Paul F McLaughlin Chairman and CEO 2015 Annual Shareholders Meeting Flanders, New Jersey May 20, 2015

Safe Harbor Statement This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”) which include the benefits to customers of Rudolph’s products, Rudolph’s business momentum and future growth, Rudolph’s existing market position and its ability to maintain and advance such position relative to its competitors and Rudolph’s ability to meet the expectations and needs of our customers as well as other matters that are not purely historical data. Rudolph wishes to take advantage of the “safe harbor” provided for by the Act and cautions that actual results may differ materially from those projected as a result of various factors, including risks and uncertainties, many of which are beyond Rudolph’s control. Such factors include, but are not limited to, delays in shipping products for technical performance, component supply or other reasons, the company’s ability to leverage its resources to improve its positions in its core markets and fluctuations in customer capital spending. Additional information and considerations regarding the risks faced by Rudolph are available in Rudolph’s Form 10-K report for the year ended December 31, 2014 and other filings with the Securities and Exchange Commission. As the forward-looking statements are based on Rudolph’s current expectations, the company cannot guarantee any related future results, levels of activity, performance or achievements. Rudolph does not assume any obligation to update the forward-looking information contained in this press release. 2

Highlights To Look for Today Unique Front-End (FE) and Back-End (BE) business model Positioned to Benefit From Industry Trends – advanced packaging, lithography, inspection, software, 3D NAND, XX patterning Capital Intensity Increasing – process control getting increasing share of spend of both FE and BE capex Market Leadership in selected growth segments Commitment to R&D & IP– first-mover advantage, disruptive technology and leads to more touches Strong financial profile Continuous Shareholder Value Creation 3

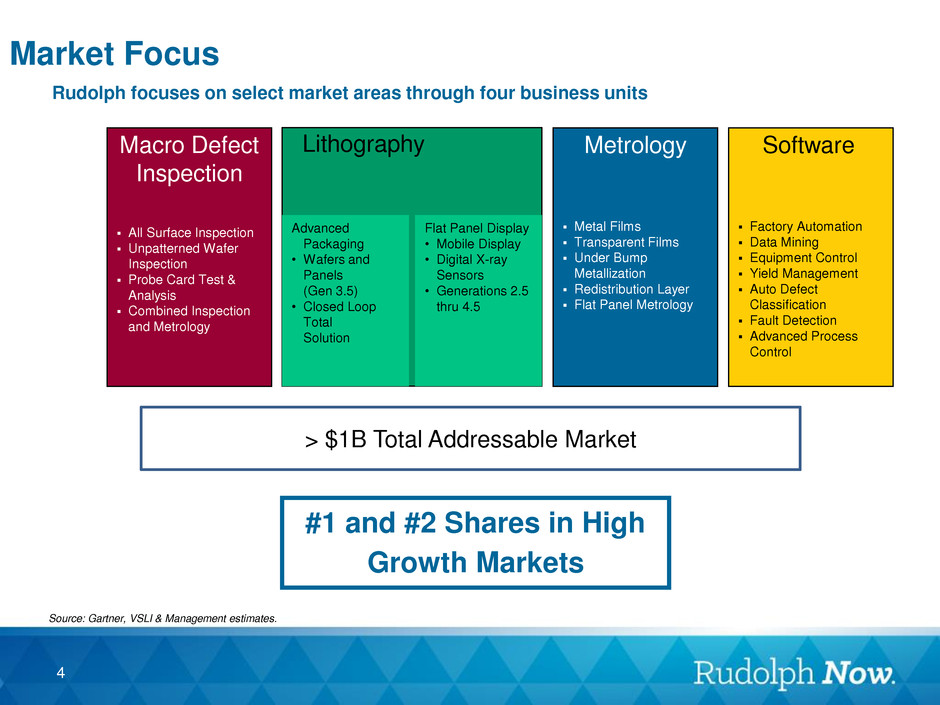

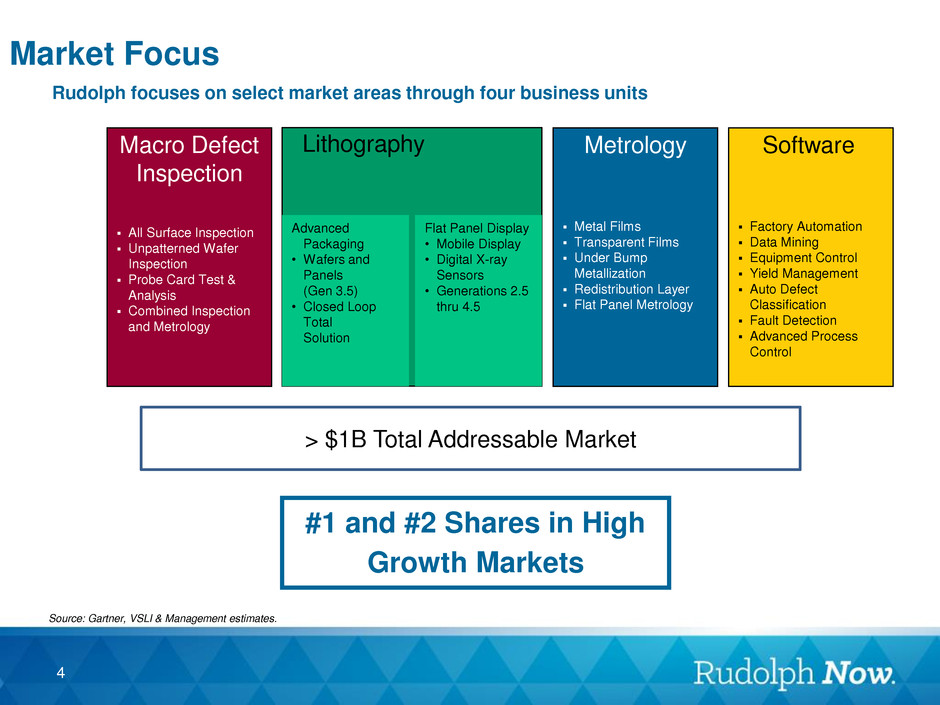

All Surface Inspection Unpatterned Wafer Inspection Probe Card Test & Analysis Combined Inspection and Metrology Macro Defect Inspection $223M Metal Films Transparent Films Under Bump Metallization Redistribution Layer Flat Panel Metrology Metrology $226M Factory Automation Data Mining Equipment Control Yield Management Auto Defect Classification Fault Detection Advanced Process Control Software $59M Market Focus 2013E Rudolph focuses on select market areas through four business units Source: Gartner, VSLI & Management estimates. Lithography Advanced Packaging • Wafers and Panels (Gen 3.5) • Closed Loop Total Solution Flat Panel Display • Mobile Display • Digital X-ray Sensors • Generations 2.5 thru 4.5 #1 and #2 Shares in High Growth Markets > $1B Total Addressable Market 4

