QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

|

(Name of Registrant as Specified In Its Charter) |

Progress Energy, Inc. |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

o |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Progress Energy, Inc.

410 S. Wilmington Street

Raleigh, NC 27601-1849

March 31, 2005

Dear Shareholder:

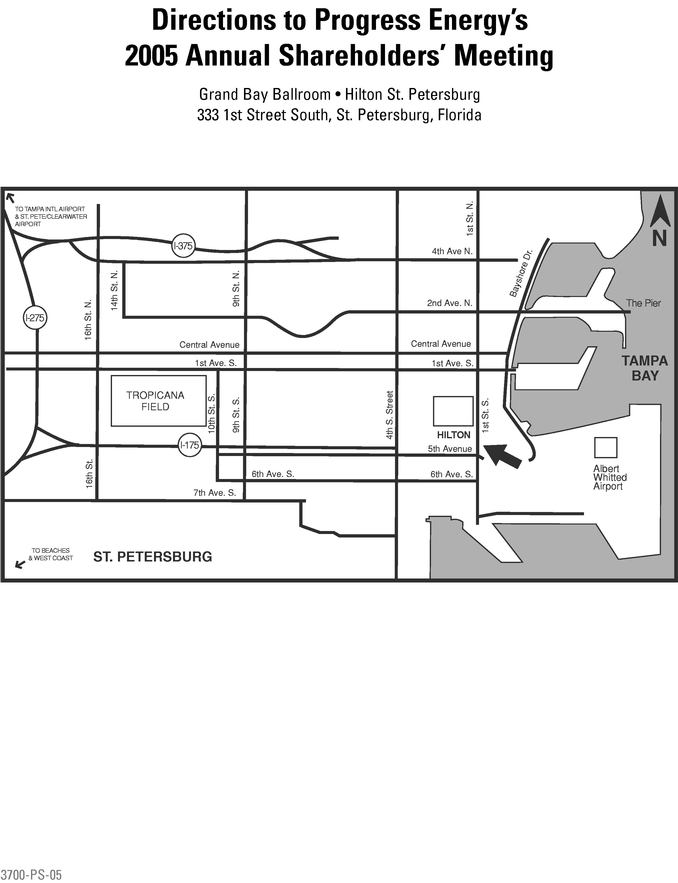

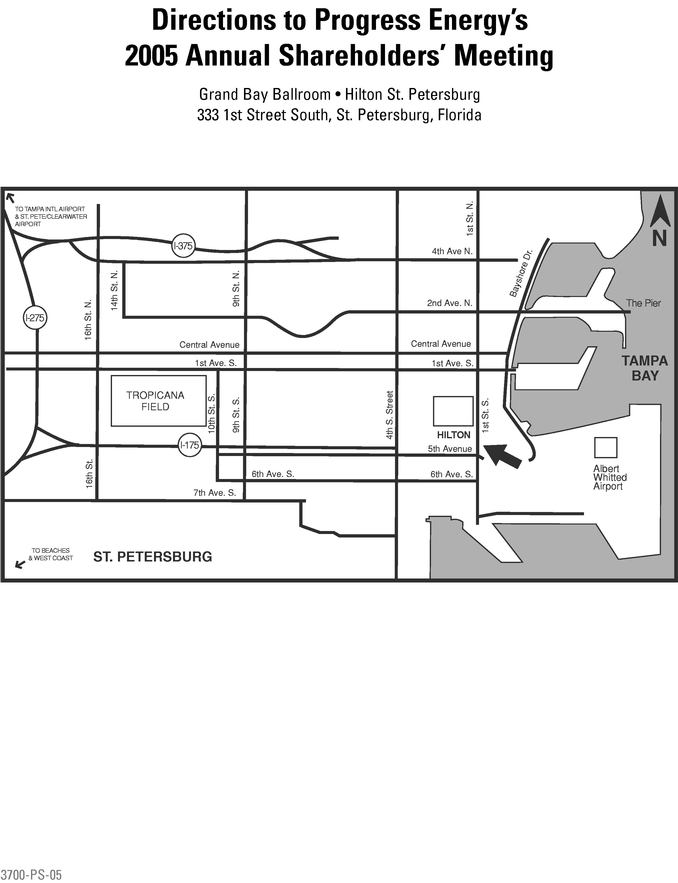

I am pleased to invite you to attend the 2005 Annual Meeting of the Shareholders of Progress Energy, Inc. The meeting will be held at 10 a.m. on May 11, 2005, in the Grand Bay Ballroom at the Hilton St. Petersburg, 333 1st Street South, St. Petersburg, Florida.

As described in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement, the matters scheduled to be acted upon at the meeting for Progress Energy, Inc. are the election of directors and the ratification of the selection of the independent registered public accounting firm for Progress Energy, Inc.

Regardless of the size of your holdings, it is important that your shares be represented at the meeting. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING ENVELOPE OR VOTE BY TELEPHONE OR VIA THE INTERNET IN ACCORDANCE WITH THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE. Voting by any of these methods will ensure that your vote is counted at the Annual Meeting if you do not attend in person.

I am delighted that you have chosen to invest in Progress Energy, Inc. and look forward to seeing you at the meeting. On behalf of the management and Directors of Progress Energy, Inc., thank you for your continued support and confidence in 2005.

Sincerely,

Robert B. McGehee

Chairman of the Board and

Chief Executive Officer | | | |

VOTING YOUR PROXY IS IMPORTANT

Your vote is important. Please promptlySIGN, DATE andRETURN the enclosed proxy card orVOTE BY TELEPHONE OR VIA THE INTERNET in accordance with the instructions on the enclosed proxy card so that as many shares as possible will be represented at the Annual Meeting.

A self-addressed envelope, which requires no postage if mailed in the United States, is enclosed for your convenience.

PROGRESS ENERGY, INC.

410 S. Wilmington Street

Raleigh, North Carolina 27601-1849

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

MAY 11, 2005

The Annual Meeting of the Shareholders of Progress Energy, Inc. (Company) will be held at 10 a.m. on May 11, 2005, in the Grand Bay Ballroom at the Hilton St. Petersburg, 333 1st Street South, St. Petersburg, Florida. The meeting will be held in order to:

- (1)

- Elect three (3) Class I directors of the Company to serve three-year terms.

- (2)

- Ratify the selection of the independent registered public accounting firm for the Company.

- (3)

- Transact any other business as may properly be brought before the meeting.

All shareholders of Common Stock of record at the close of business on March 4, 2005, are entitled to attend the meeting and to vote. The stock transfer books will remain open.

Raleigh, North Carolina

March 31, 2005

PROGRESS ENERGY, INC.

410 S. Wilmington Street

Raleigh, North Carolina 27601-1849

PROXY STATEMENT

GENERAL

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Progress Energy, Inc. (Company) of proxies to be used at the Annual Meeting of Shareholders. That meeting will be held at 10 a.m. on May 11, 2005, in the Grand Bay Ballroom at the Hilton St. Petersburg, 333 1st Street South, St. Petersburg, Florida. (For directions to the meeting location, please see the map included at the end of this Proxy Statement.) This Proxy Statement and form of proxy were first sent to shareholders on or about March 31, 2005.

An audio webcast of the Annual Meeting of Shareholders will be available online athttp://www.progress-energy.com/webcast. The webcast will be available in Windows Media Player format and will be archived on the site.

Copies of the Company's Annual Report on Form 10-K for the year ended December 31, 2004, including financial statements and schedules, are available upon written request, without charge, to the persons whose proxies are solicited. Any exhibit to the Form 10-K is also available upon written request at a reasonable charge for copying and mailing. Written requests should be made to Mr. Thomas R. Sullivan, Treasurer, P. O. Box 1551, Raleigh, North Carolina 27602.

The Securities and Exchange Commission delivery rules can be satisfied by delivering a single proxy statement and annual report to shareholders to an address shared by two or more of our shareholders. This delivery method is referred to as householding. A single copy of the annual report and of the proxy statement will be sent to multiple shareholders who share the same address unless the Company has received contrary instructions from one or more of the shareholders.

If you prefer to receive a separate copy of the proxy statement or the annual report, please write to Shareholder Relations, P. O. Box 1551, Raleigh, North Carolina 27602 or telephone the Company's Shareholder Relations Section at 800-662-7232, and we will promptly send you separate copies. If you are currently receiving multiple copies of the proxy statement or the annual report at your address and would prefer that a single copy of each be delivered there, you may contact the Company at the address or telephone number provided in this paragraph.

