Exhibit 99.2

ZIONS BANCORPORATION

and

AmegyBank of Texas

Collection of Great Banks in the Best Markets

Strategic Rationale

Expands the “Highest Growth Footprint in Banking”

Growth dynamics of Texas consistent with attractive growth dynamics in Zions’ existing markets Scale of Texas market provides substantial opportunities for long term above average growth Pro forma company has most attractive footprint in banking

Complementary Operating Models

Consistent with Zions’ “Collection of Great Banks” operating philosophy

No change to Amegy’s positioning in Texas marketplace and operating strategy (brand, image, people, and culture)

Distinct community identity Strong local management

Influential board members and senior executives with strong ties to the community Responsive customer service

1

Strategic Rationale

Enhances Diversification

Meaningful geographic diversification

Manageable Execution Risk

Zions has had meaningful success entering other states via acquisitions Meaningful integration experience No change in Amegy’s operating model Senior management and customer-facing employees to remain with Amegy Strong credit culture and asset quality ratios

Financially Attractive

Accretive to cash EPS in year 1 (1) and GAAP EPS in year 2 Conservative cost savings assumptions IRR of 14%

(1) Excluding integration charges

2

Zions Bancorporation

A Growth Story

Unique community banking model – very compatible with Amegy’s business model

Highest growth footprint in banking – just got better Attractive niche businesses Strong organic growth Successful acquisition track record

3

Amegy Bank

Another Growth Story

A great community bank

Largest independent bank in Houston

3rd largest independent commercial bank in Texas

One of the nation’s most attractive growth markets

8th largest economy in the world

2nd fastest growing population in U. S. (1990-2000)

2/3rds of Texas economic activity occurs in Houston and Dallas

Attractive niche businesses with leading cash management product

75% of growth internally generated

4

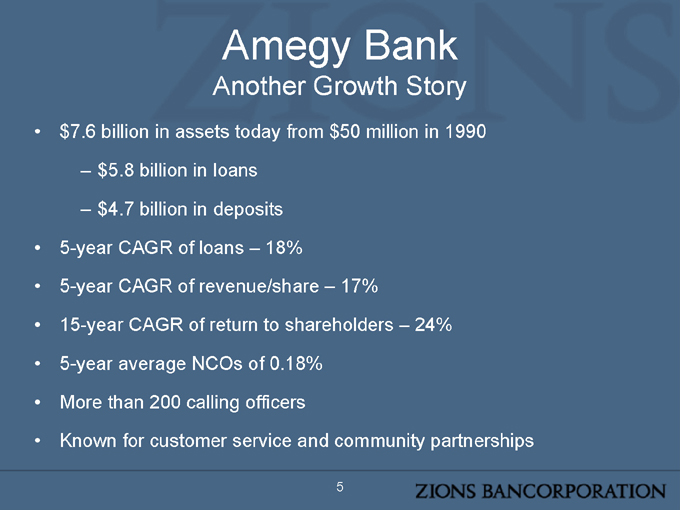

Amegy Bank

Another Growth Story $7.6 billion in assets today from $50 million in 1990 $5.8 billion in loans

$4.7 billion in deposits

5-year CAGR of loans – 18%

5-year CAGR of revenue/share – 17%

15-year CAGR of return to shareholders – 24% 5-year average NCOs of 0.18% More than 200 calling officers

Known for customer service and community partnerships

5

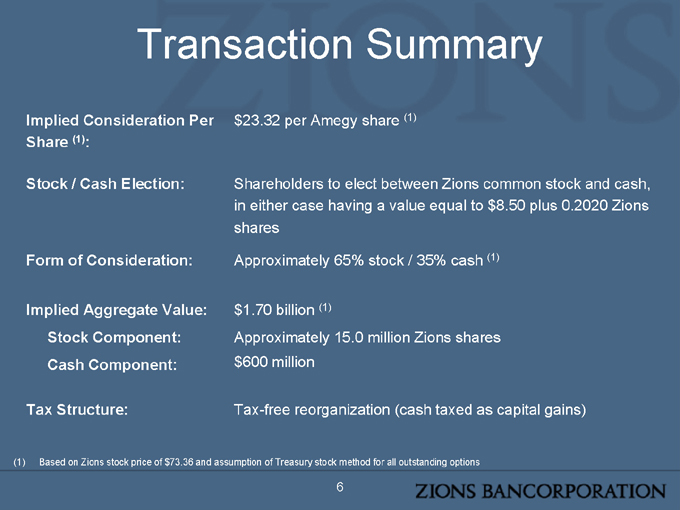

Transaction Summary

Implied Consideration Per Share (1): $23.32 per Amegy share (1)

Stock / Cash Election: Shareholders to elect between Zions common stock and cash, in either case having a value equal to $8.50 plus 0.2020 Zions shares

Form of Consideration: Approximately 65% stock / 35% cash (1)

Implied Aggregate Value: $1.70 billion (1)

Stock Component: Approximately 15.0 million Zions shares

Cash Component: $600 million

Tax Structure: Tax-free reorganization (cash taxed as capital gains)

(1) Based on Zions stock price of $73.36 and assumption of Treasury stock method for all outstanding options

6

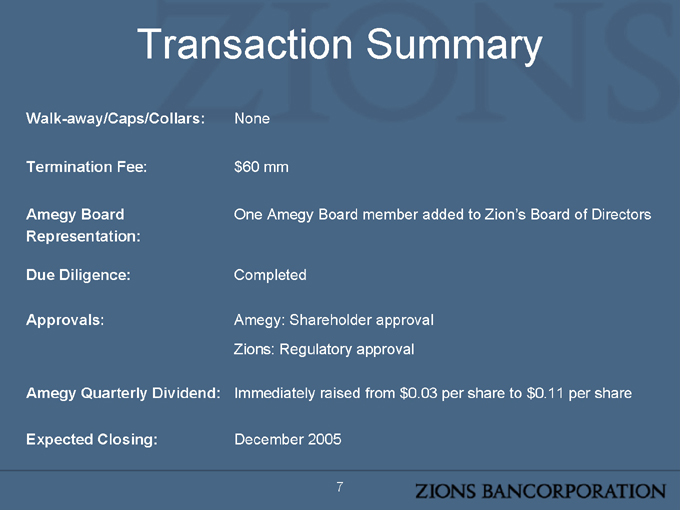

Transaction Summary

Walk-away/Caps/Collars: None

Termination Fee: $60 mm

Amegy Board One Amegy Board member added to Zion’s Board of Directors

Representation:

Due Diligence: Completed

Approvals: Amegy: Shareholder approval

Zions: Regulatory approval

Amegy Quarterly Dividend: Immediately raised from $0.03 per share to $0.11 per share

