QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12

|

FINISAR CORPORATION |

(Name of Registrant as Specified In Its Charter) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /x/ | | No Fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | 1) | | Title of each class of securities to which transaction applies:

|

| | | 2) | | Aggregate number of securities to which transaction applies:

|

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:(1)

|

| | | 4) | | Proposed maximum aggregate value of transaction:

|

| | | 5) | | Total fee paid:

|

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | 1) | | Amount Previously Paid:

|

| | | 2) | | Form, Schedule or Registration Statement No.:

|

| | | 3) | | Filing Party:

|

| | | 4) | | Date Filed:

|

- (1)

- Set forth the amount on which the filing fee is calculated and state how it was determined.

1308 Moffett Park Drive

Sunnyvale, California 94089

September 7, 2001

Dear Stockholder:

This year's annual meeting of stockholders will be held on Friday, October 5, 2001, at 10 a.m. local time, at the Wyndham Garden Hotel, 1300 Chesapeake Terrace, Sunnyvale, California. You are cordially invited to attend.

The meeting of stockholders we held earlier this year was delayed because of the need to include information about various acquisition transactions in the proxy statement for that meeting. With this meeting, we return to more conventional timing for our 2001 annual meeting of stockholders.

The Notice of Annual Meeting of Stockholders and a Proxy Statement, which describe the formal business to be conducted at the meeting, follow this letter.

After reading the Proxy Statement, please promptly mark, sign and return the enclosed proxy card in the prepaid envelope to assure that your shares will be represented. Your shares cannot be voted unless you date, sign, and return the enclosed proxy card or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before our stockholders is important.

A copy of our Annual Report to Stockholders is also enclosed for your information. At the annual meeting we will review our activities over the past year and our plans for the future. The Board of Directors and Management look forward to seeing you at the annual meeting.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held October 5, 2001

TO THE STOCKHOLDERS:

Please take notice that the 2001 annual meeting of the stockholders of Finisar Corporation, a Delaware corporation, will be held on Friday, October 5, 2001, at 10 a.m. local time, at the Wyndham Garden Hotel, 1300 Chesapeake Terrace, Sunnyvale, California, for the following purposes:

- 1.

- To elect two (2) Class II directors to hold office for a three-year term and until their respective successors are elected and qualified.

- 2.

- To consider, approve and ratify the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending April 30, 2002.

- 3.

- To transact such other business as may properly come before the meeting.

Stockholders of record at the close of business on August 31, 2001 are entitled to notice of, and to vote at, the meeting and any adjournment or postponement. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 1308 Moffett Park Drive, Sunnyvale, California 94089.

Sunnyvale, California

September 7, 2001

IMPORTANT: Please fill in, date, sign and promptly mail the enclosed proxy card in the accompanying postage-paid envelope to assure that your shares are represented at the meeting. If you attend the meeting, you may choose to vote in person even if you have previously sent in your proxy card.

TABLE OF CONTENTS

| | Page

|

|---|

| PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS | | 1 |

| SOLICITATION AND VOTING OF PROXIES | | 1 |

| INFORMATION ABOUT FINISAR CORPORATION | | 2 |

| | Stock Ownership of Certain Beneficial Owners and Management | | 2 |

| | Management | | 5 |

| EXECUTIVE COMPENSATION AND OTHER MATTERS | | 9 |

| | Executive Compensation | | 9 |

| | Employment Contracts and Termination of Employment and Change-In-Control Arrangements | | 10 |

| | Compensation of Directors | | 11 |

| | Compensation Committee Interlocks and Insider Participation In Compensation Decisions | | 11 |

| | Certain Relationships and Related Transactions | | 11 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 11 |

| REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION | | 12 |

| REPORT OF THE AUDIT COMMITTEE | | 13 |

| COMPARISON OF STOCKHOLDER RETURN | | 14 |

| ELECTION OF DIRECTORS | | 15 |

| | Vote Required and Board of Directors' Recommendation | | 15 |

| RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | | 16 |

| | Vote Required and Board of Directors' Recommendation | | 16 |

| STOCKHOLDER PROPOSALS TO BE PRESENTED AT NEXT ANNUAL MEETING | | 17 |

| TRANSACTION OF OTHER BUSINESS | | 17 |

i

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is solicited by the Board of Directors of Finisar Corporation, a Delaware corporation, for use at its annual meeting of stockholders to be held on October 5, 2001, or any adjournment or postponement, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The date of this Proxy Statement is September 7, 2001, the approximate date on which this Proxy Statement and the accompanying form of proxy were first sent or given to stockholders.

SOLICITATION AND VOTING OF PROXIES

Finisar will bear the cost of soliciting proxies. In addition to soliciting stockholders by mail, we will request banks and brokers, and other custodians, nominees and fiduciaries, to solicit their customers who hold our stock registered in the names of such persons and will reimburse them for their reasonable, out-of-pocket costs. We may use the services of our officers, directors and others to solicit proxies, personally or by telephone, without additional compensation.

On August 31, 2001, we had outstanding 191,759,390 shares of common stock, par value $.001 per share, all of which are entitled to vote with respect to all matters to be acted upon at the annual meeting. Each stockholder of record as of that date is entitled to one vote for each share of common stock held by him or her. Our Bylaws provide that a majority of all of the shares of the stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Votes for and against, abstentions and "broker non-votes" will each be counted as present for purposes of determining the presence of a quorum.

All valid proxies received before the meeting will be exercised. All shares represented by a proxy will be voted, and where a stockholder specifies by means of his or her proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specification so made. If no choice is indicated on the proxy, the shares will be voted in favor of the proposal. A stockholder giving a proxy has the power to revoke his or her proxy at any time before the time it is exercised by delivering to our Secretary a written instrument revoking the proxy or a duly executed proxy with a later date, or by attending the meeting and voting in person.

Voting By Telephone

If you hold your shares directly registered in your name with American Stock Transfer & Trust Company, you may vote by telephone. To vote by telephone, call 1-800-PROXIES.

