EXHIBIT 13

[FINANCIAL HIGHLIGHTS]

| | | | | | | | | | | | | | | | | | | |

| (In millions, except per share amounts) | | 2004/2003

CHANGE

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

FOR THE YEAR | | | | | | | | | | | | | | | | | | | |

Net interest income | | +7 | % | | $ | 1,174.5 | | | 1,095.5 | | | 1,035.1 | | | 949.8 | | | 803.4 | |

Noninterest income | | -15 | % | | | 417.9 | | | 490.1 | | | 376.8 | | | 412.2 | | | 192.6 | |

Total revenue | | – | | | | 1,592.4 | | | 1,585.6 | | | 1,411.9 | | | 1,362.0 | | | 996.0 | |

Provision for loan losses | | -37 | % | | | 44.1 | | | 69.9 | | | 71.9 | | | 73.2 | | | 31.8 | |

Noninterest expense | | +3 | % | | | 923.3 | | | 893.9 | | | 858.9 | | | 836.1 | | | 721.3 | |

Impairment loss on goodwill | | -99 | % | | | 0.6 | | | 75.6 | | | – | | | – | | | – | |

Income from continuing operations before income taxes and minority interest | | +14 | % | | | 624.4 | | | 546.2 | | | 481.1 | | | 452.7 | | | 242.9 | |

Income taxes | | +3 | % | | | 220.1 | | | 213.8 | | | 167.7 | | | 161.9 | | | 79.7 | |

Minority interest | | -76 | % | | | (1.7 | ) | | (7.2 | ) | | (3.7 | ) | | (7.8 | ) | | 1.5 | |

Income from continuing operations | | +20 | % | | | 406.0 | | | 339.6 | | | 317.1 | | | 298.6 | | | 161.7 | |

Loss on discontinued operations | | -100 | % | | | – | | | (1.8 | ) | | (28.4 | ) | | (8.4 | ) | | – | |

Cumulative effect adjustment | | – | | | | – | | | – | | | (32.4 | ) | | (7.2 | ) | | – | |

Net income | | +20 | % | | | 406.0 | | | 337.8 | | | 256.3 | | | 283.0 | | | 161.7 | |

| | | | | | |

PER SHARE | | | | | | | | | | | | | | | | | | | |

Income from continuing operations – diluted | | +20 | % | | | 4.47 | | | 3.74 | | | 3.44 | | | 3.24 | | | 1.86 | |

Net income – diluted | | +20 | % | | | 4.47 | | | 3.72 | | | 2.78 | | | 3.07 | | | 1.86 | |

Net income – basic | | +21 | % | | | 4.53 | | | 3.75 | | | 2.80 | | | 3.10 | | | 1.87 | |

Dividends declared | | +24 | % | | | 1.26 | | | 1.02 | | | .80 | | | .80 | | | .89 | |

Book value(1) | | +10 | % | | | 31.06 | | | 28.27 | | | 26.17 | | | 24.74 | | | 20.42 | |

Market price – end | | | | | | 68.03 | | | 61.34 | | | 39.35 | | | 52.58 | | | 62.44 | |

Market price – high | | | | | | 69.29 | | | 63.86 | | | 59.65 | | | 64.00 | | | 62.75 | |

Market price – low | | | | | | 54.08 | | | 39.31 | | | 34.14 | | | 42.30 | | | 36.44 | |

| | | | | | |

AT YEAR-END | | | | | | | | | | | | | | | | | | | |

Assets | | +10 | % | | | 31,470 | | | 28,558 | | | 26,566 | | | 24,304 | | | 21,939 | |

Net loans and leases | | +14 | % | | | 22,627 | | | 19,920 | | | 19,040 | | | 17,311 | | | 14,378 | |

Loans sold being serviced(2) | | +10 | % | | | 3,066 | | | 2,782 | | | 2,476 | | | 2,648 | | | 1,750 | |

Deposits | | +11 | % | | | 23,292 | | | 20,897 | | | 20,132 | | | 17,842 | | | 15,070 | |

Long-term borrowings | | +4 | % | | | 1,919 | | | 1,843 | | | 1,310 | | | 1,022 | | | 563 | |

Shareholders’ equity | | +10 | % | | | 2,790 | | | 2,540 | | | 2,374 | | | 2,281 | | | 1,779 | |

| | | | | | |

PERFORMANCE RATIOS | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | | | | 1.31 | % | | 1.20 | % | | 0.97 | % | | 1.19 | % | | 0.74 | % |

Return on average shareholders’ equity | | | | | | 15.27 | % | | 13.69 | % | | 10.95 | % | | 13.28 | % | | 9.65 | % |

Efficiency ratio | | | | | | 57.22 | % | | 55.65 | % | | 63.40 | % | | 61.60 | % | | 71.13 | % |

Net interest margin | | | | | | 4.32 | % | | 4.45 | % | | 4.56 | % | | 4.64 | % | | 4.27 | % |

| | | | | | |

CAPITAL RATIOS(1) | | | | | | | | | | | | | | | | | | | |

Equity to assets | | | | | | 8.87 | % | | 8.89 | % | | 8.94 | % | | 9.38 | % | | 8.11 | % |

Tier 1 leverage | | | | | | 8.31 | % | | 8.06 | % | | 7.56 | % | | 6.56 | % | | 6.38 | % |

Tier 1 risk-based capital | | | | | | 9.35 | % | | 9.42 | % | | 9.26 | % | | 8.25 | % | | 8.53 | % |

Total risk-based capital | | | | | | 14.05 | % | | 13.52 | % | | 12.94 | % | | 12.20 | % | | 10.83 | % |

| | | | | | |

SELECTED INFORMATION | | | | | | | | | | | | | | | | | | | |

Average common and common-equivalent shares (in thousands) | | | | | | 90,882 | | | 90,734 | | | 92,079 | | | 92,174 | | | 87,120 | |

Common dividend payout ratio | | | | | | 28.23 | % | | 27.20 | % | | 28.58 | % | | 26.11 | % | | 47.47 | % |

Full-time equivalent employees | | | | | | 8,026 | | | 7,896 | | | 8,073 | | | 8,124 | | | 6,915 | |

Commercial banking offices | | | | | | 386 | | | 412 | | | 415 | | | 412 | | | 373 | |

ATMS | | | | | | 475 | | | 553 | | | 588 | | | 589 | | | 509 | |

| (2) | Amount represents the outstanding balance of loans sold and being serviced by the Company, excluding conforming first mortgage residential real estate loans. |

INSIDE FRONT COVER

MANAGEMENT’S DISCUSSION AND ANALYSIS

FORWARD-LOOKING INFORMATION

Statements in this Annual Report to Shareholders that are based on other than historical data are forward-looking, within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations or forecasts of future events and include, among others:

| • | | statements with respect to the Company’s beliefs, plans, objectives, goals, guidelines, expectations, anticipations, and future financial condition, results of operations and performance; |

| • | | statements preceded by, followed by or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “projects,” or similar expressions. |

These forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties and actual results may differ materially from those presented, either expressed or implied, in Management’s Discussion and Analysis. Factors that might cause such differences include, but are not limited to:

| • | | the Company’s ability to successfully execute its business plans and achieve its objectives; |

| • | | changes in political and economic conditions, including the economic effects of terrorist attacks against the United States and related events; |

| • | | changes in financial market conditions, either nationally or locally in areas in which the Company conducts its operations, including without limitation, reduced rates of business formation and growth and commercial real estate development; |

| • | | fluctuations in the equity and fixed-income markets; |

| • | | changes in interest rates; |

| • | | acquisitions and integration of acquired businesses; |

| • | | increases in the levels of losses, customer bankruptcies, claims and assessments; |

| • | | changes in fiscal, monetary, regulatory, trade and tax policies and laws; |

| • | | continuing consolidation in the financial services industry; |

| • | | new litigation or changes in existing litigation; |

| • | | success in gaining regulatory approvals, when required; |

| • | | changes in consumer spending and savings habits; |

| • | | increased competitive challenges and expanding product and pricing pressures among financial institutions; |

| • | | inflation and deflation; |

| • | | legislation or regulatory changes which adversely affect the Company’s operations or business; |

| • | | the Company’s ability to comply with applicable laws and regulations; and |

| • | | changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or regulatory agencies. |

The Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments.

