UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D. C. 20549

FORM 10-QSB

x Quarterly report pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934

For the quarterly period ended June 30, 2007

¨ Transition report pursuant to Section 13 or 15(d) of the Exchange Act

For the transition period from _________ to _________

Commission File Number: 814-00699

INTEGRATIVE HEALTH TECHNOLOGIES, INC.

(F/K/A SENTICORE, INC.)

(Exact name of registrant as specified in charter)

DELAWARE | | 11-3504866 |

| (State of or other jurisdiction of incorporation or organization) | | (IRS Employer I.D. Number) |

4940 Broadway, Suite 201

San Antonio, TX 78209

(Address of Principal Executive Offices)

(210) 824-4200

(Registrant's Telephone Number, Including Area Code)

Check whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filed ¨Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NOx

Indicate the number of shares outstanding of each of the issuer’s classes of stock on August 15, 2007:

40,704,483 Common Shares

(No convertible preferred shares)

INTEGRATIVE HEALTH TECHNOLOGIES, INC.

(F/K/A SENTICORE, INC.)

INDEX TO FORM 10-QSB

| | Page |

PART I. FINANCIAL INFORMATION | |

| | |

Item 1. Financial Statements (unaudited) | |

| Consolidated Balance Sheet as of June 30, 2007 | 3 |

| Consolidated Statements of Operations for the three and six months ended June 30, 2007 and 2006 | 4 |

| Statements of Cash Flows for the six months ended June 30, 2007 and 2006 | 5 |

| Statement of Shareholders’ Equity | 6 |

| Notes to Financial Statements | 7 – 11 |

| NOTE 1: FORMATION AND OPERATIONS OF THE COMPANY | |

| Formation | |

| Business Description | |

| NOTE 2: SIGNIFICANT ACCOUNTING POLICIES | |

| Withdrawal of Development Stage Classification | |

| Basis of Presentation | |

| Management’s Use of Estimates | |

| Stock-Based Compensation | |

| Valuation of Long-Lived and Intangible Assets | |

| Earnings/(Loss) Per Share) | |

| NOTE 3: INCOME TAXES | |

| NOTE 4: RELATED PARTY TRANSACTIONS | |

| Operating Agreement with Health & Medical Research, Inc. (“HMRI”) | |

| Operating Agreement with HealthTech Development, LLC. (“HTD”) | |

| Operating Agreement with HealthTech Products, LLC. (“HTP”) | |

| Acquisition of 8% ownership in AlgaeCal International | |

| Sale of Taj Systems shares | |

| NOTE 5: HISTORICAL AND CURRENT FINANCIAL HIGHLIGHTS | |

| Graphic Representation of Number of Issued and Outstanding Shares | |

| Graphic Representation of Net Profit/(Loss) (by quarters and cumulative) | |

| Graphic Representation of Net Assets per quarter | |

| Graphic Representation of Shareholder’s Equity | |

| Graphic Representation of Equity per Share | |

| NOTE 6: SUBSEQUENT EVENTS | |

| | |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations (including Cautionary Statement) | 12 |

| Note Regarding Forward-Looking Statements | |

| Overview and a Chronology of Recent Events | |

| Additional Information | |

| How portfolio companies impact a BDC’s profit or loss | |

| How portfolio companies impact a non-BDC’s profit or loss | |

| Change in BDC status causes change in focus for profit and loss | |

| Planned restatement of financial statements | |

| Critical Accounting Policies | |

| | |

Item 3. Controls and Procedures | 14 |

| (1) Uncertainties of reorganization and restructuring | |

| (2) Uncertainties of the effects of the Company’s previous BDC status | |

| (3) Uncertainties of resolution of unresolved issues inherited from previous management | |

| | |

Item 4. Quantitative and Qualitative Disclosures about Market Risk | 15 |

| Quarterly evaluation controls | |

| CEO/CFO certifications | |

| Disclosure controls and internal controls | |

| Limitations on the effectiveness of controls | |

| Scope of the evaluation | |

| Conclusions | |

| | |

PART II. OTHER INFORMATION | |

| | |

Item 1. Legal Proceedings | 17 |

| | |

Item 2. Defaults Upon Senior Securities | 17 |

| | |

Item 3. Submission of Matters to a Vote of Securities Holders | 17 |

| | |

Item 4. Other Information | 17 |

| | |

Item 5. Exhibits and Reports on Form 8-K | 17 |

| | |

| Signatures | 17 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

INTEGRATIVE HEALTH TECHNOLOGIES, INC's

previously known as Senticore, Inc.

BALANCE SHEET

FOR THE QUARTERS ENDING JUNE 30, 2007 AND 2006

(UNAUDITED)

| | | June 30, | | | June 30, | |

| | | 2007 | | | 2006 | |

| | | | | | | |

ASSETS | | | | | | |

| | | | | | | |

| CURRENT ASSETS | | | | | | |

| Available for sale Investments--Public Companies | | $ | 44,668 | | | $ | 2,664,796 | |

| Non Controlled Companies (Non-Publicly traded) | | | 452,000 | | | | -- | |

| Controlled Companies (Non-Publicly traded) | | | 7,806,692 | | | | -- | |

| Cash and cash equivalents | | | 10,859 | | | | 112 | |

| Accounts Receivable from Nutmeg, LLC | | | 225,171 | | | | -- | |

| Inventory | | | 94,933 | | | | -- | |

| TOTAL CURRENT ASSETS | | | 8,634,322 | | | | 2,664,908 | |

| | | | | | | | | |

| PROPERTY AND EQUIPMENT | | | | | | | | |

| Furniture, equipment, computers & peripherals, Net | | | 18,500 | | | | -- | |

| Net Property and Equipment | | | 18,500 | | | | -- | |

| | | | | | | | | |

| OTHER ASSETS | | | | | | | | |

| Prepaid Clinical Trials | | | 1,234,463 | | | | -- | |

| Net Other Assets | | | 1,234,463 | | | | -- | |

TOTAL ASSETS | | $ | 9,887,285 | | | $ | 2,664,908 | |

| | | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Current Liabilities: | | | | | | | | |

| Accounts Payable | | $ | 225,171 | | | $ | 393,683 | |

| Notes Payable | | | -- | | | | 300,000 | |

| Stockholder Loans Payable | | | -- | | | | 314,058 | |

TOTAL LIABILITIES | | | 225,171 | | | | 1,007,741 | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY | | | | | | | | |

| Common stock, $0.001 par value, 200,000,000 shares authorized; 40,704,597 issued and outstanding | | | 40,705 | | | | 181,145 | |

| Additional Paid-in-Capital | | | 12,350,069 | | | | 3,972,662 | |

| Retained Deficit | | | (2,769,193 | ) | | | (2,496,640 | ) |

TOTAL STOCKHOLDERS' EQUITY | | $ | 9,621,580 | | | $ | 1,657,167 | |

| | | | | | | | | |

| Shares Outstanding | | | 40,704,483 | | | | 181,145,154 | |

NET ASSET VALUE PER SHARE - fully diluted | | $ | 0.2364 | | | $ | 0.0091 | |

The accompanying notes are an integral part of these consolidated unaudited financial statements.

INTEGRATIVE HEALTH TECHNOLOGIES, INC's

previously known as Senticore, Inc.

