Exhibit 13

[FINANCIAL HIGHLIGHTS]

| | | | | | | | | | | | |

| (In millions except per share amounts) | | 2003 /2002

CHANGE

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

|

FOR THE YEAR | | | | | | | | | | | | |

INCOME FROM CONTINUING OPERATIONS | | +7% | | 339.6 | | 317.1 | | 298.6 | | 161.7 | | 194.1 |

NET INCOME | | +32% | | 337.8 | | 256.3 | | 283.0 | | 161.7 | | 194.1 |

| | | | | | |

PER SHARE | | | | | | | | | | | | |

INCOME FROM CONTINUING OPERATIONS – DILUTED | | +9% | | 3.74 | | 3.44 | | 3.24 | | 1.86 | | 2.26 |

NET INCOME – DILUTED | | +34% | | 3.72 | | 2.78 | | 3.07 | | 1.86 | | 2.26 |

NET INCOME – BASIC | | +34% | | 3.75 | | 2.80 | | 3.10 | | 1.87 | | 2.29 |

DIVIDENDS DECLARED | | +28% | | 1.02 | | .80 | | .80 | | .89 | | .72 |

BOOK VALUE(1) | | +8% | | 28.27 | | 26.17 | | 24.74 | | 20.42 | | 19.39 |

MARKET PRICE – END | | | | 61.34 | | 39.35 | | 52.58 | | 62.44 | | 59.19 |

MARKET PRICE – HIGH | | | | 63.86 | | 59.65 | | 64.00 | | 62.75 | | 75.88 |

MARKET PRICE – LOW | | | | 39.31 | | 34.14 | | 42.30 | | 36.44 | | 49.00 |

| | | | | | |

AT YEAR-END | | | | | | | | | | | | |

ASSETS | | +8% | | 28,558 | | 26,566 | | 24,304 | | 21,939 | | 20,281 |

LOANS AND LEASES | | +5% | | 19,920 | | 19,040 | | 17,311 | | 14,378 | | 12,791 |

LOANS SOLD BEING SERVICED(2) | | +12% | | 2,782 | | 2,476 | | 2,648 | | 1,750 | | 1,252 |

DEPOSITS | | +4% | | 20,897 | | 20,132 | | 17,842 | | 15,070 | | 14,062 |

LONG-TERM BORROWINGS | | +41% | | 1,843 | | 1,310 | | 1,022 | | 563 | | 566 |

SHAREHOLDERS’ EQUITY | | +7% | | 2,540 | | 2,374 | | 2,281 | | 1,779 | | 1,660 |

| | | | | | |

PERFORMANCE RATIOS | | | | | | | | | | | | |

RETURN ON AVERAGE ASSETS | | | | 1.20% | | .97% | | 1.19% | | .74% | | .97% |

RETURN ON AVERAGE SHAREHOLDERS’ EQUITY | | | | 13.69% | | 10.95% | | 13.28% | | 9.65% | | 12.42% |

EFFICIENCY RATIO | | | | 55.65% | | 63.40% | | 61.60% | | 64.92%(3) | | 66.55% |

NET INTEREST MARGIN | | | | 4.45% | | 4.56% | | 4.64% | | 4.27% | | 4.31% |

| | | | | | |

CAPITAL RATIOS(1) | | | | | | | | | | | | |

EQUITY TO ASSETS | | | | 8.89% | | 8.94% | | 9.38% | | 8.11% | | 8.18% |

TIER 1 LEVERAGE | | | | 8.06% | | 7.56% | | 6.56% | | 6.38% | | 6.16% |

TIER 1 RISK-BASED CAPITAL | | | | 9.42% | | 9.26% | | 8.25% | | 8.53% | | 8.64% |

TOTAL RISK-BASED CAPITAL | | | | 13.52% | | 12.94% | | 12.20% | | 10.83% | | 11.29% |

| | | | | | |

SELECTED INFORMATION | | | | | | | | | | | | |

AVERAGE COMMON-EQUIVALENT SHARES (in thousands) | | | | 90,734 | | 92,079 | | 92,174 | | 87,120 | | 85,695 |

COMMON DIVIDEND PAYOUT RATIO | | | | 27.20% | | 28.58% | | 26.11% | | 34.65%(3) | | 29.33% |

FULL-TIME EQUIVALENT EMPLOYEES | | | | 7,896 | | 8,073 | | 8,124 | | 6,915 | | 6,833 |

COMMERCIAL BANKING OFFICES | | | | 412 | | 415 | | 412 | | 373 | | 362 |

ATMS | | | | 553 | | 588 | | 589 | | 509 | | 484 |

| (2) | Amount represents the outstanding balance of loans sold and being serviced by the Company, excluding conforming first mortgage residential real estate loans. |

| (3) | Before impairment loss of $96.6 million on First Security Corporation common stock. |

INSIDE FRONT COVER

MANAGEMENT’S DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

COMPANY OVERVIEW

Zions Bancorporation (“the Parent”) and subsidiaries (collectively “the Company”, “Zions”, “we”, “our”) is a financial holding company headquartered in Salt Lake City, Utah. The Company operates banking businesses primarily in seven Western states. These banking operations currently generate the majority of the Company’s revenues and profits. In addition, Zions operates a number of specialty financial services and financial technology businesses on a regional or national scale.

In operating its banking businesses, Zions seeks to combine the advantages that it believes can result from decentralized organization and branding, with those that can come from centralized risk management, capital management and operations. In its specialty financial services and technology businesses, Zions seeks to develop a competitive advantage in a particular product, customer or technology niche.

BANKING BUSINESSES

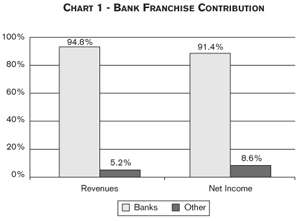

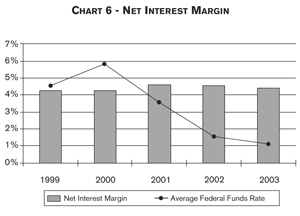

As shown in Chart 1, in 2003 the banking franchises accounted for 94.8% of the Company’s total revenue and 91.4% of its net income. Other sources of income for 2003 consisted primarily of gains on sales of investments, which are discussed in more detail in “Noninterest Income” on page 35.

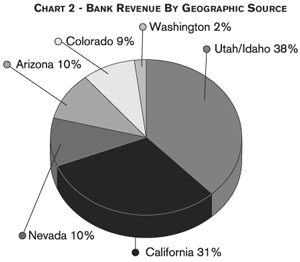

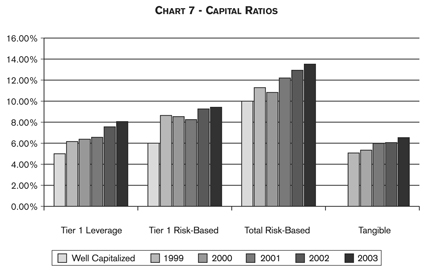

As shown in Chart 2, revenue from the banking franchises is widely diversified among the states in which the Company operates.

Our growth strategy for Zions’ banking business is driven by several key factors: (1) focus on high growth markets; (2) keep decisions about customers local; and (3) centralize technology and operations to achieve economies of scale.

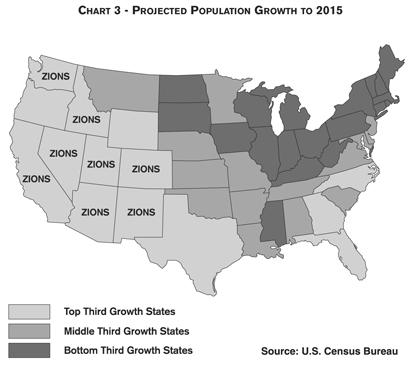

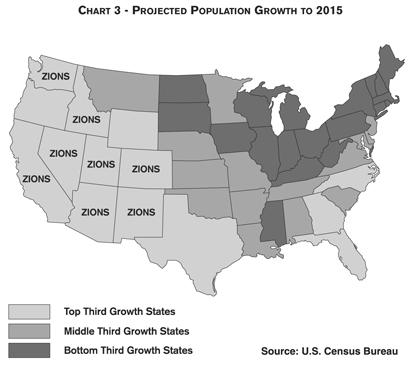

Focus on high growth markets:Zions conducts its banking business in the Western States – primarily Arizona, California, Colorado, Idaho, Nevada, Utah, and Washington, with a small presence in New Mexico. Each of these states has experienced historical growth and each ranks among the top one-third of the fastest growing states as projected by the U. S. Census Bureau. These states have high population growth relative to other states, largely driven by inward migration from other parts of the United States and from other countries.

Within these geographic regions, we focus on what we believe to be the most attractive segments. We believe that the states in which Zions operates have rates of business formation and expansion higher than in other states. We also believe that these states have higher rates of commercial real estate development to provide housing, shopping, business locations and other

23

amenities for their growing populations. As a result, a common focus of all of Zions’ subsidiary banks is small and middle market business banking (including the executives and employees of those businesses) and commercial real estate development. In many cases the Company’s relationship with these customers is primarily driven by the goal to satisfy their needs for credit to finance their expanding business opportunities. In some states we also pursue a broad base of consumer business, which is often more deposit driven. This mix of business often leads to loan balances growing faster than internally generated deposits. In addition, it has important implications for the Company’s management of certain risks, including interest rate and liquidity risks, which are discussed further in later sections of this document.

