Investor Conference Salt Lake City

19 February 2004

The Intermountain West’s Largest Banking Company

• Total Assets of $29 Billion

• 28th Largest Domestic Bank by Deposits

• S&P 500 Index

• NASDAQ Financial 100 Index

• 400+ Offices and 550+ ATMs in 8 States

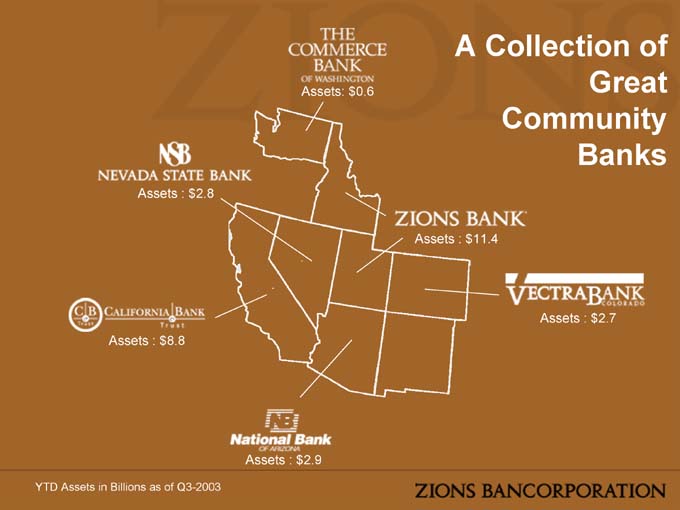

A Collection of Great Community Banks

Assets: $0.6

Assets : $11.4

Assets : $2.7

Assets : $2.9

Assets : $8.8

Assets : $2.8

YTD Assets in Billions as of Q3-2003

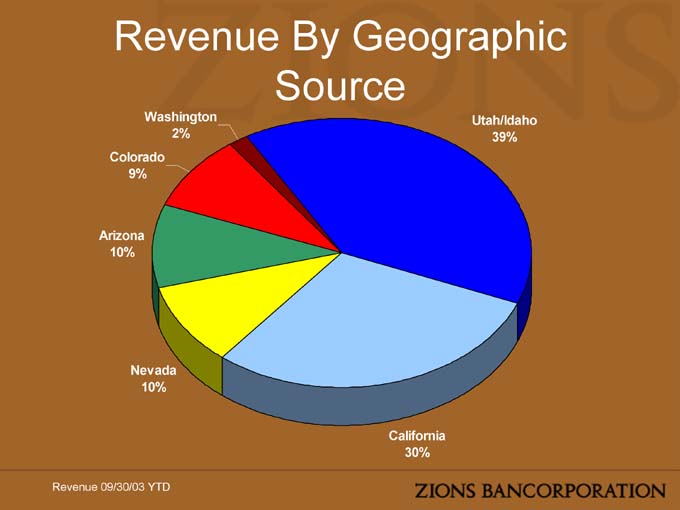

Revenue By Geographic Source

Washington Utah/Idaho

2% 39% Colorado 9%

Arizona 10%

Nevada 10%

California 30%

Revenue 09/30/03 YTD

Advantages of Community Banking Structure

• Better Talent

• Flexibility to Address Market Opportunities

• Strong Customer Relationships

Core Strengths

Across Multiple Franchises

• Small Business Lending

• Commercial Real Estate Lending

• Niche Businesses

– Municipal Finance

– Government Guaranteed Lending

• Strong Risk Management

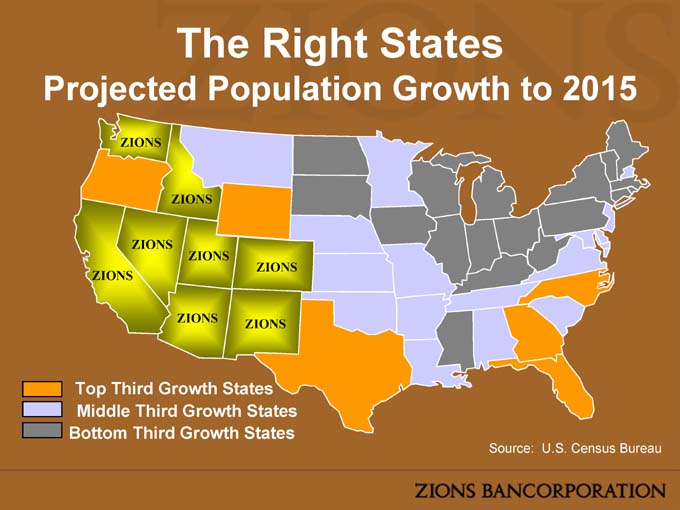

The Right States

Projected Population Growth to 2015

Top Third Growth States

Middle Third Growth States

Bottom Third Growth States

Source: U.S. Census Bureau

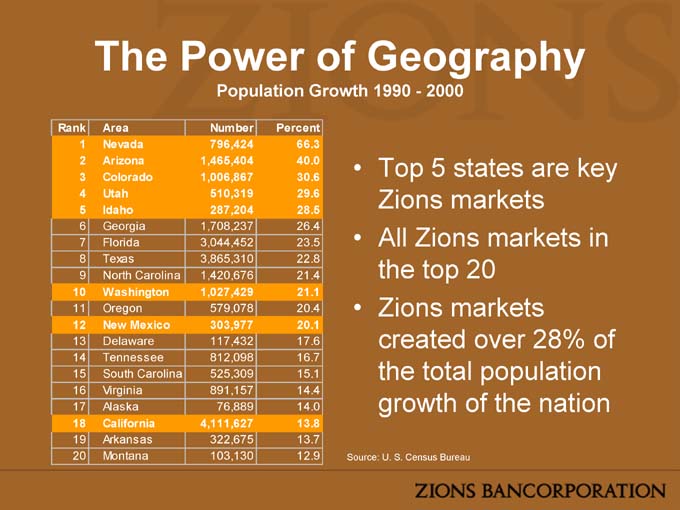

The Power of Geography

Population Growth 1990—2000

Rank Area Number Percent

1 Nevada 796,424 66.3

2 Arizona 1,465,404 40.0

3 Colorado 1,006,867 30.6

4 Utah 510,319 29.6

5 Idaho 287,204 28.5

6 Georgia 1,708,237 26.4

7 Florida 3,044,452 23.5

8 Texas 3,865,310 22.8

9 North Carolina 1,420,676 21.4

10 Washington 1,027,429 21.1

11 Oregon 579,078 20.4

12 New Mexico 303,977 20.1

13 Delaware 117,432 17.6

14 Tennessee 812,098 16.7

15 South Carolina 525,309 15.1

16 Virginia 891,157 14.4

17 Alaska 76,889 14.0

18 California 4,111,627 13.8

19 Arkansas 322,675 13.7

20 Montana 103,130 12.9

• Top 5 states are key Zions markets

• All Zions markets in the top 20

• Zions markets created over 28% of the total population growth of the nation

Source: U. S. Census Bureau

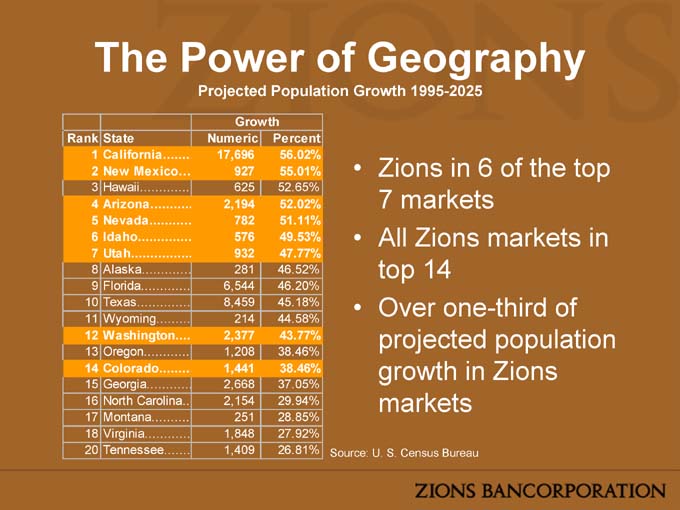

The Power of Geography

Projected Population Growth 1995-2025

Growth

Rank State Numeric Percent

1 California 17,696 56.02%

2 New Mexico… 927 55.01%

3 Hawaii 625 52.65%

4 Arizona 2,194 52.02%

5 Nevada 782 51.11%

6 Idaho 576 49.53%

7 Utah 932 47.77%

8 Alaska 281 46.52%

9 Florida 6,544 46.20%

10 Texas 8,459 45.18%

11 Wyoming 214 44.58%

12 Washington 2,377 43.77%

13 Oregon 1,208 38.46%

14 Colorado 1,441 38.46%

15 Georgia 2,668 37.05%

16 North Carolina… 2,154 29.94%

17 Montana 251 28.85%

18 Virginia 1,848 27.92%

20 Tennessee 1,409 26.81%

• Zions in 6 of the top 7 markets

• All Zions markets in top 14

• Over one-third of projected population growth in Zions markets

Source: U. S. Census Bureau

National Rankings

• #1 Purchaser of SBA 504 Loans

• #1 Originator of Agricultural Mortgages Sold in Secondary Market

• #2 Electronic Odd-Lot Corporate Bond Trader

• #8 Most “Small Business Friendly” Bank (per SBA)

• #9 Largest Municipal Finance Advisor

• #10 Largest SBA 7(a) Lender

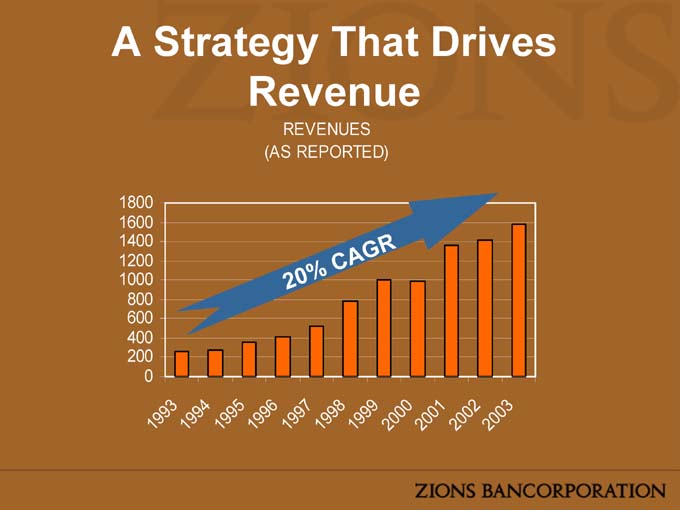

A Strategy That Drives Revenue

REVENUES (AS REPORTED)

1800

1600

1400

1200

1000

800

600

400

200

0 1993 1994 1995 1996 1997 1998

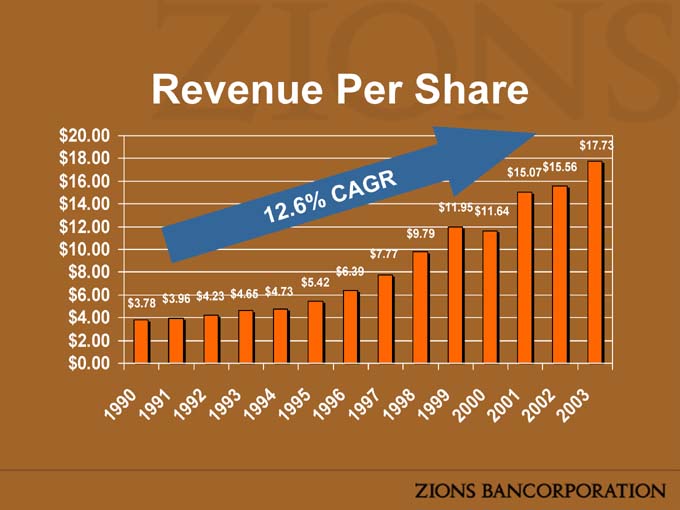

Revenue Per Share

$20.00

$18.00

$16.00

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

$0.00

$1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

What has changed?

Last Ten Years

• Numerous acquisitions using pooling

• Significant investment in niche businesses

• Strong revenue growth but high efficiency ratio

Zions Today

• Less reliance on acquisitions

• Stronger focus on organic growth

• Stronger focus on expense management

• More disciplined investing

Acquisitions

• “Keeping Hope • Emphasis on

Alive” – the impact community bank “in-

of Bank of America / fill” transactions

Fleet • A smaller role than

• Focus on IRR, in the past?

marginal returns on

capital—not just

accretion/dilution

Whose shareholders are we benefiting?

Focused Organic Growth

• Acquire or hire?

– The best way to spend $100 million

– Flagstaff experience

• The de novo tidal wave

Investing for the Future

• Electronic bond trading

– “Shoestring” start-up

– Investment in ICAP in 2000

–$ 5 million income from investment in 1H03

–$ 68 million gain on sale of stock in 2003

– The resulting business:

• 1500 trades daily

•$ 27 million in annual revenue

Investing for the Future:

A Sampling

• Wealth management

– The tarnished reputation of current players

– Close customer ties of a bank which focuses on small and mid-sized businesses

• NetDeposit

– Impact of Check 21

– Bank of America’s use of Zions’ technology

Zions Today

• The best geography

– The country still tilts to the west

• A management model that drives revenue

– Community banks with top 40 resources

• A focus on organic growth

– Acquiring producers vs. companies

• Innovative investing in the future

– Controlled investment in new products and services

Today’s Agenda

• Meet and hear from the bank presidents

• Meet and hear from managers of key niche businesses

• Discussion about issues of importance to all of us

Investor Conference

19 February

2004 Salt Lake City

2004 Analyst Day Presentation

February 19, 2004

Scott Anderson, President and CEO

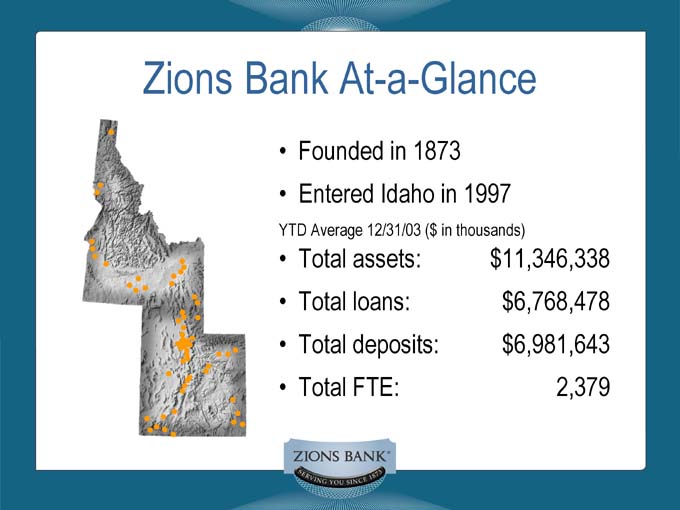

Zions Bank At-a-Glance

• Founded in 1873

• Entered Idaho in 1997

YTD Average 12/31/03 ($ in thousands)

• Total assets: $11,346,338

• Total loans: $6,768,478

• Total deposits: $6,981,643

• Total FTE: 2,379

Zions Bank—Utah

YTD Average 12/31/03 ($ in millions)

Branches 125

Deposits (% of total) $ 6,621 (94.8%)

Loans (% of total) $ 6,172 (91.2%)

Net Income(% of total) $ 148.9 (95.2%)

FTE (% of total) 2,191 (92.1%)

#1 bank in Utah (ranked by deposits)

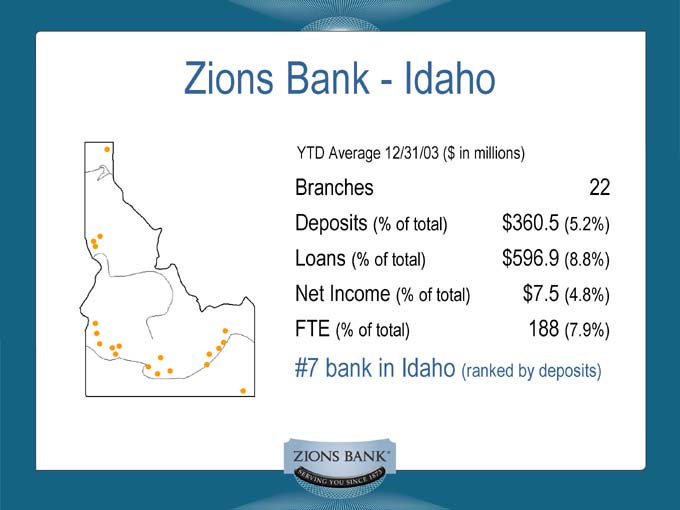

Zions Bank—Idaho

YTD Average 12/31/03 ($ in millions)

Branches 22

Deposits (% of total) $ 360.5 (5.2%)

Loans (% of total) $ 596.9 (8.8%)

Net Income(% of total) $7.5 (4.8%)

FTE (% of total) 188 (7.9%)

#7 bank in Idaho (ranked by deposits)

Specialty Businesses

• Zions Credit Corporation – Leasing

• Corporate Trust

• Zions Public Finance

• Zions Agricultural Finance

• National Real Estate Department (SBA 504)

• Internet Banking

Specialty Businesses

• Zions Insurance Agency

• Zions Investment Securities, Inc.

• Correspondent Banking

• Electronic Bond Trading

Specialty Businesses

Internet Banking – Deposit Distribution

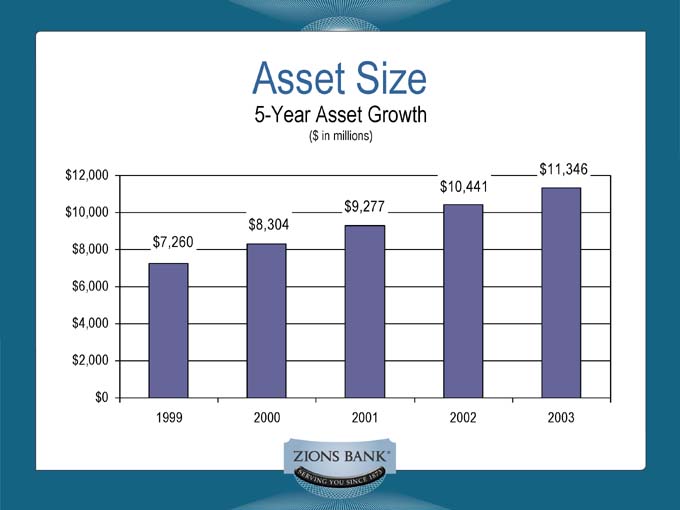

Asset Size

5-Year Asset Growth

($ in millions)

$ 12,000 $11,346

$9,277 $10,441

$ 10,000 $8,304

$ 8,000 $7,260

$ 6,000

$ 4,000

$ 2,000

$ 0

1999 2000 2001 2002 2003

Utah Economic Outlook

• In 2003, Utah experienced first meaningful rise in employment in nearly three years .

• Projecting 15,000 to 18,000 net new jobs during 2004.

• Among top eight states in economic performance, business vitality, and development capacity.

• New home construction activity across the state continues to be rock solid.

Source: Winter 2004 Zions Bank Insight – Economic News of Utah and the Nation

Idaho Economic Outlook

• In 2003, Idaho experienced one of largest employment gains in over three years .

• Projecting 11,000 to 13,000 net new jobs during 2004.

• Idaho continues to benefit from stronger U.S. economic growth.

Source: Winter 2004 Zions Bank Insight – Economic News of Idaho and the Nation

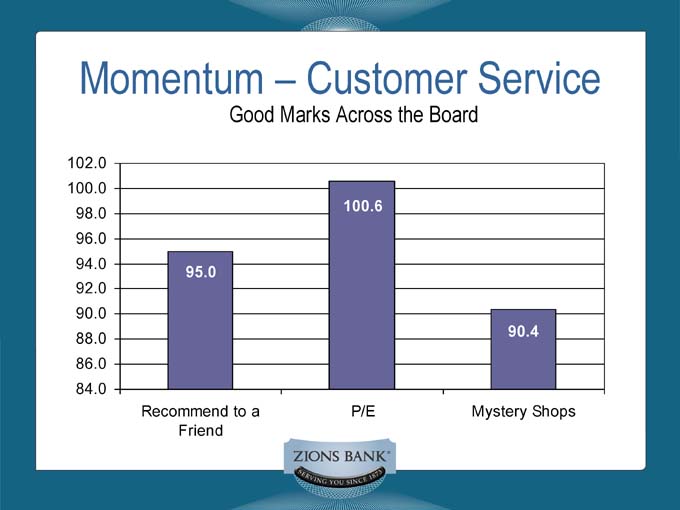

Momentum – Customer Service

Good Marks Across the Board

102.0

100.0

98.0 100.6

96.0

94.0

95.0

92.0

90.0

88.0 90.4

86.0

84.0

Recommend to a P/E Mystery Shops

Friend

Momentum – Employee Referrals

Great Cross-Sell 2003

Total referrals: 219,690

Products sold: 144,627

Number of employees participating: 3,154

(including affiliate companies)

New loans in 2003: $ 401,888,627

New deposits in 2003: $ 231,232,801

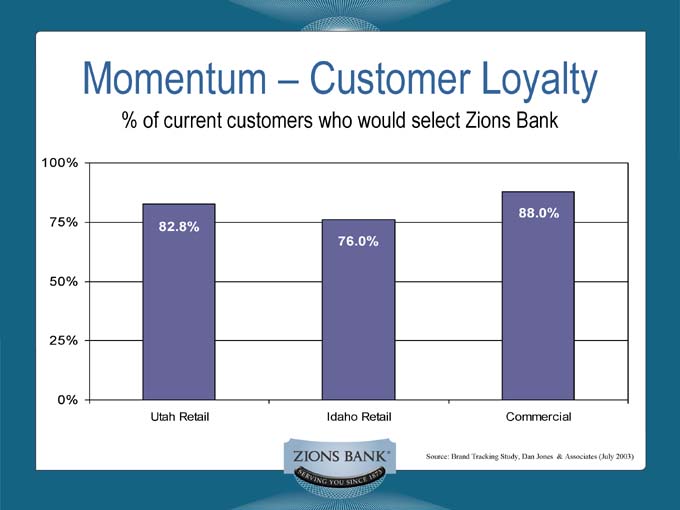

Momentum – Customer Loyalty

% of current customers who would select Zions Bank

100% 82.8%

88.0%

75% 76.0%

50%

25%

0% Utah Retail Idaho Retail Commercial

Source: Brand Tracking Study, Dan Jones & Associates (July 2003)

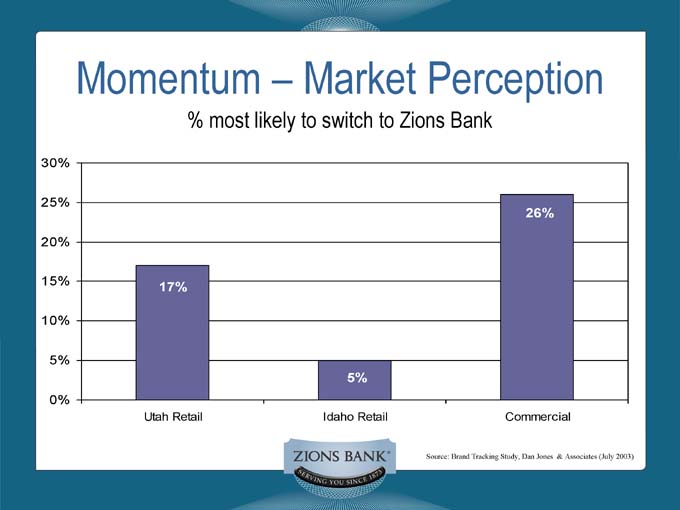

Momentum – Market Perception

% most likely to switch to Zions Bank

30%

25%

26%

20%

15%

17%

10%

5%

5%

0%

Utah Retail Idaho Retail Commercial

Source: Brand Tracking Study, Dan Jones & Associates (July 2003)

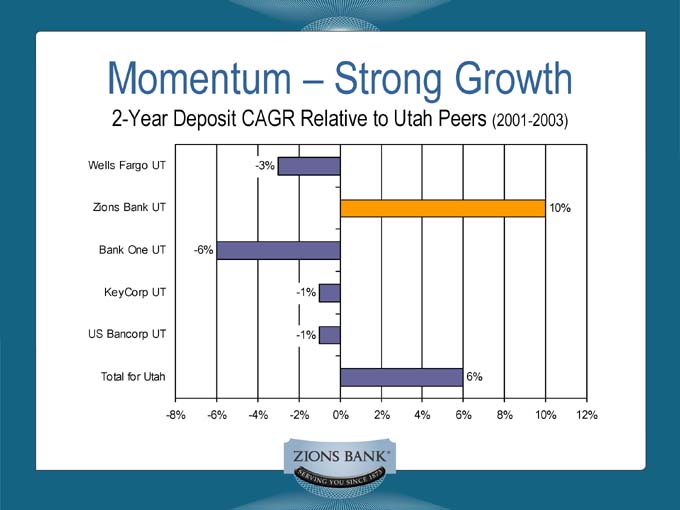

Momentum – Strong Growth

2-Year Deposit CAGR Relative to Utah Peers (2001-2003)

Wells Fargo UT -3%

Zions Bank UT 10%

Bank One UT -6%

KeyCorp UT -1%

US Bancorp UT -1%

Total for Utah 6%

-8% -6% -4% -2% 0% 2% 4% 6% 8% 10% 12%

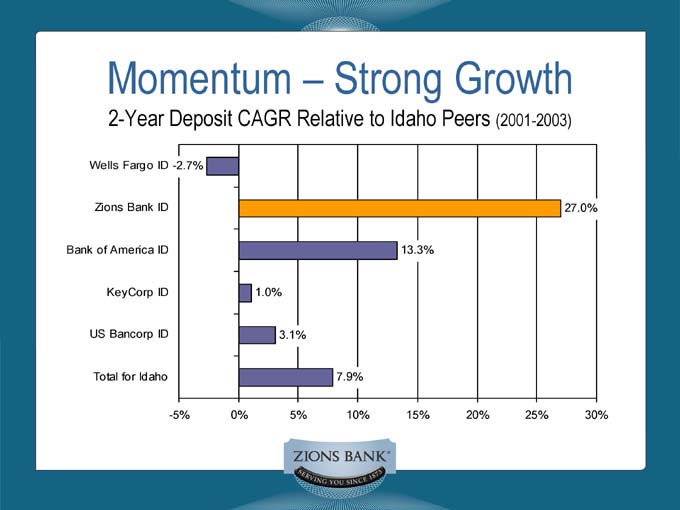

Momentum – Strong Growth

2-Year Deposit CAGR Relative to Idaho Peers (2001-2003)

Wells Fargo ID -2.7%

Zions Bank ID 27.0%

Bank of America ID 13.3%

KeyCorp ID 1.0%

US Bancorp ID 3.1%

Total for Idaho 7.9%

-5% 0% 5% 10% 15% 20% 25% 30%

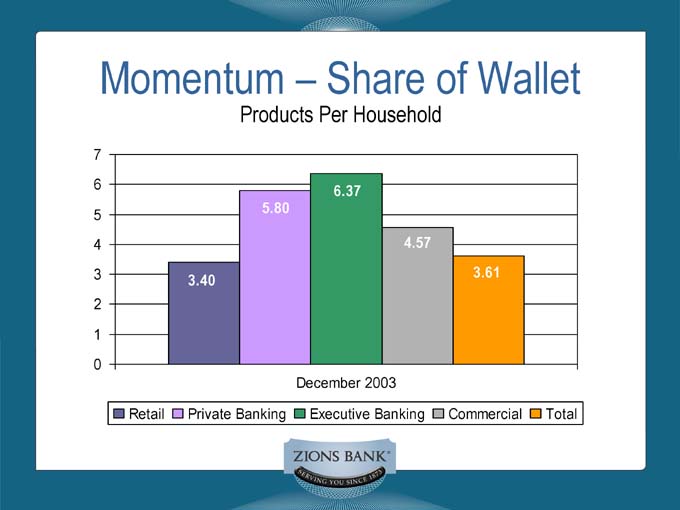

Momentum – Share of Wallet

Products Per Household

7

6 6.37

5 5.80

4 4.57

3 3.61

3.40

2

1

0

December 2003

Retail Private Banking Executive Banking Commercial Total

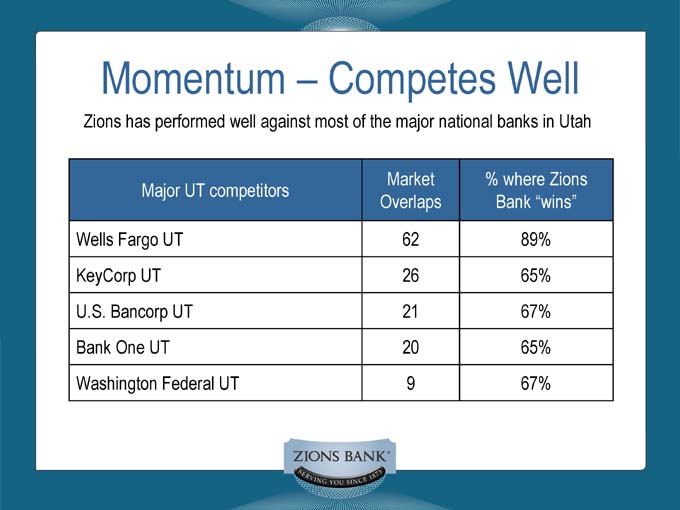

Momentum – Competes Well

Zions has performed well against most of the major national banks in Utah

Market % where Zions

Major UT competitors

Overlaps Bank “wins”

Wells Fargo UT 62 89%

KeyCorp UT 26 65%

U.S. Bancorp UT 21 67%

Bank One UT 20 65%

Washington Federal UT 9 67%

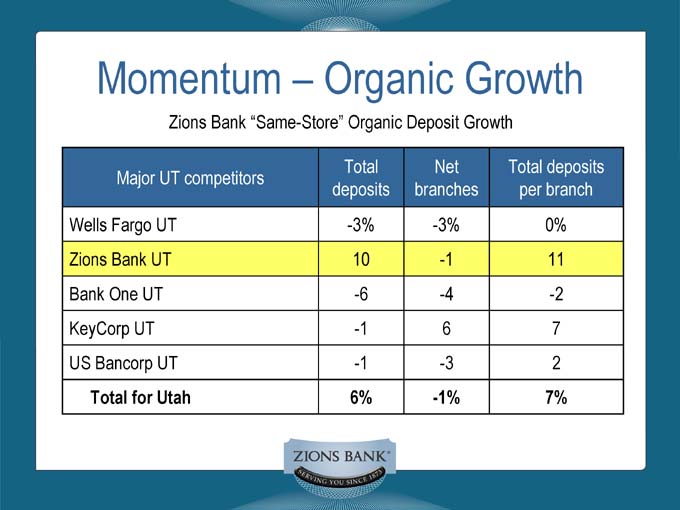

Momentum – Organic Growth

Zions Bank “Same-Store” Organic Deposit Growth

Total Net Total deposits

Major UT competitors

deposits branches per branch

Wells Fargo UT -3% -3% 0%

Zions Bank UT 10 -1 11

Bank One UT -6 -4 -2

KeyCorp UT -1 6 7

US Bancorp UT -1 -3 2

Total for Utah 6% -1% 7%

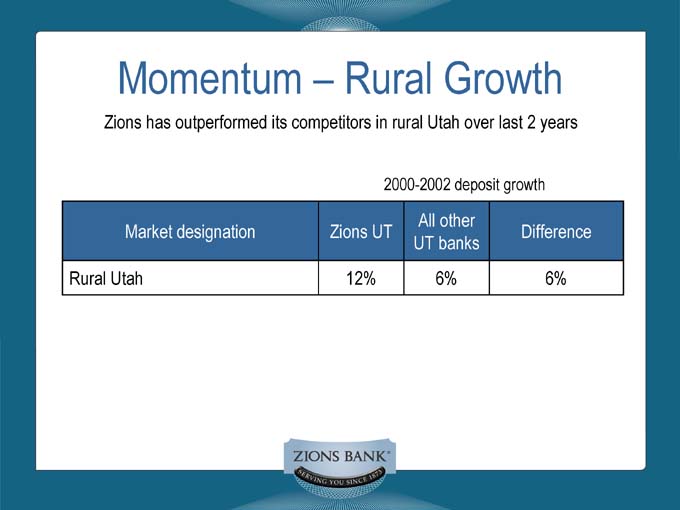

Momentum – Rural Growth

Zions has outperformed its competitors in rural Utah over last 2 years

2000-2002 deposit growth

All other

Market designation Zions UT Difference

UT banks

Rural Utah 12% 6% 6%

Key Rankings

• #1 SBA lender in Utah

• #1 SBA lender in Boise, ID District

• #1 lender for women and minorities (SBA)

• #1 Farmer Mac originator of long-term ag loans

• #1 secondary market purchaser of SBA 504 loans

• #1 regional bank website (Source: Speer & Associates, Inc.)

