July 26, 2022 Second Quarter 2022 Financial Review

2 Forward-Looking Statements; Use of Non-GAAP Financial Measures Forward Looking Information This earnings presentation includes “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements, often accompanied by words such as “may,” “might,” “could,” “anticipate,” “expect,” and similar terms, are based on management’s current expectations and assumptions regarding future events or determinations, all of which are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees, nor should they be relied upon as representing management’s views as of any subsequent date. Factors that could cause our actual results, performance or achievements, industry trends, and results or regulatory outcomes to differ materially from those expressed or implied in the forward-looking statements are discussed in our 2021 Form 10-K and subsequent filings with the Securities and Exchange Commission (SEC) and are available on our website (www.zionsbancorporation.com) and from the SEC (www.sec.gov). Except to the extent required by law, we specifically disclaim any obligation to update any factors or to publicly announce the revisions to any forward-looking statements to reflect future events or developments. Use of Non-GAAP Financial Measures: This document contains several references to non-GAAP measures, including pre-provision net revenue and the “efficiency ratio,” which are common industry terms used by investors and financial services analysts. Certain of these non-GAAP measures are key inputs into Zions’ management compensation and are used in Zions’ strategic goals that have been and may continue to be articulated to investors. Therefore, the use of such non-GAAP measures are believed by management to be of substantial interest to the consumers of these financial disclosures and are used prominently throughout the disclosures. A full reconciliation of the difference between such measures and GAAP financials is provided within the document, and users of this document are encouraged to carefully review this reconciliation.

▪ We are well positioned for rising interest rates ▪ We have positioned the bank’s balance sheet for higher interest rates ▪ Our loans are underwritten to withstand the effects of higher interest rates ▪ We are carefully managing our loan growth ▪ More than half of the 1H growth was in lower-risk categories including loans backed by 1-4 family residential property and owner-occupied real estate, and municipal loans ▪ Growth was achieved using generally consistent underwriting standards and risk-based concentration limits which produced superior credit losses during recent years. ▪ Recent deposit attrition is primarily attributable to larger balance accounts ▪ The composition of our balance sheet allows for a great deal of flexibility ▪ The loan-to-deposit ratio is 66% ▪ We are well prepared for a recession ▪ We have lower concentrations and hold limits in higher-risk categories, including high leverage, enterprise value, and land development loans ▪ We have a greater concentration in lower-risk credits such as residential mortgages, municipal loans, term commercial real estate and owner- occupied commercial loans ▪ We have very little unsecured consumer exposure 3 Select Themes Rising rates are expected to lead to a significant increase in revenue. Credit quality remains clean.

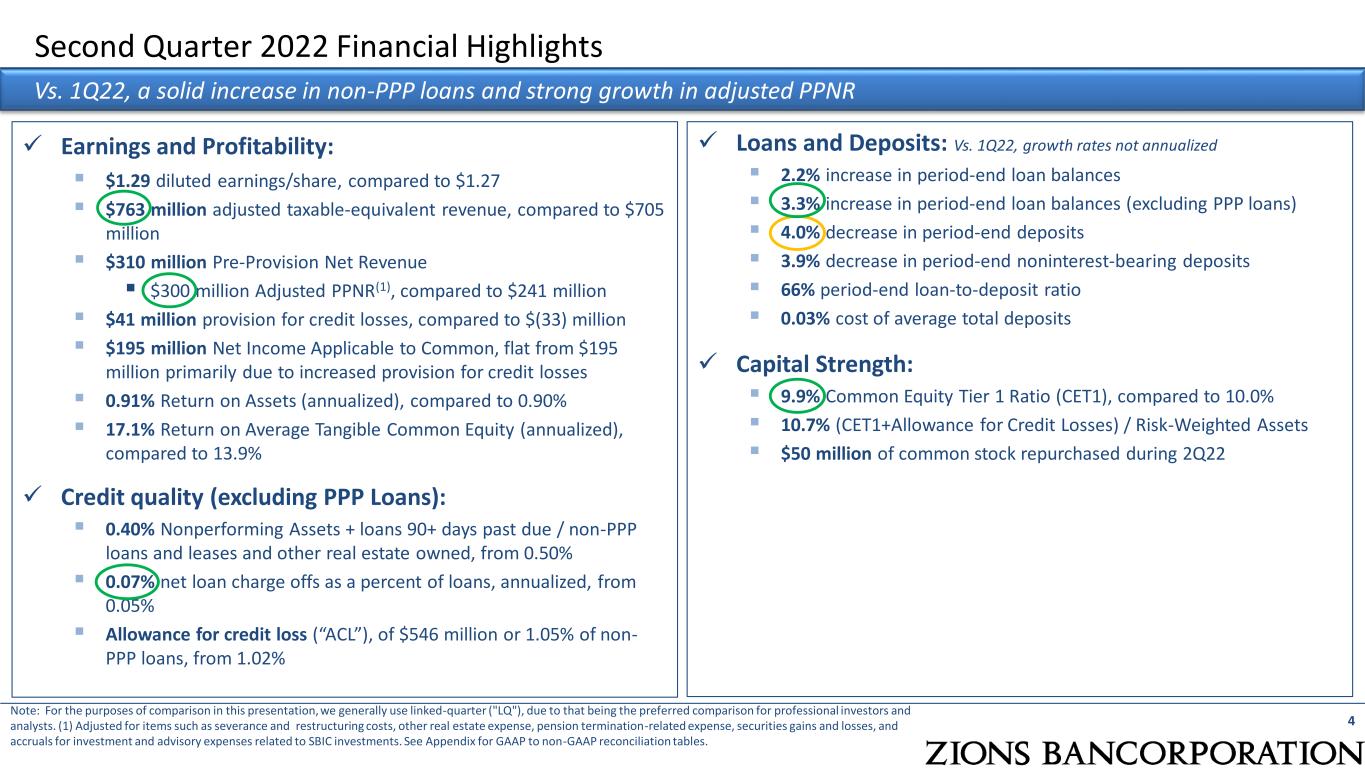

✓ Earnings and Profitability: ▪ $1.29 diluted earnings/share, compared to $1.27 ▪ $763 million adjusted taxable-equivalent revenue, compared to $705 million ▪ $310 million Pre-Provision Net Revenue ▪ $300 million Adjusted PPNR(1), compared to $241 million ▪ $41 million provision for credit losses, compared to $(33) million ▪ $195 million Net Income Applicable to Common, flat from $195 million primarily due to increased provision for credit losses ▪ 0.91% Return on Assets (annualized), compared to 0.90% ▪ 17.1% Return on Average Tangible Common Equity (annualized), compared to 13.9% ✓ Credit quality (excluding PPP Loans): ▪ 0.40% Nonperforming Assets + loans 90+ days past due / non-PPP loans and leases and other real estate owned, from 0.50% ▪ 0.07% net loan charge offs as a percent of loans, annualized, from 0.05% ▪ Allowance for credit loss (“ACL”), of $546 million or 1.05% of non- PPP loans, from 1.02% 4 Second Quarter 2022 Financial Highlights Vs. 1Q22, a solid increase in non-PPP loans and strong growth in adjusted PPNR Note: For the purposes of comparison in this presentation, we generally use linked-quarter ("LQ"), due to that being the preferred comparison for professional investors and analysts. (1) Adjusted for items such as severance and restructuring costs, other real estate expense, pension termination-related expense, securities gains and losses, and accruals for investment and advisory expenses related to SBIC investments. See Appendix for GAAP to non-GAAP reconciliation tables. ✓ Loans and Deposits: Vs. 1Q22, growth rates not annualized ▪ 2.2% increase in period-end loan balances ▪ 3.3% increase in period-end loan balances (excluding PPP loans) ▪ 4.0% decrease in period-end deposits ▪ 3.9% decrease in period-end noninterest-bearing deposits ▪ 66% period-end loan-to-deposit ratio ▪ 0.03% cost of average total deposits ✓ Capital Strength: ▪ 9.9% Common Equity Tier 1 Ratio (CET1), compared to 10.0% ▪ 10.7% (CET1+Allowance for Credit Losses) / Risk-Weighted Assets ▪ $50 million of common stock repurchased during 2Q22

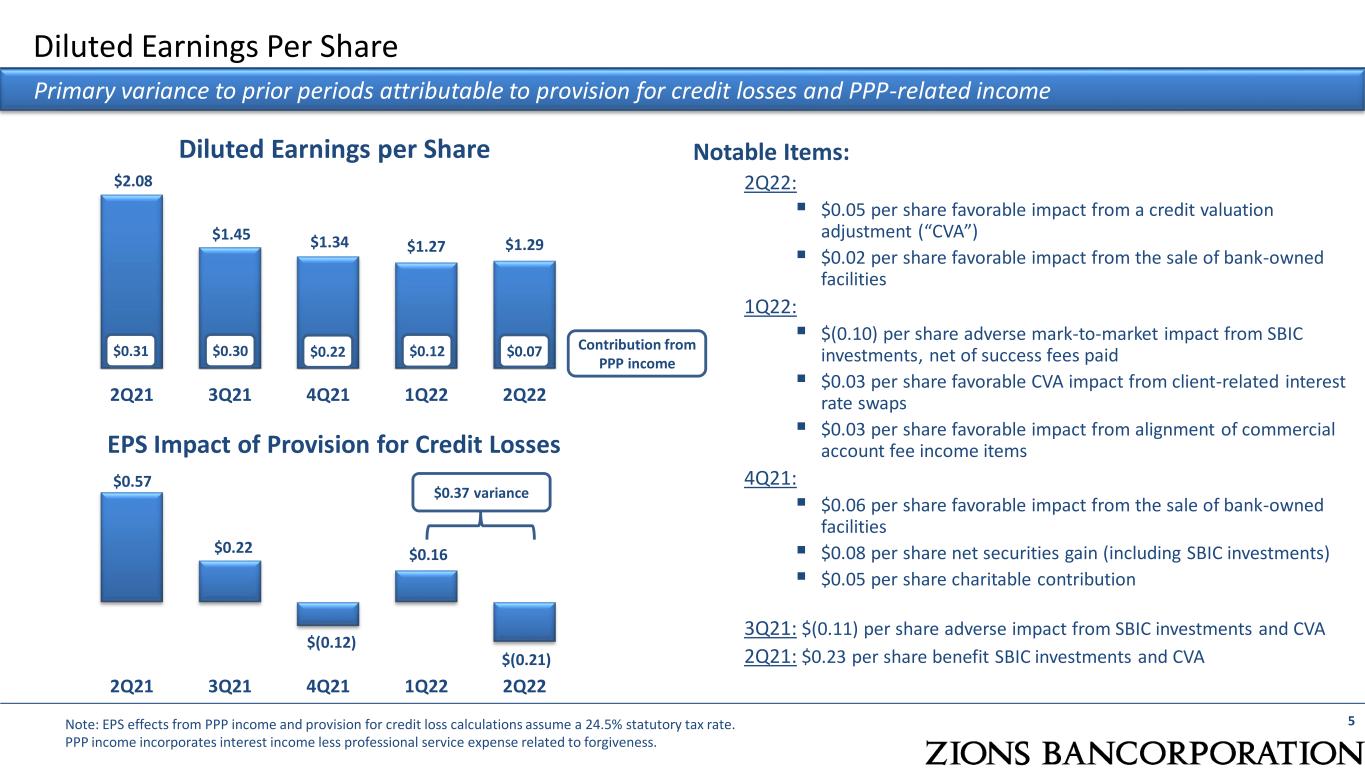

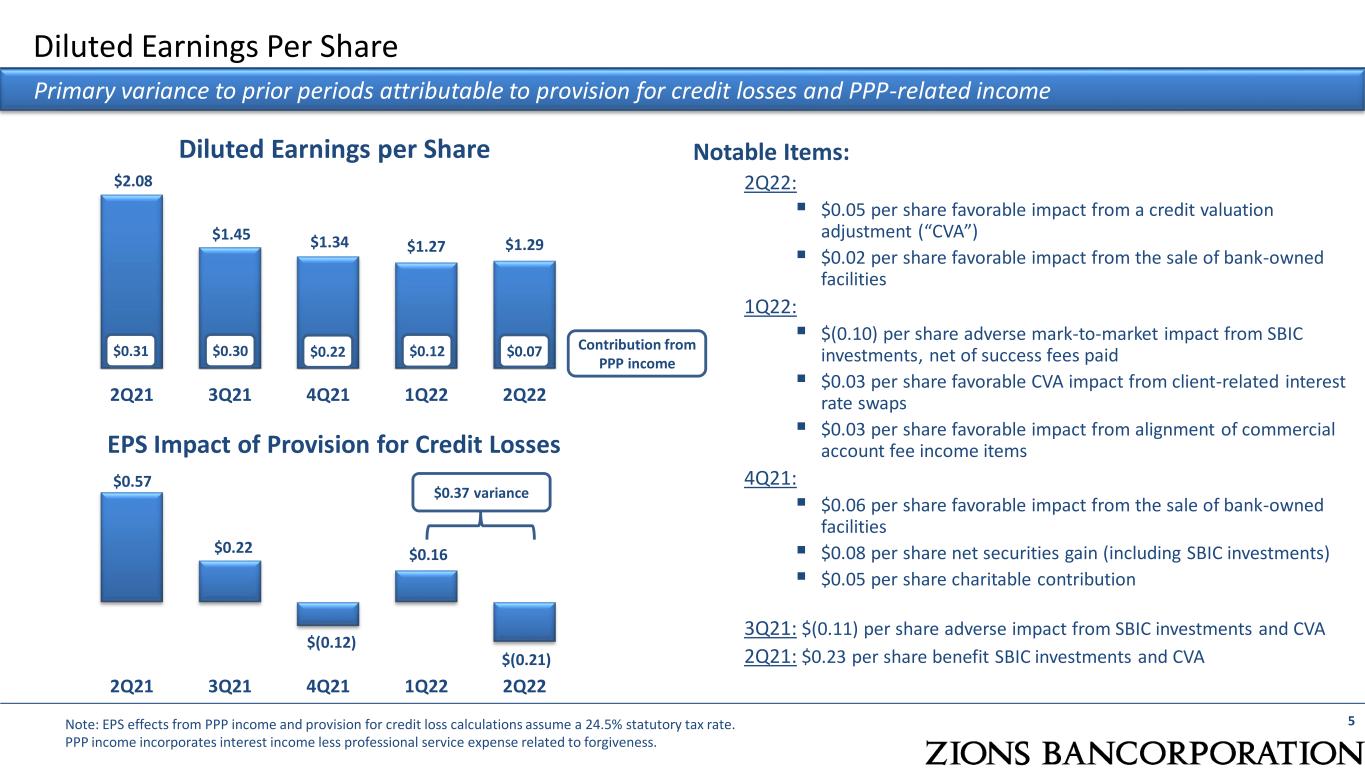

$2.08 $1.45 $1.34 $1.27 $1.29 2Q21 3Q21 4Q21 1Q22 2Q22 Diluted Earnings Per Share Notable Items: 2Q22: ▪ $0.05 per share favorable impact from a credit valuation adjustment (“CVA”) ▪ $0.02 per share favorable impact from the sale of bank-owned facilities 1Q22: ▪ $(0.10) per share adverse mark-to-market impact from SBIC investments, net of success fees paid ▪ $0.03 per share favorable CVA impact from client-related interest rate swaps ▪ $0.03 per share favorable impact from alignment of commercial account fee income items 4Q21: ▪ $0.06 per share favorable impact from the sale of bank-owned facilities ▪ $0.08 per share net securities gain (including SBIC investments) ▪ $0.05 per share charitable contribution 3Q21: $(0.11) per share adverse impact from SBIC investments and CVA 2Q21: $0.23 per share benefit SBIC investments and CVA 5 Primary variance to prior periods attributable to provision for credit losses and PPP-related income Diluted Earnings per Share Note: EPS effects from PPP income and provision for credit loss calculations assume a 24.5% statutory tax rate. PPP income incorporates interest income less professional service expense related to forgiveness. $0.57 $0.22 $(0.12) $0.16 $(0.21) 2Q21 3Q21 4Q21 1Q22 2Q22 EPS Impact of Provision for Credit Losses $0.31 $0.30 $0.22 $0.12 Contribution from PPP income $0.07 $0.37 variance

67 64 44 24 15 290 290 288 241 300 2Q21 3Q21 4Q21 1Q22 2Q22 Adjusted Pre-Provision Net Revenue (“PPNR”) Adjusted PPNR increased considerably from 1Q22, primarily due to the benefit of higher rates and loan growth (1) Adjusted for items such as severance costs, restructuring costs, other real estate expense, pension termination-related expense, securities gains and losses, and accruals for investment and advisory expenses related to the unrealized gains/(losses) on SBIC investments. See Appendix for GAAP to non-GAAP reconciliation table. Adjusted PPNR(1) ($ millions) 6 Linked quarter: ▪ Adjusted PPNR increased 24% primarily from ▪ Higher yields on all major asset categories from rising interest rates combined with minimal change in funding costs ▪ Increased concentration of higher yield assets (e.g., loans and securities) ▪ Reduced seasonal impacts from 1Q (e.g., share-based compensation, payroll taxes, one less day of interest income) ▪ Stability in customer-related noninterest income ▪ Reduced PPP income, additional employees, and increased incentive compensation Year-over-year: ▪ Adjusted PPNR increased 3% due to ▪ A 4% higher balance of average earning assets primarily from strong growth of deposits, securities, and loans, partially offset by a decline in money market investments ▪ An 11% increase in customer-related noninterest income ▪ An 11% increase in adjusted noninterest expense

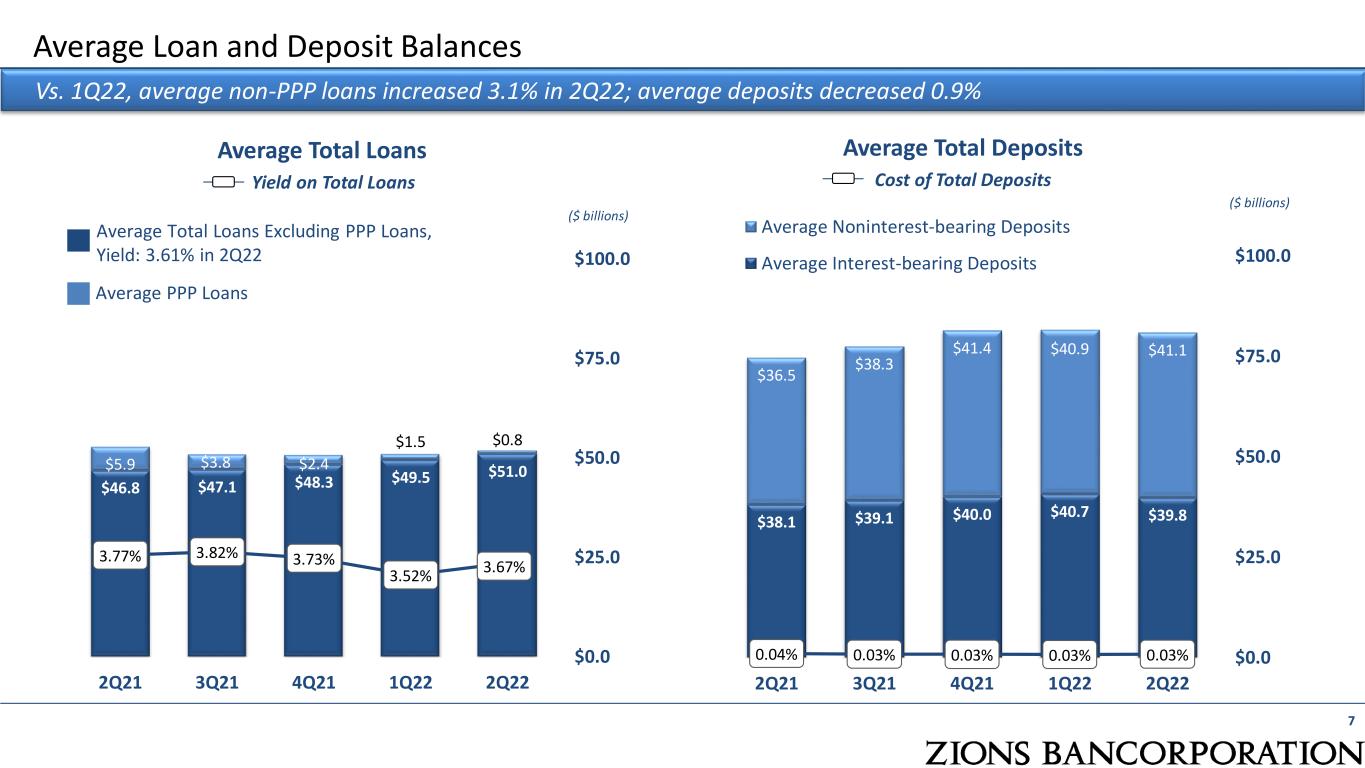

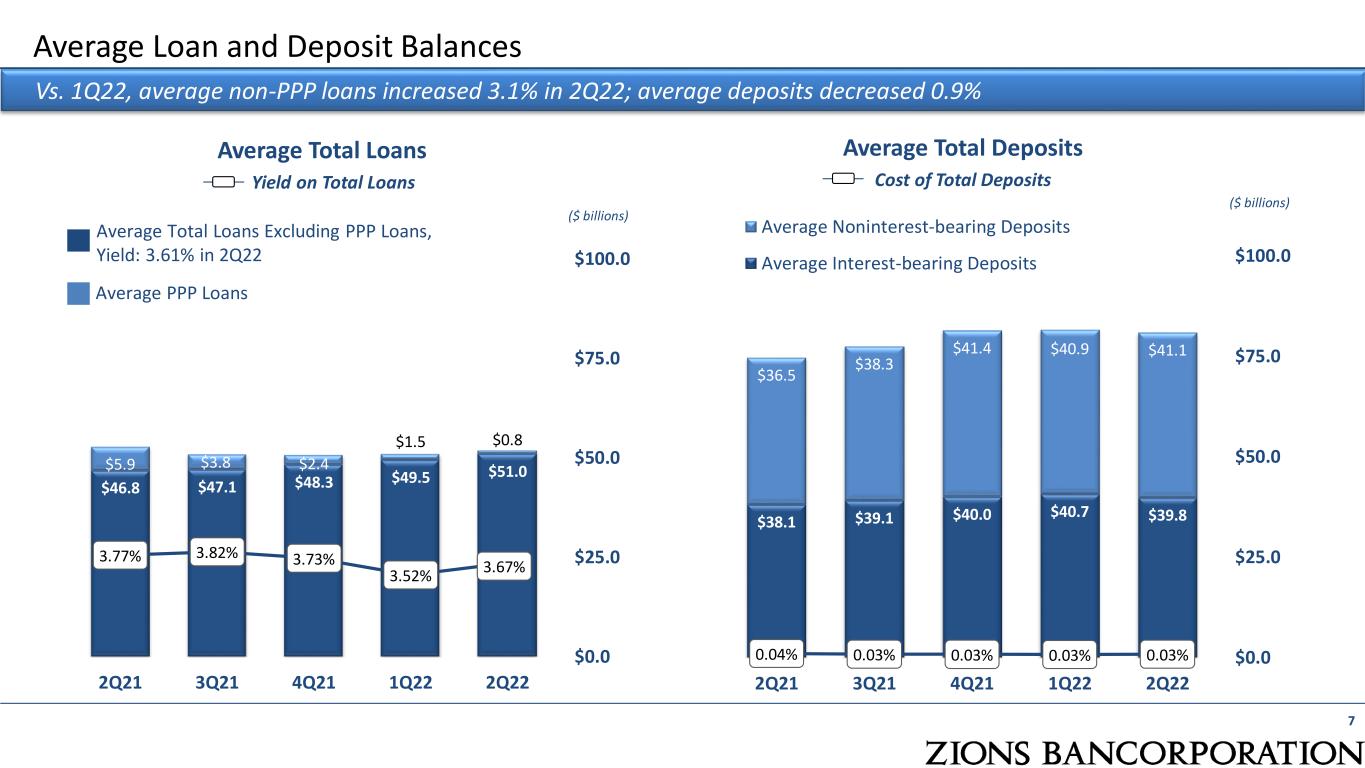

$46.8 $47.1 $48.3 $49.5 $51.0$5.9 $3.8 $2.4 $1.5 $0.8 3.77% 3.82% 3.73% 3.52% 3.67% $0.0 $25.0 $50.0 $75.0 $100.0 2Q21 3Q21 4Q21 1Q22 2Q22 Average Total Loans Excluding PPP Loans, Yield: 3.61% in 2Q22 Average PPP Loans Average Loan and Deposit Balances Average Total Loans Yield on Total Loans Average Total Deposits Cost of Total Deposits 7 Vs. 1Q22, average non-PPP loans increased 3.1% in 2Q22; average deposits decreased 0.9% $38.1 $39.1 $40.0 $40.7 $39.8 $36.5 $38.3 $41.4 $40.9 $41.1 0.04% 0.03% 0.03% 0.03% 0.03% $0.0 $25.0 $50.0 $75.0 $100.0 2Q21 3Q21 4Q21 1Q22 2Q22 Average Noninterest-bearing Deposits Average Interest-bearing Deposits ($ billions) ($ billions)

