ZIONS2024 THIRD QUARTER O c t o b e r 2 1 , 2 0 2 4 Financial Review

FORWARD-LOOKING STATEMENTS; USE OF NON-GAAP FINANCIAL MEASURES 2 Forward Looking Information This presentation includes “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and assumptions regarding future events or determinations, all of which are subject to known and unknown risks, uncertainties, and other factors that may cause our actual results, performance or achievements, industry trends, and results or regulatory outcomes to differ materially from those expressed or implied. Forward-looking statements include, among others: Statements with respect to the beliefs, plans, objectives, goals, targets, commitments, designs, guidelines, expectations, anticipations, and future financial condition, results of operations and performance of Zions Bancorporation, National Association and its subsidiaries (collectively “Zions Bancorporation, N.A.,” “the Bank,” “we,” “our,” “us”); and Statements preceded or followed by, or that include the words “may,” “might,” “can,” “continue,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “forecasts,” “expect,” “intend,” “target,” “commit,” “design,” “plan,” “projects,” “will,” and the negative thereof and similar words and expressions. Forward-looking statements are not guarantees, nor should they be relied upon as representing management’s views as of any subsequent date. Actual results and outcomes may differ materially from those presented. Although the following list is not comprehensive, important factors that may cause material differences include: The quality and composition of our loan and securities portfolios and the quality and composition of our deposits; Changes in general industry, political and economic conditions, including elevated inflation, economic slowdown or recession, or other economic challenges; changes in interest and reference rates, which could adversely affect our revenue and expenses, the value of assets and liabilities, and the availability and cost of capital and liquidity; deterioration in economic conditions that may result in increased loan and leases losses; The effects of newly enacted and proposed regulations affecting us and the banking industry, as well as changes and uncertainties in applicable laws, and fiscal, monetary, regulatory, trade, and tax policies, and actions taken by governments, agencies, central banks, and similar organizations, including those that result in decreases in revenue; increases in bank fees, insurance assessments and capital standards; and other regulatory requirements; Competitive pressures and other factors that may affect aspects of our business, such as pricing and demand for our products and services, and our ability to recruit and retain talent; The impact of technological advancements, digital commerce, artificial intelligence, and other innovations affecting the banking industry; Our ability to complete projects and initiatives and execute on our strategic plans, manage our risks, control compensation and other expenses, and achieve our business objectives; Our ability to develop and maintain technology, information security systems and controls designed to guard against fraud, cybersecurity, and privacy risks; Our ability to provide adequate oversight of our suppliers or prevent inadequate performance by third parties upon whom we rely for the delivery of various products and services; Natural disasters, pandemics, catastrophic events and other emergencies and incidents and their impact on our and our customers’ operations and business and communities, including the increasing difficulty in, and the expense of, obtaining property, auto, business, and other insurance products; Governmental and social responses to environmental, social, and governance issues, including those with respect to climate change; Securities and capital markets behavior, including volatility and changes in market liquidity and our ability to raise capital; The possibility that our recorded goodwill could become impaired, which may have an adverse impact on our earnings and shareholders’ equity; The impact of bank closures or adverse developments at other banks on general investor sentiment regarding the stability and liquidity of banks; Adverse news and other expressions of negative public opinion whether directed at us, other banks, the banking industry, or otherwise that may adversely affect our reputation and that of the banking industry generally; Protracted congressional negotiations and political stalemates regarding government funding and other issues, including those that increase the possibility of government shutdowns, downgrades in United States (“U.S.”) credit ratings, or other economic disruptions; and The effects of wars and geopolitical conflicts, such as the ongoing war between Russia and Ukraine, the war in the Middle East, and other local, national, or international disasters, crises, or conflicts that may occur in the future. Factors that could cause our actual results, performance or achievements, industry trends, and results or regulatory outcomes to differ materially from those expressed or implied in the forward-looking statements are discussed in our 2023 Form 10-K and subsequent filings with the Securities and Exchange Commission (SEC) and are available on our website (www.zionsbancorporation.com) and from the SEC (www.sec.gov). We caution against the undue reliance on forward-looking statements, which reflect our views only as of the date they are made. Except to the extent required by law, we specifically disclaim any obligation to update any factors or to publicly announce the revisions to any forward-looking statements to reflect future events or developments. Use of Non-GAAP Financial Measures: This document contains several references to non-GAAP measures, including but not limited to, pre-provision net revenue and the “efficiency ratio,” which are common industry terms used by investors and financial services analysts. Certain of these non-GAAP measures are key inputs into Zions’ management compensation and are used in Zions’ strategic goals that have been and may continue to be articulated to investors. Therefore, the use of such non-GAAP measures are believed by management to be of substantial interest to the consumers of these financial disclosures and are used prominently throughout the disclosures. A reconciliation of the difference between such measures and GAAP financials is provided within the document, and users of this document are encouraged to carefully review this reconciliation.

Net interest margin expanded for a third consecutive quarter while credit losses remain low FINANCIAL PERFORMANCE 3 (1) See Appendix for non-GAAP financial measures. Key Metrics 3Q24 2Q24 • Net earnings to common improved by $14 million due to higher revenues and lower expenses • Earning assets continued to reprice upward while funding costs remained flat, resulting in a 5-basis point improvement in net interest margin • Net charge-offs were 0.02% of loans, annualized, and remain below peer median • Loss-absorbing capital continued to strengthen, with the CET1 ratio at 10.7%, up from 10.2% a year ago • Improved efficiency ratio reflects both higher adjusted revenues and lower adjusted expenses during the quarter Net earnings to common $204 million $190 million Diluted earnings per share (GAAP) $1.37 $1.28 Net Interest Margin 3.03% 2.98% Loan growth (QoQ) Ending 0.8% Average 0.6% Ending 0.5% Average 0.7% Customer deposit growth (QoQ) (excluding brokered) Ending 1.5% Average 0.7% Ending (0.7%) Average 0.3% Net charge-offs / loans (annualized) 0.02% (annualized) 0.10% Return on average tangible common equity1 17.4% 17.5% Common equity tier 1% 10.7% 10.6% Efficiency ratio1 62.5% 64.5%

DILUTED EARNINGS PER SHARE 4 (1) Items that were $0.05 per share or more. Earnings per share increased 7% over prior quarter from improved pre-provision net revenue, slightly offset by an increase in provision Diluted Earnings per Share EPS Impact of Provision for Credit Losses Notable Items1: 3Q24: • No items with impact > $0.05 per share during the quarter 2Q24: • $0.07 per share positive impact from gains on sale of our Enterprise Retirement Solutions business and a bank-owned property 1Q24: • $(0.07) per share negative impact from FDIC Special Assessment 4Q23: • $(0.46) per share negative impact from FDIC Special Assessment • $(0.05) per share negative impact from Credit Valuation Adjustment 3Q23: • No items with impact > $0.05 per share during the quarter $1.13 $0.78 $0.96 $1.28 $1.37 3Q23 4Q23 1Q24 2Q24 3Q24 $(0.21) $- $(0.07) $(0.03) $(0.07) 3Q23 4Q23 1Q24 2Q24 3Q24

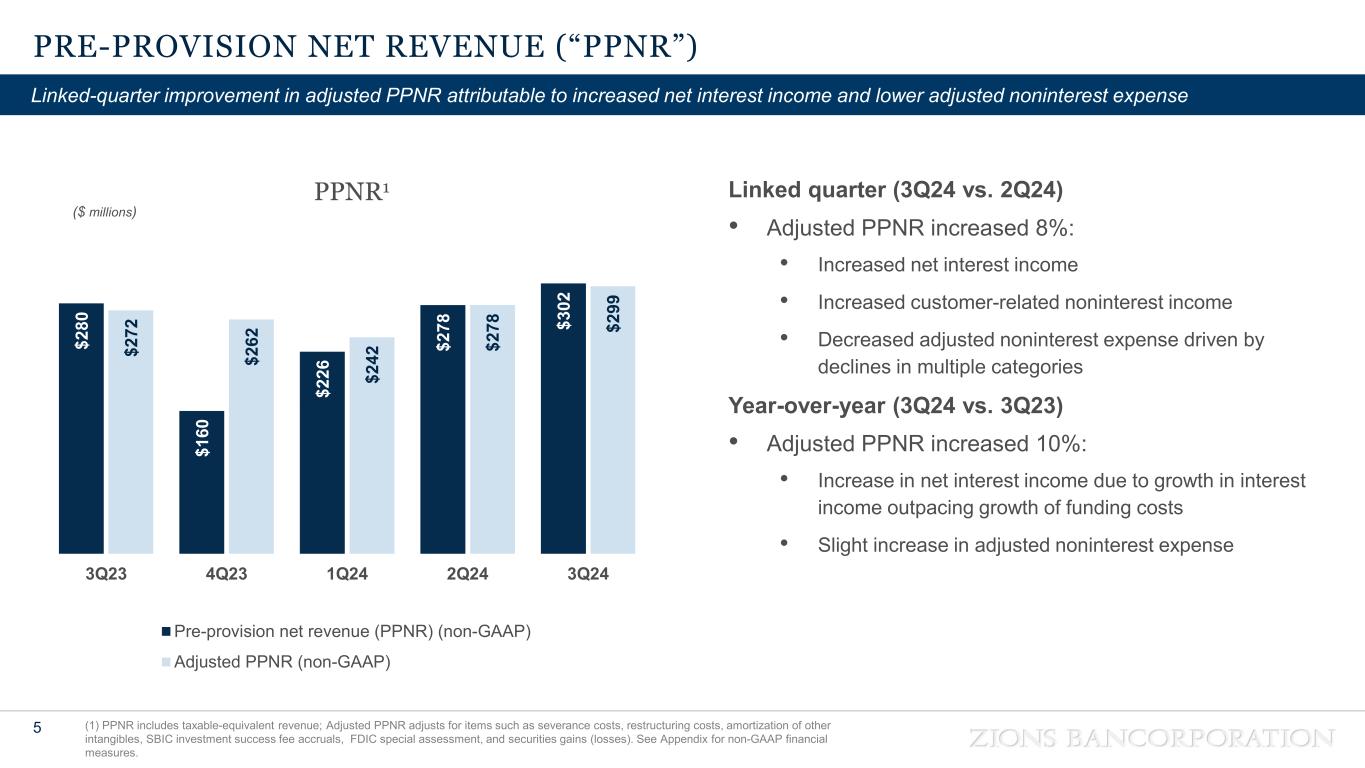

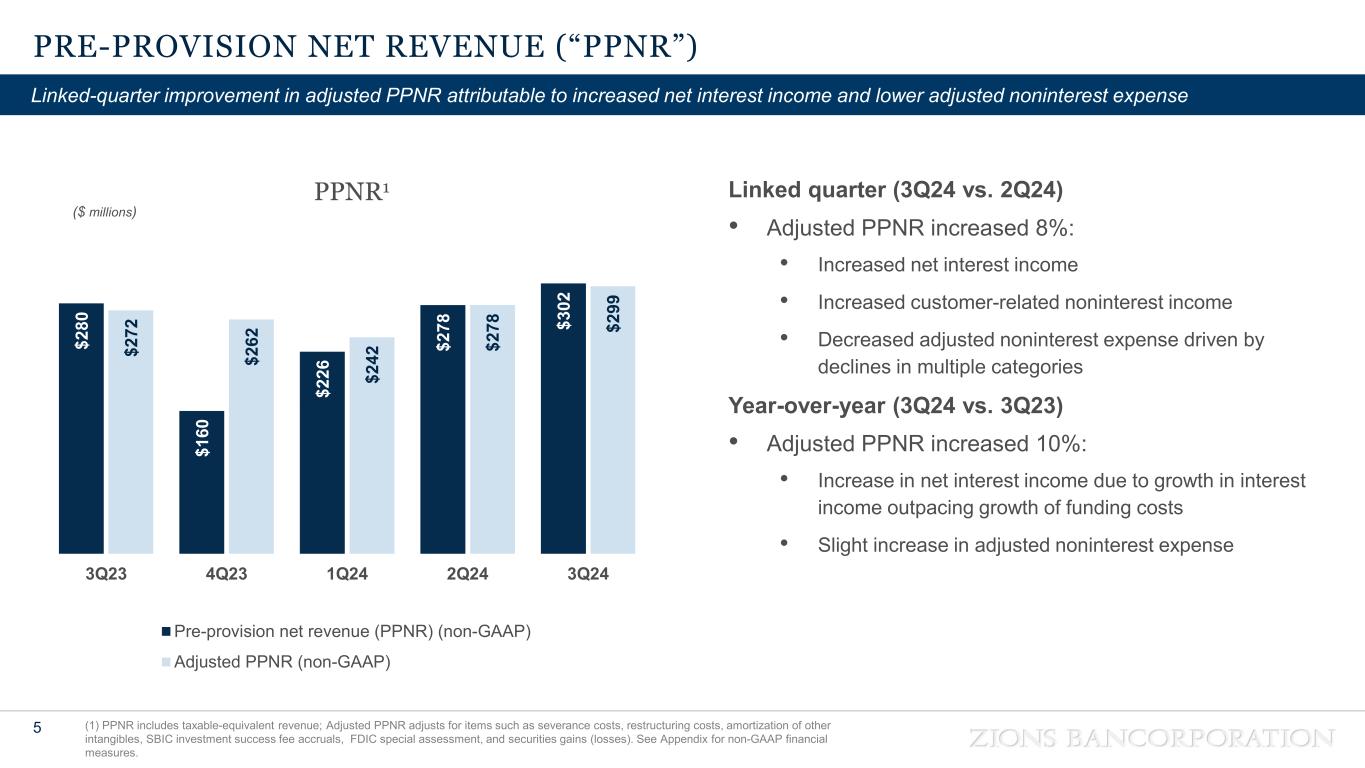

PRE-PROVISION NET REVENUE (“PPNR”) 5 (1) PPNR includes taxable-equivalent revenue; Adjusted PPNR adjusts for items such as severance costs, restructuring costs, amortization of other intangibles, SBIC investment success fee accruals, FDIC special assessment, and securities gains (losses). See Appendix for non-GAAP financial measures. Linked-quarter improvement in adjusted PPNR attributable to increased net interest income and lower adjusted noninterest expense Linked quarter (3Q24 vs. 2Q24) • Adjusted PPNR increased 8%: • Increased net interest income • Increased customer-related noninterest income • Decreased adjusted noninterest expense driven by declines in multiple categories Year-over-year (3Q24 vs. 3Q23) • Adjusted PPNR increased 10%: • Increase in net interest income due to growth in interest income outpacing growth of funding costs • Slight increase in adjusted noninterest expense $2 80 $1 60 $2 26 $2 78 $3 02 $2 72 $2 62 $2 42 $2 78 $2 99 3Q23 4Q23 1Q24 2Q24 3Q24 Pre-provision net revenue (PPNR) (non-GAAP) Adjusted PPNR (non-GAAP) PPNR1 ($ millions)

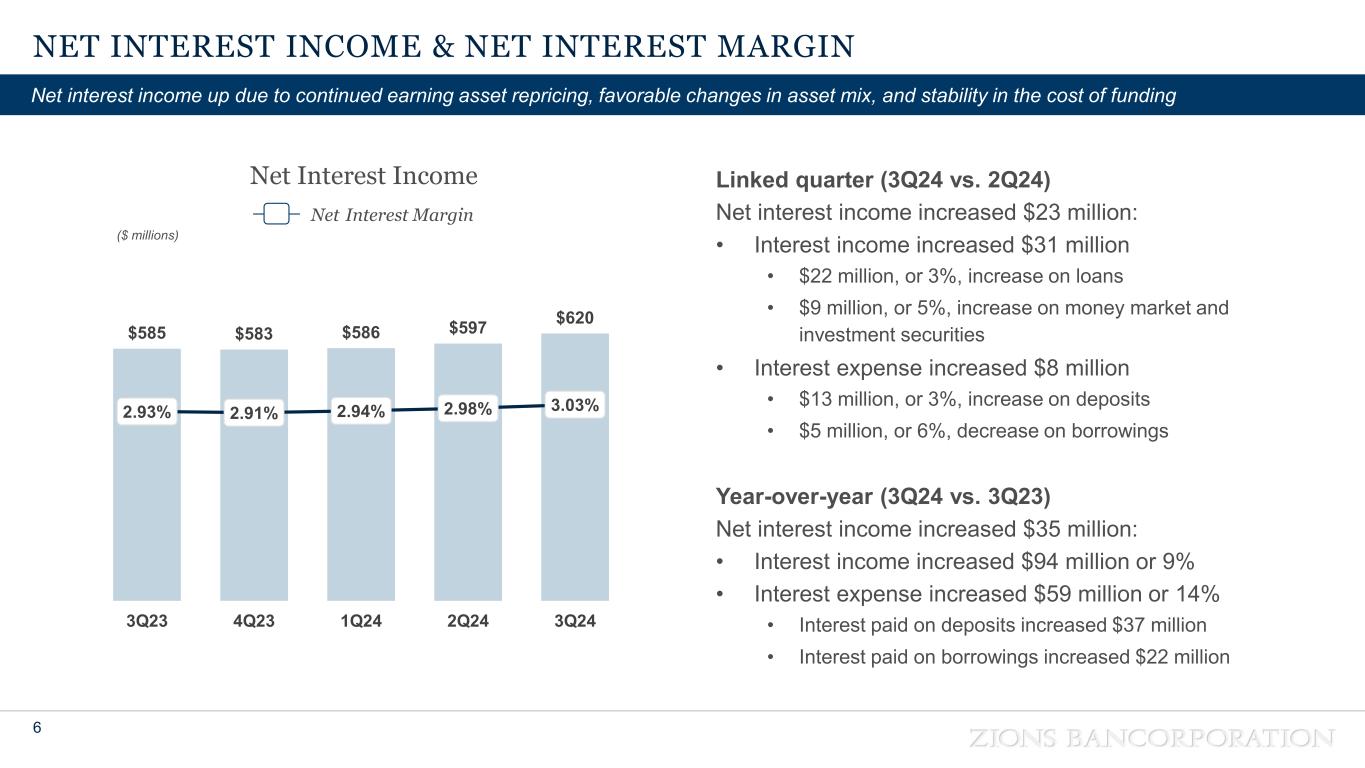

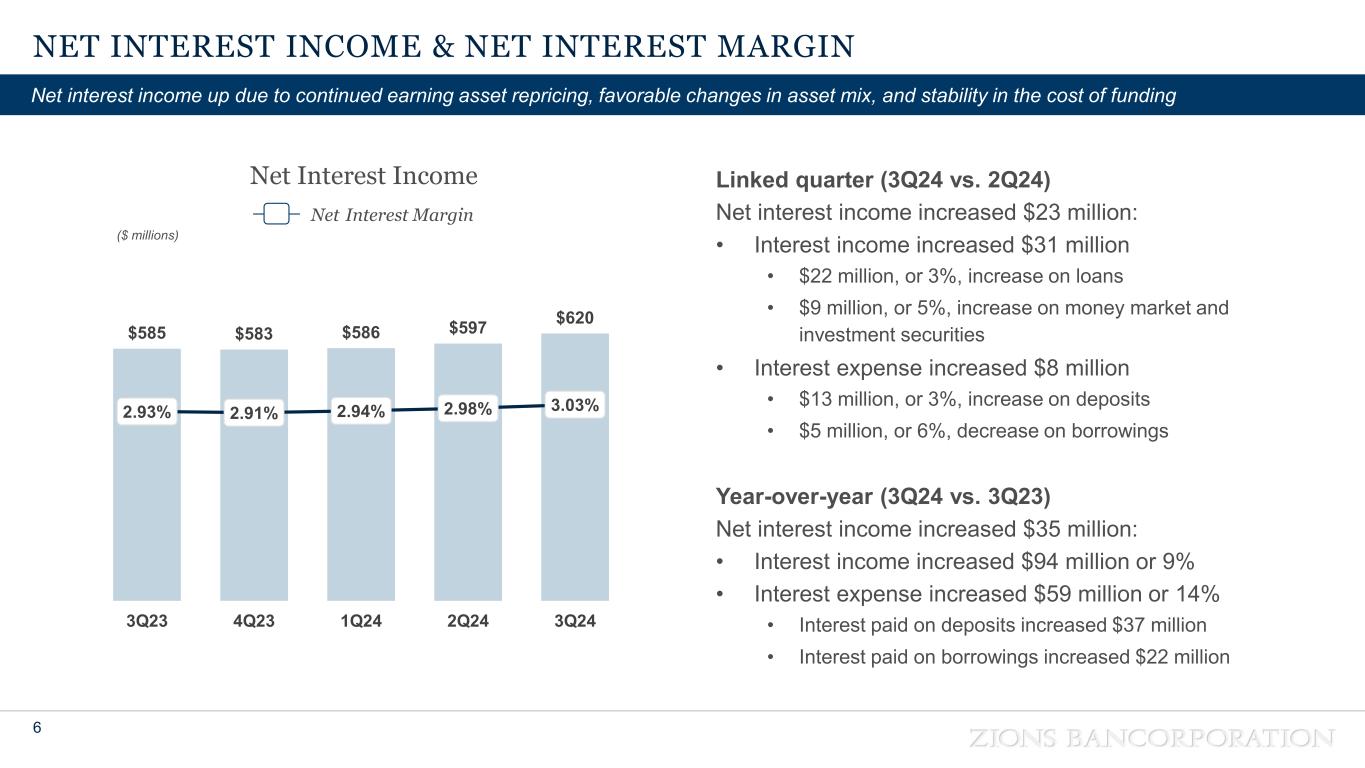

NET INTEREST INCOME & NET INTEREST MARGIN 6 Net interest income up due to continued earning asset repricing, favorable changes in asset mix, and stability in the cost of funding $585 $583 $586 $597 $620 2.93% 2.91% 2.94% 2.98% 3.03% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% $0 3Q23 4Q23 1Q24 2Q24 3Q24 Net Interest Income Net Interest Margin ($ millions) Linked quarter (3Q24 vs. 2Q24) Net interest income increased $23 million: • Interest income increased $31 million • $22 million, or 3%, increase on loans • $9 million, or 5%, increase on money market and investment securities • Interest expense increased $8 million • $13 million, or 3%, increase on deposits • $5 million, or 6%, decrease on borrowings Year-over-year (3Q24 vs. 3Q23) Net interest income increased $35 million: • Interest income increased $94 million or 9% • Interest expense increased $59 million or 14% • Interest paid on deposits increased $37 million • Interest paid on borrowings increased $22 million