1

PROXIES

The accompanying proxy is solicited by the Board of Directors of the Company and the entire cost of solicitation will be borne by the Company. The Company expects to solicit proxies primarily by mail. Proxies may also be solicited by telephone, e-mail or other electronic media or personally by officers and employees of the Company and its subsidiaries, who will not be specially compensated for such services.

You may vote shares either in person or by duly authorized proxy. In addition, you may vote your shares by telephone or via the Internet by following the instructions provided on the enclosed proxy card. Please be aware that if you vote via the Internet, you may incur costs such as telecommunication and Internet access charges for which you will be responsible. The Internet and telephone voting facilities for shareholders of record will close at 12:01 a.m. E.D.T. on the morning of the meeting. Any shareholder who has executed a proxy and attends the meeting may elect to vote in person rather than by proxy. You may revoke any proxy given by you in response to this solicitation at any time before the proxy is exercised by delivering a written notice of revocation, by filing with the Secretary of the Company a subsequently dated, properly executed proxy or by attending the Annual Meeting and electing to vote in person. Your attendance at the Annual Meeting, by itself, will not constitute a revocation of a proxy. If you vote by telephone or via the Internet, you may also revoke your vote by any of the three methods noted above, or you may change your vote by voting again by telephone or via the Internet. If you decide to vote by completing and mailing the enclosed proxy card, you should retain a copy of certain identifying information found on the proxy card in the event that you decide later to change or revoke your proxy by accessing the Internet. You should address any written notices of proxy revocation to: Progress Energy, Inc., P.O. Box 1551, Raleigh, North Carolina 27602, Attention: Secretary.

All shares represented by effective proxies received by the Company at or before the Annual Meeting, and not revoked before they are exercised, will be voted in the manner specified therein. Proxies that do not contain specifications will be voted"FOR" the election of all Directors as set forth in this Proxy Statement and"FOR" the ratification of the selection of Deloitte & Touche LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2005, as set forth in this Proxy Statement. Proxies will be voted at the discretion of the named proxies on any other business properly brought before the meeting.

If you are a participant in the Company's 401(k) Savings & Stock Ownership Plan or the Savings Plan for Employees of Florida Progress Corporation (FPC), shares allocated to your Plan account will be voted by the Trustee only if you execute and return your proxy, or vote by telephone or via the Internet. Company stock remaining in the ESOP Stock Suspense Account that has not been allocated to employee accounts shall be voted by the Trustee in the same proportion as shares voted by participants in the 401(k) Plan.

Special Note for Shares Held in "Street Name"

If your Common Stock is held by a brokerage firm, bank or other nominee (i.e., in "street name"), you will receive directions from your nominee that you must follow in order to have your Common Stock voted. "Street name" shareholders who wish to vote in person at the meeting will need to obtain a special proxy form from the brokerage firm, bank or other nominee that holds their Common Stock of record. You should contact your brokerage firm, bank or other bank nominee for details regarding how you may obtain this special proxy form.

If your Common Stock is held in "street name" and you fail to give instructions as to how you want your shares voted (a "non-vote"), the brokerage firm, bank or other nominee who holds Progress Energy shares on your behalf may, in certain circumstances, vote the Common Stock in their discretion. However, such brokerage firm, bank or other nominee is not required to vote the shares of Common Stock and may choose to enter a "broker non-vote."

2

With respect to "routine" matters, such as the election of Directors, ratification of the selection of the independent registered public accounting firm, and shareholder proposals, a brokerage firm, bank or other nominee has authority (but is not required) under the rules governing self-regulatory organizations (the "SRO rules"), including the New York Stock Exchange ("NYSE"), to vote its clients' Common Stock shares if the clients do not provide instructions. When a brokerage firm, bank or other nominee votes its clients' Common Stock shares on routine matters without receiving voting instructions, these shares are counted both for establishing a quorum to conduct business at the meeting and in determining the number of Shares voted FOR, WITHHELD FROM or AGAINST such routine matters.

With respect to "non-routine" matters, a brokerage firm, bank or other nominee is not permitted under the SRO rules to vote its clients' Common Stock shares if the clients do not provide instructions. The brokerage firm or other nominee will so note on the vote card, and this constitutes a "broker non-vote." "Broker non-votes" will be counted for purposes of establishing a quorum to conduct business at the meeting but not for determining the number of Common Stock shares voted FOR, AGAINST or ABSTAINING from such non-routine matters.

Accordingly, if you do not vote your proxy, your brokerage firm, bank or other nominee may either: (i) vote your Common Stock shares on routine matters and cast a "broker non-vote" on non-routine matters, or (ii) leave your Common Stock shares unvoted altogether.

At the 2005 Annual Meeting of Shareholders, no non-routine matters are expected to be presented for a vote. However, we encourage you to provide instructions to your brokerage firm or other nominee by voting your proxy. This action ensures that your Common Stock shares and voting preferences will be fully represented at the meeting.

VOTING SECURITIES

The Directors of the Company have fixed March 4, 2005, as the record date for shareholders entitled to vote at the Annual Meeting. Only holders of the Company's Common Stock of record at the close of business on that date are entitled to notice of and to vote at the Annual Meeting. Each share is entitled to one vote. As of March 4, 2005, there were outstanding 248,533,367 shares of Common Stock.

Consistent with state law, the presence, in person or by proxy, of holders of at least a majority of the total number of Common Stock shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Once a share of Common Stock is represented for any purpose at a meeting, it is deemed present for quorum purposes for the remainder of the meeting and any adjournment thereof, unless a new record date is or must be set for the adjournment. Common Stock shares held of record by shareholders or their nominees who do not vote by proxy or attend the Annual Meeting in person will not be considered present or represented at the Annual Meeting and will not be counted in determining the presence of a quorum. Proxies that withhold authority or reflect abstentions or "broker non-votes" will be counted for purposes of determining whether a quorum is present.

Pursuant to the provisions of the North Carolina Business Corporation Act, Directors will be elected by a plurality of the votes cast by the shares entitled to vote. Withheld votes or shares held in "street name" that are not voted in the election of Directors will not be included in determining the number of votes cast. Approval of the proposal to ratify the selection of the Company's independent registered public accounting firm and other matters to be presented at the Annual Meeting, if any, generally will require the affirmative vote of a majority of the shares voted on such matters. Abstentions from voting and broker non-votes will not count as shares voted and will not have the effect of a "negative" vote with respect to any such matters.

We will announce preliminary voting results at the Annual Meeting. We will publish the final results in our quarterly report on Form 10-Q for the second quarter of fiscal year 2005. A copy of this quarterly report may be obtained without charge by any of the means outlined above for obtaining a copy of the Annual Report on Form 10-K.

3

PROPOSAL 1—ELECTION OF DIRECTORS

Based on the report of the Corporate Governance Committee (see page 11), the Board of Directors nominates the following three nominees: William O. McCoy, John H. Mullin, III, and Carlos A. Saladrigas. The nominees would serve as Directors in Class I with terms expiring in 2008 and until their respective successors are elected and qualified.

There are no family relationships among any of the nominees for Director or among any nominee and any Director or officer of the Company or its subsidiaries, and there is no arrangement or understanding between any nominee and any other person pursuant to which the nominee was selected.

The election of Directors will be determined by a plurality of the votes cast at the Annual Meeting at which a quorum is present. Shareholders do not have cumulative voting rights in connection with the election of Directors. This means that the three nominees receiving the highest number of "FOR" votes will be elected as Directors. Withheld votes and broker non-votes, if any, are not treated as votes cast and, therefore, will have no effect on the proposal to elect Directors.

Valid proxies received pursuant to this solicitation will be voted in the manner specified. Where specifications are not made, the shares represented by the accompanying proxy will be votedFOR the election of each of the three nominees. Votes (other than votes withheld) will be cast pursuant to the accompanying proxy for the election of the nominees listed above unless, by reason of death or other unexpected occurrence, one or more of such nominees shall not be available for election, in which event it is intended that such votes will be cast for such substitute nominee or nominees as may be determined by the persons named in such proxy. The Board of Directors has no reason to believe that any of the nominees listed above will not be available for election as a Director.

