- TM Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Toyota Motor (TM) 6-KReport of Foreign Private Issuer

Filed: 13 May 19, 6:20am

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation.

< Toyota Global Vision >

Toyota will lead the way to the future of mobility,

enriching lives around the world with the safest

and most responsible ways of moving people.

Through our commitment to quality,

constant innovation and respect for the planet,

we aim to exceed expectations

and be rewarded with a smile.

We will meet challenging goals by engaging the

talent and passion of people,

who believe there is always a better way.

Toyota is a Worldwide Olympic/Paralympic Partner in the category of vehicles, mobility support robots and mobility services.

1

I would like to express our gratitude for your ongoing support and understanding of our company.

The Heisei era has ended and the Reiwa era has just begun.

The advent of new technologies referred to by the acronym “CASE,” which stands for “Connected” cars, “Autonomous” driving, “Sharing” and “Electrification,” will greatly change our competitors and the rules of competition, as well as the very concept of the automobile.

It is necessary to remember our unshakeable foundation and return to our roots especially because we are in this age of dynamic changes. This unshakeable foundation comprises the “Toyota Production System (TPS)” and our “capabilities to refine costs,” which are the values we have upheld since our founding and our strength. We must constantly be aware that there is always a better way, and continue to change the way we work. Innovation is the result of a process of imitation and improvement. That is to say, we start by imitating superior products around us and then thoroughly improve them.

Beside these “manufacturing (monozukuri) capabilities,” the “advantage of our global network,” which we have built together with our dealers and suppliers, as well as the “units in operation” generated by sales volume based on the relationship of trust with customers since our establishment, are our “real capabilities” that cannot be acquired overnight.

Toyota cannot create the future on its own. I believe that developing our “real capabilities,” staying highly competitive and continuing to be the choice of our customers will lead to sustainable growth.

It is our fervent hope to work with you to create a prosperous mobility society of the future where every individual can move safely and enjoyably.

We look forward to your ongoing support.

2

(Securities Code 7203)

May 23, 2019

To All Shareholders:

President Akio Toyoda

TOYOTA MOTOR CORPORATION

1,Toyota-cho, Toyota City, Aichi Prefecture

Notice of Convocation of the 115th Ordinary General Shareholders’ Meeting

(Unless otherwise stated, all financial information has been prepared

in accordance with accounting principles generally accepted in Japan)

Dear Shareholder,

Please refer to the following for information about the upcoming the 115th Ordinary General Shareholders’ Meeting (the “General Shareholders’ Meeting”) of Toyota Motor Corporation (“TMC”). We hope that you will be able to attend this meeting.

If you are unable to attend the meeting, you can exercise your voting rights by paper ballot or by electromagnetic means. Please review the enclosed Reference Documents and exercise your voting rightsby no later than the close of business (5:30 p.m.) on Wednesday, June 12, 2019 (Japan Time). Thank you very much for your cooperation.

1. Date and time: | 10:00 a.m., Thursday, June 13, 2019 | |

2. Venue: | Toyota Head Office, 1,Toyota-cho, Toyota City, Aichi Prefecture | |

3. Meeting Agenda:

Reports:

Reports on business review, consolidated and unconsolidated financial statements for FY2019 (April 1, 2018 through March 31, 2019) and report by the Accounting Auditor and the Audit & Supervisory Board on the audit results of the consolidated financial statements.

Resolutions:

Proposed Resolution 1: | Election of 9 Members of the Board of Directors | |

Proposed Resolution 2: | Election of 4 Audit & Supervisory Board Members | |

Proposed Resolution 3: | Election of 1 Substitute Audit & Supervisory Board Member | |

Proposed Resolution 4: | Determination of Compensation for Granting Restricted Shares to Members of the Board of Directors (excluding Outside Members of the Board of Directors) and Revision of the Amount of Compensation Payable to Members of the Board of Directors |

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation.

3

Notes

You are kindly requested to review the Reference Documents and exercise your voting rights.

You can exercise your voting rights by any of the following three methods.

By attending the meeting Date and time of the meeting: 10:00 a.m., June 13, 2019 (Japan Time) | By postal mail Deadline for exercise: Your ballot must reach us by post no later than 5:30 p.m. on June 12, 2019 (Japan Time). | Via the Internet Deadline for exercise: Enter your vote by no later than 5:30 p.m. on June 12, 2019 (Japan Time). |

| (1) | Points to note when attending the meeting |

| - | If you attend the meeting in person, please submit the enclosed ballot at the reception desk. It will serve as your admission pass. |

You are also kindly requested to bring this Notice of Convocation as meeting materials when you attend.

| - | Please be advised in advance that you may be guided to an alternative venue if the main venue becomes fully occupied. |

| - | Only our shareholders are allowed to enter the venue. Persons who are attending as proxies of shareholders need to be themselves shareholders. |

Shareholders who concurrently exercise the voting rights of other shareholders are kindly requested to submit their ballots as shareholders in addition to their ballots for voting as proxies together with documents certifying their status as proxies.

| (2) | Split voting |

| - | If you intend to engage in split voting, please submit to us written notice to that effect and the reasons for the split voting at least three days prior to the General Shareholders’ Meeting. |

| (3) | Matters to be disclosed via the Internet |

| - | If any revisions are made to the reference documents or attachments for the General Shareholders’ Meeting, the revisions will be posted on Toyota Motor Corporation’s website (https://global.toyota/en/ir/). |

| - | From this year, the result of resolutions of this General Shareholders’ Meeting will be posted on the above web site instead of sending you the Notice of Resolutions in writing. |

| (4) | Other information |

| - | For shareholders who require sign-language interpretation: Please consult with the staff at the reception desk at the venue. |

| - | For shareholders who wish to visit the venue by wheelchair: Wheelchair pickup from Toyotashi Station to the venue is available. (Please contact our General Administration Department (secretariat of the General Shareholders’ Meeting) in advance. Tel:0565-28-2121 (main)) |

4

Proposed resolutions and reference matters

Proposed Resolution 1: Election of 9 Members of the Board of Directors

All Members of the Board of Directors will retire upon the expiration of their term of office at the conclusion of this General Shareholders’ Meeting. Accordingly, we hereby request that 9 Members of the Board of Directors be elected. The candidates for the positions of Members of the Board of Directors are as follows:

Following are the nominees

No. | Name (birth date) No. and type of TMC | Position and areas of responsibility | Brief career summary and important concurrent duties | |||||||

1 | Takeshi Uchiyamada (8/17/1946) 77,039 common shares Reappointed | Chairman of the Board of Directors | Apr. | 1969 | Joined TMC | |||||

| Jun. | 1998 | Member of the Board of Directors of TMC | ||||||||

| Jun. | 2001 | Managing Director of TMC | ||||||||

| Jun. | 2003 | Senior Managing Director of TMC | ||||||||

| Jun. | 2005 | Executive Vice President of TMC | ||||||||

| Jun. | 2012 | Vice Chairman of TMC | ||||||||

| Jun. | 2013 | Chairman of TMC (to present) | ||||||||

(important concurrent duties) | ||||||||||

| Audit & Supervisory Board Member of TOKAI RIKA CO., LTD. | ||||||||||

| Audit & Supervisory Board Member of Toyoda Gosei Co., Ltd. | ||||||||||

| Director of JTEKT Corporation | ||||||||||

2 | Shigeru Hayakawa (9/15/1953) 34,611 common shares Reappointed | Vice Chairman of the Board of Directors | Apr. | 1977 | Joined Toyota Motor Sales Co., Ltd. | |||||

| Jun. | 2007 | Managing Officer of TMC | ||||||||

| Sep. | 2007 | Toyota Motor North America, Inc. President | ||||||||

| Jun. | 2009 | Retired from Toyota Motor North America, Inc. President | ||||||||

| Apr. | 2012 | Senior Managing Officer of TMC | ||||||||

| Jun. | 2015 | Member of the Board of Directors and Senior Managing Officer of TMC | ||||||||

| Apr. | 2017 | Vice Chairman of TMC (to present) | ||||||||

(important concurrent duties) | ||||||||||

| Representative Director of Institute for International Economic Studies | ||||||||||

5

No. | Name (birth date) No. and type of TMC | Position and areas of responsibility | Brief career summary and important concurrent duties | |||||||

3 | Akio Toyoda (5/3/1956) 4,752,895 common shares Reappointed | President, Member of the Board of Directors

- Chief Executive Officer - Chief Branding Officer

| Apr. | 1984 | Joined TMC | |||||

| Jun. | 2000 | Member of the Board of Directors of TMC | ||||||||

Jun. | 2002 | Managing Director of TMC | ||||||||

| Jun. | 2003 | Senior Managing Director of TMC | ||||||||

Jun. | 2005 | Executive Vice President of TMC | ||||||||

Jun. | 2009 | President of TMC (to present) | ||||||||

(important concurrent duties) | ||||||||||

Chairman and CEO of Toyota Motor North America, Inc. | ||||||||||

Chairman of TOWA REAL ESTATE Co., Ltd. | ||||||||||

Chairman of Japan Automobile Manufacturers Association, Inc. | ||||||||||

4 | Koji Kobayashi (10/23/1948) 22,347 common shares Reappointed | Member of the Board of Directors