The Company historically has also generated rapid growth through acquisitions of other community banks. However, in recent years acquisitions have not been an important contributor to growth. We believe that average prices paid for acquired banks have generally steadily escalated over the past two decades, as measured by such common metrics as premium-to-deposits and price-to-book value. Price expectations of sellers, therefore, have become high. At prices typically paid in today’s market, we believe that it could be more difficult than in prior years to create economic value for the Company’s shareholders through acquisitions. While we will continue to pursue acquisitions as a growth strategy, we believe that bank acquisitions, in general, may be a less important contributor to the Company’s growth in the near future.

Keep decisions about customers local:To assure that decisions related to customers stay local, the Company operates six different community/regional banks, each under a different name and a separate charter and each with its own chief executive officer, management team and local market strategies. Each bank controls, among other things, all decisions related to its branding, market strategies, its customer relationships, pricing and credit decisions (within corporate policy). In this way each bank seeks to differentiate itself in the market from much larger “mass market” banking competitors that operate regional or national franchises under a common

24

brand, often organized around “vertical” product silos. We believe that this management approach allows Zions to attract and retain superior management, and we believe that it results in superior customer service to our target customers. We also believe that this strategy over time generates superior growth.

Centralize technology and operations to achieve economies of scale:We seek to differentiate the Company from smaller banks in two ways. First, we use the combined scale of all the Company’s banks to create a broad product offering without the fragmentation of systems and operations that would drive up costs. Second, for certain products for which economies of scale are believed to be important, the Company “manufactures” the product centrally, or outsources it from a third party. Examples include cash management, credit card, mortgage servicing, trust and deposit operations. In this way the Company over time seeks to remain efficient while generating superior growth.

SPECIALTY FINANCE AND TECHNOLOGY BUSINESSES

In addition to its community and regional banking businesses, the Company operates a number of specialized businesses that are not geographically organized, but rather are national in scope. In some cases, results from these businesses are included within the results of one or more of the bank business segments. In other cases, these businesses are included in the “Other” segment, which also includes the Parent and other nonbanking subsidiaries. Key among these businesses are:

Included in Bank Segments:

| • | Low loan-to-value, owner-occupied, first mortgage small business commercial loans |

| • | Identrus, LLC – identity authentication |

| • | Odd lot electronic bond trading |

| • | Public finance advisory and underwriting |

Included in “Other” Segment:

| • | NetDeposit, Inc. – check digital imaging and clearing software and services |

| • | P5, Inc. – health care claims reconciliation services and receivables factoring |

| • | Providus Software Solutions, Inc. – software for assessing and managing operating risk |

RISK MANAGEMENT

Zions has centralized key risk management functions to assure independence and consistent application. The key centralized risk functions are:

| • | Credit policy and credit examination |

| • | Interest rate and market risk management (“Asset-Liability Management” or “ALM”) |

| • | Liquidity risk management |

| • | Operational risk assessment |

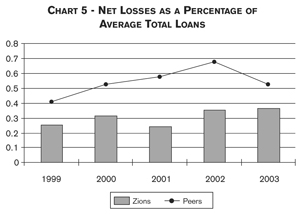

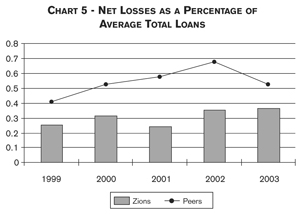

We believe that centralization of these risk management functions is in part responsible for consistently superior risk performance in relation to peers. For example, as displayed in Charts 4 and 5, for two key measures of credit risk (nonperforming assets to total assets and net losses to average total loans), the Company has consistently recorded better results than the average of peer bank-holding companies.

The nature of the Company’s core banking businesses poses particular challenges for managing liquidity and interest rate risk. Zions’ location in the fast-growing West and its focus on business banking means that it often does not generate deposit growth as rapidly as loan growth. While in late 2002 and much of 2003 robust deposit growth more than kept pace with

Note: Peer group is defined as bank holding companies with assets > $10 billion.

Peer data source: SNL Financial Database

Peer information for 2003 is from 3rd quarter 2003.

25

Note: Peer group is defined as bank holding companies with assets > $10 billion.

Peer data source: SNL Financial Database

Peer information for 2003 is from 3rd quarter 2003.

slower loan growth, historically this has not been the case. We also do not believe this will be the case going forward. Hence, we have engaged in securitizing assets and managing a securities conduit to help fund asset growth. This is explained in more detail in “Liquidity Management” on page 64.

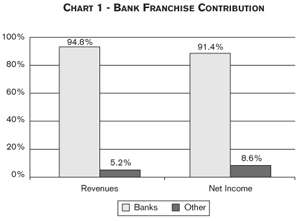

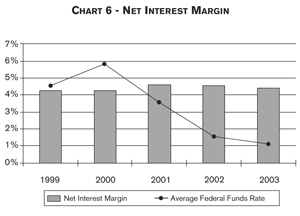

Our focus on business banking also determines the nature of the Company’s asset-liability management posture. In particular, this business mix leads naturally to a highly “asset sensitive” position, which we seek to mitigate in various ways, including an ongoing program of hedging floating rate commercial loans. Our approach toward asset-liability management, which is discussed in more detail in the section on page 59 entitled “Interest Rate Risk”, has enabled the Company to achieve a relatively stable net interest margin in a volatile interest rate environment. For example, Chart 6 shows the Company’s margin over time, compared to the average Federal Funds rate.

Of particular note, in January 2004 the staff of the Financial Accounting Standards Board (“FASB”) issued for comment a proposed interpretation of Statement of Financial Accounting Standards (“SFAS”) No. 133,Accounting for Derivative Instruments and Hedging Activities, that would disallow “Prime” as an acceptable index for cash flow hedges. We believe that a number of banks (including Zions), accounting firms and regulators will submit comments opposing this proposal. However, if it is issued in its current form, we would be required to significantly change the Company’s interest rate risk management practices.

Further discussion of the Company’s use of and accounting for hedges is found in the section entitled “Interest Rate and Market Risk Management” on page 59 and Notes 1 and 7 of the Notes to Consolidated Financial Statements.

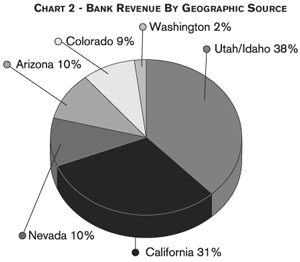

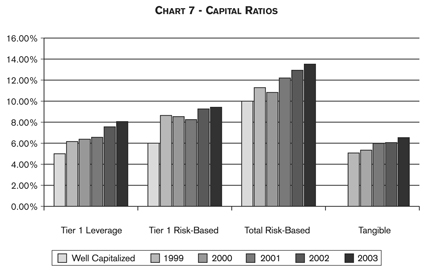

CAPITAL MANAGEMENT

We believe that the Company should maintain adequate capital to support its businesses and the risks inherent in them, but it should not retain capital in excess of those needs. Thus, we seek to maintain capital ratios consistent with achieving an “investment grade” rating on the Company’s debt, and to meet relevant “well capitalized” regulatory standards at all times. We believe that the capital ratios achieved in 2003 are consistent with those objectives, and presently do not plan to further materially increase the Company’s key capital ratios. See “Capital Management” on page 66 for more information on capital requirements.

26

MANAGEMENT’S OVERVIEW OF 2003

The Company reported record earnings for 2003 of $337.8 million or $3.72 per diluted share, compared with $256.3 million or $2.78 per share for 2002, and $283.0 million or $3.07 per share in 2001. Income from continuing operations for 2003 was $339.6 million or $3.74 per diluted share, an increase from $317.1 million or $3.44 for 2002, and $298.6 million or $3.24 for 2001.

The Company’s primary or “core” business consists of providing community and regional banking services to both individuals and businesses in the Western states. We believe that this core banking business performed well during 2003 despite the difficult economic environment that these markets continue to experience. However, while we believe that the general economy in the Company’s markets is improving, the cautious optimism that we maintained in 2003 with regard to the Company’s growth is still appropriate and will continue to influence our decisions.

PERFORMANCE SUMMARY

The key indicators that we look to when evaluating the Company’s performance displayed positive and encouraging results for 2003. Taxable-equivalent net interest income increased 5.9% over 2002, despite the difficult interest rate environment that persisted throughout 2003, and in light of a slight erosion in the net interest margin that we experienced during the same period. We attribute this reduction in the margin to the Company’s “asset sensitive” position with regard to asset-liability management (“ALM”), in an environment that has been characterized by sustained low interest rates. We also expect that we will see continued downward pressures on our margins in 2004. See “Interest Rate Risk” on page 59 for more information on the Company’s ALM philosophy and practice.

EXPENSES

In 2002, we announced our intention to place a greater focus on controlling expenses with a goal of taking $50 million out of the annual run-rate of expenses by mid-2003. We believe that our efforts have been successful as reflected in the improvement in the Company’s efficiency ratio from 63.40% in 2002 to 55.65% in 2003. The efficiency ratio is the relationship between noninterest expense and total taxable-equivalent revenue. However, since the ratio for 2003 was favorably influenced by some large equity gains that took place in the third quarter of 2003, it may not be indicative of a sustainable ratio in the future. We believe that the efficiency ratio that we achieved in the fourth quarter of 2003 of 56.38% may be more indicative of the current “run-rate” for the ratio, although we expect to continue our efforts to identify opportunities for operating efficiencies and additional cost savings in the future.

27

ASSET QUALITY

The Company’s asset quality also experienced improvements during 2003. The ratio of nonperforming assets to net loans and other real estate owned was 0.49%, which is its lowest level since the fourth quarter of 2000. Based on data that we have available, the Company’s credit quality trends remain better than its peer average as measured by nonperforming asset and charge-off data. In addition, if the present economic recovery continues, we expect, based on the data available, to see continued stable to improving trends in credit quality indicators.

