This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation.

< Toyota Global Vision >

Toyota will lead the way to the future of mobility,

enriching lives around the world with the safest

and most responsible ways of moving people.

Through our commitment to quality,

constant innovation and respect for the planet,

we aim to exceed expectations

and be rewarded with a smile.

We will meet challenging goals by engaging the

talent and passion of people,

who believe there is always a better way.

Table of Contents

Toyota has become a Worldwide Olympic/Paralympic Partner in the category of vehicles, mobility services and mobility solutions.

1

I would like to express our gratitude for your ongoing support and understanding of our company. Thanks to your support we have been able to add yet another year of growth ring to the history of our company.

As technological innovation in the automotive industry such as electrification, automated driving, and connected vehicles heats up, a battle under new rules of competition and with new rivals has begun, not one about winning or losing, but one about surviving or dying.

“Having speed and being open” are the key to our survival. In addition to revising our organizational structure to further accelerate the decision-making process, we will also learn from, and work with, other companies and partners from different industries, with the aim of achieving an even better mobility society in the future. To make steady progress to that end, we are working exhaustively to eliminate waste and also making a company-wide effort in the area of cost planning.

We have declared our intention to transition from a car manufacturer to a mobility company so that cars will continue to be loved by the general public for the next 100 years, and to create a society where every individual can experience greater freedom and joy of movement. Change may not be as easy for Toyota, which has grown into a huge automotive company. However, under the slogan of “Start Your Impossible,” each and every executive and employee of our company will challenge their impossible, and create new forms of mobility that will make the impossible possible, through innovation and passion.

We look forward to your ongoing support.

2

(Securities Code 7203)

May 24, 2018

To All Shareholders:

President Akio Toyoda

TOYOTA MOTOR CORPORATION

1,Toyota-cho, Toyota City, Aichi Prefecture

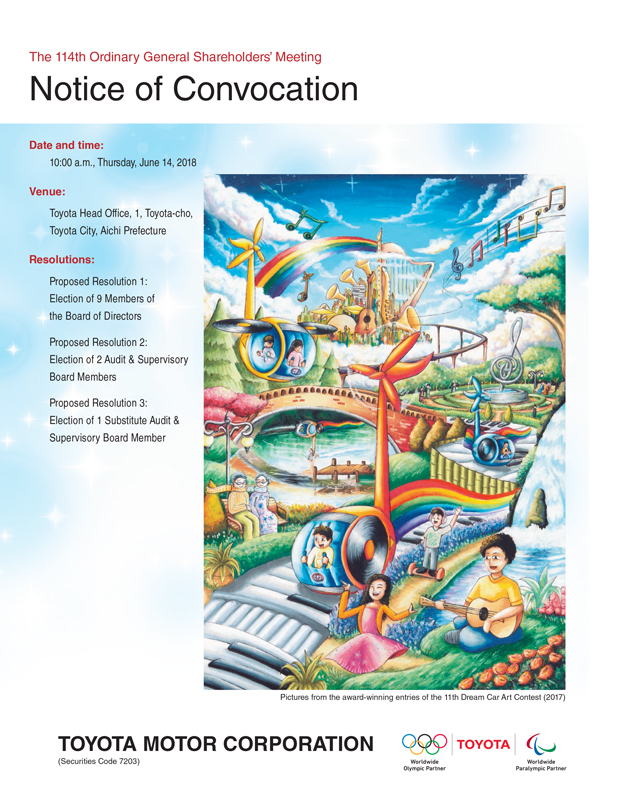

Notice of Convocation of the 114th Ordinary General Shareholders’ Meeting

(Unless otherwise stated, all financial information has been prepared

in accordance with accounting principles generally accepted in Japan)

Dear Shareholder,

Please refer to the following for information about the upcoming the 114th Ordinary General Shareholders’ Meeting (the “General Shareholders’ Meeting”) of Toyota Motor Corporation (“TMC”). We hope that you will be able to attend this meeting.

If you are unable to attend the meeting, you can exercise your voting rights by paper ballot or by electromagnetic means. Please review the enclosed Reference Documents and exercise your voting rightsby no later than the close of business (5:30 p.m.) on Wednesday, June 13, 2018 (Japan Time). Thank you very much for your cooperation.

| | |

1. Date and time: | | 10:00 a.m., Thursday, June 14, 2018 |

| |

2. Venue: | | Toyota Head Office, 1,Toyota-cho, Toyota City, Aichi Prefecture |

3. Meeting Agenda:

Reports:

Reports on business review, consolidated and unconsolidated financial statements for FY2018 (April 1, 2017 through March 31, 2018) and report by the Accounting Auditor and the Audit & Supervisory Board on the audit results of the consolidated financial statements.

Resolutions:

| | |

Proposed Resolution 1: | | Election of 9 Members of the Board of Directors |

Proposed Resolution 2: | | Election of 2 Audit & Supervisory Board Members |

Proposed Resolution 3: | | Election of 1 Substitute Audit & Supervisory Board Member |

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation.

3

Notes

You are kindly requested to review the Reference Documents and exercise your voting rights.

You can exercise your voting rights by any of the following three methods.

| | | | |

By attending the meeting Date and time of the meeting: 10:00 a.m., June 14, 2018 (Japan Time) | | By postal mail Deadline for exercise: Your ballot must reach us by post no later than 5:30 p.m. on June 13, 2018 (Japan Time). | | Via the Internet Deadline for exercise:

Enter your vote by no later than 5:30 p.m. on June 13, 2018 (Japan Time). |

| | (1) | Points to note when attending the meeting |

| | - | | If you attend the meeting in person, please submit the enclosed ballot at the reception desk. It will serve as your admission pass. |

You are also kindly requested to bring this Notice of Convocation as meeting materials when you attend.

| | - | | Please be advised in advance that you may be guided to an alternative venue if the main venue becomes fully occupied. |

| | - | | Only our shareholders are allowed to enter the venue. Persons who are attending as proxies of shareholders need to be themselves shareholders. |

Shareholders who concurrently exercise the voting rights of other shareholders are kindly requested to submit their ballots as shareholders in addition to their ballots for voting as proxies together with documents certifying their status as proxies.

| | - | | If you intend to engage in split voting, please submit to us written notice to that effect and the reasons for the split voting at least three days prior to the General Shareholders’ Meeting. |

| | (3) | Matters to be disclosed via the Internet |

| | - | | If any revisions are made to the reference documents or attachments for the General Shareholders’ Meeting, the revisions will be posted on Toyota Motor Corporation’s Web site (http://www.toyota.co.jp/jpn/investors/). |

| | - | | For shareholders who require sign-language interpretation: Please consult with the staff at the reception desk at the venue. |

| | - | | For shareholders who wish to visit the venue by wheelchair: Wheelchair pickup from Toyotashi Station to the venue is available. (Please contact our General Administration Department (secretariat of the General Shareholders’ Meeting) in advance. Tel:0565-28-2121 (main)) |

4

Reference Documents

Proposed resolutions and reference matters

Proposed Resolution 1: Election of 9 Members of the Board of Directors

All Members of the Board of Directors will retire upon the expiration of their term of office at the conclusion of this General Shareholders’ Meeting. Accordingly, we hereby request that 9 Members of the Board of Directors be elected. The candidates for the positions of Members of the Board of Directors are as follows:

Following are the nominees

| | | | | | | | | | |

No. | | Name (birth date) No.and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

| 1 | | Takeshi Uchiyamada (8/17/1946) 58,939 common shares Reappointed | | Chairman of the Board of Directors - Frontier Research Center (Chairman) | | Apr. | | 1969 | | Joined TMC |

| | | | Jun. | | 1998 | | Member of the Board of Directors of TMC |

| | | | Jun. | | 2001 | | Managing Director of TMC |

| | | | Jun. | | 2003 | | Senior Managing Director of TMC |

| | | | Jun. | | 2005 | | Executive Vice President of TMC |

| | | | Jun. | | 2012 | | Vice Chairman of TMC |

| | | | Jun. | | 2013 | | Chairman of TMC (to present) |

| | | | (important concurrent duties) |

| | | | President and Representative Director of Toyota Kuragaike Kaihatsu Kabushiki Kaisha |

| | | | | |

| 2 | | Shigeru Hayakawa (9/15/1953)

33,000 common shares Reappointed | | Vice Chairman of the Board of Directors | | Apr. | | 1977 | | Joined Toyota Motor Sales Co., Ltd. |

| | | | Jun. | | 2007 | | Managing Officer of TMC |

| | | | Sep. | | 2007 | | Toyota Motor North America, Inc. President |

| | | | Jun. | | 2009 | | Retired from Toyota Motor North America, Inc. President |

| | | | Apr. | | 2012 | | Senior Managing Officer of TMC |

| | | | Jun. | | 2015 | | Member of the Board of Directors and Senior Managing Officer of TMC |

| | | | Apr. | | 2017 | | Vice Chairman of TMC (to present) |

| | | | (important concurrent duties) |

| | | | Representative Director of Institute for International Economic Studies |

5

| | | | | | | | | | |

No. | | Name (birth date) No.and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

| 3 | | Akio Toyoda (5/3/1956) 4,737,475 common shares Reappointed | | President, Member of the Board of Directors | | Apr. | | 1984 | | Joined TMC |

| | | | Jun. | | 2000 | | Member of the Board of Directors of TMC |

| | | | Jun. | | 2002 | | Managing Director of TMC |

| | | | Jun. | | 2003 | | Senior Managing Director of TMC |

| | | | Jun. | | 2005 | | Executive Vice President of TMC |

| | | | Jun. | | 2009 | | President of TMC (to present) |

| | | | (important concurrent duties) |

| | | | Chairman and CEO of Toyota Motor North America, Inc. |

| | | | Chairman of TOWA REAL ESTATE Co., Ltd. |

| | | | Chairman and Executive Director of Toyota Alvark Tokyo Corporation |

| | | | Chairman of Nagoya Grampus Eight Inc. |

| | | | | |

| 4 | | Koji Kobayashi (10/23/1948) 20,736 common shares Newly appointed | | Operating Officer (Executive Vice President) - Chief Financial Officer - Chief Risk Officer | | Apr. | | 1972 | | Joined TMC |

| | | | Jun. | | 2004 | | Executive Director of DENSO CORPORATION |

| | | | Jun. | | 2007 | | Senior Executive Director, Member of the Board of Directors of DENSO CORPORATION |

| | | | Jun. | | 2010 | | Executive Vice President of DENSO CORPORATION |

| | | | Jun. | | 2015 | | Vice Chairman of DENSO CORPORATION |

| | | | Feb. | | 2016 | | Advisor of TMC |

| | | | Apr. | | 2017 | | Senior Advisor of TMC |

| | | | Jan. | | 2018 | | Operating Officer (Executive Vice President) of TMC (to present) |

