Notice of Convocation of the 112th Ordinary General Shareholders’ Meeting

Date and time:

10:00 a.m., Wednesday, June 15, 2016

Venue:

Toyota Head Office, 1, Toyota-cho, Toyota City, Aichi Prefecture

Reports:

Reports on business review, consolidated and unconsolidated financial statements for FY2016 (April 1, 2015 through March 31, 2016) and report by the Accounting Auditor and the Audit & Supervisory Board on the audit results of the consolidated financial statements.

Resolutions:

Proposed Resolution 1:

Election of 11 Members of the Board of Directors

Proposed Resolution 2:

Election of 1 Substitute Audit & Supervisory Board Member

Proposed Resolution 3:

Payment of Bonuses to Members of the Board of Directors

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation.

< Toyota Global Vision >

Toyota will lead the way to the future of mobility,

enriching lives around the world with the safest

and most responsible ways of moving people.

Through our commitment to quality,

constant innovation and respect for the planet,

we aim to exceed expectations

and be rewarded with a smile.

We will meet challenging goals by engaging the

talent and passion of people,

who believe there is always a better way.

Table of Contents

| | | | |

To Our Shareholders | | | 2 | |

Notice of Convocation | | | 3 | |

Reference Documents | | | 5 | |

| |

(Attachment to the Notice of Convocation of the 112th Ordinary General Shareholders’ Meeting) | | | | |

Business Report | | | 15 | |

1. Outlook of Associated Companies | | | 15 | |

2. Status of Shares | | | 26 | |

3. Status of Stock Acquisition Rights, Etc. | | | 27 | |

4. Status of Members of the Board of Directors and Audit & Supervisory Board Members | | | 28 | |

5. Status of Accounting Auditor | | | 32 | |

6. System to Ensure the Appropriateness of Business Operations and Outline of Implementation Status of such Systems | | | 33 | |

Consolidated Financial Statements | | | 42 | |

Unconsolidated Financial Statements | | | 50 | |

Independent Auditor’s Report and Audit & Supervisory Board’s Report | | | 61 | |

Toyota Q&A | | | 66 | |

Financial Highlights | | | 69 | |

1

I would like to express our gratitude for your ongoing support and understanding of our company.

We wish to continue growing sustainably, like a tree adding annual growth rings, in order to ensure that we meet the expectations of the shareholders who support our company and give them every reason to continue holding our company’s shares.

We have developed an automobile design framework from the ground up to launch the new Prius, a vehicle that materializes our desire to “manufacture ever-better cars” and delivers not only heightened environmental friendliness but also vastly enhanced basic performance on points such as driving pleasure and riding comfort, as the first model under the “Toyota New Global Architecture (TNGA).” We will continue to promote these efforts under the TNGA while strengthening our competitiveness through simple, streamlined and innovative Monozukuri (manufacturing) and human resource development. We will also make headway in our efforts to take on new challenges for the future by pursuing measures under the “Toyota Environmental Challenge 2050” to promote the popularization of hybrid vehicles and fuel cell vehicles and reduce the levels of carbon dioxide emissions in production processes while developing automated driving technology toward the coexistence of safety, peace of mind and a driving experience of “Fun to Drive.” Through these efforts, we will strive to realize a future mobile society where people will continue loving automobiles for the next hundred years. We will also make initiatives for “enriching lives of communities” in unison with local residents through various activities that contribute to society such as projects to assist with the reconstruction from the Great East Japan Earthquake.

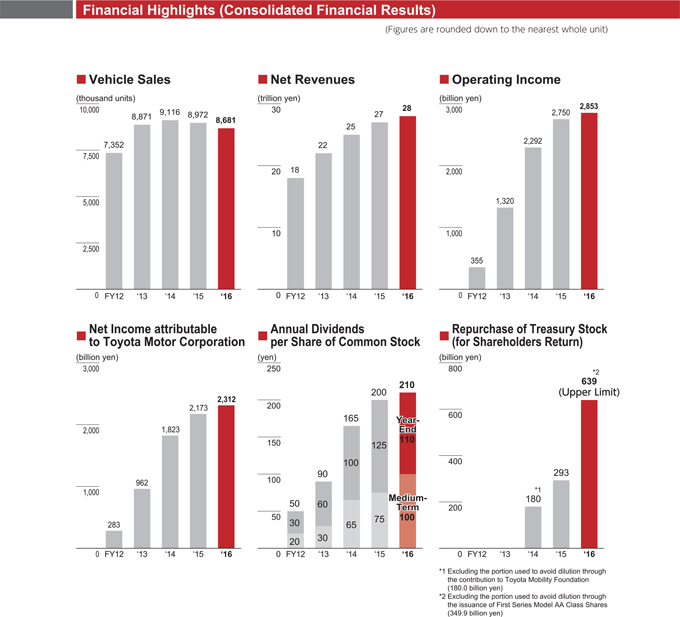

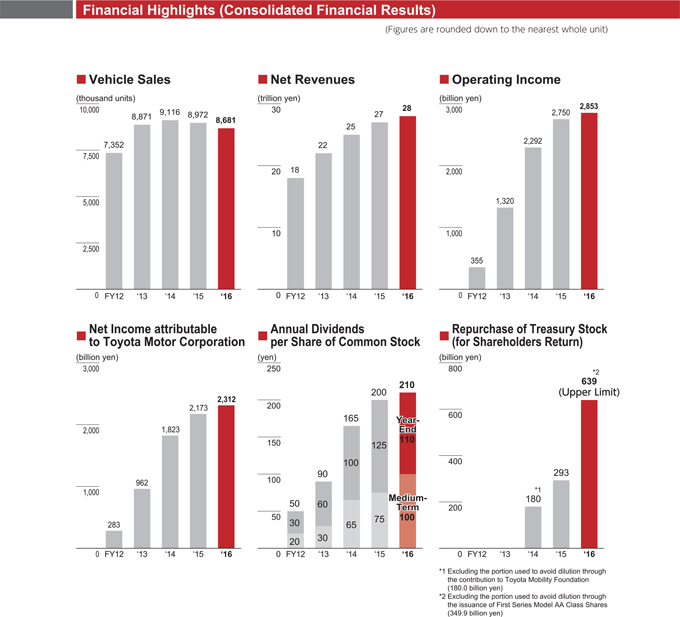

With regard to our consolidated financial results for FY2016, consolidated net revenue was 28,403.1 billion yen and consolidated net income was 2,312.6 billion yen. We have determined to pay a year-end dividend of 110 yen per share of common stock. This, combined with the interim dividend of 100 yen per share of common stock, will result in a total annual dividend of 210 yen per share of common stock for FY2016. In addition, we have decided to repurchase treasury stock as a measure for returning profits to shareholders.

We will provide our customers with a steady succession of new automobiles they can drive with “pleasure and smiles,” sending each and every member of our global workforce of 340,000 employees out to the batter’s box to take on the challenge of “manufacturing ever-better cars.” We look forward to your ongoing support.

2

(Securities Code 7203)

May 25, 2016

To All Shareholders:

President Akio Toyoda

TOYOTA MOTOR CORPORATION

1, Toyota-cho, Toyota City, Aichi Prefecture

Notice of Convocation of the 112th Ordinary General Shareholders’ Meeting

(Unless otherwise stated, all financial information has been prepared

in accordance with accounting principles generally accepted in Japan)

Dear Shareholder,

Please refer to the following for information about the upcoming the 112th Ordinary General Shareholders’ Meeting (the “General Shareholders’ Meeting”) of Toyota Motor Corporation (“TMC”). We hope that you will be able to attend this meeting.

If you are unable to attend the meeting, you can exercise your voting rights by paper ballot or by electromagnetic means. Please review the enclosed Reference Documents and exercise your voting rightsby no later than the close of business (5:30 p.m.) on Tuesday, June 14, 2016 (Japan Time). Thank you very much for your cooperation.

| | |

1. Date and time: | | 10:00 a.m., Wednesday, June 15, 2016 |

| |

2. Venue: | | Toyota Head Office, 1, Toyota-cho, Toyota City, Aichi Prefecture |

3. Meeting Agenda:

Reports:

Reports on business review, consolidated and unconsolidated financial statements for FY2016 (April 1, 2015 through March 31, 2016) and report by the Accounting Auditor and the Audit & Supervisory Board on the audit results of the consolidated financial statements.

Resolutions:

| | |

Proposed Resolution 1: | | Election of 11 Members of the Board of Directors |

Proposed Resolution 2: | | Election of 1 Substitute Audit & Supervisory Board Member |

Proposed Resolution 3: | | Payment of Bonuses to Members of the Board of Directors |

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation.

3

Notes

You are kindly requested to review the Reference Documents and exercise your voting rights.