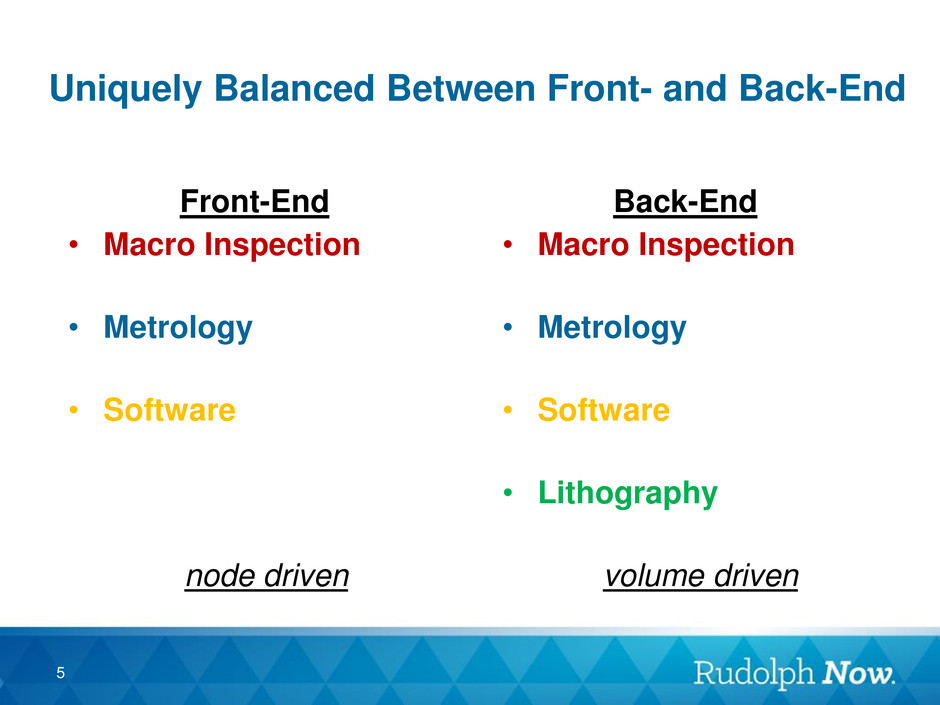

Uniquely Balanced Between Front- and Back-End Front-End • Macro Inspection • Metrology • Software node driven Back-End • Macro Inspection • Metrology • Software • Lithography volume driven 5

2014 REVENUE PERCENTAGE BY CUSTOMER Top 10 Customers All Others (128) BROAD CUSTOMER BASE IN MULTIPLE GROWTH SEGMENTS Packaging Front-end FPD 45% 10% ALL UNDER 6

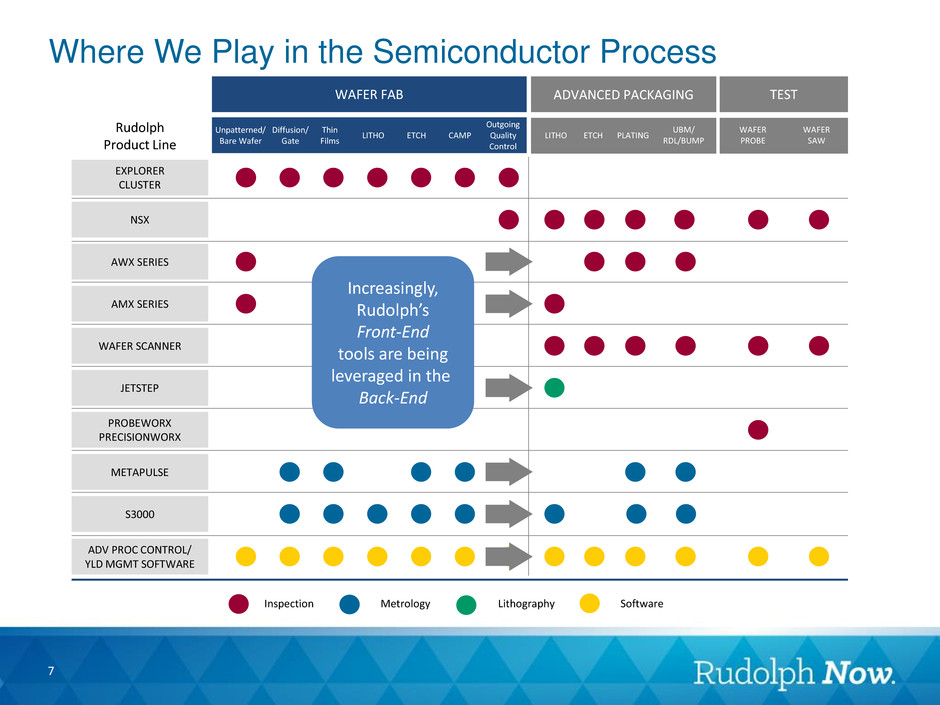

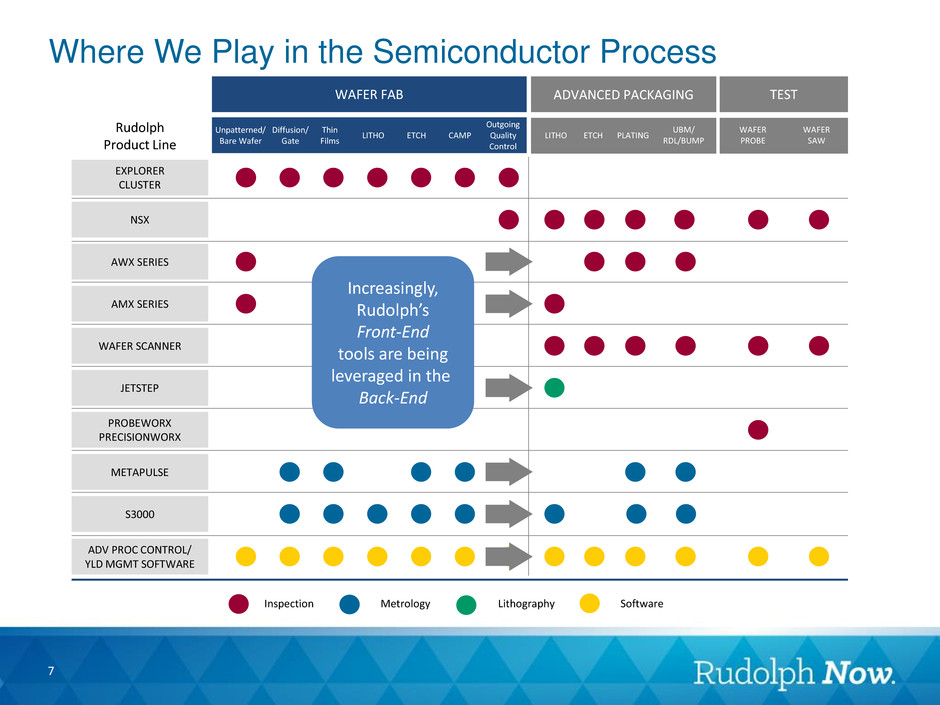

WAFER FAB ADVANCED PACKAGING TEST EXPLORER CLUSTER NSX AWX SERIES AMX SERIES WAFER SCANNER JETSTEP PROBEWORX PRECISIONWORX METAPULSE S3000 Rudolph Product Line ADV PROC CONTROL/ YLD MGMT SOFTWARE Unpatterned/ Bare Wafer Diffusion/ Gate Thin Films LITHO ETCH CAMP Outgoing Quality Control LITHO ETCH PLATING UBM/ RDL/BUMP WAFER PROBE WAFER SAW Where We Play in the Semiconductor Process 7 Inspection Metrology Lithography Software Increasingly, Rudolph’s Front-End tools are being leveraged in the Back-End