1

INFORMATION ABOUT FINISAR CORPORATION

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth information known to us regarding the beneficial ownership of our common stock as of August 31, 2001 by:

- •

- each stockholder who is known by us to beneficially own more than 5% of our common stock;

- •

- each of our executive officers listed on the Summary Compensation Table under "Executive Compensation and Other Matters" below;

- •

- each of our directors; and

- •

- all of our executive officers and directors as a group.

| | Shares of Common Stock

Beneficially Owned(1)

| |

|---|

Name of Beneficial Owner(1)

| |

|---|

| | Number

| | Percentage

| |

|---|

| 5% Stockholders: | | | | | |

| Putnam Investments, LLC(2) | | 18,991,710 | | 9.9 | % |

| FMR Corp.(3) | | 17,556,390 | | 9.2 | % |

| Margaret G. Rawls | | 9,898,753 | | 5.2 | % |

| Executive Officers and Directors: | | | | | |

| Frank H. Levinson(4) | | 40,937,879 | | 21.4 | % |

| Jerry S. Rawls(5) | | 8,280,978 | | 4.3 | % |

| Gregory H. Olsen(6) | | 6,926,038 | | 3.6 | % |

| Mark J. Farley(7) | | 4,328,975 | | 2.3 | % |

| Jan Lipson(8) | | 602,312 | | * | |

| Stephen K. Workman(9) | | 530,238 | | * | |

| Michael C. Child | | 32,836 | | * | |

| Roger C. Ferguson(10) | | 90,000 | | * | |

| Richard B. Lieb(11) | | 24,800 | | * | |

| Larry D. Mitchell(12) | | 25,500 | | * | |

| All executive officers and directors as a group (12 persons)(13) | | 62,599,556 | | 32.3 | % |

- *

- Less than 1%.

- (1)

- Unless otherwise indicated, the address of each of the named individuals is: c/o Finisar Corporation, 1308 Moffett Park Drive, Sunnyvale, CA 94089. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. All shares of common stock subject to options exercisable within 60 days following August 31, 2001 are deemed to be outstanding and beneficially owned by the person holding those options for the purpose of computing the number of shares beneficially owned and the percentage of ownership of that person. They are not, however, deemed to be outstanding and beneficially owned for the purpose of computing the percentage ownership of any other person. Accordingly, percent ownership is based on 191,759,390 shares of common stock outstanding as of August 31, 2001 plus any shares issuable pursuant to options held by the person or group in question which may be exercised within 60 days following August 31, 2001. Except as indicated in the other footnotes to the table and subject to applicable community property laws, based on information provided by the persons named in the table, these persons have sole voting and investment power with respect to all shares of the common stock shown as beneficially owned by them.

2

- (2)

- Based on information contained in a Schedule 13G dated February 14, 2001, filed with the Securities and Exchange Commission. Includes 16,593,460 shares held by Putnam Investment Management, LLC and 2,398,250 shares held by The Putnam Advisory Company, LLC. Putnam Investment Management, LLC and The Putnam Advisory Company, LLC are both wholly-owned subsidiaries of Putnam Investments, LLC. Both subsidiaries have dispository power over the shares as investment managers, but each of the mutual fund's trustees have voting power over the shares held by each fund, and The Putnam Advisory Company, LLC has shared voting power over the shares held by the institutional clients. Putnam Investment Management, LLC, which is the investment adviser to the Putnam family of mutual funds, and the Putnam Advisory Company, LLC, which is the investment adviser to Putnam's institutional clients, are both registered investment advisors. Putnam Investments, LLC is a wholly-owned subsidiary of Marsh & McLennan Companies, Inc. The address of Marsh & McLennan Companies, Inc. is 1166 Avenue of the Americas, New York, New York 10036 and the address of Putnam Investments, LLC is One Post Office Square, Boston, Massachusetts 02109.

- (3)

- Based on information contained in a Schedule 13G dated April 10, 2001, filed with the Securities and Exchange Commission. Includes 17,051,590 shares beneficially owned by Fidelity Management & Research Company ("Fidelity") as a result of acting as investment adviser to various investment companies, including Fidelity Growth Company Fund which holds 11,920,600 shares, and 503,000 shares beneficially owned by Fidelity Management Trust Company as a result of serving as investment manager of its institutional account(s). Fidelity and Fidelity Management Trust Company are both wholly-owned subsidiaries of FMR Corp. Fidelity is registered under Section 203 of the Investment Advisers Act of 1940 as an investment advisor to various investment companies. Fidelity Management Trust Company is a bank as defined in Section 3(a)(6) of the Securities Exchange Act serves as investment manager of institutional account(s). The address of FMR Corp., Fidelity, and Fidelity Management Trust Company is 82 Devonshire Street, Boston, Massachusetts 02109.

- (4)

- Includes 34,047,879 shares held by the Frank H. & Wynnette Levinson 1998 Revocable Trust, 2,915,000 held by Seti Trading Co., Inc., an investment company owned by Frank and Wynnette Levinson, 1,325,000 shares held by the Rose Wynnette Levinson 1998 Gift Trust, 1,325,000 shares held by the Alana Marie Levinson 1998 Gift Trust and 1,325,000 shares held by the Frank Henry Levinson 1998 Gift Trust.

- (5)

- Includes 5,404,775 shares held by The Rawls Family, L.P. Mr. Rawls is the president of the Rawls Management Corporation, the general partner of The Rawls Family, L.P. Includes 3,000,000 shares subject to a prepaid forward contract pursuant to which the Rawls Family L.P. wrote a covered call option and purchased a put option.

- (6)

- Includes 4,957,500 shares held in escrow in connection with our acquisition of Sensors. One third of such amount will be released on each of the first three anniversaries of October 17, 2000, subject to the achievement of certain development milestones set forth in the acquisition agreement. Includes 60,000 shares issuable upon exercise of options exercisable within 60 days following August 31, 2001

- (7)

- Includes 1,770,620 shares issuable upon exercise of options exercisable within 60 days following August 31, 2001, 1,679,355 shares held by the Farley Family Trust and 900,000 shares held by an irrevocable trust for the benefit of Mr. Farley's child.