You can exercise your voting rights by any of the following three methods.

| | | | |

By attending the meeting Date and time of the meeting: 10:00 a.m., June 15, 2016 (Japan Time) | | By postal mail Deadline for exercise: Your ballot must reach us by post no later than 5:30 p.m. on June 14, 2016 (Japan Time). | | Via the Internet Deadline for exercise: Enter your vote by no later than 5:30 p.m. on June 14, 2016 (Japan Time). |

| | (1) | Points to note when attending the meeting |

| | - | | If you attend the meeting in person, please submit the enclosed ballot at the reception desk. It will serve as your admission pass. |

You are also kindly requested to bring this Notice of Convocation as meeting materials when you attend.

| | - | | Roads around the venue will be crowded on the day of the General Shareholders’ Meeting, especially immediately before the start time. You are kindly advised to arrive early at the venue. |

| | - | | Please be advised in advance that you may be guided to an alternative venue if the main venue becomes fully occupied. |

| | - | | Only our shareholders are allowed to enter the venue. Persons who are attending as proxies of shareholders need to be themselves shareholders. |

Shareholders who concurrently exercise the voting rights of other shareholders are kindly requested to submit their ballots as shareholders in addition to their ballots for voting as proxies together with documents certifying their status as proxies.

| | - | | If you intend to engage in split voting, please submit written notice to that effect and the reasons for the split voting at least three days prior to the General Shareholders’ Meeting. |

| | (3) | Matters to be disclosed via the Internet |

| | - | | If any revisions are made to the reference documents or attachments for the General Shareholders’ Meeting, the revisions will be posted on Toyota Motor Corporation’s Web site (http://www.toyota.co.jp/jpn/investors/). |

4

Reference Documents

Proposed resolutions and reference matters

Proposed Resolution 1: Election of 11 Members of the Board of Directors

All Members of the Board of Directors will retire upon the expiration of their term of office at the conclusion of this General Shareholders’ Meeting. Accordingly, we hereby request that 11 Members of the Board of Directors be elected. The candidates for the position of Member of the Board of Directors are as follows:

Following are the nominees

| | | | | | | | | | |

No. | | Name

(birth date)

No. and kind of TMC

shares owned | | Position and areas of

responsibility | | Brief career summary and important concurrent duties |

| 1 | | Takeshi Uchiyamada (8/17/1946) 47,539 common shares Reappointed | | Chairman of the Board of Directors | | Apr. | | 1969 | | Joined TMC |

| | | | Jun. | | 1998 | | Member of the Board of Directors of TMC |

| | | | Jun. | | 2001 | | Managing Director of TMC |

| | | | Jun. | | 2003 | | Senior Managing Director of TMC |

| | | | Jun. | | 2005 | | Executive Vice President of TMC |

| | | | Jun. | | 2012 | | Vice Chairman of TMC |

| | | | Jun. | | 2013 | | Chairman of TMC (to present) |

| | | | (important concurrent duties) |

| | �� | | Senior Executive of TOYOTA CENTRAL R&D LABS., INC. |

| | | | | |

| 2 | | Akio Toyoda (5/3/1956) 4,650,275 common shares Reappointed | | President, Member of the Board of Directors | | Apr. | | 1984 | | Joined TMC |

| | | | Jun. | | 2000 | | Member of the Board of Directors of TMC |

| | | | Jun. | | 2002 | | Managing Director of TMC |

| | | | Jun. | | 2003 | | Senior Managing Director of TMC |

| | | | Jun. | | 2005 | | Executive Vice President of TMC |

| | | | Jun. | | 2009 | | President of TMC (to present) |

| | | | (important concurrent duties) |

| | | | Chairman and CEO of Toyota Motor North America, Inc. |

| | | | Chairman of Nagoya Grampus Eight Inc. |

| | | | Chairman of TOWA REAL ESTATE Co., Ltd. |

5

| | | | | | | | | | |

No. | | Name (birth date) No. and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

3 | | Nobuyori Kodaira (3/18/1949) 26,800 common shares Reappointed | | Executive Vice President, Member of the Board of Directors - Chief Risk Officer | | Apr. | | 1972 | | Joined Ministry of International Trade and Industry |

| | | | Jul. | | 2004 | | Director-General, Agency for Natural Resources and Energy |

| | | | Jul. | | 2006 | | Retired from Director-General, Agency for Natural Resources and Energy |

| | | | Aug. | | 2008 | | Advisor of TMC |

| | | | Jun. | | 2009 | | Managing Officer of TMC |

| | | | Jun. | | 2010 | | Senior Managing Director of TMC |

| | | | Jun. | | 2011 | | Member of the Board of Directors and Senior Managing Officer of TMC |

| | | | Jun. | | 2012 | | Executive Vice President of TMC (to present) |

| | | | (important concurrent duties) |

| | | | Director of KDDI Corporation |

| | | | Audit & Supervisory Board Member of AICHI STEEL CORPORATION |

| | | | | |

4 | | Mitsuhisa Kato (3/2/1953) 13,750 common shares Reappointed | | Executive Vice President, Member of the Board of Directors - Frontier Research Center (Chief Officer) | | Apr. | | 1975 | | Joined TMC |

| | | | Jun. | | 2004 | | Managing Officer of TMC |

| | | | Jun. | | 2006 | | Toyota Technocraft Co., Ltd. President |

| | | | Jun. | | 2006 | | Advisor of TMC |

| | | | Jun. | | 2007 | | Retired from Advisor of TMC |

| | | | Jun. | | 2010 | | Retired from Toyota Technocraft Co., Ltd. President |

| | | | Jun. | | 2010 | | Senior Managing Director of TMC |

| | | | Jun. | | 2011 | | Senior Managing Officer of TMC |

| | | | Jun. | | 2012 | | Executive Vice President of TMC (to present) |

| | | | (important concurrent duties) |

| | | | Director of Toyota Boshoku Corporation |

| | | | Audit & Supervisory Board Member of Aisin Seiki Co., Ltd. |

| | | | Director of Daihatsu Motor Co., Ltd. |

| | | | Director of Toyota Industries Corporation |

| | | | Director of Hino Motors, Ltd. |

| | | | Representative Director of GENESIS RESERCH INSTITUTE, INC. |

| | | | Senior Executive Chairman of TOYOTA CENTRAL R&D LABS., INC. |

6

| | | | | | | | | | |

No. | | Name (birth date)

No. and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

| 5 | | Takahiko Ijichi (7/15/1952) 30,800 common shares Reappointed | | Executive Vice President, Member of the Board of Directors - Chief Financial Officer - Sales Financial Business - Purchasing | | Apr. | | 1976 | | Joined TMC |

| | | | Jun. | | 2004 | | Managing Officer of TMC |

| | | | Jun. | | 2008 | | Senior Managing Director of TMC |

| | | | Jun. | | 2011 | | Member of the Board of Directors and Senior Managing Officer of TMC |

| | | | Jun. | | 2013 | | Advisor of TMC |

| | | | Jun. | | 2013 | | Director and President of TOWA REAL ESTATE Co., Ltd. |

| | | | Jun. | | 2015 | | Retired from Advisor of TMC |

| | | | Jun. | | 2015 | | Executive Vice President of TMC (to present) |

| | | | Jun. | | 2015 | | Retired from Director and President of TOWA REAL ESTATE Co., Ltd. |

| | | | (important concurrent duties) |

| | | | Audit & Supervisory Board Member of TOKAI RIKA CO., LTD. |

| | | | Audit & Supervisory Board Member of Toyota Industries Corporation |

| | | | | |

| 6 | | Didier Leroy (12/26/1957) 2,000 common shares Reappointed | | Executive Vice President, Member of the Board of Directors - Toyota No. 1 (President) - Chief Competitive Officer | | Apr. | | 1982 | | Joined Renault S.A. |

| | | | Aug. | | 1998 | | Retired from Renault S.A. |

| | | | Sep. | | 1998 | | Joined Toyota Motor Manufacturing France S.A.S. |

| | | | Sep. | | 1998 | | Toyota Motor Manufacturing France S.A.S. Vice President |

| | | | Jan. | | 2005 | | Toyota Motor Manufacturing France S.A.S. President |

| | | | Jun. | | 2007 | | Managing Officer of TMC |

| | | | Jul. | | 2007 | | Toyota Motor Europe NV/SA Executive Vice President |

| | | | Jul. | | 2009 | | Toyota Motor Manufacturing France S.A.S. Chairman |

| | | | Jun. | | 2010 | | Toyota Motor Europe NV/SA President |

| | | | Jul. | | 2010 | | Retired from Toyota Motor Manufacturing France S.A.S. Chairman |

| | | | Apr. | | 2011 | | Toyota Motor Europe NV/SA President and CEO |

| | | | Apr. | | 2012 | | Senior Managing Officer of TMC |

| | | | Apr. | | 2015 | | Toyota Motor Europe NV/SA Chairman (to present) |

| | | | Jun. | | 2015 | | Executive Vice President of TMC (to present) |

| | | | (important concurrent duties) |

| | | | Chairman of Toyota Motor Europe NV/SA |

| | | | Chairman of Toyota Motor Engineering & Manufacturing North America, Inc. |

| | | | Vice Chairman of Toyota Motor North America, Inc. |

7

| | | | | | | | | | |

No. | | Name (birth date)