Positioned to Benefit From Industry Trends 8

Middle-end is a strategic area where the Foundries, OSATs, wafer level packaging houses and Integrated Device Manufacturers (“IDMs”) overlap Rudolph is well positioned to take advantage of this growth across all business lines Rudolph products have traditionally been used in both front-end and back-end as a ‘bridge’ between the semiconductor fabrication plants (“fabs”) and the OSATs Unique solutions are well positioned to serve the emerging middle-end-of-line market Source : Yole Développement SA. Advanced Packaging Manufacturing Occurs in the Middle-end Traditional front-end and back-end players are competing for next generation business of the middle-end Inspection 9

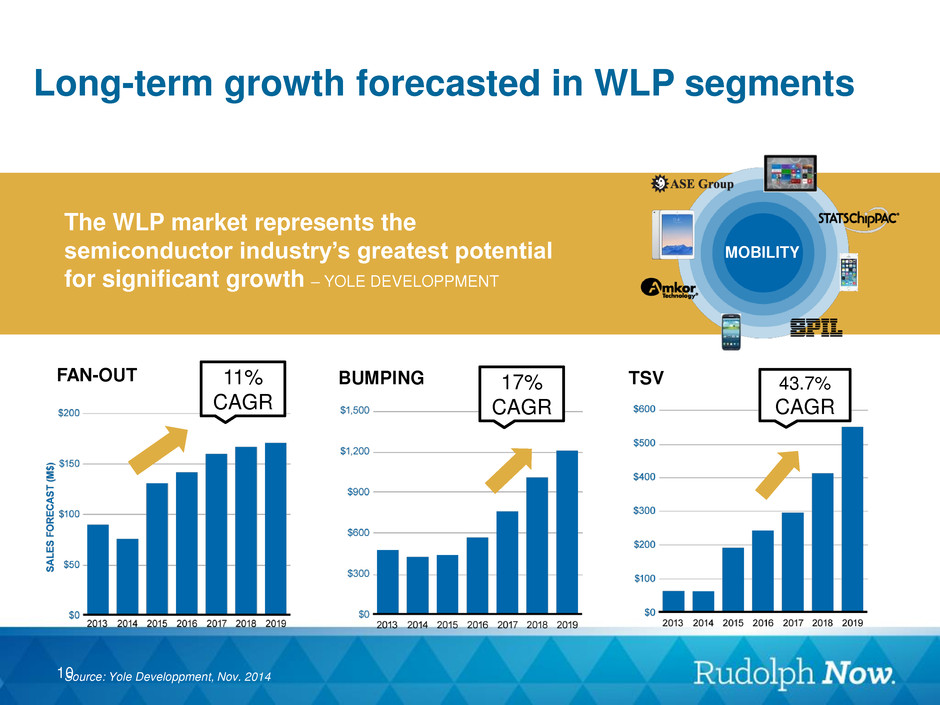

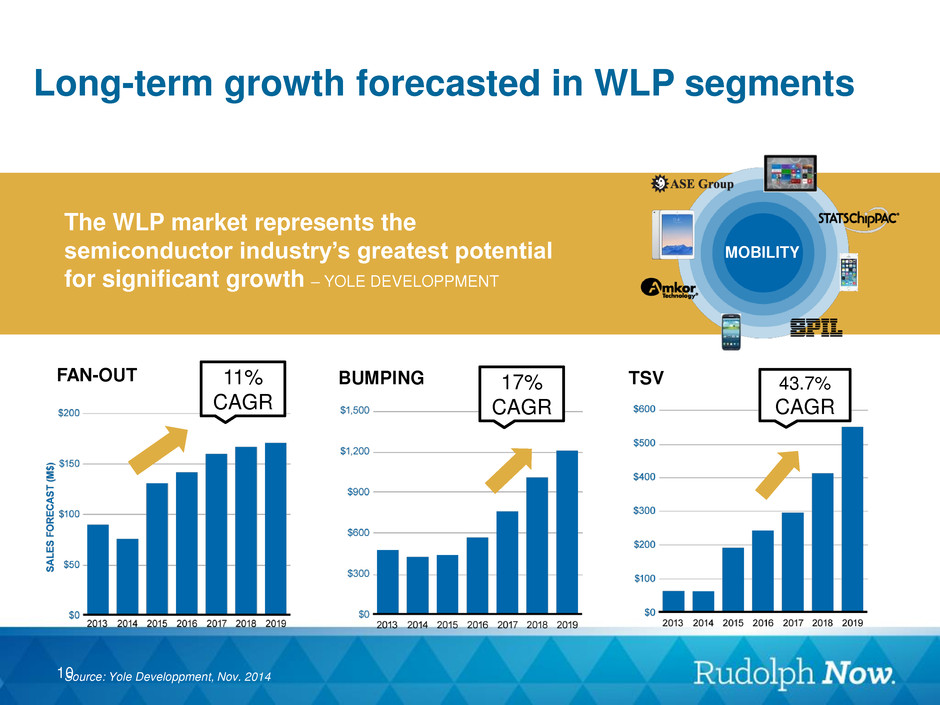

Long-term growth forecasted in WLP segments BUMPING MOBILITY TSV FAN-OUT The WLP market represents the semiconductor industry’s greatest potential for significant growth – YOLE DEVELOPPMENT 17% CAGR 43.7% CAGR Source: Yole Developpment, Nov. 2014 11% CAGR 10

Inspection & Metrology market for Advanced Packaging Total Packaging and Assembly Equipment Inspection & Metrology Source: Gartner, April 2015 and Yole Developpment, November 2014. 11

Commitment to R&D & IP– first-mover advantage, disruptive technology and leads to more touches 12

