UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No._)

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

MUTUALFIRST FINANCIAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| | 5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount previously paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

| | 3) | Filing Party: |

| | 4) | Date Filed: |

MutualFirst

Financial, Inc.

110 E. Charles Street

Muncie, Indiana 47305-2400

(765) 747-2800

March 25, 2016

Dear Fellow Stockholder:

On behalf of the Board of Directors and management of MutualFirst Financial, Inc., I cordially invite you to attend our 2016 annual meeting of Stockholders. The meeting will be held at 3:00 p.m., local time, on Wednesday, May 4, 2016, at our main office, located at 110 E. Charles Street, Muncie, Indiana.

We are distributing the Proxy Statement for the Annual Meeting and our Annual Report to Stockholders over the Internet as a cost-saving measure. In addition, stockholders will be able to cast their votes on the Internet or by phone. You may read, download and print the Proxy Statement and Annual Report and vote by Internet at http://www.proxyvote.com. On March 25, 2016, we mailed to our stockholders of record as of March 7, 2016, a notice of the Annual Meeting and of the availability of the proxy materials on the Internet. That notice contained instructions on how to access the proxy materials, including requesting an emailed or paper copy, and on how to cast your vote by Internet, phone or regular mail. (You also may vote in person at the Annual Meeting by completing a ballot.) The notice also contained a 16 digit number assigned to each stockholder of record in a box marked by an arrow as follows: ® xxxx-xxxx-xxxx-xxxx. That number is required to vote and to access the proxy materials on the Internet. If you hold your shares in “street name” with a bank, broker or other nominee, you should be receiving similar instructions on how to access the proxy materials and vote your shares.

An important part of the Annual Meeting is the stockholder vote on corporate business items. The Proxy Statement for the Annual Meeting describes the business to be conducted at the Annual Meeting. I urge you to exercise your rights as a stockholder to vote and participate in this process. Stockholders are being asked to consider and vote upon: (1) the election of four directors of the Company; (2) an advisory (non-binding) resolution to approve our executive compensation as disclosed in the enclosed Proxy Statement; and (3) ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016. At the Annual Meeting, we will report on the operations of the Company. Directors and officers of the Company as well as representatives of BKD, LLP, the Company’s independent registered public accounting firm, will be present to respond to any questions that our stockholders may have. Detailed information concerning our activities and operating performance is contained in our Annual Report.

We encourage you to attend the meeting in person. Whether or not you plan to attend the Annual Meeting, please read the Proxy Statement and vote by Internet or telephone or by sending a completed Proxy Card as promptly as possible. This will ensure that your shares are represented at the meeting.

Your Board of Directors and management are committed to the success of the Company and the enhancement of the value of your investment. As President and Chief Executive Officer, I want to express my appreciation for your confidence and support.

Very truly yours,

David W. Heeter

President and Chief Executive Officer

MutualFirst

Financial, Inc.

110 E. Charles Street

Muncie, Indiana 47305-2400

(765) 747-2800

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 4, 2016

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of MutualFirst Financial, Inc. will be held as follows:

