IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF KANSAS

KANSAS CITY DIVISION

| IN RE: ) | |

| ) | Case No. 11-20140-11-rdb |

| DIGITAL SYSTEMS, INC. ) | Chapter 11 |

| Debtor. ) | |

_______________________________) | |

| | |

DEBTOR'S STANDARD MONTHLY OPERATING REPORT (BUSINESS)

FOR THE PERIOD

FROM July 1, 2011 TO July 31, 2011

Comes now the above-named debtor and files its Monthly Operating Reports in accordance with the Guidelines established by the United States Trustee and FRBP 2015.

| | /s/ Joanne B. Stutz |

| | Attorney for Debtor’s Signature |

| Debtor's Address | Attorney's Address |

| and Phone Number: | and Phone Number: |

15621 W. 87th Street, Box 355 Lenexa, KS 66219 | 7225 Renner Road, Suite 200 Shawnee, KS 66217 (913) 962-8700; (913) 962-8701 (FAX) |

Note: The original Monthly Operating Report is to be filed with the court and a copy simultaneously provided to the United States Trustee Office. Monthly Operating Reports must be filed by the 21st day of the following month.

For assistance in preparing the Monthly Operating Report, refer to the following resources on the United States Trustee Program Website, http://www.justice.gov/ust/r20/index.htm.

| 1) | Instructions for Preparations of Debtor’s Chapter 11 Monthly Operating Report |

| 2) | Initial Filing Requirements |

| 3) | Frequently Asked Questions (FAQs)http://www.usdoj.gov/ust/ |

SCHEDULE OF RECEIPTS AND DISBURSEMENTS

FOR THE PERIOD BEGINNING July 1, 2011 and ending July 31, 2011

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Date of Petition: January 21, 2011

| | | | | Current | | | | Cumulative | | |

| | | | | Month | | | | to Petition Date | | |

| | | | | | | | | | | |

| 1. FUNDS AT BEGINNING OF PERIOD | | $ | 205,895.33 | | (a) | | $ | 24,201.83 | | (b) |

| 2. RECEIPTS: | | | | | | | | | | |

| | | A. Cash Sales | | | | | | | | - | | |

| | | Minus: Cash Refunds | | | | | | | | - | | |

| | | Net Cash Sales | | | | | | | | - | | |

| | | B. Accounts Receivable | | | | | | | | 202,714.26 | | |

| | | C. Other Receipts (See MOR-3) | | | 11,793.90 | | | | | 762,859.56 | | |

| | | (If you receive rental income, | | | | | | | | - | | |

| | | you must attach a rent roll.) | | | | | | | | | | |

3. TOTAL RECEIPTS (Lines 2A+2B+2C) | | | 11,793.90 | | | | | 965,573.82 | | |

| | 4. | | TOTAL FUNDS AVAILABLE FOR OPERATIONS (Line 1 + Line 3) | | $ | 217,689.23 | | | | $ | 989,775.65 | | |

| 5. DISBURSEMENTS | | | | | | | | | | |

| | | | A. Advertising | | | | | | | | - | | |

| | | | B. Bank Charges | | | | | | | | 1,430.10 | | |

| | | | C. Contract Labor | | | 3,600.00 | | | | | 46,034.85 | | |

| | | | D. Fixed Asset Payments (not incl. in “N”) | | | | | | | | - | | |

| | | | E. Insurance | | | | | | | | 41,943.00 | | |

| | | | F. Inventory Payments (See Attach. 2) | | | | | | | | - | | |

| | | | G. Leases | | | | | | | | - | | |

| | | | H. Manufacturing Supplies | | | | | | | | - | | |

| | | | I. Office Supplies | | | 733.89 | | | | | 1,370.84 | | |

| | | | J. Payroll - Net (See Attachment 4B) | | | | | | | | 167,780.49 | | |

| | | | K. Professional Fees (Accounting & Legal) | | | 7,068.48 | | | | | 152,596.09 | | |

| | | | L. Rent | | | 750.00 | | | | | 48,875.66 | | |

| | | | M. Repairs & Maintenance | | | | | | | | - | | |

| | | | N. Secured Creditor Payments (See Attach. 2) | | | | | | | | 186,977.59 | | |

