QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

|

(Name of Registrant as Specified In Its Charter) |

Progress Energy, Inc. |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

o |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Progress Energy, Inc.

410 S. Wilmington Street

Raleigh, NC 27601-1849

April 3, 2008

Dear Shareholder:

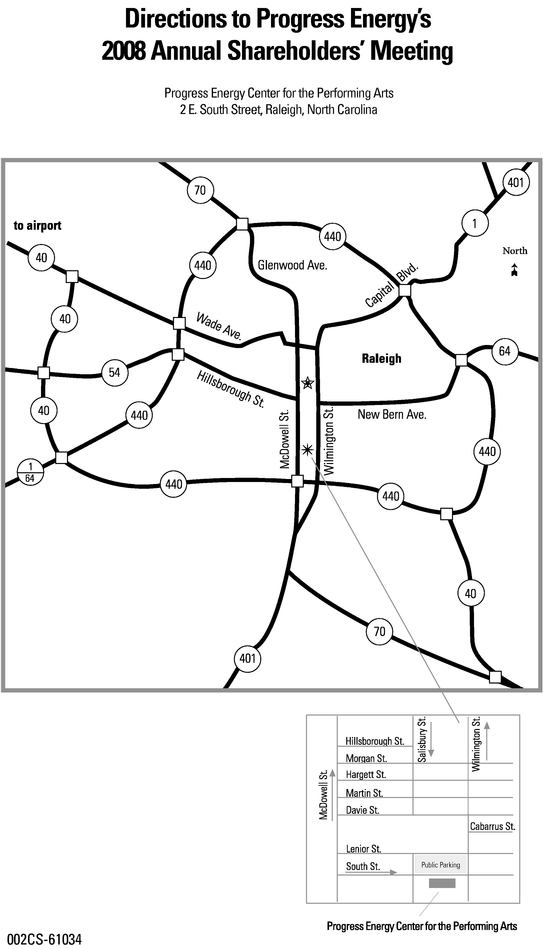

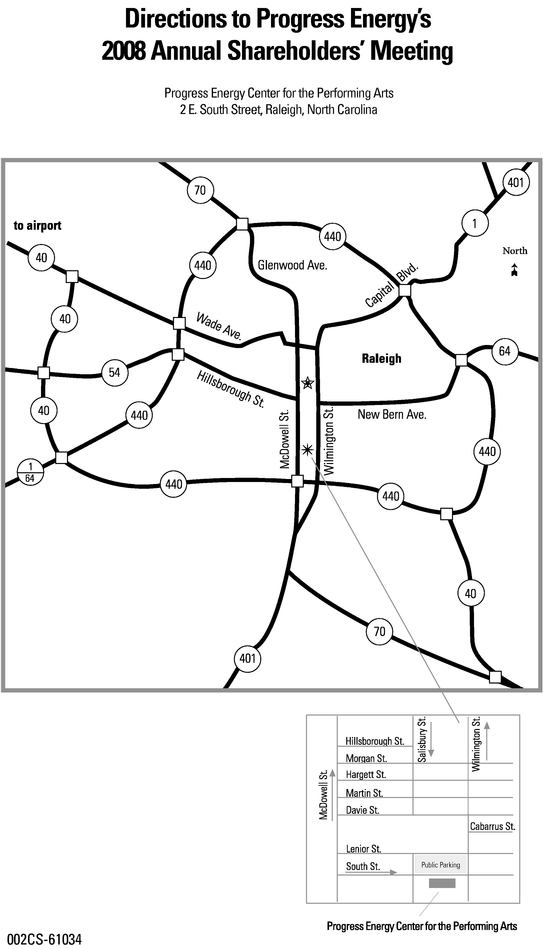

I am pleased to invite you to attend the 2008 Annual Meeting of the Shareholders of Progress Energy, Inc. The meeting will be held at 10:00 a.m. on May 14, 2008, at the Progress Energy Center for the Performing Arts, 2 East South Street, Raleigh, North Carolina.

As described in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement, the matters scheduled to be acted upon at the meeting for Progress Energy, Inc. are the election of directors, the ratification of the selection of the independent registered public accounting firm for Progress Energy, Inc., and a shareholder proposal regarding executive compensation.

Regardless of the size of your holdings, it is important that your shares be represented at the meeting. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING ENVELOPE OR VOTE BY TELEPHONE OR VIA THE INTERNET IN ACCORDANCE WITH THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE. Voting by any of these methods will ensure that your vote is counted at the Annual Meeting if you do not attend in person.

I am delighted that you have chosen to invest in Progress Energy, Inc., and look forward to seeing you at the meeting. On behalf of the management and directors of Progress Energy, Inc., thank you for your continued support and confidence in 2008.

Sincerely,

William D. Johnson

Chairman of the Board, President and

Chief Executive Officer

VOTING YOUR PROXY IS IMPORTANT

Your vote is important. Please promptlySIGN, DATE and RETURN the enclosed proxy card orVOTE BY TELEPHONE OR VIA THE INTERNET in accordance with the instructions on the enclosed proxy card so that as many shares as possible will be represented at the Annual Meeting.

A self-addressed envelope, which requires no postage if mailed in the United States, is enclosed for your convenience.

PROGRESS ENERGY, INC.

410 S. Wilmington Street

Raleigh, North Carolina 27601-1849

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON

MAY 14, 2008

This notice, along with our proxy statement and annual report to shareholders, are available at http://progress-energy.com/proxy.

The Annual Meeting of the Shareholders of Progress Energy, Inc. (the "Company") will be held at 10:00 a.m. on May 14, 2008, at the Progress Energy Center for the Performing Arts, 2 East South Street, Raleigh, North Carolina. The meeting will be held in order to:

- (1)

- Elect twelve (12) directors of the Company, each to serve a one-year term. The Company recommends a voteFOR each of the nominees for director.

- (2)

- Ratify the selection of Deloitte & Touche LLP as the independent registered public accounting firm for the Company. The Company recommends a voteFOR the ratification of the selection of Deloitte & Touche LLP as the Company's independent registered public accounting firm.

- (3)

- Vote on a shareholder proposal regarding executive compensation. The Company recommends a voteAGAINST the shareholder proposal.

- (4)

- Transact any other business as may properly be brought before the meeting.

All holders of the Company's Common Stock of record at the close of business on March 7, 2008, are entitled to attend the meeting and to vote. The stock transfer books will remain open.

| | | By order of the Board of Directors |

|

|

JOHN R. MCARTHUR

Senior Vice President,

General Counsel and Secretary |

Raleigh, North Carolina

April 3, 2008

PROXY STATEMENT

TABLE OF CONTENTS

| | Page

|

|---|

| Annual Meeting and Voting Information | | |

| Proposal 1—Election of Directors | | 4 |

| Principal Shareholders | | 7 |

| Management Ownership of Common Stock | | 8 |

| Transactions with Related Persons | | 11 |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 11 |

| Corporate Governance Guidelines and Code of Ethics | | 11 |

| Director Independence | | 13 |

| Board, Board Committee and Annual Meeting Attendance | | 13 |

| Board Committees | | 14 |

| | Executive Committee | | 14 |

| | Audit and Corporate Performance Committee | | 14 |

| | Corporate Governance Committee | | 14 |

| | Finance Committee | | 15 |

| | Operations and Nuclear Oversight Committee | | 15 |

| | Organization and Compensation Committee | | 15 |

| | Compensation Committee Interlocks and Insider Participation | | 16 |

| Director Nominating Process and Communications with Board of Directors | | 16 |

| Compensation Discussion and Analysis | | 18 |

| Compensation Tables | | 42 |

| | Summary Compensation | | 42 |

| | Grants of Plan-Based Awards | | 49 |

| | Outstanding Equity Awards at Fiscal Year End | | 53 |

| | Option Exercises and Stock Vested | | 55 |

| | Pension Benefits | | 57 |

| | Nonqualified Deferred Compensation | | 59 |

| | Cash Compensation and Value of Vesting Equity | | 61 |

| | Potential Payments Upon Termination | | 64 |

| | Director Compensation | | 76 |

| Equity Compensation Plan Information | | 80 |

| Report of the Audit and Corporate Performance Committee | | 80 |

| Disclosure of Independent Registered Public Accounting Firm's Fees | | 81 |

| Proposal 2—Ratification of Selection of Independent Registered Public Accounting Firm | | 83 |

| Proposal 3—Shareholder Proposal Regarding Executive Compensation | | 83 |

| Financial Statements | | 86 |

| Future Shareholder Proposals | | 86 |

| Other Business | | 87 |

| Exhibit A—Policy and Procedures with Regard to Related Person Transactions | | A-1 |

| Exhibit B—Standards for Board Independence (excerpted from Progress Energy, Inc. Corporate Governance Guidelines) | | B-1 |

PROGRESS ENERGY, INC.

