ZIONS BANCORPORATION

Press Release – Page 1

July 23, 2018

|

| |

Zions Bancorporation

One South Main

Salt Lake City, UT 84133

July 23, 2018 | |

| www.zionsbancorporation.com |

Second Quarter 2018 Financial Results: FOR IMMEDIATE RELEASE

Investor and Media Contact: James Abbott (801) 844-7637

|

|

| Zions Bancorporation Reports: 2Q18 Net Earnings¹ of $187 million, diluted EPS of $0.89 |

compared with 2Q17 Net Earnings¹ of $154 million, diluted EPS of $0.73,

and 1Q18 Net Earnings¹ of $231 million, diluted EPS of $1.09 |

|

SECOND QUARTER RESULTS

|

| | | | | | |

| $0.89 | | $187 million | | 3.56% | | 12.2% |

| Earnings per diluted common share | | Net Earnings 1 | | Net interest margin (“NIM”) | | Common Equity Tier 1 |

|

| | |

| SECOND QUARTER HIGHLIGHTS² |

| | | |

| Net Interest Income and NIM | | Net interest income was $548 million, up 4% |

| NIM was 3.56%, compared with 3.52% |

| | | |

| Operating Performance | | Pre-provision net revenue ("PPNR") was $263 million, compared with $264 million |

| Adjusted PPNR³ was $270 million, compared with $268 million |

| Noninterest expense was $428 million, compared with $405 million |

| Adjusted noninterest expense³ was $420 million, compared with $399 million |

| Efficiency ratio³ was 60.9%, compared with 59.8% |

| | | |

| Loans and Credit Quality | | Net loans and leases were $45.2 billion, up 4% |

| Classified loans were $947 million, down 28%; and nonperforming assets were $347 million, down 29% |

| Provision for credit losses was $12 million, compared with $10 million |

| Net credit recoveries of 0.11% of average loans, compared with 0.06% of net charge-offs |

| | | |

| Capital Returns | | Return on average tangible common equity³ was 12.4%, compared with 10.2% |

| Common stock repurchases of $120 million, 2.1 million shares, or 1.1% of shares outstanding as of March 31, 2018 |

| Common dividend increased to $0.24 per share from $0.08 per share |

| | | |

| Notable Items | | Our proposed merger of the Bank Holding Company into the Bank remains on track to close in the third quarter of 2018 |

|

|

| CEO COMMENTARY |

| |

Harris H. Simmons, Chairman and CEO, commented, “Second quarter results reflect continued strong credit quality, tempered by modest linked-quarter loan growth. We experienced net recoveries this quarter and only three basis points of net loan losses as a percentage of total loans over the past twelve months. At the same time, competitive pressures in the market for commercial real estate loans led to additional runoff in that portfolio as we’ve exercised discipline with respect to pricing and terms, muting overall loan growth.” Mr. Simmons continued, “We’re encouraged by recent legislative and regulatory developments that should provide us with greater flexibility with respect to capital management, and we expect that we will be able to increase the pace of capital distribution in coming quarters. We’re also optimistic that, pending shareholder approval, we’ll be able to complete the planned merger of Zions Bancorporation into its subsidiary, ZB, N.A., by the end of the third quarter, leading to a more efficient regulatory structure for the company.”

|

|

|

¹ Net Earnings is net earnings applicable to common shareholders.

² Comparisons noted in the bullet points are calculated for the current quarter versus the same prior-year period, unless otherwise specified.

³ For information on non-GAAP financial measures and why the Company presents these numbers, see pages 17-20. |

ZIONS BANCORPORATION

Press Release – Page 2

July 23, 2018

Comparisons noted in the sections below are calculated for the current quarter versus the same prior-year period, unless otherwise specified.

RESULTS OF OPERATIONS

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income and Margin |

| | | | | | | | 2Q18 - 1Q18 | | 2Q18 - 2Q17 |

| (In millions) | 2Q18 | | 1Q18 | | 2Q17 | | $ | | % | | $ | | % |

| Interest and fees on loans | $ | 514 |

| | $ | 497 |

| | $ | 469 |

| | $ | 17 |

| | 3 | % | | $ | 45 |

| | 10 | % |

| Interest on money market investments | 7 |

| | 6 |

| | 5 |

| | 1 |

| | 17 |

| | 2 |

| | 40 |

|

| Interest on securities | 85 |

| | 86 |

| | 84 |

| | (1 | ) | | (1 | ) | | 1 |

| | 1 |

|

| Total interest income | 606 |

| | 589 |

| | 558 |

| | 17 |

| | 3 |

| | 48 |

| | 9 |

|

| Interest on deposits | 29 |

| | 20 |

| | 14 |

| | 9 |

| | 45 |

| | 15 |

| | 107 |

|

| Interest on short and long-term borrowings | 29 |

| | 27 |

| | 16 |

| | 2 |

| | 7 |

| | 13 |

| | 81 |

|

| Total interest expense | 58 |

| | 47 |

| | 30 |

| | 11 |

| | 23 |

| | 28 |

| | 93 |

|

| Net interest income | $ | 548 |

| | $ | 542 |

| | $ | 528 |

| | $ | 6 |

| | 1 |

| | $ | 20 |

| | 4 |

|

| | | | | | | | bps | | | | bps | | |

| Net interest margin | 3.56 | % | | 3.56 | % | | 3.52 | % | | — |

| |

| | 4 |

| | |

Net interest income increased to $548 million in the second quarter of 2018 from $528 million in the second quarter of 2017. The $20 million, or 4%, increase in reported net interest income was attributable to a $45 million increase in interest and fees on loans, resulting from increases in short-term interest rates and loan growth in consumer and commercial loans, partially offset by an increase to interest expense. The prior year period included $16 million of interest recoveries of at least $1 million per loan, while the current period included only $1 million of such recoveries. Adjusted for these interest income recoveries, the increase in net interest income relative to the prior year period would have been 7%. The $28 million increase in interest expense was evenly distributed between higher rates paid on deposits and an increase in interest on short and long-term borrowings.

The yield on interest earning assets increased 6 basis points, compared with the first quarter of 2018, and 21 basis points, compared with the second quarter of 2017. When adjusted for interest recoveries of $1 million in the second quarter of 2018, $11 million in the first quarter of 2018, and $16 million in the second quarter of 2017, the yield on interest earning assets increased 12 basis points compared with the first quarter of 2018, and 31 basis points, compared with the second quarter of 2017. The yield benefited from the recent increases in short-term interest rates.

The effective rate on total deposits and interest-bearing liabilities increased to 0.40% for the second quarter of 2018, from 0.33% for the first quarter of 2018, and 0.21% for the second quarter of 2017. The increase from both prior periods was primarily due to an increase in both the rate paid on wholesale funding and deposits as a result of changes in short-term interest rates and a change in the overall composition of balance sheet funding. The total cost of deposits for the second quarter of 2018 was 0.22%, compared with 0.15% for the first quarter of 2018, and 0.11% for the second quarter of 2017.

The net interest margin remained flat at 3.56% in the second quarter of 2018, compared with the first quarter of 2018, and increased from 3.52% in the same prior year period. Excluding the previously described effect of interest

ZIONS BANCORPORATION

Press Release – Page 3

July 23, 2018

recoveries and adjusting for the effect of the change to the corporate tax rate on fully taxable equivalent yields, the net interest margin would have been 3.55% in the current period, which compares with 3.49% and 3.39% in the prior quarter and the year ago period, respectively.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Income |

| | | | | | | | 2Q18 - 1Q18 | | 2Q18 - 2Q17 |

| (In millions) | 2Q18 | | 1Q18 | | 2Q17 | | $ | | % | | $ | | % |

| Service charges and fees on deposit accounts | $ | 42 |

| | $ | 42 |

| | $ | 43 |

| | $ | — |

| | — | % | | $ | (1 | ) | | (2 | )% |

| Other service charges, commissions and fees | 55 |

| | 55 |

| | 56 |

| | — |

| | — |

| | (1 | ) | | (2 | ) |

| Wealth management and trust income | 14 |

| | 12 |

| | 10 |

| | 2 |

| | 17 |

| | 4 |

| | 40 |

|

| Loan sales and servicing income | 7 |

| | 6 |

| | 6 |

| | 1 |

| | 17 |

| | 1 |

| | 17 |

|

| Capital markets and foreign exchange | 7 |

| | 8 |

| | 6 |

| | (1 | ) | | (13 | ) | | 1 |

| | 17 |

|

| Customer-related fees | 125 |

| | 123 |

| | 121 |

| | 2 |

| | 2 |

| | 4 |

| | 3 |

|

| Dividends and other investment income | 11 |

| | 11 |

| | 10 |

| | — |

| | — |

| | 1 |

| | 10 |

|

| Securities gains (losses), net | 1 |

| | — |

| | 2 |

| | 1 |

| | NM |

| | (1 | ) | | (50 | ) |

| Other | 1 |

| | 4 |

| | (1 | ) | | (3 | ) | | (75 | ) | | 2 |

| | 200 |

|

| Total noninterest income | $ | 138 |

| | $ | 138 |

| | $ | 132 |

| | $ | — |

| | — |

| | $ | 6 |

| | 5 |

|

Total noninterest income for the second quarter of 2018 increased by $6 million, or 5%, to $138 million from $132 million, primarily due to a $4 million, or 3%, increase in customer-related fees and a $2 million increase in other noninterest income. Customer-related fees increased mainly from wealth management and trust income, loan syndication fees, and investment service fees.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Expense |