EXECUTIVE SUMMARY

COMPANY OVERVIEW

Zions Bancorporation (“the Parent”) and subsidiaries (collectively “the Company,” “Zions,” “we,” “our,” “us”) is a $30 billion financial holding company headquartered in Salt Lake City, Utah. The Company is the twenty-third largest domestic bank in terms of deposits, operating banking businesses through nearly 400 offices and 475 ATMs in eight Western states: Utah, Idaho, California, Arizona, Nevada, Colorado, Washington and New Mexico. The Company is a national leader in Small Business Administration (“SBA”) lending, public finance advisory services and electronic bond trading. Zions also operates a number of specialty financial services and financial technology businesses that conduct business on a regional or national scale. In addition, Zions is included in the S&P 500 and NASDAQ Financial 100 indices.

In operating its banking businesses, Zions seeks to combine the advantages that it believes can result from decentralized organization and branding, with those that can come from centralized risk management, capital management and operations. In its specialty financial services and technology businesses, Zions seeks to develop a competitive advantage in a particular product, customer or technology niche.

22

BANKING BUSINESSES

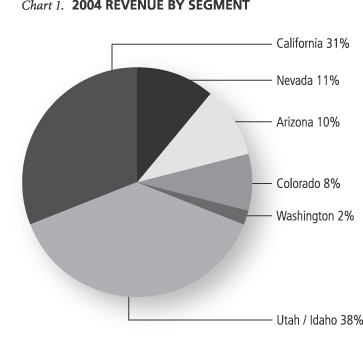

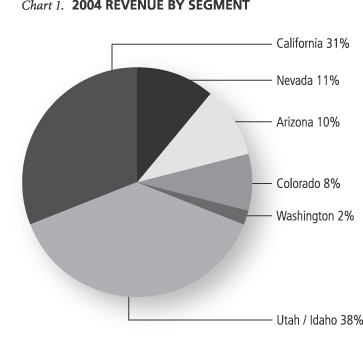

As shown in Chart 1, revenue from the banking franchises is widely diversified among the states in which the Company operates.

.

We believe that Zions distinguishes itself by having a strategy for growth in its banking businesses that is unique for a bank holding company of its size. This growth strategy is driven by three key factors: (1) focus on high growth markets; (2) keep decisions about customers local; and (3) centralize technology and operations to achieve economies of scale.

Focus on high growth markets:Each of the states in which Zions conducts its banking businesses has experienced relatively high levels of historical economic growth and each ranks among the top one-third of the fastest growing states as projected by the U. S. Census Bureau. In addition, in the recent past these states have experienced relatively high levels of population growth compared to the rest of the country.

DEMOGRAPHIC PROFILE

BY STATE

| | | | | | | | | | | | | | | | | | | | |

(Dollar amounts in

thousands) | | Number of

branches

12/31/2004

| | Deposits in

market at

12/31/2004(1)

| | Percent of

Zions’

deposit base

| | Estimated

2004 total

population(2)

| | Estimated

population

% change

2000-2004(2)

| | Projected

population

% change

2004-2009(2)

| | Estimated

median

household

income

2004(2)

| | Estimated

household

income

% change

2000-2004(2)

| | Projected

household

income

% change

2004-2009(2)

|

California | | 91 | | $ | 8,327,512 | | 35.75% | | 35,849,123 | | 5.84% | | 6.75% | | $ | 52.6 | | 9.74% | | 12.64% |

Utah | | 110 | | | 6,611,865 | | 28.39 | | 2,377,214 | | 6.45 | | 7.38 | | | 51.3 | | 11.23 | | 14.18 |

Arizona | | 54 | | | 3,026,041 | | 12.99 | | 5,684,787 | | 10.80 | | 12.22 | | | 45.0 | | 9.44 | | 10.46 |

Nevada | | 67 | | | 2,929,406 | | 12.58 | | 2,296,683 | | 14.93 | | 16.08 | | | 48.6 | | 7.80 | | 11.20 |

Colorado | | 39 | | | 1,531,388 | | 6.57 | | 4,597,702 | | 6.89 | | 7.15 | | | 54.0 | | 13.38 | | 15.35 |

Washington | | 1 | | | 408,638 | | 1.75 | | 6,182,560 | | 4.89 | | 5.61 | | | 49.4 | | 7.00 | | 10.15 |

Idaho | | 23 | | | 441,918 | | 1.90 | | 1,383,295 | | 6.90 | | 8.10 | | | 41.7 | | 9.42 | | 11.06 |

New Mexico | | 1 | | | 15,493 | | 0.07 | | 1,889,363 | | 3.87 | | 5.18 | | | 37.8 | | 10.34 | | 13.24 |

| | | | | | | | | |

Zions’ weighted average | | | | | | | | | | | 7.82 | | 8.79 | | | 50.6 | | 10.10 | | 12.76 |

Aggregate national | | | | | | | | | 292,936,668 | | 4.09 | | 4.84 | | | 46.5 | | 8.77 | | 11.02 |

| (1) | Excludes intercompany deposits. |

| (2) | Data Source: SNL Financial Database |

23

Within each of the states that Zions operates, we focus on the market segments that we believe present the best opportunities for us. Currently, we believe that these states have experienced higher rates of business formation and expansion than other states. We also believe that these states have experienced higher rates of commercial real estate development as local businesses strive to provide housing, shopping, business facilities and other amenities for their growing populations. As a result, a common focus of all of Zions’ subsidiary banks is small and middle market business banking (including the executives and employees of those businesses) and commercial real estate development. In many cases, the Company’s relationship with its customers is primarily driven by the goal to satisfy their needs for credit to finance their expanding business opportunities. In addition to our commercial business, we also provide a broad base of consumer financial products in selected markets, including home mortgages, home equity lines, auto loans and credit cards. This mix of business often leads to loan balances growing faster than internally generated deposits. In addition, it has important implications for the Company’s management of certain risks, including interest rate and liquidity risks, which are discussed further in later sections of this document.

Historically, the Company has been able to generate growth through acquisitions of other community banks. In recent years, however, acquisitions have not been an important contributor to our growth. The average prices paid for acquired banks have, in general, steadily escalated over the past two decades, as measured by such common metrics as premium-to-deposits and price-to-book value. As a result, price expectations of sellers have become high. At prices typically paid in today’s market, it is more difficult than in prior years to create economic value for the Company’s shareholders through acquisitions. While we will continue to consider acquisitions as a growth strategy, we believe that bank acquisitions, in general, may continue to be a less important contributor to the Company’s growth in the near future.

Keep decisions about customers local: The Company operates six different community/regional banks, each under a different name, each with its own charter and each with its own chief executive officer and management team. This structure helps to assure that decisions related to customers are made at a local level. In addition, each bank controls, among other things, all decisions related to its branding, market strategies, customer relationships, product pricing and credit decisions (within the limits of established corporate policy). In this way we are able to differentiate our banks from much larger, “mass market” banking competitors that operate regional or national franchises under a common brand and often around “vertical” product silos. We believe that this approach allows Zions to attract and retain exceptional management, and that it also results in providing service of the highest quality to our targeted customers. In addition, we believe that over time this strategy generates superior growth in our banking businesses.

Centralize technology and operations to achieve economies of scale: We seek to differentiate the Company from smaller banks in two ways. First, we use the combined scale of all of the banking operations to create a broad product offering without the fragmentation of systems and operations that would typically drive up costs. Second, for certain products for which economies of scale are believed to be important, the Company “manufactures” the product centrally, or outsources it from a third party. Examples include cash management, credit card administration, mortgage servicing and deposit operations. In this way the Company seeks to create and maintain efficiencies while generating superior growth.

SPECIALTY FINANCIAL SERVICES AND TECHNOLOGY BUSINESSES

In addition to its community and regional banking businesses, the Company operates a number of specialized businesses that in many cases are national in scope. These include a number of businesses in which the Company believes it ranks in the top ten institutions nationally such as SBA 7(a) loan originations, odd-lot electronic corporate bond trading, public finance advisory and underwriting services, and the origination of farm mortgages sold to Farmer Mac.

High growth market opportunities are not always geographically defined. The Company is investing in several expanded or new initiatives that we believe present unusual opportunities for us, including the following:

24

NATIONAL REAL ESTATE LENDING

This business consists of making SBA 504 and similar low loan-to-value, owner-occupied, first mortgage small business commercial loans. During 2004, the Company originated directly and purchased from correspondents approximately $964 million of these loans and securitized $605 million. A qualifying special-purpose entity (“QSPE”) purchases these securities after credit enhancement, and funds them with commercial paper. We continue to invest in this business and believe that such investment will result in continued growth.

NETDEPOSIT AND RELATED SERVICES

NetDeposit, Inc. is a subsidiary of Zions Bancorporation that was created to develop and sell software and processes that facilitate electronic check clearing. With the implementation of Check 21 late in 2004, this company and its products are well positioned to take advantage of the revolution in check processing now underway in America. During 2004, NetDeposit created a drag on earnings of about $0.06 per share. However, revenues have been rising and we have continued to increase our investment in this business.