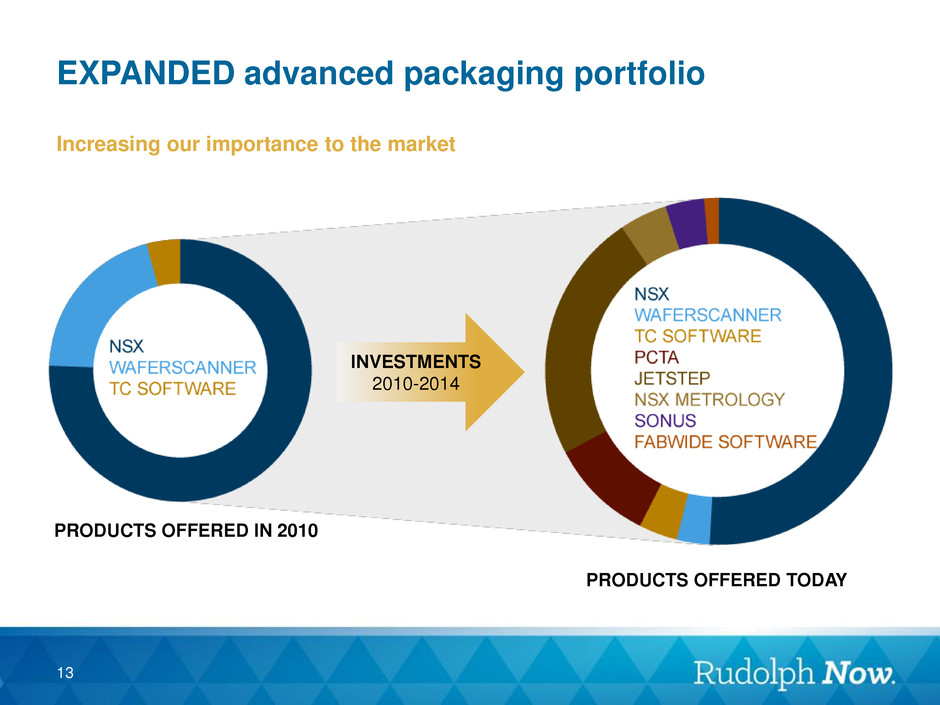

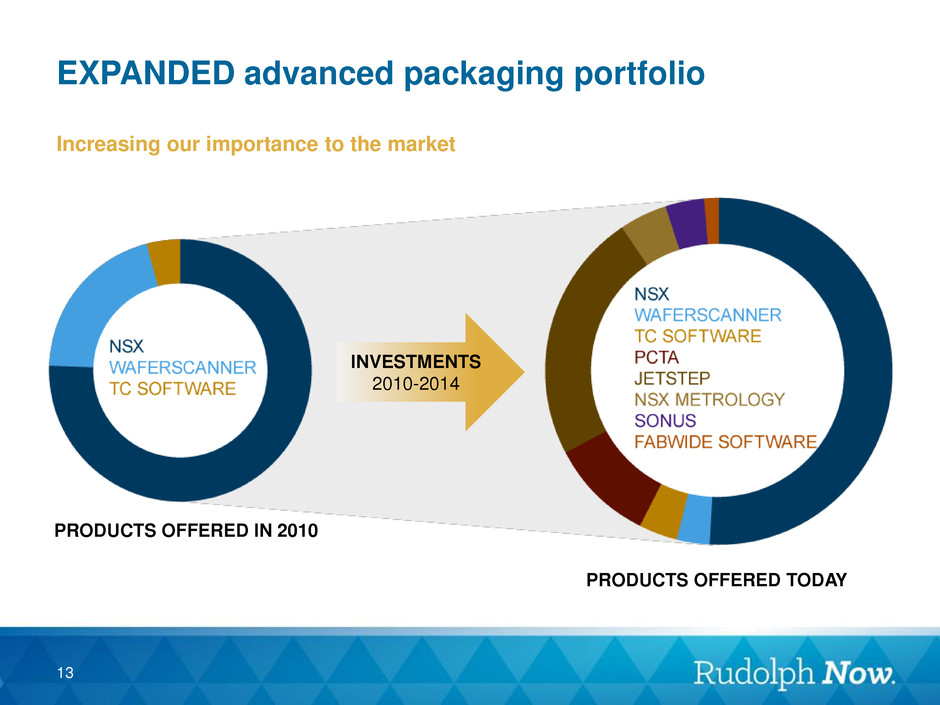

EXPANDED advanced packaging portfolio Increasing our importance to the market INVESTMENTS 2010-2014 PRODUCTS OFFERED IN 2010 PRODUCTS OFFERED TODAY 13

Rudolph Surrounds Advanced Packaging Discover® Yield Management Software JetStep® W Series Lithography System (wafer or round substrates) ProcessWORKS® Run-to-Run Control Software ARTIST® Fault Detection & Classification Software TrueADC™ Automatic Defect Classification Software WS 3880 3D Bump Height Metrology MPG RDL/UBM Metrology NSX ® 2D Inspection RDL / TSV Metrology S3000S™ Thick Resist Metrology JetStep® S Series Lithography System (rectangular substrates) SONUS™ TSV Void Detection Bump Thickness Metrology NEXT GEN RDL / TSV Metrology New Tools in 2015 14

Interconnect Solder bump; Cu Pillar bump TSV Re-distribution Layers Packaging WLCSP (Fan-in and Fan-out) Package-on-Package MPG TSV & UBM NSX 320 + Tamar TSV inspection and metrology WS 3880 bump and cu-pillar inspection and metrology 15 RUDOLPH PRODUCT SUITE ENABLING ADVANCED PACKAGING JetStep 2um RDL, cu-pillar, TSV Sonus TSV and cu-pillar void detection Comprehensive Device Characterization Applied to Multiple Applications S3000 Dielectric / passivation thickness, stress