Financial History—Deposits

5-Year Deposit Growth

(Average Deposits—$ in millions)

$ 8,000

$ 6,982

$ 7,000

$ 6,116

$ 6,000

$ 4,714

$ 5,000 $ 4,169

$ 3,777

$ 4,000

$ 3,000

$ 2,000

$ 1,000

$0

1999 2000 2001 2002 2003

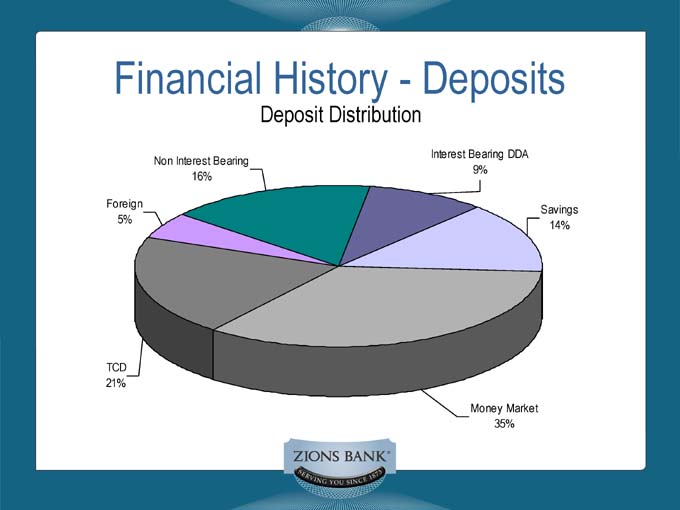

Financial History—Deposits

Deposit Distribution

Non Interest Bearing 16%

Interest Bearing DDA

9%

Savings 14%

Money Market 35%

TCD 21%

Foreign 5%

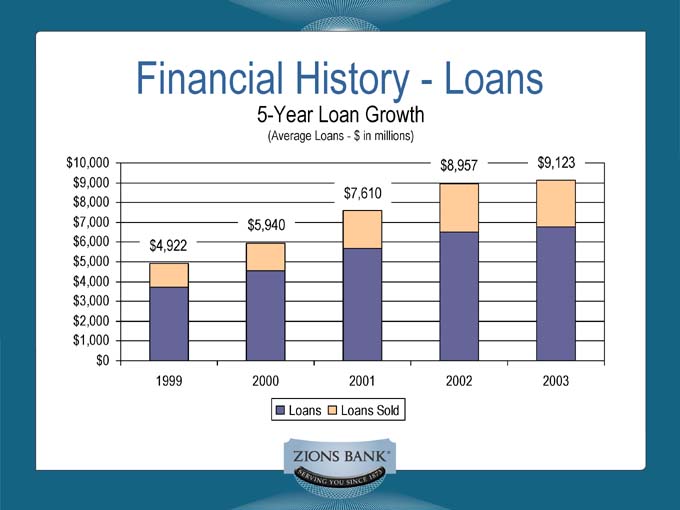

Financial History—Loans

5-Year Loan Growth

(Average Loans—$ in millions)

$ 10,000 $ 8,957 $ 9,123

$ 9,000

$ 7,610

$ 8,000

$ 7,000 $ 5,940

$ 6,000 $ 4,922

$ 5,000

$ 4,000

$ 3,000

$ 2,000

$ 1,000

$ 0

1999 2000 2001 2002 2003

Loans Loans Sold

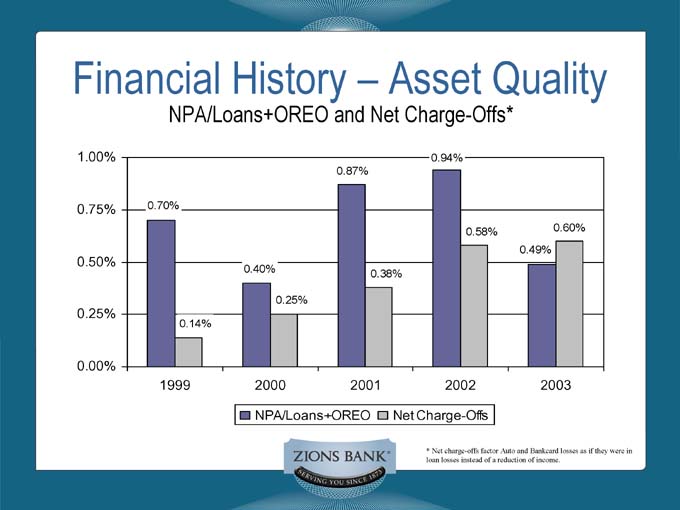

Financial History – Asset Quality

NPA/Loans+OREO and Net Charge-Offs*

1.00% 0.94%

0.87%

0.75% 0.70%

0.58% 0.60%

0.49%

0.50%

0.40% 0.38%

0.25%

0.25%

0.14%

0.00%

1999 2000 2001 2002 2003

NPA/Loans+OREO Net Charge-Offs

* Net charge-offs factor Auto and Bankcard losses as if they were in loan losses instead of a reduction of income.

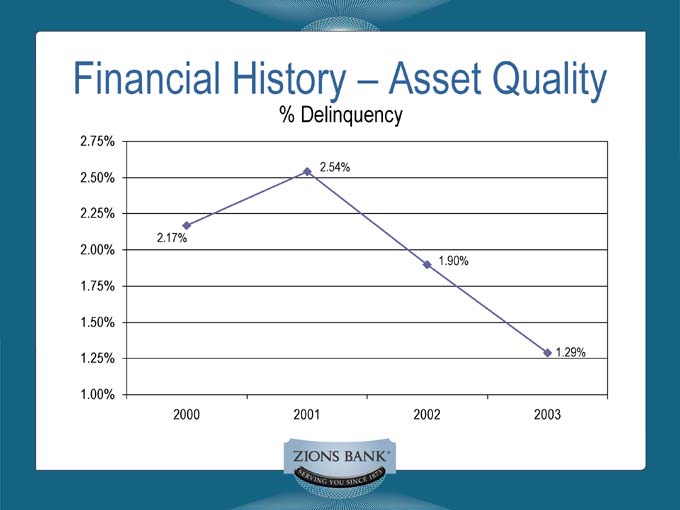

Financial History – Asset Quality

% Delinquency

2.75%

2.54%

2.50%

2.25%

2.17%

2.00%

1.90%

1.75%

1.50%

1.25% 1.29%

1.00%

2000 2001 2002 2003

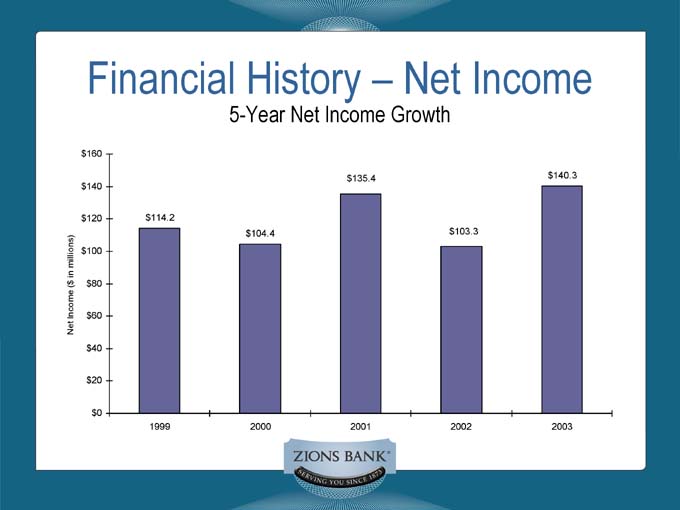

Financial History – Net Income

5-Year Net Income Growth

Net Income ($ in millions)

$ 160

$ 135.4 $ 140.3

$ 140

$ 120 $ 114.2

$ 104.4 $ 103.3

$ 100

$ 80

$ 60

$ 40

$ 20

$ 0

1999 2000 2001 2002 2003

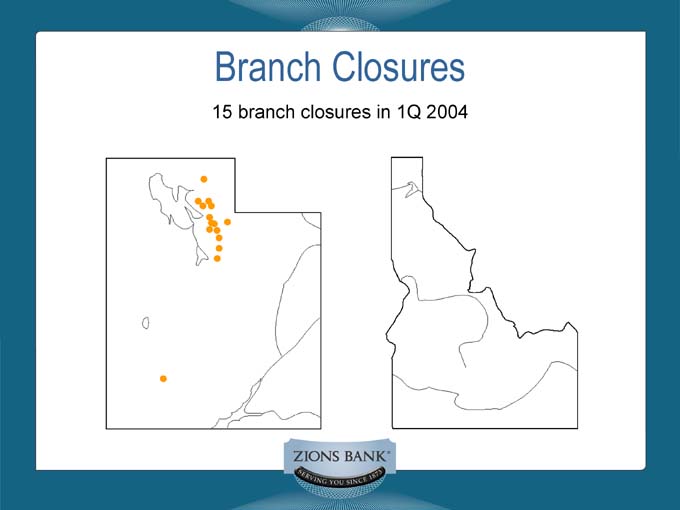

Branch Closures

15 branch closures in 1Q 2004

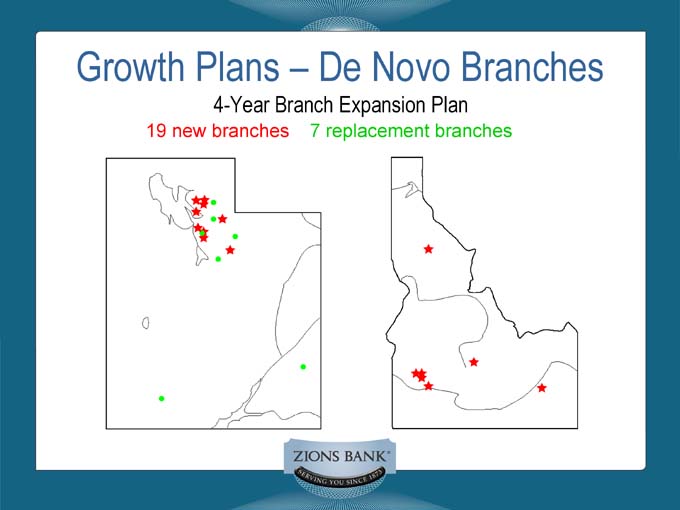

Growth Plans – De Novo Branches

4-Year Branch Expansion Plan

19 new branches 7 replacement branches

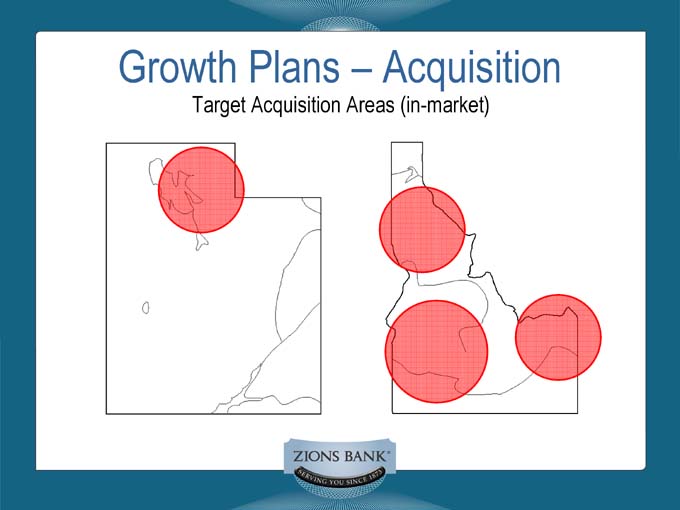

Growth Plans – Acquisition

Target Acquisition Areas (in-market)

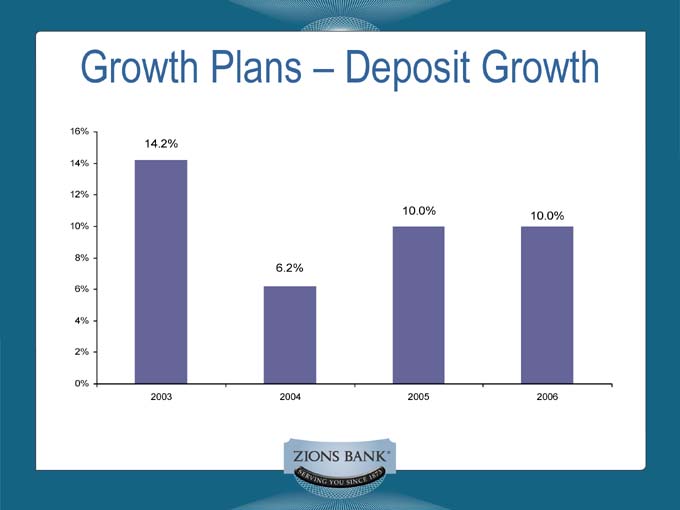

Growth Plans – Deposit Growth

16%

14.2%

14%

12%

10.0% 10.0%

10%

8%

6.2%

6%

4%

2%

0%

2003 2004 2005 2006

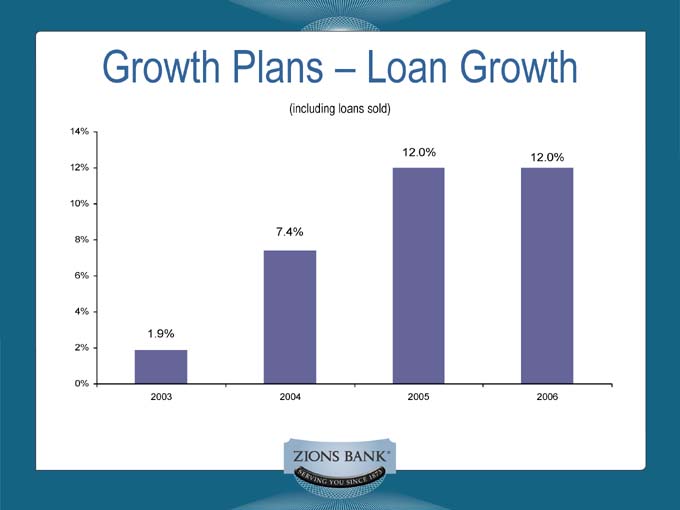

Growth Plans – Loan Growth

(including loans sold)

14%

12.0% 12.0%

12%

10%

7.4%

8%

6%

4%

1.9%

2%

0%

2003 2004 2005 2006

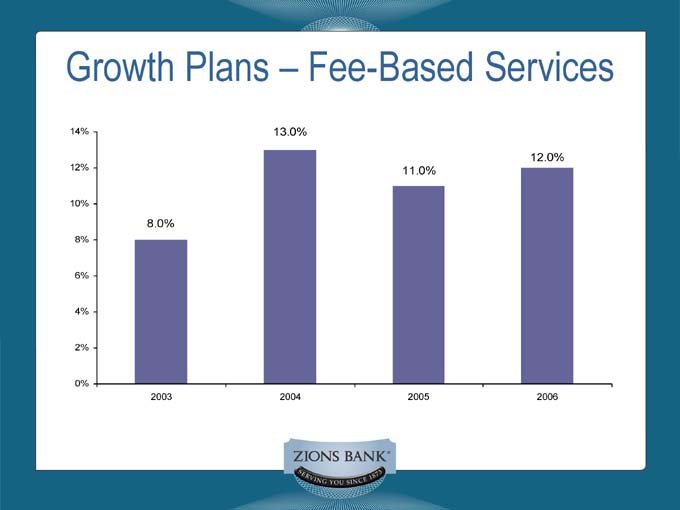

Growth Plans – Fee-Based Services

14% 13.0%

12.0%

12% 11.0%

10%

8.0%

8%

6%

4%

2%

0%

2003 2004 2005 2006

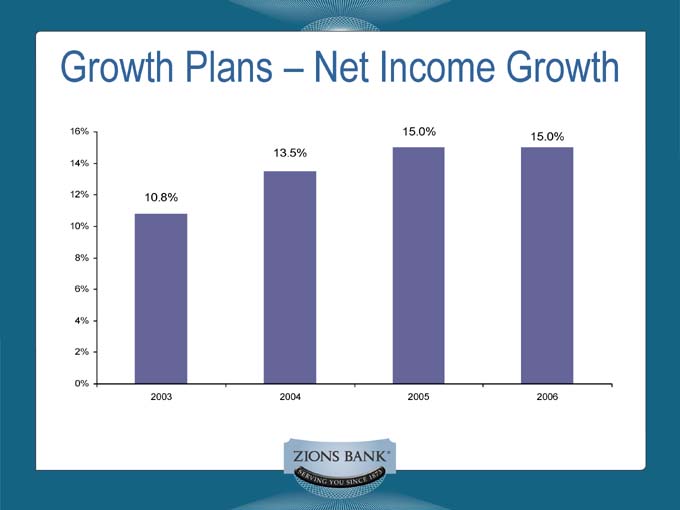

Growth Plans – Net Income Growth

16% 15.0%

15.0%

13.5%

14%

12% 10.8%

10%

8%

6%

4%

2%

0%

2003 2004 2005 2006

2004 Areas of Focus

• Small business lending

• National real estate (SBA 504) lending

• Internet

• Utah and Idaho “fill-in”

• Hispanic market

The California Marketplace

California is the 6th largest economy in the world

World Ranking—2002 Gross Product—$ billions

$ 12,000

$ 10,417

$ 10,000

$ 8,000

$ 6,000

$ 3,979

$ 4,000

$ 1,976 $ 1,552 $ 1,410 $ 1,403

$ 2,000 $ 1,237

$ 0

U.S. Japan Germany U.K France CALIF. China

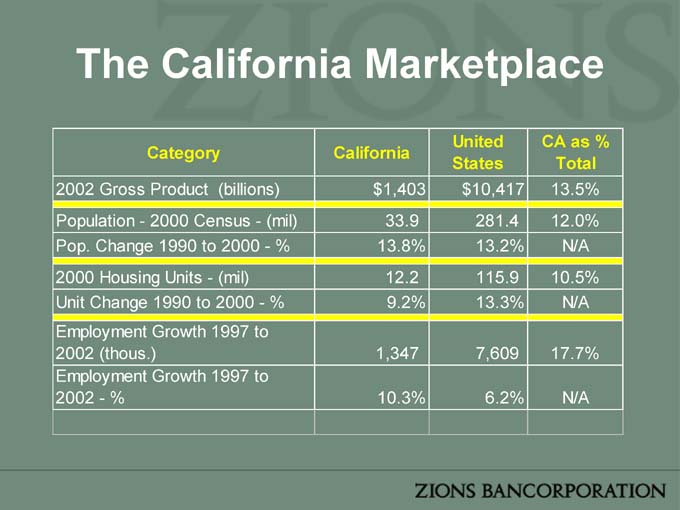

The California Marketplace

United CA as %

Category California

States Total

2002 Gross Product (billions) $ 1,403 $ 10,417 13.5%

Population—2000 Census—(mil) 33.9 281.4 12.0%

Pop. Change 1990 to 2000—% 13.8% 13.2% N/A

2000 Housing Units—(mil) 12.2 115.9 10.5%

Unit Change 1990 to 2000—% 9.2% 13.3% N/A

Employment Growth 1997 to

2002 (thous.) 1,347 7,609 17.7%

Employment Growth 1997 to

2002—% 10.3% 6.2% N/A

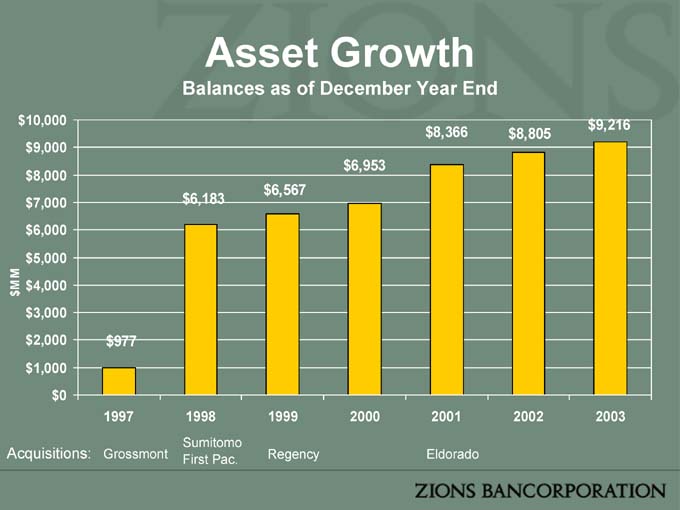

A Brief History

• 1997 – Acquired Grossmont Bank

• 1998 – Acquired First Pacific Bank

• 1998 – Acquired Sumitomo Bank

• 1999 – Acquired Regency Bank

• 2001 ��� Acquired Eldorado Bank

Asset Growth

Balances as of December Year End

$ 10,000 $ 9,216

$ 8,366 $ 8,805

$ 9,000

$ 6,953

$ 8,000

$ 6,567

$ 7,000 $ 6,183

$ 6,000

$ 5,000

MM $ 4,000

$

$ 3,000

$ 2,000 $ 977

$ 1,000

$ 0

1997 1998 1999 2000 2001 2002 2003

Sumitomo

Acquisitions: Grossmont First Pac. Regency Eldorado

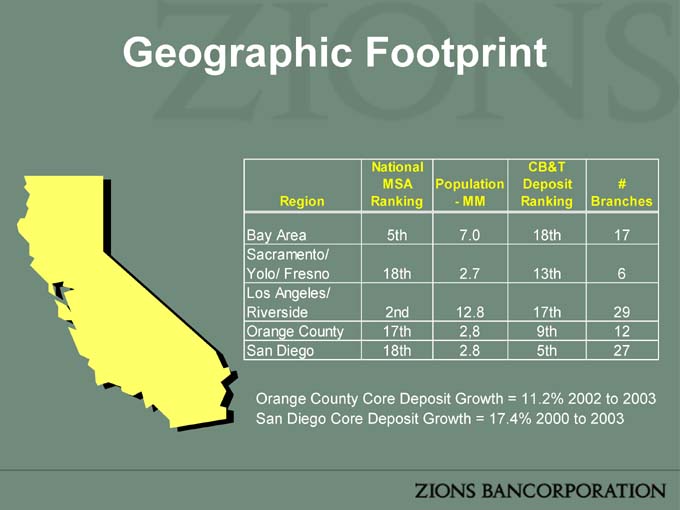

Geographic Footprint

National CB&T

MSA Population Deposit #

Region Ranking - MM Ranking Branches

Bay Area 5th 7.0 18th 17

Sacramento/

Yolo/ Fresno 18th 2.7 13th 6

Los Angeles/

Riverside 2nd 12.8 17th 29

Orange County 17th 2,8 9th 12

San Diego 18th 2.8 5th 27

Orange County Core Deposit Growth = 11.2% 2002 to 2003 San Diego Core Deposit Growth = 17.4% 2000 to 2003

Key Niches and Businesses

• San Diego Community Bank

• SBA and Small Business Lending through Retail Banking Division

• Commercial Real Estate Lending Group

• Growing Commercial Banking Group

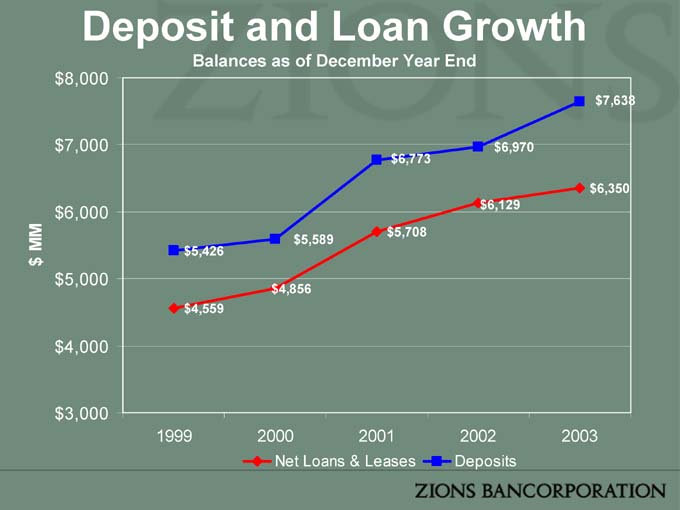

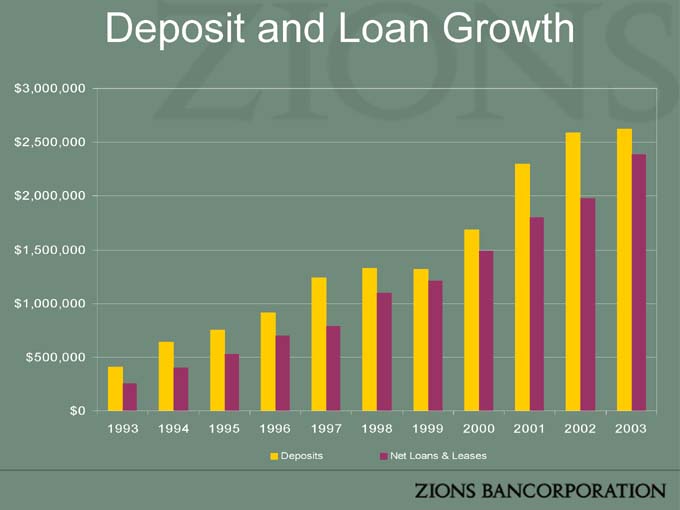

Deposit and Loan Growth

Balances as of December Year End

$ 8,000

$7,638

$ 7,000 $ 6,970

$ 6,773

$ 6,350

$ 6,000 $ 6,129

$ 5,708

MM $ 5,589

$ 5,426

$

$ 5,000

$ 4,856

$ 4,559

$ 4,000

$ 3,000

1999 2000 2001 2002 2003

Net Loans & Leases Deposits

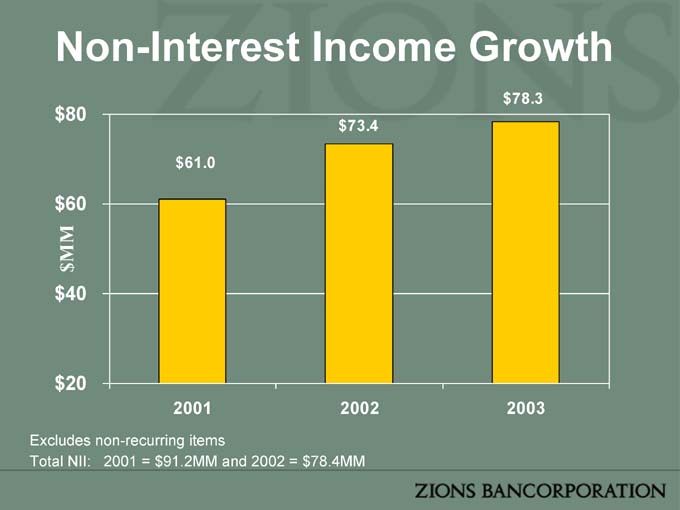

Non-Interest Income Growth

$ 78.3

$ 80

$ 73.4

$ 61.0

$ 60

MM

$

$ 40

$ 20

2001 2002 2003

Excludes non-recurring items

Total NII: 2001 = $91.2MM and 2002 = $78.4MM

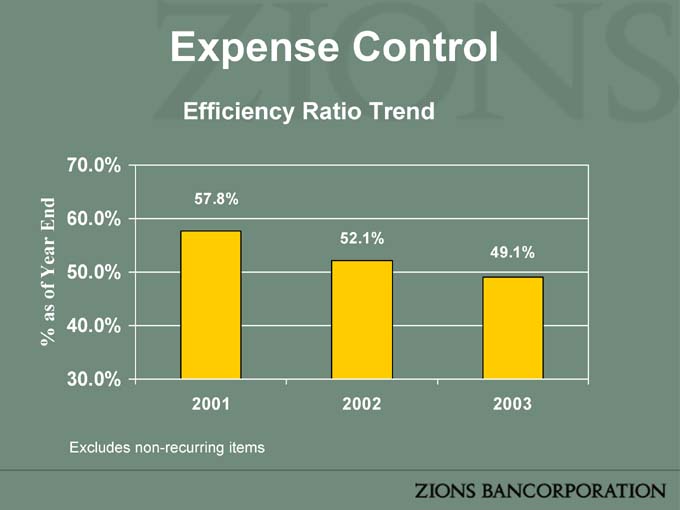

Expense Control

Efficiency Ratio Trend

% as of Year End 40.0%

70.0%

57.8%

60.0%

52.1%

49.1%

50.0%

30.0%

2001 2002 2003

Excludes non-recurring items

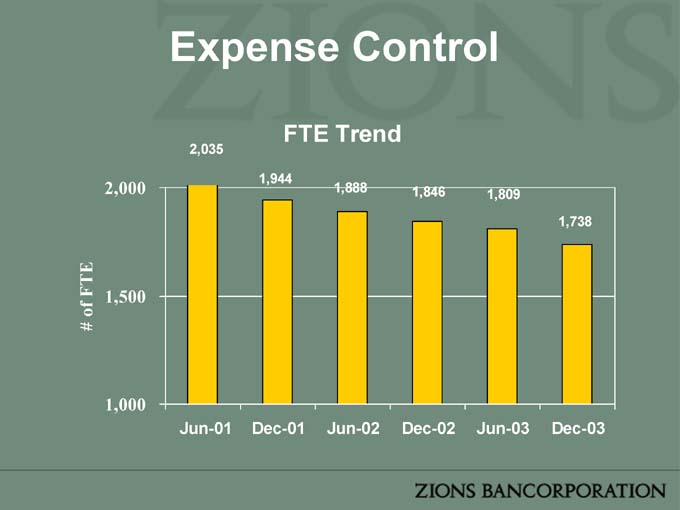

Expense Control

FTE Trend

2,035

1,944

2,000 1,888 1,846

1,809

1,738

1,500

1,000

Jun-01 Dec-01 Jun-02 Dec-02 Jun-03 Dec-03

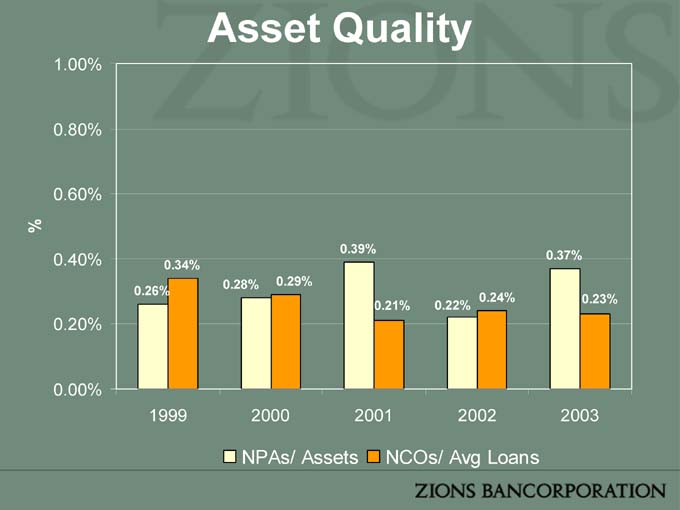

Asset Quality

1.00%

0.80%

0.60%

%

0.39%

0.40% 0.37%

0.34%

0.28% 0.29%

0.26%

0.24% 0.23%

0.21% 0.22%

0.20%

0.00%

1999 2000 2001 2002 2003

NPAs/ Assets NCOs/ Avg Loans

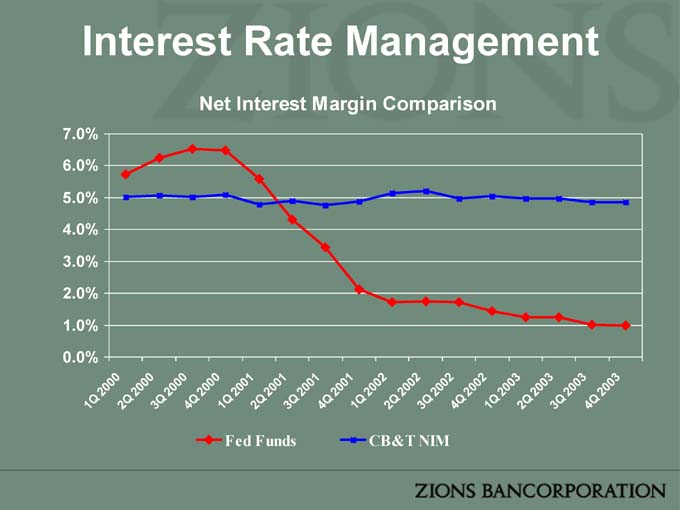

Interest Rate Management

Net Interest Margin Comparison

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0% 1 Q 2000 2 Q 2 000 3 Q 2 000 4 Q 2 000 1Q 2001 2Q 2001 3Q 2001 4 Q 2001 1 Q 2002 2 Q 2 002 3 Q 2 002 4 Q 2 002 1Q 2003 2Q 2003 3Q 2003 4 Q2003