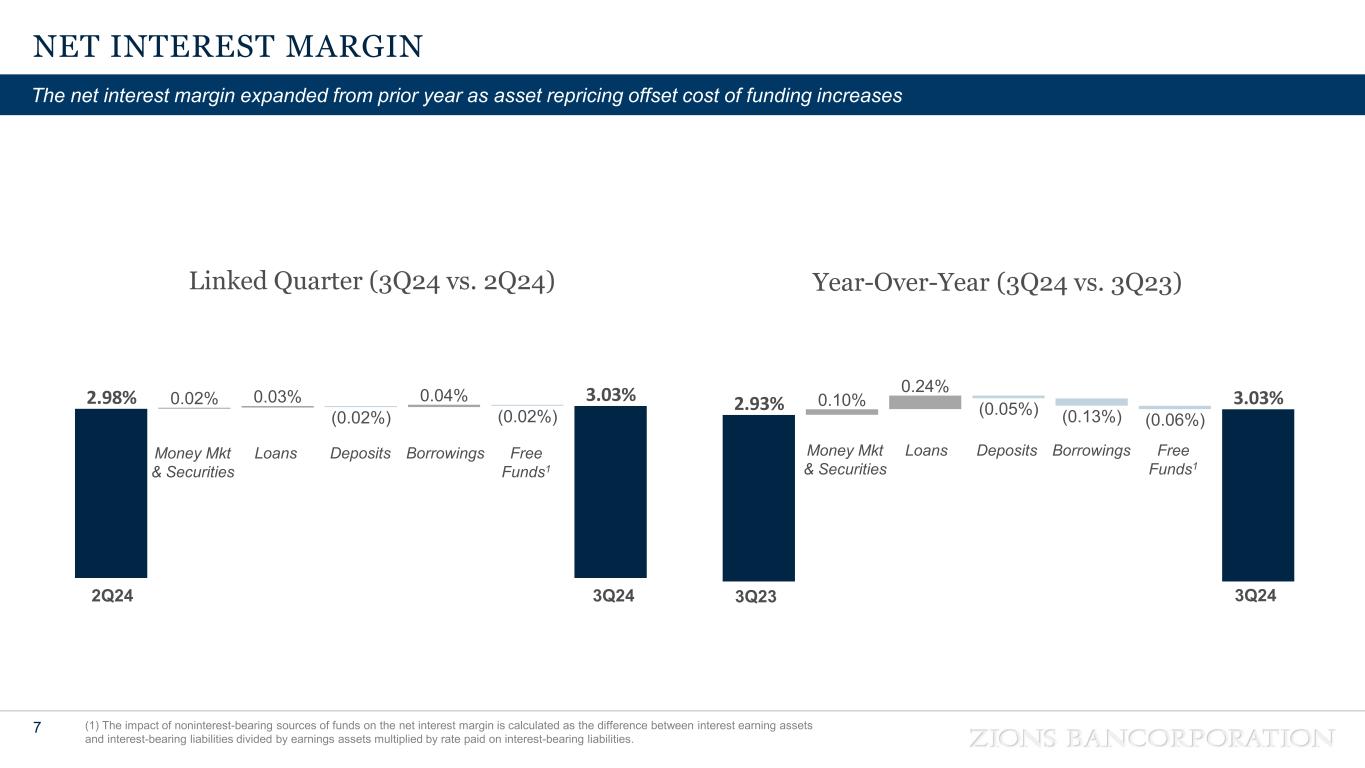

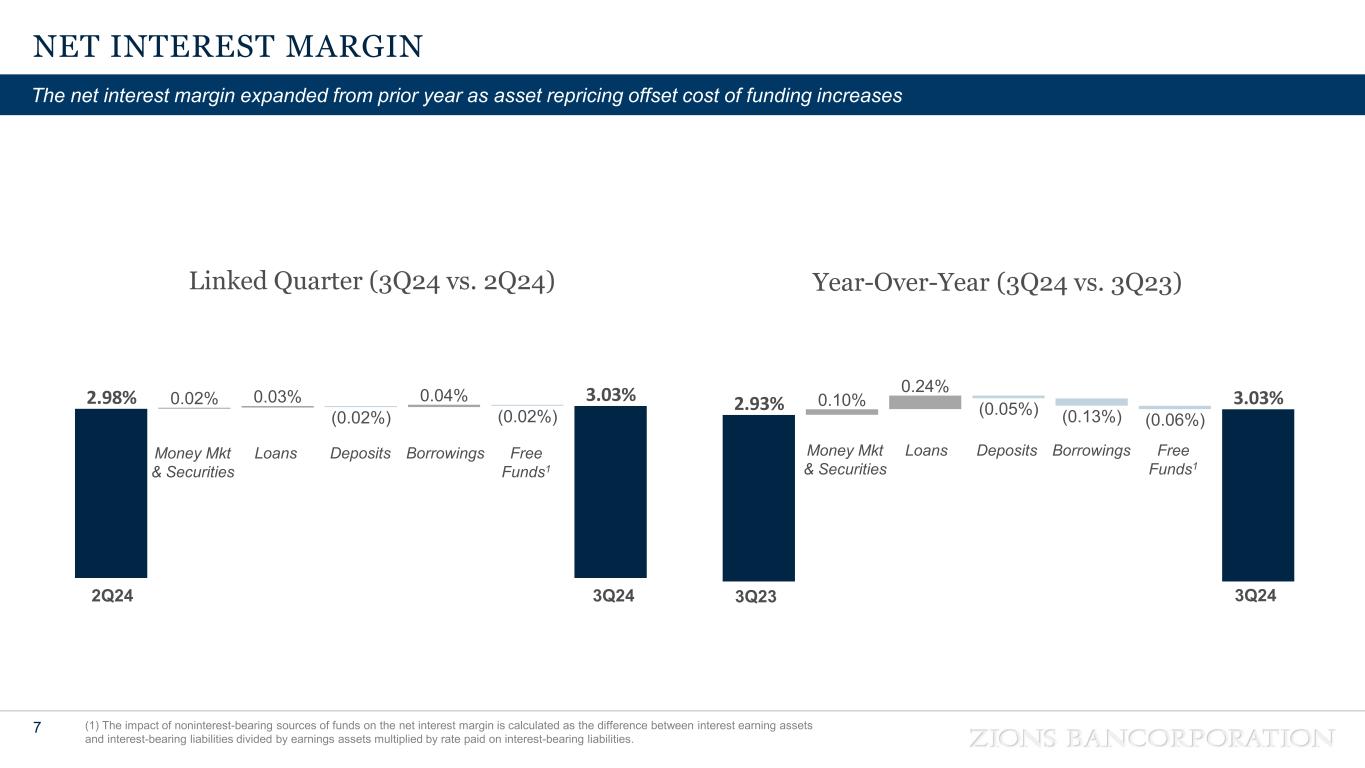

NET INTEREST MARGIN 7 (1) The impact of noninterest-bearing sources of funds on the net interest margin is calculated as the difference between interest earning assets and interest-bearing liabilities divided by earnings assets multiplied by rate paid on interest-bearing liabilities. The net interest margin expanded from prior year as asset repricing offset cost of funding increases Year-Over-Year (3Q24 vs. 3Q23)Linked Quarter (3Q24 vs. 2Q24) 0.02% 0.03% (0.02%) 0.04% (0.02%) 2.98% 3.03% 0.10% 0.24% (0.05%) (0.13%) (0.06%) 2.93% 3.03% Loans DepositsMoney Mkt & Securities Borrowings Free Funds1 Loans DepositsMoney Mkt & Securities Borrowings Free Funds1 3Q23 3Q242Q24 3Q24

NONINTEREST INCOME AND REVENUE 8 (1) Reflects total customer-related noninterest income, which excludes items such as fair value and non-hedge derivative income, securities gains (losses), and other items as detailed in the noninterest income section of the earnings release. (2) Adjusted revenue is the sum of taxable-equivalent net interest income and noninterest income less adjustments. It excludes the impact of securities gains (losses) and fair value and non-hedge derivative income. See Appendix for non-GAAP financial measures. Increase in customer-related income largely due to growth in Capital Markets $157 $150 $151 $154 $161 3Q23 4Q23 1Q24 2Q24 3Q24 Customer-Related Noninterest Income 1 ($ millions) $7 65 $7 31 $7 42 $7 76 $7 92 $7 65 $7 51 $7 53 $7 84 $7 98 3Q23 4Q23 1Q24 2Q24 3Q24 Total Revenue (GAAP) Adjusted Revenue (Non-GAAP) Total Revenue 2 ($ millions)

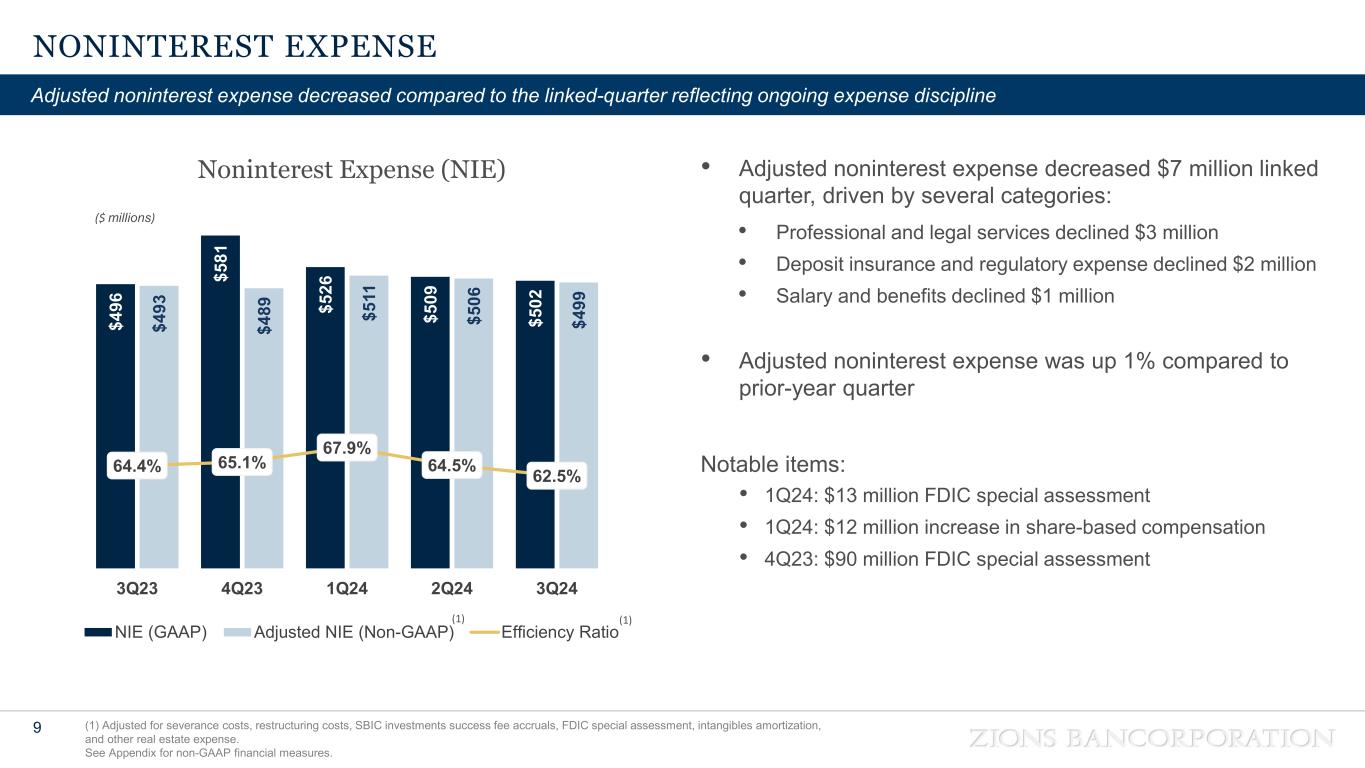

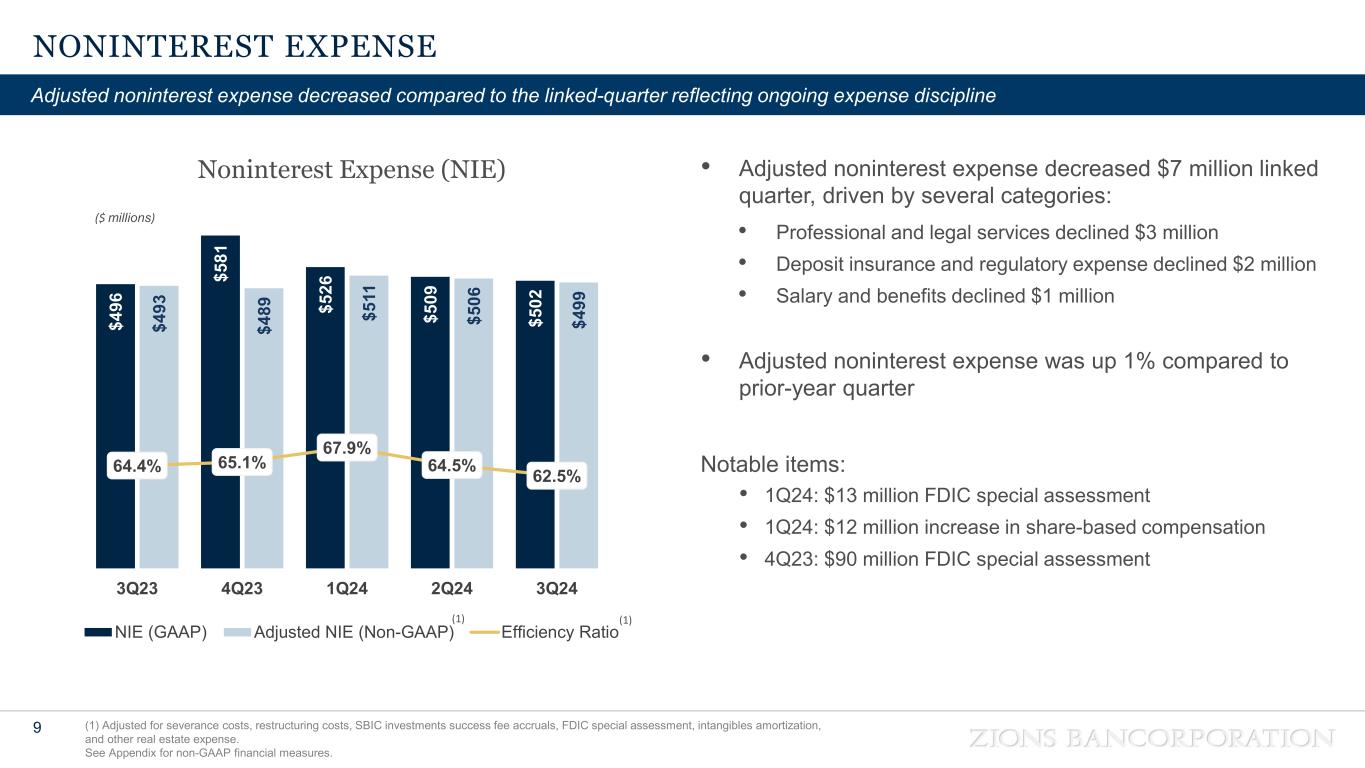

NONINTEREST EXPENSE 9 (1) Adjusted for severance costs, restructuring costs, SBIC investments success fee accruals, FDIC special assessment, intangibles amortization, and other real estate expense. See Appendix for non-GAAP financial measures. Adjusted noninterest expense decreased compared to the linked-quarter reflecting ongoing expense discipline • Adjusted noninterest expense decreased $7 million linked quarter, driven by several categories: • Professional and legal services declined $3 million • Deposit insurance and regulatory expense declined $2 million • Salary and benefits declined $1 million • Adjusted noninterest expense was up 1% compared to prior-year quarter Notable items: • 1Q24: $13 million FDIC special assessment • 1Q24: $12 million increase in share-based compensation • 4Q23: $90 million FDIC special assessment $4 96 $5 81 $5 26 $5 09 $5 02 $4 93 $4 89 $5 11 $5 06 $4 99 64.4% 65.1% 67.9% 64.5% 62.5% 3Q23 4Q23 1Q24 2Q24 3Q24 NIE (GAAP) Adjusted NIE (Non-GAAP) Efficiency Ratio ($ millions) Noninterest Expense (NIE) (1) (1)