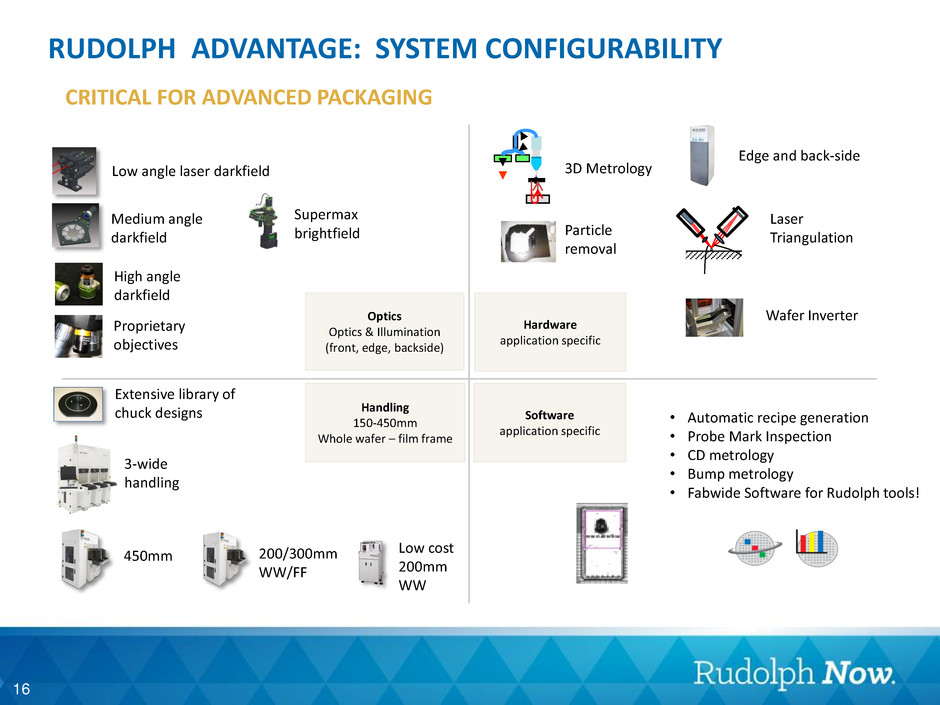

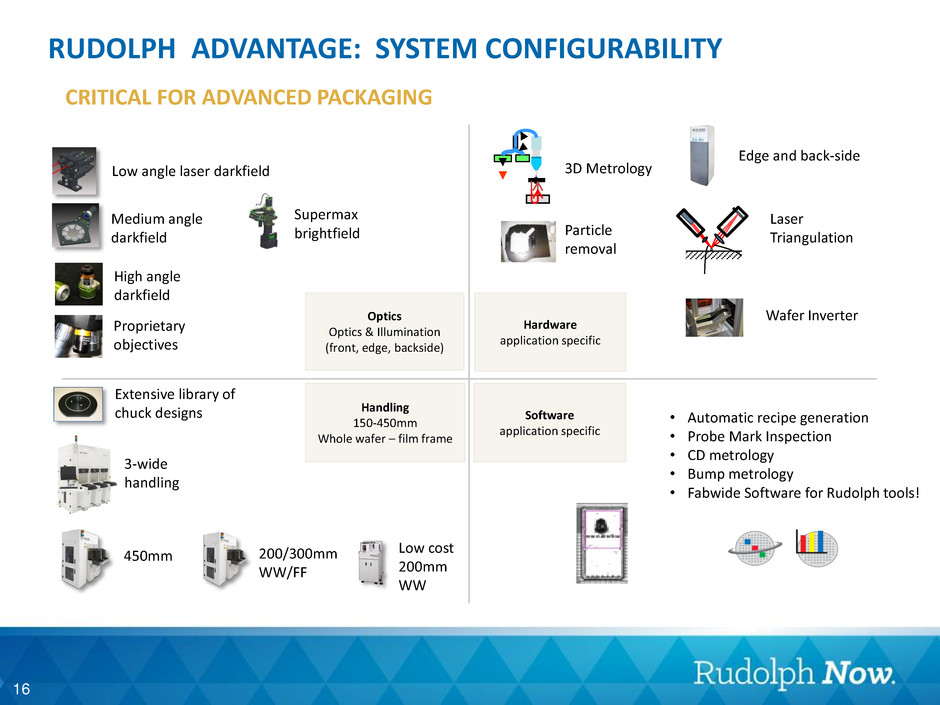

Supermax brightfield High angle darkfield Low angle laser darkfield Medium angle darkfield Proprietary objectives 200/300mm WW/FF Low cost 200mm WW Extensive library of chuck designs 450mm Edge and back-side Particle removal Laser Triangulation Wafer Inverter 3D Metrology • Automatic recipe generation • Probe Mark Inspection • CD metrology • Bump metrology • Fabwide Software for Rudolph tools! 3-wide handling RUDOLPH ADVANTAGE: SYSTEM CONFIGURABILITY Optics Optics & Illumination (front, edge, backside) Hardware application specific Handling 150-450mm Whole wafer – film frame Software application specific CRITICAL FOR ADVANCED PACKAGING 16

ACROSS THE SUPPLY CHAIN “We need to understand what is going on in our suppliers’ operations. Stacking tolerances are a growing issue.” WITHIN THE FACTORY “Our customers are lowering their tolerance for field returns. We need to leverage all systems to help us minimize outliers.” Changing Dynamics in Process Control Software (1) Reducing the Dimensionality of Data with Neural Networks. 17 Requiring New Analytics (1) From New Data Sources Rudolph is Uniquely Positioned to Address This Need Mobility, influence of fabless, process coupling and industry consolidation drive new approaches to process control software