Fed Funds CB&T NIM

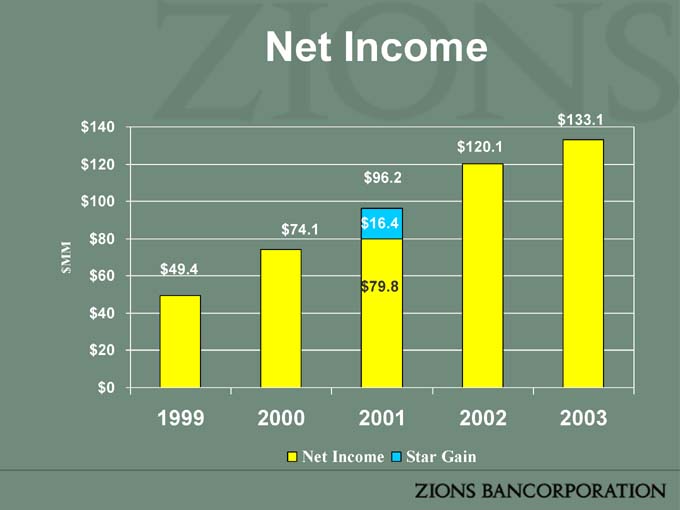

Net Income

$ 133.1

$ 140

$ 120.1

$ 120

$ 96.2

$ 100

$ 74.1 $ 16.4

$ 80

MM

$ $ 60 $ 49.4

$ 79.8

$ 40

$ 20

$ 0

1999 2000 2001 2002 2003

Net Income Star Gain

Return on Equity

16.0%

14.0% 13.53%

11.69%

12.0%

10.50% 10.47%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

2000 2001 2002 2003

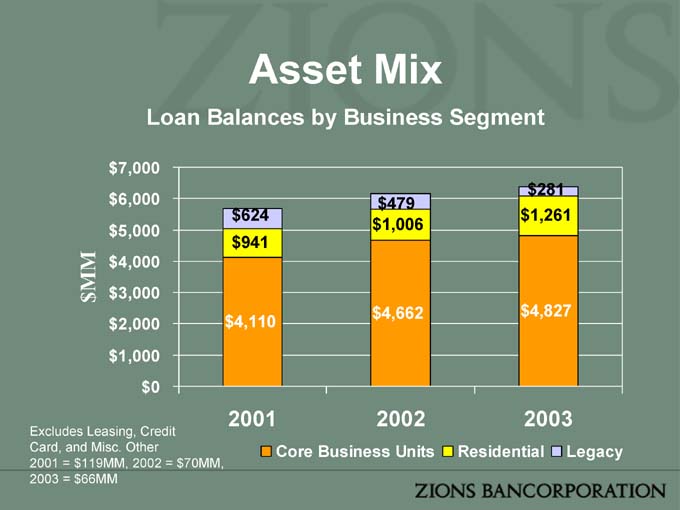

Asset Mix

Loan Balances by Business Segment

$ 7,000

$ 281

$ 6,000 $ 479

$ 624 $ 1,261

$ 5,000 $ 1,006

$ 941

MM $ 4,000

$ $ 3,000

$ 4,662 $ 4,827

$ 2,000 $ 4,110

$ 1,000

$ 0

2001 2002 2003

Excludes Leasing, Credit

Card, and Misc. Other Core Business Units Residential Legacy

2001 = $119MM, 2002 = $70MM,

2003 = $66MM

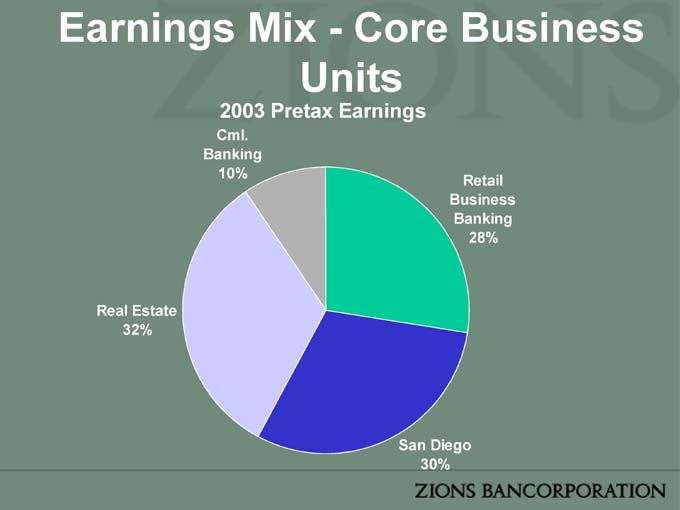

Earnings Mix—Core Business Units

2003 Pretax Earnings

Cml. Banking 10%

Retail Business Banking 28%

Real Estate 32%

San Diego 30%

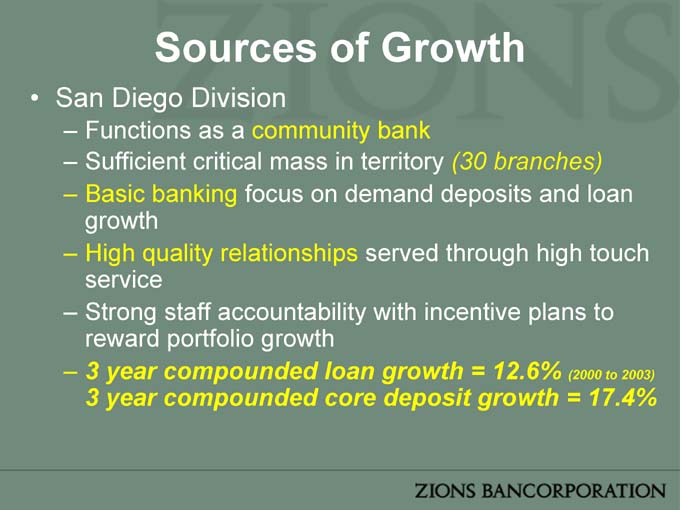

Sources of Growth

• San Diego Division

– Functions as a community bank

– Sufficient critical mass in territory (30 branches)

– Basic banking focus on demand deposits and loan growth

– High quality relationships served through high touch service

– Strong staff accountability with incentive plans to reward portfolio growth

– 3 year compounded loan growth = 12.6% (2000 to 2003) 3 year compounded core deposit growth = 17.4%

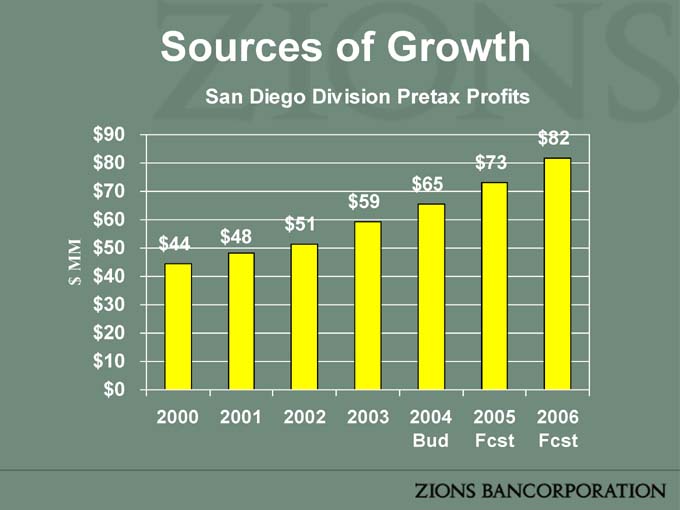

Sources of Growth

San Diego Division Pretax Profits

$ 90 $ 82

$ 80 $ 73

$ 70 $ 65

$ 59

$ 60 $ 51

$ 44 $ 48

MM $ 50

$ 40

$

$ 30

$ 20

$ 10

$ 0

2000 2001 2002 2003 2004 2005 2006

Bud Fcst Fcst

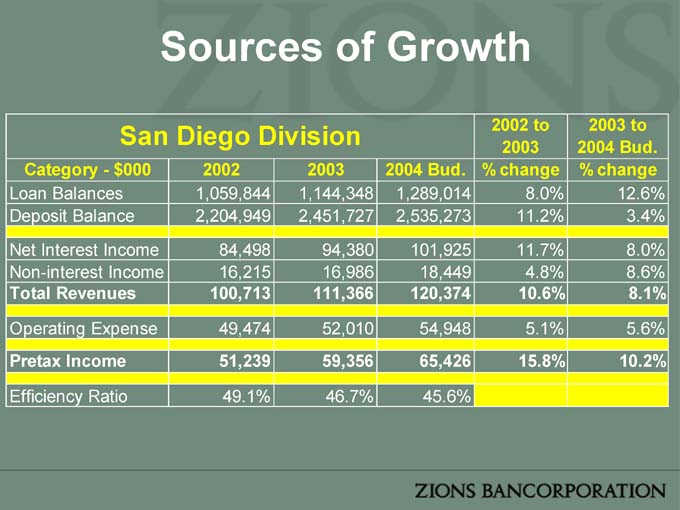

Sources of Growth

San Diego Division 2002 to 2003 to

2003 2004 Bud.

Category—$ 000 2002 2003 2004 Bud. % change % change

Loan Balances 1,059,844 1,144,348 1,289,014 8.0% 12.6%

Deposit Balance 2,204,949 2,451,727 2,535,273 11.2% 3.4%

Net Interest Income 84,498 94,380 101,925 11.7% 8.0%

Non-interest Income 16,215 16,986 18,449 4.8% 8.6%

Total Revenues 100,713 111,366 120,374 10.6% 8.1%

Operating Expense 49,474 52,010 54,948 5.1% 5.6%

Pretax Income 51,239 59,356 65,426 15.8% 10.2%

Efficiency Ratio 49.1% 46.7% 45.6%

Sources of Growth

• Retail Business Banking

– Core strategy to provide full array of products and services to small business customers

– Retail business distinguished by experienced staff skilled at deposit gathering and service

– Significant restructure accomplished

• Expansion of SBA lending—#4 lender in CA

• Streamlined delivery system

• New management with focus on results and accountability

– Use sales campaigns to reach retail and small business customers $320MM + generated from 2003 campaigns

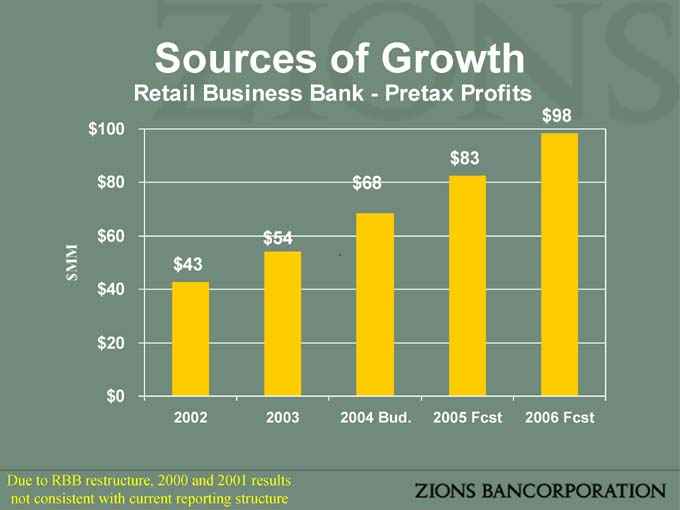

Sources of Growth

Retail Business Bank—Pretax Profits

$ 98

$ 100

$ 83

$ 80 $ 68

$ 60 $ 54

MM $ 43

$

$ 40

$ 20

$ 0

2002 2003 2004 Bud. 2005 Fcst 2006 Fcst

Due to RBB restructure, 2000 and 2001 results not consistent with current reporting structure

Retail Business Banking 2002 to 2003 to

2003 2004 Bud.

Category—$ 000 2002 2003 2004 Bud. % change % change

Loan Balances 1,041,446 1,273,556 1,808,864 22.3% 42.0%

Deposit Balance 4,154,226 4,379,393 4,726,177 5.4% 7.9%

Net Interest Income 116,632 125,957 146,084 8.0% 16.0%

Non-interest Income 27,362 30,825 33,255 12.7% 7.9%

Total Revenues 143,994 156,782 179,339 8.9% 14.4%

Operating Expense 101,246 102,683 110,905 1.4% 8.0%

Pretax Income 42,749 54,099 68,435 26.6% 26.5%

Efficiency Ratio 70.3% 65.5% 61.8%

Sources of Growth

• Commercial Real Estate

–Substantial contribution to CB&T 1999 to 2002 earnings growth

– Division posted 17.5% annual compounded growth 1999-2002

–Strong repeat business with experienced and well capitalized developers –Disciplined underwriting with significant equity component Avg LTV as of 9/03 = 64.5%

–Strong project and market fundamentals

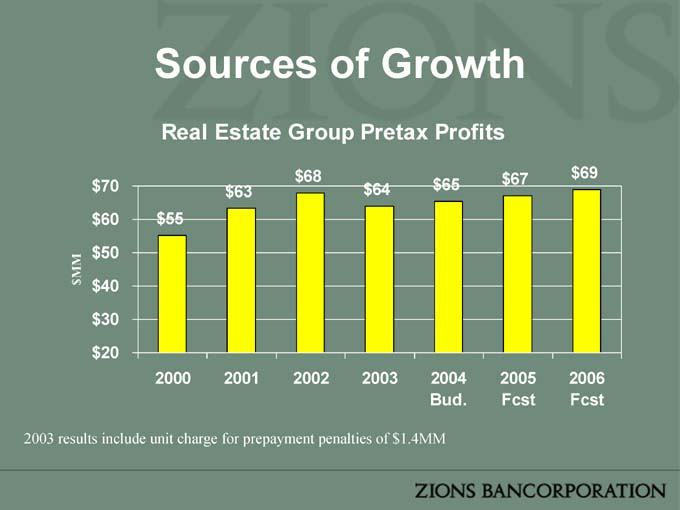

Sources of Growth

Real Estate Group Pretax Profits

2003 results include unit charge for prepayment penalties of $1.4MM

Sources of Growth

• CRE Portfolio Results

–$ 6.9B of originations over 5 years

–$ 2.1MM of net losses over same period (3bp)

–$ 1.84B currently outstanding

– Market conditions support continued caution and underwriting discipline

CRE Originations versus

Payoffs - $ Commitments

$ 1.8

$ 1.6 $ 1.6

$ 1.6

$ 1.3 $ 1.4

$ 1.4 $ 1.2 $ 1.3

$ 1.2

$ 1.0

$ 0.8

$ 0.6

$ 0.4

$ 0.2

$ 0.0

2001 2002 2003

Originations Payoffs

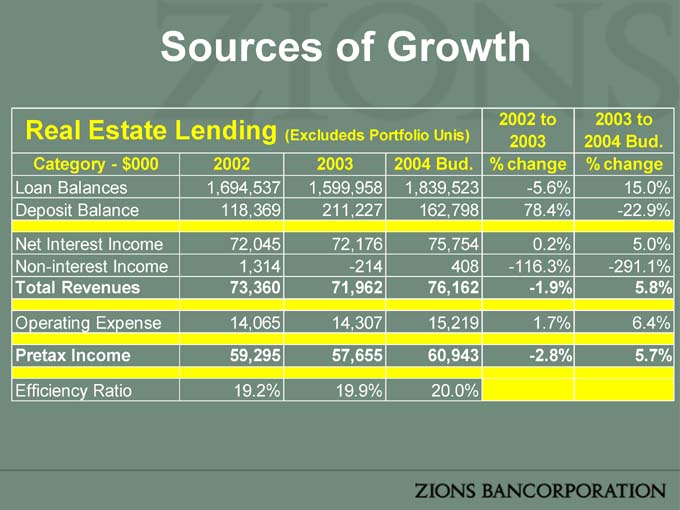

Sources of Growth

Real Estate Lending 2002 to 2003 to

(Excludeds Portfolio Unis) 2003 2004 Bud.

Category—$ 000 2002 2003 2004 Bud. % change % change

Loan Balances 1,694,537 1,599,958 1,839,523 -5.6% 15.0%

Deposit Balance 118,369 211,227 162,798 78.4% -22.9%

Net Interest Income 72,045 72,176 75,754 0.2% 5.0%

Non-interest Income 1,314 -214 408 -116.3% -291.1%

Total Revenues 73,360 71,962 76,162 -1.9% 5.8%

Operating Expense 14,065 14,307 15,219 1.7% 6.4%

Pretax Income 59,295 57,655 60,943 -2.8% 5.7%

Efficiency Ratio 19.2% 19.9% 20.0%

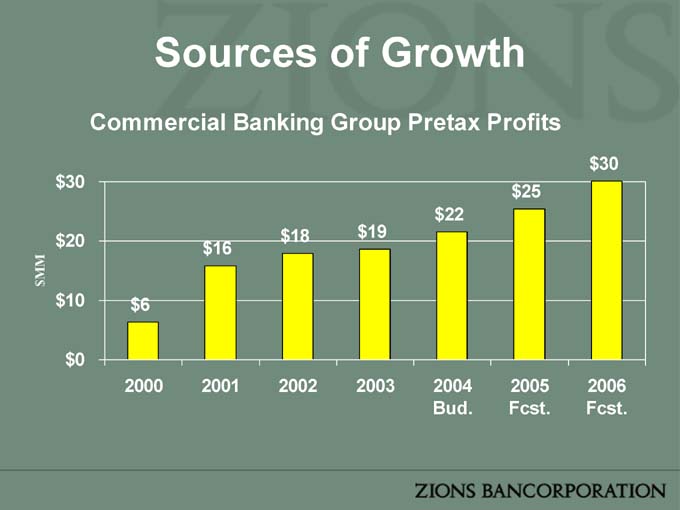

Sources of Growth

•Commercial Banking

–Market and economic conditions supported cautious strategy to business growth –Turnaround initiated 2003. New leadership hired

• Eight middle market lenders added during 2003

–Improving economy and higher quality staff positions CB&T for earnings growth in 2004 –2004 Plan includes impact of new LPO in Inland

• New management hired/office opened 4Q 2003

–1Q 2004 Pipeline up 138% from $104MM to $247MM

• Improvement reflects initial success of staff changes and improved economy

Sources of Growth

Commercial Banking Group Pretax Profits

$ 30

$ 30

$ 25

$ 22

$ 18 $ 19

$ 20 $ 16

MM

$

$ 10 $ 6

$ 0

2000 2001 2002 2003 2004 2005 2006

Bud. Fcst. Fcst.

Sources of Growth

Commercial Banking Group 2002 to 2003 to

2003 2004 Bud.

Category—$000 2002 2003 2004 Bud. % change % change

Loan Balances 639,667 643,003 805,150 0.5% 25.2%

Deposit Balance 492,799 563,179 548,826 14.3% -2.5%

Net Interest Income 31,253 32,676 36,368 4.6% 11.3%

Non-interest Income 5,176 5,308 5,878 2.5% 10.7%

Total Revenues 36,429 37,983 42,246 4.3% 11.2%

Operating Expense 18,516 19,355 20,667 4.5% 6.8%

Pretax Income 17,913 18,629 21,579 4.0% 15.8%

Efficiency Ratio 50.8% 51.0% 48.9%

Sources of Growth

$ 300 Pretax Earnings Comparison—Core Units

$ 30

$ 250

$ 69

$ 200

$ 18

MM $ 150

$ $ 82

$ 68

$ 100

$ 51 $ 98

$ 50

$ 43

$ 0

2002 2006 Fcst

Retail Business Banking San Diego

Real Estate Cml. Banking

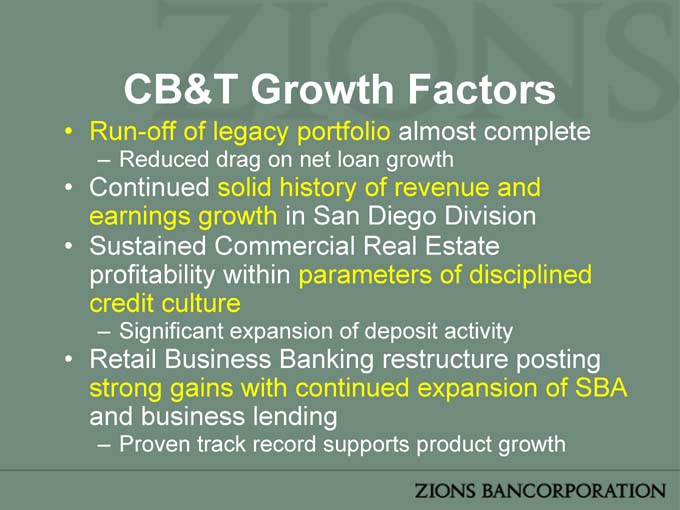

CB&T Growth Factors

• Run-off of legacy portfolio almost complete

– Reduced drag on net loan growth

• Continued solid history of revenue and earnings growth in San Diego Division

• Sustained Commercial Real Estate profitability within parameters of disciplined credit culture

– Significant expansion of deposit activity

• Retail Business Banking restructure posting strong gains with continued expansion of SBA and business lending

– Proven track record supports product growth

CB&T Growth Factors (con’t)

• Commercial Banking Division forecast to post double digit growth with improving CA economy

• De novo activity focused on IPO lending offices in high business growth areas

• Continued strong credit profile with losses below industry norms

• Interest rate risk managed to stabilize margins

• Limited expense growth

CB&T Long Term Outlook

• Run each business line to capitalize on specific competitive strengths and opportunities

• Invest in staff through strong hires and incentive plans that reward value creation

• Develop clear performance goals and use measurement tools to enforce accountability

• Utilize infrastructure investment in Sacramento and SLC processing centers to execute growing lending business

• Grow revenue through increased penetration and expansion of market share with existing business lines

ZIONS BANCORPORATION

ANALYST DAY

February 19, 2004

The Arizona Marketplace

• 2nd fastest growing population in the United States

• Population expected to surpass 6 million by 2006

• Over 65,000 residential permits in 2003

• Personal income growth expected to surpass 7% annually

A Brief History

• 1984—Founded in Tucson, AZ

• 1994—Acquired by Zions Bancorporation

($ .4B assets at acquisition)

• 1994—Acquired Rio Salado Bank

• 1996—Acquired Southern Arizona Bank

• 2000—Acquired County Bank

• 2001—Acquired Pacific Century Bank – Arizona

• 2002—Acquired Frontier State Bank

Asset Growth

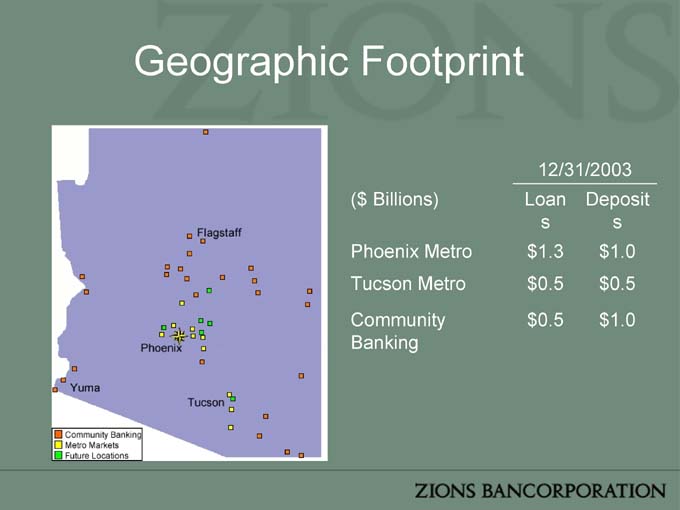

Geographic Footprint

12/31/2003

($ Billions) Loan Deposit

s s

Phoenix Metro $ 1.3 $ 1.0

Tucson Metro $ 0.5 $ 0.5

Community $ 0.5 $ 1.0

Banking

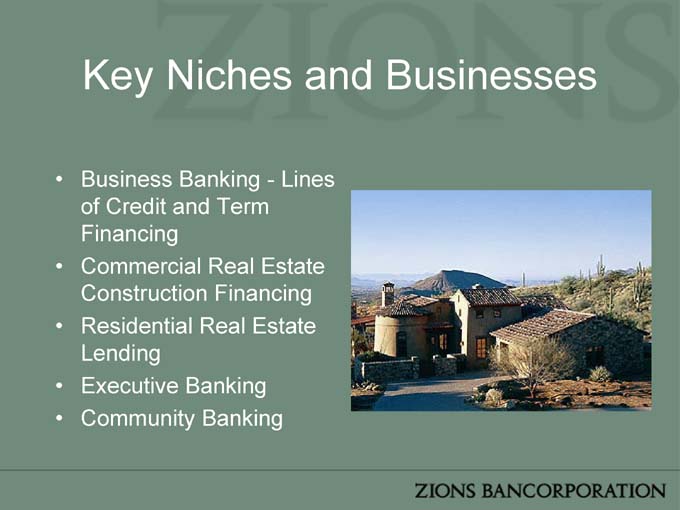

Key Niches and Businesses

• Business Banking—Lines of Credit and Term Financing

• Commercial Real Estate Construction Financing

• Residential Real Estate Lending

• Executive Banking

• Community Banking

Deposit and Loan Growth

Asset Quality

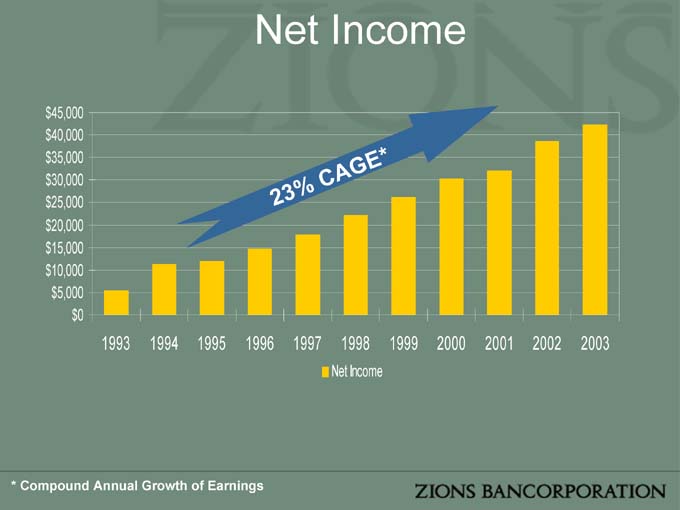

Net Income

* Compound Annual Growth of Earnings

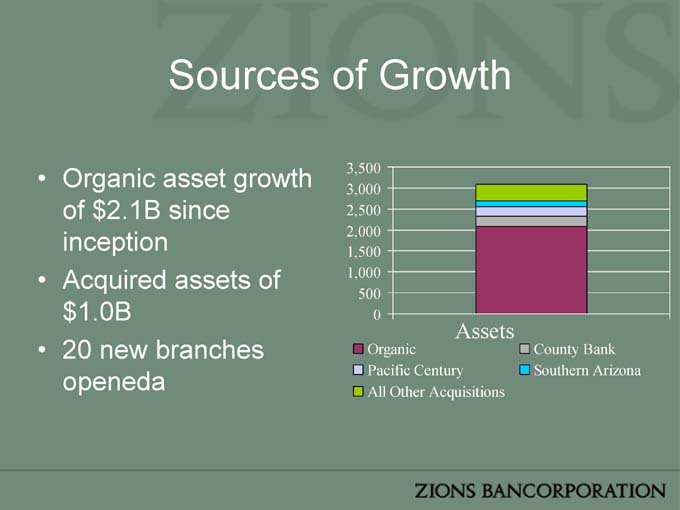

Sources of Growth

• Organic asset growth of $2.1B since inception

• Acquired assets of $1.0B

• 20 new branches openeda

Organic County Bank Pacific Century Southern Arizona All Other Acquisitions

Sources of Growth

• Established business banking acumen

–$ 1.7B of commercial and commercial real estate relationships

– 73% growth in past five years

Sources of Growth

• Recognized leader in residential lending

– Originated over $ 650MM in residential loans in 2003

– Maintain nearly $400MM in residential lot and construction loans

– Less than 25% of residential activity due to refinancing

Sources of Growth

• Executive Banking

– Division opened in 2002

– In excess of $150MM in loan commitments since inception

– Over 1,500 customer relationships

Sources of Growth

• Community Banking

– Reorganized in mid-2002 – recognizing the community market strength

– 33 community branches combined for local synergies

– Anticipate over 20% loan growth in 2004

Future Growth Opportunities

• Expanding Business Reach

• Community Banking

• Cross-Sell Expanding Client Services

• Strength From Expanding Retail Reach

• Strategic Acquisitions

Long-Term Outlook

Moderate Organic Revenue Growth + Continued Expense Control =

10% Annual Earnings Growth

[Acquisitions = Additional Growth]