Expected Closing: December 2005

7

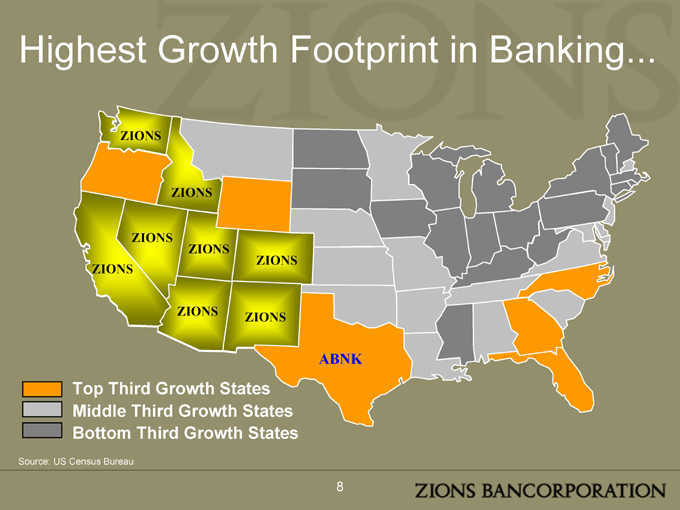

Highest Growth Footprint in Banking

ZIONS

ABNK

Top Third Growth States Middle Third Growth States Bottom Third Growth States

Source: US Census Bureau

8

…Only Gets Better

ZIONS

Top Third Growth States Middle Third Growth States Bottom Third Growth States

Source: US Census Bureau

9

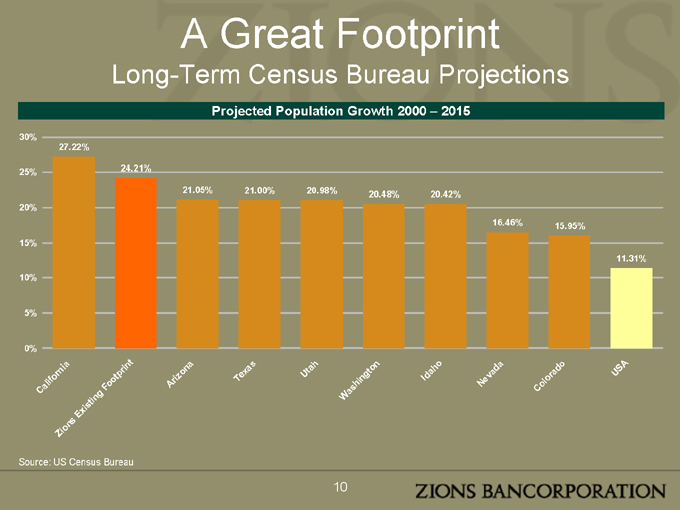

A Great Footprint

Long-Term Census Bureau Projections

Projected Population Growth 2000 – 2015

30% 25% 20% 15% 10% 5% 0%

27.22%

24.21%

21.05%

21.00%

20.98%

20.48%

20.42%

16.46%

15.95%

11.31%

California

Zions Existing Footp rint

Arizona

Texas

Utah

Washington

Idaho

Nevada

Colorado

USA

Source: US Census Bureau

10

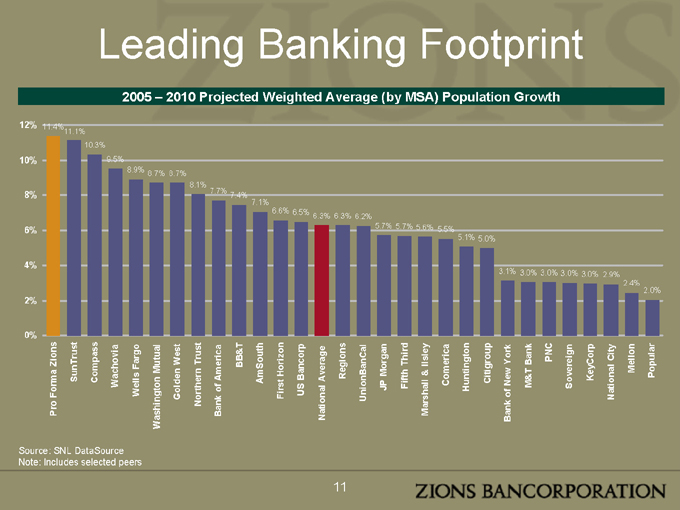

Leading Banking Footprint

2005 – 2010 Projected Weighted Average (by MSA) Population Growth

12% 10% 8% 6% 4% 2% 0%

11.4% 11.1% 10.3% 9.5%

8.9% 8.7% 8.7%

8.1%

7.7% 7.4% 7.1% 6.6%

6.5% 6.3% 6.3% 6.2%

5.7% 5.7%

5.6% 5.5%

5.1% 5.0%

3.1% 3.0% 3.0% 3.0% 3.0% 2.9% 2.4% 2.0%

Pro Forma Zions SunTrust Compass Wachovia Wells Fargo Washington Mutual Golden West Northern Trust Bank of America BB&T

AmSouth First Horizon US Bancorp National Average Regions UnionBanCal JP Morgan Fifth Third Marshall & Ilsley Comerica Huntington Citigroup Bank of New York M&T Bank PNC

Sovereign KeyCorp National City Mellon Popular

Source: SNL DataSource Note: Includes selected peers

11

Complementary Operating Models

Amegy has experienced excellent growth by positioning the bank as a local community bank with “Big Bank” capabilities

Zions has a unique and successful Community Banking Model

Separate charters with local names and identities Local boards Local management teams with real authority

Localized incentive systems tied to long-term performance Consolidated technology and operations Centralized oversight of risk management

12

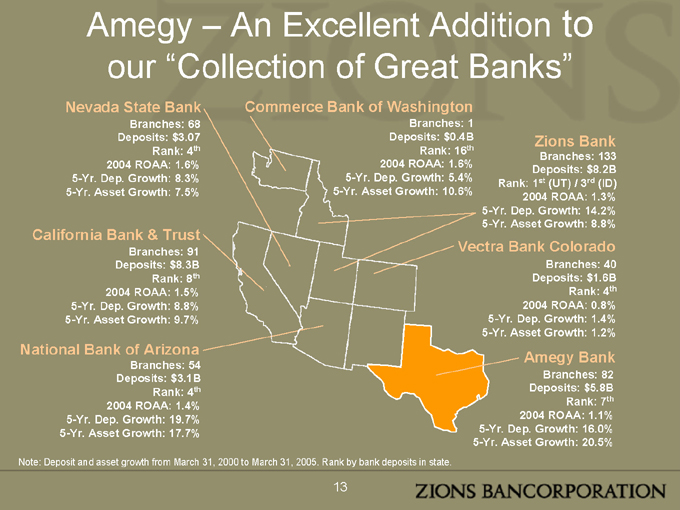

Amegy – An Excellent Addition to our “Collection of Great Banks”