The names of the three nominees for election to the Board of Directors and of the other Directors, along with their ages, principal occupations or employment for the past five years, and current directorships of public companies are set forth below. No information is included regarding Richard A. Nunis, who will reach the mandatory retirement age for non-employee Board members this year, and thus will retire from the Board at the Annual Meeting of Shareholders on May 11, 2005. No information is included regarding W. D. Frederick, Jr., who recently notified the Company that he will not stand for re-election at the Annual Meeting of Shareholders on May 11, 2005. (Carolina Power & Light Company d/b/a Progress Energy Carolinas, Inc. (PEC) and FPC, which are noted in the descriptions below, are both wholly owned subsidiaries of the Company.) Information concerning the number of shares of the Company's Common Stock beneficially owned, directly or indirectly, by all current Directors appears on page 8 of this Proxy Statement.

The Board of Directors recommends a voteFOR each nominee for Director.

Nominees for Election—Class I

(Terms Expiring in 2008)

WILLIAM O. MCCOY, age 71, is a partner in Franklin Street Partners, an investment management firm (since 1997). He previously served as Interim Chancellor of the University of North Carolina at Chapel Hill from April 1999 to August 2000. He was also formerly Vice Chairman of the Board, BellSouth Corp., and President and Chief Executive Officer, BellSouth Enterprises. He has served as a Director of the Company and its predecessors since 1996 and also serves as a Director of PEC, FPC, Duke Realty Corporation, The Liberty Corporation and North Carolina Capital Management Trust, and as a Trustee of Fidelity Investments.

JOHN H. MULLIN, III, age 63, is Chairman of Ridgeway Farm, LLC, a limited liability company engaged in farming and timber management. He is a former Managing Director of Dillon, Read & Co. (investment bankers). He has served as a Director of the Company and its predecessors since 1999 and also

4

serves as a Director of PEC, FPC, The Liberty Corporation and Sonoco Products Company, and as a Trustee of The Putnam Funds.

CARLOS A. SALADRIGAS, age 56, is Chairman of Premier American Bank in Miami, Florida. In 2002, he retired as Chief Executive Officer of ADP TotalSource (previously The Vincam Group, Inc.), a Miami-based human resources outsourcing company that provides services to small and mid-sized businesses. He has served as a Director of the Company since 2001 and also serves as a Director of PEC, FPC and Advance Auto Parts, Inc.

Directors Continuing in Office—Class II

(Terms Expiring in 2006)

EDWIN B. BORDEN, age 71, is retired President of The Borden Manufacturing Company, a textile management services company. He has served as a Director of the Company and its predecessors since 1985 and also serves as a Director of PEC, FPC, Jefferson-Pilot Corporation, Jefferson-Pilot Financial, Jefferson-Pilot Life Insurance Company, Ruddick Corporation and Winston Hotels, Inc.

JAMES E. BOSTIC, JR., age 57, is Executive Vice President of Georgia-Pacific Corporation, a manufacturer and distributor of tissue, paper, packaging, building products, pulp and related chemicals (since January 2001). He previously served as Senior Vice President of Georgia-Pacific Corporation (from January 1995 to December 2000). He has served as a Director of the Company since 2002 and also serves as a Director of PEC and FPC.

DAVID L. BURNER, age 65, is retired Chairman and Chief Executive Officer of the Goodrich Corporation, a provider of aerospace components, systems and services. He has served as a Director of the Company and its predecessors since 1999 and also serves as a Director of PEC, FPC, Milacron, Inc., Lance, Inc., Engelhard Corporation and Briggs & Stratton Corporation.

RICHARD L. DAUGHERTY, age 69, was formerly Executive Director of NCSU Research Corporation, a development corporation of the Centennial Campus of North Carolina State University. He previously served as Vice President of IBM PC Company and Senior State Executive of IBM Corp. He has served as a Director of the Company and its predecessors since 1992 and also serves as a Director of PEC, FPC and Winston Hotels, Inc.

Directors Continuing in Office—Class III

(Terms Expiring in 2007)

CHARLES W. COKER, age 71, is Chairman of Sonoco Products Company, a manufacturer of paperboard and paper and plastics packaging products (since April 1998). He has served as a Director of the Company and its predecessors since 1975 and also serves as a Director of PEC, FPC, Bank of America Corporation and Sara Lee Corporation.

ROBERT B. MCGEHEE, age 62, is Chairman and Chief Executive Officer of the Company (since May 2004 and March 2004, respectively). Mr. McGehee joined PEC in 1997 as Senior Vice President and General Counsel. Since that time, he has held several senior management positions of increasing responsibility within the Company. Most recently, Mr. McGehee served as President and Chief Operating Officer of the Company, having responsibility for the day-to-day operations of both the Company's regulated and nonregulated businesses. Prior to that, Mr. McGehee served as President and Chief Executive Officer of Progress Energy Service Company, LLC. He has served as a Director of the Company since 2004 and also serves as a Director of PEC and FPC.

E. MARIE MCKEE, age 54, is Senior Vice President of Corning Incorporated, a developer of technologies for glass, ceramics, fiber optics and photonics. She also serves as President and Chief Executive Officer of Steuben Glass. She has served as a Director of the Company and its predecessors since 1999 and also serves as a Director of PEC and FPC.

5

PETER S. RUMMELL, age 59, is Chairman and Chief Executive Officer of St. Joe Company, a real estate operating company in Jacksonville, Florida (since 1997). He previously served as Chairman of Walt Disney Imagineering, the division responsible for The Walt Disney Company's worldwide creative design, real estate and research and development activities from 1985 until 1996. He has served as a Director of the Company since 2003 and also serves as a Director of PEC and FPC.

JEAN GILES WITTNER, age 70, is President and Secretary of Wittner & Co., Inc., a Florida holding company for companies that provide life insurance products, employee benefit insurance programs, and commercial office leasing and property management services. She has served as a Director of the Company since 2000 and also serves as a Director of PEC, FPC and Raymond James Bank, FSB.

PROPOSAL 2—RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit and Corporate Performance Committee of the Company's Board of Directors (the "Audit Committee") has selected Deloitte & Touche LLP ("Deloitte & Touche") as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2005, and has directed that management submit the selection of that independent registered public accounting firm for ratification by the shareholders at the 2005 Annual Meeting of the Shareholders. Deloitte & Touche is an independent registered public accounting firm and has served as the independent registered public accounting firm for the Company and its predecessors since 1930. In selecting Deloitte & Touche, the Audit Committee considered carefully Deloitte & Touche's previous performance for the Company, its independence with respect to the services to be performed and its general reputation for adherence to professional auditing standards. A representative of Deloitte & Touche will be present at the Annual Meeting of Shareholders, will have the opportunity to make a statement and will be available to respond to appropriate questions. Shareholder ratification of the selection of Deloitte & Touche as the Company's independent registered public accounting firm is not required by the Company's By-Laws or otherwise. However, the Company is submitting the selection of Deloitte & Touche to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain Deloitte & Touche. Even if the shareholders ratify the selection, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it is determined that such a change would be in the best interest of the Company and its shareholders.

The Audit Committee and the Board of Directors recommend a voteFOR the ratification of the selection of Deloitte & Touche as the independent registered public accounting firm for the Company.

Valid proxies received pursuant to this solicitation will be voted in the manner specified. Where no specification is made, the shares represented by the accompanying proxy will be votedFOR the ratification of the selection of Deloitte & Touche as the independent registered public accounting firm for the Company. Votes (other than votes withheld) will be cast pursuant to the accompanying proxy for the ratification of the selection of Deloitte & Touche.

The affirmative vote of a majority of all the votes cast at the meeting is required to approve the proposal to ratify the selection of Deloitte & Touche to serve as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2005. This means that, assuming a quorum is present, the number of "FOR" votes cast at the meeting for the proposal must exceed the number of "AGAINST" votes cast at the meeting in order for this proposal to be approved. Both "FOR" and "AGAINST" votes are counted as votes cast. Neither abstentions nor broker non-votes are treated as votes cast and, therefore, do not affect the outcome.

6

PRINCIPAL SHAREHOLDERS

The following table sets forth the only shareholders known to the Company to beneficially own more than 5% of the outstanding shares of the Common Stock of the Company as of December 31, 2004. The Company has no other class of voting securities.

Title of Class

| | Name and Address of

Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percentage of

Class

| |

|---|

| Common Stock | | State Street Bank and Trust Company

225 Franklin Street

Boston, MA 02110 | | 23,851,1061 | | 9.7 | % |

|

|

Capital Research and Management Company

333 Hope Street

Los Angeles, CA 90071 |

|

16,962,3402 |

|

6.9 |

% |

1Consists of shares of Common Stock held by State Street Bank and Trust Company, acting in various fiduciary capacities. State Street Bank has sole power to vote with respect to 23,851,106 shares and shared power to dispose of 23,851,106 shares. State Street Bank has disclaimed beneficial ownership of all shares of Common Stock. (Based solely on information contained in a Schedule 13G filed by State Street Bank and Trust Company on February 22, 2005.)