ZIONS BANCORPORATION

ANALYST DAY

Nevada State Bank

Geographic Footprint

• More than $2.9 billion in assets

• 66 branches throughout Nevada

• Serving 18 communities

• 46 branch locations in Las Vegas

• 11 branch locations in Reno/Carson City

Nevada State Bank

P

History of The Bank

1959—Nevada State Bank founded in Las Vegas 1985—Purchased by Zions Bancorporation 1989—Opened the first supermarket branch in Nevada 1997—Purchased Sun State Bank & five rural Wells Fargo locations 1999—Merged with Pioneer Citizens Bank of Nevada

• Pioneer Citizens Bank—Commercial/Real Estate focus

• Nevada State Bank—Retail/Small Business focus

Nevada State Bank

The Nevada Marketplace

• More than 42,200 new jobs in 2003

– 4% increase—the nation’s largest

• #1 in the nation for 17 consecutive years for population growth

• Median income

– NV $48,715

– USA $46,868

Nevada State Bank

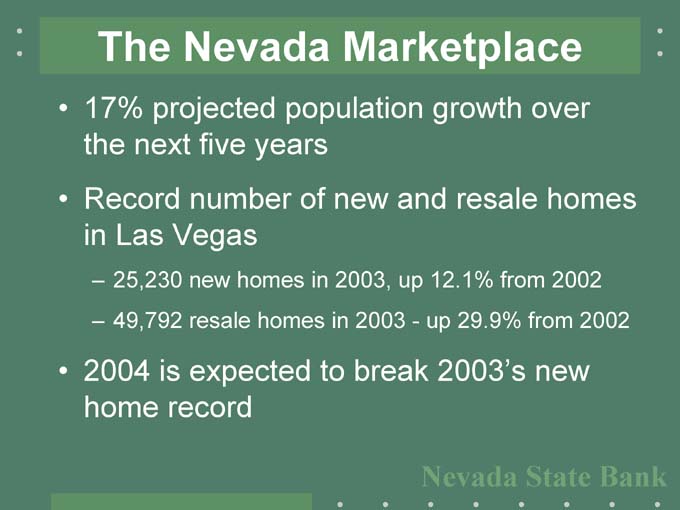

The Nevada Marketplace

• 17% projected population growth over the next five years

• Record number of new and resale homes in Las Vegas

– 25,230 new homes in 2003, up 12.1% from 2002

– 49,792 resale homes in 2003—up 29.9% from 2002

• 2004 is expected to break 2003’s new home record

Nevada State Bank

The Nevada Marketplace

Business Growth—Key Drivers

• Retail Growth—taxable sales up 7.5%

• Tourism/Travel—visitor volume up 1.1%

• Gaming Revenue—up 1.9% from 2002

Nevada State Bank

The Las Vegas Marketplace

• More than 131,000 hotel rooms at the end of 2003

• More than 1,400 new hotel rooms opening in 2004

• More than 5,000 rooms forecasted for 2005

• Rated #1 convention/trade show location for 2003

– 13.2 million square feet of rented exhibition space (#1 in US)

Nevada State Bank

Market Approach

Consumer Niche

• NSB’s position—alternative to the impersonal style of big banks

“Mega-bank products with community bank service”

• Greater product line advantage over community banks

Nevada State Bank

Market Approach

Corporate/Commercial Real Estate Niche

• NSB Advantage

– Business/professional products customized to specific needs

– Superior reputation as having “willing to go the extra mile” lenders

Nevada State Bank

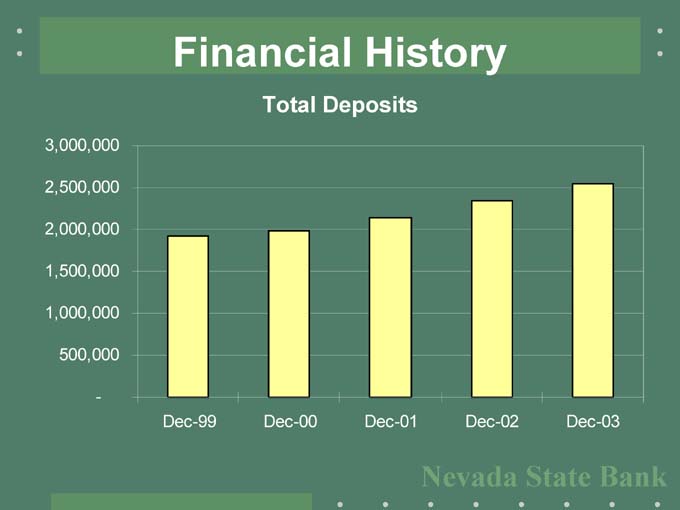

Financial History

Total Deposits

Nevada State Bank

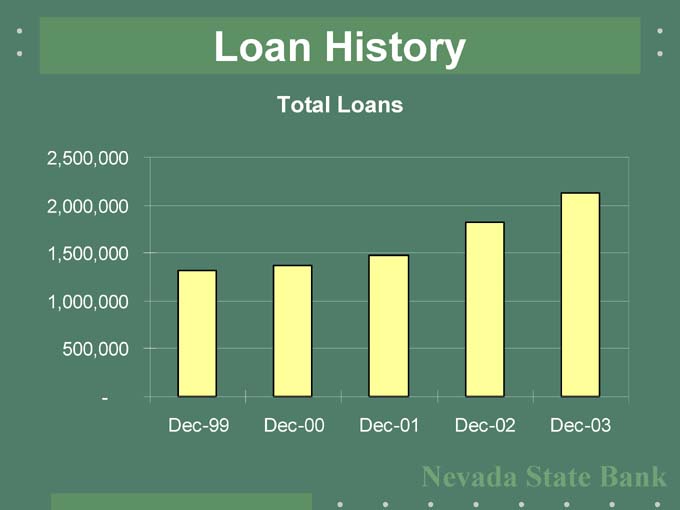

Loan History

Total Loans

Nevada State Bank

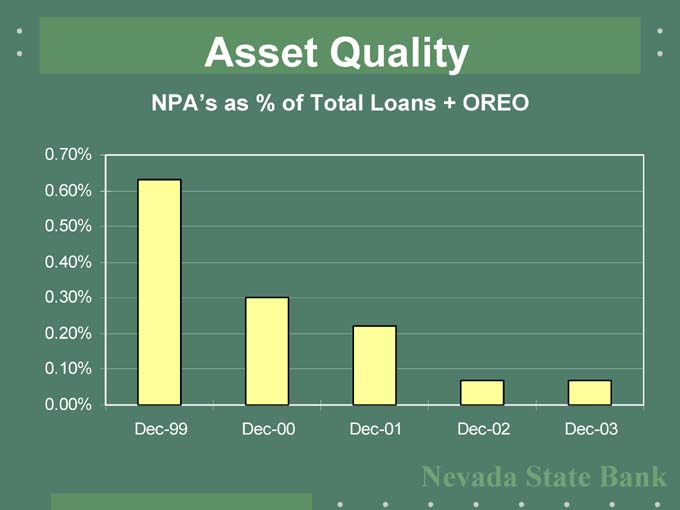

Asset Quality

NPA’s as % of Total Loans + OREO

Nevada State Bank

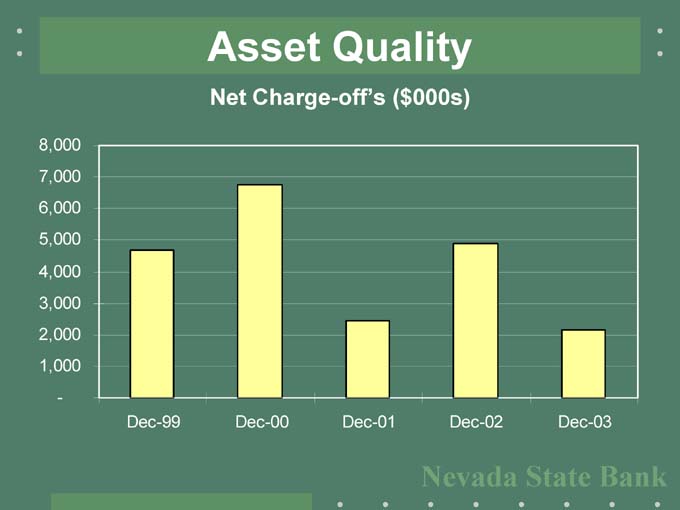

Asset Quality

Net Charge-off’s ($000s)

Nevada State Bank

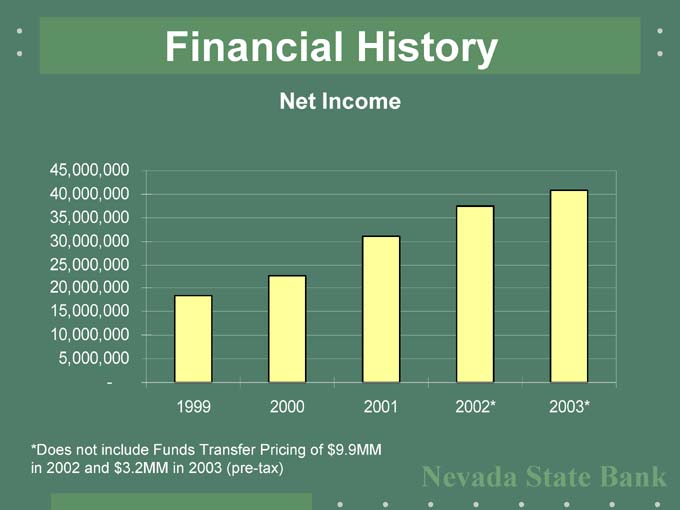

Financial History

Net Income

*Does not include Funds Transfer Pricing of $9.9MM in 2002 and $3.2MM in 2003 (pre-tax)

Nevada State Bank

Organic Growth

Branch Network

• 3 branches opened in 2003

• 6 branches planned for 2004

Nevada State Bank

Acquisition Growth

• No major opportunities

• Possible selective market fill-in’s

Nevada State Bank

Long-Term Growth Targets

CAGR (2005 – 2009)

• Revenue—10%

• Net Income – 10.9%

Nevada State Bank

Nevada State Bank

Zions Bancorporation

Analyst Day February 2004

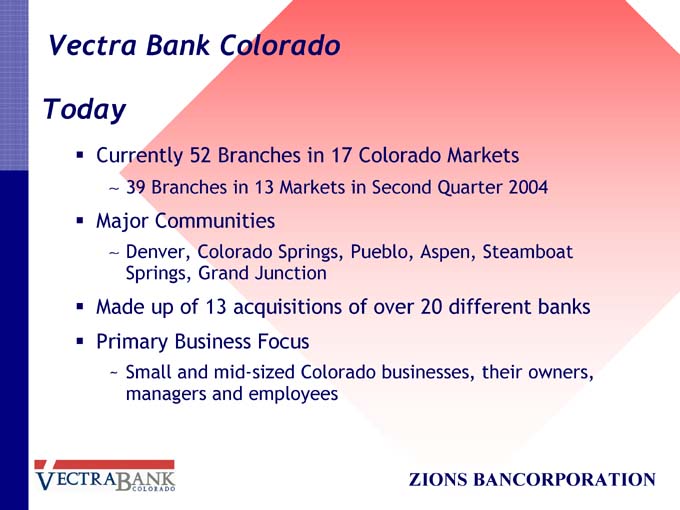

Vectra Bank Colorado

Today

Currently 52 Branches in 17 Colorado Markets

~ 39 Branches in 13 Markets in Second Quarter 2004

Major Communities

~ Denver, Colorado Springs, Pueblo, Aspen, Steamboat

Springs, Grand Junction

Made up of 13 acquisitions of over 20 different banks

Primary Business Focus

~ Small and mid-sized Colorado businesses, their owners,

managers and employees

ZIONS BANCORPORATION

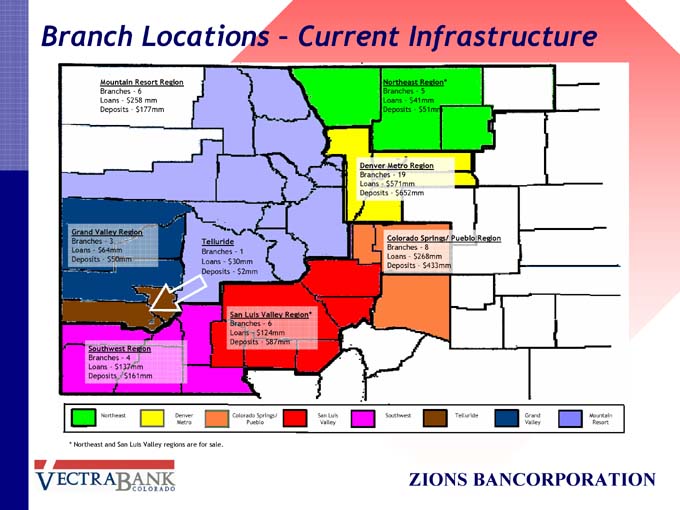

Branch Locations – Current Infrastructure

Mountain Resort Region

Branches – 6

Loans – $258 mm

Deposits – $177mm

Grand Valley Region

Branches – 3

Loans – $64mm

Deposits – $50mm

Southwest Region

Branches – 4

Loans – $137mm

Deposits – $161mm

Telluride

Branches – 1

Loans – $30mm

Deposits – $2mm

San Luis Valley Region*

Branches – 6

Loans – $124mm

Deposits – $87mm

Northeast Region*

Branches – 5

Loans – $41mm

Deposits – $51mm

Denver Metro Region

Branches – 19

Loans – $571mm

Deposits – $652mm

Colorado Springs/ Pueblo Region

Branches – 8

Loans – $268mm

Deposits – $433mm

Northeast

Denver Metro

Colorado Springs/ Pueblo

San Luis Valley

Southwest

Telluride

Grand Valley

Mountain Resort

ZIONS BANCORPORATION

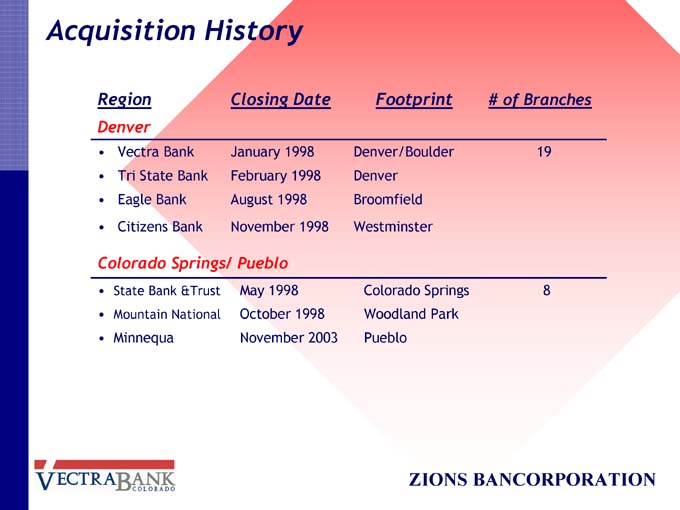

Acquisition History

Region Closing Date Footprint # of Branches

Denver

• Vectra Bank January 1998 Denver/Boulder 19

• Tri State Bank February 1998 Denver

• Eagle Bank August 1998 Broomfield

• Citizens Bank November 1998 Westminster

Colorado Springs/ Pueblo

• State Bank &Trust May 1998 Colorado Springs 8

• Mountain National October 1998 Woodland Park

• Minnequa November 2003 Pueblo

ZIONS BANCORPORATION

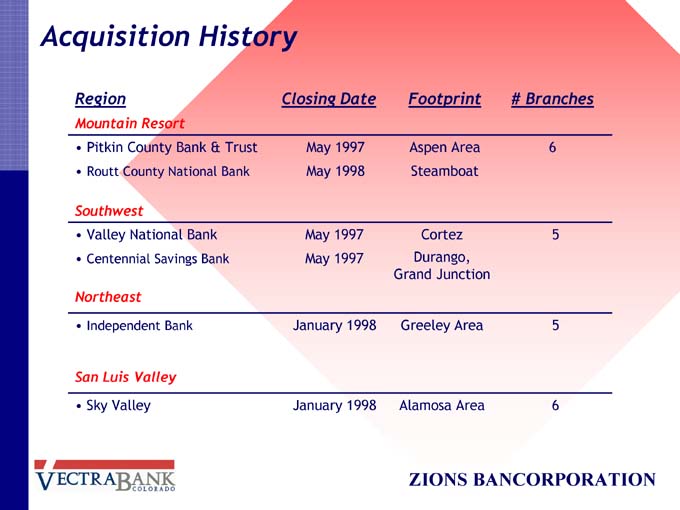

Acquisition History

Region Closing Date Footprint # Branches

Mountain Resort

• Pitkin County Bank & Trust May 1997 Aspen Area 6

• Routt County National Bank May 1998 Steamboat

Southwest

• Valley National Bank May 1997 Cortez 5

• Centennial Savings Bank May 1997 Durango,

Grand Junction

Northeast

• Independent Bank January 1998 Greeley Area 5

San Luis Valley

• Sky Valley January 1998 Alamosa Area 6

ZIONS BANCORPORATION

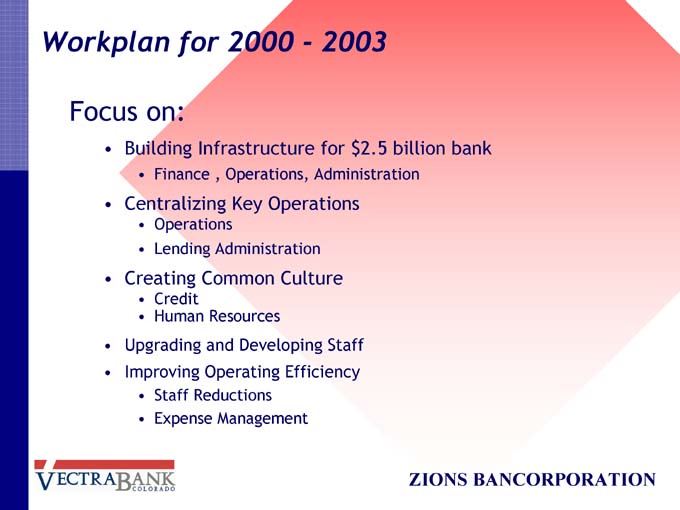

Workplan for 2000—2003

Focus on:

• Building Infrastructure for $2.5 billion bank

• Finance , Operations, Administration

• Centralizing Key Operations

• Operations

• Lending Administration

• Creating Common Culture

• Credit

• Human Resources

• Upgrading and Developing Staff

• Improving Operating Efficiency

• Staff Reductions

• Expense Management

ZIONS BANCORPORATION

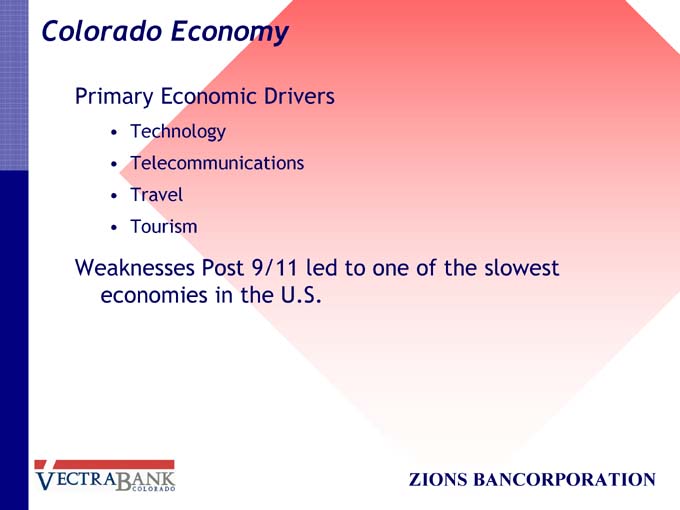

Colorado Economy

Primary Economic Drivers

• Technology

• Telecommunications

• Travel

• Tourism

Weaknesses Post 9/11 led to one of the slowest economies in the U.S.

ZIONS BANCORPORATION

Colorado Economy

Colorado Job Growth

Year Jobs Increase/Decrease

2002 - 40,000

2003 - 20,000

2004 + 15,000-25,000 (Projected)

Colorado Unemployment Rate

Year

2002 (average) 5.7%

December 31, 2003 5.6%

ZIONS BANCORPORATION

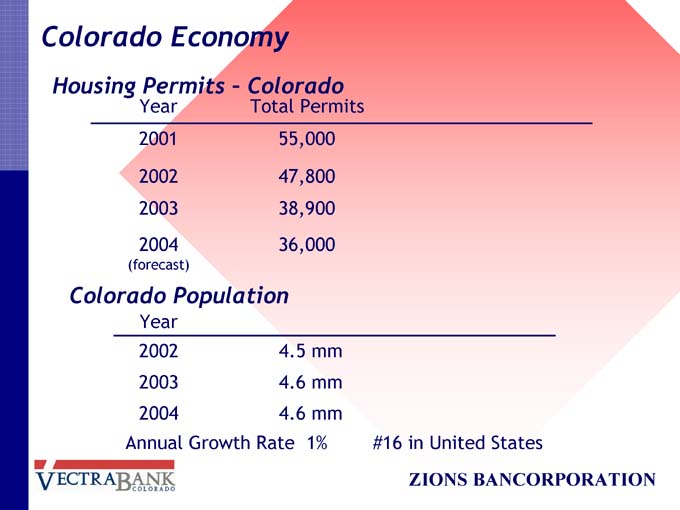

Colorado Economy

Housing Permits – Colorado

Year Total Permits

2001 55,000

2002 47,800

2003 38,900

2004 36,000

(forecast)

Colorado Population

2002 4.5 mm

2003 4.6 mm

2004 4.6 mm

Annual Growth Rate 1% #16 in United States

ZIONS BANCORPORATION

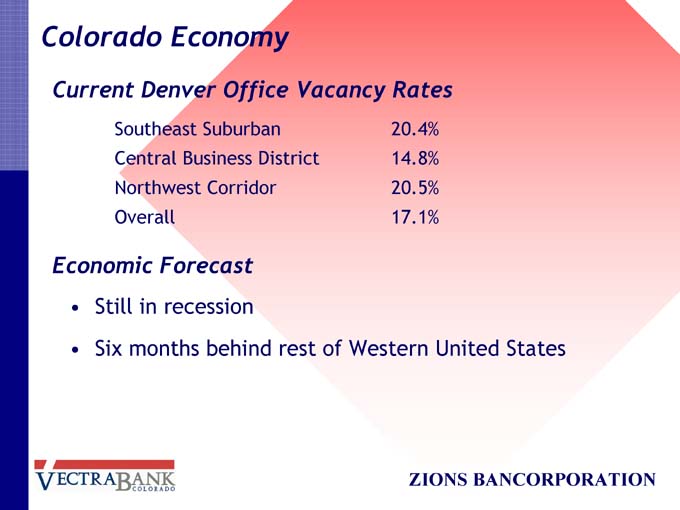

Colorado Economy

Current Denver Office Vacancy Rates

Southeast Suburban 20.4%

Central Business District 14.8%

Northwest Corridor 20.5%

Overall 17.1%

Economic Forecast

• Still in recession

• Six months behind rest of Western United States

ZIONS BANCORPORATION

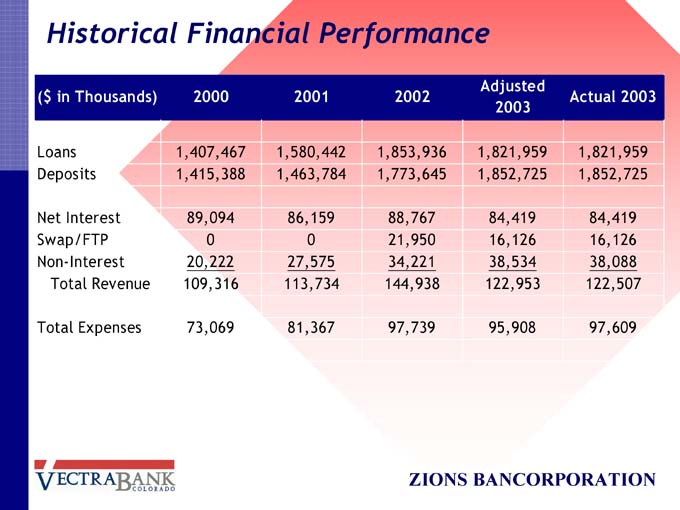

Historical Financial Performance

Adjusted

($ in Thousands) 2000 2001 2002 Actual 2003

2003

Loans 1,407,467 1,580,442 1,853,936 1,821,959 1,821,959

Deposits 1,415,388 1,463,784 1,773,645 1,852,725 1,852,725

Net Interest 89,094 86,159 88,767 84,419 84,419

Swap/FTP 0 0 21,950 16,126 16,126

Non-Interest 20,222 27,575 34,221 38,534 38,088

Total Revenue 109,316 113,734 144,938 122,953 122,507

Total Expenses 73,069 81,367 97,739 95,908 97,609

ZIONS BANCORPORATION

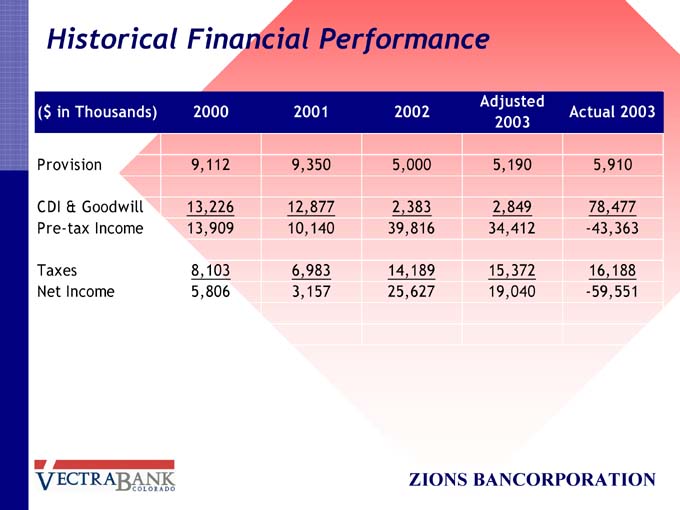

Historical Financial Performance

Adjusted

($ in Thousands) 2000 2001 2002 Actual 2003

2003

Provision 9,112 9,350 5,000 5,190 5,910

CDI & Goodwill 13,226 12,877 2,383 2,849 78,477

Pre-tax Income 13,909 10,140 39,816 34,412 -43,363

Taxes 8,103 6,983 14,189 15,372 16,188

Net Income 5,806 3,157 25,627 19,040 -59,551

ZIONS BANCORPORATION

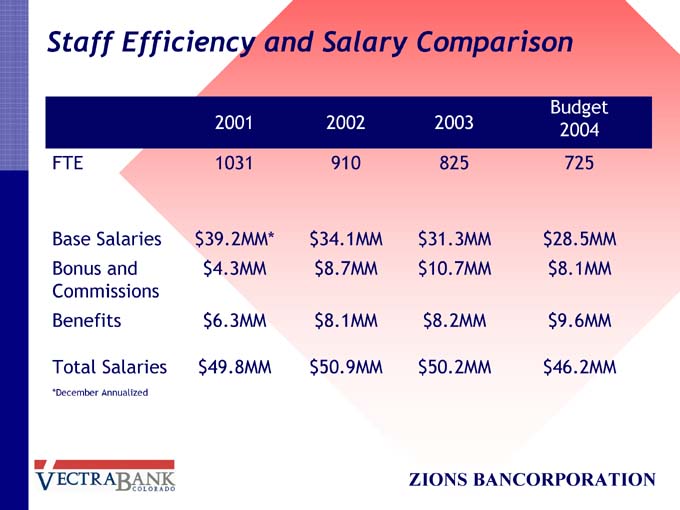

Staff Efficiency and Salary Comparison

Budget

2001 2002 2003 2004

FTE 1031 910 825 725

Base Salaries $ 39.2MM* $ 34.1MM $ 31.3MM $ 28.5MM

Bonus and $4.3MM $8.7MM $ 10.7MM $8.1MM

Commissions

Benefits $6.3MM $8.1MM $8.2MM $9.6MM

Total Salaries $49.8MM $ 50.9MM $ 50.2MM $ 46.2MM

*December Annualized

ZIONS BANCORPORATION

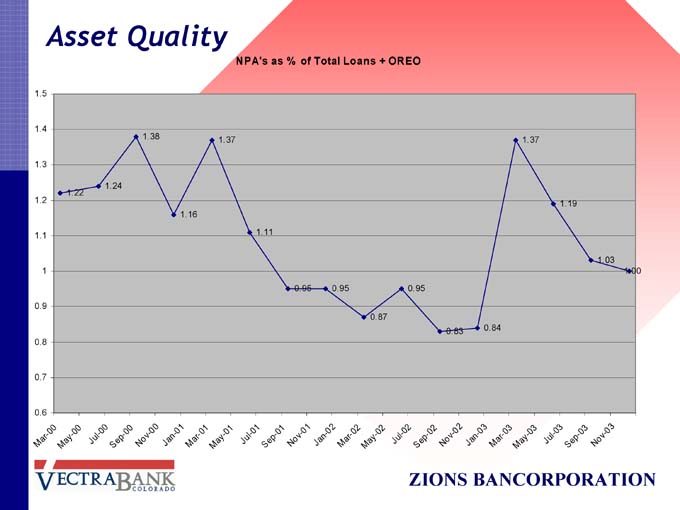

Asset Quality

NPA's as % of Total Loans + OREO

Mar- 00

May- 00

Jul- 00

Sep- 00

No

v—00

Jan- 01

Mar- 01

May- 01

Jul—01

Sep- 01

No

v—01

Jan-

02

Mar

- 02

May

- 02

Jul- 02

Sep

- 02

Nov-

02

Jan- 03

Mar

- 03

May

- 03

Jul- 03

Sep- 03

Nov-

03

ZIONS BANCORPORATION

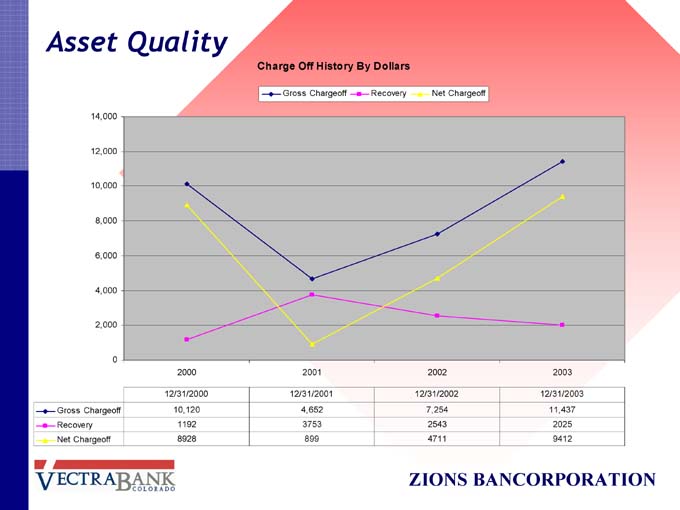

Asset Quality

Charge Off History By Dollars

Gross Chargeoff Recovery Net Chargeoff

12/31/2000 12/31/2001 12/31/2002 12/31/2003

Gross Chargeoff 10,120 4,652 7,254 11,437

Recovery 1192 3753 2543 2025

Net Chargeoff 8928 899 4711 9412

ZIONS BANCORPORATION

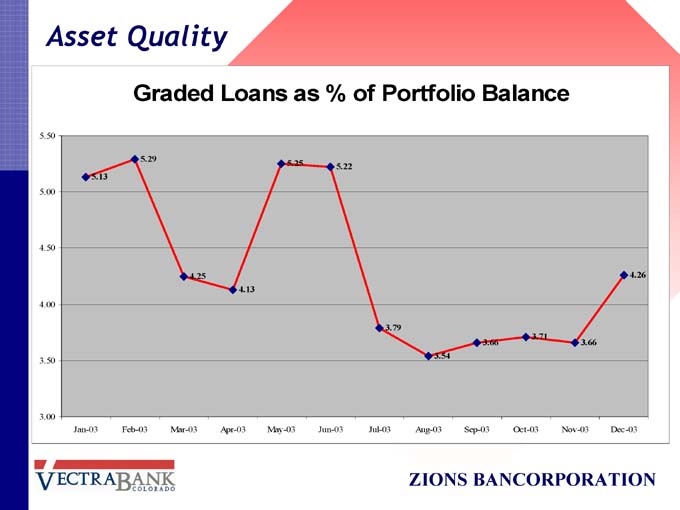

Asset Quality

Graded Loans as % of Portfolio Balance

Jan-03 Feb-03 Mar-03 Apr-03 May-03 Jun-03 Jul-03 Aug-03 Sep-03 Oct-03 Nov-03 Dec-03