| | | | | | | | 2Q18 - 1Q18 | | 2Q18 - 2Q17 |

| (In millions) | 2Q18 | | 1Q18 | | 2Q17 | | $ | | % | | $ | | % |

| Salaries and employee benefits | $ | 266 |

| | $ | 269 |

| | $ | 240 |

| | $ | (3 | ) | | (1 | )% | | $ | 26 |

| | 11 | % |

| Occupancy, net | 32 |

| | 31 |

| | 32 |

| | 1 |

| | 3 |

| | — |

| | — |

|

| Furniture, equipment and software, net | 32 |

| | 33 |

| | 32 |

| | (1 | ) | | (3 | ) | | — |

| | — |

|

| Credit-related expense | 7 |

| | 7 |

| | 8 |

| | — |

| | — |

| | (1 | ) | | (13 | ) |

| Provision for unfunded lending commitments | 7 |

| | (7 | ) | | 3 |

| | 14 |

| | 200 |

| | 4 |

| | 133 |

|

| Professional and legal services | 14 |

| | 12 |

| | 14 |

| | 2 |

| | 17 |

| | — |

| | — |

|

| Advertising | 7 |

| | 5 |

| | 6 |

| | 2 |

| | 40 |

| | 1 |

| | 17 |

|

| FDIC premiums | 14 |

| | 13 |

| | 13 |

| | 1 |

| | 8 |

| | 1 |

| | 8 |

|

| Other | 49 |

| | 49 |

| | 57 |

| | — |

| | — |

| | (8 | ) | | (14 | ) |

| Total noninterest expense | $ | 428 |

| | $ | 412 |

| | $ | 405 |

| | $ | 16 |

| | 4 |

| | $ | 23 |

| | 6 |

|

Adjusted noninterest expense 1 | $ | 420 |

| | $ | 419 |

| | $ | 399 |

| | $ | 1 |

| | — | % | | $ | 21 |

| | 5 | % |

| |

1 | For information on non-GAAP financial measures, see pages 17-20. |

Noninterest expense for the second quarter of 2018 was $428 million, compared with $405 million for the second quarter of 2017. Salaries and employee benefits increased $26 million from the second quarter of 2017 to the second quarter of 2018. The increase was primarily due to an $11 million increase in incentive compensation due to stronger financial performance relative to 2017, an $8 million increase in base salaries due to increased headcount and annual merit increases, and $3 million increases in base salaries and bonuses to be paid to certain employees as a result of the recent tax reform. The provision for unfunded lending commitments increased by $4 million, primarily due to

ZIONS BANCORPORATION

Press Release – Page 4

July 23, 2018

increased unfunded lending commitments and a change in the mix of the portfolio. Other noninterest expense decreased by $8 million, primarily due to reduced revenue sharing with the FDIC for certain loans purchased in 2009 as the agreement with the FDIC ended in the first quarter of 2018.

Adjusted noninterest expense for the second quarter of 2018 increased $21 million, or 5%, to $420 million, compared with $399 million for the same prior year period. The main variance between noninterest expense and adjusted noninterest expense for both the second quarters of 2018 and 2017 is the provision for unfunded lending commitments, which was $7 million and $3 million, respectively.

Our efficiency ratio was 60.9% in the second quarter of 2018, compared with 61.3% in the first quarter of 2018, and 59.8% in the second quarter of 2017. For information on non-GAAP financial measures, see pages 17-20.

Our income tax rate was 22.1% for the second quarter of 2018, compared with 22.7% for the first quarter of 2018 and 32.3% for the second quarter of 2017. The income tax rates for the first and second quarters of 2018 were positively impacted by the decrease in the corporate federal income tax rate to 21% from 35%, effective January 1, 2018.

BALANCE SHEET ANALYSIS

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset Quality |

| | | | | | | | 2Q18 - 1Q18 | | 2Q18 - 2Q17 |

| (In millions) | 2Q18 | | 1Q18 | | 2Q17 | | bps | | | | bps | | |

| Ratio of nonperforming assets to loans and leases and other real estate owned | 0.77 | % | | 0.87 | % | | 1.12 | % | | (10 | ) | | | | (35 | ) | | |

| Annualized ratio of net loan and lease charge-offs (recoveries) to average loans | (0.11 | )% | | 0.05 | % | | 0.06 | % | | (16 | ) | | | | (17 | ) | | |

Ratio of allowance for loan losses to loans and leases, at period end

| 1.08 | % | | 1.05 | % | | 1.25 | % | | 3 |

| | | | (17 | ) | | |

| | | | | | | | $ | | % | | $ | | % |

| Classified loans | $ | 947 |

| | $ | 1,023 |

| | $ | 1,317 |

| | $ | (76 | ) | | (7 | )% | | $ | (370 | ) | | (28 | )% |

| Nonperforming assets | 347 |

| | 392 |

| | 490 |

| | (45 | ) | | (11 | )% | | (143 | ) | | (29 | )% |

| Net loan and lease charge-offs (recoveries) | (12 | ) | | 5 |

| | 7 |

| | (17 | ) | | (340 | )% | | (19 | ) | | (271 | )% |

| Provision for credit losses | 12 |

| | (47 | ) | | 10 |

| | 59 |

| | 126 | % | | 2 |

| | 20 | % |

Asset quality continued to improve for the entire loan portfolio when compared with the prior quarter and the same prior year period, primarily due to improvements in the oil and gas-related portfolio and decreases in overall classified and nonperforming assets.

The Company recorded a $12 million provision for credit losses during the second quarter of 2018, compared with $(47) million during the first quarter of 2018, and $10 million for the second quarter of 2017. The $12 million provision primarily reflects qualitative adjustments related to enhancements to our internal risk grading system, increased economic uncertainty related to potential trade disruptions, and the potential credit impacts of rising interest rates, offset by net recoveries and improved credit quality metrics in the entire loan portfolio. The allowance for loan

ZIONS BANCORPORATION

Press Release – Page 5

July 23, 2018

losses was $490 million at June 30, 2018, compared with $544 million at June 30, 2017, or 1.08% and 1.25% of loans and leases, respectively.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans and Leases |

| | | | | | | | 2Q18 - 1Q18 | | 2Q18 - 2Q17 |

| (In millions) | 2Q18 | | 1Q18 | | 2Q17 | | $ | | % | | $ | | % |

| Loans held for sale | $ | 84 |

| | $ | 90 |

| | $ | 53 |

| | $ | (6 | ) | | (7 | )% | | $ | 31 |

| | 58 |

|

| Loans and leases: | | | | | | | | | | | | | |

| Commercial | 23,245 |

| | 23,140 |

| | 22,203 |

| | 105 |

| | — |

| | 1,042 |

| | 5 |

|

| Commercial real estate | 10,973 |

| | 11,122 |

| | 11,198 |

| | (149 | ) | | (1 | ) | | (225 | ) | | (2 | ) |

| Consumer | 11,012 |

| | 10,821 |

| | 10,282 |

| | 191 |

| | 2 |

| | 730 |

| | 7 |

|

| Loans and leases, net of unearned income and fees | 45,230 |

| | 45,083 |

| | 43,683 |

| | 147 |

| | — |

| | 1,547 |

| | 4 |

|

| Less allowance for loan losses | 490 |

| | 473 |

| | 544 |

| | 17 |

| | 4 |

| | (54 | ) | | (10 | ) |

| Loans held for investment, net of allowance | $ | 44,740 |

| | $ | 44,610 |

| | $ | 43,139 |

| | $ | 130 |

| | — |

| | $ | 1,601 |

| | 4 |

|

Loans and leases, net of unearned income and fees, increased $1.5 billion, or 4%, to $45.2 billion at June 30, 2018 from $43.7 billion at June 30, 2017. The largest increases were in commercial loans, predominantly in municipal loans, which increased $517 million, and consumer loans, mainly 1-4 family residential loans, which increased $502 million. Term commercial real estate loans declined slightly from the prior year, primarily due to payoffs and a decline in originations. Unfunded lending commitments increased to $21.2 billion at June 30, 2018, compared with $19.3 billion at June 30, 2017.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits |

| | | | | | | | 2Q18 - 1Q18 | | 2Q18 - 2Q17 |

| (In millions) | 2Q18 | | 1Q18 | | 2Q17 | | $ | | % | | $ | | % |

| Noninterest-bearing demand | $ | 24,007 |

| | $ | 23,909 |

| | $ | 24,172 |

| | $ | 98 |

| | — | % | | $ | (165 | ) | | (1 | )% |

| Interest-bearing: | | | | | | | | | | | | | |

| Savings and money market | 25,562 |

| | 25,473 |

| | 25,165 |

| | 89 |

| | — |

| | 397 |

| | 2 |

|

| Time | 4,011 |

| | 3,581 |

| | 3,041 |

| | 430 |

| | 12 |

| | 970 |

| | 32 |

|

| Total deposits | $ | 53,580 |

| | $ | 52,963 |

| | $ | 52,378 |

| | $ | 617 |

| | 1 |

| | $ | 1,202 |

| | 2 |

|

Total deposits increased by $1.2 billion, or 2%, from $52.4 billion at June 30, 2017. Average total deposits increased slightly to $52.9 billion for the second quarter of 2018 compared with $52.3 billion for the second quarter of 2017. Average noninterest bearing deposits decreased slightly to $23.6 billion for the second quarter of 2018, compared with $23.8 billion for the second quarter of 2017, and were approximately 45% of average total deposits for both periods.

