UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2006

INTEGRATIVE HEALTH TECHNOLOGIES, INC.

Delaware | | 11-3504866 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

4940 Broadway Suite 201 San Antonio, TX 78209

(Address of principal executive offices) (Zip Code)

(210) 824.4200

(Registrant's telephone number, including area code)

Issued pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.00001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

o Large accelerated filer

o Accelerated filer

x Non-accelerated filer

Indicate by check mark whether the registrant is a shell company (defined in Rule 12b-2 of the Act).

o Yes x No

The number of shares outstanding of Integrative Health Technologies, Inc.’s common stock on April 16, 2007 was 40,642,597.

TABLE OF CONTENTS

Item 1. Caveats Regarding Forward Looking Statements

Item 2. Formation of the Business and Historical Summary of Senticore, Inc. (SNIO)

Item 3. Current Description of Integrative Health Technology, Inc.’s (IHTI) Business (With subsequent events)

| C. | Historical Summary of IHTI’s Activities (includes significant events subsequent to the end of the quarter) |

Item 4. Market for Registrant’s Common Stock

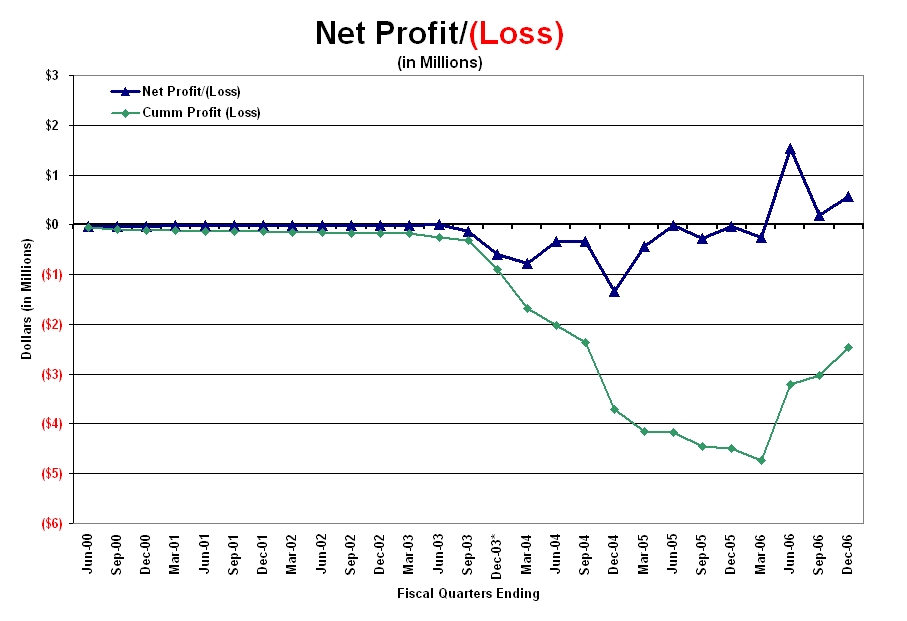

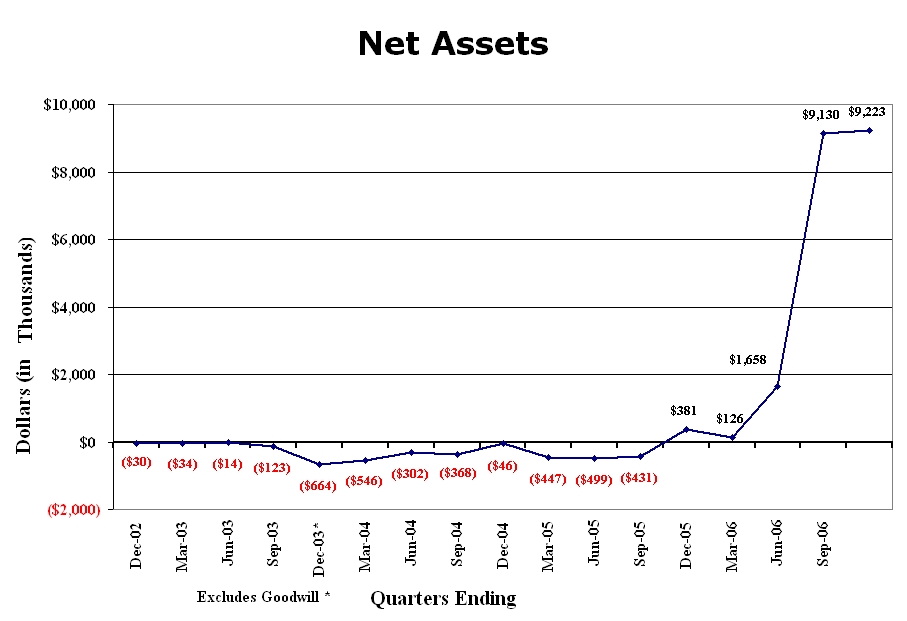

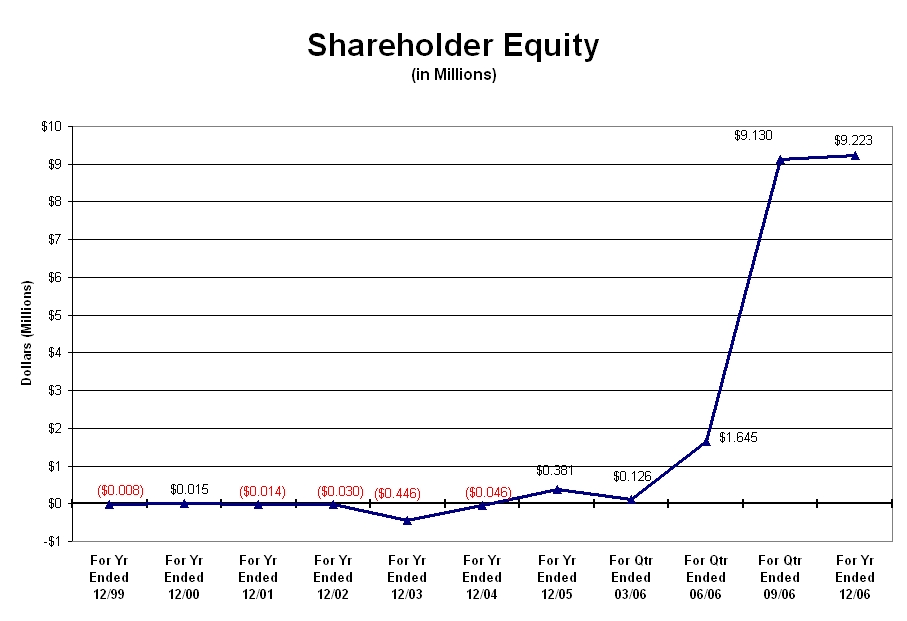

Item 5. Selected Financial Data: Graphic Depictions of:

