MicroCapClub Invitational January 29, 2014 OTCQB: OPCO www.ourpets.com

Safe Harbor Statement This presentation may contain various “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), which represent our expectations or beliefs concerning future events. Forward - looking statements generally include words such as “anticipates,” “believes,” “expects,” “planned,” “scheduled,” or similar expressions and statements. Although we believe these forward - looking statements are based on reasonable assumptions, statements made regarding future results are subject to a number of assumptions, uncertainties, and risks that could cause future results to be materially different from the results stated or implied in this presentation. Uncertainties, risks, and other factors that may cause actual results or performance to differ materially from any results of performance expressed or implied by forward - looking statements in this presentation include: (1) our ability to manage our operating expenses and realize operating efficiencies, (2) our ability to maintain and grow our sales with existing and new customers, (3) our ability to retain existing members of our senior management team and to attract additional management employees, (4) our ability to manage fluctuations in the availability and cost of key materials and tools of production, (5) general economic conditions that might impact demand for our products, (6) competition from existing or new participants in the pet products industry, (7) our ability to design and bring to market new products on a timely and profitable basis, (8) challenges to our patents or trademarks on existing or new products, or (9) our ability to secure access to sufficient capital on favourable terms to manage and grow our business. We caution that these risk factors are not exclusive. Additionally, we do not undertake to update any forward looking statements that may be made from time to time by or on behalf of us except as required by law.

• Founded in 1995 by Dr. Steve Tsengas and Dean Tsengas - “Big Dog Feeder” • Focused on high growth categories in non - food pet products • Feline waste and odor control solutions ($250 million/year category) • Interactive cat and dog toys and accessories ($315 million/year category) • Healthy feeding/storage systems ($100 million/year category) • Products designed to: • Satisfy the mental/physical health, safety and comfort of pets • Satisfy the pet owners pleasure and convenience of owning a pet • Satisfy the needs of retailers for innovative, upscale, profitable, products • Strong, diversified product portfolio (approximately 1500 SKUs ) • Solid pipeline of new, innovative products and line extensions (225 patents issued/pending) The OurPet’s Company

U.S. Pet Industry • Third largest consumer market ($60 billion in 2013) • Forecasted compound annual growth rate of 4% - 5% through 2017 • 68% of households own a pet totaling 82.5 million pet owners • Dogs owned by 47% and cats by 37% of households • Average annual spending on non - food pet products: • $1,135 for dogs, $931 for cats • Recession resistant Pet Accessories and Treats Category • Represents 19% of U.S. Pet Industry annual sales • Category sales expected to be $12.5 billion in 2014 • Forecasted compound annual growth rate of 8% - 10% through 2017 • Pets are living longer – 40% are “seniors” Source: Packaged Facts U.S. Pet Market Outlook 2013 - 2014 Market Trends

Innovative products such as raised feeders and the Play - N - Squeak Mouse are instantly disruptive and successful Major Products & Acquisition Timeline Our History 1995 1999 - 2000 2013 2010 2006 Market Entrance Market Acceptance & Recognition Continued Expansion & Acquisition 1995 1997 1999 2000 2001 1998 2004 2006 2007 2009 2012 2010 2013 2014 EZ Scoop, Corknip Corporate Timeline & Milestones Founded with launch of the Big Dog Feeder Durapet Hybrid line launched at Walmart and continues to set sales records while only in limited stores 1997 - 1998 Enters into Canine & Feline Toys; Changes name to OurPets Acquires Cosmic Catnip Products Company Acquires PetZone, which includes rights to SmartScoop 2007 Litigation begins between Applica/LitterMaid and SmartScoop 2012 SmartScoop litigation is resolved Launch New Branding 1985 Founded in 1985 as Napro Inc. 2001 Becomes publically traded company under the symbol OPCO (OTCBB) 2004 Durapet is introduced and quickly becomes a winner in all retail channels Wonder Bowl

Business Model Innovative Product Offerings Backed by Strong R&D and Patents Positioning with Leading Retailers x Products are brought to market after careful investment in both behavioral research and technology research x Focus on products with proven efficacy x Strong sell - through history with retailers such as Wal - Mart, PetSmart, and Petco x Private label business helps maintain shelf space within pet specialty retailers Specific Pet Industry Trends x Consolidation of vendors within leading retailers x Growth in Toys & Accessories continue x #1 ranking within product category position at Amazon x Broad retail presence across pet specialty and food, drug & mass retailers, as well within e - commerce x The feline Waste & Odor control market represents a particularly attractive, growing segment x Aversion to developing commodity products x Formidable patent fencing process to secure inimitability versus the competition

