UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Rainmaker Systems, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of the transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 15, 2007

TO THE STOCKHOLDERS OF

RAINMAKER SYSTEMS, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Rainmaker Systems, Inc., a Delaware corporation (the “Company”), will be held on Tuesday, May 15, 2007, at 8:00 a.m. Pacific Daylight Savings Time at the PruneYard Plaza Hotel, 1995 South Bascom Ave, Campbell, CA 95008, for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

| | 1. | To elect five directors separated into three classes to serve staggered terms on the Company’s Board of Directors ending at the Annual Meeting of Stockholders to be held in 2008, 2009 and 2010, respectively, or until each director’s successor is duly elected and qualified; |

| | 2. | To ratify the appointment of BDO Seidman, LLP as independent registered public accountants of the Company for the fiscal year ending December 31, 2007; |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on March 30, 2007, are entitled to notice of and to vote at the Annual Meeting. The stock transfer books of the Company will remain open between the record date and the date of the meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at the executive offices of the Company.

All stockholders are cordially invited to attend the meeting in person. Whether or not you plan to attend, please sign and return the enclosed proxy as promptly as possible in the envelope enclosed for your convenience. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the Annual Meeting. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted.

By Order of the Board of Directors,

Michael Silton

President and Chief Executive Officer

Campbell, California

April 12, 2007

YOUR VOTE IS VERY IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY; COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE.

Rainmaker Systems, Inc.

900 East Hamilton Suite 400

Campbell, CA 95008

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 15, 2007

General

The enclosed proxy (“Proxy”) is solicited on behalf of the Board of Directors of Rainmaker Systems, Inc., a Delaware corporation (the “Company”), for use at the Annual Meeting of Stockholders to be held on Tuesday, May 15, 2007 (the “Annual Meeting”). The Annual Meeting will be held at 8:00 a.m. Pacific Daylight Savings Time at the PruneYard Plaza Hotel, 1995 South Bascom Ave, Campbell, CA 95008. These proxy solicitation materials were mailed on or about April 12, 2007, to all stockholders entitled to vote at the Annual Meeting.

Voting; Quorum

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice and are described in more detail in this Proxy Statement. On March 30, 2007, the record date (the “Record Date”) for determination of stockholders entitled to notice of and to vote at the Annual Meeting, 15,137,510 shares of the Company’s common stock, par value $0.001 (the “Common Stock”), were issued and outstanding. No shares of the Company’s Preferred Stock, par value $0.001, were outstanding.

In the election of directors, the five nominees receiving the highest number of affirmative votes shall be elected. Proposal Two must be approved by the affirmative vote of holders of outstanding shares of Common Stock representing a majority of the voting power present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. The presence at the Annual Meeting, either in person or by proxy, of holders of shares of outstanding Common Stock entitled to vote and representing a majority of the voting power of such shares shall constitute a quorum for the transaction of business. Abstentions and shares held by brokers that are present in person or represented by proxy but that are not voted because the brokers were prohibited from exercising discretionary authority (“broker non-votes”) will be counted for the purpose of determining if a quorum is present. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes, whereas broker non-votes will not be counted for purposes of determining whether a proposal has been approved. The inspector of election appointed for the meeting will tabulate all votes and will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Proxies

If the enclosed form of Proxy is properly signed and returned, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon. If the Proxy does not specify how the shares represented thereby are to be voted, the Proxy will be voted FOR the election of the five nominees to the Board of Directors listed in the Proxy, unless the authority to vote for the election of any such nominee is

1

withheld, and, if no contrary instructions are given, the Proxy will be voted FOR the approval of Proposal Two described in the accompanying Notice and this Proxy Statement. You may revoke or change your Proxy at any time before the Annual Meeting by filing with the Secretary of the Company at the Company’s principal executive offices, located at 900 East Hamilton Avenue, Suite 400, Campbell, California 95008, a notice of revocation or another signed Proxy with a later date. You may also revoke your Proxy by attending the Annual Meeting and voting in person.

Solicitation

The Company will bear the entire cost of the solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the Proxy and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. The Company may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone, telegram or any other means by directors, officers or employees of the Company. No additional compensation will be paid to these individuals for any such services. Except as described above, the Company does not presently intend to solicit proxies by any process other than by mail.

2

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL ONE: ELECTION OF DIRECTORS

General

The Company’s Certificate of Incorporation provides for a classified Board of Directors consisting of three classes of directors with staggered three-year terms, with each class consisting, as nearly as possible, of one-third of the total number of directors. While our common stock was listed on the Nasdaq Capital Market, we were subject to various restrictions under Section 2115 of the California Corporations Code that prohibited us from having a classified board. Now that our common stock is listed on the Nasdaq Global Market, we are no longer subject to those restrictions. Accordingly, we intend to implement a classified board at the Annual Meeting. The Board currently consists of five persons, each of whose current term of office ends at the Annual Meeting and each of whom is standing for re-election. If this proposal is approved, our Board of Directors will be divided into three classes, Class I, Class II and Class III, with Class I consisting of two directors, Class II consisting of two directors and Class III consisting of one director. The directors elected to Class I will serve for a term of three years, expiring at the 2010 Annual Meeting of Stockholders, or until their successors have been duly elected and qualified; the directors elected to Class II will serve for a term of two years, expiring at the 2009 Annual Meeting of Stockholders, or until their successors have been duly elected and qualified; and the director elected to Class III will serve for a term of one year, expiring at the 2008 Annual Meeting of Stockholders, or until his successor has been duly elected and qualified.

Each returned Proxy can only be voted for the number of persons nominated (five). Unless individual stockholders specify otherwise, each returned Proxy will be voted FOR the election of the five nominees who are listed below. If, however, the nominees named herein are unable to serve or decline to serve at the time of the Annual Meeting, the persons named in the enclosed Proxy will exercise discretionary authority to vote for substitutes. The nominees for election have agreed to serve if elected, and management has no reason to believe that the nominees will be unavailable to serve.

Nominees for Election as Directors of the Company

The name, age, principal occupation, other business affiliations and certain other information concerning each nominee for election as director of the Company is set forth below. Each of the nominees is currently a director of the Company.

Class I Director Nominees for Term Ending at the 2010 Annual Meeting of Stockholders

Michael Silton, 42, has served as Chief Executive Officer of our Company since October 1997 and as President of our Company since March 2005. He also served as Chairman of the Board since our Company’s inception through July 2003. In 1991, he founded our former business UniDirect, which specialized in the direct marketing and sales of business software.

Alok Mohan, 58, has served as a director of our Company since 1996 and as our Company’s Chairman of the Board since July 2003. Mr. Mohan also serves on the Company’s Audit Committee and its Governance and Nominating Committee. Mr. Mohan has also served on the board of directors of Saama Technologies, a privately held technology services firm, since April 2006, and on the board of directors of Tech Team Global, Inc., a provider of outsourced, multilingual help desk services and specialized IT solutions listed on the Nasdaq Global Market, since May 2006. Mr. Mohan served as the Chairman of the board of directors of Tarantella, until its acquisition by Sun Microsystems in 2005. Prior to that appointment, he served as Chief Executive Officer of Santa Cruz Operations, or SCO, from July 1995 until April 1998. Prior to that, from May 1994 to July 1995, Mr. Mohan served as Senior Vice President, Operations and Chief Financial Officer of SCO. Prior to joining SCO, Mr. Mohan was employed with NCR, a business software and services company, where he served as Vice President of Strategic Planning and Controller from July 1993 to May 1994. From January 1990 until July 1993,

3

Mr. Mohan served as Vice President and General Manager of the Workstation Products Division at NCR. Mr. Mohan also serves on the board of directors of Stampede and Crystal Graphics.