- Chief Financial Officer - Chief Risk Officer

| Apr. | 1972 | Joined TMC | |||||

| Jun. | 2004 | Executive Director of DENSO CORPORATION | ||||||||

| Jun. | 2007 | Senior Executive Director, Member of the Board of Directors of DENSO CORPORATION | ||||||||

| Jun. | 2010 | Executive Vice President of DENSO CORPORATION | ||||||||

| Jun. | 2015 | Vice Chairman of DENSO CORPORATION | ||||||||

Feb. | 2016 | Advisor of TMC | ||||||||

| Apr. | 2017 | Senior Advisor of TMC | ||||||||

| Jan. | 2018 | Operating Officer (Executive Vice President) of TMC | ||||||||

| Jan. | 2018 | Member of the Board of Directors of DENSO CORPORATION | ||||||||

| Jun. | 2018 | Retired as Member of the Board of Directors of DENSO CORPORATION | ||||||||

| Jun. | 2018 | Member of the Board of Directors of TMC (to present) | ||||||||

(important concurrent duties) | ||||||||||

Chairman and Executive Director of TOYOTA Mobility Tokyo Inc. | ||||||||||

6

No. | Name (birth date) No. and type of TMC | Position and areas of responsibility | Brief career summary and important concurrent duties | |||||||

5 | Didier Leroy (12/26/1957) 50,000 common shares Reappointed | Member of the Board of Directors

- Chief Competitive Officer | Sep. | 1982 | Joined Renault S.A. | |||||

| Aug. | 1998 | Retired from Renault S.A. | ||||||||

| Sep. | 1998 | Joined Toyota Motor Manufacturing France S.A.S. | ||||||||

| Sep. | 1998 | Toyota Motor Manufacturing France S.A.S. Vice President | ||||||||

| Jan. | 2005 | Toyota Motor Manufacturing France S.A.S. President | ||||||||

| Jun. | 2007 | Managing Officer of TMC | ||||||||

| Jul. | 2007 | Toyota Motor Europe NV/SA Executive Vice President | ||||||||

| Jul. | 2009 | Toyota Motor Manufacturing France S.A.S. Chairman | ||||||||

| Jun. | 2010 | Toyota Motor Europe NV/SA President | ||||||||

| Jul. | 2010 | Retired from Toyota Motor Manufacturing France S.A.S. Chairman | ||||||||

| Apr. | 2011 | Toyota Motor Europe NV/SA President and CEO | ||||||||

| Apr. | 2012 | Senior Managing Officer of TMC | ||||||||

| Apr. | 2015 | Toyota Motor Europe NV/SA Chairman (to present) | ||||||||

| Jun. | 2015 | Member of the Board of Directors and Executive Vice President of TMC | ||||||||

| Apr. | 2017 | Member of the Board of Directors of TMC (to present) | ||||||||

(important concurrent duties) | ||||||||||

Chairman of Toyota Motor Europe NV/SA | ||||||||||

Vice Chairman of Toyota Motor North America, Inc. Member of the Board of Directors, Toyota Tsusho Corporation | ||||||||||

7

No. | Name (birth date) No. and type of TMC | Position and areas of responsibility | Brief career summary and important concurrent duties | |||||||

6 | Shigeki Terashi (2/16/1955) 49,011 common shares Reappointed

| Member of the Board of Directors

- Chief Technology Officer | Apr. | 1980 | Joined TMC | |||||

| Jun. | 2008 | Managing Officer of TMC | ||||||||

| Jun. | 2008 | Toyota Motor Engineering & Manufacturing North America, Inc. Executive Vice President | ||||||||

| May | 2011 | Toyota Motor Engineering & Manufacturing North America, Inc. President and COO | ||||||||

| Apr. | 2012 | Toyota Motor Engineering & Manufacturing North America, Inc. President and CEO | ||||||||

| Apr. | 2012 | Toyota Motor North America, Inc. President and COO | ||||||||

| Apr. | 2013 | Retired from Toyota Motor Engineering & Manufacturing North America, Inc. President and CEO | ||||||||

| Apr. | 2013 | Retired from Toyota Motor North America, Inc. President and COO | ||||||||

| Apr. | 2013 | Senior Managing Officer of TMC | ||||||||

| Jun. | 2013 | Member of the Board of Directors and Senior Managing Officer of TMC | ||||||||

| Jun. | 2015 | Executive Vice President of TMC | ||||||||

| Apr. | 2017 | Member of the Board of Directors of TMC (to present) | ||||||||

(important concurrent duties) | ||||||||||

| Director of Hino Motors, Ltd. | ||||||||||

| President, Representative Director of EV C.A. Spirit Corporation | ||||||||||

8

No. | Name (birth date) | Position and areas of responsibility | Brief career summary and important concurrent duties | |||||||

7 | Ikuro Sugawara (3/6/1957) 0 shares Reappointed Outside / Independent | Member of the Board of Directors | Apr. | 1981 | Joined Ministry of International Trade and Industry | |||||

| Jul. | 2010 | Director-General of the Industrial Science and Technology Policy and Environment Bureau, Ministry of Economy, Trade and Industry | ||||||||

| Sep. | 2012 | Director-General of the Manufacturing Industries Bureau, Ministry of Economy, Trade and Industry | ||||||||

| Jun. | 2013 | Director-General of the Economic and Industrial Policy Bureau, Ministry of Economy, Trade and Industry | ||||||||

| Jul. | 2015 | Vice-Minister of Ministry of Economy, Trade and Industry | ||||||||

| Jul. | 2017 | Retired from the Ministry of Economy, Trade and Industry | ||||||||

| Aug. | 2017 | Special Advisor to the Cabinet | ||||||||

| Jun. | 2018 | Retired as Special Advisor to the Cabinet | ||||||||

| Jun. | 2018 | Member of the Board of Directors of TMC (to present) | ||||||||

[Reasons for nomination as a candidate to become an Outside Member of the Board of Directors] Mr. Ikuro Sugawara was involved in policy planning and other operations for many years, holding various posts such as Director-General of the Manufacturing Industries Bureau andVice-Minister of the Ministry of Economy, Trade and Industry. As we would like him to draw on his wealth of experience and wide range of knowledge to add value to the management of the Company, we hereby nominate him as a candidate to continue as an Outside Member of the Board of Directors. Since assuming office, he has played an important role as an Outside Member of the Board of Directors in providing the Company with both management guidelines based on his broad perspective as well as courses of action on how to cope with business risks. | ||||||||||

9

No. | Name (birth date) No. and type of TMC shares owned | Position and areas of responsibility | Brief career summary and important concurrent duties | |||||||

8 | Sir Philip Craven (7/4/1950) 0 shares Reappointed Outside / Independent | Member of the Board of Directors | Oct. | 1998 | President of the International Wheelchair Basketball Federation | |||||

| Dec. | 2001 | President of the International Paralympic Committee | ||||||||

| Jul. | 2002 | Retired as President of the International Wheelchair Basketball Federation | ||||||||

| Sep. | 2017 | Retired as President of the International Paralympic Committee | ||||||||

| Jun. | 2018 | Member of the Board of Directors of TMC (to present) | ||||||||

[Reasons for nomination as a candidate to become an Outside Member of the Board of Directors] Sir Philip Craven participated in the Paralympic Games as a wheelchair basketball player, and served as President of the International Paralympic Committee. As we would like him to draw on the wide range of experience he has acquired through promoting sports for the disabled and highly specialized knowledge regarding management of international organizations to add value to the management of the Company, we hereby nominate him as a candidate to continue as an Outside Member of the Board of Directors. Since assuming office, he has played an important role as an Outside Member of the Board of Directors in providing the Company with a broad range of thoughts, based on a global perspective or from a diversity-minded perspective, on management guidelines with regards to issues concerning organizational operations and human resource development. | ||||||||||

9 | Teiko Kudo (5/22/1964) common shares Reappointed Outside / Independent | Member of the Board of Directors | Apr. | 1987 | Joined Sumitomo Bank | |||||

| Apr. | 2014 | Executive Officer of Sumitomo Mitsui Banking Corporation | ||||||||

| Apr. | 2017 | Managing Executive Officer of Sumitomo Mitsui Banking Corporation (to present) | ||||||||

| Jun. | 2018 | Member of the Board of Directors of TMC (to present) | ||||||||

(important concurrent duties) | ||||||||||

| Managing Executive Officer of Sumitomo Mitsui Banking Corporation | ||||||||||

[Reasons for nomination as a candidate to become an Outside Member of the Board of Directors] Ms. Teiko Kudo possesses a high level of expertise in financial areas given that she is a Managing Executive Officer of Sumitomo Mitsui Banking Corporation, and we would like her to draw on her wealth of experience and wide range of knowledge to add value to the management of the Company. As such, we hereby nominate her as a candidate to continue as an Outside Member of the Board of Directors. Since assuming office, she has played an important role as an Outside Member of the Board of Directors in providing the Company with thoughts and guidelines with regards to finance and business risk management, etc. | ||||||||||