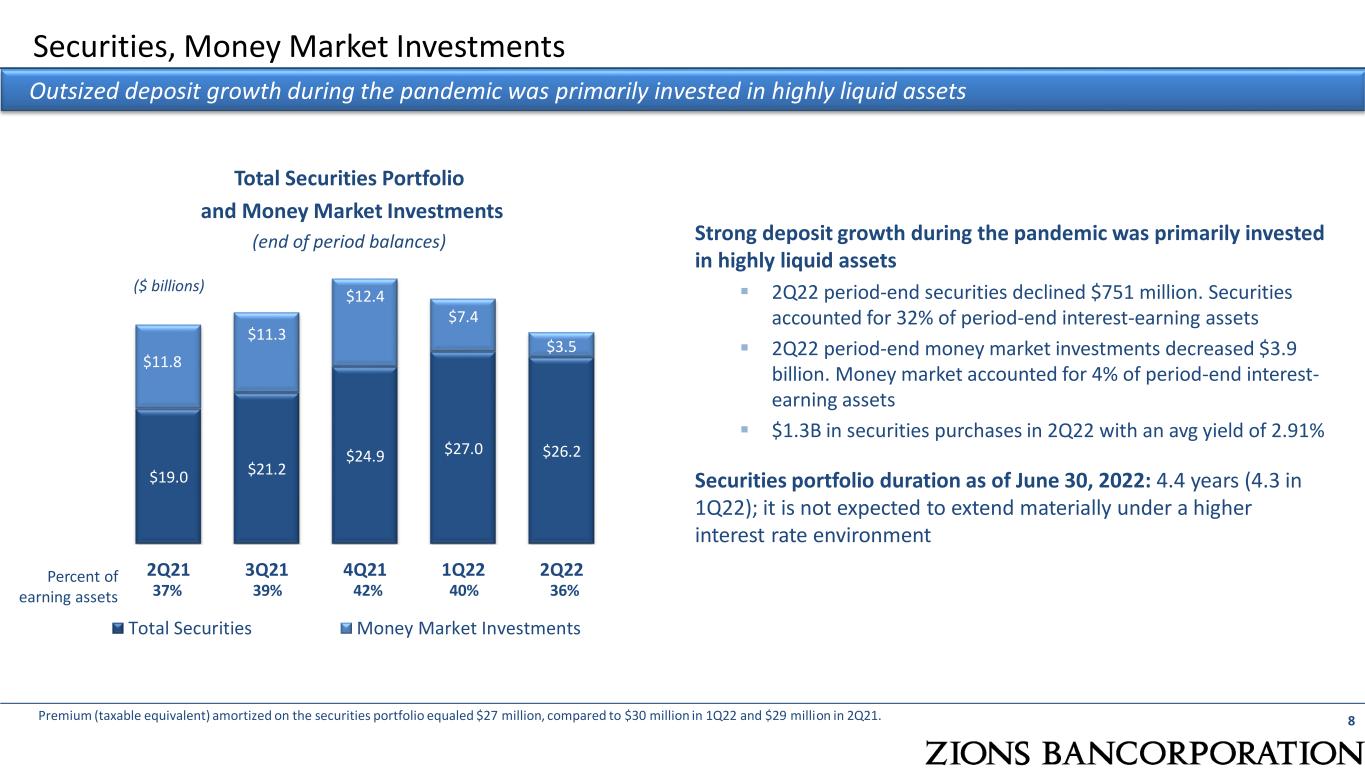

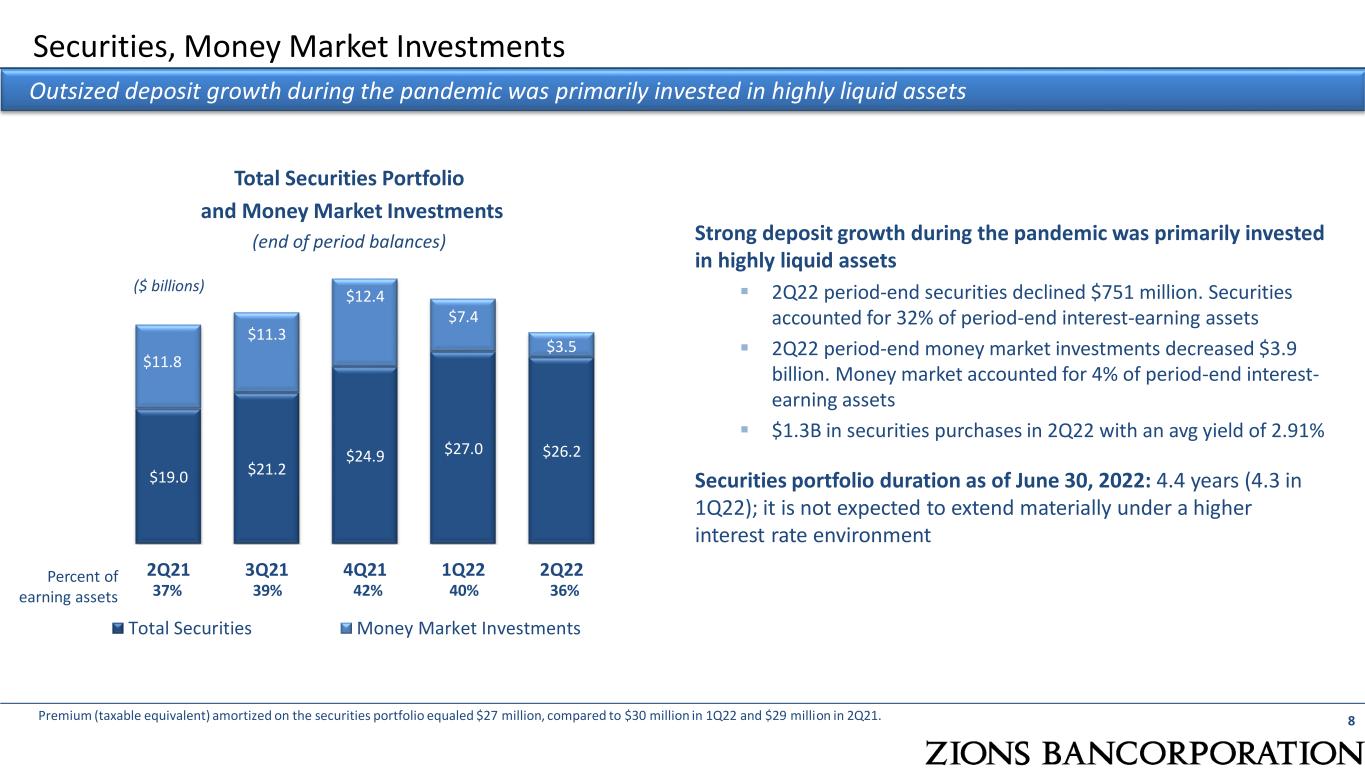

Securities, Money Market Investments 8 Total Securities Portfolio and Money Market Investments (end of period balances) $19.0 $21.2 $24.9 $27.0 $26.2 $11.8 $11.3 $12.4 $7.4 $3.5 2Q21 3Q21 4Q21 1Q22 2Q22 Total Securities Money Market Investments ($ billions) Outsized deposit growth during the pandemic was primarily invested in highly liquid assets Strong deposit growth during the pandemic was primarily invested in highly liquid assets ▪ 2Q22 period-end securities declined $751 million. Securities accounted for 32% of period-end interest-earning assets ▪ 2Q22 period-end money market investments decreased $3.9 billion. Money market accounted for 4% of period-end interest- earning assets ▪ $1.3B in securities purchases in 2Q22 with an avg yield of 2.91% 37% 39% 42% 40% 36% Percent of earning assets Securities portfolio duration as of June 30, 2022: 4.4 years (4.3 in 1Q22); it is not expected to extend materially under a higher interest rate environment Premium (taxable equivalent) amortized on the securities portfolio equaled $27 million, compared to $30 million in 1Q22 and $29 million in 2Q21.

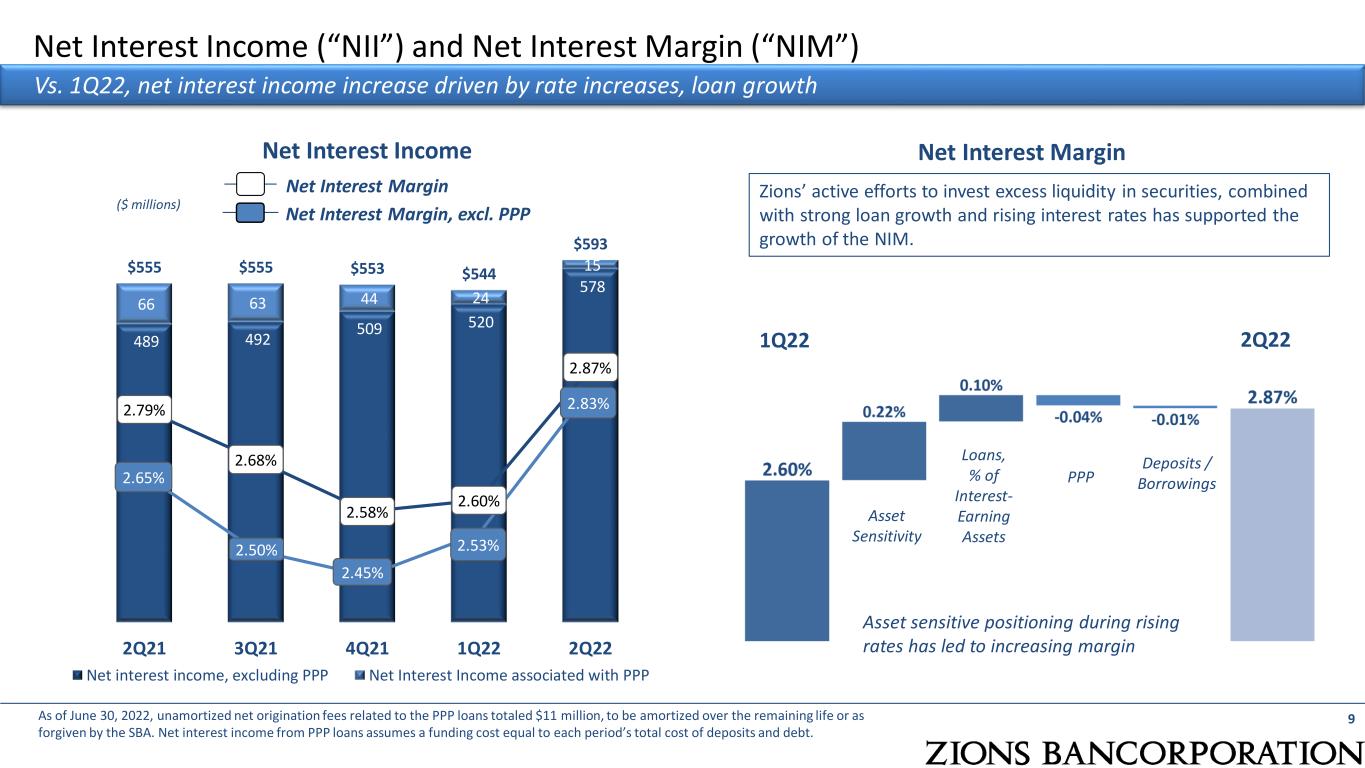

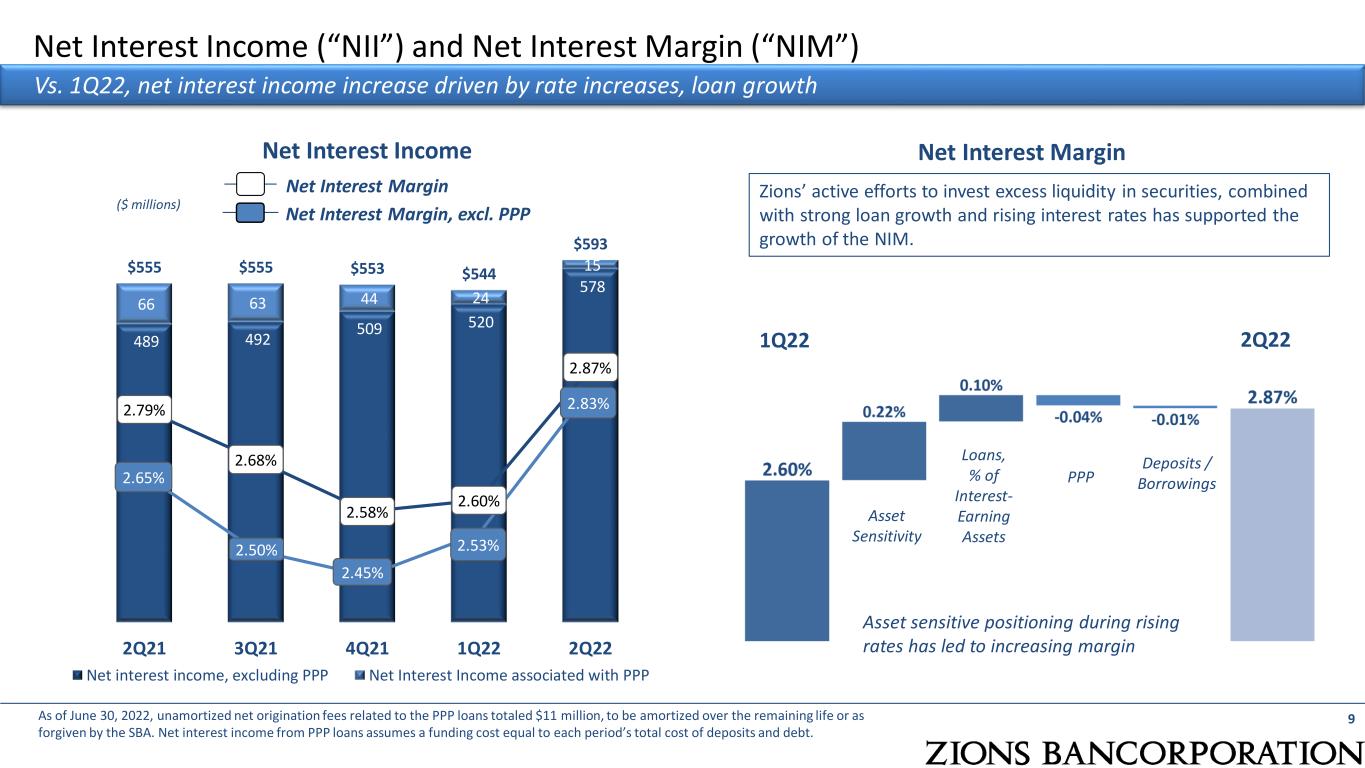

489 492 509 520 578 66 63 44 24 15 $555 $555 $553 $544 $593 2.79% 2.68% 2.58% 2.60% 2.87% 2.65% 2.50% 2.45% 2.53% 2.83% $0 2Q21 3Q21 4Q21 1Q22 2Q22 Net interest income, excluding PPP Net Interest Income associated with PPP Net Interest Income (“NII”) and Net Interest Margin (“NIM”) Net Interest Income Net Interest Margin Net Interest Margin, excl. PPP 9 Vs. 1Q22, net interest income increase driven by rate increases, loan growth ($ millions) Net Interest Margin 1Q22 2Q22 Loans, % of Interest- Earning Assets PPP Deposits / Borrowings As of June 30, 2022, unamortized net origination fees related to the PPP loans totaled $11 million, to be amortized over the remaining life or as forgiven by the SBA. Net interest income from PPP loans assumes a funding cost equal to each period’s total cost of deposits and debt. Zions’ active efforts to invest excess liquidity in securities, combined with strong loan growth and rising interest rates has supported the growth of the NIM. Asset Sensitivity Asset sensitive positioning during rising rates has led to increasing margin

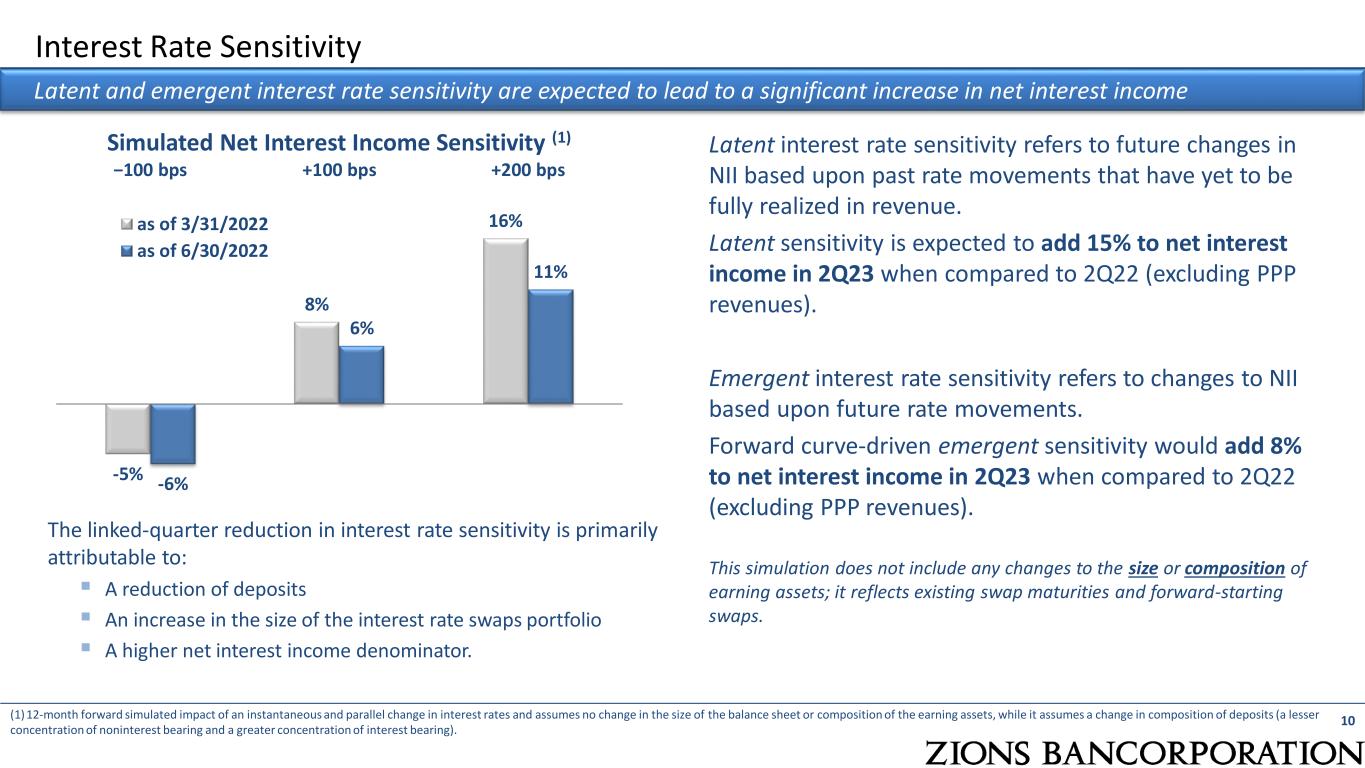

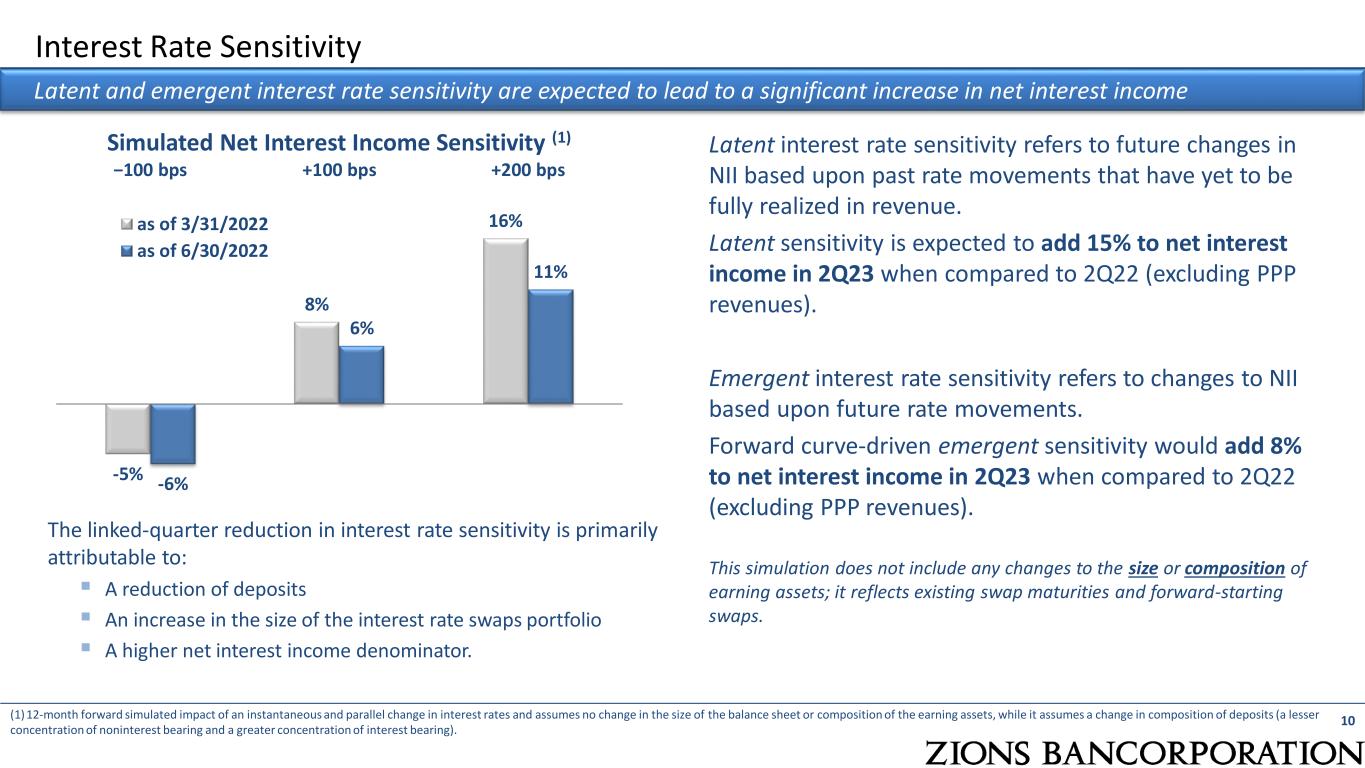

Interest Rate Sensitivity 10 Latent and emergent interest rate sensitivity are expected to lead to a significant increase in net interest income (1) 12-month forward simulated impact of an instantaneous and parallel change in interest rates and assumes no change in the size of the balance sheet or composition of the earning assets, while it assumes a change in composition of deposits (a lesser concentration of noninterest bearing and a greater concentration of interest bearing). Latent interest rate sensitivity refers to future changes in NII based upon past rate movements that have yet to be fully realized in revenue. Latent sensitivity is expected to add 15% to net interest income in 2Q23 when compared to 2Q22 (excluding PPP revenues). Emergent interest rate sensitivity refers to changes to NII based upon future rate movements. Forward curve-driven emergent sensitivity would add 8% to net interest income in 2Q23 when compared to 2Q22 (excluding PPP revenues). This simulation does not include any changes to the size or composition of earning assets; it reflects existing swap maturities and forward-starting swaps. -5% 8% 16% -6% 6% 11% −100 bps +100 bps +200 bps Simulated Net Interest Income Sensitivity (1) as of 3/31/2022 as of 6/30/2022 The linked-quarter reduction in interest rate sensitivity is primarily attributable to: ▪ A reduction of deposits ▪ An increase in the size of the interest rate swaps portfolio ▪ A higher net interest income denominator.