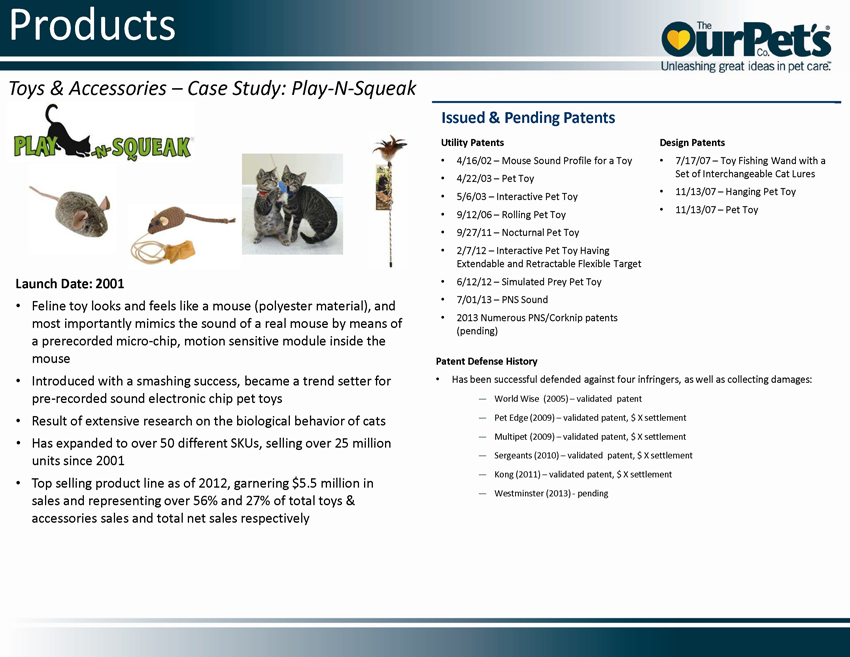

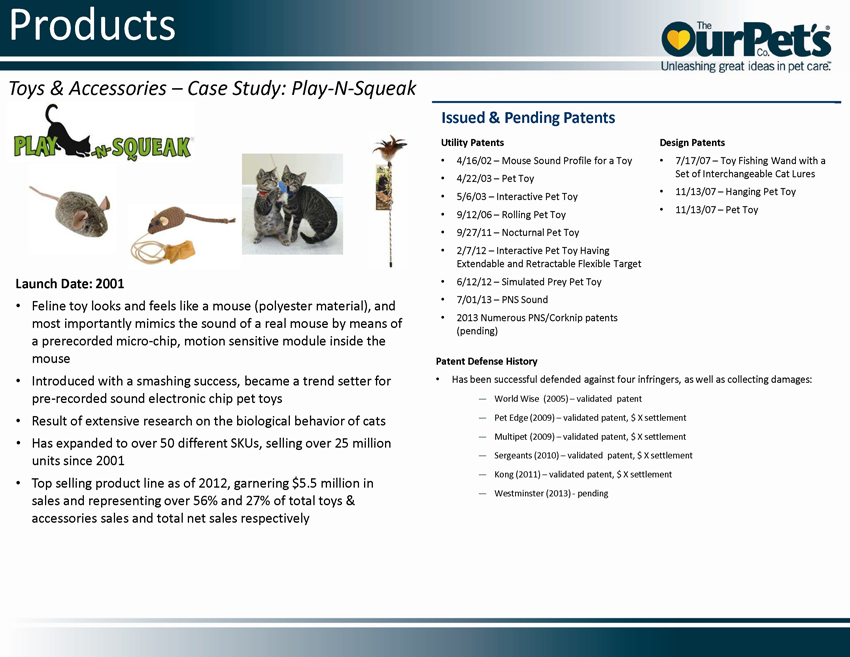

Products Toys & Accessories – Case Study: Play - N - Squeak Issued & Pending Patents Launch Date: 2001 • Feline toy looks and feels like a mouse (polyester material), and most importantly mimics the sound of a real mouse by means of a prerecorded micro - chip, motion sensitive module inside the mouse • Introduced with a smashing success, became a trend setter for pre - recorded sound electronic chip pet toys • Result of extensive research on the biological behavior of cats • Has expanded to over 50 different SKUs, selling over 25 million units since 2001 • Top selling product line as of 2012, garnering $5.5 million in sales and representing over 56% and 27% of total toys & accessories sales and total net sales respectively Utility Patents • 4/16/02 – Mouse Sound Profile for a Toy • 4/22/03 – Pet Toy • 5/6/03 – Interactive Pet Toy • 9/12/06 – Rolling Pet Toy • 9/27/11 – Nocturnal Pet Toy • 2/7/12 – Interactive Pet Toy Having Extendable and Retractable Flexible Target • 6/12/12 – Simulated Prey Pet Toy • 7/01/13 – PNS Sound • 2013 Numerous PNS/Corknip patents (pending) Design Patents • 7/17/07 – Toy Fishing Wand with a Set of Interchangeable Cat Lures • 11/13/07 – Hanging Pet Toy • 11/13/07 – Pet Toy Patent Defense History • Has been successful defended against four infringers, as well as collecting damages: — World Wise (2005) – validated patent — Pet Edge (2009) – validated patent, $ X settlement — Multipet (2009) – validated patent, $ X settlement — Sergeants (2010) – validated patent, $ X settlement — Kong (2011) – validated patent, $ X settlement — Westminster (2013) - pending

Products Product Overview - 2013 Canine Feline Other Pet Total Revenue by Pet, 2013 43.9% 55.8% 0.3% Canine Feline Other Pet Toys & Accessories by Pet, 2013 15.6% 84.2% 0.2% Canine Feline Other Pet Waste & Odor by Pet, 2013 36.1% 63.9% Canine Feline Other Pet Feeding & Storage, 2013 87.6% 11.7% 0.7% Canine Feline Other Pet

Products Product Offerings Toys & Accessories Feeding & Storage Waste & Odor Canines Felines Feeder products are “Pet - Agnostic”

Healthy Feeding/Storage Systems

Interactive Cat Toys

Interactive Cat Toys

FLAPPY Dog Toys

Smarter Toys = Smarter Dogs • Provides mental and physical stimulation • Three learning levels for added difficulty as dogs learn: • * Smart * Brilliant * Genius • Two sizes for each style Smarter Toys™ For Dogs

Feline Waste Management Solutions Fresh Scoop Litter Box & System • Litter box with convenient disposal and storage in one unit • Includes 1 Activated Carbon Filter to eliminate odor • Includes 4 no - touch waste bags to line the waste bin • Nests on shelf for optimal merchandising • Retail Price Range $29.99 - $39.99 SmartScoop Automatic Litter Box • Easy to clean and maintain • No expensive trays or cartridges to buy • Use any clumping litter or crystals • Rugged and reliable - metal gears • Quiet operation • Includes 6 activated carbon zeolite filters and 24 no - touch bags • One to Two Year Warranty • Retail Price Range $129.99 - $149.99 EZ Scoop Manual Litter Box • One Easy Sweep cleans the whole box • Hands - free scooping • Easy to clean • No - touch waste bags • Special no - stick coating • Advanced carbon zeolite filter* • No assembly required • Made in the USA • One Year Warranty • Retail Price Range - $59.99 - $69.99