Nevada State Bank

Branches: 68 Deposits: $3.07 Rank: 4th 2004 ROAA: 1.6% 5-Yr. Dep. Growth: 8.3% 5-Yr. Asset Growth: 7.5%

California Bank & Trust

Branches: 91 Deposits: $8.3B

Rank: 8th 2004 ROAA: 1.5% 5-Yr. Dep. Growth: 8.8% 5-Yr. Asset Growth: 9.7%

National Bank of Arizona

Branches: 54 Deposits: $3.1B

Rank: 4th 2004 ROAA: 1.4% 5-Yr. Dep. Growth: 19.7% 5-Yr. Asset Growth: 17.7%

Commerce Bank of Washington

Branches: 1 Deposits: $0.4B

Rank: 16th 2004 ROAA: 1.6% 5-Yr. Dep. Growth: 5.4% 5-Yr. Asset Growth: 10.6%

Zions Bank

Branches: 133 Deposits: $8.2B

Rank: 1st (UT) / 3rd (ID) 2004 ROAA: 1.3% 5-Yr. Dep. Growth: 14.2% 5-Yr. Asset Growth: 8.8%

Vectra Bank Colorado

Branches: 40 Deposits: $1.6B

Rank: 4th 2004 ROAA: 0.8% 5-Yr. Dep. Growth: 1.4% 5-Yr. Asset Growth: 1.2%

Amegy Bank

Branches: 82 Deposits: $5.8B

Rank: 7th 2004 ROAA: 1.1% 5-Yr. Dep. Growth: 16.0% 5-Yr. Asset Growth: 20.5%

Note: Deposit and asset growth from March 31, 2000 to March 31, 2005. Rank by bank deposits in state.

13

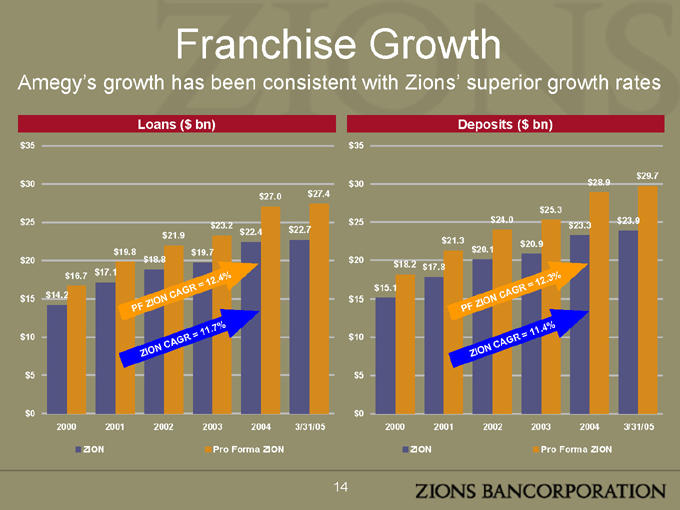

Franchise Growth

Amegy’s growth has been consistent with Zions’ superior growth rates

Loans ($bn) $35 $30 $25 $20 $15 $10 $5 $0 $14.2 $16.7 $17.1 $19.8 $18.8 $21.9 $19.7 $23.2 $22.4 $27.0 $22.7 $27.4

PFZION CAGR = 12.4 %

ZION CAGR = 11.7%

2000 2001 2002 2003 2004 3/31/05

ZION

Pro Forma ZION

Deposits ($bn) $35 $30 $25 $20 $15 $10 $5 $0 $15.1 $18.2 $17.8 $21.3 $20.1 $24.0 $20.9 $25.3 $23.3 $28.9 $23.9 $29.7

PF ZION CAGR = 12.3 %

F Z IO N CAGR = 11.4%

2000 2001 2002 2003 2004 3/31/05

ZION

Pro Forma ZION

14

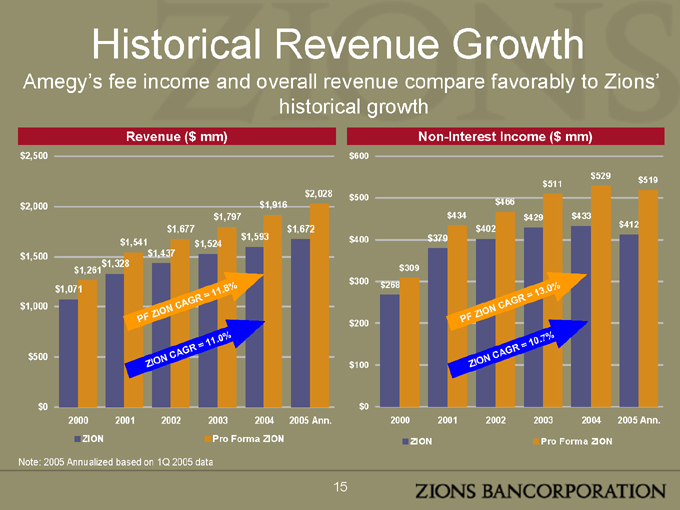

Historical Revenue Growth

Amegy’s fee income and overall revenue compare favorably to Zions’ historical growth

Revenue ($mm) $2,500 $2,000 $1,500 $1,000 $500 $0 $1,071 $1,261 $1,328 $1,541 $1,437 $1,677 $1,524 $1,797 $1,593 $1,916 $1,672 $2,028

PF ZION CAGR = 11.8 %

ZION CAGR = 11.0%

2000 2001 2002 2003 2004 2005 Ann.

ZION

Pro Forma ZION Non-Interest Income ($ mm)

$600 $500 $400 $300 $200 $100 $0 $268 $309 $379 $434 $402 $466 $429 $511 $433 $529 $412 $519

P F Z IO N CAGR = 13.0 %

F Z IO N CAGR = 10.7%

2000 2001 2002 2003 2004 2005 Ann.