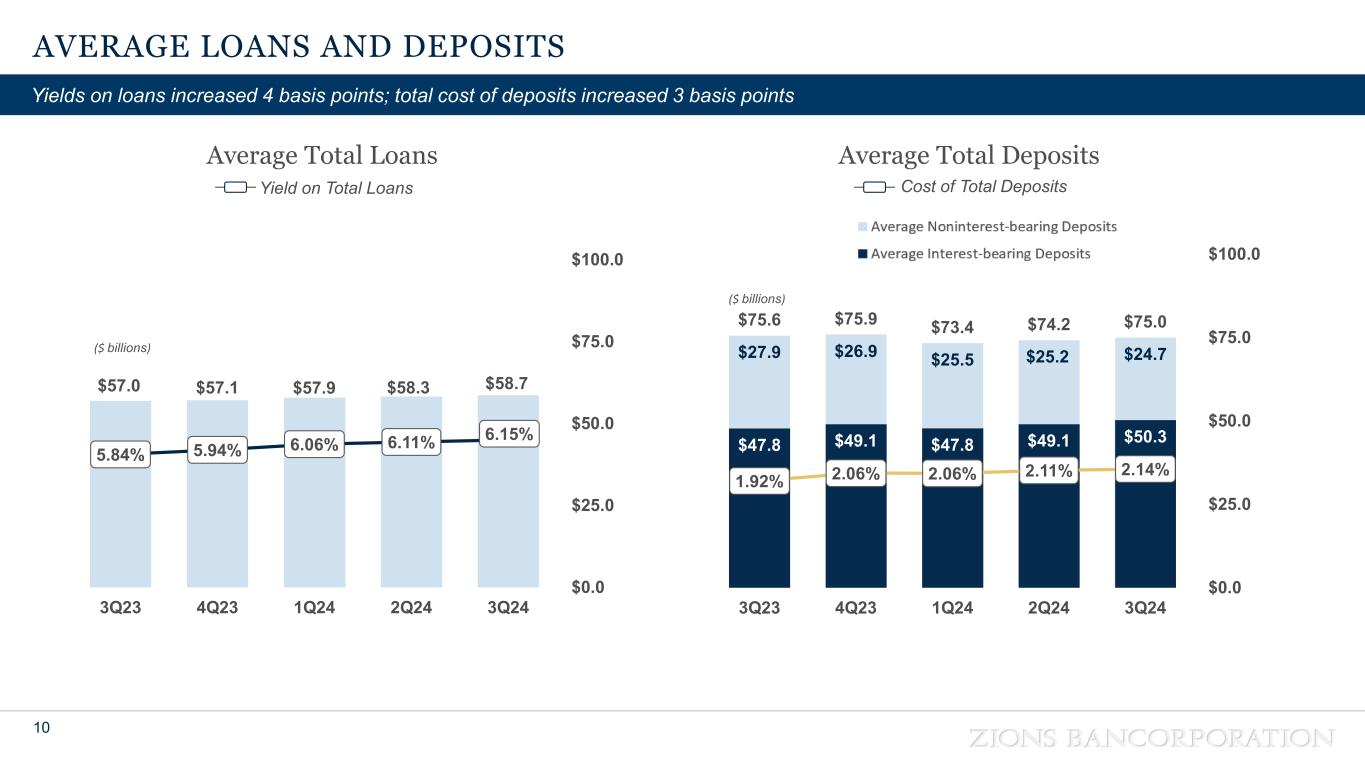

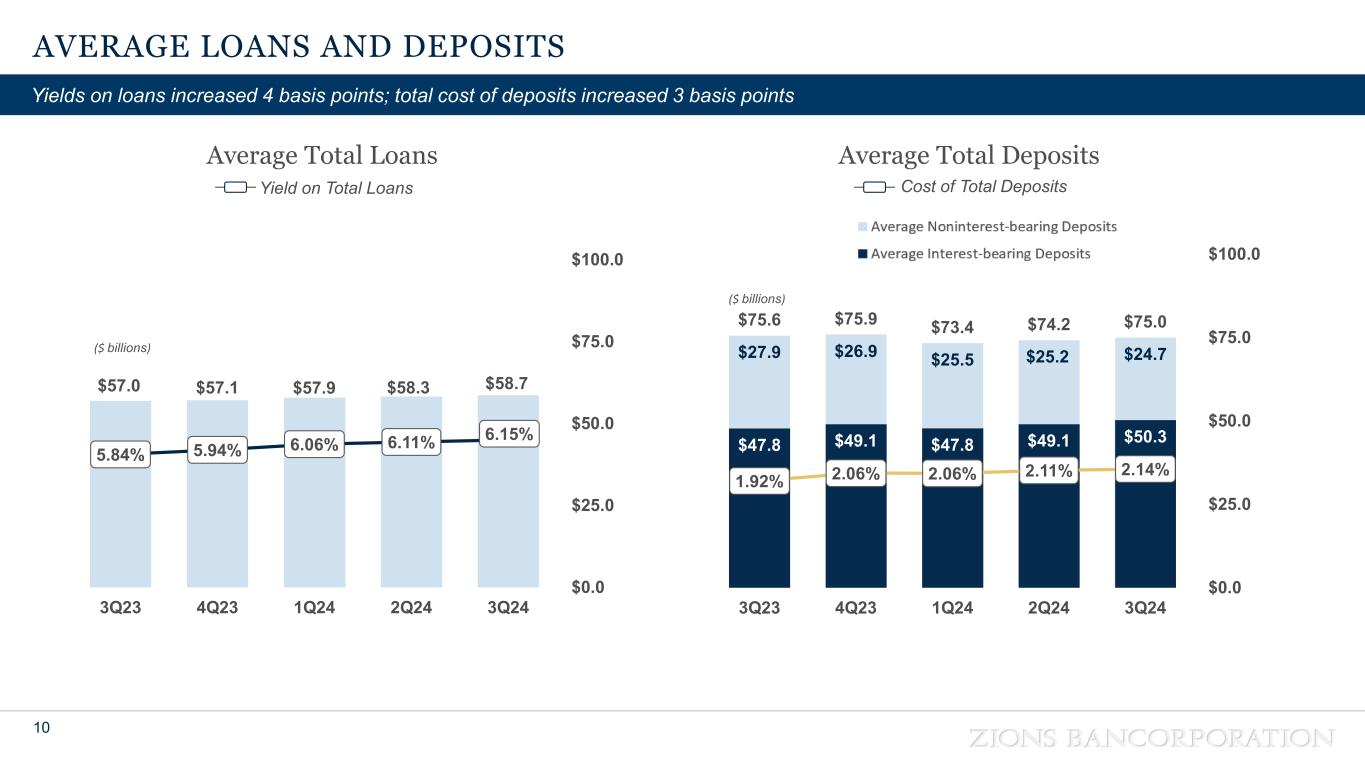

AVERAGE LOANS AND DEPOSITS 10 Yields on loans increased 4 basis points; total cost of deposits increased 3 basis points Average Total Loans Yield on Total Loans Average Total Deposits Cost of Total Deposits $57.0 $57.1 $57.9 $58.3 $58.7 5.84% 5.94% 6.06% 6.11% 6.15% $0.0 $25.0 $50.0 $75.0 $100.0 3Q23 4Q23 1Q24 2Q24 3Q24 ($ billions) $47.8 $49.1 $47.8 $49.1 $50.3 $27.9 $26.9 $25.5 $25.2 $24.7 $75.6 $75.9 $73.4 $74.2 $75.0 1.92% 2.06% 2.06% 2.11% 2.14% $0.0 $25.0 $50.0 $75.0 $100.0 3Q23 4Q23 1Q24 2Q24 3Q24 ($ billions)

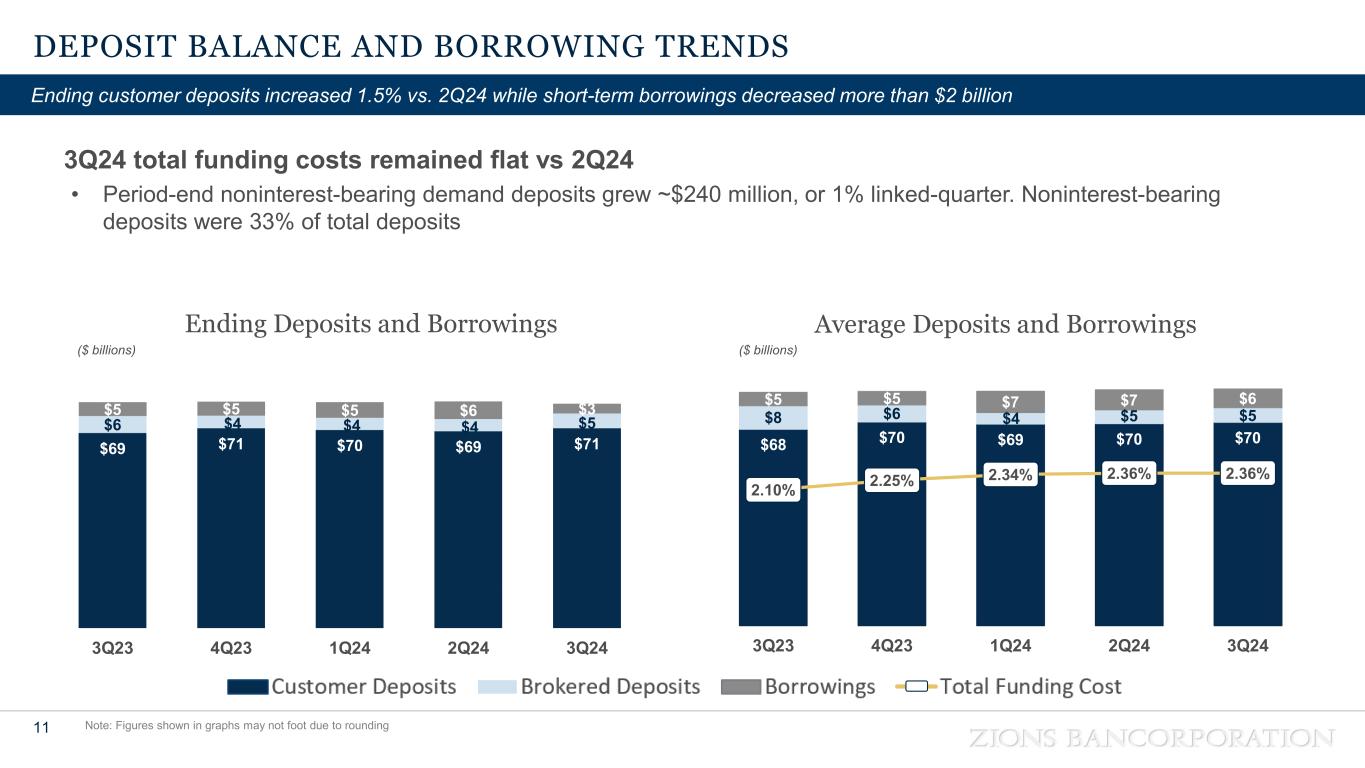

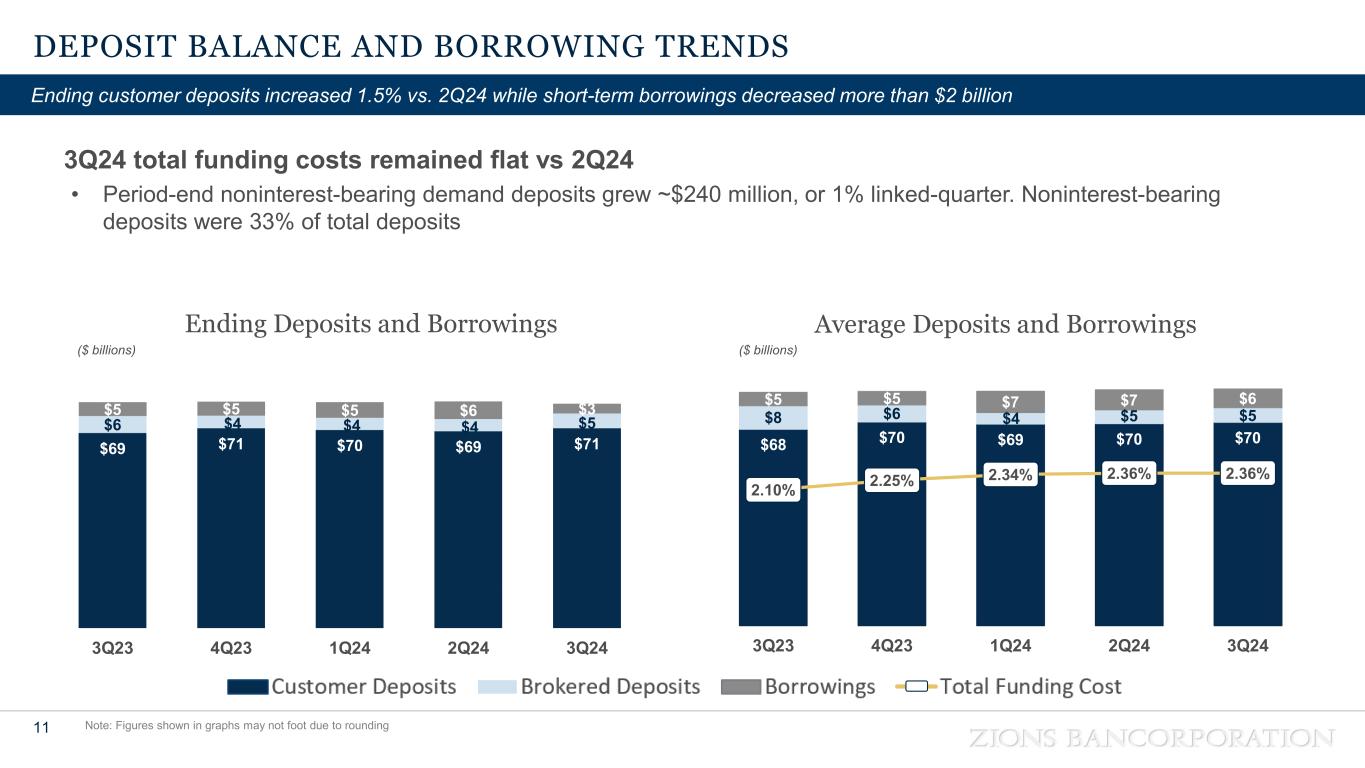

DEPOSIT BALANCE AND BORROWING TRENDS 11 Note: Figures shown in graphs may not foot due to rounding Ending customer deposits increased 1.5% vs. 2Q24 while short-term borrowings decreased more than $2 billion 3Q24 total funding costs remained flat vs 2Q24 • Period-end noninterest-bearing demand deposits grew ~$240 million, or 1% linked-quarter. Noninterest-bearing deposits were 33% of total deposits Average Deposits and Borrowings ($ billions) Ending Deposits and Borrowings ($ billions) $69 $71 $70 $69 $71 $6 $4 $4 $4 $5 $5 $5 $5 $6 $3 - 10 20 30 40 50 60 70 80 90 100 3Q23 4Q23 1Q24 2Q24 3Q24 $68 $70 $69 $70 $70 $8 $6 $4 $5 $5 $5 $5 $7 $7 $6 2.10% 2.25% 2.34% 2.36% 2.36% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% - 10 20 30 40 50 60 70 80 90 100 3Q23 4Q23 1Q24 2Q24 3Q24

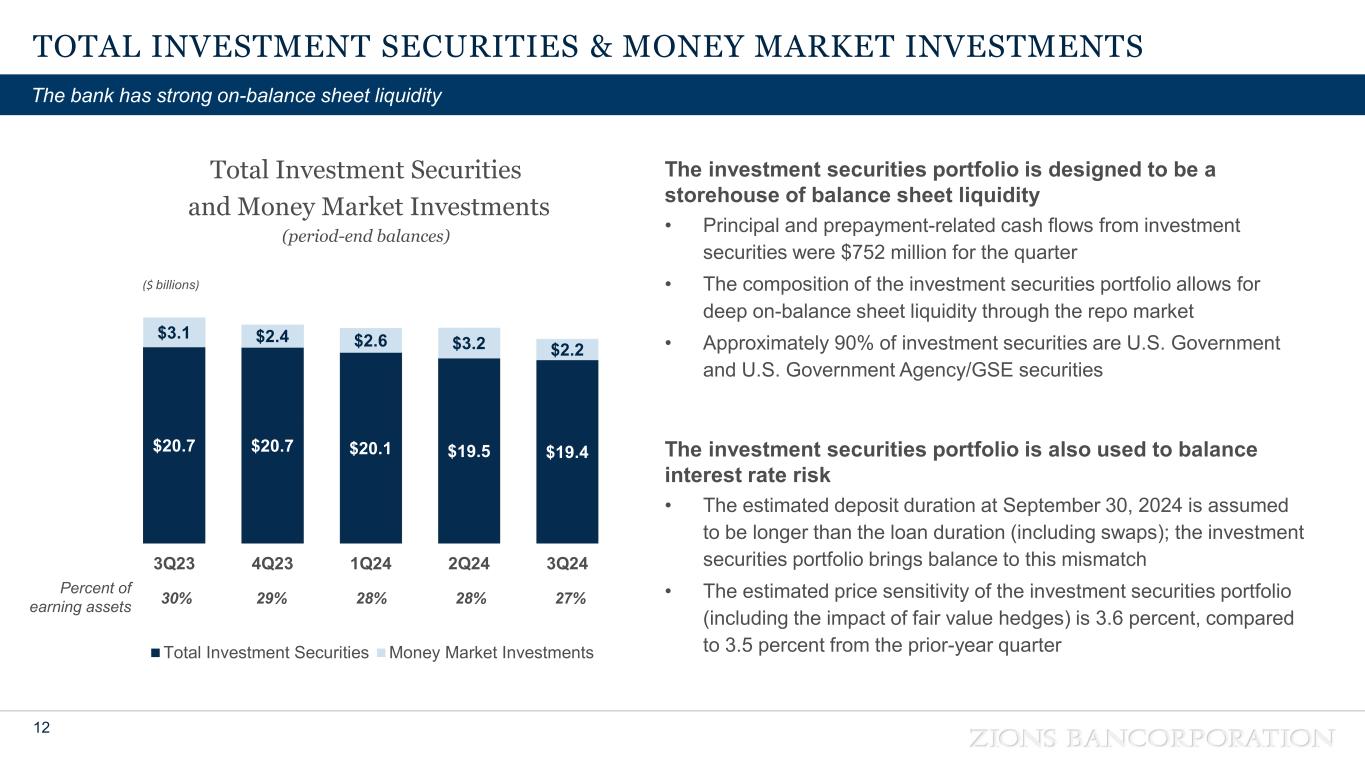

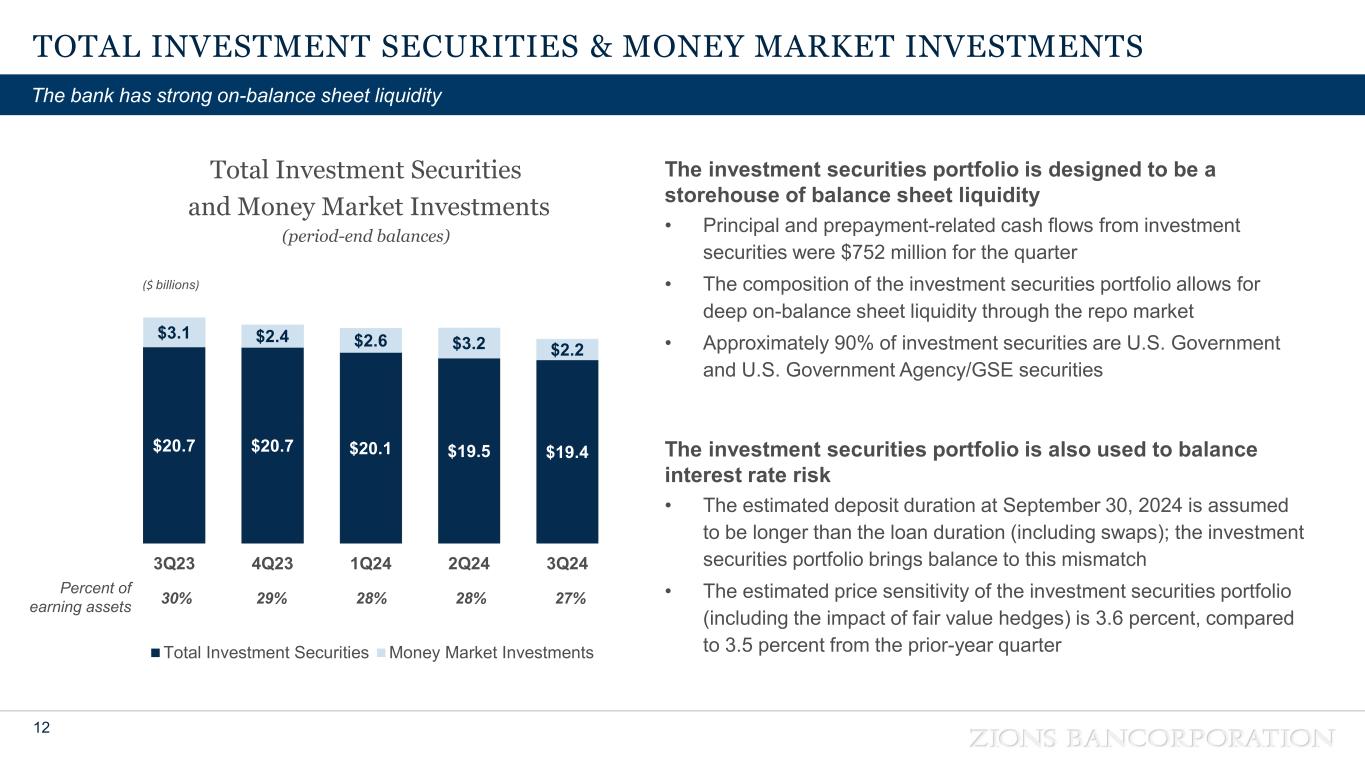

TOTAL INVESTMENT SECURITIES & MONEY MARKET INVESTMENTS 12 The bank has strong on-balance sheet liquidity The investment securities portfolio is designed to be a storehouse of balance sheet liquidity • Principal and prepayment-related cash flows from investment securities were $752 million for the quarter • The composition of the investment securities portfolio allows for deep on-balance sheet liquidity through the repo market • Approximately 90% of investment securities are U.S. Government and U.S. Government Agency/GSE securities The investment securities portfolio is also used to balance interest rate risk • The estimated deposit duration at September 30, 2024 is assumed to be longer than the loan duration (including swaps); the investment securities portfolio brings balance to this mismatch • The estimated price sensitivity of the investment securities portfolio (including the impact of fair value hedges) is 3.6 percent, compared to 3.5 percent from the prior-year quarter Total Investment Securities and Money Market Investments (period-end balances) $20.7 $20.7 $20.1 $19.5 $19.4 $3.1 $2.4 $2.6 $3.2 $2.2 3Q23 4Q23 1Q24 2Q24 3Q24 Total Investment Securities Money Market Investments 30% 29% 28% 28% 27%Percent of earning assets ($ billions)