Notes:

| 1. | The information included in the above table is as of the date of this reference document for this General Shareholders’ Meeting (5/8/2019) except for the information of the number and type of TMC shares owned, which is as of 3/31/2019. |

| 2. | Mr. Akio Toyoda, who is President and Member of the Board of Directors, concurrently serves as Operating Officer (President). |

| 3. | Mr. Koji Kobayashi, Mr. Didier Leroy and Mr. Shigeki Terashi, all of whom are Members of the Board of Directors, concurrently serve as Operating Officers (Executive Vice Presidents). |

10

| 4. | Matters related to the candidates to become Outside Members of the Board of Directors are as follows: |

| (1) | Mr. Ikuro Sugawara, Sir Philip Craven, and Ms. Teiko Kudo are candidates to become Outside Members of the Board of Directors. Each of them is registered as an independent director with the Japanese stock exchanges on which TMC is listed. Upon approval of their reappointment pursuant to this Proposed Resolution, TMC plans to maintain such registration. |

| (2) | Outline of limited liability agreements |

TMC has entered into limited liability agreements with Mr. Ikuro Sugawara, Sir Philip Craven, and Ms. Teiko Kudo to limit the amount of their liabilities as stipulated in Article 423, Paragraph 1 of the Companies Act of Japan (the “Companies Act”) to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act. Upon approval of their reappointment pursuant to this Proposed Resolution, TMC plans to continue such agreements with them.

| (3) | Number of years as Outside Member of the Board of Directors of TMC since assumption of office (as of the conclusion of this General Shareholders’ Meeting) |

Mr. Ikuro Sugawara | 1 year | |

Sir Philip Craven | 1 year | |

Ms.Teiko Kudo | 1 year |

11

Proposed Resolution 2: Election of 4 Audit & Supervisory Board Members

Each of the terms of office of Audit & Supervisory Board Members Mr. Masahiro Kato, Mr. Yoshiyuki Kagawa, Ms. Yoko Wake and Mr. Hiroshi Ozu will expire upon the conclusion of this General Shareholders’ Meeting. Accordingly, we hereby request that 4 Audit & Supervisory Board Members be elected. The candidates for the positions of Audit & Supervisory Board Members are as follows:

The submission of this proposal at this General Shareholders’ Meeting was approved by the Audit & Supervisory Board.

Following are the nominees

No. | Name (birth date) No. and type of TMC | Position | Brief career summary and important concurrent duties | |||||||

1 | Haruhiko Kato (7/21/1952) 0 shares Newly appointed | Apr. | 1975 | Joined Ministry of Finance | ||||||

| Jul. | 2007 | Director-General of the Tax Bureau, Ministry of Finance | ||||||||

| Jul. | 2009 | Commissioner of National Tax Agency | ||||||||

| Jul. | 2010 | Retired from Commissioner of National Tax Agency | ||||||||

| Jan. | 2011 | Senior Managing Director of Japan Securities Depository Center, Inc. | ||||||||

| Jun. | 2011 | President of Japan Securities Depository Center, Inc. | ||||||||

| Jun. | 2013 | Member of the Board of Directors of TMC (to present) | ||||||||

| Jul. | 2015 | President and CEO of Japan Securities Depository Center, Inc. | ||||||||

| Jun. | 2018 | Retired as Member of the Board of Directors of TMC | ||||||||

| Apr. | 2019 | Director of Japan Securities Depository Center, Inc. (to present) | ||||||||

(important concurrent duties) | ||||||||||

| Director of Japan Securities Depository Center, Inc. | ||||||||||

| Outside Director of Canon Inc. | ||||||||||

2 | Katsuyuki Ogura (1/25/1963) 4,391 common shares Newly appointed | General Manager of Audit & Supervisory Board Office | Apr. | 1985 | Joined TMC | |||||

| Jan. | 2015 | General Manager of Affiliated Companies Finance Dept. of TMC | ||||||||

| Jan. | 2018 | General Manager of Audit & Supervisory Board Office of TMC (to present) | ||||||||

12

No. | Name (birth date) No. and type of TMC | Position | Brief career summary and important concurrent duties | |||||||

3 | Yoko Wake (11/18/1947) 0 shares Reappointed Outside / Independent | Outside Audit & Supervisory Board Member | Apr. | 1970 | Joined Fuji Bank, Limited | |||||

| Dec. | 1973 | Retired from Fuji Bank, Limited | ||||||||

| Apr. | 1977 | Assistant Lecturer of Faculty of Business and Commerce of Keio University | ||||||||

| Apr. | 1982 | Associate Professor of Faculty of Business and Commerce of Keio University | ||||||||

| Apr. | 1993 | Professor of Faculty of Business and Commerce of Keio University | ||||||||

| Jun. | 2011 | Outside Audit & Supervisory Board Member of TMC (to present) | ||||||||

| Apr. | 2013 | Professor Emeritus of Keio University (to present) | ||||||||

(important concurrent duties) | ||||||||||

| Professor Emeritus of Keio University | ||||||||||

[Reasons for nomination as a candidate to become an Outside Audit & Supervisory Board Member] Ms. Yoko Wake possesses deep knowledge and extensive experience in the areas of international and environmental economics. As such, we believe she is capable of adequately executing her duties and hereby nominate her as a candidate to continue as an Outside Audit & Supervisory Board Member. Since assuming office, she has played an important role as an Outside Audit & Supervisory Board Member by expressing valuable thoughts on TMC’s environmental initiatives as well as its efforts to realize a sustainable society. | ||||||||||

4 | Hiroshi Ozu (7/21/1949) 73 common shares Reappointed Outside / Independent | Outside Audit & Supervisory Board Member | Jul. | 2012 | Prosecutor-General | |||||

| Jul. | 2014 | Retired from Prosecutor-General | ||||||||

| Sep. | 2014 | Registered as Attorney | ||||||||

| Jun. | 2015 | Outside Audit & Supervisory Board Member of TMC (to present) | ||||||||

(important concurrent duties) | ||||||||||

| Attorney | ||||||||||

| Outside Audit & Supervisory Board Member of Mitsui & Co., Ltd. | ||||||||||

| Audit & Supervisory Board Member (External) of Shiseido Company, Limited | ||||||||||

[Reasons for nomination as a candidate to become an Outside Audit & Supervisory Board Member] Mr. Hiroshi Ozu has served as Prosecutor-General and in other important roles and possesses a wealth of experience and highly specialized knowledge in the legal profession. As such, we believe he is capable of adequately executing his duties and hereby nominate him as a candidate to continue as an Outside Audit & Supervisory Board Member. Since assuming office, he has played an important role as an Outside Audit & Supervisory Board Member by providing appropriate advice regarding TMC’s initiatives relating to corporate governance and risk management. | ||||||||||

Notes:

| 1. | The information included in the above table is as of the date of this reference document for this General Shareholders’ Meeting (5/8/2019) except for the information of the number and type of TMC shares owned, which is as of 3/31/2019. |

13

| 2. | Matters related to the candidates to become Outside Audit & Supervisory Board Members are as follows: |

| (1) | Ms. Yoko Wake and Mr. Hiroshi Ozu are candidates to become Outside Audit & Supervisory Board Members. Each of them is registered as Independent Audit & Supervisory Board Members with the Japanese stock exchanges on which TMC is listed. Upon approval of their reappointment pursuant to this Proposed Resolution, TMC plans to maintain such registration. |

| (2) | Outline of limited liability agreements |

TMC has entered into limited liability agreements with Ms. Yoko Wake and Mr. Hiroshi Ozu to limit the amount of their liabilities as stipulated in Article 423, Paragraph 1 of the Companies Act to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act. Upon approval of their reappointment pursuant to this Proposed Resolution, TMC plans to continue such agreements with them.

| (3) | Number of years as Outside Audit & Supervisory Board Members of TMC since assumption of office (as of the conclusion of this General Shareholders’ Meeting) |

Ms. Yoko Wake | 8 years | |

Mr. Hiroshi Ozu | 4 years |

14

Proposed Resolution 3: Election of 1 Substitute Audit & Supervisory Board Member

In order to be prepared in the event that TMC lacks the number of Audit & Supervisory Board Members and it becomes less than that required by laws and regulations, we hereby request that 1 Substitute Audit & Supervisory Board Member be elected. The candidate for the position of a Substitute Audit & Supervisory Board Member is as below.

This proposal is made to elect a substitute for the current Outside Audit & Supervisory Board Member Mr. Nobuyuki Hirano as well as for Ms. Yoko Wake and Mr. Hiroshi Ozu subject to the approval of Proposed Resolution 2. In the event the candidate becomes an Audit & Supervisory Board Member, his term of office shall be the remaining part of his predecessor’s term.