ZION

Pro Forma ZION

Note: 2005 Annualized based on 1Q 2005 data

15

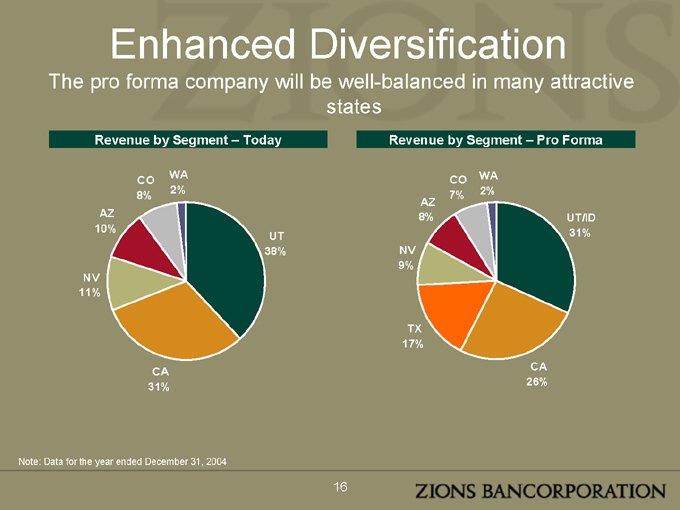

Enhanced Diversification

The pro forma company will be well-balanced in many attractive states

Revenue by Segment – Today

WA 2%

CO 8%

AZ 10%

NV 11%

CA 31%

UT 38%

Revenue by Segment – Pro Forma

TX 17%

NV 9%

AZ 8%

CO 7%

WA 2%

UT/ID 31%

CA 26%

Note: Data for the year ended December 31, 2004

16

Enhanced Diversification

Commercial real estate exposure will be more diversified

Zions

WA 2%

Other 4%

No. CA

7% CO 7%

UT/ID 14%

NV 16%

AZ 22%

So. CA 28%

Pro Forma Zions

WA 2%

Other 4%

No. CA

5%

CO 6%

UT/ID 12%

NV 13%

TX 17%

So. CA 23%

AZ 18%

Note: Data as of December 31, 2004

17

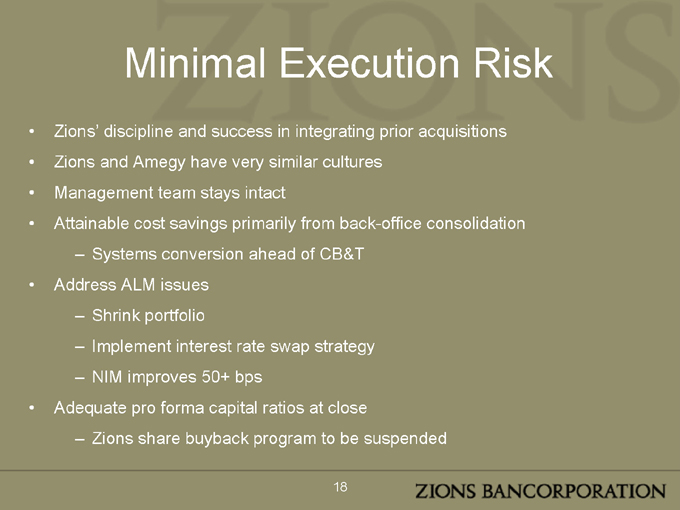

Minimal Execution Risk

Zions’ discipline and success in integrating prior acquisitions Zions and Amegy have very similar cultures Management team stays intact Attainable cost savings primarily from back-office consolidation

Systems conversion ahead of CB&T

Address ALM issues

Shrink portfolio

Implement interest rate swap strategy NIM improves 50+ bps

Adequate pro forma capital ratios at close

Zions share buyback program to be suspended

18

Similarities Between California Bank & Trust (CB&T) and Amegy

In 1997, Zions made its entry into the California market by acquiring Grossmont Bank, the largest independent bank in San Diego

Very successful franchises

Entry into large and fast-growing markets

In 1998, Zions acquired Sumitomo Bank (renamed CB&T) and has experienced significant growth and favorable operating results

Dynamics of the California and Texas markets are similar in many respects

Strong growth prospects

Large, out-of-state competitors

Excellent opportunities for well-run community banks

19

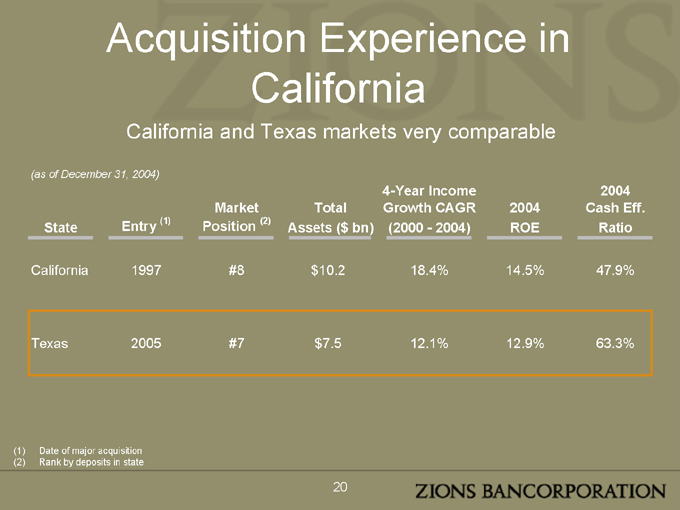

Acquisition Experience in California

California and Texas markets very comparable

(as of December 31, 2004)

State Entry (1) Market Position (2) Total Assets ($bn) 4-Year Income Growth CAGR (2000—2004) 2004 ROE 2004 Cash Eff. Ratio

California 1997 #8 $10.2 18.4% 14.5% 47.9%

Texas 2005 #7 $7.5 12.1% 12.9% 63.3%

(1) Date of major acquisition (2) Rank by deposits in state

20

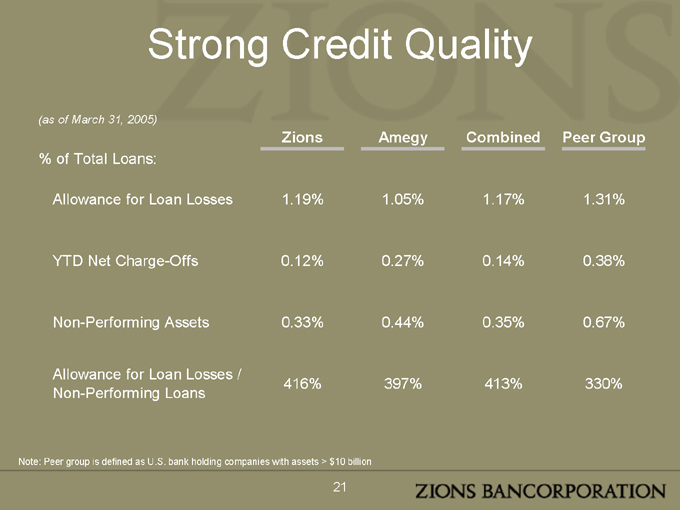

Strong Credit Quality

(as of March 31, 2005)

Zions Amegy Combined Peer Group

% of Total Loans:

Allowance for Loan Losses 1.19% 1.05% 1.17% 1.31%

YTD Net Charge-Offs 0.12% 0.27% 0.14% 0.38%

Non-Performing Assets 0.33% 0.44% 0.35% 0.67%

Allowance for Loan Losses / Non-Performing Loans 416% 397% 413% 330%

Note: Peer group is defined as U.S. bank holding companies with assets > $10 billion