Class II Director Nominees for Term Ending at the 2009 Annual Meeting of Stockholders

Robert Leff, 60, has served as a director of the Company since 1996. He is currently a member of the Audit Committee and the Compensation Committee. Mr. Leff is a strategic consultant to early and growth stage companies in the personal computer industry. He is also a director of PackageX, a private company that delivers a web-based collaboration system for the packaging industry. He co-founded Merisel (formerly Softsel Computer Products) in 1980 and successfully developed the venture into one of the nation’s largest and fastest growing service companies. In 1993, Merisel was named to both theForbes 500 andFortune Service 500 lists. Mr. Leff served as President of Softsel for five years. Under his direction the company grew rapidly into a $200 million multinational computer products distributor. In 1985, Softsel was rated the fourth fastest growing private company in the US byInc. magazine. As Co-Chairman and European Managing Director he ran the company’s European operations from its London headquarters during 1985 and 1986. He was responsible for product acquisitions from 1986 through 1990 and then served as Senior Vice President of Worldwide MIS through 1992. Mr. Leff was named one of the PC industry’s 25 most influential executives byCRN (Computer Reseller News) in 1988. In 1994, he retired from Merisel. Prior to founding Softsel, he worked in various data processing development and management positions for companies including BASF, Informatics and Citibank. Mr. Leff earned a BS degree in business administration and a MS degree in computer science from the University at Albany.

Mitchell Levy, 46, has served as a director of our Company since 2004 and is currently a member of the Governance and Nominating Committee. He is Chief Executive Officer of Happy About, a quick2publish book publishing company, a partner in CXOnetworking, and a director of the Silicon Valley Executive Business Program. Mr. Levy is an author, consultant, educator, and evangelist of strategic management, and a frequent public speaker on business trends. Previously, he was the conference chair at four Comdex conferences, founded and operated the E-Commerce Management Program at San Jose State University and spent nine years at Sun Microsystems, the last four of which he ran the e-commerce component of Sun Microsystems’ supply chain.

Class III Director Nominee for Term Ending at the 2008 Annual Meeting of Stockholders

Bradford Peppard, 51, has served as a director of our Company since 2004 and is currently a member of the Audit Committee and the Compensation Committee. Since 2003, Mr. Peppard has been President of LTP, a consulting firm specializing in high tech sales & marketing, direct marketing and market research. In addition, since 2002, Mr. Peppard has been President of Lime Tree Productions, a strategic marketing consulting firm. From 1999 to 2002, Mr. Peppard was President of CinemaScore Online, an online source of movie rating information. Prior to that, Mr. Peppard held Vice President of marketing positions at Aladdin Systems, Software Publishing Corporation and Quarterdeck Office Systems. Mr. Peppard’s financial experience includes positions as Treasurer of Trader Joe’s, Director of Finance and Administration (Controller) for CBS TV and CBS/Fox Studios, an MBA from Stanford Business School with a concentration in Finance, and prior audit committee experience with a number of public companies, including: Aladdin Systems, Monterey Bay Technology, and Oppenheimer Industries.

Director Independence

The Board of Directors has determined that each of Messrs. Leff, Levy, Mohan and Peppard is “independent,” as that term is defined by applicable rules of the SEC and the Nasdaq Global Market.

Meetings and Committees of the Board of Directors

The Board of Directors held 4 regularly scheduled meetings and, 2 special meetings during the fiscal year ended December 31, 2006 (the “2006 Fiscal Year”). The Board of Directors has an Audit Committee, a

4

Governance and Nominating Committee and a Compensation Committee. Each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which such director served during the 2006 Fiscal Year. The Board of Directors also consulted informally with management during the 2006 Fiscal Year.

We have not established a formal policy regarding director attendance at our annual meetings of stockholders. One director attended last year’s annual meeting of stockholders.

Audit Committee.The Audit Committee presently consists of Messrs. Leff, Mohan and Peppard, with Mr. Peppard serving as the Chairman of the Audit Committee. The Audit Committee oversees the Company’s accounting and financial reporting policies and internal controls, reviews and monitors the corporate financial reporting and external audit of the Company, including, among other things, the independent auditors’ qualifications and independence, the results and scope of the annual audit and other services provided by the Company’s independent auditors and the Company’s compliance with legal matters that have a significant impact on the Company’s financial reports. The Audit Committee also consults with the Company’s management and the Company’s independent auditors prior to the presentation of financial statements to stockholders and, as appropriate, initiates inquiries into various aspects of the Company’s financial affairs. In addition, the Audit Committee is responsible for considering and recommending the appointment of, and reviewing fee arrangements with, the Company’s independent auditors. The Audit Committee was formed in May 1999 and held 4 meetings during the 2006 Fiscal Year. Members of the Audit Committee are elected by the Board of Directors and serve one-year terms. The Annual Report of the Audit Committee appears hereafter under “Report of the Audit Committee of the Board of Directors.” The Board of Directors adopted a written charter for the Audit Committee in 2000. A copy of the Audit Committee charter is attached to the Company’s definitive proxy statement on Schedule 14A filed with the SEC on April 18, 2005.

The Board of Directors has determined that each of the members of the Audit Committee is “independent,” as that term is defined by applicable rules of the SEC and the Nasdaq Global Market. The Board of Directors has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Committee. The Board has also determined that Mr. Peppard, Chairman of the Audit Committee, is an “audit committee financial expert” as defined under applicable rules of the SEC and the Nasdaq Global Market.

Governance and Nominating Committee. The Board formed a Nominating Committee in February 2004, which in 2006 was renamed its “Governance and Nominating Committee”. The Governance and Nominating Committee is currently composed of Messrs. Mohan and Levy, with Mr. Levy serving as the Chairman of the Governance and Nominating Committee. The Governance and Nominating Committee oversees the Company’s corporate governance functions on behalf of the Board, recommends to the Board the persons to be nominated for election as directors at any meeting of stockholders and oversees the evaluation of the Board. The Board has determined that Messrs. Mohan and Levy are each “independent,” as that term is defined by applicable rules of the SEC and the Nasdaq Global Market. The Governance and Nominating Committee acts pursuant to a written charter. A copy the Governance and Nominating Committee charter is attached to the Company’s definitive proxy statement on Schedule 14A filed with the SEC on April 18, 2005.

Stockholders may recommend director candidates for inclusion by the Board of Directors in the slate of nominees that the Board recommends to stockholders for election. The Governance and Nominating Committee will review the qualifications of recommended candidates. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election as a director by the stockholders, his or her name will be included in the Company’s proxy card for the stockholder meeting at which his or her election is recommended.

Stockholders may recommend individuals to the Governance and Nominating Committee for consideration as potential director candidates by submitting their names and background to the Chairman of the Governance and Nominating Committee, at the address set forth below under the heading “Stockholder Communications”.

5

The Governance and Nominating Committee will consider a recommendation only if appropriate biographical information and background material is provided on a timely basis. The process followed by the Governance and Nominating Committee to identify and evaluate candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Governance and Nominating Committee and the Board. The Governance and Nominating Committee is authorized to retain advisers and consultants and to compensate them for their services.

