February 25, 2016 2016 Biennial Investor Conference Focus on Performance

Forward-Looking Statements & Peer Group Abbreviations This presentation contains statements that relate to the projected or modeled performance or condition of Zions Bancorporation and elements of or affecting such performance or condition, including statements with respect to forecasts, opportunities, models, illustrations, scenarios, beliefs, plans, objectives, goals, guidance, expectations, anticipations or estimates, and similar matters. These statements constitute forward-looking information within the meaning of the Private Securities Litigation Reform Act. Actual facts, determinations, results or achievements may differ materially from the statements provided in this presentation since such statements involve significant known and unknown risks and uncertainties. Factors that might cause such differences include, but are not limited to: competitive pressures among financial institutions; economic, market and business conditions, either nationally, internationally, or locally in areas in which Zions Bancorporation conducts its operations, being less favorable than expected; changes in the interest rate environment reducing expected interest margins; changes in debt, equity and securities markets; adverse legislation or regulatory changes; Federal Reserve review of our stress testing and capital plans; and other factors described in Zions Bancorporation’s most recent annual and quarterly reports. In addition, the statements contained in this presentation are based on facts and circumstances as understood by management of the company on the date of this presentation, which may change in the future. Except as required by law, Zions Bancorporation disclaims any obligation to update any statements or to publicly announce the result of any revisions to any of the forward-looking statements included herein to reflect future events, developments, determinations or understandings. 2 ASB: Associated Banc Corp BBT: BB&T Corporation BOKF: BOK Financial Corporation CFG: Citizens Financial Group Inc. CBSH: Commerce Bancshares, Inc. CMA: Comerica Incorporated EWBC: East West Bancorp, Inc. FHN: First Horizon National Corp FITB: Fifth Third Bancorp FMER: Firstmerit Corp FRC: First Republic Bank HBAN: Huntington Bancshares Incorporated KEY: KeyCorp MTB: M&T Bank Corporation PBCT: People’s United Financial, Inc. RF: Regions Financial Corporation SNV: Synovus Financial Corp. STI: SunTrust Banks, Inc.

Agenda 3 • Company Overview • Geographic Footprint • Commercial Bank Orientation • Commercial Lender • Small Business Focus • Strong Capital, Reserves & Low Debt • Credit Quality Today and Through the Cycles • Liquidity • Profitability • Asset Sensitivity • Accomplishments and Strategic Outlook • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Risk Management • Credit Quality • Energy Portfolio • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

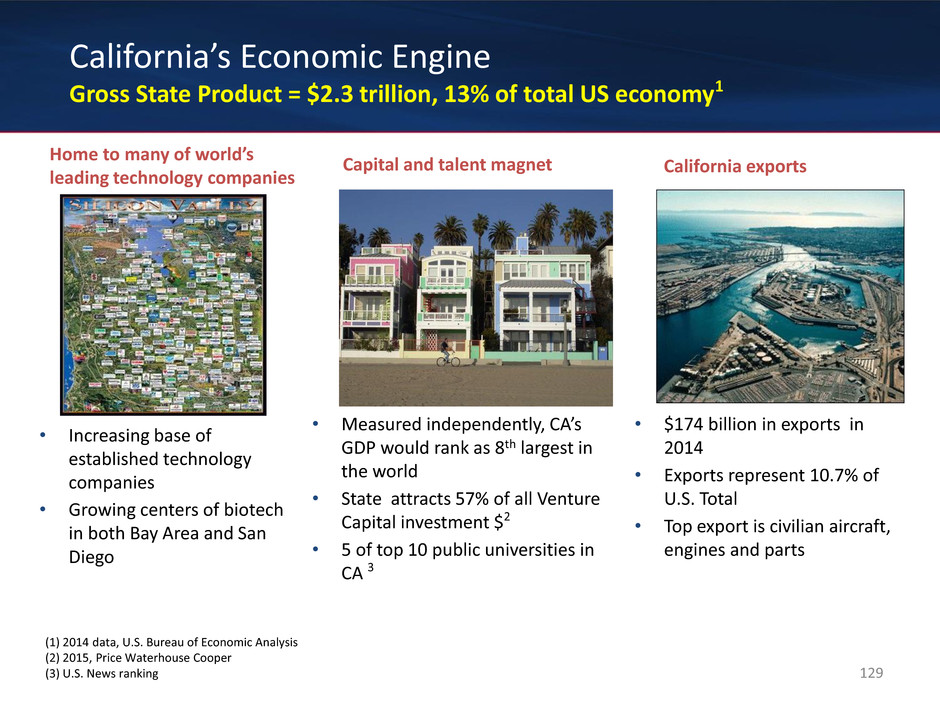

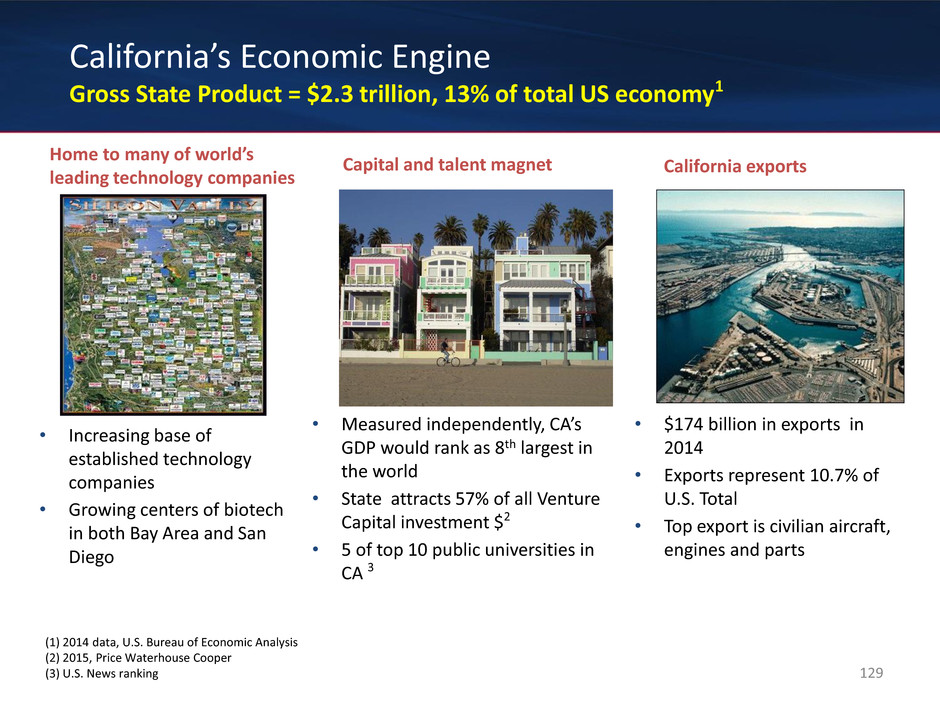

Bank Headquarters Assets % of Total Zions Bank Salt Lake City $20B 33% Amegy Houston $14B 23% CB&T San Diego $12B 20% NB|AZ Phoenix $5B 8% NSB Las Vegas $4B 7% Vectra Denver $3B 6% Commerce Bank - WA/OR Seattle $1B 2% Zions Bancorporation Salt Lake City $60B 100% Strategic local “ownership” of market opportunities and challenges Superior local customer access to bank decision makers relative to big nationals Footprint (by deposit market share) is located in high-growth markets A Collection of Community Banks Local decision-making and top-notch service separate Zions from peers 4 0% 1% 2% 3% 4% 5% 6% Z IO N B O K F B B T E W B C F R C MT B K E Y R F S T I F H N S N V C F G C M A A S B P B C T C B S H F IT B H B A N Nominal GDP Footprint Growth Comparison weighted based on deposits Source: SNL Financial, BEA.gov, Zions’ calculations, using simple average of trailing 10 years of annual GDP growth by state multiplied by the percent of deposits in each state

13% 35% 20% 17% 15% 4% 30% 10% 28% 22% Cash Commercial Loans Commercial Real Estate Loans Consumer Loans Securities Earning Assets 5 Zions Is a Commercially-Oriented Bank 55% of earning assets are commercial loans (vs. 40% for peers), and 38% of earning assets are funded by noninterest bearing deposits (vs. 25% for peers) 38% 48% 2% 11% 1.4% 25% 53% 10% 11% 0.4% 0% 10% 20% 30% 40% 50% 60% Noninterest- Bearing Deposits Interest- Bearing Deposits Total Debt Common Equity + AOCI Pref Equity Liabilities and Equity Source: Peer information via SNL Financial as 3Q15, ZION as of 4Q15; Income ratios based on full year results. Noninterest income excludes securities gains / losses. Major categories of assets and liabilities included, and percentages expressed as a sum of the total of the categories; does not include other assets or liabilities, such as property, equipment, accounts payable, etc.. Median is calculated by major category; as such, the sum of the median ratios does not equal 100%. 77% 23% 62% 38% 0% 20% 40% 60% 80% Net Interest Income Noninterest Income Revenue ZION Peer Median

$0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 WF C B A C JP M US B B B T P N C ZIO N M TB R F ST I C H B A N FIT B KE Y CM A U B Commercial Loans Sized $100k - $1M Small Business Lending: Zions Punches Above Its Weight 6 Source: Call report data via SNL Financial, as of 2Q15; peer group different than typical peer group in order to show the position of the largest U.S. banks (In millions) 0% 5% 10% 15% 20% 25% ZIO N B B T H B A N R F M TB US B WF C JP M KE Y B A C P N C ST I CM A FIT B C U B Commercial Loans Sized $100k-$1M, As a percent of total commercial loans

Top Quartile Balance Sheet: Capital and reserve ratios are among the strongest, debt ratio the lowest of peers Regulatory capital ratios are Basel III. Source: SNL Financial as of 3Q15 for peers, 4Q15 for ZION 7 12.2% B O K F ZIO N CF G C B SH R F EWB C FH N FR C FM ER SN V CM A KE Y B B T M TB ST I PB C T H B A N FIT B A SB Common Equity Tier 1 Capital Ratio 14.1% 8% 9% 10% 11% 12% 13% 14% 15% ZIO N FR C B O K F C B SH FH N CF G M TB R F B B T EWB C ST I KE Y FME R SN V CM A H B A N FIT B A SB PB C T Tier 1 Risk-Based Capital Ratio 1.7% 0.0% 0.5% 1.0% 1.5% 2.0% ZIO N A SB FIT B R F M TB KE Y CM A ST I B O K F H B A N CF G FH N C B SH EWB C SN V B B T FM ER PB C T FR C Total Allowance for Credit Losses / Loans 20% 0% 50% 100% 150% 200% 250% ZIO N EWB C CM A R F ST I SN V CF G FM ER C B SH FR C KE Y M TB FH N H B A N PB C T B B T FIT B B O K F A SB Debt / Tier 1 Common Capital (CET1)

Credit Quality Current and through-the-cycle losses rank in the best quartile of peers 8 Source: SNL Financial as of 3Q15; ZION data as of 4Q15. FRC and PBCT had insufficient history during financial crisis to be included in the 1990-2013 analysis 0.0% 0.5% 1.0% 1.5% 2.0% B O K F M TB C B SH A SB ZI O N EW B C C M A B B T FM ER ST I C FG R F H B A N FIT B KE Y FH N SN V Average Annual NCOs / Loans 1990-2013 0.00% 0.50% 1.00% 1.50% 2.00% B O K F FR C EWB C PB C T ZIO N SN V A SB M TB FH N H B A N CM A ST I FM ER KE Y C B SH CF G R F B B T FIT B Last 12 Months NCOs / Avg Loans FR C C B SH ST I EW B C C M A FM ER PB C T KE Y B B T H B A N FIT B ZIO N A SB B O K F CF G SN V M TB R F FH N Last 4 Quarter Average (NPAs + 90DPD) / (Loans + OREO)

Strong Liquidity, Superior Deposit Franchise Over Time Zions Liquidity Coverage Ratio is comfortably in excess of the regulatory minimum 9 0% 10% 20% 30% 40% 50% 60% 2000 2005 2010 2015 Noninterest-Bearing Deposits / Total Deposits* ZION Peer Median Source: SNL Financial as of 3Q15; ZION data as of 4Q15 *FRC and PBCT removed from peer group due to incomparable historical data 50% 60% 70% 80% 90% 100% C B SH BO K F FME R ZI O N CM A R F EW B C K EY FH N A SB ST I HB A N B B T FIT B MT B CF G FR C SN V P B C T Loans / Deposits 0% 10% 20% 30% 40% 50% 60% CM A ZI O N FR C MT B K EY C B SH R F FIT B EW B C B B T SN V FH N CF G ST I A SB P B C T HB A N FME R B O K F Noninterest-Bearing Deposits / Total Deposits

Profitability: Expected Improvement to be Driven Primarily by Positive Operating Leverage via the Efficiency Initiative 10 Source: SNL Financial, Zions calculations *Adjusted ROAA and ROTCE for ZION excludes gains/losses on fixed income securities, debt extinguishment and preferred stock redemption cost, and reserve release, which is defined as provision for credit losses net of NCOs. Peers include the CCAR peers, as reported (unadjusted for any non-core / nonrecurring items) 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 Adjusted ROAA, Annualized ZION Peer Median 0% 2% 4% 6% 8% 10% 12% 14% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 Adjusted ROTCE, Annualized ZION Peer Median

Asset Sensitivity Zions is among the most asset sensitive of its peers 11 -5% 0% 5% 10% 15% 20% 25% 30% EW B C C M A ZIO N FH N M TB SN V CF G R F P BC T ST I FR C FM ER B B T A SB K EY FI TB H B A N CB SH BO K F Percent Change in Net Interest Income Interest Rates +200 basis points Company Reported 0% 5% 10% 15% 20% 25% 30% ZIO N R F M TB KE Y ST I FIT B B B T H B A N Percent Change in Net Interest Income Interest Rates +200 basis points Vining Sparks Analysis** Source: SNL, Zions interpolations & calculations based upon 3Q15 10-Q disclosures. Zions ratio in the left chart is the mid- point of the fast and slow analysis as of 4Q15. Peers not included in the right chart were absent from the Vining Sparks analysis. **”The Impact of Balance Sheet Structure on Earnings Potential from Rising Rates” by Marty Mosby and Mason Mosby on September 28, 2015, exhibit 12. The output of the analysis was measured in basis points of NIM, and for the purposes of comparability, Zions has converted that into a percentage of net interest income.