No. and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

| 7 | | Shigeki Terashi (2/16/1955) 20,700 common shares Reappointed | | Executive Vice President, Member of the Board of Directors - Strategic Top Executive Meeting Office (Secretary General) - Global Audit Div. (Chief Officer) - Corporate Strategy Div. (Chief Officer) - Research Div. (Chief Officer) - Quality | | Apr. | | 1980 | | Joined TMC |

| | | | Jun. | | 2008 | | Managing Officer of TMC |

| | | | Jun. | | 2008 | | Toyota Motor Engineering & Manufacturing North America, Inc. Executive Vice President |

| | | | May | | 2011 | | Toyota Motor Engineering & Manufacturing North America, Inc. President and COO |

| | | | Apr. | | 2012 | | Toyota Motor Engineering & Manufacturing North America, Inc. President and CEO |

| | | | Apr. | | 2012 | | Toyota Motor North America, Inc. President and COO |

| | | | Apr. | | 2013 | | Retired from Toyota Motor Engineering & Manufacturing North America, Inc. President and CEO |

| | | | Apr. | | 2013 | | Retired from Toyota Motor North America, Inc. President and COO |

| | | | Apr. | | 2013 | | Senior Managing Officer of TMC |

| | | | Jun. | | 2013 | | Member of the Board of Directors and Senior Managing Officer of TMC |

| | | | Jun. | | 2015 | | Executive Vice President of TMC (to present) |

| | | | | |

8 | | Shigeru Hayakawa (9/15/1953) 18,000 common shares Reappointed | | Member of the Board of Directors, Senior Managing Officer - External Affairs & Public Affairs Group (Chief Officer) - Chief Communications Officer | | Apr. | | 1977 | | Joined Toyota Motor Sales Co., Ltd. |

| | | | Jun. | | 2007 | | Managing Officer of TMC |

| | | | Sep. | | 2007 | | Toyota Motor North America, Inc. President |

| | | | Jun. | | 2009 | | Retired from Toyota Motor North America, Inc. President |

| | | | Apr. | | 2012 | | Senior Managing Officer of TMC |

| | | | Jun. | | 2015 | | Member of the Board of Directors and Senior Managing Officer of TMC (to present) |

| | | | (important concurrent duties) |

| | | | Representative Director of Institute for International |

| | | | Economic Studies |

8

| | | | | | | | | | |

No. | | Name

(birth date)

No. and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

9 | | Ikuo Uno (1/4/1935) 0 shares Reappointed Outside / Independent | | Member of the Board of Directors | | Mar. | | 1959 | | Joined Nippon Life Insurance Company |

| | | | Jul. | | 1986 | | Director of Nippon Life Insurance Company |

| | | | Mar. | | 1989 | | Managing Director of Nippon Life Insurance Company |

| | | | Mar. | | 1992 | | Senior Managing Director of Nippon Life Insurance Company |

| | | | Mar. | | 1994 | | Vice President of Nippon Life Insurance Company |

| | | | Apr. | | 1997 | | President of Nippon Life Insurance Company |

| | | | Apr. | | 2005 | | Chairman of Nippon Life Insurance Company |

| | | | Apr. | | 2011 | | Director and Advisor of Nippon Life Insurance Company |

| | | | Jul. | | 2011 | | Advisor of Nippon Life Insurance Company |

| | | | Jun. | | 2013 | | Member of the Board of Directors of TMC (to present) |

| | | | Jul. | | 2015 | | Honorary Advisor of Nippon Life Insurance Company (to present) |

| | | | (important concurrent duties) Honorary Advisor of Nippon Life Insurance Company Outside Director of FUJI KYUKO CO., LTD. External Auditor of Odakyu Electric Railway Co., Ltd. External Audit & Supervisory Board Member of Tohoku Electric Power Co., Inc. Outside Corporate Auditor of Sumitomo Mitsui Financial Group, Inc. |

| | | | | |

10 | | Haruhiko Kato (7/21/1952) 0 shares Reappointed Outside / Independent | | Member of the Board of Directors | | Apr. | | 1975 | | Joined Ministry of Finance |

| | | | Jul. | | 2007 | | Director-General of the Tax Bureau, Ministry of Finance |

| | | | Jul. | | 2009 | | Commissioner of National Tax Agency |

| | | | Jul. | | 2010 | | Retired from Commissioner of National Tax Agency |

| | | | Jan. | | 2011 | | Senior Managing Director of Japan Securities Depository Center, Inc. |

| | | | Jun. | | 2011 | | President of Japan Securities Depository Center, Inc. |

| | | | Jun. | | 2013 | | Member of the Board of Directors of TMC (to present) |

| | | | Jul. | | 2015 | | President and CEO of Japan Securities Depository Center, Inc. (to present) |

| | | | (important concurrent duties) President and CEO of Japan Securities Depository Center, Inc. Outside Director of Canon Inc. |

9

| | | | | | | | | | |

No. | | Name (birth date)

No. and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

11 | | Mark T. Hogan (5/15/1951) 0 shares Reappointed Outside / Independent | | Member of the Board of Directors | | Sep. | | 1973 | | Joined General Motors Corporation |

| | | | Aug. | | 2002 | | Group Vice President of General Motors Corporation |

| | | | Aug. | | 2004 | | Retired from Group Vice President of General Motors Corporation |

| | | | Sep. | | 2004 | | President of Magna International Inc. |

| | | | Dec. | | 2007 | | Retired from President of Magna International Inc. |

| | | | Jan. | | 2008 | | President and CEO of The Vehicle Production Group LLC |

| | | | Feb. | | 2010 | | Retired from President and CEO of The Vehicle Production Group LLC |

| | | | Mar. | | 2010 | | President of Dewey Investments LLC (to present) |

| | | | Jun. | | 2013 | | Member of the Board of Directors of TMC (to present) |

| | | | | | | | | | (important concurrent duties) |

| | | | | | | | | | President of Dewey Investments LLC |

Notes:

| 1. | The information included in the above table is as of the date of this reference document for this General Shareholders’ Meeting. |

| 2. | Matters related to the candidates to become Outside Members of the Board of Directors are as follows: |

| | (1) | Mr. Ikuo Uno, Mr. Haruhiko Kato, and Mr. Mark T. Hogan are candidates to become Outside Members of the Board of Directors. Each of them is registered as an independent director with the Japanese stock exchanges on which TMC is listed. Upon approval of their re-election pursuant to this Proposed Resolution, TMC plans to maintain such registration. |

| | (2) | Reasons for their nomination as candidates to become Outside Members of the Board of Directors: |

| | • | | Mr. Ikuo Uno has played an active part as an executive at Nippon Life Insurance Company over a number of years and possesses a wide range of knowledge and a wealth of experience in risks relating to business, investment and management among many industries. As we expect him to make use of this knowledge and experience for the management strategy of the Company, we nominate him as a candidate to become an Outside Member of the Board of Directors. Since assuming office as an Outside Member of the Board of Directors of TMC, he has actively expressed his opinions about issues on organizational operations from the viewpoint of sustainable growth of TMC based on his deep insight and knowledge regarding financial and capital markets. He has also played an important role as an Outside Member of the Board of Directors by advising the company on the formation of management guidelines on human resource development and response measures to business risks of TMC. |

| | • | | Mr. Haruhiko Kato has served as Director-General of the Tax Bureau of the Ministry of Finance, Commissioner of the National Tax Agency, and has also held various other prominent positions in management of public finance of Japan, gaining a wealth of experience and highly specialized knowledge. He also has management experience with Japan Securities Depository Center, Inc. |

10

| | As we expect him to make use of this knowledge and experience for the management strategy of the Company, we nominate him as a candidate to become an Outside Member of the Board of Directors. Since assuming office as an Outside Member of the Board of Directors of TMC, he has played an important role as an Outside Member of the Board of Directors by demonstrating his opinion and guidance from external, managerial and objective viewpoints on financial issues and operational risk management based on his highly specialized knowledge about financial and capital markets and finance. |

| | • | | Mr. Mark T. Hogan has management experience in automotive-related companies, including General Motors Corporation. He also has served as an advisory board member for the Company regarding management issues. As we expect him to make use of this experience for the management strategy of the Company, we nominate him as a candidate to continue as an Outside Member of the Board of Directors. Since assuming office as an Outside Member of the Board of Directors of TMC, he has played an important role as an Outside Member of the Board of Directors by expressing many opinions on business strategy and marketing corresponding to market trends based on his deep knowledge about the automotive market in the Americas. |

| | (3) | Panasonic Corporation, during Mr. Ikuo Uno’s period of service as an Outside Director, was fined by the European Commission (in December 2011) due to violations of antitrust laws in the refrigerator compressor business. Panasonic Corporation also agreed with the United States Department of Justice (in July 2013) and the Canadian Competition Bureau (in February 2014) to pay penalties due to violations of antitrust laws in the automobile parts business for certain customers. While Mr. Uno was unaware of all such violations until they were revealed, he consistently sought to ensure that business operations were conducted in compliance with applicable laws through his execution of his duties as a director. After the violations were disclosed, he confirmed the contents of the actions taken by the company to prevent recurrences. |

| | (4) | Outline of limited liability agreements |

TMC has entered into limited liability agreements with Mr. Ikuo Uno, Mr. Haruhiko Kato, and Mr. Mark T. Hogan to limit the amount of their liabilities as stipulated in Article 423, Paragraph 1 of the Companies Act to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act. Upon approval of their re-election pursuant to this Proposed Resolution, TMC plans to continue such agreements with them.

| | (5) | Mr. Mark T. Hogan has received remunerations from Toyota Motor North America, Inc., an affiliate of TMC, as an advisor for the past two years, which he will continue to receive in the future as well. |

11

| | (6) | Number of years as Outside Member of the Board of Directors of TMC since assumption of office (as of the conclusion of this General Shareholders’ Meeting) |

| | |

Mr. Ikuo Uno | | 3 years |

Mr. Haruhiko Kato | | 3 years |

Mr. Mark T. Hogan | | 3 years |

12

Proposed Resolution 2: Election of 1 Substitute Audit & Supervisory Board Member

In order to be prepared in the event that TMC lacks the number of Audit & Supervisory Board Members and it becomes less than that required by laws and regulations, we hereby request that 1 Substitute Audit & Supervisory Board Member be elected. The candidate to become a SubstituteAudit & Supervisory Board Member is as below.