- (8)

- Includes 360,000 shares subject to a right of repurchase in favor of Finisar which lapses over time and 13,000 shares issuable upon exercise of options exercisable within 60 days following August 31, 2001.

3

- (9)

- Includes 360,000 shares subject to a right of repurchase in favor of Finisar which lapses over time and 13,000 shares issuable upon exercise of options exercisable within 60 days following August 31, 2001.

- (10)

- Includes 60,000 shares which are subject to a right of repurchase in favor of Finisar which lapses over time.

- (11)

- Includes 18,000 shares issuable upon exercise of options exercisable within 60 days following August 31, 2001. Includes 500 shares held by Mr. Lieb's spouse and 300 shares held by Mr. Lieb's children.

- (12)

- Includes 36,000 shares issuable upon exercise of options exercisable within 60 days following August 31, 2001.

- (13)

- Includes 1,132,000 shares subject to a right of repurchase in favor of Finisar, 1,993,620 shares issuable upon exercise of options exercisable within 60 days following August 31, 2001 and 4,957,500 shares held in escrow in connection with our acquisition of Sensors.

4

Management

Our Board of Directors is currently fixed at seven directors. Our certificate of incorporation provides that the terms of office of the members of the Board of Directors will be divided into three classes: Class I, whose term will expire at the annual meeting of stockholders to be held in 2003, Class II, whose term will expire at the annual meeting of stockholders to be held in 2001, and Class III, whose term will expire at the annual meeting of stockholders to be held in 2002. At each annual meeting of stockholders, the successors to directors whose term will then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election. Our nonemployee directors devote such time to our affairs as is necessary to discharge their duties. There are no family relationships among any of our directors, officers or key employees.

Our President, Secretary and Chief Financial Officer are elected by the Board of Directors, all other executive officers are elected by the Board of Directors or appointed by the President, and all officers serve at the discretion of the Board of Directors. Each of our officers and directors, other than nonemployee directors, devotes his full time to the affairs of Finisar.

Directors. This section sets forth for our current directors, including the Class II nominees to be elected at this meeting, information concerning their age and background as of August 31, 2001.

Name

| | Position With Finisar

| | Age

| | Director Since

|

|---|

| Class II directors nominated for election at the 2001 Annual Meeting of Stockholders: |

| Frank H. Levinson | | Chairman of the Board and Chief Technical Officer | | 48 | | 1988 |

| Richard B. Lieb | | Director | | 53 | | 1999 |

Class III directors whose terms expire at the 2002 Annual Meeting of Stockholders: |

| Michael C. Child | | Director | | 46 | | 1998 |

| Jerry S. Rawls | | Director, President and Chief Executive Officer | | 57 | | 1989 |

Class I directors whose terms expire at the 2003 Annual Meeting of Stockholders: |

| Roger C. Ferguson | | Director | | 58 | | 1999 |

| Larry D. Mitchell | | Director | | 58 | | 1999 |

| Gregory H. Olsen | | Director and Executive Vice President | | 56 | | 2000 |

Nominees for Election for a Three Year Term expiring at the 2004 Annual Meeting of Stockholders

Frank H. Levinson founded Finisar in April 1987 and has served as a member of our Board of Directors since February 1988 and as our Chairman of the Board and Chief Technical Officer since August 1999. Dr. Levinson also served as our Chief Executive Officer from February 1988 to August 1999. From September 1980 to December 1983, Dr. Levinson was a member of Technical Staff at AT&T Bell Laboratories. From January 1984 to July 1984, he was a Member of Technical Staff at Bellcore, a provider of services and products to the communications industry. From April 1985 to December 1985, Dr. Levinson was the principal optical scientist at Raychem Corporation, and from January 1986 to February 1988, he was Optical Department Manager at Raynet, Inc., a fiber optic systems company. Dr. Levinson holds a B.S. in Mathematics/Physics from Butler University and an M.S. and Ph.D. in Astronomy from the University of Virginia.

Richard B. Lieb has been a member of our Board of Directors since October 1999. Since November 1990 Mr. Lieb has served as Executive President of SEI Investments, an investment and investment processing business solutions company. He is also on the Advisory Board of Cross Atlantic Technology Fund, a technology venture capital fund in Radnor, Pennsylvania. Mr. Lieb holds a B.A. in History from Duke University and an M.A. in Public Administration from the Wharton School of Business at the University of Pennsylvania. Mr. Lieb also serves on the Board of Directors of OAO Technology Solutions, Inc.

5

Directors Continuing in Office until the 2002 Annual Meeting of Stockholders

Michael C. Child has been a member of our Board of Directors since November 1998. Mr. Child has been employed by TA Associates, Inc., a venture capital investment firm, since July 1982 where he currently serves as a Managing Director. Mr. Child also serves on the Board of Directors of Fargo Electronics. Mr. Child holds a B.S. in Electrical Engineering from the University of California at Davis and an M.B.A. from the Stanford Graduate School of Business.

Jerry S. Rawls has served as a member of our Board of Directors since March 1989, as our President since April 1989 and as our Chief Executive Officer since August 1999. From September 1968 to February 1989, Mr. Rawls was employed by Raychem Corporation, a materials science and engineering company, where he held various management positions including Division General Manager of the Aerospace Products Division and Interconnection Systems Division. Mr. Rawls holds a B.S. in Mechanical Engineering from Texas Tech University and an M.S. in Industrial Administration from Purdue University.

Directors Continuing in Office until the 2003 Annual Meeting of Stockholders

Roger C. Ferguson has been a member of our Board of Directors since August 1999. Mr. Ferguson has served as Chief Executive Officer of Semio Inc., an early stage software company, since July 1999 and as a principal in VenCraft, LLC, a venture capital partnership, since July 1997. From 1993 to 1997, Mr. Ferguson was Chief Executive Officer of DataTools, Inc., a database software company. From 1987 to 1993, Mr. Ferguson served as Chief Operating Officer for Network General Inc., a network analysis company. Mr. Ferguson also serves on the Boards of Directors of Microtest, Inc. and several private companies. Mr. Ferguson holds a B.A. in Psychology from Dartmouth College and an M.B.A. from the Amos Tuck School at Dartmouth.