| | | | Jan. | | 2018 | | Member of the Board of Directors of DENSO CORPORATION (to present) |

| | | | (important concurrent duties) |

| | | | Member of the Board of Directors of DENSO CORPORATION |

6

| | | | | | | | | | |

No. | | Name (birth date) No.and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

| 5 | | Didier Leroy (12/26/1957) 40,000 common shares Reappointed | | Member of the Board of Directors - Business Planning & Operation (President) - Chief Competitive Officer | | Apr. | | 1982 | | Joined Renault S.A. |

| | | | Aug. | | 1998 | | Retired from Renault S.A. |

| | | | Sep. | | 1998 | | Joined Toyota Motor Manufacturing France S.A.S. |

| | | | Sep. | | 1998 | | Toyota Motor Manufacturing France S.A.S. Vice President |

| | | | Jan. | | 2005 | | Toyota Motor Manufacturing France S.A.S. President |

| | | | Jun. | | 2007 | | Managing Officer of TMC |

| | | | Jul. | | 2007 | | Toyota Motor Europe NV/SA Executive Vice President |

| | | | Jul. | | 2009 | | Toyota Motor Manufacturing France S.A.S. Chairman |

| | | | Jun. | | 2010 | | Toyota Motor Europe NV/SA President |

| | | | Jul. | | 2010 | | Retired from Toyota Motor Manufacturing France S.A.S. Chairman |

| | | | Apr. | | 2011 | | Toyota Motor Europe NV/SA President and CEO |

| | | | Apr. | | 2012 | | Senior Managing Officer of TMC |

| | | | Apr. | | 2015 | | Toyota Motor Europe NV/SA Chairman (to present) |

| | | | Jun. | | 2015 | | Member of the Board of Directors and Executive Vice President of TMC |

| | | | Apr. | | 2017 | | Member of the Board of Directors of TMC (to present) |

| | | | (important concurrent duties) |

| | | | Chairman of Toyota Motor Europe NV/SA |

| | | | Vice Chairman of Toyota Motor North America, Inc. |

7

| | | | | | | | | | |

No. | | Name (birth date) No.and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

| 6 | | Shigeki Terashi (2/16/1955) 43,500 common shares Reappointed | | Member of the Board of Directors - Advanced R&D and Engineering Company (President) - Powertrain Company (Chairman) - Chief Safety Technology Officer | | Apr. | | 1980 | | Joined TMC |

| | | | Jun. | | 2008 | | Managing Officer of TMC |

| | | | Jun. | | 2008 | | Toyota Motor Engineering & Manufacturing North America, Inc. Executive Vice President |

| | | | May | | 2011 | | Toyota Motor Engineering & Manufacturing North America, Inc. President and COO |

| | | | Apr. | | 2012 | | Toyota Motor Engineering & Manufacturing North America, Inc. President and CEO |

| | | | Apr. | | 2012 | | Toyota Motor North America, Inc. President and COO |

| | | | Apr. | | 2013 | | Retired from Toyota Motor Engineering & Manufacturing North America, Inc. President and CEO |

| | | | Apr. | | 2013 | | Retired from Toyota Motor North America, Inc. President and COO |

| | | | Apr. | | 2013 | | Senior Managing Officer of TMC |

| | | | Jun. | | 2013 | | Member of the Board of Directors and Senior Managing Officer of TMC |

| | | | Jun. | | 2015 | | Executive Vice President of TMC |

| | | | Apr. | | 2017 | | Member of the Board of Directors of TMC (to present) |

| | | | | | (important concurrent duties) |

| | | | | | Director of Hino Motors, Ltd. |

| | | | | | President, Representative Director of EV C.A. Spirit Corporation |

8

| | | | | | | | | | |

No. | | Name (birth date) No.and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

7 | | Ikuro Sugawara (3/6/1957) 0 shares Newly appointed Outside / Independent | | | | Apr. | | 1981 | | Joined Ministry of International Trade and Industry |

| | | | Jul. | | 2010 | | Director-General of the Industrial Science and Technology Policy and Environment Bureau, Ministry of Economy, Trade and Industry |

| | | | Sep. | | 2012 | | Director-General of the Manufacturing Industries Bureau, Ministry of Economy, Trade and Industry |

| | | | Jun. | | 2013 | | Director-General of the Economic and Industrial Policy Bureau, Ministry of Economy, Trade and Industry |

| | | | Jul. | | 2015 | | Vice-Minister of Ministry of Economy, Trade and Industry |

| | | | Jul. | | 2017 | | Retired from the Ministry of Economy, Trade and Industry |

| | | | Aug. | | 2017 | | Special Advisor to the Cabinet (to present) |

| | | | (important concurrent duties) |

| | | | Special Advisor to the Cabinet |

[Reasons for nomination as a candidate to become an Outside Member of the Board of Directors] Mr. Ikuro Sugawara was involved in policy planning and other operations from a broad perspective for many years, holding various posts such as Director-General of the Manufacturing Industries Bureau and Vice-Minister of the Ministry of Economy, Trade and Industry. As we would like him to draw on his wealth of experience and wide range of knowledge he possesses to add value to the management of the Company, we hereby nominate him as a candidate to become an Outside Member of the Board of Directors. |

| | | | | |

8 | | Sir Philip Craven (7/4/1950) 0 shares Newly appointed Outside / Independent | | | | Oct. | | 1998 | | President of the International Wheelchair Basketball Federation |

| | | | Dec. | | 2001 | | President of the International Paralympic Committee |

| | | | Jul. | | 2002 | | Retired as President of the International Wheelchair Basketball Federation |

| | | | Sep. | | 2017 | | Retired as President of the International Paralympic Committee |

[Reasons for nomination as a candidate to become an Outside Member of the Board of Directors] Sir Philip Craven participated in the Paralympic Games as a wheelchair basketball player and, until last year, served as President of the International Paralympic Committee. As we would like him to draw on his wide range of experience he has acquired through promoting sports for the disabled and highly specialized knowledge regarding management of international organizations to add value to the management of the Company, we hereby nominate him as a candidate to become an Outside Member of the Board of Directors. |

9

| | | | | | | | | | |

No. | | Name (birth date) No. and kind of TMC

shares owned | | Position and areas of responsibility | | Brief career summary and important concurrent duties |

| 9 | | Teiko Kudo

(5/22/1964) 0 shares Newly appointed Outside / Independent | | | | Apr. | | 1987 | | Joined Sumitomo Bank |

| | | | Apr. | | 2014 | | Executive Officer of Sumitomo Mitsui Banking Corporation |

| | | | Apr. | | 2017 | | Managing Executive Officer of Sumitomo Mitsui Banking Corporation (to present) |

| | | | | (important concurrent duties) Managing Executive Officer of Sumitomo Mitsui Banking Corporation |

[Reasons for nomination as a candidate to become an Outside Member of the Board of Directors] Ms. Teiko Kudo plays an active part as Managing Executive Officer of Sumitomo Mitsui Banking Corporation and possesses a high level of expertise as a finance specialist. As we would like her to draw on her wealth of experience and wide range of knowledge she possesses to add value to the management of the Company, we hereby nominate her as a candidate to become an Outside Member of the Board of Directors. |

Notes:

| 1. | The information included in the above table is as of the date of this reference document for this General Shareholders’ Meeting (5/9/2018). |

| 2. | Mr. Akio Toyoda, who is President, Member of the Board of Directors, concurrently serves as Operating Officer (President). |

| 3. | Mr. Didier Leroy and Mr. Shigeki Terashi, both of whom are Members of the Board of Directors, concurrently serve as Operating Officers (Executive Vice Presidents). |

| 4. | Matters related to the candidates to become Outside Members of the Board of Directors are as follows: |

| | (1) | Mr. Ikuro Sugawara, Sir Philip Craven, and Ms. Teiko Kudo are candidates to become Outside Members of the Board of Directors. Upon approval of their election pursuant to this Proposed Resolution, TMC plans to register each of them as an Independent Director with the Japanese stock exchanges on which TMC is listed. |

| | (2) | Outline of limited liability agreements |

Upon approval of the election of Mr. Ikuro Sugawara, Sir Philip Craven, and Ms. Teiko Kudo pursuant to this Proposed Resolution, TMC plans to enter into limited liability agreements with them to limit the amount of their liabilities as stipulated in Article 423, Paragraph 1 of the Companies Act of Japan (the “Companies Act”) to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act.

10

Proposed Resolution 2: Election of 2 Audit & Supervisory Board Members

Each of the terms of office of Audit & Supervisory Board Members Mr. Masaki Nakatsugawa and Mr. Teisuke Kitayama will expire upon the conclusion of this General Shareholders’ Meeting. Accordingly, we hereby request that 2 Audit & Supervisory Board Members be elected. The candidates for the positions of Audit & Supervisory Board Members are as follows:

The submission of this proposal at this General Shareholders’ Meeting was approved by the Audit & Supervisory Board.

Following are the nominees

| | | | | | | | | | |

No. | | Name (birth date) No. and kind of TMC

shares owned | | Position | | Brief career summary and important concurrent duties |

1 | | Masahide Yasuda

(4/1/1949) 9,300 common shares Newly appointed | | | | Oct. | | 1972 | | Joined TMC |

| | | | Jan. | | 2000 | | General Manager of Overseas Parts Div. of TMC |

| | | | Jun. | | 2007 | | President of Toyota Motor Corporation Australia Ltd. |

| | | | May | | 2014 | | Chairman of Toyota Motor Corporation Australia Ltd. |

| | | | Dec. | | 2017 | | Retired as Chairman of Toyota Motor Corporation Australia Ltd. |

11

| | | | | | | | | | |

No. | | Name (birth date) No. and kind of TMC

shares owned | | Position | | Brief career summary and important concurrent duties |