ZIONS BANCORPORATION

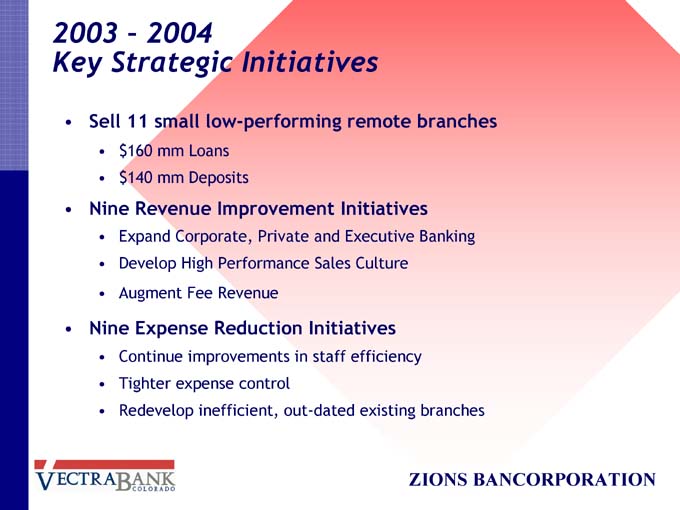

2003 – 2004

Key Strategic Initiatives

• Sell 11 small low-performing remote branches

• $160 mm Loans

• $140 mm Deposits

• Nine Revenue Improvement Initiatives

• Expand Corporate, Private and Executive Banking

• Develop High Performance Sales Culture

• Augment Fee Revenue

• Nine Expense Reduction Initiatives

• Continue improvements in staff efficiency

• Tighter expense control

• Redevelop inefficient, out-dated existing branches

ZIONS BANCORPORATION

Significant Growth Opportunities

2003 Average 2004 Pretax 2003 Pretax ($ in Thousands) Loan Operating Operating Income Balances Income

Corporate Banking 97,350 6,776 7,850

Real Estate Joint Venture 72,867 3,188 3,163

Private Banking 55,067 3,214 4,028

Executive Banking 0 0 -514

Total 225,284 13,178 14,527

ZIONS BANCORPORATION

Outlook for Growth

• Realigned Management Structure to focus on business opportunities

• Successful Recruiting efforts (New High Quality Staff)

• New Leadership in:

• Corporate Banking

• Community Banking

• Private Banking

• Chief Financial Officer

• Denver Commercial Banking

• Lower Expense Base (Staff and Operating costs)

• Develop Expansion Strategy in High Growth Business Markets

• Denver

• Colorado Springs

• Grand Junction

ZIONS BANCORPORATION

Outlook for Growth

• Acquisition opportunities exist for Colorado business Banks with

assets < $1 Billion

• Improving Asset Quality

• Shift in Focus from building infrastructure and expense control

to revenue growth

• Begin implementation of high performance sales and service

quality culture.

• New Business Pipelines (Strong Backlog of New Business)

• Improving Colorado Economy

ZIONS BANCORPORATION

THE COMMERCE BANK

OF WASHINGTON

Historical Data

• Opened for business July 1, 1988

– Merged with Zions Bancorporation in September, 1998

• Currently over $700 million in assets

Market Foot Print

• Washington State

– Population 6,041,700

– Median Household Income: $ 50,568

• TCB Market Area

– King

• Population: 1,774,300

• Median Household Income: $ 58,040

– Snohomish

• Population: 628,000

• Median Household Income: $ 56,329

– Pierce

• Population: 725,000

• Median Household Income: $ 48,298

Office of Financial Management (OFM) – 2003 Population Trends for Washington State (based on 2002 estimates)

Market Opportunity

FDIC-Insured Deposits on 6/30/2003

Statewide Deposits: $81.5 billion

King County $ 40.2 billion (49%)

Pierce County $ 6.4 billion (8%)

Snohomish County $ 6.1 billion (7%)

Total $ 52.7 billion (65%)

FDIC – County Summaries Market Share Report for Washington as of June 30, 2003

Bank’s Market Focus

• Puget Sound region

– 3 Counties (King, Snohomish, Pierce)

• 3.1 million residents

• 52% of Washington State’s population

• 65% of deposits

U.S. Census Bureau 2002 Data – released September, 2003

Our Niche

• Small to medium sized businesses

• Individuals

– Higher net worth

– Higher salaries

• No broad consumer banking

“Bank those who value a very high

level of service and will pay for it”

Our position in the marketplace

(FDIC insured deposits—6/30/2003 for King, Pierce and Snohomish Counties)

Bank of America $ 14.0 billion (27%)

Washington Mutual $ 11.4 billion (22%)

U.S. Bank $ 6.5 billion (12%)

Key Bank $ 3.2 billion (6%)

Wells Fargo $ 2.5 billion (5%)

Columbia State Bank $ 1.4 billion (3%)

Frontier Bank $ 1.4 billion (3%)

Pacific Northwest Bank (Wells) $ .49 billion (1%)

The Commerce Bank $ .47 billion (0.93%)

Who we are

• Entrepreneurial spirit

– no titles, job grades, or physical separation

between operations and relationship

management personnel

• Partnership philosophy

– structured like medium-sized law firm

• Single bonus program for all

employees

– pool funded by corporate results

Positioning of Products

• Deliver internally only those products in

which we can excel.

• Primary focus has been interest

differential products:

– Loans (including commercial real estate)

– Deposits and cash management

– Niche products

(i.e., Multiple Participant Deposit [MPD] Accounts)

Product Delivery

• No branches

– Single location on 36th floor of downtown Seattle high-rise

• Courier system

– 5 vans

– 2 modified armored trucks

– one walk-route messenger

• Electronic Convenience

– ATM network member

– Bank-by-Mail

– ACH

– Internet banking

– Bill paying capability

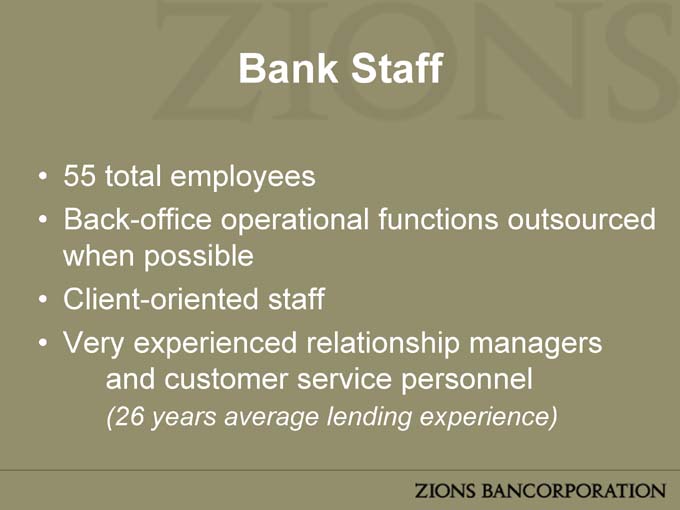

Bank Staff

• 55 total employees

• Back-office operational functions outsourced

when possible

• Client-oriented staff

• Very experienced relationship managers

and customer service personnel

(26 years average lending experience)

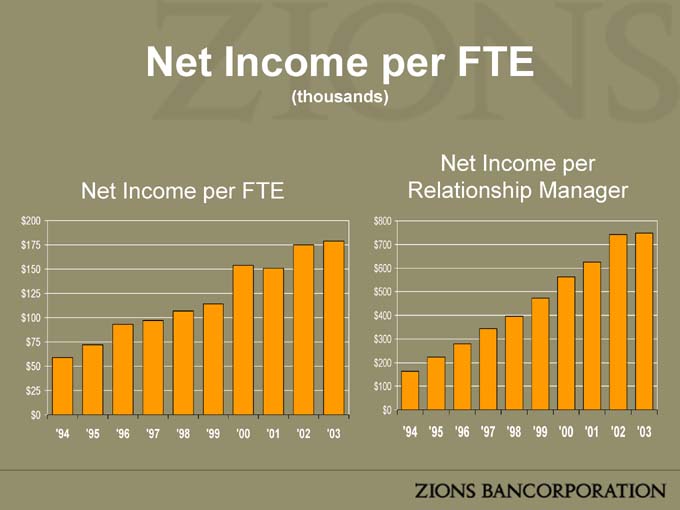

Net Income per FTE

(thousands)

Net Income per FTE

‘94 ‘95 ‘96 ‘97 ‘98 ‘99 ‘00 ‘01 ‘02 ‘03

Net Income per Relationship Manager

‘94 ‘95 ‘96 ‘97 ‘98 ‘99 ‘00 ‘01 ‘02 ‘03

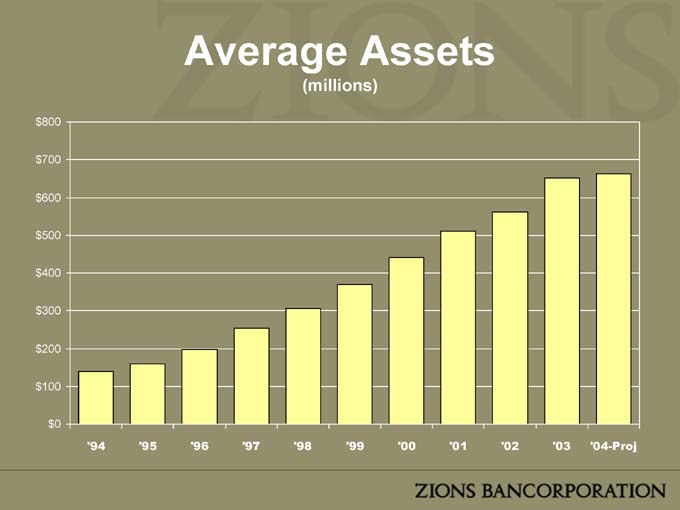

Average Assets

(millions)

‘94 ‘95 ‘96 ‘97 ‘98 ‘99 ‘00 ‘01 ‘02 ‘03 ‘04-Proj

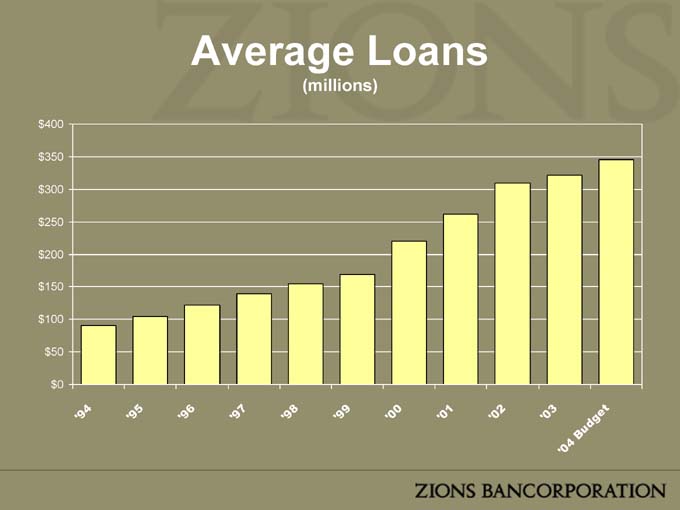

Average Loans

(millions)

‘ 94

‘95

‘96

‘97

‘ 98

‘99

‘ 00

‘ 01

‘02

‘03

‘04

Budget

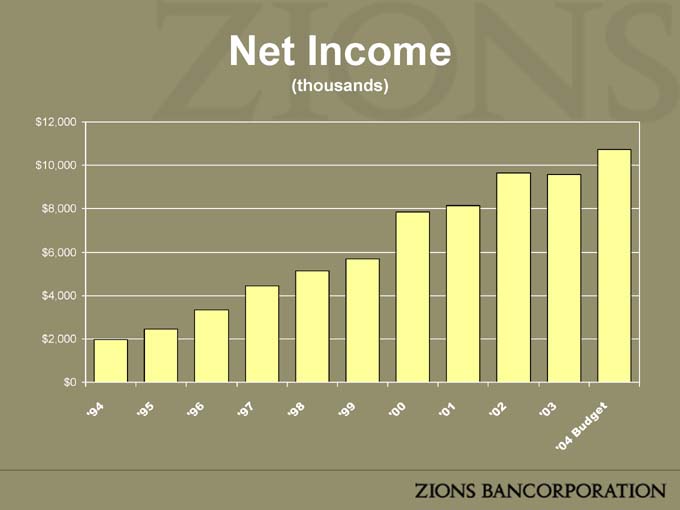

Net Income

(thousands)

‘94

‘95

‘96

‘ 97

‘98

‘ 99

‘00

‘01

‘02

‘ 03

‘ 04

Bud get

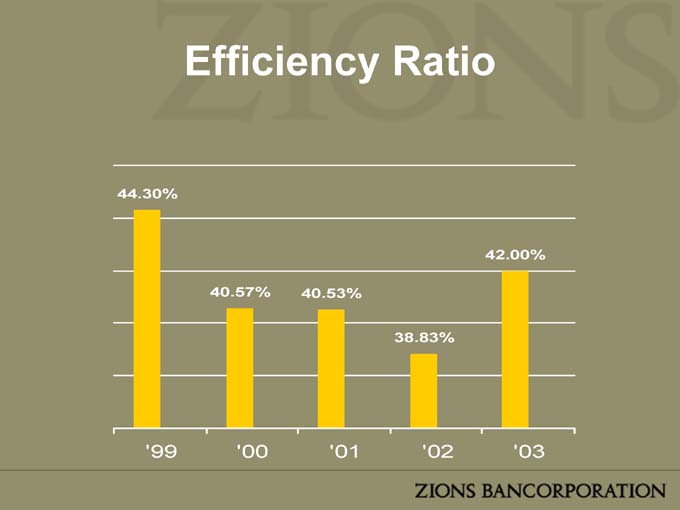

Key Ratios

ROE %

‘99 ‘00 ‘01 ‘02 ‘03

ROA %

‘99 ‘00 ‘01 ‘02 ‘03

Efficiency Ratio

‘99 ‘00 ‘01 ‘02 ‘03

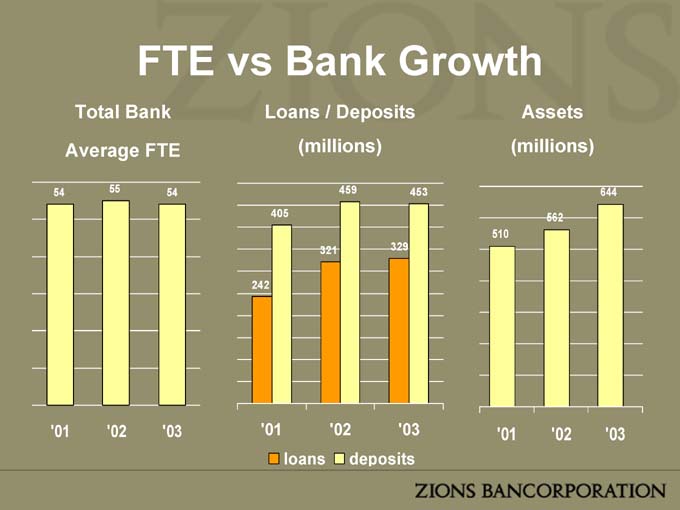

FTE vs Bank Growth

Total Bank

Average FTE

‘01 ‘02 ‘03

Loans / Deposits (millions)

‘01 ‘02 ‘03

Assets (millions)

‘01 ‘02 ‘03

loans deposits

Asset Quality

2000 2001 2002 2003

NPAs/Avg Loans NCOs/ Avg Loans ALLL/Avg Loans

CHALLENGES

• Maintain quality growth

• Narrow margins

• Grow non-interest revenue

• Preserve integrity of The Commerce Bank

model

• Broaden Zions’ geographic franchise without

risking uniqueness of The Commerce Bank

• Continue to attract experienced bankers

• Economy

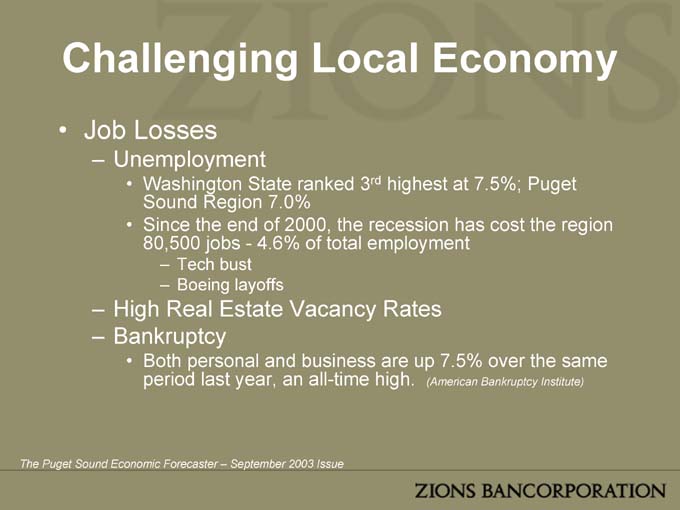

Challenging Local Economy

• Job Losses

– Unemployment

• Washington State ranked 3rd highest at 7.5%; Puget

Sound Region 7.0%

• Since the end of 2000, the recession has cost the region

80,500 jobs - - 4.6% of total employment

– Tech bust

– Boeing layoffs

– High Real Estate Vacancy Rates

– Bankruptcy

• Both personal and business are up 7.5% over the same

period last year, an all-time high. (American Bankruptcy Institute)

The Puget Sound Economic Forecaster – September 2003 Issue

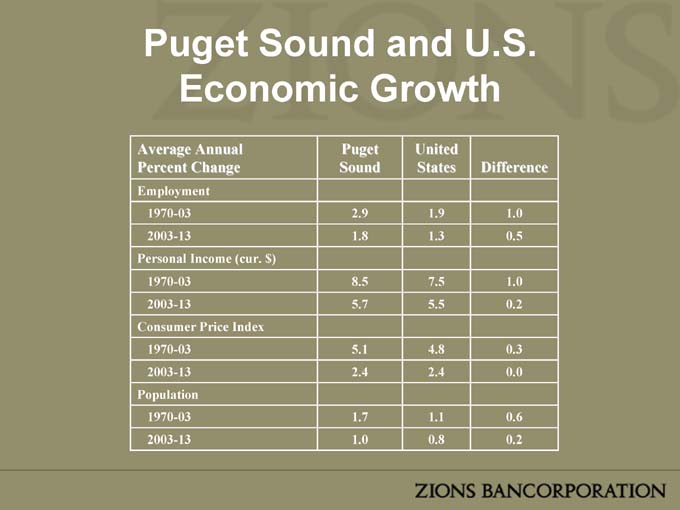

Puget Sound and U.S.

Economic Growth

Average Annual Puget United

Percent Change Sound States Difference

Employment

1970-03 2.9 1.9 1.0

2003-13 1.8 1.3 0.5

Personal Income (cur. $)

1970-03 8.5 7.5 1.0

2003-13 5.7 5.5 0.2

Consumer Price Index

1970-03 5.1 4.8 0.3

2003-13 2.4 2.4 0.0

Population

1970-03 1.7 1.1 0.6

2003-13 1.0 0.8 0.2

Opportunities

• Continue to capitalize on market position:

– A high quality relationship bank which provides great service

• Capture more revenue dollars per client by expanding the use of Zions products

Wealth Management SBA Lending

Trust Services Public Finance

Loan Participations International

Commercial Real Estate Roth Capital

Initiatives to Grow the Bank

• Maintain quality growth of loans and

deposits

– Increase market share per relationship

manager

• Maintain margins

• Manage non-interest expense

Product Expansion

• Wealth Management Initiatives

– Trust Services

– Private Banking

• Cash Management

(i.e., real-time wire transfer)

• Product Mix

– Emphasize fee income opportunities in Cash

Management, Deposit, Loan, FX and Zions

cross-sales

Growth Through Acquisition

• Potential Target Areas

– Commercial Banks / Savings Banks

– Investment Management / Trust

Companies

– Growth through expansion to Bellevue and

Portland

Zions Bancorporation Analyst Day

19 February 2004 Salt Lake City, Utah

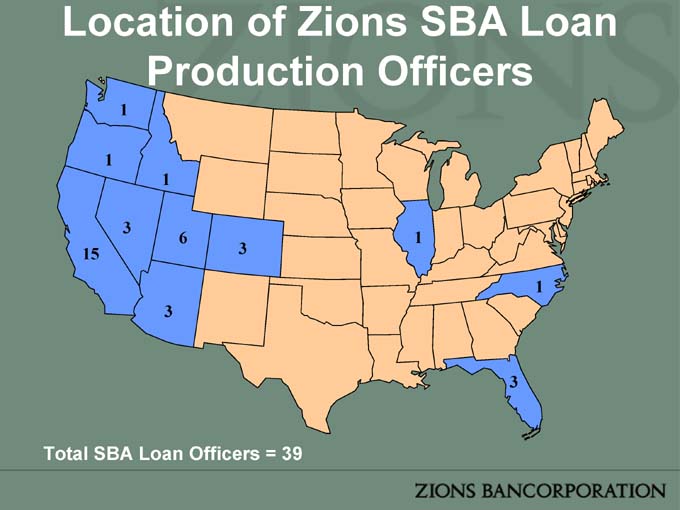

Location of Zions SBA Loan Production Officers

Total SBA Loan Officers = 39

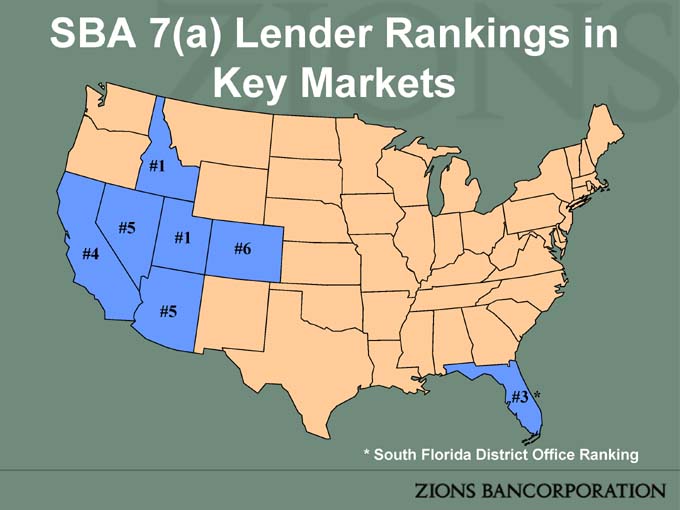

SBA 7(a) Lender Rankings in Key Markets

* South Florida District Office Ranking

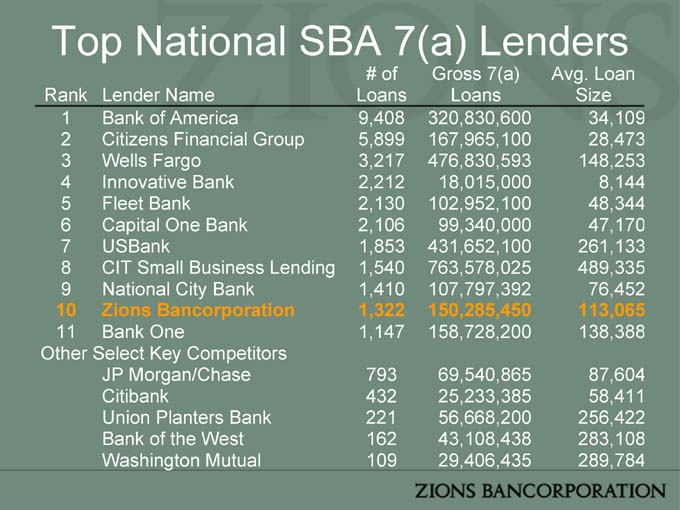

Top National SBA 7(a) Lenders

# of Gross 7(a) Avg. Loan

Rank Lender Name Loans Loans Size

1 Bank of America 9,408 320,830,600 34,109

2 Citizens Financial Group 5,899 167,965,100 28,473

3 Wells Fargo 3,217 476,830,593 148,253

4 Innovative Bank 2,212 18,015,000 8,144

5 Fleet Bank 2,130 102,952,100 48,344

6 Capital One Bank 2,106 99,340,000 47,170

7 USBank 1,853 431,652,100 261,133

8 CIT Small Business Lending 1,540 763,578,025 489,335

9 National City Bank 1,410 107,797,392 76,452

10 Zions Bancorporation 1,322 150,285,450 113,065

11 Bank One 1,147 158,728,200 138,388

Other Select Key Competitors

JP Morgan/Chase 793 69,540,865 87,604

Citibank 432 25,233,385 58,411

Union Planters Bank 221 56,668,200 256,422

Bank of the West 162 43,108,438 283,108

Washington Mutual 109 29,406,435 289,784

Changing Competitive Landscape

• Emergence of Credit Scored Lenders

– Lenders using SBA Express Product

Bank of America Fleet Bank Innovative Bank Capital One, FSB Credit Unions Citizens Financial Group

– SBA 7a Only Lenders

USBank Business Loan Express Temecula Valley Bank CIT

– Full Service Lenders (Express, 7(a), 504)

Zions Wells Fargo

Zions Bancorporation SBA Strategy

• Utilize SBA financing to provide maximum benefits to client

• Strengthen Client Relationships

• Provide a full array of SBA product suite options to clients and prospects

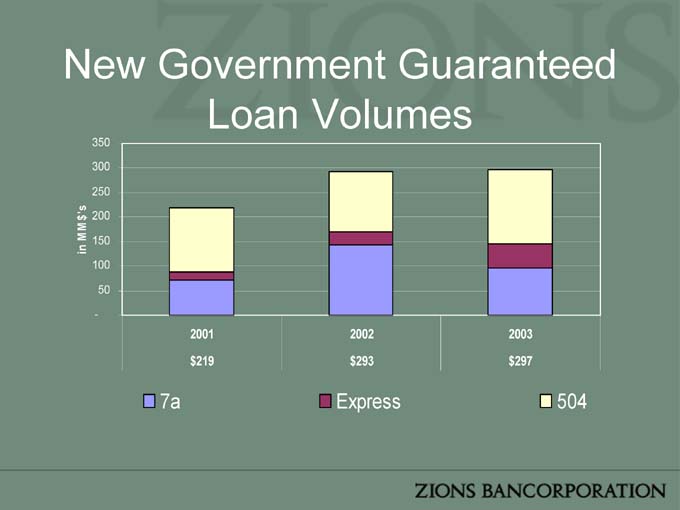

New Government Guaranteed Loan Volumes

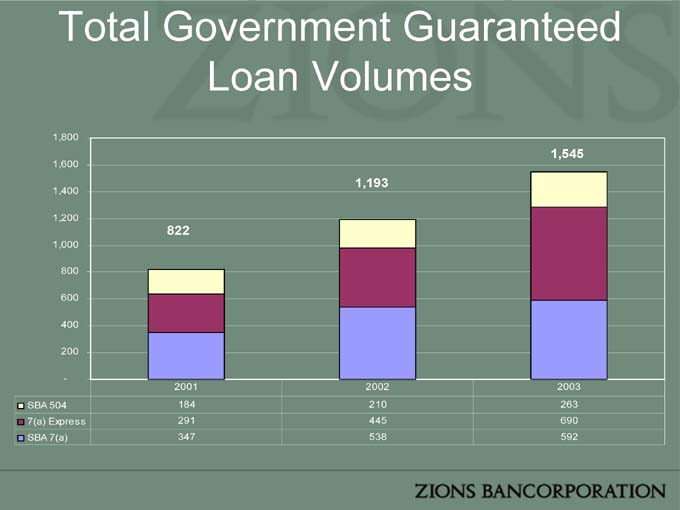

Total Government Guaranteed Loan Volumes

2004 Business Plan

• Growth of Business Development Officers

– New Market Areas:

• North Carolina

• Illinois

– Growth in Existing Market Areas:

• Arizona

• Nevada

• Colorado

– Expansion is People Driven

• Online Loan Application

• Increase SBA lending volume by $75MM in 2004

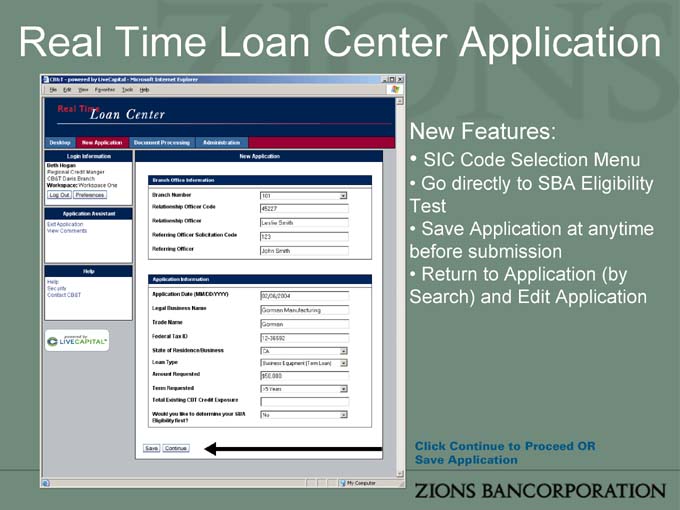

Real Time Loan Center Application

New Features:

• SIC Code Selection Menu

• Go directly to SBA Eligibility Test

• Save Application at anytime before submission

• Return to Application (by Search) and Edit Application

Click Continue to Proceed OR Save Application

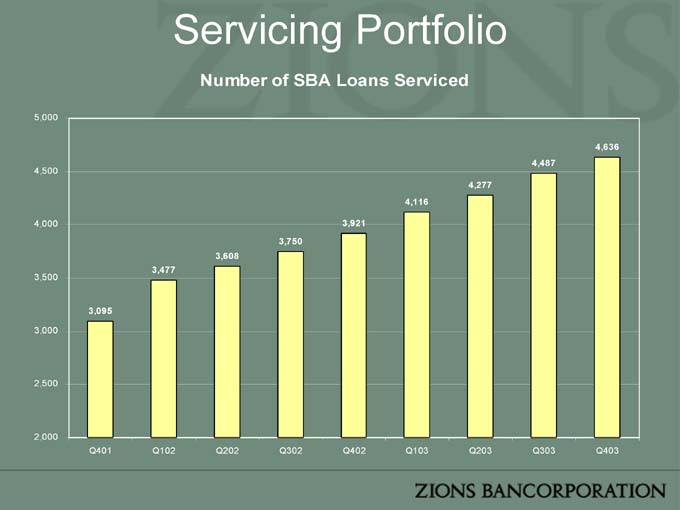

Servicing Portfolio

Number of SBA Loans Serviced

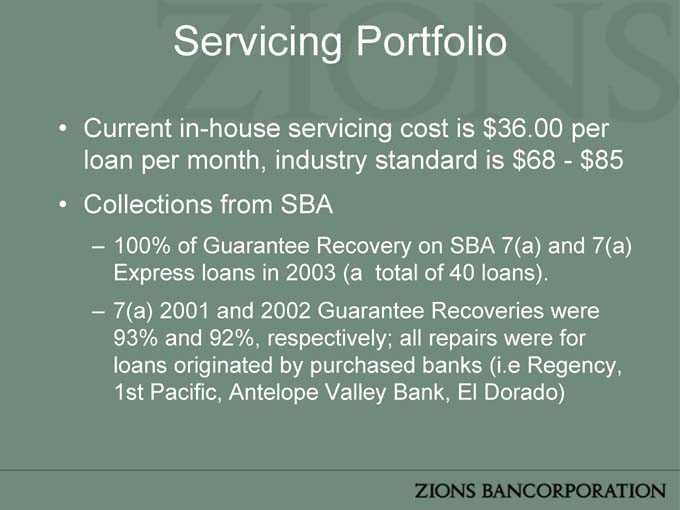

Servicing Portfolio

• Current in-house servicing cost is $36.00 per loan per month, industry standard is $68—$85

• Collections from SBA

– 100% of Guarantee Recovery on SBA 7(a) and 7(a) Express loans in 2003 (a total of 40 loans).