2Consists of shares of Common Stock held by Capital Research and Management Company as an investment advisor that manages The American Funds Group of mutual funds. Capital Research and Management Company has sole power to dispose of 16,962,340 shares of Common Stock, and has disclaimed beneficial ownership of all shares of Common Stock. (Based solely on information contained in a Schedule 13G filed by Capital Research and Management Company on February 14, 2005.)

7

MANAGEMENT OWNERSHIP OF COMMON STOCK

The following table describes the beneficial ownership of the Common Stock of the Company and ownership of Common Stock units as of February 28, 2005, of (i) all current Directors and nominees for Director, (ii) each executive officer of the Company named in the Summary Compensation Table presented later in this document and (iii) all Directors and executive officers as a group. The table does not include shares beneficially owned by William Cavanaugh III, former Chairman and CEO, who retired from the Company, effective June 1, 2004, and Tom D. Kilgore, former Group President of PEC, who resigned from the Company, effective February 28, 2005. A unit of Common Stock does not represent an equity interest in the Company and possesses no voting rights, but is equal in economic value at all times to one share of Common Stock. As of February 28, 2005, none of the individuals or the group in the above categories owned one percent (1%) or more of the Company's voting securities. Unless otherwise noted, all shares of Common Stock set forth in the table are beneficially owned, directly or indirectly, with sole voting and investment power, by such shareholder.

| |

|---|

Name

| | Number of Shares

of Common Stock

Beneficially Owned

| | Units Representing Shares

of Common Stock1,2,3,4,5,6

| |

|---|

| |

|---|

| Edwin B. Borden | | 10,264 | 7 | 39,761 | 8 |

| James E. Bostic, Jr. | | 3,589 | 7 | 3,367 | 8 |

| David L. Burner | | 5,000 | 7 | 10,886 | 8 |

| Charles W. Coker | | 11,498 | 7 | 45,658 | 8 |

| Richard L. Daugherty | | 5,177 | 7 | 30,584 | 8 |

| W. D. Frederick, Jr. | | 5,000 | 7 | 10,245 | 8 |

| William D. Johnson | | 176,489 | 9 | 30,434 | 10 |

| William O. McCoy | | 5,175 | 7 | 20,836 | 8 |

| Robert B. McGehee (CEO as of March 1, 2004) | | 283,671 | 9 | 65,448 | 11 |

| E. Marie McKee | | 5,500 | 7 | 14,153 | 8 |

| John H. Mullin, III | | 8,000 | 7 | 14,338 | 8 |

| Richard A. Nunis | | 9,000 | 7 | 5,062 | 8 |

| William S. Orser (separating as of April 1, 2005) | | 188,381 | 9 | 69,710 | 12 |

| Peter S. Rummell | | 2,400 | | 2,753 | 8 |

| Carlos A. Saladrigas | | 8,600 | 7 | 3,085 | 8 |

| Peter M. Scott III | | 181,229 | 9 | 37,572 | 13 |

| Jean Giles Wittner | | 7,000 | 7 | 10,020 | 8 |

| Shares of Common Stock14 and Units beneficially owned by all Directors and executive officers of the Company as a group (27 persons) | | 1,526,137 | | 635,750 | |

1Includes units representing Common Stock of the Company under the Directors' Deferred Compensation Plan and the Non-Employee Director Stock Unit Plan (see "Directors' Compensation" on page 15).

2Includes accumulated replacement units representing Common Stock of the Company under the Management Deferred Compensation Plan.

3Includes performance units under the Long-Term Compensation Program.

8

4Includes performance shares awarded under the Performance Share Sub-Plan of the 1997 and 2002 Equity Incentive Plans (see "Long-Term Incentive Plan Awards Table" on page 21.

5Includes replacement units to replace the value of Company contributions to the 401(k) Savings & Stock Ownership Plan that would have been made but for the deferral of salary under the Management Deferred Compensation Plan and contribution limitations under Section 415 of the Internal Revenue Code of 1986, as amended (see "Summary Compensation Table" on page 17 and footnote 5 thereunder).

6Includes performance units recorded to reflect awards deferred under the Management Incentive Compensation Plan.

7Includes shares of Company Common Stock such director has the right to acquire beneficial ownership of within 60 days through the exercise of certain stock options, and, where indicated, shares over which the director shares voting and investment powers with a family member and has not disclaimed beneficial ownership, as follows:

Edwin B. Borden—4,000

James E. Bostic, Jr.—2,000

David L. Burner—4,000

Charles W. Coker—4,000 and 7,298, respectively

Richard L. Daugherty—4,000

W. D. Frederick, Jr.—4,000

William O. McCoy—4,000 and 175, respectively

E. Marie McKee—4,000

John H. Mullin, III—4,000

Richard A. Nunis—4,000

Carlos A. Saladrigas—4,000

Jean Giles Wittner—4,000 and 1,000 shares, respectively

8Consists of units representing Common Stock of the Company under the Directors' Deferred Compensation Plan and units under the Non-Employee Director Stock Unit Plan as follows:

Edwin B. Borden—32,188 and 7,573, respectively

James E. Bostic, Jr.—3,003 and 364, respectively

David L. Burner—8,372 and 2,514, respectively

Charles W. Coker—36,659 and 8,999, respectively

Richard L. Daugherty—25,057 and 5,527, respectively

W. D. Frederick, Jr.—7,731 and 2,514, respectively

William O. McCoy—16,485 and 4,351, respectively

E. Marie McKee—11,639 and 2,514, respectively

John H. Mullin, III—11,450 and 2,888, respectively

Richard A. Nunis—2,548 and 2,514, respectively

Peter S. Rummell—2,753 (Directors' Deferred Compensation Plan Units only)

Carlos A. Saladrigas—1,972 and 1,113, respectively

Jean Giles Wittner—7,506 and 2,514, respectively

9Includes shares of Restricted Stock and shares of Company Common Stock such officer has the right to acquire beneficial ownership of within 60 days through the exercise of certain stock options as follows:

William D. Johnson—61,333 and 94,833, respectively

Robert B. McGehee—113,967 and 152,500, respectively

William S. Orser—41,466 and 106,667, respectively

Peter M. Scott III—70,434 and 90,500, respectively

10Consists of (i) 1,287 performance units recorded to reflect awards deferred under the Management Incentive Compensation Plan, (ii) 28,351 performance shares awarded under the Performance Share

9

Sub-Plan of the 1997 and 2002 Equity Incentive Plans, and (iii) 796 replacement units under the Management Deferred Compensation Plan.

11Consists of (i) 2,474 performance units recorded to reflect awards deferred under the Management Incentive Compensation Plan, (ii) 61,321 performance shares awarded under the Performance Share Sub-Plan of the 1997 and 2002 Equity Incentive Plans, and (iii) 1,653 replacement units under the Management Deferred Compensation Plan.

12Consists of (i) 13,310 performance units under the Long-Term Compensation Program, (ii) 51,899 shares awarded under the Performance Share Sub-Plan of the 1997 and 2002 Equity Incentive Plans, and (iii) 4,501 replacement units under the Management Deferred Compensation Plan.

13Consists of 36,858 performance shares awarded under the Performance Share Sub-Plan of the 1997 and 2002 Equity Incentive Plans and 714 replacement units under the Management Deferred Compensation Plan.

14Includes shares each group member (shares in the aggregate) has the right to acquire beneficial ownership of within 60 days through the exercise of certain stock options.

10

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During 2004, six of the Company's Directors had indirect interests in routine commercial transactions for the sale of goods and services to which the Company or one of its subsidiaries was a party; however, none of those interests were material and thus are not required to be disclosed.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's Directors and executive officers to file reports of their holdings and transactions in the Company's securities with the Securities and Exchange Commission and the New York Stock Exchange. Based on Company records and other information, the Company believes that all Section 16(a) filing requirements applicable to its Directors and executive officers with respect to the Company's 2004 fiscal year were met.

CORPORATE GOVERNANCE

The Board of Directors operates pursuant to an established set of written Corporate Governance Guidelines (the "Guidelines") that set forth the Company's corporate governance philosophy and the governance policies and practices the Company has implemented in support of that philosophy. The three core governance principles embraced by the Board are integrity, accountability and independence.