| | | | O. Taxes Paid - Payroll (See Attachment 4C) | | | | | 83,905.08 | | |

| | | | P. Taxes Paid - Sales & Use (See Attachment 4C) | | | | | - | | |

| | | | Q. Taxes Paid - Other (See Attachment 4C) | | | | | | | | 5,714.52 | | |

| | | | R. Telephone | | | 143.67 | | | | | 7,164.82 | | |

| | | | S. Travel & Entertainment | | | | | | | | 4,185.62 | | |

| | | | Y. U.S. Trustee Quarterly Fees | | | | | | | | 4,875.00 | | |

| | | | U. Utilities | | | 285.70 | | | | | 5,917.65 | | |

| | | | V. Vehicle Expenses | | | | | | | | - | | |

| | | | W. Other Operating Expenses (See MOR-3) | | | | | | | | 25,896.85 | | |

6. TOTAL DISBURSEMENTS (Sum of 5A thru W) | | | 12,581.74 | | | | | 784,668.16 | | |

7. ENDING BALANCE (Line 4 Minus Line 6) | | $ | 205,107.49 | | (c) | | $ | 205,107.49 | | (c) |

I declare under penalty of perjury that this statement and the accompanying documents and reports are true and correct to the best of my knowledge and belief.

This 20th day of August, 2011. | /s/ David C. Owen | |

| | By: David C. Owen, Chairman/CEO |

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This figure will not change from month to month. It is always the amount of funds on hand as of the date of the petition.

(c)These two amounts will always be the same if form is completed correctly.

MONTHLY SCHEDULE OF RECEIPTS AND DISBURSEMENTS (cont’d)

Detail of Other Receipts and Other Disbursements

OTHER RECEIPTS:

Describe Each Item of Other Receipt and List Amount of Receipt. Write totals on Page MOR-2, Line 2C.

| Description | Current Month | Cumulative | |

| | | Petition to Date | |

| | | | |

| TOTAL OTHER RECEIPTS | Refunds | | |

“Other Receipts” includes Loans from Insiders and other sources (i.e. Officer/Owner, related parties directors, related corporations, etc.). Please describe below:

| | | Source | | | |

| Loan Amount | | of Funds | | Purpose | Repayment Schedule |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

OTHER DISBURSEMENTS:

Describe Each Item of Other Disbursement and List Amount of Disbursement. Write totals on Page MOR-2, Line 5W.

| | | | | Cumulative |

| Description | | Current Month | | Petition to Date |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| TOTAL OTHER DISBURSEMENTS | | | | |

NOTE: Attach a current Balance Sheet and Income (Profit & Loss) Statement.

ATTACHMENT 1

MONTHLY ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning July 1, 2011 Period ending July 31, 2011

ACCOUNTS RECEIVABLE AT PETITION DATE:

ACCOUNTS RECEIVABLE RECONCILIATION

(Include all accounts receivable, pre-petition and post-petition, including charge card sales which have not been received):

| Beginning of Month Balance | $ 176,140 (a) | |

| PLUS: Current Month New Billings | | |

| MINUS: Collection During the Month | $ (b) | |

| PLUS/MINUS: Adjustments or Writeoffs | $ * | |

| End of Month Balance | $ 176,140 (c) | |

| | | |

*For any adjustments or Write-offs provide explanation and supporting documentation, if applicable:

Customer receipts paid to FCG offset against interest and penalty fees

Adjustment made to refund overpayment on account

POST PETITION ACCOUNTS RECEIVABLE AGING

(Show the total for each aging category for all accounts receivable)

| | 0-30 Days | 31-60 Days | 61-90 Days | Over 90Days | Total |

| 0.00 | | 0.00 | | (66.96) | | (199,292.32) | | 375,499.08 | | 176,139.80 |

| | | | | | | | | | | | | |

For any receivables in the “Over 90 Days” category, please provide the following:

| Customer | | Status (Collection efforts taken, estimate of collectibility, write-off, disputed account, etc.) |

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This must equal the number reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 2B).

(c)These two amounts must equal.

ATTACHMENT 2

MONTHLY ACCOUNTS PAYABLE AND SECURED PAYMENTS REPORT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning July 1, 2011 Period ending July 31, 2011

In the space below list all invoices or bills incurred and not paid since the filing of the petition. Do not include amounts owed prior to filing the petition. In the alternative, a computer generated list of payables may be attached provided all information requested below is included.

POST-PETITION ACCOUNTS PAYABLE

| Date | | Days | | | | | | |

| Incurred | | Outstanding | | Vendor | | Description | | Amount |

| See Attached | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

X Check here if pre-petition debts have been paid. Attach an explanation and copies of supporting

documentation.