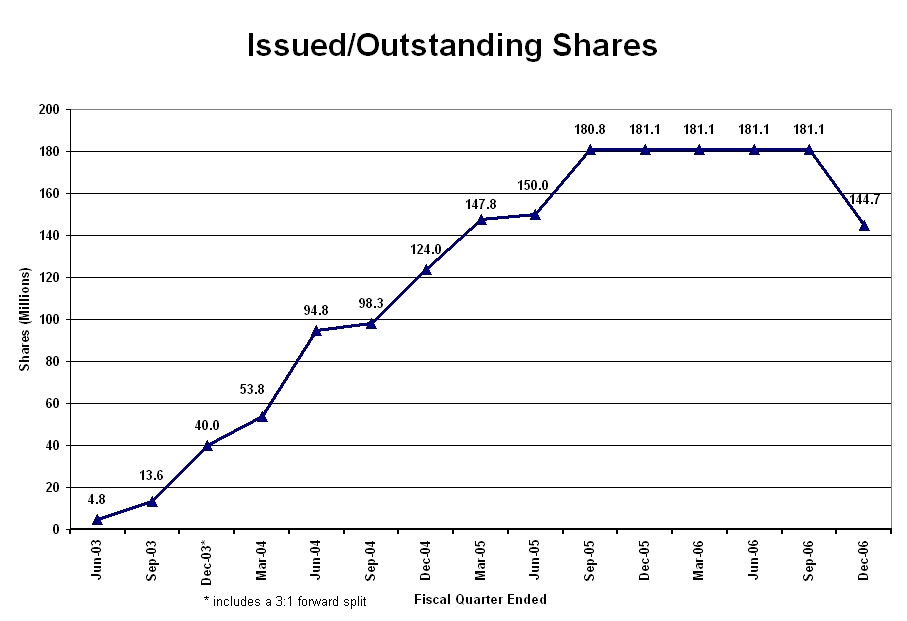

A. Number of Issued and Outstanding Shares (by quarter)

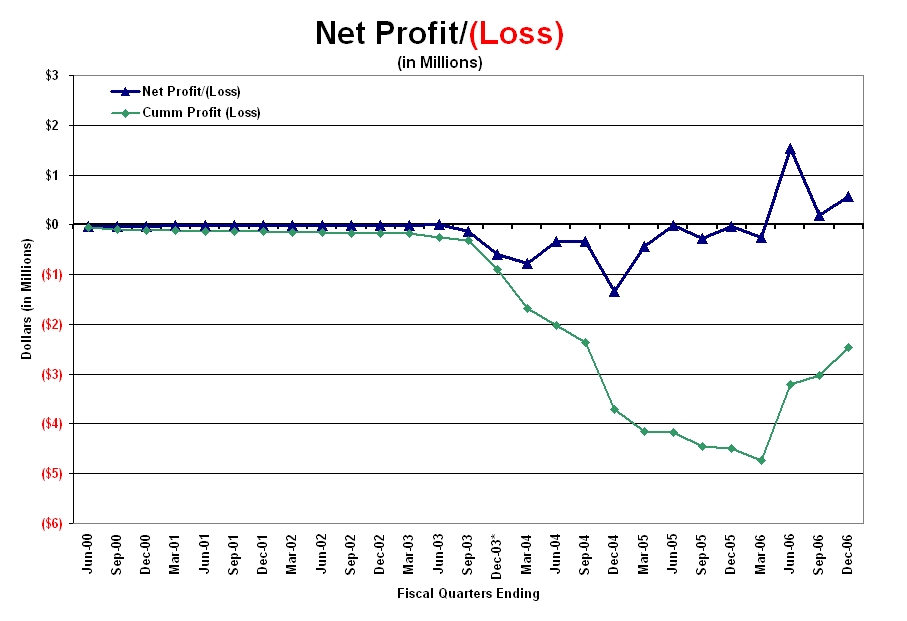

B. Net Profit/(Loss) (by quarters and cumulative)

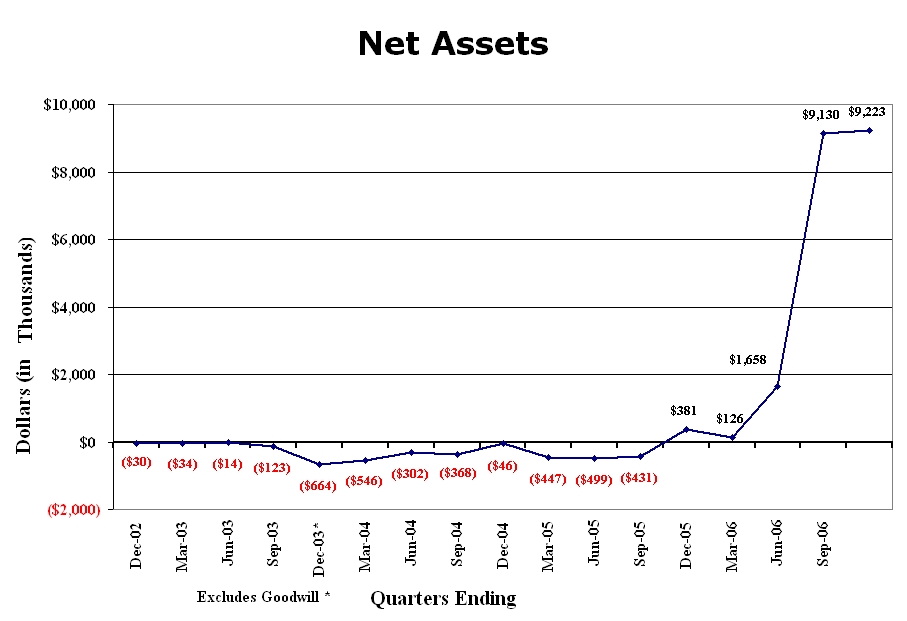

C. Net Assets per quarter

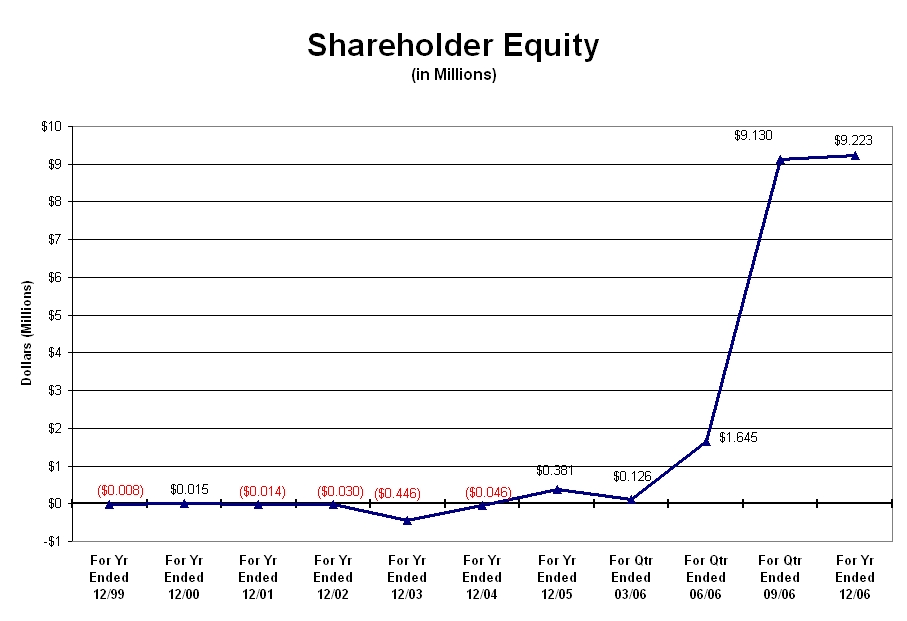

D. Shareholder’s Equity

E. Equity per Share

Item 6. Management's Discussion and Analysis of Financial Condition and Results of Operations

Operating Changes

Previous Investment Strategy

Changes in Investment Strategy and Operating Policies and Actions Taken by Current Management

Activities of Portfolio Companies

Health and Medical Research, Inc.

HealthTech Development, LLC

HealthTech Products, LLCBoard of Directors passed a resolution recommending the Company withdraw its BDC status

Board of Directors passed a resolution recommending a reverse split of the Company’s stock

Board of Directors passed a resolution recommending conversion ratio of preferred stock from 400 to 1 to 2 to 1

Company receives an independent audit of its portfolio company, IHT-IL

IHT-IL’s Scientific Advisory Board agreed to serve as IHHT’s Scientific Advisory Board

Company acquires three wholly owned portfolio companies in the healthcare industry

Liabilities reduced through exchanging or selling of shares in non-core investments

Issuance of new shares suspended as of June 3, 2006

Number of outstanding shares reduced by recapturing and exchanging shares in non-core investments

Plan to liquidate all non-core investments adopted

Operating expenses met through managerial fees received from portfolio companies

Item 7. Financial Statements

Item 8. Notes to Financial Statements

| C. | Management’s Use of Estimates |

| D. | Stock-Based Compensation |

| E. | Valuation of Long-Lived and Intangible Assets |

| F. | Earnings/(Loss) Per Share |

| H. | Related party transactions |

| I. | Significant events subsequent to the end of the quarter. (All significant events are reported above in Item 3-C.) |

Item 9. Subsequent Events (Incorporated into Items 2 and 3)

Item 10. Quantitative and Qualitative Disclosures about Market Risk

Reverse stock split

Impending Issuance of 40 million shares after reverse split is consummated

Uncertainties of reorganization and restructuring

Uncertain effects of de-election of Company’s BDC status

Uncertainties of resolution of unresolved issues inherited from previous management

General nature of unresolved issues

Item 11. Controls and Procedures

Quarterly evaluation controls

CEO/CFO Certifications

Disclosure controls and internal controls

Limitations on the effectiveness of controls

Scope of the evaluation

Conclusions

Item 12. Directors and Officers of the Registrant

Item 13. Security Ownership of Certain Beneficial Owners and Management Owners of 5% or more of the common stock (as converted after the reverse split) of Integrative Health Technologies, Inc.

Item 14. Unregistered Sales of Equity Securities and Use of Proceeds

Item 15. Defaults upon Senior Securities

Item 16. Submission of Matters to a Vote of Securities Holders

Item 17. Other Information

Item 18. Exhibits

Item 1. Caveats Regarding Forward Looking Statements

The matters discussed in this section and in certain other sections of this Form 10-K contain forward-looking statements within the meaning of Section 21D of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, that involve risks and uncertainties. All statements other than statements of historical information provided herein may be deemed to be forward-looking statements. Without limiting the foregoing, the words "may", "will", "could", "should", "intends", "thinks", "believes", "anticipates", "estimates", "plans", "expects", or the negative of such terms and similar expressions are intended to identify assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this report. The following cautionary statements identify important factors that could cause Integrative Health Technologies, Inc. ("IHTI," "we" or "Company") actual results to differ materially from those projected in the forward-looking statements made in this Report. Among the key factors that have a direct bearing on IHTI’s results of operations include:

| · | General economic and business conditions; changes in political, social and economic conditions; |

| · | Previous management’s widespread failure to comply with government regulations; |

| · | Absence of adequate corporate books and records and improperly issued shares from 2003 through May 2006 |

| · | Success of operating initiatives; changes in business strategy or development plans; management of growth; |

| · | Changes in marketing and technology; availability, terms and deployment of capital; |

| · | Legal, administrative and accounting expenses; existence or absence of adverse publicity; |

| · | Short-term over reliance on senior management; business abilities and judgment of personnel; |

| · | Availability of qualified personnel |

| · | Development risks; risks relating to the availability of financing, and other factors referenced in this Report. |

Because the risks factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by IHTI, you should not place undue reliance on any such forward-looking statements. Other factors may be described from time to time in IHTI's other filings with the Securities and Exchange Commission, news releases and other communications. Further, any forward-looking statement speaks only as of the date on which it is made and IHTI undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for IHTI to predict which will arise. In addition, IHTI cannot assess the impact of each factor on IHTI's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Subsequent written and oral forward-looking statements attributable to IHTI or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements set forth above and contained elsewhere in this Annual Report on Form 10-K.