The Company generates revenues in three ways from this business. First, NetDeposit licenses software to other banks and processors, including Bank of America and Fiserv, Inc. These licensing and consulting fees tend to be relatively small at the time a sale is made, with much of the revenue based on usage. NetDeposit also has licensed its software to EDS, which either remarkets it to other financial institutions or uses it to process checks for other banks.

Second, NetDeposit has licensed its software to the Company’s banks, which use the capabilities of the software to provide state-of-the-art cash management services to business customers. Our banks are receiving strong market acceptance in the sale of these cash management services and we have cleared over $100 million in checks in a single day for these customers.

Third, Zions First National Bank (“ZFNB”) uses NetDeposit software to provide check-clearing services to correspondent banks. ZFNB has contracts and co-marketing agreements with a number of bank processors and resellers. We began clearing check images in January 2005 for correspondent bank customers.

WEALTH MANAGEMENT

We have extensive relationships with small and middle-market businesses and business owners that we believe present an unusual opportunity to offer wealth management services. As a result, the Company established a wealth management business, Contango Capital Advisors, Inc. (“Contango”), and launched the business in the latter half of 2004. The basic business is a fee-only advisory service meeting the needs of our clients with sophisticated advice and noncommissioned, no- or low-load financial products. During 2004, this business generated net losses of approximately $0.04 per share, and we expect net losses in 2005 may approximate $0.08 per share. We anticipate that revenues from this business will continue to grow but will remain modest during 2005 and that expenses will grow in concert with revenues throughout 2005 as we continue to expand this business.

HISPANIC BUSINESS BANKING

Historically the Company has conducted its banking business through geographically defined bank subsidiaries. We believe that our management model – creating a distinct bank charter to serve a defined customer base – can also be applicable and effective for serving a demographic (vs. geographic) customer base. The Hispanic market for consumer- and business-related banking services is among the fastest growing in numerous parts of the United States. We anticipate that during 2005 we may have opportunities to invest in one or more banking franchises that are focused on the rapidly growing number of Hispanic-owned businesses in the United States.

MANAGEMENT’S OVERVIEW OF 2004 PERFORMANCE

The Company’s primary or “core” business consists of providing community and regional banking services to both individuals and businesses in eight Western states. We believe that this core banking business performed well during 2004 as the difficult economic environment that these markets experienced in 2003 began to improve. Looking forward, we believe that the general economy in the Company’s markets should continue to improve.

The Company reported record earnings for 2004 of $406.0 million or $4.47 per diluted share. This compares with

25

$337.8 million or $3.72 per diluted share for 2003 and $256.3 million or $2.78 per share for 2002. Return on average common equity was 15.27% and return on average assets was 1.31% in 2004, compared with 13.69% and 1.20% in 2003 and 10.95% and 0.97% in 2002.

The key drivers of the Company’s performance during 2004 were as follows:

KEY DRIVERS OF PERFORMANCE

2004 COMPARED TO 2003

| | | | | | | |

Driver

| | 2004

| | 2003

| | Change

|

| | | (in billions) | | |

Net loans and leases | | $ | 22.6 | | 19.9 | | 14% |

Total noninterest-bearing demand deposits | | | 6.8 | | 5.9 | | 16% |

Total deposits | | | 23.3 | | 20.9 | | 11% |

| | | |

Net interest margin | | | 4.32% | | 4.45% | | (13)bp |

| | |

| | | (in millions) | | |

Net interest income | | $ | 1,174.5 | | 1,095.5 | | 7% |

Provision for loan losses | | | 44.1 | | 69.9 | | (37)% |

Restructuring, impairment and debt extinguishment charges | | | 2.4 | | 104.4 | | (98)% |

As illustrated by the previous table, the Company’s earnings growth in 2004 compared to 2003 reflected the following:

| • | | Strong loan and deposit growth; |

| • | | A lower net interest margin; |

| • | | Reduced provision for loan losses; and |

| • | | Minimal restructuring and impairment charges and no debt extinguishment costs. |

We believe that the performance the Company experienced in 2004 was a direct result of our focusing on four primary objectives: 1) keep the banks growing, 2) maintain credit quality at high levels, 3) effectively manage interest rate risk, and 4) control expenses.

KEEP THE BANKS GROWING

Since 2000, Zions has experienced steady and strong loan and deposit growth. This was accomplished despite a challenging economic environment that was present during a large portion of this time period. We consider this performance to be a direct result of effectively executing our operating strategies. Chart 2 depicts this growth.

The Company experienced strong loan growth throughout some or all of 2004 in all of its markets except Colorado. In particular, we continued to see the strong loan growth in Arizona and Nevada that we began to experience in 2003. In addition, loan growth in both Utah and California improved in 2004 as the demand for loan products strengthened in the second half of the year. Finally, we began to see improved loan growth in Washington in the second half 2004.

The poor economic environment in Colorado continued to depress net loan and deposit growth at Vectra Bank Colorado (“Vectra”). In addition, the sales of eleven branches with approximately $130 million of loans and $165 million of deposits were consummated in 2004, contributing to the lack of growth in loans and deposits in Colorado for 2004. The Company has continued its efforts to improve the performance at Vectra and we saw some positive indicators of potential growth in late 2004.

The Company enjoyed strong deposit growth in 2004. The growth rate of 11.5% in 2004 was significantly higher than the 3.8% achieved in 2003. In addition, the mix of deposits continued to improve in 2004 with time deposits generally being replaced by demand, savings and money market deposits. The rate of deposit growth began to decline in late 2004 and we may not experience the same strong growth in deposits in 2005. A downward trend in deposit growth would require us to use alternative sources to meet our funding needs.

26

MAINTAIN CREDIT QUALITY AT HIGH LEVELS

The ratio of nonperforming assets to net loans and other real estate owned was 0.37%, which is its lowest level since the first quarter of 1998. The Company’s credit quality has seen continuous improvement throughout 2004. Both the nonperforming asset totals as well as the levels of charged-off loans have improved when compared to 2003. See Chart 3. In addition, if the present economic recovery continues, we would expect to experience continued favorable credit quality.

EFFECTIVELY MANAGE INTEREST RATE RISK

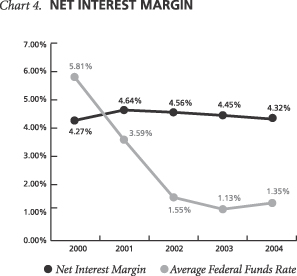

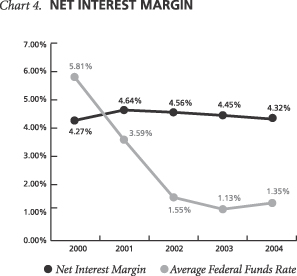

Our focus in managing interest rate risk is not to take positions based upon management’s forecasts of interest rates, but rather to maintain a position of slight “asset-sensitivity.” This means that our assets tend to reprice more quickly than our liabilities. These practices have enabled us to achieve a relatively stable net interest margin during periods of volatile interest rates, which is depicted in Chart 4. They also resulted in our experiencing a lower net interest margin for the full year 2004, compared to 2003, due to persistently low interest rates. However, the margin recovered in the latter half of 2004 due to improvements in our balance sheet mix along with increases in short-term interest rates that took effect.

Taxable-equivalent net interest income in 2004 increased 6.9% over 2003, despite the continuing difficult interest rate environment that persisted throughout much of 2004, and in light of a slight erosion in the net interest margin that we experienced compared to 2003. We attribute this reduction in the margin to the Company’s slightly asset sensitive position, in an environment that was characterized by sustained low interest rates. In addition, the acquisition of Van der Moolen UK Ltd. (now Zions Bank International Ltd.) also had a negative impact on the Company’s net interest margin for 2004, as a result of its large portfolio of trading securities. The Company’s net interest margin improved during the second half of 2004, however, and we expect that the annual margin for 2005 will be higher that the annual margin for 2004.

See the section “Interest Rate Risk” on page 69 for more information regarding the Company’s asset-liability management (“ALM”) philosophy and practice and our interest rate risk management.

CONTROL EXPENSES

In 2002, we made a commitment to reduce the annual run rate of expenses by $50 million. In 2003, we met that commitment. We also began addressing the under-performance of specific business, including a restructuring of the operations at Vectra and the exiting of certain e-commerce businesses in which we had invested. In 2004, we continued to focus attention on controlling costs and

27

identifying opportunities for operating efficiencies. Overall, these efforts resulted in improving the Company’s efficiency ratio from 63.4% in 2002 to 57.2% in 2004, a ratio more in line with those of our peer banks, as depicted in Chart 5. The efficiency ratio is the relationship between noninterest expense and total taxable-equivalent revenue.