Larry D. Mitchell has been a member of our Board of Directors since October 1999. Mr. Mitchell has been retired since October 1997. From October 1994 to October 1997, he served as a site General Manager in Roseville, California for Hewlett-Packard. Mr. Mitchell holds a B.A. in Engineering Science from Dartmouth College and an M.B.A. from the Stanford Graduate School of Business.

Gregory H. Olsen has served on our Board of Directors, as our Executive Vice President and President and Chief Executive Officer of Sensors Unlimited, Inc., a wholly owned subsidiary of Finisar, since the closing of our acquisition of Sensors Unlimited in October 2000. Dr. Olsen founded Sensors Unlimited, a fiber optic component company, in 1991 and has served as its President and Chief Executive Officer since inception. In 1984 Dr. Olsen founded EPITAXX, Inc., and served as its President and Chief Executive Officer from inception until 1990 when EPITAXX was acquired by Nippon Sheet Glass. Dr. Olsen holds a B.S. in Physics, a B.S.E.E. and an M.S. in Physics (magna cum laude) from Fairleigh Dickenson University and a Ph.D. in Material Science from the University of Virginia.

6

Executive Officers. This section sets forth a list of our current executive officers and information concerning their age and background as of August 31, 2001.

Name

| | Position With Finisar

| | Age

|

|---|

| Jerry S. Rawls | | President and Chief Executive Officer | | 57 |

| Frank H. Levinson | | Chief Technical Officer | | 48 |

| Mark J. Farley | | Vice President, Digital Systems Engineering | | 39 |

| Jan Lipson | | Vice President, Optical Engineering | | 50 |

| Dallas W. Meyer | | Vice President, Operations | | 38 |

| Gregory H. Olsen | | Executive Vice President | | 56 |

| Richard Woodrow | | Vice President, Sales and Marketing | | 57 |

| Stephen K. Workman | | Vice President, Finance, Chief Financial Officer and Secretary | | 50 |

Information concerning Messrs. Rawls, Levinson and Olsen is set forth above under "Directors."

Mark J. Farley has served as our Vice President, Digital Systems Engineering since April 1996. From August 1991 to April 1996, Mr. Farley was a consulting design engineer. During that time, Mr. Farley was heavily involved in the design of Finisar's early products. From September 1986 to August 1991, Mr. Farley was a hardware design manager with Raynet, Inc. From September 1984 to September 1986, he was a hardware design manager at Tandem Computers. Mr. Farley holds a B.S. in Electrical Engineering from the Massachusetts Institute of Technology.

Jan Lipson has served as our Vice President, Optical Engineering since April 1998. From June 1995 to April 1998, Dr. Lipson was Vice-President, Advanced Technology for Ortel Corporation, a fiber optic components supplier to the cable television industry. From March 1982 to June 1995, Dr. Lipson was employed by AT&T Bell Laboratories, and most recently held the position of Department Head and Development Manager for the Subsystems Development Group in the Lightwave Communications Area. From October 1978 to March 1982, Dr. Lipson was a member of the technical staff at Los Alamos National Labs. Dr. Lipson holds a B.S. in Physics from the California Institute of Technology, a Ph.D. in Physics from the University of California at San Diego and an M.B.A. from the University of Pittsburgh.

Dallas W. Meyer has served as our Vice President, Operations since September 2000. Prior to joining Finisar, Dr. Meyer worked in various aspects of rigid disc-drive integration and recording head fabrication at Read-Rite Corporation from February 1999 to August 2000, at Seagate Corporation from July 1993 to February 1999 and at IBM Corporation prior to that. Dr. Meyer holds a B.S. in Structural Engineering from the University of Nebraska-Lincoln and a Ph.D. in Engineering Mechanics, Mathematics and Materials Science from the University of Wisconsin-Madison.

Richard Woodrow has served as our Vice President, Sales and Marketing, since November 2000. Mr. Woodrow joined Finisar in June 1998 as Director of Marketing-Optics. Prior to joining Finisar, Mr. Woodrow was employed by Raychem Corporation from 1974 until June 1998 in various sales and marketing positions and served as Director of North American Sales for the Electronics Division from March 1995 to June 1998. Mr. Woodrow holds a B.A. in Mathematics from Rutgers University.

Stephen K. Workman has served as our Vice President, Finance and Chief Financial Officer since March 1999 and as our Secretary since August 1999. From November 1989 to March 1999, Mr. Workman served as Chief Financial Officer at Ortel Corporation. Mr. Workman holds a B.S. in Engineering Science and an M.S. in Industrial Administration from Purdue University.

Meetings of the Board of Directors. During the fiscal year ended April 30, 2001, our Board of Directors held eight meetings. During that period the Audit Committee of the Board held four

7

meetings and the Compensation Committee of the Board held one meeting. Attendance at Board and committee meetings was at least 75 percent for each director. We have no standing nominating committee of the Board.

The members of the Audit Committee during fiscal 2001 were Messrs. Child, Ferguson and Mitchell. The Audit Committee of our Board of Directors recommends the appointment of our independent auditors, reviews our internal accounting procedures and financial statements and consults with and reviews the services provided by our independent auditors, including the results and scope of their audit. For additional information about the Audit Committee, see "Report of the Audit Committee" below.

The members of the Compensation Committee during fiscal 2001 were Messrs. Child and Ferguson. The Compensation Committee of our Board of Directors reviews and recommends to the Board of Directors the compensation and benefits of all of our executive officers and establishes and reviews general policies relating to compensation and benefits of our employees. For additional information about the Compensation Committee, see "Report Of The Compensation Committee On Executive Compensation" and "Executive Compensation and Other Matters" below.