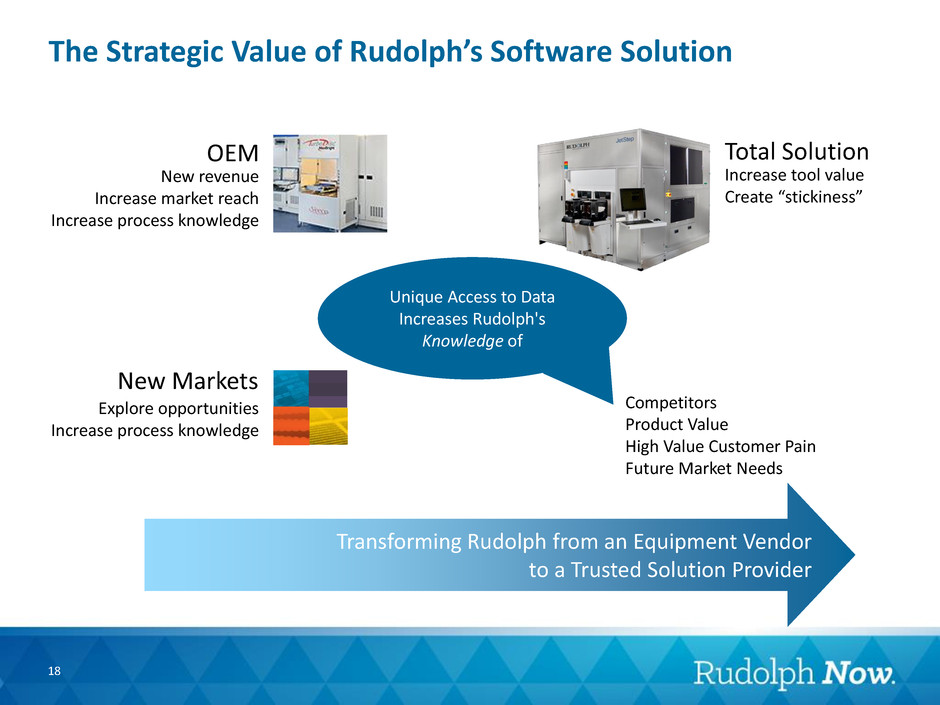

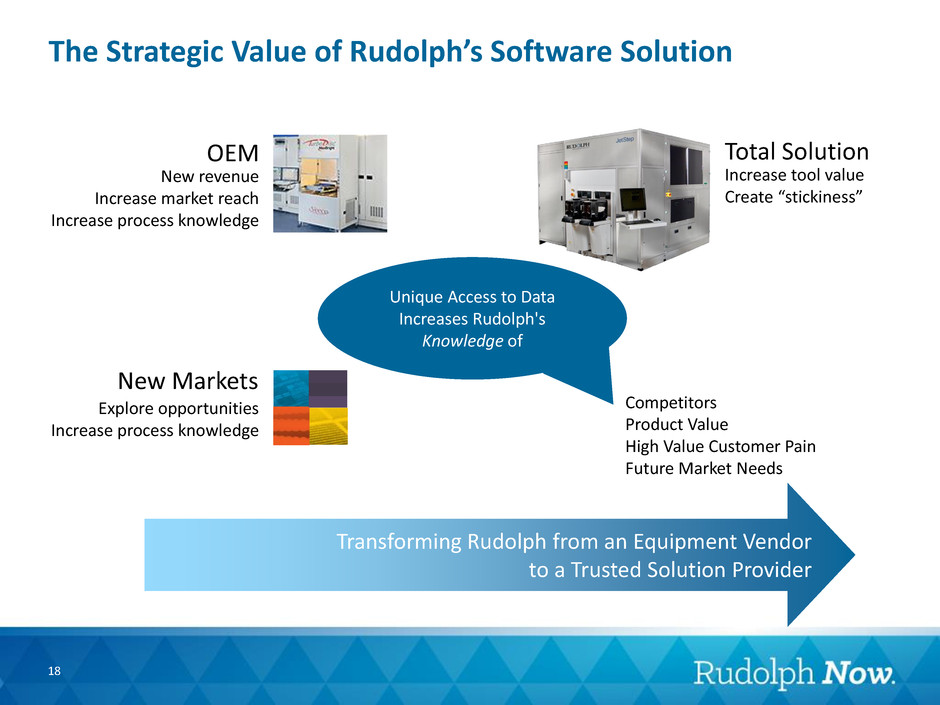

Total Solution Increase tool value Create “stickiness” OEM New revenue Increase market reach Increase process knowledge New Markets Explore opportunities Increase process knowledge Unique Access to Data Increases Rudolph’s Knowledge of Competitors Product Value High Value Customer Pain Future Market Needs Unique Access to Data Increases Rudolph's Knowledge f Transforming Rudolph from an Equipment Vendor to a Trusted Solution Provider 18 The Strategic Value of Rudolph’s Software Solution

Rudolph Transformation, enabling Process not only controlling it JETSTEP LITHOGRAPHY ENABLES ADVANCES IN WLP • Critical to device manufacturing – can’t print can’t play • Engage in definition of customer roadmaps • Interface at the “C-suite” • Value added services Inspection/Metrology Litho WLP Equipment $1.57B JETSTEP INCREASES RUDOLPH TAM by ≈$150M 9% 14% Source: Gartner, Apr. 2015 19