21

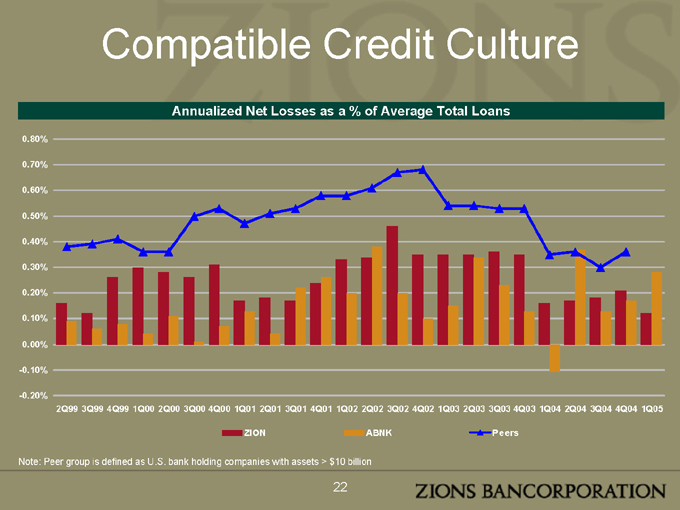

Compatible Credit Culture

Annualized Net Losses as a % of Average Total Loans

0.80% 0.70% 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% 0.00% -0.10% -0.20%

2Q99 3Q99 4Q99 1Q00 2Q00 3Q00 4Q00 1Q01 2Q01 3Q01 4Q01 1Q02 2Q02 3Q02 4Q02 1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05

ZION

ABNK

Peers

Note: Peer group is defined as U.S. bank holding companies with assets > $10 billion

22

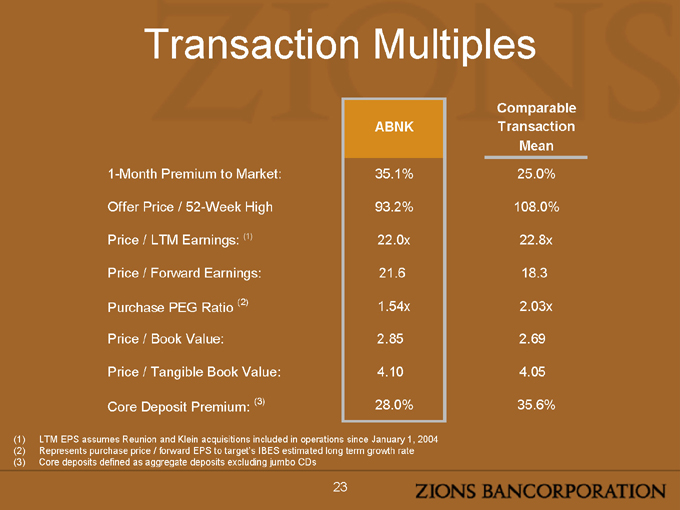

Transaction Multiples

Comparable

ABNK Transaction

Mean

1-Month Premium to Market: 35.1% 25.0%

Offer Price / 52-Week High 93.2% 108.0%

Price / LTM Earnings: (1) 22.0x 22.8x

Price / Forward Earnings: 21.6 18.3

Purchase PEG Ratio (2) 1.54x 2.03x

Price / Book Value: 2.85 2.69

Price / Tangible Book Value: 4.10 4.05

Core Deposit Premium: (3) 28.0% 35.6%

(1) LTM EPS assumes Reunion and Klein acquisitions included in operations since January 1, 2004 (2) Represents purchase price / forward EPS to target’s IBES estimated long term growth rate (3) Core deposits defined as aggregate deposits excluding jumbo CDs

23

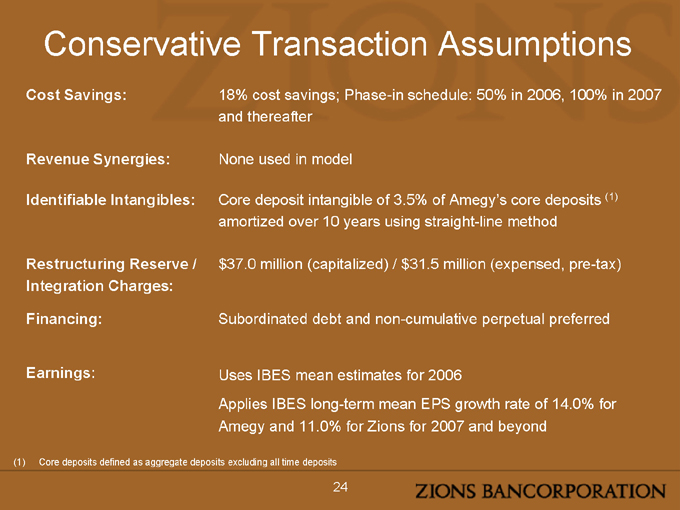

Conservative Transaction Assumptions

Cost Savings: 18% cost savings; Phase-in schedule: 50% in 2006, 100% in 2007 and thereafter

Revenue Synergies: None used in model

Identifiable Intangibles: Core deposit intangible of 3.5% of Amegy’s core deposits (1) amortized over 10 years using straight-line method

Restructuring Reserve / $37.0 million (capitalized) / $31.5 million (expensed, pre-tax)

Integration Charges:

Financing: Subordinated debt and non-cumulative perpetual preferred

Earnings: Uses IBES mean estimates for 2006

Applies IBES long-term mean EPS growth rate of 14.0% for Amegy and 11.0% for Zions for 2007 and beyond

(1) Core deposits defined as aggregate deposits excluding all time deposits

24

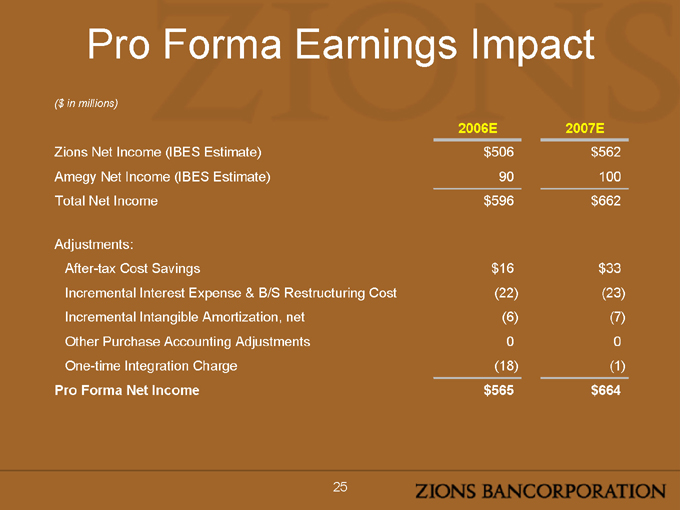

Pro Forma Earnings Impact

($ in millions)