CAPITAL AND RETURN ON CAPITAL

As regulated financial institutions, the Parent and its subsidiary banks are required to maintain adequate levels of capital as measured by several regulatory capital ratios. One of our goals is to maintain capital levels that are at least “well capitalized” under regulatory standards. In addition, the Parent and certain of its banking subsidiaries have issued various debt securities that have been rated by the principal rating agencies. As a result, another goal is to maintain capital at levels consistent with an “investment grade” rating for these debt securities. The Parent and its banking subsidiaries have maintained their well capitalized status and “investment grade” debt ratings, and their capital ratios have increased over the past three years to their current levels. See Chart 6.

We believe that the Company’s capital ratios are adequate for the risks of the business in which it engages, and also believe that excess capital should be returned to the shareholders. As illustrated in Chart 7, the Company has been returning increasing amounts of capital in the form of increased dividends and repurchases of its common stock.

28

In addition, we believe that the Company should engage in businesses that provide attractive returns on equity. Chart 8 illustrates that as a result of earnings improvement, the exit of underperforming businesses and returning unneeded capital to the shareholders, the Company’s return on equity has improved in recent years.

CHALLENGES TO OPERATIONS

As detailed in the chart titled “Key Drivers of Performance” on page 26, several factors combined to improve the Company’s performance in 2004 from 2003. The Company experienced both strong loan and deposit growth. While 2004 began with somewhat soft economic conditions, by year-end the economy had improved in all of our markets. During the fourth quarter of 2004, we experienced loan growth of over $1 billion. Earnings from the growth in loans and deposits were moderated by a decline in the average net interest margin for the year. Earnings for the year also reflect the decline in the provision for loan losses.

As we enter 2005, we see several significant challenges to improving performance. First, we entered the year with the best loan quality – measured by nonperforming assets as a percentage of net loans, leases and other real estate owned – in almost seven years. While we do not see any indications that loan quality will deteriorate significantly, it is likely that the 2005 annual provision for loan losses will be greater than the provision in 2004 as the loan portfolios grow. Second, we saw deposit growth slow in the fourth quarter of 2004 compared to loan growth and we anticipate that the growth of loans will outpace the growth of deposits in 2005. While this is not unusual for us, it does present challenges in terms of asset-liability management and liquidity. Historically we have used loan securitizations as one way of addressing stronger loan than deposit growth. We also believe that we have ample sources of liquidity to enable us to fund loan growth, including reducing short-term investments and increasing borrowings if necessary.

We anticipate that we may see increased pressure on the pricing of both loans and deposits as the economy continues to expand and competition for good business increases. Recent and potential increases in short term rates are likely to continue to result in increases on deposit rates. A flattening yield curve puts pressure on our net interest margin and requires that we continue to work diligently to maintain a high and stable net interest margin. For more information on our asset-liability management processes, see “Interest Rate and Market Risk Management” on page 69.

While we anticipate that economic conditions will generally be stronger in 2005 than in 2004, any number of unforeseen events could result in a weaker economy that, in turn, could negatively impact loan growth and credit quality.

Our electronic odd-lot bond trading business, while profitable, came under pressure from significantly reduced trading margins in 2004. We anticipate that this margin pressure may continue through some or all of 2005, and we have taken and may need to take additional actions to control expenses and improve the profitability of this business.

We expect to see moderate growth in both revenues and expenses during 2005, and realize that controlling operating expenses will be an important factor in improving our overall performance. We will continue to see increased expense levels during 2005 for systems conversions at California Bank & Trust as well as for compliance issues, particularly compliance with the requirements of the Sarbanes-Oxley Act, the USA Patriot Act and the Bank Secrecy Act. We are also investing in creating systems, data and processes that will enable us to qualify for the proposed Basel II capital requirements, which will be implemented by U. S. regulatory agencies.

Compliance with regulatory requirements, particularly those mentioned above, pose an ongoing challenge. A failure in our internal controls could have a significant negative impact not only on our earnings but also on the perception

29

that customers, regulators and investors may have of the Company. We continue to devote a significant amount of effort, time and resources to improving our controls and ensuring compliance with these complex regulations.

We have a number of business initiatives that, while we believe they will ultimately produce profits for our shareholders, currently generate expenses in excess of revenues. These include Contango, a new wealth management business, and NetDeposit, a subsidiary that provides electronic check processing systems. We will need to manage these businesses carefully to ensure that expenses and revenues develop in a planned way and that profits are not impaired to an extent that is not warranted by the opportunities these businesses provide.

Finally, competition from credit unions continues to pose a significant challenge. The aggressive expansion of some credit unions, far beyond the traditional concept of a common bond, presents a competitive threat to Zions and many other banking companies. While this is an issue in all of our markets, it is especially acute in Utah where two of the five largest financial institutions (measured by local deposits) are credit unions that are exempt from all state and federal income tax.

STRATEGIC DECISIONS

During 2003, we made a number of strategic decisions to help position the Company for improved performance in the future. These events are discussed below and also in subsequent sections of Management’s Discussion and Analysis.

VECTRA BANK COLORADO

In 2003, we decided to restructure Vectra to enable it to focus its direction on small- and mid-sized businesses and their employees. This restructuring and an accompanying goodwill impairment analysis in accordance with the requirements of Statement of Financial Accounting Standards (“SFAS”) No. 142,Goodwill and Other Intangible Assets, resulted in our writing off $75.6 million of the goodwill that was recorded at Vectra in 2003.

In addition, Vectra took a number of other steps to improve its financial performance, including a decision to sell eleven branches in areas that no longer fit Vectra’s new strategic direction. These branch sales all closed in 2004 and a gain of approximately $0.7 million was recognized. While the associated revenues and expenses will no longer be included in Vectra’s financial statements, temporarily depressing Vectra’s net growth, we believe that the restructuring was a positive step toward improving the future profitability of this subsidiary bank.

EQUITY SALES

In 2003, we sold the Company’s investment in ICAP plc (“ICAP”). Net proceeds from the sale were approximately $106.8 million and the Company realized a pretax gain of approximately $68.5 million in connection with the sale. In 2003, we also sold our investment in Lending Tree, Inc. for net proceeds of $25.6 million, from which the Company realized a pretax gain of approximately $21.1 million.

Also in 2003, we sold our investment in Lexign, Inc., which completed our previously announced plan to sell portions of the Company’s e-commerce investments. The sale resulted in a pretax loss of $2.4 million. With this sale, the Company disposed of the last of the businesses that were written down in 2002 and moved into discontinued operations.

CRITICAL ACCOUNTING POLICIES AND SIGNIFICANT ESTIMATES

The Notes to Consolidated Financial Statements contain a summary of the Company’s significant accounting policies. We believe that an understanding of certain of these policies, along with the related estimates that we are required to make in recording the financial transactions of the Company, is important to have a complete picture of the Company’s financial condition. In addition, in arriving at these estimates, we are required to make complex and subjective judgments, many of which include a high degree of uncertainty. The following is a discussion of these critical accounting policies and significant estimates related to these policies. We have discussed each of these accounting policies and the related estimates with the Audit Committee of the Board of Directors.

SECURITIZATION TRANSACTIONS

The Company periodically enters into securitization transactions that involve transfers of loans or other receivables to off-balance-sheet QSPEs. In most instances, we provide the servicing on these loans as a condition of the sale. In addition,

30

as part of these transactions, the Company may retain a cash reserve account, an interest-only strip, or in some cases a subordinated tranche, all of which are considered to be retained interests in the securitized assets.

Whenever we initiate a securitization, the first determination that we must make in connection with the transaction is whether the transfer of the assets constitutes a sale under U.S. generally accepted accounting principles. If it does, the assets are removed from the Company’s consolidated balance sheet with a gain or loss recognized. Otherwise, the transfer is considered a financing, resulting in no gain or loss being recognized and the recording of a liability on the Company’s consolidated balance sheet. The financing treatment could have unfavorable financial implications including an adverse effect on Zions’ results of operations and capital ratios. However, all of the Company’s securitizations have been structured to meet the existing criteria for sale treatment.

Another determination that must be made is whether the special-purpose entity involved in the securitization is independent from the Company or whether it should be included in its consolidated financial statements. If the entity’s activities meet certain criteria for it to be considered a QSPE, no consolidation is required. Since all of the Company’s securitizations have been with entities that have met the requirements to be treated as QSPEs, they have met the existing accounting criteria for nonconsolidation.