ZIONS BANCORPORATION

Press Release – Page 6

July 23, 2018

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders’ Equity |

| | | | | | | | 2Q18 - 1Q18 | | 2Q18 - 2Q17 |

| (In millions) | 2Q18 | | 1Q18 | | 2Q17 | | $ | | % | | $ | | % |

| Shareholders’ equity: | | | | | | | | | | | | | |

| Preferred Stock | $ | 566 |

| | $ | 566 |

| | $ | 566 |

| | $ | — |

| | — | % | | $ | — |

| | — | % |

| Common Stock | 4,231 |

| | 4,346 |

| | 4,660 |

| | (115 | ) | | (3 | ) | | (429 | ) | | (9 | ) |

| Retained earnings | 3,139 |

| | 2,999 |

| | 2,572 |

| | 140 |

| | 5 |

| | 567 |

| | 22 |

|

| Accumulated other comprehensive income (loss) | (315 | ) | | (267 | ) | | (49 | ) | | (48 | ) | | (18 | ) | | (266 | ) | | (543 | ) |

| Total shareholders' equity | $ | 7,621 |

| | $ | 7,644 |

| | $ | 7,749 |

| | $ | (23 | ) | | — |

| | $ | (128 | ) | | (2 | ) |

During the second quarter of 2018, the Company increased its common stock dividend to $0.24 per share from $0.20 per share in the first quarter of 2018. Common stock repurchases during the current quarter totaled $120 million, or 2.1 million shares, which is equivalent to 1.1% of common stock outstanding as of March 31, 2018. During the last four quarters the Company has repurchased $465 million, or 9.2 million shares, which is equivalent to 4.5% of common stock outstanding as of June 30, 2017. Weighted average diluted shares increased by 1.1 million compared with the second quarter of 2017, primarily due to the dilutive impact of warrants that have been outstanding since 2008 (“TARP” warrants - NASDAQ: ZIONZ) and 2010 (NASDAQ: ZIONW) and employee equity grants. The dilutive effect of the warrants has been particularly prominent during the past year as the stock price has appreciated $8.78 per share, or 20%. As of June 30, 2018, the Company had 2.5 million and 29.3 million warrants outstanding of ZIONZ (TARP) and ZIONW warrants, respectively. The ZIONZ warrants expire on November 14, 2018 and the ZIONW warrants expire on May 22, 2020. Preferred dividends are expected to be $34 million for all of 2018.

Tangible book value per common share increased to $30.91 at June 30, 2018, compared with $30.50 at June 30, 2017. Basel III common equity tier 1 (“CET1”) capital was $6.4 billion at June 30, 2018, compared with $6.2 billion at June 30, 2017; the increase was primarily due to a $567 million increase in retained earnings, partially offset by share repurchases. The estimated Basel III CET1 capital ratio was 12.2% at June 30, 2018 compared to 12.3% at June 30, 2017. For information on non-GAAP financial measures, see pages 17-20.

On June 21, 2018, the Company announced the results of its internal stress test exercise as well as results communicated to the Company by the Federal Reserve Board with respect to the Federal Reserve's stress test of Zions' financial and capital strength. In prior years, the Federal Reserve Board of Governors has released the results of its own Dodd-Frank Act stress tests ("DFAST") for Zions Bancorporation and other regional and larger banks. However, in accordance with the Economic Growth, Regulatory Relief and Consumer Protection Act of 2018, which was recently signed into law, Zions Bancorporation and other bank holding companies with assets of less than $100 billion are, at this point in time, no longer subject to the Federal Reserve's DFAST protocols. The Federal Reserve announced that it will not publicly release the results of its stress test for Zions Bancorporation, but authorized Zions to publish the Federal Reserve's results as communicated to the Company. The results of both stress tests reflect DFAST capital actions as defined in relevant regulations. Subsequently, interagency regulatory guidance was issued, effectively notifying the Company that it would no longer be subject to the requirements of the Comprehensive

ZIONS BANCORPORATION

Press Release – Page 7

July 23, 2018

Capital Analysis and Review, DFAST, liquidity stress testing and the Liquidity Coverage Ratio, and the so-called “Living Will” requirement, all of which is expected to reduce the Company’s regulatory burden.

The Company continues to pursue its proposed merger of the Bank Holding Company with, and into, its Bank in order to further reduce regulatory duplication. In July 2018, the Company received approvals for the merger from the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation. Additionally, the Company has received notice of the proposed decision by the Financial Stability Oversight Council that ZB, N.A., as successor to Zions Bancorporation in the merger, should not be treated as a systemically important financial institution under the Dodd-Frank Act pursuant to an appeal made by the Company under Section 117 of the Act. Subject to shareholder approval and the satisfaction of certain other conditions, the Company anticipates that the merger will be completed by the end of the third quarter of 2018. Once completed, the restructuring would eliminate the bank holding company structure and associated regulatory framework, and would result in ZB, N.A. being renamed Zions Bancorporation, National Association and becoming the top-level entity within our corporate structure. The Company believes the elimination of the holding company will create significant operational efficiencies, including the elimination of substantial duplicative regulatory examinations and supervision.

ZIONS BANCORPORATION

Press Release – Page 8

July 23, 2018

Supplemental Presentation and Conference Call

Zions has posted a supplemental presentation to its website, which will be used to discuss these second quarter results at 5:30 p.m. ET this afternoon (July 23, 2018). Media representatives, analysts, investors, and the public are invited to join this discussion by calling (253)-237-1247 (domestic and international) and entering the passcode 8594735 or via on-demand webcast. A link to the webcast will be available on the Zions Bancorporation website at zionsbancorporation.com. The webcast of the conference call will also be archived and available for 30 days. About Zions Bancorporation

Zions Bancorporation is one of the nation's premier financial services companies with total assets exceeding $65 billion. Zions operates under local management teams and distinct brands in 11 western states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington and Wyoming. The company is a national leader in Small Business Administration lending and public finance advisory services. In addition, Zions is included in the S&P 500 and NASDAQ Financial 100 indices. Investor information and links to local banking brands can be accessed at zionsbancorporation.com. Forward-Looking Information

This earnings release includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Statements in the earnings release that are based on other than historical information or that express Zions Bancorporation’s expectations regarding future events or determinations are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect, among other things, our current expectations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, industry results or regulatory outcomes to differ materially from those expressed or implied by such forward-looking statements.

Without limiting the foregoing, the words “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “projects,” “should,” “would,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about future financial and operating results, the potential timing or consummation of the merger described in the presentation and final report of FSOC, actions to be taken by Zions or receipt of any required approvals or determinations, or the anticipated benefits thereof, including, without limitation, future financial and operating results. Actual results and outcomes may differ materially from those presented, either expressed or implied, in the presentation. Important risk factors that may cause such material differences include, but are not limited to, the actual amount and duration of declines in the price of oil and gas; Zions’ ability to meet operating leverage goals; the rate of change of interest sensitive assets and liabilities relative to changes in benchmark interest rates; risks and uncertainties related to the ability to obtain shareholder and regulatory determinations, or the possibility that such determinations may be

ZIONS BANCORPORATION

Press Release – Page 9

July 23, 2018

delayed; the ability of Zions Bancorporation to achieve anticipated benefits from the consolidation and regulatory determinations; and legislative, regulatory and economic developments that may diminish or eliminate the anticipated benefits of the consolidation. These risks, as well as other factors, are discussed in Zions Bancorporation’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (SEC) and available at the SEC’s Internet site (https://www.sec.gov/), and other risks associated with the merger will be more fully discussed in the proxy statement that will be filed with the SEC in connection with the merger, a preliminary version of which was filed with the SEC on July 13, 2018.

Except as required by law, Zions Bancorporation specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments.