IHTI has been and is currently subject to the informational requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940 as amended. In accordance with those requirements, we file reports and other information with the Securities and Exchange Commission. Such reports and other information can be inspected and copied at the public reference facilities maintained by the SEC. Please call the SEC at 1-800-SEC-0330 for more information on the operation of its public reference rooms. The SEC also maintains a Web site that contains reports, proxy and information statements and other materials that are filed through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. All of the Company’s reports, registration statements, proxy and information statements and other information that is filed electronically with the SEC are available on:

http://www.sec.gov/cgi-bin/browse-edgar?company=Integrative+Health+Technologies&CIK=ihht&filenum=&State=&SIC=&owner=include&action=getcompany

Item 2. Formation of the Business and Historical Summary of Senticore, Inc (SNIO)

The Company was incorporated on January 5, 1999 under the laws of the state of Delaware as HOJO Holdings, Inc. as an internet professional services firm specializing in high end web site development. However, due to the lack of success in developing this business model, in April 2003, former management resigned and was replaced by a new board and new officers and directors led by Rohit Patel and the Company was renamed at Senticore, Inc. (SNIO). At the time of acquisition by SNIO, HOJO Holdings, Inc. reported that it had 20,000,000 authorized shares, 4,800,000 issued and outstanding shares, a stockholders’ deficit of $(30,235) and a net operating loss of $(179,720) since inception.

SNIO sought business opportunities with target businesses that offered significant long term growth potential. Although the new management had experience in the hospitality industry and real estate, they also sought opportunities in any specific business, industry or geographical location for participation in business ventures of virtually any kind or nature. Due to SNIO’s limited capital resources, it sought the acquisition of, or merger or consolidation with, companies that did not need substantial additional capital but that desired to establish a public trading market for its shares. These companies could, therefore, avoid the potential adverse consequences of undertaking a public offering, such as the time delays and significant expenses incurred to comply with the various federal and state securities laws that regulate initial public offerings. These businesses were thought to create a public market for their shares in order to enhance liquidity for current shareholders, facilitate raising capital through the public sale of securities of which a prior existence of a public market for our securities exists, and/or acquire additional assets through the issuance of securities rather than for cash.

As part of their business plan, on February 11, 2005 SNIO filed the required Form N-54 with the SEC electing to be regulated as a Business Development Company (“BDC”) in accordance with the Investment Company Act of 1940. The company submitted an Offering Circular Under Regulation E on February 10, 2005 ultimately issuing 78,324,075 shares of common stock under the Regulation E exemption.

As a result of a series of failed acquisitions, business losses, questionable issuance of shares for services and collateral surrendered for defaulted loans, the absence of any cash flow or operating profits to defer operating expenses, multiple changes in auditors and accountants, SNIO reported in its 2005 annual filing that it had increased its:

| · | authorized shares to 200,000,000, |

| · | issued and outstanding shares to 181,145,154, |

| · | retained deficit to $(3,772,359) and |

| · | cumulative net loss since its January 1999 inception to $(4,482,091). |

While we have verified these figures, due to the incomplete and inconsistent books and records we received in conjunction with our acquisition SNIO in June 2006, we are unable to attest to the accuracy of any the additional information reported in the SEC filings and the financial information contained therein. Therefore, while the financial statements provided in this report have been prepared by a certified public accountant, the pre-merger historical information presented in this filing should be viewed as our estimate, not certification, of the events, transactions and financial information that were reported in the quarterly and annual filings beginning with the quarter ending March 31, 2003 through and including the quarter ending June 30, 2006.

In a complicated series of transaction reported in SNIO’s 2005 annual filing (pgs 33-35), on October 18, 2005, SNIO acquired 7,000,000 common shares, (as converted) in Taj Systems, Inc. (Pink Sheets: TJSS) an on-line gambling company trading for $0.25 a share; 11,538 shares of Strategic Growth Ventures, Inc. (Pink Sheets: SGWV [later acquired by Beere Financial and reverse split to 2,307 shares]), and 882,353 shares of AdZone Research (OTC: ADZR) trading for $.06 a share.

On May 12, 2006, SNIO filed an Form 8-K with the SEC announcing that it planned to enter into an Agreement and Plan of Reorganization (the “Agreement”), with Integrative Health Technologies, Inc., an Illinois corporation (“IHT”); the common stockholders of IHT (the “IHT Stockholders”); and Jay Patel, SNIO’s CEO. Pursuant to the terms of the Agreement, all 80,000,000 shares of common stock, $.0001 par value, of IHT (the “IHT Common Stock”) issued and outstanding prior to the closing, will be exchanged in the aggregate for 20,000,000 shares of Series A Convertible Preferred Stock, $.001 par value, of SNIO (the “Convertible Preferred Stock”). As a result of the exchange, IHT will become a wholly-owned subsidiary of SNIO and the shareholders of IHT will have voting control of SNIO.

Each share of Convertible Preferred Stock has the right to convert into 400 shares of SNIO common stock, $.001 par value and the right to vote on an as converted basis. The Convertible Preferred Stock is non-participating only with regard to dividends distributed prior to the conversion. The Certificate of Designation of the Convertible Preferred Stock was filed with the Secretary of State of Delaware and contains certain other covenants to protect the priority of the Convertible Preferred Stock, and its claim to assets of SNIO in certain events, all of which are set forth in Exhibit A to the Agreement, attached as Exhibit 10.1 to the 8-K and is hereby incorporated by reference.

SNIO, IHT and the IHT Stockholders have structured a merger transaction in which the holders of the outstanding shares of SNIO’s Common Stock and the IHT Stockholders will together become shareholders of SNIO, and their plan is that all shareholders shall be provided with an equity participation in SNIO equivalent of the dollar value of their equity interests on the date of closing. After giving effect to the transaction, SNIO will own all of the issued and outstanding shares of IHT and IHT will become a wholly-owned subsidiary of SNIO. The IHT Stockholders will have voting control of SNIO amounting to approximately 97.7% of SNIO’s total combined voting powe.

IHT is engaged in the research and development of healthcare products and technologies, and its headquarters are located in San Antonio, Texas. IHT had an unaudited balance sheet as of April 30, 2006, presenting total assets of $8,097,515 and stockholders equity of $7,710,883. IHT intends to file an amendment to this Form 8-K within 71 calendar days disclosing its audited and pro forma combined financial statements with the Registrant, as required by Item 9.01 of Form 8-K.

As previously reported, SNIO filed a Form N-54A with the Commission on February 11, 2005 and elected to become a business development company subject to Sections 55 through 65, among others, of the Investment Company Act of 1940, as amended. As a result of this transaction, IHT will become SNIO’s largest portfolio company. In addition, the management of IHT will assume management of SNIO after the filing of a Schedule 14F-1 with the Commission and the required waiting period. The new management intends to continue to operate SNIO as a business development company and to make additional acquisitions limited to the healthcare and related industries. As a result of the acquisition, SNIO will have an 181,145,154 shares of common stock issued and outstanding, and 20,000,000 shares of Convertible Preferred Stock issued and outstanding.

The Agreement closed on June 3, 2006 as reported in a Form 8-K filed with the SEC on that date and is hereby incorporated by reference.

Item 3. Current Description of Integrative Health Technology, Inc.’s (IHTI) Business

A. Company Mission. Integrative Health Technologies, Inc’s (IHTI) mission is to use its scientific and testing resources, research and development experience, and financial resources to aid healthcare companies in the discovery, testing and marketing of their healthcare products and technologies. In return for this support, IHTI receives equity or stock in the companies for whom it provided these services or royalties from the products and technologies it helped develop.

The Company is limiting its involvement to healthcare entities that can provide products and services that can contribute to the prevention and reduction of the global health problems as reported by the World Health Organization (WHO):

“Nearly 400 million people will die from heart disease, diabetes and other chronic ailments over the next 10 years, but many of those deaths can be prevented by healthier lifestyles, diets and increased physical activity. Exercise and better diets can help prevent 80 percent of premature cases of heart disease, strokes and diabetes… The financial burden from an increasing death toll from such non-communicable diseases will also be enormous. China could spend $558 billion, Russia, $303 billion and India, $236 billion over the next decade treating heart disease, strokes and diabetes. ‘The lives of far too many people in the world are being blighted and cut short by chronic diseases, diseases that can be prevented with healthier diets and increased physical activity’ said Lee Jong-Wook, WHO Director-General.”

IHTI’s, business plan is to conduct research and development of products, programs and technologies aimed at enhancing body composition. Improvements in body composition are achieved as a result of decreasing body fat while maintaining or increasing lean mass and bone density. Improvements in these parameters will make major contributions to the reduction of risk factors for three major global disorders: osteoporosis, obesity and sarcopenia (the progressive loss of lean mass with aging and inactivity). All three of these disorders result from sub-optimal levels of muscle, fat and bone mass, or a combination of the three. Osteoporosis is the result of too little bone mass or density; obesity is the result of too much fat mass; and sarcopenia is the result of too little muscle mass. Click on the following icons for more information on the Company’s progress to date and its potential for future growth. A more detailed description of the Company’s mission can be found on www.ihtglobal.com under the following headings:

Scientific Advisory Board - lists the current members and their institutional affiliations whom the Company relies upon for independent evaluations of its research and development projects and programs.

Strategic Alliances - lists and describes the organizations with whom the Company has formed strategic alliances.

Significance of Body Composition Measurements - provides information on the importance of using changes in Body Composition, instead of changes in scale weight, to evaluate the safety and efficacy of medical and nutritional interventions, the research conducted to date, and current and future R & D activities.

On-site DEXA Measurements - provides information on Dual Energy X-ray Absorptiometry (DEXA) and why it is considered the “gold standard” for measuring fat, lean and bone. The Company’s mobile testing units have enabled the company to acquire measurements throughout the United States and Canada.