410 S. Wilmington Street

Raleigh, North Carolina 27601-1849

PROXY STATEMENT

GENERAL

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (at times referred to as the "Board") of proxies to be used at the Annual Meeting of Shareholders. That meeting will be held at 10:00 a.m. on May 14, 2008, at the Progress Energy Center for the Performing Arts, 2 East South Street, Raleigh, North Carolina. (For directions to the meeting location, please see the map included at the end of this Proxy Statement.) Throughout this Proxy Statement, Progress Energy, Inc. is at times referred to as "we," "our" or "us." This Proxy Statement and form of proxy were first sent to shareholders on or about April 3, 2008.

An audio Webcast of the Annual Meeting of Shareholders will be available online in Windows Media Player format atwww.progress-energy.com/investor. The Webcast will be archived on the site.

Copies of our Annual Report on Form 10-K for the year ended December 31, 2007, including financial statements and schedules, are available upon written request, without charge, to the persons whose proxies are solicited. Any exhibit to the Form 10-K is also available upon written request at a reasonable charge for copying and mailing. Written requests should be made to Mr. Thomas R. Sullivan, Treasurer, P.O. Box 1551, Raleigh, North Carolina 27602. Our Form 10-K is also available through the Securities and Exchange Commission's (the "SEC") Web site atwww.sec.gov or through our Web site atwww.progress-energy.com. The contents of these Web sites are not, and shall not be deemed to be, a part of this proxy statement or proxy solicitation materials.

The SEC delivery rules can be satisfied by delivering a single proxy statement and annual report to shareholders to an address shared by two or more of our shareholders. This delivery method is referred to as householding. A single copy of the annual report and of the proxy statement will be sent to multiple shareholders who share the same address unless we have received contrary instructions from one or more of the shareholders.

If you prefer to receive a separate copy of the proxy statement or the annual report, please write to Shareholder Relations, P.O. Box 1551, Raleigh, North Carolina 27602 or telephone our Shareholder Relations Section at 919-546-3014, and we will promptly send you separate copies. If you are currently receiving multiple copies of the proxy statement or the annual report at your address and would prefer that a single copy of each be delivered there, you may contact us at the address or telephone number provided in this paragraph.

1

PROXIES

The accompanying proxy is solicited by our Board of Directors, and we will bear the entire cost of solicitation. We expect to solicit proxies primarily by mail. Proxies may also be solicited by telephone, e-mail or other electronic media or personally by our and our subsidiaries' officers and employees, who will not be specially compensated for such services. Additionally, the Company will pay Morrow & Co., Inc. approximately $70,000 plus out-of-pocket expenses in connection with the solicitation of proxies.

You may vote shares either in person or by duly authorized proxy. In addition, you may vote your shares by telephone or via the Internet by following the instructions provided on the enclosed proxy card. Please be aware that if you vote via the Internet, you may incur costs such as telecommunication and Internet access charges for which you will be responsible. The Internet and telephone voting facilities for shareholders of record will close at 12:01 a.m. E.D.T. on the morning of the meeting. Any shareholder who has executed a proxy and attends the meeting may elect to vote in person rather than by proxy. You may revoke any proxy given by you in response to this solicitation at any time before the proxy is exercised by (i) delivering a written notice of revocation, (ii) timely filing with our Secretary, a subsequently dated, properly executed proxy or (iii) attending the Annual Meeting and electing to vote in person. Your attendance at the Annual Meeting, by itself, will not constitute a revocation of a proxy. If you vote by telephone or via the Internet, you may also revoke your vote by any of the three methods noted above, or you may change your vote by voting again by telephone or via the Internet. If you decide to vote by completing and mailing the enclosed proxy card, you should retain a copy of certain identifying information found on the proxy card in the event that you decide later to change or revoke your proxy by accessing the Internet. You should address any written notices of proxy revocation to: Progress Energy, Inc., P.O. Box 1551, Raleigh, North Carolina 27602, Attention: Secretary.

All shares represented by effective proxies received by the Company at or before the Annual Meeting, and not revoked before they are exercised, will be voted in the manner specified therein. Executed proxies that do not contain voting instructions will be voted"FOR" the election of all directors as set forth in this Proxy Statement;"FOR" the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008, as set forth in this Proxy Statement; and"AGAINST" the proposal regarding executive compensation as set forth in this Proxy Statement. Proxies will be voted at the discretion of the named proxies on any other business properly brought before the meeting.

If you are a participant in our 401(k) Savings & Stock Ownership Plan, shares allocated to your Plan account will be voted by the Trustee only if you execute and return your proxy, or vote by telephone or via the Internet. Company stock remaining in the ESOP Stock Suspense Account that has not been allocated to employee accounts shall be voted by the Trustee in the same proportion as shares voted by participants in the 401(k) Plan.

If you are a participant in the Savings Plan for Employees of Florida Progress Corporation (the "FPC Savings Plan"), shares allocated to your Plan account will be voted by the Trustee when you execute and return your proxy, or vote by telephone or via the Internet. If no direction is given, your shares will be voted in proportion with the shares held in the FPC Savings Plan and in the best interest of the FPC Savings Plan.

Special Note for Shares Held in "Street Name"

If your shares are held by a brokerage firm, bank or other nominee (i.e., in "street name"), you will receive directions from your nominee that you must follow in order to have your shares voted. "Street name" shareholders who wish to vote in person at the meeting will need to obtain a special proxy form from the brokerage firm, bank or other nominee that holds their shares of record. You should contact your brokerage firm, bank or other bank nominee for details regarding how you may obtain this special proxy form.

2

If your shares are held in "street name" and you do not give instructions as to how you want your shares voted (a "nonvote"), the brokerage firm, bank or other nominee who holds Progress Energy shares on your behalf may, in certain circumstances, vote the shares at its discretion. However, such brokerage firm, bank or other nominee is not required to vote the shares of Common Stock and therefore these unvoted shares would be counted as "broker nonvotes."

With respect to "routine" matters, such as the election of directors and ratification of the selection of the independent registered public accounting firm, a brokerage firm, bank or other nominee has authority (but is not required) under the rules governing self-regulatory organizations (the "SRO rules"), including the New York Stock Exchange ("NYSE"), to vote its clients' shares if the clients do not provide instructions. When a brokerage firm, bank or other nominee votes its clients' Common Stock shares on routine matters without receiving voting instructions, these shares are counted both for establishing a quorum to conduct business at the meeting and in determining the number of shares voted"FOR" or"AGAINST" such routine matters.

With respect to "nonroutine" matters, a brokerage firm, bank or other nominee is not permitted under the SRO rules to vote its clients' shares if the clients do not provide instructions. The brokerage firm or other nominee will so note on the vote card, and this constitutes a "broker nonvote." "Broker nonvotes" will be counted for purposes of establishing a quorum to conduct business at the meeting but not for determining the number of shares voted"FOR," "AGAINST" or"ABSTAINING" from such nonroutine matters.

Accordingly, if you do not vote your proxy, your brokerage firm, bank or other nominee may either: (i) vote your shares on routine matters and cast a "broker nonvote" on nonroutine matters, or (ii) leave your shares unvoted altogether.

At the 2008 Annual Meeting of Shareholders, one nonroutine matter, a proposal regarding executive compensation, will be presented for a vote. Therefore, we encourage you to provide instructions to your brokerage firm or other nominee by voting your proxy. This action ensures that your shares and voting preferences will be fully represented at the meeting.