DEPOSIT AND LOAN GROWTH

Growth in deposits and loans is also a gauge that we use to measure the Company’s performance. The strong deposit growth that the Company enjoyed in 2002 slowed significantly in 2003. The 12.8% growth in 2002 decreased to 3.8% in 2003. However, the mix of deposits improved during 2003 with time deposits generally being replaced by demand, savings and money market deposits. We believe that the rate of increase in 2002 and early 2003 was unusual and caused by a combination of two factors. These were reduced levels of investments in market instruments (e.g., stocks, bonds and mutual funds) during periods of perceived high risk, and businesses reducing expenses and inventories during a period of slower economic activity, both of which resulted in increased cash balances in bank deposit accounts. We believe that these deposit growth drivers may be weakening as financial markets and economic activity rebound. This could result in a downward trend in deposit growth, which may continue throughout 2004 and require us to use alternative sources to meet our funding needs.

Loan growth was modest for 2003 reflecting an improving but still soft economy in Zions’ primary markets. In particular, we experienced strong loan growth in Arizona and Nevada but this strength was offset by net slower growth in California and Colorado. In addition, in Utah we experienced moderate loan growth that we expect will continue in 2004.

In California, we continue to experience reasonably strong new originations of commercial real estate, commercial business and consumer loans, although the consumer lending business for us in California is relatively new and growing from a small base. However, intentional run-off of certain acquired portfolios, a high rate of refinance activity in commercial real estate term lending and rapid sales of completed homes in our residential construction lending offset these originations. Finally, a portion of the growth that we experienced in California in 2003 resulted from purchases of adjustable-rate (generally “5/1 ARM”) mortgages by California Bank & Trust in connection with its asset-liability management efforts. We anticipate that in 2004 this commercial real estate refinance activity and intentional run-off of acquired portfolios will diminish, allowing California Bank & Trust to generate net loan growth for the year.

In Colorado, the Company engaged in a complete strategic review of its subsidiary, Vectra Bank Colorado (“Vectra”). As part of the review, the Company recorded impairment charges, severance and restructuring charges and made a number of decisions regarding Vectra’s strategy. We decided to deemphasize certain types of businesses, including several specific lending products, and focus more specifically on providing services to small- and mid-sized businesses and their employees. Net loan, deposit and income growth was depressed in 2003 by both the implementation of those decisions and the poor economic environment. In addition, eleven branches with approximately $150 million of loans and deposits are currently under contracts to be sold. These sales are expected to close in the first half of 2004, and selling those loans and deposits will depress net growth in the first half of the year. However, as 2003 ended, Vectra’s pipeline of new potential business was strengthening, and we currently believe that net positive growth will resume later in 2004.

CAPITAL

Since Zions is a regulated financial institution, the Company and the subsidiary banks are required to maintain adequate levels of capital as measured by

28

several regulatory capital ratios. One of our goals is to maintain capital levels that are at least “well capitalized” under regulatory standards. In addition, the Parent and its subsidiaries have issued various debt securities that have been rated by the principal rating agencies. Another goal is to maintain capital at levels consistent with an “investment grade” rating for these securities. The Company has maintained its well capitalized status and its capital ratios have increased over the past five years to their current levels.

We believe that the Company has adequate levels of capital in relation to its balance sheet size, business mix and levels of risk and, as a result, we do not presently plan that the capital ratios will materially increase from their present levels. It is our belief that capital not considered necessary to support current and anticipated business should be returned to the Company’s shareholders through dividends and repurchases of its shares and, in particular, the Company does not hold capital in anticipation of possible acquisitions. Historically, the Company has emphasized share repurchases over dividends, due to the lower federal tax rate applied to capital gains. However, with the change in tax law to reduce and equalize the tax rates applied to dividends and capital gains, in the third quarter of 2003 the Company increased its quarterly per share dividend 43%, from $0.21 per share to the current rate of $0.30 per share. The Company paid $91.9 million in common stock dividends in 2003, and used $106.8 million to repurchase shares of Zions common stock. In total, we returned to shareholders $198.7 million out of total net income of $337.8 million, or 58.8%. Additional information on capital management is found in the section entitled “Capital Management” on page 66.

CHALLENGES TO OPERATIONS

By far the largest operating challenges that we faced during 2003 were directly tied to the economies in our various markets and we believe that these challenges will continue into 2004, although they do appear to be moderating. The interest rate environment that we experienced has left little room for us to reduce the costs of our deposits, while at the same time older higher-rate loans and investments have been maturing or paying down. This has placed downward pressure on our net interest margin.

Loan demand remains weak in some geographical areas and for some product lines. In addition, we believe that expense and inventory reductions that have been realized by companies in the industrial sectors have led to cash build-ups, which likely will be reduced before new loan funding is needed.

On the positive side, however, Arizona and Nevada have experienced improved loan demand. In addition, low rates continue to help keep the demand for consumer mortgages relatively high, and our credit quality has consistently improved throughout 2003 and exceeds most of our peers in terms of nonperforming assets and net charge-offs.

The geographic regions in which the Company operates should strengthen with the anticipated improvements in the economy. However, if the economy continues to improve, we would also expect to begin to see customer funds leave the safety of insured deposits and move to such areas as higher-risk stocks and mutual funds, or to fund customers’ business activities. If this occurs, we will need to look to securitization of assets and higher-cost funding sources to finance earning asset growth.

29

Competition with credit unions also continues to be a significant challenge. Their aggressive expansion with new branch construction moving across the Company’s markets will present ongoing competitive pressures. While this is an issue in all of Zions’ markets, it is especially acute in Utah at the present time.

STRATEGIC DECISIONS

Over the past three years, we have made a number of strategic decisions to help position the Company for improved performance in the future. The following table summarizes the income statement effects of these and certain other actions on pretax and after-tax earnings and on diluted earnings per share for the years 2003, 2002 and 2001.

Please refer to this table as part of the following discussions of the key decisions that we made during 2003. These events are also more fully discussed in subsequent sections of Management’s Discussion and Analysis.

VECTRA BANK COLORADO

Beginning in 1997, the Company commenced banking operations in Colorado through a series of acquisitions, which were combined into Vectra. In the ensuing years, Vectra has taken a number of steps to improve its performance. However, in light of continued weak economic conditions in Colorado, Vectra’s performance has not yet met our expectations. Early in 2003, we engaged a national consulting firm to assist Vectra in analyzing its strategy and accelerating its performance improvement. This analysis resulted in a decision to restructure Vectra to enable it to focus on small- and mid-sized businesses and their employees. As noted in the following table, this restructuring and an accompanying goodwill impairment analysis in accordance with the requirements of SFAS No. 142,Goodwill and Other Intangible Assets,resulted in our writing off $75.6 million of the goodwill associated with Vectra.

| | | | | | | | | | | | | | | | | | | |

| | | 2003

| | 2002

| | 2001

|

| (In millions, except per share amounts) | | Pretax

| | After-tax

| | EPS

effect

| | Pretax

| | After-tax

| | EPS

effect

| | Pretax

| | After-tax

| | EPS

effect

|

Noninterest income: | | | | | | | | | | | | | | | | | | | |

Equity securities gains (losses), net: | | | | | | | | | | | | | | | | | | | |

Net write-downs of venture capital investments and a minority interest in an investment banking firm | | $ | (30.6) | | (18.9) | | (0.21) | | (28.7) | | (17.7) | | (0.19) | | (39.6) | | (24.4) | | (0.26) |

Gain on sale of ICAP, plc | | | 68.5 | | 42.3 | | 0.47 | | – | | – | | – | | – | | – | | – |

Net gain on sales of other equity investments | | | 25.9 | | 16.0 | | 0.18 | | 3.4 | | 2.1 | | 0.02 | | 6.0 | | 3.7 | | 0.04 |

Gains from Concord EFS, Inc. transactions | | | – | | – | | – | | – | | – | | – | | 70.8 | | 42.7 | | 0.46 |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

Subtotal | | | 63.8 | | 39.4 | | 0.44 | | (25.3) | | (15.6) | | (0.17) | | 37.2 | | 22.0 | | 0.24 |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

Noninterest expense: | | | | | | | | | | | | | | | | | | | |

Debt extinguishment cost | | | 24.2 | | 15.0 | | (0.16) | | – | | – | | – | | – | | – | | – |

Restructuring charges | | | 1.9 | | 1.2 | | (0.01) | | 3.3 | | 2.0 | | (0.02) | | – | | – | | – |

Impairment losses on certain long-lived assets | | | 2.7 | | 1.6 | | (0.02) | | 4.9 | | 3.1 | | (0.03) | | – | | – | | – |

Merger related expense | | | – | | – | | – | | – | | – | | – | | 7.3 | | 4.5 | | (0.05) |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

Subtotal | | | 28.8 | | 17.8 | | (0.19) | | 8.2 | | 5.1 | | (0.05) | | 7.3 | | 4.5 | | (0.05) |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

Impairment loss on goodwill | | | 75.6 | | 75.6 | | (0.83) | | – | | – | | – | | – | | – | | – |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

Other tax effects | | | n/a | | 7.3 | | 0.08 | | – | | – | | – | | – | | – | | – |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

Discontinued operations: | | | | | | | | | | | | | | | | | | | |

Impairment losses and loss on sale | | | (2.4) | | (1.5) | | (0.02) | | (28.7) | | (22.7) | | (0.25) | | – | | – | | – |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

Cumulative effect of change in accounting principle | | | – | | – | | – | | (35.0) | | (32.4) | | (0.35) | | (11.7) | | (7.2) | | (0.08) |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

Total significant unusual items | | $ | (43.0) | | (48.2) | | (0.52) | | (97.2) | | (75.8) | | (0.82) | | 18.2 | | 10.3 | | 0.11 |

| | |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

30

In addition, Vectra has taken a number of other steps to improve its financial performance, including consolidating operations, reducing staff costs, and hiring new business development officers and management. Also included in these actions is the sale of eleven branches in areas that no longer fit Vectra’s new strategic direction. These branches are all under contracts of sale in two transactions and are expected to close in the first half of 2004. Upon closing, approximately $150 million of loans and deposits, and associated revenues and expenses, will no longer be included in Vectra’s financial statements, temporarily depressing Vectra’s net growth. We believe, however, that the restructuring is a positive step toward improving the future profitability of this subsidiary bank.