Agenda 12 • Company Overview • Accomplishments and Strategic Outlook • Focus on Performance • Accomplishments • Local Brands = Strong Brand Value • Reduced Risk Profile / Enhanced Risk Management • Strategic Outlook: Next Two Years • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Risk Management • Credit Quality • Energy Portfolio • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

Zions: A Focus on Performance 13 • Substantial Progress: Many action items accomplished during the past five years • Lower risk profile • Lower cost of capital • Lower operating costs • Self-Help Story: Actions initiated and expected to be completed during next two years • Greater focus on growth opportunities • Simplification of business processes • Elimination of production roadblocks • Stated multi-year expense discipline

Major Accomplishments since 2014 Investor Day 14 • Profitability: The Adjusted Return on Assets increased by approximately 20 basis points • Substantially strengthened pre-provision net revenue profile with increased investment in medium duration assets • Simplified and reduced the cost of the capital structure • Held noninterest expense flat from a $1.6 billion annualized level in 2H141 while investing substantially in technology systems • Embarked on a major initiative to simplify and streamline back- and middle-office processes, which resulted in consolidation of seven banking charters and various duplicate processes • Risk Management: Substantial strengthening and progress in positioning the company to be a positive outlier in future economic recessions • Capital: Capital ratios are now among the strongest of the peer group • Technology: Completed or nearly completed several technology updates including accounting, management information systems, front-end loan entry system, enterprise loan operations • Brand value: Improved to Top Ranked Bank by Greenwich Associates for 2015 for Middle Market and Small Business Banking2 The Adjusted ROA normalized for the effect of a reserve build or release and excludes securities gains / losses 1 Excludes debt extinguishment expense in 4Q14 and excludes the provision for unfunded lending commitments 2 Improved from seventh place in the 2013 survey

On June 1, 2015, Zions announced several organizational and operational changes, including: • Consolidate bank charters from seven to one while maintaining local leadership, local product pricing, and local brands • Create a Chief Banking Officer position; realign responsibility for retail banking, wealth management, and residential mortgage lending • Consolidate risk functions • No need for two “second lines of defense” • Retain local credit decision-making • Consolidate various non-customer facing operations (e.g. Accounting, Loan Operations) • Build best-in-class technology infrastructure 15 Zions’ Major Announcement: Organizational Restructure Percent Complete Today1 100% 60% 75% 75% 40% Percent Complete by 20182 100% 100% 100% 100% 80% - 90% 1 Estimated by management 2 Expected

Why Maintain Local Brands? Zions is Nationally Recognized for Excellence 16 Staying Local Where it Matters: • Maintaining our strong local brands • Experienced regional executive leadership teams • Credit decision-making close to the customer • Regional pricing of credit and noncredit services • Regionally designed “go to market” strategies Results of this customer-centric model have resulted in superior brand recognition

Superior Brand: Nationally Recognized for Excellence • Ranked #1 Nationally by Greenwich Associates (2015) • Thirty-One (31) Greenwich Excellence Awards in small business and middle market banking This year including: Excellence: Overall Satisfaction (seven consecutive years) Excellence: Likelihood to Recommend Excellence: Treasury Management (seven consecutive years) Excellence: Treasury Management Product Capabilities (sole winner in 2015) Zions is one of only four (4) banks that have been consistently awarded more than 10 Excellence awards since 2009, when the first survey was conducted. The biggest four domestic U.S. banks experienced a median of only one (1) award in 2015 • Top team of women bankers – American Banker1 • Amegy Bank named Ex-Im Bank Small Business Lender of the Year2 • California Bank & Trust consistently voted Best Bank in San Diego and Orange Counties3 • National Bank of Arizona voted #1 Bank in Arizona 13 straight years4 17 1. One of five winning teams, 2015, Zions Bank; 2. exim.gov, April 24, 2014; 3.Readers of the San Diego Union- Tribune, August 2015, for 5 years; Orange County Register, for two years in a row; 4.Ranking Arizona, 2015

Reduced Risk Profile Expect substantially reduced volatility in credit performance in future cycles 18 Excerpts from Zions’ Corporate Policies Collateralized Debt Obligations (CDOs): “The Company’s CDO portfolio is a legacy asset that is in run-off and should be prudently managed down. No new CDO securities may be purchased, except in the event that an opportunity arises whereby the purchase of CDOs will result in a net decrease in the Company’s exposure to such securities, by for example, facilitating the disposition of a larger block of such securities held by the Company.” Structured Securities. “Structured securities other than CDOs, particularly those with any form of embedded leverage, pose particular credit, market and liquidity risks, and require detailed analysis. Generally, the purchase of such securities should be avoided, and a decision to make any such purchases requires approval of the management Enterprise Risk Management Committee in addition to ALCO prior to purchase” Safeguard against similar potential purchases– Chief Risk Officer Veto Power “Corporate Chief Risk Officer will serve as a member of ALCO with veto power over any ALCO decision” 0% 100% 200% 300% 400% 500% 2007 2015 CDOs & Construction and Land Development Loans, as a Percent of Common Equity Tier 1 Capital ZION Peer Median • Zions has made strong strides in reducing assets that exhibit higher loss rates under economic stress • Zions’ exposure to CDOs and C&D loans moved from the high end of the peers to just slightly above the peer median • Policies in place make purchasing of structured securities in the future subject to a review of Zions’ Board of Directors 90% reduction for ZION Source: Zions and SNL Financial

New Board Members Since 2013 Additional Risk Management Expertise • Edward F. Murphy, CPA • Served as CFO of Federal Reserve Bank of New York from 2005 to 2013 • Held the position of Global Audit Director at JP Morgan & Co. • Served as Executive Vice President and CFO of retail division and Chief Operating Officer of JPMorgan Chase • John C. Erickson • Served as Vice Chairman of Union Bank from 2007 to 2014 • Held the positions of Chief Risk Officer and Chief Corporate Banking Officer during his time with Union Bank • Served in various other executive leadership roles at Union Bank, where he was employed for more than 30 years • Dr. Vivian S. Lee • SVP for health sciences and Dean of the medical school - University of Utah • Responsible for an annual budget of more than $2.4 billion • Leads a healthcare system comprising four hospitals, numerous clinical and research specialty centers, neighborhood health centers, an insurance plan, and more than 1.200 board certified physicians • Previously served as senior vice president and chief scientific officer of New York University Medical Center • Suren L. Gupta • Executive vice president of Technology and Strategic Ventures at Allstate Insurance Company • Responsible for Allstate’s information systems, technology, strategy, operations and processes • Oversees Allstate’s strategic ventures with companies that advance its innovation strategy • Previously served as executive vice president and chief information officer for consumer lending at Wells Fargo 19

Next Two Years: Growth Through Simplification and Focus 20 • Accelerate Positive Operating Leverage • Implement Technology Strategies • Increase the Return on and of Capital • Execute on our community bank model – doing business on a “local” basis

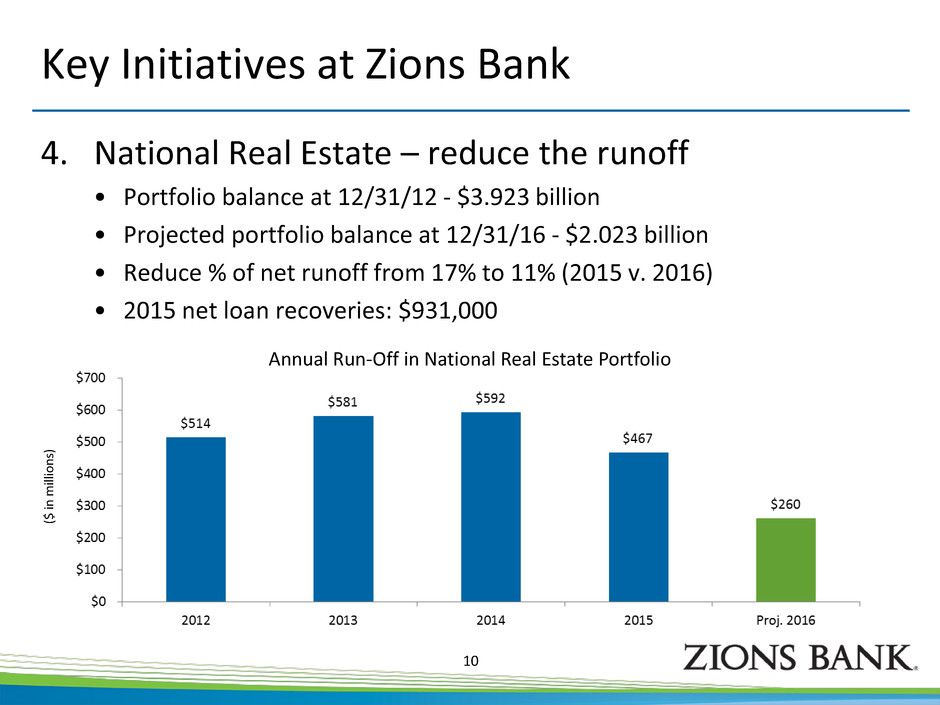

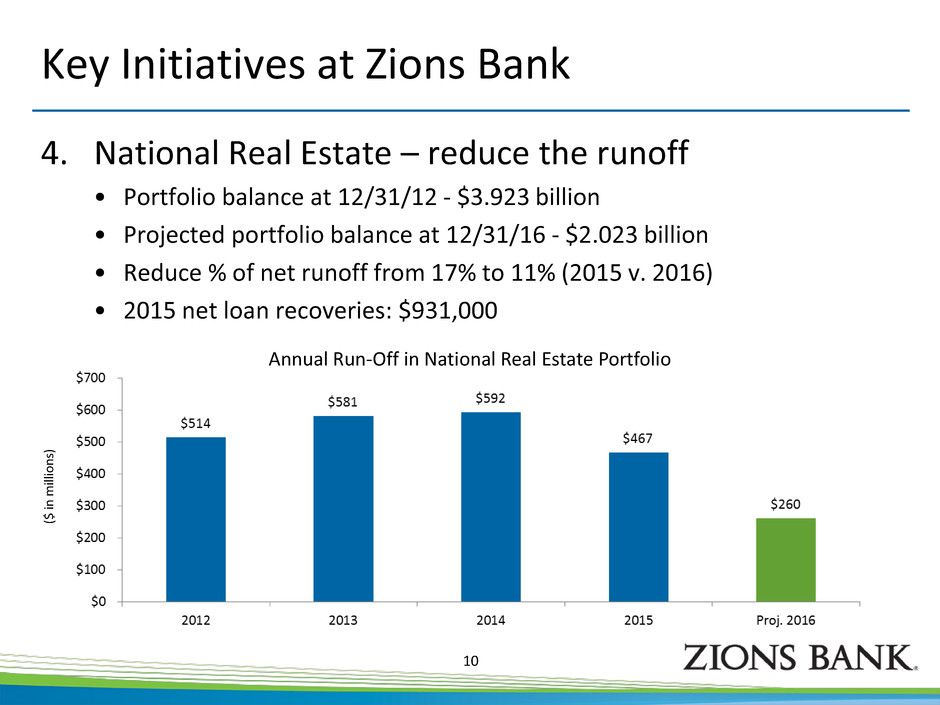

Next Two Years: Growth Through Simplification and Focus 21 • Accelerate Positive Operating Leverage Accelerate loan growth rates • Key drivers of acceleration include: Invest cash into medium duration securities Maintain mid-single digit growth rates in core fee income: • Stronger corporate product development • Enhanced reporting and accountability Maintain non-interest expenses at or below $1.6 billion through simplification Compensation: Tighter incentive compensation linked to achievement of articulated efficiency ratio targets Continued on next slide • Focus on market share gains in Treasury Management, Corporate Card, Mortgage Banking and Wealth • Improved focus on C&I, consumer lending, private banking • Decision making moved closer to the field • Significant productivity enhancements in retail, small business and mortgage banking pull through • Reduced attrition from National Real Estate Group • Charter consolidation • Consolidation of accounting & loan operations • Accelerated adoption of common practices • Enhanced financial reporting

22 Next Two Years: Growth Through Simplification and Focus • Implement Technology Strategies: Achieve substantial progress on core systems upgrade • Increase the Return on and of Capital: • Improvements in operating leverage and loan growth lead to stronger returns on capital • Improved risk profile and risk management should lead to better returns of capital • Execute on our community bank model – doing business on a “local” basis Expected Result: Achieve a substantially better efficiency ratio and stronger returns on assets and equity while upgrading the technology infrastructure and expanding upon an exceptional brand

Agenda 23 • Company Overview • Accomplishments and Strategic Outlook • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Risk Management • Credit Quality • Energy Portfolio • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

These changes are designed to: • Improve the customer experience (e.g., faster turnaround times) • Simplify the corporate structure and how Zions does business • Drive substantial positive operating leverage: + Increased revenue from growth in loans, deployment of cash to mortgage-backed securities, interest-rate swaps, and core fee income + Holding noninterest expense to below $1.6 billion in FY15 and FY16, slight increase in FY17 = Efficiency Ratio ≤ 70% in 2H15, ≤ 66% in FY16, and low 60s in FY171 24 Zions’ Major Announcement: The Efficiency Initiative 1 Assumes an additional 25 basis point fed funds rate increase by the end of 2017

25 The Efficiency Initiative Path to low 60% or Better Efficiency Ratio 76 % Low 60s FY14 Actual Normalized FY14 (1) Debt Reduction Savings from Operational, Technology and Charter Consolidation Balance Sheet Repositioning (e.g. MBS) Loan & Fee Income Growth Other Expense Increases (2) Pro Forma FY17 Efficiency Ratio and 50 bps of interest rate hikes Note: Savings from tech projects includes effect of increased depreciation after assets are placed into service. (1) Normalization: Securities Gains, Debt Extinguishment, Severance, Provision for Unfunded Commitments & FDIC-Supported Loans; (2) Includes normal salary increases, investment in growth businesses. Excl severance and related restructuring costs.