NET INTEREST INCOME – OUTLOOK & RATE SENSITIVITY 13 Net interest income is expected to be slightly to moderately increasing in 3Q25 relative to 3Q24 Net Interest Income Sensitivity (0.8%) 1.4% 3.1% -100 bps Implied Rate Path as of 9/30 +100 bps 3Q25 vs 3Q24 Net interest income increased by 4% from 2Q24 to 3Q24. Assuming interest rates follow the rate path implied as of September 30, net interest income is projected to increase in 3Q25 vs 3Q24 by an additional 1.4%. This assumes Fed Funds Target reaches 3.25% by 3Q25 and total deposit beta of approximately 36%. -100 and +100 parallel interest rate shocks suggest moderate rate sensitivity between -0.8% and +3.1% Assumes no change in the size or composition of the earning assets excluding derivative hedge activity but does assume a change in composition of deposits (a lesser proportion of noninterest-bearing relative to total deposits). Beta calculated comparing 5.00% Fed Funds Rate at 9/30 vs target rate of 3.255 implied as of September 30th

CREDIT QUALITY 14 Net charge-offs remain low, with trailing 12 months net charge-offs at 0.06% of average loans Key Credit Metrics • Net charge-offs relative to average loans: • 0.02% annualized in 3Q24 • 0.06% over the last 12 months • 0.62%: NPAs / loans + OREO • NPA balance increased $103 million in 3Q24 from 2Q24 • 3.6%: Classified loans / total loans • Classified balance increased $829 million in 3Q24 from 2Q24, driven largely by loans in the commercial real estate portfolio (primarily multifamily) • 4.5%: Criticized loans / total loans • Criticized balance increased $426 million in 3Q24 from 2Q24, driven largely by loans in the commercial real estate portfolio (primarily multifamily) Allowance for Credit Losses • 1.25% of total loans and leases, up 1 basis point from 2Q24 reflecting little change in economic forecasts Credit Quality Ratios 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 3Q23 4Q23 1Q24 2Q24 3Q24 Criticized / Loans NPAs / Loans + OREO Classified / Loans 342% 308% 282% 267% 191% 1.30% 1.26% 1.27% 1.24% 1.25% 3Q23 4Q23 1Q24 2Q24 3Q24 ALLL / Nonaccrual loans ACL / Loans

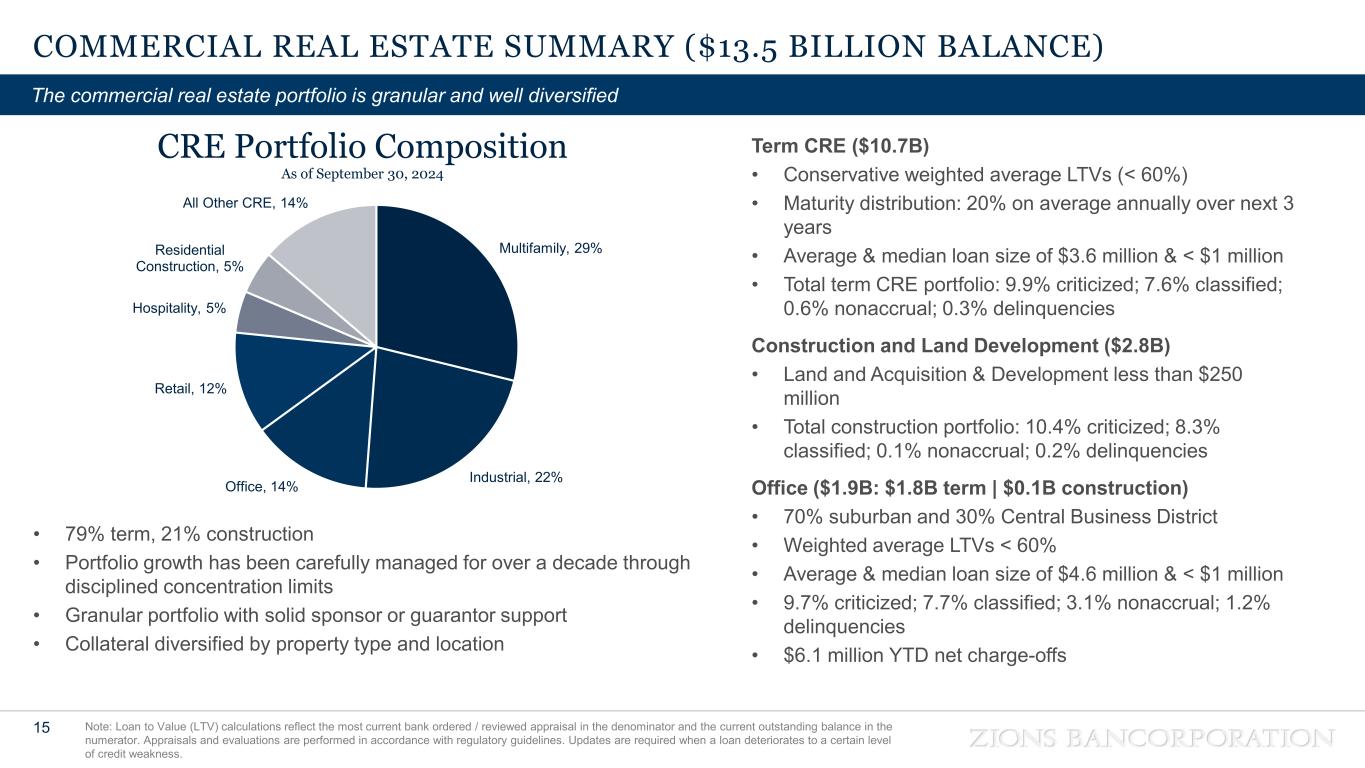

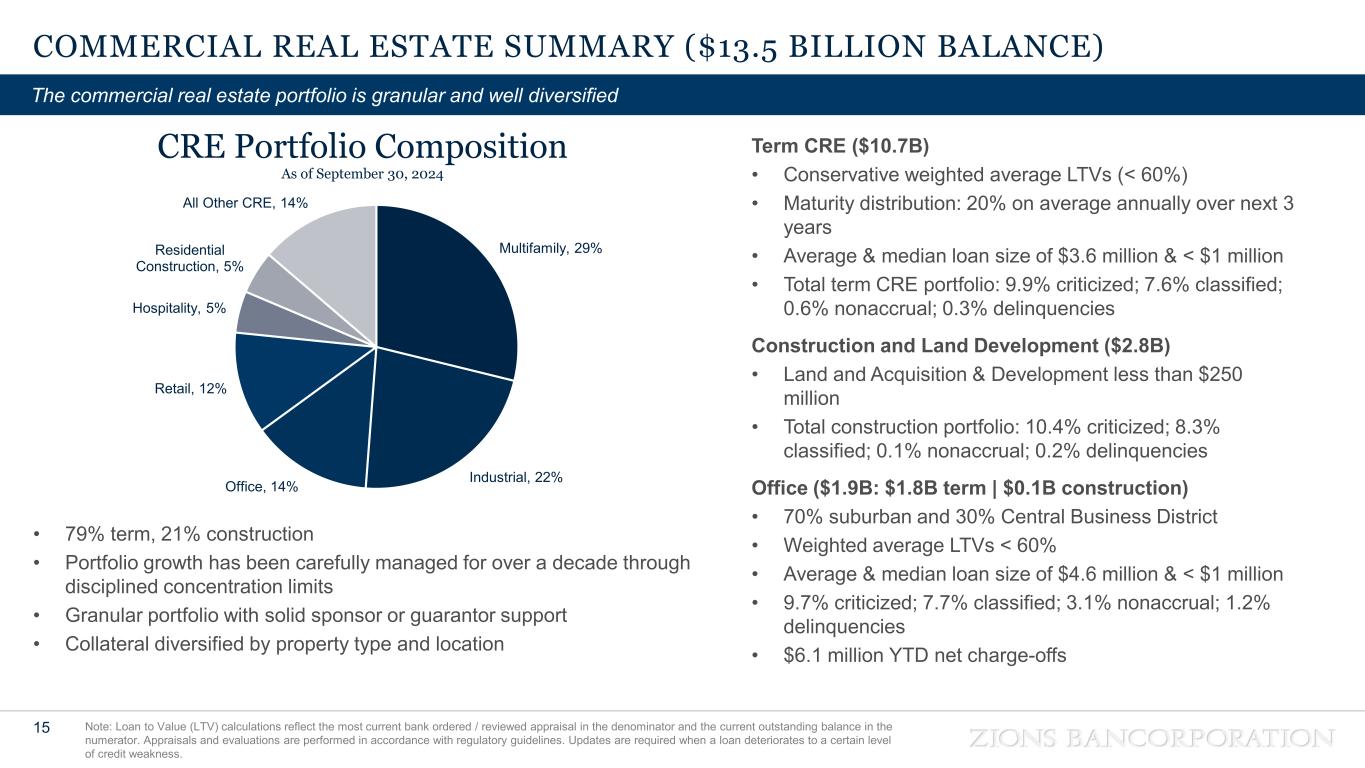

COMMERCIAL REAL ESTATE SUMMARY ($13.5 BILLION BALANCE) 15 Note: Loan to Value (LTV) calculations reflect the most current bank ordered / reviewed appraisal in the denominator and the current outstanding balance in the numerator. Appraisals and evaluations are performed in accordance with regulatory guidelines. Updates are required when a loan deteriorates to a certain level of credit weakness. The commercial real estate portfolio is granular and well diversified Term CRE ($10.7B) • Conservative weighted average LTVs (< 60%) • Maturity distribution: 20% on average annually over next 3 years • Average & median loan size of $3.6 million & < $1 million • Total term CRE portfolio: 9.9% criticized; 7.6% classified; 0.6% nonaccrual; 0.3% delinquencies Construction and Land Development ($2.8B) • Land and Acquisition & Development less than $250 million • Total construction portfolio: 10.4% criticized; 8.3% classified; 0.1% nonaccrual; 0.2% delinquencies Office ($1.9B: $1.8B term | $0.1B construction) • 70% suburban and 30% Central Business District • Weighted average LTVs < 60% • Average & median loan size of $4.6 million & < $1 million • 9.7% criticized; 7.7% classified; 3.1% nonaccrual; 1.2% delinquencies • $6.1 million YTD net charge-offs • 79% term, 21% construction • Portfolio growth has been carefully managed for over a decade through disciplined concentration limits • Granular portfolio with solid sponsor or guarantor support • Collateral diversified by property type and location Multifamily, 29% Industrial, 22%Office, 14% Retail, 12% Hospitality, 5% Residential Construction, 5% All Other CRE, 14% CRE Portfolio Composition As of September 30, 2024

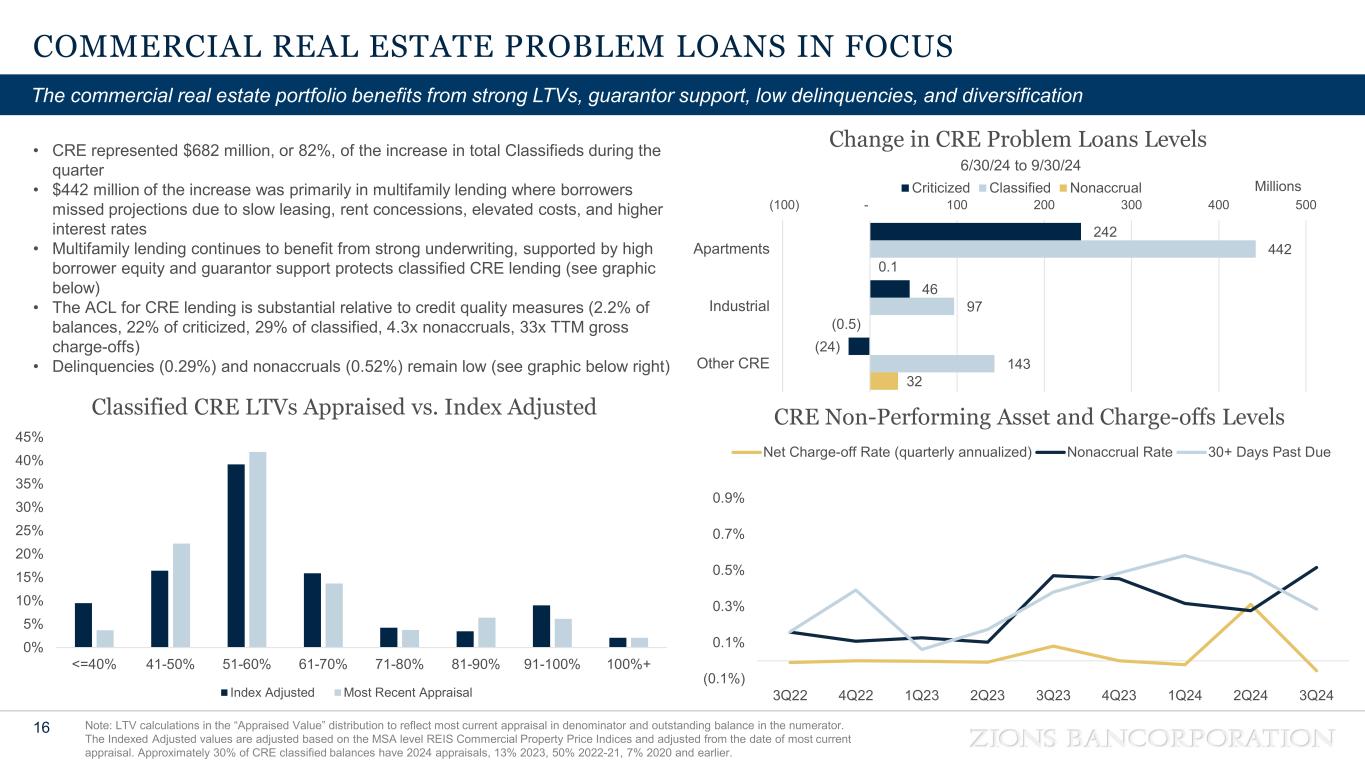

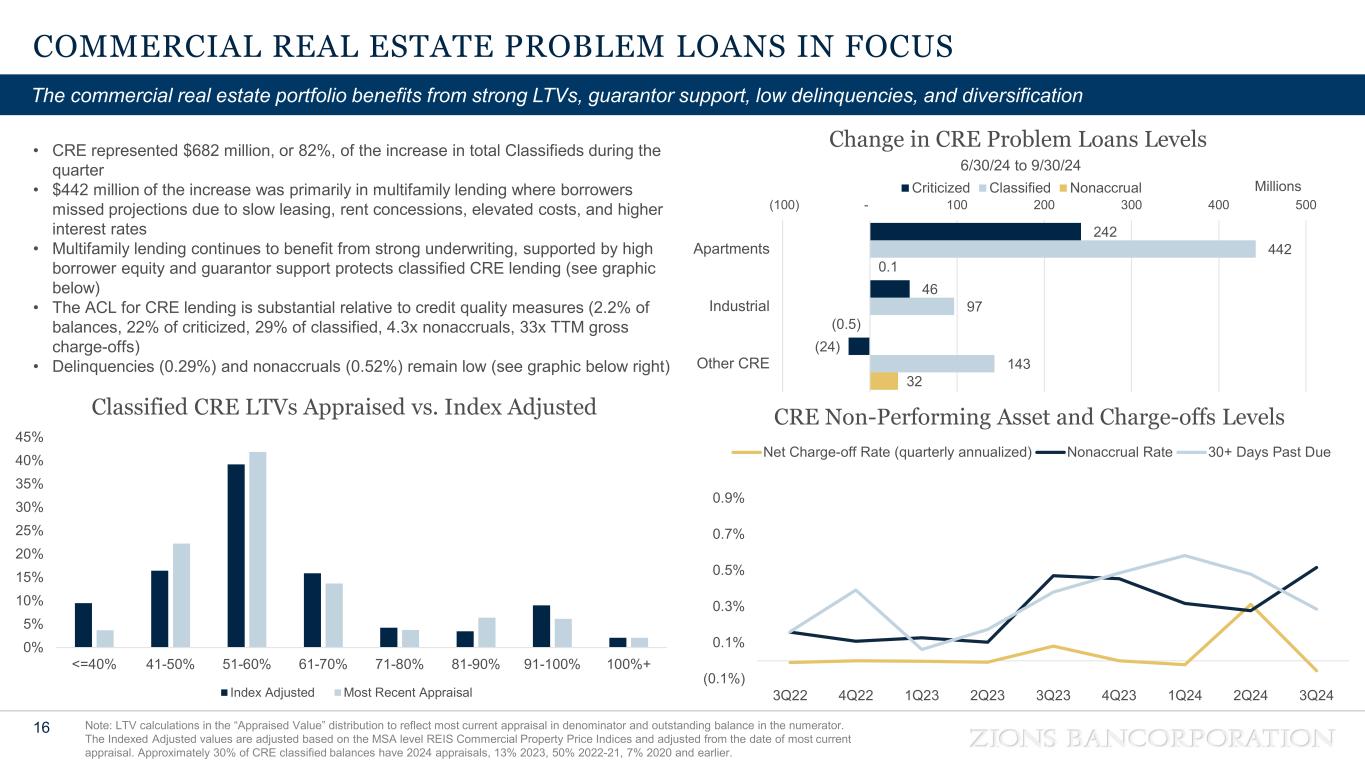

COMMERCIAL REAL ESTATE PROBLEM LOANS IN FOCUS 16 Note: LTV calculations in the “Appraised Value” distribution to reflect most current appraisal in denominator and outstanding balance in the numerator. The Indexed Adjusted values are adjusted based on the MSA level REIS Commercial Property Price Indices and adjusted from the date of most current appraisal. Approximately 30% of CRE classified balances have 2024 appraisals, 13% 2023, 50% 2022-21, 7% 2020 and earlier. The commercial real estate portfolio benefits from strong LTVs, guarantor support, low delinquencies, and diversification • CRE represented $682 million, or 82%, of the increase in total Classifieds during the quarter • $442 million of the increase was primarily in multifamily lending where borrowers missed projections due to slow leasing, rent concessions, elevated costs, and higher interest rates • Multifamily lending continues to benefit from strong underwriting, supported by high borrower equity and guarantor support protects classified CRE lending (see graphic below) • The ACL for CRE lending is substantial relative to credit quality measures (2.2% of balances, 22% of criticized, 29% of classified, 4.3x nonaccruals, 33x TTM gross charge-offs) • Delinquencies (0.29%) and nonaccruals (0.52%) remain low (see graphic below right) 242 46 (24) 442 97 143 0.1 (0.5) 32 (100) - 100 200 300 400 500 Apartments Industrial Other CRE Millions Change in CRE Problem Loans Levels 6/30/24 to 9/30/24 Criticized Classified Nonaccrual (0.1%) 0.1% 0.3% 0.5% 0.7% 0.9% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 CRE Non-Performing Asset and Charge-offs Levels Net Charge-off Rate (quarterly annualized) Nonaccrual Rate 30+ Days Past Due 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% <=40% 41-50% 51-60% 61-70% 71-80% 81-90% 91-100% 100%+ Classified CRE LTVs Appraised vs. Index Adjusted Index Adjusted Most Recent Appraisal

CAPITAL STRENGTH 17 Loss-absorbing capital remains strong relative to our risk profile; low credit losses relative to CET1 + ACL Net Charge-offs annualized, as a percentage of risk-weighted assets 0. 01 % 0. 04 % 0. 06 % 0. 16 % (0 .0 2% ) 0. 00 % 0. 08 % 0. 08 % 0. 05 % 0. 04 % 0. 09 % 0. 02 % (4%) (2%) 0% 2% 4% 6% 8% 10% 12% 14% 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 Common Equity Tier 1 Capital and Allowance for Credit Losses as a percentage of risk-weighted assets 10 .2 % 10 .0 % 9. 9% 9. 6% 9. 8% 9. 9% 10 .0 % 10 .2 % 10 .3 % 10 .4 % 10 .6 % 10 .7 % 11 .1 % 10 .9 % 10 .7 % 10 .5 % 10 .7 % 11 .0 % 11 .1 % 11 .3 % 11 .3 % 11 .5 % 11 .6 % 11 .8 % 0% 2% 4% 6% 8% 10% 12% 14% 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 Common Equity Tier 1 ACL / Risk-weighted Assets