This proposal is made to elect a substitute for either Ms. Yoko Wake, Mr. Teisuke Kitayama or Mr. Hiroshi Ozu, all of whom are currently Outside Audit & Supervisory Board Members. In the event he becomes an Audit & Supervisory Board Member, his term of office shall be the remaining part of his predecessor’s term. This resolution shall be effective until the commencement of the next Ordinary General Shareholders’ Meeting, provided, however, that this resolution may be cancelled before the proposed Substitute Audit & Supervisory Board Member assumes office, by a resolution of the Board of Directors, subject to the approval of the Audit & Supervisory Board.

The submission of this proposal at this General Shareholders’ Meeting was approved by the Audit & Supervisory Board.

Following is the nominee

| | | | | | | | |

No. | | Name (birth date) No. of TMC

shares owned | | Position | | Brief career summary and important concurrent duties |

1 | | Ryuji Sakai (8/7/1957) 0 shares Reappointed | | Substitute Audit & Supervisory Board Member | | Apr. 1985 | | Registered as attorney Joined Nagashima & Ohno |

| | | | Sep. 1990 | | Worked at Wilson Sonsini Goodrich & Rosati (located in U.S.) |

| | | | Jan. 1995 | | Partner, Nagashima & Ohno |

| | | | Jan. 2000 | | Partner, Nagashima Ohno & Tsunematsu (to present) |

| | | | (important concurrent duties) |

| | | | Attorney |

| | | | Outside Audit & Supervisory Board Member of Kobayashi Pharmaceutical Co., Ltd. |

| | | | Outside Audit & Supervisory Board Member of Tokyo Electron Limited |

Notes:

| 1. | The information included in the above table is as of the date of this reference document for this General Shareholders’ Meeting. |

| 2. | Matters related to the candidate to become a Substitute Outside Audit & Supervisory Board Member are as follows: |

| | (1) | Mr. Ryuji Sakai is a candidate to become a Substitute Outside Audit & Supervisory Board Member. |

| | (2) | Reasons for his nomination as a candidate to become a Substitute Outside Audit & Supervisory Board Member: |

| | • | | Mr. Ryuji Sakai has not been directly involved in the management of corporations, but he possesses a wealth of experience and highly specialized knowledge acquired through his long years of activities mainly related to corporate legal matters including advisory services on corporate overseas expansion, overseas investment and other international transactions, and advisory services on various legal matters such as antitrust law, intellectual property rights, capital raising and M&A. As we expect him to adequately execute his duties as an Outside Audit & Supervisory Board Member with this knowledge and experience, we hereby nominate him as a candidate to become a Substitute Outside Audit & Supervisory Board Member. |

13

| | (3) | Outline of limited liability agreement |

Upon approval of his election pursuant to this Proposed Resolution and his assumption of office as an Audit & Supervisory Board Member, TMC will enter into a limited liability agreement with him to limit the amount of his liability as stipulated in Article 423, Paragraph 1 of the Companies Act to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act.

| | (4) | Kobayashi Pharmaceutical Co., Ltd., a company where Mr. Ryuji Sakai has served as an Outside Audit & Supervisory Board Member since June 2005, was involved in July 2011 in a case where a person in charge of development in one of its subsidiaries included data different from that produced through actual examinations in certain portions of application-for-approval materials for products (two products) developed in-house for medical institutions. Because of this, Kobayashi Pharmaceutical Co., Ltd. received a business suspension order for a period of 10 days. While Mr. Ryuji Sakai had been providing advice as appropriate concerning the importance of compliance with laws and regulations and how to thoroughly achieve such compliance at the Board of Directors’ meetings and the Audit & Supervisory Board meetings of the company, he was unaware of the facts of this incident until they were reported to him. Since the revelation of the facts, he has discharged his duties responsibly by strongly pressing for the establishment of measures to prevent recurrences and by conducting a hearing with the investigation committee of the subsidiary to investigate the causes of the case. At the same time, he has actively given advice in the company’s discussions to deliberate on the actions taken by the company to prevent recurrences. |

Proposed Resolution 3: Payment of Bonuses to Members of the Board of Directors

In consideration of the results for FY2016 and other factors, the 9 Members of the Board of Directors (excluding Outside Members of the Board of Directors) in office as of the end of FY2016 will be paid a total amount of 1,105,580,000 yen as Bonuses.

14

Attachment to the Notice of Convocation of the 112th Ordinary General Shareholders’ Meeting

Business Report (Fiscal Year under review: April 1, 2015 through March 31, 2016)

1. Outlook of Associated Companies

(1) Progress and Achievement in Operation

General Economic Environment in FY2016

Reviewing the general economic environment for the fiscal year ended March 2016 (“FY2016”), with respect to the world economy, the U.S. economy has seen ongoing recovery mainly due to steady progress of personal consumption, and the European economy has seen a moderate recovery in the eurozone. Meanwhile, weaknesses have been seen in China and other Asian emerging countries. The Japanese economy has been on a moderate recovery as a whole, while weakness could be seen in personal consumption and other areas.

For the automobile industry, although markets have progressed in a steady manner, especially in the U.S., markets in some emerging countries have become stagnant, and the Japanese market has slowed down mainly in the sales of mini-vehicles due to the tax increase. Meanwhile, the development of automated driving technology, as well as efforts toward improvement in environmental friendliness and safety, has made significant progress.

Overview of Operations

In this business environment, we are striving to manufacture “ever-better cars” in order to enhance the satisfaction of our customers worldwide. The new “Prius,” launched in December 2015, delivers not only heightened environmental friendliness but also – as the first model under the “Toyota New Global Architecture” – substantially enhanced basic performance such as driving pleasure and riding comfort. The “Sienta” was fully remodeled with a sporty exterior and a low-floor for a roomy interior. For overseas markets, we launched the new “Hilux” in Thailand and other regions as the first model of the new IMV series. The vehicle is equipped with a newly developed frame and engine to realize enhanced riding comfort and more powerful drive. The Lexus brand introduced a new model in the “RX” series, the leader in the premium crossover market.

In this way, we continued to actively launch new models in Japan and abroad and carried out vigorous sales efforts in collaboration with dealers in each country and region in which we operate. However, due to the stagnant market in Asia, the slowdown of mini-vehicle sales in Japan, and the suspension of production at plants in February 2016, global vehicle sales for FY2016, including the Daihatsu and Hino brands, decreased by 74 thousand units (or 0.7%) from FY2015 to 10,094 thousand units. As for profit improvement activities, we have made concerted efforts throughout the entire Toyota group such as implementation of cost improvement measures.

15

In addition to these activities, we established Toyota Research Institute, Inc. as a move to accelerate research and development in artificial intelligence, which has significant potential to support future industrial technologies.

With a view to creating a whole new set of values for cars, we entered into an agreement to build a mutually beneficial long-term partnership with Mazda Motor Corporation. Moreover, in order to further reinforce our small vehicle business, we entered into an agreement with Daihatsu Motor Co., Ltd. to make it a wholly-owned subsidiary. To strengthen our true competitiveness toward sustainable growth, we will endeavor to build cooperative relationships with other companies and to further strengthen our foundation within the Toyota Group.

We will also contribute to building an enriched society by extending support to sporting activities. Following the agreement with the International Olympic Committee in 2015, we signed a “Worldwide Paralympic Partner Sponsorship Agreement” with the International Paralympic Committee. We will strive to realize “freedom of mobility” for all people and to spread the “excitement of sports.”

16

Consolidated Financial Results for FY2016

For the consolidated financial results for FY2016, reflect the progress of profit improvement activities such as cost improvement. As a result, consolidated net revenues increased by 1,168.5 billion yen (or 4.3%) to 28,403.1 billion yen compared with FY2015 and consolidated operating income increased by 103.4 billion yen (or 3.8%) to 2,853.9 billion yen compared with FY2015. Consolidated net income attributable to Toyota Motor Corporation increased by 139.3 billion yen (or 6.4%) to 2,312.6 billion yen compared with FY2015.