2 | | Nobuyuki Hirano

(10/23/1951) 0 shares Newly appointed Outside /

Independent | | | | Apr. | | 1974 | | Joined Mitsubishi Bank |

| | | | Jun. | | 2001 | | Executive Officer of The Bank of Tokyo-Mitsubishi, Ltd. |

| | | | Oct. | | 2005 | | Director of Mitsubishi UFJ Financial Group, Inc. |

| | | | Jan. | | 2006 | | Managing Director of The Bank of Tokyo-Mitsubishi UFJ, Ltd. |

| | | | Oct. | | 2008 | | Senior Managing Director of The Bank of Tokyo-Mitsubishi UFJ, Ltd. |

| | | | Jun. | | 2009 | | Deputy President of The Bank of Tokyo-Mitsubishi UFJ, Ltd. |

| | | | Jun. | | 2009 | | Managing Officer of Mitsubishi UFJ Financial Group, Inc. |

| | | | Oct. | | 2010 | | Deputy President of Mitsubishi UFJ Financial Group, Inc. |

| | | | Apr. | | 2012 | | President of The Bank of Tokyo-Mitsubishi UFJ, Ltd. |

| | | | Apr. | | 2012 | | Director of Mitsubishi UFJ Financial Group, Inc. |

| | | | Apr. | | 2013 | | President & CEO of Mitsubishi UFJ Financial Group, Inc. |

| | | | Jun. | | 2015 | | Director, President & Group CEO of Mitsubishi UFJ Financial Group, Inc. (to present) |

| | | | Apr. | | 2016 | | Chairman of the Board of Directors of Bank of Tokyo-Mitsubishi UFJ, Ltd. |

| | | | Apr. | | 2018 | | Company name changed from The Bank of Tokyo-Mitsubishi UFJ, Ltd. to MUFG Bank, Ltd. |

| | | | (important concurrent duties) |

| | | | Director, President & Group CEO of Mitsubishi UFJ Financial Group, Inc. |

| | | | Chairman of the Board of Directors of MUFG Bank, Ltd. Director of Morgan Stanley |

[Reasons for nomination as a candidate to become an Outside Audit & Supervisory Board Member] Mr. Nobuyuki Hirano serves as Group CEO of Mitsubishi UFJ Financial Group, Inc. and possesses highly specialized knowledge in a wide range of subjects mainly in the field of financial affairs, as well as outstanding management expertise. As we expect him to adequately execute his duties as an Outside Audit & Supervisory Board Member with this knowledge and expertise, we hereby nominate him as a candidate to become an Outside Audit & Supervisory Board Member. |

| 1. | The information included in the above table is as of the date of this reference document for this General Shareholders’ Meeting (5/9/2018). |

12

| 2. | Matters related to the candidate to become an Outside Audit & Supervisory Board Member are as follows: |

| | (1) | Mr. Nobuyuki Hirano is a candidate to become an Outside Audit & Supervisory Board Member. Upon approval of his election pursuant to this Proposed Resolution, TMC plans to register him as an Independent Audit & Supervisory Board Member with the Japanese stock exchanges on which TMC is listed. |

| | (2) | During Mr. Nobuyuki Hirano’s term of office as President of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (“BTMU”), BTMU reached a settlement with the UK Prudential Regulation Authority (“PRA”) relating to BTMU’s failure to notify the PRA of BTMU’s discussions with the New York State Department of Financial Services, and agreed to pay the PRA GBP17,850 thousand. He was not aware of these matters until receiving reports. However, he had commented on the importance of legal compliance at meetings of the Board of Directors and other meetings. After these discoveries, he monitored the formulation of plans such as the operational improvement plan at meetings of the Board of Directors and other meetings. |

| | (3) | Outline of limited liability agreements |

Upon approval of his election pursuant to this Proposed Resolution, TMC plans to enter into limited liability agreement with him to limit the amount of his liabilities as stipulated in Article 423, Paragraph 1 of the Companies Act to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act.

13

Proposed Resolution 3: Election of 1 Substitute Audit & Supervisory Board Member

In order to be prepared in the event that TMC lacks the number of Audit & Supervisory Board Members and it becomes less than that required by laws and regulations, we hereby request that 1 Substitute Audit & Supervisory Board Member be elected. The candidate for the position of a Substitute Audit & Supervisory Board Member is as below.

This proposal is made to elect a substitute for the current Outside Audit & Supervisory Board Members Ms. Yoko Wake and Mr. Hiroshi Ozu as well as for Mr. Nobuyuki Hirano subject to the approval of Proposed Resolution 2. In the event the candidate becomes an Audit & Supervisory Board Member, his term of office shall be the remaining part of his predecessor’s term.

This resolution shall be effective until the commencement of the next Ordinary General Shareholders’ Meeting, provided, however, that this resolution may be cancelled before the proposed Substitute Audit & Supervisory Board Member assumes office, by a resolution of the Board of Directors, subject to the approval of the Audit & Supervisory Board.

The submission of this proposal at this General Shareholders’ Meeting was approved by the Audit & Supervisory Board.

Following is the nominee

| | | | | | | | | | |

No. | | Name (birth date) No. and kind of TMC

shares owned | | Position | | Brief career summary and important concurrent duties |

1 | | Ryuji Sakai

(8/7/1957) 0 shares

Reappointed | | Substitute Audit & Supervisory Board

Member | | Apr. | | 1985 | | Registered as attorney Joined Nagashima & Ohno |

| | | | Sep. | | 1990 | | Worked at Wilson Sonsini Goodrich & Rosati (located in U.S.) |

| | | | Jan. | | 1995 | | Partner, Nagashima & Ohno |

| | | | Jan. | | 2000 | | Partner, Nagashima Ohno & Tsunematsu (to present) |

| | | | (important concurrent duties) |

| | | | Attorney |

| | | | Outside Audit & Supervisory Board Member of Kobayashi Pharmaceutical Co., Ltd. |

| | | | Outside Audit & Supervisory Board Member of Tokyo Electron Limited |

|

[Reasons for nomination as a candidate to become a Substitute Outside Audit & Supervisory Board Member] Mr. Ryuji Sakai has not been directly involved in the management of corporations, but he possesses a wealth of experience and highly specialized knowledge acquired through his many years of activities mainly related to corporate legal matters including advisory services on corporate overseas expansion, overseas investment and other international transactions, and advisory services on various legal matters such as antitrust law, intellectual property rights, capital raising and M&A. As we expect him to adequately execute his duties as an Outside Audit & Supervisory Board Member with this knowledge and experience, we hereby nominate him as a candidate to become a Substitute Outside Audit & Supervisory Board Member. |

Notes:

| 1. | The information included in the above table is as of the date of this reference document for this General Shareholders’ Meeting (5/9/2018). |

| 2. | Matters related to the candidate to become a Substitute Outside Audit & Supervisory Board Member are as follows: |

| | (1) | Mr. Ryuji Sakai is a candidate to become a Substitute Outside Audit & Supervisory Board Member. |

| | (2) | Outline of limited liability agreement |

Upon approval of his election pursuant to this Proposed Resolution and his assumption of office as an Audit & Supervisory Board Member, TMC plans to enter into a limited liability agreement with him to limit the amount of his liability as stipulated in Article 423, Paragraph 1 of the Companies Act to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act.

14

Attachment to the Notice of Convocation of the 114th Ordinary General Shareholders’ Meeting

Business Report (Fiscal Year under review: April 1, 2017 through March 31, 2018)

1. Outlook of Associated Companies

(1) Progress and Achievement in Operation

General Economic Environment in FY2018

Reviewing the general economic environment for the fiscal year ended March 2018 (“FY2018”), the world economy has continued its moderate recovery on the back of the global expansion of trade and production and steady domestic demand. The Japanese economy has also been on a moderate recovery due to improvements in employment and income conditions.

For the automotive industry, markets have remained stable in the developed countries and expanded in China, but have slowed down in some resource-rich countries. Meanwhile, there have been movements in different countries and regions to tighten existing regulations or introduce new regulations for the reduction of greenhouse gases, including compulsory quotas for the sale of electrified vehicles.

Overview of Operations

In this business environment, the Toyota group has been striving to make “ever-better cars” that exceed customer expectations. We have completely remodeled the “Camry,” Toyota’s globalmid-size sedan, by introducing a new platform and powertrain units based on the TNGA (Toyota New Global Architecture), realizing responsive driving performance and a beautiful design. We also newly launched the “JPN TAXI” to provide usability and comfort to a wide range of people, including children, elderly people, wheelchair users, and visitors to Japan from abroad, while embodying the spirit of Japanese hospitality. Furthermore, we reintroduced the “Hilux,” a pickup truck that has been widely used by customers worldwide since its initial launch in 1968, into the Japanese market after a13-year hiatus. The Lexus brand launched theall-new “LS,” a luxury sedan equipped with innovative styling, emotional driving, and advanced active safety technologies. We also reinforced our commitment to cultivate a sense of excitement around car culture by, for example, launching the new “GR” sports car series, a lineup of vehicles based on technology and knowledge obtained through motorsports activities such as the World Rally Championship (WRC), a competition we returned to in 2017 after 18 years.

In this way, we have actively improved the productline-up to further meet customer needs and carried out vigorous sales efforts in collaboration with dealers in each country and region in which we operate. As a result, global vehicle sales for FY2018, including the Daihatsu and Hino brands, increased by 190 thousand units (or 1.9%) from FY2017 to 10,441 thousand units. We also made concerted efforts throughout the entire Toyota group on profit improvement activities such as cost reduction efforts.

15

Innon-automotive operations, we have developed a network for providing financial services throughout the world including emerging countries, and have proceeded to construct a solid business base through reinforced customer service, risk control, investment in information infrastructure, and the development of a talented workforce, while strengthening our financial standing by improving profitability. We have also accelerated initiatives focused on the future, including the introduction of telematics insurance and the provision of financial services incar-sharing and ride-sharing. In the housing business, consolidated housing sales reached 16,222 units, mainly thanks to the reinforced collaboration with TOYOTA HOUSING CORPORATION and Misawa Homes Co., Ltd. We are also conducting a wide range of activities such as the launch of a rental service of the “WelwalkWW-1000” rehabilitation assist robot in the field of partner robots.