VOTING SECURITIES

Our directors have fixed March 7, 2008, as the record date for shareholders entitled to vote at the Annual Meeting. Only holders of our Common Stock of record at the close of business on that date are entitled to notice of and to vote at the Annual Meeting. Each share is entitled to one vote. As of March 7, 2008, there were outstanding 260,183,301 shares of Common Stock.

Consistent with state law and our By-Laws, the presence, in person or by proxy, of holders of at least a majority of the total number of Common Stock shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Once a share of Common Stock is represented for any purpose at a meeting, it is deemed present for quorum purposes for the remainder of the meeting and any adjournment thereof, unless a new record date is or must be set in connection with any adjournment. Common Stock shares held of record by shareholders or their nominees who do not vote by proxy or attend the Annual Meeting in person will not be considered present or represented at the Annual Meeting and will not be counted in determining the presence of a quorum. Proxies that withhold authority or reflect abstentions or "broker nonvotes" will be counted for purposes of determining whether a quorum is present.

Pursuant to the provisions of our Articles of Incorporation, as amended effective May 10, 2006, a candidate for director will be elected upon receipt of at least a majority of the votes cast by the holders of Common Stock entitled to vote. Accordingly, assuming a quorum is present, each director shall be elected by a vote of the majority of the votes cast with respect to that director. A majority of the votes cast means that the number of shares voted"FOR" a director must exceed the number of votes cast

3

"AGAINST" that director. Shares voting"ABSTAIN" and shares held in "street name" that are not voted in the election of directors will not be included in determining the number of votes cast.

Approval of the proposal to ratify the selection of our independent registered public accounting firm, and other matters to be presented at the Annual Meeting, if any, generally will require the affirmative vote of a majority of votes actually cast by holders of Common Stock entitled to vote. Assuming a quorum is present, the number of"FOR" votes cast at the meeting for this proposal must exceed the number of"AGAINST" votes cast at the meeting in order for this proposal to be approved. Abstentions from voting and "broker nonvotes" will not count as votes cast and will not have the effect of a "negative" vote with respect to any such matters.

Approval of the shareholder proposal regarding executive compensation will require the affirmative vote of a majority of the votes cast on the proposal provided that the total votes cast on the proposal represents over 50 percent of the shares entitled to vote on the proposal. Abstentions will not have the effect of "negative" votes with respect to the proposal. Shares held in street name that are not voted with respect to the shareholder proposal regarding executive compensation will not be included in determining the number of votes cast.

We will announce preliminary voting results at the Annual Meeting. We will publish the final results in our quarterly report on Form 10-Q for the second quarter of fiscal year 2008. A copy of this quarterly report may be obtained without charge by any of the means outlined above for obtaining a copy of our Annual Report on Form 10-K.

PROPOSAL 1—ELECTION OF DIRECTORS

The Company's amended By-Laws provide that the number of directors of the Company shall be between eleven (11) and fifteen (15). The amended By-Laws also provide for annual elections of each director. Directors will serve one-year terms upon election at the 2008 Annual Meeting of Shareholders.

Our Articles of Incorporation require that a candidate in an uncontested election for director receive a majority of the votes cast in order to be elected as a director (number of votes cast"FOR" a director must exceed the number of votes cast"AGAINST" that director). In a contested election (i.e., a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the votes cast. Under North Carolina law, a director continues to serve in office until his or her successor is elected or until there is a decrease in the number of directors, even if the director is a candidate for re-election and does not receive the required vote, referred to as a "holdover director." To address the potential for such a "holdover director," our Board of Directors approved a provision in our Corporate Governance Guidelines. The guideline provides that if an incumbent director is nominated, but not re-elected by a majority vote, the director shall tender his or her resignation to the Board. The Corporate Governance Committee would then make a recommendation to the Board whether to accept or reject the resignation. The Board will act on the Corporate Governance Committee's recommendation and publicly disclose its decision and the rationale regarding it within 90 days after receipt of the tendered resignation. Any director who tenders his or her resignation pursuant to this provision shall not participate in the Corporate Governance Committee's recommendation or Board of Directors action regarding the acceptance of the resignation offer. However, if all members of the Governance Committee do not receive a vote sufficient for re-election, then the independent directors who did not fail to receive a sufficient vote shall appoint a committee amongst themselves to consider the resignation offers and recommend to the Board of Directors whether to accept them. If the only directors who did not fail to receive a sufficient vote for re-election constitute three or fewer directors, all directors may participate in the action regarding whether to accept the resignation offers.

4

Based on the report of the Corporate Governance Committee (see page 14), the Board of Directors nominates the following 12 nominees to serve as directors with terms expiring in 2009 and until their respective successors are elected and qualified: James E. Bostic, Jr., David L. Burner, Harris E. DeLoach, Jr., William D. Johnson, Robert W. Jones, W. Steven Jones, E. Marie McKee, John H. Mullin, III, Charles W. Pryor, Jr., Carlos A. Saladrigas, Theresa M. Stone, and Alfred C. Tollison, Jr.

There are no family relationships among any of the nominees for director or among any nominee and any director or officer of the Company or its subsidiaries, and there is no arrangement or understanding between any nominee and any other person pursuant to which the nominee was selected.

The election of directors will be determined by a majority of the votes cast at the Annual Meeting at which a quorum is present. This means that the number of votes cast"FOR" a director must exceed the number of votes cast"AGAINST" that director in order for the director to be elected. Abstentions and broker nonvotes, if any, are not treated as votes cast and, therefore, will have no effect on the proposal to elect directors. Shareholders do not have cumulative voting rights in connection with the election of directors.

Valid proxies received pursuant to this solicitation will be voted in the manner specified. Where specifications are not made, the shares represented by the accompanying proxy will be voted"FOR" the election of each of the twelve nominees. Votes (other than abstentions) will be cast pursuant to the accompanying proxy for the election of the nominees listed above unless, by reason of death or other unexpected occurrence, one or more of such nominees shall not be available for election, in which event it is intended that such votes will be cast for such substitute nominee or nominees as may be determined by the persons named in such proxy. The Board of Directors has no reason to believe that any of the nominees listed above will not be available for election as a director.

The names of the 12 nominees for election to the Board of Directors, along with their ages, principal occupations or employment for the past five years, and current directorships of public companies, are set forth below. No information is included regarding Richard L. Daugherty, who will reach the mandatory retirement age for non-employee Board members this year, and thus will retire from the Board at the Annual Meeting of Shareholders on May 14, 2008. Upon the Board's approval, Ms. Theresa M. Stone will replace Mr. Daugherty on the various Board committees on which he currently serves. Charles W. Pryor, Jr., and William D. Johnson, who were elected by the Board on July 11, 2007, and October 12, 2007, respectively, are directors standing for election to the Board by our shareholders for the first time. Mr. Pryor was recommended to the Corporate Governance Committee by Mr. Mullin, who is lead director of our Board. (Carolina Power & Light Company d/b/a Progress Energy Carolinas, Inc. ("PEC") and Florida Power Corporation d/b/a Progress Energy Florida, Inc. ("PEF"), which are noted below, are wholly owned subsidiaries of the Company.) Information concerning the number of shares of our Common Stock beneficially owned, directly or indirectly, by all current directors appears on page 8 of this Proxy Statement.

The Board of Directors recommends a vote"FOR" each nominee for director.

Nominees for Election

JAMES E. BOSTIC, JR., age 60, is Managing Director of HEP Associates, a business consulting firm. He was formerly Executive Vice President of Georgia-Pacific Corporation, a manufacturer and distributor of tissue, paper, packaging, building products, pulp and related chemicals. He has served as a director of the Company since 2002. Mr. Bostic is a member of the Board's Audit and Corporate Performance Committee and the Operations and Nuclear Oversight Committee.

DAVID L. BURNER, age 68, is retired Chairman and Chief Executive Officer of Goodrich Corporation, a provider of aerospace components, systems and services. He has served as a director of the Company and its predecessors since 1999 and also serves as a director of Briggs & Stratton

5

Corporation. Mr. Burner is Chair of the Board's Finance Committee and a member of the Executive Committee, the Corporate Governance Committee and the Organization and Compensation Committee.