This resolution shall be effective until the commencement of the next Ordinary General Shareholders’ Meeting, provided, however, that this resolution may be cancelled before the proposed Substitute Audit & Supervisory Board Member assumes office, by a resolution of the Board of Directors, subject to the approval of the Audit & Supervisory Board.

The submission of this proposal at this General Shareholders’ Meeting was approved by the Audit & Supervisory Board.

Following is the nominee

No. | Name (birth date) No. and type of TMC shares owned | Position | Brief career summary and important concurrent duties | |||||||

1 | Ryuji Sakai (8/7/1957) 0 shares Reappointed | Substitute Audit & Supervisory Board Member | Apr. | 1985 | Registered as attorney Joined Nagashima & Ohno | |||||

| Sep. | 1990 | Worked at Wilson Sonsini Goodrich & Rosati (located in U.S.) | ||||||||

| Jan. | 1995 | Partner, Nagashima & Ohno | ||||||||

| Jan. | 2000 | Partner, Nagashima Ohno & Tsunematsu (to present) | ||||||||

(important concurrent duties) Attorney | ||||||||||

| Outside Audit & Supervisory Board Member of Kobayashi Pharmaceutical Co., Ltd. | ||||||||||

| Outside Audit & Supervisory Board Member of Tokyo Electron Limited | ||||||||||

[Reasons for nomination as a candidate to become a Substitute Outside Audit & Supervisory Board Member] Mr. Ryuji Sakai possesses a wealth of experience and highly specialized knowledge acquired through his many years of activities mainly related to corporate legal matters including advisory services on corporate overseas expansion, overseas investment and other international transactions, and advisory services on various legal matters such as antitrust law, intellectual property rights, capital raising and M&A. As such, we believe that he is capable of adequately executing his duties and hereby nominate him as a candidate to continue as a Substitute Outside Audit & Supervisory Board Member. | ||||||||||

Notes:

| 1. | The information included in the above table is as of the date of this reference document for this General Shareholders’ Meeting (5/8/2019) except for the information of the number and type of TMC shares owned, which is as of 3/31/2019. |

| 2. | Matters related to the candidate to become a Substitute Outside Audit & Supervisory Board Member are as follows: |

| (1) | Mr. Ryuji Sakai is a candidate to become a Substitute Outside Audit & Supervisory Board Member. |

15

| (2) | Outline of limited liability agreement |

Upon approval of his election pursuant to this Proposed Resolution and his assumption of office as an Audit & Supervisory Board Member, TMC plans to enter into a limited liability agreement with him to limit the amount of his liability as stipulated in Article 423, Paragraph 1 of the Companies Act to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act.

16

Proposed Resolution 4: Determination of Compensation for Granting Restricted Shares to Members of the Board of Directors (excluding Outside Members of the Board of Directors) and Revision of the Amount of Compensation Payable to Members of the Board of Directors

Compensation payable to Members of the Board of Directors has been set at a maximum total of 4.0 billion yen per year (of which, the maximum amount payable to Outside Members of the Board of Directors is 0.3 billion yen per year; hereinafter “Cash Compensation”) since the 113th Ordinary General Shareholders’ Meeting held on June 14, 2017.

This proposal is made, as part of a review of the executive compensation system, with the aim of encouraging Members of the Board of Directors (excluding Outside Members of the Board of Directors; hereinafter “Eligible Members of the Board of Directors”) to work to improve the medium- to long-term corporate value of TMC, and for each Eligible Member of the Board of Directors to promote management from the same viewpoint as our shareholders with a stronger sense of responsibility as a corporate manager. In addition to revising the Cash Compensation above, we also propose the establishment of a new compensation for granting restricted shares (hereinafter “Share Compensation”).

With regard to the Cash Compensation and Share Compensation, in order to enable the setting of compensation levels that will allow TMC to secure and retain talented personnel, and in consideration of the balance between the two types of compensation, the maximum Cash Compensation of 4.0 billion yen per year will be reduced to a maximum of 3.0 billion yen per year (of which, the maximum amount payable to Outside Members of the Board of Directors is 0.3 billion yen per year), and the new Share Compensation will be set at a maximum of 4.0 billion yen per year.

Upon approval of this proposed resolution, the composition of the compensation payable to Members of the Board of Directors (excluding compensation payable to Members of the Board of Directors as officers or employees, for those who serve concurrently as officers or employees) will be as shown in the table below.

<Compositions of Compensation to Members of the Board of Directors>

Compensation Composition | Amount of Compensation | |||

Monthly Compensation | Amount of Cash Compensation | Maximum of 3.0 billion yen per year (of which, the maximum amount payable to Outside Members of the Board of Directors is 0.3 billion yen per year) | ||

Bonus | ||||

Share Compensation | Amount of Share Compensation | Maximum of 4.0 billion yen per year | ||

| Total | Maximum of 7.0 billion yen per year (of which, the maximum amount payable to Outside Members of the Board of Directors is 0.3 billion yen per year) | |||

The decision on the compensation payable to each Member of the Board of Directors will be entrusted by the Board of Directors within the abovementioned maximum total amount per year to the “Executive Compensation Meetings” in which half of the members are Outside Members of the Board of Directors, and will be made taking into consideration such factors as corporate results as well as the duties and performance of the Member of the Board of Directors. We will continue to fulfill our accountability to shareholders with regard to executive compensation and corporate results by disclosing these details in the business reports and annual securities reports in accordance with laws and regulations and by explaining our initiatives for realizing the Toyota Global Vision at the general shareholders’ meetings of TMC.

Number of the Board of Directors will be 9 Members (including 3 Outside Members of the Board of Directors) if Proposed Resolution 1 is approved as proposed.

17

< Details of the Restricted Share Compensation Plan>

The major terms of the restricted share compensation plan are as detailed below. Other matters related to this compensation plan and the restricted share allotment agreement shall be determined by the Board of Directors of TMC.

Eligible persons | Members of the Board of Directors of TMC (excluding Outside Members of the Board of Directors) | |

Total amount of Share Compensation | Maximum of 4.0 billion yen per year | |

Amount of share compensation payable to each Member of the Board of Directors | Set each year considering factors such as corporate results, duties and performance | |

Type of shares to be allotted and method of allotment | Issue or disposal of common shares (with transfer restrictions under an allotment agreement) | |

| Total number of shares to be allotted | Maximum of 800,000 shares per year in total to Eligible Members of the Board of Directors | |

| Amount to be paid | Determined by the Board of Directors of TMC based on the closing price of TMC’s common shares on the Tokyo Stock Exchange on the business day prior to each resolution of the Board of Directors, within a range that is not particularly advantageous to Eligible Members of the Board of Directors | |

| Transfer restriction period | A period of between three and fifty years, as predetermined by the Board of Directors of TMC | |

Conditions for removal of transfer restrictions | Restrictions will be removed upon the expiration of the transfer restriction period. However, restrictions will also be removed in the case of expiration of the term of office, death or other legitimate reasons. | |

Gratis acquisition by TMC | TMC will be able to acquire all allotted shares without consideration in the case of violations of laws and regulations or other reasons specified by the Board of Directors of TMC during the transfer restriction period. | |

(Reference)

Subject to approval of Proposed Resolution 4 as proposed, we plan to apply a restricted share compensation plan similar to that above to Operating Officers of TMC as well.

18

Attachment to the Notice of Convocation of the 115th Ordinary General Shareholders’ Meeting

Business Report (Fiscal Year under review: April 1, 2018 through March 31, 2019)

1. Outlook of Associated Companies

(1) Progress and Achievement in Operation

General Economic Environment in FY2019

Reviewing the general economic environment for the fiscal year ended March 2019 (“FY2019”), the world economy overall has continued its moderate recovery despite the sluggish growth in some sectors. The Japanese economy has also been on a moderate recovery due to improvements in employment and income conditions.

Automotive markets have remained stable in developed countries, but have slowed down in China, which had been experiencing continued expansion, as well as in some resource-rich countries.