16

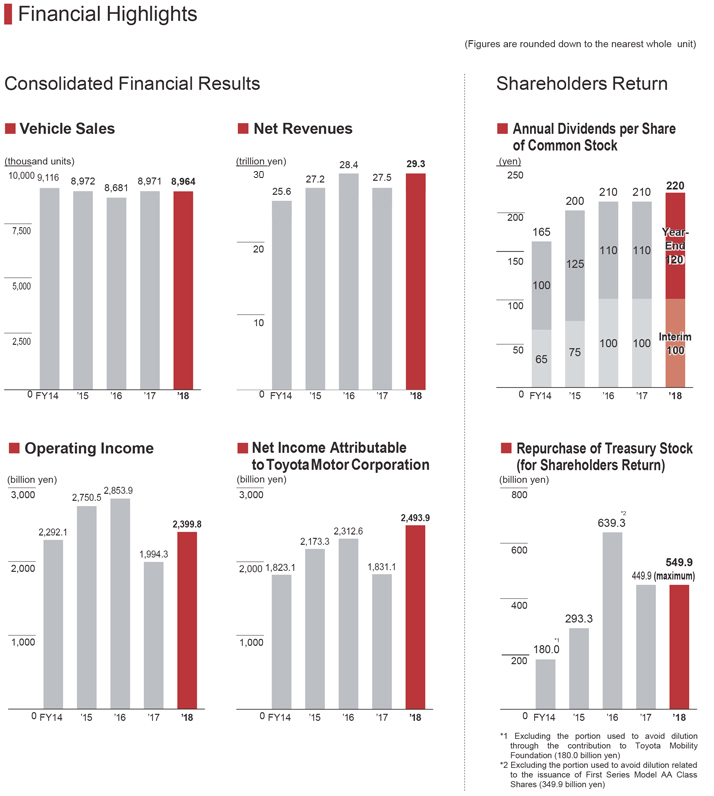

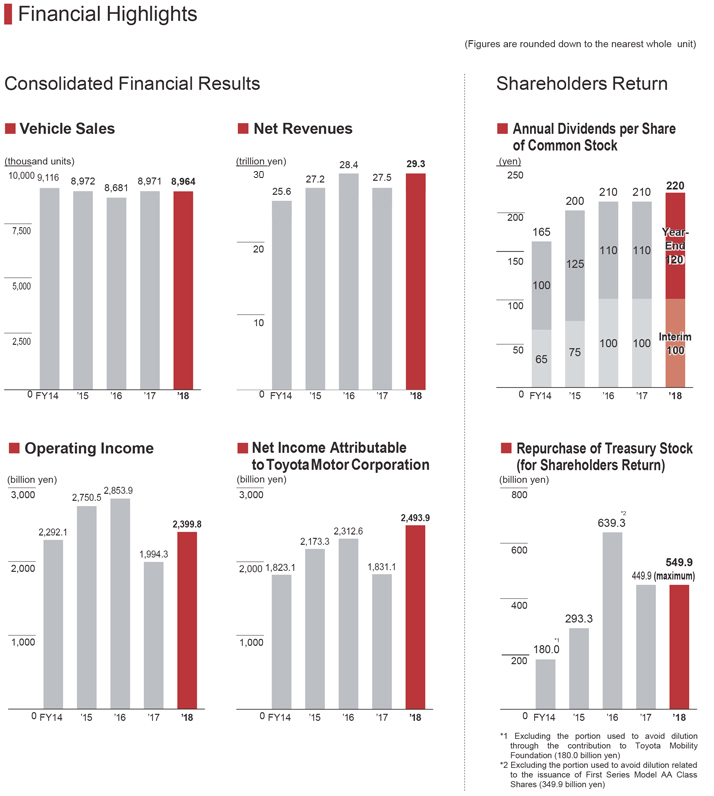

Consolidated Financial Results for FY2018

For FY2018, consolidated net revenues increased by 1,782.3 billion yen (or 6.5%) to 29,379.5 billion yen compared with FY2017 and consolidated operating income increased by 405.4 billion yen (or 20.3%) to 2,399.8 billion yen compared with FY2017, mainly thanks to the progress in profit improvement activities such as cost reduction, as well as the depreciation of the yen. Consolidated net income attributable to Toyota Motor Corporation increased by 662.8 billion yen (or 36.2%) to 2,493.9 billion yen compared with FY2017.

The breakdown of consolidated net revenues is as follows:

| | | | | | | | | | | | | | | | |

| | | Yen in millions unless otherwise stated | |

| | | FY2018

(April 2017 through

March 2018) | | | FY2017

(April 2016 through

March 2017) | | | Increase

(Decrease) | | | Change

(%) | |

Vehicles | | | 22,631,201 | | | | 21,540,563 | | | | 1,090,638 | | | | 5.1 | |

Parts and components for overseas production | | | 498,802 | | | | 468,214 | | | | 30,588 | | | | 6.5 | |

Parts and components for after service | | | 2,044,104 | | | | 1,955,781 | | | | 88,323 | | | | 4.5 | |

Other | | | 1,173,122 | | | | 1,067,671 | | | | 105,451 | | | | 9.9 | |

Total Automotive | | | 26,347,229 | | | | 25,032,229 | | | | 1,315,000 | | | | 5.3 | |

Financial Services | | | 1,959,234 | | | | 1,783,697 | | | | 175,537 | | | | 9.8 | |

Other | | | 1,073,047 | | | | 781,267 | | | | 291,780 | | | | 37.3 | |

| | | | | | | | | | | | | | | | |

Total | | | 29,379,510 | | | | 27,597,193 | | | | 1,782,317 | | | | 6.5 | |

| | | | | | | | | | | | | | | | |

Notes:

| 1. | Consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles. |

| 2. | The amounts represent net revenues from external customers. |

| 3. | Net revenues do not include consumption taxes, etc. |

(2) Funding

Funds necessary for the automotive business are mainly financed with funds from business operations. Funds necessary for the financial services business are mainly financed through the issuance of bonds and medium-term notes, as well as with borrowings. The balance of debt as of the end of FY2018 was 19,347.5 billion yen.

(3) Capital Expenditures and R&D

As for capital expenditures, the Toyota group has promoted activities to decrease expenditures through effective use of our existing facilities and prioritization of individual projects. At the same time, we made investments in areas such as the remodeling of cars and the renovation of the Kentucky plant in the United States to strengthen our competitiveness. As a result, consolidated capital expenditures for FY2018 were 1,302.7 billion yen.

As for R&D expenditures, we allocated further development resources to upfront investments for development in new fields such as vehicle electrification and automated driving while also endeavoring to improve development efficiency. As a result, consolidated R&D expenditures for FY2018 were 1,064.2 billion yen.

17

(4) Consolidated Financial Summary

| | | | | | | | | | | | | | | | |

| | | Yen in millions unless otherwise stated | |

| | | FY2015

(April 2014

through

March 2015) | | | FY2016

(April 2015

through

March 2016) | | | FY2017

(April 2016

through

March 2017) | | | FY2018

(April 2017

through

March 2018) | |

Net revenues | | | 27,234,521 | | | | 28,403,118 | | | | 27,597,193 | | | | 29,379,510 | |

Operating income | | | 2,750,564 | | | | 2,853,971 | | | | 1,994,372 | | | | 2,399,862 | |

Net income attributable to Toyota Motor Corporation | | | 2,173,338 | | | | 2,312,694 | | | | 1,831,109 | | | | 2,493,983 | |

Net income attributable to Toyota Motor Corporation

per common share – Basic (yen) | | | 688.02 | | | | 741.36 | | | | 605.47 | | | | 842.00 | |

Mezzanine equity and Shareholders’ equity | | | 17,647,329 | | | | 18,088,186 | | | | 18,668,953 | | | | 19,922,076 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 47,729,830 | | | | 47,427,597 | | | | 48,750,186 | | | | 50,308,249 | |

| | | | | | | | | | | | | | | | |

(5) Issues to be Addressed

As for the future automotive market, developed countries are expected to remain steady while emerging countries are expected to expand gradually on the back of economic recovery and other factors. Meanwhile, the automotive industry is facing the time of profound transformation that could happen only once in a hundred years in response to increasing serious environmental issues and other social challenges, technological innovation such as automated driving, connected vehicles and robotics which adopts the rapidly evolving technology of artificial intelligence, and diversification of lifestyles.

In such a business environment, the Toyota group intends to accelerate activities in the following fields to pursue its objective of “challenging for the future” to create new value and “growing steadily each year” to strengthen true competitiveness year by year, while ensuring quality and safety as top priority.

18

1) Electrification

The electrification of vehicles is imperative to address environmental issues. The Toyota group aims to provide the most suitable vehicles that match customer preferences in light of the energy and infrastructure development situation in each country and region, as well as the characteristics ofeco-cars, based on the stance thateco-cars can only truly have a significant positive impact if they are widely used.

In addition to hybrid electric vehicles, the global cumulative sales of which exceeded 10 million units in 2017, andplug-in hybrid electric vehicles, we are making headway in the development and popularization of fuel cell electric vehicles, the “ultimateeco-car.” For battery electric vehicles, we are accelerating our initiatives by establishing the EV Business Planning Dept. as an internal venture, as well as a new company for the joint development of technology with Mazda Motor Corporation and DENSO CORPORATION. We began a feasibility study of working together with Panasonic Corporation in the area of automotive batteries, which are crucial technologies for electrified vehicles. We are also proceeding with research and development of a solid-state battery that will serve as a high-performing next-generation battery.

We will further accelerate technological developments to realize a sustainablelow-carbon society, with the aspirational goal of achieving “global annual sales of more than 5.5 million electrified vehicles in 2030.”

Start feasibility study of joint automotive battery business with Panasonic

2) Automated driving

Since the 1990s, the Toyota group has continuously engaged in automated driving technology R&D aimed at contributing to the complete elimination of traffic casualties. The development philosophy, “Mobility Teammate Concept” is an approach built on the belief that people and vehicles can work together in the service of safe, convenient, and efficient mobility.

To further promote the usage of automated driving technology and advanced safety technology, we have developed a package of automatic braking and other active safety technologies, and have fully integrated the package into almost all passenger cars we sell in Japan, North America, and Europe. We also installed one of the world’s most advanced driving assistance technology in the “LS,” our new model launched in October 2017.

Toyota Research Institute, Inc., our research and development base established to focus on artificial intelligence as the underpinning technology for automated driving launched a fund to expand collaboration with venture companies who have innovative technologies of their own. We have also established the Toyota Research Institute – Advanced Development, Inc. as an entity to develop fully-integrated, production-quality software that will allow us to efficiently link the results of our advanced research to product development.

19

We are working on the development and popularization of automated driving technology with the ultimate aim of providing all people with safe, convenient, and enjoyable mobility.

LEXUS “LS+ Concept”

(Concept car with an eye toward application of automated driving technologies in the future)

3) MaaS (Mobility as a Service)

The Toyota group is endeavoring to create new vehicle values and mobility services that fit the diverse values and lifestyles of customers by having all vehicles connected in addition to electrification and automated driving. We will accelerate our transformation from an automotive company into a mobility company while collaborating with various other industries and IT companies.

The“e-Palette Concept Vehicle” presented at the International Consumer Electronics Show (CES) in the U.S. in January 2018 is a next-generation electric vehicle designed exclusively for the new mobility service “MaaS” to meet the demands of future multi-mode transportation and business applications beyond the traditional vehicle concepts. We will continue our efforts toward full-fledged practical use by openly collaborating with service providers and development companies from the planning stage.

e-Palette Concept Vehicle

4) Alliance

We are also promoting alliances with the aim of enhancing technology and product competitiveness as the business environment becomes more and more complex.

In August 2017, Toyota Motor Corporation (TMC) entered a business and capital alliance with Mazda Motor Corporation and began considering matters such as a joint technology development for electric vehicles. In March 2018, we established MAZDA TOYOTA MANUFACTURING, U.S.A., INC., a new joint-venture company that will produce vehicles in the U.S. In November 2017, TMC entered into a memorandum of understanding with SUZUKI MOTOR CORPORATION to introduce electric vehicles in the Indian market. We will promote activities in which parties concerned mutually benefit from synergy effects through alliance in a spirit of “having speed and being open.”