EQUITY SALES

In 2003, we made a decision to sell the Company’s investment in ICAP plc (“ICAP”). Net proceeds from the sale were approximately $106.8 million and the Company realized a pretax gain of approximately $68.5 million in connection with the sale. In 2003, we also sold our investment in Lending Tree, Inc. for net proceeds of $25.6 million, from which the Company realized a pretax gain of approximately $21.1 million.

In addition, we sold our investment in Lexign, Inc., which completed our previously announced plan to sell portions of the Company’s e-commerce investments. The sale resulted in a pretax loss of $2.4 million. With this sale, the Company disposed of the last of the businesses that were written down in 2002 and moved into discontinued operations.

RESULTS OF OPERATIONS

NET INTEREST INCOME, MARGIN AND INTEREST RATE SPREADS

Net interest income is the difference between interest earned on assets and interest incurred on liabilities. When we discuss net interest income on a taxable-equivalent basis, we have adjusted net interest income such that any income that is exempt from income taxes is “grossed-up” to become comparable to the income that is taxable. We believe that presenting net interest income on a tax-equivalent basis provides a better comparability of income received from both taxable and tax-exempt sources. In addition, such presentation is consistent with industry practice.

On a taxable-equivalent basis, net interest income for 2003 was up 5.9% from 2002, which was up 8.9% from 2001. The tax-equivalent adjustments to net interest income for 2003, 2002 and 2001 were $22.9 million, $21.3 million, and $20.2 million, respectively. The increase in taxable-equivalent net interest income for both years was driven primarily by growth in average earning assets of 8.4% in 2003 and 10.8% in 2002, offset by the effects of declining net interest margins.

Taxable-equivalent net interest income is the largest component of Zions’ revenue. For the year 2003, it was 69.5% of our taxable-equivalent revenues, compared to 73.7% in 2002 and 70.2% in 2001. The decrease in the percentage for 2003 was primarily caused by the previously discussed gain on the sale of ICAP, which increased noninterest income in relation to total taxable-equivalent revenues. By its nature, net interest income is especially vulnerable to changes in the mix and amounts of interest-earning assets and interest-bearing liabilities. In addition, changes in the interest rates and yields associated with these assets and liabilities significantly impact net interest income. See “Interest Rate and Market Risk Management” on page 59 for a complete discussion of how we manage the portfolios of interest-earning assets and interest-bearing liabilities.

31

SCHEDULE 1

DISTRIBUTION OF ASSETS, LIABILITIES, AND SHAREHOLDERS’ EQUITY

AVERAGE BALANCE SHEETS, YIELDS AND RATES

| | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | 2002

| | | | | | |

(Amounts in millions) | | Average

balance

| | Amount

of

interest(1)

| | Average

rate

| | Average

balance

| | Amount

of

interest(1)

| | Average

rate

| | | | | | |

ASSETS: | | | | | | | | | | | | | | | | | | | | | |

Money market investments | | $ | 1,343 | | 13.0 | | 0.97% | | $ | 1,199 | | 18.6 | | 1.55% | | | | | | | |

Securities: | | | | | | | | | | | | | | | | | | | | | |

Held to maturity | | | – | | – | | | | | 43 | | 2.3 | | 5.34 | | | | | | | |

Available for sale | | | 3,736 | | 171.5 | | 4.59 | | | 3,209 | | 170.0 | | 5.30 | | | | | | | |

Trading account | | | 711 | | 24.7 | | 3.47 | | | 611 | | 22.1 | | 3.62 | | | | | | | |

| | |

|

| |

| | | |

|

| |

| | | | | | | | | |

Total securities | | | 4,447 | | 196.2 | | 4.41 | | | 3,863 | | 194.4 | | 5.03 | | | | | | | |

| | |

|

| |

| | | |

|

| |

| | | | | | | | | |

Loans: | | | | | | | | | | | | | | | | | | | | | |

Loans held for sale | | | 220 | | 8.3 | | 3.77 | | | 210 | | 9.4 | | 4.50 | | | | | | | |

Net loans and leases(2) | | | 19,105 | | 1,204.8 | | 6.31 | | | 17,904 | | 1,254.8 | | 7.01 | | | | | | | |

| | |

|

| |

| | | |

|

| |

| | | | | | | | | |

Total loans and leases | | | 19,325 | | 1,213.1 | | 6.28 | | | 18,114 | | 1,264.2 | | 6.98 | | | | | | | |

| | |

|

| |

| | | |

|

| |

| | | | | | | | | |

Total interest-earning assets | | | 25,115 | | 1,422.3 | | 5.66 | | | 23,176 | | 1,477.2 | | 6.37 | | | | | | | |

| | | | | |

| | | | | | |

| | | | | | | | | |

Cash and due from banks | | | 953 | | | | | | | 939 | | | | | | | | | | | |

Allowance for loan losses | | | (282) | | | | | | | (267) | | | | | | | | | | | |

Goodwill | | | 711 | | | | | | | 744 | | | | | | | | | | | |

Core deposit and other intangibles | | | 77 | | | | | | | 98 | | | | | | | | | | | |

Other assets | | | 1,630 | | | | | | | 1,606 | | | | | | | | | | | |

| | |

|

| | | | | |

|

| | | | | | | | | | | |

Total assets | | $ | 28,204 | | | | | | $ | 26,296 | | | | | | | | | | | |

| | |

|

| | | | | |

|

| | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | |

Savings and NOW | | $ | 2,984 | | 19.1 | | 0.64 | | $ | 2,555 | | 26.5 | | 1.04 | | | | | | | |

Money market super NOW | | | 8,890 | | 92.5 | | 1.04 | | | 8,021 | | 138.1 | | 1.72 | | | | | | | |

Time under $100,000 | | | 1,644 | | 36.9 | | 2.25 | | | 1,911 | | 62.1 | | 3.25 | | | | | | | |

Time $100,000 and over | | | 1,290 | | 33.3 | | 2.58 | | | 1,487 | | 50.5 | | 3.40 | | | | | | | |

Foreign | | | 186 | | 1.7 | | 0.89 | | | 106 | | 1.5 | | 1.42 | | | | | | | |

| | |

|

| |

| | | |

|

| |

| | | | | | | | | |

Total interest-bearing deposits | | | 14,994 | | 183.5 | | 1.22 | | | 14,080 | | 278.7 | | 1.98 | | | | | | | |

| | |

|

| |

| | | |

|

| |

| | | | | | | | | |

Borrowed funds: | | | | | | | | | | | | | | | | | | | | | |

Securities sold, not yet purchased | | | 538 | | 20.4 | | 3.80 | | | 394 | | 16.4 | | 4.17 | | | | | | | |

Federal funds purchased and security repurchase agreements | | | 2,605 | | 25.5 | | 0.98 | | | 2,528 | | 39.1 | | 1.55 | | | | | | | |

Commercial paper | | | 215 | | 3.0 | | 1.41 | | | 359 | | 7.5 | | 2.09 | | | | | | | |

FHLB advances and other borrowings: | | | | | | | | | | | | | | | | | | | | | |

One year or less | | | 145 | | 1.9 | | 1.32 | | | 533 | | 10.3 | | 1.93 | | | | | | | |

Over one year | | | 237 | | 12.3 | | 5.19 | | | 240 | | 12.5 | | 5.18 | | | | | | | |

Long-term debt | | | 1,277 | | 57.3 | | 4.48 | | | 874 | | 56.3 | | 6.45 | | | | | | | |

| | |

|

| |

| | | |

|

| |

| | | | | | | | | |

Total borrowed funds | | | 5,017 | | 120.4 | | 2.40 | | | 4,928 | | 142.1 | | 2.88 | | | | | | | |

| | |

|

| |

| | | |

|

| |

| | | | | | | | | |

Total interest-bearing liabilities | | | 20,011 | | 303.9 | | 1.52 | | | 19,008 | | 420.8 | | 2.21 | | | | | | | |

| | | | | |

| | | |

|

| |

| | | | | | | | | |

Noninterest-bearing deposits | | | 5,259 | | | | | | | 4,522 | | | | | | | | | | | |

Other liabilities | | | 444 | | | | | | | 404 | | | | | | | | | | | |

| | |

|

| | | | | |

|

| | | | | | | | | | | |

Total liabilities | | | 25,714 | | | | | | | 23,934 | | | | | | | | | | | |

Minority interest | | | 22 | | | | | | | 21 | | | | | | | | | | | |

Total shareholders’ equity | | | 2,468 | | | | | | | 2,341 | | | | | | | | | | | |

| | |

|

| | | | | |

|

| | | | | | | �� | | | | |

Total liabilities and shareholders’ equity | | $ | 28,204 | | | | | | $ | 26,296 | | | | | | | | | | | |

| | |

|

| | | | | |

|

| | | | | | | | | | | |

Spread on average interest-bearing funds | | | | | | | 4.14% | | | | | | | 4.16% | | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | | |

Taxable-equivalent net interest income and net yield on interest-earning assets | | | | | 1,118.4 | | 4.45% | | | | | 1,056.4 | | 4.56% | | | | | | | |

| | | | | |

| |

| | | | |

| |

| | | | | | | |

| | | |

| | | 2001

| | 2000

| | 1999

|

| (Amounts in millions) | | Average

balance

| | Amount

of

interest(1)

| | Average

rate

| | Average

balance

| | Amount

of

interest(1)

| | Average

rate

| | Average

balance

| | Amount

of

interest(1)

| | Average

rate

|

ASSETS: | | | | | | | | | | | | | | | | | | | | | |

Money market investments | | $ | 924 | | 34.9 | | 3.78% | | $ | 1,061 | | 67.4 | | 6.35% | | $ | 1,185 | | 67.2 | | 5.67% |

Securities: | | | | | | | | | | | | | | | | | | | | | |

Held to maturity | | | 56 | | 3.4 | | 5.98 | | | 3,254 | | 222.1 | | 6.83 | | | 3,277 | | 204.6 | | 6.24 |

Available for sale | | | 3,269 | | 207.2 | | 6.34 | | | 685 | | 44.8 | | 6.53 | | | 741 | | 42.4 | | 5.72 |

Trading account | | | 647 | | 30.9 | | 4.78 | | | 574 | | 36.3 | | 6.32 | | | 538 | | 30.1 | | 5.59 |

| | |

|

| |

| | | |

|

| |

| |

| |

|

| |

| | |

Total securities | | | 3,972 | | 241.5 | | 6.08 | | | 4,513 | | 303.2 | | 6.72 | | | 4,556 | | 277.1 | | 6.08 |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Loans: | | | | | | | | | | | | | | | | | | | | | |

Loans held for sale | | | 220 | | 13.1 | | 5.94 | | | 192 | | 14.5 | | 7.52 | | | 178 | | 12.2 | | 6.85 |

Net loans and leases(2) | | | 15,795 | | 1,322.6 | | 8.37 | | | 13,457 | | 1,259.2 | | 9.36 | | | 11,641 | | 1,019.0 | | 8.75 |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Total loans and leases | | | 16,015 | | 1,335.7 | | 8.34 | | | 13,649 | | 1,273.7 | | 9.33 | | | 11,819 | | 1,031.2 | | 8.72 |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Total interest-earning assets | | | 20,911 | | 1,612.1 | | 7.71 | | | 19,223 | | 1,644.3 | | 8.55 | | | 17,560 | | 1,375.5 | | 7.83 |

| | | | | |

| | | | | | |

| | | | | | |

| | |

Cash and due from banks | | | 821 | | | | | | | 826 | | | | | | | 856 | | | | |

Allowance for loan losses | | | (229) | | | | | | | (203) | | | | | | | (211) | | | | |

Goodwill | | | 703 | | | | | | | 572 | | | | | | | 574 | | | | |

Core deposit and other intangibles | | | 101 | | | | | | | 76 | | | | | | | 81 | | | | |

Other assets | | | 1,513 | | | | | | | 1,228 | | | | | | | 1,052 | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

Total assets | | $ | 23,820 | | | | | | $ | 21,722 | | | | | | $ | 19,912 | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

LIABILITIES: | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | |

Savings and NOW | | $ | 2,060 | | 32.3 | | 1.57 | | $ | 1,783 | | 40.0 | | 2.24 | | $ | 1,812 | | 44.1 | | 2.43 |

Money market super NOW | | | 7,039 | | 219.3 | | 3.12 | | | 6,210 | | 289.4 | | 4.66 | | | 5,521 | | 203.6 | | 3.69 |

Time under $100,000 | | | 1,984 | | 98.2 | | 4.95 | | | 1,719 | | 87.7 | | 5.10 | | | 2,085 | | 98.5 | | 4.72 |

Time $100,000 and over | | | 1,658 | | 86.5 | | 5.22 | | | 1,408 | | 80.4 | | 5.71 | | | 1,257 | | 61.1 | | 4.86 |

Foreign | | | 106 | | 2.9 | | 2.79 | | | 138 | | 6.3 | | 4.56 | | | 165 | | 7.2 | | 4.36 |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Total interest-bearing deposits | | | 12,847 | | 439.2 | | 3.42 | | | 11,258 | | 503.8 | | 4.48 | | | 10,840 | | 414.5 | | 3.82 |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Borrowed funds: | | | | | | | | | | | | | | | | | | | | | |

Securities sold, not yet purchased | | | 340 | | 17.0 | | 5.01 | | | 311 | | 19.7 | | 6.32 | | | 271 | | 15.6 | | 5.76 |

Federal funds purchased and security repurchase agreements | | | 2,668 | | 95.9 | | 3.59 | | | 2,747 | | 159.7 | | 5.81 | | | 2,369 | | 108.5 | | 4.58 |

Commercial paper | | | 336 | | 14.5 | | 4.30 | | | 316 | | 20.7 | | 6.55 | | | 194 | | 10.8 | | 5.57 |

FHLB advances and other borrowings: | | | | | | | | | | | | | | | | | | | | | |

One year or less | | | 404 | | 21.7 | | 5.37 | | | 1,161 | | 76.2 | | 6.56 | | | 545 | | 28.5 | | 5.23 |

Over one year | | | 203 | | 11.1 | | 5.44 | | | 140 | | 8.5 | | 6.06 | | | 76 | | 4.8 | | 6.32 |

Long-term debt | | | 569 | | 42.7 | | 7.51 | | | 429 | | 34.2 | | 7.98 | | | 453 | | 35.1 | | 7.75 |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Total borrowed funds | | | 4,520 | | 202.9 | | 4.49 | | | 5,104 | | 319.0 | | 6.25 | | | 3,908 | | 203.3 | | 5.20 |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Total interest-bearing liabilities | | | 17,367 | | 642.1 | | 3.70 | | | 16,362 | | 822.8 | | 5.03 | | | 14,748 | | 617.8 | | 4.19 |

| | | | | |

| | | | | | |

| | | | | | |

| | |

Noninterest-bearing deposits | | | 3,907 | | | | | | | 3,316 | | | | | | | 3,249 | | | | |

Other liabilities | | | 385 | | | | | | | 329 | | | | | | | 316 | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

Total liabilities | | | 21,659 | | | | | | | 20,007 | | | | | | | 18,313 | | | | |

Minority interest | | | 30 | | | | | | | 40 | | | | | | | 37 | | | | |

Total shareholders’ equity | | | 2,131 | | | | | | | 1,675 | | | | | | | 1,562 | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

Total liabilities and shareholders’ equity | | $ | 23,820 | | | | | | $ | 21,722 | | | | | | $ | 19,912 | | | | |

| | |

|

| | | | | |

|

| | | | | |

|

| | | | |

Spread on average interest-bearing funds | | | | | | | 4.01% | | | | | | | 3.52% | | | | | | | 3.64% |

| | | | | | | |

| | | | | | |

| | | | | | |

|

Taxable-equivalent net interest income and net yield on interest-earning assets | | | | | 970.0 | | 4.64% | | | | | 821.5 | | 4.27% | | | | | 757.7 | | 4.31% |

| | | | | |

| |

| | | | |

| |

| | | | |

| |

|

| (1) | Taxable-equivalent rates used where applicable. |

| (2) | Net of unearned income and fees, net of related costs. Loans include nonaccrual and restructured loans. |

32

[THIS PAGE INTENTIONALLY LEFT BLANK]

33

One of the gauges that we use to measure success in managing our interest-earning assets and interest-bearing liabilities is the net interest margin. The net interest margin was 4.45% in 2003 compared with 4.56% in 2002 and 4.64% in 2001. The lower margin for 2003 was primarily the result of the continued declining interest rate environment that we also experienced in 2002. The loan portfolio experienced the largest rate decline, primarily as a result of the maturity and pre-payment of higher rate fixed-interest loans, which were replaced by new lower-yielding loans. For 2002, the margin was affected by deposit

SCHEDULE 2

ANALYSIS OF INTEREST CHANGES DUE TO VOLUME AND RATE

| | | | | | | | | | | | | |

| | | 2003 over 2002

| | 2002 over 2001

|

| | | Changes due to

| | Total

changes

| | Changes due to

| | Total

changes

|

| (Amounts in millions) | | Volume

| | Rate(1)

| | | Volume

| | Rate(1)

| |

INTEREST-EARNING ASSETS: | | | | | | | | | | | | | |

Money market investments | | $ | 1.4 | | (7.0) | | (5.6) | | 4.3 | | (20.6) | | (16.3) |

Securities: | | | | | | | | | | | | | |

Held to maturity | | | (2.3) | | – | | (2.3) | | (0.7) | | (0.4) | | (1.1) |

Available for sale | | | 24.2 | | (22.7) | | 1.5 | | (3.2) | | (34.0) | | (37.2) |

Trading account | | | 3.5 | | (0.9) | | 2.6 | | (1.3) | | (7.5) | | (8.8) |

| | |

|

| |

| |

| |

| |

| |

|

Total securities | | | 25.4 | | (23.6) | | 1.8 | | (5.2) | | (41.9) | | (47.1) |

| | |

|

| |

| |

| |

| |

| |

|

Loans: | | | | | | | | | | | | | |

Loans held for sale | | | 0.4 | | (1.5) | | (1.1) | | (0.5) | | (3.2) | | (3.7) |

Net loans and leases (2) | | | 75.1 | | (125.1) | | (50.0) | | 147.6 | | (215.4) | | (67.8) |

| | |

|

| |

| |

| |

| |

| |

|

Total loans and leases | | | 75.5 | | (126.6) | | (51.1) | | 147.1 | | (218.6) | | (71.5) |

| | |

|

| |

| |

| |

| |

| |

|

Total interest-earning assets | | $ | 102.3 | | (157.2) | | (54.9) | | 146.2 | | (281.1) | | (134.9) |

| | |

|

| |

| |

| |

| |

| |

|

INTEREST-BEARING LIABILITIES: | | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | |

Savings and NOW | | $ | 2.8 | | (10.2) | | (7.4) | | 5.1 | | (10.9) | | (5.8) |

Money market super NOW | | | 9.1 | | (54.7) | | (45.6) | | 17.0 | | (98.2) | | (81.2) |

Time under $100,000 | | | (6.1) | | (19.1) | | (25.2) | | (2.4) | | (33.7) | | (36.1) |

Time $100,000 and over | | | (5.1) | | (12.1) | | (17.2) | | (5.9) | | (30.1) | | (36.0) |

Foreign | | | 0.7 | | (0.5) | | 0.2 | | – | | (1.4) | | (1.4) |

| | |

|

| |

| |

| |

| |

| |

|

Total interest-bearing deposits | | | 1.4 | | (96.6) | | (95.2) | | 13.8 | | (174.3) | | (160.5) |

| | |

|

| |

| |

| |

| |

| |

|

Borrowed funds: | | | | | | | | | | | | | |

Securities sold, not yet purchased | | | 5.5 | | (1.5) | | 4.0 | | 2.3 | | (2.9) | | (0.6) |

Federal funds purchased and security repurchase agreements | | | 0.7 | | (14.3) | | (13.6) | | (2.2) | | (54.6) | | (56.8) |

Commercial paper | | | (2.1) | | (2.4) | | (4.5) | | 0.4 | | (7.4) | | (7.0) |

FHLB advances and other borrowings: | | | | | | | | | | | | | |

One year or less | | | (5.1) | | (3.3) | | (8.4) | | 2.5 | | (13.9) | | (11.4) |

Over one year | | | (0.2) | | – | | (0.2) | | 1.9 | | (0.5) | | 1.4 |

Long-term debt | | | 18.2 | | (17.2) | | 1.0 | | 19.6 | | (6.0) | | 13.6 |

| | |

|

| |

| |

| |

| |

| |

|

Total borrowed funds | | | 17.0 | | (38.7) | | (21.7) | | 24.5 | | (85.3) | | (60.8) |

| | |

|

| |

| |

| |

| |

| |

|

Total interest-bearing liabilities | | $ | 18.4 | | (135.3) | | (116.9) | | 38.3 | | (259.6) | | (221.3) |

| | |

|

| |

| |

| |

| |

| |

|

Change in taxable-equivalent net interest income | | $ | 83.9 | | (21.9) | | 62.0 | | 107.9 | | (21.5) | | 86.4 |

| | |

|

| |

| |

| |

| |

| |

|

| (1) | Taxable-equivalent income used where applicable. |

| (2) | Net of unearned income and fees. Loans include nonaccrual and restructured loans. |

In the analysis of interest changes due to volume and rate, changes due to the volume/rate variance are allocated to volume with the following exceptions: when volume and rate both increase, the variance is allocated proportionately to both volume and rate; when the rate increases and volume decreases, the variance is allocated to rate.

34

growth exceeding loan growth, which resulted in our investing funds in lower-yielding money market investments, particularly in the second half of the year. We believe that as a result of the Company’s previously discussed “asset sensitive” ALM position, the net interest margin will continue to experience downward pressures in 2004.

Schedule 1 summarizes the average balances, the amount of interest earned or incurred, and the applicable yields for interest-earning assets and the costs of interest-bearing liabilities that generate taxable-equivalent net interest income.

Schedule 2 analyzes the year-to-year changes in net interest income on a fully taxable-equivalent basis for the years indicated. For purposes of calculating the yields in these schedules, the average loan balances also include the principal amounts of nonaccrual and restructured loans. However, interest received on nonaccrual loans is included in income only to the extent that cash payments have been received and not applied to principal reductions. In addition, interest on restructured loans is generally accrued at reduced rates.

The incremental tax rate used for calculating the taxable-equivalent adjustments was 35% for all years presented.

PROVISION FOR LOAN LOSSES

The provision for loan losses is the amount of expense that, based on our judgment, is required to maintain the allowance for loan losses at an adequate level. In determining an adequate level for the allowance, we perform periodic evaluations of the Company’s various portfolios, the levels of actual loan losses, and statistical trends and other economic factors. See “Credit Risk Management” on page 52 for a complete discussion of how we determine the appropriate level for the allowance.

The provision for loan losses for 2003 was $69.9 million or .36% of average loans for the year. This compares to $71.9 million or .40% for 2002, and $73.2 million or .46% for 2001. The declining trend in the provision corresponds to the improvements that have taken place during 2003 and 2002 in the loan and lease portfolios and, in particular, the improving levels of nonperforming assets.

NONINTEREST INCOME

Noninterest income represents revenues that the Company earns for products and services that have no interest rate or yield associated with them. Noninterest income for 2003 comprised 30.5% of net taxable-equivalent revenues compared to 26.3% in 2002 and 29.8% in 2001. Schedule 3 presents a comparison of the major components of noninterest income for the past five years.

SCHEDULE 3

NONINTEREST INCOME

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in millions) | | 2003

| | Percent

change

| | 2002

| | Percent

change

| | 2001

| | Percent

change

| | 2000

| | Percent

change

| | 1999

|

Service charges and fees on deposit accounts | | $ | 129.8 | | 9.1% | | $ | 119.0 | | 17.8% | | $ | 101.0 | | 29.0% | | $ | 78.3 | | 2.0% | | $ | 76.8 |

Loan sales and servicing income | | | 85.1 | | 21.4 | | | 70.1 | | (27.6) | | | 96.8 | | 87.2 | | | 51.7 | | 27.7 | | | 40.5 |

Other service charges, commissions and fees | | | 88.9 | | 9.5 | | | 81.2 | | 11.2 | | | 73.0 | | 12.1 | | | 65.1 | | (1.5) | | | 66.1 |

Trust and investment management income | | | 21.1 | | 14.1 | | | 18.5 | | 1.1 | | | 18.3 | | 0.5 | | | 18.2 | | 15.2 | | | 15.8 |

Income from securities conduit | | | 29.4 | | 44.8 | | | 20.3 | | 65.0 | | | 12.3 | | 6,050.0 | | | 0.2 | | – | | | – |

Dividends and other investment income | | | 28.5 | | (19.7) | | | 35.5 | | 25.4 | | | 28.3 | | 4.8 | | | 27.0 | | 51.7 | | | 17.8 |

Market making, trading and nonhedge derivative income | | | 29.4 | | (24.6) | | | 39.0 | | 14.4 | | | 34.1 | | 237.6 | | | 10.1 | | (12.2) | | | 11.5 |

Equity securities gains (losses), net | | | 63.8 | | 352.2 | | | (25.3) | | (168.0) | | | 37.2 | | 68.3 | | | 22.1 | | (49.9) | | | 44.1 |

Fixed income securities gains (losses), net | | | – | | (100.0) | | | 0.4 | | 110.5 | | | (3.8) | | (860.0) | | | 0.5 | | 105.1 | | | (9.9) |

Impairment loss on First Security Corporation common stock | | | – | | – | | | – | | – | | | – | | (100.0) | | | (96.9) | | – | | | – |

Other | | | 14.1 | | (22.1) | | | 18.1 | | 20.7 | | | 15.0 | | (8.0) | | | 16.3 | | 297.6 | | | 4.1 |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | |

|

|

Total | | $ | 490.1 | | 30.1% | | $ | 376.8 | | (8.6)% | | $ | 412.2 | | 114.0% | | $ | 192.6 | | (27.8)% | | $ | 266.8 |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | |

|

|

35

Compared to 2002, noninterest income increased $113.3 million or 30.1% in 2003. The largest component of this increase was in net equity securities gains, which was $63.8 million compared with losses of $25.3 million in 2002. As previously discussed, we made the decision to sell the Company’s holdings of ICAP for $106.8 million, resulting in a pretax gain of $68.5 million. The Company also sold several equity investment securities resulting in net gains of $25.9 million, of which approximately $21.1 million resulted from the sale of our investment in Lending Tree, Inc. The ICAP and other gains were partially offset by $30.6 million in write-downs of venture capital and other investments.

The growth in service charges and fees on deposit accounts that we experienced in both 2002 and 2001 continued in 2003, reflecting strong core deposit growth and the effects of the acquisitions that were consummated in 2001.

Loan sales and servicing income includes revenues from securitizations of loans as well as revenues that we earn through servicing loans that have been sold to third parties. For 2003, loan sales and servicing income increased 21.4% compared with 2002. However, 2002 included a write-down of approximately $13.6 million on capitalized excess servicing related to an auto securitization nonhedge derivative transaction. The $13.6 million fair value of a swap entered into in this transaction was recorded as an asset and non-hedge derivative income was increased by this amount. The effects of this transaction constituted substantially all of the 21.4% increase from 2002 to 2003, however, the transaction had no effect on net income. See Note 6 of the Notes to Consolidated Financial Statements for additional information on the Company’s securitization programs.

Other services charges, commissions and fees, which is comprised of investment, brokerage and fiscal agent fees, Automated Teller Machine (“ATM”) fees, insurance commissions, bankcard merchant fees and other miscellaneous fees, increased $7.7 million or 9.5% from 2002, which was up 11.2% from 2001. The increases in both years are largely the result of increased fees from ATM usage and higher insurance commissions as well as growth in revenues from the Company’s municipal finance operations, reflecting the continued low interest rate environment.

Trust and investment management income for 2003 increased 14.1% compared to 2002, which was essentially the same as 2001. The increase in 2003 was primarily attributable to stock market increases, which resulted in higher asset values upon which trust fees are determined, coupled with increased sales activities.