HARRIS E. DELOACH, JR., age 63, is Chairman, President and Chief Executive Officer of Sonoco Products Company, a manufacturer of paperboard and paper and plastics packaging products. He previously served as President and CEO of Sonoco Products Company (from July 2000 to April 2005). Mr. DeLoach has served as a Director of the Company since 2006. He also serves as a director of Sonoco Products Company and Goodrich Corporation. Mr. DeLoach is Chair of the Board's Operations and Nuclear Oversight Committee, and a member of the Board's Organization and Compensation Committee, Executive Committee and the Corporate Governance Committee.

WILLIAM D. JOHNSON, age 54, is Chairman, President and Chief Executive Officer of Progress Energy, Inc. He served as President and Chief Operating Officer of Progress Energy from January 2005 to October 2007. In that role, Mr. Johnson oversaw the generation and delivery of electricity by PEC and PEF. Mr. Johnson has been with Progress Energy (previously CP&L) in a number of roles since 1992, including Group President for Energy Delivery, President and Chief Executive Officer for Progress Energy Service Company, and General Counsel and Secretary for Progress Energy, Inc. Before joining Progress Energy, Mr. Johnson was a partner with the Raleigh, North Carolina, office of Hunton & Williams, where he specialized in the representation of utilities.

ROBERT W. JONES, age 57, is a Senior Advisor of Morgan Stanley, a global provider of financial services to companies, governments and investors. Mr. Jones has held various positions with Morgan Stanley since 1974, most recently serving as Managing Director and Vice Chairman of Investment Banking. He has served as a director of the Company since 2007. Mr. Jones is a member of the Board's Finance Committee and Organization and Compensation Committee.

W. STEVEN JONES, age 56, is Dean and Professor of Management of UNC Kenan-Flagler Business School at the University of North Carolina at Chapel Hill. He is a former CEO and Managing Director of Suncorp-Metway, Ltd. in Brisbane, Queensland, Australia, which provides banking, insurance and investing services. He has served as a director of the Company since 2005 and also serves as a director of Bank of America Corporation and Premier Global. Mr. Jones is a member of the Board's Operations and Nuclear Oversight Committee and the Organization and Compensation Committee.

E. MARIE MCKEE, age 57, is Senior Vice President of Corning Incorporated, manufacturer of components for high-technology systems for consumer electronics, mobile emissions control, telecommunications and life sciences. She also serves as President and Chief Executive Officer of Steuben Glass. She has served as a director of the Company and its predecessors since 1999. Ms. McKee is Chair of the Board's Organization and Compensation Committee and a member of the Executive Committee, the Corporate Governance Committee and the Operations and Nuclear Oversight Committee.

JOHN H. MULLIN, III, age 66, is Chairman of Ridgeway Farm, LLC, a limited liability company engaged in farming and timber management. He is a former Managing Director of Dillon, Read & Co. (investment bankers). He has served as a director of the Company and its predecessors since 1999 and also serves as a director of Hess Corporation and Sonoco Products Company. Mr. Mullin is the Board's Lead Director and Chair of the Board's Corporate Governance Committee. He is a member of the Board's Executive Committee, the Finance Committee and the Organization and Compensation Committee.

CHARLES W. PRYOR, JR., age 63, is Chairman of Urenco Investments, Inc., which oversees construction of uranium enrichment plants. He also has served as President of Urenco Investments Inc. since 2004. Dr. Pryor served as President and CEO of the Utilities Business Group of British Nuclear

6

Fuels from 2002 to 2004. He has served as a director of the Company since 2007 and also serves as a director of DTE Energy. He is a member of the Board's Audit and Corporate Performance Committee and the Operations and Nuclear Oversight Committee.

CARLOS A. SALADRIGAS, age 59, is Vice Chairman of Premier American Bank in Miami, Florida. In 2002, he retired as Chief Executive Officer of ADP TotalSource (previously the Vincam Group, Inc.), a Miami-based human resources outsourcing company that provides services to small and mid-sized businesses. He has served as a director of the Company since 2001 and also serves as a director of Advance Auto Parts, Inc. Mr. Saladrigas is a member of the Board's Audit and Corporate Performance Committee and the Finance Committee.

THERESA M. STONE, age 63, is Executive Vice President and Treasurer of the Massachusetts Institute of Technology Corporation (since February 2007). She previously served as Executive Vice President and Chief Financial Officer of Jefferson-Pilot Financial, now Lincoln Financial Group (from November 2001 to March 2006). She also served as President of Lincoln Financial Media Company (formerly known as Jefferson-Pilot Communications Company) from July 1997 to May 2006. She has served as a director of the Company since 2005. Ms. Stone is a member of the Board's Audit and Corporate Performance Committee and the Finance Committee.

ALFRED C. TOLLISON, JR., age 65, is retired Chairman and Chief Executive Officer of the Institute of Nuclear Power Operations, a nuclear industry-sponsored nonprofit organization. He has served as a director of the Company since 2006. Mr. Tollison is a member of the Board's Audit and Corporate Performance Committee and the Operations and Nuclear Oversight Committee. He also serves as the Nuclear Oversight Director.

PRINCIPAL SHAREHOLDERS

The table below sets forth the only shareholder we know to beneficially own more than 5 percent of the outstanding shares of our Common Stock as of December 31, 2007. We do not have any other class of voting securities.

Title of Class

| | Name and Address of

Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percentage of

Class

|

|---|

| Common Stock | | State Street Bank and Trust Company

One Lincoln Street

Boston, MA 02111 | | 20,709,660 | 1 | 7.99 |

1Consists of shares of Common Stock held by State Street Bank and Trust Company, acting in various fiduciary capacities. State Street Bank has sole power to vote with respect to 8,452,003 shares, sole dispositive power with respect to 0 shares, shared power to vote with respect to 12,257,657 shares and shared power to dispose of 20,709,660 shares. State Street Bank has disclaimed beneficial ownership of all shares of Common Stock. (Based solely on information contained in a Schedule 13G filed by State Street Bank and Trust Company on February 12, 2008.)

7

MANAGEMENT OWNERSHIP OF COMMON STOCK

The following table describes the beneficial ownership of our Common Stock and ownership of Common Stock units as of February 29, 2008, of (i) all current directors and nominees for director, (ii) each executive officer named in the Summary Compensation Table presented later in this proxy statement and (iii) all directors and nominees for director and executive officers as a group. A unit of Common Stock does not represent an equity interest in the Company and possesses no voting rights, but is equal in economic value at all times to one share of Common Stock. As of February 29, 2008, none of the individuals or the group in the above categories owned one percent (1%) or more of our voting securities. Unless otherwise noted, all shares of Common Stock set forth in the table are beneficially owned, directly or indirectly, with sole voting and investment power, by such shareholder.

| |

|---|

Name

| | Number of Shares

of Common Stock

Beneficially Owned1

| |

|---|

| |

|---|

| James E. Bostic, Jr. | | 5,865 | 1 |

| David L. Burner | | 7,000 | 1 |

| Richard L. Daugherty (Retiring from the Board at the 2008 Annual Shareholders' Meeting) | | 7,381 | 1 |

| Fred N. Day IV (Retired effective July 1, 2007) | | 51,336 | 2,3 |

| Harris E. DeLoach, Jr. | | 5,000 | |

| Clayton S. Hinnant (Retired effective January 1, 2008) | | 127,828 | 2,4 |

| William D. Johnson | | 96,232 | 2 |

| Robert W. Jones | | 1,000 | |

| W. Steven Jones | | 1,000 | |

| Jeffrey J. Lyash | | 15,684 | 2 |

| John R. McArthur | | 27,605 | 2 |

| E. Marie McKee | | 3,500 | 1 |

| John H. Mullin, III | | 10,000 | 1,5 |

| Charles W. Pryor, Jr. | | 242 | |

| Carlos A. Saladrigas | | 10,600 | 1 |

| Peter M. Scott III | | 127,446 | 2 |

| Theresa M. Stone | | 1,000 | |

| Alfred C. Tollison, Jr. | | 1,000 | |

| Shares of Common Stock and Units beneficially owned by all Directors and executive officers of the Company as a group (25 persons) | | 595,698 | 6 |

1Includes shares of our Common Stock such director has the right to acquire beneficial ownership of within 60 days through the exercise of certain stock options, as follows:

Director

| | Stock Options

|

|---|

| James E. Bostic, Jr. | | 4,000 |

| David L. Burner | | 6,000 |

| Richard L. Daugherty | | 6,000 |

| E. Marie McKee | | 2,000 |

| John H. Mullin, III | | 6,000 |

| Carlos A. Saladrigas | | 6,000 |

8

2Includes shares of Restricted Stock currently held, and shares of our Common Stock such officer has the right to acquire beneficial ownership of within 60 days through the exercise of certain stock options as follows:

Officer

| | Restricted Stock

| | Stock Options

|

|---|

| Fred N. Day IV | | — | | 44,000 |

| Clayton S. Hinnant | | — | | 106,100 |

| William D. Johnson | | 44,000 | | — |

| Jeffrey J. Lyash | | 10,400 | | — |

| John R. McArthur | | 13,134 | | — |

| Peter M. Scott III | | 41,501 | | 52,000 |

3Reflects shares of our Common Stock Mr. Day owned as of July 31, 2007.

