounts for only 4% of Retail C&I balances Of the total exposure, 71% is term, primarily real estate exposure Exposure is centered at ZFNB, which notably includes dealer flooring Retail C&I Revolving vs Term Retail C&I Collateral Types Retail C&I By Affiliate Note: Data as of 4Q-17

Retail C&I Summary – More Insulated 29 More Insulated (84%; $1.9 billion) includes auto dealers, gas stations, supermarkets, home improvement, and non-store retailers Approximately half of the More Insulated exposure is real estate secured with another 22% comprised of dealer flooring lines Only 3% is unsecured Approximately 70% of the More Insulated exposure is term Approximately 70% of the revolving exposure is dealer flooring lines More Insulated is dominated by Term Debt secured by Real Estate or Dealer Flooring More Insulated Sub-sectors More Insulated History More Insulated by Collateral Types ($ Thousands) Note: Data as of 4Q-17 Descrip ion Balance Motor Vehicle and Parts Dealers 1,092 Gasoline Stations/Convenience Stores 368 Supermarkets 191 Home Improvement 137 Non-store Retailers 104 Tot l 1,890

Retail C&I Summary – Less Insulated 30 Less insulated (20%; $403 million) includes those providing products widely available both on-line and through traditional brick and mortal channels Limited exposure to national, legacy brick and mortar retailers Majority of borrowers defined as less insulated are smaller, niche companies, with on-line and other non-brick-and-mortar distribution channels Nearly 60% of the exposure is real estate secured Only 11% of the Less Insulated exposure is unsecured Approximately 85% of the exposure is term Less Insulated by Collateral Types Less Insulated Sub-sectors Less Insulated is dominated by Term Debt secured by Real Estate ($ Thousands) Less Insulated History Note: Data as of 4Q-17 Description Balance H e Furni hings 123 Miscellaneous Store Retailers 63 Apparel & Footware 61 Specialty Retailers 52 Electronics and Appliance 34 Drug Stores 29 General Merchandise Stores 5 Tot l 366

31 Loan Growth by Bank Brand and Loan Type Note: National Real Estate (NRE) is a division of Zions Bank with a focus on small business loans with low LTV ratios, which generally are in line with SBA 504 program parameters. “Other” loans includes municipal and other consumer loan categories. Totals shown above may not foot due to rounding. Year over Year Loan Growth (4Q17 vs. 4Q16) Linked Quarter Loan Growth (4Q17 vs. 3Q17) (in millions) Zions Bank Amegy CB&T NBAZ NSB Vectra CBW ZBNA Other Total C&I (ex-Oil & Gas) (202) (63) 299 25 (27) 24 - - 56 Owner occupied (ex-NRE) 8 121 8 52 16 (24) 29 - 210 CRE C&D 31 (76) (34) 30 (44) (61) 5 - (149) CRE Term (ex-NRE) 77 28 (12) 37 (10) 33 39 - 192 1-4 Family 26 69 3 8 2 3 3 26 140 National Real Estate (37) - - - - - - - (37) Energy (Oil & Gas) (22) (48) - 4 - (7) - - (73) Home Equity 8 2 20 6 3 (13) 6 - 32 Other 81 22 44 17 50 40 (4) 3 253 Total net loans (30) 55 328 179 (10) (5) 78 29 624 (in millions) Zions Bank Amegy CB&T NBAZ NSB Vectra CBW ZBNA Other Total C&I (ex-Oil & Gas) (253) 287 486 72 8 77 - - 677 Owner occupied (ex-NRE) 14 257 86 62 (1) (14) 64 - 468 CRE C&D 76 (25) (1) 10 (41) (47) 30 - 2 CRE Term (ex-NRE) 139 (38) (212) (123) (41) 95 65 - (115) 1-4 Family 79 411 18 20 4 38 10 191 771 National Real Estate (246) - - - - - - - (246) Energy (Oil & Gas) (13) (169) (1) 7 - (9) - - (185) Home Equity (20) 30 62 20 11 12 17 - 132 Other 178 84 144 78 70 89 (21) 5 627 Total net loans (46) 837 582 146 10 241 165 196 2,131