20

For alliance with different industries, TMC entered into a basic agreement with JapanTaxi Co., Ltd. in February 2018 to consider joint development of taxi services. We will consider business collaboration in such areas as joint development of vehicle-dispatch support systems andbig-data collection by utilizing their respective expertise in services and technologies.

By collaborating with partners who share the passion to “make our mobility society better and better,” we will create new values useful for people’s lives with the aim of realizing sustainable growth.

Agreement reached on a business and capital alliance with Mazda Motor Corporation

5) Business innovation

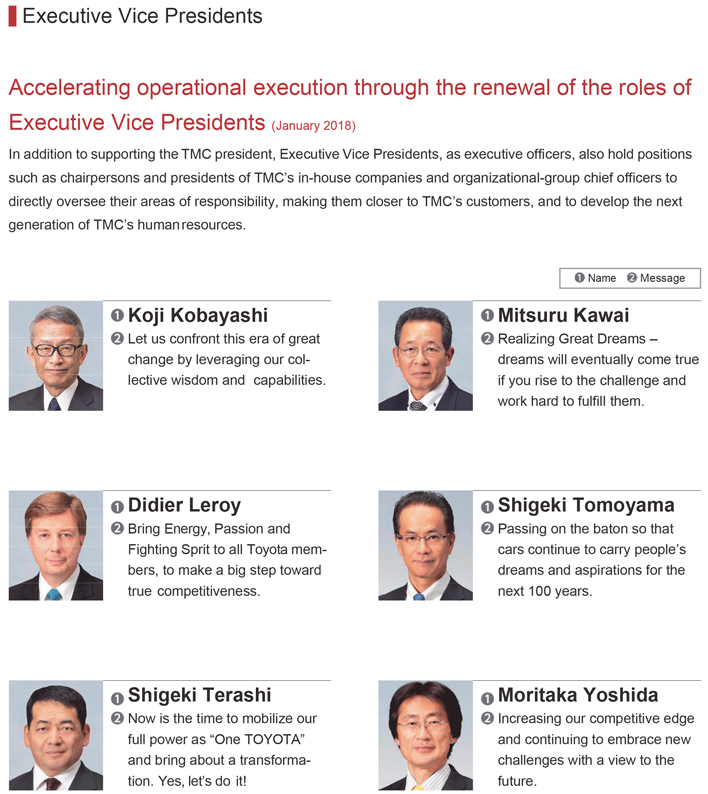

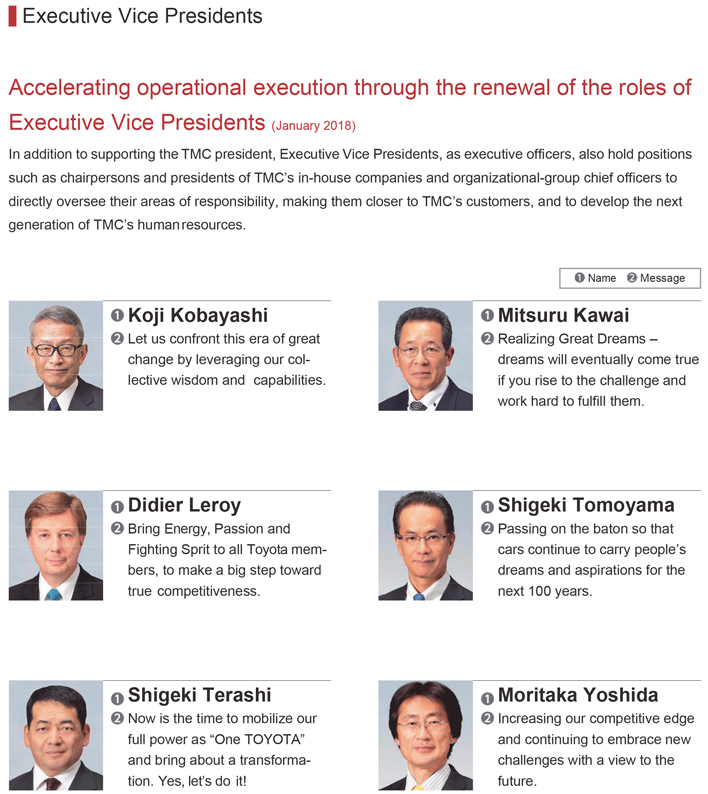

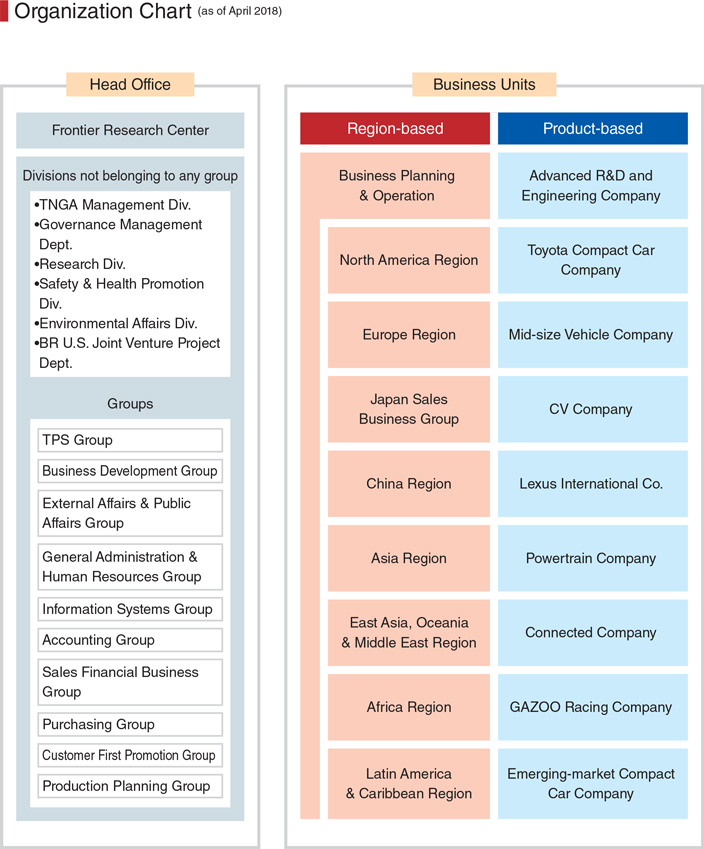

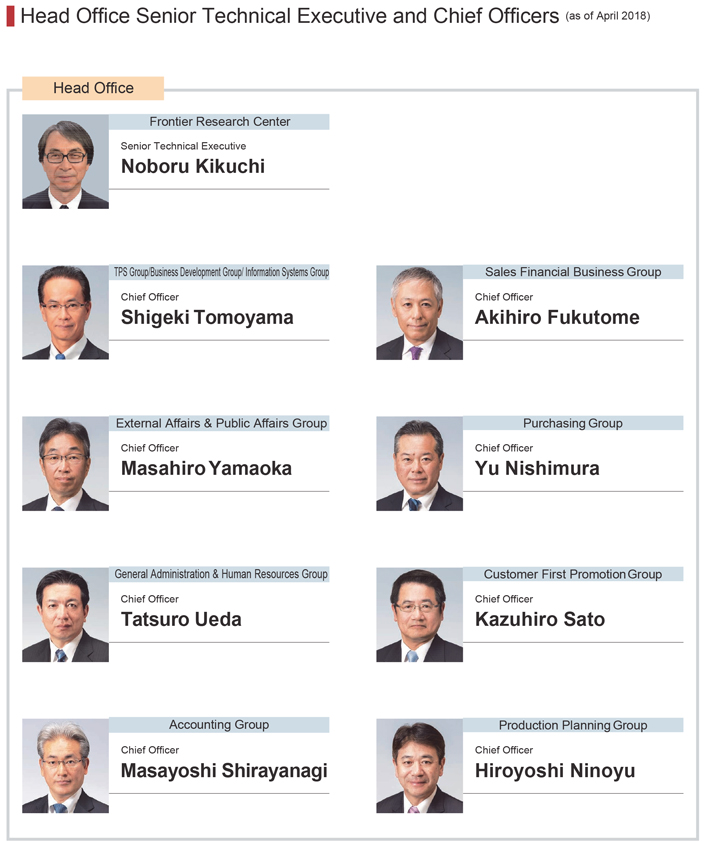

We have continually restructured the organization and reviewed our executive lineups in order to further promote the “development of human resources” and the “innovation of the way we work” which support the activities mentioned above. Due to other industries entering the market and rapid technological innovation, structural changes are taking place in today’s automotive industry at an unprecedented speed and scale, in which we are facing a crucial battle to survive tomorrow.