STATEMENTS OF OPERATIONS

| | | Three months ending June 30, | | | Sis months ending June 30, | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | |

| INCOME FROM OPERATIONS: | | | | | $ | -- | | | | | | $ | -- | |

| Clinical trials, Consulting/R & D, & Product Sales | | $ | 174,408 | | | $ | -- | | | $ | 47,521 | | | | -- | |

Total income | | | 174,408 | | | | -- | | | | 47,521 | | | | -- | |

| | | | | | | | | | | | | | | | | |

| COST OF SALES | | | | | | | | | | | | | | | | |

| Inventory Cost | | | -- | | | | -- | | | | -- | | | | -- | |

| Research studies and sales supports | | | 15,811 | | | | -- | | | | 80,918 | | | | -- | |

| Cost of services and sales | | | 15,811 | | | | -- | | | | 80,918 | | | | -- | |

Net income from operations | | | 158,597 | | | | -- | | | | (33,397 | ) | | | -- | |

| | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | |

| Administrative expenses and fees | | | 6,788 | | | | 14,680 | | | | 10,157 | | | | 77,085 | |

| Stock Based Compensation | | | -- | | | | -- | | | | -- | | | | -- | |

| Loss in equity of LLC | | | -- | | | | -- | | | | -- | | | | -- | |

Total Expenses | | $ | 6,788 | | | $ | 14,680 | | | $ | 10,157 | | | $ | 77,085 | |

| | | | | | | | | | | | | | | | | |

NET INVESTMENT INCOME (LOSS) | | $ | 151,810 | | | $ | (14,680 | ) | | $ | (43,554 | ) | | $ | (77,085 | ) |

| | | | | | | | | | | | | | | | | |

| NET REALIZED GAIN (LOSS) ON INVESTMENTS | | | n/a | | | $ | -- | | | $ | -- | | | $ | -- | |

| | | | | | | | | | | | | | | | | |

| NET CHANGE IN UNREALIZED GAIN AND LOSSES ON INVESTMENTS (1) | | | n/a | | | $ | 1,545,519 | | | $ | 61,178 | | | $ | 1,352,804 | |

| | | | | | | | | | | | | | | | | |

| INCOME (LOSS) BEFORE CUMULATIVE EFFECT OF ACCOUNTING CHANGES | | | n/a | | | $ | -- | | | $ | -- | | | $ | -- | |

| | | | | | | | | | | | | | | | | |

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 151,810 | | | $ | 1,530,839 | | | $ | 17,624 | | | $ | 1,275,719 | |

| LOSS PER COMMON SHARE, BASIC & DILUTED | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Beginning Retain Deficit | | | (2,921,003 | ) | | | (4,027,479 | ) | | | (2,914,093 | ) | | | (3,772,359 | ) |

Ending Retained Deficit | | $ | (2,769,193 | ) | | $ | (2,496,640 | ) | | $ | (2,896,468 | ) | | $ | (2,496,640 | ) |

The accompanying notes are an integral part of these consolidated unaudited financial statements.

INTEGRATIVE HEALTH TECHNOLOGIES, INC's

previously known as Senticore, Inc.

STATEMENTS OF CASH FLOWS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2007 AND 2006

(UNAUDITED)

| | | For 3 Months Ended June 30, | | | For 6 Months Ended June 30, | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

| | | as IHT, Inc | | | as Senticore | | | as IHT, Inc | | | as Senticore | |

| | | | | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 151,810 | | | $ | 1,530,839 | | | $ | 83,721 | | | $ | 1,468,434 | |

| Adjustments to reconcile net increase (decrease): | | | | | | | | | | | | | | | | |

| Add back depreciation & amortization | | | -- | | | | -- | | | | -- | | | | -- | |

| Loss on disposal of fixed assets | | | -- | | | | -- | | | | -- | | | | -- | |

| Loss in equity of LLC | | | -- | | | | -- | | | | -- | | | | -- | |

| Stock based compensation | | | -- | | | | -- | | | | -- | | | | -- | |

| Stock based interest | | | -- | | | | -- | | | | -- | | | | -- | |

| Other stock based expenses | | | -- | | | | -- | | | | -- | | | | -- | |

| (Increase) decrease in prepaid expenses | | | -- | | | | -- | | | | -- | | | | -- | |

| (Increase) decrease in other assets | | | 48,125 | | | | -- | | | $ | 98,735 | | | | -- | |

| (Increase) in available for sale investments | | | -- | | | | (1,518,779 | ) | | | -- | | | $ | (1,518,779 | ) |

| Increase (decrease) in accounts payable and accrued payables | | | (76,169 | ) | | | (12,500 | ) | | | (76,169 | ) | | | 49,905 | |

NET CASH PROVIDED (USED) IN OPERATING ACTIVITIES | | | 123,766 | | | | (440 | ) | | | 106,287 | | | | (440 | ) |

| | | | | | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | | | | | | | | |

| Net Proceeds from sale of investments | | | -- | | | | -- | | | | -- | | | | -- | |

| Net Proceeds from sale of assets | | | -- | | | | -- | | | | -- | | | | -- | |

| Investment in Portfolio Company | | | -- | | | | -- | | | | -- | | | | -- | |

| Goodwill acquired (given back to seller due to unwinding) | | | -- | | | | -- | | | | -- | | | | -- | |

| Software received (given back due to unwinding) in purchase of Pokerbook | | | -- | | | | -- | | | | -- | | | | -- | |

| (Purchases) of property, plant and equipment | | | -- | | | | -- | | | | -- | | | | -- | |

NET CASH FROM INVESTING ACTIVITIES | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | | | | | | | | |

| Proceeds from borrowings under note payable | | | -- | | | | -- | | | | -- | | | | -- | |

| Repayments under note payable | | | -- | | | | -- | | | | -- | | | | -- | |

| Excess of outstanding checks over bank balance | | | -- | | | | -- | | | | -- | | | | -- | |

| Proceeds from sale of land | | | -- | | | | -- | | | | -- | | | | -- | |

| Incurrence (repayment) of advances | | | -- | | | | -- | | | | -- | | | | -- | |

| Advances from stockholder | | | -- | | | | -- | | | | -- | | | | -- | |

| Proceeds from issuance of common stock | | | -- | | | | -- | | | | -- | | | | -- | |

| Other capital contributions | | | -- | | | | -- | | | | -- | | | | -- | |

| Loan repayments | | | -- | | | | -- | | | | -- | | | | -- | |

NET CASH (USED) IN FINANCING ACTIVITIES | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | |

| NON-CASH FLOW INVESTING ACTIVITIES | | | | | | | | | | | | | | | | |

| Issuance of preferred stock (acquisition of companies) | | | -- | | | | -- | | | | -- | | | | -- | |

| Acquisitions of wholly owned subsidiaries, fixed assets, intangibles and liabilities | | | -- | | | | -- | | | | -- | | | | -- | |

| Issuance of portfolio holding in exchange for debt reduction | | | -- | | | | -- | | | | -- | | | | -- | |

| Debt reduction in exchange for portfolio holding | | | -- | | | | -- | | | | -- | | | | -- | |

NET NON-CASH INVESTING ACTIVITIES | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | |

| INCREASE (DECREASE) IN CASH | | $ | 123,766 | | | $ | (440 | ) | | $ | 106,287 | | | $ | (440 | ) |

| | | | | | | | | | | | | | | | | |

| CASH, Beginning of Period | | | 12,206 | | | | 552 | | | | 29,685 | | | | 552 | |

| CASH, Ending of Period | | $ | 135,972 | | | $ | 112 | | | $ | 135,972 | | | $ | 112 | |

The accompanying notes are an integral part of these consolidated unaudited financial statements.

INTEGRATIVE HEALTH TECHNOLOGIES, INC's

previously known as Senticore, Inc.