Efficiency Initiative Expense progress is tracking well 26 Noninterest Expense: • Commitment to hold expenses below $1.6 billion in 2015 (and 2016). • Status: On track Cost savings: • Commitment to achieve $120 million of gross savings by FY17 • Status: On track $0 $20 $40 $60 $80 $100 $120 $140 2017 Gross Cost Savings Goal 2015 Savings Realized Cost Saving Initiative Progress Operations -- Affiliate Banks Operations -- Bancorp Technology Charter Consolidation (In millions)

Efficiency Ratio: Sharp focus leading to substantial improvement 27 • The efficiency ratio improved to 69.8% (4Q15), from 74.1% a year ago. • Achieved the commitment of an efficiency ratio of less than or equal to 70% in 2H15. • Reiterating the commitment to drive the efficiency ratio to: • Less than or equal to 66% for 2016 • The low 60s for 2017 1) Efficiency ratio defined as noninterest expense adjusted for severance, other real estate expense, provision for unfunded lending commitments, debt extinguishment costs, amortization of core deposit intangibles, restructuring costs, expressed as a percentage of, the sum of fully-taxable equivalent net interest income, noninterest income excluding gains / losses on securities, and fair value and nonhedge derivative income. See the 4Q15 earnings release for reconciling table. 74.1% 72.1% 71.4% 69.3% 69.8% 55% 60% 65% 70% 75% 80% 4Q14 1Q15 2Q15 3Q15 4Q15 Noninterest Expenses as a Percentage of Net Revenue1 Less than 70% for 2H15

Agenda 28 • Company Overview • Accomplishments and Strategic Outlook • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Risk Management • Credit Quality • Energy Portfolio • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

Major Investments in the Business Substantial planning and effort has resulted in an on-track outcome 29 Chart of Accounts / Financial Reporting Simplification Credit Approval Front-End Work Flow System Enterprise Loan Operations Core System (FutureCore): Loan and Deposit Processing Systems Other Announced Organizational Alignments on Schedule

Key Benefits of Technology Upgrade One integrated loans, deposits, and customer system Easier integration with a significant reduction in system interfaces Real-time payments and transaction processing Quicker product development and deployment Expense reductions through greater efficiency Regular vendor provided system upgrades Modern, intuitive user-interface Systems Upgrade Overview-- FutureCore 30 batch batch online batch batch batch batch batch batch batch batch batch batch batch batch batch batch & online batch batch batch batch batch batch batch & online batch RCIF (Customer Information) Account Analysis Address Standardization (Code-1) Data Warehouse Norkom AML Kiting Inbound Returns (IRX) General Ledger Exceptions Express Retirement Reporting Relationship Pricing Overdraft Review (ORS) Statements, Notices & Forms Transaction Gateway batch batch batch batch & online batch & online batch & online batch & online batch & online batch batch & online batch batch & online batch batch & online batch & online batch & online batch & online Affinity Reporting Amegy Mortgage Bankcard (FDR) Chargeoffs Cash Management Combined Statements Collections ESB Web Services Card Management (Trans24) Fraudlink On-us Fraudlink Deposit Batch & Online batch & online batch & online batch batch batch batch batch Batch batch & online Batch online Flooring Leasing Mortgage Loans Internet Banking OFAC Vector 11 Safebox Zeus Service Desktop Wiresbatchbatch online online Online batch batch batch batch & online Settlement Manager batch Large Cash Reporting batch Tax Reportingbatch Voice Response Interface Details MICR batch Deposits (Checking, Savings, Money Market, OD Credit Lines) Account Recon Credit Bureaus FDIC Failed Bank ERD/ FAX ATM Mini Statements Click Tactics Dreyfuss sub-accounting Controlled Disbursements Microlink Banklink Metavante Risk Management Reg E Provider Pay Vector 3000 Finesort Treasury Internet Banking batch batch batch & online batch batch batch batch batch & online batch batch batch batch & online batch batch batch & online batch batch batch batch batch batch batch batch batch batch & online batch batch batch & online batch batch batch batch & online batch batch Consumer Loan Origination (APPRO) Collateral File Float Pricing online batch batch & online batch batch batch batch Interf c Details Time (CD’s & IRA’s) Esigna Frontier Harland Clark BaRT Retail Services NBA Amegy ACH Hart Hanks batch batch batch batch batch batch batch batch & online batch batch batch batch batch online batch batch batch batch batch batch online batch & online Interfac Details batch Base24 ATM/POS ACLS (Consumer Loans) batch & online batch batch batch batch batch batch batch batch batch batch MDM Risk Grade batch batch Patriot Officer Bar Code System Debt Cancellation Imaging Premier Insurance Tickler PMP (Experian) Payment Coupon Vendor batch batch batch batch & online Interface De il Shaw CL (Commercial Loans) batch & online batch & online batch batch batch batch batch batch batch & online batch batch Bloomberg (rate updates) batch batch batch Interface Details Online Online Online CLCS (Construction Loans) Interface Details Batch batch Dunn & Bradstreet batch batch batch batch batch Affiliate Banks Batch Common Integration Services Layer A count AnalysisAddress Standardization (Code-1) Data Warehouse Norkom AML Kiting General Ledger Retirement Reporting Statements, Notices & Formsbatch batch batch & online batch & online batch batch batch & online batch & online Affinity Reporting Amegy Mortgage Bankcard (FDR) Chargeoffs Cash Management Combined Statements Collections ESB Web Services Card Management (Trans24) Fraudlink On-us Fraudlink Deposit batch & online batch & online batch & online batch batch batch batch batch batch & online batch online Flooring Leasing Mortgage Loans Internet Banking OFAC Vector 11 Safebox Zeus Service DesktopWires batchbatch online online online batch batch batch batch batch & online Settlement Manager batch Large Cash Reporting batch Tax Reporting batch Voice Response MICR batch Account ReconCredit Bureaus FDIC Failed Bank ERD/ FAX ATM Mini- Statements Click Tactics Dreyfuss sub-accounting Controlled Disbursements Microlink Banklink Metavante Risk Management Reg E Provider Pay Vector 3000 Finesort Treasury Internet Banking batch batch batch batch batch batch & online batch batch batch batch & online batch batch batch batch Consumer Loan Origination (APPRO) Collateral File Float Pricing batch batch Esigna Frontier Harland Clark Retail Services NBA Amegy ACH Hart Hanks batch batch batch batch batch Base24 ATM/POS batch batch batch MDM Risk Grade batch Patriot Officer Bar Code System Debt Cancellation Imaging Premier Insurance Tickler PMP (Experian) Payment Coupon Vendor batch batch batch batch Bloomberg (rate updates) online batch batch Dunn & Bradstreet batch batch batch batch batch Affiliate Banks batch Integrated Core (CIF, Deposits, Loans) Interf De ailsbatch Commercial Loan Origination (Capital Stream) batch Current State– Six Instances Future State– One Instance FutureCore is a program initiated by Zions Bancorporation with board led third-party oversight to replace its core operating systems with TCS BαNCS from Tata Consultancy Services.

Systems Upgrade Benefits– Chart of Accounts 31 “Creating One Reporting Language” 2013 Functions 2017 Yes One General Ledger Yes 7 Uses Use of GL 1 Use Multiple Robust Reporting Platform Hyperion Inconsistent Data Standards Consistent Non-Existent LOB/Product Reporting* Robust Complex Regulatory and Period-End Closing Streamlined *Effective upon completion of FutureCore project.

System Upgrade Benefits– Credit LEAD 32 • One workflow system to originate and maintain loans across all commercial lending phases (new, renewal, modification, review) • Facilitates credit approval • Enhances data consistency • With auto-boarding…will require most data entry only once • Single system across all affiliates • Supports single credit policy • Promotes workflow best practices Financing Request is Submitted

System Upgrade Benefits– Loan Operations Consolidation 33 • Transition 15 affiliate centers to 2 • Will rely heavily on an effective affiliate “middle office” • Simplifies FutureCore implementation • Reduces complexity • Ability to support growth of banks in a more agile manner…scalable • Simplifies data consistency and regulatory reporting • Improves risk management with consistent practices • More discreet disaster recovery plan Detailed Analysis of Affiliates’ Loan Servicing Practices Develop practices for 2 centers and affiliate middle office Transition affiliates to centers…build out affiliate middle office • Amegy Bank May ‘15 • Nevada State Bank June ‘15 • Vectra Bank July ‘15 • National Bank of Arizona September ‘15 • California Bank and Trust October ’15 • Zions First National Bank October ‘15 All Affiliates currently transitioned to new operation centers April – September 2014 October 2014 – January 2015 April 2014 – October 2015 Test , Train, Transition to FutureCore March 2016 – September 2016

Agenda 34 • Company Overview • Accomplishments and Strategic Outlook • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Pre-Provision Net Revenue • Net Interest Income • Interest Rate Sensitivity • Capital Management • Financial Outlook • Risk Management • Credit Quality • Energy Portfolio • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

35 • This improvement has been driven by a focus on expense control and improved contribution from the investment portfolio • Looking forward, loan growth and improvement in non- interest income is expected to continue this positive trend Pre-Provision Net Revenue Building on Positive Momentum Pre-Provision Net Revenue has strengthened over the past year 13.9% -10% -5% 0% 5% 10% 15% 20% 25% F IT B ** Z IO N * C F G F R C H B A N MT B P B C T S N V A S B F H N E W B C K E Y B O K F C B S H B B T C M A S T I R F F M E R Year over Year PPNR Improvement Source: SNL Financial as of 4Q15 *ZION excludes $44.4 million related to debt extinguishment expense in 2014. **FITB reflects the 2015 sale of Vantiv.