8

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive Compensation

The following table sets forth information concerning the compensation of our Chief Executive Officer and our four other most highly compensated executive officers, as of April 30, 2001, during the fiscal years ended April 30, 2001, 2000 and 1999.

Summary Compensation Table

| |

| |

| |

| |

| | Long Term

Compensation

Awards

Securities

Underlying

Options

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | All Other

Compensation

|

|---|

Jerry S. Rawls

President and Chief Executive Officer | | 2001

2000

1999 | | $

| 220,192

200,000

189,423 | | $

| 500

1,000

106,192 | | $

| 42,017

1,923

4,677 | | —

—

— | | —

—

— |

Frank Levinson

Chief Technical Officer | | 2001

2000

1999 | | | 220,192

200,000

189,423 | | | 500

1,000

106,192 | | | 36,829

2,308

3,581 | | —

—

— | | —

—

— |

Mark J. Farley

Vice President, Digital Systems Engineering | | 2001

2000

1999 | | | 193,269

165,000

149,423 | | | 5,500

6,000

64,731 | | | 9,155,951

1,587

2,857 | (1)

| 105,000

—

— | (2)

| —

—

— |

Jan Lipson

Vice President, Optical Engineering | | 2001

2000

1999 | | | 190,355

150,000

142,308 | | | 5,500

6,000

44,077 | | | 4,716

1,731

162 | | 65,000

—

900,000 | (2)

(3) | —

—

— |

Stephen K. Workman

Vice President, Finance, Chief Financial Officer and Secretary | | 2001

2000

1999 | | | 190,385

150,000

17,308 | | | 5,500

6,000

3,500 | | | 2,354

1,298

— | | 65,000

—

600,000 | (2)

(3) | —

—

— |

- (1)

- Includes $9,139,821 realized upon the exercise of stock options, based on the difference between the market value on the date of exercise and the exercise price of the options.

- (2)

- This option vests at the rate of 20% per year over a period of five years.

- (3)

- This option is immediately exercisable, subject to a right of repurchase in favor of Finisar which lapses at a rate of 20% per year over a period of five years.

The following table sets forth information regarding grants of stock options to the executive officers named in the Summary Compensation Table above during the fiscal year ended April 30, 2001. All of these options were granted under our 1999 stock option plan. The percentage of total options set forth below is based on an aggregate of 12,736,573 options granted during the fiscal year. All options were granted at the fair market value of our common stock, as determined by the Board of Directors on the date of grant. Potential realizable values are net of exercise price, but before taxes associated with exercise. Amounts represent hypothetical gains that could be achieved for the options if exercised at the end of the option term. The assumed 5% and 10% rates of stock price appreciation are provided

9

in accordance with rules of the SEC and do not represent Finisar's estimate or projection of the future common stock price.

Options Granted in Fiscal Year Ended April 30, 2001

| | Individual Grants

| |

| |

| |

|

|---|

| |

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation

for Option Term

|

|---|

| | Number of

Securities

Underlying

Options

Granted(1)

| | % of Total

Options

Granted to

Employees in

Fiscal Year

| |

| |

| | Deemed

Value Per

Share At

Date of

Grant

|

|---|

Name

| | Exercise

Price

($/Share)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Jerry S. Rawls | | — | | — | | | — | | — | | | — | | | — | | | — |

| Frank H. Levinson | | — | | — | | | — | | — | | | — | | | — | | | — |

| Mark J. Farley | | 105,000 | | 0.82 | % | $ | 21.5625 | | 6/15/10 | | $ | 21.5625 | | $ | 113,203.12 | | $ | 226,406.25 |

| Jan Lipson | | 65,000 | | 0.51 | % | $ | 21.5625 | | 6/15/10 | | $ | 21.5625 | | $ | 70,078.13 | | $ | 140,156.25 |

| Stephen K. Workman | | 65,000 | | 0.51 | % | $ | 21.5625 | | 6/15/10 | | $ | 21.5625 | | $ | 70,078.13 | | $ | 140,156.25 |

- (1)

- These options vest at the rate of 20% per year over a period of five years.

The following table provides the specified information concerning exercises of options to purchase our common stock in the fiscal year ended April 30, 2001, and unexercised options held as of April 30, 2001, by the persons named in the Summary Compensation Table above.

Aggregate Option Exercises In Fiscal 2001 and Values at April 30, 2001

| |

| |

| | Number of

Securities Underlying

Unexercised Options

At Fiscal Year End

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-The Money Options

At Fiscal Year End(1)

|

|---|

Name

| | Shares

Acquired

on Exercise

| | Value

Realized

|

|---|

| | Exercisable(2)

| | Unexercisable(2)

| | Exercisable(2)

| | Unexercisable(2)

|

|---|

| Jerry S. Rawls | | — | | | — | | — | | — | | | — | | — |

| Frank H. Levinson | | — | | | — | | — | | — | | | — | | — |

| Mark J. Farley | | 235,000 | | $ | 9,139,821 | | 1,749,620 | | 105,000 | | $ | 26,081,060 | | — |

| Jan Lipson | | — | | | — | | — | | 65,000 | | | — | | — |

| Stephen K. Workman | | — | | | — | | — | | 65,000 | | | — | | — |

- (1)

- Based on a fair market value of $14.95 the closing price of our common stock on April 30, 2001, as reported by the Nasdaq National Market.

- (2)

- Stock options granted under the 1999 Option Plan prior to our initial public offering of common stock in November 1999 are generally immediately exercisable at the date of grant, but shares received upon exercise of unvested options are subject to repurchase by Finisar. Options granted after this date under the 1999 Option Plan are generally not immediately exercisable at the date of grant and vest at the rate of 20% per year over a period of five years.

Employment Contracts and Termination of Employment and Change-In-Control Arrangements

There are no employment contracts or change-in-control arrangements with any of the officers named in the Summary Compensation Table above.