STATEMENTS OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

| | | Series A | | | Series A | | | Additional | | | Deferred Stock | | | | | | | | | Additional | | | | |

| | | Common | | | Common | | | Paid-in | | | and Interest | | | Preferred | | | Preferred | | | Paid-in | | | Retained | |

| | | Shares | | | Stock | | | Capital | | | Compensation | | | Shares | | | Shares | | | Capital | | | Deficit | |

| | | (000's) | | | | | | | | | $ | | | | (000's) | | | $ | | | | | | | $ | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, December 31, 2003 | | | 40,040 | | | $ | 40,040 | | | $ | 492,256 | | | $ | (314,950 | ) | | | | | | | | | | | | $ | (881,670 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares canceled | | | (12,000 | ) | | | (12,000 | ) | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of deferred compensation | | | | | | | | | | | | | | | 291,200 | | | | | | | | | | | | | | | |

| Issuance of stock for services | | | 21,841 | | | | 21,841 | | | | 2,107,417 | | | | | | | | | | | | | | | | | | | |

| Issuance of stock for interest, payable, acquisitions | | | 74,150 | | | | 74,150 | | | | 971,603 | | | | | | | | | | | | | | | | | | | |

| Net Income (Loss) for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (2,835,517 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, December 31, 2004 | | | 124,031 | | | $ | 124,031 | | | $ | 3,571,276 | | | $ | (23,750 | ) | | | | | | | | | | | | $ | (3,717,187 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of stock for cash | | | 34,727 | | | | 34,727 | | | | 401,386 | | | | | | | | | | | | | | | | | | | |

| Issuance of stock for services | | | 22,387 | | | | 22,387 | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of deferred compensation | | | | | | | | | | | | | | $ | 23,750 | | | | | | | | | | | | | | | |

| Net Income (Loss) for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (55,172 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, December 31, 2005 | | | 181,145 | | | $ | 181,145 | | | $ | 3,972,662 | | | $ | -- | | | | | | | | | | | | | $ | (3,772,359 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Correction of an error | | | | | | | | | | | 20 | | | | | | | | | | | | | | | | | | | |

| Shares canceled | | | (36,409 | ) | | | (36,409 | ) | | | 36,349 | | | | | | | | | | | | | | | | | | | |

| Issuance of stock for acquisitions | | | | | | | | | | | | | | | | | | | 20,000 | | | | 200,000 | | | | 7,269,025 | | | | | |

| Net Income (Loss) for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 858,266 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, December 31, 2006 | | | 144,736 | | | $ | 144,736 | | | $ | 4,009,031 | | | $ | -- | | | | 20,000 | | | $ | 200,000 | | | $ | 7,269,025 | | | $ | (2,914,093 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of stock for cash | | | 0 | | | | -- | | | | -- | | | | -- | | | | 0 | | | | -- | | | | -- | | | | | |

| Issuance of stock for acquisitions | | | 0 | | | | -- | | | | -- | | | | -- | | | | 0 | | | | -- | | | | -- | | | | | |

| Effects of Reverse Stock Split | | | 40,497,861 | | | $ | (104,093 | ) | | $ | 7,573,118 | | | | | | | | (20,000 | ) | | $ | (200,000 | ) | | $ | (7,269,025 | ) | | | | |

| Net Income (Loss) for the quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | (6,910 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, March 31, 2007 | | | 40,704,483 | | | $ | 40,704 | | | $ | 11,582,149 | | | $ | -- | | | | 0 | | | $ | -- | | | $ | 0 | | | $ | (2,921,003 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of stock for cash | | | 0 | | | | -- | | | | -- | | | | -- | | | | 0 | | | | -- | | | | -- | | | | | |

| Issuance of stock for acquisitions | | | 0 | | | | -- | | | | -- | | | | -- | | | | 0 | | | | -- | | | | -- | | | | | |

| Net Income (Loss) for the quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 151,810 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, June 30, 2007 | | | 40,704,483 | | | $ | 40,704 | | | $ | 12,350,069 | | | $ | -- | | | | 0 | | | $ | -- | | | $ | 0 | | | $ | (2,769,193 | ) |

The accompanying notes are an integral part of these consolidated unaudited financial statements.

INTEGRATIVE HEALTH TECHNOLOGIES, INC. (F/K/A SENTICORE, INC.)

NOTES TO FINANCIAL STATEMENTS

NOTE 1. FORMATION AND OPERATIONS OF THE COMPANY

Formation. Integrative Health Technologies, Inc., formerly known as Senticore, Inc. (“IHTI”, “the Company”, “we”, “us”, or “our”) was incorporated under the laws of the state of Delaware on January 5, 1999. On February 11, 2005 IHTI elected to become a Business Development Company (“BDC”) and be regulated under the Investment Company Act of 1940 (the “ICA”). From that date to May 7, 2007 the Company operated as a publicly-traded, closed-end investment company which, as a BDC, could raise money in the public sector and invest in the private sector. On May 7, 2007 the Company withdrew its BDC election

Business Description. While the Company was a BDC, it provided capital, equipment, scientific advice and extensive hands-on managerial assistance to portfolio companies in the healthcare and nutritional industries. The company also held some investments in three public companies and one private company that are not in the healthcare and nutritional industries. IHTI’s three major healthcare and nutritional portfolio companies were all wholly-owned subsidiaries of IHTI: (1) Health and Medical Research Inc. (“HMRI”) is a clinical research organization that has conducted clinical trials and research for over 20 years capitalizing on the growing importance of scientific support for the marketing of healthcare and nutritional products and technologies. (2) HealthTech Development, LLC. (“HTD”) provides consulting to healthcare and nutritional companies and product research and development including feasibility and marketing studies. (3) HealthTech Products, LLC. (“HTP”) markets clinically-tested healthcare and nutritional products.

After the Company ceased to be a BDC it reorganized its holdings as described below with each of its previous portfolio companies performing the same functions as they did under when we were a BDC. While HMRI continues to operate as a wholly-owned subsidiary of IHTI, HTD and HTP now operate as independent companies and IHTI’s ownership in these two LLCs has been replaced with strategic alliance agreements as described in NOTE 4 below.

On April 16, 2007 the Company filed its 10-K for the fiscal year ending December 31, 2006 within the required time period for the annual filing. However, the required annual independent audit of the financial statements was not included since the auditor became seriously ill and, in addition, had an unexpected death of a parent, thus preventing the completion of the audit. We had insufficient time and records to employ a replacement auditor before the April 16 filing. In order for a filing to be complete, it must contain all required certifications and have been reviewed or audited as applicable, by an account registered with the Public Company Accounting Oversight Board (PCAOB). Absent the required audit, NASDAQ placed an “e” on the company’s trading symbol, providing a 30-day grace period through May 17, 2007 to complete the filing. Although the PCAOB auditor returned to work in early May, it was insufficient time to complete the audit by May 17th, causing the Company to be removed from the OTCBB and classified as a “Pink Sheet” company on May 21, 2007.

On May 21, 2007, the Company filed its 10-Q for the quarter ending March 31, 2007 in the required time frame. On May 31, 2007, the Company received the required audit and, since it differed little from the Company’s 2006 annual filing, it was included in an amendment to the 2006 filing which was filed on June 4, 2007. Thus, in the Company’s view, we have met the required filings for an OTCBB company and are presently taking the required actions to request that we regain our status to be eligible for quotation on the OTCBB.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

Withdrawal of Development Stage Reporting. A company is considered in the “Development Stage” if it is devoting substantially all of its efforts to establishing a new business, or if planned principal operations have not commenced, or if planned principal operations have commenced, but there has been no significant revenues. A development stage enterprise will typically be devoting most of its efforts to activities such as financial planning; raising capital; exploring for natural resources; developing natural resources; research and development; establishing sources of supply; acquiring property, plant, equipment, or other operating assets, such as mineral rights; recruiting and training personnel; developing markets; and starting up production.