ACCOUNTS PAYABLE RECONCILIATION (Post Petition Unsecured Debt Only)

| Opening Balance | $ 4,941.02 (a) |

PLUS: New Indebtedness Incurred This Month $

MINUS: Amount Paid on Post Petition,

| Accounts Payable This Month | $ | |

| PLUS/MINUS: Adjustments | $ * |

Ending Month Balance $ 4,941.02 (c)

*For any adjustments provide explanation and supporting documentation, if applicable.

SECURED PAYMENTS REPORT

List the status of Payments to Secured Creditors and Lessors (Post Petition Only). If you have entered into a modification agreement with a secured creditor/lessor, consult with your attorney and the United States Trustee Program prior to completing this section).

| | | | | | | Number | | Total |

| | | Date | | | | of Post | | Amount of |

| Secured | | Payment | | Amount | | Petition | | Post Petition |

| Creditor/ | | Due This | | Paid This | | Payments | | Payments |

| Lessor | | Month | | Month | | Deliquent | | Deliquent |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL | | | | | (d) | | | |

(a)This number is carried forward from last month’s report. For the first report only, this number will be zero.

(b, c)The total of line (b) must equal line (c).

(d)This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 5N).

ATTACHMENT 3

INVENTORY AND FIXED ASSETS REPORT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning July 1, 2011 Period ending July 31, 2011

INVENTORY REPORT

INVENTORY BALANCE AT PETITION DATE: $

INVENTORY RECONCILIATION:

Inventory Balance at Beginning of Month $ 0.00 (a)

| | PLUS: Inventory Purchased During Month $ |

MINUS: Inventory Used or Sold $

| | PLUS/MINUS: Adjustments or Write-downs $ * |

| | Inventory on Hand at End of Month $ 0.00 |

METHOD OF COSTING INVENTORY: FIFO

*For any adjustments or write-downs provide explanation and supporting documentation, if applicable.

Sale of Assets March 2011.

INVENTORY AGING

| | Less than 6 | | Greater than | Considered |

* Aging Percentages must equal 100%.

☐ Check here if inventory contains perishable items.

Description of Obsolete Inventory:

FIXED ASSET REPORT

FIXED ASSETS FAIR MARKET VALUE AT PETITION DATE: $ 1.219.241.95(b)

(Includes Property, Plant and Equipment)

BRIEF DESCRIPTION (First Report Only):

FIXED ASSETS RECONCILIATION:

Fixed Asset Book Value at Beginning of Month $ -0- (a)(b)

MINUS: Depreciation Expense $

PLUS: New Purchases $

PLUS/MINUS: Adjustments or Write-downs $

| Ending Monthly Balance | $ -0- |

*For any adjustments or write-downs, provide explanation and supporting documentation, if applicable.

Asset Sale March 2011.

BRIEF DESCRIPTION OF FIXED ASSETS PURCHASED OR DISPOSED OF DURING THE REPORTING PERIOD:

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)Fair Market Value is the amount at which fixed assets could be sold under current economic conditions. Book Value is the cost of the fixed assets minus accumulated depreciation and other adjustments.