The breakdown of consolidated net revenues is as follows:

| | | | | | | | | | | | | | | | |

| | | Yen in millions unless otherwise stated | |

| | | FY2016

(April 2015 through

March 2016) | | | FY2015

(April 2014 through

March 2015) | | | Increase

(Decrease) | | | Change

(%) | |

Vehicles | | | 22,267,136 | | | | 21,557,684 | | | | 709,452 | | | | 3.3 | |

Parts and components for overseas production | | | 493,499 | | | | 402,864 | | | | 90,635 | | | | 22.5 | |

Parts and components for after service | | | 2,042,623 | | | | 1,921,764 | | | | 120,859 | | | | 6.3 | |

Other | | | 1,120,555 | | | | 1,123,912 | | | | (3,357) | | | | (0.3) | |

Total Automotive | | | 25,923,813 | | | | 25,006,224 | | | | 917,589 | | | | 3.7 | |

Financial Services | | | 1,854,007 | | | | 1,621,685 | | | | 232,322 | | | | 14.3 | |

Other | | | 625,298 | | | | 606,612 | | | | 18,686 | | | | 3.1 | |

| | | | | | | | | | | | | | | | |

Total | | | 28,403,118 | | | | 27,234,521 | | | | 1,168,597 | | | | 4.3 | |

| | | | | | | | | | | | | | | | |

Notes:

| 1. | Consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles. |

| 2. | The amounts represent net revenues from external customers. |

| 3. | Net revenues do not include consumption taxes, etc. |

17

Environmental and Safety Initiatives

Toyota group considers addressing both environmental and safety issues as one of its top management priorities.

With regard to environmental initiatives, we announced the “Toyota Environmental Challenge 2050” in October 2015 as a new initiative to contribute to global environmental sustainability. We have made headway in various efforts, including promotion of broader use of hybrid vehicles and fuel cell vehicles as well as reduction of carbon dioxide emitted in production processes.

With regard to safety initiatives, we are proceeding with the global promotion of “Toyota Safety Sense,” a safety package equipped with functions such as collision prevention and mitigation, and optimal forward visibility enhancement during nighttime driving, with a view toward achieving high market prevalence. We have also begun to equip new Toyota models with “ITS Connect,” a cooperative safety system using vehicle-to-infrastructure and vehicle-to-vehicle communication. Through these efforts, we work actively toward the development of ever-safer vehicles and technologies.

Activities in Pursuit of Attractive Vehicles

Toyota group works in pursuit of the enjoyment of vehicles and the joy of driving.

By widely applying the “Toyota New Global Architecture,” a technology that vastly enhances the basic performance and marketability of our vehicles, to the development of future models, we will make steady progress in our efforts to manufacture attractive vehicles.

Through initiatives such as our participation in the 24-hour Nürburgring endurance race in Germany, the World Rally Championship (WRC) starting in 2017, and the Five Continents Driving Project aimed at training and honing abilities to create better cars, we are making progress in our efforts to strengthen technology development capabilities and develop human resources.

18

Non-Automotive Operations

In non-automotive operations, we are creating new businesses that will lead the next generation and are actively developing businesses to meet diverse customer needs.

In financial services, we have actively developed our network throughout the world, including emerging countries, have built a robust business base through risk management, investment in information infrastructure, and human resources development, and have strengthened our balance sheet by improving our profitability. We plan to provide a broad range of support for the car experience of our customers in concert with our automotive operations by developing and providing financial products and services satisfying the needs of individual customers.

In the housing business, we are combining the technologies of the Toyota group companies to build advanced housing that is not only safe and comfortable but also aimed at non-emission of carbon dioxide.

We are also conducting a wide range of activities such as measures to expand the test operation of “Ha:mo,” an ultra compact electric vehicle car-sharing service, and to develop robotics technologies supporting nursing and healthcare.

19

(2) Funding

Funds necessary for the automotive business are mainly financed with funds from business operations. Funds necessary for the financial services business are mainly financed through the issuance of bonds and medium-term notes, as well as with borrowings. The balance of debt as of the end of FY2016 was 18,293.1 billion yen.

Toyota Motor Corporation issued 47,100,000 shares of the First Series Model AA Class Shares (the total amount paid in to TMC was 476.7 billion yen) in July 2015 in order to enhance our corporate value over the medium- to long-term through the pursuit and creation of development of cutting-edge innovative technologies.

(3) Capital Expenditures and R&D

As for capital expenditures, Toyota group has promoted activities to decrease expenditures through measures to make facilities simple, streamlined, and flexible, as well as measures to make more effective use of existing facilities. At the same time, Toyota group has focused on making expenditures on eco-cars such as hybrid vehicles and fuel cell vehicles, as well as expenditures contributing to the enhancement of its competitiveness in emerging countries. As a result, consolidated capital expenditures for FY2016 were 1,292.5 billion yen.

As for R&D expenditures, we made active investments to accelerate the development of next-generation technologies while also endeavoring to further improve development efficiency, for example through the reorganization of Toyota Technical Development Corporation. As a result, consolidated R&D expenditures for FY2016 were 1,055.6 billion yen.

(4) Consolidated Financial Summary

| | | | | | | | | | | | | | | | |

| | | Yen in millions unless otherwise stated | |

| | | FY2013

(April 2012

through

March 2013) | | | FY2014

(April 2013

through

March 2014) | | | FY2015

(April 2014

through

March 2015) | | | FY2016

(April 2015

through

March 2016) | |

Net revenues | | | 22,064,192 | | | | 25,691,911 | | | | 27,234,521 | | | | 28,403,118 | |

Operating income | | | 1,320,888 | | | | 2,292,112 | | | | 2,750,564 | | | | 2,853,971 | |

Net income attributable to Toyota Motor Corporation | | | 962,163 | | | | 1,823,119 | | | | 2,173,338 | | | | 2,312,694 | |

Net income attributable to Toyota Motor Corporation

per common share – Basic (yen) | | | 303.82 | | | | 575.30 | | | | 688.02 | | | | 741.36 | |

Mezzanine equity and Shareholders’ equity | | | 12,772,856 | | | | 15,218,987 | | | | 17,647,329 | | | | 18,088,186 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 35,483,317 | | | | 41,437,473 | | | | 47,729,830 | | | | 47,427,597 | |

| | | | | | | | | | | | | | | | |

20

(5) Issues to be Addressed

As for our future business environment, the U.S. is expected to continue recovering and Europe, chiefly in the eurozone, is expected to continue its moderate recovery. Meanwhile, China and other emerging countries are showing a risk of a slowdown. The Japanese economy is expected to recover gradually, supported by continuing improvements in employment and income conditions, although attention needs to be paid to an economic decline caused by a slowdown in emerging countries.

The automotive market is expected to progress steadily in developed countries, though concerns over slowdowns in emerging countries continue. In addition, measures to respond to environmental and fuel consumption regulations in various countries and to reinforce efforts toward the development of safety technologies are required, while companies in other businesses are newly venturing into the development of automated driving technology. Fierce competition is thus intensifying on a global scale.

In this severe business environment, Toyota group intends to steadily progress toward the realization of the Toyota Global Vision through sustainable growth based on the following policies:

First, we intend to contribute to the realization of a future mobility society through pioneering technologies, products and businesses. We will develop human resources who will foresee the future and courageously take on new challenges.

Second, we intend to reinforce true competitiveness in order to grow as steadily as a tree adding annual growth rings. We will thoroughly improve quality, establish new working methods to sincerely engage with “customers and cars,” and enhance our crisis management abilities for responding to crises of every type. In order to realize the above vision, we reorganized our corporate structure in April 2016 to establish a three-part structure: product-based in-house companies, region-based business units, and the head office. At the product-based in-house companies, streamlined operation from planning through manufacturing enables quick and independent decision-making. Within the region-based business units, we aim to build even more regional operations. The head office will work to formulate a medium- to long-term vision and management strategy, including an appropriate allocation of resources, with an eye toward the future.

Based on these initiatives, Toyota group will contribute to “enriching lives of communities” by providing “ever-better cars.” This is expected to encourage more customers to purchase Toyota cars and thereby lead to the establishment of a stable business base. By perpetuating this cycle, we will aim to realize sustainable growth and enhance corporate value. In addition, through full observance of corporate ethics such as compliance with applicable laws and regulations, Toyota group will fulfill its social responsibilities.

By staying true to its founding spirit of “contribute to society by Monozukuri, manufacturing,” Toyota group will move forward through the united efforts of its officers and employees toward the realization of the Toyota Global Vision with humility, gratitude and passion. We sincerely hope that our shareholders will continue to extend their patronage and support to us.

21

(6) Policy on Distribution of Surplus by Resolution of the Board of Directors

TMC deems the benefit of its shareholders as one of its priority management policies, and it continues to work to improve its corporate structure to realize sustainable growth in order to enhance its corporate value. TMC will strive for the stable and continuous payment of dividends aiming at a consolidated payout ratio of 30% to shareholders of common stock while giving due consideration to factors such as business results for each term, investment plans and its cash reserves. In addition, TMC will pay a prescribed amount of dividends to shareholders of First Series Model AA Class Shares.

With regard to the repurchase of treasury stock, TMC will implement a flexible capital policy in response to business circumstance with a view to improving shareholder return and capital efficiency.