Since we have been an operating company since we withdrew our BDC status, have substantial assets, and have derived revenues from our operations, we do not fit the requirements of a development stage company. Therefore, we have removed the “Development Stage” from our financial statements.

Basis of Presentation. Our accompanying un-audited financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and the instructions to Form 10-QSB and Article 6 of Regulation S-X of the Securities and Exchange Commission (the "SEC"). Accordingly, these financial statements do not include all of the footnotes required by generally accepted accounting principles. In our opinion, all adjustments (consisting of normal and recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the three months ended June 30, 2007 are not necessarily indicative of the results that may be expected for subsequent quarters or for the year ending December 31, 2007. The accompanying financial statements and the notes thereto should be read in conjunction with our audited financial statements as of and for the year ended December 31, 2006 contained in our Form 10-K which is incorporated by reference.

There are differences in accounting treatment between BDC’s and non-BDC’s. For comparison purposes, financial information from prior periods has been restated and presented on the same basis as the current financial statements.

Management’s Use of Estimates. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements. The reported amounts of revenues and expenses during the reporting period may be affected by the estimates and assumptions we are required to make. Actual results could differ from our estimates.

Stock-Based Compensation. No stock-based compensation was issued during this quarter.

INTEGRATIVE HEALTH TECHNOLOGIES, INC.(F/K/A SENTICORE, INC.)

NOTES TO FINANCIAL STATEMENTS

Valuation of Long-Lived and Intangible Assets. The recoverability of long-lived assets requires considerable judgment and is evaluated on an annual basis or more frequently if events or circumstances indicate that the assets may be impaired. As it relates to definite life intangible assets, we apply the impairment rules as required by SFAS No. 121, "Accounting for the Impairment of Long-Lived Assets and Assets to be Disposed Of" as amended by SFAS No. 144, which also requires significant judgment and assumptions related to the expected future cash flows attributable to the intangible asset. The impact of modifying any of these assumptions can have a significant impact on the estimate of fair value and, thus, the recoverability of the asset.

Earnings/(Loss) Per Share. We compute net earnings/(loss) per share in accordance with SFAS No. 128 "Earnings per Share” (“SFAS No. 128”) and SEC Staff Accounting Bulletin No. 98 ("SAB 98"). Under the provisions of SFAS No. 128 and SAB 98, basic net earnings/(loss) per share is computed by dividing the net earnings/(loss) available to common stockholders for the period by the weighted average number of common shares outstanding during the period. Diluted net earnings/(loss) per share is computed by dividing the net earnings/(loss) for the period by the weighted average number of common and common equivalent shares outstanding during the period. For this purpose, each share of Series A Convertible Preferred Stock was treated as 400 common equivalent shares prior to the March 26, 2007 reverse split and two common equivalent shares thereafter.

NOTE 3. INCOME TAXES

The Company’s records for periods prior to its change of control in 2006 have not permitted timely income tax filings. However, based on the loss carry-forwards of “approximately $494,500” reported in its Form 10-KSB/A for the fiscal year ended in 2003, and even after taking into account the limitation imposed by the change of control on the use of loss carry-forwards, the Company does not expect to owe any taxes.

NOTE 4. RELATED PARTY TRANSACTIONS

Sale of Taj Systems shares. On August 15, 2006 the Company entered into an agreement with a shareholder, The Nutmeg Group LLC (“Nutmeg”), under which Nutmeg agreed to purchase 3,281,186 shares of the Company’s stock in Taj Systems, Inc., a pink-sheet company trading under the symbol TJSS, for a purchase price of $671,927. The TJSS shares in question are restricted preferred shares, but could be converted into common stock under a Rule 144 exemption if TJSS files current financial information. All of these shares will become free-trading under a Rule 144-K exemption on August 31, 2007. However, the agreement is not contingent upon convertibility. As of the end of the reporting period, Nutmeg had paid all but $225,171 of the agreed $671,927. The $225,171 is shown as an accounts receivable on the Company’s balance sheet. Upon receipt of the final payment, the Company has agreed to transfer the shares. The Board of Directors has approved the sale with the restriction that all proceeds must be used for the reduction of outstanding debts, and not for operating capital or executive or consultant compensation.

NOTE 5. FINANCIAL HIGHLIGHTS

Outstanding shares. The Company is authorized to issue both common shares and preferred shares that are convertible to common shares. All preferred shares issued have been converted to common shares so that there were no preferred shares issued as of the end of the reporting period. The common shares were the subject of a 200:1 reverse split on March 26, 2007. To give a consistent presentation, this report treats any preferred shares that were outstanding from time to time as if they had already been converted to common shares, and it reports all shares outstanding on the current, post-split basis.

The philosophy of the Company with respect to issuing shares and funding its operations changed at the time of the change of control in June 2006. Prior to the change of control, the Company raised its funding from loans and from issuing shares. From June 2003 until June 2006 the Company issued an average of nearly 25,000 shares a month. After the change of control, the Company funded its operations by charging managerial fees to its portfolio companies and also reduced its debt by liquidating shares held in public companies that are incompatible with the Company’s healthcare mission. From June 2006 to date, no shares have been issued. To the contrary, from June 2006 through June 2007, approximately 200,000 shares have been recaptured for improper issuance or exchanged for TJSS shares.

INTEGRATIVE HEALTH TECHNOLOGIES, INC.

(F/K/A SENTICORE, INC.)