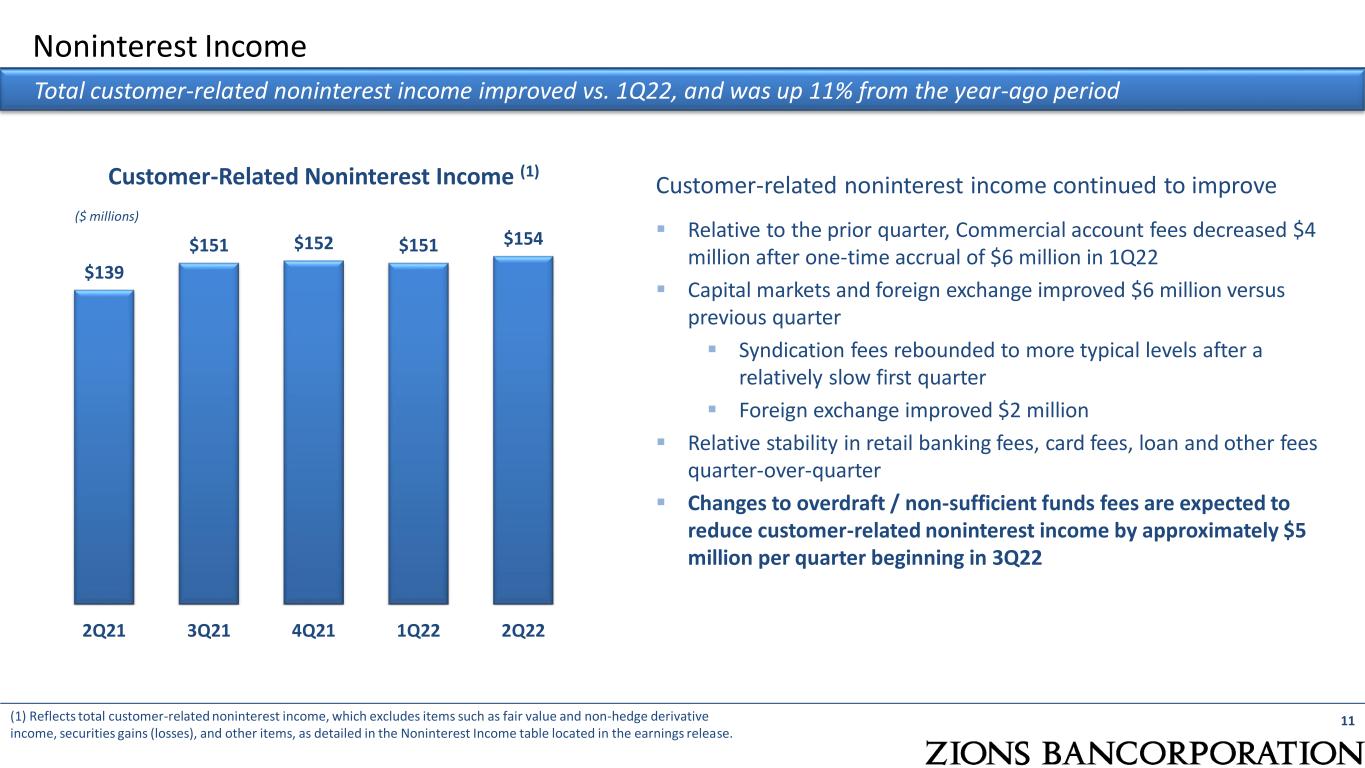

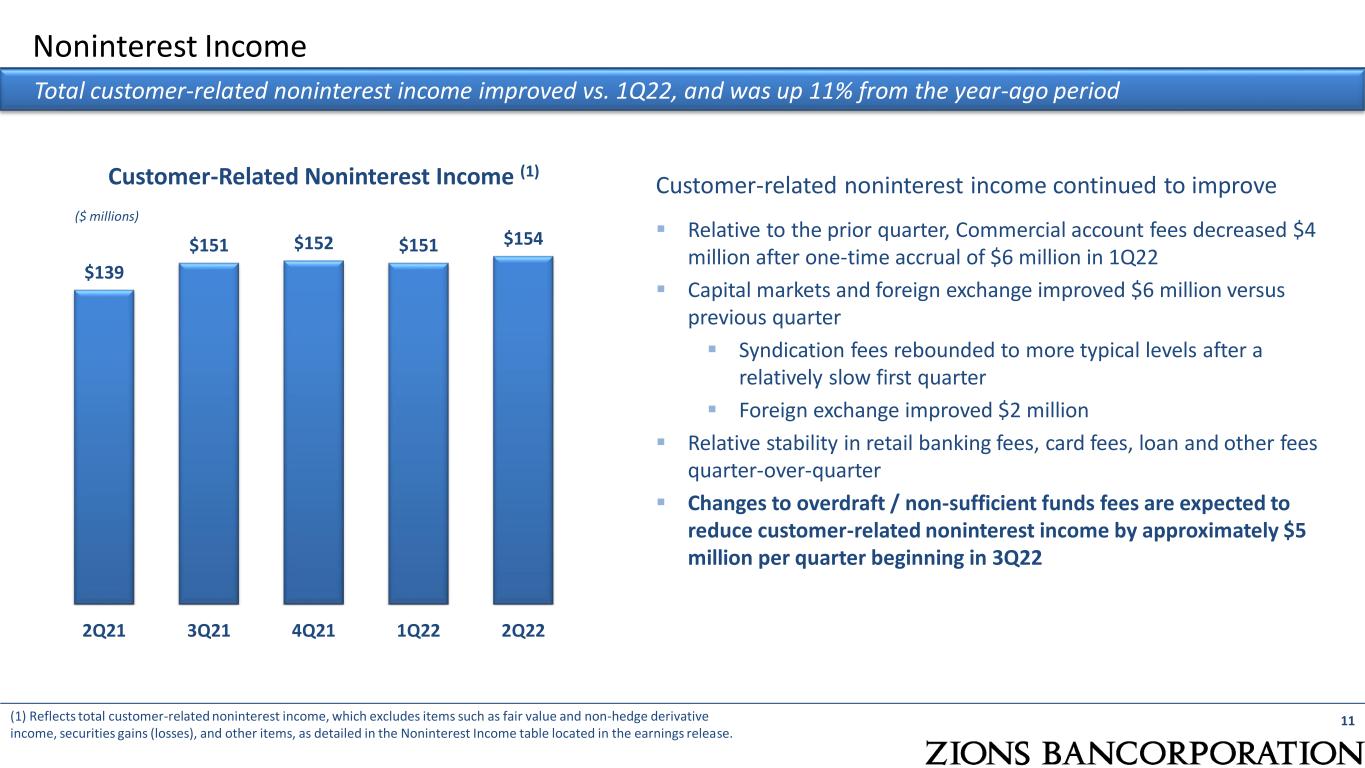

$139 $151 $152 $151 $154 2Q21 3Q21 4Q21 1Q22 2Q22 Customer-related noninterest income continued to improve ▪ Relative to the prior quarter, Commercial account fees decreased $4 million after one-time accrual of $6 million in 1Q22 ▪ Capital markets and foreign exchange improved $6 million versus previous quarter ▪ Syndication fees rebounded to more typical levels after a relatively slow first quarter ▪ Foreign exchange improved $2 million ▪ Relative stability in retail banking fees, card fees, loan and other fees quarter-over-quarter ▪ Changes to overdraft / non-sufficient funds fees are expected to reduce customer-related noninterest income by approximately $5 million per quarter beginning in 3Q22 Noninterest Income 11 Customer-Related Noninterest Income (1) Total customer-related noninterest income improved vs. 1Q22, and was up 11% from the year-ago period (1) Reflects total customer-related noninterest income, which excludes items such as fair value and non-hedge derivative income, securities gains (losses), and other items, as detailed in the Noninterest Income table located in the earnings release. ($ millions)

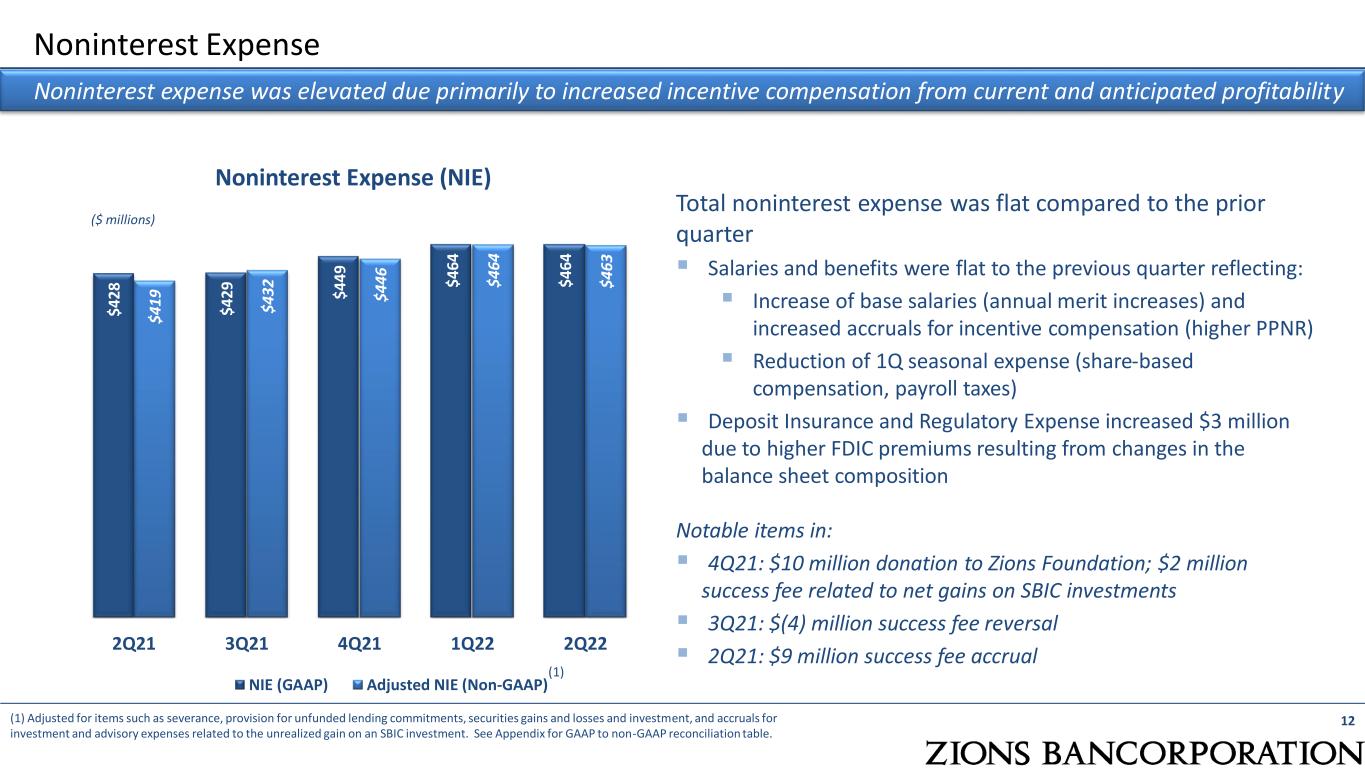

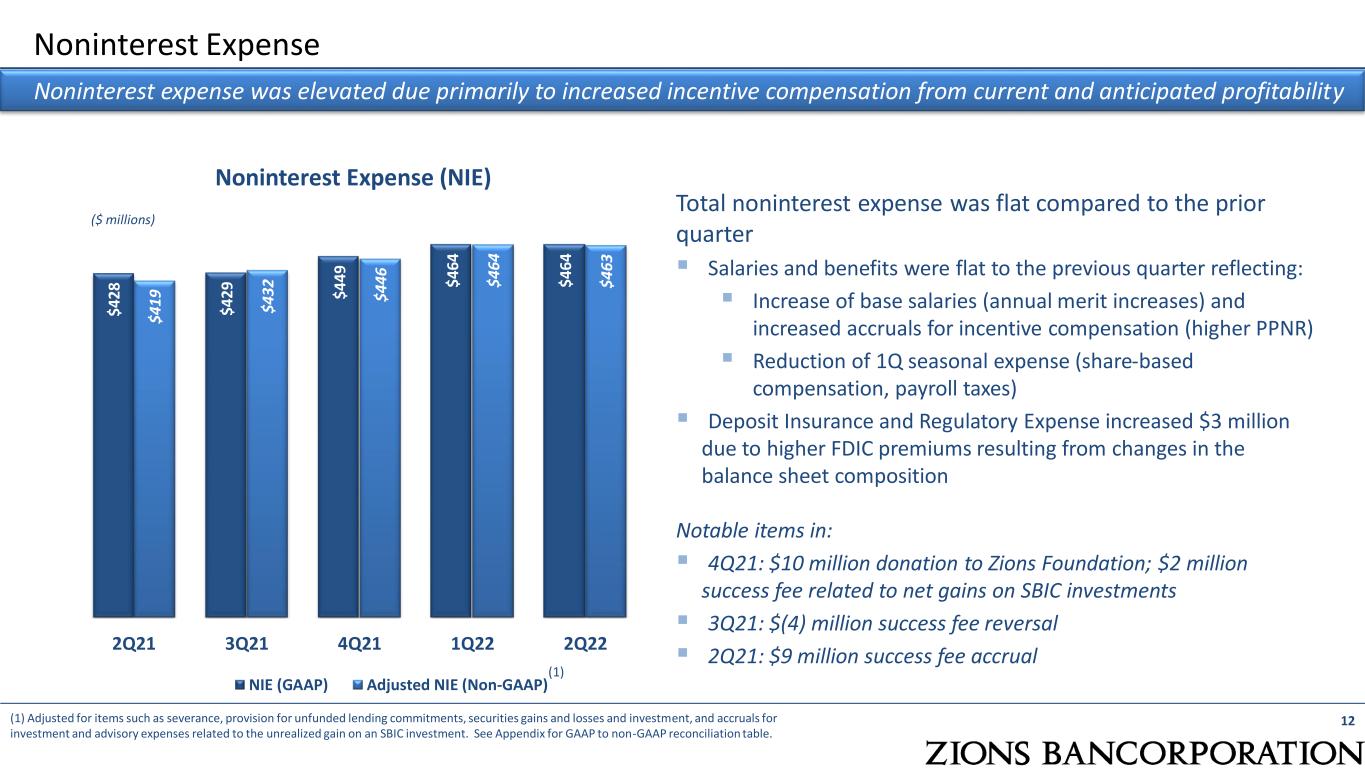

$4 28 $4 29 $4 49 $4 64 $4 64 $4 19 $4 32 $4 46 $4 64 $4 63 2Q21 3Q21 4Q21 1Q22 2Q22 NIE (GAAP) Adjusted NIE (Non-GAAP) ($ millions) Noninterest Expense 12 Noninterest expense was elevated due primarily to increased incentive compensation from current and anticipated profitability Total noninterest expense was flat compared to the prior quarter ▪ Salaries and benefits were flat to the previous quarter reflecting: ▪ Increase of base salaries (annual merit increases) and increased accruals for incentive compensation (higher PPNR) ▪ Reduction of 1Q seasonal expense (share-based compensation, payroll taxes) ▪ Deposit Insurance and Regulatory Expense increased $3 million due to higher FDIC premiums resulting from changes in the balance sheet composition Notable items in: ▪ 4Q21: $10 million donation to Zions Foundation; $2 million success fee related to net gains on SBIC investments ▪ 3Q21: $(4) million success fee reversal ▪ 2Q21: $9 million success fee accrual (1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and investment, and accruals for investment and advisory expenses related to the unrealized gain on an SBIC investment. See Appendix for GAAP to non-GAAP reconciliation table. Noninterest Expense (NIE) (1)

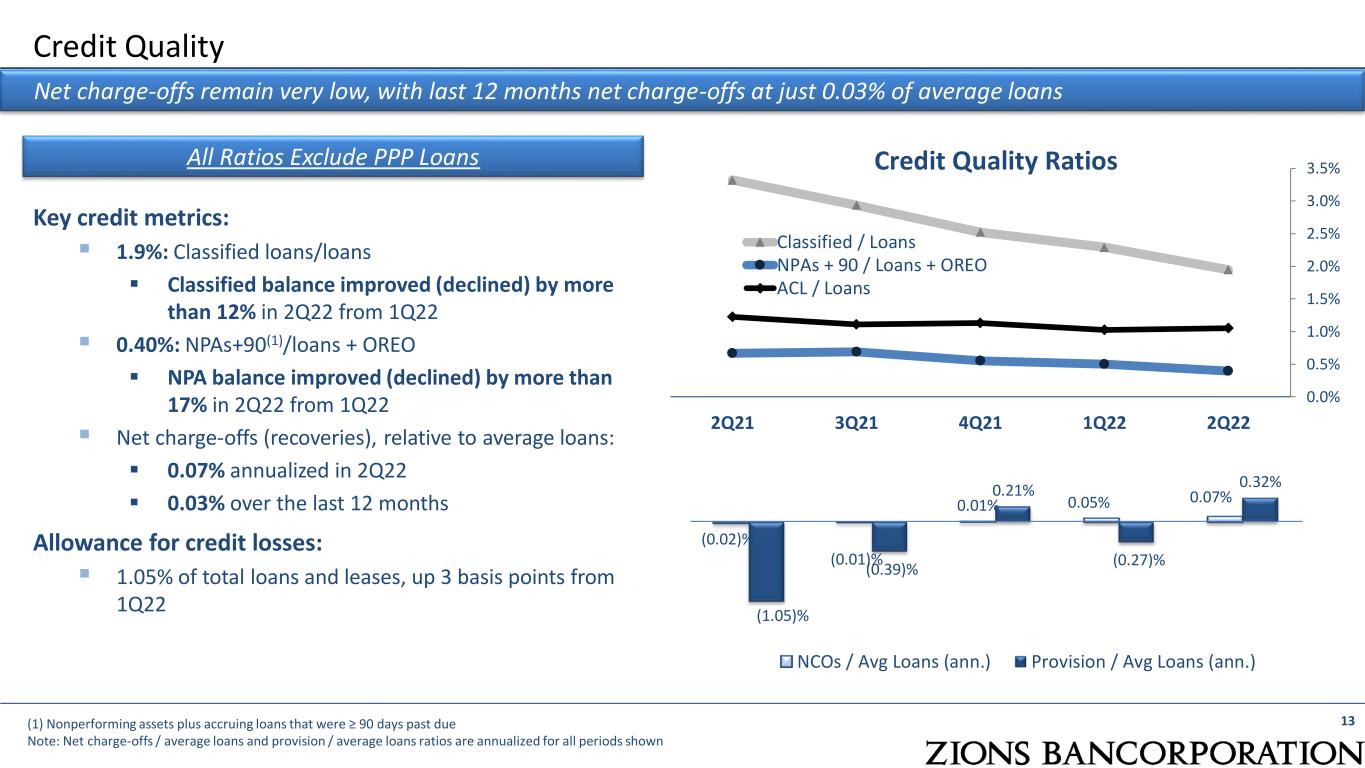

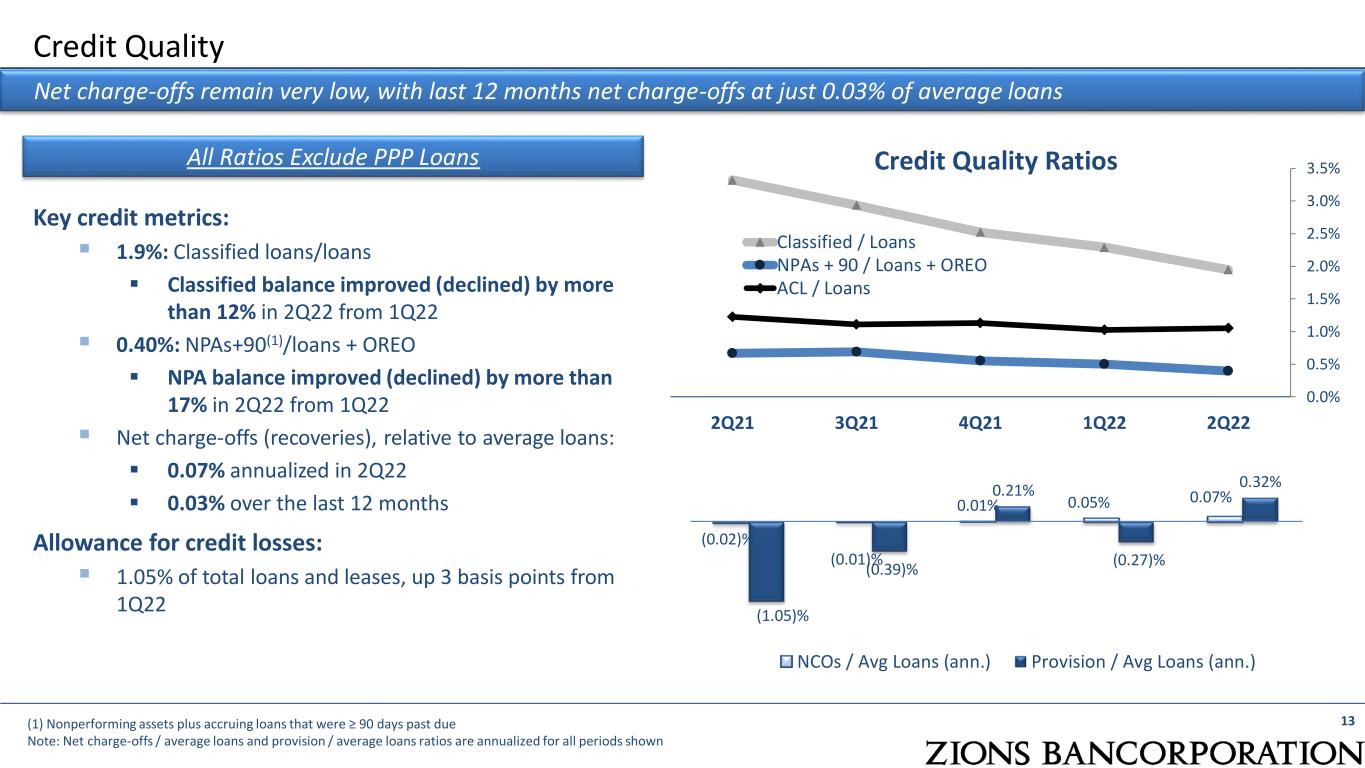

13 Credit Quality Ratios Net charge-offs remain very low, with last 12 months net charge-offs at just 0.03% of average loans Key credit metrics: ▪ 1.9%: Classified loans/loans ▪ Classified balance improved (declined) by more than 12% in 2Q22 from 1Q22 ▪ 0.40%: NPAs+90(1)/loans + OREO ▪ NPA balance improved (declined) by more than 17% in 2Q22 from 1Q22 ▪ Net charge-offs (recoveries), relative to average loans: ▪ 0.07% annualized in 2Q22 ▪ 0.03% over the last 12 months Allowance for credit losses: ▪ 1.05% of total loans and leases, up 3 basis points from 1Q22 (1) Nonperforming assets plus accruing loans that were ≥ 90 days past due Note: Net charge-offs / average loans and provision / average loans ratios are annualized for all periods shown Credit Quality 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 2Q21 3Q21 4Q21 1Q22 2Q22 Classified / Loans NPAs + 90 / Loans + OREO ACL / Loans All Ratios Exclude PPP Loans (0.02)% (0.01)% 0.01% 0.05% 0.07% (1.05)% (0.39)% 0.21% (0.27)% 0.32% NCOs / Avg Loans (ann.) Provision / Avg Loans (ann.)