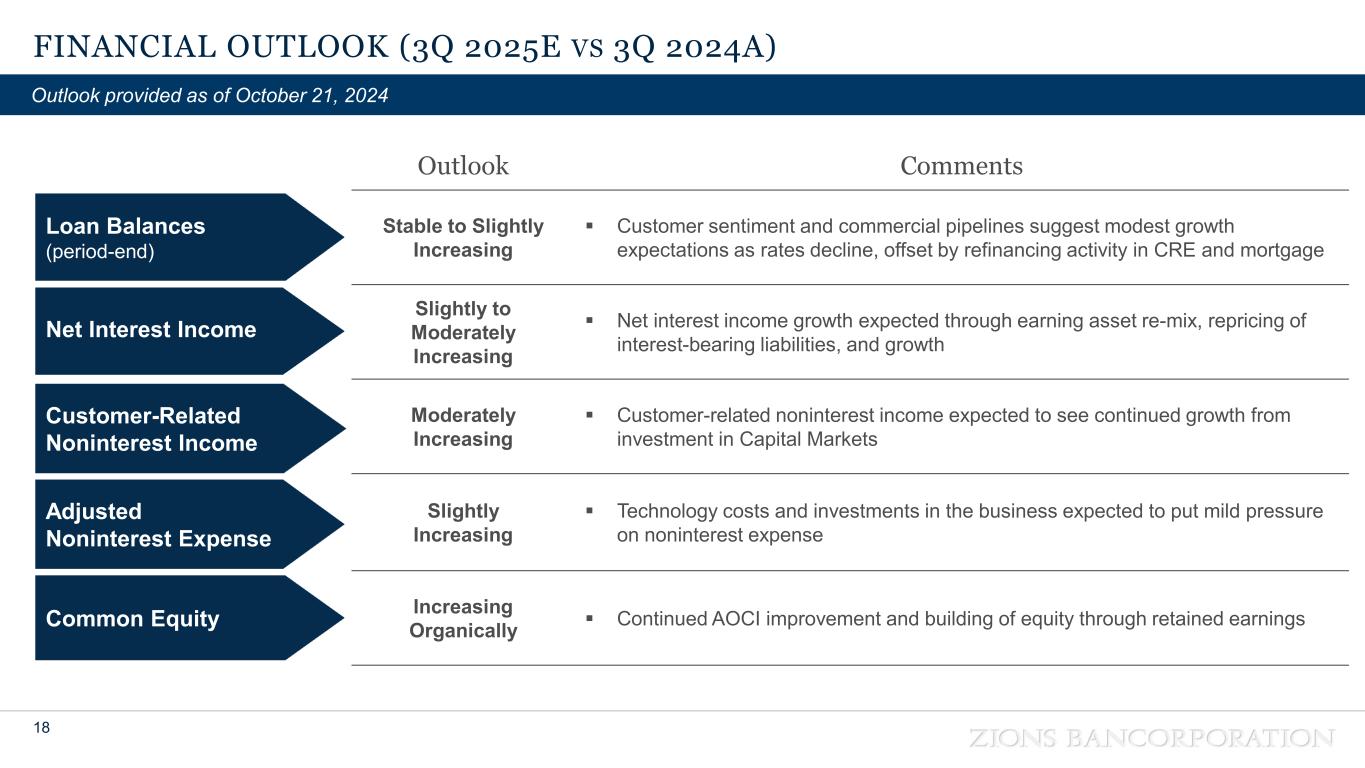

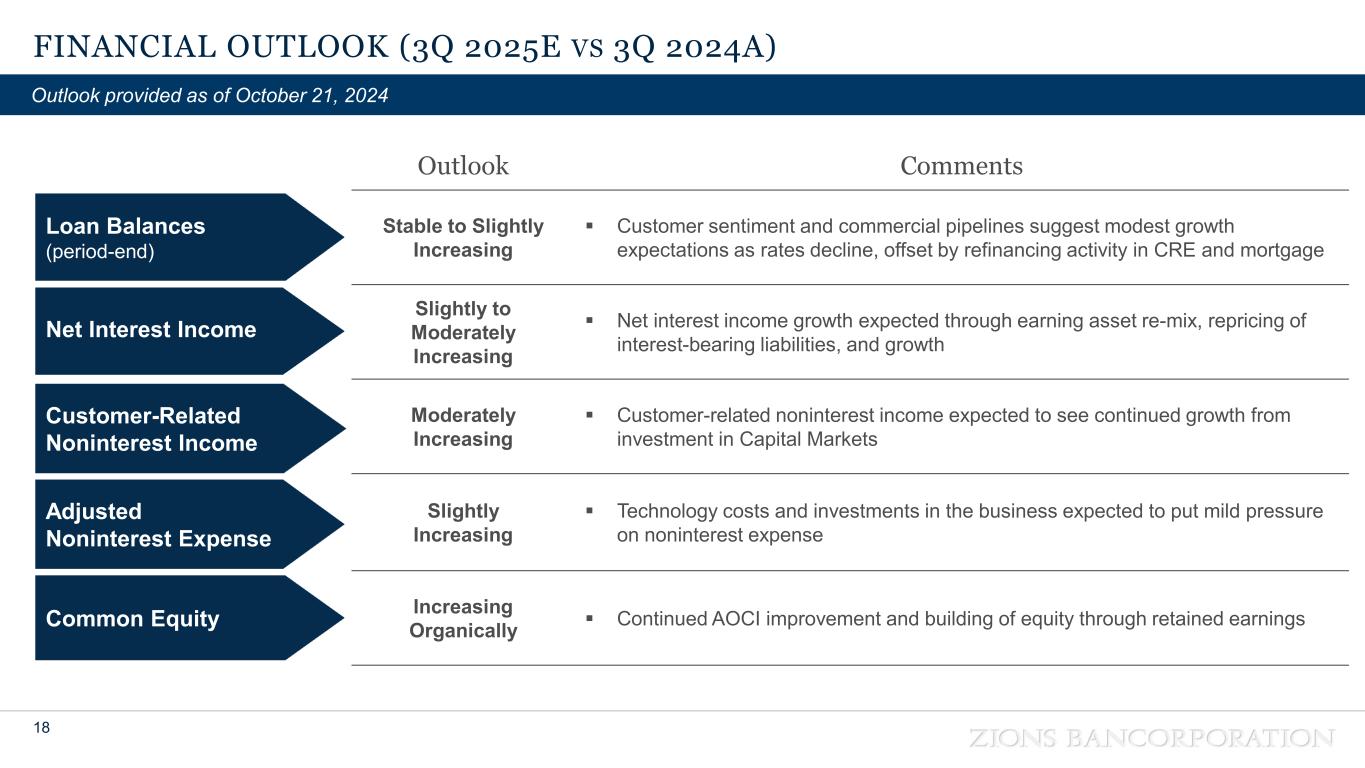

FINANCIAL OUTLOOK (3Q 2025E VS 3Q 2024A) 18 Outlook provided as of October 21, 2024 Outlook Comments Stable to Slightly Increasing Customer sentiment and commercial pipelines suggest modest growth expectations as rates decline, offset by refinancing activity in CRE and mortgage Slightly to Moderately Increasing Net interest income growth expected through earning asset re-mix, repricing of interest-bearing liabilities, and growth Moderately Increasing Customer-related noninterest income expected to see continued growth from investment in Capital Markets Slightly Increasing Technology costs and investments in the business expected to put mild pressure on noninterest expense Increasing Organically Continued AOCI improvement and building of equity through retained earnings Customer-Related Noninterest Income Loan Balances (period-end) Net Interest Income Common Equity Adjusted Noninterest Expense

ZIONS BANCORPORATION DRIVES VALUE FOR ITS STAKEHOLDERS 19 We are determined to help build strong, successful communities, create economic opportunity and help our clients achieve greater financial strength through the relationships we develop and the services we provide. Distinctive Local Operating Model Managing Risk Delivering Value to Our Stakeholders • Transformation of our core systems to a modern, real-time architecture improving banker productivity and customer experience • New digital products and services streamlining our customer interactions • Returning capital to shareholders • Focus on serving small- to medium-sized businesses, resulting in a granular deposit franchise and a long-term funding advantage • Local decision making and empowered bankers support strong customer relationships • Ranked third among all U.S. banks in overall 2023 Greenwich Excellence Awards • Have built and maintained a robust risk management team and framework since the global financial crisis • Net credit losses to loan ratio that is consistently in the top quartile of peer banks • Empower every employee to be accountable for assessing and managing risk Across 11 western states, our footprint includes some of the strongest markets in the country reflected in the quality and diversity of our portfolio • These states create 35% of national GDP • Population and job growth outpace national average Strong Geographic Footprint

APPENDIX 20 • Financial Results Summary • Accumulated Other Comprehensive Income (AOCI) • Balance Sheet Profitability • Loan Growth by Type • Allowance and Credit Metrics • Earning Asset Repricing • Interest Rate Swaps • Interest Rate Sensitivity – Parallel Shock Analysis • Loan Loss Severity (NCOs as a percentage of nonaccrual loans) • Credit Metrics: Commercial Real Estate • Coalition Greenwich Customer Satisfaction • Non-GAAP Financial Measures

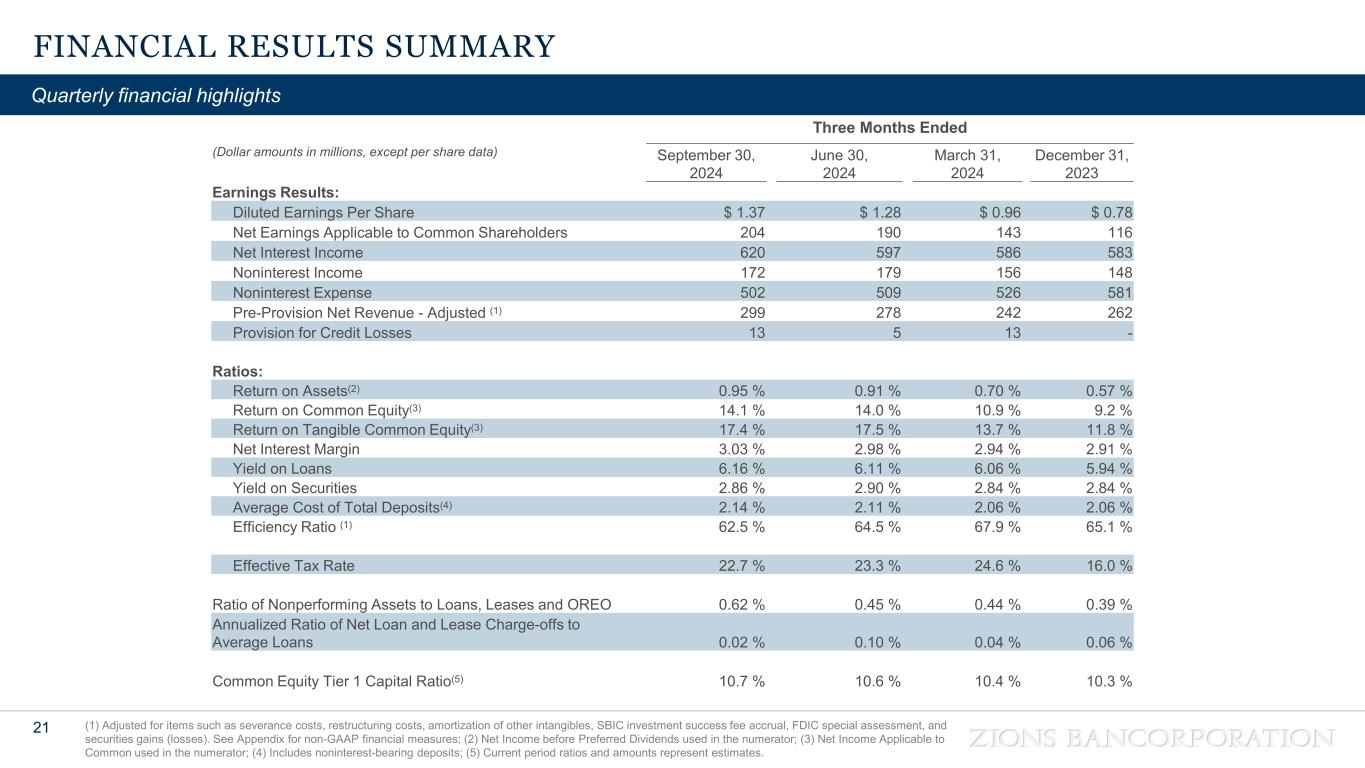

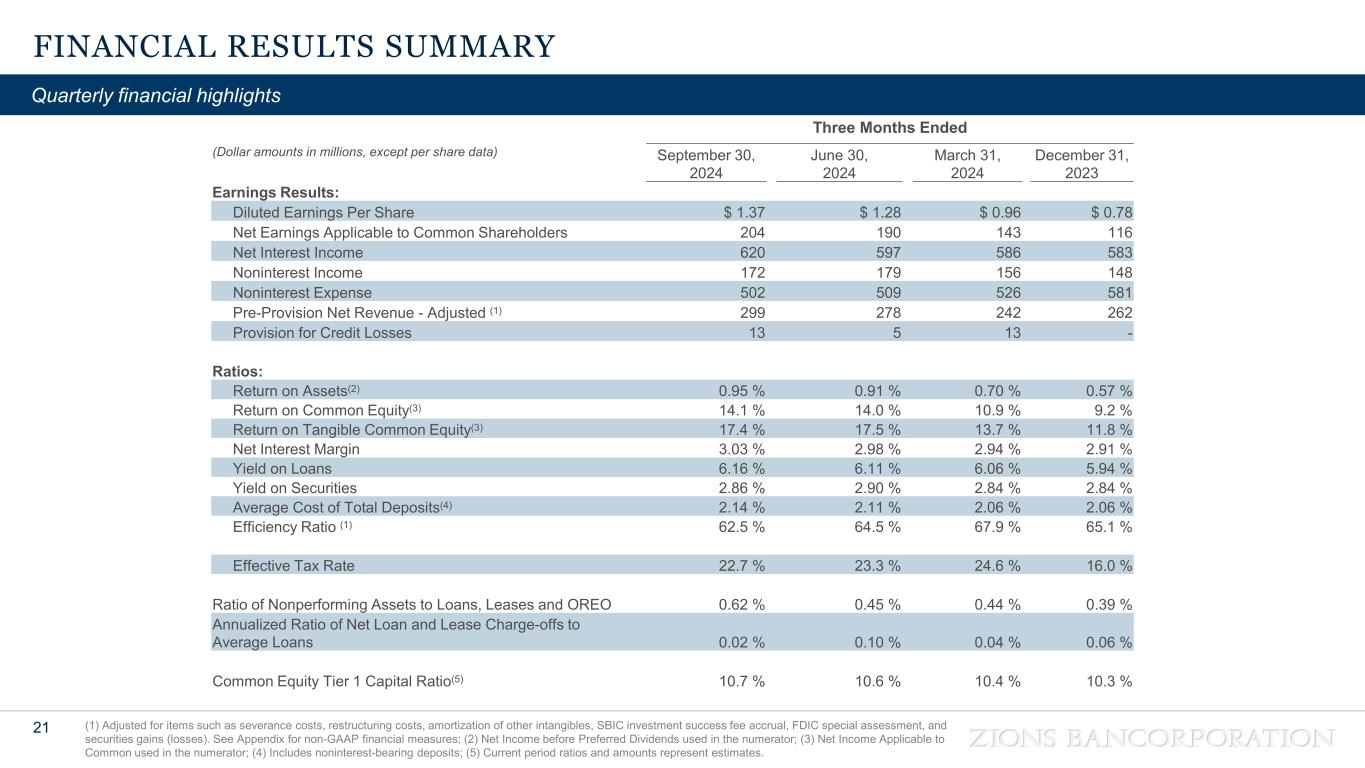

FINANCIAL RESULTS SUMMARY 21 (1) Adjusted for items such as severance costs, restructuring costs, amortization of other intangibles, SBIC investment success fee accrual, FDIC special assessment, and securities gains (losses). See Appendix for non-GAAP financial measures; (2) Net Income before Preferred Dividends used in the numerator; (3) Net Income Applicable to Common used in the numerator; (4) Includes noninterest-bearing deposits; (5) Current period ratios and amounts represent estimates. Quarterly financial highlights Three Months Ended (Dollar amounts in millions, except per share data) September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Earnings Results: Diluted Earnings Per Share $ 1.37 $ 1.28 $ 0.96 $ 0.78 Net Earnings Applicable to Common Shareholders 204 190 143 116 Net Interest Income 620 597 586 583 Noninterest Income 172 179 156 148 Noninterest Expense 502 509 526 581 Pre-Provision Net Revenue - Adjusted (1) 299 278 242 262 Provision for Credit Losses 13 5 13 - Ratios: Return on Assets(2) 0.95 % 0.91 % 0.70 % 0.57 % Return on Common Equity(3) 14.1 % 14.0 % 10.9 % 9.2 % Return on Tangible Common Equity(3) 17.4 % 17.5 % 13.7 % 11.8 % Net Interest Margin 3.03 % 2.98 % 2.94 % 2.91 % Yield on Loans 6.16 % 6.11 % 6.06 % 5.94 % Yield on Securities 2.86 % 2.90 % 2.84 % 2.84 % Average Cost of Total Deposits(4) 2.14 % 2.11 % 2.06 % 2.06 % Efficiency Ratio (1) 62.5 % 64.5 % 67.9 % 65.1 % Effective Tax Rate 22.7 % 23.3 % 24.6 % 16.0 % Ratio of Nonperforming Assets to Loans, Leases and OREO 0.62 % 0.45 % 0.44 % 0.39 % Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.02 % 0.10 % 0.04 % 0.06 % Common Equity Tier 1 Capital Ratio(5) 10.7 % 10.6 % 10.4 % 10.3 %