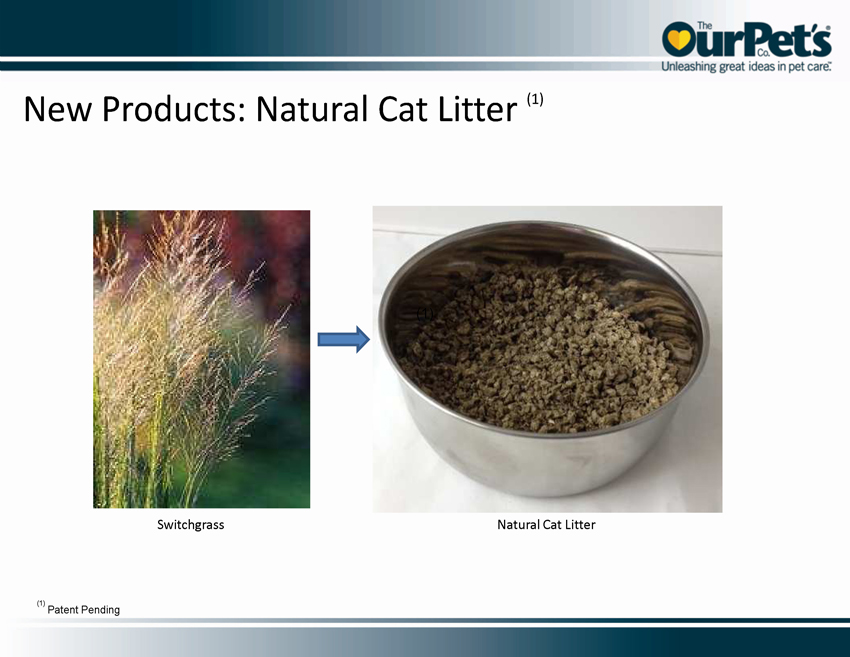

Growth Through Product Innovation • Toys and Accessories: • Corknip™ • Catnip Gel • Scent toys • Feeding & Storage: • WonderBowl™ and other Wireless Products • New feeding & storage products • Waste & Odor Control: • odorLESS™ Technology • Natural cat litter • Accessories Notes

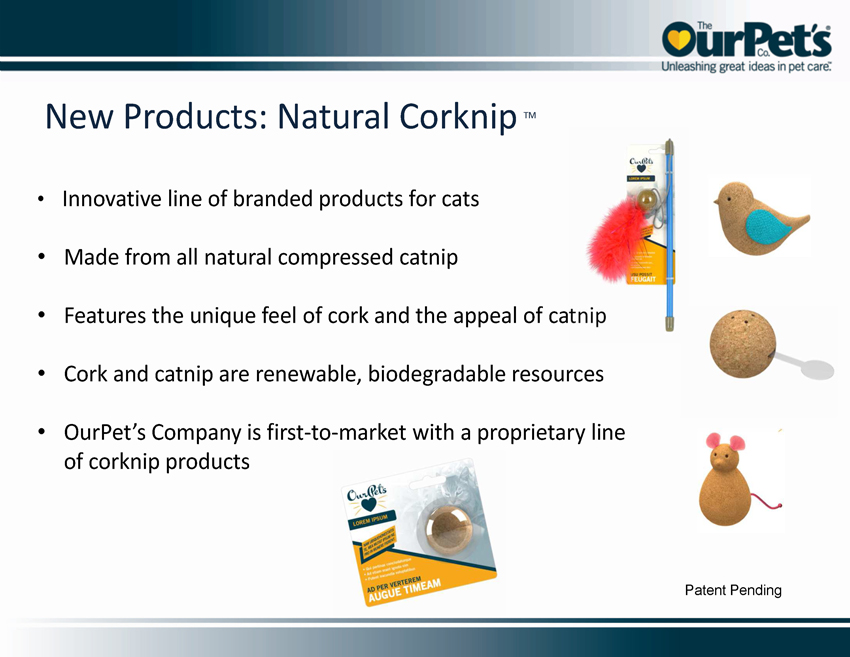

• Innovative line of branded products for cats • Made from all natural compressed catnip • Features the unique feel of cork and the appeal of catnip • Cork and catnip are renewable, biodegradable resources • OurPet’s Company is first - to - market with a proprietary line of corknip products Patent Pending New Products: Natural Corknip TM

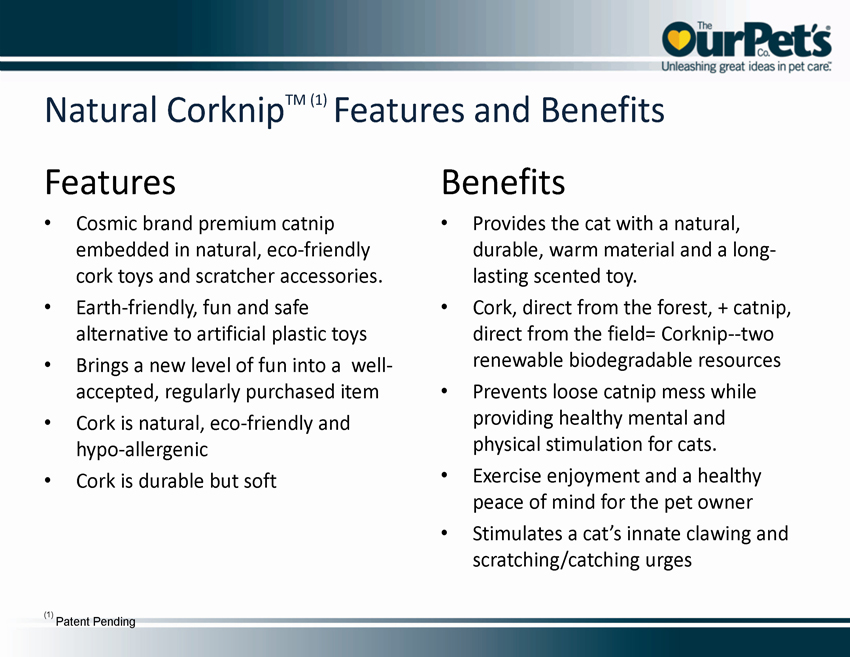

Natural Corknip TM (1) Features and Benefits Features • Cosmic brand premium catnip embedded in natural, eco - friendly cork toys and scratcher accessories. • Earth - friendly, fun and safe alternative to artificial plastic toys • Brings a new level of fun into a well - accepted, regularly purchased item • Cork is natural, eco - friendly and hypo - allergenic • Cork is durable but soft Benefits • Provides the cat with a natural, durable, warm material and a long - lasting scented toy. • Cork, direct from the forest, + catnip, direct from the field= Corknip -- two renewable biodegradable resources • Prevents loose catnip mess while providing healthy mental and physical stimulation for cats. • Exercise enjoyment and a healthy peace of mind for the pet owner • Stimulates a cat’s innate clawing and scratching/catching urges (1) Patent Pending