Overview of Operations

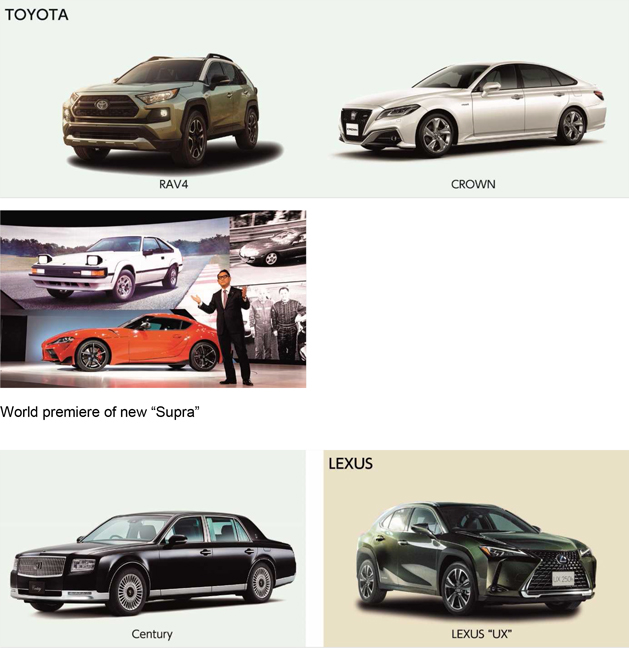

In this business environment, the Toyota group has been striving to make “ever-better cars” that exceed customer expectations. We have completely remodeled “RAV4,” one of Toyota’s core global models, by introducing a new platform and powertrain units based on the TNGA (Toyota New Global Architecture), and were able to achieve responsive driving as well as a powerful and sophisticated design. We also completely redesigned the “Crown,” and newly launched the “Corolla Sport,” as first-generation connected vehicles that propose a life of new mobility. Furthermore, we redesigned the “Century,” a model that has remained a favorite of many users for more than 50 years, with significantly improved ride comfort and cruising stability, while carrying on the tradition of master craftsmanship and high-qualitymonozukuri(all-encompassing manufacturing). In addition, to respond to the rising demand for passenger transportation centered around emerging markets, we have added a new series to the “Hiace” model, for overseas markets. The Lexus brand commenced sales of the “ES” for the first time in Japan, which model has helped establish the brand as its core product in many other countries and regions. It also introduced the “UX,” a compact crossover designed for the modern urban explorer, as a new addition to its lineup. We also premiered ourall-new “Supra,” the first global model of the “GR” series, at the North American International Auto Show, implementing the knowledge we have gained in motorsports activities to our product development.

In this way, we have actively improved the product lineup to further meet customer needs and carried out vigorous sales efforts in collaboration with dealers in each country and region in which we operate. As a result, global vehicle sales for FY2019, including the Daihatsu and Hino brands, increased by 162 thousand units (or 1.5%) from FY2018 to 10,603 thousand units. Furthermore, in February 2019, we reached cumulative global Lexus brand sales of 10 million units. Going forward, we will continue to accelerate local production and development, including in the U.S. and China, in order to contribute to countries and regions around the world.

19

Innon-automotive operations, for our financial services, besides providing sales finance as a tool for promoting automobile sales, we have also worked to enhance our value chain to create added value in our financial services operations at all stages of the life cycle of our cars from manufacturing to disposal. For our housing business, we are implementing efforts to enhance our TQM (Total Quality Management) activities with a view to realize our customers’ ideal lifestyles, and in October 2018, won the Deming Prize, one of the highest awards in quality management in the world.

20

Consolidated Financial Results for FY2019

For FY2019, consolidated net revenues increased by 846.1 billion yen (or 2.9%) to 30,225.6 billion yen compared with FY2018 and consolidated operating income increased by 67.6 billion yen (or 2.8%) to 2,467.5 billion yen compared with FY2018, mainly thanks to profit improvement activities such as cost reduction and marketing efforts. Consolidated net income attributable to Toyota Motor Corporation decreased by 611.1 billion yen (or 24.5%) to 1,882.8 billion yen compared with FY2018.

The breakdown of consolidated net revenues is as follows:

| Yen in millions unless otherwise stated | ||||||||||||||||

| FY2019 (April 2018 through March 2019) | FY2018 (April 2017 through March 2018) | Increase (Decrease) | Change (%) | |||||||||||||

Vehicles | 23,066,190 | 22,631,201 | 434,989 | 1.9 | ||||||||||||

Parts and components for overseas production | 625,483 | 498,802 | 126,681 | 25.4 | ||||||||||||

Parts and components for after service | 2,093,437 | 2,044,104 | 49,333 | 2.4 | ||||||||||||

Other | 1,249,382 | 1,173,122 | 76,260 | 6.5 | ||||||||||||

Total Automotive | 27,034,492 | 26,347,229 | 687,263 | 2.6 | ||||||||||||

Financial Services | 2,120,343 | 1,959,234 | 161,109 | 8.2 | ||||||||||||

Other | 1,070,846 | 1,073,047 | (2,201 | ) | (0.2 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Total | 30,225,681 | 29,379,510 | 846,171 | 2.9 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Notes:

| 1. | Consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles. |

| 2. | The amounts represent net revenues from external customers. |

| 3. | Net revenues do not include consumption taxes, etc. |

(2) Funding

Funds necessary for the automotive business are mainly financed with funds from business operations. Funds necessary for the financial services business are mainly financed through the issuance of bonds and medium-term notes, as well as with borrowings. The balance of debt as of the end of FY2019 was 20,150.1 billion yen.

(3) Capital Expenditures and R&D

As for capital expenditures, the Toyota group has promoted activities to decrease expenditures through effective use of our existing facilities and prioritization of individual projects. At the same time, we made investments in areas such as the remodeling of cars and the improvement of technological capabilities and productivity to strengthen our competitiveness. As a result, consolidated capital expenditures for FY2019 were 1,465.8 billion yen.

21

As for R&D expenditures, we aspired to reinforce advanced development for the future in new fields such as vehicle electrification and automated driving while also endeavoring to improve development efficiency. As a result, consolidated R&D expenditures for FY2019 were 1,048.8 billion yen.

(4) Consolidated Financial Summary

| Yen in millions unless otherwise stated | ||||||||||||||||

| FY2016 (April 2015 through March 2016) | FY2017 (April 2016 through March 2017) | FY2018 (April 2017 through March 2018) | FY2019 (April 2018 through March 2019) | |||||||||||||

Net revenues | 28,403,118 | 27,597,193 | 29,379,510 | 30,225,681 | ||||||||||||

Operating income | 2,853,971 | 1,994,372 | 2,399,862 | 2,467,545 | ||||||||||||

Net income attributable to Toyota Motor Corporation | 2,312,694 | 1,831,109 | 2,493,983 | 1,882,873 | ||||||||||||

Net income attributable to Toyota Motor Corporation | 741.36 | 605.47 | 842.00 | 650.55 | ||||||||||||

Mezzanine equity and Shareholders’ equity | 18,088,186 | 18,668,953 | 19,922,076 | 20,565,210 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total assets | 47,427,597 | 48,750,186 | 50,308,249 | 51,936,949 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

(5) Issues to be Addressed

The future automotive market is expected to revert to a gradual expansion in the medium term, due in part to the wider use of cars mainly in emerging countries, despite entering a phase of cyclical changes in the short term. Meanwhile, the automotive industry is entering aonce-in-a-century transformational period in response to environmental issues and other social challenges, as well as the rapid progress in technological innovation such as electrification, automated driving, connected vehicles andcar-sharing. In such a business environment, the Toyota group will leverage its collective strength amassed in vehicle quality and in sales and service networks in the real world, as well as its capabilities in responding to technological innovation in the virtual world, to transform itself into a mobility company that provides all kinds of services related to transportation. To this end, we intend to accelerate activities in the following fields to pursue our objective of “challenging for the future” to create new value and “growing steadily each year” to strengthen true competitiveness year by year.

22

1) Electrification

he electrification of vehicles is imperative to address environmental issues. The Toyota group aims to provide the most suitable vehicles that match customer preferences in light of the energy and infrastructure development situation in each country and region, as well as the characteristics ofeco-cars, based on the stance thateco-cars can only truly have a significant positive impact if they are widely used. For hybrid electric vehicles, which are our main type of electrified vehicles, we will not only further improve the fuel efficiency, cost and driving performance of the conventional Toyota Hybrid System, but will also develop various types of vehicles including sports models with superior acceleration performance. Furthermore, with the aim of sharing our goals with numerous stakeholders and to cooperatively promote the further use of electrified vehicles, we decided to grant royalty-free licenses on patents we hold for vehicle electrification-related technologies we have cultivated through hybrid electric vehicle development. For battery electric vehicles, we will accelerate their introduction from 2020, starting with the Chinese market, and will expand the lineup to 10 or more models globally by early 2020s. As for fuel cell electric vehicles, in addition to expanding the product lineups for passenger vehicles and commercial vehicles, we will also deploy our fuel cell technology in various sectors in collaboration with a wide range of stakeholders including the Japan Aerospace Exploration Agency (JAXA). Moreover, in the area of automotive batteries, which is the key factor for the popularization of electrified vehicles, we agreed to establish a joint venture with Panasonic Corporation to strengthen and accelerate efforts to achieve competitive batteries.

We will further accelerate technological developments to realize a sustainablelow-carbon society, with the aspirational goal of achieving “global annual sales of more than 5.5 million electrified vehicles in 2030.”

C-HR and IZOA battery electric vehicles that are slated to start from 2020 in China

2) Automated driving

Since the 1990s, the Toyota group has continuously engaged in automated driving technology R&D aimed at contributing to the complete elimination of traffic casualties. The development philosophy, “Mobility Teammate Concept” is an approach built on the belief that people and vehicles can work together in the service of safe, convenient, and efficient mobility.