– 7(a) 2001 and 2002 Guarantee Recoveries were 93% and 92%, respectively; all repairs were for loans originated by purchased banks (i.e Regency, 1st Pacific, Antelope Valley Bank, El Dorado)

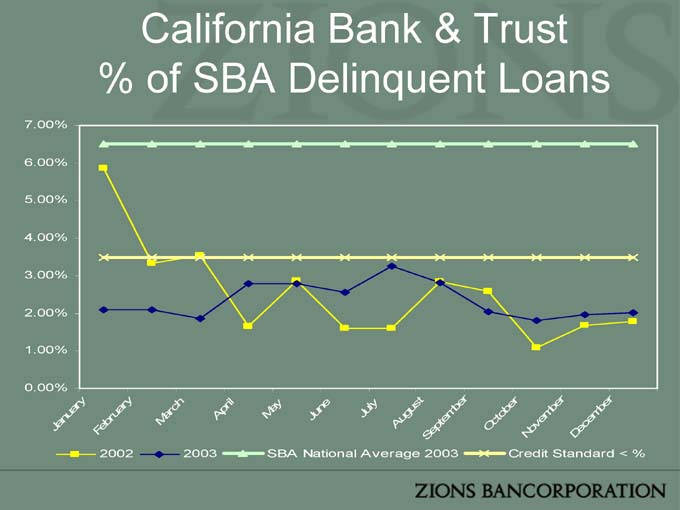

California Bank & Trust % of SBA Delinquent Loans

California Bank & Trust % of SBA Loan Loss Actuals

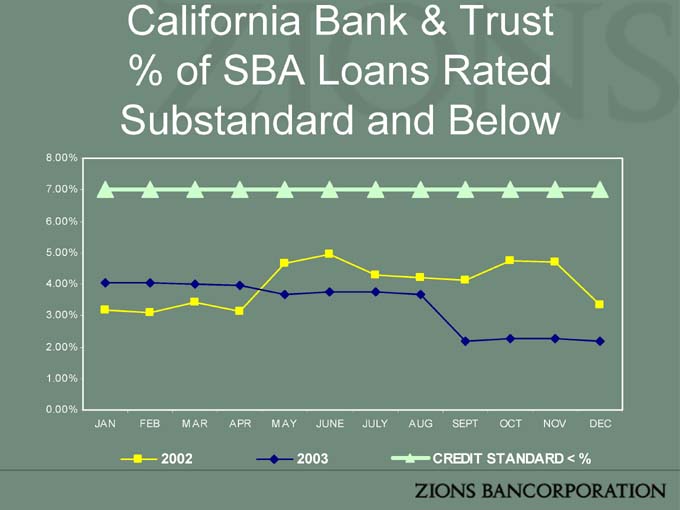

California Bank & Trust % of SBA Loans Rated Substandard and Below

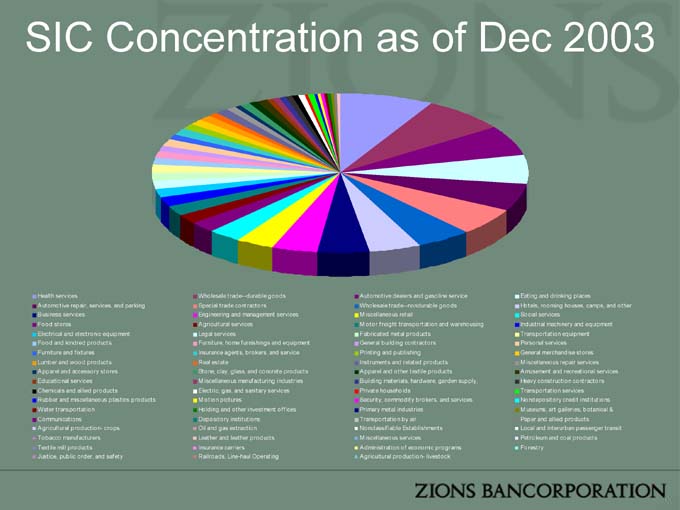

SIC Concentration as of Dec 2003

Health services Wholesale trade—durable goods

Automotive repair, services, and parking Special trade contractors

Business services Engineering and management services

Food stores Agricultural services

Electrical and electronic equipment Legal services

Food and kindred products Furniture, home furnishings and equipment

Furniture and fixtures Insurance agents, brokers, and service

Lumber and wood products Real estate

Apparel and accessory stores Stone, clay, glass, and concrete products

Educational services M iscellaneous manufacturing industries

Chemicals and allied products Electric, gas, and sanitary services

Rubber and miscellaneous plastics products M otion pictures

Water transportation Holding and other investment offices

Communications Depository institutions

Agricultural production- crops Oil and gas extraction

Tobacco manufacturers Leather and leather products

Textile mill products Insurance carriers

Justice, public order, and safety Railroads, Line-haul Operating

Automotive dealers and gasoline service Eating and drinking places

Wholesale trade—nondurable goods Hotels, rooming houses, camps, and other

M iscellaneous retail Social services

M otor freight transportation and warehousing Industrial machinery and equipment

Fabricated metal products Transportation equipment

General building contractors Personal services

Printing and publishing General merchandise stores

Instruments and related products M iscellaneous repair services

Apparel and other textile products Amusement and recreational services

Building materials, hardware, garden supply, Heavy construction contractors

Private households Transportation services

Security, commodity brokers, and services Nondepository credit institutions

Primary metal industries M useums, art galleries, botanical &

Transportation by air Paper and allied products

Nonclassifiable Establishments Local and interurban passenger transit

M iscellaneous services Petroleum and coal products

Administration of economic programs Forestry

Agricultural production- livestock

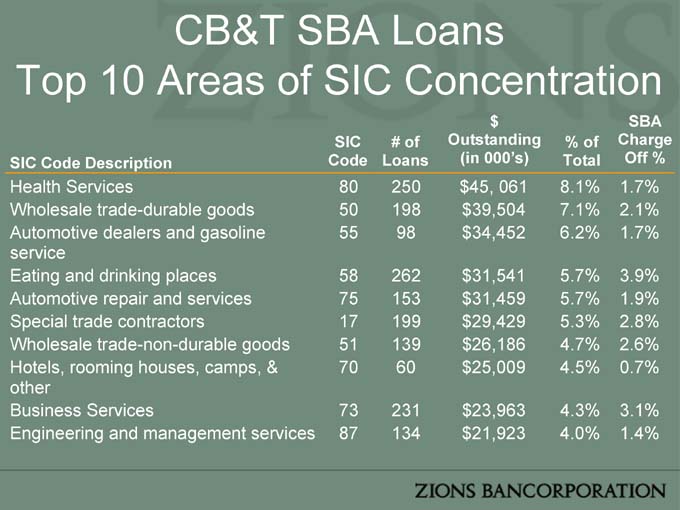

CB&T SBA Loans

Top 10 Areas of SIC Concentration

SIC # of $Outstanding % of SBA Charge

SIC Code Description Code Loans (in 000’s) Total Off %

Health Services 80 250 $45, 061 8.1% 1.7%

Wholesale trade-durable goods 50 198 $39,504 7.1% 2.1%

Automotive dealers and gasoline service 55 98 $34,452 6.2% 1.7%

Eating and drinking places 58 262 $31,541 5.7% 3.9%

Automotive repair and services 75 153 $31,459 5.7% 1.9%

Special trade contractors 17 199 $29,429 5.3% 2.8%

Wholesale trade-non-durable goods 51 139 $26,186 4.7% 2.6%

Hotels, rooming houses, camps, & other 70 60 $25,009 4.5% 0.7%

Business Services 73 231 $23,963 4.3% 3.1%

Engineering and management services 87 134 $21,923 4.0% 1.4%

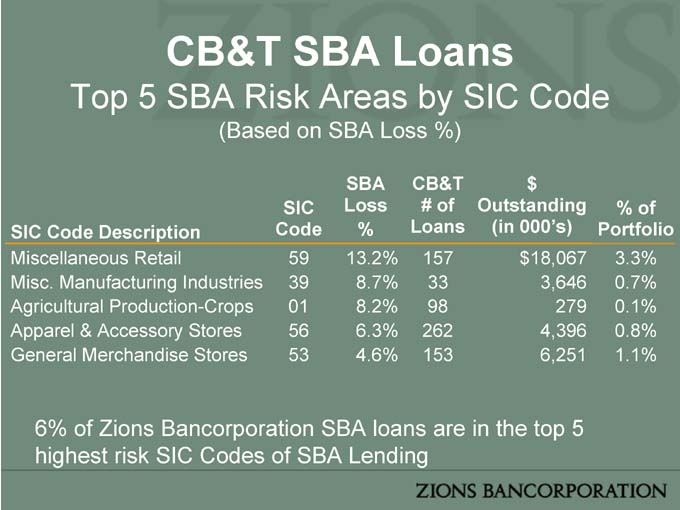

CB&T SBA Loans

Top 5 SBA Risk Areas by SIC Code

(Based on SBA Loss %)

SIC SBA Loss CB&T # of $ Outstanding % of

SIC Code Description Code % Loans (in 000’s) Portfolio

Miscellaneous Retail 59 13.2% 157 $ 18,067 3.3%

Misc. Manufacturing Industries 39 8.7% 33 3,646 0.7%

Agricultural Production-Crops 01 8.2% 98 279 0.1%

Apparel & Accessory Stores 56 6.3% 262 4,396 0.8%

General Merchandise Stores 53 4.6% 153 6,251 1.1%

6% of Zions Bancorporation SBA loans are in the top 5 highest risk SIC Codes of SBA Lending

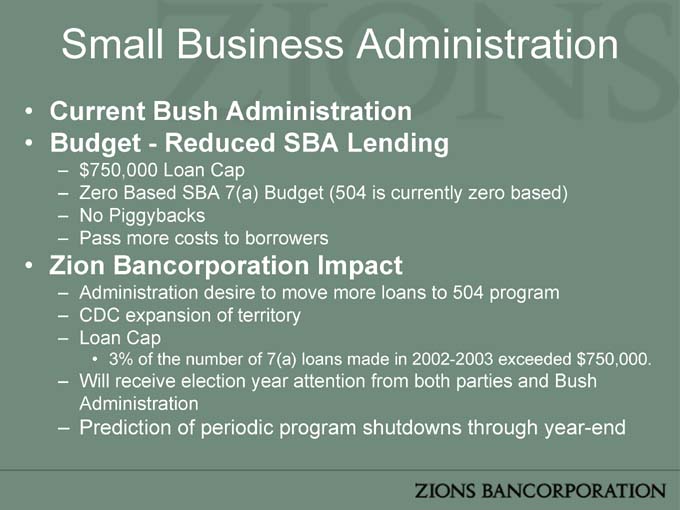

Small Business Administration

• Current Bush Administration

• Budget—Reduced SBA Lending

–$ 750,000 Loan Cap

– Zero Based SBA 7(a) Budget (504 is currently zero based)

– No Piggybacks

– Pass more costs to borrowers

• Zion Bancorporation Impact

– Administration desire to move more loans to 504 program

– CDC expansion of territory

– Loan Cap

• 3% of the number of 7(a) loans made in 2002-2003 exceeded $750,000.

– Will receive election year attention from both parties and Bush Administration

– Prediction of periodic program shutdowns through year-end

Small Business Administration (cont’d)

• Zions Bancorporation Strengths

– Historic 504 presence

– Lack of reliance on 7(a) to drive CRE and large loans

– Can gap fund loans during program shutdowns

National Real Estate Department

National Real Estate Dept.

“We provide our lending partners with a national secondary market for owner-occupied commercial real estate loans. Our service achieves two primary objectives:”

• We help our lending partners meet customers needs by increasing commercial lending capacity.

• We help our partner lenders generate fee income with nominal credit risk.

Dept Products & Functions

• Originate and purchase SBA 504, 7(a) piggyback and conv. 1st mortgages on commercial properties

• Active relationship with approximately 250 lenders nationwide

• Local lender performs some underwriting to determine eligibility

• Zions pays lender a premium; predominantly servicing released

• Securitize loans annually into CP Conduit

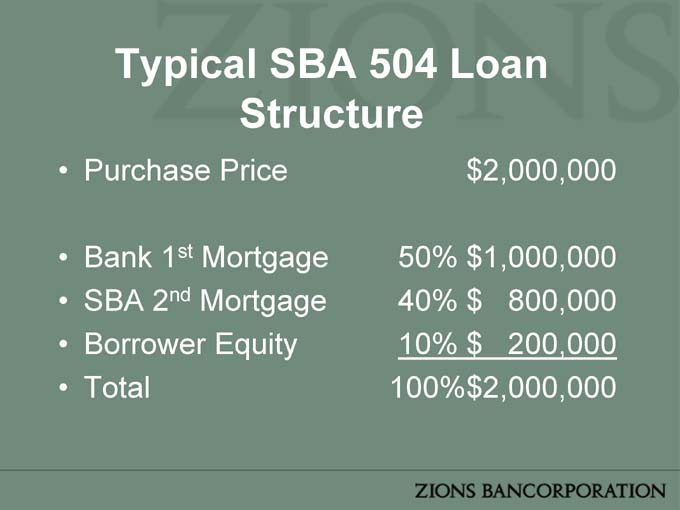

Typical SBA 504 Loan Structure

• Purchase Price $ 2,000,000

• Bank 1st Mortgage 50% $ 1,000,000

• SBA 2nd Mortgage 40% $ 800,000

• Borrower Equity 10% $ 200,000

• Total 100%$ 2,000,000

Commercial Property Types

• Multi-purpose

- Office, warehouse, office/warehouse mix, light industrial, retail, manufacturing, medical

• Special-use

- Hotels/motels, restaurants, day-care, gas station c-stores, car washes, golf courses, assisted living centers

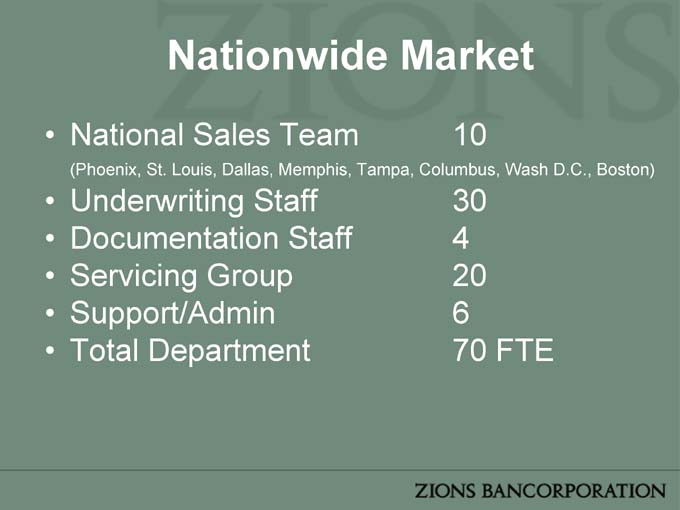

Nationwide Market

• National Sales Team 10

(Phoenix, St. Louis, Dallas, Memphis, Tampa, Columbus, Wash D.C., Boston)