In order to survive tough competition, TMC will utilize its internal funds mainly for the early commercialization of technologies for next-generation environment and safety, giving priority to customer safety and security.

22

(7) Main Business

Toyota group’s business segments are automotive operations, financial services operations and all other operations.

| | |

Business | | Main products and services |

Automotive Operations | | Vehicles (passenger vehicles, trucks and buses, and mini-vehicles), Parts & components for overseas production, Parts, etc. |

| |

Financial Services Operations | | Auto sales financing, Leasing, etc. |

| |

Other Operations | | Housing, Information Technology, etc. |

(8) Main Sites

<TMC>

| | |

Name | | Location |

Head Office | | Aichi Prefecture |

Tokyo Head Office | | Tokyo |

Nagoya Office | | Aichi Prefecture |

Honsha Plant | | Aichi Prefecture |

Motomachi Plant | | Aichi Prefecture |

Kamigo Plant | | Aichi Prefecture |

Takaoka Plant | | Aichi Prefecture |

Miyoshi Plant | | Aichi Prefecture |

Tsutsumi Plant | | Aichi Prefecture |

Myochi Plant | | Aichi Prefecture |

Shimoyama Plant | | Aichi Prefecture |

Kinu-ura Plant | | Aichi Prefecture |

Tahara Plant | | Aichi Prefecture |

Teiho Plant | | Aichi Prefecture |

Hirose Plant | | Aichi Prefecture |

Higashi-Fuji Technical Center | | Shizuoka Prefecture |

<Domestic and overseas subsidiaries>

Please see section “(10) Status of Principal Subsidiaries. ”

(9) Employees

| | |

Number of employees | | Increase (Decrease) from end of FY2015 |

348,877 | | + 4,768 |

23

(10) Status of Principal Subsidiaries

| | | | | | | | | | | | |

| | | Company name | | Location | | Capital/

Subscription | | Percentage

ownership

interest | | | Main business |

| | | | | | million yen | | | | | | |

| Japan | | Toyota Financial Services Corporation | | Aichi Prefecture | | 78,525 | | | 100.00 | | | Management of domestic and overseas financial companies, etc. |

| | Hino Motors, Ltd. | | Tokyo | | 72,717 | | | 50.21 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Kyushu, Inc. | | Fukuoka Prefecture | | 45,000 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Daihatsu Motor Co., Ltd. | | Osaka Prefecture | | 28,404 | | | 51.33 | * | | Manufacture and sales of automobiles |

| | Toyota Finance Corporation | | Tokyo | | 16,500 | | | 100.00 | * | | Finance of automobile sales, Card business |

| | Toyota Auto Body Co., Ltd. | | Aichi Prefecture | | 10,371 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota Motor East Japan, Inc. | | Miyagi Prefecture | | 6,850 | | | 100.00 | | | Manufacture and sales of automobiles |

| | | | | | | in thousands | | | | | |

| North America | | Toyota Motor Engineering & Manufacturing North America, Inc. | | U.S.A. | | USD 1,958,949 | | | 100.00 | * | | Management of manufacturing companies in North America |

| | Toyota Motor Manufacturing, Kentucky, Inc. | | U.S.A. | | USD 1,180,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor North America, Inc. | | U.S.A. | | USD 1,005,400 | | | 100.00 | * | | Government, public affairs and research of North America |

| | Toyota Motor Credit Corporation | | U.S.A. | | USD 915,000 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota Motor Manufacturing, Indiana, Inc. | | U.S.A. | | USD 620,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Manufacturing, Texas, Inc. | | U.S.A. | | USD 510,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Sales, U.S.A., Inc. | | U.S.A. | | USD 365,000 | | | 100.00 | * | | Sales of automobiles |

| | Toyota Motor Manufacturing, Mississippi, Inc. | | U.S.A. | | USD 272,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Manufacturing, West Virginia, Inc. | | U.S.A. | | USD 260,000 | | | 100.00 | * | | Manufacture and sales of automobile parts |

| | Toyota Motor Manufacturing Canada Inc. | | Canada | | CAD 680,000 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota Credit Canada Inc. | | Canada | | CAD 60,000 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota Canada Inc. | | Canada | | CAD 10,000 | | | 51.00 | | | Sales of automobiles |

| | | | | | in thousands | | | | | | |

| Europe | | Toyota Motor Europe NV/SA | | Belgium | | EUR 2,524,346 | | | 100.00 | | | Management of all European affiliates |

| | Toyota Motor Manufacturing France S.A.S. | | France | | EUR 71,078 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Finance (Netherlands) B.V. | | Netherlands | | EUR 908 | | | 100.00 | * | | Loans to overseas Toyota related companies |

| | Toyota Motor Manufacturing (UK) Ltd. | | U.K. | | GBP 300,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Financial Services (UK) PLC | | U.K. | | GBP 104,500 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota (GB) PLC | | U.K. | | GBP 2,600 | | | 100.00 | * | | Sales of automobiles |

| | OOO “TOYOTA MOTOR” | | Russia | | RUB 4,875,189 | | | 100.00 | * | | Manufacture and sales of automobiles |

24

| | | | | | | | | | | | |

| | | Company name | | Location | | Capital/ Subscription | | Percentage

ownership

interest | | | Main business |

| | | | | | in thousands | | | | | | |

Asia | | Toyota Motor (China) Investment Co., Ltd. | | China | | USD 118,740 | | | 100.00 | | | Sales of automobiles |

| | Toyota Motor Finance (China) Co., Ltd. | | China | | CNY 3,100,000 | | | 100.00 | * | | Finance of automobile sales |

| | PT. Toyota Motor Manufacturing Indonesia | | Indonesia | | IDR 19,523,503 | | | 95.00 | | | Manufacture and sales of automobiles |

| | Toyota Motor Asia Pacific Pte Ltd. | | Singapore | | SGD 6,000 | | | 100.00 | | | Sales of automobiles |

| | Kuozui Motors, Ltd. | | Taiwan | | TWD 3,460,000 | | | 70.00 | * | | Manufacture and sales of automobiles |

| | Toyota Leasing (Thailand) Co., Ltd. | | Thailand | | THB 15,100,000 | | | 86.84 | * | | Finance of automobile sales |

| | Toyota Motor Thailand Co., Ltd. | | Thailand | | THB 7,520,000 | | | 86.43 | | | Manufacture and sales of automobiles |

| | Toyota Motor Asia Pacific Engineering and Manufacturing Co., Ltd. | | Thailand | | THB 1,300,000 | | | 100.00 | * | | Production support for entities in Asia and Oceania |

| | | | | | in thousands | | | | | | |

Other | | Toyota Motor Corporation Australia Ltd. | | Australia | | AUD 481,100 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota Finance Australia Ltd. | | Australia | | AUD 120,000 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota Argentina S.A. | | Argentina | | ARS 260,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota do Brasil Ltda. | | Brazil | | BRL 709,980 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota South Africa Motors (Pty) Ltd. | | South Africa | | ZAR 50 | | | 100.00 | * | | Manufacture and sales of automobiles |

Notes:

| 1. | * Indicates that the ownership interest includes such ratio of the subsidiaries. |

| 2. | The ownership interests are calculated based on the total number of shares issued at the end of the fiscal year. |

25

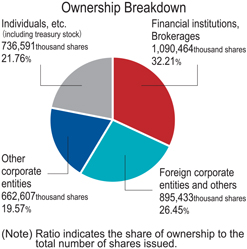

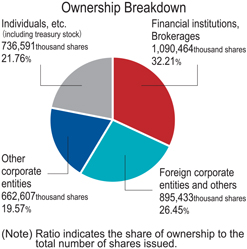

2. Status of Shares

| | | | |

| (1) | | Total Number of Shares Authorized | | 10,000,000,000 shares |

| | |

| (2) | | Total Number of Shares Issued | | |

| | |

| | Common shares | | 3,337,997,492 shares |

| | |

| | First Series Model AA Class Shares | | 47,100,000 shares |

| | |

| (3) | | Number of Shareholders | | 682,802 |

| | |

| (4) | | Major Shareholders | | |

| | | | | | | | | | | | | | | | |

Name of Shareholders | | Number of shares

(1,000 shares) | | | Percentage of

shareholding (%) | |

| | Common

shares | | | First series

Model AA

class shares | | | Total | | |

Japan Trustee Services Bank, Ltd. | | | 358,611 | | | | 180 | | | | 358,791 | | | | 11.63 | |

Toyota Industries Corporation | | | 224,515 | | | | — | | | | 224,515 | | | | 7.28 | |

The Master Trust Bank of Japan, Ltd. | | | 149,005 | | | | — | | | | 149,005 | | | | 4.83 | |

Nippon Life Insurance Company | | | 119,830 | | | | 560 | | | | 120,390 | | | | 3.90 | |

State Street Bank and Trust Company (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) | | | 115,230 | | | | — | | | | 115,230 | | | | 3.74 | |

DENSO CORPORATION | | | 86,513 | | | | — | | | | 86,513 | | | | 2.80 | |

JPMorgan Chase Bank, N.A. (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) | | | 73,483 | | | | — | | | | 73,483 | | | | 2.38 | |