Finally, we must make assumptions to determine the amount of gain or loss resulting from the securitization transaction as well as the subsequent carrying amount for the above-discussed retained interests. In determining the gain or loss, we use assumptions that are based on the facts surrounding each securitization. Using alternatives to these assumptions could affect the amount of gain or loss recognized on the transaction and, in turn, Zions’ results of operations. In valuing the retained interests, since quoted market prices of these interests are generally not available, we must estimate their value based on the present value of the future cash flows associated with the securitizations. These value estimations require the Company to make a number of assumptions including:

| • | | the method to use in computing the prepayments of the securitized loans; |

| • | | the annualized prepayment speed of the securitized loans; |

| • | | the weighted average life of the loans in the securitization; |

| • | | the expected annual net credit loss rate; and |

| • | | the discount rate for the residual cash flows. |

The following table summarizes the key economic assumptions that we used for measuring the values of the retained interests as of the date of the securitization for sales that took place during 2004, 2003 and 2002.

| | | | | | | | |

| | | Automobile

loans

| | Credit

card

receivables

| | Home equity loans

| | Small business loans

|

2004: | | | | | | | | |

Prepayment method | | | | | | NA(1) | | CPR(2) |

Annualized prepayment speed | | | | | | NA(1) | | 10, 15 Ramp up(3) |

Weighted-average life (in months) | | | | | | 11 | | 64 |

Expected annual net loss rate | | | | | | 0.10% | | 0.50% |

Residual cash flows discounted at | | | | | | 15.0% | | 15.0% |

2003: | | | | | | | | |

Prepayment method | | | | | | NA(1) | | CPR(2) |

Annualized prepayment speed | | | | | | NA(1) | | 10, 15 Ramp up(3) |

Weighted-average life (in months) | | | | | | 12 | | 62 |

Expected annual net loss rate | | | | | | 0.25% | | 0.50% |

Residual cash flows discounted at | | | | | | 15.0% | | 15.0% |

2002: | | | | | | | | |

Prepayment method | | ABS | | ABS | | CPR (2) | | CPR(2) |

Annualized prepayment speed | | 16.2% | | 5.0% | | 54.2% | | 15.0% |

Weighted-average life (in months) | | 18 | | 3 | | 14 | | 59 |

Expected annual net loss rate | | 1.25% | | 4.50% | | 0.25% | | 0.50% |

Residual cash flows discounted at | | 15.0% | | 15.0% | | 15.0% | | 15.0% |

| (1) | The model for this securitization has been modified to respond to the current interest rate environment and the high volume of refinancings. As a result, there is no assumed prepayment speed. The weighted-average life assumption includes consideration of prepayment to determine the fair value of the capitalized residual cash flows. |

| (2) | “Constant prepayment rate” |

| (3) | Annualized prepayments speed is 10% in the first year and 15% thereafter. |

31

The following table sets forth the sensitivity of the current fair value of the capitalized residual cash flows at December 31, 2004 to immediate 10% and 20% adverse changes to those key assumptions. The sensitivity includes all securitizations outstanding at December 31, 2004.

| | | | | | | |

| (In millions of dollars and annualized percentage rates) | | | | Home equity loans

| | Small business loans

|

Carrying amount/fair value of capitalized residual cash flows | | | | $ | 8.0 | | 93.0 |

Weighted-average life (in months) | | | | | 11 | | 20 - 66 |

Prepayment speed assumption | | | | | NA (1) | | 15.0% - 20.0%(2) |

Decrease in fair value due to adverse change | | -10% | | $ | NA (1) | | 2.8 |

| | | -20% | | $ | NA (1) | | 5.2 |

Expected credit losses | | | | | 0.10% | | 0.40% - 0.50% |

Decrease in fair value due to adverse change | | -10% | | $ | - | | 2.5 |

| | | -20% | | $ | 0.1 | | 5.0 |

Residual cash flows discount rate | | | | | 15.0% | | 15.0% |

Decrease in fair value due to adverse change | | -10% | | $ | 0.1 | | 2.8 |

| | | -20% | | $ | 0.1 | | 5.4 |

| (1) | The model for this securitization has been modified to respond to the current interest rate environment and the high volume of refinancings. As a result, there is no assumed prepayment speed. The weighted-average life assumption includes consideration of prepayment to determine the fair value of the capitalized residual cash flows. |

| (2) | The prepayment speed assumption for the 2004 SBA securitization is CPR 10, 15 Ramp up. |

The sensitivities in the previous table are hypothetical and should be viewed with caution. As the amounts indicate, changes in fair value based on variations in assumptions are not subject to simple extrapolation, as the relationship of the change in the assumption to the change in the fair value may not be linear. In addition, the effect of a variation in one assumption is in reality likely to cause changes in other assumptions, which could potentially magnify or counteract the sensitivities.

ALLOWANCE FOR LOAN LOSSES

The allowance for loan losses represents our estimate of the losses that are inherent in the loan and lease portfolios. The determination of the appropriate level of the allowance is based on periodic evaluations of the portfolios along with other relevant factors. These evaluations are inherently subjective and require us to make numerous assumptions, estimates and judgments.

In analyzing the adequacy of the allowance for loan losses, we utilize a comprehensive loan grading system to determine the risk potential in the portfolio and also consider the results of independent internal credit reviews. To determine the adequacy of the allowance, the Company’s loan and lease portfolio is broken into segments based on loan type. For commercial loans, we use historical loss experience factors by loan segment, adjusted for changes in trends and conditions, to help determine an indicated allowance for each segment. These factors are evaluated and updated using migration analysis techniques and other considerations based on the makeup of the specific portfolio segment. The other considerations used in our analysis include volumes and trends of delinquencies and defaults, levels of nonaccrual loans, repossessions and bankruptcies, trends in criticized and classified loans and expected losses on loans secured by real estate. In addition, new products and policies, current and projected economic conditions and trends, concentrations of credit risk, and the experience and abilities of lending personnel are also taken into consideration.

In addition to the segment evaluations, all commercial loans are subject to individual reviews to determine if specific allowances may be necessary. A specific allowance is established for a loan when it is determined that the risk associated with the loan differs significantly from the risk factor amounts established for its loan segment. Specific reserves can also be established for loans that the Company has identified as being impaired in accordance with SFAS No. 114,Accounting by Creditors for Impairment of a Loan.

For consumer loans, we use a forecasting model based on internally generated portfolio delinquencies that employs “roll rates” to calculate losses. “Roll rates” are the rates at which accounts migrate from one delinquency level to the next higher level. Using average roll rates for the most recent twelve-month period and comparing projected losses to actual loss experience, the model estimates the expected losses in dollars for the forecasted period. By refreshing it with updated data, the model is able to project losses for a new twelve-month period each month, segmenting the portfolio into nine product groupings with similar risk profiles.

32

As a final step to the evaluation process, we perform an additional review of the adequacy of the allowance based on the loan portfolio in its entirety. This enables us to mitigate the imprecision inherent in most estimates of expected credit losses. This review of the allowance includes our judgmental consideration of any adjustments necessary for subjective factors such as economic uncertainties and excessive concentration risks.

There are numerous components that enter into the evaluation of the allowance for loan losses. Some are quantitative while others require us to make qualitative judgments. Although we believe that our processes for determining an appropriate level for the allowance adequately address all of the components that could potentially result in credit losses, the processes and their elements include features that may be susceptible to significant change. Any unfavorable differences between the actual outcome of credit-related events and our estimates and projections could require an additional provision for credit losses, which would negatively impact Zions’ results of operations in future periods.As an example, if $250 million of nonclassified loans were to migrate to special mention, substandard and doubtful in the same proportion as the existing portfolio, the amount of the allowance for loan losses at December 31, 2004 would increase by approximately $18 million. In addition, since the allowance for loan losses is assigned to the Company’s business segments that have loan portfolios, any earnings impact resulting from actual results differing from our estimates would have the largest impact on those segments with the largest loan portfolios, namely Zions First National Bank and California Bank & Trust. This sensitivity analysis is hypothetical and has been provided only to indicate the potential impact that changes in the level of the criticized and classified loans may have on the allowance estimation process. We believe that given the procedures that we follow in determining the potential losses in the loan portfolio, the various components used in the current estimation processes are appropriate.

NONMARKETABLE EQUITY SECURITIES

The Company either directly, through its banking subsidiaries or through its Small Business Investment Companies (“SBIC”), owns investments in venture capital securities that are not publicly traded. Since these nonmarketable venture capital securities have no readily ascertainable fair values, they are reported at amounts that we have estimated to be their fair values. In estimating the fair value of each investment, we must apply judgment using certain assumptions. Initially, we believe that an investment’s cost is the best indication of its fair value, provided that there have been no significant positive or negative developments subsequent to its acquisition that indicate the necessity of an adjustment to a fair value estimate. If and when such an event takes place, we adjust the investment’s cost by an amount that we believe reflects the nature of the event. In addition, any minority interests in the Company’s SBICs reduce its share of any gains or losses incurred on these investments.