The Guidelines describe Board membership criteria, the Board selection and orientation process and Board leadership. The Guidelines require that a minimum of 80 percent of the Board's members be independent and that the membership of each Board Committee, except the Executive Committee, consist only of independent directors. Directors who are not full-time employees of the Company generally must retire from the Board at age 73. Directors whose job responsibilities or other factors relating to their selection to the Board change materially after their election are required to submit a letter of resignation to the Board. The Board will have an opportunity to review the continued appropriateness of the individual's Board membership and the Governance Committee will make the initial recommendation as to the individual's continued Board membership. The Guidelines also describe the stock ownership guidelines that are applicable to Board members and prohibit compensation to Board members other than directors' fees and payments.

The Guidelines provide that the Organization and Compensation Committee of the Board will evaluate the performance of the Chief Executive Officer on an annual basis, using objective criteria, and will communicate the results of its evaluation to the full Board. The Guidelines also provide that the Corporate Governance Committee is responsible for conducting an annual assessment of the performance and effectiveness of the Board, and its standing committees, and reporting the results of each assessment to the full Board annually.

The Guidelines provide that Board members have complete access to the Company's management, and can retain, at Company expense, independent advisors or consultants to assist the Board in fulfilling its responsibilities, as it deems necessary. The Guidelines also state that it is the Board's policy that the non-employee directors meet in executive session on a regularly scheduled basis. Those sessions are chaired by the Presiding Director, John H. Mullin, III, who is also Chairman of the Corporate Governance Committee. He can be contacted by writing to John H. Mullin, III, Presiding Director, Progress Energy Board of Directors, c/o Corporate Secretary, P.O. Box 1551, Raleigh, NC 27602. The Company screens mail addressed to Mr. Mullin for security purposes and to ensure that it relates to discrete business matters that are relevant to the Company. Mail addressed to Mr. Mullin which satisfies these screening criteria will be forwarded to him.

In keeping with the Board's commitment to sound corporate governance, the Company has adopted a comprehensive written Code of Ethics that incorporates an effective reporting and enforcement mechanism. The Code of Ethics is applicable to all Company employees, including the Company's Chief

11

Executive Officer, its Chief Financial Officer and its Controller. The Board has adopted the Company's Code of Ethics as its own standard. Board members, Company officers and Company employees certify their compliance with the Company Code of Ethics on an annual basis.

The Company's Corporate Governance Guidelines and Code of Ethics are posted on its Internet Web site, and can be accessed at www.progress-energy.com under the Investors section.

BOARD OF DIRECTORS

The Board of Directors is currently comprised of fourteen (14) members. The Board of Directors met eight times in 2004. Average attendance of the Directors at the meetings of the Board and its Committees held during 2004 was 95%, and no Director attended less than 85% of all Board or his/her respective Committee meetings held in 2004.

The Board of Directors has determined that the following members of the Board are independent, as that term is defined under the general independence standards contained in the listing standards of the New York Stock Exchange:

| Edwin B. Borden | | E. Marie McKee |

| James E. Bostic, Jr. | | John H. Mullin, III |

| David L. Burner | | Richard A. Nunis |

| Charles W. Coker | | Peter S. Rummell |

| Richard L. Daugherty | | Carlos A. Saladrigas |

| W. D. Frederick, Jr. | | Jean Giles Wittner |

| William O. McCoy | | |

In addition to considering the NYSE's general independence standards, the Board has adopted categorical standards to assist it in making determinations of independence. The Board's categorical independence standards address the same criteria that are included in the NYSE's independence standards, and also provide that a director who had or whose immediate family member had, during the Company's last fiscal year, a relationship that must be disclosed under Item 404(a) or (b) of Regulation S-K is not independent. In addition, the Board's categorical independence standards prohibit directors and their family members from receiving personal loans from the Company. (The categorical independence standards are outlined in the Company's Corporate Governance Guidelines, which as noted above, are posted on the Company's Internet Web site.) All Directors identified as independent in this proxy statement meet these categorical standards.

The Board of Directors appoints from its members an Executive Committee, a Committee on Audit and Corporate Performance, a Committee on Finance, a Committee on Operations, Environmental, Health and Safety Issues, a Committee on Organization and Compensation, and a Corporate Governance Committee. The charters of all Committees of the Board are posted on the Company's Internet Web site and can be accessed at www.progress-energy.com under the Investors section. The membership and functions of the standing Board Committees, as of December 31, 2004, are discussed below.

EXECUTIVE COMMITTEE

The Executive Committee is presently composed of one Director who is an officer and five independent Directors: Messrs. Robert B. McGehee—Chairman, Edwin B. Borden, Charles W. Coker, Richard L. Daugherty, William O. McCoy and John H. Mullin, III. The authority and responsibilities of the Executive Committee are described in the Company's By-Laws. Generally, the Executive Committee will review routine matters that arise between meetings of the full Board and require action by the Board. The Committee held two meetings in 2004.

12

AUDIT AND CORPORATE PERFORMANCE COMMITTEE

The Audit and Corporate Performance Committee is presently composed of the following seven non-employee Directors: Messrs. Richard L. Daugherty—Chairman, James E. Bostic, Jr., David L. Burner, W. D. Frederick, Jr., John H. Mullin, III, and Carlos A. Saladrigas and Ms. Jean Giles Wittner. All members of the Committee are independent as that term is defined under the enhanced independence standards for audit committee members contained in the Securities Exchange Act of 1934 and rules thereunder, as amended, as incorporated into the listing standards of the New York Stock Exchange. Messrs. Burner and Saladrigas have been designated by the Board as the "Audit Committee Financial Experts," as that term is defined in the Securities and Exchange Commission's rules. The work of this Committee includes oversight responsibilities relating to the integrity of the Company's financial statements, compliance with legal and regulatory requirements, the qualifications and independence of the Company's independent registered public accounting firm, performance of the internal audit function and of the independent registered public accounting firm, and the Corporate Ethics Program. The role of the committee is further discussed under "Report of the Audit and Corporate Performance Committee" below.

Mr. David L. Burner serves simultaneously on the audit committees of more than three public companies. The Company does not limit the number of audit committees on which its Audit Committee members may serve; however, the Board of Directors has determined that such service by Mr. Burner, given his other commitments, does not impair Mr. Burner's ability to serve effectively on the Company's Audit Committee. The Committee held nine meetings in 2004.

CORPORATE GOVERNANCE COMMITTEE

The Corporate Governance Committee is presently composed of the following four non-employee Directors: Messrs. John H. Mullin, III—Chairman, Edwin B. Borden, Charles W. Coker and Peter S. Rummell. All members of the Committee are independent as that term is defined under the general independence standards contained in the New York Stock Exchange listing standards. This Committee is responsible for making recommendations to the Board with respect to the governance of the Company and the Board. Its responsibilities include recommending amendments to the Company's Charter and By-Laws, making recommendations regarding the structure, charter, practices and policies of the Board, ensuring that processes are in place for annual CEO performance appraisal and review of succession planning and management development, recommending a process for the annual assessment of Board performance, recommending criteria for Board membership, reviewing the qualifications of and recommending to the Board nominees for election. The Committee is responsible for conducting investigations into or studies of matters within the scope of its responsibilities and to retain outside advisors to identify Director candidates. The Committee will consider qualified candidates for Director nominated by shareholders at an annual meeting of shareholders; provided, however, that written notice of any shareholder nominations must be received by the Secretary of the Company no later than the close of business on the 120th calendar day before the date of the Company's proxy statement released to shareholders in connection with the previous year's annual meeting. See "Future Shareholder Proposals" below for more information regarding shareholder nominations of directors. The Committee held six meetings in 2004.

FINANCE COMMITTEE

The Finance Committee is presently composed of the following six non-employee Directors: Messrs. William O. McCoy—Chairman, David L. Burner, Charles W. Coker, John H. Mullin, III, Richard A. Nunis and Carlos A. Saladrigas. The Committee reviews and oversees the Company's financial policies and planning, financial position, strategic planning and investments, pension funds and financing plans. The Committee also monitors the Company's risk management activities, financial position and recommends changes to the Company's dividend policy and proposed budget. The Committee held six meetings in 2004.