Toyota Research Institute, Inc., which is engaged in the research and development of artificial intelligence as the underpinning technology for automated driving, launched a global program to offer support to promising startups in partnership with a venture capital fund established in 2017. The company also opened a test facility to develop automated vehicle technology in Michigan, U.S. and has since unveiled the“TRI-P4” automated driving test vehicle, accelerating its automated driving system development. Advanced development is now underway on software to enable its commercialization by Toyota Research Institute - Advanced Development, Inc., which has commenced full-fledged operations. Furthermore, to enable customers to use the achievements from our research of automated driving technology widely, we have proceeded with the introduction of a preventive safety package, and in 2018, the number of vehicles equipped with this package around the world topped the 10 million unit mark.

We are working on the development and popularization of automated driving technology with the ultimate aim of providing all people with safe, convenient, and enjoyable mobility.

23

3) MaaS (Mobility as a Service)

The Toyota group is promoting the MaaS business to offer customers a variety of mobility options.

We concluded an agreement with Grab Holdings Inc. to deepen collaboration in the mobility services area, and began offering the Total-care Service developed by Toyota Motor Corporation to vehicles owned by ride-hailing service companies. We also agreed to expand our collaboration aimed at advancing autonomous ride-sharing services with Uber Technologies, Inc. Furthermore, we agreed to form a strategic partnership to facilitate the creation of new mobility services with SoftBank Corp. and established a joint venture company, MONET Technologies Inc.

As society shifts from owning cars to using cars, we started abeloved-car subscription service called “KINTO” to enable customers to more freely enjoy cars. Through a monthlyfixed-sum service that packages not only the cost of the vehicle but procedures such as tax and insurance payments as well as vehicle maintenance, we will propose a newuser-car relationship.

With respect to initiatives in Japan, we are working to transform our sales network, including making all vehicle models of Toyota brand available through all Toyota sales outlets in Japan, to respond to the various needs of customers together with the sales companies. Through these efforts, we will develop and provide new, locally-rooted mobility services and aim to become an indispensable presence in local communities.

Agreement reached on strategic partnership with SoftBank Corp.

4) Creating friends and allies

The Toyota group’s strategy to create friends and allies has three main pillars.

The first is to strengthen ties with group companies that have the same roots as Toyota. From a “home and away” perspective, this involves the reorganization of businesses within the Toyota group to consolidate duplicated functions into more competitive “home” companies, and the establishment of new companies within the group by bringing together each group company’s strength. At the same time, we have to increase the number of friends and allies, and create de facto standards by actively selling competitive products to companies inside and outside the group. Based on this idea, we are pressing ahead with the drive to consolidate the core electronic component operations of both Toyota Motor Corporation (TMC) and DENSO CORPORATION (DENSO) into DENSO, transfer sales & marketing operations for Africa conducted by TMC to Toyota Tsusho Corporation, and transfer TMC’s van business to Toyota Auto Body Co., Ltd.

24

The second pillar is strengthening alliances with other automakers. The purpose of these alliances is not to become bigger through investment. The objective is to enhance competitiveness with an aim to make “ever-better cars,” respecting each other’s strengths in technological development, production engineering, and sales networks. In March 2019, we concluded an agreement with SUZUKI MOTOR CORPORATION (SUZUKI) to collaborate in new fields, such as joint collaboration in production and in the widespread popularization of electrified vehicles, bringing together our strength in electrification technologies and SUZUKI’s strength in technologies for compact vehicles.

The third pillar is strengthening alliances with new friends and allies that are providing mobility services. We aim to create new mobility services, openly partnering with various service providers such as SoftBank Corp., Grab Holdings Inc. and Uber Technologies, Inc., via the “Mobility Services Platform,” an information infrastructure for connected vehicles.

5) Cost reduction and Toyota Production System (TPS)

To strengthen our true competitiveness, we are thoroughly honing our TPS and approach to cost reduction, which are components of our corporate DNA that have been passed down from our predecessors as our strengths.

Our “cost reduction” does not simply refer to cutting budgets and costs uniformly. Rather, it stands for cost planning by checking real blueprints, actual products and manufacturing sites, thoroughly eliminating waste, and changing the way we work to improve productivity. We will come up with ideas with the participation of all executives and employees, and work to reduce outlays and waste from all stages of the manufacturing process with passion and a spirit of getting better and better, to develop the human resources we will need to survive in the future and strengthen our corporate structure.

In addition, we are instilling TPS not only at production sites but also in administrative and engineering divisions, and are implementing company-wide awareness-raising and improvement activities. For example, the Accounting Division is working with the TPS Group, which was newly established in January 2018, in reviewing its account settlement operations to identify waste and effect improvements. We will aim for a company-wide application of TPS by continuing to steadily implement similar efforts in each division and sharing best practices across the company.

6) Human resources system

We have continually restructured the organization and reviewed our executive lineups in order to further promote the “development of human resources” and the “innovation of the way we work” which support the activities mentioned above. Due to other industries entering the market and rapid technological innovation, structural changes are taking place in today’s automotive industry at an unprecedented speed and scale.

25

Under these circumstances, in January 2019, we reduced the number of layers in our executive structure. Executives are now composed of former senior managing officers and people of higher rank, whereas former managing officers, executive general managers, senior managers and others are now classified as “senior professional/senior management.” By appointing the right people to the right positions in a wide range of posts, regardless of their age or length of employment, we will enable them to reach conclusions more swiftly, make prompt decisions, and take immediate action in responding to management issues as they arise. We will also reinforce our efforts to cultivate professionals who combine expertise and “human competencies” in the workplace.

To advance these initiatives, at Toyota group, we will stay true to our founding spirit of “contributing to society by Monozukuri, manufacturing,” and will move forward through the united efforts of our executives and employees with humility, gratitude and passion, placing top priority on quality and safety. We sincerely hope that our shareholders will continue to extend their patronage and support to us.

26

(6) Policy on Distribution of Surplus by Resolution of the Board of Directors

TMC deems the benefit of its shareholders as one of its priority management policies, and it continues to work to improve its corporate structure to realize sustainable growth in order to enhance its corporate value.

TMC will strive for the stable and continuous payment of dividends considering a consolidated payout ratio of 30% to shareholders of common stock as an indication. In addition, TMC will pay a prescribed amount of dividends to shareholders of First Series Model AA Class Shares.

With regard to the repurchase of shares of our common stock, TMC will flexibly repurchase its common stock while comprehensively considering factors such as its cash reserves and the price level of its common stock in order to promote capital efficiency.

In order to survive tough competition, TMC will utilize its internal funds mainly for the early commercialization of technologies for next-generation environment and safety, giving priority to customer safety and security.

27

(7) Main Business

The Toyota group’s business segments are automotive operations, financial services operations and all other operations.

Business | Main products and services | |

Automotive Operations | Vehicles (passenger vehicles, trucks and buses, and mini-vehicles), Parts & components for overseas production, Parts, etc. | |

Financial Services Operations | Auto sales financing, Leasing, etc. | |

Other Operations | Housing, Information Technology, etc. | |

(8) Main Sites

<TMC>

Name | Location | |

Head Office |

Aichi Prefecture | |

Tokyo Head Office | Tokyo | |

Nagoya Office | Aichi Prefecture | |

Honsha Plant | Aichi Prefecture | |

Motomachi Plant | Aichi Prefecture | |

Kamigo Plant | Aichi Prefecture | |

Takaoka Plant | Aichi Prefecture | |

Miyoshi Plant | Aichi Prefecture | |

Tsutsumi Plant | Aichi Prefecture | |

Myochi Plant | Aichi Prefecture | |

Shimoyama Plant | Aichi Prefecture | |

Kinu-ura Plant | Aichi Prefecture | |

Tahara Plant | Aichi Prefecture | |

Teiho Plant | Aichi Prefecture | |

Hirose Plant | Aichi Prefecture | |

Higashi-Fuji Technical Center | Shizuoka Prefecture |

<Domestic and overseas subsidiaries>

Please see section “(10) Status of Principal Subsidiaries.”