As of December 31, 2004, the Company’s total investment in nonmarketable equity securities was $100.2 million, of which its equity exposure to investments held by the SBICs, net of related minority interest of $23.5 million and Small Business Administration debt of $7 million, was $39.4 million. In addition, exposure to non-SBIC equity investments was $30.3 million.

The values that we have assigned to these securities where no market quotations exist are based upon available information and may not necessarily represent amounts that will ultimately be realized on these securities. Although we believe that our estimates reasonably reflect the fair value of these securities, key assumptions regarding the projected financial performance of these companies, the evaluation of the investee company’s management team, and other industry, economic and market factors may not necessarily be reflective of those assumptions if an active market existed for these investments. If there had been an active market for these securities, the carrying value may have been significantly different from the amounts reported. In addition, since ZFNB is the principal business segment holding these investments, it would experience the largest impact of any changes in the fair values of these securities.

ACCOUNTING FOR GOODWILL

Goodwill arises from business acquisitions and represents the value attributable to the unidentifiable intangible elements in our acquired businesses. Goodwill is initially recorded at fair value and is subsequently evaluated at least annually for

33

impairment in accordance with SFAS No. 142. The Company performs this annual test as of October 1 of each year. Evaluations are also performed on a more frequent basis if events or circumstances indicate that an impairment could have taken place. Such events could include, among others, a significant adverse change in the business climate, an adverse action by a regulator, an unanticipated change in the competitive environment and a decision to change the operations or dispose of a reporting unit.

The first step in this evaluation process is to determine if a potential impairment exists in any of the Company’s reporting units and, if required from the results of this step, a second step measures the amount of any impairment loss. The computations required by steps 1 and 2 call for us to make a number of estimates and assumptions. In completing step 1, we determine the fair value of the reporting unit that is being evaluated. In determining the fair value, we generally calculate value using a combination of up to three separate methods: comparable publicly traded banks in the Western states; comparable bank acquisitions in the Western states; and, the discounted present value of management’s estimates of future cash or income flows. Critical assumptions that are used as part of these calculations include:

| • | | selection of comparable publicly traded companies, based on location, size and business composition; |

| • | | selection of comparable bank acquisition transactions, based on location, size, business composition and date of the transaction; |

| • | | the discount rate applied to future earnings, based on an estimate of the cost of capital; |

| • | | the potential future earnings of the reporting unit; |

| • | | the relative weight given to the valuations derived by the three methods described. |

If step 1 indicates a potential impairment of a reporting unit, step 2 requires us to estimate the “implied fair value” of the reporting unit. This process estimates the fair value of the unit’s individual assets and liabilities in the same manner as if a purchase of the reporting unit were taking place. To do this we must determine the fair value of the assets, liabilities and identifiable intangible assets of the reporting unit based upon the best available information. If the value of goodwill calculated in step 2 is less that the carrying amount of goodwill for the reporting unit, an impairment is indicated and the carrying value of goodwill is written down to the calculated value.

Since estimates are an integral part of the impairment computations, changes in these estimates could have a significant impact on any calculated impairment amount. Factors that may significantly affect the estimates include, among others, competitive forces, customer behaviors and attrition, changes in revenue growth trends, cost structures and technology, changes in discount rates, changes in stock and mergers and acquisitions market values and changes in industry or market sector conditions.

During the third quarter of 2004, we made the decision to reorganize the operations at Zions Bank International Ltd. (“ZBI”). The decision was a result of disappointing performance at ZBI and resulted in discontinuing ZBI’s Euro-denominated bond trading operations and downsizing the U.S. dollar-denominated bond trading operations. As a result of this reorganization, we performed an evaluation of the $1.2 million of goodwill associated with ZBI in accordance with the requirements of SFAS 142. To calculate the fair value of ZBI, we identified the net operating income from its reorganized activities and projected this income stream into the future. We then computed the present value of this income stream using Zions’ minimum required rate of return on investments. Our computations determined that there was a potential impairment associated with this goodwill. After performing step 2 of the impairment evaluation process, we determined that an impairment in the amount of $0.6 million was indicated, which was recorded in the third quarter.

During the fourth quarter of 2004, we performed our annual goodwill impairment evaluation for the entire organization, effective October 1, 2004. Step 1 was performed by using both market value and transaction value approaches for all reporting units and, in certain cases, the discounted cash flow approach was also used. In the market value approach, we identified a group of publicly traded banks that are similar in size and location to Zions’ subsidiary banks and then used valuation multiples developed from the group to apply to our subsidiary banks. In the transaction value approach, we reviewed the purchase price paid in recent mergers and acquisitions of banks similar in size to Zions’ subsidiary banks. From these purchase prices we developed a set of valuation multiples, which we applied to our subsidiary

34

banks. In instances where the discounted cash flow approach was used, we discounted projected cash flows to their present value to arrive at our estimate of fair value.

Upon completion of step 1 of the evaluation process, we concluded that no potential impairment existed for any of the Company’s reporting units. In reaching this conclusion, we determined that the fair values of goodwill exceeded the recorded values of goodwill. Since this evaluation process required us to make estimates and assumptions with regard to the fair value of the Company’s reporting units, actual values may differ significantly from these estimates. Such differences could result in future impairment of goodwill that would, in turn, negatively impact the Company’s results of operations and the business segments where the goodwill is recorded. However, had our estimated fair values been 10% lower, there would still have been no indication of impairment for any of our reporting units.

ACCOUNTING FOR DERIVATIVES

Our interest rate risk management strategy involves hedging the repricing characteristics of certain assets and liabilities so as to mitigate adverse effects on the Company’s net interest margin and cash flows from changes in interest rates. While we do not participate in speculative derivatives trading, we consider it prudent to use certain derivative instruments to add stability to the Company’s interest income and expense, to modify the duration of specific assets and liabilities, and to manage the Company’s exposure to interest rate movements. In addition, beginning in the first half of 2004, the Company initiated a program to provide derivative financial instruments to certain customers, acting as an intermediary in the transaction. All of these customer derivatives, however, are immediately hedged upon issuance such that the Company has no net interest rate risk exposure resulting from the transaction.

All derivative instruments are carried on the balance sheet at fair value. As of December 31, 2004, the recorded amounts of derivative assets and liabilities were $55.3 million and $16.6 million, respectively. Since there are no market value quotes for the specific derivative instruments that the Company holds, we must estimate their fair values. Generally this estimate is made by an independent third party using a standardized methodology that nets the discounted future cash receipts and cash payments. These future net cash flows, however, are susceptible to change due primarily to fluctuations in interest rates. As a result, the estimated values of these derivatives will typically change over time as cash is received and paid and also as market conditions change. As these changes take place, they may have a positive or negative impact on our estimated valuations. However, based on the nature and limited purposes of the derivatives that the Company employs, fluctuations in interest rates have only a modest effect on its results of operations.

In addition to making the valuation estimates, we also face the risk that certain derivative instruments that have been designated as hedges and currently meet the strict hedge accounting requirements of SFAS No. 133,Accounting for Derivative Instruments and Hedging Activities, may not qualify in the future as “highly effective”, as defined by the Statement. Further, new interpretations and guidance related to SFAS 133 continue to be issued and we cannot predict the possible impact that they will have on our use of derivative instruments in the future.

PENSION ACCOUNTING

As explained in detail in Note 20 of the Notes to Consolidated Financial Statements, we have a noncontributory defined benefit pension plan that is available to employees who have met specific eligibility requirements. Also as explained in the Note, as of January 1, 2003, no new employees are eligible to participate in the plan and future benefit accruals granted by the plan have been significantly reduced.

In accounting for the plan, we must determine the obligation associated with the plan benefits and compare that with the assets that the plan owns. This requires us to incorporate numerous assumptions, including the expected rate of return on plan assets, the projected rate of increase of the salaries of the eligible employees and the discount rates to use in estimating the fair value of the net periodic benefit cost. The expected rate of return on plan assets is intended to approximate the long-term rate of return that we anticipate receiving on the plan’s investments, considering the mix of the assets that the plan holds as investments, the expected return of those underlying investments, the diversification of those investments and the re-balancing strategy employed. The projected rate of salary increases is management’s estimate of future pay increases that the remaining eligible employees will receive until their retirement. The discount rate reflects the yields available on long-term, high-quality

35

fixed-income debt instruments with cash flows similar to the obligations of the plan, reset annually on the measurement date, which is December 31 of each year.