NOTES TO FINANCIAL STATEMENTS

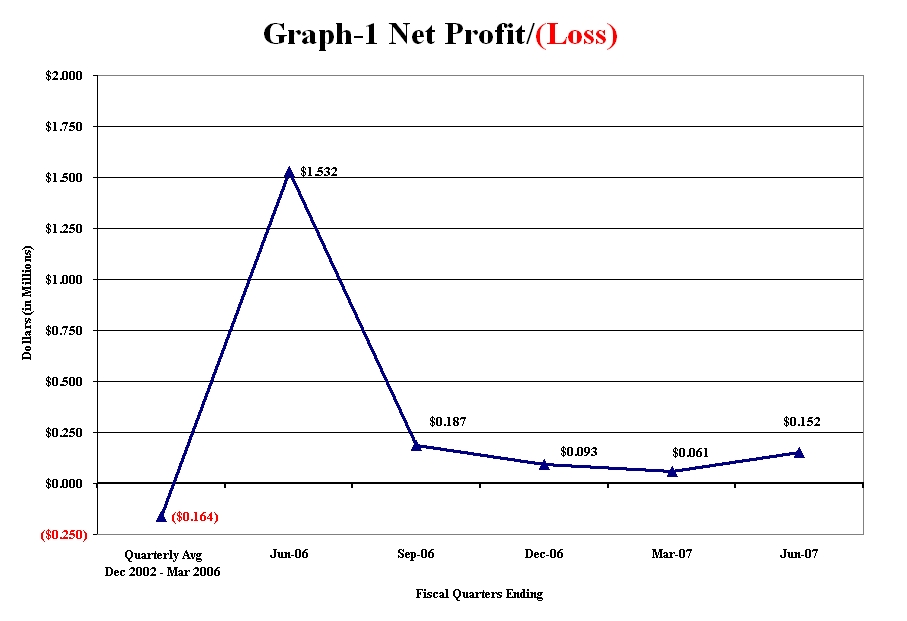

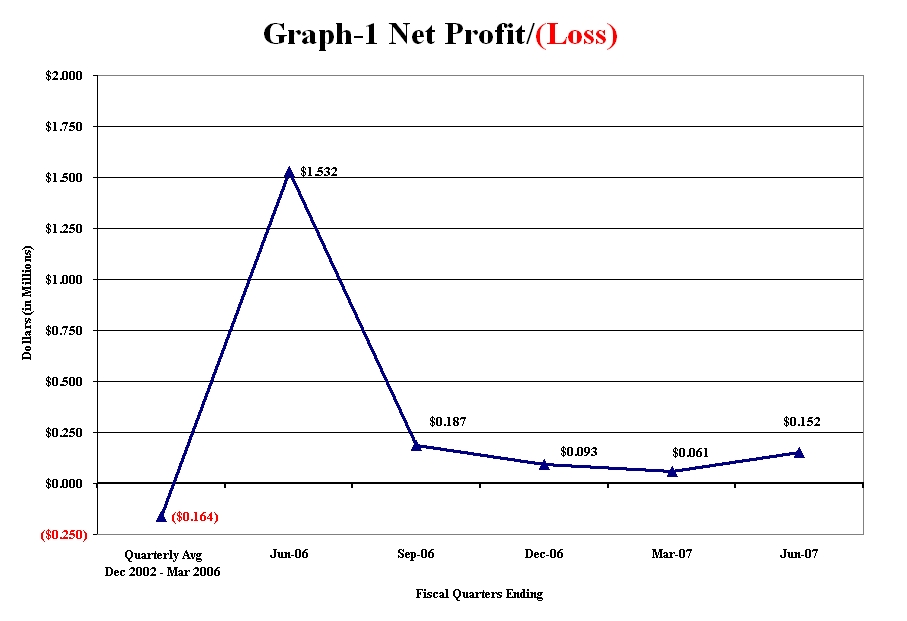

Net Profit/Loss (see Graph-1). From its inception in 1999 to the quarter ended March 31, 2006, the Company never reported a profitable quarter. Over that period, the average quarterly loss was approximately $165,000, as shown on the left side of Graph-1. Graph-1 shows a $1.5 million profit for the quarter ended June 30, 2006, due entirely to the increased value of restricted shares held in a portfolio company, TJSS. At that time the Company was a BDC, and, as explained further in “Results of Operations” below, increases and decreases in the value of portfolio companies were accounted for as profit and loss respectively. Note that the TJSS shares were not liquid, so that the Company never had an opportunity to realize this gain. As events unfolded, the value of TJSS subsequently fell by approximately $2.4 million, so that one would have expected to see a loss of approximately $2.4 million over the next few quarters. These losses were in fact incurred, but were offset by other gains. Therefore, despite the later losses due to the declining value of TJSS, since June 30, 2006, the Company has remained profitable.

INTEGRATIVE HEALTH TECHNOLOGIES, INC.

(F/K/A SENTICORE, INC.)

NOTES TO FINANCIAL STATEMENTS

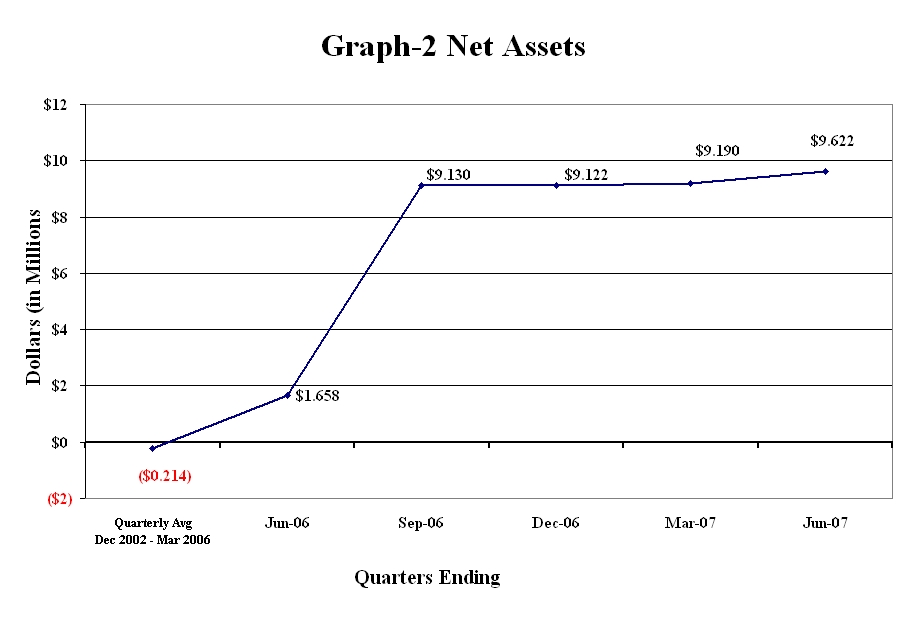

Net Assets (see Graph-2). From its inception in 1999 to the quarter ended March 31, 2006, on average the Company’s liabilities exceeded its assets at the end of each quarter by approximately $215,000, as shown on the left side of Graph-2. Graph-2 shows an increase in net assets as of June 30, 2006, driven by the increased value of the Company’s TJSS shares as discussed above under “Net Profit/Loss”. The large increase in net assets reported as of September 30, 2006 resulted from the incorporation into the Company’s financial statements of the assets of Integrative Health Technologies of Illinois after the merger and change of control. As depicted by Graph-2, since September 30, 2006 the Company’s net assets have remained relatively steady and increased slightly despite the approximate $2.4 million decline in value of the TJSS shares.

INTEGRATIVE HEALTH TECHNOLOGIES, INC.

(F/K/A SENTICORE, INC.)

NOTES TO FINANCIAL STATEMENTS

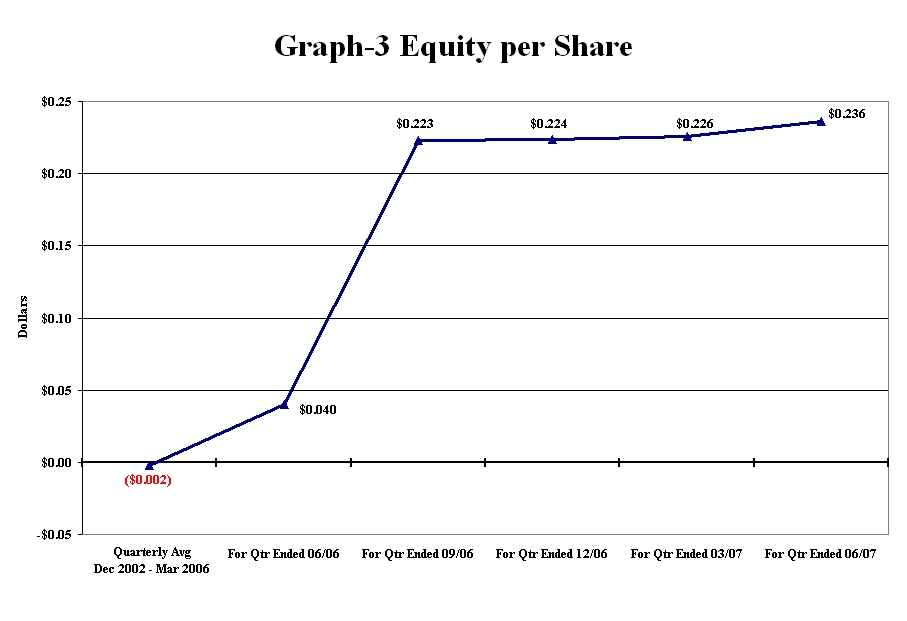

Equity Per Share (see Graph-3). From its inception in 1999 to the quarter ended March 31, 2006, on average the Company’s Equity Per Share was negative $0.002. The increases shown on Graph-3 for June 30, 2006 and September 30, 2006 were due to the increased value of TJSS shares and the merger respectively, as explained under “Net Profit/Loss” and “Net Assets” above. As depicted by Graph-3, since September 30, 2006 the Company’s Equity Per Share has remained relatively steady and increased slightly despite the approximate $2.4 million decline in value of the TJSS shares.