Balance Sheet - Net Interest Income Expecting stronger loan growth in 2016 36 We expect headwinds in: • Energy, National real estate We are targeting mid- to high-single digit growth in: • Small and middle-market C&I, Residential mortgage & Consumer -20% -10% 0% 10% 20% C&I (ex Energy) Owner Occupied (ex NRE) C&D Term CRE (ex NRE) 1-4 Family National Real Estate Energy Other Total Year-over-Year Loan Growth C&I (ex Energy) 26% Owner Occupied (ex NRE) 14% C&D 5% Term CRE (ex NRE) 19% 1-4 Family 13% National Real Estate 6% Energy 6% Other 11% 2015 growth limited due to: • Disciplined underwriting • Concentration limits intentionally constraining growth of certain loan types • Adjustments to residential mortgage origination process Source: Company documents; NRE = National Real Estate Group, a division of Zions Bank that focuses on small business loans with low loan-to-value ratios, generally in line with SBA 504 program parameters. Other loans includes Leasing, Municipal, Home Equity, and other consumer

$0 $2,000 $4,000 $6,000 $8,000 $10,000 4Q14 1Q15 2Q15 3Q15 4Q15 Total Securities Other Securities Municipal Securities Small Business Administration Loan-Backed Securities Agency Securities Agency Guaranteed MBS Securities Balance Sheet - Net Interest Income Expecting continued investment portfolio growth 37 In Millions • Added $3.7 billion of securities during 20151 • Securities portfolio duration is relatively short, with limited extension risk: • Current: 2.9 years • 200 bps increase from current interest rates: 3.1 years • Expect to continue the reported 2015 pace of portfolio additions, noting that variations could occur between calendar quarters 1 based upon fair value of securities

Balance Sheet - Net Interest Income Deposit growth remains a key focus 38 In Millions • Properly priced core deposits are a key factor in both profitability and liquidity • Deposits continue to grow: • Noninterest-bearing deposits are up over 8% in the past year • Interest-bearing deposits are up over 4% in the past year • Loan to deposit ratio remains strong at just over 80% at 4Q 2015 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 4Q14 1Q15 2Q15 3Q15 4Q15 Total Deposits Noninterest-bearing Demand Savings & Money Market Time & Foreign

Source: SNL Financial as of 4Q15. *Risk adjusted NIM calculated as net interest income less net charge-offs divided by average earning assets. Revenue – Net Interest Income Net Interest Margin and Risk-Adjusted NIM Remain Strong 39 • NIM in 4Q15 expanded primarily due to recoveries of interest income and income from loans purchased from the FDIC in 2009; these items are not expected to be recurring • However, FOMC’s interest rate hike in December 2015 is expected to lift net interest income by a similar amount as the noted unusual items • Continue to expect substantial improvement in earnings if short-term interest rates increase 3.26% B B T F M E R E W B C Z IO N S N V MT B F R C H B A N R F S T I C B S H K E Y F IT B P B C T F H N A S B C F G B O K F C M A Net Interest Margin 3.14% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% E W B C Z IO N S N V F M E R F R C B B T MT B H B A N R F S T I F H N C B S H P B C T K E Y A S B F IT B B O K F C F G C M A Risk Adjusted NIM*

Source: SNL Financial as of 4Q15. Revenue – Net Interest Income Loan and Deposit Pricing Provide Strong NIM Foundation 40 • Strength in the net interest margin can be found in the core business, as yields on loans are among the highest in the peer group while the cost of total deposits is among the lowest • These factors are driven by the strength of ZION business mix, with particular emphasis on business banking and middle-market banking, complemented by retail banking 4.25% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% B B T E W B C Z IO N F M E R S N V M T B C B S H H B A N R F K E Y F H N P B C T B O K F S T I F IT B C F G A S B F R C C M A Average Loan Yield 0.10% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% C M A Z IO N R F C B S H F H N F R C M T B K E Y S T I H B A N B B T A S B F IT B F M E R B O K F C F G S N V E W B C P B C T Cost of Total Deposits

3.25% 3.22% 3.18% 3.11% 3.23% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 4Q14 1Q15 2Q15 3Q15 4Q15 Net Interest Margin (NIM) Revenue – Net Interest Income Loan yield has been relatively stable; margin higher in part due to mix shift 41 • 4Q15 NIM was 3.23% • If adjusted for income recoveries in 4Q15, the NIM would have been 3.18%. This adjustment makes the result more comparable to the prior quarter’s result of 3.11% • Mix shift: An increase in securities and loans, and a decrease in cash as a percentage of earning assets was a significant driver of the linked-quarter NIM expansion • Continued reduction of high-cost debt, completed in November 2015, was also a contributor • Relative to 3Q15, asset sensitivity was not a significant driver of NIM expansion in 4Q15 Loan Yield Securities Yield Interest Expense / Interest Earning Assets: Black Net Interest Margin Cash Yield: White [CATEGORY NAME] [PERCENTA GE] [CATEGORY NAME] 15% [CATEGORY NAME] 12% Earning Asset Mix

Revenue – Net Interest Income Loan pricing has been generally stable during the past year 42 3.64% 4.24% 3.87% 2.5% 3.0% 3.5% 4.0% 4.5% 4Q14 1Q15 2Q15 3Q15 4Q15 Portfolio Yield vs. Production Yield • Linked-quarter loan yield higher entirely due to recoveries of interest income • Yield essentially flat when adjusting for recoveries – still a positive sign • Coupon rate of new loan production (green) remained relatively stable at 3.64% • Production yields on larger loans improved somewhat more than the move in LIBOR • Volume of new production (not shown) was more concentrated in larger loans than the prior quarter (seasonal pattern) Loans HFI = Loans held for investment; the difference between the coupon and the yield is the net of amortizing fee income, partially offset by amortizing expense. Loan Portfolio HFI Yield Loan Portfolio HFI Coupon Loan HFI Production Yield

43 $0 $50 $100 $150 $200 $250 $300 $350 $0 $500 $1,000 $1,500 $2,000 $2,500 2012 2013 2014 4Q15 (Annualized) Wholesale Borrowings Profile Senior Debt Subordinated Debt Total Interest Expense Interest Expense on Debt Borrowings (In Millions) Annual Interest Expense (In Millions) Wholesale borrowings are down 65% since 2012, leading to a 78% reduction in related interest expense over that time Revenue – Net Interest Income Debt Reductions Driving Lower Interest Expense

Interest Sensitivity Profile is Being Actively Managed Moving Potential Income to Current Income 44 The movement of cash to liquid, fixed rate securities is increasing net interest income and reducing estimated asset sensitivity. * 12-month simulated impact using a static size balance sheet and a parallel shift in the federal funds rate and benchmark yield curves (i.e. US Treasuries and Libor/Libor swaps). “Slow” refers to an assumption that market rates on deposits will adjust at a more moderate rate (i.e. migration from DDA to interest-bearing deposits) than under the Fast scenario. Zions’ Asset-Liability Committee adopted a new interest rate risk model (shown here) in 4Q15, and therefore historical disclosures are not directly comparable. 9% 16% 0% 5% 10% 15% 20% 25% 1Q15 2Q15 3Q15 4Q15 Net Interest Income Sensitivity Change in Net Interest Income Fast Slow

45 Deconstructing Interest Rate Sensitivity Deposit Repricing • In addition to changes in interest-bearing deposit rates, ZION assumes large movements from noninterest-bearing demand deposit products to interest-bearing deposit products as interest rates change Assumptions regarding the reaction of core deposit behavior to changes in market interest rates significantly impact interest rate risk estimates Effective Deposit Beta +200 bp shock Fast Slow Interest-Bearing 77% 55% Total Deposits 46% 31% • The assumed movement of demand deposits significantly increases the effective beta of interest-bearing deposits, and is the key driver of the difference between the “fast” and “slow” interest rate sensitivity estimates • In the 2004-2005 interest rate cycle, Zions’ total deposit beta was approximately 20% for the first 200 bps Measured from 1Q04 (immediately prior to the increases in the Federal Funds rate by the FOMC) to the average of 1Q05 and 2Q05 when the increases in rates averaged 200 bps. If lagged by six months, the total deposit beta increased to approximately 40%. “Beta” refers to the increase in the cost of deposits relative to the increase in the FF rate.

Deconstructing Interest Rate Sensitivity Asset Repricing 46 Earning Asset Basis Volume Investments Fed Funds $ 6.7 Prime 1.9 Loans LIBOR 13.2 Prime 6.9 Swaps & Rate Floors1 (4.4) Net repricing < six months $24.3 • Approximately 44% of earning assets (net) reprice within six months • The movement of key repricing indices has not always been predictable • Uncertain outcomes occur when these indices move in non-traditional ways The impact of “negative interest rates” on profitability is difficult to estimate: In addition to the reaction of core deposit rates and volumes to changes in short-term interest rates, the repricing basis of earning assets will also drive the revenue impact of rate changes • Relationships between repricing indices and deposit rates and related deposit fees may deviate substantially from historical averages • Relationships between repricing indices and loan yields / floors may deviate substantially from historical averages 1 Approximately $3 billion of loans have floors that are at or “in the money” (the coupon is greater than the indexed note rate); this balance differs at varying market interest rates, and has been gradually decreasing over time primarily due to the competitive pricing landscape.

47 Source: SNL Financial; most recent available data. Capital Management Opportunity for Improved Shareholder Payout ZION capital ratios are among the highest while capital return is the lowest among peers Our focus on revenue improvements and risk positioning are designed to improve our return on capital and our return of capital More active capital management has been constrained by stress test results 18% 0% 20% 40% 60% 80% 100% 120% 140% B O K F S N V F H N R F A S B C F G K E Y P B C T F IT B C B S H C M A H B A N S T I F M E R B B T MT B E W B C F R C Z IO N Common Payout Ratio 12.2% 0% 2% 4% 6% 8% 10% 12% 14% Z IO N B O K F C F G C B S H MT B K E Y R F F R C F M E R C M A E W B C F H N S N V B B T S T I F IT B H B A N P B C T A S B Common Equity Tier 1 Ratio Subject to CCAR Not Subject to CCAR

Actively working toward an improved result in the annual CCAR stress tests Expected Improvements: • CDO Sales1 • Stronger starting capital position • Higher base pre-provision net revenues Possible Headwinds: • Stress in Oil & Gas portfolio, including impact on overall classified loans • Negative interest rates in the FRB Severely Adverse scenario, and stated expectations from the Federal Reserve: “Compared with the 2015 severely adverse scenario, weaker economic conditions in the 2016 severely adverse scenario may be expected to result in higher credit losses on a wide range of loans and securities…..Negative short-term interest rates may be expected to reduce banks’ net interest margins and ultimately, to lower PPNR.” Source: 2016 Supervisory Scenarios for Annual Stress Tests Required under the Dodd-Frank Act Stress Testing Rules and the Capital Plan Rule; January 28, 2016 48 1 Assumes an impairment charge in 2015 Federal Reserve modeled results attributable to the CDOs Capital Management CCAR Stress Testing

Next Four Quarter Outlook Summary Relative to 4Q15 Results Financial Measure Outlook Comment Loan Balances Slightly to Moderately Increasing • Expect strengthening growth in residential mortgage (mostly short duration ARMs) and general C&I, partially offset by continued attrition from National Real Estate and Energy portfolios Net Interest Income Increasing • Expect 1Q16 to be similar to the reported 4Q15A, driven by asset sensitivity, loan and security growth, partially offset by one fewer day of interest income and no anticipated large interest income recoveries. • Expect continued increases in loans and securities to result in increased net interest income Provisions Increasing • On average, quarterly provisions likely to be moderately higher relative to 4Q15A, reflecting moderate total net charge-offs (30-35 bps), loan growth, and expected downgrades of energy-related loans Noninterest Income Slightly to Moderately Increasing • Excluding securities gains/losses and fair value & nonhedge derivative income. • Dividends from federal agencies declining due to charter consolidation and FAST Act (transportation, H.R. 22) Noninterest Expense Stable • Targeting NIE of less than $1.6 billion in FY16. • 1Q16 NIE expected to be slightly above $400 million due to seasonal factors • Includes continued elevated spending on technology systems overhaul Preferred Dividends Declining • $180 million tender offer completed in 4Q15 reduces preferred dividend expense in 2016 by approximately $10 million, or about $0.05/share annually compared to FY15 49

Agenda 50 • Company Overview • Accomplishments and Strategic Outlook • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Risk Management • Credit Quality • Energy Portfolio • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

Substantially Completed Buildout of Risk Management Infrastructure 51 Key Takeaways: • Strong concentration risk management • Strong oversight of areas that are growing faster than expected levels, or of “hot spots” – resulting in detailed white papers and reporting to the Board • Strong subject matter experts in CRE / Consumer / C&I • Supply / demand outlook for CRE, by major MSA • Risk Matrix: Dollar limits on different industries, depending upon the cyclicality of such industries • Training program for lenders

Enhanced and Reorganized Risk Management Staffing • Increased risk management staffing with expertise in specific areas including: • Investments • Operations • Model management • Credit 52 2012 2016