• Underwriting Staff 30

• Documentation Staff 4

• Servicing Group 20

• Support/Admin 6

• Total Department 70 FTE

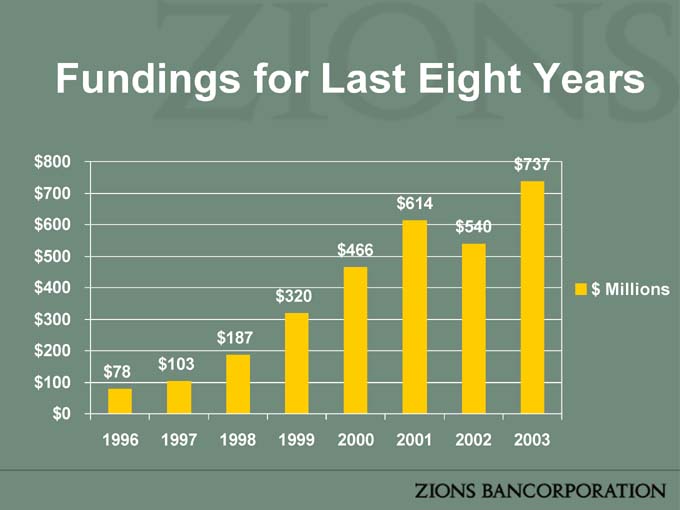

Fundings for Last Eight Years

$78 $103 $187 $320 $466 $614 $540 $737

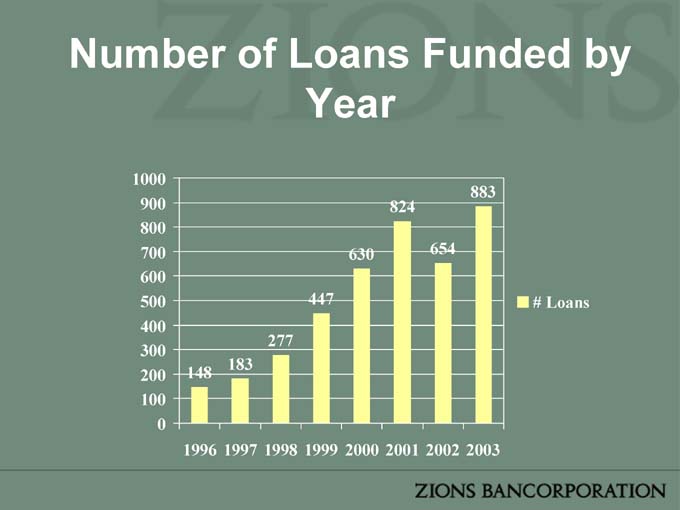

Number of Loans Funded by Year

148 183 277 447 630 824 654 883

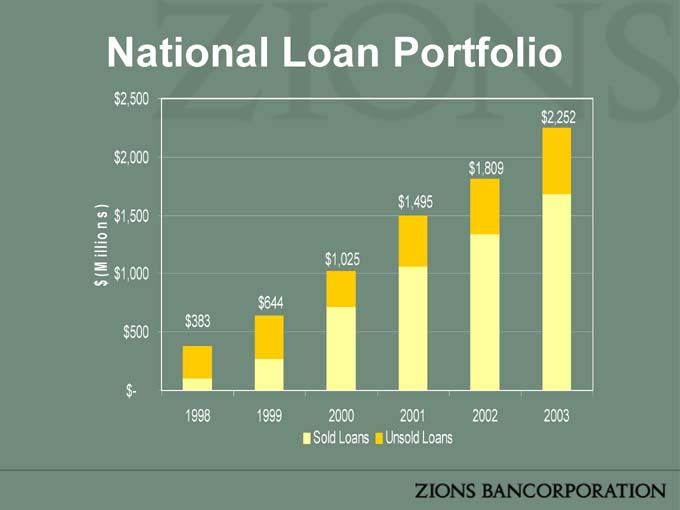

National Loan Portfolio $383 $644 $1,025 $1,495 $1,809 $2,252

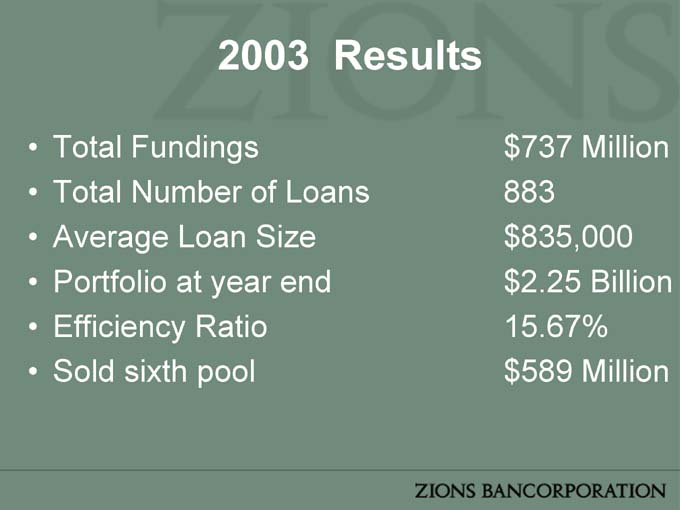

2003 Results

• Total Fundings $737 Million

• Total Number of Loans 883

• Average Loan Size $ 835,000

• Portfolio at year end $2.25 Billion

• Efficiency Ratio 15.67%

• Sold sixth pool $589 Million

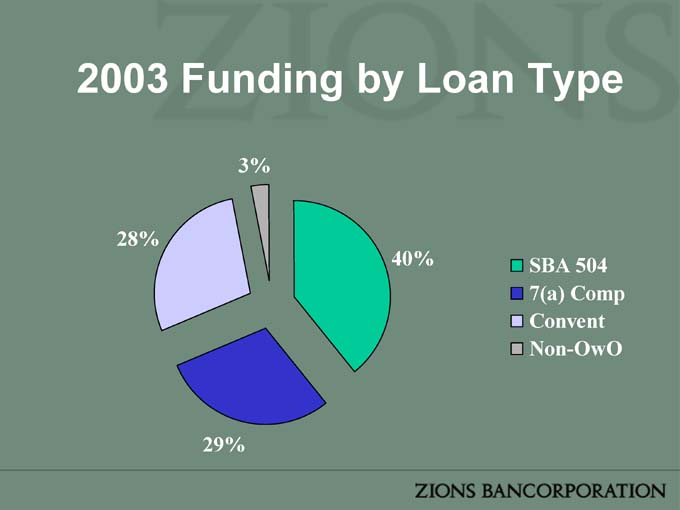

2003 Funding by Loan Type

40% 29% 28% 3%

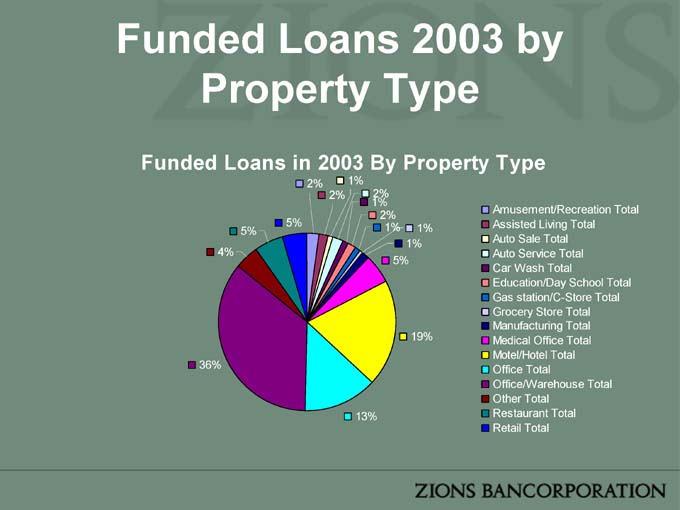

Funded Loans 2003 by Property Type

Funded Loans in 2003 By Property Type

2% 2% 1% 2% 1% 2% 1% 1% 1% 5% 19% 13% 36% 4% 5% 5%

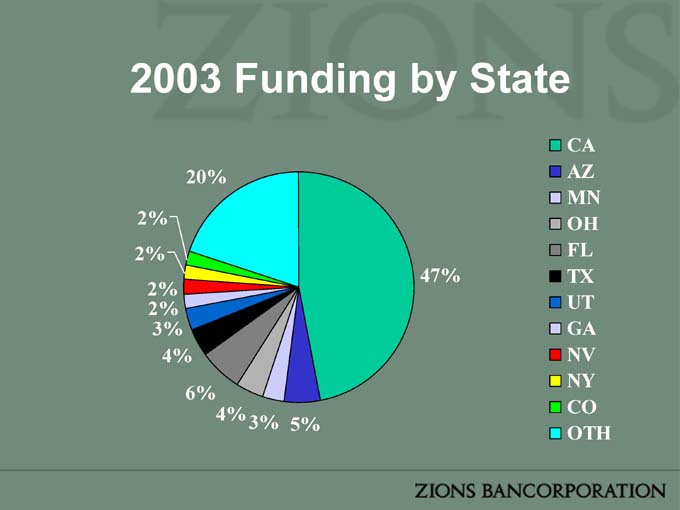

2003 Funding by State

47% 5% 3% 4% 6% 4% 2% 2% 2% 2% 3% 20%

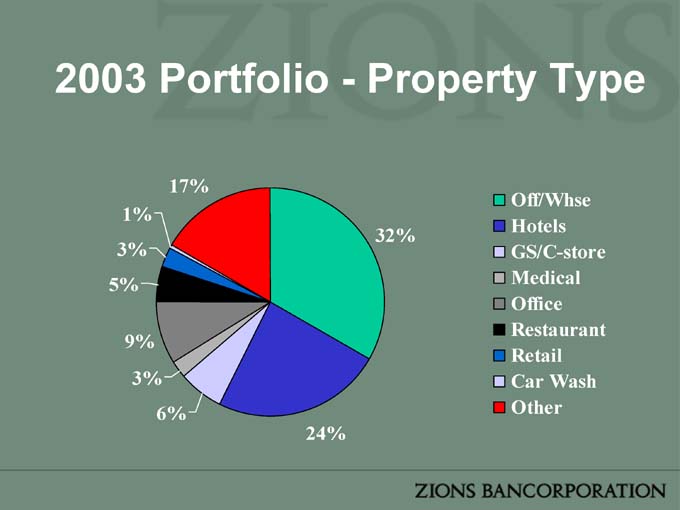

2003 Portfolio—Property Type

17% 32% 24% 1% 3% 5% 9% 3% 6%

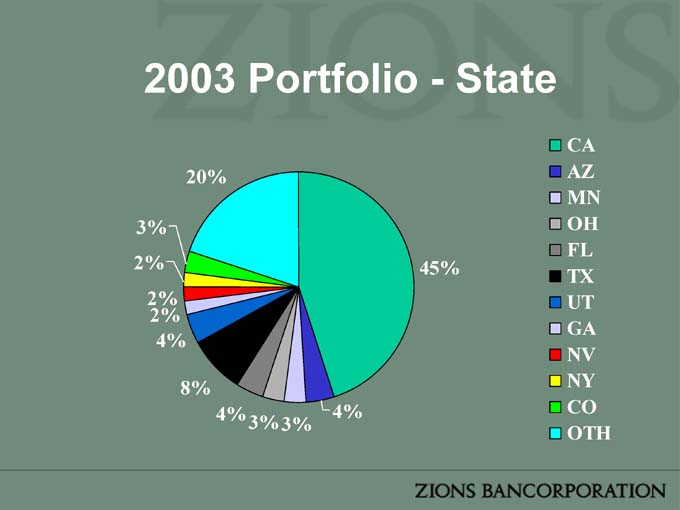

2003 Portfolio—State

45% 4% 4% 3% 3% 3% 2% 2% 2% 4% 8% 20%

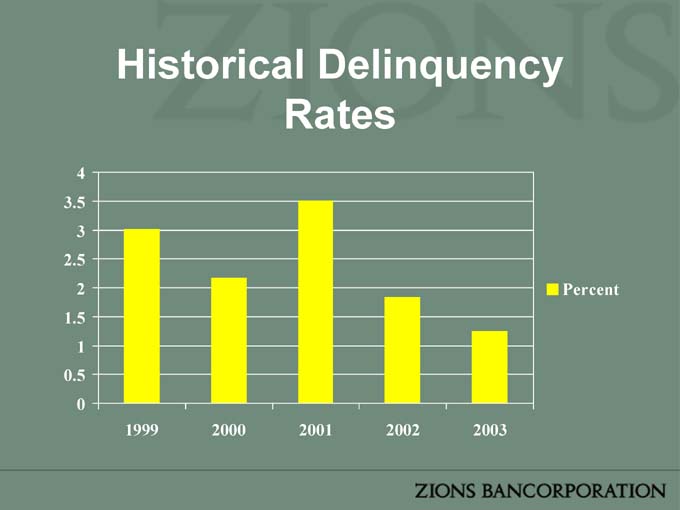

Historical Delinquency Rates

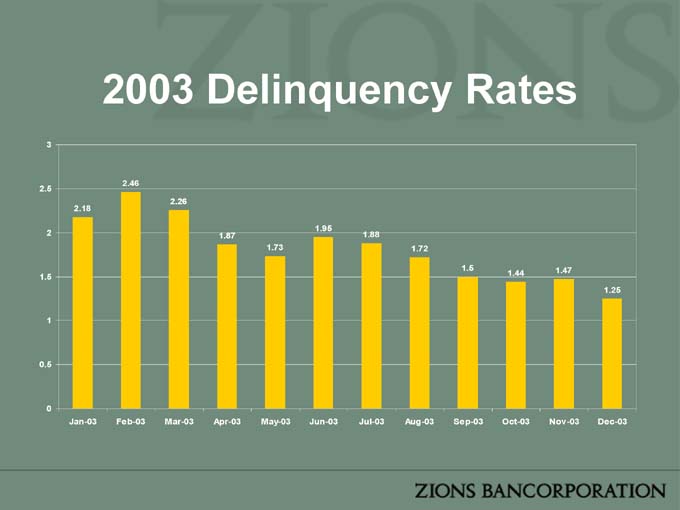

2003 Delinquency Rates

2.18 2.46 2.26 1.87 1.73 1.95 1.88 1.72 1.5 1.44 1.47 1.25

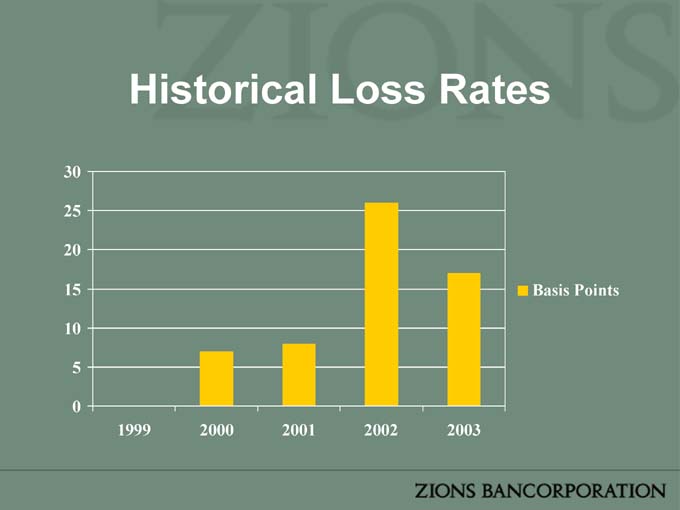

Historical Loss Rates

Zions Bancorporation Analyst Day

19 February 2004

1

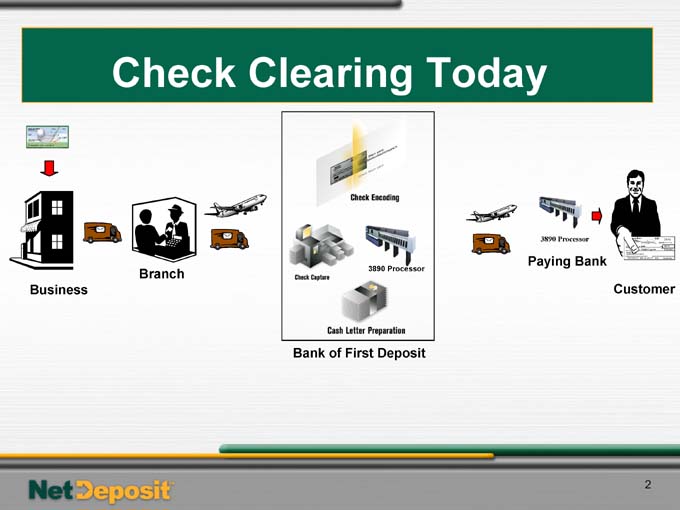

Check Clearing Today

Business

Branch

Bank of First Deposit

Paying Bank

Customer

2

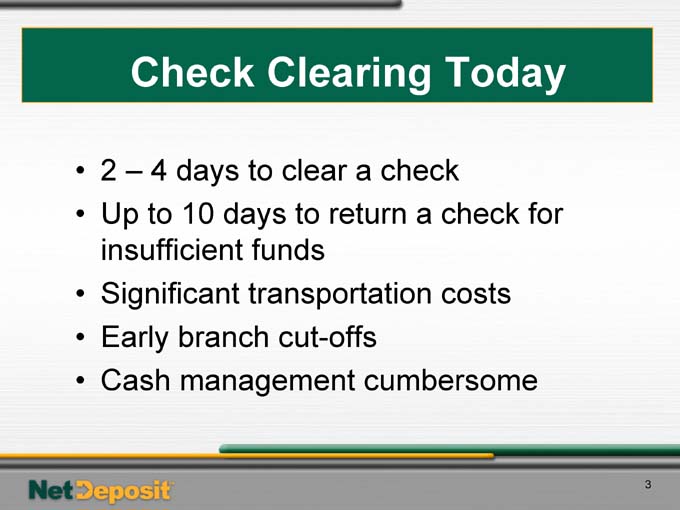

Check Clearing Today

• 2 – 4 days to clear a check

• Up to 10 days to return a check for insufficient funds

• Significant transportation costs

• Early branch cut-offs

• Cash management cumbersome

3

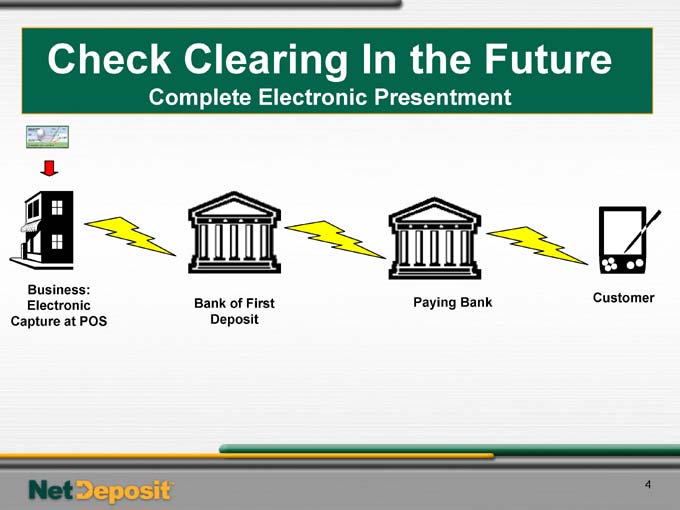

Check Clearing In the Future

Complete Electronic Presentment

Business: Electronic Capture at POS

Bank of First Deposit

Paying Bank

Customer

4

Obstacles to the Future

• Full electronic presentment requires individual agreements between individual banks.

• 8,000 banks would have to make significant investment in systems and talent.

5

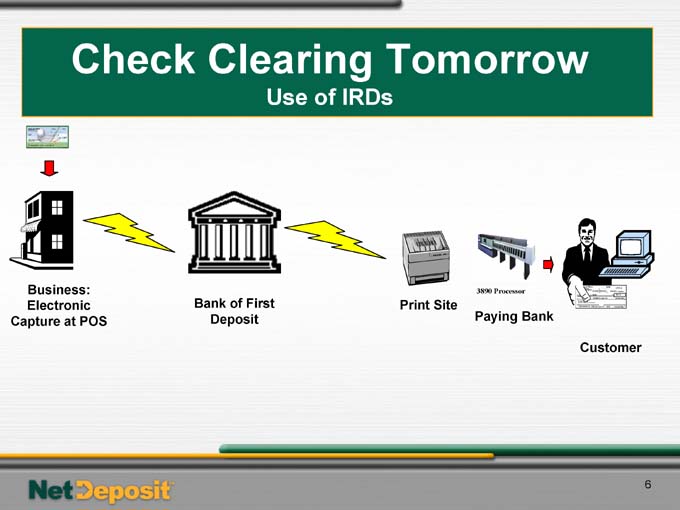

Check Clearing Tomorrow

Use of IRDs

Business: Electronic Capture at POS

Bank of First Deposit

Print Site

Paying Bank

Customer

What is NetDeposit?

• A subsidiary of Zions Bancorporation

• A patent-pending suite of products that reduces the time and cost of collecting payments, and processing returns by enhancing existing remittance processing activities

• A tool to optimize how individual payments are collected

7

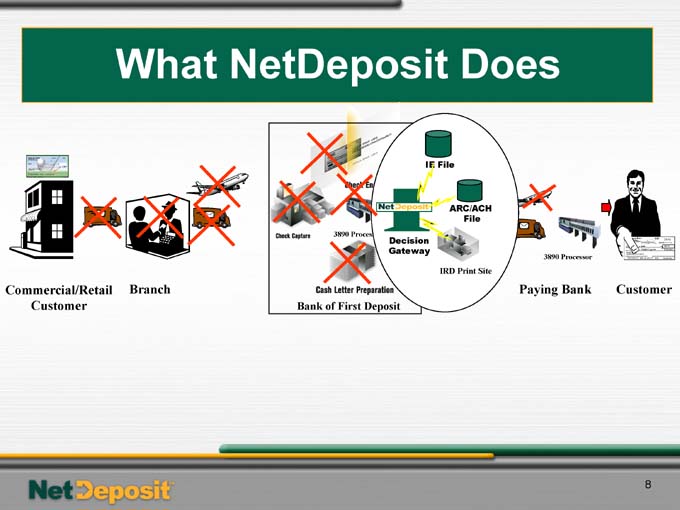

What NetDeposit Does

Commercial/Retail Branch Customer

Bank of First Deposit

Paying Bank

Customer

8

What NetDeposit Does

• Eliminates

– Transportation to bank

– Night drop deposit

– Teller function

– Capture, proof, encoding, balancing

• Reduces

– Cash letter preparation

– Transportation

– Incoming capture

9

Benefits of NetDeposit

• Accelerated clearing

• Less float

• Extended processing windows

• Reduction in clearing fees

10

Patents Pending

• Remote capture of remittance payments

• Delivery of check data

• Decision gateway

• Return items

11

Check 21

• Does not mandate anything

• Does not deal with electronic presentment

• Simply gives “Image Replacement Documents” the same legal validity as original checks

• Effective October 28, 2004

12

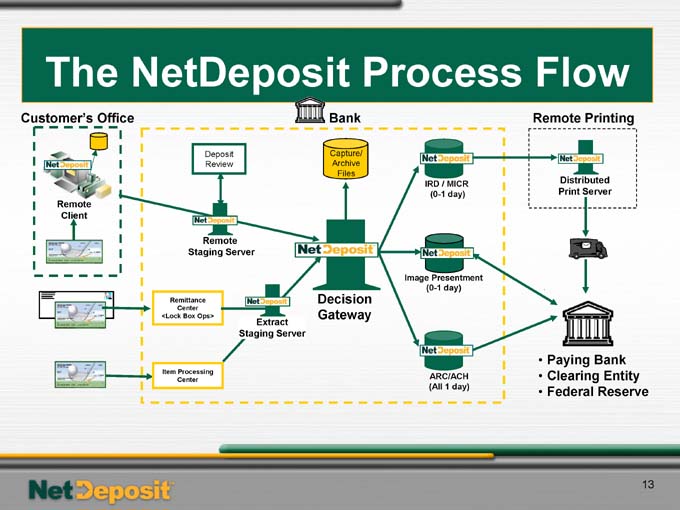

The NetDeposit Process Flow

Customer’s Office

Bank

Remote Printing

Remote Client

Deposit Review

Archive Files

IRD / MICR

(0-1 day)

Distributed Print Server

Remote Staging Server

Image Presentment (0-1 day)

Remittance Center <Lock Box Ops>

Extract Staging Server

Decision Gateway

ARC/ACH (All 1 day)

Item Processing Center

• Paying Bank

• Clearing Entity

• Federal Reserve

13

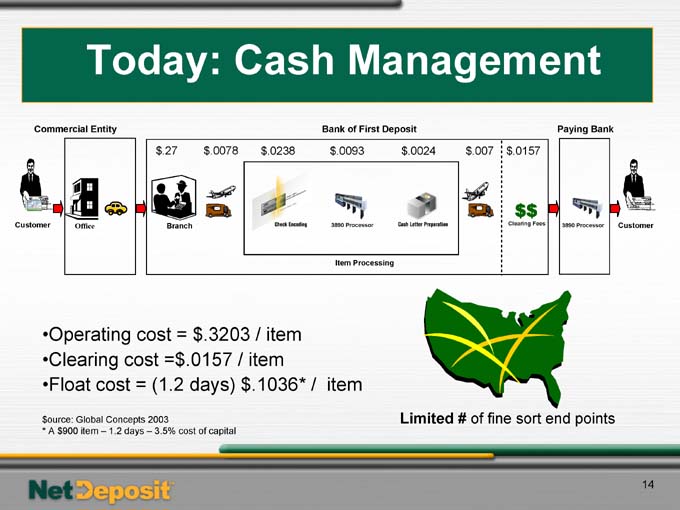

Today: Cash Management

Commercial Entity

Bank of First Deposit

Paying Bank

Customer

Office

Branch

Item Processing

$ .27 $ .0078 $ .0238 $ .0093 $ .0024 $ .007

Clearing Fees

3890 Processor

Customer

•Operating cost = $.3203 / item •Clearing cost =$.0157 / item •Float cost = (1.2 days) $.1036* / item

$ource: Global Concepts 2003

* A $900 item – 1.2 days – 3.5% cost of capital

Limited # of fine sort end points

14

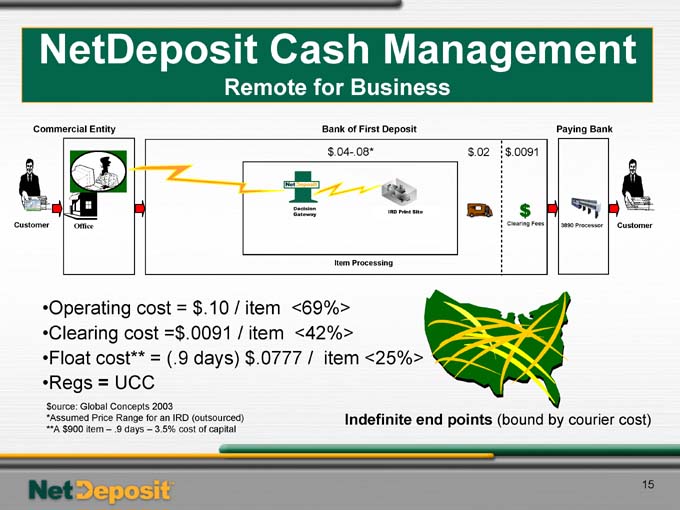

NetDeposit Cash Management

Remote for Business

Commercial Entity

Bank of First Deposit

Paying Bank

Customer

Office

Item Processing $.04-.08* $.02 $.0091

Clearing Fees

3890 Processor

•Operating cost = $.10 / item <69%> •Clearing cost =$.0091 / item <42%> •Float cost** = (.9 days) $.0777 / item <25%> •Regs = UCC $ource: Global Concepts 2003

*Assumed Price Range for an IRD (outsourced) **A $900 item – .9 days – 3.5% cost of capital

Indefinite end points (bound by courier cost)

15

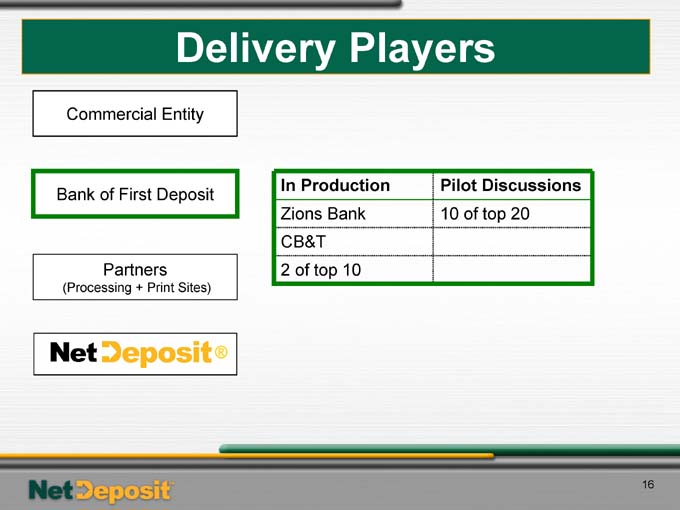

Delivery Players

Commercial Entity

Bank of First Deposit

Partners

(Processing + Print Sites)

®

In Production Pilot Discussions

Zions Bank 10 of top 20

CB&T

2 of top 10

16

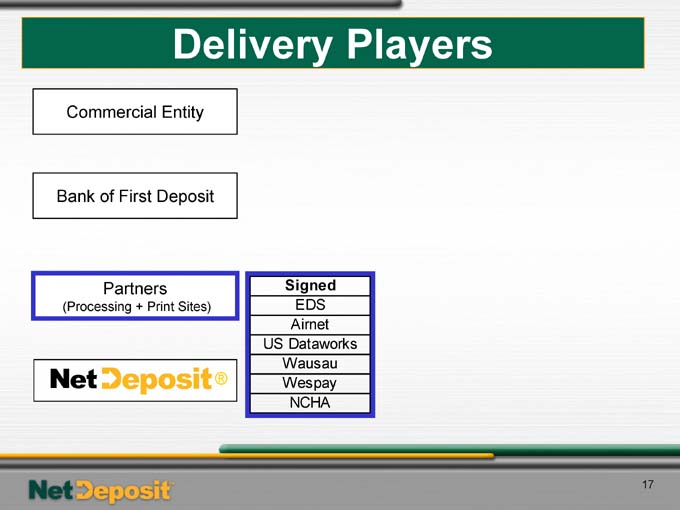

Delivery Players

Commercial Entity

Bank of First Deposit

Partners

(Processing + Print Sites)

Signed

EDS

Airnet

US Dataworks

Wausau

Wespay

NCHA

17

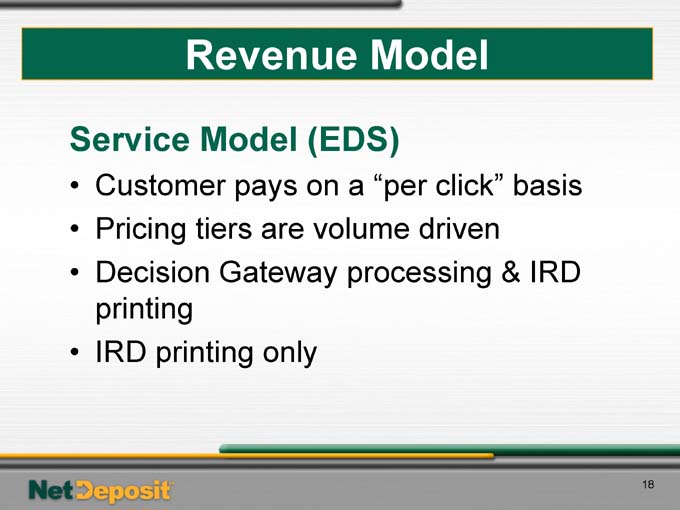

Revenue Model

Service Model (EDS)

• Customer pays on a “per click” basis

• Pricing tiers are volume driven

• Decision Gateway processing & IRD printing

• IRD printing only

18

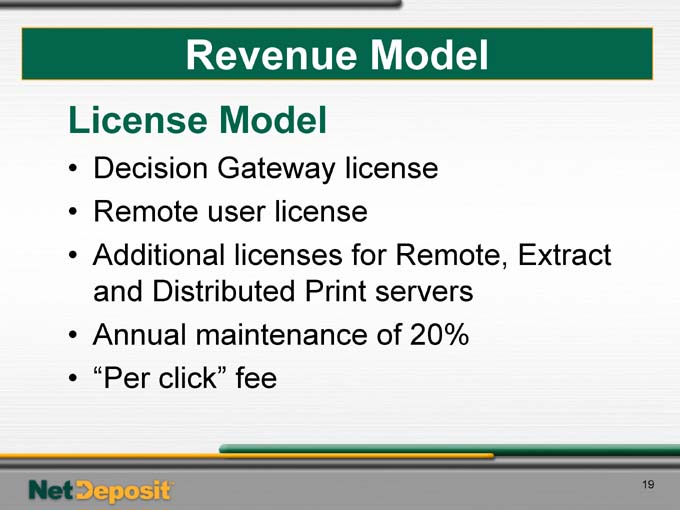

Revenue Model

License Model

• Decision Gateway license

• Remote user license

• Additional licenses for Remote, Extract and Distributed Print servers

• Annual maintenance of 20%

• “Per click” fee

19

20

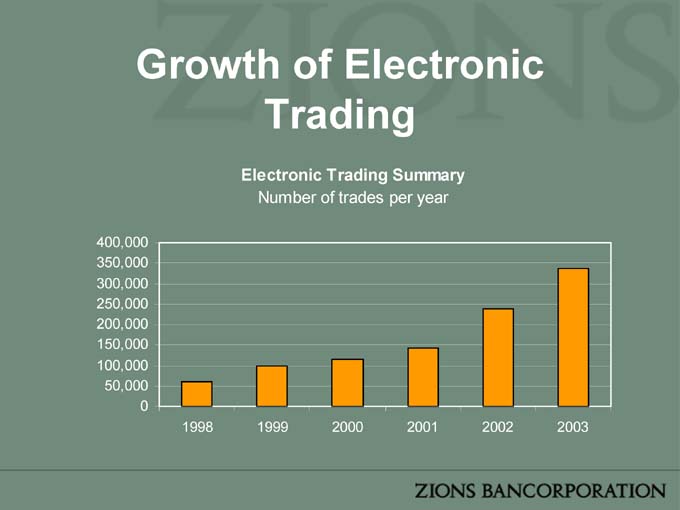

Electronic Bond Trading

Growth of Electronic Trading

Electronic Trading Summary

Number of trades per year

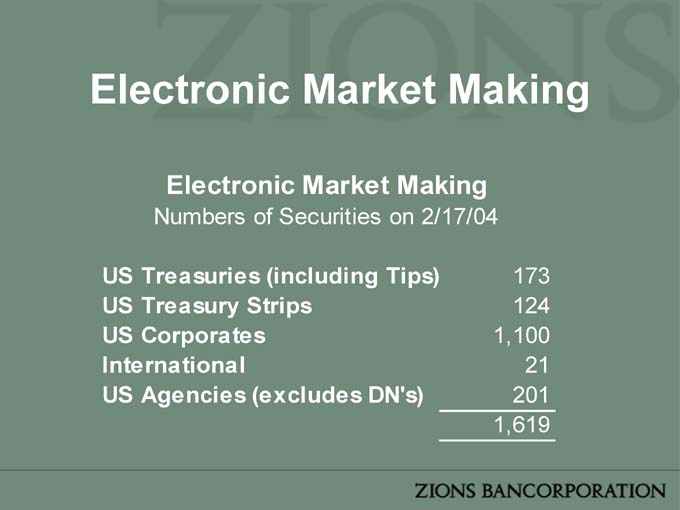

Electronic Market Making

Electronic Market Making

Numbers of Securities on 2/17/04

US Treasuries (including Tips) 173

US Treasury Strips 124

US Corporates 1,100

International 21

US Agencies (excludes DN’s) 201

1,619

Zions Bank Public Finance

Roles Performed by Zions Bank

• Financial Advisor – As Agent for the issuer, Zions Bank advises on the origination, development and sale of bond issues.

• Underwriter – Zions Bank purchases the bonds from the issuer and then sells them through the Bank’s institutional/retail distribution system

• Private Purchaser – Zions Bank assists the issuers by purchasing the bonds for investment in the Bank’s own investment portfolio.

Top Financial Advisors 2003

As Financial Advisor, Zions Bank ranked 9th nationally by bringing to market over 169 issues aggregating more than $5.376 billion.

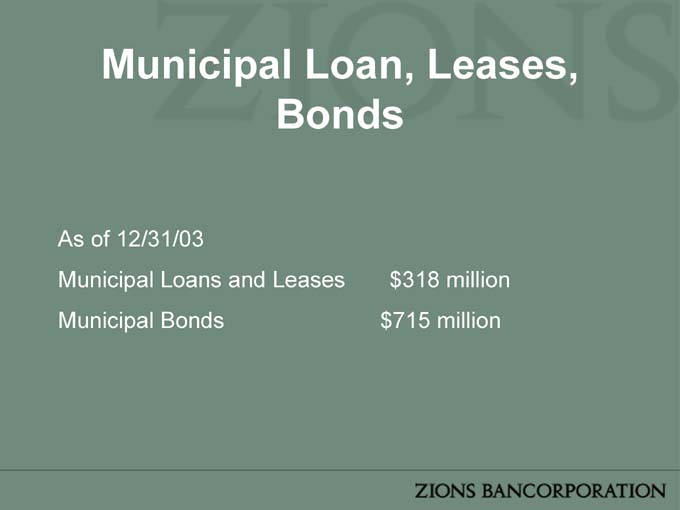

Municipal Loan, Leases, Bonds

As of 12/31/03

Municipal Loans and Leases $318 million

Municipal Bonds $715 million

Interest Sensitive Income and Liquidity

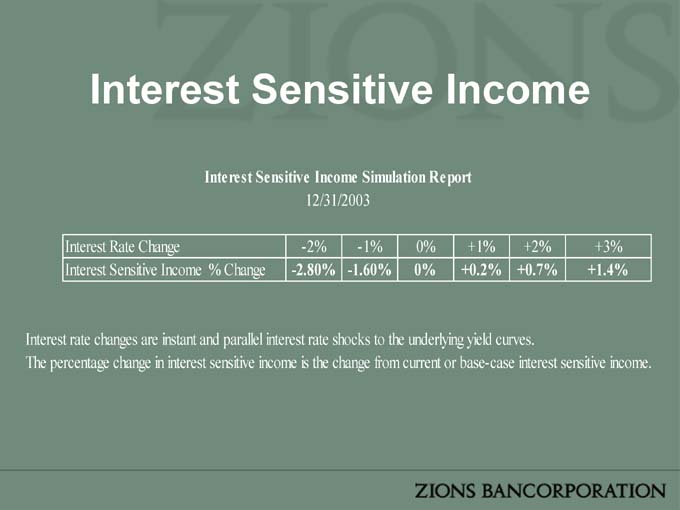

Interest Sensitive Income

Interest Sensitive Income Simulation Report

12/31/2003

Interest Rate Change -2% -1% 0% +1% +2% +3%

Interest Sensitive Income % Change -2.80% -1.60% 0% +0.2% +0.7% +1.4%

Interest rate changes are instant and parallel interest rate shocks to the underlying yield curves.

The percentage change in interest sensitive income is the change from current or base-case interest sensitive income.

Liquidity

Liquidity Report

12/31/03

Total FHLB FHLB Borrowing Available Collateral Available Collateral

Eligible Loans and (actual) for FHLB for FHLB

Unpledged Borrowing Borrowing to

Securities External FF

Purchased Plus

CDs>1year

6,318,364,455 426,412,807 5,891,951,648 287%

The Federal Home Loan Bank will allow a portion of total loans and securities to be eligible as collateral for borrowing. Total FHLB eligible loans and securities have already been discounted by the required FHLB haircut.

Lockhart Funding LLC

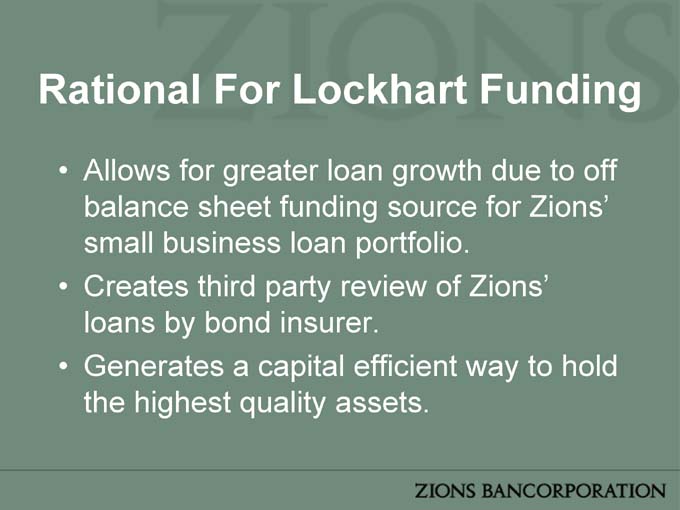

Rational For Lockhart Funding

• Allows for greater loan growth due to off balance sheet funding source for Zions’ small business loan portfolio.

• Creates third party review of Zions’ loans by bond insurer.

• Generates a capital efficient way to hold the highest quality assets.

Portfolio Growth

Growth of Lockhart Assets

9/12 Liquidity draw $ 180 million,

$286 million fixed rate assets called

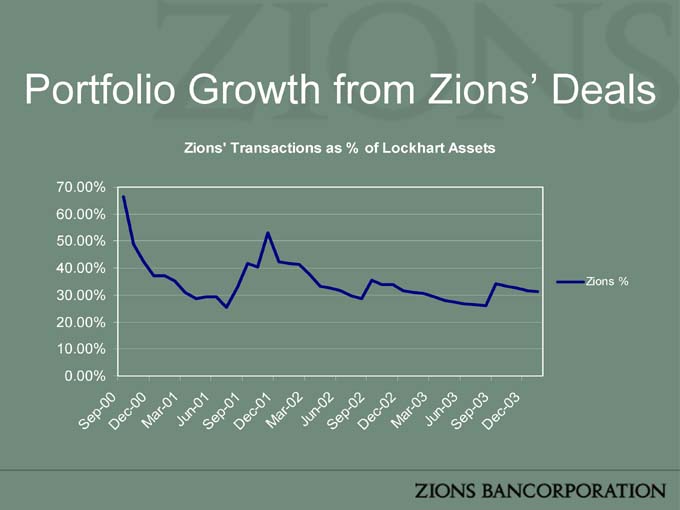

Portfolio Growth from Zions’ Deals

Zions’ Transactions as % of Lockhart Assets

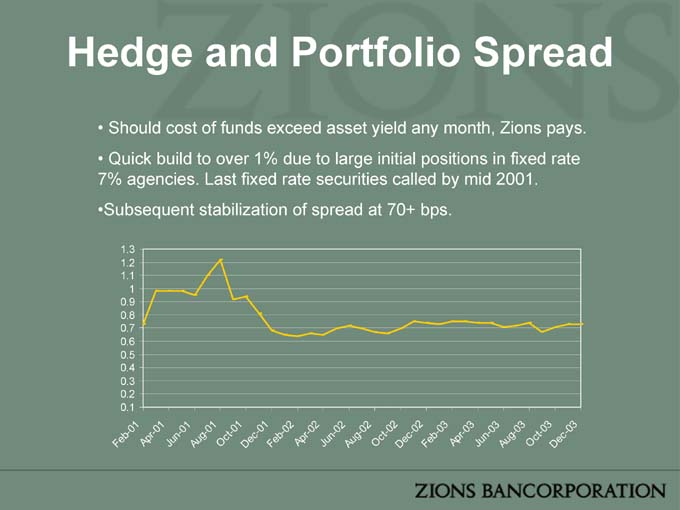

Hedge and Portfolio Spread

• Should cost of funds exceed asset yield any month, Zions pays.