2006E 2007E

Zions Net Income (IBES Estimate) $506 $562

Amegy Net Income (IBES Estimate) 90 100

Total Net Income $596 $662

Adjustments:

After-tax Cost Savings $16 $33

Incremental Interest Expense & B/S Restructuring Cost (22) (23)

Incremental Intangible Amortization, net (6) (7)

Other Purchase Accounting Adjustments 0 0

One-time Integration Charge (18) (1)

Pro Forma Net Income $565 $664

25

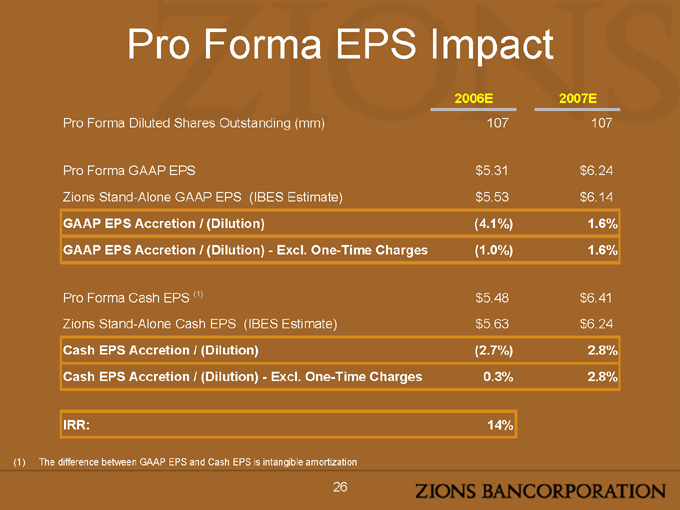

Pro Forma EPS Impact

2006E 2007E

Pro Forma Diluted Shares Outstanding (mm) 107 107

Pro Forma GAAP EPS $5.31 $6.24

Zions Stand-Alone GAAP EPS (IBES Estimate) $5.53 $6.14

GAAP EPS Accretion / (Dilution) (4.1%) 1.6%

GAAP EPS Accretion / (Dilution)—Excl. One-Time Charges (1.0%) 1.6%

Pro Forma Cash EPS (1) $5.48 $6.41

Zions Stand-Alone Cash EPS (IBES Estimate) $5.63 $6.24

Cash EPS Accretion / (Dilution) (2.7%) 2.8%

Cash EPS Accretion / (Dilution)—Excl. One-Time Charges 0.3% 2.8%

IRR: 14%

(1) The difference between GAAP EPS and Cash EPS is intangible amortization

26

Summary Conclusion

Compatible growth profile

Demographics of Amegy’s markets among the best in the U.S. Non-dilutive to Zions’ current growth prospects Solid track record of growth and profitability

Strong cultural affinity

Excellent credit culture

Focus on small and middle-market lending Long-term relationship with management

27

Summary Conclusion

Solid transaction economics

Accretion of $0.10 per share in Zions’ earnings in 2007 Mid-teens internal rate of return

Manageable execution risk

Amegy will operate as a separate bank under current name and leadership Identified and achievable cost savings

A genuinely unique opportunity to expand the collection of great banks and create long-term value for shareholders

28

Appendix

Precedent Transaction Comparison IRR Detail Value Equalization Analysis Pro Forma Balance Sheet Amegy – Historical Balance Sheet Amegy – Historical Income Statement

29

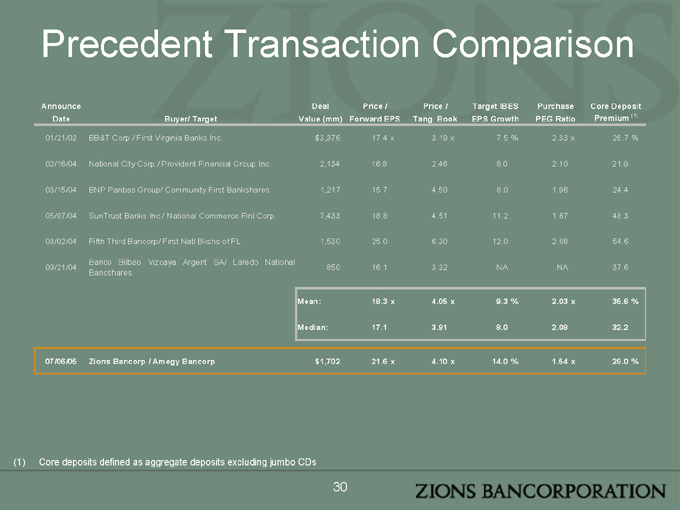

Precedent Transaction Comparison

Announce Date Buyer/ Target Deal Value (mm) Price / Forward EPS Price / Tang. Book Target IBES EPS Growth Purchase PEG Ratio Core Deposit Premium (1)

01/21/03 BB&T Corp./ First Virginia Banks Inc. $3,376 17.4 x 3.19 x 7.5 % 2.33 x 26.7 %

02/16/04 National City Corp./ Provident Financial Group Inc. 2,134 16.8 2.46 8.0 2.10 21.9

03/15/04 BNP Paribas Group/ Community First Bankshares 1,217 15.7 4.50 8.0 1.96 24.4

05/07/04 SunTrust Banks Inc./ National Commerce Finl Corp. 7,433 18.8 4.51 11.2 1.67 48.3

08/02/04 Fifth Third Bancorp/ First Natl Bkshs of FL 1,530 25.0 6.30 12.0 2.08 54.6

Banco Bilbao Vizcaya Argent SA/ Laredo National

09/21/04 850 16.1 3.32 NA NA 37.6

Bancshares

Mean: 18.3 x 4.05 x 9.3 % 2.03 x 35.6 %

Median: 17.1 3.91 8.0 2.08 32.2

07/06/05 Zions Bancorp / Amegy Bancorp $1,702 21.6 x 4.10 x 14.0 % 1.54 x 28.0 %

(1) Core deposits defined as aggregate deposits excluding jumbo CDs

30

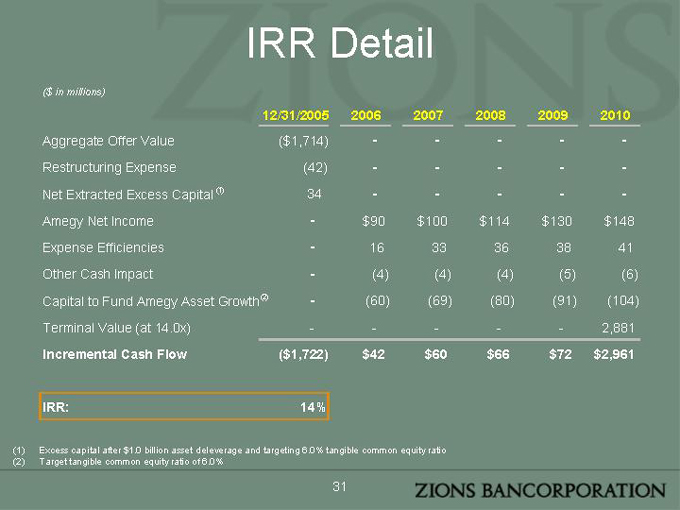

IRR Detail

($ in millions)