ATTACHMENT 4A

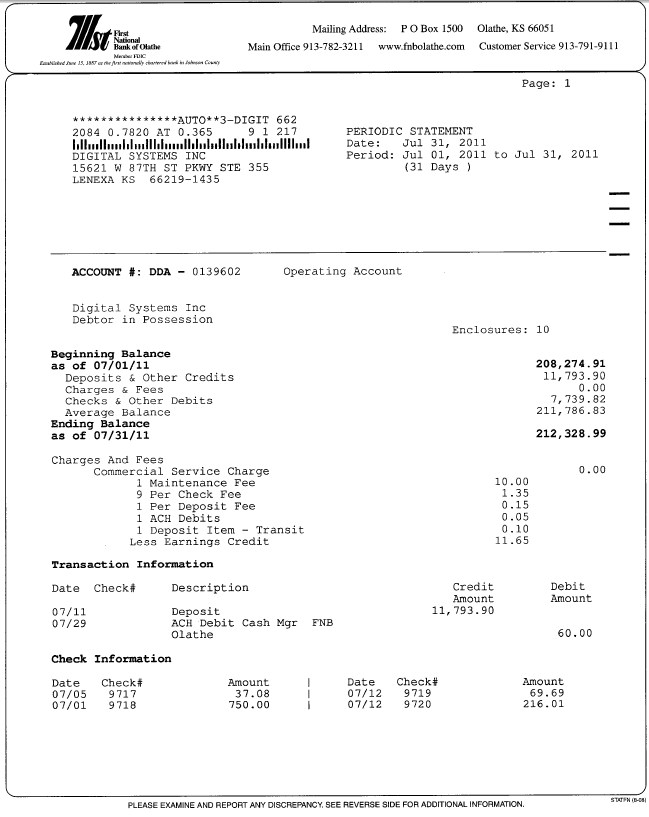

MONTHLY SUMMARY OF BANK ACTIVITY - OPERATING ACCOUNT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning July 1, 2011 Period ending July 31, 2011

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm. If bank accounts other than the three required by the United States Trustee Program are necessary, permission must be obtained from the United States Trustee prior to opening the accounts. Additionally, use of less than the three required bank accounts must be approved by the United States Trustee.

NAME OF BANK: FNB Olathe BRANCH:

ACCOUNT NAME: Operating Account ACCOUNT NUMBER: 0139602

PURPOSE OF ACCOUNT: OPERATING

| | Ending Balance per Bank Statement $ 212,328.99 |

Plus Total Amount of Outstanding Deposits $

| | Minus Total Amount of Outstanding Checks and other debits $ 7,658.09 * |

Ending Balance per Check Register $ 204,670.90**(a)

*Debit cards are used by

**If Closing Balance is negative, provide explanation:.

The following disbursements were paid in Cash (do not includes items reported as Petty Cash on Attachment 4D: ( ☐ Check here if cash disbursements were authorized by United States Trustee)

| Date | Amount | Payee | Purpose | Reason for Cash Disbursement |

TRANSFERS BETWEEN DEBTOR IN POSSESSION ACCOUNTS

“Total Amount of Outstanding Checks and other debits”, listed above, includes:

$________________Transferred to Payroll Account

$________________Transferred to Tax Account

(a) The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 5A

CHECK REGISTER - OPERATING ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME:

ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: OPERATING

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

| | | CHECK | | | | | | |

| DATE | | NUMBER | | PAYEE | | PURPOSE | | AMOUNT |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL | | | | | | | | $ |

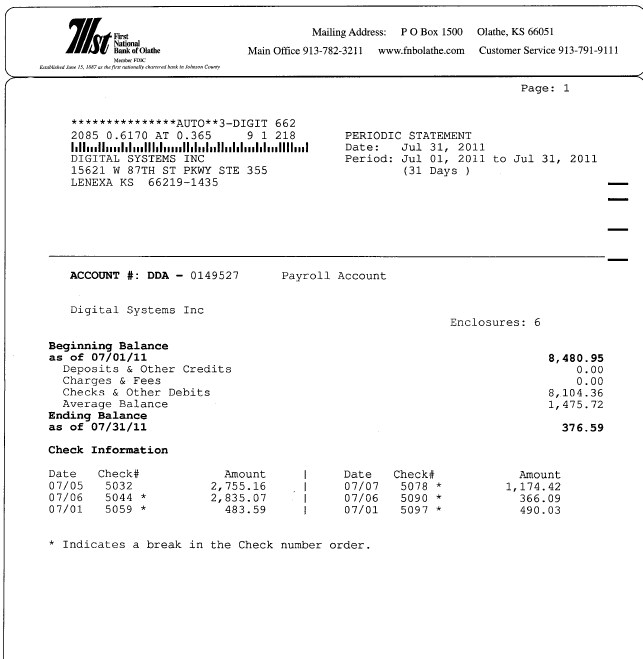

ATTACHMENT 4B

MONTHLY SUMMARY OF BANK ACTIVITY - PAYROLL ACCOUNT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning July 1, 2011 Period ending July 31, 2011

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm.