NOTE 6. SUBSEQUENT EVENTS

Events occurring subsequent to the quarter ending June 30, 2007 are reported on the date of the event in the “Overview and Chronology of Recent Events” presented below.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Preliminary Note Regarding Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the private securities litigation reform act of 1995. Prospective shareholders should understand that several factors govern whether any forward-looking statement contained herein will be or can be achieved. Any one of those factors could cause actual results to differ materially from those projected herein. These forward-looking statements include plans and objectives of management for future operations, including plans and objectives relating to the products and the future economic performance of the company. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, future business decisions, and the time and money required to successfully complete development projects, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the company. Although the company believes that the assumptions underlying the forward - looking statements contained herein are reasonable, any of those assumptions could prove inaccurate and, therefore, there can be no assurance that the results contemplated in any of the forward-looking statements contained herein will be realized. Based on actual experience and business development, the company may alter its marketing, capital expenditure plans or other budgets, which may in turn, affect the company's results of operations. In light of the significant uncertainties inherent in the forward-looking statements included therein, the inclusion of any such statement should not be regarded as a representation by the company or any other person that the objectives or plans of the company will be achieved.

The following discussion and analysis should be read in conjunction with the financial statements and Preliminary Note Regarding Forward-Looking Statements provided above. This section also contains reports of activities and results of operations that occurred in the current quarter up to the filing date of this Form and subsequent to the quarter ending June 30, 2007. In some cases, the conditions and results of operations are reported without accompanying distinctions between the quarter in which these activities and events occurred.

Overview and a Chronology of Recent Events

The Company was incorporated as HOJO Holdings, Inc. on January 5, 1999 under the laws of the state of Delaware. The Company was renamed Senticore, Inc. in March 2003 and traded under the symbol SNIO. Senticore, Inc. was renamed Integrative Health Technologies, Inc. on August 1, 2006 and traded under the symbol IHHT until its current trading symbol, IHTI, was assigned in conjunction with a reverse split that became effective on March 27, 2007. Integrative Health Technologies, Inc. is referred as “the Company”, “we”, “us”, or “our” in this filing.

April 2, 2007. The Company filed a Form 8-K reporting that, on February 11, 2005, it filed Form N-54 in which it elected to become a Business Development Corporation (“BDC”) under the Investment Company Act of 1940. The Company believed that this election was valid and reported that it was a BDC. However, the Company reported in a Form 8-K filed on February 21, 2007 that it had discovered an irregularity in the filing of the N-54, and that it had concluded, as a result, that it was not and had never been a BDC. Subsequently representatives of the Company discussed the situation with representatives of the SEC. It was the view of the SEC that the Company’s election to become a BDC was a valid election, and that it remains a BDC despite the statements to the contrary contained in the February 21, 2007 Form 8-K.

April 10, 2007. The Company, having decided that it would be in the best interests of the Company and its shareholders to render the BDC issue moot by filing a notice of withdrawal of its BDC election, filed Form 14-C filed announcing its intention to withdraw its election to be regulated under sections 55 to 65 of the investment company act of 1940, as amended.

April 17, 2007. The Company filed Form 10-K Annual Report for 2006 within the required filing period but without its independent audit completed for the year ending 2006. The audit completion was delayed due to a sudden and unexpected death in the auditor’s family and the illness of the auditor.

May 7, 2007. The Company filed Form N-15C reporting that the inherent generic difficulties and costs associated with being a BDC and lack of any perceived advantages led the Board of Directors to authorize the withdrawal of this election. Holders of shares of common stock of the Company representing in excess of eighty five and two-tenths percent (85.2%) of the 40,552,397 validly issued shares of the Company, signed the Action By Written Consent in favor of the change. There were no votes cast against the decision to cease being a business development company. A Definitive Information Statement on Schedule 14C was filed by the Company with the Commission on Apr 5, 2007 in connection with the decision, and was mailed to shareholders on that date.

May 17, 2007. Absent completion of the independent audit of the 2006 Annual Filing, NASDAQ removed the Company from the OTC.BB reclassifying it as a Pink Sheet stock. NASDAQ advised that it will consider re-admission as an OTC.BB stock upon submission of Form 15-211C by a sponsoring market maker.

June 4, 2007. The Company filed Form 10-K/A amending its previously filed 10-K to include the independent auditor’s report. There were no material differences between the audited financial statements and the unaudited financial statements previously filed.

June 5, 2007. The Company filed Form 8-K explaining the status of its filings and that it was taking actions designed to regain eligibility for quotation on the OTCBB.

June 19, 2007. The Company announced the launching of its new Algae Cal/Strontium Pro Bone-Health Products based pm the U.S. Surgeon General’s (“SG”) Bone Health Report. The SG’s Report cited a USDA study that almost 85% of adolescent girls and 65% of boys weren’t getting enough calcium and bone-building nutrients to support normal bone growth at a time when 90% of their bone growth occurs. The report also cited an increasing number of aging adults who are deficient in bone-building nutrients. The SG concluded, “America's bone health in jeopardy…” and that “…you are never too old or too young to improve your bone health.” To address this problem, he issued a “Call to Action” to the healthcare industry to develop bone-health plans to:

(1) improve nutrition,

(2) increase physical activity and

(3) improve health literacy.

The Company responded to the call to action by having its scientists conduct an exhaustive review of published studies to identify the nutrients and nutrient amounts that had the highest probability of enhancing bone health. Once identified, these nutrients were then combined with AlgaeCal’s plant-derived calcium (www.algaecal.com) to create an evidence-based bone-health supplement. To “increase physical activity,” a practical, well-researched pedometer-based behavior modification program was incorporated into the plan. To “improve health literacy,” a reader-friendly summary of the scientific literature along with practical steps that can be taken to improve bone health was added to the plan.

To evaluate the safety and efficacy of the plan, 400 subjects aged 8-80 were recruited into a study to follow the plan and to complete a bone density test, a 43-item blood chemistry panel, and self-reported quality-of-life inventories at baseline, 90 days, 6 months, one year and 5 years. Although only a few subjects have now completed the one-year tests, analysis of the 6-month test results revealed that instead of the generally expected decline in BMD, over two thirds of women over 50 years of age increased their bone densities. Additionally, about two thirds of post-menopausal women reported a reduction in the severity of post-menopausal symptoms. There were no adverse effects found in the blood chemistry panels or from the subjects’ self-reports.

July 31, 2007. The Company announced that it is seeking participants for a study on its Bone-Health Program for adolescents participating in physically demanding sports and training programs. Many parents and coaches of highly physically active adolescents may be surprised to learn of recent studies showing such adolescents to be at risk for an impairment of lifetime bone health. Adolescents at risk include those participating in gymnastics, football, basketball, cheerleading, martial arts and dance. Since physically demanding activities also provide significant benefits, both physical and psychological, it is important that we understand how to counteract any consequential bone health issues, particularly during the critical adolescent period when most bone development occurs.

The Company’s recent study of the positive effects of the AlgaeCal Bone-Health “cookie” on adolescents participating in normal activities suggests it may also enhance the bone health of those adolescents participating in highly demanding physical activities. This study is designed to (1) examine that possibility and (2) to explore the feasibility of marketing the bone-health cookie to these adolescents or their parents.

The bone health cookie is a highly palatable cookie intended to promote compliance among young people – quite simply, they are less likely to forget to take the cookie than to forget a pill or capsule. The cookie contains important bone nutrients, including calcium, vitamin D and other trace minerals that have been shown to promote bone health.