526 777 914 917 835 695 574 529 553 514 546 1.08 1.56 1.88 1.91 1.74 1.48 1.22 1.11 1.13 1.02 1.05 1/1/20 CECL 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 Allowance for Credit Loss ACL (%) ex-PPP 14 Allowance for Credit Loss (“ACL”) The ACL increase vs. 1Q22 is due to increased economic uncertainty ▪ The increase in the 2Q22 ACL from 1Q22 reflects an increase in the likelihood of a recession and growth in the loan portfolio ▪ Credit quality remain very clean ($ millions)

Net Charge-offs annualized, as a percentage of risk-weighted assets 0 .0 0% 0 .1 0% 0. 01 % 0. 16 % 0. 05 % 0. 22 % 0. 37 % 0. 11 % 0. 06 % (0 .0 1 )% (0 .0 1) % 0. 01 % 0. 04 % 0. 06 % -4% -2% 0% 2% 4% 6% 8% 10% 12% 14% 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 Capital Strength 15 Balance sheet capital remains strong relative to our risk profile Common Equity Tier 1 Capital and Allowance for Credit Losses as a percentage of risk-weighted assets 11 .3 % 10 .8 % 10 .4 % 10 .2 % 10 .0 % 10 .2 % 10 .4 % 10 .8 % 11 .2 % 1 1 .3 % 10 .9 % 1 0 .2 % 1 0. 0% 9. 9% 12 .3 % 11 .8 % 11 .4 % 11 .2 % 11 .4 % 11 .8 % 12 .0 % 12 .3 % 12 .5 % 12 .3 % 11 .8 % 11 .1 % 10 .8 % 10 .7 % 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 CET1 ACL/RWA

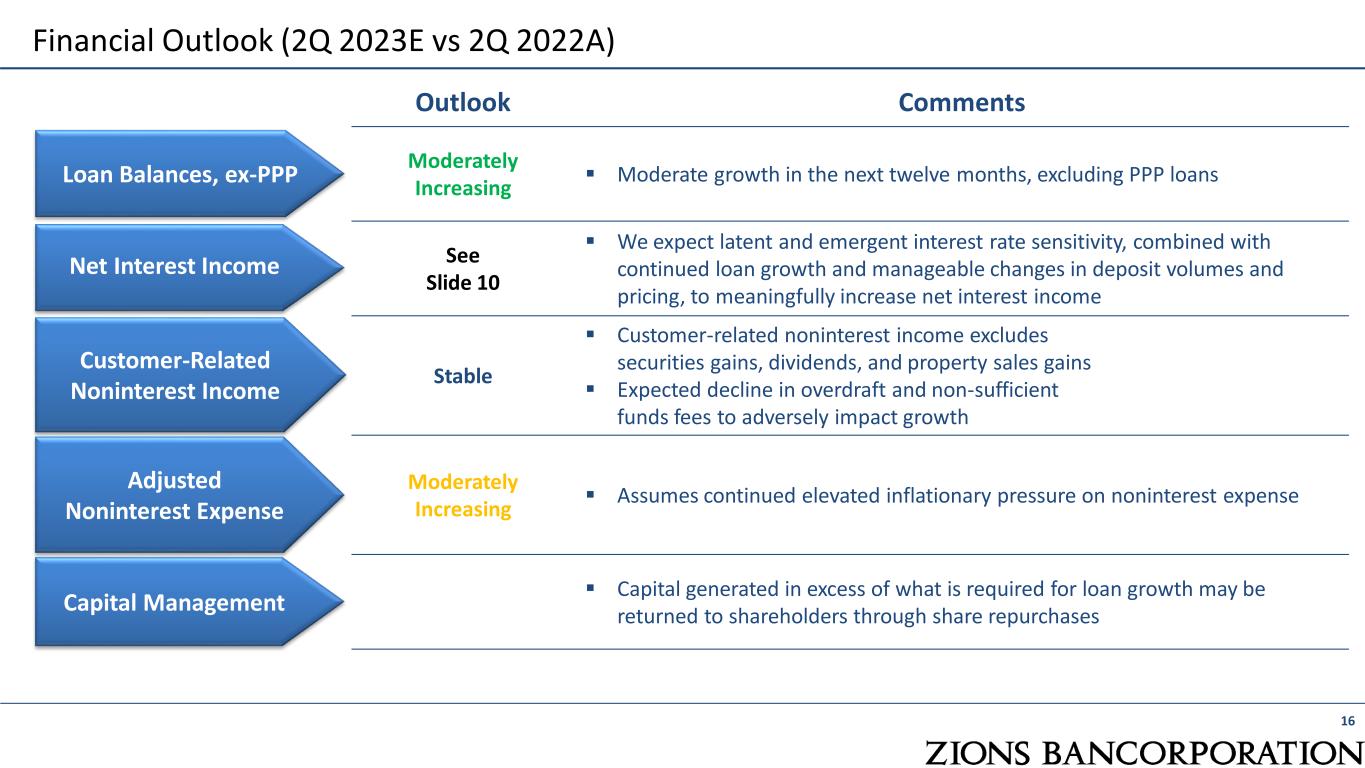

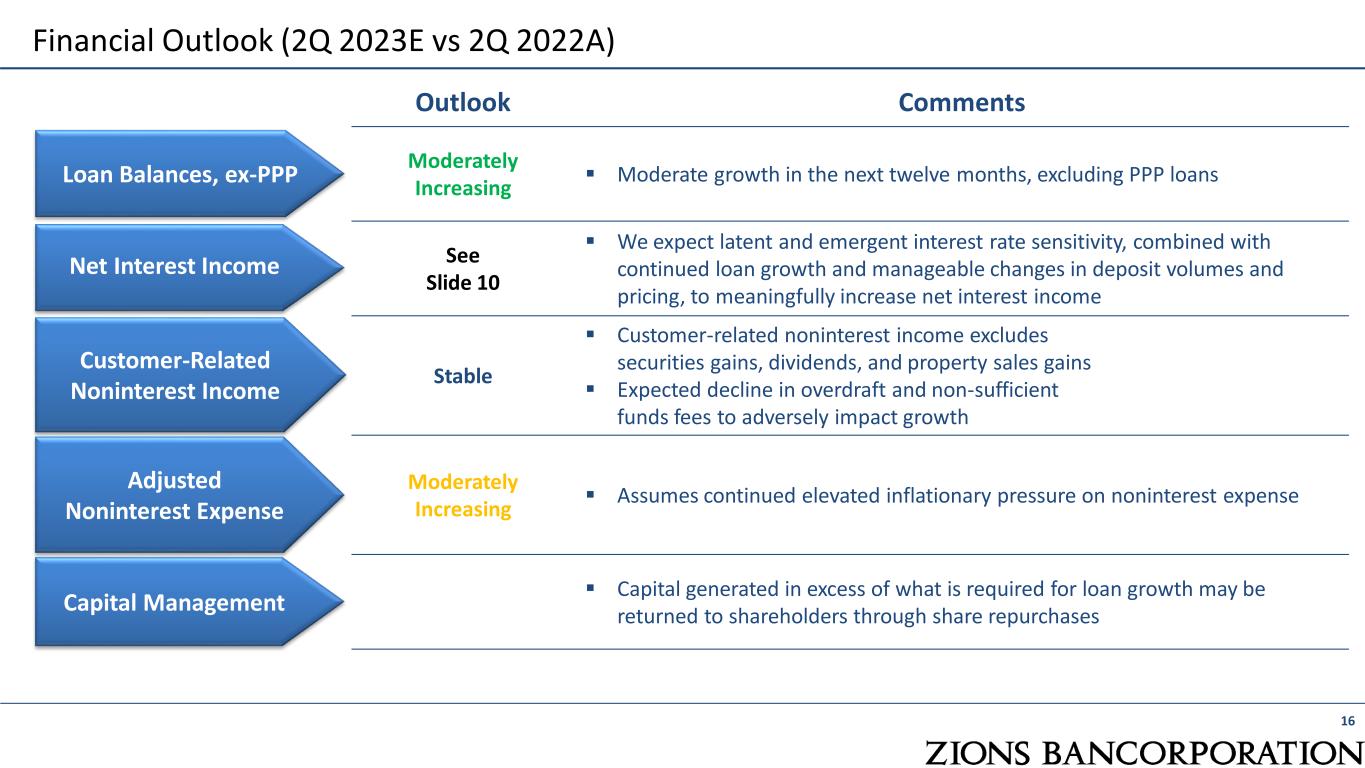

Financial Outlook (2Q 2023E vs 2Q 2022A) 16 Outlook Comments Moderately Increasing ▪ Moderate growth in the next twelve months, excluding PPP loans See Slide 10 ▪ We expect latent and emergent interest rate sensitivity, combined with continued loan growth and manageable changes in deposit volumes and pricing, to meaningfully increase net interest income Stable ▪ Customer-related noninterest income excludes securities gains, dividends, and property sales gains ▪ Expected decline in overdraft and non-sufficient funds fees to adversely impact growth Moderately Increasing ▪ Assumes continued elevated inflationary pressure on noninterest expense ▪ Capital generated in excess of what is required for loan growth may be returned to shareholders through share repurchases Customer-Related Noninterest Income Loan Balances, ex-PPP Net Interest Income Capital Management Adjusted Noninterest Expense

▪ Financial Results Summary ▪ Credit Metrics ▪ Loan Loss Severity (NCOs as a percentage of nonperforming assets) ▪ Balance Sheet Profitability ▪ Earning Asset Repricing ▪ Interest Rate Swaps ▪ Loan Growth by Geography and Type ▪ Mortgage Banking ▪ FutureCore Project ▪ Technology Initiatives ▪ GAAP to Non-GAAP Reconciliation 17 Appendix

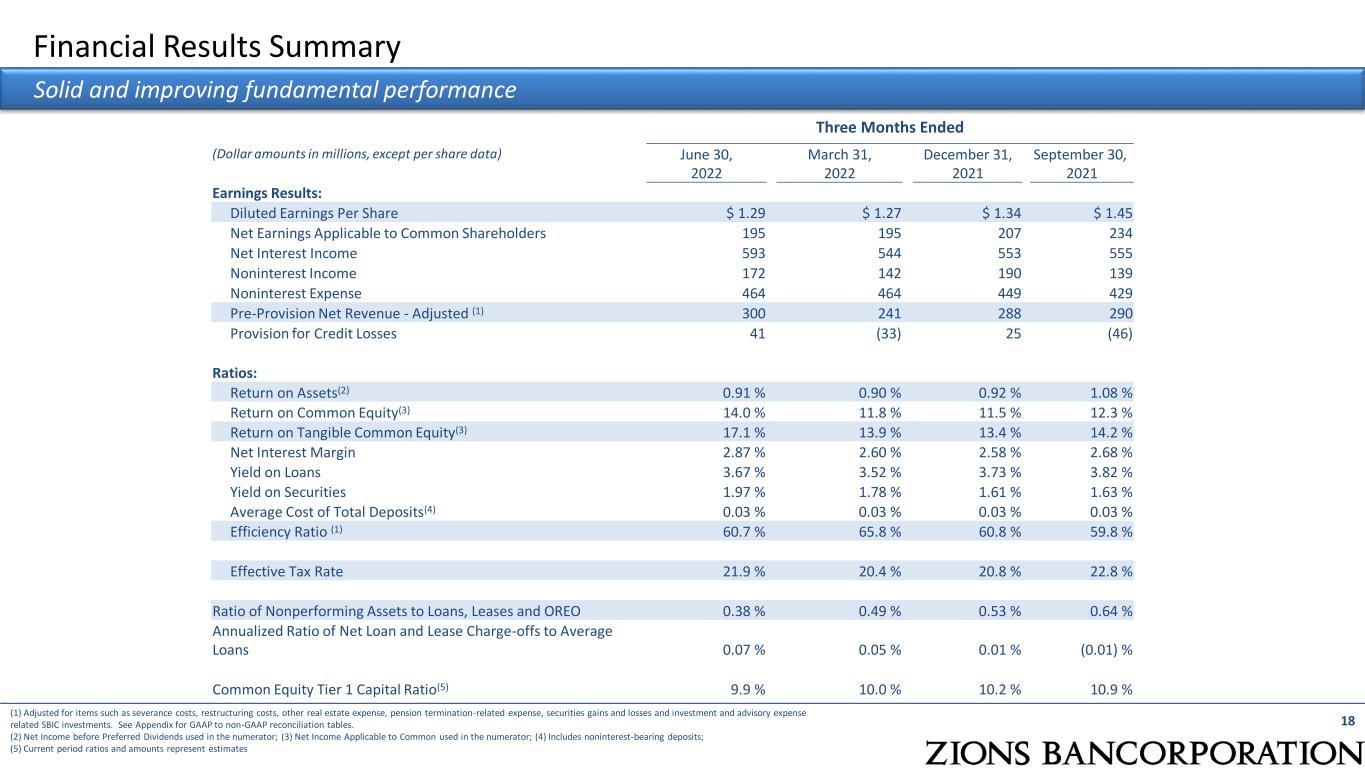

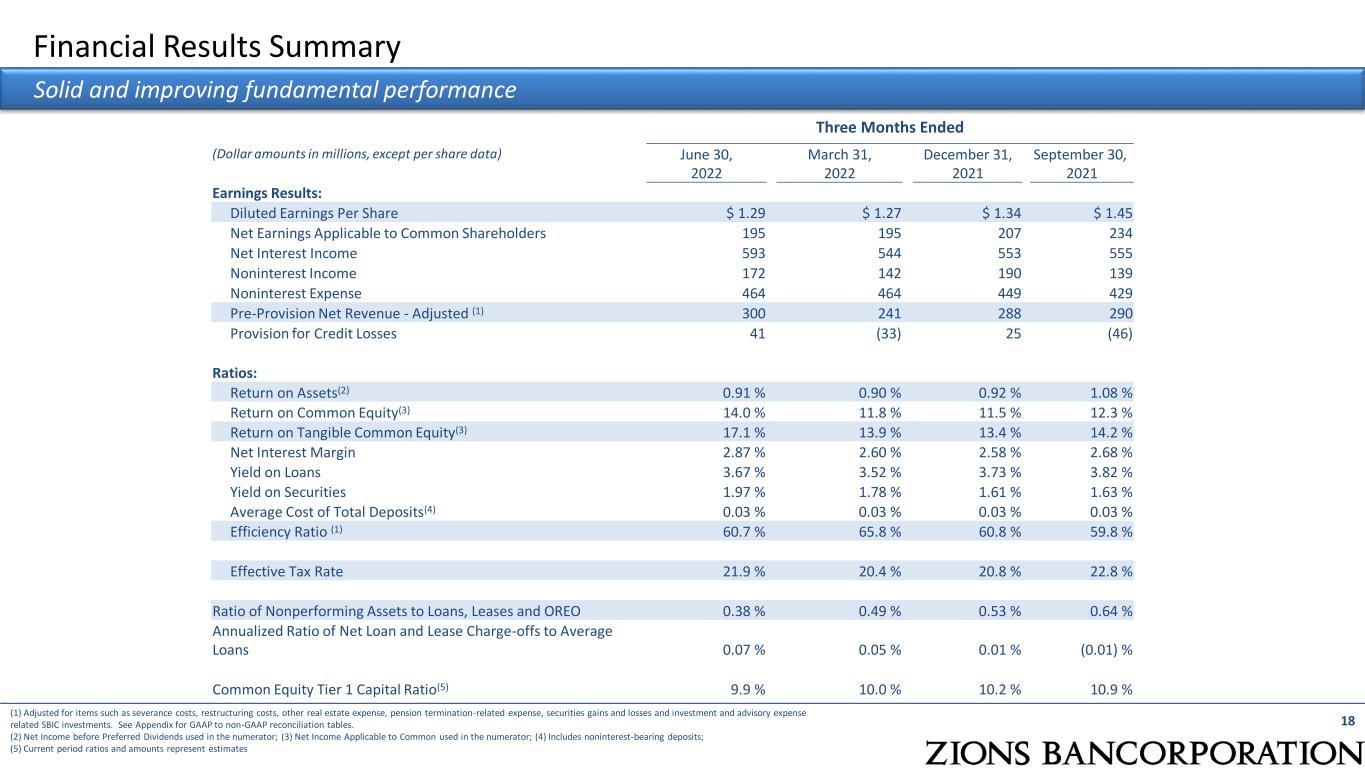

Financial Results Summary 18 Solid and improving fundamental performance Three Months Ended (Dollar amounts in millions, except per share data) June 30, 2022 March 31, 2022 December 31, 2021 September 30, 2021 Earnings Results: Diluted Earnings Per Share $ 1.29 $ 1.27 $ 1.34 $ 1.45 Net Earnings Applicable to Common Shareholders 195 195 207 234 Net Interest Income 593 544 553 555 Noninterest Income 172 142 190 139 Noninterest Expense 464 464 449 429 Pre-Provision Net Revenue - Adjusted (1) 300 241 288 290 Provision for Credit Losses 41 (33) 25 (46) Ratios: Return on Assets(2) 0.91 % 0.90 % 0.92 % 1.08 % Return on Common Equity(3) 14.0 % 11.8 % 11.5 % 12.3 % Return on Tangible Common Equity(3) 17.1 % 13.9 % 13.4 % 14.2 % Net Interest Margin 2.87 % 2.60 % 2.58 % 2.68 % Yield on Loans 3.67 % 3.52 % 3.73 % 3.82 % Yield on Securities 1.97 % 1.78 % 1.61 % 1.63 % Average Cost of Total Deposits(4) 0.03 % 0.03 % 0.03 % 0.03 % Efficiency Ratio (1) 60.7 % 65.8 % 60.8 % 59.8 % Effective Tax Rate 21.9 % 20.4 % 20.8 % 22.8 % Ratio of Nonperforming Assets to Loans, Leases and OREO 0.38 % 0.49 % 0.53 % 0.64 % Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.07 % 0.05 % 0.01 % (0.01) % Common Equity Tier 1 Capital Ratio(5) 9.9 % 10.0 % 10.2 % 10.9 % (1) Adjusted for items such as severance costs, restructuring costs, other real estate expense, pension termination-related expense, securities gains and losses and investment and advisory expense related SBIC investments. See Appendix for GAAP to non-GAAP reconciliation tables. (2) Net Income before Preferred Dividends used in the numerator; (3) Net Income Applicable to Common used in the numerator; (4) Includes noninterest-bearing deposits; (5) Current period ratios and amounts represent estimates