4Reflects shares of our Common Stock Mr. Hinnant owned as of December 31, 2007.

5Mr. Mullin has a line of credit with Merrill Lynch for which he has pledged as collateral 4,000 shares of Company Common Stock that he owns. No amount is currently outstanding under the line of credit.

6Includes shares each group member (shares in the aggregate) has the right to acquire beneficial ownership of within 60 days through the exercise of certain stock options.

Management Ownership of Units Representing Common Stock

The table below shows ownership of units representing our Common Stock under the Non-Employee Director Deferred Compensation Plan and units under the Non-Employee Director Stock Unit Plan as of February 29, 2008:

Director

| | Directors' Deferred

Compensation Plan

| | Non-Employee Director

Stock Unit Plan

|

|---|

| James E. Bostic, Jr. | | 8,175 | | 6,092 |

| David L. Burner | | 12,261 | | 8,615 |

| Richard L. Daugherty | | 35,653 | | 12,149 |

| Harris E. DeLoach, Jr. | | 4,202 | | 2,540 |

| Robert W. Jones | | 1,793 | | 1,260 |

| W. Steven Jones | | 6,096 | | 3,892 |

| E. Marie McKee | | 21,205 | | 8,615 |

| John H. Mullin, III | | 15,872 | | 9,053 |

| Charles W. Pryor | | 479 | | 1,260 |

| Carlos A. Saladrigas | | 4,753 | | 6,971 |

| Theresa M. Stone | | 6,187 | | 3,892 |

| Alfred C. Tollison, Jr. | | 3,949 | | 2,540 |

The table below shows ownership as of February 29, 2008, of (i) performance units under the Long-Term Compensation Program; (ii) performance units recorded to reflect awards deferred under the Management Incentive Compensation Plan ("MICP"); (iii) performance shares awarded under the Performance Share Sub-Plan of the 1997 and 2002 Equity Incentive Plans ("PSSP") (see "Outstanding

9

Equity Awards at Fiscal Year End Table" on page 53); (iv) units recorded to reflect awards deferred under the PSSP; (v) replacement units representing the value of our contributions to the 401(k) Savings & Stock Ownership Plan that would have been made but for the deferral of salary under the Management Deferred Compensation Plan and contribution limitations under Section 415 of the Internal Revenue Code of 1986, as amended; and (vi) Restricted Stock Units ("RSUs") awarded under the 2002 Equity Incentive Plan.

Officer

| | Long-Term

Compensation

Program

| | MICP

| | PSSP

| | PSSP

Deferred

| | MDCP

| | RSUs

|

|---|

| Fred N. Day III | | — | | 1,276 | | 55,469 | | 12,289 | | 390 | | — |

| Clayton S. Hinnant | | 1,681 | | 4,835 | | 57,718 | | 15,583 | | 1,263 | | 1,018 |

| William D. Johnson | | — | | 1,509 | | 158,305 | | — | | 939 | | 14,808 |

| Jeffrey J. Lyash | | — | | — | | 44,201 | | — | | 277 | | 13,727 |

| John R. McArthur | | — | | — | | 46,915 | | — | | — | | 13,432 |

| Peter M. Scott III | | — | | — | | 115,169 | | 11,727 | | 837 | | 11,690 |

10

TRANSACTIONS WITH RELATED PERSONS

There were no transactions in 2007 and there are no currently proposed transactions involving more than $120,000 in which the Company or any of its subsidiaries was or is to be a participant and in which any of the Company's directors, executive officers, nominees for director or any of their immediate family members had a direct or indirect material interest.

Our Board of Directors has adopted policies and procedures for the review, approval or ratification of Related Person Transactions under Item 404(a) of Regulation S-K (the "Policy"), which is attached to this Proxy Statement as Exhibit A. The Board has determined that the Corporate Governance Committee (the "Governance Committee") is best suited to review and approve Related Person Transactions because the Governance Committee oversees the Board of Directors' assessment of our directors' independence. The Governance Committee will review and may recommend to the Board amendments to this Policy from time to time.

For the purposes of the Policy, a "Related Person Transaction" is a transaction, arrangement or relationship, including any indebtedness or guarantee of indebtedness (or any series of similar transactions, arrangements or relationships), in which we (including any of our subsidiaries) were, are or will be a participant and the amount involved exceeds $120,000, and in which any Related Person had, has or will have a direct or indirect material interest. The term "Related Person" is defined under the Policy to include our directors, executive officers, nominees to become directors and any of their immediate family members.

Our general policy is to avoid Related Person Transactions. Nevertheless, we recognize that there are situations where Related Person Transactions might be in, or might not be inconsistent with, our best interests and those of our shareholders. These situations could include (but are not limited to) situations where we might obtain products or services of a nature, quantity or quality, or on other terms, that are not readily available from alternative sources or when we provide products or services to Related Persons on an arm's length basis on terms comparable to those provided to unrelated third parties or on terms comparable to those provided to employees generally.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers to file reports of their holdings and transactions in our securities with the SEC and the New York Stock Exchange. Based on our records and other information, we believe that all Section 16(a) filing requirements applicable to our directors and executive officers with respect to the Company's 2007 fiscal year were met except as follows: Jeffrey A. Corbett, Senior Vice President of PEC, inadvertently failed to file on a timely basis a Form 4 with respect to the deferral of a portion of an award granted under the Management Incentive Compensation Plan. A Form 4 reporting the transaction was filed on March 15, 2007. Paula J. Sims, Senior Vice President of PEC and Florida Power Corporation d/b/a Progress Energy Florida, Inc. ("PEF"), inadvertently failed to file on a timely basis a Form 4 with respect to the deferral of a portion of an award granted under the Management Incentive Compensation Plan. A Form 4 reporting the transaction was filed on March 15, 2007. E. Michael Williams, formerly Senior Vice President of PEC and PEF, inadvertently failed to file on a timely basis a Form 4 with respect to the distribution/payout of an award granted under the Management Incentive Compensation Plan. A Form 4 reporting the transaction was filed on May 3, 2007.

CORPORATE GOVERNANCE GUIDELINES AND CODE OF ETHICS

The Board of Directors operates pursuant to an established set of written Corporate Governance Guidelines (the "Governance Guidelines") that set forth our corporate governance philosophy and the governance policies and practices we have implemented in support of that philosophy. The three core governance principles the Board embraces are integrity, accountability and independence.

11

The Governance Guidelines describe Board membership criteria, the Board selection and orientation process and Board leadership. The Governance Guidelines require that a minimum of 80 percent of the Board's members be independent and that the membership of each Board committee, except the Executive Committee, consist solely of independent directors. Directors who are not full-time employees of the Company must retire from the Board at age 73. Directors whose job responsibilities or other factors relating to their selection to the Board change materially after their election are required to submit a letter of resignation to the Board. The Board will have an opportunity to review the continued appropriateness of the individual's Board membership and the Corporate Governance Committee will make the initial recommendation as to the individual's continued Board membership. The Governance Guidelines also describe the stock ownership guidelines that are applicable to Board members and prohibit compensation to Board members other than directors' fees and retainers.