Important Additional Information and Where to Find It

Zions will file a proxy statement, a preliminary version of which was filed with the SEC on July 13, 2018, and other relevant documents concerning the merger with the SEC. INVESTORS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain the documents free of charge at the website maintained by the SEC at www.sec.gov. In addition, you may obtain documents filed with the SEC by Zions free of charge by contacting: Investor Relations, Zions Bancorporation, One South Main Street, 11th Floor, Salt Lake City, Utah 84133, (801) 844-7637.

Participants in Proxy Solicitation

Zions and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Zions’s shareholders in connection with the merger. Information about the directors and executive officers of Zions and their ownership of Zions stock is set forth in Zions’s Annual Report on Form 10-K for the year ended December 31, 2017 and the proxy statement for Zions’ 2017 Annual Meeting of Shareholders. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement for the proposed merger, a preliminary version of which was filed with the SEC on July 13, 2018.

ZIONS BANCORPORATION

Press Release – Page 10

July 23, 2018

FINANCIAL HIGHLIGHTS

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions, except share, per share, and ratio data) | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

BALANCE SHEET 1 | | | | | | | | | |

| Loans held for investment, net of allowance | $ | 44,740 |

| | $ | 44,610 |

| | $ | 44,262 |

| | $ | 43,615 |

| | $ | 43,139 |

|

| Total assets | 66,457 |

| | 66,481 |

| | 66,288 |

| | 65,564 |

| | 65,446 |

|

| Deposits | 53,580 |

| | 52,963 |

| | 52,621 |

| | 52,099 |

| | 52,378 |

|

| Total shareholders’ equity | 7,621 |

| | 7,644 |

| | 7,679 |

| | 7,761 |

| | 7,749 |

|

| STATEMENT OF INCOME | | | | | | | | | |

| Net earnings applicable to common shareholders | $ | 187 |

| | $ | 231 |

| | $ | 114 |

| | $ | 152 |

| | $ | 154 |

|

| Net interest income | 548 |

| | 542 |

| | 526 |

| | 522 |

| | 528 |

|

Taxable-equivalent net interest income 2 | 553 |

| | 547 |

| | 535 |

| | 531 |

| | 537 |

|

| Total noninterest income | 138 |

| | 138 |

| | 139 |

| | 139 |

| | 132 |

|

| Total noninterest expense | 428 |

| | 412 |

| | 417 |

| | 413 |

| | 405 |

|

Adjusted pre-provision net revenue 2 | 270 |

| | 265 |

| | 259 |

| | 251 |

| | 268 |

|

| Provision for loan losses | 5 |

| | (40 | ) | | (11 | ) | | 5 |

| | 7 |

|

| Provision for unfunded lending commitments | 7 |

| | (7 | ) | | (1 | ) | | (4 | ) | | 3 |

|

| Provision for credit losses | 12 |

| | (47 | ) | | (12 | ) | | 1 |

| | 10 |

|

| SHARE AND PER COMMON SHARE AMOUNTS | | | | | | | | | |

| Net earnings per diluted common share | $ | 0.89 |

| | $ | 1.09 |

| | $ | 0.54 |

| | $ | 0.72 |

| | $ | 0.73 |

|

| Dividends | 0.24 |

| | 0.20 |

| | 0.16 |

| | 0.12 |

| | 0.08 |

|

Book value per common share 1 | 36.11 |

| | 35.92 |

| | 36.01 |

| | 36.03 |

| | 35.54 |

|

Tangible book value per common share 1, 2 | 30.91 |

| | 30.76 |

| | 30.87 |

| | 30.93 |

| | 30.50 |

|

| Weighted average common and common-equivalent shares outstanding (in thousands) | 209,247 |

| | 210,243 |

| | 209,681 |

| | 209,106 |

| | 208,183 |

|

Common shares outstanding (in thousands) 1 | 195,392 |

| | 197,050 |

| | 197,532 |

| | 199,712 |

| | 202,131 |

|

| SELECTED RATIOS AND OTHER DATA | | | | | | | | | |

| Return on average assets | 1.19 | % | | 1.45 | % | | 0.74 | % | | 0.97 | % | | 1.03 | % |

| Return on average common equity | 10.6 | % | | 13.3 | % | | 6.3 | % | | 8.3 | % | | 8.6 | % |

Tangible return on average tangible common equity 2 | 12.4 | % | | 15.5 | % | | 7.4 | % | | 9.8 | % | | 10.2 | % |

| Net interest margin | 3.56 | % | | 3.56 | % | | 3.45 | % | | 3.45 | % | | 3.52 | % |

| Cost of total deposits, annualized | 0.22 | % | | 0.15 | % | | 0.13 | % | | 0.12 | % | | 0.11 | % |

Efficiency ratio 2 | 60.9 | % | | 61.3 | % | | 61.6 | % | | 62.3 | % | | 59.8 | % |

| Effective tax rate | 22.1 | % | | 22.7 | % | | 52.5 | % | | 34.2 | % | | 32.3 | % |

| Ratio of nonperforming assets to loans and leases and other real estate owned | 0.77 | % | | 0.87 | % | | 0.93 | % | | 1.06 | % | | 1.12 | % |

| Annualized ratio of net loan and lease charge-offs (recoveries) to average loans | (0.11 | )% | | 0.05 | % | | 0.11 | % | | 0.07 | % | | 0.06 | % |

Ratio of total allowance for credit losses to loans and leases outstanding 1 | 1.21 | % | | 1.16 | % | | 1.29 | % | | 1.36 | % | | 1.39 | % |

| Full-time equivalent employees | 10,217 |

| | 10,122 |

| | 10,083 |

| | 10,041 |

| | 10,074 |

|

CAPITAL RATIOS AND DATA 1 | | | | | | | | | |

| Common equity tier 1 capital | $ | 6,360 |

| | $ | 6,333 |

| | $ | 6,239 |

| | $ | 6,238 |

| | $ | 6,217 |

|

| Risk-weighted assets | $ | 52,012 |

| | $ | 51,779 |

| | $ | 51,456 |

| | $ | 51,043 |

| | $ | 50,575 |

|

| Tangible common equity ratio | 9.2 | % | | 9.3 | % | | 9.3 | % | | 9.6 | % | | 9.6 | % |

| Common equity tier 1 capital ratio | 12.2 | % | | 12.2 | % | | 12.1 | % | | 12.2 | % | | 12.3 | % |

| Tier 1 leverage ratio | 10.5 | % | | 10.5 | % | | 10.5 | % | | 10.6 | % | | 10.5 | % |

| Tier 1 risk-based capital ratio | 13.3 | % | | 13.3 | % | | 13.2 | % | | 13.3 | % | | 13.4 | % |

| Total risk-based capital ratio | 14.8 | % | | 14.8 | % | | 14.8 | % | | 15.0 | % | | 15.1 | % |

| |

2 | For information on non-GAAP financial measures, see pages 17-20. |

ZIONS BANCORPORATION

Press Release – Page 11

July 23, 2018

CONSOLIDATED BALANCE SHEETS

|

| | | | | | | | | | | | | | | | | | | |

| (In millions, shares in thousands) | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| | (Unaudited) | | (Unaudited) | | | | (Unaudited) | | (Unaudited) |

| ASSETS | | | | | | | | | |

| Cash and due from banks | $ | 468 |

| | $ | 470 |

| | $ | 548 |

| | $ | 541 |

| | $ | 481 |

|

| Money market investments: | | | | | | | | | |

| Interest-bearing deposits | 698 |

| | 717 |

| | 782 |

| | 765 |

| | 1,167 |

|

| Federal funds sold and security resell agreements | 558 |

| | 696 |

| | 514 |

| | 467 |

| | 427 |

|

| Investment securities: | | | | | | | | | |

| Held-to-maturity, at amortized cost (approximate fair value $866, $752, $762, $743 and $774) | 878 |