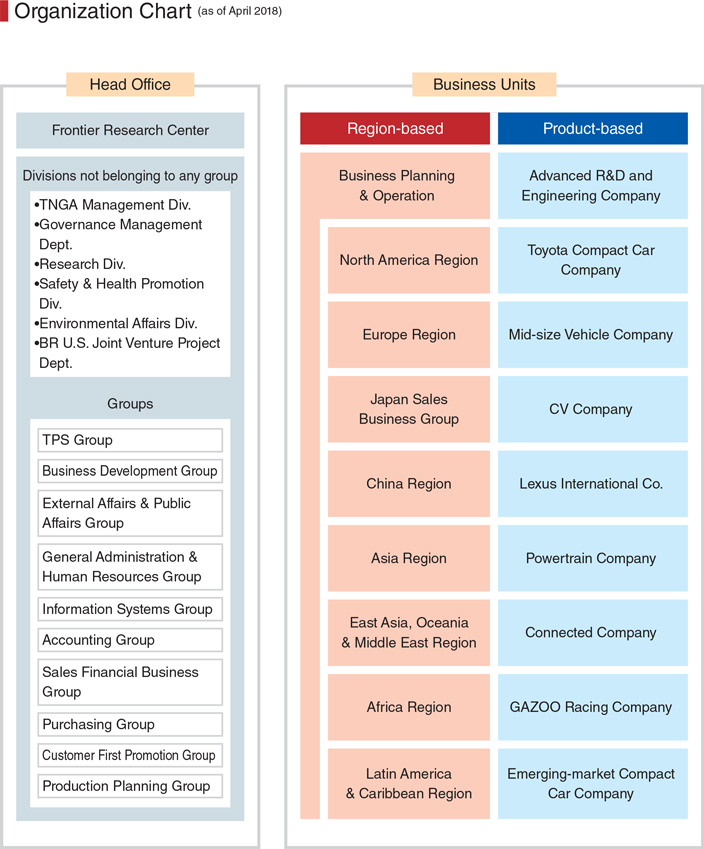

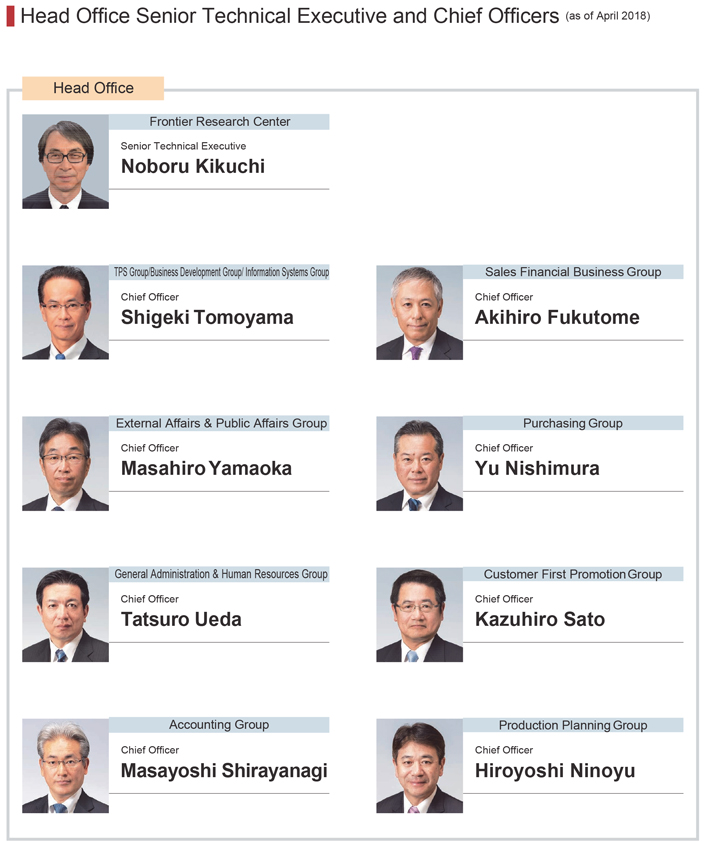

Under these circumstances, we started a product-basedin-house company system in April 2016 to facilitate “quick judgment, quick decision and quick action” through “genchi genbutsu(on-site learning and problem-solving),” with the principle of “Customer First” more firmly in mind. In January 2018, we brought forward the timing of executive changes, which had used to take place each April, in order to further accelerate management oversight that is fully coordinated with the workplace. Additionally, to encourage executives to take initiatives to reform their roles and approaches, we reviewed executive positions and appointed people with high levels of expertise from both inside and outside the company based on the principle of putting the right people in the right places. For the organization, we established a new TPS Group with the aim of improving productivity by thoroughly reinforcing the Toyota Production System (TPS), the base of the Toyota group’s competitiveness, in areas not limited to manufacturing.

All of our executives and employees will continue taking on challenges in a belief that “there is always a better way.”

21

Through these initiatives, and by delivering “ever-better cars,” the Toyota group aims to contribute to society. This is expected to encourage more customers to purchase Toyota cars and thereby lead to the establishment of a stable business base. By maintaining this cycle, we aim to realize sustainable growth and enhance our corporate value. In addition, through full observance of corporate conducts and ethics including compliance with applicable laws and regulations, the Toyota group will remain committed to its social responsibilities.

By staying true to our founding spirit of “contributing to society by Monozukuri, manufacturing,” we will move forward through the united efforts of the executives and employees toward the realization of the Toyota Global Vision with humility, gratitude and passion. We sincerely hope that our shareholders will continue to extend their patronage and support to us.

22

(6) Policy on Distribution of Surplus by Resolution of the Board of Directors

TMC deems the benefit of its shareholders as one of its priority management policies, and it continues to work to improve its corporate structure to realize sustainable growth in order to enhance its corporate value. TMC will strive for the stable and continuous payment of dividends aiming at a consolidated payout ratio of 30% to shareholders of common stock while giving due consideration to factors such as business results for each term, investment plans and its cash reserves. In addition, TMC will pay a prescribed amount of dividends to shareholders of First Series Model AA Class Shares.

With regard to the repurchase of treasury stock, TMC will implement a flexible capital policy in response to business circumstance with a view to improving shareholder return and capital efficiency.

In order to survive tough competition, TMC will utilize its internal funds mainly for the early commercialization of technologies for next-generation environment and safety, giving priority to customer safety and security.

23

(7) Main Business

The Toyota group’s business segments are automotive operations, financial services operations and all other operations.

| | |

Business | | Main products and services |

Automotive Operations | | Vehicles (passenger vehicles, trucks and buses, and mini-vehicles), Parts & components for overseas production, Parts, etc. |

| |

Financial Services Operations | | Auto sales financing, Leasing, etc. |

| |

Other Operations | | Housing, Information Technology, etc. |

(8) Main Sites

<TMC>

| | |

Name | | Location |

Head Office | | Aichi Prefecture |

Tokyo Head Office | | Tokyo |

Nagoya Office | | Aichi Prefecture |

Honsha Plant | | Aichi Prefecture |

Motomachi Plant | | Aichi Prefecture |

Kamigo Plant | | Aichi Prefecture |

Takaoka Plant | | Aichi Prefecture |

Miyoshi Plant | | Aichi Prefecture |

Tsutsumi Plant | | Aichi Prefecture |

Myochi Plant | | Aichi Prefecture |

Shimoyama Plant | | Aichi Prefecture |

Kinu-ura Plant | | Aichi Prefecture |

Tahara Plant | | Aichi Prefecture |

Teiho Plant | | Aichi Prefecture |

Hirose Plant | | Aichi Prefecture |

Higashi-Fuji Technical Center | | Shizuoka Prefecture |

<Domestic and overseas subsidiaries>

Please see section “(10) Status of Principal Subsidiaries.”

(9) Employees

| | |

Number of employees | | Increase (Decrease) from end of FY2017 |

369,124 | | + 4,679 |

24

(10) Status of Principal Subsidiaries

| | | | | | | | | | | | |

| | | Company name | | Location | | Capital/ Subscription | | Percentage

ownership

interest | | | Main business |

| | | | | | million yen | | | | | | |

| Japan | | Toyota Financial Services Corporation | | Aichi Prefecture | | 78,525 | | | 100.00 | | | Management of domestic and overseas financial companies, etc. |

| | Hino Motors, Ltd. | | Tokyo | | 72,717 | | | 50.21 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Kyushu, Inc. | | Fukuoka Prefecture | | 45,000 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Daihatsu Motor Co., Ltd. | | Osaka Prefecture | | 28,404 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota Finance Corporation | | Aichi Prefecture | | 16,500 | | | 100.00 | * | | Finance of automobile sales, Card business |

| | Misawa Homes Co., Ltd. | | Tokyo | | 11,892 | | | 51.00 | * | | Manufacture and sales of housing |

| | Toyota Auto Body Co., Ltd. | | Aichi Prefecture | | 10,371 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota Motor East Japan, Inc. | | Miyagi Prefecture | | 6,850 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Daihatsu Motor Kyushu Co., Ltd. | | Oita Prefecture | | 6,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | | | | | in thousands | | | | | | |

| North America | | Toyota Motor Engineering & Manufacturing North America, Inc. | | U.S.A. | | USD 1,958,949 | | | 100.00 | * | | Management of manufacturing companies in North America |

| | Toyota Motor Manufacturing, Kentucky, Inc. | | U.S.A. | | USD 1,180,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor North America, Inc. | | U.S.A. | | USD 1,005,400 | | | 100.00 | * | | Management of all North American affiliates |

| | Toyota Motor Credit Corporation | | U.S.A. | | USD 915,000 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota Motor Manufacturing, Indiana, Inc. | | U.S.A. | | USD 620,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Manufacturing, Texas, Inc. | | U.S.A. | | USD 510,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Sales, U.S.A., Inc. | | U.S.A. | | USD 365,000 | | | 100.00 | * | | Sales of automobiles |

| | Toyota Motor Manufacturing de Baja California S .de R.L.de C.V. | | Mexico | | USD 239,949 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Manufacturing Canada Inc. | | Canada | | CAD 680,000 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota Credit Canada Inc. | | Canada | | CAD 60,000 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota Canada Inc. | | Canada | | CAD 10,000 | | | 51.00 | | | Sales of automobiles |

| | | | | | in thousands | | | | | | |

| Europe | | Toyota Motor Europe NV/SA | | Belgium | | EUR 2,524,346 | | | 100.00 | | | Management of all European affiliates |

| | Toyota Motor Manufacturing France S.A.S. | | France | | EUR 71,078 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Motor Finance (Netherlands) B.V. | | Netherlands | | EUR 908 | | | 100.00 | * | | Loans to overseas Toyota related companies |

| | Toyota Motor Manufacturing (UK) Ltd. | | U.K. | | GBP 300,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota Financial Services (UK) PLC | | U.K. | | GBP 114,500 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota Motor Manufacturing Turkey Inc. | | Turkey | | TRY 150,165 | | | 90.00 | * | | Manufacture and sales of automobiles |

| | OOO “TOYOTA MOTOR” | | Russia | | RUB 4,875,189 | | | 100.00 | * | | Manufacture and sales of automobiles |

25

| | | | | | | | | | | | |

| | | Company name | | Location | | Capital/ Subscription | | Percentage

ownership

interest | | | Main business |

| | | | | | in thousands | | | | | | |

Asia | | Toyota Motor (China) Investment Co., Ltd. | | China | | USD 118,740 | | | 100.00 | | | Sales of automobiles |

| | Toyota Motor Finance (China) Co., Ltd. | | China | | CNY 3,100,000 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota Kirloskar Motor Private Ltd. | | India | | INR 7,000,000 | | | 89.00 | | | Manufacture and sales of automobiles |

| | P.T. Astra Daihatsu Motor | | Indonesia | | IDR 894,370,000 | | | 61.75 | * | | Manufacture and sales of automobiles |

| | PT. Toyota Motor Manufacturing Indonesia | | Indonesia | | IDR 19,523,503 | | | 95.00 | | | Manufacture and sales of automobiles |

| | Toyota Motor Asia Pacific Pte Ltd. | | Singapore | | SGD 6,000 | | | 100.00 | | | Sales of automobiles |

| | Toyota Leasing (Thailand) Co., Ltd. | | Thailand | | THB 15,100,000 | | | 86.84 | * | | Finance of automobile sales |

| | Toyota Motor Thailand Co., Ltd. | | Thailand | | THB 7,520,000 | | | 86.43 | | | Manufacture and sales of automobiles |

| | Toyota Daihatsu Engineering & Manufacturing Co., Ltd. | | Thailand | | THB 1,300,000 | | | 100.00 | * | | Production support for entities in Asia and Oceania |

| | | | | | in thousands | | | | | | |

| Other | | Toyota Motor Corporation Australia Ltd. | | Australia | | AUD 481,100 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota Finance Australia Ltd. | | Australia | | AUD 120,000 | | | 100.00 | * | | Finance of automobile sales |

| | Toyota Argentina S.A. | | Argentina | | ARS 260,000 | | | 100.00 | * | | Manufacture and sales of automobiles |

| | Toyota do Brasil Ltda. | | Brazil | | BRL 709,980 | | | 100.00 | | | Manufacture and sales of automobiles |

| | Toyota South Africa Motors (Pty) Ltd. | | South Africa | | ZAR 50 | | | 100.00 | * | | Manufacture and sales of automobiles |