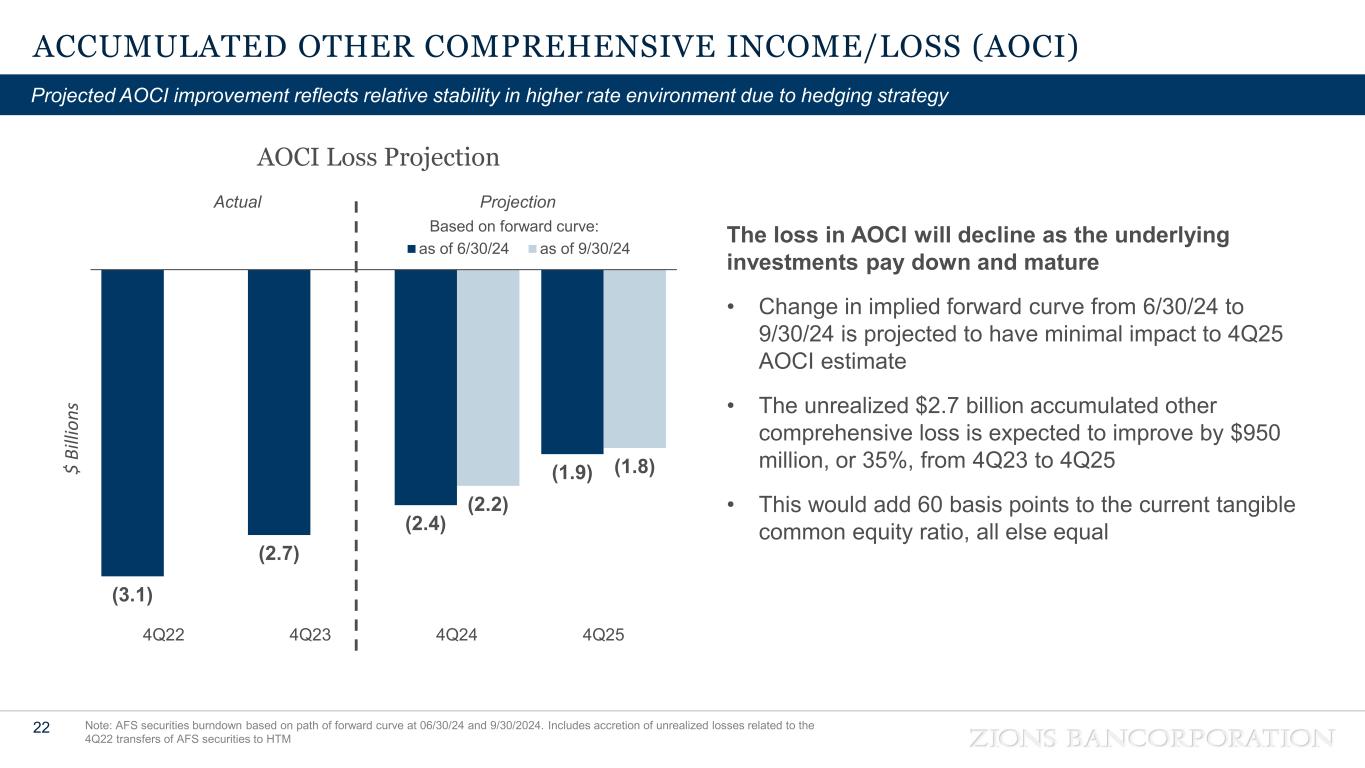

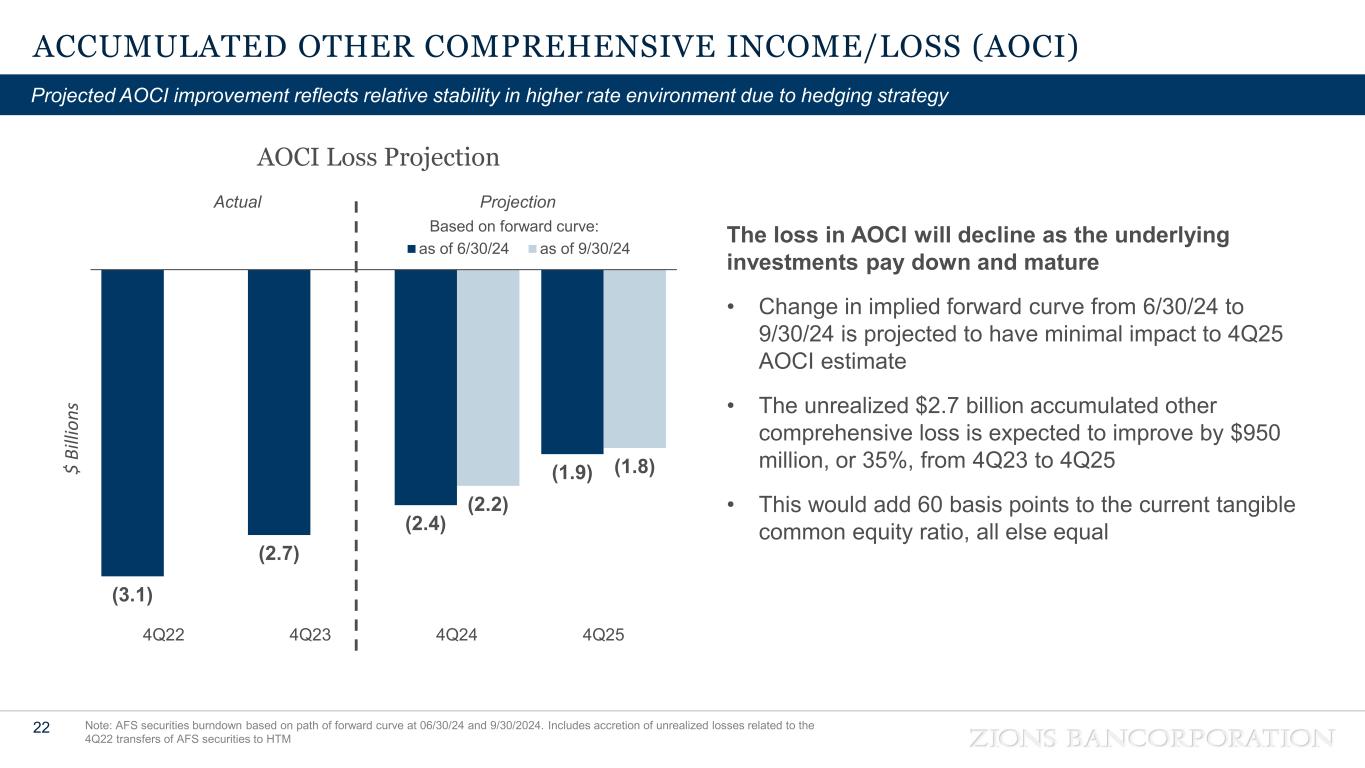

(3.1) (2.7) (2.4) (1.9) (2.2) (1.8) 4Q22 4Q23 4Q24 4Q25 as of 6/30/24 as of 9/30/24 ACCUMULATED OTHER COMPREHENSIVE INCOME/LOSS (AOCI) 22 Note: AFS securities burndown based on path of forward curve at 06/30/24 and 9/30/2024. Includes accretion of unrealized losses related to the 4Q22 transfers of AFS securities to HTM Projected AOCI improvement reflects relative stability in higher rate environment due to hedging strategy The loss in AOCI will decline as the underlying investments pay down and mature • Change in implied forward curve from 6/30/24 to 9/30/24 is projected to have minimal impact to 4Q25 AOCI estimate • The unrealized $2.7 billion accumulated other comprehensive loss is expected to improve by $950 million, or 35%, from 4Q23 to 4Q25 • This would add 60 basis points to the current tangible common equity ratio, all else equal $ Bi lli on s AOCI Loss Projection Actual Projection Based on forward curve:

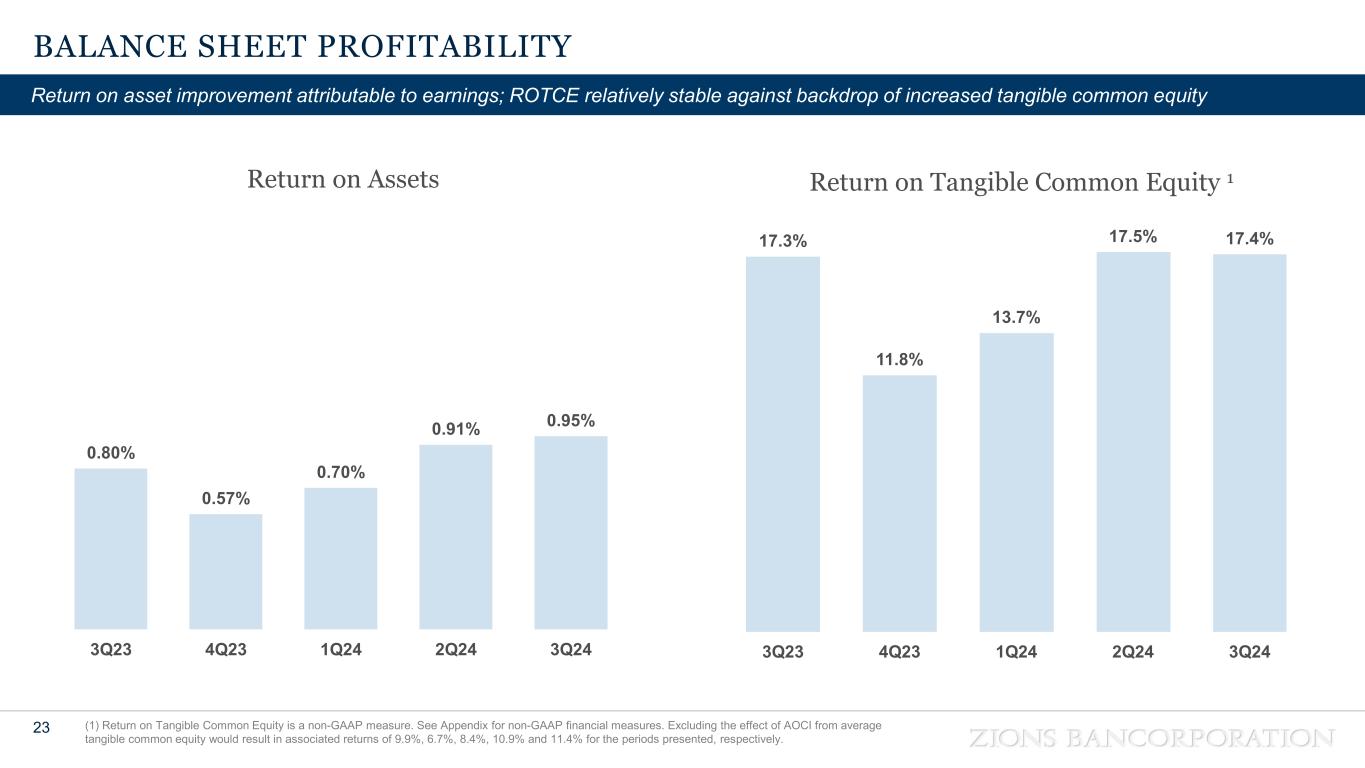

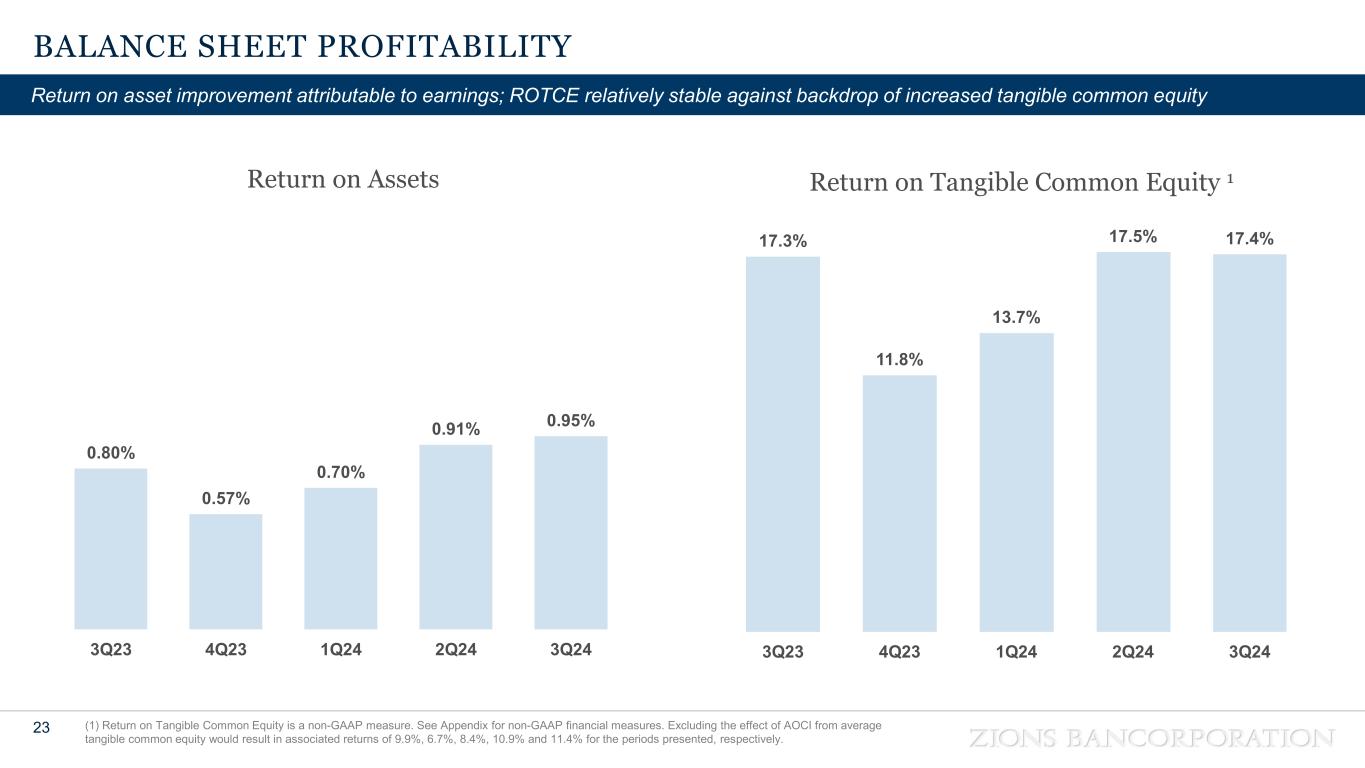

BALANCE SHEET PROFITABILITY 23 (1) Return on Tangible Common Equity is a non-GAAP measure. See Appendix for non-GAAP financial measures. Excluding the effect of AOCI from average tangible common equity would result in associated returns of 9.9%, 6.7%, 8.4%, 10.9% and 11.4% for the periods presented, respectively. Return on asset improvement attributable to earnings; ROTCE relatively stable against backdrop of increased tangible common equity 0.80% 0.57% 0.70% 0.91% 0.95% 3Q23 4Q23 1Q24 2Q24 3Q24 17.3% 11.8% 13.7% 17.5% 17.4% 3Q23 4Q23 1Q24 2Q24 3Q24 Return on Assets Return on Tangible Common Equity 1

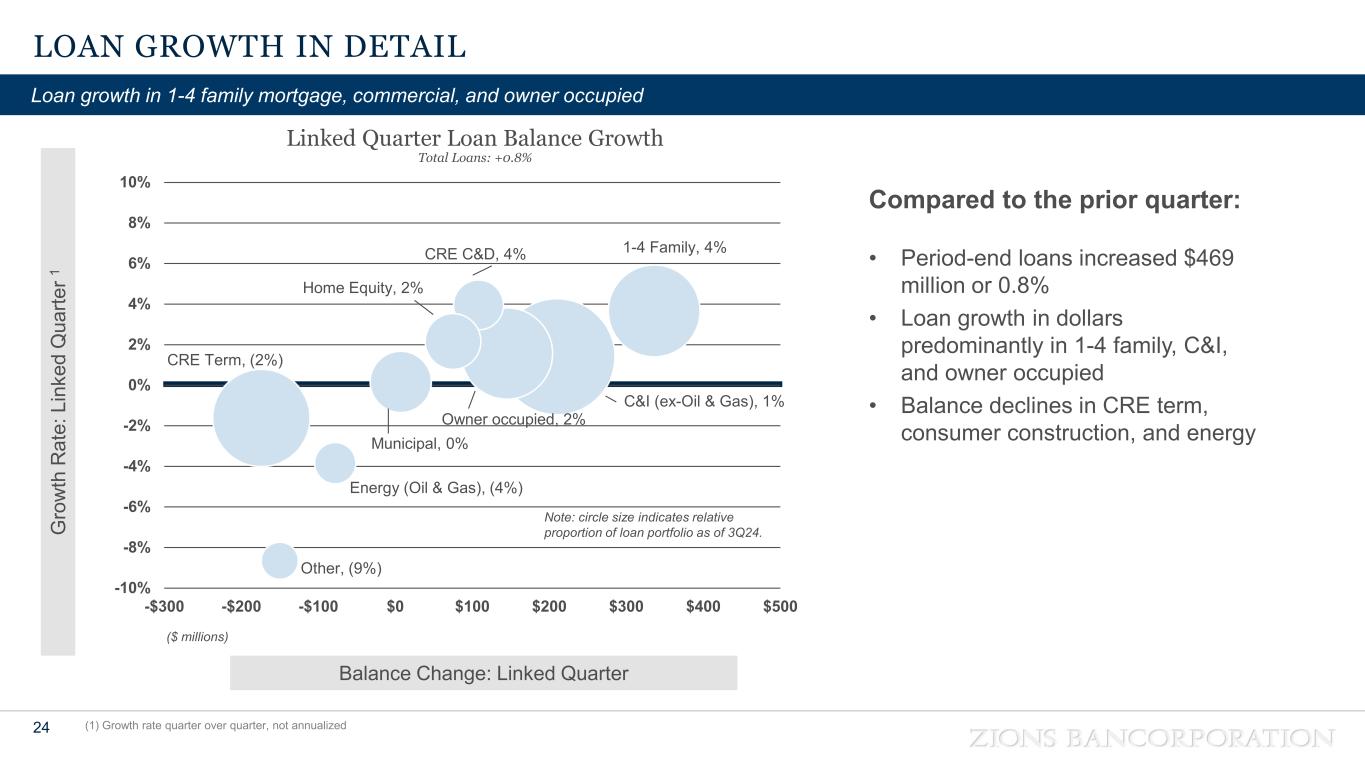

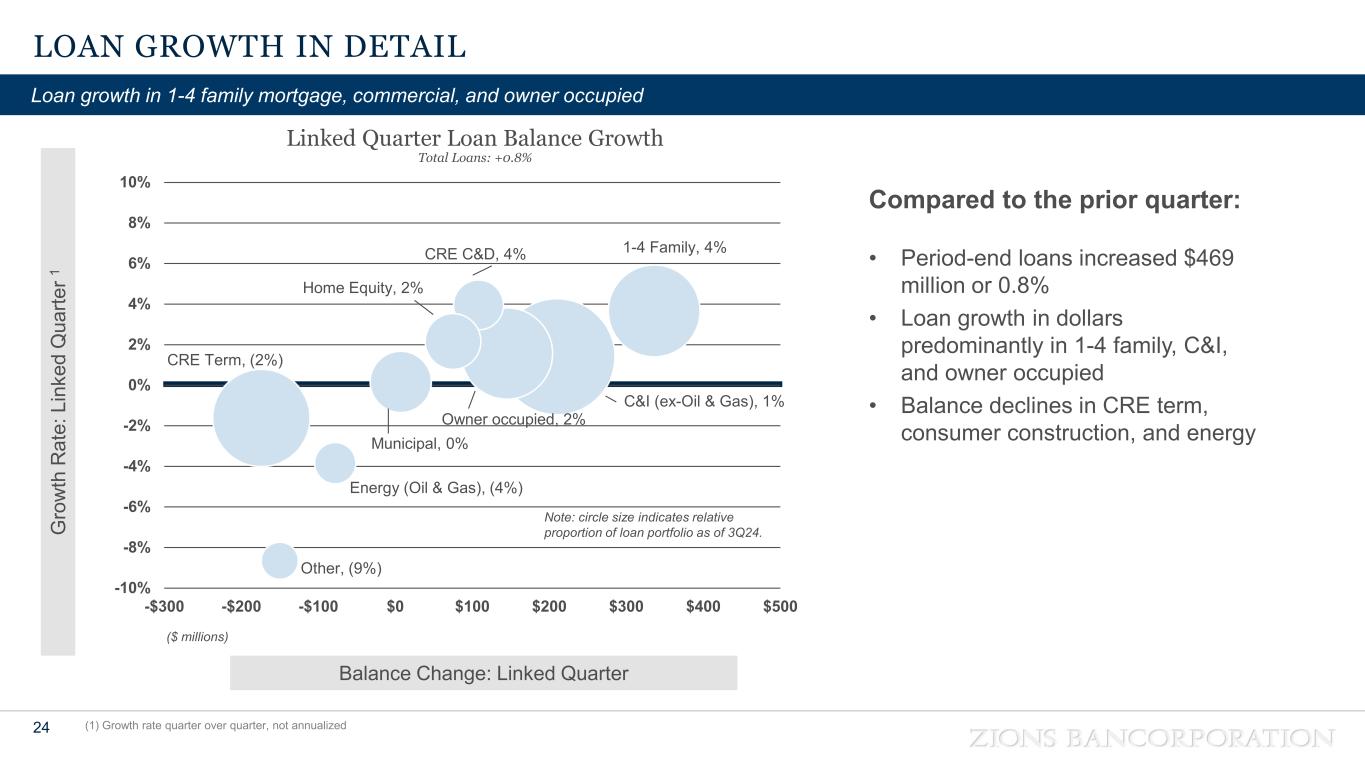

LOAN GROWTH IN DETAIL 24 (1) Growth rate quarter over quarter, not annualized Loan growth in 1-4 family mortgage, commercial, and owner occupied Compared to the prior quarter: • Period-end loans increased $469 million or 0.8% • Loan growth in dollars predominantly in 1-4 family, C&I, and owner occupied • Balance declines in CRE term, consumer construction, and energy Linked Quarter Loan Balance Growth Total Loans: +0.8% G ro w th R at e: L in ke d Q ua rte r 1 Balance Change: Linked Quarter C&I (ex-Oil & Gas), 1% Owner occupied, 2% CRE C&D, 4% CRE Term, (2%) Home Equity, 2% 1-4 Family, 4% Energy (Oil & Gas), (4%) Municipal, 0% Other, (9%) -10% -8% -6% -4% -2% 0% 2% 4% 6% 8% 10% -$300 -$200 -$100 $0 $100 $200 $300 $400 $500 Note: circle size indicates relative proportion of loan portfolio as of 3Q24. ($ millions)