| | 768 |

| | 770 |

| | 746 |

| | 775 |

|

| Available-for-sale, at fair value | 14,627 |

| | 14,896 |

| | 15,161 |

| | 15,242 |

| | 15,341 |

|

| Trading account, at fair value | 207 |

| | 143 |

| | 148 |

| | 56 |

| | 61 |

|

| Total investment securities | 15,712 |

| | 15,807 |

| | 16,079 |

| | 16,044 |

| | 16,177 |

|

| Loans held for sale | 84 |

| | 90 |

| | 44 |

| | 71 |

| | 53 |

|

| Loans and leases, net of unearned income and fees | 45,230 |

| | 45,083 |

| | 44,780 |

| | 44,156 |

| | 43,683 |

|

| Less allowance for loan losses | 490 |

| | 473 |

| | 518 |

| | 541 |

| | 544 |

|

| Loans held for investment, net of allowance | 44,740 |

| | 44,610 |

| | 44,262 |

| | 43,615 |

| | 43,139 |

|

| Other noninterest-bearing investments | 1,054 |

| | 1,073 |

| | 1,029 |

| | 1,008 |

| | 1,012 |

|

| Premises, equipment and software, net | 1,099 |

| | 1,098 |

| | 1,094 |

| | 1,083 |

| | 1,069 |

|

| Goodwill and intangibles | 1,015 |

| | 1,016 |

| | 1,016 |

| | 1,017 |

| | 1,019 |

|

| Other real estate owned | 5 |

| | 5 |

| | 4 |

| | 3 |

| | 4 |

|

| Other assets | 1,024 |

| | 899 |

| | 916 |

| | 950 |

| | 898 |

|

| Total assets | $ | 66,457 |

| | $ | 66,481 |

| | $ | 66,288 |

| | $ | 65,564 |

| | $ | 65,446 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | |

| Deposits: | | | | | | | | | |

| Noninterest-bearing demand | $ | 24,007 |

| | $ | 23,909 |

| | $ | 23,886 |

| | $ | 24,011 |

| | $ | 24,172 |

|

| Interest-bearing: | | | | | | | | | |

| Savings and money market | 25,562 |

| | 25,473 |

| | 25,620 |

| | 25,179 |

| | 25,165 |

|

| Time | 4,011 |

| | 3,581 |

| | 3,115 |

| | 2,909 |

| | 3,041 |

|

| Total deposits | 53,580 |

| | 52,963 |

| | 52,621 |

| | 52,099 |

| | 52,378 |

|

| Federal funds purchased and other short-term borrowings | 4,158 |

| | 4,867 |

| | 4,976 |

| | 4,624 |

| | 4,342 |

|

| Long-term debt | 383 |

| | 383 |

| | 383 |

| | 383 |

| | 383 |

|

| Reserve for unfunded lending commitments | 58 |

| | 51 |

| | 58 |

| | 59 |

| | 63 |

|

| Other liabilities | 657 |

| | 573 |

| | 571 |

| | 638 |

| | 531 |

|

| Total liabilities | 58,836 |

| | 58,837 |

| | 58,609 |

| | 57,803 |

| | 57,697 |

|

| Shareholders’ equity: | | | | | | | | | |

| Preferred stock, without par value; authorized 4,400 shares | 566 |

| | 566 |

| | 566 |

| | 566 |

| | 566 |

|

| Common stock, without par value; authorized 350,000 shares; issued and outstanding 195,392, 197,050, 197,532, 199,712, and 202,131 shares | 4,231 |

| | 4,346 |

| | 4,445 |

| | 4,552 |

| | 4,660 |

|

| Retained earnings | 3,139 |

| | 2,999 |

| | 2,807 |

| | 2,700 |

| | 2,572 |

|

| Accumulated other comprehensive income (loss) | (315 | ) | | (267 | ) | | (139 | ) | | (57 | ) | | (49 | ) |

| Total shareholders’ equity | 7,621 |

| | 7,644 |

| | 7,679 |

| | 7,761 |

| | 7,749 |

|

| Total liabilities and shareholders’ equity | $ | 66,457 |

| | $ | 66,481 |

| | $ | 66,288 |

| | $ | 65,564 |

| | $ | 65,446 |

|

ZIONS BANCORPORATION

Press Release – Page 12

July 23, 2018

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) |

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions, except share and per share amounts) | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| Interest income: | | | | | | | | | |

| Interest and fees on loans | $ | 514 |

| | $ | 497 |

| | $ | 477 |

| | $ | 468 |

| | $ | 469 |

|

| Interest on money market investments | 7 |

| | 6 |

| | 5 |

| | 5 |

| | 5 |

|

| Interest on securities | 85 |

| | 86 |

| | 80 |

| | 84 |

| | 84 |

|

| Total interest income | 606 |

| | 589 |

| | 562 |

| | 557 |

| | 558 |

|

| Interest expense: | | | | | | | | | |

| Interest on deposits | 29 |

| | 20 |

| | 17 |

| | 15 |

| | 14 |

|

| Interest on short- and long-term borrowings | 29 |

| | 27 |

| | 19 |

| | 20 |

| | 16 |

|

| Total interest expense | 58 |

| | 47 |

| | 36 |

| | 35 |

| | 30 |

|

| Net interest income | 548 |

| | 542 |

| | 526 |

| | 522 |

| | 528 |

|

| Provision for loan losses | 5 |

| | (40 | ) | | (11 | ) | | 5 |

| | 7 |

|

| Net interest income after provision for loan losses | 543 |

| | 582 |

| | 537 |

| | 517 |

| | 521 |

|

| Noninterest income: | | | | | | | | | |

| Service charges and fees on deposit accounts | 42 |

| | 42 |

| | 44 |

| | 42 |

| | 43 |

|

| Other service charges, commissions and fees | 55 |

| | 55 |

| | 56 |

| | 55 |

| | 56 |

|

| Wealth management and trust income | 14 |

| | 12 |

| | 12 |

| | 11 |

| | 10 |

|

| Loan sales and servicing income | 7 |

| | 6 |

| | 6 |

| | 6 |

| | 6 |

|

| Capital markets and foreign exchange | 7 |

| | 8 |

| | 9 |

| | 8 |

| | 6 |

|

| Customer-related fees | 125 |

| | 123 |

|

| 127 |

| | 122 |

| | 121 |

|

| Dividends and other investment income | 11 |

| | 11 |

| | 10 |

| | 9 |

| | 10 |

|

| Securities gains (losses), net | 1 |

| | — |

| | — |

| | 5 |

| | 2 |

|

| Other | 1 |

| | 4 |

| | 2 |

| | 3 |

| | (1 | ) |

| Total noninterest income | 138 |

| | 138 |

| | 139 |

| | 139 |

| | 132 |

|

| Noninterest expense: | | | | | | | | | |

| Salaries and employee benefits | 266 |

| | 269 |

| | 253 |

| | 251 |

| | 240 |

|

| Occupancy, net | 32 |

| | 31 |

| | 29 |

| | 35 |

| | 32 |

|

| Furniture, equipment and software, net | 32 |

| | 33 |

| | 34 |

| | 32 |

| | 32 |

|

| Other real estate expense, net | — |

| | — |

| | — |

| | (1 | ) | | — |

|

| Credit-related expense | 7 |

| | 7 |

| | 6 |

| | 7 |

| | 8 |

|

| Provision for unfunded lending commitments | 7 |

| | (7 | ) | | (1 | ) | | (4 | ) | | 3 |

|

| Professional and legal services | 14 |

| | 12 |

| | 13 |

| | 15 |

| | 14 |

|

| Advertising | 7 |

| | 5 |

| | 5 |

| | 6 |

| | 6 |

|

| FDIC premiums | 14 |

| | 13 |

| | 13 |

| | 15 |

| | 13 |

|

| Other | 49 |

| | 49 |

| | 65 |

| | 57 |

| | 57 |

|

| Total noninterest expense | 428 |

| | 412 |

| | 417 |

| | 413 |

| | 405 |

|

| Income before income taxes | 253 |

| | 308 |

| | 259 |

| | 243 |

| | 248 |

|

| Income taxes | 56 |

| | 70 |

| | 136 |

| | 83 |

| | 80 |

|

| Net income | 197 |

| | 238 |

| | 123 |

| | 160 |

| | 168 |

|

| Preferred stock dividends | (10 | ) | | (7 | ) | | (9 | ) | | (8 | ) | | (12 | ) |

| Preferred stock redemption | — |

| | — |

| | — |

| | — |

| | (2 | ) |

| Net earnings applicable to common shareholders | $ | 187 |

| | $ | 231 |

| | $ | 114 |

| | $ | 152 |

| | $ | 154 |

|

| Weighted average common shares outstanding during the period: | | | | | | | | |

| Basic shares (in thousands) | 195,583 |

| | 196,722 |

| | 198,648 |

| | 200,332 |

| | 201,822 |

|

| Diluted shares (in thousands) | 209,247 |

| | 210,243 |

| | 209,681 |

| | 209,106 |

| | 208,183 |

|

| Net earnings per common share: | | | | | | | | | |

| Basic | $ | 0.95 |

| | $ | 1.16 |

| | $ | 0.57 |

| | $ | 0.75 |

| | $ | 0.76 |

|

| Diluted | 0.89 |

| | 1.09 |

| | 0.54 |

| | 0.72 |

| | 0.73 |

|

ZIONS BANCORPORATION

Press Release – Page 13

July 23, 2018

Loan Balances Held for Investment by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| (In millions) | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| Commercial: | | | | | | | | | |