• Quick build to over 1% due to large initial positions in fixed rate 7% agencies. Last fixed rate securities called by mid 2001. •Subsequent stabilization of spread at 70+ bps.

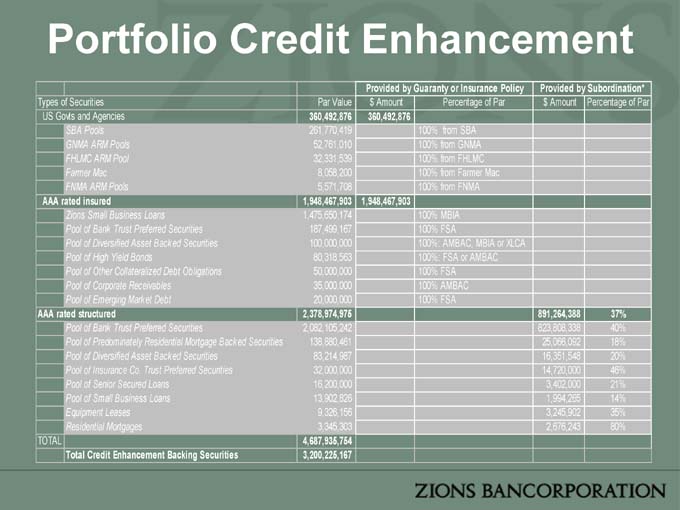

Portfolio Credit Enhancement

Provided by Guaranty or Insurance Policy Provided by Subordination*

Types of Securities Par Value $ Amount Percentage of Par $ Amount Percentage of Par

US Govts and Agencies 360,492,876 360,492,876

SBA Pools 261,770,419 100% from SBA

GNMA ARM Pools 52,761,010 100% from GNMA

FHLMC ARM Pool 32,331,539 100% from FHLMC

Farmer Mac 8,058,200 100% from Farmer Mac

FNMA ARM Pools 5,571,708 100% from FNMA

AAA rated insured 1,948,467,903 1,948,467,903

Zions Small Business Loans 1,475,650,174 100% MBIA

Pool of Bank Trust Preferred Securities 187,499,167 100% FSA

Pool of Diversified Asset Backed Securities 100,000,000 100%: AMBAC, MBIA or XLCA

Pool of High Yield Bonds 80,318,563 100%: FSA or AMBAC

Pool of Other Collateralized Debt Obligations 50,000,000 100% FSA

Pool of Corporate Receivables 35,000,000 100% AMBAC

Pool of Emerging Market Debt 20,000,000 100% FSA

AAA rated structured 2,378,974,975 891,264,388 37%

Pool of Bank Trust Preferred Securities 2,082,105,242 823,808,338 40%

Pool of Predominately Residential Mortgage Backed Securities 138,880,461 25,066,092 18%

Pool of Diversified Asset Backed Securities 83,214,987 16,351,548 20%

Pool of Insurance Co. Trust Preferred Securities 32,000,000 14,720,000 46%

Pool of Senior Secured Loans 16,200,000 3,402,000 21%

Pool of Small Business Loans 13,902,826 1,994,265 14%

Equipment Leases 9,326,156 3,245,902 35%

Residential Mortgages 3,345,303 2,676,243 80%

TOTAL 4,687,935,754

Total Credit Enhancement Backing Securities 3,200,225,167

Technology, Operations & Support

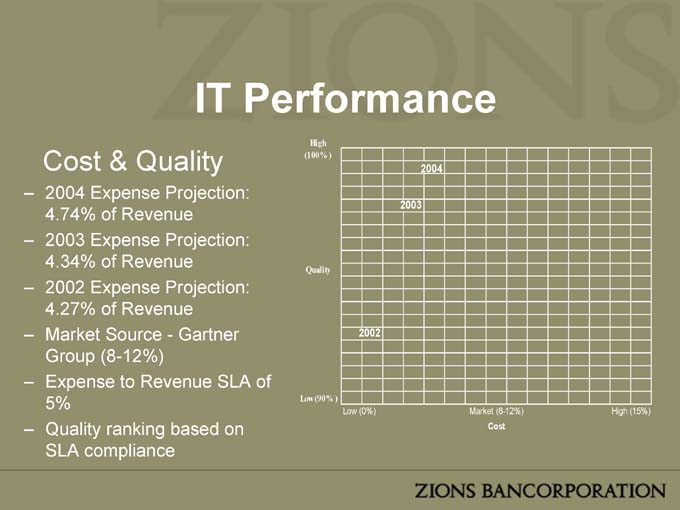

IT Performance

Cost & Quality

– 2004 Expense Projection: 4.74% of Revenue

– 2003 Expense Projection: 4.34% of Revenue

– 2002 Expense Projection: 4.27% of Revenue

– Market Source—Gartner Group (8-12%)

– Expense to Revenue SLA of 5%

– Quality ranking based on SLA compliance

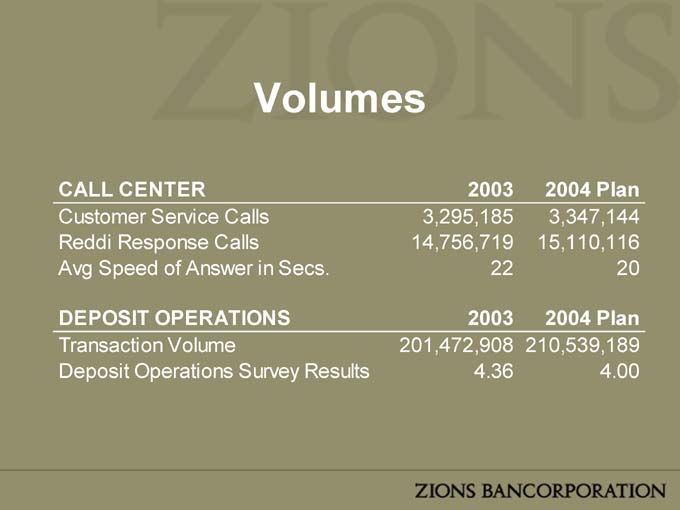

Volumes

CALL CENTER 2003 2004 Plan

Customer Service Calls 3,295,185 3,347,144

Reddi Response Calls 14,756,719 15,110,116

Avg Speed of Answer in Secs. 22 20

DEPOSIT OPERATIONS 2003 2004 Plan

Transaction Volume 201,472,908 210,539,189

Deposit Operations Survey Results 4.36 4.00

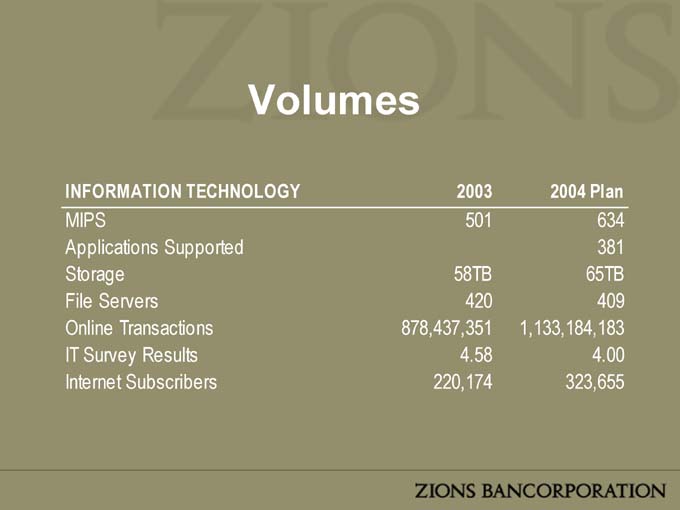

Volumes

INFORMATION TECHNOLOGY 2003 2004 Plan

MIPS 501 634

Applications Supported 381

Storage 58TB 65TB

File Servers 420 409

Online Transactions 878,437,351 1,133,184,183

IT Survey Results 4.58 4.00

Internet Subscribers 220,174 323,655

Strategic Focus

– Continue to invest in highly available, highly reliable infrastructure

– Consolidate/Simplify the technology, environment

– Value added solutions

Unify Update

– Infrastructure Investments

– NBA Conversion

– CB&T Conversion

– Estimated Financial Impact over $15MM

The Credit Process at Zions Bancorporation

2004

Six Banks Covering Eight States

• How We Maintain a Common Credit Culture

• Credit Quality

• Loan Portfolio Composition

Maintaining a Common Credit Culture

• Credit Administration / Loan Origination

• Corporate Credit Policy

• Loan Approval Process

• Regulatory Issues

• Standardization of Credit Procedures

Common Credit Culture -Continued

• Portfolio Management

– Corporate Risk Rating Standard

– Concentration Analysis

– Special Assets

– Establishing House Limits (criteria)

• Credit Examination Function

Credit Quality

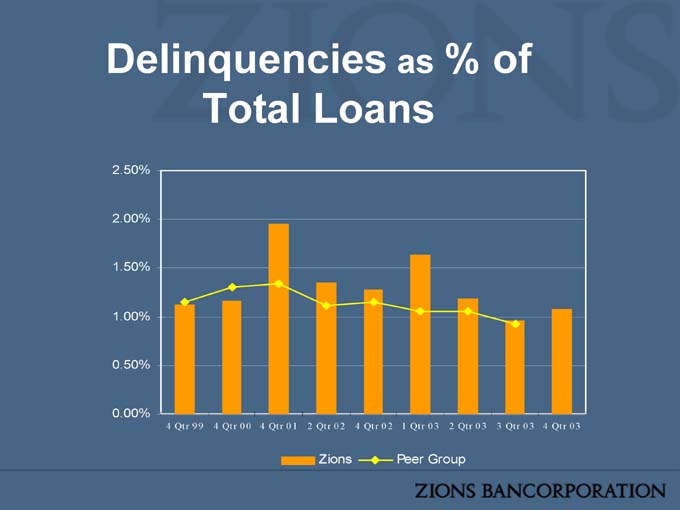

Delinquencies as % of Total Loans

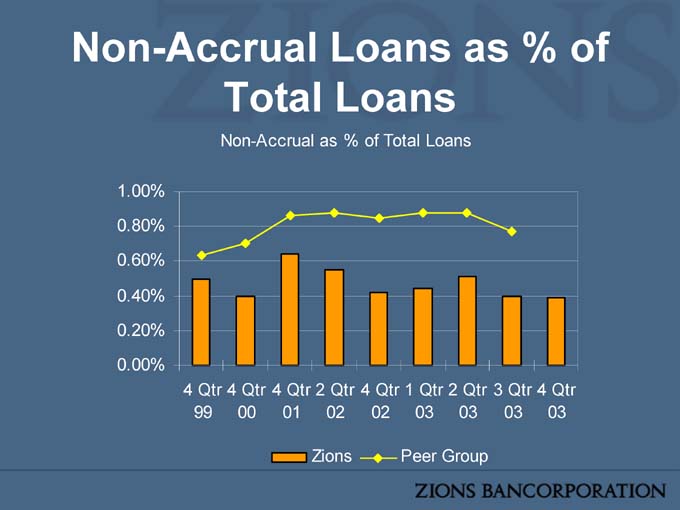

Non-Accrual Loans as % of Total Loans

Non-Accrual as % of Total Loans

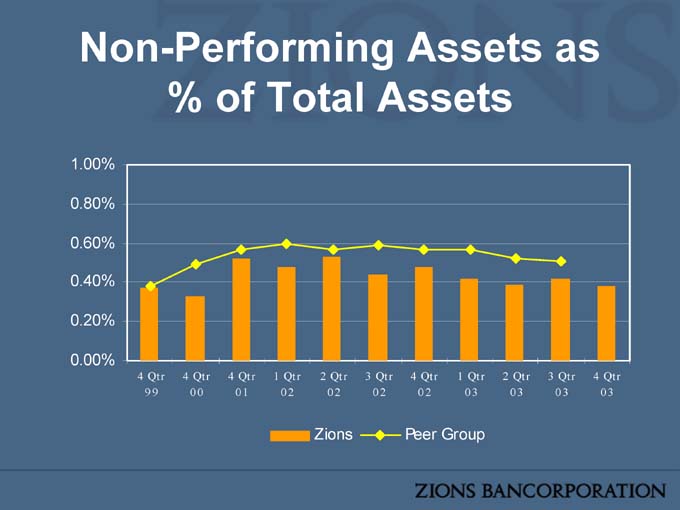

Non-Performing Assets as % of Total Assets

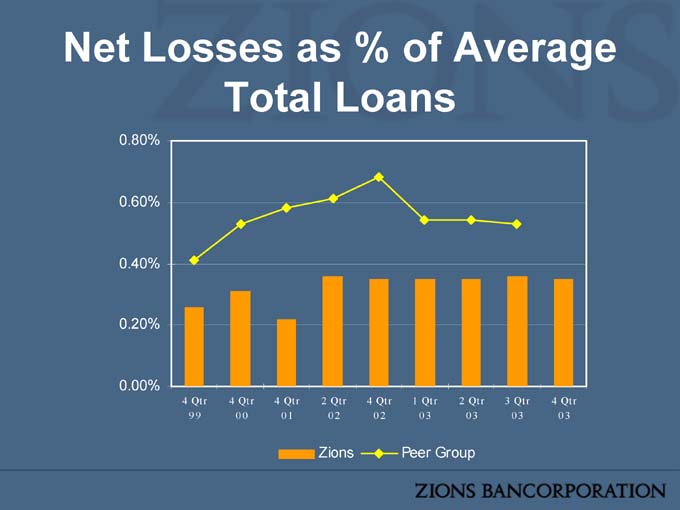

Net Losses as % of Average Total Loans

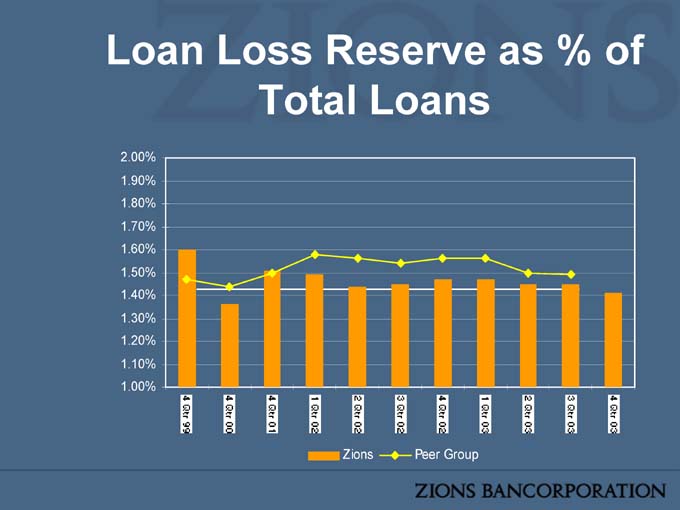

Loan Loss Reserve as % of Total Loans

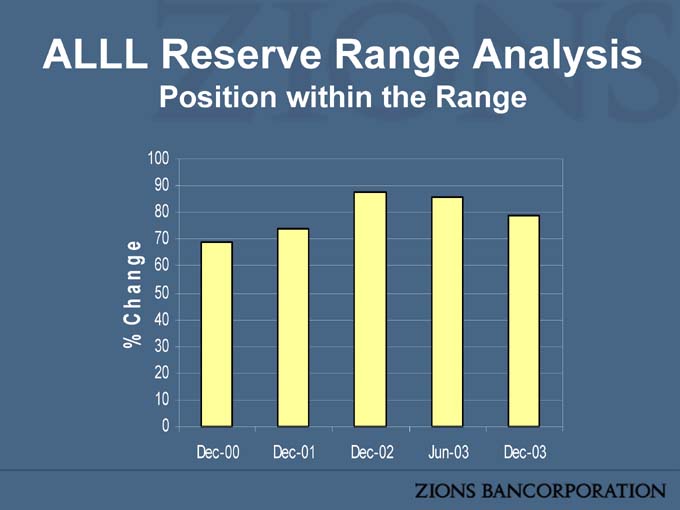

ALLL Reserve Range Analysis

Position within the Range

Portfolio Composition

Analyze Concentrations by

– Industry – Relationship

– Product Type

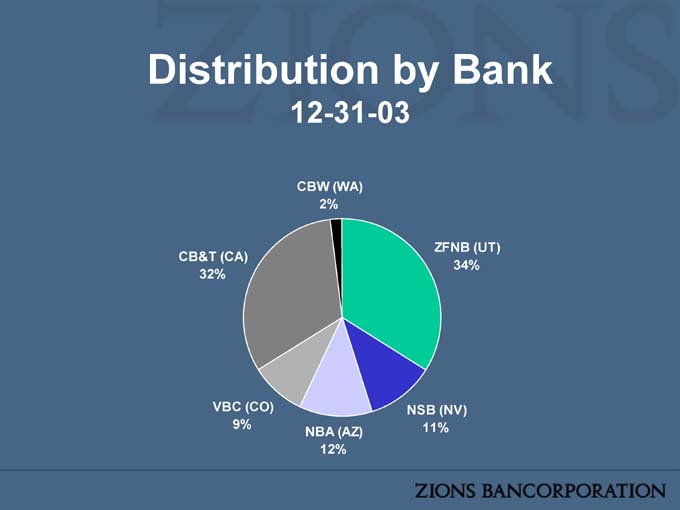

Distribution by Bank

12-31-03

CBW (WA) 2%

ZFNB (UT) 34%

NSB (NV) 11%

NBA (AZ) 12%

VBC (CO) 9%

CB&T (CA) 32%

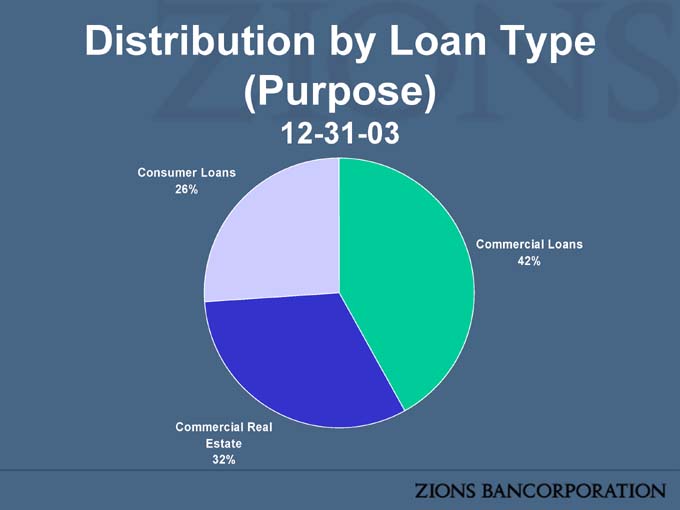

Distribution by Loan Type (Purpose)

12-31-03

Commercial Loans 42%

Commercial Real Estate 32%

Consumer Loans 26%

Secured by Real Estate

12-31-03

Total CRE 43.9%

Commercial Construction

20.0%

Commercial Term

23.9%

Residential (Consumer) 33.2%

Owner Occupied 23.0%

Includes some Commercial and some Consumer Loans and represents 72.5% of Zions Total Loan Portfolio.

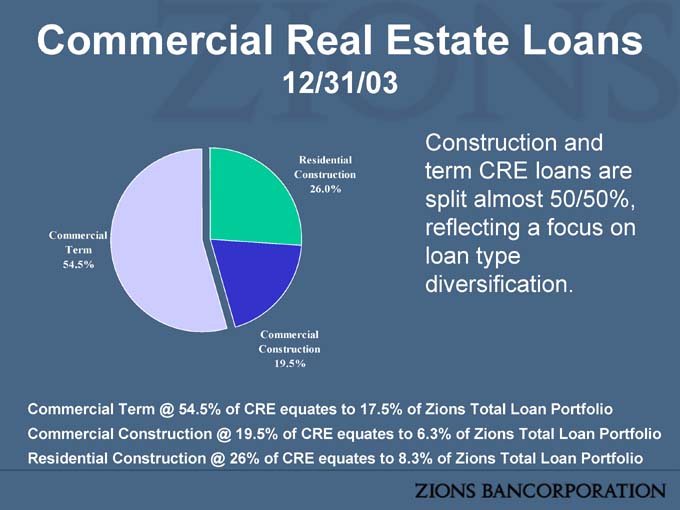

Commercial Real Estate Loans

12/31/03

Residential Construction 26.0%

Commercial Construction 19.5%

Commercial Term 54.5%

Construction and term CRE loans are split almost 50/50%, reflecting a focus on loan type diversification.

Commercial Term @ 54.5% of CRE equates to 17.5% of Zions Total Loan Portfolio Commercial Construction @ 19.5% of CRE equates to 6.3% of Zions Total Loan Portfolio Residential Construction @ 26% of CRE equates to 8.3% of Zions Total Loan Portfolio

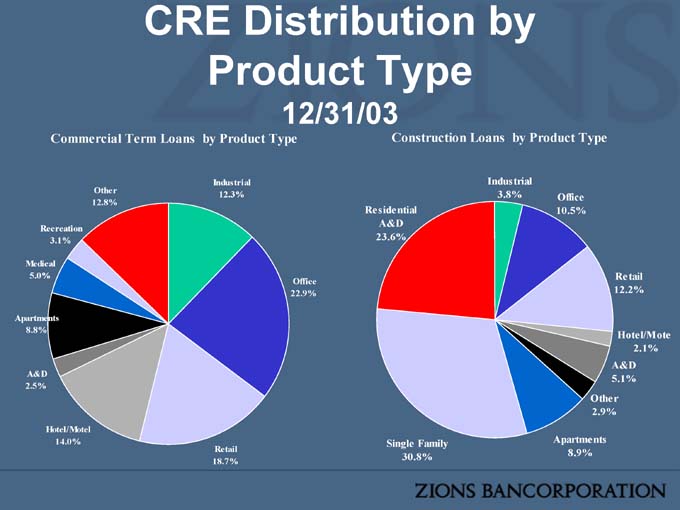

CRE Distribution by Product Type

12/31/03

Commercial Term Loans by Product Type

Industrial 12.3%

Office 22.9%

Retail 18.7%

Hotel/Motel 14.0%

A&D 2.5%

Apartments 8.8%

Medical 5.0%

Recreation 3.1%

Other 12.8%

Construction Loans by Product Type

Industrial 3.8%

Office 10.5%

Retail 12.2%

Hotel/Mote 2.1%

A&D 5.1%

Other 2.9%

Apartments 8.9%

Single Family 30.8%

Residential A&D

23.6%

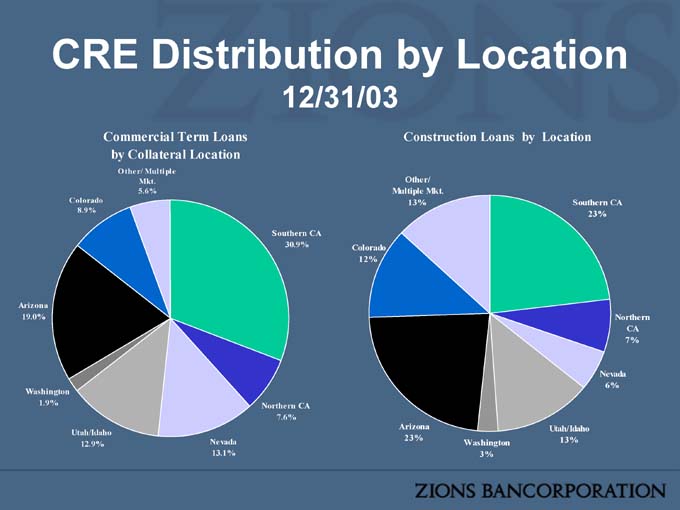

CRE Distribution by Location

12/31/03

Commercial Term Loans by Collateral Location

Other/ Multiple Mkt.

5.6%

Southern CA

30.9%

Northern CA

7.6%

Nevada 13.1%

Utah/Idaho 12.9%

Washington 1.9%

Arizona 19.0%

Colorado 8.9%

Construction Loans by Location

Southern CA

23%

Northern CA

7%

Nevada 6%

Utah/Idaho 13%

Washington 3%

Arizona 23%

Colorado 12%

Other/ Multiple Mkt.

13%

Doyle Arnold ¦19 February 2004

Accomplishments: 2001-2003

• Rebuild management team post First Security

• Keep growing the banks

• Put mistakes behind us

• Increase investment discipline

• Manage risk in tough environment

• Reduce Exp/Rev Ratio

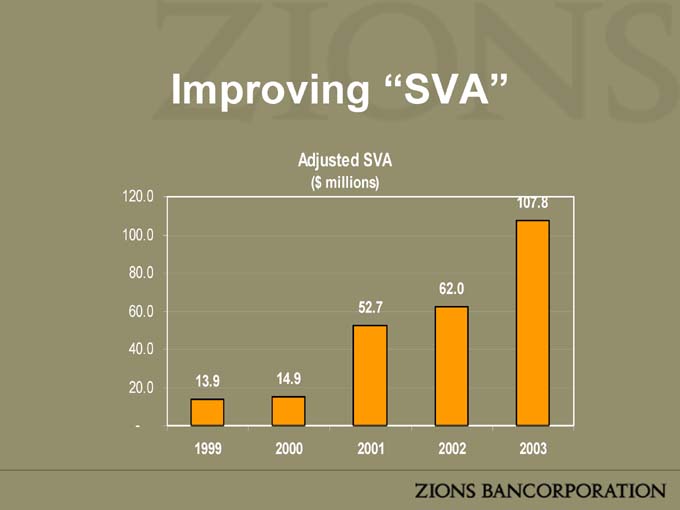

Improving “SVA”

Adjusted SVA

($ millions)

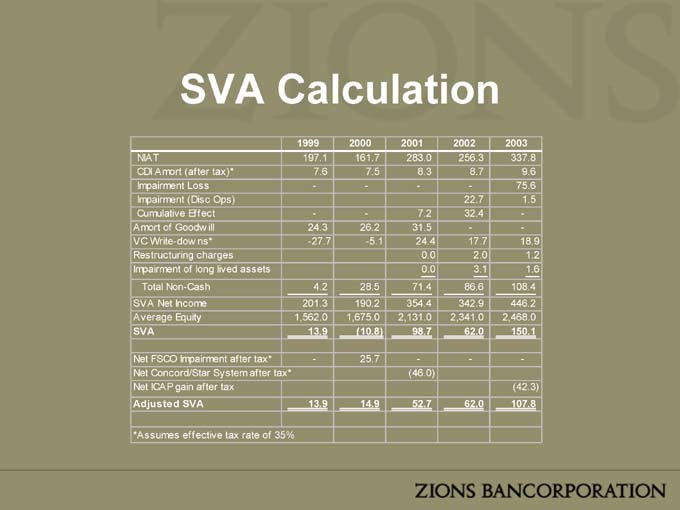

SVA Calculation

1999 2000 2001 2002 2003

NIAT 197.1 161.7 283.0 256.3 337.8

CDI Amort (after tax)* 7.6 7.5 8.3 8.7 9.6

Impairment Loss - - - - 75.6

Impairment (Disc Ops) 22.7 1.5

Cumulative Effect - - 7.2 32.4 -

Amort of Goodw ill 24.3 26.2 31.5 - -

VC Write-dow ns* -27.7 -5.1 24.4 17.7 18.9

Restructuring charges 0.0 2.0 1.2

Impairment of long lived assets 0.0 3.1 1.6

Total Non-Cash 4.2 28.5 71.4 86.6 108.4

SVA Net Income 201.3 190.2 354.4 342.9 446.2

Average Equity 1,562.0 1,675.0 2,131.0 2,341.0 2,468.0

SVA 13.9 (10.8) 98.7 62.0 150.1

Net FSCO Impairment after tax* - 25.7 - - -

Net Concord/Star System after tax* (46.0)

Net ICAP gain after tax (42.3)

Adjusted SVA 13.9 14.9 52.7 62.0 107.8

*Assumes effective tax rate of 35%

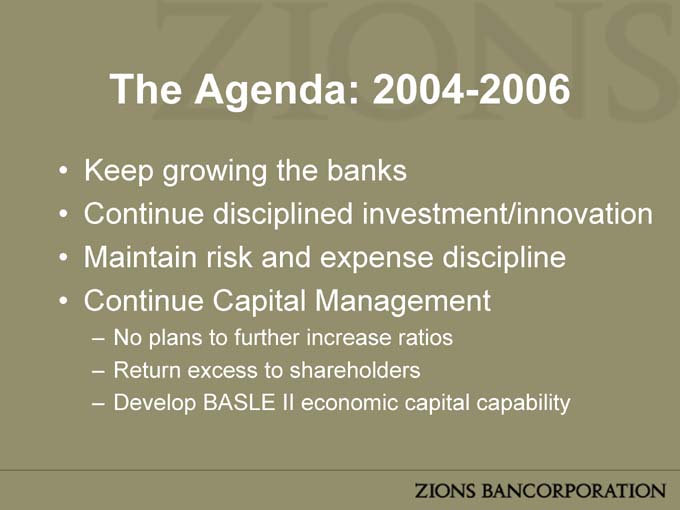

The Agenda: 2004-2006

• Keep growing the banks

The Agenda: 2004-2006

• Keep growing the banks

– More organic growth than acquisition

– Better SVA-oriented Management Reporting

– Identify and spread best practices and eliminate weaknesses

The Agenda: 2004-2006

• Keep growing the banks

• Continue disciplined investment/innovation

The Agenda: 2004-2006

• Keep growing the banks

• Continue disciplined investment/innovation

– Private client services

– Net Deposit

– Hispanic business banking

– Other

The Agenda: 2004-2006

• Keep growing the banks

• Continue disciplined investment/innovation

• Maintain risk and expense discipline

The Agenda: 2004-2006

• Keep growing the banks

• Continue disciplined investment/innovation

• Maintain risk and expense discipline

• Continue Capital Management

The Agenda: 2004-2006

• Keep growing the banks

• Continue disciplined investment/innovation

• Maintain risk and expense discipline

• Continue Capital Management

– No plans to further increase ratios

– Return excess to shareholders

– Develop BASLE II economic capital capability

Forward-Looking Statements

This presentation contains statements regarding the projected performance of Zions Bancorporation. These statements constitute forward-looking information within the meaning of the Private Securities Litigation Reform Act. Actual results or achievements may differ materially from the projections provided in this presentation since such projections involve significant known and unknown risks and uncertainties. Factors that might cause such differences include, but are not limited to: competitive pressures among financial institutions increasing significantly; economic conditions, either nationally or locally in areas in which Zions Bancorporation conducts their operations, being less favorable than expected; changes in the interest rate environment reducing expected interest margins; legislation or regulatory changes, which adversely affect the ability of the company to conduct the business in which the company would be engaged; delays in adoption of digital certificates for online services. Zions Bancorporation disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein to reflect future events or developments.

Zions Bancorporation Analyst Day

19 February 2004 Salt Lake City, Utah