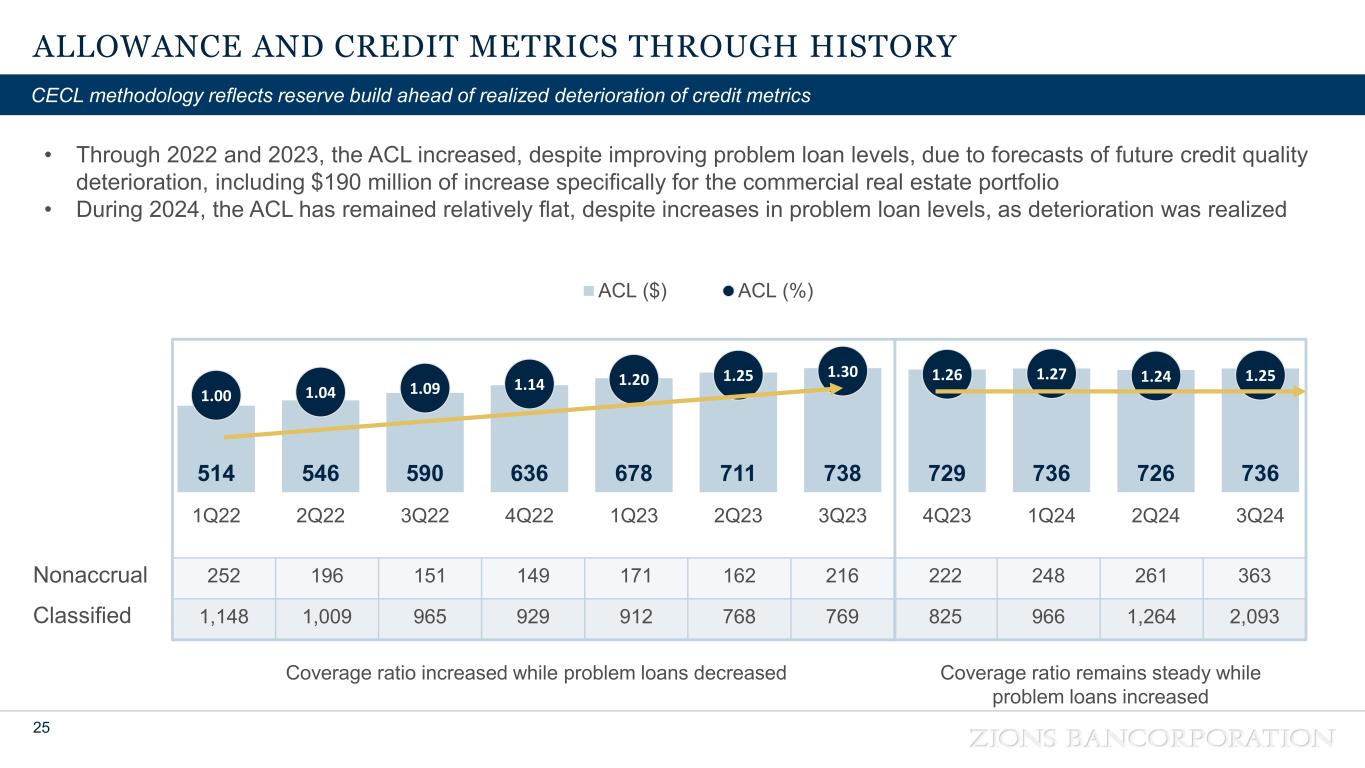

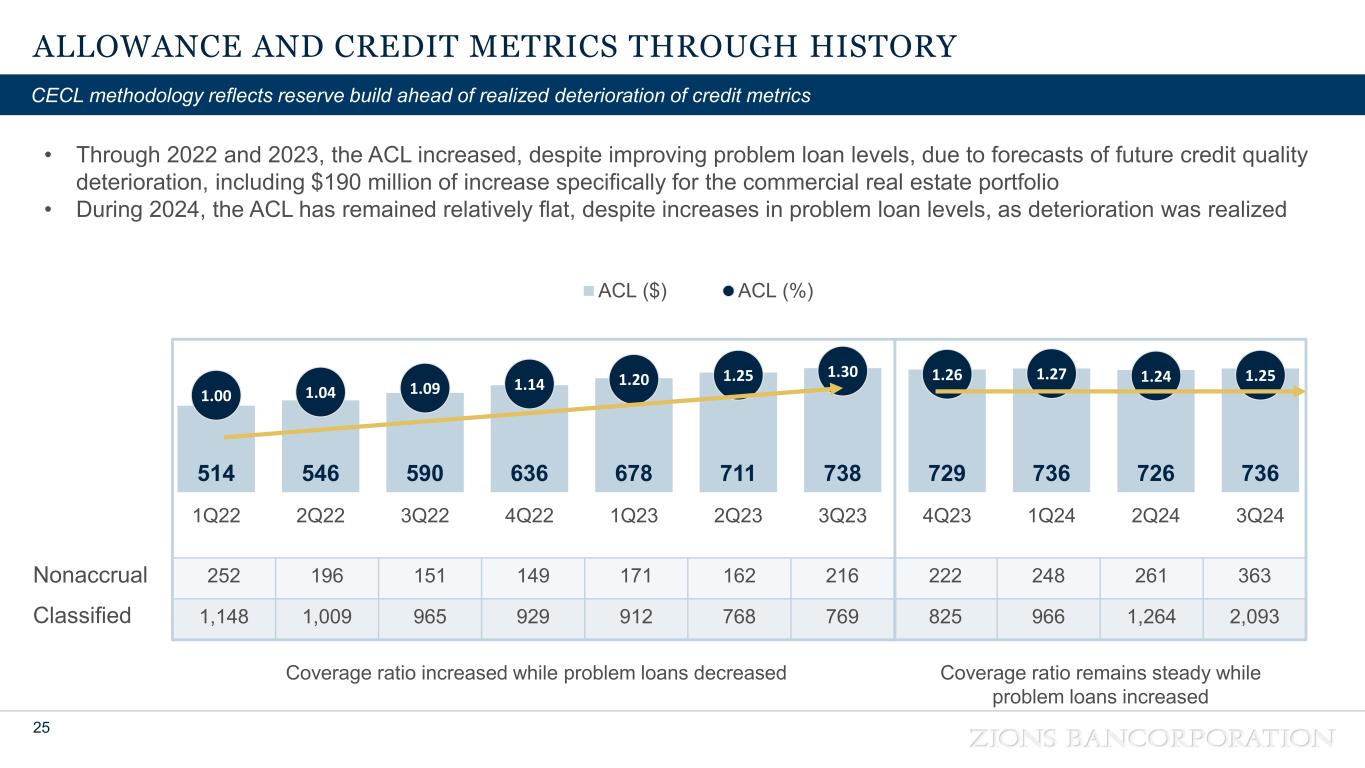

ALLOWANCE AND CREDIT METRICS THROUGH HISTORY 25 CECL methodology reflects reserve build ahead of realized deterioration of credit metrics 514 546 590 636 678 711 738 729 736 726 736 1.00 1.04 1.09 1.14 1.20 1.25 1.30 1.26 1.27 1.24 1.25 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 ACL ($) ACL (%) • Through 2022 and 2023, the ACL increased, despite improving problem loan levels, due to forecasts of future credit quality deterioration, including $190 million of increase specifically for the commercial real estate portfolio • During 2024, the ACL has remained relatively flat, despite increases in problem loan levels, as deterioration was realized 252 196 151 149 171 162 216 222 248 261 363 1,148 1,009 965 929 912 768 769 825 966 1,264 2,093 Nonaccrual Classified Coverage ratio remains steady while problem loans increased Coverage ratio increased while problem loans decreased

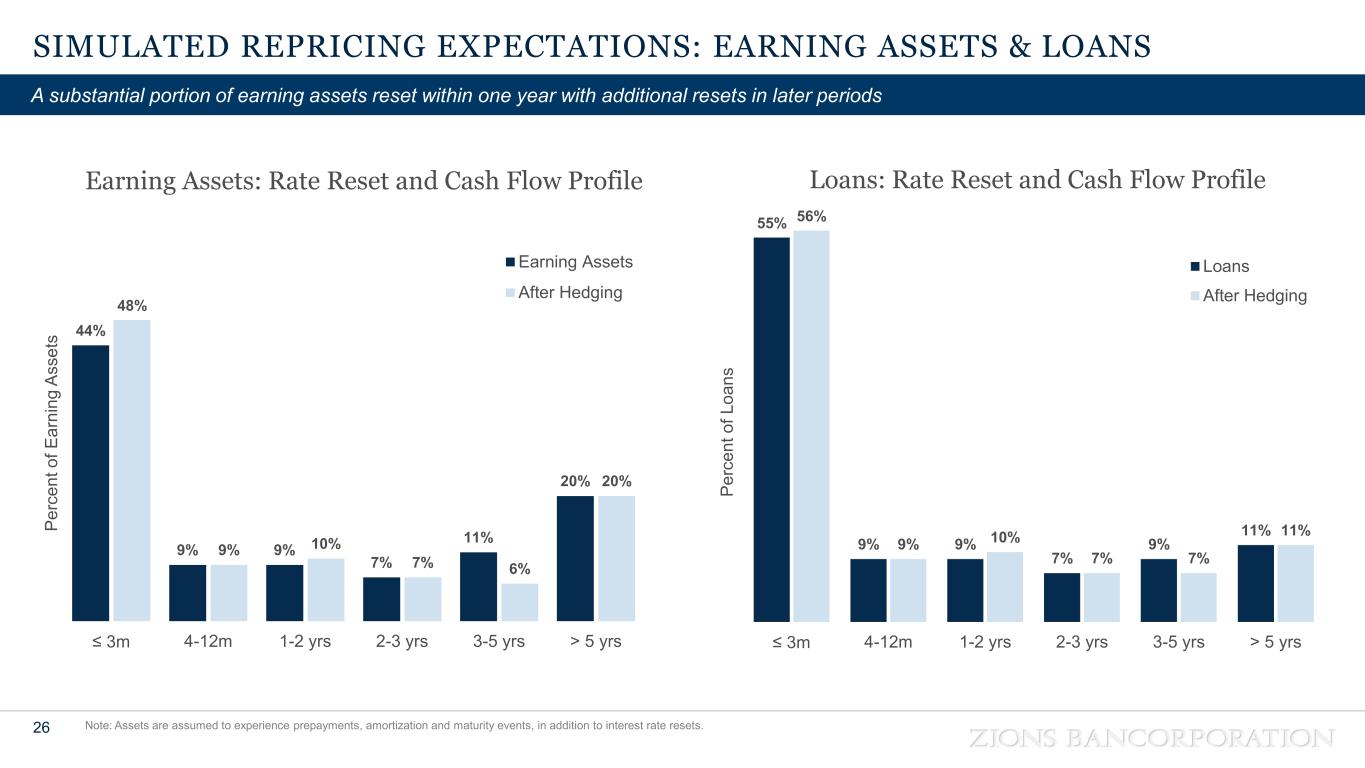

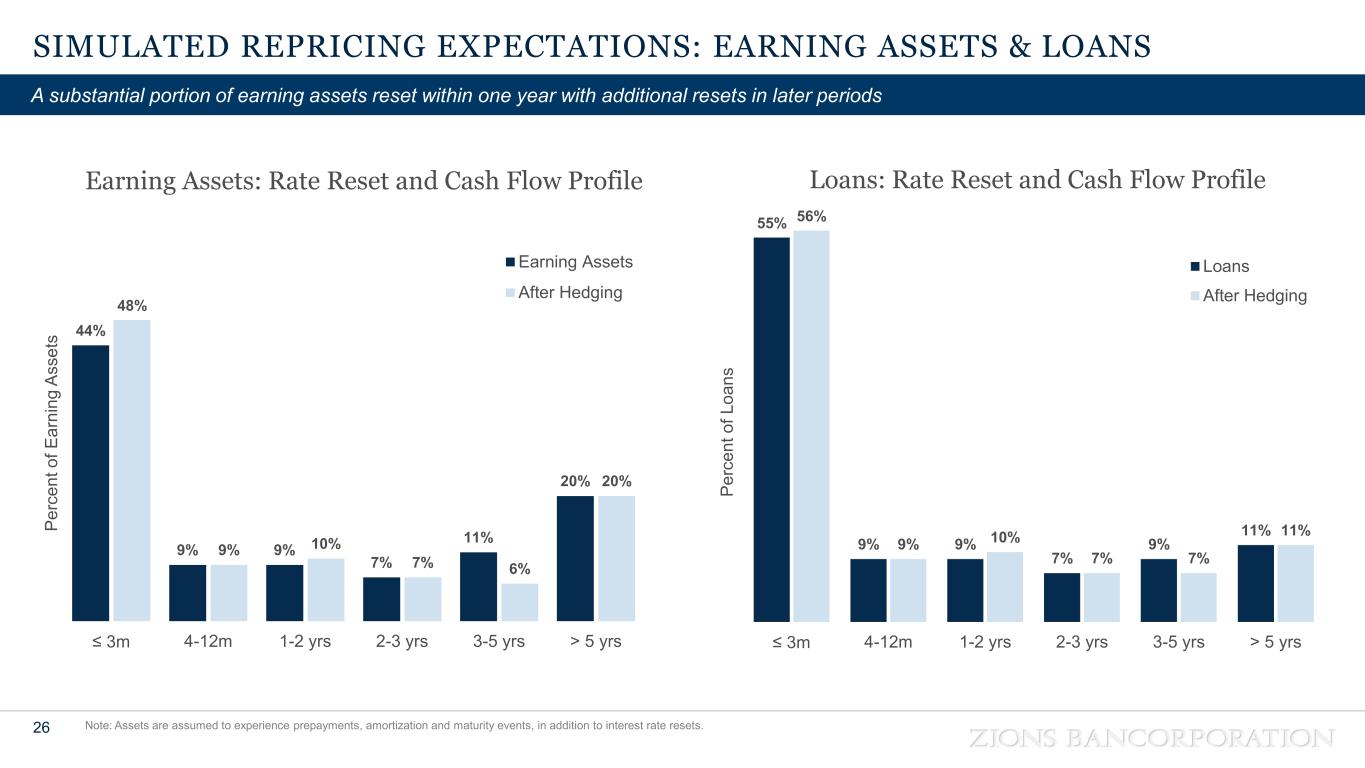

SIMULATED REPRICING EXPECTATIONS: EARNING ASSETS & LOANS 26 Note: Assets are assumed to experience prepayments, amortization and maturity events, in addition to interest rate resets. A substantial portion of earning assets reset within one year with additional resets in later periods 55% 9% 9% 7% 9% 11% 56% 9% 10% 7% 7% 11% ≤ 3m 4-12m 1-2 yrs 2-3 yrs 3-5 yrs > 5 yrs Pe rc en t o f L oa ns Loans: Rate Reset and Cash Flow Profile Loans After Hedging 44% 9% 9% 7% 11% 20% 48% 9% 10% 7% 6% 20% ≤ 3m 4-12m 1-2 yrs 2-3 yrs 3-5 yrs > 5 yrs Pe rc en t o f E ar ni ng A ss et s Earning Assets After Hedging Earning Assets: Rate Reset and Cash Flow Profile

INTEREST RATE SWAPS AT SEPTEMBER 30, 2024 27 (1) Cash flow hedges consist of receive-fixed swaps hedging pools of floating rate loans. Swaps are used to balance our interest rate sensitivity Outstanding Notional Weighted Average Fixed Rate Received Weighted Average Maturity 2Q23 $2,850 2.40% 7/24 3Q23 $2,550 2.37% 8/24 4Q23 $1,450 2.66% 9/24 1Q24 $850 2.53% 3/25 2Q24 $550 2.56% 9/25 3Q24 $350 2.34% 4/26 Received-Fixed Rate Loan & Long-Term Debt Cash Flow Hedges1 (pay floating rate) Outstanding Notional Weighted Average Fixed Rate Paid Weighted Average Maturity 2Q23 $4,072 3.13% 10/30 3Q23 $5,072 3.27% 4/30 4Q23 $5,071 3.27% 4/30 1Q24 $5,070 3.27% 4/30 2Q24 $5,069 3.27% 4/30 3Q24 $5,068 3.27% 4/30 Pay-Fixed Rate Securities Portfolio Fair Value Hedges / Fixed Rate Loan Hedges / Short-Term Debt Hedges (receive floating rate) Interest rate sensitivity is managed in part with portfolio interest rate hedges1 • In 3Q24, $200 million in receive-fixed swaps matured with an average fixed rate of 2.96%

INTEREST RATE SENSITIVITY – PARALLEL RATE SHOCKS 28 (1) 12-month forward simulated impact of an instantaneous and parallel change in interest rates and assumes no change in the size or composition of the earning assets excluding derivative hedge activity but does assume a change in composition of deposits (a lesser proportion of noninterest-bearing relative to total deposits). Standard parallel rate shocks suggest asset sensitivity (5%) (3%) 3% 6% (6%) (3%) 3% 5% −200 bps −100 bps +100 bps +200 bps Simulated Net Interest Income Sensitivity 1 as of 6/30/2024 as of 9/30/2024

LOAN LOSS SEVERITY 29 Source: S&P Global. Calculated using the average of annualized quarterly results. When problems arise, Zions generally experiences less severe loan losses due to strong collateral and underwriting practices 8% 15 % 18 % 20 % 23 % 23 % 26 % 29 % 36 % 38 % 48 % 49 % 52 % 57 % 58 % 59 % 61 % 73 % W AL M TB ZI O N C AD E FH N BO KF C M A W BS EW BC W TF C KE Y C FG H BA N FI TB SN V R F C FR PN FP C O LB Annualized NCOs / Nonaccrual Loans Five Year Average (2019Q3 – 2024Q2) Annualized NCOs / Nonaccrual Loans Fifteen Year Average (2009Q3 – 2024Q2) 17 % 19 % 20 % 21 % 23 % 28 % 28 % 32 % 40 % 42 % 46 % 48 % 49 % 52 % 52 % 53 % 56 % 67 % BO KF M TB W AL ZI O N C AD E FH N C M A W BS C FG C FR W TF C KE Y EW BC PN FP R F H BA N SN V FI TB C O LB >1 00 % >1 00 %

IN-DEPTH REVIEW: COMMERCIAL REAL ESTATE 30 Data is updated through 3Q24. LTV calculations in the “Appraised Value” distribution to reflect most current appraisal in denominator and outstanding balance in the numerator. The Indexed Adjusted values are adjusted based on the MSA level REIS Commercial Property Price Indices and adjusted from the date of most current appraisal. . Limited tail loan-to-value risk in portfolio; controlled CRE growth Term WAVG LTV % of CRE Term % of CRE Construction Multifamily 57% 26% 52% Industrial / Warehouse 52% 24% 23% Office 56% 16% 5% Retail 47% 14% 5% Hospitality 45% 6% 2% Zions has modest “tail risk” in its CRE portfolio Total CRE Portfolio Trends Total CRE Problem Loan Trends as a percentage of total loans 0% 5% 10% 15% 20% 25% 30% 35% 40% <=40% 41-50% 51-60% 61-70% 71-80% 81-90% 91-100% 100%+ Term CRE LTVs Appraised vs. Indexed Most Current Appraisal Index Adjusted 0% 2% 4% 6% 8% 10% 12% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Criticized % Classified % Nonaccrual % TTM GCO Rate 2.6 2.7 2.7 2.7 2.8 10.6 10.7 10.9 10.8 10.7 3Q23 4Q24 1Q24 2Q24 3Q24 Construction Balances Term Balances

DISCIPLINED COMMERCIAL REAL ESTATE GROWTH 31 Data as of June 30, 2024; peer growth rates are normalized for significant acquisitions Commercial real estate loan growth lags peers due to continued exercise of concentration risk discipline Zions has exercised caution in CRE concentrations for more than a decade and in underwriting standards for many decades. • Key factors for consideration in credit risk within CRE • Measured and disciplined growth compared to peers • Significant borrower equity – conservative LTVs • Disciplined underwriting on debt service coverage • Diversified by geography and asset class • Limited exposure to land 0 50 100 150 200 250 300 350 1Q 15 1Q 16 1Q 17 1Q 18 1Q 19 1Q 20 1Q 21 1Q 22 1Q 23 2Q 24 ZION Peer Top Quartile Peer Bottom Quartile Indexed: 1Q15 = 100 Commercial Real Estate Excluding Owner Occupied