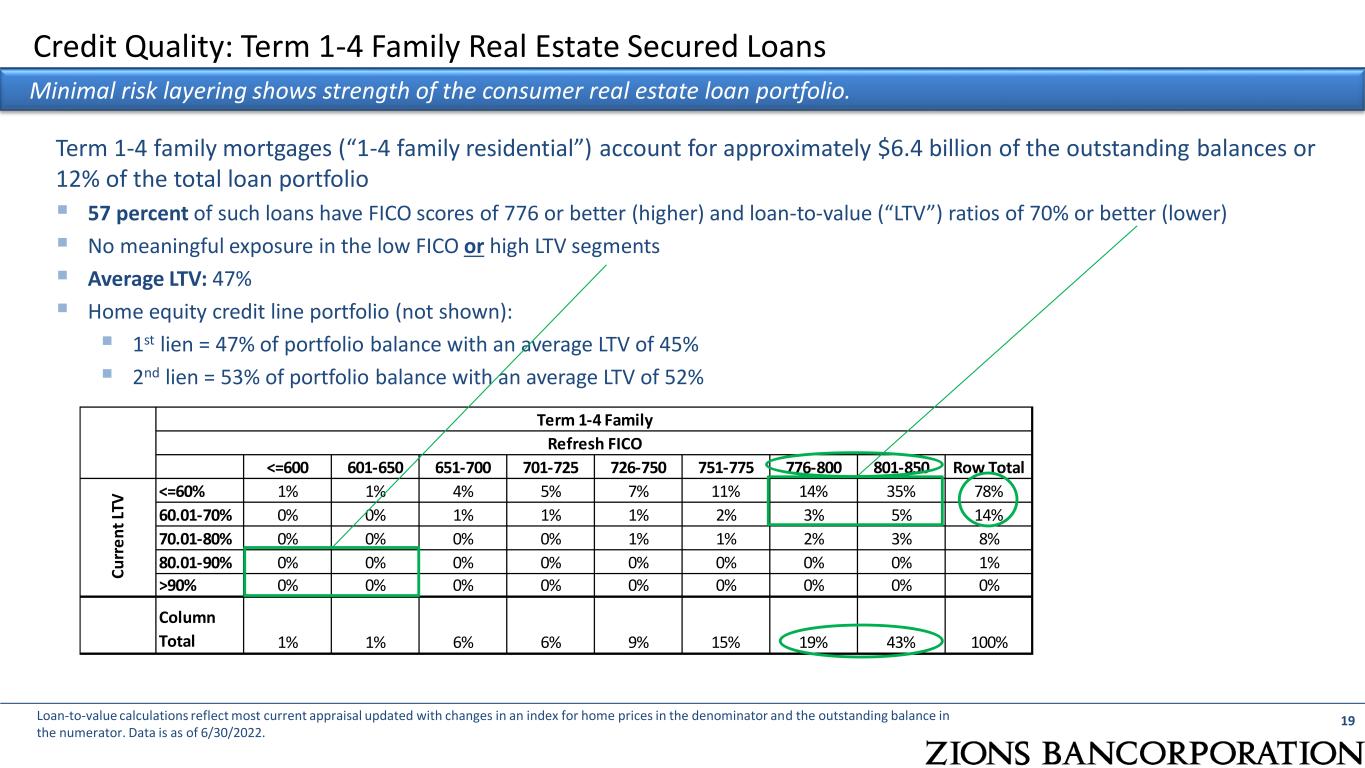

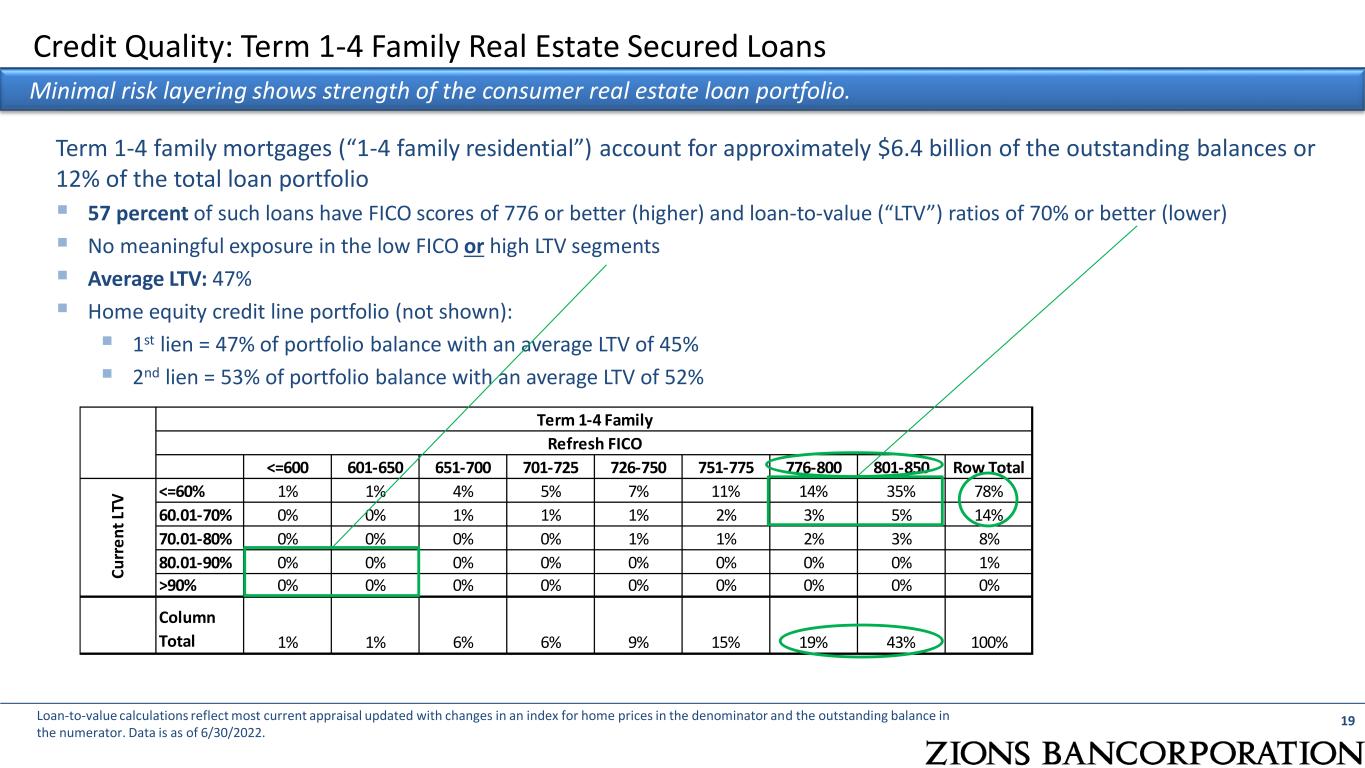

Credit Quality: Term 1-4 Family Real Estate Secured Loans 19 Minimal risk layering shows strength of the consumer real estate loan portfolio. Term 1-4 family mortgages (“1-4 family residential”) account for approximately $6.4 billion of the outstanding balances or 12% of the total loan portfolio ▪ 57 percent of such loans have FICO scores of 776 or better (higher) and loan-to-value (“LTV”) ratios of 70% or better (lower) ▪ No meaningful exposure in the low FICO or high LTV segments ▪ Average LTV: 47% ▪ Home equity credit line portfolio (not shown): ▪ 1st lien = 47% of portfolio balance with an average LTV of 45% ▪ 2nd lien = 53% of portfolio balance with an average LTV of 52% <=600 601-650 651-700 701-725 726-750 751-775 776-800 801-850 Row Total <=60% 1% 1% 4% 5% 7% 11% 14% 35% 78% 60.01-70% 0% 0% 1% 1% 1% 2% 3% 5% 14% 70.01-80% 0% 0% 0% 0% 1% 1% 2% 3% 8% 80.01-90% 0% 0% 0% 0% 0% 0% 0% 0% 1% >90% 0% 0% 0% 0% 0% 0% 0% 0% 0% Column Total 1% 1% 6% 6% 9% 15% 19% 43% 100% Term 1-4 Family Refresh FICO C u rr e n t LT V Loan-to-value calculations reflect most current appraisal updated with changes in an index for home prices in the denominator and the outstanding balance in the numerator. Data is as of 6/30/2022.

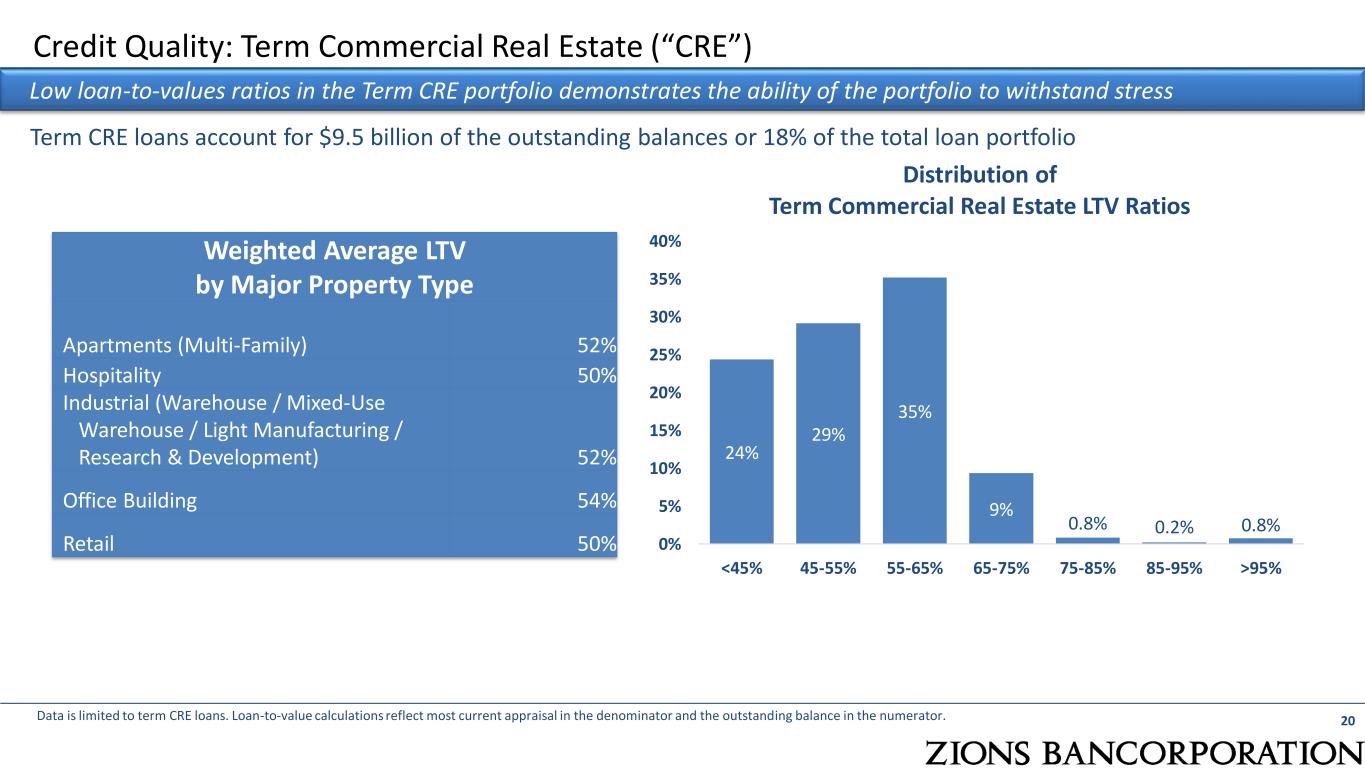

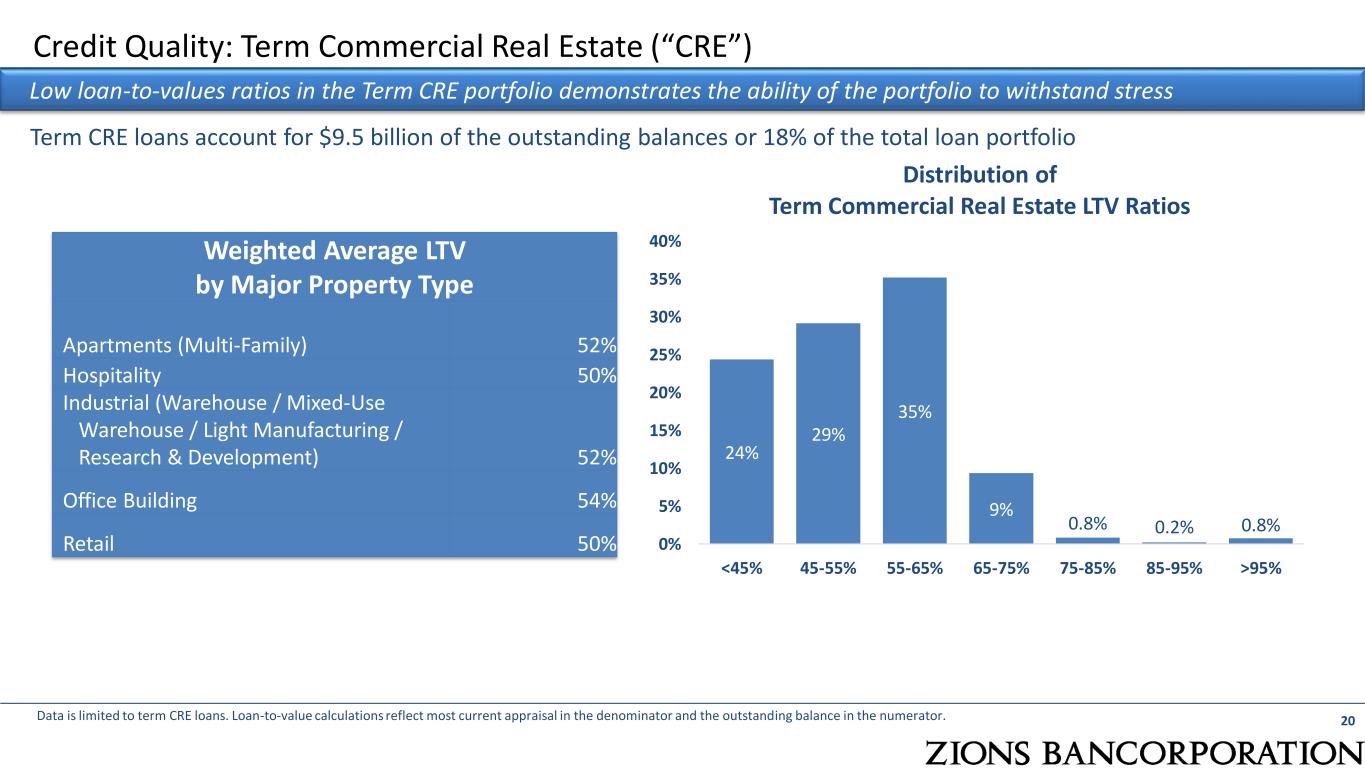

Credit Quality: Term Commercial Real Estate (“CRE”) 20 Low loan-to-values ratios in the Term CRE portfolio demonstrates the ability of the portfolio to withstand stress 24% 29% 35% 9% 0.8% 0.2% 0.8% 0% 5% 10% 15% 20% 25% 30% 35% 40% <45% 45-55% 55-65% 65-75% 75-85% 85-95% >95% Distribution of Term Commercial Real Estate LTV Ratios Weighted Average LTV by Major Property Type Apartments (Multi-Family) 52% Hospitality 50% Industrial (Warehouse / Mixed-Use Warehouse / Light Manufacturing / Research & Development) 52% Office Building 54% Retail 50% Term CRE loans account for $9.5 billion of the outstanding balances or 18% of the total loan portfolio Data is limited to term CRE loans. Loan-to-value calculations reflect most current appraisal in the denominator and the outstanding balance in the numerator.

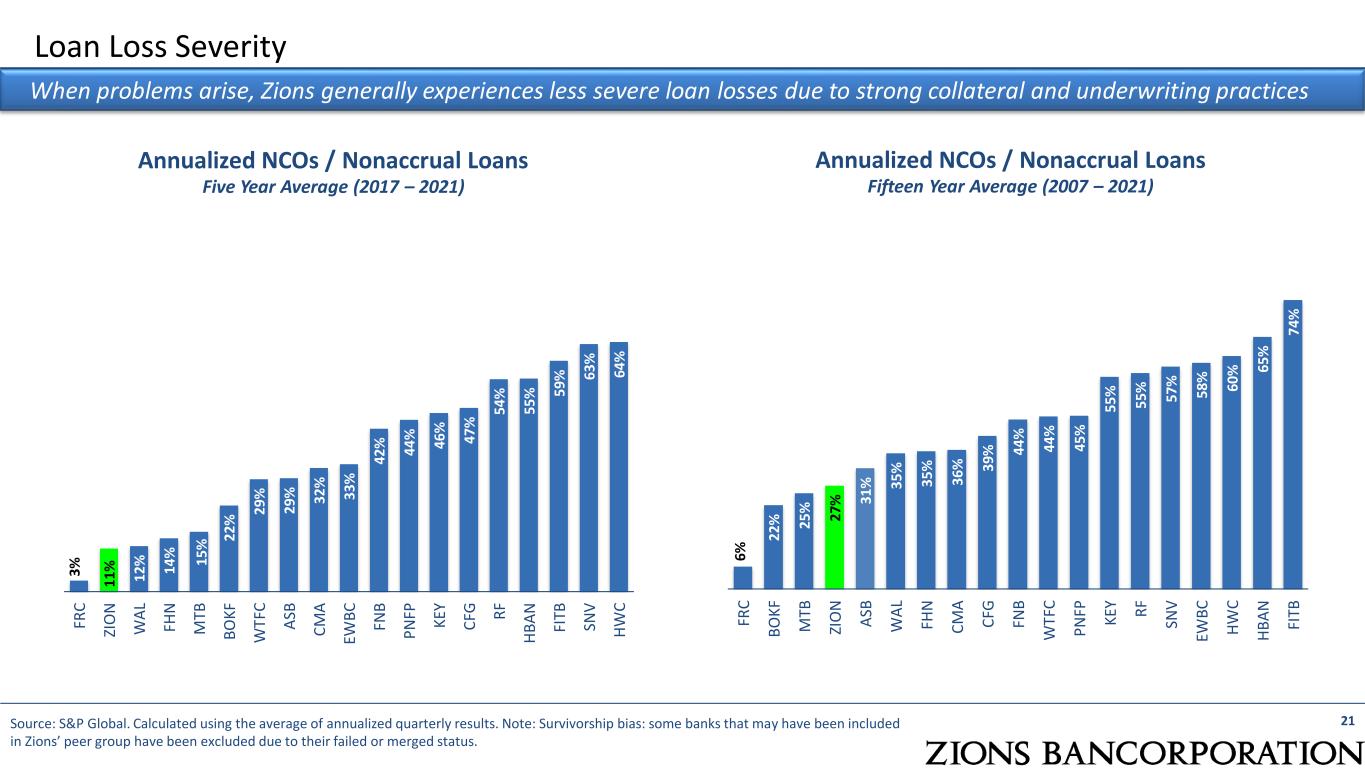

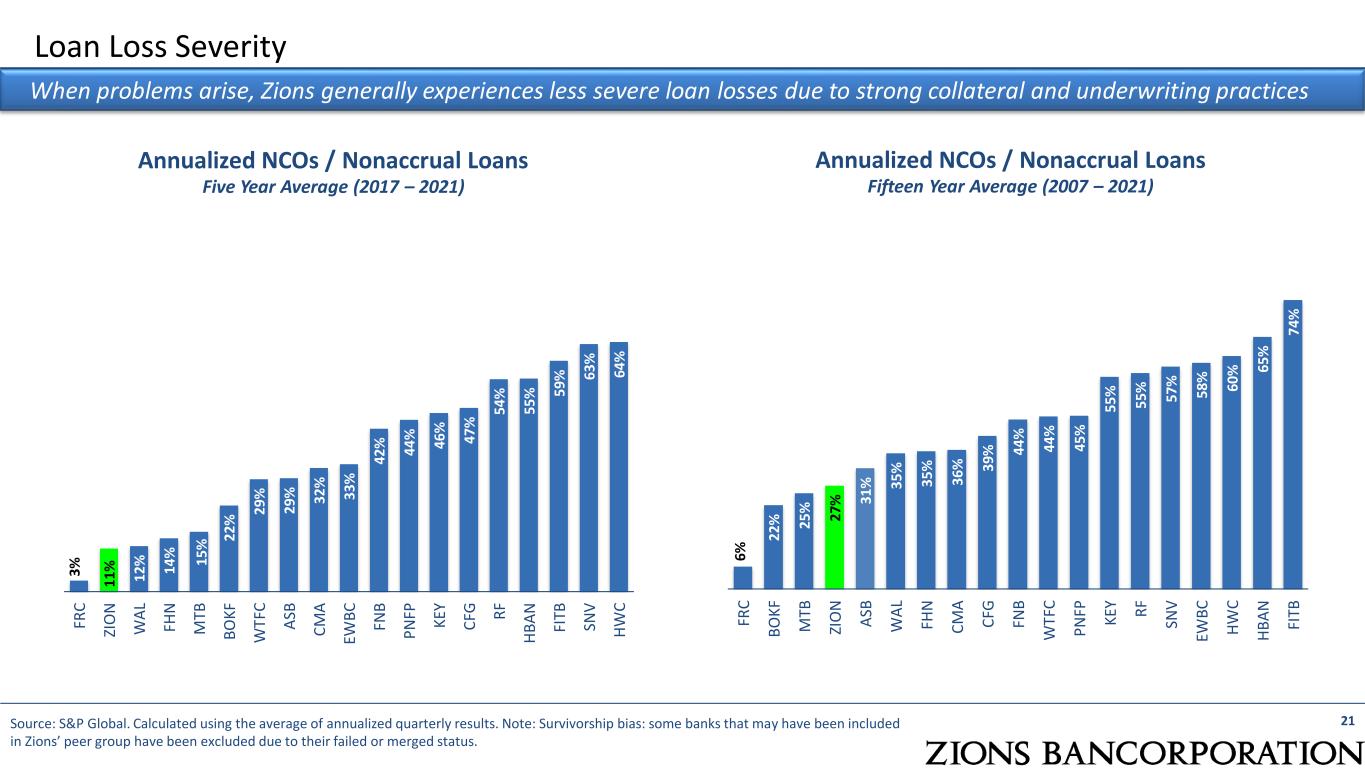

6% 22 % 25 % 27 % 31 % 35 % 35 % 36 % 39 % 4 4 % 44 % 45 % 55 % 55 % 57 % 58 % 60 % 65 % 74 % FR C B O K F M TB ZI O N A SB W A L FH N C M A C FG FN B W TF C P N FP K EY R F SN V EW B C H W C H B A N FI TB 3% 11 % 12 % 14 % 15 % 22 % 29 % 29 % 32 % 33 % 42 % 4 4 % 46 % 47 % 54 % 55 % 59 % 63 % 64 % FR C ZI O N W A L FH N M TB B O K F W T FC A SB C M A EW B C FN B P N FP K EY C FG R F H B A N FI TB SN V H W C Loan Loss Severity Annualized NCOs / Nonaccrual Loans Five Year Average (2017 – 2021) Annualized NCOs / Nonaccrual Loans Fifteen Year Average (2007 – 2021) 21Source: S&P Global. Calculated using the average of annualized quarterly results. Note: Survivorship bias: some banks that may have been included in Zions’ peer group have been excluded due to their failed or merged status. When problems arise, Zions generally experiences less severe loan losses due to strong collateral and underwriting practices