32 GAAP to Non-GAAP Reconciliation (Amounts in millions) 4Q17 3Q17 2Q17 1Q17 4Q16 Efficiency Ratio Noninterest expense (GAAP) (1) (a) $ 417 $ 413 $ 405 $ 414 $ 404 Adjustments: Severance costs 1 1 - 5 1 Other real estate expense - (1) - - - Provision for unfunded lending commitments (1) (4) 3 (5) 3 Debt extinguishment cost - - - - - Amortization of core deposit and other intangibles 1 2 2 2 2 Restructuring costs 1 1 1 1 3 Total adjustments (b) 2 (1) 6 3 9 Adjusted noninterest expense (non-GAAP) (a) - (b) = (c) 415 414 399 411 395 Net Interest Income (GAAP) (d) 526 522 528 489 480 Fully taxable-equivalent adjustments (e) 9 9 9 8 8 Taxable-equivalent net interest income (non-GAAP) (d) + (e) = (f) 535 531 537 497 488 Noninterest income (GAAP) (1) (g) 139 139 132 132 128 Combined income (f) + (g) = (h) 674 670 669 629 616 Adjustments: Fair value and nonhedge derivative income (loss) - - - - 7 Equity securities gains (losses), net - 5 2 5 (3) Total adjustments (i) - 5 2 5 4 Adjusted taxable-equivalent revenue (non-GAAP) (h) - (i) = (j) 674 665 667 624 612 Pre-provision net revenue (PPNR), as reported (h) – (a) $ 257 $ 257 $ 264 $ 215 $ 212 Adjusted pre-provision net revenue (PPNR) (j) - (c) $ 259 $ 251 $ 268 $ 213 $ 217 Efficiency Ratio (1) (c) / (j) 61.6 % 62.3 % 59.8 % 65.9 % 64.5 %

33 GAAP to Non-GAAP Reconciliation $ In millions except per share amounts 4Q17 3Q17 2Q17 1Q17 4Q16 Pre-Provision Net Revenue (PPNR) (a) Total noninterest expense (1) $413 $413 $405 $414 $404 LESS adjustments: Severance costs 1 1 - 5 1 Other real estate expense - (1) - - - Provision for unfunded lending commitments (1) (4) 3 (5) 3 Debt extinguishment cost - - - - - Amortization of core deposit and other intangibles 1 2 2 2 2 Restructuring costs 1 1 1 1 3 (b) Total adjustments 2 (1) 6 3 9 (a-b)=(c) Adjusted noninterest expense $415 $414 $399 $411 $395 (d) Net interest income 526 522 528 489 480 (e) Fully taxable-equivalent adjustments 9 9 9 8 8 (d+e)=(f) Taxable-equivalent net interest income (TENII) 535 531 537 497 488 (g) Noninterest Income 139 139 132 132 128 (f+g)=(h) Combined Income $674 $670 $669 $629 $616 LESS adjustments: Fair value and nonhedge derivative income (loss) - - - - 7 Securities gains (losses), net - 5 2 5 (3) (i) Total adjustments - 5 2 5 4 (h-i)=(j) Adjusted revenue $674 $665 $667 $624 $612 (j-c) Adjusted pre-provision net revenue (PPNR) $259 $251 $268 $213 $217 Net Earnings Applicable to Common Shareholders (NEAC) (k) Net earnings applicable to common 114 152 154 129 125 (l) Diluted Shares 209,681 209,106 208,183 210,405 205,446 GAAP EPS 0.54 0.72 0.73 0.61 0.60 PLUS Adjustments: Adjustments to noninterest expense 2 (1) 6 3 9 Adjustments to revenue - (5) (2) (5) (4) Tax effect for adjustments (38%) (1) 2 (2) 1 (2) Preferred stock redemption - - (2) - - (m) Total adjustments 1 (4) - (1) 3 (k+m)=(n) Adjusted net earnings applicable to common (NEAC) $115 $148 $154 $128 $128 (n)/(l) Adjusted EPS 0.55 0.71 0.75 0.64 0.62 (o) Average assets 65,697 65,339 65,411 63,995 61,746 (p) Average tangible common equity 6,203 6,212 6,123 5,974 5,974 Profitability (n)/(o) Adjusted Return on Assets (Annualized) 0.70% 0.91% 0.94% 0.80% 0.83% (n)/(p) Adjusted Return on Tangible Common Equity (Annualized) 7.43% 9.55% 10.09% 8.55% 8.58% (c)/(j) Efficiency Ratio 61.6% 62.3% 59.8% 65.9% 64.5%