13

COMMITTEE ON OPERATIONS, ENVIRONMENTAL, HEALTH AND SAFETY ISSUES

The Committee on Operations, Environmental, Health and Safety Issues is presently composed of the following seven non-employee Directors: Messrs. Edwin B. Borden—Chairman, James E. Bostic, Jr., Richard L. Daugherty, W. D. Frederick, Jr., and Peter S. Rummell, and Ms. E. Marie McKee and Ms. Jean Giles Wittner. The Committee reviews the Company's load forecasts and plans for generation, transmission and distribution, fuel production and transportation, customer service, energy trading and term marketing, and other Company operations. The Committee reviews and assesses Company policies, procedures, and practices relative to the protection of the environment and the health and safety of employees, customers, contractors and the public. The Committee advises the Board and makes recommendations for the Board's consideration regarding operational, environmental and safety-related issues. The Committee held three meetings in 2004.

COMMITTEE ON ORGANIZATION AND COMPENSATION

The Committee on Organization and Compensation is presently composed of the following six non-employee Directors: Messrs. Charles W. Coker—Chairman, Edwin B. Borden, William O. McCoy, Richard A. Nunis and Peter S. Rummell and Ms. E. Marie McKee. All members of the Committee are independent as that term is defined under the general independence standards contained in the New York Stock Exchange listing standards. The Committee verifies that personnel policies and procedures are in keeping with all governmental rules and regulations and are designed to attract and retain competent, talented employees and develop the potential of these employees. The Committee reviews all executive development plans, makes executive compensation decisions, evaluates the performance of the Chief Executive Officer and oversees plans for management succession. The Committee held seven meetings in 2004.

DIRECTOR NOMINATING PROCESS AND COMMUNICATIONS BETWEEN

SHAREHOLDERS AND BOARD OF DIRECTORS

The Corporate Governance Committee

The Corporate Governance Committee ("Governance Committee") of the Board of Directors performs the functions of a nominating committee. The Governance Committee's Charter describes the Committee's responsibilities, including recommending criteria for membership on the Board, reviewing qualifications of candidates and recommending to the Board nominees for election to the Board. As noted above, the Guidelines contain information concerning the Committee's responsibilities with respect to reviewing with the Board on an annual basis the qualification standards for Board membership and identifying, screening and recommending potential directors to the Board. All members of the Governance Committee are independent as defined under the general independence standards of the New York Stock Exchange's listing standards. Additionally, the Guidelines require that all members of the Committee be independent.

Director Candidate Recommendations and Nominations by Shareholders

Shareholders should submit any Director candidate recommendations in writing in accordance with the method described under "Communications with the Board of Directors" below. Any Director candidate recommendation that is submitted by a shareholder of the Company to the Governance Committee will be acknowledged, in writing, by the Corporate Secretary. The recommendation will be promptly forwarded to the Chairman of the Governance Committee, who will place consideration of the recommendation on the agenda for the Governance Committee's regular December meeting. The Committee will discuss candidates recommended by shareholders at its December meeting, and present information regarding such candidates, along with the Committee's recommendation regarding each

14

candidate, to the full Board for consideration. The full Board will determine whether it will nominate a particular candidate for election to the Board.

Additionally, in accordance with Section 11 of the Company's By-Laws, any shareholder of record entitled to vote for the election of Directors at the applicable meeting of shareholders may nominate persons for election to the Board of Directors if such shareholder complies with the notice procedure set forth in the By-Laws and summarized in "Future Shareholder Proposals" below.

Governance Committee Process for Identifying and Evaluating Director Candidates

The Governance Committee evaluates all Director candidates, including those nominated or recommended by shareholders, in accordance with the Board's qualification standards, which are described in the Guidelines. The Committee evaluates each candidate's qualifications and assesses them against the perceived needs of the Board. Qualification standards for all Board members include: integrity, sound judgment, independence as defined under the general independence standards contained in the New York Stock Exchange listing standards, and the categorical standards adopted by the Board, financial acumen, strategic thinking, ability to work effectively as a team member, demonstrated leadership and excellence in a chosen field of endeavor, experience in a field of business, professional or other activities that bear a relationship to the Company's mission and operations, appreciation of the business and social environment in which the Company operates, an understanding of the Company's responsibilities to shareholders, employees, customers and the communities it serves, and service on other boards of directors that could detract from service on the Company's Board.

Communications with the Board of Directors

The Board has approved a process for shareholders to send communications to the Board. That process provides that shareholders can send communications to the Board and, if applicable, to the Governance Committee or to specified individual directors in writing c/o John R. McArthur, Senior Vice President, General Counsel and Secretary, Progress Energy, Inc., Post Office Box 1551, Raleigh, North Carolina 27602-1551.

The Company screens mail addressed to the Board, the Governance Committee or any specified individual Director for security purposes and to ensure that the mail relates to discrete business matters that are relevant to the Company. Mail that satisfies these screening criteria is forwarded to the appropriate Director.

Director Attendance at Annual Meeting

The Company expects all Directors to attend the Annual Meeting of Shareholders. Such attendance is monitored by the Governance Committee. All Directors attended the 2004 Annual Meeting of Shareholders with the exception of Peter S. Rummell.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

DIRECTORS' COMPENSATION

Directors who are not employees of the Company receive an annual retainer of $45,000, of which $15,000 is automatically deferred under the Directors' Deferred Compensation Plan (see below), and an attendance fee of $1,500 per meeting for regularly scheduled Board meetings. Directors who are not employees of the Company also receive an attendance fee for committee meetings of $1,500. The Chairman of each Committee receives an additional retainer of $5,000 per year. Directors who are not employees of the Company receive an attendance fee of $1,500 for each day of a visit to a plant or office of the Company or its subsidiaries or for attendance at any other business meeting to which the Director is

15

invited by the Company. Directors who are officers do not receive an annual retainer or attendance fees. All Directors are reimbursed for expenses incident to their service as Directors.

In addition to $15,000 from the annual retainer and any matching contributions under the incentive compensation program that are automatically deferred, outside Directors may elect to defer any portion of the remainder of their annual retainer and Board attendance fees until after the termination of their service on the Board under the Directors' Deferred Compensation Plan. Any deferred fees are deemed to be invested in a number of units of Common Stock of the Company, but participating Directors receive no equity interest or voting rights in any shares of the Common Stock. The number of units credited to the account of a participating Director is equal to the dollar amount of the deferred fees divided by the average of the high and low selling prices (i.e., market value) of the Common Stock on the day the deferred fees would otherwise be payable to the participating Director. The number of units in each account is adjusted from time to time to reflect the payment of dividends on the number of shares of Common Stock represented by the units. Unless otherwise agreed to by the participant and the Board, when the participant ceases to be a member of the Board of Directors, he or she will receive cash equal to the market value of a share of the Company's Common Stock on the date of payment multiplied by the number of units credited to the participant's account.

Directors are also eligible for matching contributions of up to $15,000 under an incentive compensation program. Awards under this program are based upon the achievement of the corporate incentive goals established each year by the Board and used as the basis for a matching contribution of shares of Common Stock for participating employees in the Company's 401(k) Savings & Stock Ownership Plan. In the event that five of the corporate incentive goals are met, the $15,000 portion of the annual retainer that is automatically deferred pursuant to the Directors' Deferred Compensation Plan will be increased by 50 percent, with an additional 10 percent increase for each corporate incentive goal met in excess of five (up to a maximum matching contribution of 100 percent). Such matching contribution is automatically deferred until the Director's retirement.

Pursuant to the Company's 2002 Equity Incentive Compensation Plan, Directors are also eligible to receive grants of up to 2,000 non-qualified stock options on May 1 of each year, subject to the Board's approval. The grants will be made pursuant to individual award agreements between the Company and each Director. In order to be eligible for an annual grant, an individual must have been an outside member of the Company's Board of Directors on May 1 of the year in which the award is granted. Each annual grant will vest on the first anniversary of the grant date, and will be exercisable for 10 years from the grant date. Stock options granted to Directors will vest early in the event of a change-in-control of the Company. (The Company ceased granting stock options in 2004. All stock options granted prior to January 1, 2005, remain valid in accordance with their terms and conditions.)

Effective January 1, 1998, the Company established the Non-Employee Director Stock Unit Plan ("Stock Unit Plan"). The Stock Unit Plan provides for an annual grant of 350 "stock units" to each non-employee Director who has served on the Board for at least one year and for matching grants of up to 350 additional units to be awarded to those Directors for each year in which certain incentive goals established by the Board are met. (Effective January 1, 2005, the Stock Unit Plan provides for an annual grant of 1,200 "stock units" to each non-employee Director and the matching program for grants under the Stock Unit Plan was discontinued.) Each unit is equal in economic value to one share of the Company's Common Stock, but does not represent an equity interest or entitle its holder to vote. The number of units is adjusted from time to time to reflect the payment of dividends with respect to the Common Stock of the Company. Benefits under the Stock Unit Plan vest after a participant has been a member of the Board for five years and are payable solely in cash.