Assuming that appropriate biographical and background material is provided for candidates recommended by stockholders, the Governance and Nominating Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board members or by other persons. In considering whether to recommend any candidate for inclusion in the Board’s slate of recommended director nominees, including candidates recommended by stockholders, the Governance and Nominating Committee will apply the criteria which are set forth in its written charter. These criteria include the candidate’s integrity, business acumen, age, experience, diligence, conflicts of interest and the ability to act in the interests of all stockholders. The Governance and Nominating Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. We believe that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

Stockholders also have the right to nominate director candidates themselves, without any prior review or recommendation by the Governance and Nominating Committee or the Board, by the procedures set forth below under the heading “Deadline for Receipt of Stockholder Proposals for 2008 Annual Meeting.”

Compensation Committee. The Compensation Committee consists of Messrs. Leff and Peppard, with Mr. Leff serving as the Chairman of the Compensation Committee. The Compensation Committee reviews and approves salaries, benefits and bonuses for the Chief Executive Officer, Chief Financial Officer and other executive officers of the Company. It reviews and recommends to the Board of Directors on matters relating to employee compensation and benefit plans. The Compensation Committee also administers the Company’s stock plans. The Board has determined that Messrs. Leff and Peppard are each “independent” as that term is defined by the applicable rules of the SEC and the Nasdaq Global Market.

The Compensation Committee was formed in May 1999. There was one meeting held in 2006. The Annual Report of the Compensation Committee appears hereafter under the heading “Compensation Committee Report.”

Stockholder Communications

The Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Absent unusual circumstances or as contemplated by committee charters and subject to any required assistance or advice from legal counsel, the Chairman of the Governance and Nominating Committee is primarily responsible for monitoring communications from stockholders and for providing copies or summaries of such communications to the other directors as he considers appropriate.

Communications are forwarded to all Directors if they relate to important substantive matters and include suggestions or comments that the Chairman of the Governance and Nominating Committee considers to be important to the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or duplicative communications.

Stockholders who wish to send communications on any topic to the Board should address such communications to: The Board of Directors, Rainmaker Systems, Inc., 900 East Hamilton Avenue, Suite 400, Campbell, CA 95008, Attention: Chairman of the Governance and Nominating Committee.

6

Director Compensation

Effective as of the first day of the calendar quarter in which the Annual Meeting occurs, all non-employee directors shall be paid (i) $7,500 in quarterly fees for each quarter of service as a director (with the exception of the Chairman of the Board, who shall be paid $15,000 in quarterly fees, the Chairman of the Audit Committee, who shall be paid $9,500 in quarterly fees, the Chairman of the Compensation Committee, who shall be paid $8,750 in quarterly fees, and the Chairman of the Governance and Nominating Committee, who shall be paid $8,750 in quarterly fees), (ii) $1,500 per Board meeting attended during the year subject to a maximum of $1,500 per quarter, and (iii) $500 per Audit Committee meeting attended during the year subject to a maximum of $500 per quarter.

In addition, each non-employee Board member who continues to serve as a non-employee Board member after each annual meeting of stockholders, commencing with the Annual Meeting, including each of the Company’s current non-employee Board members, will be granted under the Company’s 2003 Stock Incentive Plan (i) an option to purchase 8,500 shares of Common Stock (with the exception of the Chairman of the Board, who will be granted an option to purchase 21,250 shares) at an exercise price equal to the fair market value per share of the Common Stock on the date of such annual meeting of stockholders, and (ii) 8,500 restricted shares of Common Stock (with the exception of the Chairman of the Board, who will be granted 21,250 restricted shares), in each case, provided such individual has served on the Board for at least six months. The annual option grants to the non-employee Board members shall vest 1/24 per month over 24 months and shall otherwise be subject to the terms and conditions of the Company’s 2003 Stock Incentive Plan, and the annual restricted stock grants to the non-employee Board members shall vest 1/2 per year over 2 years and shall otherwise be subject to the terms and conditions of the Company’s 2003 Stock Incentive Plan.

The table below summarizes the compensation paid by the Company to non-employee Directors for the year ended December 31, 2006.

Director Compensation Table—2006

| | | | | | | | | | | | | | |

Name and Title | | (1) Fees

Earned

or Paid

in Cash ($) | | (2)

Stock

Awards ($) | | (2)

Option

Awards ($) | | Non-Equity

Incentive Plan

Compensation ($) | | Change in

Pension Value

and Non

Qualified

Deferred

Compensation | | All Other

Compensation ($) | | Total ($) |

Alok Mohan, Chairman | | 50,671 | | 5,883 | | 5,032 | | — | | — | | — | | 61,586 |

Robert Leff, Director | | 27,813 | | — | | 2,549 | | — | | — | | — | | 30,362 |

Brad Peppard, Director | | 26,000 | | — | | 2,842 | | — | | — | | — | | 28,842 |

Mitchell Levy, Director | | 24,000 | | — | | 2,842 | | — | | — | | — | | 26,842 |

| (1) | Includes retainer fees as applicable to each Director’s position on the Board and their participation in additional committees as well as any reimbursement for travel or other fees. |

| (2) | Stock and option awards relate to the accounting expense for unvested options and restricted stock awards in accordance with Statement of Financial Accounting Standards No. 123(revised 2004), Share-Based Payment, (SFAS 123(R)), which requires the expensing of equity stock awards. As Board Chairman, Mr. Mohan was awarded 31,000 shares of nonvested restricted stock on November 20, 2006, which vest annually over four years beginning on November 20, 2007. Option expense for all directors relates to grants made prior to 2006. No option awards were awarded to the directors during 2006. |

Transactions with Related Persons

The Chairman of our Board of Directors also serves on the board of directors of Saama Technologies, a technology services firm. During the year ended December 31, 2006, we paid Saama Technologies $150,000 for technology services. We continue to utilize their services and may expand the scope of Saama Technologies’ engagement.

7

Although no formal written policy is in place, our Board of Directors is responsible for reviewing and approving the terms and conditions of all significant related party transactions.

Required Vote

The five nominees receiving the highest number of affirmative votes of the outstanding shares of Common Stock, present or represented and entitled to be voted for such nominees, shall be elected as directors. The Proxies cannot be voted for a greater number of persons than five.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the election of the nominees listed above.

PROPOSAL TWO: RATIFICATION OF BDO SEIDMAN, LLP

AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BDO Seidman, LLP (“BDO Seidman”) was engaged as the Company’s independent registered public accounting firm on October 7, 2004. Audit services provided by BDO Seidman during the 2006 Fiscal Year included the examination of our financial statements and services related to filings with the SEC and other regulatory bodies.

Principal Accountant Fees and Services

For the fiscal years ended December 31, 2006 and December 31, 2005, BDO Seidman, our independent registered public accounting firm, billed the approximate fees set forth below:

Audit Fees

Aggregate fees consist of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements, reviews of the interim condensed consolidated financial statements included in quarterly filings, and services that are normally provided by BDO Seidman in connection with statutory and regulatory filings or engagements, except those not required by statute or regulation. Aggregate fees billed for audit services were $401,668 and $372,610 for the years ended December 31, 2006 and December 31, 2005, respectively.

Audit-Related Fees

Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.” These services include due diligence and audits in connection with acquisitions, and consultations concerning financial accounting and reporting standards. Aggregate fees billed for audit-related services were $29,618 and $184,611 for the years ended December 31, 2006 and December 31, 2005 respectively, including $126,022 in fees billed during 2005 for an audit performed in connection with an acquisition.