WonderBowl Wireless Technology • Multi - species homes – different diets • Multi - pet homes with behavioral issues • Pets on prescription diets • Keep food fresh and clean • Keep toddlers from eating kibble Technology Applications – facilitating human - animal interactions within the home

New Products: Natural Cat Litter (1) (1) Patent Pending Switchgrass (1) Natural Cat Litter

Brand Strategy

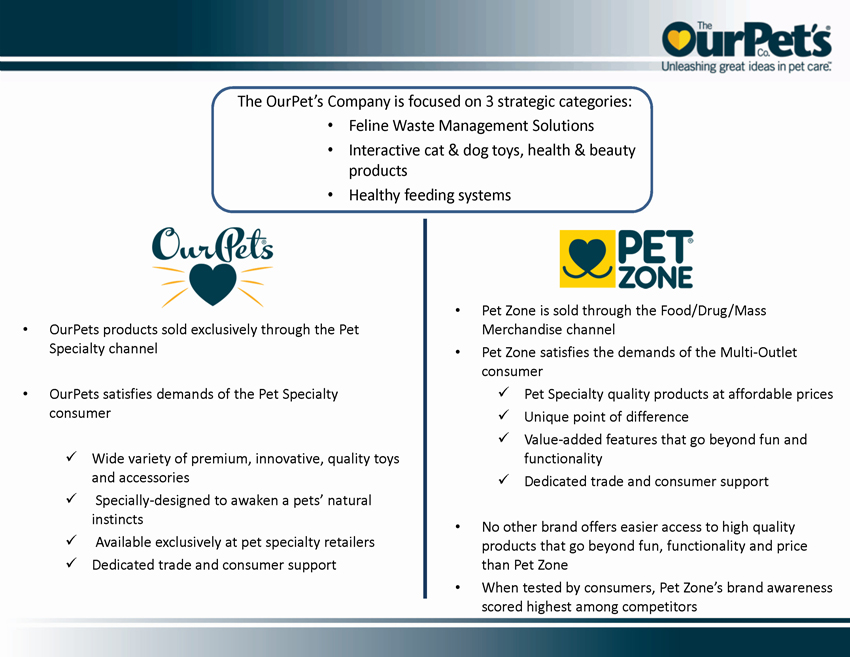

Dual Brand Strategy Premium brand and pet specialty channel of products for “pet parents” Pet - specialty quality products at affordable prices for pet enthusiasts

• Pet Zone is sold through the Food/Drug/Mass Merchandise channel • Pet Zone satisfies the demands of the Multi - Outlet consumer x Pet Specialty quality products at affordable prices x Unique point of difference x Value - added features that go beyond fun and functionality x Dedicated trade and consumer support • No other brand offers easier access to high quality products that go beyond fun, functionality and price than Pet Zone • When tested by consumers, Pet Zone’s brand awareness scored highest among competitors • OurPet s products sold exclusively through the Pet Specialty channel • OurPets satisfies demands of the Pet Specialty consumer x Wide variety of premium, innovative, quality toys and accessories x Specially - designed to awaken a pets’ natural instincts x Available exclusively at pet specialty retailers x Dedicated trade and consumer support The OurPet’s Company is focused on 3 strategic categories: • Feline Waste Management Solutions • Interactive cat & dog toys, health & beauty products • Healthy feeding systems