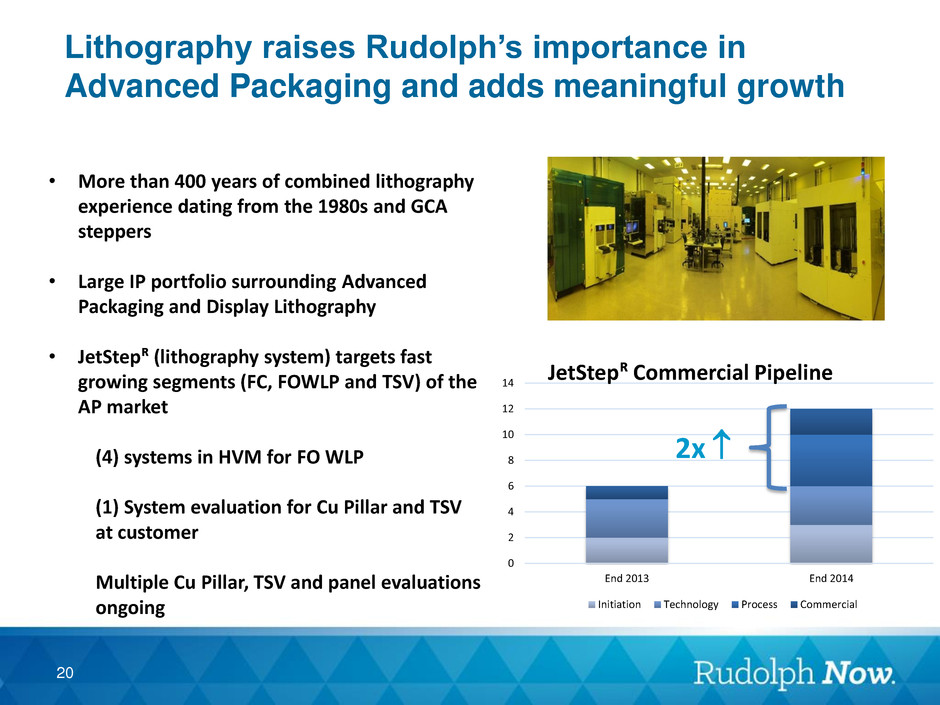

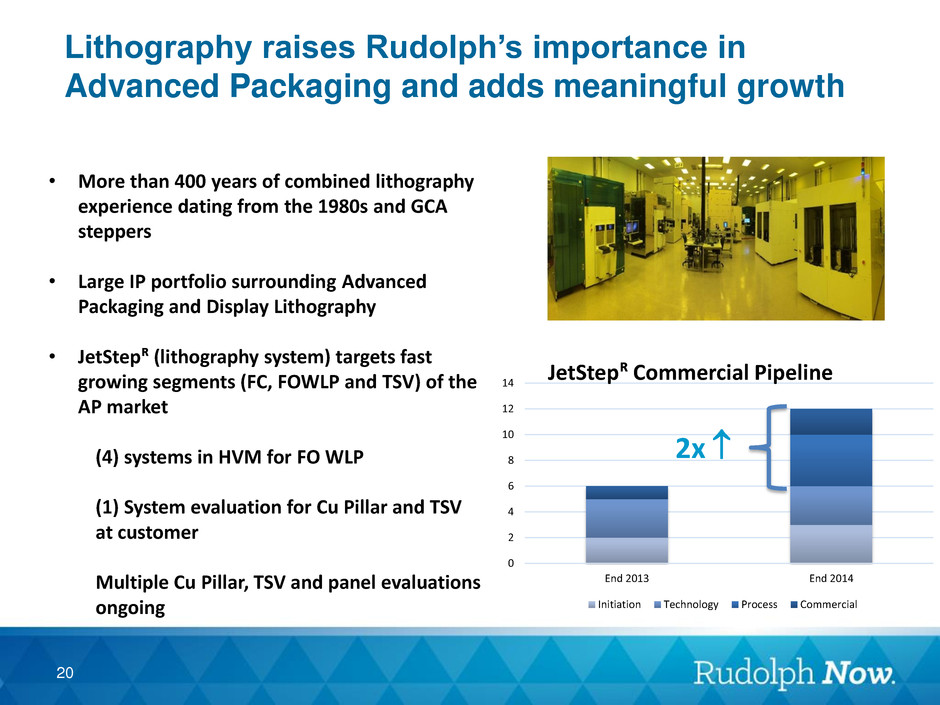

Lithography raises Rudolph’s importance in Advanced Packaging and adds meaningful growth 0 2 4 6 8 10 12 14 End 2013 End 2014 Initiation Technology Process Commercial 2x • More than 400 years of combined lithography experience dating from the 1980s and GCA steppers • Large IP portfolio surrounding Advanced Packaging and Display Lithography • JetStepᴿ (lithography system) targets fast growing segments (FC, FOWLP and TSV) of the AP market (4) systems in HVM for FO WLP (1) System evaluation for Cu Pillar and TSV at customer Multiple Cu Pillar, TSV and panel evaluations ongoing JetStepᴿ Commercial Pipeline 20

Lithography Market 0 50 100 150 200 250 300 350 $400 2013 2014 2015 2016 2017 2018 Sa les Fore ca sts ($ M) Gartner Advanced Packaging Lithography Yole Exposure & Photo-Lithography Source: Gartner, December 2014 and Yole Developpment, November 2014. 21

JetStep® System the Complete Advanced Packaging System Covers all Application Space Wafer Wafer Panel Panel Wafer Wafer Panel Wafer 22

1999 – 100% Metrology 2002 – ISOA Entered macro defect inspection market 2006 – August Technology Expanded front-end macro presence and entered back-end inspection 2007 – Applied Precision, Semiconductor Division Expanded reach across test floor – in probe card test and analysis 2008 – RVSI Inspection Industry-leading 3D technology 2009 – Adventa Control Technologies Process control software complement existing process analysis software 2010 – Yield Dynamics (MKSI China) Parametric analysis and data mining software 2012 – NanoPhotonics Bare wafer, AP and mask inspection 2012 – Azores AP & DP Lithography 2013 – Tamar 3D metrology for advanced packaging Inspection Metrology Lithography Software Product Offering Evolution Since 1999 IPO Rudolph has selectively acquired and leveraged additional products and technology to augment organic growth 23

Customer Centric Focus Driving decisions across supply chain Unique position with both leading FE and BE customers makes Rudolph highly relevant to fabless Relationships help guide R&D spend – promotes relevance and mind share Fabless require more data to manage supply chain Fr o n t- En d B ac k- En d Fables s Rudolph’s Top FE Customers Rudolph’s Top BE Customers 24

Financials 25

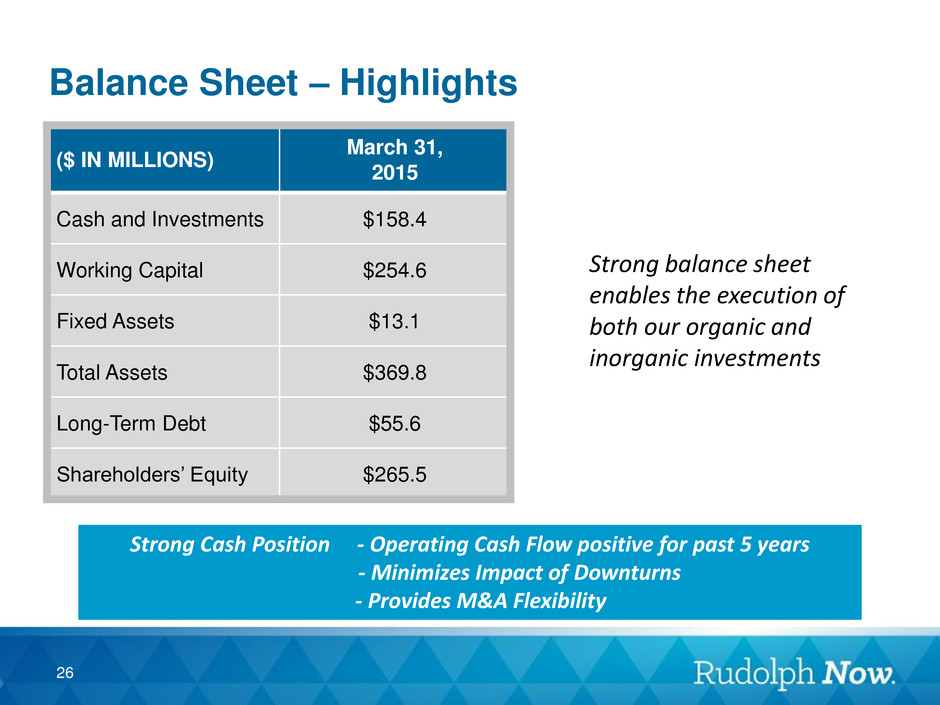

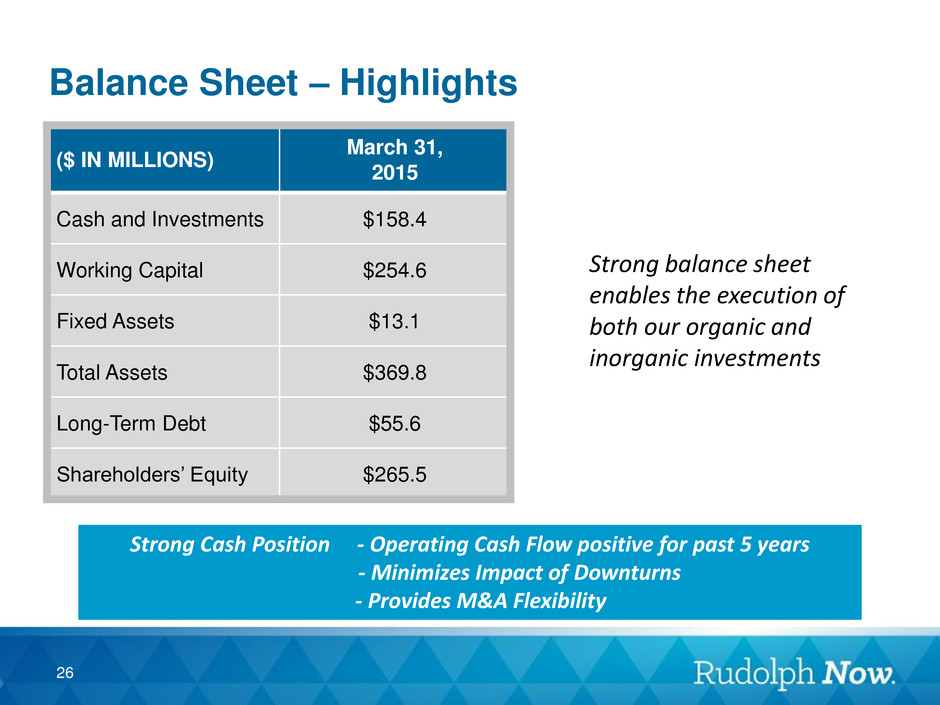

Balance Sheet – Highlights ($ IN MILLIONS) March 31, 2015 Cash and Investments $158.4 Working Capital $254.6 Fixed Assets $13.1 Total Assets $369.8 Long-Term Debt $55.6 Shareholders’ Equity $265.5 Strong Cash Position - Operating Cash Flow positive for past 5 years - Minimizes Impact of Downturns - Provides M&A Flexibility Strong balance sheet enables the execution of both our organic and inorganic investments 26