Tax Fees

Tax fees consist of fees billed for professional services rendered for state and federal tax compliance and advice, and tax planning. Aggregate fees for tax services were $39,904 and $40,990 during the years ended December 31, 2006 and 2005, respectively.

8

All Other Fees

None.

All engagements for services by BDO Seidman or other independent registered public accountants are subject to pre-approval by the Audit Committee; however, de minimis non-audit services may instead be approved in accordance with applicable SEC rules. The pre-approval of the Audit Committee was obtained for all services provided by BDO Seidman in the 2006 Fiscal Year.

The Audit Committee, composed entirely of independent directors, recommended to the Board of Directors that BDO Seidman be appointed as our independent registered public accounting firm for the fiscal year ending December 31, 2007. As our independent registered public accounting firm, BDO Seidman will audit our financial statements for the 2007 fiscal year and perform audit-related services in connection with various accounting and financial reporting matters. BDO Seidman may perform certain non-audit services for the Company, subject to pre-approval by the Audit Committee.

The Board of Directors approved the selection of BDO Seidman as our independent registered public accounting firm for the 2007 fiscal year and is asking the stockholders for ratification of their selection. A representative of BDO Seidman is expected to be present at the Annual Meeting, will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions.

Required Vote

The affirmative vote of a majority of the shares represented and voting at the Annual Meeting is required to ratify the selection of BDO Seidman. In the event that the stockholders do not approve the selection of BDO Seidman, the Board of Directors will reconsider the appointment of the independent auditors. Even if the selection is ratified, the Board of Directors in its discretion may direct the appointment of a different independent auditing firm at any time during the year if the Board of Directors believes that such a change would be in the best interests of the Company and its stockholders.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR the ratification of the selection of BDO Seidman, LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2007.

OTHER MATTERS

The Company knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend. Discretionary authority with respect to such other matters is granted by the execution of the enclosed Proxy.

OWNERSHIP OF SECURITIES

The following table sets forth certain information as of February 28, 2007, regarding the ownership of our common stock by (i) each person, to our knowledge, who is known by us to beneficially own more than five percent of our common stock, (ii) each named executive officer, (iii) each of our company’s directors, and (iv) all of our company’s directors and executive officers as a group. This table lists applicable percentage ownership based on 15,175,812 shares of common stock outstanding as of February 28, 2007. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. Shares subject to options or warrants that are

9

exercisable currently or within 60 days of February 28, 2007, are deemed to be outstanding and beneficially owned by the person for the purpose of computing share and percentage ownership of that person. They are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them. Unless otherwise indicated, all addresses for the stockholders set forth below is c/o Rainmaker Systems, Inc., 900 East Hamilton Avenue, Suite 400, Campbell, California 95008.

| | | | | | | |

Name of Beneficial Owner | | Number of Shares

Beneficially Owned

(Including the Number

of Shares Shown in the

Second Column) | | Number of Shares

Owned as a Result of

Options and

Warrants Exercisable

Within 60 Days of

February 28, 2007 | | Percentage

of Shares

Outstanding | |

Michael Silton | | 1,550,009 | | 282,000 | | 10.0 | % |

Diker GP, L.L.C.(1) | | 1,482,717 | | 130,611 | | 9.7 | |

Fort Mason Capital, LLC(2) | | 778,106 | | 433,333 | | 5.0 | |

Peter Lynch(3) | | 755,425 | | — | | 5.0 | |

Alok Mohan | | 227,151 | | 143,333 | | 1.5 | |

Steve Valenzuela | | 201,111 | | 120,667 | | 1.3 | |

Robert Leff(4) | | 173,121 | | 81,833 | | 1.1 | |

Clinton Hauptmeier | | 129,066 | | 75,067 | | * | |

Robert Langer | | 102,611 | | 68,167 | | * | |

Kenneth Forbes(5) | | 83,392 | | — | | * | |

Bradford Peppard | | 61,122 | | 47,833 | | * | |

Ritch Haselden | | 55,500 | | 34,000 | | * | |

Mitchell Levy(6) | | 51,356 | | 46,833 | | * | |

All directors and officers as a group (10 persons) | | 2,634,439 | | 899,733 | | 16.4 | |

| (1) | Beneficial and percentage ownership information is based on information contained in Amendment No. 2 to Schedule 13G filed with the SEC on February 12, 2007 by Diker GP, L.L.C. on behalf of itself and affiliated persons and entities. |

| (2) | Beneficial and percentage ownership information is based on information contained Amendment No. 1 to Schedule 13G filed with the SEC on February 12, 2007 by Fort Mason Capital, LLC on behalf of itself and affiliated persons and entities. |

| (3) | Beneficial and percentage ownership information is based on information contained in Amendment No. 2 to Schedule 13G filed with the SEC on January 11, 2007 by Peter S. Lynch on behalf of himself and affiliated persons and entities. |

| (4) | Includes 400 shares owned by Mr. Leff’s wife. |

| (5) | Common stock holdings include 67,544 shares (20,000 of which are restricted shares) held by Mr. Forbes and 15,848 shares held by Business Telemetry, Inc., of which Mr. Forbes is a shareholder. |

| (6) | Includes 2,100 shares owned by Mr. Levy’s wife. |

Section 16(a) Beneficial Ownership Reporting Compliance

The members of the Board of Directors, the executive officers of the Company and persons who hold more than ten percent (10%) of the Company’s outstanding Common Stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934 which require them to file reports with respect to their ownership of the Common Stock and their transactions in such Common Stock. To the Company’s knowledge,

10

based solely on review of the copies of such reports furnished to the Company and written representation that no other reports were required, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent shareholders were complied with.

Equity Compensation Plans

The following table sets forth information as of December 31, 2006 with respect to shares of the Company’s Common Stock that may be issued under the Company’s existing equity compensation plans, including our 2003 Stock Incentive Plan and our 1999 Employee Stock Purchase Plan.

| | | | | | |

Plan Category | | Number of Securities to be Issued Upon Exercise of

Outstanding Options,

Warrants and Rights | | Weighted Average Exercise

Price of Outstanding Options,

Warrants and Rights | | Number of Securities Remaining Available for Future Issuance |

Equity compensation plans approved by security holders | | 1,715,486 | | $4.20 | | 1,027,779 (1) |

| (1) | Includes 506,744 shares of our common stock remaining available for future issuance under our 2003 Stock Incentive Plan, and 521,035 shares of our common stock remaining available for future issuance under our 1999 Employee Stock Purchase Stock Plan, all as of December 31, 2006. |

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following table provides the name, age and positions of our executive officers and certain key employees.

| | | | |

Name | | Age | | Position |

Michael Silton | | 42 | | President, Chief Executive Officer and Director |

Steve Valenzuela | | 50 | | Vice President, Finance, Chief Financial Officer and Corporate Secretary |

Kenneth Forbes | | 58 | | Vice President and Chief Technology Officer |

Ritch Haselden | | 41 | | General Manager, Service Sales |

Clinton Hauptmeier | | 38 | | General Manager, Lead Generation |

Robert Langer | | 51 | | General Manager, Service Sales |

Set forth below is a description of the backgrounds, including business experience over the past five years, for each of our executive officers and certain key employees.

Michael Silton has served as Chief Executive Officer of our Company since October 1997 and as President of our Company since March 2005. He also served as Chairman of the Board since our Company’s inception through July 2003. In 1991, he founded our former business UniDirect, which specialized in the direct marketing and sales of business software.