Blood Chemistry Testing - describes the typical 43-item blood chemistry panel that has been obtained from approximately 9,000 subjects who have participated in the company’s research studies over the past 30 years and the potential these measurements have to expand client research designs and to contribute to the general body of scientific information.

On-going R & D - describes the Company’s on-going clinical trials and research and the development of health-enhancing and risk-reducing products and technologies.

The Database of Medical Biomarkers - contains over two million medical measurements that have been acquired from a national sample of over 40,000 people of all ages, genders, ethnic backgrounds. It includes over 22,000 DEXA tests acquired over the last 30 years.

B. Revenue Sources. IHTI’s revenues are being derived from the Strategic Alliances IHTI has established with companies to whom it provides technical, testing and scientific support. The revenues include:

| · | Sales of shares in companies that have been acquired from services provided by IHTI |

| · | Fees paid by healthcare companies for the conduct of pilot studies and clinical trials by Health & Medical Research, Inc. |

| · | Royalties or overrides from products/technologies for which HealthTech Development, LLC provided R & D services |

| · | All consulting fees and R & D profits earned by Dr. Kaats in his capacity as CEO of HealthTech Development, |

| · | LLC become the property of IHTI to avoid a conflict of interest |

| · | Profit sharing of as much as 50% for all nutritional products/technologies sold by HealthTech Products, LLC. |

| · | Shared profits for services IHTI provides to it’s portfolio companies, e.g. Innovative Functional Foods for sales of the bone-health cookie |

| · | Fees for testing and scientific services provided through sub-contracts for other testing/research agencies |

C. Historical Summary of IHTI’s Activities (Includes significant events subsequent to the end of the quarter). Copies of all SNIO, IHHT and IHTI filings are available on the SEC website cited above and on the Company’s www.ihtglobal website.

Copies of all press releases are available on the Company’s website under the icon, “Company Press Room.”

A chronological summary of all filings and press releases is presented below.

May 12, 2006, SEC Form 8-K SNIO Announces Merger/Reorganization Plan. SNIO announced plan to enter into an Agreement and Plan of Reorganization (the “Agreement”), with Integrative Health Technologies, Inc. (see summary of 8-K above).

May 25, 2006 IHT’s Press Release Announces Agreement Providing Description of it’s Business. Integrative Health Technologies, Inc. (IHT) of San Antonio announced the signing of a merger agreement in which it will become a wholly owned subsidiary of, and transfer its assets and outstanding shares to, Senticore, Inc. (OTC Bulletin Board: SNIO), a business development company. IHT and its subsidiary, Health and Medical Research Center, have been engaged in the research and development of nutritional and healthcare products and technologies for over 20 years. Relying on the advice and guidance provided by its highly qualified Scientific Advisory Board (www.ihtglobal.com), IHT receives grants from a number of leading companies in the healthcare and nutrition industries to conduct independent studies of the safety and efficacy of products and supplements designed to facilitate weight loss while improving bone health, blood chemistries, and quality of life. Its assets include a national database of over 2,000,000 measurements of bone density, lean and fat mass, and blood chemistries obtained from some of the most sophisticated technologies available. It contains data from people residing in every state in the union from measurements obtained from IHT's five mobile testing units.

“The database is a virtual scientific gold mine for the purpose of examining the relationships between the various measurements, and can aid in the development of prediction models designed to personalize nutritional and medical recommendations to the individual's unique physiological and biochemical requirements,” said Dr. Joel Michalek, a university professor on IHT's Scientific Advisory Board.

“There is no doubt that the measurements of changes in lean, fat and bone mass contained in the database are going to have a profound effect on how we view weight loss,” said Dr. Harry G. Preuss, a member of IHT's Scientific Board, Professor of Medicine at Georgetown University and former President of the American College of Nutrition. “We are re-framing the way we think about weight loss and paying much more attention to the kind, not the amount, of weight that is lost. Obviously, losing muscle and bone mass is hardly indicative of healthy weight loss,” added Dr. Preuss.

The company has derived its income from ongoing research and consulting contracts with its healthcare and nutritional clientele. As of May 15, 2006, IHT had an un-audited balance sheet indicating assets of $8,097,515 and liabilities of $522,952. “We need to underscore the 'un-audited' nature of these figures until we obtain an independent audit, which will be filed as an amendment to our Form 8-K within 71 calendar days of closing,” said IHT's CEO, Gilbert R. Kaats, PhD.

IHT will become Senticore's largest portfolio company and, in conjunction with the merger, IHT's management team will replace Senticore's management after the SEC's required 10-day waiting period. At that time, the company will continue to operate as a business development company, but will limit its acquisitions and its research and development, to the healthcare and nutritional industries utilizing its networking connections that have been developed over the past 20 years.

June 3, 2006 SEC Form 8-K Reports Merger/Reorganiztion Agreement Closed. Filed by SNIO announcing closing of Merger Agreement and Plan of Reorganization with Integrative Health Technologies, Inc. In addition to the conditions set forth in the planned Agreement, the final Agreement included an exchange of Taj Systems shares owned by SNIO for cancellation of SNIO’s current liabilities by $736,400, a reduction from $958,572 to $222,172.

June 3, 2006 SEC Form 8-K Reports Change in SNIO’s Board and Officers. In conjunction with announcing the closing Agreement, an 8K filed on the same date announced the replacement of SNIO’s Board members and officers with IHT’s board members and officers describing their qualifications.

June 14, 2006 Press Release Announces $736,400 (77%) Reduction of SNIO’s Outstanding Liabilities. SNIO’s incoming CEO, Gilbert R. Kaats, PhD, pointed out that “I think it is important for our shareholders to know that this was not the result of the investment of additional funds,” said Kaats. “We offset these liabilities by providing the creditors with preferred shares in Taj Systems, Inc., one of our portfolio companies that trades on the Pink Sheets under TJSS. Thus, while our liabilities were reduced, so were our assets,” Kaats pointed out. Kaats also reported that “…even after offsetting the $736,400 of liabilities with Taj shares, SNIO retains approximately 4,246,394 shares…”

SNIO's new management team will continue to focus their energies on its research and development activities, particularly its $1,300,000 grant previously awarded to IHT Research & Development, Inc., one of SNIO's portfolio companies. This grant is to conduct clinical trials involving 400 subjects from ages 8 to 80, to develop a bone-health program. 'Our inclusion of adolescents in this study is in direct response to the U.S. Surgeon General's 'call to action' to the healthcare industry in light of a study finding that almost 85% of high school girls are receiving insufficient amounts of bone-building nutrients for normal growth,' said Sam Keith, the R & D company's CEO. 'This nutritional deficiency is particularly troublesome,' Keith pointed out, 'since most of the adolescents' bone growth occurs during these critical early years.'

June 14, 2006 Press Release Describes IHTI’s Bone Health Study. SNIO describes how the Company’s portfolio companies are working together on a grant to complete a $1,286,897 study to develop and market a bone-health program for adolescents and adults. The grant, jointly funded by AlgaeCal International and IHT prior to its merger with SNIO, involves 400 subjects and is being conducted by investigators from two major universities. The study is in response to a 'call to action' issued in the U.S. Surgeon General's (SG) 2004 Bone Health report citing studies that 85% of adolescent girls and 65% of boys do not consume sufficient calcium and bone building nutrients for normal bone growth. The SG reported that the lack of adequate nutrition during these critical bone-building years has placed America's bone health in jeopardy. The Report encourages development of programs to increase bone health by improving diets, increasing physical activity, and improving 'health literacy' and to '...get started by taking action today in homes, health care settings, and communities across our nation...you are never too old or too young to improve your bone health,' pointed out the SG.

Using AlgaeCal's plant-derived calcium with natural occurring magnesium and 73 other trace minerals, IHT conducted an exhaustive review of the research on bone-building ingredients. This research supported the addition of higher than recommended levels of vitamins D-3 and K-2 to the blend and the incorporation of recently discovered bone-building mineral, strontium, into the adult program. The blend was incorporated into bone-health cookies along with Z-trim fat-replacer (AMEX: ZTM; health-enhancing Enova oil (www.enovaoil.com), a product of a joint venture between Japanese Kao Corporation and Archer Daniels Midland; and Fibersol-2 (www.matsutaniamerica.com) soluble dietary fiber. Prior to beginning the study, a series of pilot studies were conducted using adolescents and adults to evaluate the taste and texture of the cookies using increasingly finer grinds of the calcium.

After completion of the pilot studies designed to refine the plan, formal clinical trials began in early 2006. The trials involved 400 subjects, including adults, adolescents and children. Subjects completed self-reports, bone density x-rays (DEXA), and a 43-item blood chemistry panel at baseline, and will complete the same tests after 90-days, 6-months, one-year and five-years. “In addition to the benefits derived from the research data,” said Samuel Keith, CEO of the Research Center, “the children, adolescents and adults are all being provided with comprehensive test reports of their bone density and blood chemistries, the cost of which would be prohibitive to most of these people.”

“In return for their support of our clinical trials,”said Dean Neuls, President of AlgaeCal International, “we have a long-term strategic relationship with SNIO providing them with a royalty based on our gross national and international sales of AlgaeCal as well as the bone-health program we are presently studying. “In our view, developing and marketing the bone-health program that incorporates the use of bone-health supplements to improve diets, a practical pedometer-based program to increase physical activity and feedback of test and tracking data to improve health literacy is an example of the synergy of our portfolio companies,” said Gilbert Kaats, SNIO's CEO.