(9) Employees

Number of employees | Increase (Decrease) from end of FY2018 | |

370,870 |

+ 1,746 |

28

(10) Status of Principal Subsidiaries

Company name | Location | Capital/ Subscription | Percentage ownership interest | Main business | ||||||||

| million yen | ||||||||||||

| Japan | Toyota Financial Services Corporation | Aichi Prefecture | 78,525 | 100.00 | Management of domestic and overseas financial companies, etc. | |||||||

| Hino Motors, Ltd. | Tokyo | 72,717 | 50.21 | * | Manufacture and sales of automobiles | |||||||

| Toyota Motor Kyushu, Inc. | Fukuoka Prefecture | 45,000 | 100.00 | Manufacture and sales of automobiles | ||||||||

| Daihatsu Motor Co., Ltd. | Osaka Prefecture | 28,404 | 100.00 | Manufacture and sales of automobiles | ||||||||

| Toyota Finance Corporation | Aichi Prefecture | 16,500 | 100.00 | * | Finance of automobile sales, Card business | |||||||

| Misawa Homes Co., Ltd. | Tokyo | 11,892 | 51.00 | * | Manufacture and sales of housing | |||||||

| Toyota Auto Body Co., Ltd. | Aichi Prefecture | 10,371 | 100.00 | Manufacture and sales of automobiles | ||||||||

| Toyota Motor East Japan, Inc. | Miyagi Prefecture | 6,850 | 100.00 | Manufacture and sales of automobiles | ||||||||

| Daihatsu Motor Kyushu Co., Ltd. | Oita Prefecture | 6,000 | 100.00 | * | Manufacture and sales of automobiles | |||||||

| in thousands | ||||||||||||

| North America | Toyota Motor Engineering & Manufacturing North America, Inc. | U.S.A. | USD 1,958,949 | 100.00 | * | Management of manufacturing companies in North America | ||||||

| Toyota Motor Manufacturing, Kentucky, Inc. | U.S.A. | USD 1,180,000 | 100.00 | * | Manufacture and sales of automobiles | |||||||

| Toyota Motor North America, Inc. | U.S.A. | USD 1,005,400 | 100.00 | * | Management of all North American affiliates | |||||||

| Toyota Motor Credit Corporation | U.S.A. | USD 915,000 | 100.00 | * | Finance of automobile sales | |||||||

| Toyota Motor Manufacturing, Indiana, Inc. | U.S.A. | USD 620,000 | 100.00 | * | Manufacture and sales of automobiles | |||||||

| Toyota Motor Manufacturing, Texas, Inc. | U.S.A. | USD 510,000 | 100.00 | * | Manufacture and sales of automobiles | |||||||

| Toyota Motor Sales, U.S.A., Inc. | U.S.A. | USD 365,000 | 100.00 | * | Sales of automobiles | |||||||

| Toyota Motor Manufacturing de Baja California S .de R.L.de C.V. | Mexico | USD 239,949 | 100.00 | * | Manufacture and sales of automobiles | |||||||

| Toyota Motor Manufacturing Canada Inc. | Canada | CAD 680,000 | 100.00 | Manufacture and sales of automobiles | ||||||||

| Toyota Credit Canada Inc. | Canada | CAD 60,000 | 100.00 | * | Finance of automobile sales | |||||||

| Toyota Canada Inc. | Canada | CAD 10,000 | 51.00 | Sales of automobiles | ||||||||

| in thousands | ||||||||||||

| Europe | Toyota Motor Europe NV/SA | Belgium | EUR 2,524,346 | 100.00 | Management of all European affiliates | |||||||

| Toyota Motor Manufacturing France S.A.S. | France | EUR 71,078 | 100.00 | * | Manufacture and sales of automobiles | |||||||

| Toyota Kreditbank GmbH | Germany | EUR 30,000 | 100.00 | * | Finance of automobile sales | |||||||

| Toyota Motor Finance (Netherlands) B.V. | Netherlands | EUR 908 | 100.00 | * | Loans to overseas Toyota related companies | |||||||

| Toyota Motor Manufacturing (UK) Ltd. | U.K. | GBP 300,000 | 100.00 | * | Manufacture and sales of automobiles | |||||||

| Toyota Financial Services (UK) PLC | U.K. | GBP 119,800 | 100.00 | * | Finance of automobile sales | |||||||

| Toyota Motor Manufacturing Turkey Inc. | Turkey | TRY 150,165 | 90.00 | * | Manufacture and sales of automobiles | |||||||

| OOO“TOYOTA MOTOR” | Russia | RUB 4,875,189 | 100.00 | * | Manufacture and sales of automobiles | |||||||

29

Company name | Location | Capital/ Subscription | Percentage ownership interest | Main business | ||||||||

| in thousands | ||||||||||||

| Asia | Toyota Motor (China) Investment Co., Ltd. | China | USD 118,740 | 100.00 | Sales of automobiles | |||||||

| Toyota Motor Finance (China) Co., Ltd. | China | CNY 3,100,000 | 100.00 | * | Finance of automobile sales | |||||||

| Toyota Kirloskar Motor Private Ltd. | India | INR 7,000,000 | 89.00 | Manufacture and sales of automobiles | ||||||||

| P.T. Astra Daihatsu Motor | Indonesia | IDR 894,370,000 | 61.75 | * | Manufacture and sales of automobiles | |||||||

| PT. Toyota Motor Manufacturing Indonesia | Indonesia | IDR 19,523,503 | 95.00 | Manufacture and sales of automobiles | ||||||||

| Toyota Motor Asia Pacific Pte Ltd. | Singapore | SGD 6,000 | 100.00 | Sales of automobiles | ||||||||

| Toyota Leasing (Thailand) Co., Ltd. | Thailand | THB 15,100,000 | 86.84 | * | Finance of automobile sales | |||||||

| Toyota Motor Thailand Co., Ltd. | Thailand | THB 7,520,000 | 86.43 | Manufacture and sales of automobiles | ||||||||

| Toyota Daihatsu Engineering & Manufacturing Co., Ltd. | Thailand | THB 1,300,000 | 100.00 | * | Production support for entities in Asia | |||||||

| in thousands | ||||||||||||

| Other | Toyota Motor Corporation Australia Ltd. | Australia | AUD 481,100 | 100.00 | Sales of automobiles | |||||||

| Toyota Finance Australia Ltd. | Australia | AUD 120,000 | 100.00 | * | Finance of automobile sales | |||||||

| Toyota Argentina S.A. | Argentina | ARS 260,000 | 100.00 | * | Manufacture and sales of automobiles | |||||||

| Toyota do Brasil Ltda. | Brazil | BRL 709,980 | 100.00 | Manufacture and sales of automobiles | ||||||||

| Toyota South Africa Motors (Pty) Ltd. | South Africa | ZAR 50 | 100.00 | * | Manufacture and sales of automobiles | |||||||

Notes:

| 1. | * Indicates that the ownership interest includes such ratio of the subsidiaries. |

| 2. | The ownership interests are calculated based on the total number of shares issued at the end of the fiscal year. |

30

| (1) | Total Number of Shares Authorized | 10,000,000,000 shares | ||

| (2) | Total Number of Shares Issued | |||

Common shares | 3,262,997,492 shares | |||

First Series Model AA Class Shares | 47,100,000 shares | |||

| (3) | Number of Shareholders | 623,599 | ||

| (4) | Major Shareholders | |||

Name of Shareholders | Number of shares (1,000 shares) | Percentage of shareholding (%) | ||||||||||||||

| Common shares | First series Model AA class shares | Total | ||||||||||||||

Japan Trustee Services Bank, Ltd. | 376,258 | 180 | 376,438 | 13.07 | ||||||||||||

Toyota Industries Corporation | 238,466 | — | 238,466 | 8.28 | ||||||||||||

The Master Trust Bank of Japan, Ltd. | 182,663 | — | 182,663 | 6.34 | ||||||||||||

Nippon Life Insurance Company | 110,813 | 560 | 111,373 | 3.87 | ||||||||||||

JPMorgan Chase Bank, N.A. (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) | 100,932 | — | 100,932 | 3.51 | ||||||||||||

DENSO CORPORATION | 89,915 | — | 89,915 | 3.12 | ||||||||||||

State Street Bank and Trust Company (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) | 86,044 | — | 86,044 | 2.99 | ||||||||||||

Trust & Custody Services Bank, Ltd. | 57,685 | — | 57,685 | 2.00 | ||||||||||||

Mitsui Sumitomo Insurance Company, Limited | 56,811 | — | 56,811 | 1.97 | ||||||||||||

Tokio Marine & Nichido Fire Insurance Co., Ltd. | 51,045 | — | 51,045 | 1.77 | ||||||||||||

| Note: | The percentage of shareholding is calculated after deducting the number of shares of treasury stock (430,558 thousand shares) from the total number of shares issued. |

31

3. Status of Members of the Board of Directors and Audit & Supervisory Board Members

(1) Members of the Board of Directors and Audit & Supervisory Board Members

Name | Position | Areas of responsibility | Important concurrent duties | |||

| Takeshi Uchiyamada | * Chairman of the Board of Directors | - Audit & Supervisory Board Member of TOKAI RIKA CO., LTD. - Audit & Supervisory Board Member of Toyoda Gosei Co., Ltd. - Director of JTEKT Corporation | ||||

Shigeru Hayakawa | * Vice Chairman of the Board of Directors | - Representative Director of Institute for International Economic Studies | ||||

Akio Toyoda | * President, Member of the Board of Directors | - Chief Executive Officer - Chief Branding Officer | - Chairman and CEO of Toyota Motor North America, Inc. - Chairman of TOWA REAL ESTATE Co., Ltd. - Chairman of Japan Automobile Manufacturers Association, Inc. | |||

Koji Kobayashi | * Member of the Board of Directors | - Chief Financial Officer - Chief Risk Officer | - Chairman and Executive Director of TOYOTA Mobility Tokyo Inc. | |||