| Commercial and industrial | $ | 14,134 |

| | $ | 14,125 |

| | $ | 14,003 |

| | $ | 14,041 |

| | $ | 13,850 |

|

| Leasing | 358 |

| | 371 |

| | 364 |

| | 343 |

| | 387 |

|

| Owner occupied | 7,365 |

| | 7,345 |

| | 7,288 |

| | 7,082 |

| | 7,095 |

|

| Municipal | 1,388 |

| | 1,299 |

| | 1,271 |

| | 1,073 |

| | 871 |

|

| Total commercial | 23,245 |

| | 23,140 |

| | 22,926 |

| | 22,539 |

| | 22,203 |

|

| Commercial real estate: | | | | | | | | | |

| Construction and land development | 2,202 |

| | 2,099 |

| | 2,021 |

| | 2,170 |

| | 2,186 |

|

| Term | 8,771 |

| | 9,023 |

| | 9,103 |

| | 8,944 |

| | 9,012 |

|

| Total commercial real estate | 10,973 |

| | 11,122 |

| | 11,124 |

| | 11,114 |

| | 11,198 |

|

| Consumer: | | | | | | | | | |

| Home equity credit line | 2,825 |

| | 2,792 |

| | 2,777 |

| | 2,745 |

| | 2,697 |

|

| 1-4 family residential | 6,861 |

| | 6,768 |

| | 6,662 |

| | 6,522 |

| | 6,359 |

|

| Construction and other consumer real estate | 661 |

| | 599 |

| | 597 |

| | 558 |

| | 560 |

|

| Bankcard and other revolving plans | 490 |

| | 488 |

| | 509 |

| | 490 |

| | 478 |

|

| Other | 175 |

| | 174 |

| | 185 |

| | 188 |

| | 188 |

|

| Total consumer | 11,012 |

| | 10,821 |

| | 10,730 |

| | 10,503 |

| | 10,282 |

|

| Loans and leases, net of unearned income and fees | $ | 45,230 |

| | $ | 45,083 |

| | $ | 44,780 |

| | $ | 44,156 |

| | $ | 43,683 |

|

Nonperforming Assets

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| (In millions) | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| | | | | | | | | | |

Nonaccrual loans1 | $ | 342 |

| | $ | 387 |

| | $ | 414 |

| | $ | 465 |

| | $ | 486 |

|

| Other real estate owned | 5 |

| | 5 |

| | 4 |

| | 3 |

| | 4 |

|

| Total nonperforming assets | $ | 347 |

| | $ | 392 |

| | $ | 418 |

| | $ | 468 |

| | $ | 490 |

|

Ratio of nonperforming assets to loans1 and leases and other real estate owned | 0.77 | % | | 0.87 | % | | 0.93 | % | | 1.06 | % | | 1.12 | % |

| Accruing loans past due 90 days or more | $ | 5 |

| | $ | 16 |

| | $ | 22 |

| | $ | 30 |

| | $ | 19 |

|

Ratio of accruing loans past due 90 days or more to loans1 and leases | 0.01 | % | | 0.04 | % | | 0.05 | % | | 0.07 | % | | 0.04 | % |

| Nonaccrual loans and accruing loans past due 90 days or more | $ | 347 |

| | $ | 403 |

| | $ | 436 |

| | $ | 495 |

| | $ | 505 |

|

Ratio of nonaccrual loans and accruing loans past due 90 days or more to loans1 and leases | 0.77 | % | | 0.89 | % | | 0.97 | % | | 1.12 | % | | 1.15 | % |

| Accruing loans past due 30-89 days | $ | 119 |

| | $ | 98 |

| | $ | 120 |

| | $ | 99 |

| | $ | 98 |

|

| Restructured loans included in nonaccrual loans | 77 |

| | 86 |

| | 87 |

| | 115 |

| | 137 |

|

| Restructured loans on accrual | 104 |

| | 143 |

| | 139 |

| | 133 |

| | 167 |

|

| Classified loans | 947 |

| | 1,023 |

| | 1,133 |

| | 1,248 |

| | 1,317 |

|

1 Includes loans held for sale.

ZIONS BANCORPORATION

Press Release – Page 14

July 23, 2018

Allowance for Credit Losses

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (In millions) | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| Allowance for Loan Losses | | | | | | | | | |

| Balance at beginning of period | $ | 473 |

| | $ | 518 |

| | $ | 541 |

| | $ | 544 |

| | $ | 544 |

|

| Provision for loan losses | 5 |

| | (40 | ) | | (11 | ) | | 5 |

| | 7 |

|

| Loan and lease charge-offs | 13 |

| | 26 |

| | 27 |

| | 25 |

| | 35 |

|

| Less: Recoveries | 25 |

| | 21 |

| | 15 |

| | 17 |

| | 28 |

|

| Net loan and lease charge-offs (recoveries) | (12 | ) | | 5 |

| | 12 |

| | 8 |

| | 7 |

|

| Balance at end of period | $ | 490 |

| | $ | 473 |

| | $ | 518 |

| | $ | 541 |

| | $ | 544 |

|

Ratio of allowance for loan losses to loans1 and leases, at period end | 1.08 | % | | 1.05 | % | | 1.16 | % | | 1.23 | % | | 1.25 | % |

Ratio of allowance for loan losses to nonaccrual loans1 at period end | 143 | % | | 131 | % | | 129 | % | | 120 | % | | 115 | % |

| Annualized ratio of net loan and lease charge-offs (recoveries) to average loans | (0.11 | )% | | 0.05 | % | | 0.11 | % | | 0.07 | % | | 0.06 | % |

| | | | | | | | | | |

| Reserve for Unfunded Lending Commitments | | | | | | | | | |

| Balance at beginning of period | $ | 51 |

| | $ | 58 |

| | $ | 59 |

| | $ | 63 |

| | $ | 60 |

|

| Provision for unfunded lending commitments | 7 |

| | (7 | ) | | (1 | ) | | (4 | ) | | 3 |

|

| Balance at end of period | $ | 58 |

| | $ | 51 |

| | $ | 58 |

| | $ | 59 |

| | $ | 63 |

|

| | | | | | | | | | |

| Allowance for Credit Losses | | | | | | | | | |

| Allowance for loan losses | $ | 490 |

| | $ | 473 |

| | $ | 518 |

| | $ | 541 |

| | $ | 544 |

|

| Reserve for unfunded lending commitments | 58 |

| | 51 |

| | 58 |

| | 59 |

| | 63 |

|

| Total allowance for credit losses | $ | 548 |

| | $ | 524 |

| | $ | 576 |

| | $ | 600 |

| | $ | 607 |

|

Ratio of total allowance for credit losses to loans1 and leases outstanding, at period end | 1.21 | % | | 1.16 | % | | 1.29 | % | | 1.36 | % | | 1.39 | % |

1 Does not include loans held for sale.

ZIONS BANCORPORATION

Press Release – Page 15

July 23, 2018

Nonaccrual Loans by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| (In millions) | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| | | | | | | | | | |

| Loans held for sale | $ | — |

| | $ | 26 |

| | $ | 12 |

| | $ | 13 |

| | $ | 12 |

|

| Commercial: | | | | | | | | | |

| Commercial and industrial | $ | 142 |

| | $ | 140 |

| | $ | 195 |

| | $ | 257 |

| | $ | 278 |

|

| Leasing | 7 |

| | 8 |

| | 8 |

| | 8 |

| | 10 |

|

| Owner occupied | 63 |

| | 80 |

| | 90 |

| | 85 |

| | 86 |

|

| Municipal | 1 |

| | 1 |

| | 1 |

| | 1 |

| | 1 |

|

| Total commercial | 213 |

| | 229 |

| | 294 |

| | 351 |

| | 375 |

|

| Commercial real estate: | | | | | | | | | |

| Construction and land development | 5 |

| | 5 |

| | 4 |

| | 6 |

| | 6 |

|

| Term | 53 |

| | 57 |

| | 36 |

| | 41 |

| | 37 |

|

| Total commercial real estate | 58 |

| | 62 |

| | 40 |

| | 47 |

| | 43 |

|

| Consumer: | | | | | | | | | |

| Home equity credit line | 14 |

| | 14 |

| | 13 |

| | 11 |

| | 11 |

|

| 1-4 family residential | 56 |

| | 54 |

| | 55 |

| | 40 |

| | 43 |

|

| Construction and other consumer real estate | 1 |

| | 1 |

| | — |

| | 1 |

| | 1 |

|

| Bankcard and other revolving plans | — |

| | 1 |

| | — |

| | 1 |

| | — |

|

| Other | — |

| | — |

| | — |

| | 1 |

| | 1 |

|

| Total consumer | 71 |

| | 70 |

| | 68 |

| | 54 |

| | 56 |

|

| Total nonaccrual loans | $ | 342 |

| | $ | 387 |

| | $ | 414 |

| | $ | 465 |

| | $ | 486 |

|

Net Charge-Offs by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| (In millions) | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| Commercial: | | | | | | | | | |

| Commercial and industrial | $ | (10 | ) | | $ | — |

| | $ | 10 |

| | $ | 4 |

| | $ | 11 |

|

| Leasing | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Owner occupied | — |