Income from securities conduit represents fees that we receive from Lockhart Funding, LLC, a “qualified special-purpose entity” securities conduit (“Lockhart”), in return for liquidity, an interest rate agreement and administrative services that Zions provides to the entity in accordance with a servicing agreement. The increases in income for both 2003 and 2002 resulted from increased investment holdings in Lockhart’s securities portfolio, which created higher servicing fees. See “Liquidity Management” on page 64 and Note 6 of the Notes to Consolidated Financial Statements for further information regarding securitizations and Lockhart.

Dividends and other investment income consist of revenue from the Company’s bank-owned life insurance program, dividends on securities holdings and equity in earnings from investments in unconsolidated companies. Income from bank-owned life insurance programs was $19.0 million in 2003, $18.9 million in 2002 and $16.6 million in 2001. The growth in revenues resulted mainly from increased investment holdings of the programs. Income from investments in unconsolidated subsidiaries includes dividends on Federal Home Loan Bank (“FHLB”) stock and equity earnings in unconsolidated affiliates and was $9.5 million in 2003, $16.6 million in 2002 and $11.7 million in 2001. The decrease in 2003 was caused primarily by reduced holdings in FHLB stock and other investments, coupled with a lower dividend rate being paid on the FHLB stock.

36

Market making, trading and nonhedge derivative income consists of the following:

| | | | | | | | | | | | | |

| (Amounts in millions) | | 2003

| | Percent

change

| | 2002

| | Percent

change

| | 2001

|

Market making and trading income | | $ | 27.4 | | 11.4 % | | $ | 24.6 | | 33.0 % | | $ | 18.5 |

Nonhedge derivative income | | | 2.0 | | (86.1) | | | 14.4 | | (7.7) | | | 15.6 |

| | |

|

| | | |

|

| | | |

|

|

Total | | $ | 29.4 | | | | $ | 39.0 | | | | $ | 34.1 |

| | |

|

| | | |

|

| | | |

|

|

Zions added corporate bonds to its odd lot bond trading business in 2001, which resulted in an increase in trading income for 2002 and 2003. Trading income for 2001 also included $3.3 million in appreciation of held to maturity securities transferred to trading in conjunction with the adoption of SFAS 133. These same securities were subsequently sold in the first quarter of 2001. Nonhedge derivative income for 2002 includes the previously discussed $13.6 million nonhedge derivative transaction. In January 2004 the Company announced its plans to purchase Van der Moolen UK Ltd., which is an odd lot bond trading firm in the United Kingdom. The acquisition is expected to increase Zions’ daily electronic bond trading volume by approximately 20 percent. The transaction is subject to the approval by regulators in the United States and United Kingdom, and closing is anticipated in the first half of 2004.

As previously discussed, equity securities gains for 2003 included a $68.5 million gain on the sale of ICAP, $25.9 million in other equity securities gains and $30.6 million of investment write-downs. Net equity securities losses for 2002 included $28.7 million of write-downs of various venture capital investments and the Company’s minority interest in an investment banking firm. Net equity securities gains in 2001 included gains of $70.8 million from the sale of our investment in Concord EFS, Inc., which we describe in more detail below, and losses of $39.6 million from write-downs of various venture capital investments.

During 2001, the Company recognized an aggregate gain of $70.8 million in connection with the sale of its equity interest in Star Systems, Inc. to Concord EFS. Consideration received in the amount of approximately $83 million was in the form of restricted Concord securities that were hedged by the Company through a forward sale contract. Both the securities and the forward contract were subsequently contributed to an off-balance sheet trust. The contribution represented a sale of the transferred assets for financial reporting purposes. The forward sale contract was treated as a fair value derivative hedge contract of securities resulting in a $4.3 million gain reported in other noninterest income. We have determined that this transaction will not require consolidation into the Company’s financial statements under FASB Interpretation No. 46 (“FIN 46”),Consolidation of Variable Interest Entities.

NONINTEREST EXPENSE

Actions taken by management to control expenses included restructuring the e-commerce operations, closing unproductive branches, scaling back the indirect auto financing business, consolidating operations, and improving the procurement processes. As part of these cost reduction efforts, the Company incurred restructuring charges of $1.9 million in 2003 and $3.3 million in 2002 related to several cost-saving steps that included branch closures in Utah and Colorado and the restructuring of trust operations and administrative functions. In addition, the Company incurred impairment losses of $2.7 million in 2003 and $4.9 million in 2002 on certain software related to its e-commerce activities and in response to ZFNB’s efforts to exit certain branches. See Note 16 of the Notes to Consolidated Financial Statements for additional information on these restructuring and impairment charges.

Noninterest expense for 2003 increased 4.1% to $893.9 million, compared with $858.9 million in 2002, which was up 2.7% over the $836.1 million in 2001. Approximately 69% of the increase in noninterest expense for 2003 relates to debt extinguishment costs of $24.2 million, which were incurred in the third quarter when the Company repurchased $197.4 million of its debt. Schedule 4 summarizes the major components of noninterest expense and provides a comparison of the components over the past five years.

37

ZIONS BANCORPORATION AND SUBSIDIARIES

SCHEDULE 4

NONINTEREST EXPENSE

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in millions) | | 2003

| | Percent

change

| | 2002

| | Percent

change

| | 2001

| | Percent

change

| | 2000

| | Percent

change

| | 1999

|

Salaries and employee benefits | | $ | 491.6 | | 2.8 % | | $ | 478.0 | | 10.4 % | | $ | 432.9 | | 24.3 % | | $ | 348.3 | | 0.5 % | | $ | 346.7 |

Occupancy, net | | | 71.0 | | 3.5 | | | 68.6 | | 7.9 | | | 63.6 | | 23.0 | | | 51.7 | | 4.7 | | | 49.4 |

Furniture and equipment | | | 65.5 | | 3.3 | | | 63.4 | | 4.3 | | | 60.8 | | 15.4 | | | 52.7 | | 16.1 | | | 45.4 |

Legal and professional services | | | 26.0 | | 2.4 | | | 25.4 | | (17.0) | | | 30.6 | | 55.3 | | | 19.7 | | 21.6 | | | 16.2 |

Postage and supplies | | | 25.8 | | (6.5) | | | 27.6 | | (0.7) | | | 27.8 | | 26.9 | | | 21.9 | | (4.4) | | | 22.9 |

Advertising | | | 18.2 | | (11.7) | | | 20.6 | | (7.6) | | | 22.3 | | (12.2) | | | 25.4 | | 37.3 | | | 18.5 |

Debt extinguishment cost | | | 24.2 | | – | | | – | | – | | | – | | – | | | – | | – | | | – |

Impairment losses on long-lived assets | | | 2.7 | | (44.9) | | | 4.9 | | – | | | – | | – | | | – | | – | | | – |

Restructuring charges | | | 1.9 | | (42.4) | | | 3.3 | | – | | | – | | – | | | – | | – | | | – |

Merger related expense | | | – | | – | | | – | | (100.0) | | | 7.3 | | (84.0) | | | 45.5 | | 64.3 | | | 27.7 |

Amortization of core deposit and other intangibles | | | 14.2 | | 6.0 | | | 13.4 | | 4.7 | | | 12.8 | | 11.3 | | | 11.5 | | (1.7) | | | 11.7 |

Amortization of goodwill | | | – | | – | | | – | | (100.0) | | | 31.5 | | 20.2 | | | 26.2 | | 6.9 | | | 24.5 |

Other | | | 152.8 | | (0.6) | | | 153.7 | | 4.9 | | | 146.5 | | 23.7 | | | 118.4 | | (0.3) | | | 118.8 |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | |

|

|

Total | | $ | 893.9 | | 4.1 % | | $ | 858.9 | | 2.7 % | | $ | 836.1 | | 15.9 % | | $ | 721.3 | | 5.8 % | | $ | 681.8 |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | |

|

|

The Company’s efficiency ratio was 55.65% for 2003 compared to 63.40% for 2002. The efficiency ratio for 2003, however, was favorably impacted by large equity gains reported in the third quarter. As a result, we believe that the 56.38% efficiency ratio that we achieved in the fourth quarter of 2003 may be more indicative of the current “run rate” for this ratio.

Salary costs for 2003 experienced a modest increase compared to 2002. Salary costs in 2002 increased significantly over 2001, partly as a result of enhanced incentive programs and the effects of the acquisitions that were completed in 2002 and 2001. The Company also added staff in 2002 in anticipation of planned conversions of all subsidiary banks to common operating platforms. Employee benefits increased in both 2003 and 2002, primarily as a result of higher employee health insurance costs and increased costs associated with the Company’s retirement plans. Salaries and employee benefits are shown in greater detail in the following table.

| | | | | | | | | | | | | |

| (Dollar amounts in millions) | | 2003

| | Percent

change

| | 2002

| | Percent

change

| | 2001

|

Salaries and bonuses | | $ | 409.7 | | 1.6 % | | $ | 403.4 | | 10.1 % | | $ | 366.3 |

Benefits: | | | | | | | | | | | | | |

Employee health and insurance | | | 28.7 | | 8.3 | | | 26.5 | | 22.7 | | | 21.6 |

Retirement | | | 25.6 | | 26.7 | | | 20.2 | | 11.6 | | | 18.1 |

Payroll taxes and other | | | 27.6 | | (1.1) | | | 27.9 | | 3.7 | | | 26.9 |

| | |

|

| | | |

|

| | | |

|

|

Total benefits | | | 81.9 | | 9.8 | | | 74.6 | | 12.0 | | | 66.6 |

| | |

|

| | | |

|

| | | |

|

|

Total salaries and employee benefits | | $ | 491.6 | | 2.8 % | | $ | 478.0 | | 10.4 % | | $ | 432.9 |

| | |

|

| | | |

|

| | | |

|

|

FTEs (at December 31) | | | 7,896 | | (2.2)% | | | 8,073 | | (0.6)% | | | 8,124 |

| | |

|

| | | |

|

| | | |

|

|

As noted in the table under FTEs (full-time equivalent employees), the Company’s ongoing efforts to consolidate operations, exit unprofitable businesses and reduce costs have resulted in a 2.8% reduction in staffing since year-end 2001.