The Governance Guidelines provide that the Organization and Compensation Committee of the Board will evaluate the performance of the Chief Executive Officer on an annual basis, using objective criteria, and will communicate the results of its evaluation to the full Board. The Governance Guidelines also provide that the Corporate Governance Committee is responsible for conducting an annual assessment of the performance and effectiveness of the Board, and its standing committees, and reporting the results of each assessment to the full Board annually.

The Governance Guidelines provide that Board members have complete access to our management, and can retain, at our expense, independent advisors or consultants to assist the Board in fulfilling its responsibilities, as it deems necessary. The Governance Guidelines also state that it is the Board's policy that the nonmanagement directors meet in executive session on a regularly scheduled basis. Those sessions are chaired by the Lead Director, John H. Mullin, III, who is also Chairman of the Corporate Governance Committee. He can be contacted by writing to John H. Mullin, III, Lead Director, Progress Energy Board of Directors, c/o John R. McArthur, Senior Vice President, General Counsel and Secretary, P.O. Box 1551, Raleigh, NC 27602-1551. We screen mail addressed to Mr. Mullin for security purposes and to ensure that it relates to discrete business matters that are relevant to the Company. Mail addressed to Mr. Mullin that satisfies these screening criteria will be forwarded to him.

In keeping with the Board's commitment to sound corporate governance, we have adopted a comprehensive written Code of Ethics that incorporates an effective reporting and enforcement mechanism. The Code of Ethics is applicable to all of our employees, including our Chief Executive Officer, our Chief Financial Officer and our Controller. The Board has adopted the Company's Code of Ethics as its own standard. Board members, our officers and our employees certify their compliance with our Code of Ethics on an annual basis.

Our Governance Guidelines and Code of Ethics are posted on our Internet Web site, and can be accessed atwww.progress-energy.com under the Investors section. This information is available in print to any shareholder who requests it at no charge.

12

DIRECTOR INDEPENDENCE

The Board of Directors has determined that the following current members of the Board are independent, as that term is defined under the general independence standards contained in the listing standards of the New York Stock Exchange (the "NYSE"):

| James E. Bostic, Jr. | | E. Marie McKee |

| David L. Burner | | John H. Mullin, III |

| Richard L. Daugherty | | Charles W. Pryor, Jr. |

| Harris E. DeLoach, Jr. | | Carlos A. Saladrigas |

| W. Steven Jones | | Theresa M. Stone |

| Robert W. Jones | | Alfred C. Tollison, Jr. |

Additionally, the Board of Directors has determined that Edwin B. Borden, W.D. Frederick, Jr. and Jean Giles Wittner, who served as members of the Board during a portion of 2007, were independent as that term is defined under the general independence standards contained in the NYSE's listing standards. In addition to considering the NYSE's general independence standards, the Board has adopted categorical standards to assist it in making determinations of independence. The Board's categorical independence standards are outlined in our Governance Guidelines and are attached to this Proxy Statement as Exhibit B. All directors, former directors and director nominees identified as independent in this proxy statement meet these categorical standards.

In determining that the individuals named above are or were independent directors, the Governance Committee considered their involvement in various ordinary course commercial transactions and relationships. During 2007, Ms. McKee and Messrs. DeLoach and Mullin served as officers and/or directors of companies that have been among the purchasers of the largest amounts of electric energy sold by PEC during the last three preceding calendar years. Mr. Mullin also serves as a director of another company that purchases electric energy from PEF. Mr. Robert W. Jones is an employee of Morgan Stanley, which has provided a variety of investment banking services to us during the past several years. Mr. W. Steven Jones is a senior academic officer of a university that received charitable contributions from us during each of the last three fiscal years. Mr. W. Steven Jones also serves as a director of a bank that provides a variety of services to us in the ordinary course of business. He is also a director of a communications technology company that provided services to us in 2007. Messrs. Daugherty and Saladrigas serve as directors of companies that purchase electric energy from PEF. Mr. Tollison is a former employee of PEC and thus receives a modest pension from us. Also in 2007, a subsidiary of a company owned by Ms. Wittner's now deceased spouse provided life and disability insurance to some employees of one of our subsidiaries. All of the described transactions were ordinary course commercial transactions. The Governance Committee considered each of these transactions and relationships and determined that none of them was material or affected the independence of the directors involved under either the general independence standards contained in the NYSE's listing standards or our categorical independence standards.

BOARD, BOARD COMMITTEE AND ANNUAL MEETING ATTENDANCE

The Board of Directors is currently comprised of thirteen (13) members. The Board of Directors met nine times in 2007. Average attendance of the directors at the meetings of the Board and its committees held during 2007 was 96.5 percent, and no director attended less than 86 percent of all Board and his/her respective committee meetings held in 2007.

Our company expects all directors to attend its annual meetings of shareholders. Such attendance is monitored by the Governance Committee. All directors who were serving as directors as of May 9, 2007, the date of the 2007 Annual Meeting of Shareholders, attended that meeting.

13

BOARD COMMITTEES

The Board of Directors appoints from its members an Executive Committee, an Audit and Corporate Performance Committee, a Finance Committee, an Operations and Nuclear Oversight Committee, an Organization and Compensation Committee, and a Corporate Governance Committee. The charters of all committees of the Board are posted on our Internet Web site and can be accessed atwww.progress-energy.com under the Investors section. The charters are available in print to any shareholder who requests them. The current membership and functions of the standing Board committees, as of December 31, 2007, are discussed below. Mr. Daugherty will retire from the Board at the Annual Meeting of Shareholders on May 14, 2008. Upon the Board's approval, Ms. Theresa M. Stone will replace him on the various Board committees on which he currently serves.

Executive Committee

The Executive Committee is presently composed of one director who is an officer and five nonmanagement Directors: Messrs. William D. Johnson—Chair, David L. Burner, Richard L. Daugherty, Harris E. DeLoach, Jr., E. Marie McKee and John H. Mullin, III. The authority and responsibilities of the Executive Committee are described in our By-Laws. Generally, the Executive Committee will review routine matters that arise between meetings of the full Board and require action by the Board. The Executive Committee held one meeting in 2007.

Audit and Corporate Performance Committee

The Audit and Corporate Performance Committee (the "Audit Committee") is presently composed of the following six nonmanagement directors: Messrs. Richard L. Daugherty—Chair, James E. Bostic, Jr., Charles W. Pryor, Jr., Carlos A. Saladrigas, Alfred C. Tollison, Jr., and Ms. Theresa M. Stone. All members of the committee are independent as that term is defined under the enhanced independence standards for audit committee members contained in the Securities Exchange Act of 1934 and the related rules, as amended, as incorporated into the listing standards of the New York Stock Exchange. Mr. Saladrigas and Ms. Stone have been designated by the Board as the "Audit Committee Financial Experts," as that term is defined in the SEC's rules. The work of the Audit Committee includes oversight responsibilities relating to the integrity of our financial statements, compliance with legal and regulatory requirements, the qualifications and independence of our independent registered public accounting firm, performance of the internal audit function and of the independent registered public accounting firm, and the Corporate Ethics Program. The role of the Audit Committee is further discussed under "Report of the Audit and Corporate Performance Committee" below. The Audit Committee held seven meetings in 2007.

Corporate Governance Committee

The Governance Committee is presently composed of the following five nonmanagement directors: Messrs. John H. Mullin, III—Chair/Lead Director, David L. Burner, Richard L. Daugherty, Harris E. DeLoach and Ms. E. Marie McKee. All members of the Governance Committee are independent as that term is defined under the general independence standards contained in the New York Stock Exchange listing standards. The Governance Committee is responsible for making recommendations to the Board with respect to the governance of the Company and the Board. Its responsibilities include recommending amendments to our Charter and By-Laws, making recommendations regarding the structure, charter, practices and policies of the Board, ensuring that processes are in place for annual CEO performance appraisal and review of succession planning and management development, recommending a process for the annual assessment of Board performance, recommending criteria for Board membership, reviewing the qualifications of and recommending to the Board nominees for election. The Governance Committee is responsible for conducting investigations into or studies of matters within the scope of its responsibilities and to retain outside advisors to identify director

14

candidates. The Governance Committee will consider qualified candidates for director nominated by shareholders at an annual meeting of shareholders; provided, however, that written notice of any shareholder nominations must be received by the Secretary of the Company no later than the close of business on the 120th calendar day before the date our proxy statement was released to shareholders in connection with the previous year's annual meeting. See "Future Shareholder Proposals" below for more information regarding shareholder nominations of directors. The Corporate Governance Committee held five meetings in 2007.