| | 1 |

| | — |

| | — |

| | 2 |

|

| Municipal | — |

| | — |

| | — |

| | — |

| | — |

|

| Total commercial | (10 | ) | | 2 |

| | 10 |

| | 4 |

| | 13 |

|

| Commercial real estate: | | | | | | | | | |

| Construction and land development | (1 | ) | | (2 | ) | | — |

| | — |

| | (8 | ) |

| Term | (2 | ) | | — |

| | 1 |

| | 2 |

| | — |

|

| Total commercial real estate | (3 | ) | | (2 | ) | | 1 |

| | 2 |

| | (8 | ) |

| Consumer: | | | | | | | | | |

| Home equity credit line | (1 | ) | | 1 |

| | — |

| | — |

| | 1 |

|

| 1-4 family residential | — |

| | 2 |

| | (1 | ) | | 1 |

| | — |

|

| Construction and other consumer real estate | — |

| | — |

| | (1 | ) | | — |

| | — |

|

| Bankcard and other revolving plans | 2 |

| | 2 |

| | 2 |

| | — |

| | 1 |

|

| Other | — |

| | — |

| | 1 |

| | 1 |

| | — |

|

| Total consumer loans | 1 |

| | 5 |

| | 1 |

| | 2 |

| | 2 |

|

| Total net charge-offs (recoveries) | $ | (12 | ) | | $ | 5 |

| | $ | 12 |

| | $ | 8 |

| | $ | 7 |

|

ZIONS BANCORPORATION

Press Release – Page 16

July 23, 2018

CONSOLIDATED AVERAGE BALANCE SHEETS, YIELDS AND RATES

(Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, 2018 | | March 31, 2018 | | June 30, 2017 |

| (In millions) | Average balance | | Average yield/rate 1 | | Average balance | | Average

yield/rate 1 | | Average balance | | Average

yield/rate 1 |

| ASSETS | | | | | | | | | | | |

| Money market investments | $ | 1,317 |

| | 2.02 | % | | $ | 1,495 |

| | 1.70 | % | | $ | 1,572 |

| | 1.20 | % |

| Securities: | | | | | | | | | | | |

| Held-to-maturity | 780 |

| | 3.60 | % | | 789 |

| | 3.54 | % | | 788 |

| | 3.97 | % |

| Available-for-sale | 14,745 |

| | 2.14 | % | | 14,948 |

| | 2.18 | % | | 15,386 |

| | 2.11 | % |

| Trading account | 179 |

| | 4.06 | % | | 102 |

| | 4.00 | % | | 79 |

| | 3.43 | % |

| Total securities | 15,704 |

| | 2.23 | % | | 15,839 |

| | 2.25 | % | | 16,253 |

| | 2.20 | % |

| Loans held for sale | 72 |

| | 4.18 | % | | 51 |

| | 3.94 | % | | 100 |

| | 3.24 | % |

Loans held for investment 2: | | | | | | | | | | | |

| Commercial | 23,275 |

| | 4.68 | % | | 23,040 |

| | 4.70 | % | | 21,885 |

| | 4.44 | % |

| Commercial real estate | 11,075 |

| | 4.94 | % | | 11,065 |

| | 4.67 | % | | 11,236 |

| | 4.74 | % |

| Consumer | 10,892 |

| | 3.98 | % | | 10,759 |

| | 3.94 | % | | 10,122 |

| | 3.83 | % |

| Total loans held for investment | 45,242 |

| | 4.57 | % | | 44,864 |

| | 4.51 | % | | 43,243 |

| | 4.38 | % |

| Total interest-earning assets | 62,335 |

| | 3.93 | % | | 62,249 |

| | 3.87 | % | | 61,168 |

| | 3.72 | % |

| Cash and due from banks | 546 |

| | | | 592 |

| | | | 795 |

| | |

| Allowance for loan losses | (480 | ) | | | | (523 | ) | | | | (546 | ) | | |

| Goodwill and intangibles | 1,016 |

| | | | 1,016 |

| | | | 1,020 |

| | |

| Other assets | 3,088 |

| | | | 3,032 |

| | | | 2,974 |

| | |

| Total assets | $ | 66,505 |

| | | | $ | 66,366 |

| | | | $ | 65,411 |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | |

| Savings and money market | $ | 25,479 |

| | 0.26 | % | | $ | 25,296 |

| | 0.19 | % | | $ | 25,467 |

| | 0.14 | % |

| Time | 3,807 |

| | 1.27 | % | | 3,280 |

| | 1.00 | % | | 3,048 |

| | 0.66 | % |

| Total interest-bearing deposits | 29,286 |

| | 0.39 | % | | 28,576 |

| | 0.28 | % | | 28,515 |

| | 0.20 | % |

| Borrowed funds: | | | | | | | | | | | |

| Federal funds purchased and other short-term borrowings | 4,927 |

| | 1.92 | % | | 5,707 |

| | 1.54 | % | | 4,302 |

| | 0.94 | % |

| Long-term debt | 383 |

| | 5.77 | % | | 383 |

| | 5.83 | % | | 383 |

| | 5.77 | % |

| Total borrowed funds | 5,310 |

| | 2.19 | % | | 6,090 |

| | 1.81 | % | | 4,685 |

| | 1.34 | % |

| Total interest-bearing liabilities | 34,596 |

| | 0.67 | % | | 34,666 |

| | 0.55 | % | | 33,200 |

| | 0.36 | % |

| Noninterest-bearing deposits | 23,610 |

| | | | 23,417 |

| | | | 23,819 |

| | |

| Total deposits and interest-bearing liabilities | 58,206 |

| | 0.40 | % | | 58,083 |

| | 0.33 | % | | 57,019 |

| | 0.21 | % |

| Other liabilities | 661 |

| | | | 656 |

| | | | 565 |

| | |

| Total liabilities | 58,867 |

| | | | 58,739 |

| | | | 57,584 |

| | |

| Shareholders’ equity: | | | | | | | | | | | |

| Preferred equity | 566 |

| | | | 566 |

| | | | 684 |

| | |

| Common equity | 7,072 |

| | | | 7,061 |

| | | | 7,143 |

| | |

| Total shareholders’ equity | 7,638 |

| | | | 7,627 |

| | | | 7,827 |

| | |

| Total liabilities and shareholders’ equity | $ | 66,505 |

| | | | $ | 66,366 |

| | | | $ | 65,411 |

| | |

| Spread on average interest-bearing funds | | | 3.26 | % | | | | 3.32 | % | | | | 3.36 | % |

| Net yield on interest-earning assets | | | 3.56 | % | | | | 3.56 | % | | | | 3.52 | % |

1 Rates are calculated using amounts in thousands and taxable-equivalent rates used where applicable. The taxable-equivalent rates used are the rates that were applicable at the time of each respective reporting period.

2 Net of unearned income and fees, net of related costs. Loans include nonaccrual and restructured loans.

ZIONS BANCORPORATION

Press Release – Page 17

July 23, 2018

GAAP to Non-GAAP Reconciliations

(Unaudited)

This press release presents non-GAAP financial measures, in addition to GAAP financial measures, to provide investors with additional information. The adjustments to reconcile from the applicable GAAP financial measures to the non-GAAP financial measures are presented in the following schedules. The Company considers these adjustments to be relevant to ongoing operating results and provide a meaningful base for period-to-period and company-to-company comparisons. These non-GAAP financial measures are used by management to assess the performance and financial position of the Company and for presentations of Company performance to investors. The Company further believes that presenting these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management.

Non-GAAP financial measures have inherent limitations, and are not required to be uniformly applied by individual entities. Although non-GAAP financial measures are frequently used by stakeholders to evaluate a company, they have limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of results reported under GAAP.

The following are non-GAAP financial measures presented in this press release and a discussion of why management uses these non-GAAP measures:

Tangible Book Value per Common Share – this schedule also includes “tangible common equity.” Tangible book value per common share is a non-GAAP financial measure that management believes provides additional useful information about the level of tangible equity in relation to outstanding shares of common stock. Management believes the use of ratios that utilize tangible equity provides additional useful information because they present measures of those assets that can generate income.

Return on Average Tangible Common Equity – this schedule also includes “net earnings applicable to common shareholders, excluding the effects of the adjustments, net of tax” and “average tangible common equity.” Return on average tangible common equity is a non-GAAP financial measure that management believes provides useful information about the Company’s use of shareholders’ equity. Management believes the use of ratios that utilize tangible equity provides additional useful information because they present measures of those assets that can generate income.

Efficiency Ratio – this schedule also includes “adjusted noninterest expense,” “taxable-equivalent net interest income,” “adjusted taxable-equivalent revenue,” and “adjusted pre-provision net revenue (PPNR).” The methodology of determining the efficiency ratio may differ among companies. Management makes adjustments to exclude certain items as identified in the subsequent schedules which it believes allows for more consistent comparability among periods. Management believes the efficiency ratio provides useful information regarding the cost of generating revenue. Adjusted noninterest expense provides a measure as to how well the Company is managing its expenses, and adjusted PPNR enables management and others to assess the Company’s ability to generate capital to cover credit losses through a credit cycle. Taxable-equivalent net interest income allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources.