Effective on the closing of the acquisition of Sensors Unlimited, Inc. on October 17, 2000, Gregory H. Olsen, the President and Chief Executive Officer of Sensors, was elected a director of

10

Finisar and appointed to the position of Executive Vice President of Finisar. In connection with his continued employment with Finisar, Dr. Olsen entered into a three-year employment agreement that provides for an annual base salary of $200,000 and annual bonuses based on performance and the achievement of financial goals. Dr. Olsen was also granted an option to purchase 300,000 shares of Finisar's common stock under Finisar's 1999 Option Plan pursuant to Finisar's standard option agreement and vesting terms. If Dr. Olsen's employment is terminated other than by reason of death or disability or for cause, he will be entitled to receive severance payments equal to twelve months of his base salary and a pro-rated portion of the annual bonus, if any, for the prior fiscal year. The severance payments will be paid in equal, bi-weekly installments over the twelve-month period following the date of termination. In addition, Dr. Olsen entered into a noncompetition agreement under which he agreed, during the three-year period following the closing of the acquisition, not to engage, other than on behalf of Finisar, in any business that competes with the business of Sensors, accept employment with a customer of Sensors with the intent of depriving Sensors of business or request or advise customers or suppliers of Sensors to withdraw or curtail their business with Sensors. The terms of these agreements were negotiated at arm's length in connection with the negotiation of the terms of the acquisition of Sensors.

Compensation of Directors

Our directors do not receive cash compensation for their services as directors or members of committees of the Board of Directors. However, non-employee directors are eligible to receive stock options. We do reimburse directors for their reasonable expenses incurred in attending meetings of the Board of Directors.

Compensation Committee Interlocks and Insider Participation In Compensation Decisions

The Compensation Committee for fiscal year 2001 was composed of Michael C. Child and Roger C. Ferguson. No member of our Compensation Committee serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

Certain Relationships and Related Transactions

Since April 30, 2000, there has not been, nor is there currently, any transaction or series of similar transactions to which Finisar was or is a party in which the amount involved exceeds $60,000 and in which any director, executive officer or holder of more than five percent of Finisar's capital stock had or will have a direct or indirect material interest other than (a) agreements which are described where required under the caption "Management" and (b) the transactions described above.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers, directors and persons who beneficially own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission ("SEC"). Such persons are required by SEC regulations to furnish Finisar with copies of all Section 16(a) forms filed by such person.

Based solely on our review of such forms furnished to us and written representations from certain reporting persons, during the fiscal year ended April 30, 2001 we believe that all filing requirements applicable to our executive officers, directors and more than 10% stockholders were complied with, except that three statements of changes in beneficial ownership involving three transactions for Jan Lipson, Mark Farley, and Steve Workman for shares purchased pursuant to our employee stock purchase plan in May 2000 were not timely filed; three statements of changes in beneficial ownership involving three transactions for Mark Farley, Richard Woodrow and Steve Workman for shares purchased pursuant to our employee stock purchase plan in November 2000 were not filed; two initial statements of beneficial ownership were not filed by Dallas Meyer and Richard Woodrow when such individuals became executive officers of Finisar in August 2000 and November 2000, respectively; and two statements of changes in beneficial ownership were not filed for the grant of options to Dallas Meyer in August 2000 and April 2001.

11

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

Compensation Philosophy

The goals of our compensation policy are to attract, retain and reward executive officers who contribute to our overall success by offering compensation that is competitive in the networking industry, to motivate executives to achieve our business objectives and to align the interests of officers with the long-term interests of stockholders. We currently use salary, bonuses and stock options to meet these goals.

Form of Compensation

We provide our executive officers with a compensation package consisting of base salary, incentive bonuses and participation in benefit plans generally available to other employees. In setting total compensation, the Compensation Committee considers individual and company performance, as well as market information regarding compensation paid by other companies in our industry.

Base Salary. Salaries for executive officers are initially set based on negotiation with individual executive officers at the time of recruitment and with reference to salaries for comparable positions in the networking industry for individuals of similar education and background to the executive officers being recruited. We also give consideration to the individual's experience, reputation in his or her industry and expected contributions to Finisar. Salaries are generally reviewed annually by the Compensation Committee and are subject to increases based on (i) the Compensation Committee's determination that the individual's level of contribution to Finisar has increased since his or her salary had last been reviewed and (ii) increases in competitive pay levels.

Bonuses. It is our policy that a substantial component of each officer's potential annual compensation take the form of a performance-based bonus. Bonus payments to officers other than the Chief Executive Officer are determined by the Compensation Committee, in consultation with the Chief Executive Officer, based on our financial performance and the achievement of the officer's individual performance objectives. The Chief Executive Officer's bonus is determined by the Compensation Committee, without participation by the Chief Executive Officer, based on the same factors.

Long-Term Incentives. Longer term incentives are provided through the 1999 Stock Option Plan, which rewards executives and other employees through the growth in value of our stock. The Compensation Committee believes that employee equity ownership is highly motivating, provides a major incentive for employees to build stockholder value and serves to align the interests of employees with those of stockholders. Grants of stock options to executive officers are based upon each officer's relative position, responsibilities, historical and expected contributions to Finisar, and the officer's existing stock ownership and previous option grants, with primary weight given to the executive officers' relative rank and responsibilities. Initial stock option grants designed to recruit an executive officer to join Finisar may be based on negotiations with the officer and with reference to historical option grants to existing officers. Stock options are granted at an exercise price equal to the market price of our Common Stock on the date of grant and will provide value to the executive officers only when the price of our Common Stock increases over the exercise price.

2001 Compensation

Compensation for the Chief Executive Officer and other executive officers for 2001 was set according to our established compensation policy described above. In December 2000, we paid holiday bonuses to our employees, including our executive officers. At the end of fiscal 2001, we did not pay performance bonuses to our executive officers. Although we achieved substantial growth in revenue and operating income during fiscal 2001, due to market conditions which led to reduced revenues in the fourth quarter and uncertainty over future orders from our customers, we did not believe that performance bonuses were appropriate at that time.

| | | COMPENSATION COMMITTEE |

|

|

Michael C. Child

Roger C. Ferguson |

12

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees Finisar's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the preparation of the financial statements and the reporting process, including internal control systems. Ernst & Young LLP is responsible for expressing an opinion as to the conformity of Finisar's audited consolidated financial statements with generally accepted accounting principles.