12/31/2005 2006 2007 2008 2009 2010

Aggregate Offer Value ($1,714) - - - - -

Restructuring Expense (42) - - - - -

Net Extracted Excess Capital (1) 34 - - - - -

Amegy Net Income - $90 $100 $114 $130 $148

Expense Efficiencies - 16 33 36 38 41

Other Cash Impact - (4) (4) (4) (5) (6)

Capital to Fund Amegy Asset Growth (2) - (60) (69) (80) (91) (104)

Terminal Value (at 14.0x) - - - - - 2,881

Incremental Cash Flow ($1,722) $42 $60 $66 $72 $2,961

IRR: 14%

(1) Excess capital after $1.0 billion asset deleverage and targeting 6.0% tangible common equity ratio (2) Target tangible common equity ratio of 6.0%

31

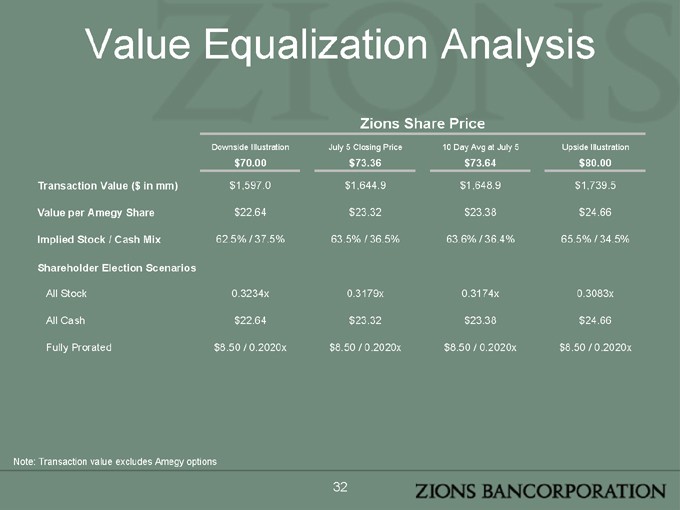

Value Equalization Analysis

Zions Share Price

Downside Illustration July 5 Closing Price 10 Day Avg at July 5 Upside Illustration

$70.00 $73.36 $73.64 $80.00

Transaction Value ($ in mm) $1,597.0 $1,644.9 $1,648.9 $1,739.5

Value per Amegy Share $22.64 $23.32 $23.38 $24.66

Implied Stock / Cash Mix 62.5% / 37.5% 63.5% / 36.5% 63.6% / 36.4% 65.5% / 34.5%

Shareholder Election Scenarios

All Stock 0.3234x 0.3179x 0.3174x 0.3083x

All Cash $22.64 $23.32 $23.38 $24.66

Fully Prorated $8.50 / 0.2020x $8.50 / 0.2020x $8.50 / 0.2020x $8.50 / 0.2020x

Note: Transaction value excludes Amegy options

32

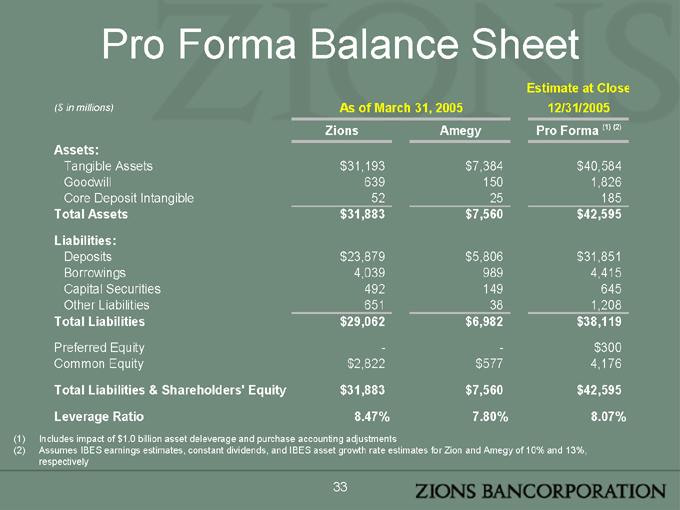

Pro Forma Balance Sheet

Estimate at Close

($ in millions) As of March 31, 2005 12/31/2005

Zions Amegy Pro Forma (1) (2)

Assets:

Tangible Assets $31,193 $7,384 $40,584

Goodwill 639 150 1,826

Core Deposit Intangible 52 25 185

Total Assets $31,883 $7,560 $42,595

Liabilities:

Deposits $23,879 $5,806 $31,851

Borrowings 4,039 989 4,415

Capital Securities 492 149 645

Other Liabilities 651 38 1,208

Total Liabilities $29,062 $6,982 $38,119

Preferred Equity - - $300

Common Equity $2,822 $577 4,176

Total Liabilities & Shareholders’ Equity $31,883 $7,560 $42,595

Leverage Ratio 8.47% 7.80% 8.07%

(1) Includes impact of $1.0 billion asset deleverage and purchase accounting adjustments

(2) Assumes IBES earnings estimates, constant dividends, and IBES asset growth rate estimates for Zion and Amegy of 10% and 13%, respectively

33

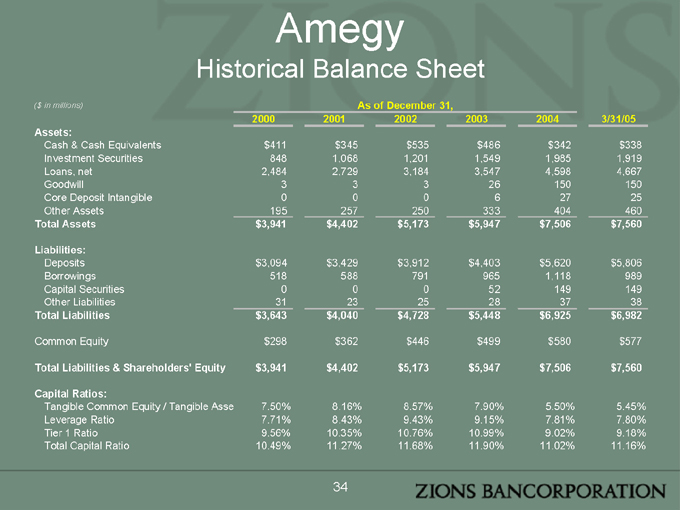

Amegy

Historical Balance Sheet

($ in millions) As of December 31,

2000 2001 2002 2003 2004 3/31/05

Assets:

Cash & Cash Equivalents $411 $345 $535 $486 $342 $338

Investment Securities 848 1,068 1,201 1,549 1,985 1,919

Loans, net 2,484 2,729 3,184 3,547 4,598 4,667

Goodwill 3 3 3 26 150 150

Core Deposit Intangible 0 0 0 6 27 25

Other Assets 195 257 250 333 404 460

Total Assets $3,941 $4,402 $5,173 $5,947 $7,506 $7,560

Liabilities:

Deposits $3,094 $3,429 $3,912 $4,403 $5,620 $5,806

Borrowings 518 588 791 965 1,118 989

Capital Securities 0 0 0 52 149 149

Other Liabilities 31 23 25 28 37 38

Total Liabilities $3,643 $4,040 $4,728 $5,448 $6,925 $6,982

Common Equity $298 $362 $446 $499 $580 $577

Total Liabilities & Shareholders’ Equity $3,941 $4,402 $5,173 $5,947 $7,506 $7,560

Capital Ratios:

Tangible Common Equity / Tangible Asse 7.50% 8.16% 8.57% 7.90% 5.50% 5.45%

Leverage Ratio 7.71% 8.43% 9.43% 9.15% 7.81% 7.80%

Tier 1 Ratio 9.56% 10.35% 10.76% 10.99% 9.02% 9.18%

Total Capital Ratio 10.49% 11.27% 11.68% 11.90% 11.02% 11.16%

34

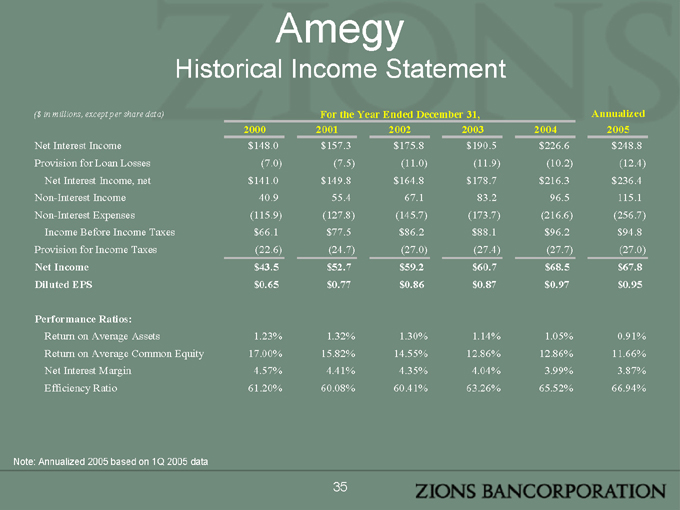

Amegy

Historical Income Statement

($ in millions, except per share data) For the Year Ended December 31, Annualized

2000 2001 2002 2003 2004 2005

Net Interest Income $148.0 $157.3 $175.8 $190.5 $226.6 $ 248.8

Provision for Loan Losses (7.0) (7.5) (11.0) (11.9) (10.2) (12.4)

Net Interest Income, net $141.0 $149.8 $164.8 $178.7 $216.3 $236.4

Non-Interest Income 40.9 55.4 67.1 83.2 96.5 115.1

Non-Interest Expenses (115.9) (127.8) (145.7) (173.7) (216.6) (256.7)

Income Before Income Taxes $66.1 $77.5 $86.2 $88.1 $96.2 $94.8

Provision for Income Taxes (22.6) (24.7) (27.0) (27.4) (27.7) (27.0)

Net Income $43.5 $52.7 $59.2 $60.7 $68.5 $67.8

Diluted EPS $0.65 $0.77 $0.86 $0.87 $0.97 $0.95

Performance Ratios:

Return on Average Assets 1.23% 1.32% 1.30% 1.14% 1.05% 0.91%

Return on Average Common Equity 17.00% 15.82% 14.55% 12.86% 12.86% 11.66%

Net Interest Margin 4.57% 4.41% 4.35% 4.04% 3.99% 3.87%

Efficiency Ratio 61.20% 60.08% 60.41% 63.26% 65.52% 66.94%

Note: Annualized 2005 based on 1Q 2005 data

35

Forward-Looking Statements

This presentation contains statements regarding the projected performance of Zions Bancorporation. These statements constitute forward-looking information within the meaning of the Private Securities Litigation Reform Act. Actual results or achievements may differ materially from the projections provided in this presentation since such projections involve significant known and unknown risks and uncertainties. Factors that might cause such differences include, but are not limited to: competitive pressures among financial institutions increasing significantly; economic conditions, either nationally or locally in areas in which Zions Bancorporation conducts their operations, being less favorable than expected; changes in the interest rate environment reducing expected interest margins; legislation or regulatory changes, which adversely affect the ability of the company to conduct the business in which the company would be engaged; delays in adoption of digital certificates for online services. Zions Bancorporation disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein to reflect future events or developments.

36

Additional Information and Where to Find It

Zions Bancorporation will file a Form S-4, Amegy Bancorporation will file a proxy statement and both companies will file other relevant documents concerning the proposed merger transaction with the Securities and Exchange Commission (SEC). INVESTORS ARE URGED TO READ THE FORM S-4 AND PROXY STATEMENT WHEN THEY BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain the documents free of charge at the website maintained by the SEC at www.sec.gov. In addition, you may obtain documents filed with the SEC by Zions free of charge by contacting: Investor Relations, Zions Bancorporation, One South Main Street, Suite 1134, Salt Lake City, Utah 84111, (801) 524-4787. You may obtain documents filed with the SEC by Amegy free of charge by contacting: Controller, Amegy Bancorporation, 4400 Post Oak Parkway, Houston, Texas 77027, (713) 235-8800.

Interest of Certain Persons in the Merger

Zions, Amegy, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies from Amegy’s shareholders in connection with the merger. Information about the directors and executive officers of Zions and their ownership of Zions stock is set forth in the proxy statement for Zions’ 2005 Annual Meeting of Shareholders. Information about the directors and executive officers of Amegy and their ownership of Amegy stock is set forth in the proxy statement for Amegy’s 2005 Annual Meeting of Shareholders. Investors may obtain additional information regarding the interests of such participants by reading the Form S-4 and proxy statement for the merger when they become available.

Investors should read the Form S-4 and proxy statement carefully when they become available before making any voting or investment decisions.

37