Both the Directors' Deferred Compensation Plan and the Non-Employee Director Stock Unit Plan were amended, effective January 1, 2005, to comply with the American Jobs Creation Act of 2004.

Service on Boards of Subsidiaries

All compensation paid to outside Directors is for services rendered on behalf of the Company's Board of Directors and the boards of PEC and FPC.

16

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | Long-Term Compensation | | | | |

| |

| | Annual Compensation

| | Awards

| | Payouts

| |

| |

|---|

Name and

Principal Position

| | Year

| | Salary1

($)

| | Bonus2

($)

| | Other

Annual

Compensation3

($)

| | Restricted

Stock

Award(s)4,5

($)

| | Securities

Underlying

Options/

SARs6

(#)

| | LTIP

Payouts7

($)

| | All Other

Compensation8

($)

| |

|---|

Robert B. McGehee,

Chairman and Chief

Executive Officer

(as of May 12, 2004 and

March 1, 2004, respectively) | | 2004

2003

2002 | | $

| 915,769

644,769

524,923 | | $

| 830,000

500,000

225,000 | | $

| 127,748

109,844

42,995 | 9

| $

| 2,568,364

784,439

1,257,073 | 10

| 0

108,000

92,100 | | $

| 490,312

453,204

280,972 | | $

| 158,149

130,149

106,122 | 11

|

William Cavanaugh III,

Chairman and Chief

Executive Officer

(through May 12 and

February 29, 2004, respectively) |

|

2004

2003

2002 |

|

$

|

550,250

1,219,692

1,134,231 |

|

$

|

0

933,000

900,000 |

|

$

|

161,976

505,700

181,661 |

12

|

$

|

43,783

1,884,337

5,938,322 |

13

|

0

258,000

228,000 |

|

$

|

2,048,765

1,709,391

1,162,641 |

|

$

|

286,492

1,071,484

414,377 |

14

|

William S. Orser,

Group President—PEC

(separating as of

April 1, 2005) |

|

2004

2003

2002 |

|

$

|

623,192

579,923

559,846 |

|

$

|

345,000

350,000

215,000 |

|

$

|

25,157

24,003

23,972 |

|

$

|

436,739

479,646

469,631 |

15

|

0

60,000

55,000 |

|

$

|

550,978

615,137

435,990 |

|

$

|

182,562

188,171

155,413 |

16

|

William D. Johnson,

President and Chief

Operating Officer

(as of January 1, 2005) |

|

2004

2003

2002 |

|

$

|

583,981

503,654

433,885 |

|

$

|

375,000

315,000

170,000 |

|

$

|

24,461

24,512

22,700 |

|

$

|

646,905

413,815

1,194,325 |

17

|

0

56,000

50,500 |

|

$

|

384,189

336,711

193,773 |

|

$

|

92,599

87,122

74,381 |

18

|

Peter M. Scott III,

President and Chief

Executive Officer,

Progress Energy

Service Co., LLC |

|

2004

2003

2002 |

|

$

|

542,442

462,385

434,846 |

|

$

|

335,000

280,000

160,000 |

|

$

|

29,283

43,517

4,586 |

|

$

|

378,583

381,205

1,195,496 |

19

|

0

52,000

46,000 |

|

$

|

424,619

377,925

N/A |

|

$

|

128,933

123,432

100,491 |

20

|

Tom D. Kilgore,

Group President—PEC

(resigned as of

February 28, 2005) |

|

2004

2003

2002 |

|

$

|

485,769

421,115

385,981 |

|

$

|

260,000

250,000

127,000 |

|

$

|

22,639

37,317

7,236 |

|

$

|

342,434

347,603

1,154,116 |

21

|

0

48,000

46,000 |

|

$

|

363,953

388,460

251,906 |

|

$

|

129,562

117,238

94,157 |

22

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Consists of base salary prior to (i) employee contributions to the Progress Energy 401(k) Savings & Stock Ownership Plan and (ii) voluntary deferrals, if any, under the Management Deferred Compensation Plan. See "Other Benefit Opportunities" on page 34.

2Except as otherwise noted, consists of amounts awarded with respect to performance in the stated year under the Management Incentive Compensation Plan. See "Other Annual Compensation Opportunities" on page 30.

3Consists of gross-up payments for certain federal and state income tax obligations, and where indicated by footnote disclosure, certain perquisites.

4Includes the value of restricted stock awards as of the grant date (calculated by multiplying the closing market price of the Company's unrestricted Common Stock on the date of grant by the number of shares awarded) granted pursuant to the Company's 1997 and 2002 Equity Incentive Plans. During the period for which the shares are restricted, the grantee will receive all voting rights and cash dividends associated with the restricted stock.

5Includes the value of matchable deferrals credited to the account of a participant to replace the value of Company contributions to the Progress Energy 401(k) Savings & Stock Ownership Plan that would have been made on behalf of the participant but for the deferral of salary under the Management Deferred Compensation Plan (MDCP) and compensation limitations under

17

Section 415 of the Internal Revenue Code of 1986, as amended. Previously, matchable deferrals were provided only in Phantom Stock Units, but effective January 1, 2003, and thereafter, the value of matchable deferrals is credited to a deemed stable value fund, rather than Phantom Stock Units to eliminate reporting requirements for de minimus incremental derivative security additions. Additional amounts are credited from time to time to reflect the payment of dividends on the underlying Common Stock. Participants with one or more years of service with the Company are 100% vested in all matchable deferrals credited to their account under the MDCP Plan. Payment of the value of the deemed investment funds will be made in cash and will generally be made on one of the following dates in accordance with the participant's deferral election: (i) the April 1 following the date that is five or more years from the last day of the MDCP Year for which the participant's salary deferral is made, (ii) the April 1 following the participant's retirement, or (iii) the April 1 following the first anniversary of the participant's retirement. The amount of the payment will equal the fair market value of notational deemed investment funds on the valuation date. See "Other Benefit Opportunities" on page 34.

6The Company ceased granting stock options in 2004.

7Consists of the value of payouts of awards granted under the Company's Performance Share Sub-Plan.

8Amounts reported in this column include dividends earned in 2004 on awards granted under the Long-Term Compensation Program and dividends allocated in 2004 on awards granted under the Performance Share Sub-Plan.

9Consists of (i) $61,575 in gross-up payments for certain federal and state income obligations; and (ii) certain perquisites, including financial planning expenses of $16,672 and automobile expenses of $18,600, which exceed thresholds for footnote disclosure.

10Consists of (i) 53,400 shares of Restricted Stock valued at $2,534,989 as of March 16, 2004; and (ii) $33,375 representing matchable salary deferrals credited to a deemed stable investment fund pursuant to the terms of the Management Deferred Compensation Plan. As of December 31, 2004, Mr. McGehee owned a total of 113,967 shares of Restricted Stock, which were valued at $5,155,867 on that date.

11Consists of (i) $126,366 which represents dividends allocated in 2004 on performance shares awarded under the Performance Share Sub-Plan; (ii) $12,150 which represents Company contributions under the Progress Energy 401(k) Savings & Stock Ownership Plan; and (iii) $19,633 which represents the dollar value of the premium relating to the term portion and the present value of the premium relating to the whole life portion of the benefit to be received pursuant to the Executive Permanent Life Insurance Program.

12Consists of (i) $60,434 in gross-up payments for certain federal and state income tax obligations; and (ii) certain perquisites, including Company airplane expenses of $31,392 and financial planning expenses of $33,219, both of which exceed thresholds for footnote disclosure.

