UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No._)

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

MutualFirst Financial, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

The following letter is being sent to the stockholders of MutualFirst Financial, Inc.

| A Message to Stockholders Thank you for your interest in and continued support of MutualFirst Financial, Inc. 2007 was a challenging year, not only for us, but for all financial institutions. However, I am pleased to report to you solid opportunities for the future. We have continued to fight the headwinds of our national and local economies, in addition to an interest rate environment that has made it difficult for our company. Organic growth in the markets in which we find ourselves, has been difficult given the economic environment. Flat asset growth challenged earnings, and a flat yield curve pressured our net interest margin from the beginning of the year until nearly the end. In the fourth quarter 2007, we did see glimpses of net interest margin expansion given the Federal Reserve’s posture in reducing short-term interest rates. We anticipate that expansion will continue throughout 2008 as the Fed has continued to reduce short-term interest rates. |

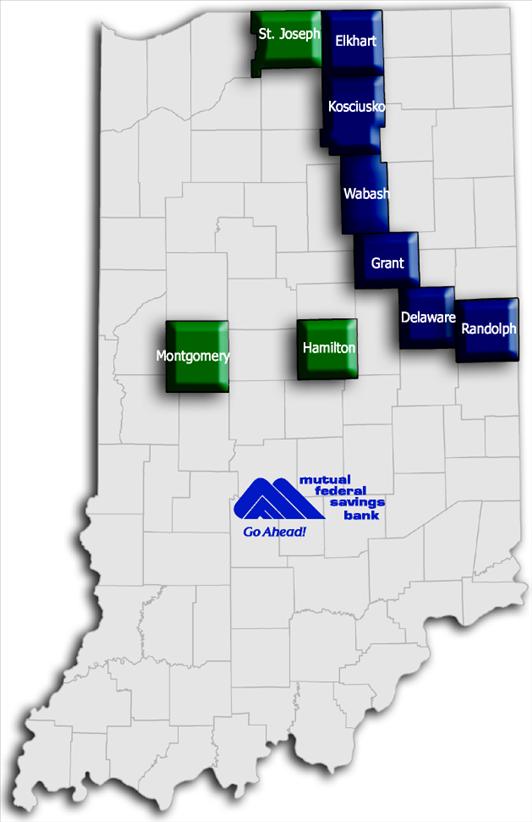

Although 2007 was difficult for our company, we were able to manage expenses at the same level as 2006, despite operating additional branches and building our newest branch in Elkhart County, Indiana. I believe 2008 shows the signs of significant progress in performance. The opening of our office in Elkhart County, a new market for us, provides a greater opportunity for growth. Most importantly, early in 2008, MutualFirst signed a definitive agreement to acquire MFB Corp., which is headquartered in Mishawaka, Indiana. MFB will bring to our company significant experience in commercial lending, investment management and trust operations. The addition of Saint Joseph County and expansion opportunities in that larger market area will provide greater growth potential for our company. Enclosed is the Proxy Statement which discusses the issuance of our shares in connection with the acquisition of MFB. I encourage you to review this information and I urge you to vote for the share issuance and the other proposals. We continue to work diligently to make MutualFirst as effective as possible and I am confident that we are continuing to make progress during these most difficult times. We look forward to the growth opportunities in 2008 as we increase our presence in Northern Indiana. David W. Heeter President, CEO MutualFirst Financial, Inc. |

Mutual Federal Savings Bank Albany Gas City Goshen Marion Muncie North Webster Syracuse Wabash Warsaw Winchester Yorktown MFB Corporation Carmel Crawfordsville Elkhart Granger Mishawaka South Bend Vision Statement We help people live better lives. Mission Statement We enhance shareholder value, measured by total return. We are relationship driven, helping people live a better life by providing valued financial services and trusted advice. | |

We create and cultivate valued customer relationships by understanding and providing financial solutions. We create valued employee relationships by attracting and retaining highly qualified, motivated and empowered employees who are essential to our success. Our culture fosters employee development, recognition and the sharing of financial success. We are committed to the effective utilization of technology to meet customer needs. Directors, officers and staff fill roles of influence and responsibility in our communities. |

MutualFirst Financial, Inc. |