June 22, 2006 Press Release Announces Plan to Change Company’s Name to Integrative Health Technologies, Inc. (IHHT) and Dividend AdZone, Inc. (ADZR) shares. SNIO’s first-ever dividend will be distributed to all shareholders of record on close of business on June 30, 2006. The amount and timing of the dividend will be based on an estimated at $58,000 to be derived from sale of its 882,353 shares in AdZone Research, Inc., a company incompatible with SNIO’s current mission. The intent to dividend was announced by the Company in its 2004 and 2005 SEC filings.

July 10, 2006 Press Release Announces Company’s First Profitable Quarter Since its Inception in 1999. Reversing a 7-year history of consistent quarterly losses averaging $150,000 per quarter, the Company announced that its net profit for the quarter ending June 30, 2006 will exceed $500,000. “We are a Business Development Company, or BDC,” explained Gilbert R. Kaats, SNIO’s CEO, “and our profit is calculated based on increases in the company's net assets from the portfolio companies it acquires. If the value of one of our portfolio companies increases, our net profit increases, providing the increase is not offset with a corresponding increase in liabilities,” Kaats pointed out. The main source of the net profit for this quarter was an increase in the value of the shares of Taj Systems, Inc. (Pink Sheets: TJSS), one of SNIO’s portfolio companies that trades on the Pink Sheets under TJSS.

The increase in assets that led to the profit does not include Integrative Health Technologies, Inc.'s (IHT) assets which were acquired in the merger. The company's May 25th release press release estimated that IHT's assets could have a value in excess of $7,800,000. “However,” Kaats pointed out that “…we also cautioned against using this value for IHT's assets until an independent audit is completed later this quarter. We have excluded these assets from our calculation of profits,” added Kaats.

August 2, 2006 SEC Form 8-K Reports Change in Company’s name to “Integrative Health Technologies, Inc.” (IHHT) and Change in Officer/Director. In connection with the name change, Carl Gessner, SNIO’s President and Director, resigned from both positions. Gilbert R. Kaats, Ph.D., Chairman and CEO of IHHT, assumed the duties of President without any increase in compensation for such service, and provided his background information.

August 22, 2006 SEC Form 10QSB For Quarter Ending June 30, 2006.

October 18, 2006 SEC Form 8-K Reports Plan to Execute a 200:1 Reverse Split of Common Stock and Reduction of Preferred Stock Conversion Ratio from 1:400 to 1:2. As a result of the Reverse Split, the Registrant will have approximately 902,292 shares issued and outstanding, which is based on a total issued and outstanding number of shares of 180,458,487 as of September 19, 2006. In addition, as a result of the Reverse Split, the Registrant will have a public float of approximately 552,562 shares, which is based on a total public float of approximately 110,512,320 shares as of September 19, 2006. Reducing the conversion ratio of the preferred shares by a factor of 200 treats holders of Series A Convertible Preferred Stock in the same way as holders of common stock which will be converted into 40,000,000 shares of common stock, instead of the 8,000,000,000 shares that would have resulted previously.

October 18, 2006 SEC Form 8-KA Filed as Amendment to a previously filed 8-K Reporting Independent Audit of IHT of Illinois’s Net Assets of $7,626,273 to be Added to Assets Acquired from SNIO.

Nov 24, 2006 SEC Preliminary 14-C Filed for Reverse Split and Change in Conversion Ratio of Preferred Shares.

Dec 19, 2006 SEC Preliminary 14-C Filed of Company’s Intent to Withdraw its Election to be Regulated as a Business Development Company (“BDC”) Under the Investment Company Act of 1940.

Dec 21, 2006 SEC Form 10-Q for Quarter Ending September 30, 2006.

Feb 21, 2007 SEC Definitive 14-C Filed for Reverse Split and Change in Conversion Ratio of Preferred Shares

Feb 22, 2007 SEC Form 8-K Reports Company’s Concern About the Legitimacy of its’ 2005 Election to be Regulated as a BDC. The Company has previously reported on several occasions that it is a Business Development Corporation (“BDC”) under the Investment Act of 1940. However, it has come to the attention of management that the Company’s election to become a BDC was ineffective and that the Company is not and has never been a BDC. On February 11, 2005, prior management had caused the company to file Form N-54 purporting to elect BDC status. Prior management apparently believed that the Company had made an effective election to become a BDC, since (1) they operated the company on that assumption, (2) represented to current management that the company was a BDC, and (3) caused the Company to specifically represent such in the closing documents for the June 3, 2006 transaction. Current management, relying on the Form N-54 filing and the representations made prior to and at closing, believed the company was a BDC.

Current management has discovered that the N-54 filing was ineffective in that it did not comply with the preconditions for an effective filing under s.54 of the Investment Company Act. Specifically, s.54 of the Investment Company Act requires one of two preconditions to be met for an effective BDC election: the company either must have a class of its equity securities registered under section 12 of the Securities Exchange Act of 1934 or it must have filed a registration statement pursuant to section 12 of the Securities Exchange Act of 1934 for a class of its equity securities. Neither precondition was met by the Company.

Although the mistaken belief as to the company’s status has led to instances of noncompliance with certain securities laws and regulations, management is not aware of any issues arising as a result that are likely to have a material effect on the company or its business prospects. Nevertheless, investors are cautioned that the laws and regulations in question are complex, that the situation is unusual, and that a full assessment of all the effects and their materiality or lack of materiality has not yet been completed.

Mar 26, 2007 Nasdaq Executes Previously Reported 200:1 Reverse Split and 1:2 Change in Conversion Ratio of Preferred Shares Announced Assigning Company New Trading Symbol of IHTI.

Mar 27, 2007 Mannatech Inc. (Nasdaq: MTEX) Announces Award of Grant to IHTI to Analyze IHTI’s Extensive Database to Determine the Health Benefits of Mannatech Glyconutrients. Mannatech, Incorporated (Nasdaq: MTEX), has awarded a grant to independent researchers to analyze a database of more than 1 million aging- and immune-related biomarkers to determine the relationship between changes in these measurements and the consumption of glyconutrients. The database contains biomarkers taken from more than 7,000 people who have consumed Mannatech's glyconutritional products over the last 13 years. It also contains biomarkers taken from more than 13,000 people who have consumed supplements from other companies during the same period. Researchers will compare changes in biomarkers between the two sets of consumers.

Biomarkers are sophisticated medical measurements that are used to track changes in biological functions or conditions within the body that relate to aging and immunity. Analysis of the database will be conducted by the Health and Medical Research Center, a wholly owned subsidiary of Integrative Health Technologies, Inc. (OTC Bulletin Board: IHTI).

'The database contains measurements from one of the industry's largest and longest-running longitudinal trials of the potential benefits of nutritional supplements,' said Dr. Harry G. Preuss, one of the researchers and former president of the American College of Nutrition. 'Our analyses will also go well beyond comparisons between glyconutrients and other supplements and will allow us to publish some heretofore unknown relationships between the millions of state-of-the-art measurements in the database.'

Mannatech awarded its first grant to the Research Center in 1994 to examine the effects of glyconutrient consumption using widely accepted biomarkers for immunity and aging. These biomarkers include body fat, lean mass, bone density, blood chemistries and self-reported quality of life.

'Our initial analysis of the data suggests that consumption of Mannatech's glyconutritional supplements may have contributed to positive changes in some of the important aging and immunity biomarkers,' said Gilbert R. Kaats, Ph.D., the team's lead investigator. 'Analyses of these short-term pilot studies in the database have indicated these glyconutritionals may help improve bone health, help maintain already healthy blood cholesterol levels and improve self-reported quality of life.'

'Mannatech is eager to analyze scientific information spanning more than a decade of consumer use of our products,' said Robert A. Sinnott, Ph.D., Mannatech's chief science officer. 'We are confident that statistical analysis of this information will add to the growing body of scientific evidence supporting the benefit of glyconutrients on various parameters of health and well-being.'

Professor Joel Michalek, another investigator and co-chairman of the Center for Epidemiology/Biostatistics at the University of Texas Health Science Center at San Antonio, said the analysis could significantly improve scientific understanding of biomarkers used to assess health and immunity.

'It would be difficult to overstate the potential contribution our analyses can make to science and medicine,' Michalek said. 'Virtually no one has the kind nor the magnitude of the sophisticated tests and measurements contained in this database, particularly since it is a national sample of subjects. We believe dozens of scientific articles will emanate from our analyses.'

Founded in 1993, Mannatech is a leading wellness company and a pioneer in the field of proprietary glyconutritional supplements and wellness products. In 1996, the company announced a ground-breaking formulation of a nutritional supplement comprised of a unique blend of plant-based saccharides, which are also known as glyconutrients ('glyco' is the Greek word for 'sweet').

Apr 9, 2007 SEC Form 8-K Reports Concern About the Legitimacy of its 2005 Election to be Regulated as a BDC Rendered Moot by Shareholders’ Approval to Withdraw its Election to be Regulated as a BDC. On February 11, 2005, the Company filed Form N-54 in which it elected to become a Business Development Corporation (“BDC”) under the Investment Company Act of 1940. The Company believed that this election was valid and reported that it was a BDC. However, the Company reported in a Form 8-K filed on February 21, 2007 that it had discovered an irregularity in the filing of the N-54, and that it had concluded, as a result, that it was not and had never been a BDC.

Since February 21, 2007, representatives of the Company have been in discussion with representatives of the SEC. It is the view of the SEC that the Company’s election to become a BDC was a valid election, and that the Company remains a BDC despite the statements to the contrary contained in the February 21, 2007 Form 8-K. The Company has decided that it would be in the best interests of the Company and its shareholders to render the issue moot by filing a notice of withdrawal of its BDC election under s.54(c) of the Investment Company Act. The Company has already filed a preliminary Form 14-C reporting that the decision to withdraw the election has been approved by the Company’s Board of Directors and shareholders and will forthwith file a Definitive 14-C notifying the SEC and its shareholders of the withdrawal of its BDC status.