13Consists of $43,783 representing matchable salary deferrals credited to a deemed stable investment fund pursuant to the terms of the Management Deferred Compensation Plan. As of December 31, 2004, Mr. Cavanaugh did not own any shares of Restricted Stock; however, as discussed herein, the vesting schedules for some of the shares of Restricted Stock that were granted to Mr. Cavanaugh prior to December 31, 2004, were accelerated in connection with his retirement on June 1, 2004. On March 18, 2003, Mr. Cavanaugh was granted 46,800 shares of Restricted Stock, which were valued at $1,834,015 on that date. (15,600 of these shares of Restricted Stock vested on March 18, 2004; 15,600 shares were to vest on March 18, 2005, and 15,600 shares were to vest on March 18, 2006; however, the Committee on Organization and Compensation decided to exercise its discretion to remove the time-based restrictions on the balance of the shares in connection with Mr. Cavanaugh's retirement on June 1, 2004; thus, those 31,200 shares all vested on June 1, 2004.) As of December 31, 2003, Mr. Cavanaugh owned a total of 294,134 shares of Restricted Stock, which were valued at $13,312,505 on that date. Of those shares, 151,767 vested by May 8, 2004. The vesting schedule for 50,000 of the remaining restricted shares, which constituted one-half of a 100,000 Restricted Stock award made on October 1, 2002, was accelerated from February 1, 2005 to June 1, 2004, consistent with the express terms of the applicable agreement. This acceleration was based on the fact that Mr. Cavanaugh had extended his retirement for approximately one-half the requested period referenced in the applicable Restricted Stock agreement and had met the non-quantitative intent of the grant. In addition, the Committee on Organization and Compensation decided to remove the restrictions on another previously granted Restricted Stock award in connection with Mr. Cavanaugh's retirement on June 1, 2004. As a result, the vesting schedule for 11,167 shares granted on May 8, 2002, was accelerated from May 8, 2005 to June 1, 2004. The applicable Restricted Stock agreement provides that the Committee has the discretion to accelerate the vesting schedule in the event of Mr. Cavanaugh's retirement.

14Consists of (i) $71,918 which represents dividends earned in 2004 on performance units awarded under the Long-Term Compensation Program; (ii) $206,068 which represents dividends allocated in 2004 on performance shares awarded under the Performance Share Sub-Plan; and (iii) $8,506 which represents Company contributions under the Progress Energy 401(k) Savings & Stock Ownership Plan.

15Consists of (i) 8,700 shares of Restricted Stock valued at $413,004 as of March 16, 2004; and (ii) $23,735 representing matchable salary deferrals credited to a deemed stable investment fund pursuant to the terms of the Management Deferred

18

Compensation Plan. As of December 31, 2004, Mr. Orser owned a total of 41,466 shares of Restricted Stock, which were valued at $1,875,922 on that date.

16Consists of (i) $29,221 which represents dividends earned in 2004 on performance units awarded under the Long-Term Compensation Program; (ii) $117,770 which represents dividends allocated in 2004 on performance shares awarded under the Performance Share Sub-Plan; (iii) $12,150 which represents Company contributions under the Progress Energy 401(k) Savings & Stock Ownership Plan; and (iv) $23,421 which represents the dollar value of the premium relating to the term portion and the present value of the premium relating to the whole life portion of the benefit to be received pursuant to the Executive Permanent Life Insurance Program.

17Consists of (i) 13,200 shares of Restricted Stock valued at $626,626 as of March 16, 2004; and (ii) $20,279 representing matchable salary deferrals credited to a deemed stable investment fund pursuant to the terms of the Management Deferred Compensation Plan. As of December 31, 2004, Mr. Johnson owned a total of 61,333 shares of Restricted Stock, which were valued at $2,774,705 on that date.

18Consists of (i) $63,755 which represents dividends allocated in 2004 on performance shares awarded under the Performance Share Sub-Plan; (ii) $12,150 which represents Company contributions under the Progress Energy 401(k) Savings & Stock Ownership Plan; and (iii) $16,694 which represents the dollar value of the premium relating to the term portion and the present value of the premium relating to the whole life portion of the benefit to be received pursuant to the Executive Permanent Life Insurance Program.

19Consists of (i) 7,600 shares of Restricted Stock valued at $360,785 as of March 16, 2004; and (ii) $17,798 representing matchable salary deferrals credited to a deemed stable investment fund pursuant to the terms of the Management Deferred Compensation Plan. As of December 31, 2004, Mr. Scott owned a total of 57,434 shares of Restricted Stock, which were valued at $2,598,314 on that date. On January 1, 2005, Mr. Scott was awarded 13,000 shares of Restricted Stock, which were valued at $586,477 on January 4, 2005.

20Consists of (i) $80,866 which represents dividends allocated in 2004 on performance shares awarded under the Performance Share Sub-Plan; (ii) $12,150 which represents Company contributions under the Progress Energy 401(k) Savings & Stock Ownership Plan; and (iii) $35,917 which represents the dollar value of the premium relating to the term portion and the present value of the premium relating to the whole life portion of the benefit to be received pursuant to the Executive Permanent Life Insurance Program.

21Consists of (i) 6,900 shares of Restricted Stock valued at $327,555 as of March 16, 2004; and (ii) $14,879 representing matchable salary deferrals credited to a deemed stable investment fund pursuant to the terms of the Management Deferred Compensation Plan. As of December 31, 2004, Mr. Kilgore owned a total of 48,300 shares of Restricted Stock, which were valued at $2,185,092 on that date.

22Consists of (i) $93,176 which represents dividends allocated in 2004 on performance shares awarded under the Performance Share Sub-Plan; (ii) $12,150 which represents Company contributions under the Progress Energy 401(k) Savings & Stock Ownership Plan; and (iii) $24,236 which represents the dollar value of the premium relating to the term portion and the present value of the premium relating to the whole life portion of the benefit to be received pursuant to the Executive Permanent Life Insurance Program.

19

OPTION/SAR GRANTS IN LAST FISCAL YEAR

The Company ceased granting stock options in 2004. Accordingly, no stock options were granted to employees during the fiscal year ended December 31, 2004.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

FY-END OPTION/SAR VALUES

| |

| |

| | Number of securities underlying unexercised options/SARs at FY-end

| | Value of unexercised

in-the-money options/SARs

at FY-end

Exercisable/

Unexercisable

|

|---|

Name

| | Shares

acquired on

exercise

| | Value

realized

|

|---|

| | Exercisable

| | Unexercisable

|

|---|

Robert B. McGehee,

Chairman and CEO (as of May 12, 2004 and March 1, 2004, respectively) | | 0 | | $ | 0.00 | | 152,500 | | 102,700 | | $314,843/$135,669 |

William Cavanaugh III,

Chairman and CEO (through May 12, 2004 and February 29, 2004, respectively) | | 0 | | $ | 0.00 | | 440,100 | | 248,000 | | $892,855/$332,800 |

William S. Orser,

Group President—PEC

(separating as of April 1, 2005) | | 0 | | $ | 0.00 | | 106,667 | | 58,333 | | $217,201/$79,549 |

William D. Johnson,

President and COO | | 0 | | $ | 0.00 | | 94,833 | | 54,167 | | $193,612/$73,338 |

Peter M. Scott III,

President and CEO, Progress Energy Service Company, LLC | | 0 | | $ | 0.00 | | 90,500 | | 50,000 | | $183,149/$67,126 |

Tom D. Kilgore,

Group President—PEC (resigned as of February 28, 2005) | | 0 | | $ | 0.00 | | 89,167 | | 47,333 | | $182,496/$65,819 |

20

LONG-TERM INCENTIVE PLAN AWARDS IN LAST FISCAL YEAR

Name

| | Number of

Units

| | Performance

Period Ends

|

|---|

Robert B. McGehee,

Chairman and CEO (as of May 12, 2004 and March 1, 2004, respectively) | | 28,228 | | 2006 |

William Cavanaugh III,

Chairman and CEO (through May 12, 2004 and February 29, 2004, respectively) | | N/A | | N/A |

William S. Orser,

Group President—PEC (separating as of April 1, 2005) | | 8,637 | | 2006 |

William D. Johnson,

President and COO | | 8,066 | | 2006 |

Peter M. Scott III,

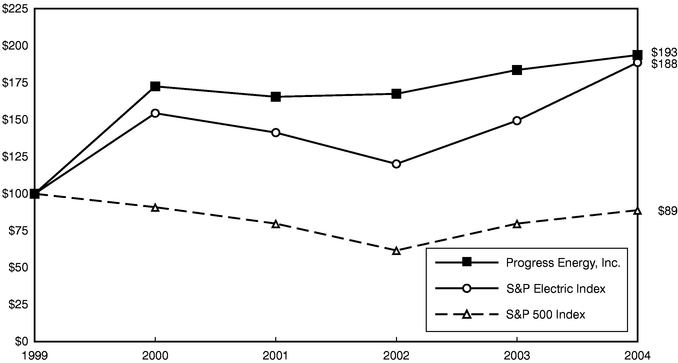

President and CEO