The annual pension expense is sensitive to the expected rate of return on plan assets. For example, for the year 2004 the expected rate of return on plan assets was 8.60%. For each 25 basis point change in this rate, the Company’s pension expense would change by approximately $300,000. In applying the expected rate of return on plan assets to our pension accounting, we base our calculations on the fair value of plan assets, using an arithmetic method to calculate the expected return on the plan assets.

The annual pension expense is also sensitive to the discount rate employed. For example, the discount rate used in the 2004 pension expense calculation was 6.25%. If this rate were 25 basis points lower, the pension expense would increase by approximately $260,000. If the rate were 25 basis points higher, the pension expense would decrease by approximately $250,000.

In estimating the annual pension expense associated with the defined benefit plan, we must make a number of assumptions and estimates based upon our judgment and also on information that we receive from an independent actuary. These assumptions and estimates are closely monitored and are reviewed at least annually for any adjustments that may be required. Under U.S. generally accepted accounting principles, any differences that arise between these estimates and actual experience are amortized on the minimum basis as prescribed by SFAS No. 87,Employer’s Accounting for Pensions. We expect that the balance of unrecognized net actuarial losses as of December 31, 2004 will decrease over time, through a combination of gradual recognition through required amortization and future actuarial gains as discount rates return to higher levels and the long-term rate of return on pension assets of 8.60% is realized over time.

RESULTS OF OPERATIONS

NET INTEREST INCOME, MARGIN AND INTEREST RATE SPREADS

Net interest income is the difference between interest earned on assets and interest incurred on liabilities. On a taxable-equivalent basis, net interest income for 2004 was up 6.9% from 2003, which was up 5.9% from 2002. The increase in taxable-equivalent net interest income for both years was driven primarily by growth in average earning assets of 10.3% in 2004 and 8.4% in 2003, partially offset by the effects of declining net interest margin. The incremental tax rate used for calculating all taxable-equivalent adjustments was 35% for all years discussed and presented.

Taxable-equivalent net interest income is the largest component of Zions’ revenue. For the year 2004, it was 74.1% of our taxable-equivalent revenues, compared to 69.5% for 2003 and 73.7% in 2002. The increase for 2004 was caused by a combination of a 6.9% increase in taxable-equivalent net interest income and a 14.7% decline in noninterest income. The lower percentage in 2003 was primarily caused by the previously discussed gain on the sale of ICAP, which increased noninterest income disproportionately in relation to total taxable-equivalent revenues. By its nature, net interest income is especially vulnerable to changes in the mix and amounts of interest-earning assets and interest-bearing liabilities. In addition, changes in the interest rates and yields associated with these assets and liabilities significantly impact net interest income. See “Interest Rate and Market Risk Management” on page 69 for a complete discussion of how we manage the portfolios of interest-earning assets and interest-bearing liabilities.

A gauge that we consistently use to measure the Company’s success in managing its interest-earning assets and interest-bearing liabilities is the level of the net interest margin. The net

36

interest margin was 4.32% in 2004 compared with 4.45% in 2003 and 4.56% in 2002. The lower margin for 2004 reflects the effects of the low interest rate environment that challenged many financial institutions. The loan portfolio experienced the largest rate decline in 2004, dropping 24 basis points, as higher rate fixed-interest loans were replaced by new lower-yielding loans. In addition, the average rate paid on borrowed funds increased 22 basis points primarily as a result of increased long-term debt. This increase was partially offset by a decline in the average rate paid on deposits. The lower margin for 2003 was principally the result of the declining interest rate environment that continued from 2002. In 2003, the loan portfolio experienced the largest rate decline, primarily as a result of the maturity and pre-payment of higher rate fixed-interest loans, which were replaced by new lower-yielding loans. In the fourth quarter of 2004, the Company experienced a net interest margin of 4.49%. We believe that this level of margin may not be sustainable into the first quarter of 2005. However, we expect that the annual margin for 2005 will be higher than the annual margin for 2004.

Schedule 1 summarizes the average balances, the amount of interest earned or incurred and the applicable yields for interest-earning assets and the costs of interest-bearing liabilities that generate taxable-equivalent net interest income.

37

SCHEDULE 1

DISTRIBUTION OF ASSETS, LIABILITIES, AND SHAREHOLDERS’ EQUITY

AVERAGE BALANCE SHEETS, YIELDS AND RATES

| | | | | | | | | | | | | | | | |

| | | 2004

| | 2003

|

| (Amounts in millions) | | Average

balance

| | | Amount

of

interest(1)

| | Average

rate

| | Average

balance

| | | Amount

of

interest(1)

| | Average

rate

|

ASSETS: | | | | | | | | | | | | | | | | |

Money market investments | | $ | 1,463 | | | 16.4 | | 1.12% | | $ | 1,343 | | | 13.0 | | 0.97% |

Securities: | | | | | | | | | | | | | | | | |

Held to maturity | | | 500 | | | 34.3 | | 6.86 | | | – | | | – | | |

Available for sale | | | 3,968 | | | 174.5 | | 4.40 | | | 3,736 | | | 171.5 | | 4.59 |

Trading account | | | 732 | | | 29.6 | | 4.04 | | | 711 | | | 24.7 | | 3.47 |

| | |

|

|

| |

| | | |

|

|

| |

| | |

Total securities | | | 5,200 | | | 238.4 | | 4.59 | | | 4,447 | | | 196.2 | | 4.41 |

| | |

|

|

| |

| | | |

|

|

| |

| | |

Loans: | | | | | | | | | | | | | | | | |

Loans held for sale | | | 159 | | | 5.1 | | 3.16 | | | 220 | | | 8.3 | | 3.77 |

Net loans and leases(2) | | | 20,887 | | | 1,266.5 | | 6.06 | | | 19,105 | | | 1,204.8 | | 6.31 |

| | |

|

|

| |

| | | |

|

|

| |

| | |

Total loans and leases | | | 21,046 | | | 1,271.6 | | 6.04 | | | 19,325 | | | 1,213.1 | | 6.28 |

| | |

|

|

| |

| | | |

|

|

| |

| | |

Total interest-earning assets | | | 27,709 | | | 1,526.4 | | 5.51 | | | 25,115 | | | 1,422.3 | | 5.66 |

| | | | | | |

| | | | | | | |

| | |

Cash and due from banks | | | 1,026 | | | | | | | | 953 | | | | | |

Allowance for loan losses | | | (272 | ) | | | | | | | (282 | ) | | | | |

Goodwill | | | 648 | | | | | | | | 711 | | | | | |

Core deposit and other intangibles | | | 65 | | | | | | | | 77 | | | | | |

Other assets | | | 1,760 | | | | | | | | 1,630 | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

Total assets | | $ | 30,936 | | | | | | | $ | 28,204 | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

LIABILITIES: | | | | | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | | | | |

Savings and NOW | | $ | 3,337 | | | 20.6 | | 0.62 | | $ | 2,984 | | | 19.1 | | 0.64 |

Money market super NOW | | | 9,480 | | | 100.6 | | 1.06 | | | 8,890 | | | 92.5 | | 1.04 |

Time under $100,000 | | | 1,436 | | | 27.5 | | 1.92 | | | 1,644 | | | 36.9 | | 2.25 |

Time $100,000 and over | | | 1,244 | | | 29.2 | | 2.35 | | | 1,290 | | | 33.3 | | 2.58 |

Foreign | | | 338 | | | 4.4 | | 1.30 | | | 186 | | | 1.7 | | 0.89 |

| | |

|

|

| |

| | | |

|

|

| |

| | |

Total interest-bearing deposits | | | 15,835 | | | 182.3 | | 1.15 | | | 14,994 | | | 183.5 | | 1.22 |

| | |

|

|

| |

| | | |

|

|

| |

| | |

Borrowed funds: | | | | | | | | | | | | | | | | |

Securities sold, not yet purchased | | | 625 | | | 24.2 | | 3.86 | | | 538 | | | 20.4 | | 3.80 |

Federal funds purchased and security repurchase agreements | | | 2,682 | | | 32.2 | | 1.20 | | | 2,605 | | | 25.5 | | 0.98 |