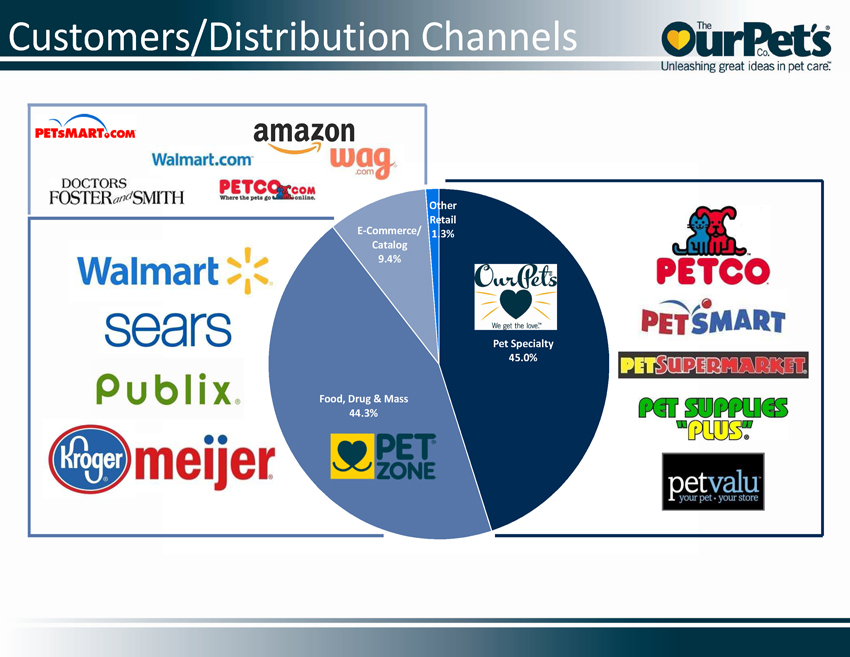

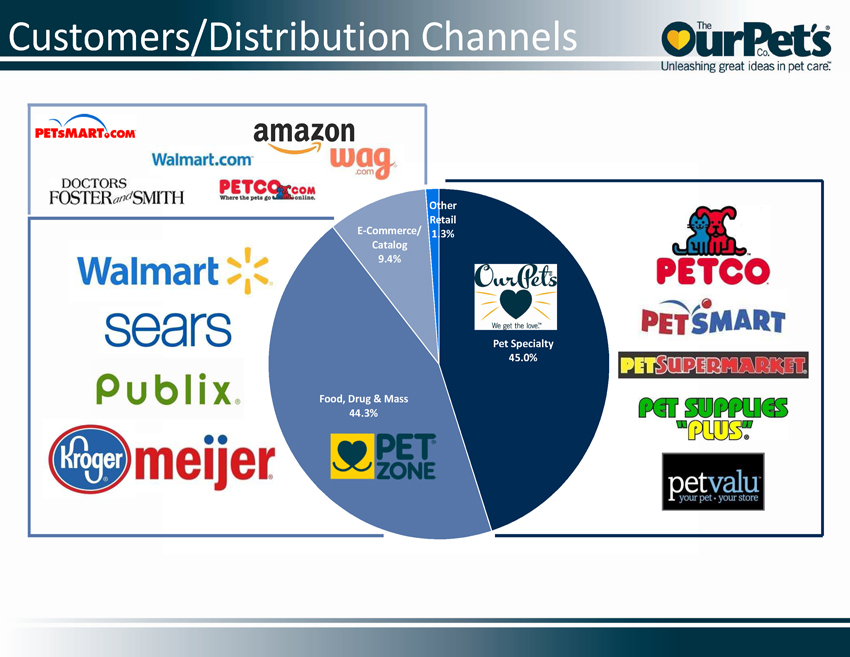

Customers/Distribution Channels Pet Specialty 45.0% Food, Drug & Mass 44.3% E - Commerce/ Catalog 9.4% Other Retail 1.3%

• One Company – two major brands – OurPets® and PetZone® • Unleashing great ideas in pet care • Over two dozen new, trend setting products • Leader in Healthy/Stimulating Toys, Waste & Odor Control and Store/Feeding Systems Global Pet Expo Booth March 12 - 14, 2014 Orange County Convention Center Orlando, Florida

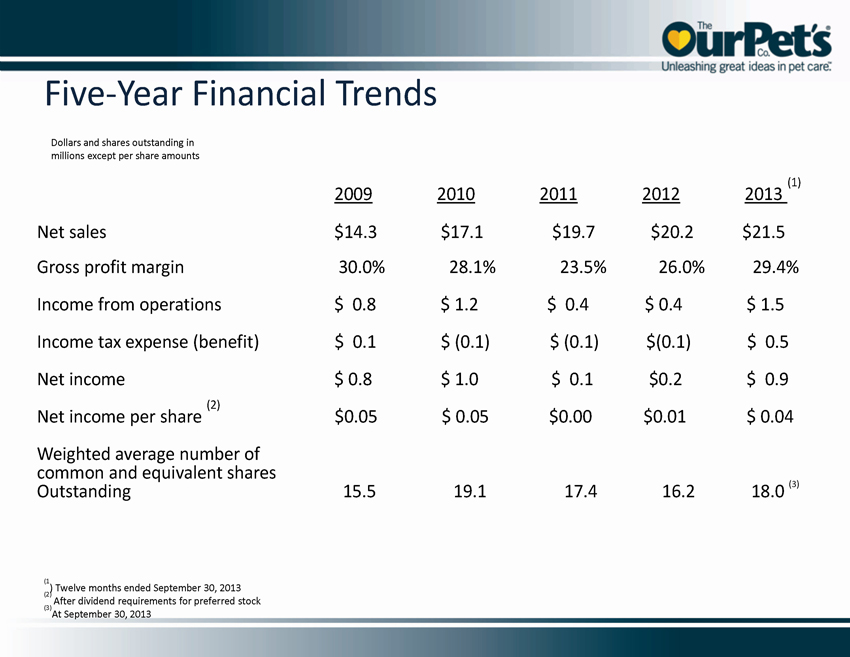

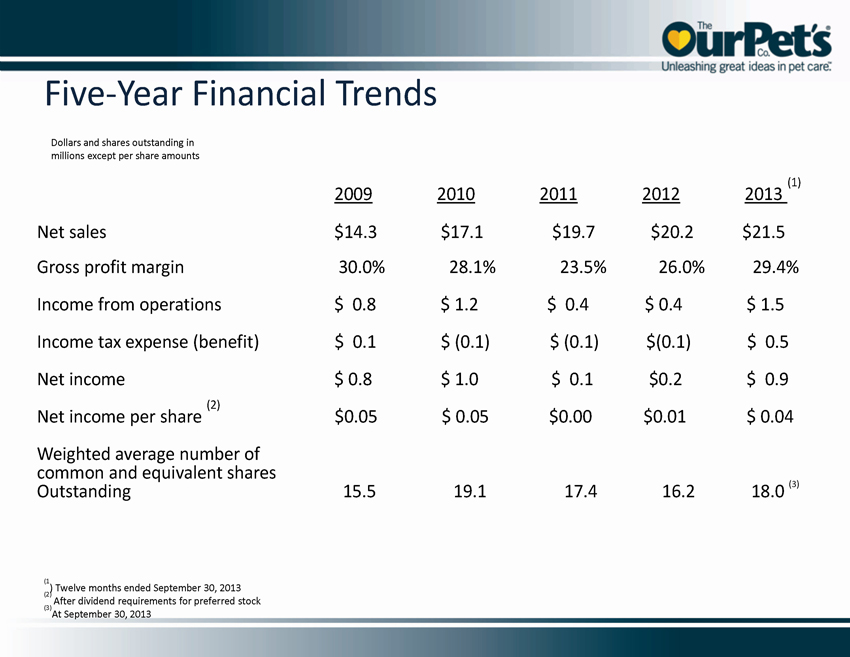

Dollars and shares outstanding in millions except per share amounts 2009 2010 2011 2012 2013 (1) Net sales $ 14.3 $17.1 $19.7 $ 20.2 $ 21.5 Gross profit margin 30.0% 28.1% 23.5% 26.0% 29.4% Income from operations $ 0.8 $ 1.2 $ 0.4 $ 0.4 $ 1.5 Income tax expense (benefit) $ 0.1 $ (0.1) $ (0.1) $(0.1) $ 0.5 Net income $ 0.8 $ 1.0 $ 0.1 $0.2 $ 0.9 Net income per share (2) $0.05 $ 0.05 $0.00 $0.01 $ 0.04 Weighted average number of common and equivalent shares Outstanding 15.5 19.1 17.4 16.2 18.0 (3) Five - Year Financial Trends (1 ) Twelve months ended September 30, 2013 (2) After dividend requirements for preferred stock (3) At September 30, 2013