Steve Valenzuela joined our Company in September 2004 as Vice President, Finance and Chief Financial Officer and was appointed Corporate Secretary in March 2005. Prior to joining our Company, from February 2003 to September 2004, Mr. Valenzuela served as the Vice President of Finance and Chief Financial Officer for the Thomas Kinkade Company, formerly Media Arts Group. From September 2000 to July 2002, Mr. Valenzuela served as the Senior Vice President and Chief Financial Officer for Silicon Access Networks, and from February 1999 to August 2000 as Senior Vice President and Chief Financial Officer for PlanetRx. Prior to PlanetRx, from August 1998 to February 1999, Mr. Valenzuela served as the Chief Financial Officer for LinkExchange. Mr. Valenzuela earned an MBA from Santa Clara University and a BS degree in Accounting from San Jose State University.

Kenneth Forbes joined our Company in May 2006 as Vice President and Chief Technology Officer following our acquisition of Metrics Corporation. Prior to Metrics, Mr. Forbes served as Chief Technology

11

Officer for Blue Pumpkin Software. Mr. Forbes was also a founder, Chief Technology Officer and patent holder of Hiho Technologies, a software-as-a-service provider of workforce management solutions. Prior to Hiho, he also held senior executive positions as CEO of TouchStone Software, Vice President, Worldwide Engineering, at NetManage, and United Parcel Service.

Ritch Haselden joined our Company in March 1998 and remained until July 2002, holding various positions including Vice President of Sales and Marketing. Mr. Haselden re-joined our company in 2005 as General Manager, Service Sales. Between 2003 and 2005, Mr. Haselden held operational management positions at Movana and Encover. Prior to 1998, Mr. Haselden held senior positions at several Fortune 100 companies, including Bell South, SBC, and Apple. Since re-joining our company he has led programs in Sales Management, Client Operations and Business Development. Mr. Haselden earned a Bachelor’s degree in Business Administration/Finance from California State University Stanislaus.

Clinton Hauptmeier joined our Company in February 2005 as General Manager of Lead Development following our acquisition of Sunset Direct. During his tenure at Sunset Direct from 1995 to 2005, Mr. Hauptmeier held several management positions, including VP of Sales, President and Chief Executive Officer. Mr. Hauptmeier began his technology sales and marketing career at Harte Hanks in 1994. Mr. Hauptmeier attended Northwest Missouri State and received a degree in Communications from the University of Nebraska-Lincoln.

Robert Langer joined our company in May 2005 as General Manager, Service Sales. Prior to joining our company, Mr. Langer was a Partner with the Peppers & Rogers Group from March 2002 to May 2005. Prior to that, Mr. Langer was the Director of Online for Dell Computer Corporation from March 1998 to April 2001. Mr. Langer has also held management positions at Sun Microsystems. Mr. Langer earned a BA degree in Political Science from Fairleigh Dickinson University.

Introductory Note to Committee Reports and Stock Performance Graph

Notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Compensation Committee Report, the Report of the Audit Committee and the Stock Performance Graph which follows shall not be deemed to be “soliciting material,” is not deemed “filed” with the SEC and shall not be incorporated by reference into any filings under the Securities Act or Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in such filing except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act or the Exchange Act.

Compensation Committee Report

Rainmaker’s executive compensation program for our named executive officers (NEOs) is administered by the Compensation Committee of the Board of Directors. The Compensation Committee currently consists of non-employee directors Robert Leff and Brad Peppard. None of the Company’s executive officers serves as a member of the Board of Directors or on the compensation committee of any entity that has one or more of its executive officers serving as a member of the Company’s Board of Directors or Compensation Committee. No current member of the Company’s Compensation Committee has been an officer or employee of the Company within the past five years.

The Compensation Committee is responsible for (a) reviewing and advising the Board of Directors on matters relating to employee compensation and benefit plans, and (b) reviewing and determining the salaries and

12

bonuses of executive officers of the Company, including the Chief Executive Officer (CEO) and the Chief Financial Officer (CFO), and establishing the general compensation policies for such individuals. We believe that the compensation programs for the Company’s NEOs should reflect the Company’s performance and the value created for the Company’s stockholders. In addition, the compensation programs should support the short-term and long-term strategic goals and values of the Company, and should reward individual contributions to the Company’s success.

On behalf of our shareholders, the Compensation Committee has carefully monitored our executive compensation programs. The Compensation Discussion and Analysis and tables that follow will show, we believe, structures for executive compensation that are appropriate and carefully considered. It is our general objective to provide our NEOs with (i) base salary at levels appropriate for the goals set for our management, and (ii) performance-based incentives that reward solid financial performance with cash bonuses, restricted stock, and stock option awards.

In 2006, we struck this balance by freezing salary levels at their 2005 levels (because we were not profitable when the year began), and by providing our NEOs with incentive compensation in the form of (i) performance-based cash bonuses ranging from 27% to 100% of their annual base salaries for 2006, and (ii) year-end restricted stock and stock option awards at levels that rewarded our NEOs for the Company’s extraordinary financial performance in 2006. The Company significantly improved its financial performance in 2006 over the prior years and achieved profitability for the first time as a public company. The Company grew net revenue to $48.9 million in 2006, an increase of 52% from net revenue of $32.1 million in 2005. The Company was profitable in each quarter of 2006 and reported $3.4 million in net income in 2006 as compared to a loss of $5.0 million in 2005.

Overall, the Compensation Committee believes that the compensation provided for NEOs in 2006 was entirely appropriate based upon our financial performance, general economic conditions, our analysis of compensation of surveyed companies, our assessments of individual and corporate performance, and other relevant factors. Our NEOs’ existing employment agreements, which were entered into prior to 2006, including the post-employment severance and change-in-control protections included therein, remained in effect during 2006.

The Compensation Committee has reviewed the Compensation Discussion and Analysis with management, and recommends to the Board of Directors that it be included in the Company’s Annual Report on Form 10-K and the Company’s Proxy Statement.

COMPENSATION COMMITTEE:

Robert Leff and Bradford Peppard

Compensation Discussion and Analysis

1. General Principles and Procedures

Our Compensation Committee firmly believes that the compensation provided to our NEOs should directly reflect the financial performance of the Company, and be closely tied to stockholder value. Our compensation plans are consequently designed to link individual rewards with Rainmaker’s performance by applying objective, quantitative factors including Rainmaker’s own business performance and general economic factors. We also rely upon subjective, qualitative factors such as technical expertise, leadership and management skills, when structuring executive compensation in a manner consistent with our compensation philosophy.

(a) Program Objectives and Performance to be Rewarded. The Company is engaged in a very competitive industry, and the Company’s success depends upon its ability to attract and retain qualified executives through the competitive compensation packages it offers to such individuals. As a result, the Compensation Committee

13

generally provides our NEOs with compensation opportunities that are based upon their personal performance, the financial performance of the Company and their contribution to that performance, and that are competitive enough to attract and retain highly skilled individuals. To this end, each executive officer’s compensation package for 2006 consisted primarily of base salary, cash bonuses, stock-based awards, and participation in Company-wide retirement and welfare plans. Each of these factors is described in detail below. The Compensation Committee may, in its discretion, apply entirely different factors, such as different measures of financial performance, for future fiscal years.