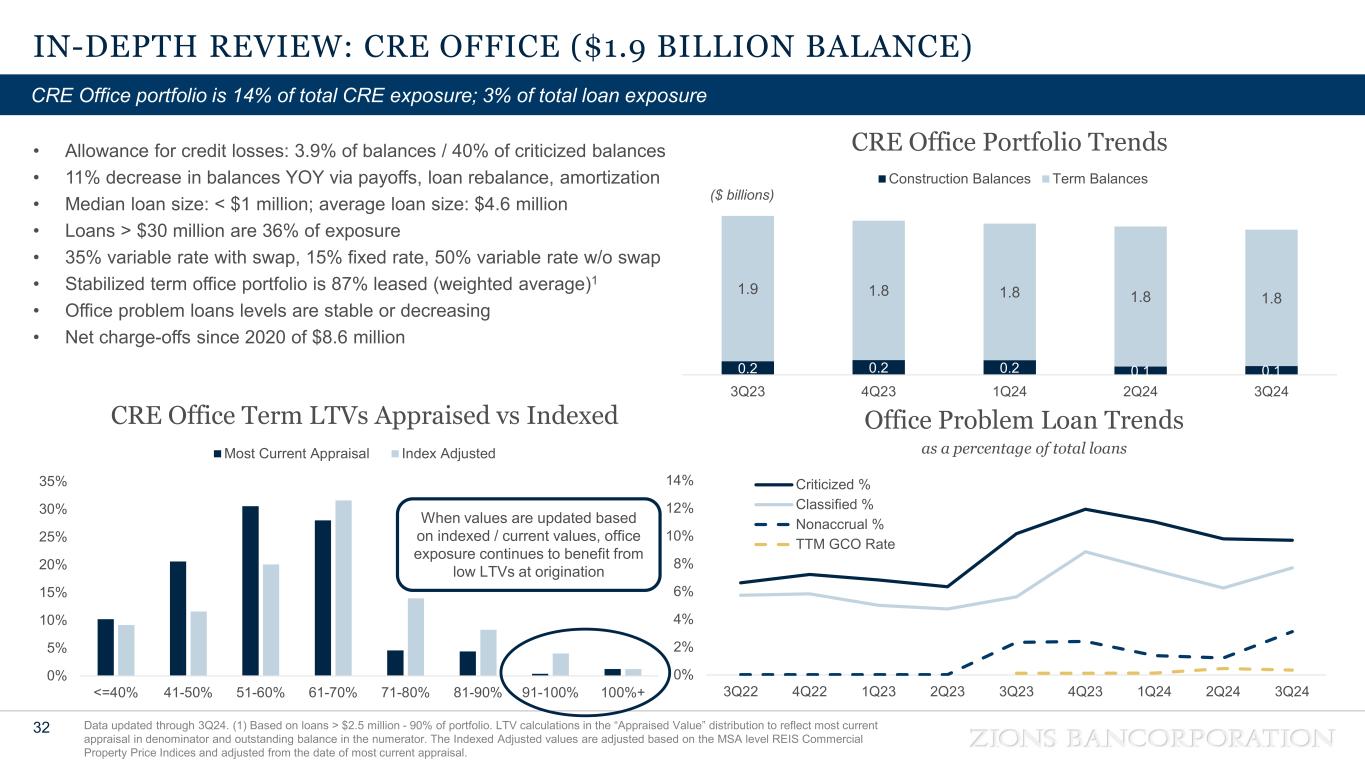

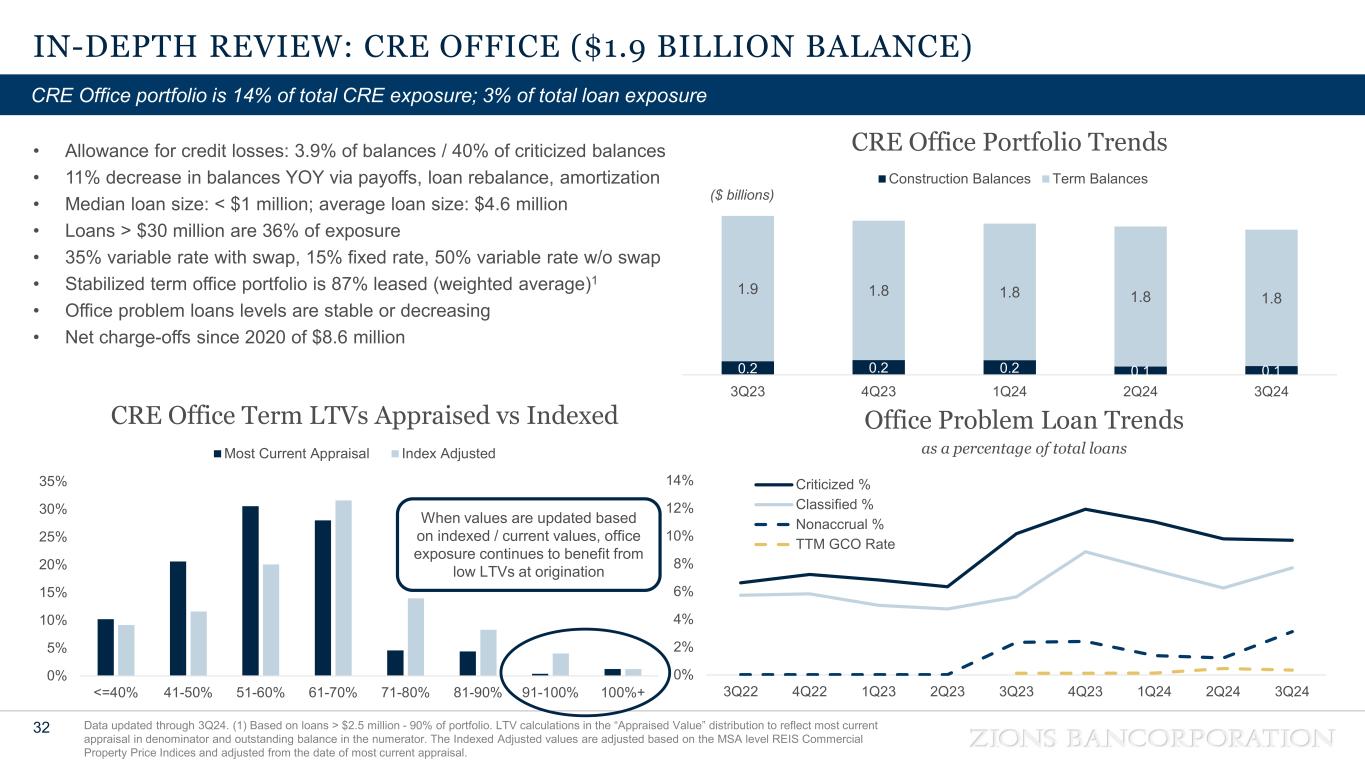

0% 5% 10% 15% 20% 25% 30% 35% <=40% 41-50% 51-60% 61-70% 71-80% 81-90% 91-100% 100%+ Most Current Appraisal Index Adjusted IN-DEPTH REVIEW: CRE OFFICE ($1.9 BILLION BALANCE) 32 Data updated through 3Q24. (1) Based on loans > $2.5 million - 90% of portfolio. LTV calculations in the “Appraised Value” distribution to reflect most current appraisal in denominator and outstanding balance in the numerator. The Indexed Adjusted values are adjusted based on the MSA level REIS Commercial Property Price Indices and adjusted from the date of most current appraisal. CRE Office portfolio is 14% of total CRE exposure; 3% of total loan exposure • Allowance for credit losses: 3.9% of balances / 40% of criticized balances • 11% decrease in balances YOY via payoffs, loan rebalance, amortization • Median loan size: < $1 million; average loan size: $4.6 million • Loans > $30 million are 36% of exposure • 35% variable rate with swap, 15% fixed rate, 50% variable rate w/o swap • Stabilized term office portfolio is 87% leased (weighted average)1 • Office problem loans levels are stable or decreasing • Net charge-offs since 2020 of $8.6 million Office Problem Loan Trends as a percentage of total loans ($ billions) CRE Office Portfolio Trends When values are updated based on indexed / current values, office exposure continues to benefit from low LTVs at origination CRE Office Term LTVs Appraised vs Indexed 0.2 0.2 0.2 0.1 0.1 1.9 1.8 1.8 1.8 1.8 3Q23 4Q23 1Q24 2Q24 3Q24 Construction Balances Term Balances 0% 2% 4% 6% 8% 10% 12% 14% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Criticized % Classified % Nonaccrual % TTM GCO Rate

- 100 200 300 400 500 600 700 800 <50 50-100 100-200 200-300 300-400 400-500 500+ Square Footage (in Thousands) Single / Multi Tenancy by Office Collateral Size Multi Tenant Single Tenant IN-DEPTH REVIEW: CRE OFFICE ($1.9 BILLION BALANCE) 33 Data is updated through 3Q24. (1) Portfolio metrics based on loans > $2.5 million – 90% of portfolio. Zions office collateral is diversified geographically, has limited exposure to CBD offices, and majority of building sizes < 200 thousand sq ft Office Collateral Summary • Largest state exposure (in millions): Utah $435 (SLC $210, Provo $145); CA $381 (So. Cal $215, No. Cal $132); WA $305, AZ $274 • Largest MSA exposure (in millions): Seattle $262, Phoenix $235, SLC $210 • 70% suburban, 30% central business district1 • 1/3 of portfolio is credit tenant leased1 • 70% Multi-tenant Office, 30% Single Tenant1 • Over 80% of single tenant buildings are leased to credit tenants • Collateral size: 65% of exposure secured by buildings < 200 thousand sq ft CRE Term Office by Maturity ($ millions) ($ millions) 168 698 241 234 77 449 2024 2025 2026 2027 2028 2029+ 17% 49% 35% 35% 3% 48% 20% 13% 83% 51% 65% 65% 97% 52% 80% 87% $58.3 $79.5 $88.7 $211.4 $274.0 $305.4 $381.0 $435.4 CO ID NV TX AZ WA CA UT CRE Office By State, CBD / Suburban ($MM) CBD Suburban

0% 10% 20% 30% 40% 50% <=40% 41-50% 51-60% 61-70% 71-80% 81-90% 91-100% 100%+ CRE Multifamily Term LTVs Appraised vs. Indexed Most Current Appraisal Index Adjusted IN-DEPTH REVIEW: CRE MULTIFAMILY ($3.9 BILLION BALANCE) 34 Data is updated through 3Q24. LTV calculations in the “Appraised Value” distribution to reflect most current appraisal in denominator and outstanding balance in the numerator. The Indexed Adjusted values are adjusted based on the MSA level REIS Commercial Property Price Indices and adjusted from the date of most current appraisal. CRE multifamily portfolio is 29% of total CRE exposure; 7% of total loan exposure • Elevated criticized levels - longer lease up timelines plus rent concessions, higher interest rates, construction delays • Allowance for credit losses: 2.4% of total multifamily balances / 14% of criticized balances • 0.02% nonaccrual, 0.05% delinquent • 10% increase in balances YOY; construction funding and term conversion • 71% term, 29% construction • Median loan size: < $1 million; average loan size: $5.6 million • 18% variable rate with swap, 11% fixed rate, 71% variable rate w/o swap • Multifamily by location – 28% CA, 28% TX, 12% AZ, 8% UT, 24% all other Multifamily Problem Loan Trends as a percentage of total loans ($ billions) CRE Multifamily Portfolio Trends 0.9 0.9 1.0 1.0 1.1 2.7 2.8 2.9 2.8 2.8 3Q23 4Q23 1Q24 2Q24 3Q24 Construction Balances Term Balances 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Criticized % Classified % Nonaccrual % TTM GCO RateWhen values are updated based on indexed / current values, office exposure continues to benefit from low LTVs at origination

ZIONS FINISHES THIRD NATIONALLY IN 2023 GREENWICH EXCELLENCE AWARDS 35 Source: 2023 Coalition Greenwich Market Tracking Program Nationwide . * Excellent Citations are a "5" on a 5 point scale from "5" excellent to "1" poor ** NPS Range: World Class 70+; Excellent 50+; Very Good 30+; Good 0 - 30; Needs Improvement (100) - 0 Zions compares favorably to major competitors Greenwich Excellence Awards • Ranked third among all U.S. banks with 20 overall national Excellence Awards • One of only three U.S. banks to average 16 or more wins since the inception of the awards in 2009 • The small business results ($1-10MM revenue) were similar to the middle market results, with even stronger scores in overall satisfaction, ease of doing business and digital product capabilities Greenwich “Best Brand” Awards • Won all three brand awards in the Middle Market and Small Business categories • Bank You Can Trust • Values Long-Term Relationships • Ease of Doing Business Zions Bancorp Major Bank Competitors (Average Score) Highest Major Bank Competitor's Score Zions’ Rank Middle Market (Revenue of $10MM-$500MM) Overall Satisfaction - Customers 54 46 53 1st Bank You Can Trust 83 53 57 1st Values Long-Term Relationships 83 53 57 1st Ease of Doing Business 64 50 54 1st Digital Product Capabilities 58 41 46 1st Overall Customer Satisfaction with Bankers 78 55 58 1st Net Promoter Score** 52 40 48 1st Coalition Greenwich Customer Satisfaction (2023) % Excellent Citations* (Major Bank Competitors: JP Morgan, Bank of America, Wells Fargo, US Bank)

NON-GAAP FINANCIAL MEASURES 36 In millions, except per share amounts 3Q24 2Q24 1Q24 4Q23 3Q23 (a) Total noninterest expense $502 $509 $526 $581 $496 LESS adjustments: Severance costs 1 1 Other real estate expense (1) Amortization of core deposit and other intangibles 2 1 2 2 2 FDIC special assessment 1 13 90 SBIC investment success fee accrual 1 Restructuring costs 1 (b) Total adjustments 3 3 15 92 3 (c) =(a - b) Adjusted noninterest expense 499 506 511 489 493 (d) Net interest income 620 597 586 583 585 (e) Fully taxable-equivalent adjustments 12 11 10 10 11 (f) = (d + e) Taxable-equivalent net interest income (TE NII) 632 608 596 593 596 (g) Noninterest Income 172 179 156 148 180 (h) = (f + g) Combined Income $804 $787 $752 $741 $776 LESS adjustments: Fair value and nonhedge derivative income (loss) (3) (1) 1 (9) 7 Securities gains (losses), net 9 4 (2) (1) 4 (i) Total adjustments 6 3 (1) (10) 11 (j) = (h - i) Adjusted revenue $798 $784 $753 $751 $765 (j - c) Adjusted pre-provision net revenue (PPNR) $299 $278 $242 $262 $272 (c) / (j) Efficiency Ratio 62.5% 64.5% 67.9% 65.1% 64.4%

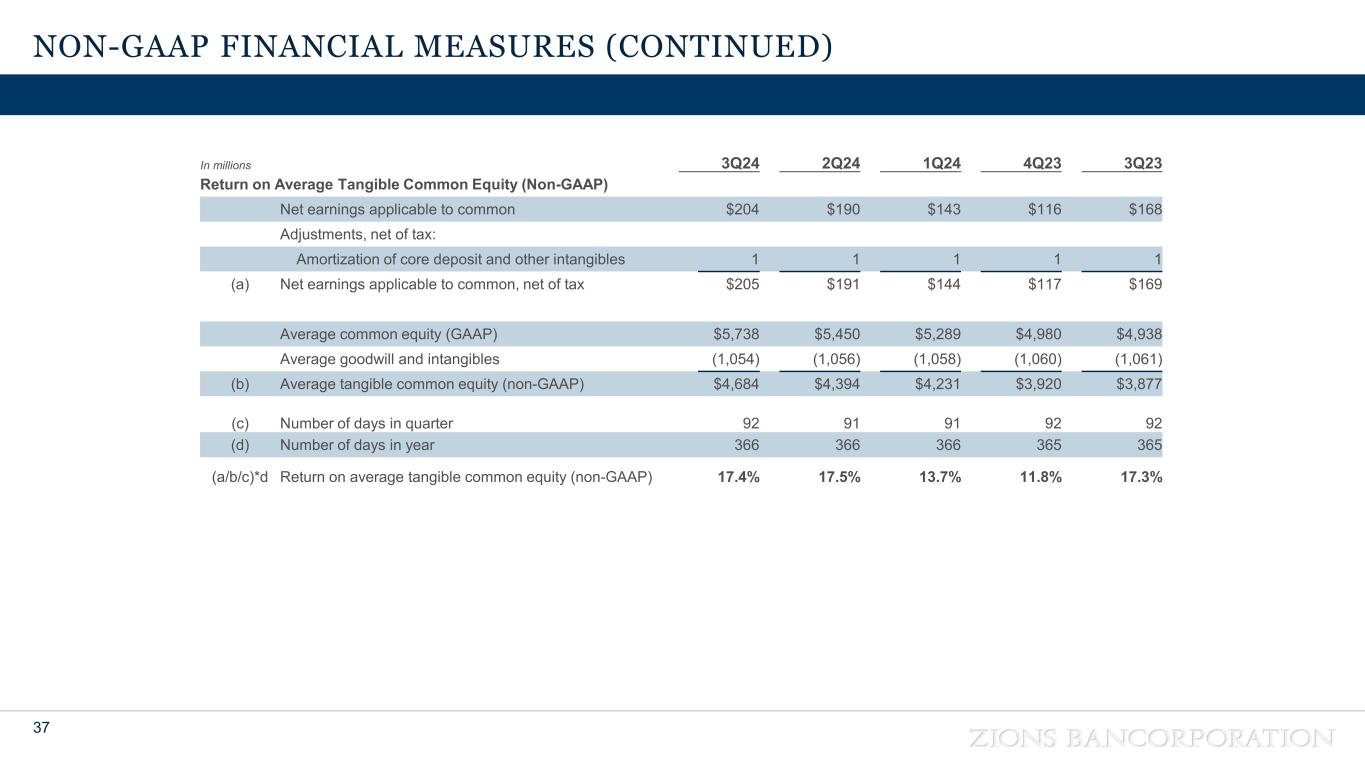

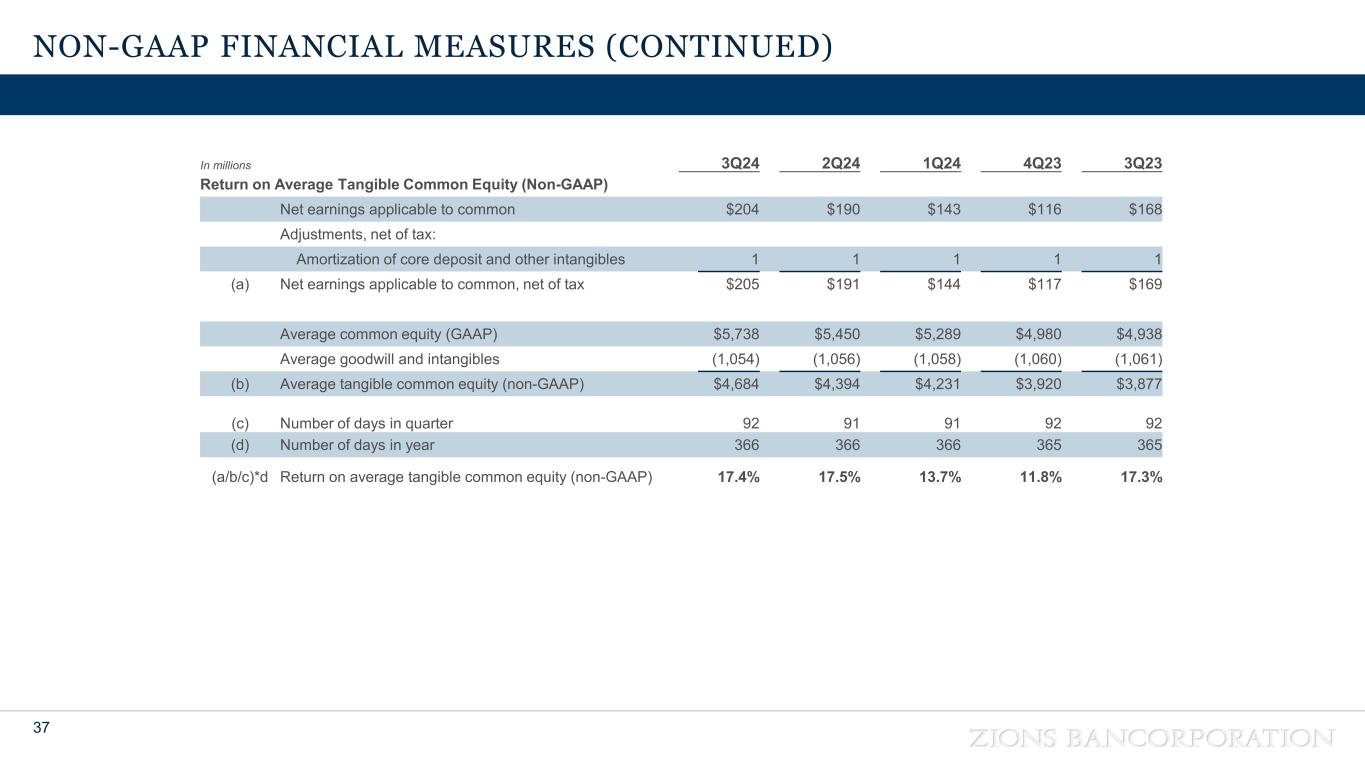

NON-GAAP FINANCIAL MEASURES (CONTINUED) 37 In millions 3Q24 2Q24 1Q24 4Q23 3Q23 Return on Average Tangible Common Equity (Non-GAAP) Net earnings applicable to common $204 $190 $143 $116 $168 Adjustments, net of tax: Amortization of core deposit and other intangibles 1 1 1 1 1 (a) Net earnings applicable to common, net of tax $205 $191 $144 $117 $169 Average common equity (GAAP) $5,738 $5,450 $5,289 $4,980 $4,938 Average goodwill and intangibles (1,054) (1,056) (1,058) (1,060) (1,061) (b) Average tangible common equity (non-GAAP) $4,684 $4,394 $4,231 $3,920 $3,877 (c) Number of days in quarter 92 91 91 92 92 (d) Number of days in year 366 366 366 365 365 (a/b/c)*d Return on average tangible common equity (non-GAAP) 17.4% 17.5% 13.7% 11.8% 17.3%

z i o n s b a n c o r p o ra t i o n . c o m