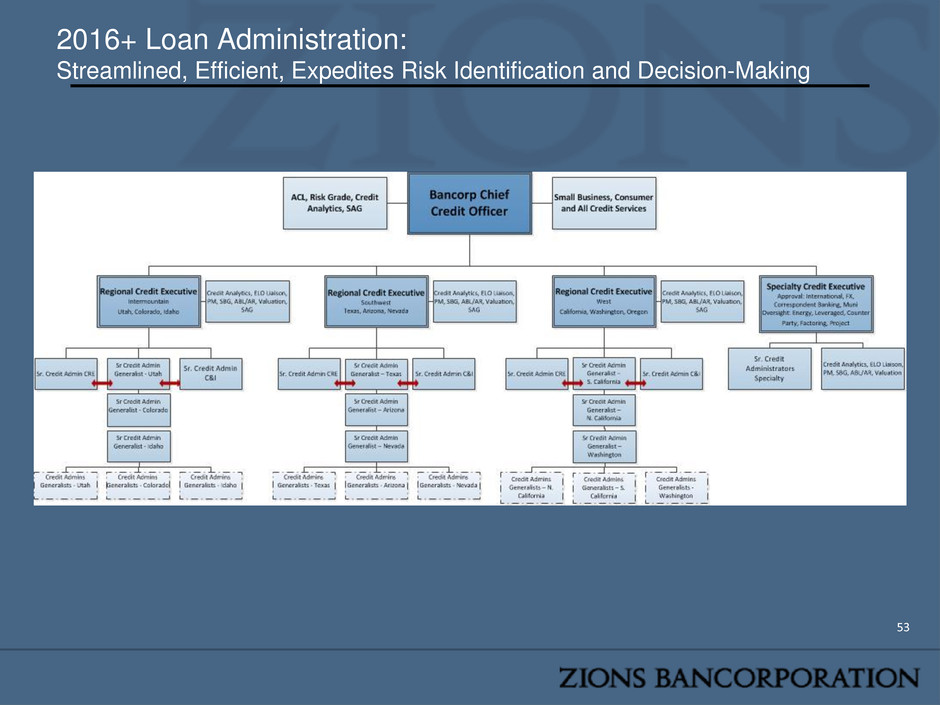

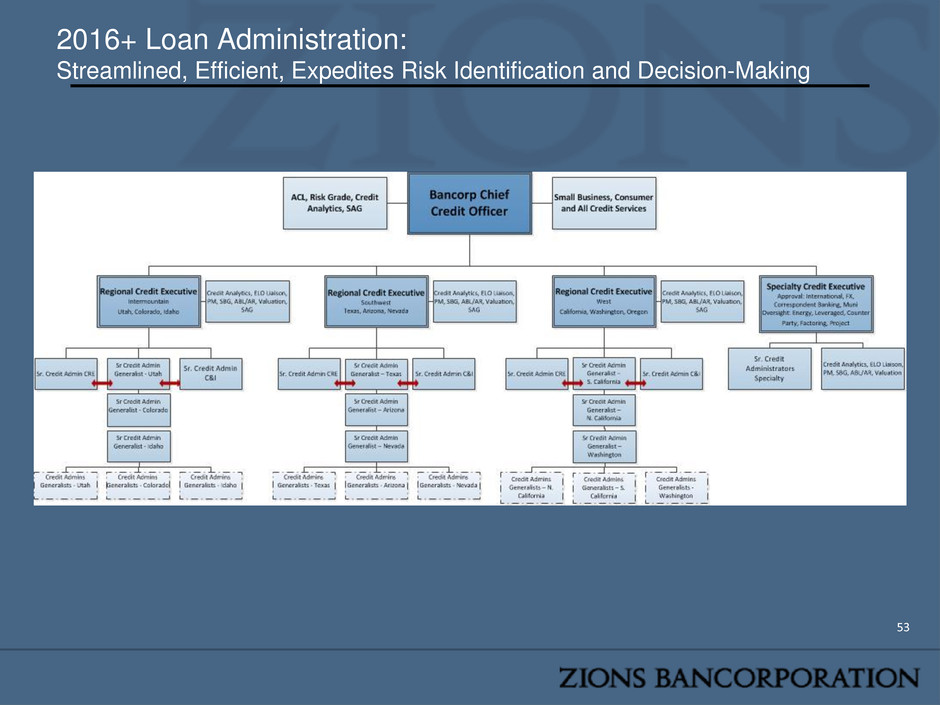

2016+ Loan Administration: Streamlined, Efficient, Expedites Risk Identification and Decision-Making 53

Risk Management Emphasis / Accomplishments • Further Refinements in: • Risk Appetite Framework • 1st Line of Defense • Accountability for Risk Management with EMC Performance • Implementation of “White Paper” Process: • Oil & Gas (example provided) • Main CRE asset classes completed (Multifamily, Office, Retail, Industrial) – Gaming and Charter Schools also covered 54 • Risk Ratings used to inform Portfolio Risk Limits/Obligor Hold Limits, to aid portfolio concentration analysis, and to influence underwriting criteria I II III IV I II III IV I II III IV 1 ### ### ### ### ### ### ### ### ### 2 ### ### ### ### ### ### ### ### ### 3 ### ### ### ### ### ### ### ### ### 4 ### ### ### ### ### ### ### ### ### 5 ### ### ### ### ### ### ### ### ### 6 ### ### ### ### ### ### ### ### ### 7 ### ### ### ### ### ### ### ### ### 8 ### ### ### ### ### ### ### ### ### 9 ### ### ### ### ### ### ### ### ### 10 ### ### ### ### ### ### ### ### ### PD Grade MULTI PROJECT/PSOR HOLD LIMITS Asset Class Risk Rating *Use Caution *Use Caution *Use Caution Asset Class Risk Rating CRE - SINGLE PROJECT HOLD LIMITS C&I - SINGLE PSOR HOLD LIMITS Asset Class Risk Rating

Agenda 55 • Company Overview • Accomplishments and Strategic Outlook • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Risk Management • Credit Quality • Energy Portfolio • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

Credit Quality Executive Summary 56 Key Takeaways • Credit Trends are still strong by historical measures • Weakness is only noticeably present in energy lending • Net charge-offs expected to be 30-35 basis points in 2016 • Still below the through-the-cycle average for ZION • About in line with peer banks • Close monitoring and active workout management with energy customers to find least cost solution

Overall Credit Quality Trends Credit quality ratios are solid, with NPAs+90s at 0.95% of loans; NCOs for 2016 expected to be 30-35 bps, still very low compared to peer quarterly median for the last decade of 48 bps. 57 -1% 0% 1% 2% 3% 4% 5% 6% 7% -$500 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 1Q 0 6 4Q 0 6 3Q 0 7 2Q 0 8 1Q 0 9 4Q 0 9 3Q 1 0 2Q 1 1 1Q 1 2 4Q 1 2 3Q 1 3 2Q 1 4 1Q 1 5 4Q 1 5 Nonperforming Assets (Includes 90+ Days Past Due) ZION NPA+90 DPD (left) Zions ratio (right) Peer Median ratio (right) -1% 0% 1% 2% 3% 4% 5% 6% 7% -$500 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 1Q 0 6 4Q 0 6 3Q 0 7 2Q 0 8 1Q 0 9 4Q 0 9 3Q 1 0 2Q 1 1 1Q 1 2 4Q 1 2 3Q 1 3 2Q 1 4 1Q 1 5 4Q 1 5 Net Charge-offs: As Reported, With Construction & Land Development >20% of Zions’ Loans in 2008 Ratios Annualized, Percentage of Average Loans ZION NCOs (left) Zions ratio (right) Peer Median ratio (right) In Millions In Millions Source: SNL Financial

$0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 Classified Loans (CRE and C&I), EXCL. Energy Loans Classified Loans Classified Loan Inflows (Qtly) Credit Quality: Non-Energy Loan Performance vs. Energy Loan Performance Continued strength in non-energy classified loans, better by 20% in 2015 58 (In billions) $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 4Q14 1Q15 2Q15 3Q15 4Q15 Classified Energy Loans • Excluding energy loans, classified commercial loans continued to improve throughout 2015 • Non-energy classified loan inflows were generally stable throughout the year • Classified energy loans increased throughout the year due largely to the deterioration of commodity prices Data is based upon loan balances

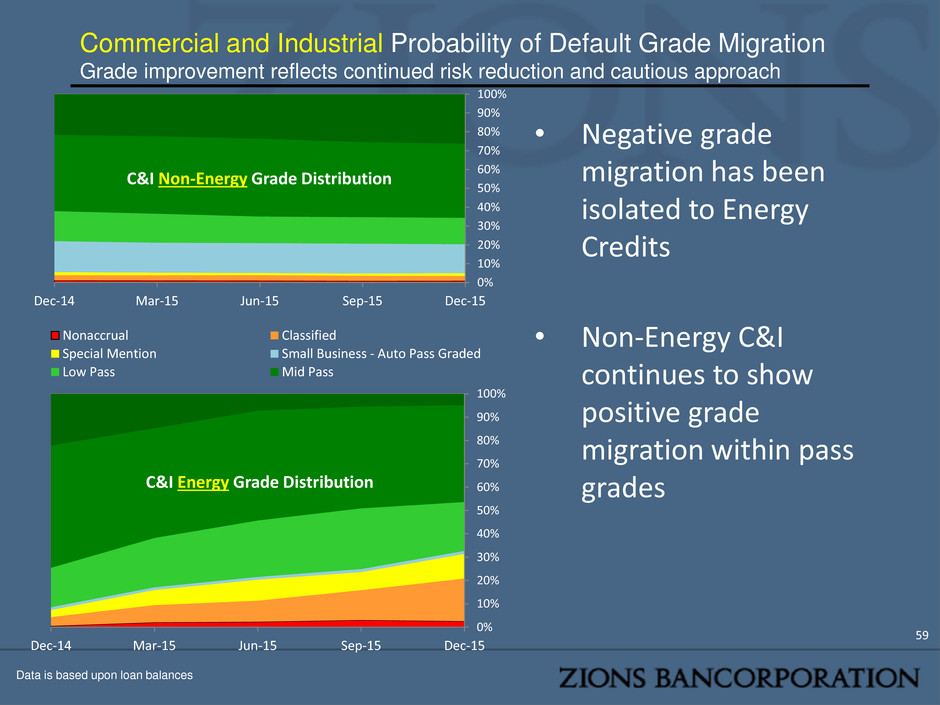

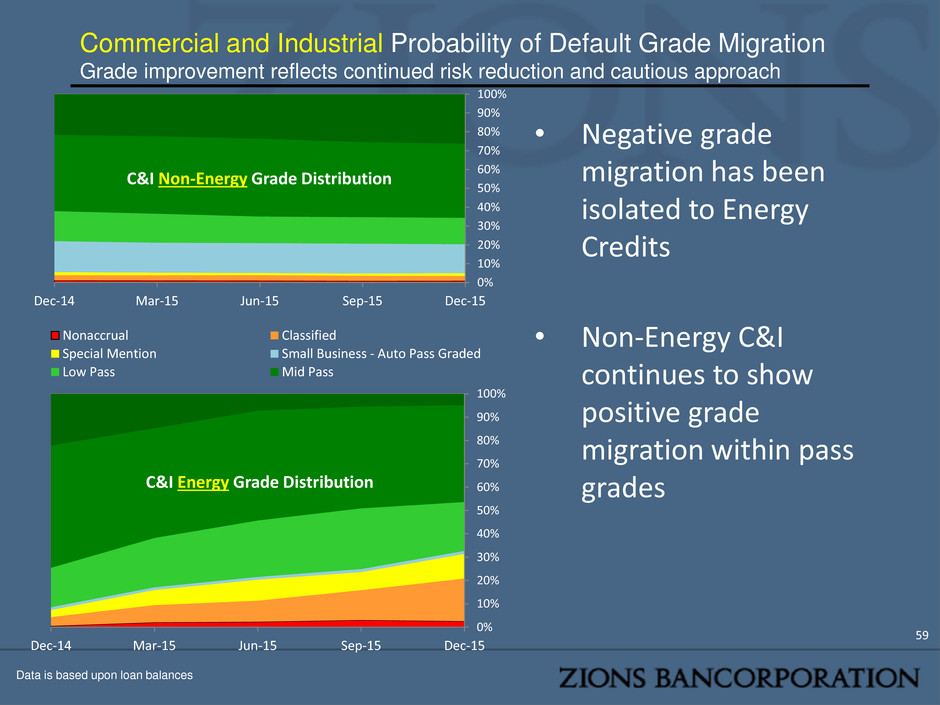

Commercial and Industrial Probability of Default Grade Migration Grade improvement reflects continued risk reduction and cautious approach 59 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 C&I Energy Grade Distribution 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 C&I Non-Energy Grade Distribution Nonaccrual Classified Special Mention Small Business - Auto Pass Graded Low Pass Mid Pass • Negative grade migration has been isolated to Energy Credits • Non-Energy C&I continues to show positive grade migration within pass grades Data is based upon loan balances