Notes:

| 1. | * Indicates that the ownership interest includes such ratio of the subsidiaries. |

| 2. | The ownership interests are calculated based on the total number of shares issued at the end of the fiscal year. |

| 3. | Toyota Daihatsu Engineering & Manufacturing Co., Ltd. was formerly called Toyota Motor Asia Pacific Engineering & Manufacturing Co., Ltd. before it was renamed on April 3, 2017. |

26

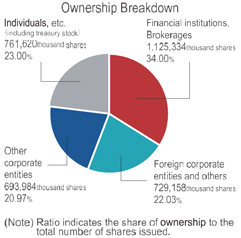

2. Status of Shares

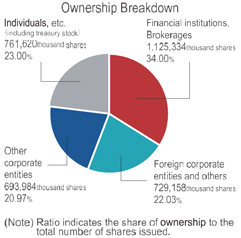

| | | | |

| (1) | | Total Number of Shares Authorized | | 10,000,000,000 shares |

| | |

| (2) | | Total Number of Shares Issued | | |

| | |

| | Common shares | | 3,262,997,492 shares |

| | |

| | First Series Model AA Class Shares | | 47,100,000 shares |

| | |

| (3) | | Number of Shareholders | | 632,418 |

| | |

| (4) | | Major Shareholders | | |

| | | | | | | | | | | | | | | | |

Name of Shareholders | | Number of shares

(1,000 shares) | | | Percentage of

shareholding (%) | |

| | Common

shares | | | First series

Model AA

class shares | | | Total | | |

Japan Trustee Services Bank, Ltd. | | | 381,087 | | | | 180 | | | | 381,267 | | | | 12.89 | |

Toyota Industries Corporation | | | 232,037 | | | | — | | | | 232,037 | | | | 7.85 | |

The Master Trust Bank of Japan, Ltd. | | | 172,408 | | | | — | | | | 172,408 | | | | 5.83 | |

State Street Bank and Trust Company (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) | | | 119,497 | | | | — | | | | 119,497 | | | | 4.04 | |

Nippon Life Insurance Company | | | 110,834 | | | | 560 | | | | 111,394 | | | | 3.77 | |

DENSO CORPORATION | | | 89,784 | | | | — | | | | 89,784 | | | | 3.04 | |

JPMorgan Chase Bank, N.A. (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) | | | 77,287 | | | | — | | | | 77,287 | | | | 2.61 | |

Mitsui Sumitomo Insurance Company, Limited | | | 58,811 | | | | — | | | | 58,811 | | | | 1.99 | |

Trust & Custody Services Bank, Ltd. | | | 58,234 | | | | — | | | | 58,234 | | | | 1.97 | |

Tokio Marine & Nichido Fire Insurance Co., Ltd. | | | 51,045 | | | | — | | | | 51,045 | | | | 1.73 | |

| Note: | The percentage of shareholding is calculated after deducting the number of shares of treasury stock (353,073 thousand shares) from the total number of shares issued. |

27

3. Status of Stock Acquisition Rights, Etc.

(1) Status of Stock Acquisition Rights as of the End of FY2018

| | 1) | Number of Stock Acquisition Rights issued: |

9,996

| | 2) | Type and Number of Shares to be Issued or Transferred upon Exercise of Stock Acquisition Rights 999,600 shares of common stock of TMC (The number of shares to be issued or transferred upon exercise of one Stock Acquisition Right is 100). |

| | 3) | Stock Acquisition Rights held by TMC’s Members of the Board of Directors and Audit & Supervisory Board Members |

| | | | | | | | | | | | |

| | | Series

(Exercise price) | | Exercise period | | Number of Stock

Acquisition Rights | | | Number of holders | |

Members of the Board

of Directors (excluding Outside Members) | | 9th (3,153 yen) | | From August 1, 2012

to July 31, 2018 | | | 530 | | | | 4 | |

28

4. Status of Members of the Board of Directors and Audit & Supervisory Board Members

(1) Members of the Board of Directors and Audit & Supervisory Board Members

| | | | | | |

Name | | Position | | Areas of responsibility | | Important concurrent duties |

| Takeshi Uchiyamada | | * Chairman of the Board of Directors | | - Frontier Research Center (Chairman) | | - President and Representative Director of Toyota Kuragaike Kaihatsu Kabushiki Kaisha |

| | | |

Shigeru Hayakawa | | Vice Chairman of the Board of Directors | | | | - Representative Director of Institute for International Economic Studies |

| | | |

Akio Toyoda | | * President, Member of the Board of Directors | | | | - Chairman and CEO of Toyota Motor North America, Inc. - Chairman of TOWA REAL ESTATE Co., Ltd. - Chairman and Executive Director of Toyota Alvark Tokyo Corporation - Chairman of Nagoya Grampus Eight Inc. |

| | | |

Didier Leroy | | Member of the Board of Directors | | - Business Planning & Operation (President) - Chief Competitive Officer | | - Chairman of Toyota Motor Europe NV/SA - Vice Chairman of Toyota Motor North America, Inc. |

| | | |

Shigeki Terashi | | Member of the Board of Directors | | - Advanced R&D and Engineering Company (President) - Powertrain Company (Chairman) - Chief Safety Technology Officer | | - Director of Hino Motors, Ltd. - President, Representative Director of EV C.A. Spirit Corporation |

| | | |

Osamu Nagata | | Member of the Board of Directors | | | | |

| | | |

Ikuo Uno | | Member of the Board of Directors | | | | - Honorary Advisor of Nippon Life Insurance Company - Outside Director of FUJI KYUKO CO., LTD. - Outside Auditor of Odakyu Electric Railway Co., Ltd. - Outside Audit & Supervisory Board Member of Tohoku Electric Power Co., Inc. |

| | | |

Haruhiko Kato | | Member of the Board of Directors | | | | - President and CEO of Japan Securities Depository Center, Inc. - Outside Director of Canon Inc. |

| | | |

Mark T. Hogan | | Member of the Board of Directors | | | | - President of Dewey Investments LLC |

| | | |

| Masaki Nakatsugawa | | Full-time Audit & Supervisory Board Member | | | | |

| | | |

Masahiro Kato | | Full-time Audit & Supervisory Board Member | | | | |

29

| | | | | | |

Name | | Position | | Areas of responsibility | | Important concurrent duties |

Yoshiyuki Kagawa | | Full-time Audit & Supervisory Board Member | | | | |

| | | |

Yoko Wake | | Audit & Supervisory Board Member | | | | - Professor Emeritus of Keio University |

| | | |

Teisuke Kitayama | | Audit & Supervisory Board Member | | | | - Special Advisor of Sumitomo Mitsui Banking Corporation - Outside Audit & Supervisory Board Member of Tokyo Broadcasting System Holdings, Inc. |

| | | |

Hiroshi Ozu | | Audit & Supervisory Board Member | | | | - Attorney - Outside Audit & Supervisory Board Member of MITSUI & CO., LTD. - Audit & Supervisory Board Member (External) of Shiseido Company, Limited |

Notes:

| 1. | * Representative Director |

| 2. | Mr. Akio Toyoda, who is President, Member of the Board of Directors, concurrently serves as Operating Officer (President). |

| 3. | Mr. Didier Leroy and Mr. Shigeki Terashi, both of whom are Members of the Board of Directors, concurrently serve as Operating Officers (Executive Vice Presidents). |

| 4. | Mr. Ikuo Uno, Mr. Haruhiko Kato and Mr. Mark T. Hogan, all of whom are Members of the Board of Directors, are Outside Members of the Board of Directors. They are also Independent Directors as provided by the rules of the Japanese stock exchanges on which TMC is listed. |

| 5. | Ms. Yoko Wake, Mr. Teisuke Kitayama and Mr. Hiroshi Ozu, all of whom are Audit & Supervisory Board Members, are Outside Audit & Supervisory Board Members. They are also Independent Audit & Supervisory Board Members as provided by the rules of the Japanese stock exchanges on which TMC is listed. |

| 6. | The “Important concurrent duties” are listed chronologically, in principle, based on the dates the executives assumed their present positions. |

30

(2) Amount of Compensation to Members of the Board of Directors and Audit & Supervisory Board Members for FY2018

| | | | | | | | | | | | | | | | | | | | | | | | |

Category | | Members of

the Board of Directors

(incl. Outside Members of

the Board of Directors) | | | Audit & Supervisory

Board Members

(incl. Outside Audit &

Supervisory Board

Members) | | | Total | |

| | No. of

persons | | | Amount

(million yen) | | | No. of

persons | | | Amount

(million yen) | | | No. of

persons | | | Amount

(million yen) | |

Compensation to Members of the Board of Directors and Audit & Supervisory Board Members | |

| 12

(3 |

) | |

| 692

(81 |

) | |

| 6

(3 |

) | |

| 223

(54 |

) | | | 18 | | | | 915 | |

Executive bonus | | | 6 | | | | 1,224 | | | | | | | | | | | | 6 | | | | 1,224 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | |

| 1,917

(81 |

) | | | | | |

| 223

(54 |

) | | | | | | | 2,140 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| 1. | The number of persons includes those eligible to receive compensation in FY2018. |

| 2. | The amount of compensation payable to Members of the Board of Directors has been set at a maximum total of 4.0 billion yen per year (of which, the maximum amount payable to Outside Members of the Board of Directors is 0.3 billion yen per year), including monthly compensation and bonuses, by the resolution of the 113th Ordinary General Shareholders’ Meeting held on June 14, 2017. The amount of compensation payable to Audit & Supervisory Board Members has been set at a maximum total of 30 million yen per month by the resolution of the 104th Ordinary General Shareholders’ Meeting held on June 24, 2008. |

| 3. | The amount of executive bonuses above were resolved at the Board of Directors meeting held on May 9, 2018. |

(3) Status of Outside Members of the Board of Directors and Outside Audit & Supervisory Board Members

1) Major activities for FY2018

| | | | | | | | | | |

Category | | Name | | Attendance of Board of

Directors meetings

(total attended/total held) | | | Attendance of Audit &

Supervisory Board

meetings (total

attended/total held) | |

Member of the Board of Directors | | Ikuo Uno | | | 13/15 | | | | — | |

Member of the Board of Directors | | Haruhiko Kato | | | 15/15 | | | | — | |

Member of the Board of Directors | | Mark T. Hogan | | | 15/15 | | | | — | |

Audit & Supervisory Board Member | | Yoko Wake | | | 15/15 | | | | 15/15 | |

Audit & Supervisory Board Member | | Teisuke Kitayama | | | 13/15 | | | | 14/15 | |

Audit & Supervisory Board Member | | Hiroshi Ozu | | | 14/15 | | | | 14/15 | |

Each Outside Member of the Board of Directors and Outside Audit & Supervisory Board Member contributed by giving opinions based on his or her experience and insight.