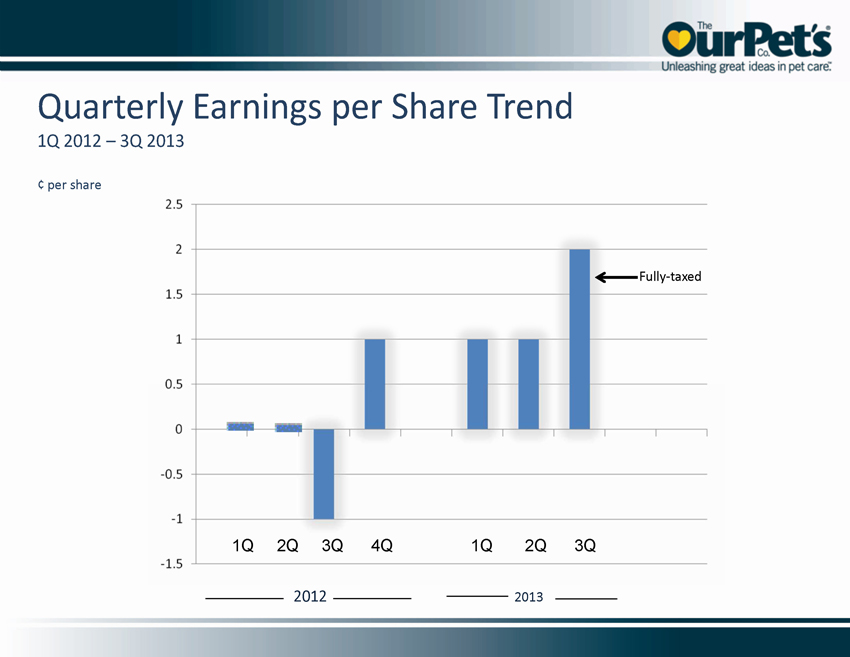

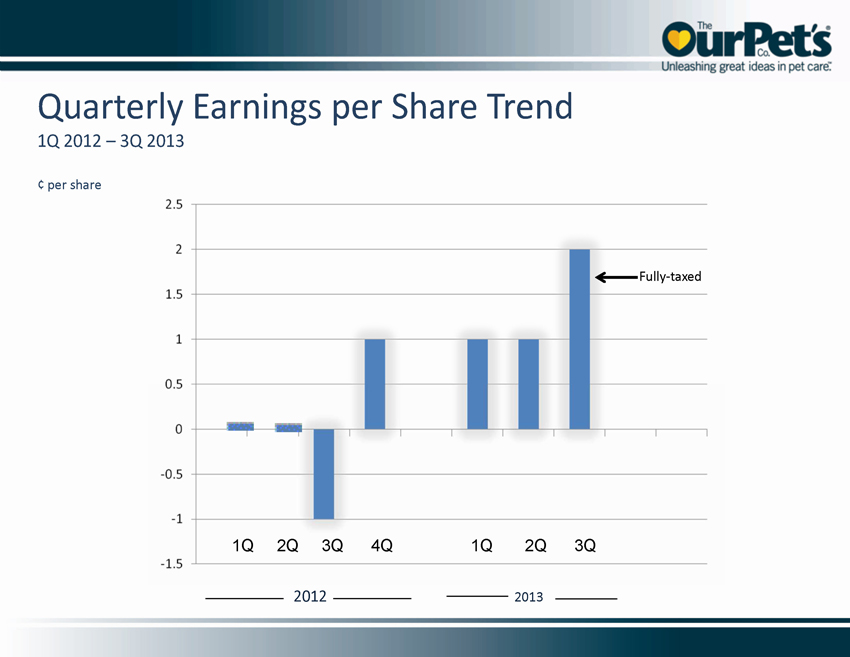

Quarterly Earnings per Share Trend 1Q 2012 – 3Q 2013 ¢ per share 2012 2013 1Q 2Q 3Q 4Q 1Q 2Q 3Q Fully - taxed