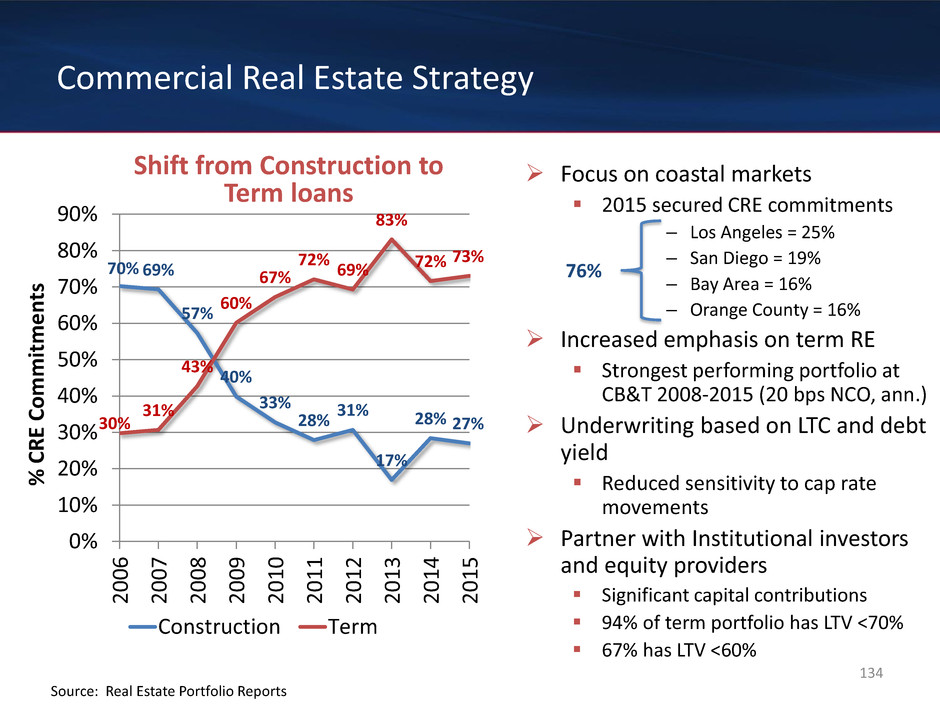

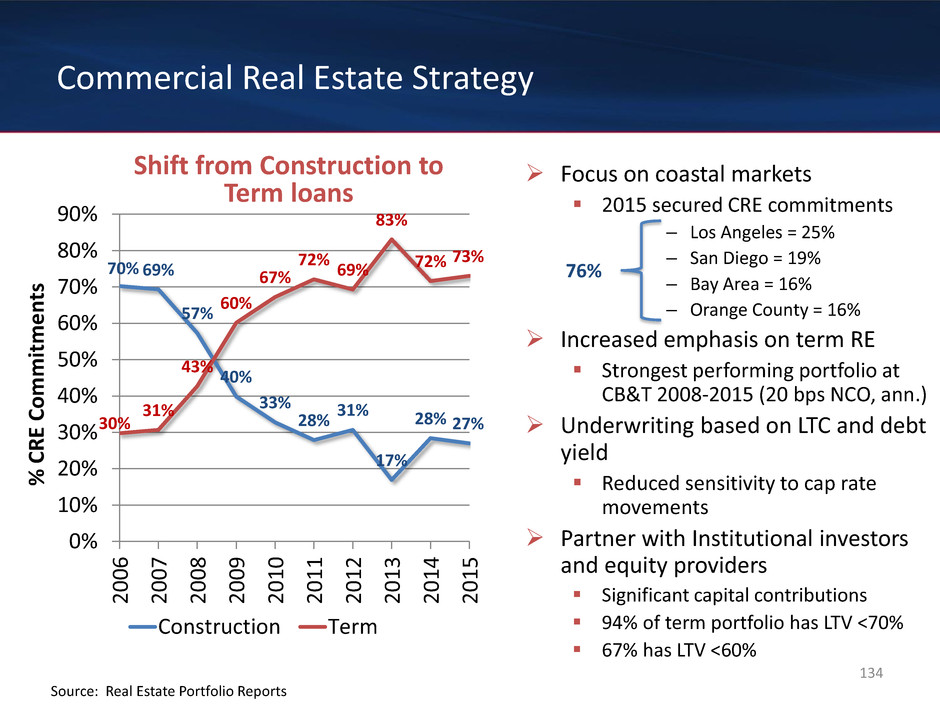

Commercial Real Estate PD Grade Migration Risk reduction and grade improvement reflects continued cautious approach 60 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Nonaccrual Classified Special Mention Small Business - Auto Pass Graded Low Pass Mid Pass High Pass • No observable deterioration in credit quality, even within pass grade buckets • Approximately 30% of CRE loans are or have similar credit characteristics to investment grade Data is based upon loan balances

Consumer Lending Stability in delinquency trends and credit scores (shown on slide 86) 61 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 90+ DPD 30-89 DPD Data is based upon outstanding balances; consumer loans defined as 1-4 family mortgage, home equity credit lines, and other consumer products such as credit cards, auto loans, etc. Peer data via SNL Financial, 4Q15 • Low delinquency level on consumer loans • No significant change in 2015 from 2014 levels and trends • Superior loss track record -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% CM A EW B C FR C ZIO N PB C T B O K F A SB SN V FH N H B A N M TB FM ER ST I R F FIT B CF G KE Y B B T C B SH Consumer NCOs / Avg Loans Last 12 Months

Reserve Coverage: Total and Excluding Energy Reserve coverage is strong relative to peers 62 -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% ZIO N A SB FIT B R F M TB KE Y CM A ST I B O K F H B A N CF G FH N C B SH EWB C SN V B B T FM ER PB C T FR C Total Allowance for Credit Losses / Loans Allowance for Credit Losses / Loans Net Charge-Offs 0.0% 0.5% 1.0% 1.5% 2.0% FI TB M TB K EY ZIO N A SB ST I R F H B A N CF G FH N CB SH EW B C SN V C M A B B T FM ER BO K F P BC T FR C Total Allowance for Non-Energy Credit Losses / Non-Energy Loans • Zions has the strongest allowance for credit losses of its peers • Excluding energy loans and the allowance for energy losses, Zions still ranks in the strongest quartile of peers

Agenda 63 • Company Overview • Accomplishments and Strategic Outlook • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Risk Management • Credit Quality • Energy Portfolio • Total Energy Portfolio Deep Dive • Upstream / Exploration & Production Portfolio Deep Dive • Energy Services Portfolio Deep Dive • Derivative Impact: Houston Economy • Derivative Impact: Commercial Real Estate in Houston • Derivative Impact: Consumer Lending in High Oil & Gas Employment Counties • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

Energy Lending: Executive Summary 64 Loss Content Manageable Relative to Earnings • No capital erosion expected – losses absorbed through earnings • Strong reserve / loan ratio The reserve for loan losses for the oil and gas portfolio is greater than 5% of oil and gas related loans Loan attrition (amortization, mergers, asset sales, recapitalizations, etc.) expected to reduce balances Strong underwriting at origination paying dividends today • Below-peer growth rate in 2013 and 2014 due to underwriting and risk management standards at Zions • Upstream: Collateral coverage remains sufficient to cover balances and handle additional borrowing base reductions • Services: Low cash-flow leverage at origination Low balance sheet leverage at origination Many Services loans are revolving lines of credit with collateral (accounts receivable, inventory) backing them

Energy Lending: At a Glance 65 • O&G (“O&G”) balances represents 6.5% of total balances. • Oil & Gas balances decreased 15% during 2015. • Criticized and classified balances increased to 31% and 20%, respectively, as of 12/31/15. • During the last cycle, criticized and classified peaked at 29% and 21% of balances. • Nonaccrual balances represented 2.6% of total O&G balances • O&G net charge-offs were $42 million during 2015. Upstream 31% Midstream 23% Downstream 5% Other non- service 2% Oilfield Services 30% Energy Service Manufacturing 9%

$0 $200 $400 $600 $800 $1,000 $1,200 $1,400 4Q14 1Q15 2Q15 3Q15 4Q15 Loan Balances by Energy Segment Upstream Services Other Oil & Gas Portfolio Trends Steadily declining balance trend in upstream and energy services 66 $0 $100 $200 $300 $400 $500 Classifieds by Energy Segment In Millions In Millions $0 $100 $200 $300 $400 $500 4Q14 1Q15 2Q15 3Q15 4Q15 Nonaccruals by Energy Segment Allowance For Credit Losses Upstream Services Other

Oil & Gas Portfolio Criticized Changes Strong resolutions offsetting much of the inflow; substantial favorable resolutions 67 • Zions is working through numerous amendments and restructurings; options include • Covenant relief in exchange for commitment reductions • Equity contributions • Workout plans • While Classified and Criticized levels continue to increase, these increases have been partially offset by favorable resolutions (upgrades payoffs or reduced balances) • More than $700 million of favorable criticized loan resolutions in 2015 • Favorable resolutions in 2015 equaled more than 300% of the beginning criticized balance • Favorable resolutions in 2015 equaled more than 50% of the criticized loan inflows • Favorable resolutions equaled nearly 17 times the charged-off balance

Oil & Gas Portfolio Key Actions to Mitigate Risk 68 Following are representative key actions taken to mitigate risks in the O&G portfolio: – Active and regular discussions with borrowers about reduction of risk and deleveraging – Corporate Credit Risk in conjunction with Executive Management completing quarterly in person and intensive portfolio reviews and sensitivity testing. – Detailed review of O&G portfolio completed monthly by the Amegy team and Corporate Credit, including loan-level reviews, sensitivity analysis of significant borrowers and risk rating accuracy. – Developed several different analysis methods to estimate potential loss ranges based upon different potential levels of West Texas Intermediate (“WTI”) oil prices per barrel. – Reduced O&G portfolio concentration limits from 100% of Bancorp Risk Based Capital to 85% with a target of 75% of Risked Based Capital. – Added additional staffing for upstream engineering (reporting to Credit) responsible for monitoring the engineering data provided to the bank by outside petroleum engineering consultant. – Heightened supervision related to potential Commercial Real Estate and Consumer knock-on risks.

Agenda: Exploration & Production Executive Summary 69 • Multiple “haircuts” on oil / gas values and commodity prices to arrive at borrowing base. • Semi-annual borrowing base redeterminations and sensitivity testing to ensure proper equity cushion throughout the life of the loan. • The O&G price deck has been lowered nine times since December 2014, of which five were from 8/3/15 through 1/19/16, given rapidly changing oil and gas prices. • Collateral coverage remains acceptable. • Conservative underwriting at origination and active management through the redetermination process has assisted in managing risk.

Example of Upstream (Reserve-Based) Underwriting 70 Typical Oil & Gas Reserve-Based Loan $100 - E&P company’s PV of oil & gas reserves using current NYMEX prices, discounted at a 9% rate (“PV9”) $ 90 - Apply “bank price deck” (generally ~90% of NYMEX) to determine collateral value. $ 77 - Zions’ risk-adjusted value of reserves (e.g. Zions applies discounts to non-producing reserves) $ 54 - Loan commitment amount (30% haircut if 25%+ of reserves are hedged) $ 46 - Loan commitment amount (40% haircut if less than 25% hedging) $ 30 - Loan balance outstanding amount (average of 60% in 2015) Note: Initial, unrisked collateral value is based on engineering firm assessment of oil/gas reserves. For lending purposes, no more than 25% of the collateral may be comprised of non-producing reserves. Cash flows from the reserves are calculated by employing engineer’s projected volumes, bank oil/gas price deck and actual operating costs, then converted to present value using a 9% discount rate. In millions

$- $20 $40 $60 $80 $100 $120 $140 $160 M ar -0 0 Oc t- 0 0 M ay -0 1 D e c- 0 1 Ju l- 0 2 Fe b -0 3 Se p -0 3 A p r- 0 4 N o v- 0 4 Ju n -0 5 Ja n -0 6 A u g- 0 6 M ar -0 7 Oc t- 0 7 M ay -0 8 D e c- 0 8 Ju l- 0 9 Fe b -1 0 Se p -1 0 A p r- 1 1 N o v- 1 1 Ju n -1 2 Ja n -1 3 A u g- 1 3 M ar -1 4 Oc t- 1 4 M ay -1 5 D e c- 1 5 Ju l- 1 6 Fe b -1 7 Se p -1 7 A p r- 1 8 N o v- 1 8 Ju n -1 9 Ja n -2 0 A u g- 2 0 M ar -2 1 Oc t- 2 1 Zions’ Price Deck v. NYMEX Oil 12-mo. Fwd Strip Zions Base Zions Sensitivity NYMEX 71 Price Deck: Consistently conservative vs. 12-month futures strip; strong allowance for credit losses informed by sensitivity case NYMEX Historical 12-Month Oil Futures Strip (Average of next 12 monthly futures contracts) NYMEX Forward 12-Month Oil Futures Strip Dollars per barrel As of January 2016. Due to the average of 12 months of futures, the current price may be above or below the current one-month contract

Upstream Collateral Coverage Distribution Strong collateral coverage of upstream borrowers; built to withstand further shocks 72 • Upstream commitments reduced approximately 20% during 2015 due largely to the borrowing base redetermination process • Since 12/31/14 there have been six borrowing base deficiencies as a result of the borrowing base redetermination process • Three of these have been cured via company sale, debt reduction from cash flow or the pledge of additional collateral (letter of credit) • We have a high degree of confidence that two of the remaining three will be resolved by mid-2016 • One of the deficiencies may take longer to resolve; however, the borrower is cooperating and is willing to consider all options to resolve the deficiency • Generally speaking, borrowing bases have decreased less than the market may have expected • Although average oil prices fell ~50% in 2015, the impact has been offset by • Increased reserve additions, • Commodity hedging • Expense reductions (approximately 2/3 from service company price reductions, 1/3 from efficiency gains)

Upstream Collateral Coverage Distribution Strong collateral coverage of upstream borrowers; built to withstand further shocks 73 • We use multiple discounts in our underwriting process. • Unrisked Reserves, Price-Deck Adjusted: Bank Price Deck applied to unrisked, proven oil and gas reserves. • Risked Reserves and Price-Deck Adjusted: Zions’ price deck applied to proven oil and gas reserves which have been adjusted to account for the uncertainty of new production volumes and the uncertainty of converting non- producing and undeveloped reserves to producing status. • While internal underwriting using Risk- Adjusted analysis may cause loans to be internally criticized or classified, on an un- risked basis collateral coverage exists. • Borrowers with satisfactory advance reserve-based loan advance rate may be classified due to higher overall leverage levels due to the presence of second lien or unsecured debt. In Millions 0 200 400 600 800 1,000 1,200 < 60% 60% - 70% 70% - 80% 80% - 90% 90% - 100% > 100% Upstream Commitments As a Percent of Collateral Value Unrisked Reserves, Price-Deck Adjusted Pass Criticized 0 200 400 600 800 1,000 1,200 < 60% 60% - 70% 70% - 80% 80% - 90% 90% - 100% > 100% Upstream Commitments As a Percent of Collateral Value Risked Reserves and Price-Deck Adjusted Pass Criticized

Upstream Deep Dive: Takeaways 74 • Balances expected to continue to decrease during the year as borrowers control operating expenses and capital expenditures, using free cash flow for debt reduction. • Commitments also expected to decrease during 2016 given borrowing base redeterminations utilizing lower forecast oil and gas bank price deck. • Companies right-sizing second lien or unsecured debt while senior- secured reserve-based loans remain protected. • Collateral coverage remains acceptable. • Conservative underwriting at origination and active management through the redetermination process has assisted in managing risk.