A number of studies have reported the positive effects of calcium and vitamin D supplements on bone health including a recent study of 5,201 female United States Navy recruits that found that taking calcium and vitamin D supplements greatly reduced stress fractures - one of the most common and debilitating overuse injuries seen in all branches of the military. These researchers concluded:

“What really surprised us is that calcium/vitamin D supplements made a significant difference in stress fractures in only eight weeks…these fractures often lead to chronic pain and disability…It appears that supplementation with calcium and vitamin D provides a health-promoting, easy and inexpensive intervention and does not interfere with training goals.”

Study participants will recruited at the Company’s research centers in San Antonio, Phoenix, College Station, Texas and Angleton, Texas. Additional information is available on the Company’s website (www.ihtglobal.com) under the “On Going Research” or by calling 210.824.4200.

Aug 2, 2007. The Company received the highest 4-Category Rating of “Willingness to Provide Adequate and Timely Public Disclosure” as published by Pink Sheets, LLC (www.pinksheets.com). The four Pink Sheets ratings categorize “the ability and willingness of individual issuers to provide adequate disclosure in a timely manner.” According to Pink Sheets, LLC, investors using pinksheets.com, “…will be able to quickly determine the level of information a company provides to the marketplace…we believe that categorizing securities by their level of disclosure will improve investor access to information…” The four categories and icons to appear next to the stock symbol used by Pink Sheets are:

| 1. | Current Information, “Ps” -- companies that submit filings to regulators with powers of review and make the filings publicly available or non-reporting companies that make current information publicly available on the Pink Sheets News Service. |

| 2. | Limited Information, “Yield” -- companies with financial reporting problems, economic distress or companies that may not be troubled but are unwilling to meet Pink Sheets’ Guidelines for Providing Adequate Current Information. |

| 3. | No Information, “Stop Sign” -- companies that are not able or willing to provide disclosure to the public markets or, if available, is older than six months. |

| 4. | Caveat Emptor, “Skull/Crossbones” -- there is public concern about the company which may include spam campaign, stock promotion, or known investigation of fraudulent activity committed by the company or insiders. |

While we think the rating system will assist investors, it should be remembered that these categories DO NOT signify the financial health, solvency or merit of any stock. Investors will still have to review the company’s filings to ascertain financial health. The rating does suggest that adequate information is available to make that determination.

Results of Operations

Additional information. The financial results of our operation during this quarter are summarized in the graphs and the supporting comments under FINANCIAL HIGHLIGHTS above. Additionally, the Company’s website (www.ihtglobal.com) provides a copy of this 10-QSB and additional information that relates to the Results of Operations. However, since we have withdrawn our BDC status, in order to clarify the impact it has had on our past operations and the impact it could have on future operations will require a review of how profits and losses are determined for BDCs.

How portfolio companies impact a BDCs profit or loss. To understand the potential impact of our withdrawal of our BDC status during this quarter will require an understanding of how BDCs, as compared to with non-BDCs, compute and report profits and losses. For the purposes of this discussion, a “portfolio company” will refer to a company in which a BDC has invested, whether wholly-owned or partially-owned, publicly traded or not. BDCs must continually track the value of their investments in portfolio companies. Any increase in value during a period is reported as a profit for that period, while a decrease in value during a period is reported as a loss for that period. If the portfolio companies are public, the valuation is derived from the ending bid or trading price of the stock on the date of the filing. If the portfolio companies are not public, the BDC must establish an appropriate valuation methodology. In either case, the principle is the same: all the portfolio companies are valued at the beginning of the period and at the end of the period, and the change in these values during the period is reported as a profit or loss.

How portfolio companies impact a non-BDCs profit or loss. A non-BDC computes its profit and loss from subsidiaries according to the consolidation rules under generally accepted accounting principles (“GAAP”). These rules are too complex to fully discuss here, but the general idea is that the subsidiaries’ individual profits and losses are consolidated into the non-BDC parent’s income statement. For example, a non-BDC parent with two wholly-owned subsidiaries that each made a profit of $1,000 during the period would typically have a profit of $2,000 for the period, subject to any “consolidation adjustments.”

Change in BDC status causes change in focus for profit and loss performance. The point of the discussion in the previous paragraphs is that while the Company was a BDC, its profits or losses were determined primarily from the increase or decrease in the value of the portfolio companies. Now that the BDC status has been de-elected, the Company’s profits and losses will no longer be impacted by changes in the value of its subsidiaries, but rather by the profit and loss performance of the subsidiaries.

Restatement of financial statements. Since the financial statements going forward will be prepared on a different basis than the historical statements, the Company intends to restate some of its financial statements to facilitate comparisons between future and past performance. Management believes that the restated financial statements, when available, will show the Company earned a profit under the direction of the current management (June 3, 2006-June 30, 2007).

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the U.S., or GAAP, requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In recording transactions and balances resulting from business operations, the Company uses estimates based on the best information available. The Company uses estimates for such items as depreciable lives and the amortization period for deferred income. The Company revises the recorded estimates when better information is available, facts change or actual amounts can be determined. These revisions can affect operating results.

The critical accounting policies and use of estimates are discussed in and should be read in conjunction with the annual consolidated financial statements and notes included in the 10-Q for the quarter ending March 31, 2007 filed with the SEC and the audited consolidated financial statements for the fiscal year ended December 31, 2006.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

(1) Uncertainties of reorganization and restructuring. We are continuing to implement a new strategy and new policies as part of the reorganization and restructuring which began on June 3, 2006. Such activities always carry risk as they can place a heavy burden on management time, they require expenditures, and there is never assurance that new strategies or policies will succeed as planned.

(2) Uncertainties of the effects of the Company’s prior BDC status. As disclosed in previous filings, from the time the Company filed its election to become a BDC through the time it withdrew the election, the Company did not fully comply with all regulatory requirements relevant to a BDC. The company has attempted to cure past violations as best it can, and it has now withdrawn its BDC election. However, withdrawing of the election to be treated as a BDC does not cure any past violations that may have occurred. If there were any violations of the securities laws, remedies for shareholders can include a rescission of a shareholder's investment, fines and penalties, and removal of officers and directors from office.

(3) Uncertainties of the effects of unresolved issues inherited from the previous management. Since taking over management of the Company on June 3, 2006, current management has uncovered a number of issues that were unresolved by the previous management, some of which are contrary to representations made in the Closing and Merger and Reorganization Agreement. Although we have resolved some of these issues, many remain unresolved. Investors bear the risk that all unresolved issues inherited from previous management have yet to be identified. There is also a risk that some or all of these issues may be incapable of resolution. There is also a risk that some or all of these issues may be more serious than they appear at this time, or they may be more costly to resolve than expected, or both.