IMPAIRMENT LOSS ON GOODWILL

As previously discussed, Vectra is in the process of restructuring to focus on serving small- and mid-sized businesses and their employees. In connection with the restructuring, in the third quarter we identified and offered eleven of Vectra’s branches for sale. The assets and liabilities from these branches were measured at their fair values based upon bids, letters of intent, and negotiations with potential buyers. The comparison of the fair values to the carrying values of

38

these assets and liabilities resulted in an impairment loss on goodwill of $7.1 million, which we recorded in 2003.

Also as a result of the Vectra restructuring, the Company, with the assistance of an independent valuation consulting firm, performed an impairment analysis on the operations that were being retained. The analysis was performed in accordance with the valuation process specified in SFAS 142. Based on the results of the analysis, the Company recognized an additional impairment loss on goodwill of $68.5 million, which when added to the $7.1 million discussed above, totals $75.6 million and is separately disclosed in the Consolidated Statements of Income.

DISCONTINUED OPERATIONS

During 2002, we took a number of actions to revalue and restructure Zions’ e-commerce activities in light of continued disappointing operating results and a difficult market environment. We determined that our plan to restructure and offer all or part of these e-commerce subsidiaries for sale met the held for sale and discontinued operations criteria of SFAS No. 144,Accounting for the Impairment or Disposal of Long-Lived Assets.

We sold the first e-commerce subsidiary, Phaos Technology Corp., in 2002 and recognized a $5.3 million income tax benefit as a result of the sale. The remaining e-commerce subsidiary that we had identified to sell, Lexign, Inc., was sold in the third quarter of 2003, resulting in a pretax loss on the sale of $2.4 million. The loss on discontinued operations decreased in 2003 to $1.8 million from $28.5 million in 2002 and $8.4 million in 2001. The loss for 2002 included additional impairment related to our restructuring efforts. See Note 16 of the Notes to Consolidated Financial Statements for additional information regarding the discontinued operations and the related impairment losses that the Company has recognized.

FOREIGN OPERATIONS

Zions First National Bank (“ZFNB”) operates a foreign branch in Grand Cayman, Grand Cayman Islands, B.W.I. The branch only accepts deposits from qualified customers. While deposits in this branch are not subject to Federal Reserve Board reserve requirements or Federal Deposit Insurance Corporation insurance requirements, there are no federal or state income tax benefits to the Company or any customers as a result of these operations.

Foreign deposits at December 31, 2003, 2002 and 2001 totaled $235 million, $191 million and $133 million, respectively, and averaged $186 million for 2003, and $106 million for both 2002 and 2001. See Schedule 8 for foreign loans outstanding.

INCOME TAXES

The Company’s income tax expense on continuing operations for 2003 was $213.8 million compared to $167.7 million in 2002 and $161.9 million in 2001. The Company’s effective income tax rate was 39.1% in 2003, 34.9% in 2002 and 35.8% in 2001. The difference between the Company’s effective tax rate for 2003 and the statutory federal income tax rate of 35% is primarily the result of higher taxable income resulting from nondeductible expenses, including goodwill impairment. See Note 17 of the Notes to Consolidated Financial Statements for more information on income taxes.

BUSINESS SEGMENT RESULTS

The Company manages its operations and prepares management reports with a primary focus on geographical area. All segments that are presented in the following discussion, except for the segment identified as “Other”, are based on geographical banking operations. The operating segment identified as “Other” includes Zions Bancorporation (“the Parent”), certain e-commerce subsidiaries, other smaller nonbank operating units and eliminations of intercompany transactions.

Operating segment information is presented in Schedule 5 and Note 24 of the Notes to Consolidated Financial Statements. The accounting policies of the individual segments are the same as those of the Company. The Company allocates centrally provided services to the business segments based upon esti-

39

SCHEDULE 5

OPERATING SEGMENTS INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Zions First

National Bank

and Subsidiaries

| | California

Bank & Trust

| | Nevada

State Bank

| | National Bank of Arizona

|

| (Amounts in millions) | | 2003

| | 2002

| | % Change

| | 2003

| | 2002

| | % Change

| | 2003

| | 2002

| | % Change

| | 2003

| | 2002

| | % Change

|

CONDENSED INCOME STATEMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 335.6 | | 296.2 | | 13 % | | $ | 385.4 | | 377.9 | | 2 % | | $ | 125.8 | | 124.9 | | 1 % | | | $128.5 | | 116.0 | | 11 % |

Noninterest income | | | 233.8 | | 199.7 | | 17 | | | 75.9 | | 78.4 | | (3) | | | 31.7 | | 28.1 | | 13 | | | 21.4 | | 19.1 | | 12 |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Total revenue | | | 569.4 | | 495.9 | | 15 | | | 461.3 | | 456.3 | | 1 | | | 157.5 | | 153.0 | | 3 | | | 149.9 | | 135.1 | | 11 |

Provision for loan losses | | | 46.3 | | 41.3 | | 12 | | | 12.1 | | 17.0 | | (29) | | | 5.6 | | 4.7 | | 19 | | | 0.2 | | 2.0 | | (90) |

Noninterest expense | | | 318.3 | | 310.1 | | 3 | | | 227.0 | | 238.2 | | (5) | | | 86.9 | | 81.9 | | 6 | | | 79.8 | | 69.0 | | 156 |

Impairment loss on goodwill | | | – | | – | | – | | | – | | – | | – | | | – | | – | | – | | | – | | – | | – |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Income from continuing operations before income taxes and minority interest | | | 204.8 | | 144.5 | | 42 | | | 222.2 | | 201.1 | | 10 | | | 65.0 | | 66.4 | | (2) | | | 69.9 | | 64.1 | | 9 |

Income tax expense (benefit) | | | 65.0 | | 42.4 | | 53 | | | 89.1 | | 81.0 | | 10 | | | 22.1 | | 22.6 | | (2) | | | 27.7 | | 25.5 | | 9 |

Minority interest | | | (0.5) | | (1.2) | | (58) | | | – | | – | | – | | | – | | – | | – | | | – | | – | | – |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Income from continuing operations | | | 140.3 | | 103.3 | | 36 | | | 133.1 | | 120.1 | | 11 | | | 42.9 | | 43.8 | | (2) | | | 42.2 | | 38.6 | | 9 |

Loss on discontinued operations | | | – | | – | | – | | | – | | – | | – | | | – | | – | | – | | | – | | – | | – |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Income before cumulative effect adjustment | | | 140.3 | | 103.3 | | 36 | | | 133.1 | | 120.1 | | 11 | | | 42.9 | | 43.8 | | (2) | | | 42.2 | | 38.6 | | 9 |

Cumulative effect adjustment | | | – | | – | | – | | | – | | – | | – | | | – | | – | | – | | | – | | – | | – |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

Net income (loss) | | $ | 140.3 | | 103.3 | | 36 % | | $ | 133.1 | | 120.1 | | 11 % | | $ | 42.9 | | 43.8 | | (2)% | | | $ 42.2 | | 38.6 | | 9 % |

| | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

YEAR END BALANCE SHEET DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 10,598 | | 10,530 | | 1 % | | $ | 9,216 | | 8,805 | | 5 % | | $ | 2,958 | | 2,683 | | 10 % | | | $3,067 | | 2,925 | | 5 % |

Net loans and leases | | | 6,888 | | 6,714 | | 3 | | | 6,349 | | 6,129 | | 4 | | | 2,162 | | 1,850 | | 17 | | | 2,381 | | 1,979 | | 20 |

Allowance for loan losses | | | 98 | | 96 | | 2 | | | 81 | | 88 | | (8) | | | 28 | | 25 | | 12 | | | 30 | | 32 | | (6) |

Goodwill, core deposit and other intangibles | | | 30 | | 30 | | – | | | 426 | | 434 | | (2) | | | 23 | | 23 | | – | | | 72 | | 74 | | (3) |

Noninterest-bearing demand deposits | | | 1,272 | | 1,178 | | 8 | | | 2,401 | | 2,035 | | 18 | | | 807 | | 653 | | 24 | | | 773 | | 721 | | 7 |

Total deposits | | | 7,104 | | 7,116 | | – | | | 7,638 | | 6,970 | | 10 | | | 2,555 | | 2,349 | | 9 | | | 2,539 | | 2,487 | | 2 |

Common equity | | | 725 | | 682 | | 6 | | | 956 | | 978 | | (2) | | | 194 | | 173 | | 12 | | | 241 | | 233 | | 3 |

| | | | | | | | | | | | |

PERFORMANCE RATIOS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 1.24% | | 0.99% | | | | | 1.51% | | 1.40% | | | | | 1.52% | | 1.70% | | | | | 1.46% | | 1.44% | | |

Return on average common equity | | | 19.99% | | 15.56% | | | | | 13.52% | | 11.69% | | | | | 23.98% | | 26.68% | | | | | 18.23% | | 17.96% | | |

Efficiency ratio | | | 54.62% | | 61.00% | | | | | 49.12% | | 52.12% | | | | | 54.83% | | 53.13% | | | | | 52.93% | | 50.84% | | |

| | | | | | | | | | | | |

OTHER INFORMATION | | | | | | | | | | | | | | | | | | | | | | | | | | | | |