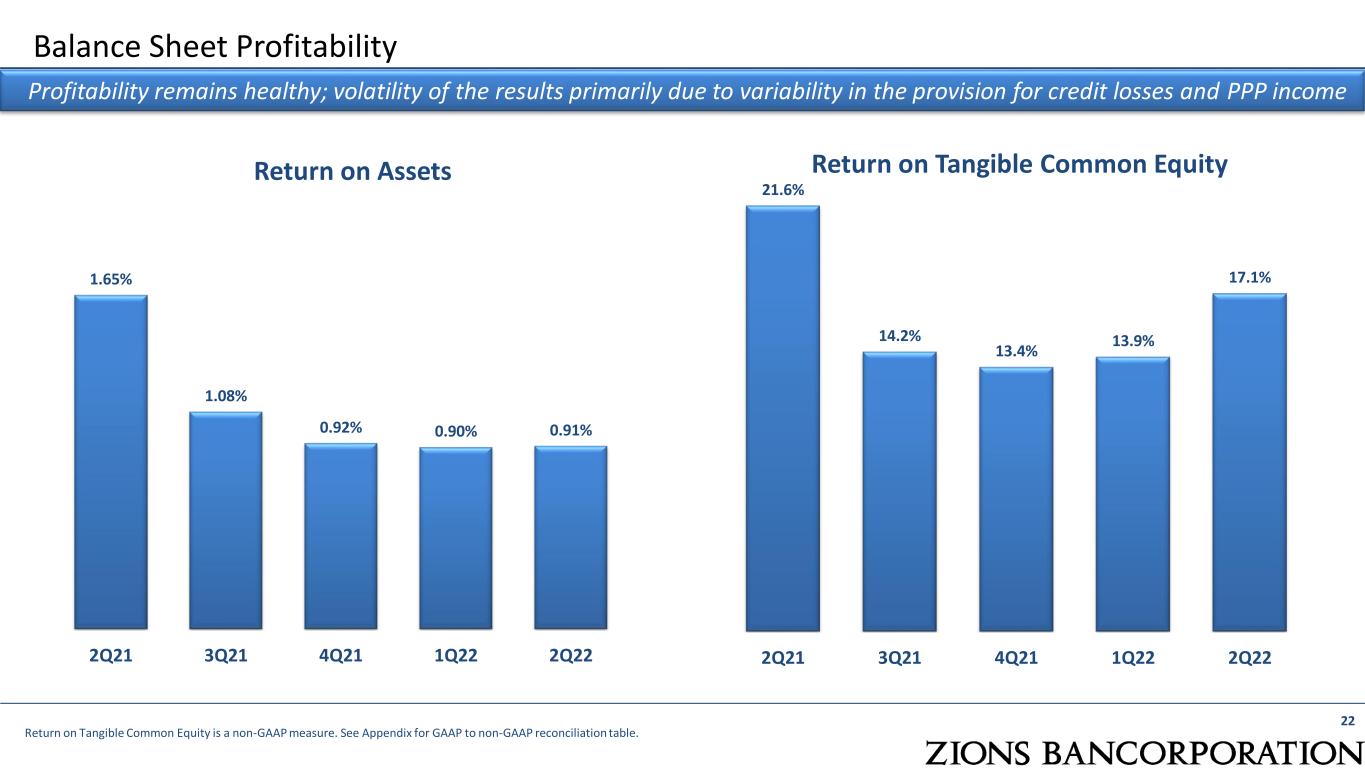

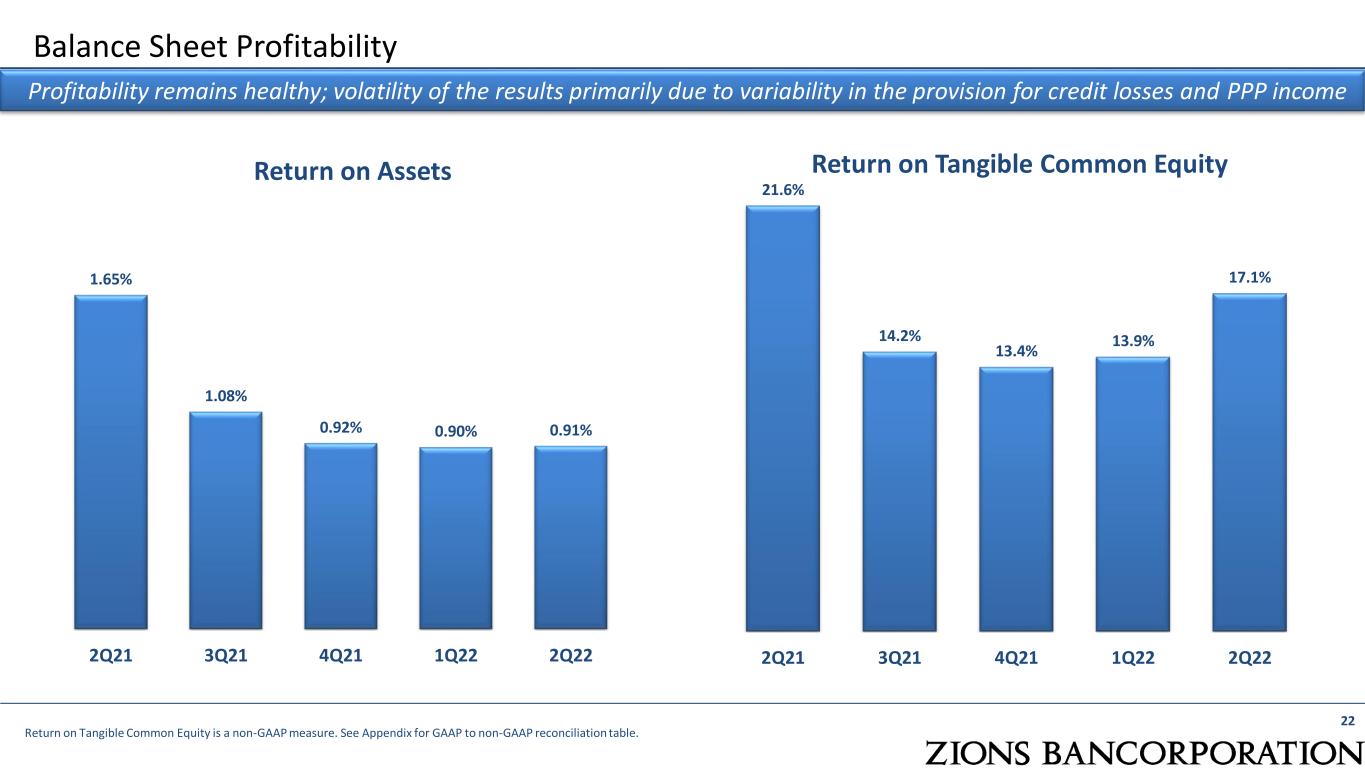

1.65% 1.08% 0.92% 0.90% 0.91% 2Q21 3Q21 4Q21 1Q22 2Q22 21.6% 14.2% 13.4% 13.9% 17.1% 2Q21 3Q21 4Q21 1Q22 2Q22 Balance Sheet Profitability 22 Profitability remains healthy; volatility of the results primarily due to variability in the provision for credit losses and PPP income Return on Assets Return on Tangible Common Equity Return on Tangible Common Equity is a non-GAAP measure. See Appendix for GAAP to non-GAAP reconciliation table.

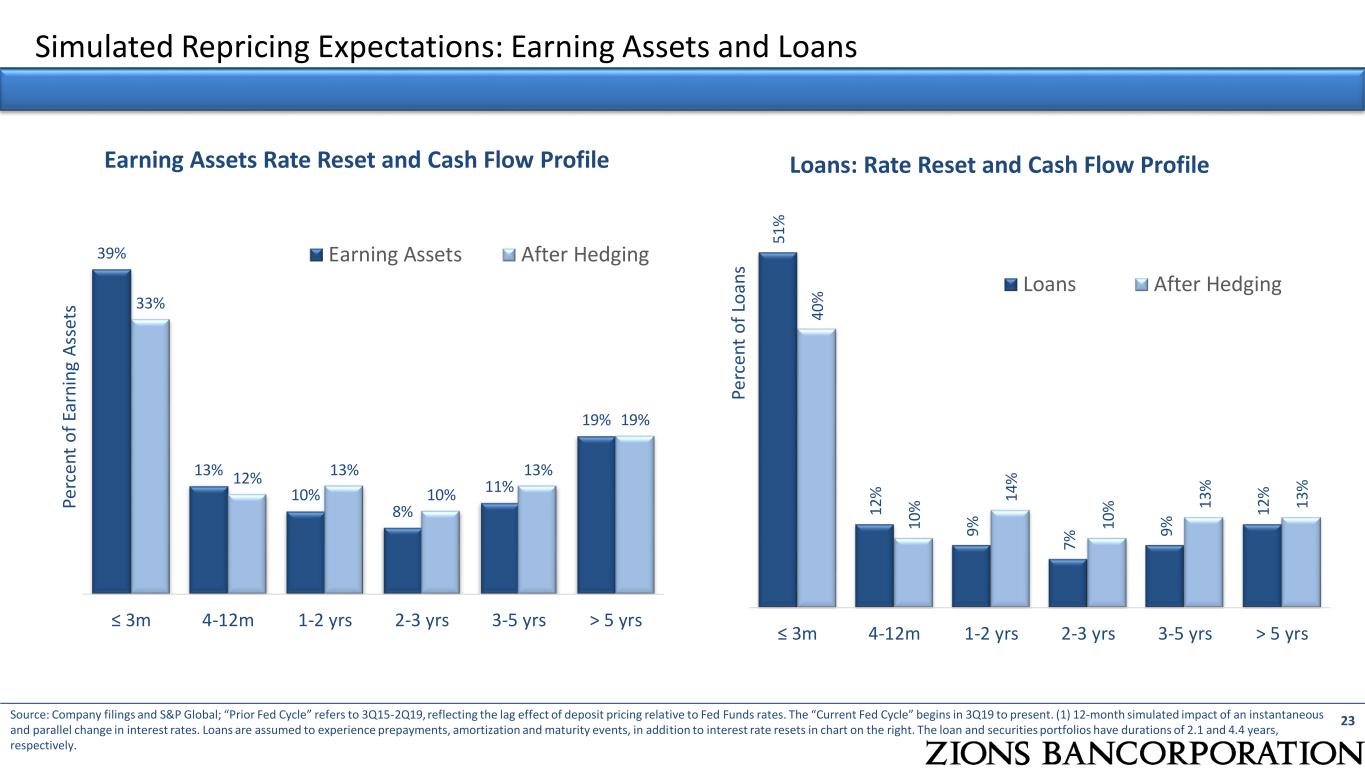

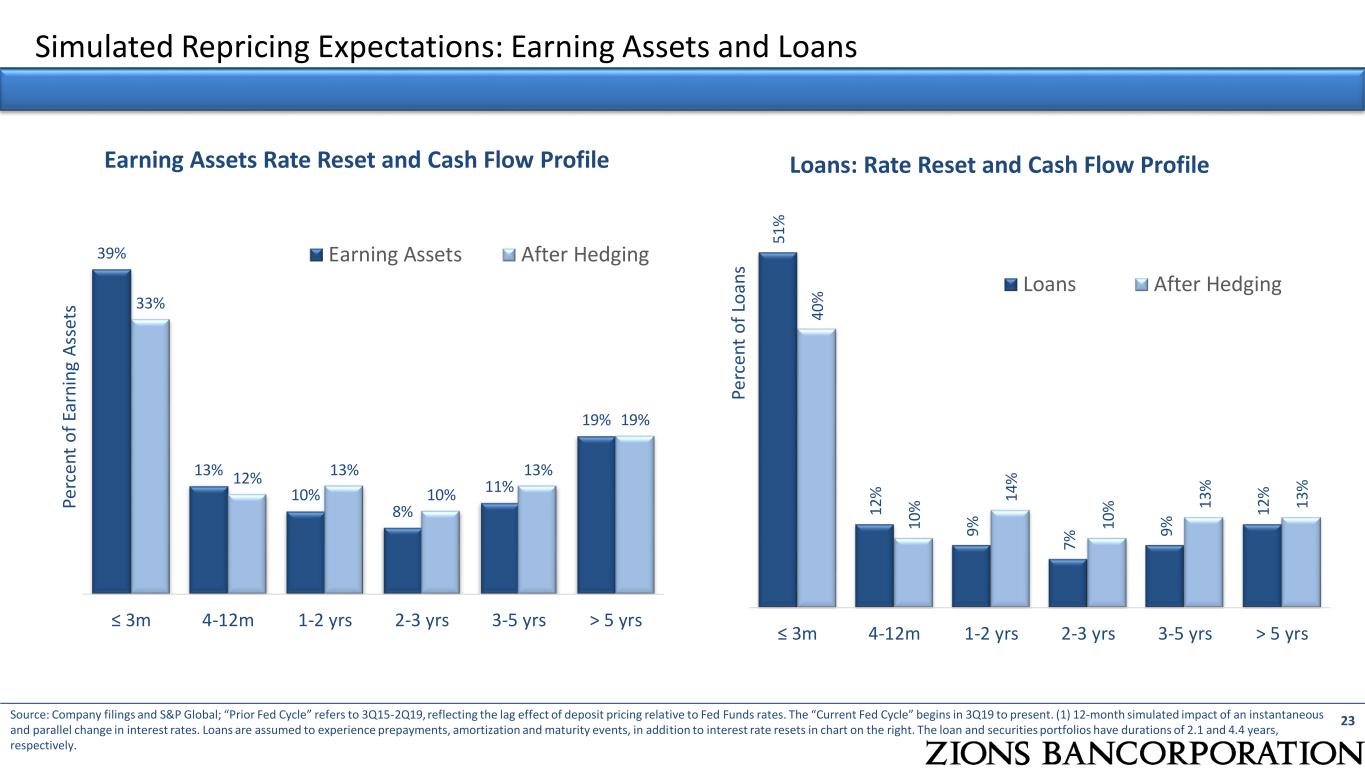

Simulated Repricing Expectations: Earning Assets and Loans 23Source: Company filings and S&P Global; “Prior Fed Cycle” refers to 3Q15-2Q19, reflecting the lag effect of deposit pricing relative to Fed Funds rates. The “Current Fed Cycle” begins in 3Q19 to present. (1) 12-month simulated impact of an instantaneous and parallel change in interest rates. Loans are assumed to experience prepayments, amortization and maturity events, in addition to interest rate resets in chart on the right. The loan and securities portfolios have durations of 2.1 and 4.4 years, respectively. 39% 13% 10% 8% 11% 19% 33% 12% 13% 10% 13% 19% ≤ 3m 4-12m 1-2 yrs 2-3 yrs 3-5 yrs > 5 yrs P er ce n t o f Ea rn in g A ss et s Earning Assets Rate Reset and Cash Flow Profile Earning Assets After Hedging 5 1 % 12 % 9% 7% 9% 12 % 40 % 10 % 14 % 10 % 13 % 13 % ≤ 3m 4-12m 1-2 yrs 2-3 yrs 3-5 yrs > 5 yrs P e rc e n t o f Lo an s Loans: Rate Reset and Cash Flow Profile Loans After Hedging

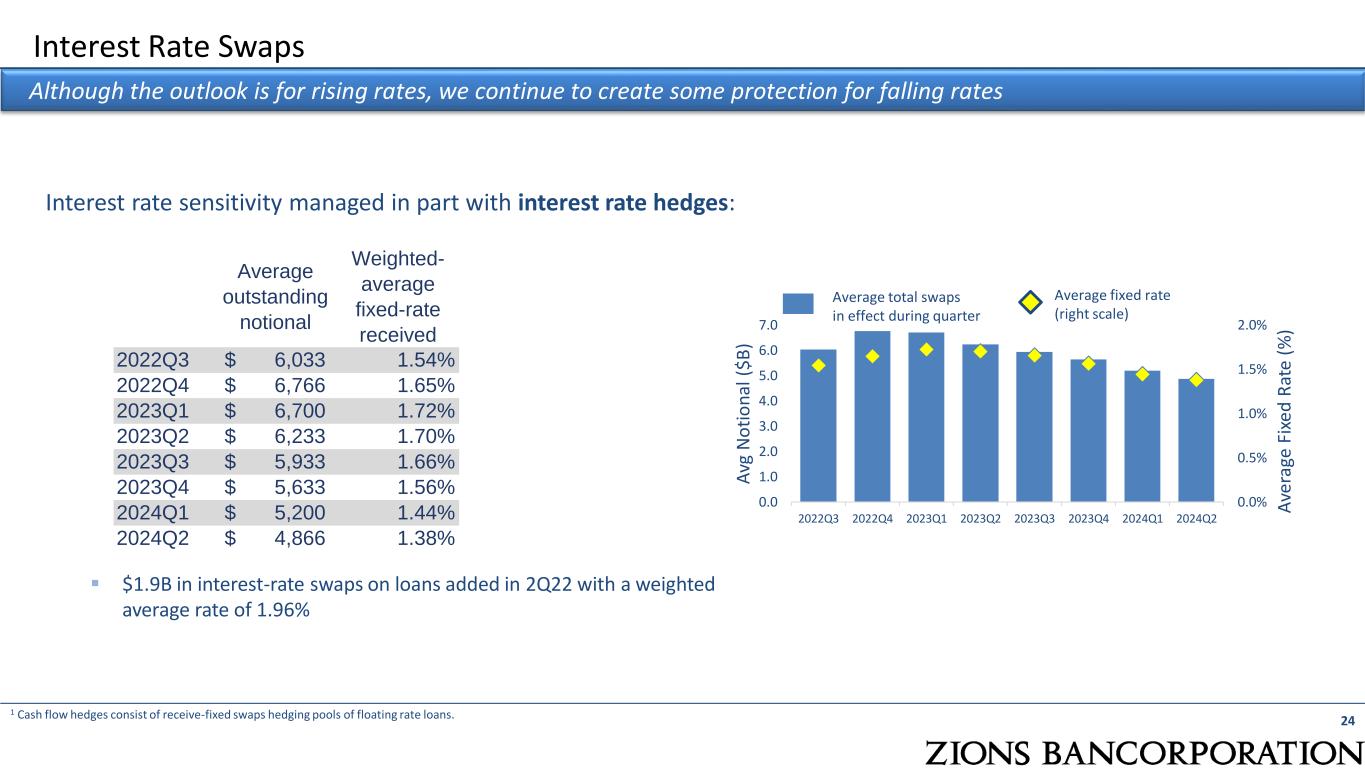

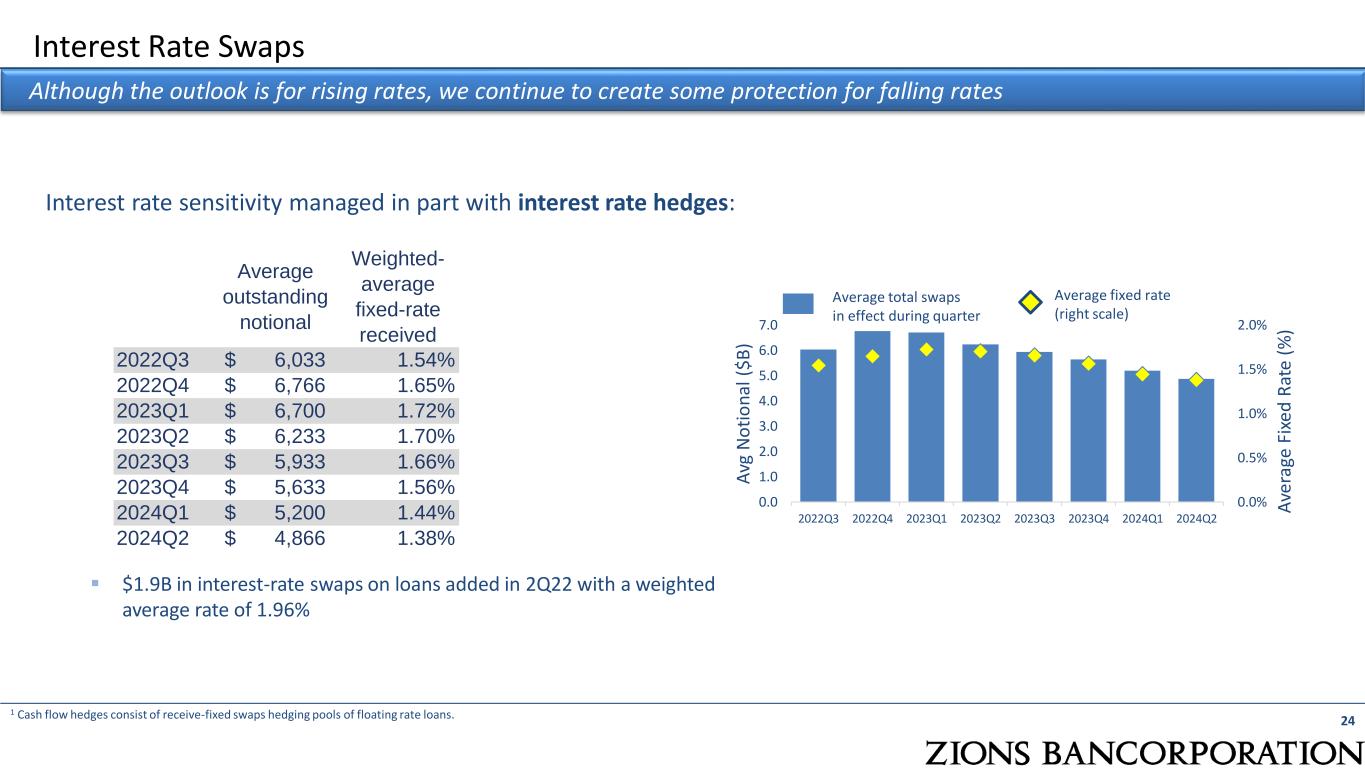

Interest Rate Swaps 24 Although the outlook is for rising rates, we continue to create some protection for falling rates Average total swaps in effect during quarter Average fixed rate (right scale) 0.0% 0.5% 1.0% 1.5% 2.0% 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 2022Q3 2022Q4 2023Q1 2023Q2 2023Q3 2023Q4 2024Q1 2024Q2 A ve ra ge F ix e d R at e ( % ) A vg N o ti o n al ($ B ) 1 Cash flow hedges consist of receive-fixed swaps hedging pools of floating rate loans. Interest rate sensitivity managed in part with interest rate hedges: ▪ $1.9B in interest-rate swaps on loans added in 2Q22 with a weighted average rate of 1.96% Average outstanding notional Weighted- average fixed-rate received 2022Q3 6,033$ 1.54% 2022Q4 6,766$ 1.65% 2023Q1 6,700$ 1.72% 2023Q2 6,233$ 1.70% 2023Q3 5,933$ 1.66% 2023Q4 5,633$ 1.56% 2024Q1 5,200$ 1.44% 2024Q2 4,866$ 1.38%