2015 Q1 Results Non-GAAP Revenues 52,570$ COGs 23,549 Gross profit 29,021 55% R&D 9,767 SG&A 8,757 Total operating exp. 18,524 Operating income 10,497 Interest expense, net (1,382) Other income / (expense) (638) Income taxes (3,097) Net income 5,380$ EPS 0.17$ Strong investments in R&D during industry downturns drives growth during up cycles Consistently strong gross margins even at low revenue volumes Ability to maintain profitability throughout all phases of cycle enue olume 27

Operating performance 2Q15 Guidance • Revenues increasing sequentially 5 -10 percent over 1Q15. • EPS between $0.16 and $0.19 per share Operating income on a Non-GAAP basis Quarter over quarter growth driven by multiple business segments REVENUE OPERATING INCOME 28

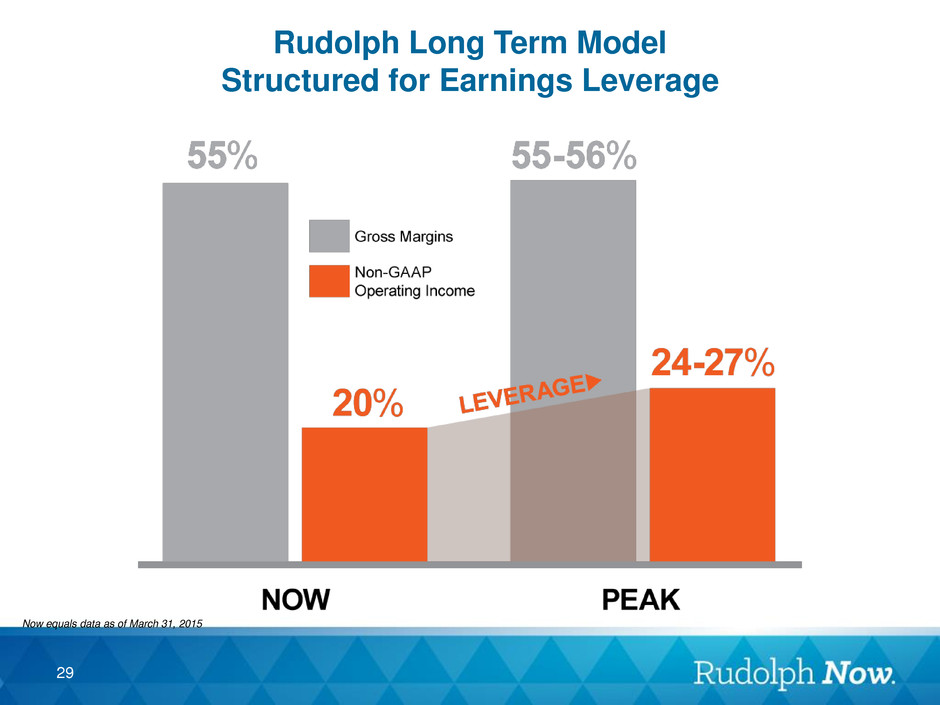

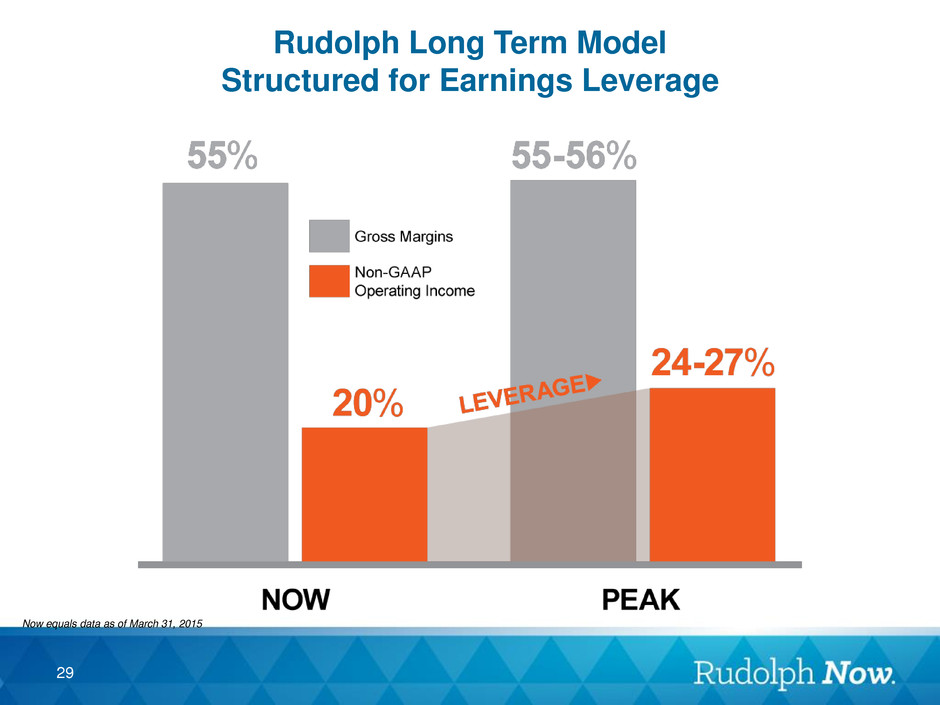

Rudolph Long Term Model Structured for Earnings Leverage Now equals data as of March 31, 2015 29

Capital Allocation Strong cash generator and where it is being deployed Conservative WC required to manage both sides of industry cycles $40-$50M Announced 1.9M shares repurchased thru 3/31/15. Board reloaded by 1.4M $25-$35M Assumes $10.50 to $13.50 per share Strong track record of successful M&A, all with a cash component to enhance shareholder value Debt used to fund new Lithography business and 2 technology bolt-ons Debt due in 2016 $60M Cash and Investments $158.4 as of 3/31/15 30

SUMMARY Your Company is driving growth and shareholder value 31

Thank You 32