Filed by Progress Energy, Inc.

Pursuant to Rule 425 Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-6

Under the Securities Exchange Act of 1934

Subject Company: Progress Energy, Inc.

Commission File No.: 333-172899

Cautionary Statements Regarding Forward-Looking Information

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “may,” “will,” “should,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. Progress Energy and Duke Energy caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving Duke Energy and Progress Energy, including future financial and operating results, Progress Energy’s or Duke Energy’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties relating to: the risk that Progress Energy or Duke Energy may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the timing to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger-related issues; general worldwide economic conditions and related uncertainties; the effect of changes in governmental regulations; and other factors discussed or referred to in the “Risk Factors” section of each of Progress Energy’s and Duke Energy’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC). These risks, as well as other risks associated with the merger, are more fully discussed in the joint proxy statement/prospectus that is included in the Registration Statement on Form S-4 that was filed by Duke Energy with the SEC in connection with the merger. Additional risks and uncertainties are identified and discussed in Progress Energy’s and Duke Energy’s reports filed with the SEC and available at the SEC’s website at www.sec.gov. Each forward-looking statement speaks only as of the date of the particular statement and neither Progress Energy nor Duke Energy undertakes any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

In connection with the proposed merger between Duke Energy and Progress Energy, Duke Energy filed with the SEC a Registration Statement on Form S-4 that includes a joint proxy statement of Duke Energy and Progress Energy and that also constitutes a prospectus of Duke Energy. The Registration Statement was declared effective by the SEC on July 7, 2011. Duke Energy and Progress Energy mailed the definitive joint proxy statement/prospectus to their respective shareholders on or about July 11, 2011.

Duke Energy and Progress Energy urge investors and shareholders to read the Registration Statement, including the joint proxy statement/prospectus that is a part of the Registration Statement, as well as other relevant documents filed with the SEC, because they contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Duke Energy’s website (www.duke-energy.com) under the heading “Investors” and then under the heading “Financials/SEC Filings.” You may also obtain these documents, free of charge, from Progress Energy’s website (www.progress-energy.com) under the tab “Our Company” by clicking on “Investor Relations,” then by clicking on “Corporate Profile” and then by clicking on “SEC Filings.”

|

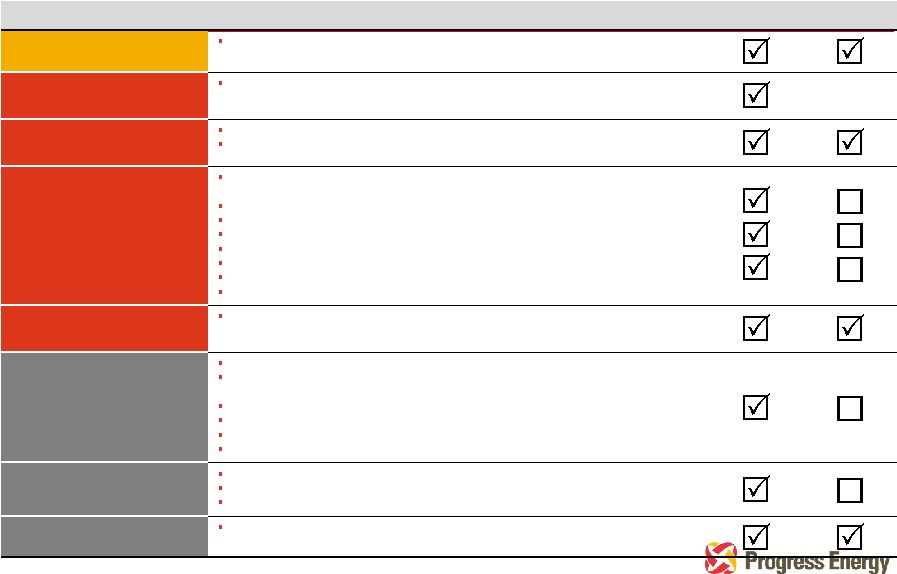

Status of Merger Filings (as of May 8, 2012) Stakeholder Progress on Key Milestones Filed Approved Shareholder Received shareholder approvals on August 23, 2011 Department of Justice (DOJ) The parties have met their obligations under the Hart-Scott-Rodino Act (HSR) Waiting Period Expired Federal Communications Commission (FCC) Received approval of Assignment of Authorization filings on July 27, 2011 On January 5, 2012, approval extended by FCC through July 12, 2012 Federal Energy Regulatory Commission (FERC) Made three merger-related filings on April 4, 2011: merger application, joint dispatch agreement (JDA) and joint open access transmission tariff (OATT) Received conditional merger approval on September 30, 2011 Filed proposed market power mitigation plan on October 17, 2011 Proposed market power mitigation plan rejected December 14, 2011 Filed revised market power mitigation plan on March 26, 2012 Responded to Request for Additional Information on April 13, 2012 Intervenor comment period for revised market power mitigation plan expired April 25, 2012 Filed response to intervenor comments May 1, 2012 Nuclear Regulatory Commission (NRC) Received approval of indirect transfer of Progress Energy licenses on December 2, 2011 North Carolina Filed merger approval application on April 4, 2011 NC Public Staff filed settlement agreement on September 2, 2011; companies signed settlement with South Carolina Office of Regulatory Staff, a party to the NC docket, on September 6, 2011 Hearings held September 20-22, 2011 Proposed orders and briefs filed with North Carolina Utilities Commission on November 23, 2011 Filed advance notice regarding revised market power mitigation plan February 22, 2012 Updated settlement agreement with NC Public Staff filed May 8, 2012 South Carolina Submitted merger-related filings on April 25, 2011 Hearing to approve joint dispatch agreement held December 12, 2011 Proposed orders and briefs filed with South Carolina Public Service Commission on December 20, 2011 Kentucky Received Kentucky Commission approval on October 28, 2011 JDA Merger OATT 1 |