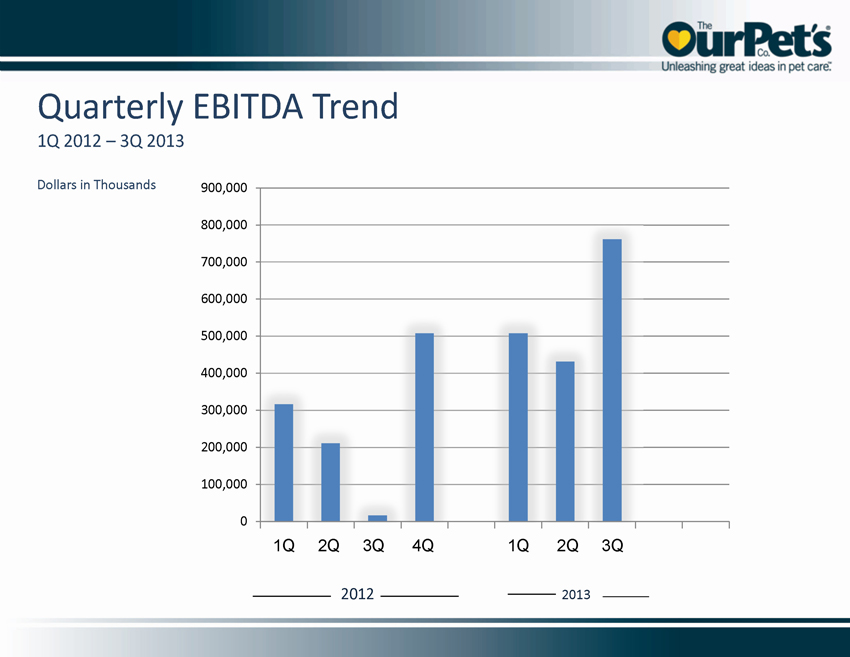

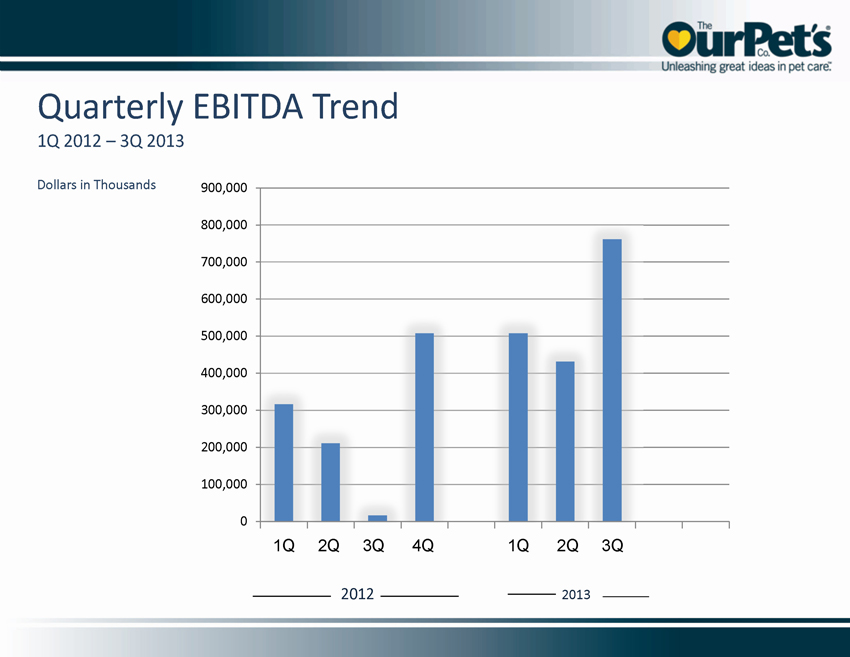

0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 1Q 2Q 3Q 4Q 1Q 2Q 3Q Quarterly EBITDA Trend 1Q 2012 – 3Q 2013 Dollars in Thousands 2012 2013

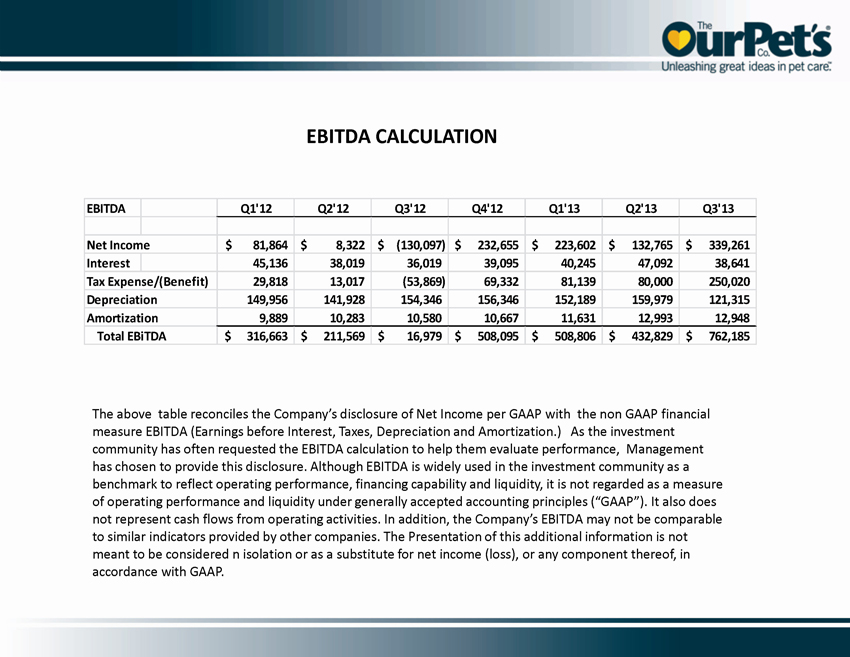

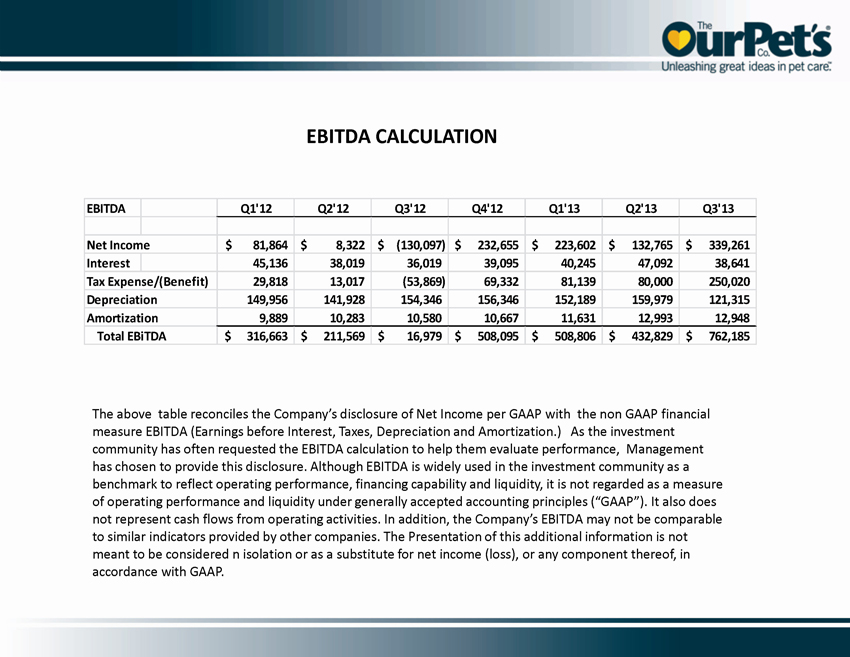

The above table reconciles the Company’s disclosure of Net Income per GAAP with the non GAAP financial measure EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization.) As the investment community has often requested the EBITDA calculation to help them evaluate performance, Management has chosen to provide this disclosure. Although EBITDA is widely used in the investment community as a benchmark to reflect operating performance, financing capability and liquidity, it is not regarded as a measure of operating performance and liquidity under generally accepted accounting principles (“GAAP”). It also does not represent cash flows from operating activities. In addition, the Company’s EBITDA may not be comparable to similar indicators provided by other companies. The Presentation of this additional information is not meant to be considered n isolation or as a substitute for net income (loss), or any component thereof, in accordance with GAAP. EBITDA CALCULATION EBITDA Q1'12 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Net Income 81,864$ 8,322$ (130,097)$ 232,655$ 223,602$ 132,765$ 339,261$ Interest 45,136 38,019 36,019 39,095 40,245 47,092 38,641 Tax Expense/(Benefit) 29,818 13,017 (53,869) 69,332 81,139 80,000 250,020 Depreciation 149,956 141,928 154,346 156,346 152,189 159,979 121,315 Amortization 9,889 10,283 10,580 10,667 11,631 12,993 12,948 Total EBiTDA 316,663$ 211,569$ 16,979$ 508,095$ 508,806$ 432,829$ 762,185$