Didier Leroy | Member of the Board of Directors | - Chief Competitive Officer | - Chairman of Toyota Motor Europe NV/SA - Vice Chairman of Toyota Motor North America, Inc. - Member of the Board of Toyota Tsusho Corporation | |||

Shigeki Terashi | Member of the Board of Directors | - Chief Technology Officer | - Director of Hino Motors, Ltd. - President, Representative Director of EV C.A. Spirit Corporation | |||

Ikuro Sugawara | Member of the Board of Directors | |||||

| Sir Philip Craven | Member of the Board of Directors | |||||

Teiko Kudo | Member of the Board of Directors | - Managing Executive Officer of Sumitomo Mitsui Banking Corporation | ||||

32

Name | Position | Areas of responsibility | Important concurrent duties | |||

Masahide Yasuda | Full-time Audit & Supervisory Board Member | |||||

Masahiro Kato | Full-time Audit & Supervisory Board Member | |||||

Yoshiyuki Kagawa | Full-time Audit & Supervisory Board Member | |||||

Yoko Wake | Audit & Supervisory Board Member | - Professor Emeritus of Keio University | ||||

Hiroshi Ozu | Audit & Supervisory Board Member | - Attorney - Outside Audit & Supervisory Board Member of MITSUI & CO., LTD. - Audit & Supervisory Board Member (External) of Shiseido Company, Limited | ||||

Nobuyuki Hirano | Audit & Supervisory Board Member | - Director, President of Mitsubishi UFJ Financial Group, Inc. - Chairman of the Board of Directors (Representative Director) of MUFG Bank, Ltd. - Director of Morgan Stanley | ||||

Notes:

| 1. | * Representative Director |

| 2. | Mr. Akio Toyoda, who is President, Member of the Board of Directors, concurrently serves as Operating Officer (President). |

| 3. | Mr. Koji Kobayashi, Mr. Didier Leroy and Mr. Shigeki Terashi, all of whom are Members of the Board of Directors, concurrently serve as Operating Officers (Executive Vice Presidents). |

| 4. | Mr. Ikuro Sugawara, Sir Philip Craven and Ms. Teiko Kudo, all of whom are Members of the Board of Directors, are Outside Members of the Board of Directors. They are also Independent Directors as provided by the rules of the Japanese stock exchanges on which TMC is listed. |

| 5. | Ms. Yoko Wake, Mr. Hiroshi Ozu and Mr. Nobuyuki Hirano, all of whom are Audit & Supervisory Board Members, are Outside Audit & Supervisory Board Members. They are also Independent Audit & Supervisory Board Members as provided by the rules of the Japanese stock exchanges on which TMC is listed. |

| 6. | The “Important concurrent duties” are listed chronologically, in principle, based on the dates the executives assumed their present positions. |

| 7. | TOYOTA Mobility Tokyo Inc. was formerly called TOYOTA Tokyo Sales Holdings Inc. before it was renamed on April 1, 2019. |

33

(2) Amount of Compensation to Members of the Board of Directors and Audit & Supervisory Board Members for FY2019

Category | Members of the Board of Directors (incl. Outside Members of the Board of Directors) | Audit & Supervisory Board Members (incl. Outside Audit & Supervisory Board Members) | Total | |||||||||||||||||||||

| No. of persons | Amount (million yen) | No. of persons | Amount (million yen) | No. of persons | Amount (million yen) | |||||||||||||||||||

Compensation to Members of the Board of Directors and Audit & Supervisory Board Members | | 13 (6 | ) | | 688 (97 | ) | | 8 (4 | ) | | 204 (54 | ) | 21 | 892 | ||||||||||

Executive bonus | 6 | 1,257 | 6 | 1,257 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | | 1,945 (97 | ) | | 204 (54 | ) | 2,149 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Notes:

| 1. | The number of persons includes those eligible to receive compensation in FY2019. |

| 2. | The amount of compensation payable to Members of the Board of Directors has been set at a maximum total of 4.0 billion yen per year (of which, the maximum amount payable to Outside Members of the Board of Directors is 0.3 billion yen per year), including monthly compensation and bonuses, by the resolution of the 113th Ordinary General Shareholders’ Meeting held on June 14, 2017. The amount of compensation payable to Audit & Supervisory Board Members has been set at a maximum total of 30 million yen per month by the resolution of the 104th Ordinary General Shareholders’ Meeting held on June 24, 2008. |

| 3. | The amount of executive bonuses above were resolved at the Board of Directors meeting held on May 8, 2019. |

(3) Status of Outside Members of the Board of Directors and Outside Audit & Supervisory Board Members

1) Major activities for FY2019

Category | Name | Attendance of Board of Directors meetings (total attended/total held) | Attendance of Audit & Supervisory Board meetings (total attended/total held) | |||||||

Member of the Board of Directors | Ikuro Sugawara | 13/13 | — | |||||||

Member of the Board of Directors | Sir Philip Craven | 13/13 | — | |||||||

Member of the Board of Directors | Teiko Kudo | 13/13 | — | |||||||

Audit & Supervisory Board Member | Yoko Wake | 16/16 | 16/16 | |||||||

Audit & Supervisory Board Member | Hiroshi Ozu | 16/16 | 16/16 | |||||||

Audit & Supervisory Board Member | Nobuyuki Hirano | 13/13 | 13/13 | |||||||

Note: The total number of meetings held varies due to the difference in the dates of assumption of office.

Each Outside Member of the Board of Directors and Outside Audit & Supervisory Board Member contributed by giving opinions based on his or her experience and insight.

2) Details of Limited Liability Agreements

Agreements between the Outside Members of the Board of Directors or Outside Audit & Supervisory Board Members and TMC to limit liability as stipulated in Article 423, Paragraph 1 of the Companies Act, with the liability limited to the amount stipulated in Article 425, Paragraph 1 of the Companies Act.

34

4. Status of Accounting Auditor

(1) Name of Accounting Auditor

PricewaterhouseCoopers Aarata LLC

(2) Compensation to Accounting Auditor for FY2019

| 1) | Total compensation and other amounts paid by TMC for the services provided in Article 2, Paragraph 1 of the Certified Public Accountants Act of Japan |

600 million yen

| 2) | Total amount of cash and other property benefits paid by Toyota |

1,726 million yen

Notes:

| 1. | The Audit & Supervisory Board examined whether the content of the Accounting Auditor’s audit plan, its execution of duties, basis for calculating the estimated compensation and others were appropriate, and thereupon agreed on the amount of compensation to the Accounting Auditor. |

| 2. | The amount in 1) above includes compensation for audits performed in compliance with the Financial Instruments and Exchange Law. |

| 3. | The amount in 2) above includes compensation for advice and consultation concerning accounting matters and information disclosure that are not included in the services provided in Article 2, Paragraph 1 of the Certified Public Accountants Act of Japan. |

| 4. | Among principal subsidiaries of TMC, Misawa Homes Co., Ltd. and overseas subsidiaries are audited by certified public accountants or audit firms other than PricewaterhouseCoopers Aarata LLC. |

(3) Policy regarding decisions on the dismissal ornon-reappointment of the Accounting Auditor

If an Accounting Auditor falls under any of the items of Article 340, Paragraph 1 of the Companies Act and the Accounting Auditor’s dismissal is accordingly deemed to be appropriate, the Audit & Supervisory Board shall dismiss the Accounting Auditor with the unanimous consent of the Audit & Supervisory Board Members.

If any event or situation that hinders an Accounting Auditor from appropriately executing its duties is deemed to have occurred, the Audit & Supervisory Board shall determine the content of a proposal for the dismissal ornon-reappointment of the Accounting Auditor to be submitted to the General Shareholders’ Meeting.

35

5. System to Ensure the Appropriateness of Business Operations and Outline of Implementation Status of Such Systems

Basic understanding of system to ensure appropriateness of business operations

TMC, together with its subsidiaries, has created and maintained a sound corporate climate based on the “Guiding Principles at Toyota” and the “Toyota Code of Conduct.” TMC integrates the principles of problem identification and continuous improvement into its business operation process and makes continuous efforts to train employees who will put these principles into practice.

System to ensure the appropriateness of business operations and outline of implementation status of such systems

TMC has endeavored to establish a system for ensuring the appropriateness of business operations as a corporate group and the proper implementation of that system in accordance with the “Basic Policies on Establishing Internal Controls.” Each business year, TMC inspects the establishment and implementation of internal controls to confirm that the organizational units responsible for implementing internal controls are functioning autonomously and are enhancing internal controls as necessary, and findings from the inspection are reviewed at Sustainability Meetings and the Board of Directors’ meetings.

| (1) | System to ensure that Members of the Board of Directors execute their responsibilities in compliance with relevant laws and regulations and the Articles of Incorporation |

[System]

| 1) | TMC will ensure that Members of the Board of Directors act in compliance with relevant laws and regulations and the Articles of Incorporation, based on the Code of Ethics and other explanatory documents that include necessary legal information, presented on occasions such as trainings for new Members of the Board of Directors. |