(b) Procedural Approach. Our Compensation Committee had various discussions during the fiscal year ended December 31, 2006, leading up to a full board meeting on November 17, 2006. During this meeting, the Board reviewed Rainmaker’s financial performance, reviewed its goals and objectives for the year ahead, and evaluated each of our NEO’s performance and compensation in view of those goals and objectives, with input and recommendations from the Compensation Committee. At this meeting, we considered the overall compensation of our NEOs, and made stock award decisions that were reviewed and approved by the Compensation Committee on November 20, 2006 (in accordance with the preestablised policy that our Board adopted in August 2006 for future stock-based awards). In addition, the Compensation Committee also acted from time to time, through authority delegated to the Chairman of the Compensation Committee, Robert Leff, to approve stock grants to new employees on the third Monday of each month following a new hire.

The Compensation Committee makes independent decisions about all aspects of NEO compensation, and takes into account (i) recommendations from our CEO with respect to the compensation of NEOs other than himself and our CFO, and (ii) information that our Human Resources department provides regarding compensation data and benchmarks for comparable positions and companies in the geographical area. We do not, however, engage in a formulaic benchmarking of total compensation or elements, although we consider benchmarks such as the Radford Compensation Survey data. The Compensation Committee does not use a consultant, but has received some advice from Paul, Hastings, Janofsky & Walker LLP, its outside legal counsel.

The Company does not have stock ownership requirements. The Company has an “Insider Trading Policy” that sets certain restrictions on trading windows and that does not allow the hedging of its stock by executives. We do not currently have any policy on recovering awards or payment under any circumstances (including events relating to financial restatements).

(c) Stock Option Granting Practices. In August of 2006, our Board established the third Monday of November as the day on which to make annual grants of stock option awards. The Board selected this time for grants because it coincides with timing for the Company’s monthly stock option grants to new hires, and because the annual grant dates in November generally fall within the middle of the fourth fiscal quarter (when the trading window is expected to be open). The Board has the flexibility to set grants at other dates during the year, but prefers this annual grant date in order to assure that there is no timing, nor reason to time, our release of material non-public information for the purpose of affecting the value of executive compensation. Regardless of when grants occur, the exercise price for stock options is always determined based on the closing market price of the Company’s common stock on the date on which the grant is approved by the Compensation Committee.

The annual grants to NEOs generally occur at the same time as grants are made to other employees, scheduled on the third Monday of November of each year. With respect to stock option grants to non-NEOs, the Compensation Committee approves and ratifies the grants. The Company’s human resources department is responsible for the Plan’s actual administration.

2. Specific Principles for Determining Executive Compensation

The material components of compensation for our NEOs from year to year, as well as the specific principles and purpose of each component, are as follows. We believe that these components of compensation are necessary and appropriate in order to attract and retain qualified NEOs. See “Executive Compensation Decisions for 2006” for amounts and further detail.

14

(a) Salary. Our Compensation Committee establishes the base salaries for our NEOs at fixed levels that are appropriate for the goals established by our management team and that take into consideration the dynamics of our business and commensurate responsibilities expected of our NEO’s. We consider that our net revenues do not fully reflect the infrastructure that our NEOs are expected to manage, because we derive a significant portion of our revenue based on net commissions. Therefore, our infrastructure must support a higher sales volume than is represented by our reported net revenue, and we take this into consideration in setting base salaries for our NEOs.

(b) Bonus. Our compensation-for-performance philosophy ensures that annual incentive compensation awards follow the achievement of business specific goals. Certain of the Company’s executive officers, including the CEO and CFO, have entered into employment agreements which provide for, in addition to base salary, bonuses to be awarded on the basis of the Company’s attainment of pre-established revenue and net income goals. It is the intent of the Compensation Committee to use these bonuses, in conjunction with the executive’s equity incentives, to tie a potentially large portion of the executive’s total compensation to the financial performance of the Company. Our bonus plan provides for cash bonuses to be paid quarterly and annually when certain predetermined performance targets are achieved.

(c) Long-Term Incentives. Our Compensation Committee makes restricted stock and stock option grants annually to certain of the Company’s executive officers. These awards are designed to create a meaningful opportunity for stock ownership based upon the NEO’s current position with the Company, the NEO’s personal performance in recent periods and his or her potential for future responsibility and promotion over the term of the award. Each grant is designed to align the interests of the executive officer with those of the stockholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. Each stock option generally becomes exercisable in a series of installments over a four-year period, contingent upon the officer’s continued employment with the Company. The same period determines the vesting for restricted stock (i.e., at the rate of 25% per year of service after the award date).

(d) Perquisites or Other Personal Benefits. The Company’s NEOs received the following perquisites in 2006, principally pursuant to their employment agreements that were in effect in 2006: personal expense reimbursements relating to health care premiums; car allowance; financial and tax planning; and 401K match at the same level provided for all eligible employees.

(e) Post-Employment Benefits. Our NEOs are entitled to severance and change-in-control benefits pursuant to employment agreements or pursuant to offer letters entered into at the time of hire. Our Compensation Committee did not see any reason to amend these agreements in 2006, on the premise that such benefits are competitive.

3. Method for Determining Amounts

(a) Annual Base Salary. The annual base salary of each executive officer is established on the basis of each individual’s personal performance and internal alignment considerations. The Compensation Committee’s policy is to target base salary levels that approximate market for similar positions at companies with which we compete for management talent. The Compensation Committee believes that the Company must remain competitive with technology companies of similar size and infrastructure in order to recruit and retain key executives.

(b) Bonus Awards. The amount of the quarterly and annual bonuses that we pay to our NEOs is determined by a formula (disclosed below for 2006) that weighs our quarterly and annual achievement of pre-established revenue and net income goals (with group contribution margin targets being part of the formula for NEOs other than our CEO and CFO).

(c) Long-Term Equity Incentives. Generally, the Compensation Committee makes restricted stock and stock option grants annually to certain of the Company’s executive officers. Each grant is designed to align the interests of the executive officer with those of the stockholders, and to provide each individual with a significant

15

incentive to manage the Company from the perspective of an owner with an equity stake in the business. Each option grant allows the officer to acquire shares of Common Stock at a fixed price per share (the market price on the grant date) over a specified period of time (up to ten years). Each option generally becomes exercisable in a series of installments over a four-year period, contingent upon the officer’s continued employment with the Company. Accordingly, the option will provide a return to the executive officer only if he remains employed by the Company during the vesting period, and then only if the market price of the shares appreciates over the option term.

The size of the option grant to each executive officer is set by the Compensation Committee in its discretion at a level that is intended to create a meaningful opportunity for stock ownership based upon the individual’s current position with the Company, the individual’s personal performance in recent periods and his or her potential for future responsibility and promotion over the option term. The Compensation Committee also takes into account the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that individual. The relevant weight given to each of these factors varies from individual to individual. The Compensation Committee has established certain guidelines with respect to the option grants made to the executive officers, but has the flexibility to make adjustments to those guidelines at its discretion.

(d) Post-Employment Severance and Change-in-Control Benefits. The Company currently has employment agreements with Michael Silton, President, Chief Executive Officer and Director and Steve Valenzuela, Vice President, Finance, Chief Financial Officer and Corporate Secretary.

The employment agreement, as amended, for Mr. Silton generally provides that if Mr. Silton’s employment is constructively terminated or terminated by the Company without cause, then Mr. Silton shall receive, with no duty to mitigate, the following: (i) an amount equal to one and one-quarter times Mr. Silton’s base salary and target annual bonus, to be paid in fifteen equal monthly payments; (ii) up to twelve months of health and life insurance benefits; and (iii) continued vesting of all unvested stock options up to fifteen months. Mr. Silton’s annual base salary and target bonus for calendar 2007 are $350,000 and $350,000 respectively.