The Audit Committee consists of three directors, each of whom, in the judgment of the Board, is an "independent director" within the meaning of the listing standards for the Nasdaq Stock Market. The Audit Committee acts pursuant to a written charter that has been adopted by the Board of Directors. A copy of the charter was attached as an appendix to Finisar's proxy statement dated May 14, 2001 for the meeting of stockholders held on June 19, 2001.

Ernst & Young LLP, Finisar's independent auditors, billed $394,000 for the fiscal year ended April 30, 2001 for the independent audit of Finisar's annual consolidated financial statements and review of the consolidated financial statements contained in Finisar's quarterly reports on Form 10-Q. Ernst & Young LLP billed Finisar $1,838,000 during the fiscal year ended April 30, 2001 for other services. Other services include fees for business acquisitions, accounting consulting, SEC registration statements, due- diligence and tax consulting. Ernst & Young LLP did not perform any financial information system design or implementation services during fiscal 2001.

The Audit Committee has received from the auditors a formal written statement describing all relationships between the auditors and Finisar that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1 (which relates to the auditors' independence from Finisar and its related entities), discussed with the auditors any relationship that may impact their objectivity and independence, and satisfied itself as to the auditors independence.

The Audit Committee has reviewed and discussed Finisar's audited consolidated financial statements with management. The Audit Committee has discussed with Ernst & Young LLP, Finisar's independent auditors, the matters required to be discussed by SAS 61 (Codification of Statements on Accounting Standards) which include, among other items, matters related to the conduct of the audit of Finisar's financial statements. In addition, the Audit Committee has met with Ernst & Young LLP, with and without management present, to discuss the overall scope of Ernst & Young LLP's audit, the result of their examinations, their evaluations of Finisar's internal controls and the overall quality of its financial reporting.

Based on the review and discussions referred to above, the Audit Committee recommended to Finisar's Board of Directors that Finisar's audited consolidated financial statements be included in Finisar's Annual Report on Form 10-K for the fiscal year ended April 30, 2001.

| | | AUDIT COMMITTEE

Michael C. Child

Roger C. Ferguson

Larry D. Mitchell |

Pursuant to Item 7(e)(3), the above information shall not be deemed to be "soliciting material" or to be "filed" with the Securities and Exchange Commission; nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that Finisar specifically incorporates it by reference in such filing.

13

COMPARISON OF STOCKHOLDER RETURN

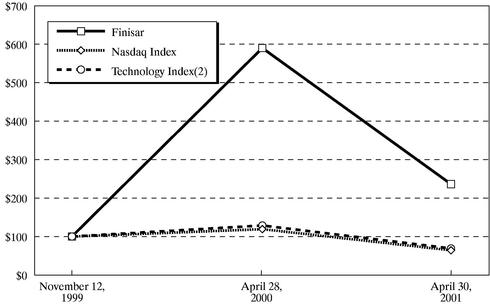

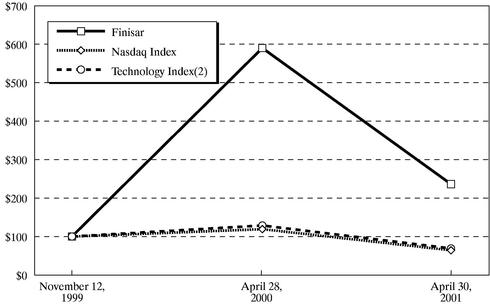

Set forth below is a line graph comparing the annual percentage change in the cumulative total return on our common stock with the cumulative total returns of the CRSP Total Return Index for the Nasdaq Stock Market and the J.P. Morgan H&Q Technology Index for the period commencing on November 12, 1999 and ending on April 30, 2001.(1)

COMPARISON OF CUMULATIVE TOTAL RETURN FROM

NOVEMBER 12, 1999 THROUGH APRIL 30, 2001(1):

FINISAR, NASDAQ INDEX

AND TECHNOLOGY INDEX

| | November 12, 1999

| | April 28, 2000

| | April 30, 2001

|

|---|

| Finisar | | $ | 100.00 | | $ | 589.00 | | $ | 236.05 |

| Nasdaq Index | | $ | 100.00 | | $ | 119.13 | | $ | 65.09 |

| Technology Index(2) | | $ | 100.00 | | $ | 130.10 | | $ | 69.64 |

- (1)

- Assumes that $100.00 was invested on November 12, 1999, at the offering price on the date of our initial public offering, in our common stock and each index. No cash dividends have been declared on our common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

- (2)

- J.P. Morgan H&Q Technology Index. This index was mistakenly identified as the CRSP Index for Nasdaq Networking Stocks in our last proxy statement. We have not selected a different index for comparison.

14

ELECTION OF DIRECTORS

We have a classified Board of Directors consisting of two Class II directors (Frank H. Levinson and Richard B. Lieb), two Class III directors (Michael C. Child and Jerry S. Rawls) and three Class I directors (Roger C. Ferguson, Larry D. Mitchell and Gregory H. Olsen) who will serve until the annual meetings of stockholders to be held in 2001, 2002 and 2003, respectively, and until their respective successors are duly elected and qualified. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting dates.

The terms of the Class II directors will expire on the date of the upcoming annual meeting. Accordingly, two persons are to be elected to serve as Class II directors of the Board of Directors at the meeting. Management's nominees for election by the stockholders to those two positions are the current Class II members of the Board of Directors: Frank H. Levinson and Richard B. Lieb. Please see "Information About Finisar Corporation—Management" above for information concerning the nominees. If elected, the nominees will serve as directors until our Annual Meeting of Stockholders in 2004 and until their successors are elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as we may designate.

Vote Required and Board of Directors' Recommendation

If a quorum is present and voting, the two nominees for Class II director receiving the highest number of votes will be elected as Class II directors. Abstentions and broker non-votes have no effect on the vote.

The Board of Directors recommends a vote "FOR" the nominees named above.