Energy Services Lending Executive Summary 75 • Low Leverage at origination • Low cash-flow leverage at origination • Low balance sheet leverage at origination: higher probability of recapitalization from investors if needed • Cash flows sensitized at underwriting; loan size based upon sensitized cash flow ratios • Diversified portfolio of services • Primary exposure to firms operating in multiple exploration basins and with diverse customer bases • Minimal exposure to firms lead by inexperienced management / private equity teams or firms focused on early stage exploration related services • Collateral and Guarantor / Sponsor Support • Many Services loans are revolving lines of credit with collateral (accounts receivable, inventory) backing them • Generally guarantor support on smaller loans • Generally private equity sponsors or public companies on larger loans

76 Services Companies: Low Leverage Very conservative cash flow leverage at underwriting, strong balance sheet capitalization • Services underwriting standards have been conservative at origination • Typical total leverage of approximately 1.5x debt / EBITDA • Aggregate services portfolio remains well capitalized, with equity accounting for 58% of total capitalization • Commitments and funded debt levels are expected to reduce further over the next several quarters due to • Working capital contraction, • Capital contributions from sponsors, • Equipment sales • Refinancings Based on the most recent financial statements provided by Zions’ customers covering 90% of total exposure. 58% 42% 0% 20% 40% 60% 80% 100% Services Capitalization Debt Equity

77 Segmenting the Services Portfolio Larger corporate loans vs. more granular, guarantor-supported deals • Corporate Energy Services: • Handled by dedicated team of energy service specialists • Public companies (32%) • Owned by energy service-focused private equity groups (51%), • Larger privately held corporate entities (17%). • Commercial Energy Services: • Direct servicing of O&G industry handled by middle market lenders across the Bancorp. • Subject to same credit policies and approval process. • Generally more granular exposure levels • Generally secured with personal guarantees • Additional Energy Services Exposure: • Non-direct servicing identified as having revenue concentration to O&G industry • Generally more granular exposure levels • Generally diversified revenue streams across multiple industries, but could experience stress given individual levels of reliance on O&G • Generally secured with personal guarantees 0 200 400 600 800 1,000 1,200 Energy Services Balances by Key Segment Corporate Energy Services Commercial Energy Services Additional Energy Services Exposure In Millions

78 Oilfield Services Deep Dive • Revolving debt: • 65% of services commitments • 36% of balances • Revolver utilization was 30% • Generally borrowing base governed unless to large corporate or public companies. • Non-formula revolvers generally subject to asset coverage test or other controls • Term debt: • 35% of services commitments • 64% of balances • Typically 5-year amortizations • 60-70% original advance rate • Collateral: 88% of commitments and 95% of balances are secured, primarily by accounts receivable, inventory and equipment. 64% 35% 36% 65% 0 500 1,000 1,500 2,000 Balance Commitment Services by Loan Type Revolving Term In Millions

79 Corporate Energy Services Deep Dive • Highly Impacted: • Providing completion and production services or equipment manufacturers • Typically already experiencing pressure; likely to continue to be stressed as long as commodity prices remain low • Moderately Impacted: • Offshore services and diversified service companies • Typically more protected from short-term commodity prices due to longer-term industry segments and greater exposure to production versus exploration. • Will become more stressed as commodity prices remain low. • Insulated: • Long term contracts and/or the ability to appropriately scale down with the market • Includes infrastructure services primarily to the Midstream sector 0 200 400 600 800 1,000 1,200 Highly Impacted Moderately Impacted Insulated Corporate Energy Services Breakout Commitment Balance In Millions

Oilfield Services Deep Dive: Takeaways 80 • Services is actively managed by a dedicated team of oilfield service specialists in a unit formed in 1997 with strong executive management depth and experience across several historical commodity cycles. • Services underwriting standards have been conservative at origination: • Typical total leverage of 1.5x to 2.0x • Equity capitalization of at least 50% • Generally maximum 5-year amortization of term debt • Many service companies are often either publically traded companies or backed by energy focused private equity groups.

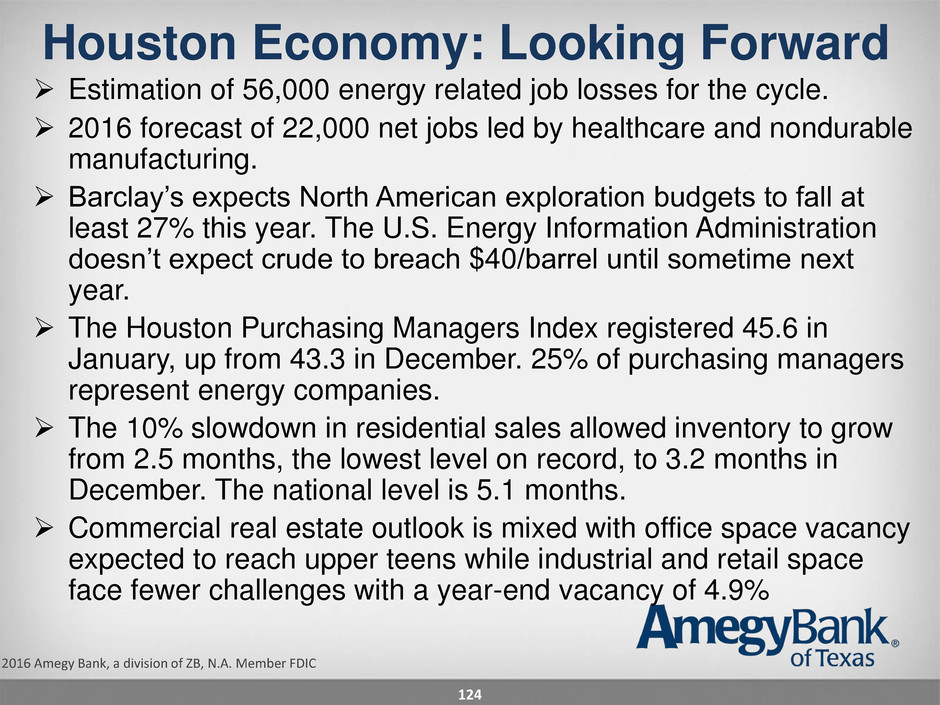

Stepping Back: Houston Economic Data: Unemployment remains in line with national levels; housing indicators show healthy volume and “seller’s market” inventory levels (<5 months of supply); businesses are less optimistic than on a national level 81 Source: Bureau of Labor Statistics, Bloomberg, Texas A&M University Real Estate Center PMI is Purchasing Managers Index. PMI is an indicator of the economic health of the manufacturing sector. The PMI Index is based on five major indicators: new orders, inventory levels, production, supplier deliveries, and the employment environment. 0 1 2 3 4 5 6 0 10,000 20,000 30,000 40,000 50,000 1H12 2H12 1H13 2H13 1H14 2H14 1H15 2H15 Houston Home Sales and Inventory Home Sales (Left) Months Inventory (Right) 4.9% 0% 2% 4% 6% 8% 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 2Q 1 5 3Q 1 5 4Q 1 5 Houston Unemployment Rate National Unemployment Rate: 4.8% 11.8% 0% 2% 4% 6% 8% 10% 12% 14% 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 2Q 1 5 3Q 1 5 4Q 1 5 Houston Employment Growth National Employment Growth: 8.5% 43.3 0 10 20 30 40 50 60 70 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 2Q 1 5 3Q 1 5 4Q 1 5 Houston PMI National PMI: 48.2

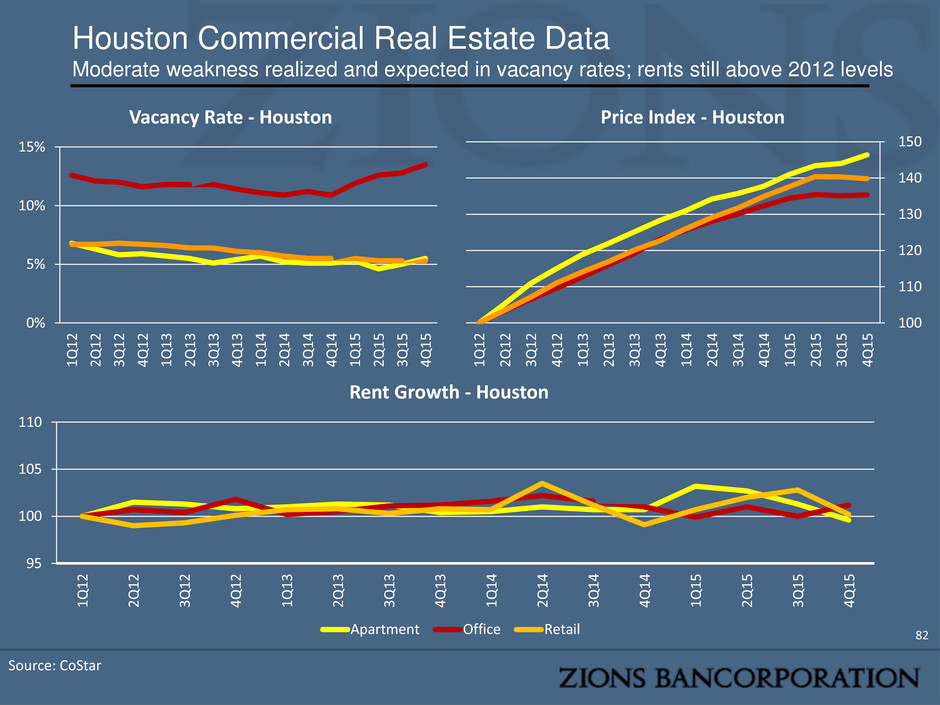

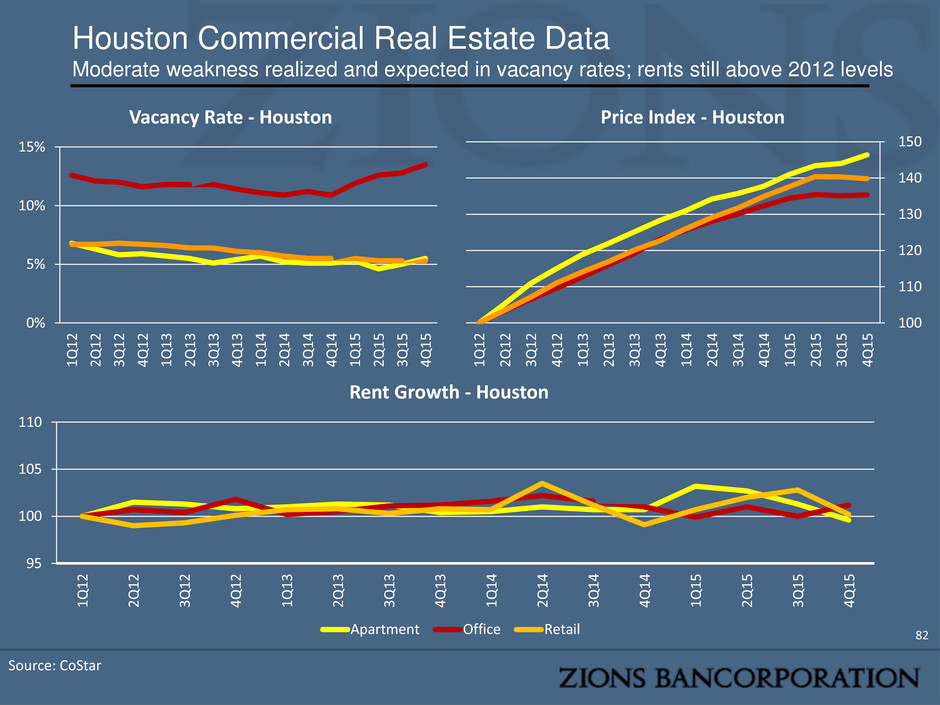

Houston Commercial Real Estate Data Moderate weakness realized and expected in vacancy rates; rents still above 2012 levels 82 0% 5% 10% 15% 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 Vacancy Rate - Houston 100 110 120 130 140 150 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 Price Index - Houston Source: CoStar 95 100 105 110 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 Rent Growth - Houston Apartment Office Retail

83 Zions’ Commercial Real Estate Portfolio in Texas Houston is approximately 3/5ths of total Texas exposure; Construction and Land Development loans in Houston have declined more than 80% from the prior credit cycle $ $100 $200 $300 $400 $500 Other Industrial Hospitality Office Retail Multifamily Commercial Term Houston (55%) TX-not Houston (45%) $ $100 $200 $300 $400 $500 Other Land Single Family Housing Residential Construction Houston (71%) TX-not Houston (29%) $ $100 $200 $300 $400 $500 Industrial Land Hospitality Other Retail Office Multifamily Commercial Construction Houston (53%) TX-not Houston (47%)