The Bank of New York Mellon as Depositary Bank for Depositary Receipt Holders | | | 66,933 | | | | — | | | | 66,933 | | | | 2.17 | |

Trust & Custody Services Bank, Ltd. | | | 64,005 | | | | — | | | | 64,005 | | | | 2.07 | |

Mitsui Sumitomo Insurance Company, Limited | | | 62,063 | | | | — | | | | 62,063 | | | | 2.01 | |

Notes:

| 1. | The Bank of New York Mellon as Depositary Bank for Depositary Receipt Holders is the nominee of the Bank of New York Mellon, which is the Depositary for holders of TMC’s American Depositary Receipts (ADRs). |

| 2. | The percentage of shareholding is calculated after deducting the number of shares of treasury stock (300,321 thousand shares) from the total number of shares issued. |

26

3. Status of Stock Acquisition Rights, Etc.

(1) Status of Stock Acquisition Rights as of the End of FY2016

| | 1) | Number of Stock Acquisition Rights issued: |

47,227

| | 2) | Type and Number of Shares to be Issued or Transferred upon Exercise of Stock Acquisition Rights |

4,722,700 shares of common stock of TMC (The number of shares to be issued or transferred upon exercise of one Stock Acquisition Right is 100).

| | 3) | Stock Acquisition Rights held by TMC’s Members of the Board of Directors and Audit & Supervisory Board Members |

| | | | | | | | | | | | |

| | | Series

(Exercise price) | | Exercise Period | | Number of Stock

Acquisition Rights | | | Number of holders | |

Members of the Board

of Directors | | 7th (4,682 yen) | | From August 1, 2010

to July 31, 2016 | | | 1,180 | | | | 5 | |

| | 8th (4,154 yen) | | From August 1, 2011

to July 31, 2017 | | | 1,480 | | | | 7 | |

| | 9th (3,153 yen) | | From August 1, 2012

to July 31, 2018 | | | 1,295 | | | | 8 | |

| | | | |

| Audit & Supervisory Board Members | | 8th (4,154 yen) | | From August 1, 2011

to July 31, 2017 | | | 84 | | | | 1 | |

Note:

The Stock Acquisition Rights held by Audit & Supervisory Board Members in the above table were acquired prior to their assumption of office and are exercisable by Audit & Supervisory Board Members.

27

4. Status of Members of the Board of Directors and Audit & Supervisory Board Members

(1) Members of the Board of Directors and Audit & Supervisory Board Members

| | | | | | |

Name | | Position | | Areas of responsibility | | Important concurrent duties |

| Takeshi Uchiyamada | | *Chairman of the Board of Directors | | | | - Senior Executive Chairman of TOYOTA CENTRAL R&D LABS., INC. |

| | | |

Akio Toyoda | | *President, Member of the Board of Directors | | | | - Chairman and CEO of Toyota Motor North America, Inc. - Chairman of Nagoya Grampus Eight Inc. - Chairman of TOWA REAL ESTATE Co., Ltd. |

| | | |

Nobuyori Kodaira | | *Executive Vice President, Member of the Board of Directors | | | | - Director of KDDI CORPORATION - Audit & Supervisory Board Member of AICHI STEEL CORPORATION |

| | | |

Mitsuhisa Kato | | *Executive Vice President, Member of the Board of Directors | | | | - Director of Toyota Boshoku Corporation - Audit & Supervisory Board Member of Aisin Seiki Co., Ltd. - Director of Daihatsu Motor Co., Ltd. - Director of Toyota Industries Corporation - Director of Hino Motors, Ltd. |

| | | |

Seiichi Sudo | | *Executive Vice President, Member of the Board of Directors | | | | - Chairman of Toyota Motor (Changshu) Auto Parts Co., Ltd. |

| | | |

Takahiko Ijichi | | *Executive Vice President, Member of the Board of Directors | | | | - Audit & Supervisory Board Member of TOKAI RIKA CO., LTD. - Audit & Supervisory Board Member of Toyota Industries Corporation |

| | | |

Didier Leroy | | *Executive Vice President, Member of the Board of Directors | | - Toyota No.1 (President) | | - Chairman of Toyota Motor Europe NV/SA - Chairman of Toyota Motor Engineering & Manufacturing North America, Inc. - Vice Chairman of Toyota Motor North America, Inc. |

| | | |

Shigeki Terashi | | *Executive Vice President, Member of the Board of Directors | | - Strategic Top Executive Meeting Office (Secretary General) - Corporate Planning Div. (Chief Officer) - Information Security Management Dept. (Chief Officer) - Research Div. (Chief Officer) - BR Connected Strategy and Planning Dept. (Chief Officer) | | |

28

| | | | | | |

Name | | Position | | Areas of responsibility | | Important concurrent duties |

Shigeru Hayakawa | | Member of the Board of Directors. Senior Managing Officer | | - Olympic & Paralympic Div. (Chief Officer) - External Affairs & Public Affairs Group (Chief Officer) - Chief Communications Officer | | - Representative Director of Institute for International Economic Studies |

| | | |

Ikuo Uno | | Member of the Board of Directors | | | | - Honorary Advisor of Nippon Life Insurance Company - Outside Director of FUJI KYUKO CO., LTD. - Outside Company Auditor of Odakyu Electric Railway Co., Ltd. - External Audit & Supervisory Board Member of Tohoku Electric Power Co., Inc. - Outside Corporate Auditor of Sumitomo Mitsui Financial Group, Inc. |

| | | |

Haruhiko Kato | | Member of the Board of Directors | | | | - President and CEO of Japan Securities Depository Center, Inc. - Outside Director of Canon Inc. |

| | | |

Mark T. Hogan | | Member of the Board of Directors | | | | - President of Dewey Investments LLC |

| | | |

Masaki Nakatsugawa | | Full-time Audit & Supervisory Board Member | | | | |

| | | |

Masahiro Kato | | Full-time Audit & Supervisory Board Member | | | | |

| | | |

Yoshiyuki Kagawa | | Full-time Audit & Supervisory Board Member | | | | |

| | | |

Yoko Wake | | Audit & Supervisory Board Member | | | | - Professor Emeritus of Keio University |

| | | |

Teisuke Kitayama | | Audit & Supervisory Board Member | | | | - Chairman of Sumitomo Mitsui Banking Corporation - Outside Director of FUJIFILM Holdings Corporation - External Statutory Auditor of Isetan Mitsukoshi Holdings Ltd. |

| | | |

Hiroshi Ozu | | Audit & Supervisory Board Member | | | | - Attorney - Outside Audit & Supervisory Board Member of MITSUI & CO., LTD. |

Notes:

| 1. | * Representative Director |

| 2. | Mr. Ikuo Uno, Mr. Haruhiko Kato and Mr. Mark T. Hogan, all of whom are Members of the Board of Directors, are Outside Members of the Board of Directors. They are also Independent Directors as provided by the rules of the Japanese stock exchanges on which TMC is listed. |

| 3. | Ms. Yoko Wake, Mr. Teisuke Kitayama and Mr. Hiroshi Ozu, all of whom are Audit & Supervisory Board Members, are Outside Audit & Supervisory Board Members. They are also Independent Audit & Supervisory Board Members as provided by the rules of the Japanese stock exchanges on which TMC is listed. |

| 4. | The “Important concurrent duties” are listed chronologically, in principle, based on the dates the executives assumed their present positions. |

29

| 5. | The areas of responsibility were changed on April 18, 2016, as follows: |

| | | | |

Name | | Position | | Areas of responsibility |

Nobuyori Kodaira | | * Executive Vice President, Member of the Board of Directors | | - Chief Risk Officer |

| | |

Mitsuhisa Kato | | * Executive Vice President, Member of the Board of Directors | | - Frontier Research Center (Chief Officer) |

| | |

Takahiko Ijichi | | * Executive Vice President, Member of the Board of Directors | | - Chief Financial Officer - Sales Financial Business - Purchasing |

| | |

Didier Leroy | | * Executive Vice President, Member of the Board of Directors | | - Toyota No.1 (President) - Chief Competitive Officer |

| | |

Shigeki Terashi | | * Executive Vice President, Member of the Board of Directors | | - Strategic Top Executive Meeting Office (Secretary General) - Global Audit Div. (Chief Officer) - Corporate Strategy Div. (Chief Officer) - Research Div. (Chief Officer) - Quality |

| | |

Shigeru Hayakawa | | Member of the Board of Directors. Senior Managing Officer | | - External Affairs & Public Affairs Group (Chief Officer) - Chief Communications Officer |

| | |

| Note: | | * Representative Director |

30

(2) Amount of Compensation to Members of the Board of Directors and Audit & Supervisory Board Members for FY2016

| | | | | | | | | | | | | | | | | | | | | | | | |

Category | | Members of

the Board of Directors

(incl. Outside Members of

the Board of Directors) | | | Audit & Supervisory

Board Members

(incl. Outside Audit &

Supervisory Board

Members) | | | Total | |

| | No. of

persons | | | Amount

(million yen) | | | No. of

persons | | | Amount

(million yen) | | | No. of

persons | | | Amount

(million yen) | |

Compensation to Members of the Board of Directors and Audit & Supervisory Board Members | |

| 18

(3 |

) | |

| 810

(79 |

) | |

| 8

(4 |

) | |

| 239

(59 |

) | | | 26 | | | | 1,050 | |

Executive bonus | | | 9 | | | | 1,105 | | | | | | | | | | | | 9 | | | | 1,105 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | |

| 1,916

(79 |

) | | | | | |

| 239

(59 |

) | | | | | | | 2,155 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| 1. | The number of persons includes those eligible to receive compensation in FY2016. |

| 2. | The amounts of executive bonuses stated above are to be decided by the resolution of the 112th Ordinary General Shareholders’ Meeting to be held on June 15, 2016. |