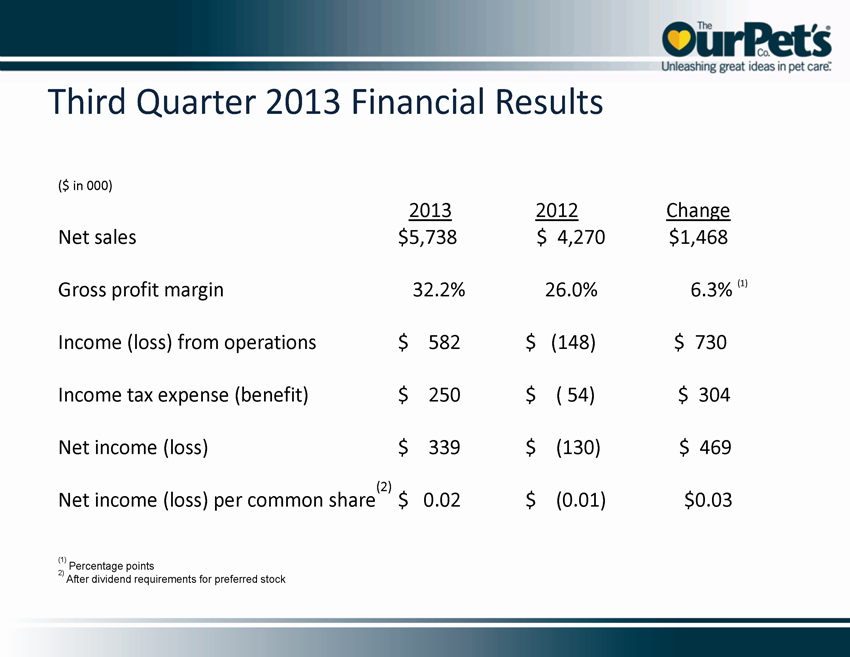

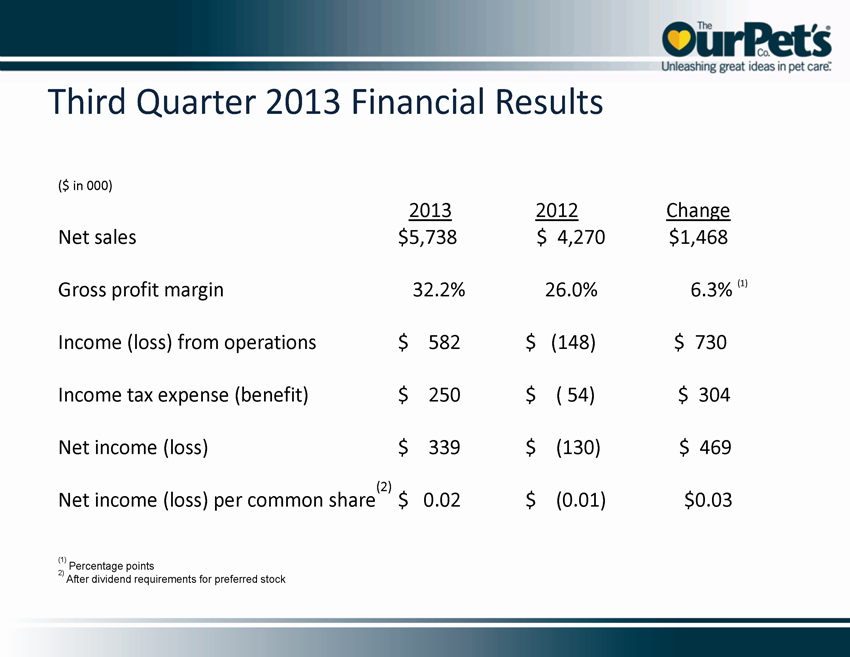

Third Quarter 2013 Financial Results ($ in 000) 2013 2012 Change Net sales $ 5,738 $ 4,270 $1,468 Gross profit margin 32.2% 26.0% 6.3% (1) Income (loss) from operations $ 582 $ (148) $ 730 Income tax expense (benefit) $ 250 $ ( 54) $ 304 Net income (loss) $ 339 $ (130) $ 469 Net income (loss) per common share (2) $ 0.02 $ (0.01) $0.03 (1) Percentage points 2) After dividend requirements for preferred stock

Investment Highlights Summary • Pet industry = continued strong, healthy growth (recession resistant) • OurPet’s (OPCO) is one of the few “Non - Retail Pure Pet Plays ” • Successfully received a patent and settled the expensive litigation involving SmartScoop (2007 - 2011 ) • OurPet’s has successfully navigated through “No Man’s Land” through the last three years: • Completed organizational restructuring and is staffed with highly experienced professional and executive personnel • Modern facility – 96,000 sq. ft./ 14 acres (east of Cleveland) • Installed a fully integrated ERP system to meet current and future information technology needs – including TWL • Integrated the Cosmic Catnip Products acquisition and moved operations into its Ohio facility • Developed and is implementing an effective two brand channel strategy

Investment Highlights (cont.) • OurPet’s has one of the most extensive new product pipelines in the pet industry - 225 patents issued or pending • Company has a well planned program for growth: • Product innovation • Marketing strategy – two brand channel strategy • Aggressive Sales effort – expand in current markets, enter new domestic markets ( e - commerce, clubs, “dollar stores”, etc. and pursue overseas opportunities (Canada, Europe, Japan, Brazil, Australia, Russia, etc.) • Strategic acquisitions • OurPet’s has strengthened its balance sheet and achieving revenue and profit growth above pet industry norms .

Thank You – Q & A