31

2) Details of Limited Liability Agreements

Agreements between the Outside Members of the Board of Directors or Outside Audit & Supervisory Board Members and TMC to limit liability as stipulated in Article 423, Paragraph 1 of the Companies Act, with the liability limited to the amount stipulated in Article 425, Paragraph 1 of the Companies Act.

32

5. Status of Accounting Auditor

(1) Name of Accounting Auditor

PricewaterhouseCoopers Aarata LLC

(2) Compensation to Accounting Auditor for FY2018

| | 1) | Total compensation and other amounts paid by TMC for the services provided in Article 2, Paragraph 1 of the Certified Public Accountants Act of Japan |

602 million yen

| | 2) | Total amount of cash and other property benefits paid by Toyota |

1,752 million yen

Notes:

| | 1. | The Audit & Supervisory Board examined whether the content of the Accounting Auditor’s audit plan, its execution of duties, basis for calculating the estimated compensation and others were appropriate, and thereupon agreed on the amount of compensation to the Accounting Auditor. |

| | 2. | The amount in 1) above includes compensation for audits performed in compliance with the Financial Instruments and Exchange Law. |

| | 3. | The amount in 2) above includes compensation for advice and consultation concerning accounting matters and information disclosure that are not included in the services provided in Article 2, Paragraph 1 of the Certified Public Accountants Act of Japan. |

| | 4. | Among principal subsidiaries of TMC, Misawa Homes Co., Ltd. and overseas subsidiaries are audited by certified public accountants or audit firms other than PricewaterhouseCoopers Aarata LLC. |

(3) Policy regarding decisions on the dismissal ornon-reappointment of the Accounting Auditor

If an Accounting Auditor falls under any of the items of Article 340, Paragraph 1 of the Companies Act and the Accounting Auditor’s dismissal is accordingly deemed to be appropriate, the Audit & Supervisory Board shall dismiss the Accounting Auditor with the unanimous consent of the Audit & Supervisory Board Members.

If any event or situation that hinders an Accounting Auditor from appropriately executing its duties is deemed to have occurred, the Audit & Supervisory Board shall determine the content of a proposal for the dismissal ornon-reappointment of the Accounting Auditor to be submitted to the General Shareholders’ Meeting.

33

6. System to Ensure the Appropriateness of Business Operations and Outline of Implementation Status of Such Systems

Basic understanding of system to ensure appropriateness of business operations

TMC, together with its subsidiaries, has created and maintained a sound corporate climate based on the “Guiding Principles at Toyota” and the “Toyota Code of Conduct.” TMC integrates the principles of problem identification and continuous improvement into its business operation process and makes continuous efforts to train employees who will put these principles into practice.

System to ensure the appropriateness of business operations and outline of implementation status of such systems

TMC has endeavored to establish a system for ensuring the appropriateness of business operations as a corporate group and the proper implementation of that system in accordance with the “Basic Policies on Establishing Internal Controls.” Each business year, TMC inspects the establishment and implementation of internal controls to confirm that the organizational units responsible for implementing internal controls are functioning autonomously and are enhancing internal controls as necessary, and findings from the inspection are reviewed at Sustainability Management Meetings and the Board of Directors’ meetings.

| (1) | System to ensure that Members of the Board of Directors execute their responsibilities in compliance with relevant laws and regulations and the Articles of Incorporation |

[System]

| | 1) | TMC will ensure that Members of the Board of Directors act in compliance with relevant laws and regulations and the Articles of Incorporation, based on the Code of Ethics and other explanatory documents that include necessary legal information, presented on occasions such as trainings for new Members of the Board of Directors. |

| | 2) | TMC will make decisions regarding business operations after comprehensive discussions at the Board of Directors’ meeting and other meetings of various cross-sectional decision-making bodies. Matters to be decided are properly submitted and discussed at the meetings of those decision-making bodies in accordance with the relevant rules. |

| | 3) | TMC will appropriately discuss significant matters and measures relating to issues such as corporate ethics, compliance and risk management at the Sustainability Management Meetings and other meetings. |

[Implementation status]

| | 1) | TMC has stipulated the fundamental provisions to be observed by Members of the Board of Directors and other executives in the “Guiding Principles at Toyota,” the “Toyota Code of Conduct,” the “Code of Ethics,” etc., and all executives have been familiarized with these provisions. The relevant laws and regulations and the Articles of Incorporation that executives are to observe are listed in manuals distributed to all executives. Newly appointed executives undergo compliance education using these manuals when they assume office. |

34

| | 2) | In executing business operations, matters to be discussed are properly presented to the Board of Directors and cross-sectional decision-making bodies in accordance with regulations that identify the matters to be discussed with decision-making bodies. Matters are then comprehensively examined before decisions are made. The following matters require a resolution of the Board of Directors: (1) matters stipulated in the Companies Act and other laws and ordinances, (2) matters stipulated in the Articles of Incorporation, (3) matters delegated for resolution at the General Shareholders’ Meeting, and (4) other material business matters. The following matters are required to be reported to the Board of Directors: (1) status of execution of business operations and other matters stipulated in the Companies Act and other laws and ordinances and (2) other matters deemed necessary by the Board of Directors. |

TMC also made changes to and altered the roles of some decision-making bodies in conjunction with a reorganization we performed in January 2018.

| | 3) | With the aim of establishing a governance structure that can deliver sustainable growth over the medium- to long-term in accordance with the “Guiding Principles at Toyota,” “Toyota Global Vision,” etc., TMC deliberates on important topics pertaining to corporate ethics, compliance and risk management as well as responses thereto at Sustainability Management Meetings chaired by Chief Risk Officer (CRO). |

| (2) | System to retain and manage information relating to the execution of the duties of Members of the Board of Directors |

[System]

Information relating to exercising duties by Members of the Board of Directors shall be appropriately retained and managed by each division in charge pursuant to the relevant internal rules and laws and regulations.

[Implementation status]

In accordance with the relevant internal rules as well as laws and regulations, all organizational units are required to properly retain and manage materials used by decision-making bodies, minutes of meetings, and other information needed for the execution of duties by Members of the Board of Directors. TMC has established global systems and mechanisms for addressing full range of information security issues, including the management of confidential information, and regularly conducts inspections of progress being made in this regard by TMC and its subsidiaries.

| (3) | Rules and systems related to the management of risk of loss |

[System]

| | 1) | TMC will properly manage the capital fund through its budgeting system and other forms of control, conduct business operations, and manage the budget, based on the authorities and responsibilities in accordance with the “Ringi” system (effective consensus-building and approval system) and other systems. Significant matters will be properly submitted and discussed at the Board of Directors’ meeting and other meetings of various bodies in accordance with the standards stipulated in the relevant rules. |

35

| | 2) | TMC will ensure accurate financial reporting by issuing documentation on the financial flow and the control system, etc., and by properly and promptly disclosing information through the Disclosure Committee. |

| | 3) | TMC will manage various risks relating to safety, quality, the environment, etc. and compliance by establishing coordinated systems with all regions, establishing rules or preparing and delivering manuals and by other means, as necessary through each relevant division. |

| | 4) | As a precaution against events such as natural disasters, TMC will prepare manuals, conduct emergency drills, arrange risk diversification and insurance, etc. as needed. |

[Implementation status]

| | 1) | Budget is allocated to each organizational unit assigned to administer each expense item, general expenses, research and development expenses, capital expenditures, etc. and is managed in accordance with the earnings plan. Significant matters are properly submitted for discussion in accordance with standards in the rules stipulating the matters to be discussed at the Board of Directors and other decision-making bodies. |

| | 2) | To ensure accurate financial reporting, commentaries are prepared on financial information collected to prepare consolidated financial reports, and these are distributed to subsidiaries as necessary. To ensure the timely and proper disclosure of information, information is collected through the Disclosure Committee, where decisions on the need for disclosure are made. |

Processes of TMC and its key subsidiaries are being documented as required by law, and the effectiveness of internal control systems with respect to financial reporting is evaluated. The effectiveness of the disclosure process is also evaluated.

| | 3) | Regional CROs have been appointed to develop and oversee risk management systems for their respective regions under the supervision of CRO, who is responsible for global risk management of safety, quality, environmental and other risks. In addition, at the internal head offices, TMC has appointed the chief officer for each group and the risk officer for each department and division to be in charge of risk management for each function, and at eachin-house company, TMC has appointed the president and the risk officer to be in charge of risk management for each product. Through this, TMC has established systems that enable collaboration and support with each regional headquarters, and these systems are reviewed and reinforced as necessary. |

In the area of quality, the HonshaGlobal-CQO (Chief Quality Officer) is in charge of eachRegional-CQO, and is promoting the improvement of products and services sincerely reflecting customer feedback, manufacturing of cars that are in compliance with laws and regulations and quality improvement activities across the entire company globally. TMC is also monitoring market developments and establishes and enhances management structure that responds to quality risks.

| | 4) | To prepare against disaster, Group/Region and all divisions have formulated business continuity plans (BCPs) for resuming production and restoring systems, among others, and they are continuing to improve these BCPs by conducting regular training (initial responses and restoration efforts) each year. TMC has also adopted a three-pronged approach to business continuity management (BCM) entailing concerted efforts by employees and their families, Toyota Group companies and their suppliers, and TMC. |

36

| (4) | System to ensure that Members of the Board of Directors exercise their duties efficiently |

[System]

| | 1) | TMC will manage consistent policies by specifying the policies at each level of the organization based on the medium- to long-term management policies and the Company’s policies for each fiscal term. |

| | 2) | Members of the Board of Directors will promptly determine the management policies based on preciseon-the-spot information and, in accordance with Toyota’s advantageous “field-oriented” approach, appoint and delegate a high level of authority to officers who take responsibility for business operations in eachin-house company, region, function, and process. The responsible officers will proactively compose relevant business plans under their leadership and execute them in a swift and timely manner in order to carry out Toyota’s management policies. Members of the Board of Directors will supervise the execution of duties by the responsible officers. |

| | 3) | TMC, from time to time, will make opportunities to listen to the opinions of various stakeholders, including external experts in each region, and reflect those opinions in TMC’s management and corporate activities. |

[Implementation status]