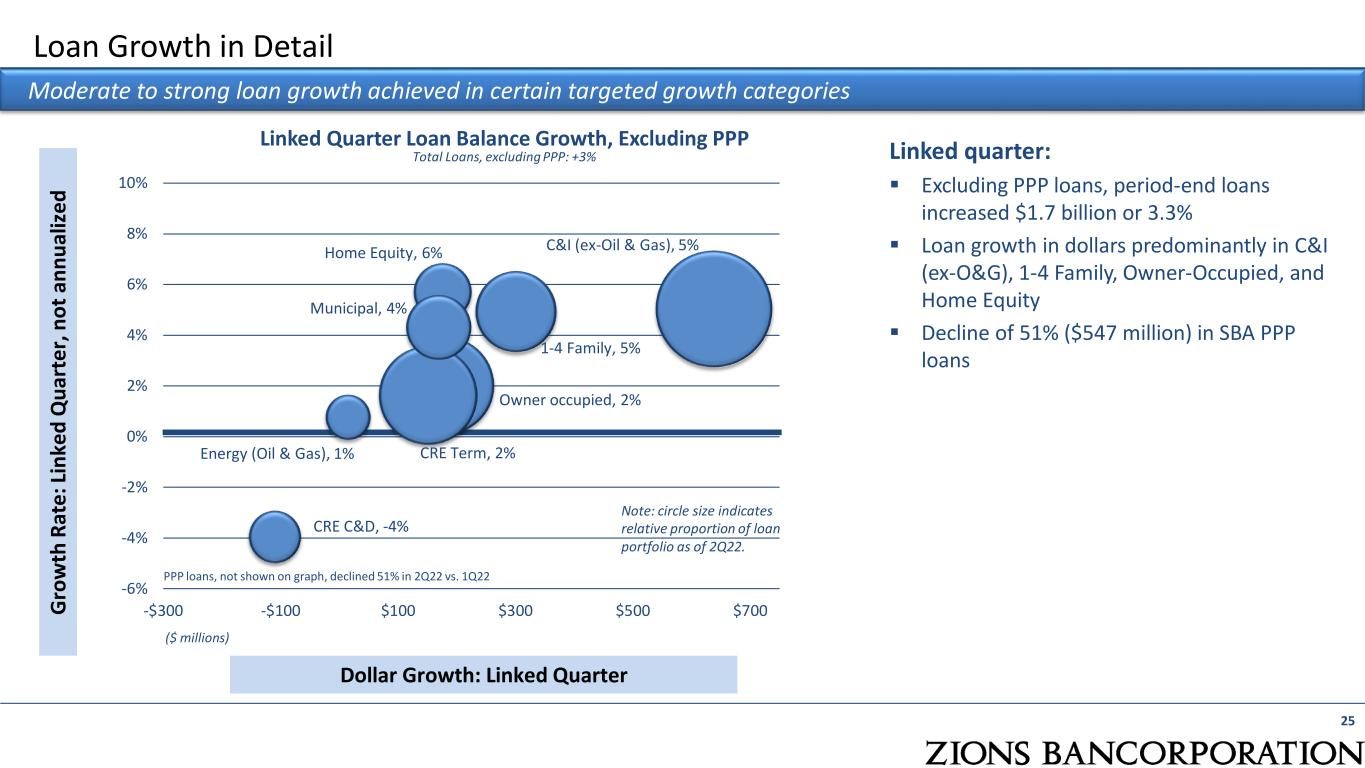

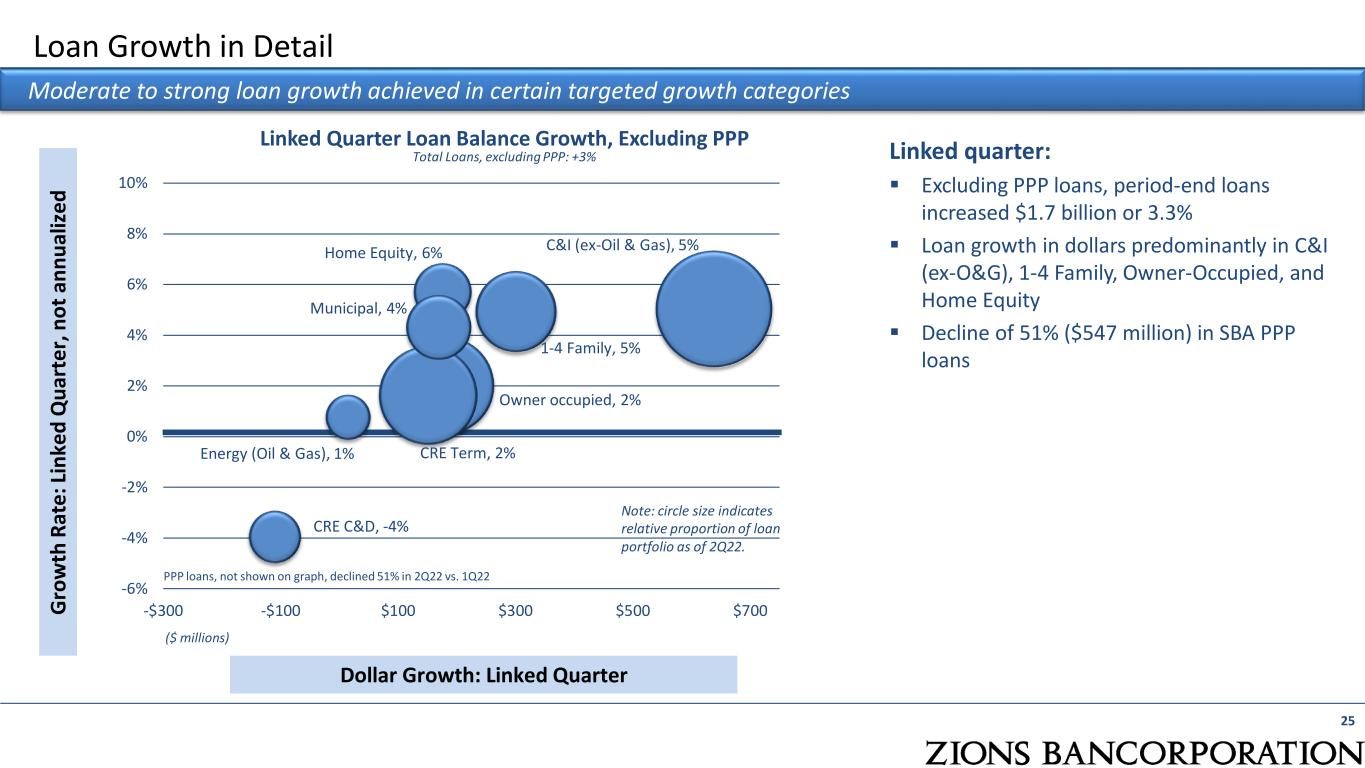

Loan Growth in Detail Moderate to strong loan growth achieved in certain targeted growth categories Linked Quarter Loan Balance Growth, Excluding PPP Total Loans, excluding PPP: +3% Linked quarter: ▪ Excluding PPP loans, period-end loans increased $1.7 billion or 3.3% ▪ Loan growth in dollars predominantly in C&I (ex-O&G), 1-4 Family, Owner-Occupied, and Home Equity ▪ Decline of 51% ($547 million) in SBA PPP loans G ro w th R at e : L in ke d Q u ar te r, n o t an n u al iz e d Dollar Growth: Linked Quarter 25 C&I (ex-Oil & Gas), 5% Owner occupied, 2% CRE C&D, -4% CRE Term, 2% Home Equity, 6% 1-4 Family, 5% Energy (Oil & Gas), 1% Municipal, 4% -6% -4% -2% 0% 2% 4% 6% 8% 10% -$300 -$100 $100 $300 $500 $700 Note: circle size indicates relative proportion of loan portfolio as of 2Q22. PPP loans, not shown on graph, declined 51% in 2Q22 vs. 1Q22 ($ millions)

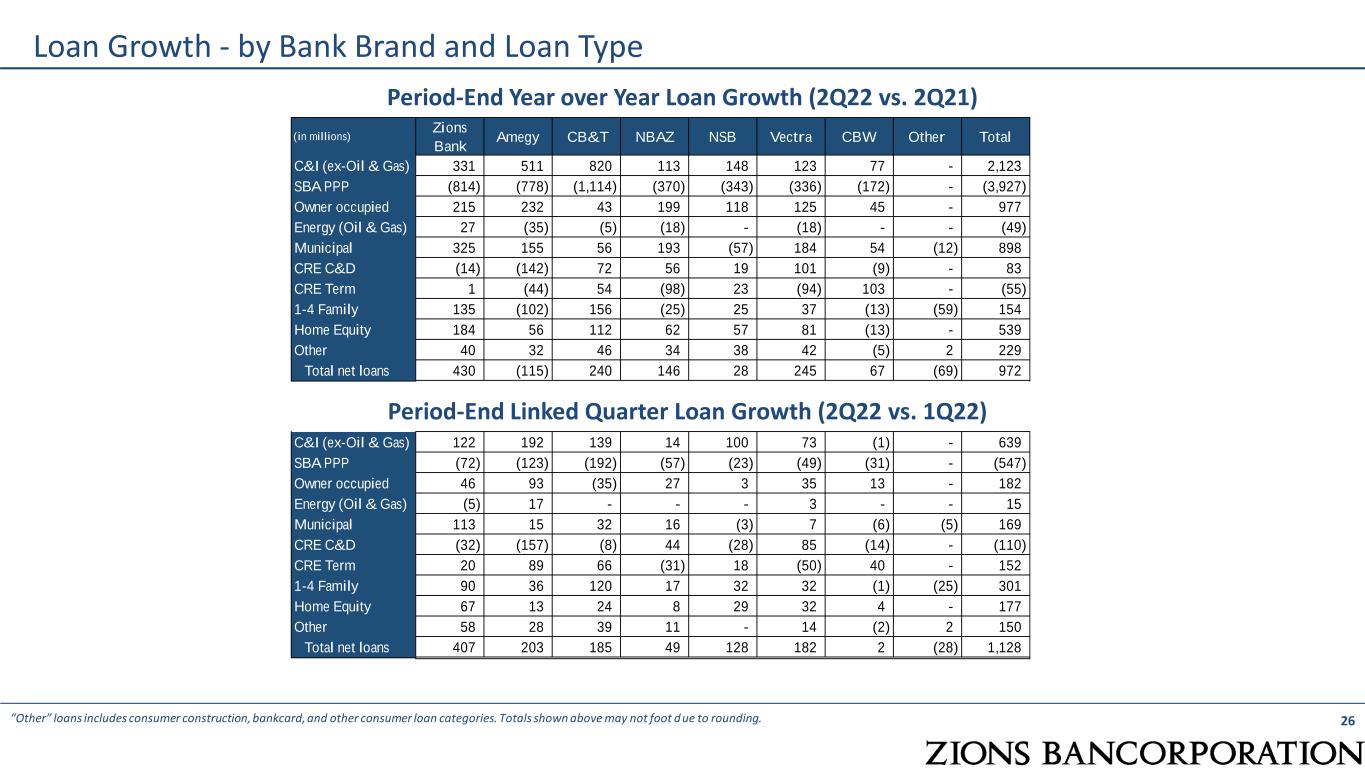

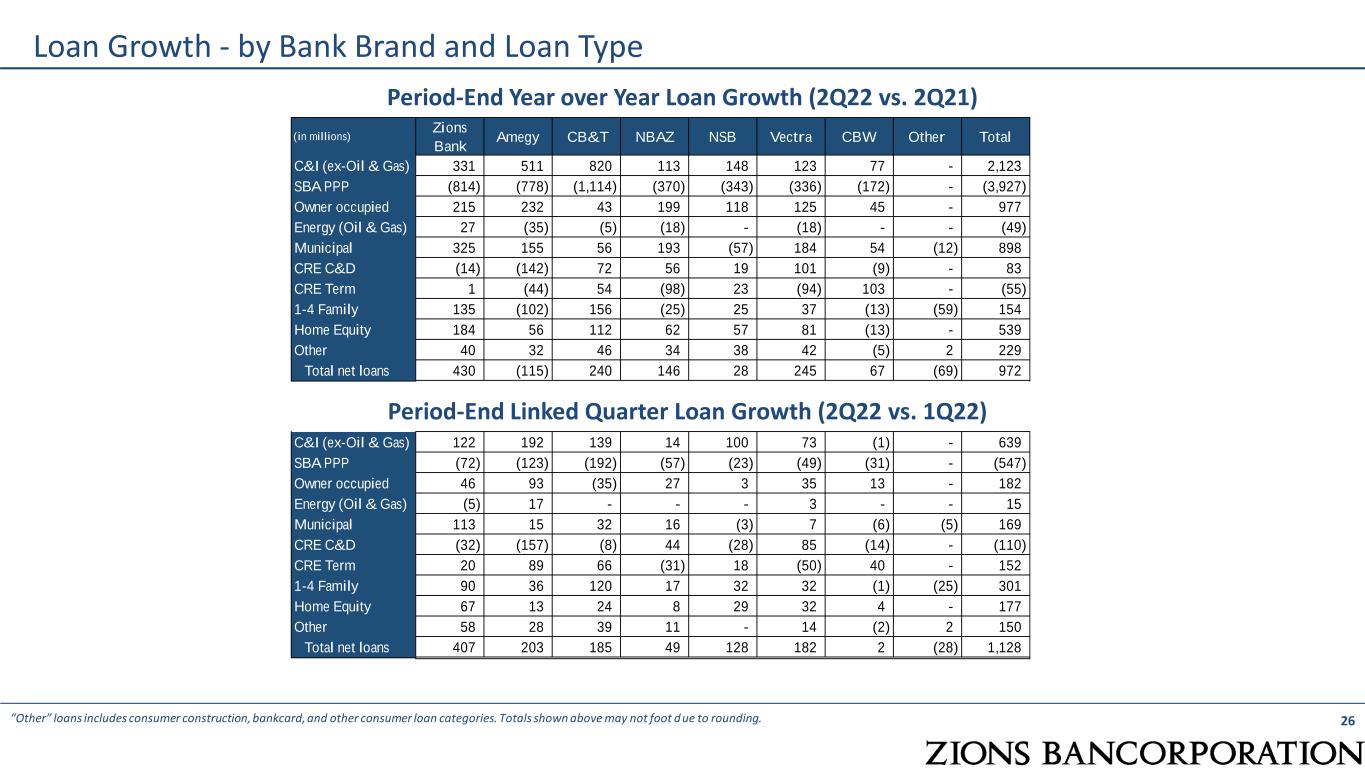

26 Loan Growth - by Bank Brand and Loan Type “Other” loans includes consumer construction, bankcard, and other consumer loan categories. Totals shown above may not foot due to rounding. Period-End Year over Year Loan Growth (2Q22 vs. 2Q21) Period-End Linked Quarter Loan Growth (2Q22 vs. 1Q22) (in millions) Zions Bank Amegy CB&T NBAZ NSB Vectra CBW Other Total C&I (ex-Oil & Gas) 331 511 820 113 148 123 77 - 2,123 SBA PPP (814) (778) (1,114) (370) (343) (336) (172) - (3,927) Owner occupied 215 232 43 199 118 125 45 - 977 Energy (Oil & Gas) 27 (35) (5) (18) - (18) - - (49) Municipal 325 155 56 193 (57) 184 54 (12) 898 CRE C&D (14) (142) 72 56 19 101 (9) - 83 CRE Term 1 (44) 54 (98) 23 (94) 103 - (55) 1-4 Family 135 (102) 156 (25) 25 37 (13) (59) 154 Home Equity 184 56 112 62 57 81 (13) - 539 Other 40 32 46 34 38 42 (5) 2 229 Total net loans 430 (115) 240 146 28 245 67 (69) 972 C&I (ex-Oil & Gas) 122 192 139 14 100 73 (1) - 639 SBA PPP (72) (123) (192) (57) (23) (49) (31) - (547) Owner occupied 46 93 (35) 27 3 35 13 - 182 Energy (Oil & Gas) (5) 17 - - - 3 - - 15 Municipal 113 15 32 16 (3) 7 (6) (5) 169 CRE C&D (32) (157) (8) 44 (28) 85 (14) - (110) CRE Term 20 89 66 (31) 18 (50) 40 - 152 1-4 Family 90 36 120 17 32 32 (1) (25) 301 Home Equity 67 13 24 8 29 32 4 - 177 Other 58 28 39 11 - 14 (2) 2 150 Total net loans 407 203 185 49 128 182 2 (28) 1,128

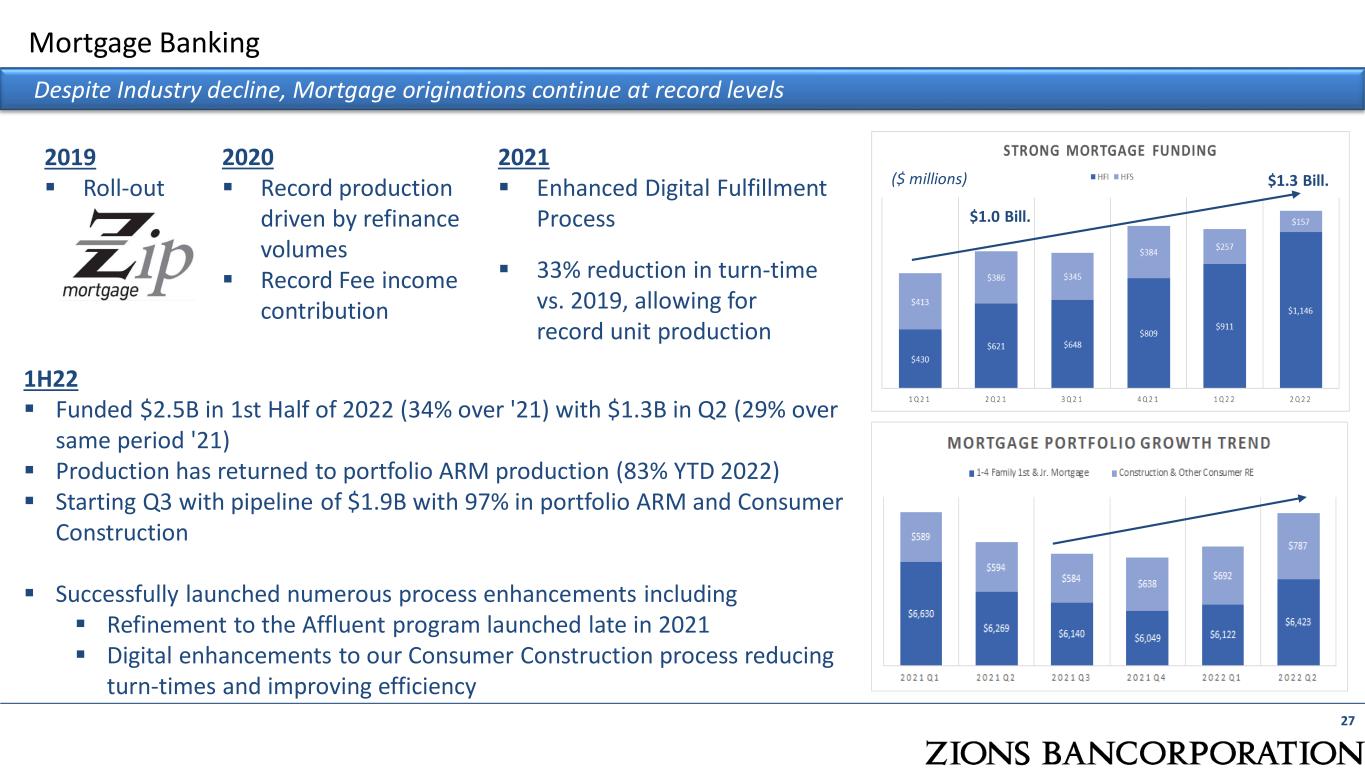

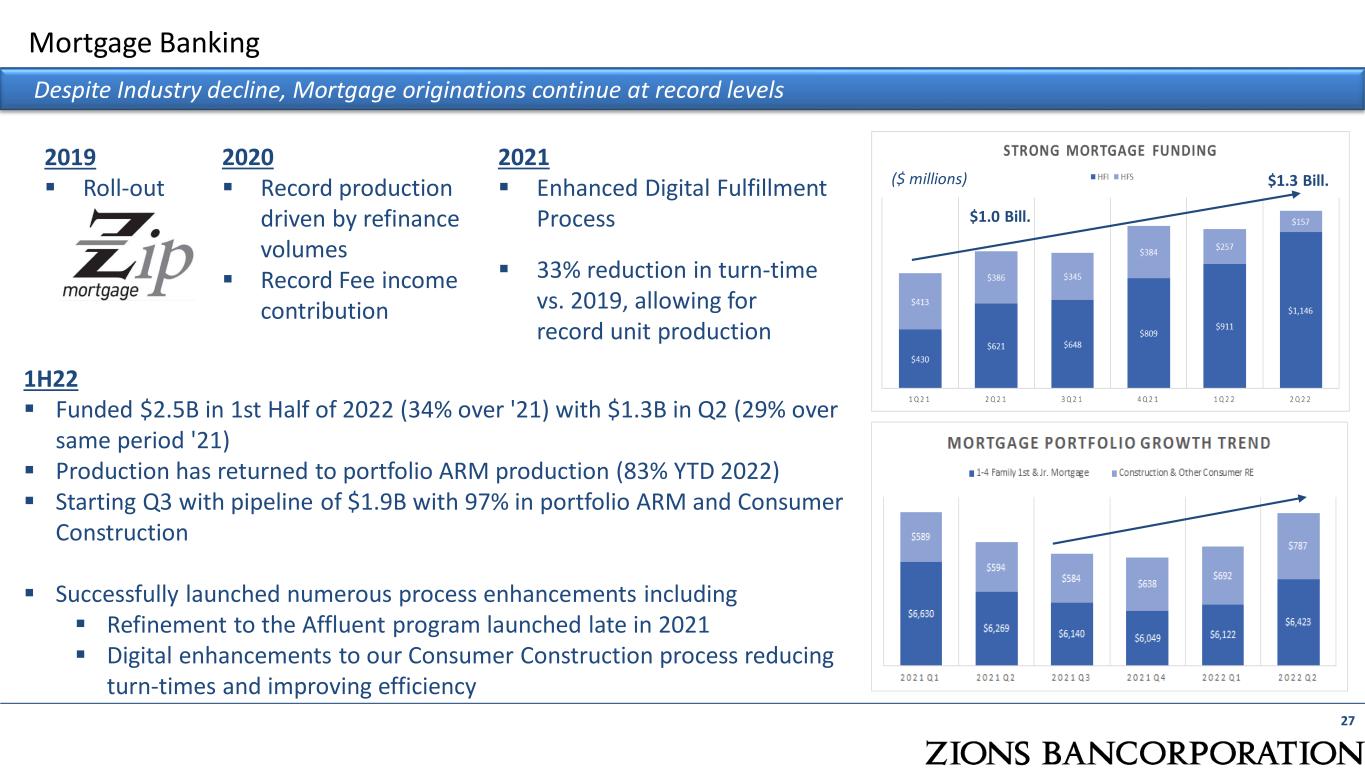

1H22 ▪ Funded $2.5B in 1st Half of 2022 (34% over '21) with $1.3B in Q2 (29% over same period '21) ▪ Production has returned to portfolio ARM production (83% YTD 2022) ▪ Starting Q3 with pipeline of $1.9B with 97% in portfolio ARM and Consumer Construction ▪ Successfully launched numerous process enhancements including ▪ Refinement to the Affluent program launched late in 2021 ▪ Digital enhancements to our Consumer Construction process reducing turn-times and improving efficiency 27 Mortgage Banking Despite Industry decline, Mortgage originations continue at record levels $1.0 Bill. $1.3 Bill.($ millions) 2019 ▪ Roll-out 2021 ▪ Enhanced Digital Fulfillment Process ▪ 33% reduction in turn-time vs. 2019, allowing for record unit production 2020 ▪ Record production driven by refinance volumes ▪ Record Fee income contribution