(3) Status of Outside Members of the Board of Directors and Outside Audit & Supervisory Board Members

1) Major activities for FY2016

| | | | | | | | | | |

Category | | Name | | Attendance of Board of

Directors meetings

(total attended/total held) | | | Attendance of Audit &

Supervisory Board

meetings (total

attended/total held) | |

Member of the Board of Directors | | Ikuo Uno | | | 17/17 | | | | — | |

Member of the Board of Directors | | Haruhiko Kato | | | 17/17 | | | | — | |

Member of the Board of Directors | | Mark T. Hogan | | | 17/17 | | | | — | |

Audit & Supervisory Board Member | | Yoko Wake | | | 17/17 | | | | 18/18 | |

Audit & Supervisory Board Member | | Teisuke Kitayama | | | 16/17 | | | | 18/18 | |

Audit & Supervisory Board Member | | Hiroshi Ozu | | | 12/13 | | | | 14/14 | |

| | Note: | The total number of meetings held varies due to the difference in the dates of assumption of office. |

Each Outside Member of the Board of Director and Outside Audit & Supervisory Board Member contributed by giving opinions based on his or her experience and insight.

2) Details of Limited Liability Agreements

Agreements between the Outside Members of the Board of Directors or Outside Audit & Supervisory Board Members and TMC to limit liability as stipulated in Article 423, Paragraph 1 of the Companies Act, with the liability limited to the amount stipulated in Article 425, Paragraph 1 of the Companies Act.

31

5. Status of Accounting Auditor

(1) Name of Accounting Auditor

PricewaterhouseCoopers Aarata

(2) Compensation to Accounting Auditor for FY2016

| | 1) | Total compensation and other amounts paid by TMC for the services provided in Article 2, Paragraph 1 of the Certified Public Accountants Act of Japan |

546 million yen

| | 2) | Total amount of cash and other property benefits paid by Toyota |

1,621 million yen

Notes:

| | 1. | The Audit & Supervisory Board examined whether the content of the Accounting Auditor’s audit plan, its execution of duties, basis for calculating the estimated compensation and others were appropriate, and thereupon agreed on the amount of compensation to the Accounting Auditor. |

| | 2. | The amount in 1) above includes compensation for audits performed in compliance with the Financial Instruments and Exchange Law. |

| | 3. | The amount in 2) above includes compensation for advice and consultation concerning accounting matters and information disclosure that are not included in the services provided in Article 2, Paragraph 1 of the Certified Public Accountants Act of Japan. |

| | 4. | Among principal subsidiaries of TMC, overseas subsidiaries are audited by certified public accountants or audit firms other than PricewaterhouseCoopers Aarata. |

(3) Policy regarding decisions on the dismissal or non-reappointment of the Accounting Auditor

If an Accounting Auditor falls under any of the items of Article 340, Paragraph 1 of the Companies Act and the Accounting Auditor’s dismissal is accordingly deemed to be appropriate, the Audit & Supervisory Board shall dismiss the Accounting Auditor with the unanimous consent of the Audit & Supervisory Board Members.

If any event or situation that hinders an Accounting Auditor from appropriately executing its duties is deemed to have occurred, the Audit & Supervisory Board shall determine the content of a proposal for the dismissal or non-reappointment of the Accounting Auditor to be submitted to the General Shareholders’ Meeting.

32

6. System to Ensure the Appropriateness of Business Operations and Outline of Implementation Status of such Systems

Basic Understanding of system to ensure appropriateness of business operations

TMC, together with its subsidiaries, has created and maintained a sound corporate climate based on the “Guiding Principles at Toyota” and the “Toyota Code of Conduct”. TMC integrates the principles of problem identification and continuous improvement into its business operation process and makes continuous efforts to train employees who will put these principles into practice.

System to ensure the appropriateness of business operations and outline of implementation status of such systems

TMC has endeavored to establish a system for ensuring the appropriateness of business operations as a corporate group and the proper implementation of that system in accordance with the “Basic Policies on Establishing Internal Controls.” Each business year, TMC inspects the establishment and implementation of internal controls to confirm that the organizational units responsible for implementing internal controls are functioning autonomously and are enhancing internal controls as necessary, and findings from the inspection are reviewed at Corporate Governance Meetings and the Board of Directors’ meetings.

| (1) | System to ensure that Members of the Board of Directors execute their responsibilities in compliance with relevant laws and regulations and the Articles of Incorporation |

[System]

| | 1) | TMC will ensure that Members of the Board of Directors act in compliance with relevant laws and regulations and the Articles of Incorporation, based on the Code of Ethics and other explanatory documents that include necessary legal information, presented on occasions such as trainings for new Members of the Board of Directors. |

| | 2) | TMC will make decisions regarding business operations after comprehensive discussions at the Board of Directors’ meeting and other meetings of various cross-sectional decision-making bodies. Matters to be decided are properly submitted and discussed at the meetings of those decision-making bodies in accordance with the relevant rules. |

| | 3) | TMC will appropriately discuss significant matters and measures relating to issues such as corporate ethics, compliance and risk management at the Corporate Governance Meeting and other meetings. |

[Implementation status]

| | 1) | TMC has stipulated the fundamental provisions to be observed by Members of the Board of Directors and other executives in the “Guiding Principles at Toyota,” the “Toyota Code of Conduct,” the “Code of Ethics,” etc., and all executives have been familiarized with these provisions. The relevant laws and regulations and the Articles of Incorporation that executives are to observe are listed in manuals distributed to all executives. Newly appointed executives undergo compliance education using these manuals when they assume office. |

33

| | 2) | In executing business operations, matters to be discussed are properly presented to the Board of Directors and cross-sectional decision-making bodies in accordance with regulations that identify the matters to be discussed with decision-making bodies. Matters are then comprehensively examined before decisions are made. |

The following matters require a resolution of the Board of Directors: (1) matters stipulated in the Companies Act and other laws and ordinances, (2) matters stipulated in the Articles of Incorporation, (3) matters delegated for resolution at the General Shareholders’ Meeting, and (4) other material business matters.

The following matters are required to be reported to the Board of Directors: (1) status of execution of business operations and other matters stipulated in the Companies Act and other laws and ordinances and (2) other matters deemed necessary by the Board of Directors

| | 3) | TMC deliberates on important topics pertaining to corporate ethics, compliance and risk management as well as responses thereto at Corporate Governance Meetings chaired by Chief Risk Officer (CRO) for the purpose of comprehensively identifying risks to business activities and initiating preventive actions. |

| (2) | System to retain and manage information relating to the execution of the duties of Members of the Board of Directors |

[System]

Information relating to exercising duties by Members of the Board of Directors shall be appropriately retained and managed by each division in charge pursuant to the relevant internal rules and laws and regulations.

[Implementation status]

In accordance with the relevant internal rules as well as laws and regulations, all organizational units are required to properly retain and manage materials used by decision-making bodies, minutes of meetings, and other information needed for the execution of duties by Members of the Board of Directors. TMC has established global systems and mechanisms for addressing full range of information security issues, including management of confidentiality, and regularly conducts inspections of progress being made in this regard by TMC and its subsidiaries.

| (3) | Rules and systems related to the management of risk of loss |

[System]

| | 1) | TMC will properly manage the capital fund through its budgeting system and other forms of control, conduct business operations, and manage the budget, based on the authorities and responsibilities in accordance with the “Ringi” system (effective consensus-building and approval system) and other systems. Significant matters will be properly submitted and discussed at the Board of Directors’ meeting and other meetings of various bodies in accordance with the standards stipulated in the relevant rules. |

34

| | 2) | TMC will ensure accurate financial reporting by issuing documentation on the financial flow and the control system, etc., and by properly and promptly disclosing information through the Disclosure Committee. |

| | 3) | TMC will manage various risks relating to safety, quality, the environment, etc. and compliance by establishing coordinated systems with all regions, establishing rules or preparing and delivering manuals and by other means, as necessary through each relevant division. |

| | 4) | As a precaution against events such as natural disasters, TMC will prepare manuals, conduct emergency drills, arrange risk diversification and insurance, etc. as needed. |

[Implementation status]

| | 1) | Budget is allocated to each organizational unit assigned to administer each expense item, and is managed in accordance with the earnings plan. Significant matters are properly submitted for discussion in accordance with standards in the rules stipulating the matters to be discussed at the Board of Directors and other decision-making bodies. |