Finance Committee

The Finance Committee is presently composed of the following six nonmanagement directors: Messrs. David L. Burner—Chair, Richard L. Daugherty, Robert W. Jones, John H. Mullin, III, Carlos A. Saladrigas, and Ms. Theresa M. Stone. The Finance Committee reviews and oversees our financial policies and planning, financial position, strategic planning and investments, pension funds and financing plans. The Finance Committee also monitors our risk management activities, financial position and recommends changes to our dividend policy and proposed budget. The Finance Committee held five meetings in 2007.

Operations and Nuclear Oversight Committee

The Operations and Nuclear Oversight Committee is presently composed of the following six nonmanagement directors: Messrs. Harris E. DeLoach, Jr.—Chair, James E. Bostic, Jr., W. Steven Jones, Charles W. Pryor, Jr., Alfred C. Tollison, Jr. and Ms. E. Marie McKee. The Operations and Nuclear Oversight Committee reviews our load forecasts and plans for generation, transmission and distribution, fuel procurement and transportation, customer service, energy trading and term marketing, and other Company operations. The Operations and Nuclear Oversight Committee reviews and assesses our policies, procedures, and practices relative to the protection of the environment and the health and safety of employees, customers, contractors and the public. The Operations and Nuclear Oversight Committee advises the Board and makes recommendations for the Board's consideration regarding operational, environmental and safety-related issues. The Operations and Nuclear Oversight Committee held three meetings in 2007.

Organization and Compensation Committee

The Organization and Compensation Committee (the "Compensation Committee") is presently composed of the following six nonmanagement directors: Ms. E. Marie McKee—Chair, Messrs. David L. Burner, Harris E. DeLoach, Jr., Robert W. Jones, W. Steven Jones, and John H. Mullin, III. All members of the Compensation Committee are independent as that term is defined under the general independence standards contained in the New York Stock Exchange listing standards. The Compensation Committee verifies that personnel policies and procedures are in keeping with all governmental rules and regulations and are designed to attract and retain competent, talented employees and develop the potential of these employees. The Compensation Committee reviews all executive development plans, makes executive compensation decisions, evaluates the performance of the Chief Executive Officer and oversees plans for management succession.

The Compensation Committee may hire outside consultants and the Compensation Committee has no limitations on its ability to select and retain consultants as it deems necessary or appropriate. Annually, the Compensation Committee evaluates the performance of its compensation consultant to assess its effectiveness. Through November 2007, the Compensation Committee retained Mercer Human Resources Consulting as its executive compensation and benefits consultant to assist the Compensation Committee in meeting its compensation objectives for our company. In November 2007, the Compensation Committee retained Hewitt Associates as its new compensation consultant. The

15

change in consultants was a result of the Compensation Committee's continuing review of its needs and the exercise of its discretion.

The Compensation Committee relies on its compensation consultant to advise it on various matters relating to our executive compensation and benefits program. These services include:

- •

- Advising the Compensation Committee on general trends in executive compensation and benefits;

- •

- Performing benchmarking and competitive assessments;

- •

- Designing incentive plans;

- •

- Performing financial analysis of and determining shareholder value drivers; and

- •

- Recommending appropriate performance metrics and financial targets.

The Compensation Committee's chair or the chairman of our Board of Directors may call meetings, other than previously scheduled meetings, as needed. The Compensation Committee may form subcommittees for any purpose that the Compensation Committee deems appropriate and may delegate to such subcommittees such power and authority as the Compensation Committee deems appropriate. Appropriate officers of the Company shall provide staff support to the Compensation Committee. Peter M. Scott III, our Chief Financial Officer, serves as management's liaison to the Compensation Committee. William D. Johnson, our Chief Executive Officer, is responsible for conducting annual performance evaluations of the other executive officers and making recommendations to the Compensation Committee regarding those executives' compensation.

The Compensation Committee held 12 meetings in 2007.

Compensation Committee Interlocks and Insider Participation

None of the directors who served as members of the Compensation Committee during 2007 was our employee or former employee and none of them had any relationship requiring disclosure under Item 404 of Regulation S-K. During 2007, none of our executive officers served on the compensation committee (or equivalent), or the board of directors of another entity whose executive officer(s) served on our Compensation Committee or Board of Directors.

DIRECTOR NOMINATING PROCESS AND COMMUNICATIONS

WITH BOARD OF DIRECTORS

The Corporate Governance Committee

The Governance Committee performs the functions of a nominating committee. The Governance Committee's Charter describes the Governance Committee's responsibilities, including recommending criteria for membership on the Board, reviewing qualifications of candidates and recommending to the Board nominees for election to the Board. As noted above, the Governance Guidelines contain information concerning the Committee's responsibilities with respect to reviewing with the Board on an annual basis the qualification standards for Board membership and identifying, screening and recommending potential directors to the Board. All members of the Governance Committee are independent as defined under the general independence standards of the New York Stock Exchange's listing standards. Additionally, the Governance Guidelines require that all members of the Committee be independent.

Director Candidate Recommendations and Nominations by Shareholders

Shareholders should submit any director candidate recommendations in writing in accordance with the method described under "Communications with the Board of Directors" below. Any director

16

candidate recommendation that is submitted by one of our shareholders to the Governance Committee will be acknowledged, in writing, by the Corporate Secretary. The recommendation will be promptly forwarded to the Chairman of the Governance Committee, who will place consideration of the recommendation on the agenda for the Governance Committee's regular December meeting. The Governance Committee will discuss candidates recommended by shareholders at its December meeting, and present information regarding such candidates, along with the Governance Committee's recommendation regarding each candidate, to the full Board for consideration. The full Board will determine whether it will nominate a particular candidate for election to the Board.

Additionally, in accordance with Section 11 of our By-Laws, any shareholder of record entitled to vote for the election of directors at the applicable meeting of shareholders may nominate persons for election to the Board of Directors if that shareholder complies with the notice procedure set forth in the By-Laws and summarized in "Future Shareholder Proposals" below.

Governance Committee Process for Identifying and Evaluating Director Candidates

The Governance Committee evaluates all director candidates, including those nominated or recommended by shareholders, in accordance with the Board's qualification standards, which are described in the Governance Guidelines. The Committee evaluates each candidate's qualifications and assesses them against the perceived needs of the Board. Qualification standards for all Board members include: integrity, sound judgment, independence as defined under the general independence standards contained in the NYSE listing standards, and the categorical standards adopted by the Board, financial acumen, strategic thinking, ability to work effectively as a team member, demonstrated leadership and excellence in a chosen field of endeavor, experience in a field of business, professional or other activities that bear a relationship to our mission and operations, appreciation of the business and social environment in which we operate, an understanding of our responsibilities to shareholders, employees, customers and the communities we serve, and service on other boards of directors that could detract from service on our Board.

Communications with the Board of Directors

The Board has approved a process for shareholders and other interested parties to send communications to the Board. That process provides that shareholders and other interested parties can send communications to the Board and, if applicable, to the Governance Committee or to specified individual directors, including the Lead Director, in writing c/o John R. McArthur, Senior Vice President, General Counsel and Secretary, Progress Energy, Inc., P.O. Box 1551, Raleigh, N.C. 27602-1551.

We screen mail addressed to the Board, the Governance Committee or any specified individual director for security purposes and to ensure that the mail relates to discrete business matters that are relevant to the Company. Mail that satisfies these screening criteria is forwarded to the appropriate director.