ZIONS BANCORPORATION

Press Release – Page 18

July 23, 2018

GAAP to Non-GAAP Reconciliations

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| (In millions, except shares and per share amounts) | | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| Tangible Book Value per Common Share | | | | | | | | |

| Total shareholders’ equity (GAAP) | | $ | 7,621 |

| | $ | 7,644 |

| | $ | 7,679 |

| | $ | 7,761 |

| | $ | 7,749 |

|

| Preferred stock | | (566 | ) | | (566 | ) | | (566 | ) | | (566 | ) | | (566 | ) |

| Goodwill and intangibles | | (1,015 | ) | | (1,016 | ) | | (1,016 | ) | | (1,017 | ) | | (1,019 | ) |

| Tangible common equity (non-GAAP) | (a) | $ | 6,040 |

| | $ | 6,062 |

| | $ | 6,097 |

| | $ | 6,178 |

| | $ | 6,164 |

|

| Common shares outstanding (in thousands) | (b) | 195,392 |

| | 197,050 |

| | 197,532 |

| | 199,712 |

| | 202,131 |

|

| Tangible book value per common share (non-GAAP) | (a/b) | $ | 30.91 |

| | $ | 30.76 |

| | $ | 30.87 |

| | $ | 30.93 |

| | $ | 30.50 |

|

| | | | | | | | | | | |

| | | Three Months Ended |

| (Dollar amounts in millions) | | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| Return on Average Tangible Common Equity | | | | | | | | |

| Net earnings applicable to common shareholders (GAAP) | | $ | 187 |

| | $ | 231 |

| | $ | 114 |

| | $ | 152 |

| | $ | 154 |

|

| Adjustments, net of tax: | | | | | | | | | | |

| Amortization of core deposit and other intangibles | | — |

| | — |

| | 1 |

| | 1 |

| | 1 |

|

| Net earnings applicable to common shareholders, excluding the effects of the adjustments, net of tax (non-GAAP) | (a) | $ | 187 |

| | $ | 231 |

| | $ | 115 |

| | $ | 153 |

| | $ | 155 |

|

| Average common equity (GAAP) | | $ | 7,072 |

| | $ | 7,061 |

| | $ | 7,220 |

| | $ | 7,230 |

| | $ | 7,143 |

|

| Average goodwill and intangibles | | (1,016 | ) | | (1,016 | ) | | (1,017 | ) | | (1,018 | ) | | (1,020 | ) |

Average tangible common equity (non-GAAP) | (b) | $ | 6,056 |

| | $ | 6,045 |

| | $ | 6,203 |

| | $ | 6,212 |

| | $ | 6,123 |

|

| Number of days in quarter | (c) | 91 |

| | 90 |

| | 92 |

| | 92 |

| | 91 |

|

| Number of days in year | (d) | 365 |

| | 365 |

| | 365 |

| | 365 |

| | 365 |

|

| Return on average tangible common equity (non-GAAP) | (a/b/c)*d | 12.4 | % | | 15.5 | % | | 7.4 | % | | 9.8 | % | | 10.2 | % |

ZIONS BANCORPORATION

Press Release – Page 19

July 23, 2018

GAAP to Non-GAAP Reconciliations

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| (In millions) | | June 30,

2018 | | March 31,

2018 | | December 31,

2017 | | September 30,

2017 | | June 30,

2017 |

| Efficiency Ratio | | | | | | | | | | |

| Noninterest expense (GAAP) | (a) | $ | 428 |

| | $ | 412 |

| | $ | 417 |

| | $ | 413 |

| | $ | 405 |

|

| Adjustments: | | | | | | | | | | |

| Severance costs | | 1 |

| | — |

| | 1 |

| | 1 |

| | — |

|

| Other real estate expense | | — |

| | — |

| | — |

| | (1 | ) | | — |

|

| Provision for unfunded lending commitments | | 7 |

| | (7 | ) | | (1 | ) | | (4 | ) | | 3 |

|

| Amortization of core deposit and other intangibles | | — |

| | — |

| | 1 |

| | 2 |

| | 2 |

|

| Restructuring costs | | — |

| | — |

| | 1 |

| | 1 |

| | 1 |

|

| Total adjustments | (b) | 8 |

| | (7 | ) | | 2 |

| | (1 | ) | | 6 |

|

| Adjusted noninterest expense (non-GAAP) | (a-b)=(c) | $ | 420 |

| | $ | 419 |

| | $ | 415 |

| | $ | 414 |

| | $ | 399 |

|

| Net interest income (GAAP) | (d) | $ | 548 |

| | $ | 542 |

| | $ | 526 |

| | $ | 522 |

| | $ | 528 |

|

| Fully taxable-equivalent adjustments | (e) | 5 |

| | 5 |

| | 9 |

| | 9 |

| | 9 |

|

| Taxable-equivalent net interest income (non-GAAP) | (d+e)=(f) | 553 |

| | 547 |

| | 535 |

| | 531 |

| | 537 |

|

| Noninterest income (GAAP) | (g) | 138 |

| | 138 |

| | 139 |

| | 139 |

| | 132 |

|

| Combined income (non-GAAP) | (f+g)=(h) | 691 |

| | 685 |

| | 674 |

| | 670 |

| | 669 |

|

| Adjustments: | | | | | | | | | | |

| Fair value and nonhedge derivative income | | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Securities gains (losses), net | | 1 |

| | — |

| | — |

| | 5 |

| | 2 |

|

| Total adjustments | (i) | 1 |

| | 1 |

| | — |

| | 5 |

| | 2 |

|

Adjusted taxable-equivalent revenue (non-GAAP) | (h-i)=(j) | $ | 690 |

| | $ | 684 |

| | $ | 674 |

| | $ | 665 |

| | $ | 667 |

|

| Pre-provision net revenue (PPNR) | (h)-(a) | $ | 263 |

| | $ | 273 |

| | $ | 257 |

| | $ | 257 |

| | $ | 264 |

|

| Adjusted PPNR (non-GAAP) | (j-c) | 270 |

| | 265 |

| | 259 |

| | 251 |

| | 268 |

|

| Efficiency ratio (non-GAAP) | (c/j) | 60.9 | % | | 61.3 | % | | 61.6 | % | | 62.3 | % | | 59.8 | % |

ZIONS BANCORPORATION

Press Release – Page 20

July 23, 2018

|

| | | | | | | | | |

| | | Six Months Ended |

| (In millions) | | June 30,

2018 | | June 30,

2017 |

| Efficiency Ratio | | | | |

| Noninterest expense (GAAP) | (a) | $ | 840 |

| | $ | 819 |

|

| Adjustments: | | | | |

| Severance costs | | (1 | ) | | 5 |

|

| Other real estate expense | | 1 |

| | — |

|

| Provision for unfunded lending commitments | | — |

| | (2 | ) |

| Debt extinguishment cost | | — |

| | — |

|

| Amortization of core deposit and other intangibles | | 1 |

| 4 |

| 3 |

|

| Restructuring costs | | — |

| | 2 |

|

| Total adjustments | (b) | 1 |

| | 8 |

|

| Adjusted noninterest expense (non-GAAP) | (a-b)=(c) | $ | 839 |

| | $ | 811 |

|

| Net interest income (GAAP) | (d) | $ | 1,090 |

| | $ | 1,017 |

|

| Fully taxable-equivalent adjustments | (e) | 10 |

| | 17 |

|

| Taxable-equivalent net interest income (non-GAAP) | (d+e)=(f) | 1,100 |

| | 1,034 |

|

| Noninterest income (GAAP) | (g) | 276 |

| | 264 |

|

| Combined income (non-GAAP) | (f+g)=(h) | 1,376 |

| | 1,298 |

|

| Adjustments: | | | | |

| Fair value and nonhedge derivative income (loss) | | 2 |

| | (1 | ) |

| Securities gains, net | | 1 |

| | 7 |

|

| Total adjustments | (i) | 3 |

| | 6 |

|

| Adjusted taxable-equivalent revenue (non-GAAP) | (h-i)=(j) | $ | 1,373 |

| | $ | 1,292 |

|

| Pre-provision net revenue (PPNR) | (h)-(a) | $ | 536 |

| | $ | 479 |

|

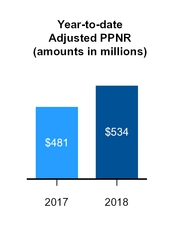

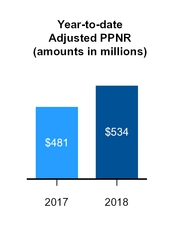

| Adjusted PPNR (non-GAAP) | (j-c) | 534 |

| | 481 |

|

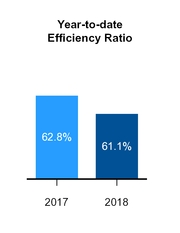

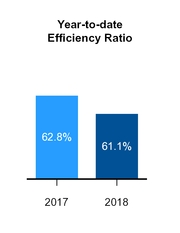

| Efficiency ratio (non-GAAP) | (c/j) | 61.1 | % | | 62.8 | % |