The employment agreement, as amended, for Mr. Valenzuela generally provides that if his employment is constructively terminated or terminated by the Company without cause, then Mr. Valenzuela shall receive, with no duty to mitigate, the following: (i) an amount equal to three-quarters times his base salary and target annual bonus, to be paid in nine equal monthly payments, (ii) nine months of health and life insurance benefits, and (iii) continued vesting of all unvested stock options for nine months. Mr. Valenzuela’s stated annual salary and target bonus for calendar 2007 are $259,000 and $129,500 respectively.

To the extent not already vested, options to purchase Common Stock held by Mr. Silton and Mr. Valenzuela will immediately become vested in the event of a merger or other transaction in which more than 50% of the Company’s outstanding securities are transferred to persons different from those persons who are the Company’s stockholders prior to the merger or other transaction or upon the sale of all or substantially all the Company’s assets in complete liquidation or dissolution. Mr. Silton shall have not less than twelve months to exercise his unexercised options and Mr. Valenzuela shall have not less than nine months to exercise his unexercised options.

In addition, in the event of a merger or other transaction in which more than 50% of the Company’s outstanding securities are transferred to persons different from those persons who are the Company’s stockholders prior to the merger or other transaction or upon the sale of all or substantially all the Company’s assets, in complete liquidation or dissolution, our other NEOs will be entitled to receive severance payments in an amount up to 6 months base salary plus any bonus payable during such period, if within one year of such change in control, either such employee is constructively terminated or terminated without cause, and, to the extent not already vested, options to purchase Common Stock held by such executive officers will immediately become vested.

16

(e) Inter-Relationship of Elements. The Compensation Committee reviews overall compensation including base salary, bonus and stock/option grants to make sure they are commensurate with the executive’s position and experience, and determines the weighting of each component of compensation based on market survey information from Radford. The Compensation Committee allocates between long-term and currently-paid out compensation, based on market survey data such as Radford, which shows the allocation of current paid-out compensation and long-term for comparable positions in the same general geographic area. Quarterly and annual cash bonuses are intended to provide executive incentives to achieve the financial objectives for the current fiscal period, whereas equity compensation is structured to reward the executive for long term performance of the company since equity vests over a number of years—usually 4 years. The Company pays all bonuses in cash.

4. Executive Compensation Decisions for 2006

The Compensation Committee made the following decisions in 2006 with respect to each distinctive component of executive compensation for the Company’s NEOs.

(a) Annual Base Salary. Because the Company was not yet profitable in early 2006, the Compensation Committee did not increase the annual base salaries that the NEOs received from the levels that were in effect in 2005.

(b) Bonus. The NEOs actual bonus for 2006 is reported under the column “Non-Equity Incentive Plan Compensation” on the Summary Compensation Table – 2006 that follows. The NEOs met or exceeded their target bonus amounts based on the Company’s financial performance in 2006. Their target bonus amounts as a percentage of base salary for the year were as follows: 100% for Mr. Silton, 27% for Mr. Valenzuela, 56% for each of Messrs. Hauptmeier and Langer, and 41% for Mr. Haselden. Their actual bonus amounts as a percentage of base salary for the year were as follows (excluding amounts paid in bonus in the first quarter of 2006 but earned in 2005): 113% for Mr. Silton, 30% for Mr. Valenzuela, 55% for Mr. Hauptmeier, 57% for Mr. Langer and 64% for Mr. Haselden. Specifically, the bonuses for the CFO and CEO arose from the following determinants that applied equally to both of them: 50% based on the Company’s achievement of quarterly revenue targets; 25% based on the Company’s achievement of quarterly net income targets, and 25% based on the Company’s achievement of annual net income targets. For our other NEOs, the bonuses arose from the following determinants that applied equally to all of them: 33.33% based on achievement of group quarterly revenue targets; 33.33% based on the achievement of quarterly group contribution margin targets and 33.33% based on the Company’s achievement of quarterly net income targets. The differences between their relative bonus amounts for 2006 occurred as a result of their respective target bonus amounts and achievement of specific group goals.

(c) Restricted Stock Awards and Stock Options. When the Compensation Committee made restricted stock and stock option awards on November 20, 2006, the award levels reflected the desirability of providing NEOs with significant equity-based incentives that aligned their financial interests with those of stockholders, by using a four-year vesting schedule to serve as a retention incentive.

(d) Perquisites and Post-Employment Benefits. The Compensation Committee did not make affirmative perquisite or post-employment benefit decisions in 2006, with the Company providing perquisites honoring past obligations and maintaining post-employment benefits under its existing employment-related agreements with the NEOs.

(e) Financial Accounting Considerations. The relative expense associated with stock option and restricted stock awards factored into the Compensation Committee’s decision to consider restricted stock awards in addition to stock options, because of the volatility of the Company’s common stock and the resulting FAS123R stock option expense attached to stock options. The Compensation Committee feels that the option value for purposes of computing the FAS123R expense attached to stock options is disproportionately high, and that restricted stock provides NEOs with an appropriate long term incentive.

17

(f) Tax Considerations. Section 162(m) of the Code imposes a limitation on the deductibility for federal income tax purposes of compensation exceeding $1.0 million paid to certain executive officers. Compensation above $1.0 million is not subject to the limitation if it is “performance-based compensation” within the meaning of the Code. The Company anticipates that any compensation deemed paid by it (whether by the disqualifying disposition of incentive stock options or the exercise of non-statutory stock options) in connection with options with exercise prices equal to the fair market of option shares on the grant date will qualify as performance-based compensation for purposes of Section 162(m) and will not have to be taken into account for purposes of the $1 million limitation per covered individual. Because all compensation paid to the executive officers has not approached the 162(m) limitation, the Compensation Committee has not had to use any of the available exemptions from the deduction limit.

Going forward, the Compensation Committee remains aware of the Code section 162(m) and 409A limitations and the available exemptions and special rules, and will address the issue of 162(m) deductibility and 409A compliance when and if circumstances warrant the use of such exemptions or other considerations.

Compensation Earned

The table below summarizes the compensation paid by the Company to the CEO, CFO and other named executive officers for the fiscal year ended December 31, 2006.