NAME OF BANK: FNB Olathe BRANCH:

ACCOUNT NAME: Payroll Account ACCOUNT NUMBER: 0149527

PURPOSE OF ACCOUNT: PAYROLL

Ending Balance per Bank Statement $ 376.59*

| | Plus Total Amount of Outstanding Deposits $ |

| | Minus Total Amount of Outstanding Checks and other debits $ 0.00* |

Ending Balance per Check Register $ 376.59**(a)

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation:

The following disbursements were paid by Cash: ( ☐ Check here if cash disbursements were authorized by United States Trustee)

| Date | Amount | Payee | Purpose | Reason for Cash Disbursement |

The following non-payroll disbursements were made from this account:

| Date | Amount | Payee | Purpose | Reason for disbursement from this account |

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 5B

CHECK REGISTER - PAYROLL ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME:

ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: PAYROLL

Account for all disbursements, including voids, lost payments, stop payment, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

| | | CHECK | | | | | | |

| DATE | | NUMBER | | PAYEE | | PURPOSE | | AMOUNT |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL | | | | | | | | $ |

ATTACHMENT 4C

MONTHLY SUMMARY OF BANK ACTIVITY - TAX ACCOUNT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning July 1, 2011 Period ending July 31, 2011

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found on the United States Trustee website, http://www.justice.gov/ust/r20/index.htm.

NAME OF BANK: BRANCH: ACCOUNT CLOSED

ACCOUNT NAME: ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: TAX

| | Ending Balance per Bank Statement $ |

Plus Total Amount of Outstanding Deposits $

Minus Total Amount of Outstanding Checks and other debits $ *

Minus Service Charges $

Ending Balance per Check Register $ **(a)

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation:

The following disbursements were paid by Cash: ( ☐ Check here if cash disbursements were authorized by

United States Trustee)

| Date | | Amount | | Payee | | Purpose | | Reason for Cash Disbursement |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

The following non-tax disbursements were made from this account:

| Date | | Amount | | Payee | | Purpose | | Reason for disbursement from this account |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 5C

CHECK REGISTER - TAX ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME: ACCOUNT #

PURPOSE OF ACCOUNT: TAX

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer-generated check register can be attached to this report, provided all the information requested below is included.

http://www.usdoj.gov/ust.

| DATE | | CHECK NUMBER | | PAYEE | | PURPOSE | | AMOUNT |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| SUMMARY OF TAXES PAID |

| |

| Payroll Taxes Paid | (a) |

| Sales & Use Taxes Paid | (b) |

| Other Taxes Paid | (c) |

| TOTAL | (d) |

(a) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements

(Page MOR-2, Line 5O).

(b) This number is reported in the “Current Month” column of Schedule or Receipts and Disbursements

(Page MOR-2, Line 5P).

(c) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements

(Page MOR-2, Line 5Q).

(d) These two lines must be equal.

ATTACHMENT 4D

INVESTMENT ACCOUNTS AND PETTY CASH REPORT

INVESTMENT ACCOUNTS

Each savings and investment account, i.e. certificates of deposits, money market accounts, stocks and bonds, etc., should be listed separately. Attach copies of account statements.

Type of Negotiable

| Instrument | | Face Value | | Purchase Price | | Date of Purchase | | Current Market Value |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL | | | | | | | | (a) |

PETTY CASH REPORT

The following Petty Cash Drawers/Accounts are maintained:

| | | (Column 2) | | (Column 3) | | (Column 4) |

| | | Maximum | | Amount of Petty | | Difference between |

| Location of | | Amount of Cash | | Cash On Hand | | (Column 2) and |

| Box/Account | | in Drawer/Acct. | | At End of Month | | (Column 3) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| TOTAL | | | | $ (b) | | |

For any Petty Cash Disbursements over $100 per transaction, attach copies of receipts. If there are no receipts, provide an explanation

TOTAL INVESTMENT ACCOUNTS AND PETTY CASH(a + b) $ (c)

(c)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the

amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page

MOR-2, Line 7).

ATTACHMENT 6

MONTHLY TAX REPORT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning July 1, 2011 Period ending July 31, 2011

TAXES OWED AND DUE

Report all unpaid post-petition taxes including Federal and State withholding FICA, State sales tax, property tax, unemployment tax, State workmen's compensation, etc.

| | Payment | | Description | | Amount | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| TOTAL | | | | | | $ | | | | |

ATTACHMENT 7

SUMMARY OF OFFICER OR OWNER COMPENSATION

SUMMARY OF PERSONNEL AND INSURANCE COVERAGES

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning July 1, 2011 Period ending July 31, 2011

Report all forms of compensation received by or paid on behalf of the Officer or Owner during the month. Include car allowances, payments to retirement plans, loan repayments, payments of Officer/Owner’s personal expenses, insurance premium payments, etc. Do not include reimbursement for business expenses Officer or Owner incurred and for which detailed receipts are maintained in the accounting records.