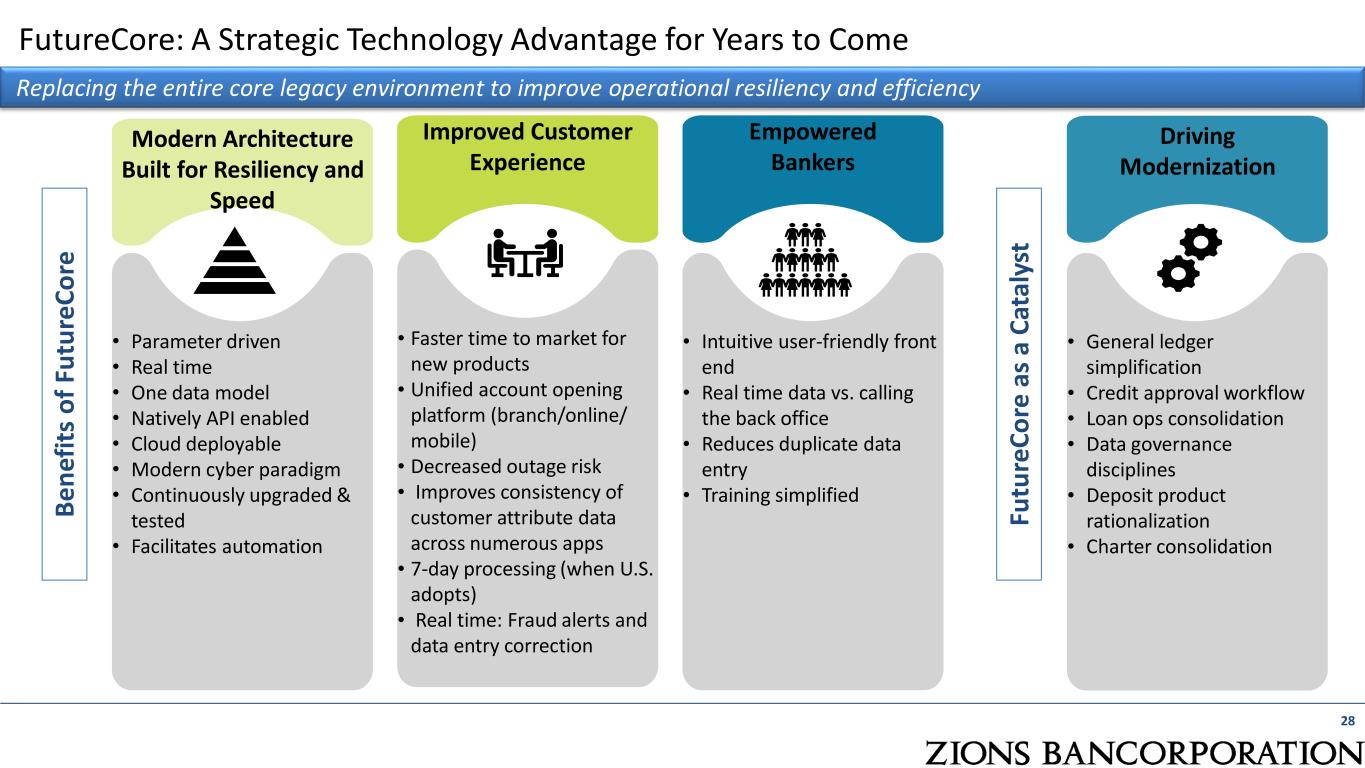

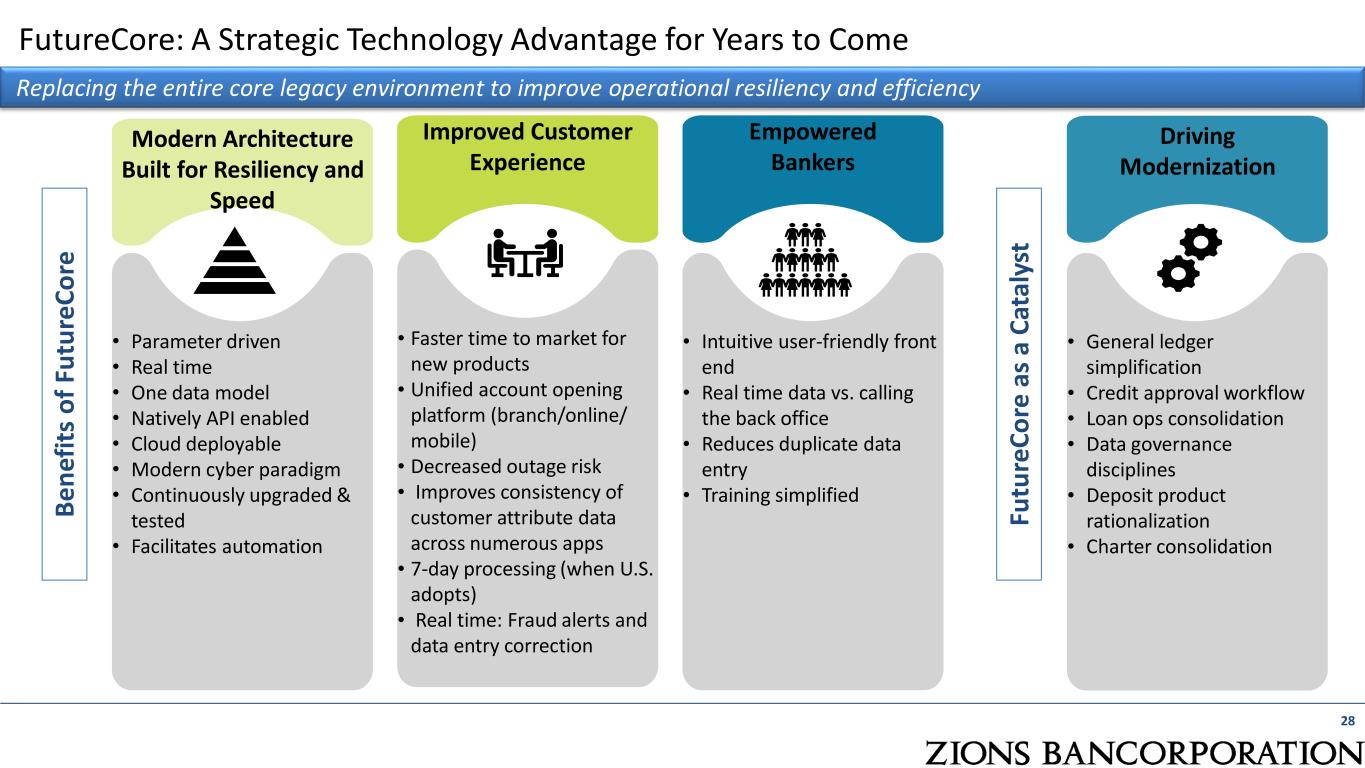

Replacing the entire core legacy environment to improve operational resiliency and efficiency • Parameter driven • Real time • One data model • Natively API enabled • Cloud deployable • Modern cyber paradigm • Continuously upgraded & tested • Facilitates automation Modern Architecture Built for Resiliency and Speed • Faster time to market for new products • Unified account opening platform (branch/online/ mobile) • Decreased outage risk • Improves consistency of customer attribute data across numerous apps • 7-day processing (when U.S. adopts) • Real time: Fraud alerts and data entry correction Improved Customer Experience • Intuitive user-friendly front end • Real time data vs. calling the back office • Reduces duplicate data entry • Training simplified Empowered Bankers • General ledger simplification • Credit approval workflow • Loan ops consolidation • Data governance disciplines • Deposit product rationalization • Charter consolidation Driving Modernization FutureCore: A Strategic Technology Advantage for Years to Come Fu tu re C o re as a C at al ys t B e n ef it s o f Fu tu re C o re 28

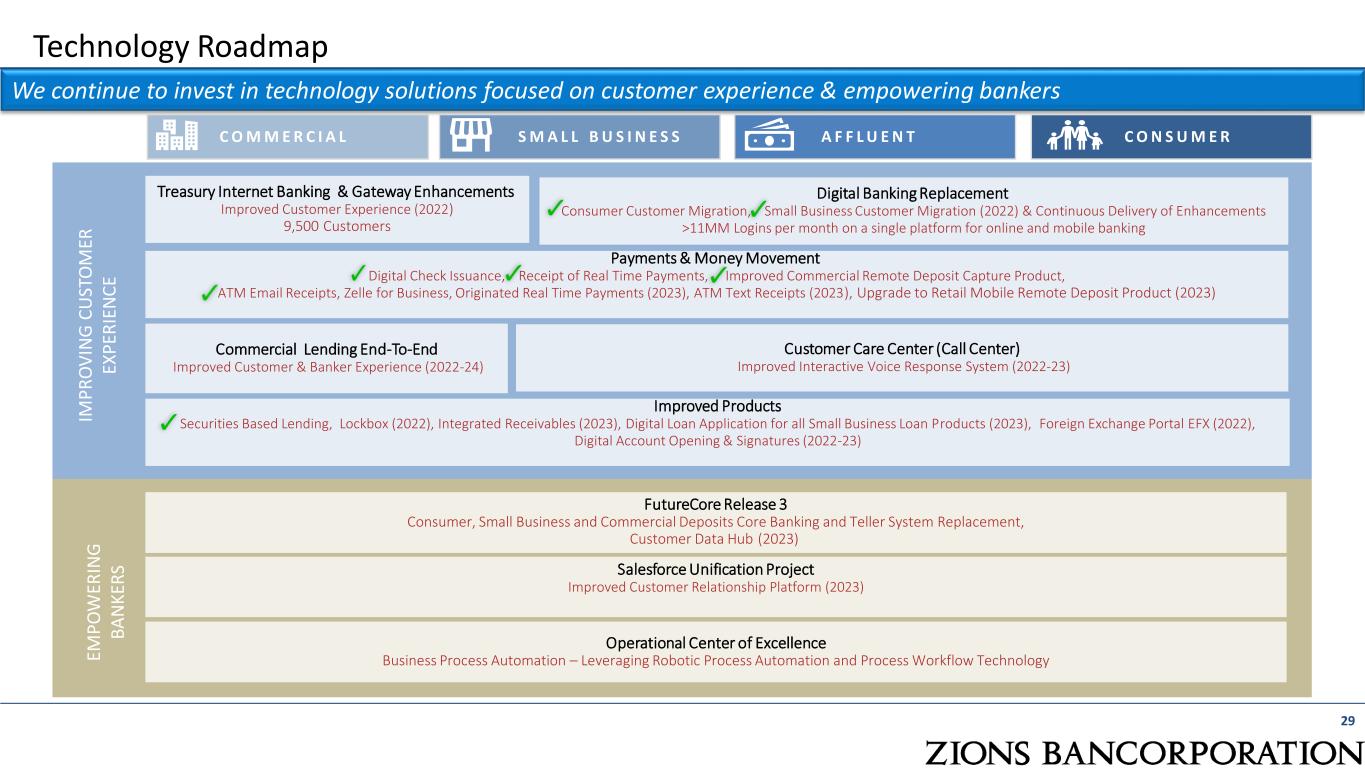

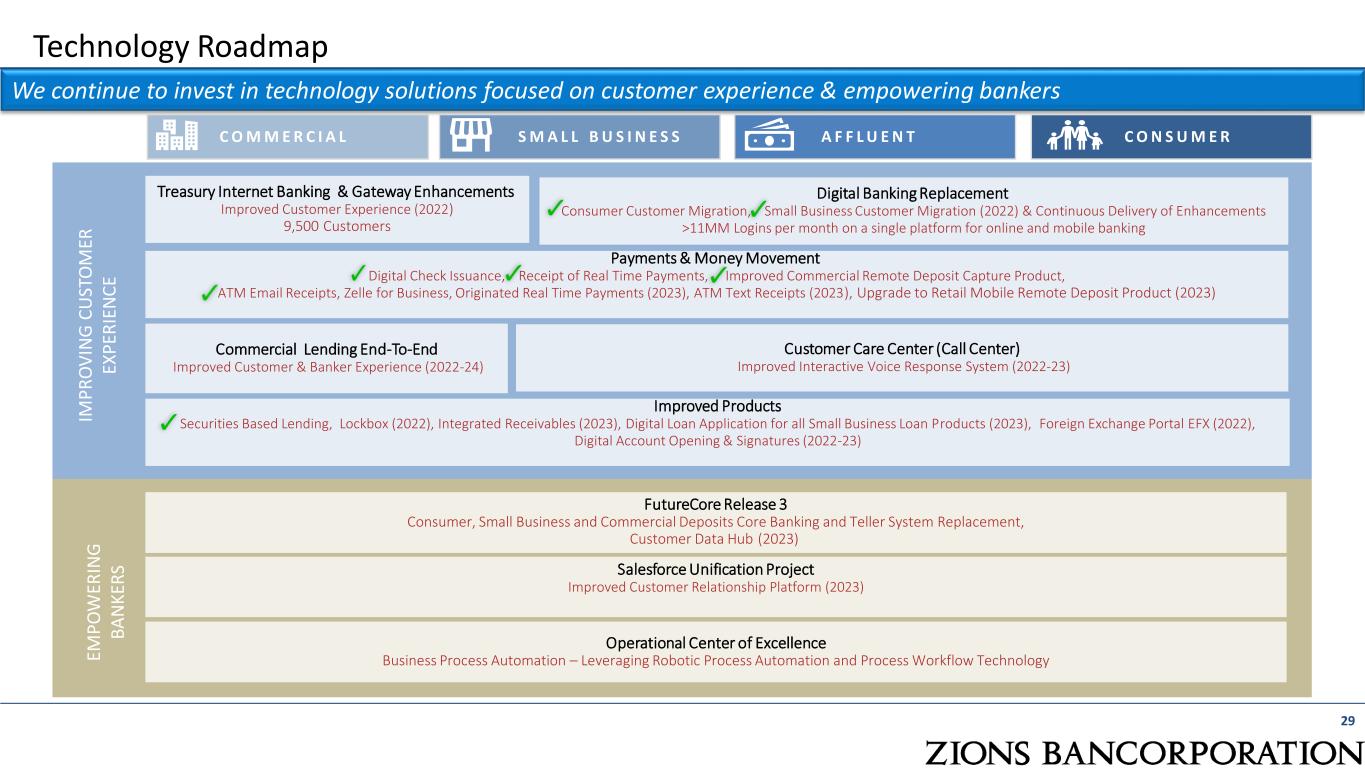

Technology Roadmap We continue to invest in technology solutions focused on customer experience & empowering bankers IM P R O V IN G C U ST O M ER EX P ER IE N C E Treasury Internet Banking & Gateway Enhancements Improved Customer Experience (2022) 9,500 Customers Payments & Money Movement Digital Check Issuance, Receipt of Real Time Payments, Improved Commercial Remote Deposit Capture Product, ATM Email Receipts, Zelle for Business, Originated Real Time Payments (2023), ATM Text Receipts (2023), Upgrade to Retail Mobile Remote Deposit Product (2023) A F F L U E N TC O M M E R C I A L S M A L L B U S I N E S S C O N S U M E R EM P O W ER IN G B A N K ER S Salesforce Unification Project Improved Customer Relationship Platform (2023) Customer Care Center (Call Center) Improved Interactive Voice Response System (2022-23) Digital Banking Replacement Consumer Customer Migration, Small Business Customer Migration (2022) & Continuous Delivery of Enhancements >11MM Logins per month on a single platform for online and mobile banking FutureCore Release 3 Consumer, Small Business and Commercial Deposits Core Banking and Teller System Replacement, Customer Data Hub (2023) Improved Products Securities Based Lending, Lockbox (2022), Integrated Receivables (2023), Digital Loan Application for all Small Business Loan Products (2023), Foreign Exchange Portal EFX (2022), Digital Account Opening & Signatures (2022-23) Operational Center of Excellence Business Process Automation – Leveraging Robotic Process Automation and Process Workflow Technology Commercial Lending End-To-End Improved Customer & Banker Experience (2022-24) 29

30 GAAP to Non-GAAP Reconciliation In millions, except per share amounts 2Q22 1Q22 4Q21 3Q21 2Q21 Pre-Provision Net Revenue (PPNR) (a) Total noninterest expense $464 $464 $449 $429 $428 LESS adjustments: Severance costs 1 1 Other real estate expense 1 Amortization of core deposit and other intangibles 1 Pension Termination related expense Restructuring costs SBIC Investment Success Fee Accrual (1) 2 (4) 9 (b) Total adjustments 1 0 3 (3) 9 (a-b)=(c) Adjusted noninterest expense 463 464 446 432 419 (d) Net interest income 593 544 553 555 555 (e) Fully taxable-equivalent adjustments 9 8 10 7 7 (d+e)=(f) Taxable-equivalent net interest income (TE NII) 602 552 563 562 562 (g) Noninterest Income 172 142 190 139 205 (f+g)=(h) Combined Income $774 $694 $753 $701 $767 LESS adjustments: Fair value and nonhedge derivative income (loss) 10 6 (1) 2 (5) Securities gains (losses), net 1 (17) 20 (23) 63 (i) Total adjustments 11 (11) 19 (21) 58 (h-i)=(j) Adjusted revenue $763 $705 $734 $722 $709 (j-c) Adjusted pre- provision net revenue (PPNR) $300 $241 $288 $290 $290 (c)/(j) Efficiency Ratio 60.7% 65.8% 60.8% 59.8% 59.1%

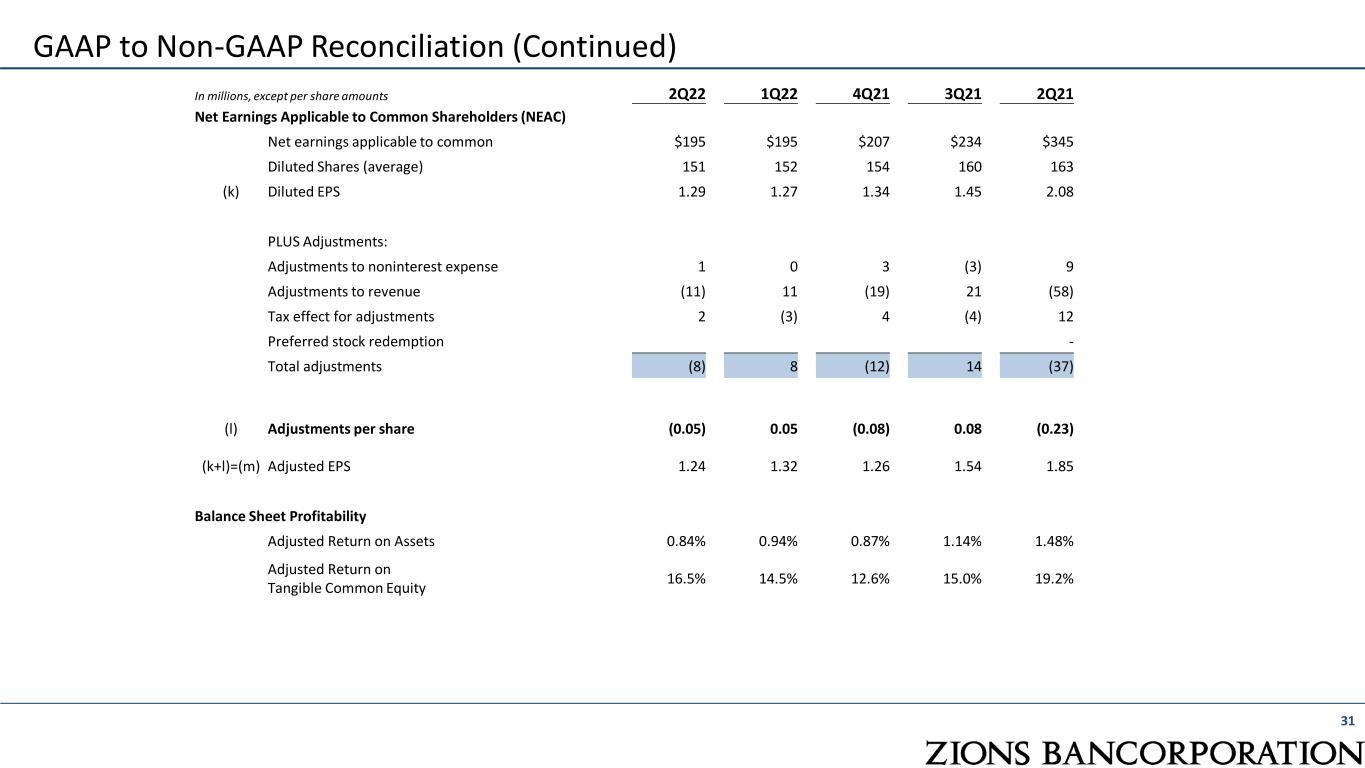

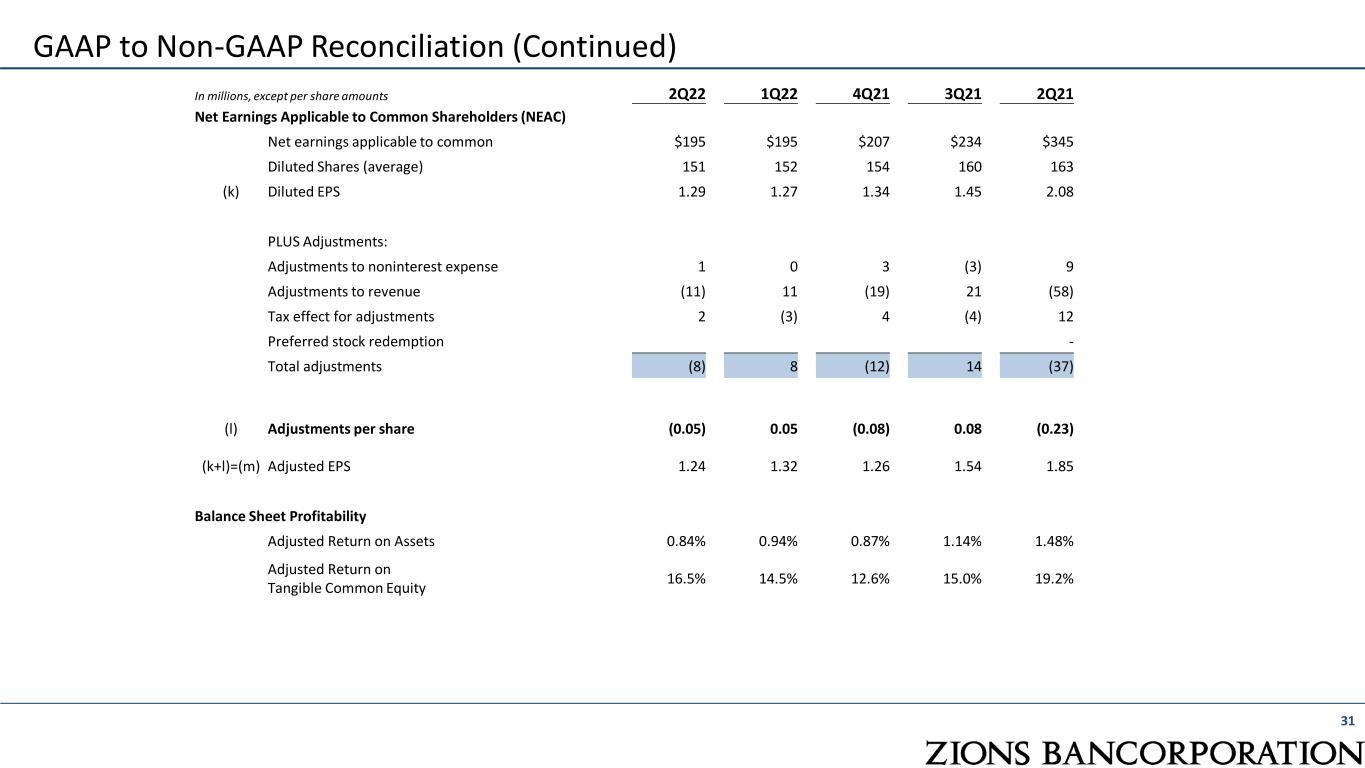

31 GAAP to Non-GAAP Reconciliation (Continued) In millions, except per share amounts 2Q22 1Q22 4Q21 3Q21 2Q21 Net Earnings Applicable to Common Shareholders (NEAC) Net earnings applicable to common $195 $195 $207 $234 $345 Diluted Shares (average) 151 152 154 160 163 (k) Diluted EPS 1.29 1.27 1.34 1.45 2.08 PLUS Adjustments: Adjustments to noninterest expense 1 0 3 (3) 9 Adjustments to revenue (11) 11 (19) 21 (58) Tax effect for adjustments 2 (3) 4 (4) 12 Preferred stock redemption - Total adjustments (8) 8 (12) 14 (37) (l) Adjustments per share (0.05) 0.05 (0.08) 0.08 (0.23) (k+l)=(m) Adjusted EPS 1.24 1.32 1.26 1.54 1.85 Balance Sheet Profitability Adjusted Return on Assets 0.84% 0.94% 0.87% 1.14% 1.48% Adjusted Return on Tangible Common Equity 16.5% 14.5% 12.6% 15.0% 19.2%