Summary Compensation Table—2006

| | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary ($)(1) | | Bonus

($)(2) | | Stock Awards

($)(3) | | Option

Awards

($)(3) | | Non-Equity Incentive Plan Compensation

($)(2) | | Change in Pension

Volume and

NQ DC

Earnings ($) | | All Other Compensation ($)(4) | | Total ($) |

Michael Silton | | 2006 | | 275,000 | | — | | 20,875 | | 57 | | 309,875 | | — | | 48,878 | | 654,685 |

President, Chief Executive Officer and Director | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Steve Valenzuela | | 2006 | | 225,000 | | — | | 14,233 | | 5,895 | | 67,610 | | — | | 28,561 | | 341,299 |

Vice President, Chief Financial Officer and Corporate Secretary | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Robert Langer | | 2006 | | 160,000 | | — | | 5,693 | | 1,415 | | 90,515 | | — | | 6,578 | | 264,201 |

General Manager | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Ritch Haselden | | 2006 | | 160,000 | | — | | 3,795 | | 1,415 | | 102,221 | | — | | 9,167 | | 276,598 |

General Manager | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Clinton Hauptmeier | | 2006 | | 160,000 | | — | | 3,795 | | 1,415 | | 87,653 | | — | | 6,142 | | 259,005 |

General Manager | | | | | | | | | | | | | | | | | | |

| (1) | Salary is reported based on the amount earned for the calendar year. |

| (2) | Bonus relates to discretionary compensation, which was not awarded in 2006. Our named executive officers received non-equity incentive plan compensation which is based on a measurable attainment schedule. This report excludes the non-equity quarterly and annual incentive bonus payments made in February 2006 that were earned in 2005 as follows: Michael Silton ($78,714), Steve Valenzuela ($8,945), Robert Langer ($16,250), Ritch Haselden ($17,062), and Clinton Hauptmeier ($11,962). |

| (3) | Stock and option award amounts in this table relate to the accounting expense for unvested options and restricted stock awards in accordance with Statement of Financial Accounting Standards No. 123(revised 2004), Share-Based Payment, (SFAS 123(R)), which requires the expensing of equity stock awards. |

| (4) | All other compensation includes auto allowance, company-paid medical and other insurance benefits, 401(k) matching and professional services paid on behalf of the named executive officers listed above. None of these amounts exceeded $25,000 (or 10% of the total reported in this column, if greater). |

18

Grants of Plan-Based Awards

| | | | | | | | | | | | | | | | | | |

| | | Grant

Date | | Estimated Possible Payouts Under Non-equity Incentive Plan Awards | | Stock Awards (#)(2)(4) | | Option Awards (#)(3)(4) | | Exercise Price of Option Awards ($/share) | | Grant Fair Value of Option Awards ($/share) |

Name | | | Threshold ($) | | Target

($)(1) | | Maximum ($) | | | | |

Michael Silton | | 1/1/07 | | — | | 350,000 | | — | | — | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | 110,000 | | — | | | — | | | — |

| | | | | | | | |

Steve Valenzuela | | 1/1/07 | | — | | 129,500 | | — | | — | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | 75,000 | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | | | 50,000 | | $ | 7.27 | | $ | 4.40 |

| | | | | | | | |

Robert Langer | | 1/1/07 | | — | | 122,400 | | — | | — | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | 30,000 | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | — | | 12,000 | | $ | 7.27 | | $ | 4.40 |

| | | | | | | | |

Ritch Haselden | | 1/1/07 | | — | | 93,500 | | — | | — | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | 20,000 | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | — | | 12,000 | | $ | 7.27 | | $ | 4.40 |

| | | | | | | | |

Clinton Hauptmeier | | 1/1/07 | | — | | 105,400 | | — | | — | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | 20,000 | | — | | | — | | | — |

| | 11/20/06 | | — | | — | | — | | — | | 12,000 | | $ | 7.27 | | $ | 4.40 |

| (1) | The named executive officers listed above were granted awards under non-equity incentive plans that are payable in cash if earned. Payment of these awards is based on the attainment of certain measurable business metrics such as revenue, contribution margin, and net income as defined in each plan. There are no minimums or maximums with regard to these plans; however each plan has an established target for incentive payout. |

| (2) | Restricted stock grants identified above vest at a rate of 25% per year of service after the award date. |

| (3) | Each stock option identified above was granted at an exercise price equal to the closing market price of the Company’s common stock on the date on which such grant was approved by the Compensation Committee, and is generally exercisable for a 10-year term and becomes exercisable in a series of installments over a four-year period with 25% vesting on the twelve month anniversary of the initial grant date and the remaining options vesting monthly over thirty-six months, contingent upon the officer’s continued employment with the Company. |

| (4) | Compensation to be settled in equity in the future as listed above was awarded at the discretion of our Board of Directors. No equity-based incentive compensation awards are available as of December 31, 2006. |

19

Outstanding Equity Awards

The following table sets forth certain information regarding the stock option grants and stock awards to the named executive officers as of the end of 2006.

Outstanding Equity Awards At Fiscal Year-End—2006

| | | | | | | | | | | | | | | | | | | |

Option Awards | | Stock Awards |

Name and

Grant Date | | Number of

Securities

Underlying

Unexercised

Options

Exercisable (#) | | Number of

Securities

Underlying

Unexercisable

Options

Unexercised (#) | | Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options | | Option

Exercise

Price

($/Share) | | Option

Expiration

Date | | Number

of Shares

or Units

of Stock

That Have

not Vested

(#) | | Market

Value of

Shares or

Units of

Stock That

Have not

Vested ($) | | Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other

Rights

That Have

not Vested

(#) | | Equity

Incentive

Plan

Awards:

Market or

Payout

Value of

Unearned

Shares,

Units or

Other Right

That Have

not Vested

($/Share) |

Michael Silton | | | | | | | | | | | | | | | | | |

11/20/06 | | — | | — | | — | | — | | — | | 110,000 | | $ | 799,700 | | — | | — |

12/29/05 | | 100,000 | | 100,000 | | — | | 2.56 | | 12/29/15 | | — | | | — | | — | | — |

4/18/05 | | 3,628 | | 3,628 | | — | | 2.55 | | 4/18/15 | | — | | | — | | — | | — |

4/18/05 | | 26,372 | | 26,372 | | — | | 2.55 | | 4/18/15 | | — | | | — | | — | | — |

6/21/04 | | 3,272 | | 3,272 | | — | | 10.20 | | 6/21/14 | | — | | | — | | — | | — |

6/21/04 | | 18,125 | | 18,125 | | — | | 10.20 | | 6/21/14 | | — | | | — | | — | | — |

6/21/04 | | 8,603 | | 8,603 | | — | | 10.20 | | 6/21/14 | | — | | | — | | — | | — |

7/25/02 | | 40,000 | | 40,000 | | — | | 1.15 | | 7/25/10 | | — | | | — | | — | | — |

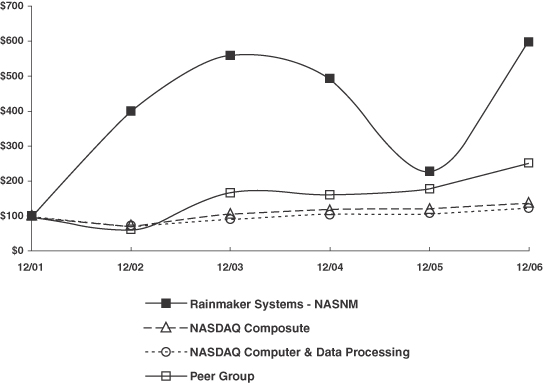

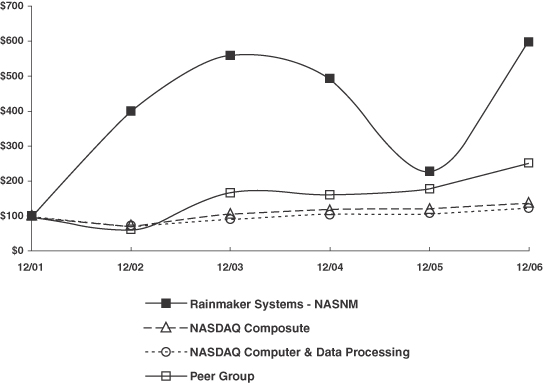

7/25/02 | | 25,001 | | 25,001 | | — | | 1.15 | | 7/25/10 | | — | | | — | | — | | — |