Apr 10, 2007 SEC Definitive Form 14-C Filed for Withdrawal of BDC status

Apr 16 SEC Form 10-K Filed for Year Ending 2006.

Apr 16, 2007 Press Release Provides Update of Company’s Activities Since Merger/Reorganization Agreement of June 3, 2006. Integrative Health Technologies, Inc.’s Reports Four Profitable Quarters, Increased Assets, Reduced Liabilities and New Product Development

SAN ANTONIO, Texas, April 16 - After closing its merger Agreement with Senticore, Inc. (SNIO) on June 3, 2006 and installing a new management team and directors, Integrative Health Technologies, Inc (IHTI) discovered a number of irregularities associated with the Company’s pre-merger 2005 election to be regulated as a Business Development Company (BDC). In July 2006, the current management decided not to publish any press releases until these irregularities could be addressed, a reverse split could be implemented, and shareholder approval was obtained to withdraw the Company’s BDC status. Those actions have now been completed and this update is being provided to existing and future shareholders. All filings and press releases from June 2006 are now, or soon will be, available on the Company’s website, www.ihtglobal.com. Since June 2006, the Company:

ྊ Completed its fourth straight quarter of net profits

ྊ Achieved an average quarterly cash flow of $152,000 over the past 4 quarters

ྊ Increased its assets to $9,321,531

ྊ Reduced its liabilities to $381,225

ྊ Recaptured 40,287,329 shares (22.2%) of the 181,145,154 previously issued and outstanding

ྊ Issued no additional shares during the last four quarters nor executed any loans

ྊ Executed reverse split reducing the common shares from 8,140,857,828 available for issuance to 40,704,443

ྊ Received a grant from Mannatech, Inc. (Nasdaq: MTEX) to analyze IHTI’s massive medical data base

ྊ Acquired ownership of 8% of AlgaeCal International (www.algaecal.com)

ྊ Completed R & D for AlgaeCal/Strontium Pro, Company’s Bone-health Program for Healthcare Professionals

ྊ Signed contract with investment relations firm to attract new investors and maintain current shareholder base

IHTI is also nearing completion of its 400-subject study of the effects of the AlgaeCal Bone-Health Plan (www.algaecal.com) on the bone density, body fat and lean of children, adolescents and adults. The study is being conducted in response to the U.S. Surgeon General’s “Call to Action” upon finding that “America’s bone health is in jeopardy” citing a USDA finding that over two-thirds of America’s adolescents are not receiving sufficient bone-building nutrients to support normal bone growth during a period when over 90% of their bone growth occurs.

| C. | Markets for Registrant’s Common Stock |

Trading Price History. Our common stock is currently traded on the on the Over the Counter Bulletin Board (OTC.BB) currently trading under the symbol “IHTI.” From July 2006 to March 25, 2007 it traded under the symbol “IHHT.” Prior to July 2006 it traded under the symbol SNIO. The table below sets forth the lowest and highest ending trading price for the quarters indicated.

| | Low | | High |

2004 | | | |

| Quarter Ending March 31 | $ 0.080 | | $ 0.210 |

| Quarter Ending June 30 | $ 0.040 | | $ 0.110 |

| Quarter Ending Sept 30 | $ 0.040 | | $ 0.150 |

| Quarter Ending Dec 31 | $ 0.070 | | $ 0.170 |

| | | | |

2005 | | | |

| Quarter Ending March 31 | $ 0.05 | | $ 0.12 |

| Quarter Ending June 30 | $ 0.01 | | $ 0.06 |

| Quarter Ending Sept 30 | $ 0.01 | | $ 0.02 |

| Quarter Ending Dec 31 | $ 0.01 | | $ 0.01 |

| | | | |

2006 | | | |

| Quarter Ending March 31 | $ 0.003 | | $ 0.009 |

| Quarter Ending June 30 | $ 0.004 | | $ 0.023 |

| Quarter Ending Sept 30 | $ 0.008 | | $ 0.020 |

| Quarter Ending Dec 31 | $ 0.002 | | $ 0.009 |

| | | | |

2007 | | | |

| Quarter Ending March 31 | $ 0.002 | | $ 0.006 |

These market quotations reflect the high and low closing prices as reflected by the OTC.BB or by prices, without retail mark-up, markdown or commissions and represent actual transactions. Some of the companies that have and are serving as market makers for the stock include Knight Equity Markets, L.P.; Hill Thompson, Magid and Co., Inc.; Stern, Agee and Leach, Inc.; Citigroup Global Markets, Inc.; Newbridge Securities Corporation; Domestic Securities, Inc.; Jefferies and Company, Inc.; Wm. V. Frankel & Co., Inc.; and Bear, Stearns & Co. Inc.

Dividends. Although we previously announced our plan to dividend cash proceeds from the sale of AdZone shares (see June 22, 2006 Press Release above), the SEC suspended trading of this stock for ~two weeks due to security violations. After this suspension was lifted, the shares began trading at $0.01-$0.02 a share and continue to linger in that range. Thus, the cost of issuing this dividend to all shareholders would exceed the amount derived from sale of the shares. These shares are still being held by the Company pending future increases in share value.

Item 5. Selected Financial Data

As shown in the graph below, absent any revenue generating investments or portfolio companies, the Company raised its operating capital from loans and from issuing an average of 15.8 million shares a month from the second quarter of 2003 until the merger and reorganization Agreement was completed in the second quarter of 2006. Starting in the second quarter of 2006, the Company raised its capital from managerial fees received from its portfolio companies and liquidation of shares in public companies that are incompatible with the Company’s healthcare mission. During the third and fourth quarters of 2006 the Company pursued an aggressive program of recapturing shares that were to be returned to the Company for acquisitions that were not consummated and exchanging shares in its public companies for Company shares, thereby reducing the outstanding shares from 181,145,154 to 144,735,787 as shown below. We are optimistic that further reductions will be achieved in the next quarter.

As shown in the graphic below, from its inception to the quarter ending March 31, 2006, the Company has never reported a net profit for any of the 24 fiscal quarters depicted. As shown by the quarterly as well as cumulative curves, these losses increased significantly in 2003 when the Company changed its name to Senticore, Inc. However, upon becoming Integrative Health Technologies in June 2006, net profits were reported for the first time in the previous quarter ending June 30, 2006 and in the current quarter. As of the date of this filing, the Company achieved another net profit for the quarter ending December 31, 2006.

The chart below depicts the Company’s net assets (Total Assets minus Total Liabilities) as reported in the Company’s filings from the quarter ending December 31, 2002 though the current quarter. The Company’s liabilities have consistently exceeded its assets until the quarter ending December 2005 when assets exceeded liabilities—the most dramatic change occurring in the current year with the acquisition of Integrative Health Technologies of Illinois’ assets.

As shown in the graph below, the shareholders’ equity remained relative constant from the year ending December 31, 1999 up to and through the quarter ending March 31, 2006. The increase in equity shown for the quarter ending June 30, 2006 resulted from an increase in the stock value of the Company’s portfolio companies. The increase in the quarter ending September 30, 2006 resulted from the acquisition of IHT of Illinois’ assets which increased slightly over the year ending December 31, 2006 as a result of an increase in the Company’s assets.

As shown in the graph below, from the year ending 2000, the equity per share had progressively declined from $0.003 to -0.011 by the end of 2003. At that time, share equity increased to $0.002 by the end of 2005 only to decline to $0.0002 by the second quarter ending June 30, 2006, but to increase over the last two quarters of 2006 to $0.001 which has been maintained. Thus, in spite of the issuance of 20,000,000 preferred shares (convertible into 8 billion common shares) the equity per share increased and been maintain over the last three quarters of 2006.

Item 6. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Preliminary Note Regarding Forward-Looking Statements

THIS DOCUMENT CONTAINS “FORWARD-LOOKING STATEMENTS” WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. PROSPECTIVE SHAREHOLDERS SHOULD UNDERSTAND THAT SEVERAL FACTORS GOVERN WHETHER ANY FORWARD - LOOKING STATEMENT CONTAINED HEREIN WILL BE OR CAN BE ACHIEVED. ANY ONE OF THOSE FACTORS COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE PROJECTED HEREIN. THESE FORWARD-LOOKING STATEMENTS INCLUDE PLANS AND OBJECTIVES OF MANAGEMENT FOR FUTURE OPERATIONS, INCLUDING PLANS AND OBJECTIVES RELATING TO THE PRODUCTS AND THE FUTURE ECONOMIC PERFORMANCE OF THE COMPANY. ASSUMPTIONS RELATING TO THE FOREGOING INVOLVE JUDGMENTS WITH RESPECT TO, AMONG OTHER THINGS, FUTURE ECONOMIC, COMPETITIVE AND MARKET CONDITIONS, FUTURE BUSINESS DECISIONS, AND THE TIME AND MONEY REQUIRED TO SUCCESSFULLY COMPLETE DEVELOPMENT PROJECTS, ALL OF WHICH ARE DIFFICULT OR IMPOSSIBLE TO PREDICT ACCURATELY AND MANY OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY. ALTHOUGH THE COMPANY BELIEVES THAT THE ASSUMPTIONS UNDERLYING THE FORWARD-LOOKING STATEMENTS CONTAINED HEREIN ARE REASONABLE, ANY OF THOSE ASSUMPTIONS COULD PROVE INACCURATE AND, THEREFORE, THERE CAN BE NO ASSURANCE THAT THE RESULTS CONTEMPLATED IN ANY OF THE FORWARD - LOOKING STATEMENTS CONTAINED HEREIN WILL BE REALIZED. BASED ON ACTUAL EXPERIENCE AND BUSINESS DEVELOPMENT, THE COMPANY MAY ALTER IT’S MARKETING, CAPITAL EXPENDITURE PLANS OR OTHER BUDGETS, WHICH MAY IN TURN, AFFECT THE COMPANY'S RESULTS OF OPERATIONS. IN LIGHT OF THE SIGNIFICANT UNCERTAINTIES INHERENT IN THE FORWARD-LOOKING STATEMENTS INCLUDED THEREIN, THE INCLUSION OF ANY SUCH STATEMENT SHOULD NOT BE REGARDED AS A REPRESENTATION BY THE COMPANY OR ANY OTHER PERSON THAT THE OBJECTIVES OR PLANS OF THE COMPANY WILL BE ACHIEVED.