17

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis ("CD&A") has four parts. The first part describes the Company's executive compensation philosophy and provides an overview of the compensation program and process. The second part describes each major element of the Company's executive compensation program. The third part describes how the Organization and Compensation Committee of the Company's Board of Directors (in this CD&A, the "Committee") applied each element to determine the compensation paid to each of the named executive officers in the Summary Compensation Table on page 42 (the "named executive officers") for the services they provided to the Company in 2007. For 2007, the Company's named executive officers were:

- •

- Robert B. McGehee, formerly Chairman and Chief Executive Officer (deceased — October 9, 2007);

- •

- William D. Johnson, Chairman, President and Chief Executive Officer (formerly President and Chief Operating Officer);

- •

- Peter M. Scott III, Executive Vice President and Chief Financial Officer;

- •

- Clayton S. Hinnant, Senior Vice President and Chief Nuclear Officer (retired effective January 1, 2008);

- •

- John R. McArthur, Senior Vice President and General Counsel;

- •

- Jeffrey J. Lyash, President and Chief Executive Officer, Progress Energy Florida, Inc.; and

- •

- Fred N. Day IV, President and Chief Executive Officer, Progress Energy Carolinas, Inc. (retired effective July 1, 2007).

The fourth part consists of the Compensation Committee's Report. Following the CD&A are the tables setting forth the 2007 compensation for each of the named executive officers, as well as a discussion concerning compensation for the members of the Company's Board of Directors. Throughout this CD&A, the Company is at times referred to as "we," "our" or "us."

I. COMPENSATION PHILOSOPHY AND OVERVIEW

We are an integrated electric utility primarily engaged in the regulated utility business. Our executive compensation philosophy is designed to provide competitive and reasonable compensation consistent with the three key principles that we believe are critical to our long-term success as described below:

- •

- Aligning the interests of shareholders and management. We believe that our major shareholders invest in the Company because they believe we can produce average annual total shareholder return in the 7 percent to 10 percent range over a three- to five-year holding period. Total shareholder return is defined as the stock price appreciation plus dividends over the period, divided by the share price at the beginning of the period. Further, our investors do not expect or desire significant volatility in our stock price. Accordingly, our executive compensation program is designed to encourage management to lead our company in a way that consistently produces earnings per share growth and sustained dividend growth.

- •

- Rewarding operating performance results that are consistent with reliable and efficient electric service. We believe that to achieve this goal over the long-term, we must:

- •

- deliver high levels of customer satisfaction;

- •

- operate our systems reliably and efficiently;

- •

- maintain a constructive regulatory environment;

18

- •

- have a productive, engaged and highly-motivated workforce;

- •

- meet or exceed our operating plans and budgets;

- •

- be a good corporate citizen; and

- •

- produce value for our investors.

Therefore, we determine base salary increases and annual incentive compensation based on corporate performance in these areas, along with individual contribution and performance.

- •

- Attracting and retaining an experienced and effective management team. The competition for skilled management is significant in the utility industry. We believe that the management of our business requires executives with a variety of experiences and skills. We expect the competition for talent to continue to intensify, particularly in the nuclear area, as the industry enters a significant capital expenditure phase. To address this issue, we have designed market-based compensation programs that are competitive and are aligned with our corporate strategy.

Consistent with these principles, the Committee seeks to provide executive officers a compensation program that is competitive in the market place and provides the incentives necessary to motivate the executives to perform in the best interest of the Company and its shareholders. The Committee also believes that it is in the best interest of the Company and its shareholders to have skilled, engaged and high-performing executives who can sustain the Company's ongoing performance.

In determining an individual executive officer's compensation opportunity, the Committee believes that the compensation opportunity must be competitive within the marketplace for the specific role of the particular executive officer. As such, the compensation opportunities vary significantly from individual to individual based on the specific nature of the executive position. For example, our Chief Executive Officer is responsible for the overall performance of the Company and, as such, his position has a greater scope of responsibility than our other executive positions. Additionally, from a market analysis standpoint, the position of chief executive officer receives a greater compensation opportunity than other executive positions. The Committee therefore sets our Chief Executive Officer's compensation opportunity at levels that reflect the responsibilities of his position and the Committee's expectations. To establish the appropriate compensation opportunity for each executive officer, the Company seeks to balance the value of the various elements of compensation to the Company against the perceived value of those elements to the executive officer.

19

COMPENSATION PROGRAM STRUCTURE

The table below summarizes the current elements of our executive compensation program.

Element

| | Description

| | Primary Purpose

| | Short- or Long-Term

Focus

|

|---|

| Base Salary | | Fixed compensation. Annual merit increases reward performance. | | Aids in attracting and retaining executives and rewards operating performance results that are consistent with reliable and efficient electric service. | | Short-term (annual) |

Annual Incentive |

|

Variable compensation based on achievement of annual performance goals. |

|

Rewards operating performance results that are consistent with reliable and efficient electric service. |

|

Short-term (annual) |

Long-Term Incentives — Performance Shares |

|

Variable compensation based on achievement of long-term performance goals. |

|

Align interests of shareholders and management and aid in attracting and retaining executives. |

|

Long-term |

Long-Term Incentives — Restricted Stock/Restricted Stock Units |

|

Fixed compensation based on target levels. Service-based vesting. |

|

Align interests of shareholders and management and aid in retaining executives. |

|

Long-term |

Supplemental Senior Executive Retirement Plan |

|

Formula-based compensation, based on salary, bonus and eligible years of service. |

|

Aids in attracting and retaining executive officers. |

|

Long-term |

Management Change-In-Control Plan |

|

Elements based on specific plan eligibility. |

|

Aligns interests of shareholders and management and aids in (i) attracting executives, and (ii) retaining executives during transition following a change-in-control. |

|

Long-term |

Employment Agreements |

|

Define Company's relationship with our executives and provide protection to each of the parties. |

|

Aid in attracting and retaining executives. |

|

Long-term |

Executive Perquisites |

|

Personal benefits awarded outside of base salaries. |

|

Aid in attracting and retaining executives. |

|

Short-term (annual) |

Other Broad-Based Benefits |

|

Employee benefits such as health and welfare benefits, 401(k) and pension plan. |

|

Aid in attracting and retaining executives. |

|

Both Short- and Long-term |

Deferred Compensation |

|

Provides executives with tax deferral options in addition to those available under our qualified plans. |

|

Aids in attracting and retaining executives. |

|

Long-term |

20

The Committee believes the various compensation program elements:

- •

- link compensation with our short-term and long-term success by using operating and financial performance measures in determining payouts for annual and long-term incentive plans;

- •

- align management interests with investor expectations by rewarding executive officers for delivering long-term total shareholder return;

- •

- attract and retain executives by maintaining compensation that is competitive with our peer group;

- •

- foster effective teamwork and collaboration between executives working in different areas to support our core values, strategy and interests;

- •

- balance the perceived value of compensation elements to our executives with our actual cost;

- •

- comply in all material respects with applicable laws and regulations; and

- •

- can be readily understood by us, the Committee, our executives and our shareholders, and provide ease of administration.

PROGRAM ADMINISTRATION

Our executive compensation program is administered by the Committee, which is composed of six independent directors (as defined under the New York Stock Exchange ("NYSE") corporate governance rules). Members of the Committee currently do not receive compensation under any compensation program in which our executive officers participate. For a discussion of director compensation, see the "Director Compensation" section on page 76 of this proxy statement.

The Committee's charter authorizes the Committee to hire outside consultants, and the Committee has no limitations on its ability to select and retain consultants as it deems necessary or appropriate. The Committee evaluates the performance of its compensation consultant annually to assess the consultant's effectiveness in assisting the Committee with implementing the Company's compensation program and principles. Through November 2007, the Committee retained Mercer Human Resources Consulting ("Mercer") as its executive compensation and benefits consultant to assist the Committee in meeting its compensation objectives for our company. In November 2007, the Committee retained Hewitt Associates ("Hewitt") as its new compensation consultant. Under the terms of its engagement, Hewitt reports directly to the Committee. The change in consultants was a result of the Committee's continuing review of its needs. Throughout the remainder of this CD&A, the term "compensation consultant" refers to Hewitt unless otherwise noted.

The Committee relies on its compensation consultant to advise it on various matters relating to our executive compensation and benefits program. These services include:

- •