15

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has selected Ernst & Young LLP as independent auditors to audit our consolidated financial statements for the fiscal year ending April 30, 2002. Ernst & Young LLP has acted in such capacity since its appointment in fiscal year 1999. A representative of Ernst & Young LLP is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Vote Required and Board of Directors' Recommendation

The affirmative vote of a majority of the votes cast affirmatively or negatively at the annual meeting of stockholders at which a quorum representing a majority of all outstanding shares of our common stock is present and voting, either in person or by proxy, is required for approval of this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Neither abstentions nor broker non-votes will have any effect on the outcome of the proposal.

The Board of Directors unanimously recommends a vote "FOR" the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending April 30, 2002.

16

STOCKHOLDER PROPOSALS TO BE PRESENTED

AT NEXT ANNUAL MEETING

We have an advance notice provision under our bylaws for stockholder business to be presented at meetings of stockholders. Such provision states that in order for stockholder business to be properly brought before a meeting by a stockholder, such stockholder must have given timely notice thereof in writing to our Secretary. A stockholder proposal to be timely must be received at our principal executive offices not less than 120 calendar days in advance of the one year anniversary of the date our proxy statement was released to stockholders in connection with the previous year's annual meeting of stockholders; except that (i) if no annual meeting was held in the previous year, (ii) if the date of the annual meeting has been changed by more than thirty calendar days from the date contemplated at the time of the previous year's proxy statement or (iii) in the event of a special meeting, then notice must be received not later than the close of business on the tenth day following the day on which notice of the date of the meeting was mailed or public disclosure of the meeting date was made.

Proposals of stockholders intended to be presented at the next annual meeting of the stockholders of Finisar must be received by us at our offices at 1308 Moffett Park Drive, Sunnyvale, California 94089, no later than May 10, 2002 and satisfy the conditions established by the Securities and Exchange Commission for stockholder proposals to be included in our proxy statement for that meeting.

TRANSACTION OF OTHER BUSINESS

At the date of this Proxy Statement, the Board of Directors knows of no other business that will be conducted at the 2001 annual meeting of stockholders of Finisar Corporation other than as described in this Proxy Statement. If any other matter or matters are properly brought before the meeting, or any adjournment or postponement of the meeting, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their best judgment.

| | | By Order of the Board of Directors |

|

|

|

| | | Stephen K. Workman

Secretary |

September 7, 2001

17

FINISAR CORPORATION

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

October 5, 2001

The undersigned hereby appoints Jerry S. Rawls and Stephen K. Workman, or either of them, as proxies and attorneys-in-fact, each with full power of substitution, to represent the undersigned at the Annual Meeting of Stockholders of Finisar Corporation (the "Company") to be held at the Wyndham Garden Hotel at 1300 Chesapeake Terrace, Sunnyvale, CA on October 5, 2001 at 10:00 a.m., and any adjournments or postponements thereof, and to vote the number of shares the undersigned would be entitled to vote if personally present at the meeting.

UNLESS A CONTRARY DIRECTION IS INDICATED, THIS PROXY WILL BE VOTED FOR THE TWO NOMINEES FOR DIRECTOR NAMED IN PROPOSAL 1 AND FOR PROPOSAL 2, AS MORE SPECIFICALLY DESCRIBED IN THE PROXY STATEMENT. IF SPECIFIC INSTRUCTIONS ARE INDICATED, THIS PROXY WILL BE VOTED IN ACCORDANCE THEREWITH. In their discretion the proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof to the extent authorized by Rule 14a-4(c) promulgated by the Securities and Exchange Commission.

(Continued, and to be signed on the reverse side)

| /x/ | PLEASE MARK

YOUR VOTES AS

IN THIS EXAMPLE. |

MANAGEMENT RECOMMENDS A VOTE FOR THE NOMINEES FOR DIRECTOR

LISTED BELOW AND A VOTE FOR PROPOSAL 2.

PROPOSAL 1.

To elect directors to hold office for three years or until their successors are elected. | | | | |

| | | FOR | | WITHHOLD

AUTHORITY |

| Nominees: | | | | |

| Frank H. Levinson | | / / | | / / |

| Richard B. Lieb | | / / | | / / |

To withhold authority to vote for any nominee(s), write such nominee(s)' name(s) below: |

|

|

|

|

|

|

|

|

|

PROPOSAL 2

To ratify the appointment of Ernst & Young LLP as the Company's independent auditors. |

|

FOR

/ / |

AGAINST

/ / |

ABSTAIN

/ /

|

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, YOU ARE URGED TO SIGN AND

PROMPTLY MAIL THIS PROXY IN THE RETURN ENVELOPE SO THAT YOUR STOCK

MAY BE REPRESENTED AT THE MEETING

| | | | | ,2001 |

| |

| |

|

| Signature | | Signature | | Date |

Sign exactly as your name(s) appears on your stock certificate. If shares of stock stand of record in the names of two or more persons or in the name of husband and wife, whether as joint tenants or otherwise, both or all of such persons should sign the above Proxy. If shares of stock are held of record by a corporation, the Proxy should be executed by the President or Vice President and the Secretary or Assistant Secretary. Executors or administrators or other fiduciaries who execute the above Proxy for a deceased Shareholder should give their full title. Please date the Proxy.

|

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held October 5, 2001TABLE OF CONTENTSPROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERSSOLICITATION AND VOTING OF PROXIESINFORMATION ABOUT FINISAR CORPORATIONEXECUTIVE COMPENSATION AND OTHER MATTERSSummary Compensation TableOptions Granted in Fiscal Year Ended April 30, 2001Aggregate Option Exercises In Fiscal 2001 and Values at April 30, 2001REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATIONREPORT OF THE AUDIT COMMITTEECOMPARISON OF STOCKHOLDER RETURNELECTION OF DIRECTORSRATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORSSTOCKHOLDER PROPOSALS TO BE PRESENTED AT NEXT ANNUAL MEETINGTRANSACTION OF OTHER BUSINESS