The following discussion and analysis should be read in conjunction with the financial statements and Preliminary Note Regarding Forward-Looking Statements provided above. The Company is considered to be in the development stage as defined in Financial Accounting Standards Board Statement No. 7. This section also contains reports of activities and results of operations that occurred in the current year up to the filing date of this Form and subsequent to the year ending December 31, 2006. In some cases, the conditions and results of operations are reported without accompanying distinctions between the quarter in which these activities and events occurred.

Operating Changes

On August 22, 2006, the Company filed a Form 10-QSB for second quarter of 2006 ending June 30, 2006 reporting the steps taken in conjunction with the reorganization and restructuring of the Company. These steps included a cost-cutting plan of consolidating executive positions, limiting executive compensation, and requiring its portfolio companies to provide the BDC with a percentage of the gross receipts to reduce the need to borrow funds and issue stock to raise operating capital. The filing also announced that the Company would limit its acquisitions to healthcare and nutritional companies to take advantage of its managerial experience, testing assets, inventory, established networking relationships, and its Scientific and Business Advisory Boards. The filing reported the Company’s intention to sell off its holdings in entities unrelated to the healthcare industry and to initiate an aggressive program to recapture shares that should have been returned to the Company for acquisitions and transactions that were not consummated. The filing also cautioned investors of the market risks posed by the impending conversion of the 20 million preferred shares into 8 billion common shares and potential distraction from the Company’s mission posed by the heavy demands on executive time and resources posed by the reorganization and restructuring.

Previous Investment Strategy

On June 3, 2006 the Company closed the transactions contemplated by the Agreement described above in Item 3. One result of that closing was the acquisition of portfolio companies in the healthcare and nutritional industries, and the installation of a new Chairman and Chief Executive Officer who has extensive experience in the healthcare and nutritional industries. Accordingly, the Company’s focus from June 3, 2006 forward has been, and continues to be, the development of business opportunities in the healthcare and nutritional industries.

From its inception until June 3, 2006, SNIO had invested in, or expended significant effort and resources attempting to invest in, diverse industries. These included timber interests in Costa Rica and Venezuela, real estate in Florida and Canada, a gas station in Illinois, a professional hockey team, a commercial glue manufacturer, an internet data-gathering company, a gaming company, and an on-line poker company. No cash flow had been generated by these activities, and the Company had raised its operating capital from loans and by the continual issuance of stock. The Company posted losses every quarter since its inception in 1999 resulting in a shareholders’ equity deficit or net operating loss of ($4,027,479) at the quarter preceding the merger and reorganization Agreement.

The current management believes that the addition of the new portfolio companies and the focus on the healthcare and nutritional industries will improve the Company’s performance. The financial reports filed herewith indicate that our financial performance has already begun to improve. It should be noted, however, that management has faced, and continues to face, a number of distractions from operating the on-going businesses due primarily to the necessity of addressing issues that were inherited from the previous management team and due secondarily to transitional issues arising from the change in investing and operating strategies.

Changes in Investment Strategy and Operating Policies and Actions Taken by Current Management

When it assumed control on June 3, 2006, our current management team implemented a number of significant changes to the Company’s previous investing strategy and operating policies. Such were reported in its 10-QSB filing for quarter ending June 30, 2006 and summarized above under “Operating Changes” and “Previous Investment Strategy”. During the current year, the Company implemented these and other changes including what management considered the most pressing investment strategy and operating policies the Company is facing—to retain or de-elect its status as a BDC and to execute a reverse split of its stock. These changes, along with actions taken and changes made in this quarter and up to the date of this filing, are summarized below:

Board of Directors passed a resolution recommending the Company withdraw its BDC status The current management conducted a thorough analysis of the appropriateness of remaining a BDC. Based on these considerations and after operating the Company as a BDC for the past six months, it is the view of the current management and the Company’s Board of Directors that it would be in the best interests of the Company to de-elect its BDC status. Accordingly, on December 18, 2006 the Company filed a Form 14C to effect this change, a copy which is incorporated by reference herein. Notice was sent to all shareholders in conjunction with this filing which will be implemented pursuant to action by written consent of the majority of the shareholders.

Board of Directors passed a resolution recommending a reverse split of the Company’s stock After conducting an extensive and protracted analysis of the pros and cons of a 200-1 reverse split in this quarter, the Board decided that it would be in the best interest of the company to execute a 200 to 1 split of the Company’s common stock and to reduce the conversion ratio accordingly reducing for the Preferred shares from 400:1 to 2:1. On October 16, 2006 the Board unanimously authorized a reverse stock split of its common stock and on October 18, 2006 announced its decision by filing Form 8-K subject to approval of the majority of the Company’s shareholders. On November 24, the Company filed a preliminary Form 14-C information statement with the SEC announcing the Company’s intention to execute the reverse split pursuant to action by written consent of approval from the majority of its shareholders. The definitive 14-C was filed on April 10, 2007.

Board of Directors passed a resolution recommending conversion ratio of preferred stock from 400:1 to 2:1 To insure equitable treatment of all shareholders, the Company’s Directors unanimously authorized a reduction in the conversion ratio of the Series A Convertible Preferred Stock so that each share is convertible into 2 shares of common stock. As a result, the 20,000,000 issued and outstanding shares of Series A Convertible Preferred Stock will be convertible into 40,000,000 shares of common stock, instead of into the 8,000,000,000 shares of common stock that would have resulted from the previous conversion ratio. This announcement was included in the Form 14-C information statement reported above.

Company received an independent two-year audit of its portfolio company, IHT-IL As reported on Form 8-K/A filed on October 24, 2006, the acquisition of IHT-IL contributed net assets of $7,626,273 to the IHHT group. A comparison to a random sample of 300 OTCBB companies suggests that the Company’s net asset value exceeds that of 84% of OTCBB companies. Additionally, combining these audited assets with the Company’s unaudited Consolidated Balance Sheet as of August 1, 2006 suggests the Company’s total combined assets are $10,235,140 with $955,234 Total Liabilities, for a Net Asset Value of $9,279,906.

IHT-IL’s Scientific Advisory Board agreed to serve as IHHT’s Scientific Advisory Board After the acquisition of IHT-IL, its Scientific Advisory Board, as listed in Exhibit 99.2, agreed to serve as IHHT’s Scientific Advisory Board. The acquisition of IHT-IL’s assets and Scientific Advisory Board brought a new revenue stream to the Company from managerial fees from its three portfolio companies as discussed below. The Scientific Advisory Board is being compensated by our major shareholders at no expense to the Company.

Company acquired three wholly owned portfolio companies in the healthcare industry On August 31, 2006 IHHT took title to IHT-IL’s assets and IHHT subsequently transferred its testing equipment and its extensive longitudinal database described in Exhibit 99.1 hereto to Health and Medical Research, Inc., IHHT’s clinical research portfolio company. IHT-IL’s inventory was transferred to HealthTech Products, LLC, IHHT’s portfolio company marketing health enhancing products and technologies. A third portfolio company, HealthTech Development, LLC, a consulting and research and development (“R & D”) company, was acquired at no cost at the same time, giving IHHT three wholly-owned portfolio companies providing different but highly compatible functions within the healthcare industry. A discussion of the current activities and operations of these portfolio companies is summarized below under “Activities of Portfolio Companies”.

Liabilities reduced through exchanging or selling of shares in investments unrelated to healthcare At closing, the Company held shares in Taj Systems, Inc. (“TJSS”), a public company in the on-line gaming business. Since the business of TJSS is unrelated to the healthcare or nutritional industries, the Company plans to liquidate its position in TJSS and to use the proceeds to reduce the Company’s liabilities and to acquire the Company’s own shares for cancellation. After execution of its current Stock Purchase Agreements and Share Exchange Agreements, the Company could reduce all of its current liabilities and still retain 1,090,173 shares of TJSS to use for operating capital or acquisition of additional portfolio companies.

Plan to liquidate all investments unrelated to the healthcare and nutrition industries In addition to its shareholdings in TJSS, the Company has shares in other public companies resulting from investments made by previous management prior to June 3, 2006. Included are shares in Adzone Research, Beere Financial and The Justice Fund. Over time, management expects to liquidate its position in most or all of these investments and apply any funds received to debt reduction and to investment in core activities in the healthcare and nutritional industries.

Operating expenses for the quarter have been met through managerial fees received from its portfolio companies The Company did not issue any new shares from June 3, 2006 to the date of this filing receiving its operating capital from management fees paid to the Company by its portfolio companies. The Company’s requirement that all of its portfolio companies provide a percentage of their gross receipts from sales and services provided sufficient capital to meet our operating needs this quarter.