(4) General Nature of Unresolved Issues. The general nature of these unresolved issues are gaps in record-keeping and apparent instances of regulatory non-compliance. Among other things, they affect the Company’s tax compliance, its SEC record-keeping requirements, and its shareholder list. A non-exhaustive selection of examples is set forth below:

| 1) | Despite a representation by previous management to the contrary, no income tax returns have been filed since Senticore acquired HOJO Holdings in March 2003. |

| 2) | The state of the Company’s records has not allowed current management to ensure that all of the required IRS Forms 1099 for stock based compensation and contract labor have been filed. |

| 3) | As of the date of this filing and despite repeated requests made to the Company’s previous management and accountants, we have yet to receive General Ledger information for the period from March 2003 to March 2004 sufficient to allow current management to demonstrate that the Company is in compliance with SEC record-keeping requirements. |

| 4) | The state of the Company’s records does not allow current management to confirm that a share log has been maintained that conforms to SEC record-keeping requirements and that allows current management to answer questions that have arisen with respect to the proper number of shares outstanding. These questions include whether shares were issued for inadequate consideration, whether shares were issued in violation of regulations applicable to BDCs, and whether shares that were to be held in escrow were in fact so held, and if so, whether the terms of the escrows were complied with. The questions concerning inadequate consideration arise mainly in connection with a lack of record-keeping that would allow a reconciliation of the Company’s financial records to its records of issued shares, and in connection with a lack of record-keeping that would accurately track loan proceeds said to have been received but not repaid relating to loans for which shares were issued as collateral. The questions concerning BDC regulations arise because BDCs are prohibited from issuing shares to pay for services rendered, and the Company may have issued such shares while it was a BDC. The escrow questions arise because shares were issued to various parties to be held in escrow pending the completion of acquisitions that were never consummated (the Westar and Smith-Forestal transactions), and these shares were not returned to the Company, and it appears that these shares should have been returned to the Company once it became clear that the transactions would not close. |

| 5) | The minutes of the meetings of the Company’s Board of Directors for periods prior to June 3, 2006 are incomplete. |

| 6) | The state of the Company’s records does not allow current management to fully understand the history of the Company’s relationship to Taj Systems, Inc. (“TJSS”) and the history of prior management’s relationship to TJSS. The President and CEO of TJSS are the former President and CEO of the Company and assumed these positions while serving in the same capacity with the Company. From public filings made before current management became involved with the Company on June 3, 2006, it appears that the Company at one time acquired approximately 44 million shares of TJSS representing 40% of TJSS issued stock. For reasons unclear to current management, it appears that the Company subsequently exchanged its 40% ownership interest in TJSS for a certificate representing 1.4 million convertible preferred shares of TJSS, each convertible to 5 shares of common stock representing a total of 7 million shares of common stock on an “as converted” basis. Since the certificate is for restricted shares, it cannot be converted into free-trading shares until August 31, 2007. Although, these shares could have been converted into free-trading common stock under Rule 144 exemption on August 31, 2006, TJSS management has been unresponsive to our repeated demands to approve the Rule 144 exemption. |

Item 4. Controls and Procedures

Quarterly Evaluation of Controls

As of the end of the period covered by this Form 10-QSB, we evaluated the effectiveness of the design and operation of (i) our disclosure controls and procedures ("Disclosure Controls"), and (ii) our internal control over financial reporting ("Internal Controls"). This evaluation ("Evaluation") was performed by our Chairman and Chief Executive Officer, Gilbert R. Kaats, ("CEO/CFO"). In this section, we present the conclusions of our CEO/CFO based on and as of the date of the Evaluation, (i) with respect to the effectiveness of our Disclosure Controls, and (ii) with respect to any change in our Internal Controls that occurred during the most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect our Internal Controls.

CEO/CFO Certifications

Attached to this annual report, as Exhibits 31.1 and 31.2, are certain certifications of the CEO/CFO, which are required in accordance with the Exchange Act and the Commission's rules implementing such section (the "Rule 13a-14(a)/15d–14(a) Certifications"). This section of the annual report contains the information concerning the Evaluation referred to in the Rule 13a-14(a)/15d–14(a) Certifications. This information should be read in conjunction with the Rule 13a-14(a)/15d–14(a) Certifications for a more complete understanding of the topic presented.

Disclosure Controls and Internal Controls

Disclosure Controls are procedures designed with the objective of ensuring that information required to be disclosed in our reports filed with the Commission under the Exchange Act, such as this annual report, is recorded, processed, summarized and reported within the time period specified in the Commission's rules and forms. Disclosure Controls are also designed with the objective of ensuring that others make material information relating to the Company known to the CEO/CFO, particularly during the period in which the applicable report is being prepared. Internal Controls, on the other hand, are procedures which are designed with the objective of providing reasonable assurance that (i) our transactions are properly authorized, (ii) the Company's assets are safeguarded against unauthorized or improper use, and (iii) our transactions are properly recorded and reported, all to permit the preparation of complete and accurate financial statements in conformity with accounting principals generally accepted in the United States.

Limitations on the Effectiveness of Controls

Our management does not expect that our Disclosure Controls or our Internal Controls will prevent all error and all fraud. A control system, no matter how well developed and operated, can provide only reasonable, but not absolute assurance that the objectives of the control system are met. Further, the design of the control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of a system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated objectives under all potential future conditions. Over time, control may become inadequate because of changes in conditions, or because the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Scope of the Evaluation

The CEO/CFO's evaluation of our Disclosure Controls and Internal Controls included a review of the controls' (i) objectives, (ii) design, (iii) implementation, and (iv) the effect of the controls on the information generated for use in this annual report. In the course of the Evaluation, the CEO/CFO sought to identify data errors, control problems, acts of fraud, and they sought to confirm that appropriate corrective action, including process improvements, was being undertaken. This type of evaluation is done on a quarterly basis so that the conclusions concerning the effectiveness of our controls can be reported in our quarterly reports on Form 10-Q and annual reports on Form 10-K. The overall goals of these various evaluation activities are to monitor our Disclosure Controls and our Internal Controls, and to make modifications if and as necessary. Our external auditors also review Internal Controls in connection with their audit and review activities. Our intent in this regard is that the Disclosure Controls and the Internal Controls will be maintained as dynamic systems that change (including improvements and corrections) as conditions warrant.

Among other matters, we sought in our Evaluation to determine whether there were any significant deficiencies or material weaknesses in our Internal Controls, which are reasonably likely to adversely affect our ability to record, process, summarize and report financial information, or whether we had identified any acts of fraud, whether or not material, involving management or other employees who have a significant role in our Internal Controls. This information was important for both the Evaluation, generally, and because the Rule 13a-14(a)/15d–14(a) Certifications, Item 5, require that the CEO/CFO disclose that information to our Board (audit committee), and to our independent auditors, and to report on related matters in this section of the annual report. In the professional auditing literature, "significant deficiencies" are referred to as "reportable conditions". These are control issues that could have significant adverse affect on the ability to record, process, summarize and report financial data in the financial statements. A "material weakness" is defined in the auditing literature as a particularly serious reportable condition where the internal control does not reduce, to a relatively low level, the risk that misstatement cause by error or fraud may occur in amounts that would be material in relation to the financial statements and not be detected within a timely period by employee in the normal course of performing their assigned functions. We also sought to deal with other controls matters in the Evaluation, and in each case, if a problem was identified; we considered what revisions, improvements and/or corrections to make in accordance with our ongoing procedures.

Conclusions

Based upon the Evaluation, the Company's CEO/CFO has concluded that, subject to the limitations noted above, our Disclosure Controls are effective to ensure that material information relating to the Company is made known to management, including the CEO/CFO, particularly during the period when our periodic reports are being prepared, and that our Internal Controls are effective to provide reasonable assurance that our financial statements are fairly presented in conformity with accounting principals generally accepted in the United States. Additionally, there has been no change in our Internal Controls that occurred during our most recent fiscal quarter that has materially affected, or is reasonably likely to affect, our Internal Controls.

PART II. - OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 2. Unregistered Sale of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Submission of Matters to a Vote of Security Holders

None.

Item 5. Other Information

None.

ITEM 6. Exhibits and Reports on Form 8-K

(b) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURE | | TITLE | | DATE |

| | | | | |

| /s/ Gilbert R. Kaats | | Chairman and CEO | | August 15, 2007 |

| /s/ Gilbert R. Kaats | | Chief Financial Officer | | August 15, 2007 |