The Derivative Effect: Commercial Real Estate Limited expected NPAs or losses on Zions’ commercial real estate portfolio in Houston Key Risks: • Heightened supervision of 23 loans/$235MM in CRE balances among multifamily/office/hospitality in Houston, as follows: • 9 multi-family construction loans totaling $72MM • 5 office construction loans totaling $63MM and 1 office term loan totaling $4MM • 4 hotel construction loans totaling $59MM and 4 hotel term loans totaling $38MM • Stress testing for adverse impact results in grade migration and likely increases in criticized/classified loans, but still no meaningful increase in NPA is expected. • To date, no new credits added to criticized/classified status resulting from the energy sector. 84 0% 10% 20% 30% 40% 50% 60% <1.0 1-1.25 1.25-1.5 1.5-1.75 1.75-2 >=2 Current Houston Term CRE Debt Service Coverage Ratios Strong Cash Flow Coverage for the Houston Term CRE Portfolio

The Derivative Effect: Commercial Real Estate Limited expected NPAs or losses on Zions’ commercial real estate portfolio in Houston Key Actions to Mitigate Risk: • Heightened supervision of the portfolio. The portfolio is monitored routinely for accurate Risk Grading, with more stress testing in 2016. • Construction for Houston assets curtailed in 4Q14, with negligible new construction loans in the Houston MSA since. • Amegy continues to sell down exposure on large credits, and seeks partners on new originations in all markets. • Actively manage the portfolio for covenant compliance (re-margin requirements, etc.) as most loans have ongoing Debt Coverage Ration/Debt Yield thresholds. Conclusions: • A healthy CRE portfolio is maintained through appropriate loan growth, monitoring CRE markets and addressing specific concerns with borrowers. 85 0% 10% 20% 30% 40% 50% 60% Under 50 50-59 60-69 70-79 80-89 90-99 100+ Current Houston Term CRE Loan-To-Value Ratio Distribution Strong Collateral Coverage for the Houston Term CRE Portfolio

The Derivative Effect: Consumer Zions’ Customers in high oil and gas employment counties (HOGECs) have not experienced credit score deterioration 86 Takeaways: • Consumer loans from high O&G employment counties performing similarly to overall consumer portfolio. Nearly all of these consumer loans are with Amegy (96%) located in Texas, primarily Houston area. • 81% of consumer loans in high-energy counties are Mortgage and HECL • Consumer FICO scores have not deteriorated in counties with high O&G employment, with the 5th, 10th, and 50th percentiles of FICO scores showing slightly favorable movement Credit Score (FICO) Migration in High Oil & Gas Employment Counties Percentile HOGECs Others HOGECs Others HOGECs Others HOGECs Others HOGECs Others 5% 603 642 598 638 5 4 595 635 8 7 10% 641 677 637 675 4 2 636 673 5 4 50% 750 777 748 779 2 -2 746 778 4 -1 Data includes consumer loans with FICO scores refreshed during the quarter shown. 2015 Q4 2014 Q4 1-Year Difference 2013 Q4 2-Year Difference

Agenda 87 • Company Overview • Accomplishments and Strategic Outlook • Efficiency Initiative • Technology Upgrade • Financial Performance, Interest Rate Risk, Capital Management • Risk Management • Credit Quality • Energy Portfolio • Fee Income / Retail / Mortgage / Wealth Management • Wrap-Up

Fee Income: Zions vs. Large Regional Peer Group Glass half full: Zions has a substantial opportunity to increase its fee income 88 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% B O K F K E Y FIT B FH N CB S H S T I B B T C M A M T B R F HB A N A S B CF G P B C T F M E R S N V ZIO N F R C E WB C Fee Income Ratio Noninterest Income as a percent of Net Revenue Source: SNL Financial 3Q15; ZION as of 4Q15. • Relative to other larger regional banks, Zions’ noninterest (or fee income) is a smaller percentage of total revenue • Significant effort is underway to greatly enhance that and to grow the revenue base • Although fee income percentages have not historically been an accurate predictor of financial institution failure rates, various rating agencies ascribe a premium value to such income • The CCAR process has been shown to favor banks with high fee income ratios

Fee Income: Zions vs. Community Bank Peers in Footprint Relative to other community banks, Zions’ fee income ratio is strong 89 Source: SNL Financial for the most recent 12 months; for ZION it is FY2015; assets $5-$15 billion in assets headquartered in Zions’ footprint. 0% 5% 10% 15% 20% 25% 30% 35% IB O C FFI N ZIO N U M P Q C O LB B B C N CV B F CAT Y WAF D N B H C TC B I P A C W WA L Fee Income Ratio Noninterest Income as a percent of Net Revenue • Relative to other community banks, Zions’ noninterest (or fee income) is strong as a percentage of total revenue • Community banks traditionally focus on lending and deposit relationships • Zions is a product of a series of mergers, where the bank remained in its market with local leadership – effectively it remains a collection of community banks • However, Zions has increased the intensity and focus needed to boost the noninterest income level substantially higher

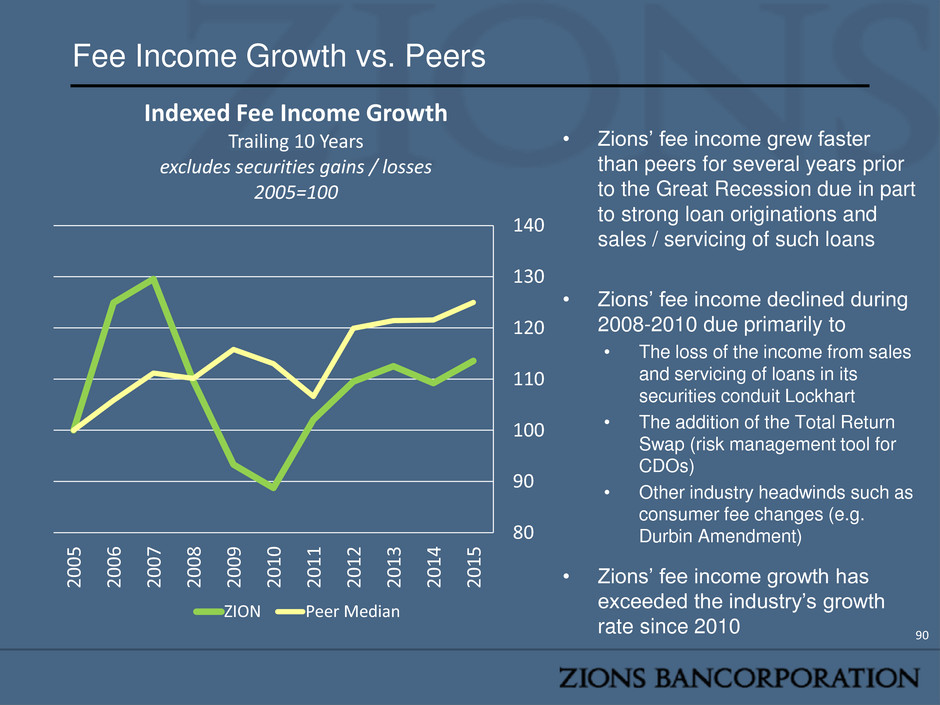

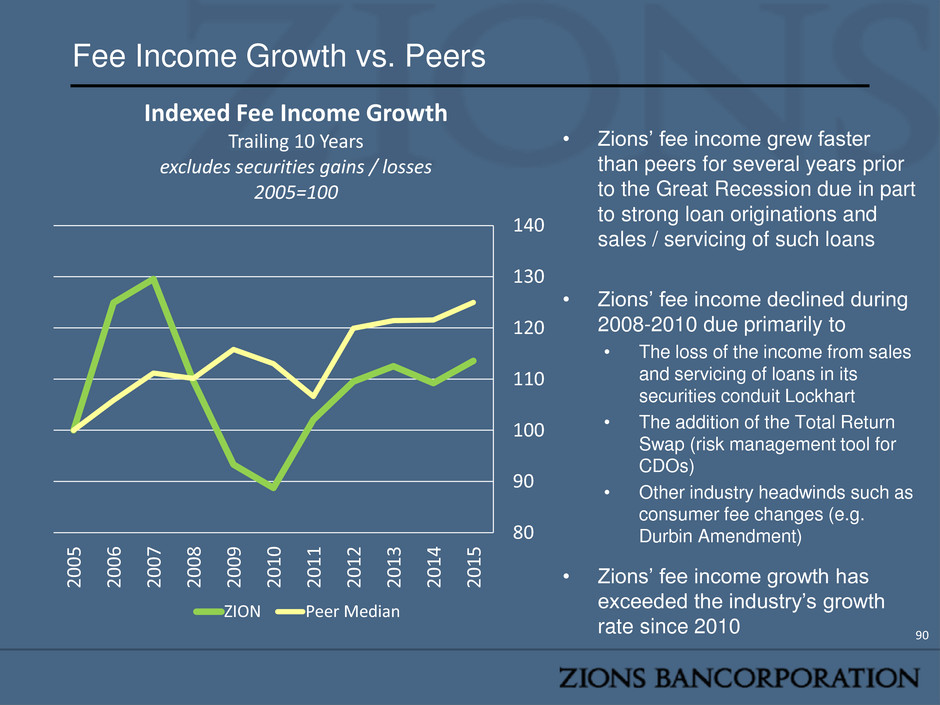

Fee Income Growth vs. Peers 90 80 90 100 110 120 130 140 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 Indexed Fee Income Growth Trailing 10 Years excludes securities gains / losses 2005=100 ZION Peer Median • Zions’ fee income grew faster than peers for several years prior to the Great Recession due in part to strong loan originations and sales / servicing of such loans • Zions’ fee income declined during 2008-2010 due primarily to • The loss of the income from sales and servicing of loans in its securities conduit Lockhart • The addition of the Total Return Swap (risk management tool for CDOs) • Other industry headwinds such as consumer fee changes (e.g. Durbin Amendment) • Zions’ fee income growth has exceeded the industry’s growth rate since 2010

Fee Income Increased focus is paying dividends 91 $400 $425 $450 $475 $500 2014 2015 Managed Fee Income 4% Growth In Millions • Managed fee income1 increased 4% from the year ago period • Strong growth in Treasury Management, Bankcard, Capital Markets, and Mortgage • Declines in loan fees attributable in part to declines in energy lending • Declines in overdraft income is consistent with industry trends and reflects a more healthy consumer 1 Managed fee income excludes dividends / income from investments (“Dividends and Other Investment Income”), gains/losses on securities, dividends from the Federal Reserve, bank-owned life insurance, and other similar items. WHAT TO EXPECT… • Greater focus and tracking • Enhanced utilization of corporate infrastructure, product development with local pricing • Above average growth rates, assisted by generally low current penetration rates • Simple products that can be leveraged over entire employee base • Community bank relationship advantage

Fee Income Strong double-digit growth in treasury management partially offset by the effects of a more healthy consumer (less overdraft income) and lower loan fees 92 $0 $20 $40 $60 $80 $100 $120 $140 $160 Treasury Management Bankcard Capital Markets Mortgage Loan Fees NSF Other Managed Fee Income Components 2014 2015 In Millions 13% Growth 4% Growth 28% Growth 14% Growth 16% Decline 10% Decline 2% Growth 1 Managed fee income excludes dividends / income from investments (“Dividends and Other Investment Income”), gains/losses on securities, dividends from the Federal Reserve, bank-owned life insurance, and other similar items.

Support and create additional value from the company’s key business focus 93 Small / Middle Market Business Retail • Focus on becoming primary personal banking relationship by improved cross sell and customer relationship analytics • Improve execution and customer experience Mortgage • Focus on jumbo ARM product and portfolio underwriting proficiency Wealth Management • Mass affluent, owners, executives, professionals • HNW / Private Bank & future liquidity events

Enterprise Retail Banking Improved coordination to capitalize on a strategic growth opportunity • 447 branches • $6 billion in loans • $21 billion in deposits • More than 800,000 consumer households • More than 290,000 small business relationships 2016 Key Initiatives • Corporate product development/local delivery • Consistent metrics • Deposit product rationalization • Consumer credit, small business, and mortgage pull- through • Branch operations standardization • Enhanced digital and online application functionality 94

Mortgage 2015 A strong production year • 2015 production levels outpaced market growth by more than 10 percentage points – approximate 15% growth in market • Funding Production in Excess of $2 Billion • Up 28% from 2014 2016 Key Initiatives: • More than $2.5 billion in fundings • “Bank of Choice” for Self- Employed Business Owners • Expand/Leverage Non-QM Solutions for Borrowers • Closer alignment with private banking and branches • Expand One-Time Close Program • Portfolio Retention • Cost per Loan Optimization 95 2012 2013 2014 2015 Portfolio ($B)1 6.8 7.1 7.8 8.0 Fundings ($B) 2.3 2.2 1.6 2.0 Fee Income ($MM) 46.1 48.6 25.4 27.9 1 Includes 1-4 family, home equity, and other residential-mortgage secured loans

Mortgage: 2015 Highlights 96 • Finishing strong: December Funding Total Exceeded $220 Million • Consistency: Each Affiliate Met Production Goal • Increased growth expectations in underserved areas where Loan Officer acquisition is underway • CB&T, Dallas, Reno, Phoenix, & Denver - 100 200 300 400 500 600 700 800 900 Zions Bank Amegy Calif. Bank & Trust NB|AZ Nevada State Bank Vectra Funded Originations 2014 2015 2016 $ in Millions