Commercial paper | | | 201 | | �� | 3.0 | | 1.51 | | | 215 | | | 3.0 | | 1.41 |

FHLB advances and other borrowings: | | | | | | | | | | | | | | | | |

One year or less | | | 252 | | | 2.9 | | 1.14 | | | 145 | | | 1.9 | | 1.32 |

Over one year | | | 230 | | | 11.7 | | 5.08 | | | 237 | | | 12.3 | | 5.19 |

Long-term debt | | | 1,659 | | | 74.3 | | 4.48 | | | 1,277 | | | 57.3 | | 4.48 |

| | |

|

|

| |

| | | |

|

|

| |

| | |

Total borrowed funds | | | 5,649 | | | 148.3 | | 2.62 | | | 5,017 | | | 120.4 | | 2.40 |

| | |

|

|

| |

| | | |

|

|

| |

| | |

Total interest-bearing liabilities | | | 21,484 | | | 330.6 | | 1.54 | | | 20,011 | | | 303.9 | | 1.52 |

| | | | | | |

| | | | | | | |

| | |

Noninterest-bearing deposits | | | 6,269 | | | | | | | | 5,259 | | | | | |

Other liabilities | | | 501 | | | | | | | | 444 | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

Total liabilities | | | 28,254 | | | | | | | | 25,714 | | | | | |

Minority interest | | | 23 | | | | | | | | 22 | | | | | |

Total shareholders’ equity | | | 2,659 | | | | | | | | 2,468 | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

Total liabilities and shareholders’ equity | | $ | 30,936 | | | | | | | $ | 28,204 | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

Spread on average interest-bearing funds | | | | | | | | 3.97% | | | | | | | | 4.14% |

| | | | | | | | |

| | | | | | | |

|

Taxable-equivalent net interest income and net yield on interest-earning assets | | | | | | 1,195.8 | | 4.32% | | | | | | 1,118.4 | | 4.45% |

| | | | | | |

| |

| | | | | |

| |

|

| (1) | Taxable-equivalent rates used where applicable. |

| (2) | Net of unearned income and fees, net of related costs. Loans include nonaccrual and restructured loans. |

38

| | | | | | | | | | | | | | | | | | | |

2002

| | 2001

| | 2000

|

Average

balance

| | Amount of

interest(1)

| | Average rate

| | Average

balance

| | Amount of

interest(1)

| | Average rate

| | Average

balance

| | Amount of

interest(1)

| | Average rate

|

| | | | | | | | | | | | | | | | | | | | |

| | $ 1,199 | | 18.6 | | 1.55% | | $ | 924 | | 34.9 | | 3.78% | | $ | 1,061 | | 67.4 | | 6.35% |

| | | | | | | | | | | | | | | | | | | | |

| | 43 | | 2.3 | | 5.34 | | | 56 | | 3.4 | | 5.98 | | | 3,254 | | 222.1 | | 6.83 |

| | 3,209 | | 170.0 | | 5.30 | | | 3,269 | | 207.2 | | 6.34 | | | 685 | | 44.8 | | 6.53 |

| | 611 | | 22.1 | | 3.62 | | | 647 | | 30.9 | | 4.78 | | | 574 | | 36.3 | | 6.32 |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

| | 3,863 | | 194.4 | | 5.03 | | | 3,972 | | 241.5 | | 6.08 | | | 4,513 | | 303.2 | | 6.72 |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

| | | | | | | | | | | | | | | | | | | | |

| | 210 | | 9.4 | | 4.50 | | | 220 | | 13.1 | | 5.94 | | | 192 | | 14.5 | | 7.52 |

| | 17,904 | | 1,254.8 | | 7.01 | | | 15,795 | | 1,322.6 | | 8.37 | | | 13,457 | | 1,259.2 | | 9.36 |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

| | 18,114 | | 1,264.2 | | 6.98 | | | 16,015 | | 1,335.7 | | 8.34 | | | 13,649 | | 1,273.7 | | 9.33 |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

| | 23,176 | | 1,477.2 | | 6.37 | | | 20,911 | | 1,612.1 | | 7.71 | | | 19,223 | | 1,644.3 | | 8.55 |

| | | |

| | | | | | |

| | | | | | |

| | |

| | 939 | | | | | | | 821 | | | | | | | 826 | | | | |

| | (267) | | | | | | | (229) | | | | | | | (203) | | | | |

| | 744 | | | | | | | 703 | | | | | | | 572 | | | | |

| | 98 | | | | | | | 101 | | | | | | | 76 | | | | |

| | 1,606 | | | | | | | 1,513 | | | | | | | 1,228 | | | | |

|

| | | | | |

|

| | | | | |

|

| | | | |

| | $ 26,296 | | | | | | $ | 23,820 | | | | | | $ | 21,722 | | | | |

|

| | | | | |

|

| | | | | |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ 2,555 | | 26.5 | | 1.04 | | $ | 2,060 | | 32.3 | | 1.57 | | $ | 1,783 | | 40.0 | | 2.24 |

| | 8,021 | | 138.1 | | 1.72 | | | 7,039 | | 219.3 | | 3.12 | | | 6,210 | | 289.4 | | 4.66 |

| | 1,911 | | 62.1 | | 3.25 | | | 1,984 | | 98.2 | | 4.95 | | | 1,719 | | 87.7 | | 5.10 |

| | 1,487 | | 50.5 | | 3.40 | | | 1,658 | | 86.5 | | 5.22 | | | 1,408 | | 80.4 | | 5.71 |

| | 106 | | 1.5 | | 1.42 | | | 106 | | 2.9 | | 2.79 | | | 138 | | 6.3 | | 4.56 |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

| | 14,080 | | 278.7 | | 1.98 | | | 12,847 | | 439.2 | | 3.42 | | | 11,258 | | 503.8 | | 4.48 |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

| | | | | | | | | | | | | | | | | | | | |

| | 394 | | 16.4 | | 4.17 | | | 340 | | 17.0 | | 5.01 | | | 311 | | 19.7 | | 6.32 |

| | 2,528 | | 39.1 | | 1.55 | | | 2,668 | | 95.9 | | 3.59 | | | 2,747 | | 159.7 | | 5.81 |

| | 359 | | 7.5 | | 2.09 | | | 336 | | 14.5 | | 4.30 | | | 316 | | 20.7 | | 6.55 |

| | | | | | | | | | | | | | | | | | | | |

| | 533 | | 10.3 | | 1.93 | | | 404 | | 21.7 | | 5.37 | | | 1,161 | | 76.2 | | 6.56 |

| | 240 | | 12.5 | | 5.18 | | | 203 | | 11.1 | | 5.44 | | | 140 | | 8.5 | | 6.06 |

| | 874 | | 56.3 | | 6.45 | | | 569 | | 42.7 | | 7.51 | | | 429 | | 34.2 | | 7.98 |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

| | 4,928 | | 142.1 | | 2.88 | | | 4,520 | | 202.9 | | 4.49 | | | 5,104 | | 319.0 | | 6.25 |

|

| |

| | | |

|

| |

| | | |

|

| |

| | |

| | 19,008 | | 420.8 | | 2.21 | | | 17,367 | | 642.1 | | 3.70 | | | 16,362 | | 822.8 | | 5.03 |

| | | |

| | | | | | |

| | | | | | |

| | |

| | 4,522 | | | | | | | 3,907 | | | | | | | 3,316 | | | | |

| | 404 | | | | | | | 385 | | | | | | | 329 | | | | |

|

| | | | | |

|

| | | | | |

|

| | | | |

| | 23,934 | | | | | | | 21,659 | | | | | | | 20,007 | | | | |

| | 21 | | | | | | | 30 | | | | | | | 40 | | | | |

| | 2,341 | | | | | | | 2,131 | | | | | | | 1,675 | | | | |

|

| | | | | |

|

| | | | | |

|

| | | | |

| | $ 26,296 | | | | | | $ | 23,820 | | | | | | $ | 21,722 | | | | |

|

| | | | | |

|

| | | | | |

|

| | | | |

| | | | | | 4.16% | | | | | | | 4.01% | | | | | | | 3.52% |

| | | | | |

| | | | | | |

| | | | | | |

|

| | | | | | | | |

| | | | 1,056.4 | | 4.56% | | | | | 970.0 | | 4.64% | | | | | 821.5 | | 4.27% |

| | | |

| |

| | | | |

| |

| | | | |

| |

|

39

Schedule 2 analyzes the year-to-year changes in net interest income on a fully taxable-equivalent basis for the years indicated. For purposes of calculating the yields in these schedules, the average loan balances also include the principal amounts of nonaccrual and restructured loans. However, interest received on nonaccrual loans is included in income only to the extent that cash payments have been received and not applied to principal reductions. In addition, interest on restructured loans is generally accrued at reduced rates.

SCHEDULE 2

ANALYSIS OF INTEREST CHANGES DUE TO VOLUME AND RATE

| | | | | | | | | | | | | |

| | | 2004 over 2003

| | 2003 over 2002

|

| (In millions) | | Changes due to

| | Total changes

| | Changes due to

| | Total

changes

|

| | | Volume

| | Rate(1)

| | | Volume

| | Rate(1)

| |

INTEREST-EARNING ASSETS: | | | | | | | | | | | | | |