Activities of Portfolio Companies

Health and Medical Research, Inc. (“HMR”) A Clinical Research Organization

Grant received for database analyses

HMR received a grant for $42,500 from Mannatech Inc. (NASDAQ:MTEX) to conduct an independent analysis of its 12-year 7,000 subject Longitudinal Trial. The Company’s scientists will work with Mannatech’s scientists to analyze this data in conjunction with the over 1,200,000 medical tests and measurements in our database. Preliminary analyses have revealed a number of heretofore unknown and misunderstood relationships between measures of bone density, body fat, lean tissue, blood chemistries and self-reported quality of life that are likely to be brought to light by these analyses.

The AlgaeCal Bone-Health study

During this quarter, HMR received a $215,400 grant to continue a Bone-Health clinical trial that was begun in conjunction with a Research Agreement funded through IHT-IL, the company that merged with Senticore on June 3, 2006. The study is described in the Study Subject’s Informed Consent provided in Exhibit 10.1. The study is examining the safety and efficacy of a Bone-Health Program in response to the U.S. Surgeon General’s “call to action” for research to combat growing problems in the bone health of Americans of all ages, particularly in children, adolescents and an aging population. The program was designed and developed by IHHT’s R & D portfolio company, HealthTech Development, LLC., (HTD) in conjunction with AlgaeCal International (www.algaecal.com), the manufacturer of a plant-derived calcium supplement enhanced with Vitamins D & K and magnesium. HTD’s pedometer-based behavior modification program was incorporated into the program along with AlgaeCal’s supplement and an additional bone-building supplement, strontium citrate.

The principal investigator for this study is Dr. Joel Michalek of the University of Texas’ Health Science Center in San Antonio and the testing and research support has been sub-contracted to HMR. The study involves examining changes in bone density, body composition, blood chemistries, osteoarthritis, and self-reported quality of life in four 100-subject study groups, 400 subjects in all, ranging from 8 to 80 years of age. Subjects are participating in one of the four different study groups as described below, which are designed to examine the effects of the Bone-Health Program on:

| 1. | Children and adolescents from 8 to 18 years of age A total of 100 children/adolescents are participating in this leg and have completed a battery of tests at baseline and will repeat these tests in 90 days, 6 months and one year. In addition to recording their daily step totals each day using HTP’s pedometer program, subjects eat two highly palatable bone-health cookies each day. In addition to the AlgaeCal calcium, the cookies contain high levels of FiberSol-2 soluble fiber (www.matsutani.com), Archer Daniels Midland’s Enova Oil () (Studies show that, compared to other cooking and salad oils, less Enova™ oil is stored in the body as fat.); and a fat replacement product developed by the USDA from corn (). The cookies were developed over a year of taste and formulation testing by IHHT’s R & D portfolio company, HealthTech Development, LLC, who retains the rights to the formula and is now working on marketing the product through the Company’s marketing portfolio, HealthTech Products, LLC. |

| 2. | Pre- and post-menopausal women seeking to improve their bone health This group includes mostly pre- and post-menopausal women, including women who are concurrently following the Curves for Women workout program. |

| 3. | Overweight subjects following a weight loss plan Previous research has shown that weight loss is typically accompanied by loss of bone density and lean body mass. This leg is designed to examine the extent to which augmenting a weight loss program with the bone-health program can attenuate or eliminate this counterproductive outcome. Subjects in this leg are moderately to excessively overweight and are participating in a weight loss program that involves replacing at least one meal a day with a vitamin/mineral enhanced nutritional shake mix. Women following the Curves for Women workout program are also participating in this leg of the study. |

| 4. | Subjects consuming glyconutrient supplements Participants in this group have been taking glyconutrient supplements supplied by Mannatech, Inc. (,), many of whom have previous measurements of bone density that are below the normal ranges for their age and gender. This leg is designed to examine the extent to which the Bone-Health program can improve bone densities in this group. |

Preliminary results suggest that the Bone-Health program is successful in improving bone health, particularly in adolescents and post-menopausal women. If these initial findings are supported in the final reports from the universities or independent research organizations that conducted the studies, IHHT’s product marketing portfolio company, HealthTech Products, LLC, will add the Bone-Health Program to its inventory of products.

Glyconutrient Longitudinal Trials

For the past 12 years, members of the Company’s staff and Scientific Advisory Board have been conducting a longitudinal trial of the safety and efficacy of glyconutrient supplementation on body composition, blood chemistries and self-reported quality of life. Funding for this study has been derived from the grantor, Mannatech Inc., and fees paid by the company’s sales associates who have been tracking their own changes in these parameters while taking glyconutrient supplements. These associates receive their test results at the time they complete the test and periodic group reports have been published and reported at sales meetings, including a company-wide convention that has been held annually. Fees from this study have averaged close to $100,000 annually and HMR has now taken over the study and will continue to add these results to its database for some time to come.

Additional clinical trials and study activities

HMR is currently involved with preparing protocols or conducting pilot studies for a number of other clinical trials that may or may not eventuate in grants. These studies involve the effects of nutritional supplements on long-distance truckers, the growth and development of impoverished children that will be housed in the Hobbs House Of Hope in Kitengela, Kenya, Africa, long-distance truckers, people suffering with toe fungus, and glucose and hemoglobin levels in diabetic and pre-diabetic subjects. HMR is currently preparing a manuscript for publication in a peer-reviewed medical journal reporting the results of a study previously completed on the effects of a glucomannan soluble fiber on weight loss and compliance. Additionally, during this period, Dr. Kaats and two Scientific Board members published an article in the Journal of the American College of Nutrition on the effects of a Chitosan fiber on body composition. Dr. Kaats served as a co-investigator of two studies presented at professional meetings reporting results of clinical trials to identify the genetic basis of obesity. These studies have been submitted for publication in Major Medicine and The European Journal of Clinical Nutrition.

HealthTech Development (“HTD”) A Consulting, Research & Development (R&D) Company

R & D of a vitamin D-enhanced bone-building supplement

A number of recent studies, including data from the U.S. Centers for Disease Control, have suggested increased levels of vitamin D, (almost three times the recommended levels of 800 IUs) may provide a variety of health and disease prevention benefits without increased adverse effects. HTD has been working with AlgaeCal International in a joint-venture to develop and test an enhanced version of AlgaeCal’s calcium supplement that will include 2,000 IUs of Vitamin D—almost the exact level recent studies recommend. The product is scheduled to be available for testing in late January, at which time 100 subjects will be recruited and tested by HMR, the Company’s clinical trial portfolio company and, if found to be safe and efficacious, will be marketed jointly by AlgaeCal International and HealthTech Products, LLC, the Company’s product marketing portfolio company.

R & D of a corporate/institutional Risk Reduction Program

Development of HTD’s Institutional Risk Factor Reduction Program which was completed during this quarter will be presented to the Memorial Medical Center of Port LaVaca, Texas for testing early in January 2007. The program includes pre- and post-tests of blood chemistries, quality of life, and bone density and body fat on site using HTD’s mobile DEXA testing unit. The program also includes HealthTech Products’ (HTP’s) vitamin/mineral enhanced meal replacement product in conjunction with the pedometer-based behavior modification program If successful, it will then be marketed to companies and institutions by HealthTech Products, LLC.

HTD program accepted for presentation at continuing education for healthcare providers

HTD’s Weight Management and Risk Factor Reduction Advisors’ Certification Course has been accepted by the Proevity Continuing Education Group (www.proevity.com) for incorporation into their continuing education program for healthcare providers. One presentation was made during this reporting period that received “outstanding” ratings by participants. Proevity has scheduled others for 2007, including a presentation made at a March 2007 convention to be attended by over 7,000 sales associates and healthcare providers.

Research for pilot studies developed or under development

HTD is currently developing pilot study protocols for several studies examining the safety and efficacy of different supplements thought to: (1) reduce stress, (2) provide appetite control, (3) reduce incontinence, (4) improve glucose control, and (5) aid in weight control. Should any of these protocols result in the funding of clinical trials, such trials will be conducted by Health and Medical Research, Inc. However, while all of these protocols are being developed during the reporting period, past experience has taught us that less than half will eventually result in funded clinical trials.

HealthTech Products (“HTP”), Marketing Clinically Validated Healthcare Products.

In addition to marketing its products and technologies directly to the consumer or wholesalers, HTP sells its products to the Company’s other two portfolio companies, HMR and HTD when they are used in their research studies. The cost of these products is included in the research study budgets. HTP’s products include pedometers, the pedometer-based behavior modification program, a meal replacement nutrition drink mix, blenders, and a wide variety of packing materials and containers.

Results of Operations

The financial results of our operation during this quarter are summarized in the graphs and the supporting comments under FINANCIAL HIGHLIGHTS above. The section on Implementing Changes in Investment Strategy and Operating Policies provides a summary of our day to day operations. Additionally, our website (www.ihtglobal.com) provides a copy of this 10-Q and additional information that relates to the Results of Operations.

General and Administrative Expenses

We had no selling, general and administrative expenses other than those shown above.

Other Income (Expenses)

All income and expenses received during this quarter is reflected in the financial statements shown above.

Liquidity and Capital Resources

From inception (Jan 1999) through June 3, 2006, the Company funded its cash operating requirements through the sale of its common stock and loans. That policy was abandoned under the new management when operating capital was derived from the management fees it received from its portfolio companies. All revenues received from sales of stock the Company held in companies with operations that were incompatible with the Company’s healthcare and nutritional mission were used for debt reduction.

Critical Accounting Policies