DATE AND TIME | Wednesday, May 4, 2016, at 3:00 p.m. local time |

| | |

PLACE | 110 E. Charles Street, Muncie, Indiana |

| | |

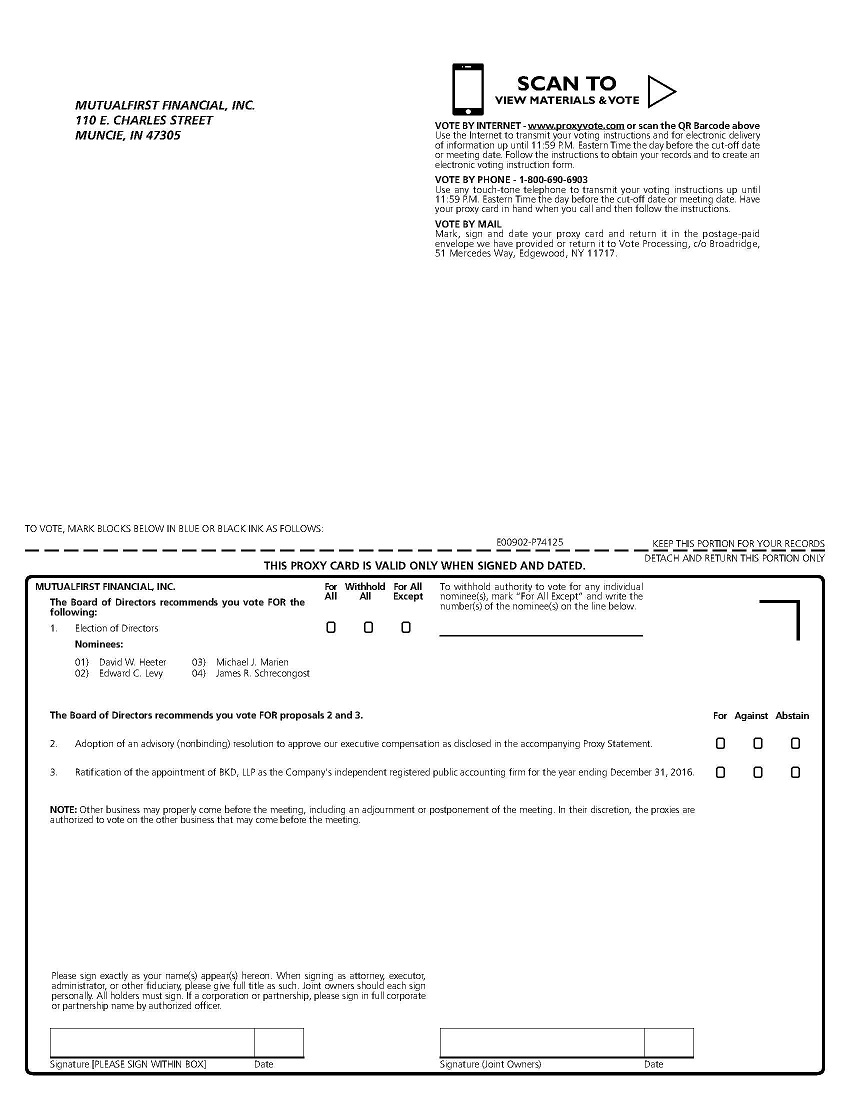

ITEMS OF BUSINESS | (1) | The election of David W. Heeter, Edward C. Levy, Michael J. Marien and James R. Schrecongost as directors for a term of three years. |

| | (2) | Adoption of an advisory (nonbinding) resolution to approve our executive compensation as disclosed in the accompanying Proxy Statement. |

| | (3) | Ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016. |

| | (4) | Any other business that may properly come before the meeting and any adjournment or postponement of the meeting. |

| | |

RECORD DATE | Holders of record of MutualFirst Financial, Inc. common stock at the close of business on March 7, 2016, will be entitled to vote at the meeting or any adjournment of the meeting. |

| | |

PROXY VOTING | It is important that your shares be represented and voted at the Annual Meeting. Stockholders have a choice of voting by Internet or telephone, by mailing a completed Proxy Card or by submitting a ballot in person at the Annual Meeting. Our Board of Directors is soliciting your votes by this notice and in the other proxy materials. To ensure that your shares are represented at the meeting, please take the time to vote as soon as possible, even if you plan to attend the meeting. Regardless of the number of shares you own, your vote is very important. Please act today. |

BY ORDER OF THE BOARD OF DIRECTORS

DAVID W. HEETER

President and Chief Executive Officer

Muncie, Indiana

March 25, 2016

IMPORTANT NOTICE: Internet Availability of Proxy Materials

for the Stockholder Meeting To Be Held on May 4, 2016.

The Company’s Proxy Statement, Annual Report to Stockholders and electronic Proxy Card are available on the Internet at

http://www.proxyvote.com. The notice we forwarded on March 25, 2016, about the availability of the proxy materials

on the Internet contained a special 16 digit identification number assigned to each stockholder of record in a box marked by an

arrow as follows: ® xxxx-xxxx-xxxx-xxxx. That number is required to vote and to access the proxy materials on the Internet.

You are encouraged to review all of the information contained in the Proxy Statement before voting.

MutualFirst

Financial, Inc.

110 E. Charles Street

Muncie, Indiana 47305-2400

(765) 747-2800

__________________________

PROXY STATEMENT

__________________________

ANNUAL MEETING TO BE HELD MAY 4, 2016

INTRODUCTION

The Board of Directors of MutualFirst Financial, Inc., is using this Proxy Statement to solicit proxies from the holders of the Company’s common stock for use at the upcoming Annual Meeting of Stockholders. The Annual Meeting will be held on Wednesday, May 4, 2016, at 3:00 p.m., local time, at the Company’s main office located at 110 E. Charles Street, Muncie, Indiana.

At the Annual Meeting, stockholders will be asked to vote on three proposals: (1) the election of David W. Heeter, Edward C. Levy, Michael J. Marien and James R. Schrecongost as directors of the Company for a term of three years; (2) an advisory (non-binding) resolution to approve our executive compensation as disclosed in this Proxy Statement; and (3) ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016. These proposals are described in more detail below. Stockholders also will consider any other matters that may properly come before the Annual Meeting, although the Board of Directors knows of no other business to be presented.

MutualFirst Financial, Inc. may be referred to from time to time in this Proxy Statement as “MutualFirst” or the “Company.” Some of the information in this Proxy Statement relates to MutualBank, a wholly owned subsidiary of the Company, which may be referred to from time to time in this Proxy Statement as the “Bank.”

By submitting your proxy, you authorize the Company’s Board of Directors to represent you and vote your shares at the Annual Meeting in accordance with your instructions. The Board also may vote your shares to adjourn the Annual Meeting from time to time and will be authorized to vote your shares at any adjournments or postponements of the Annual Meeting.

The Company’s Annual Report to Stockholders for the fiscal year ending December 31, 2015, which includes the Company’s audited financial statements, is being provided with this Proxy Statement. Although this report is being made available to stockholders with this Proxy Statement, it does not constitute a part of the proxy solicitation materials and is not incorporated into this Proxy Statement by reference.

Again this year, we are distributing the Proxy Statement and the Annual Report to Stockholders over the Internet at http://www.proxyvote.com. In addition, stockholders will be able to cast their votes on the Internet or by phone. On March 25, 2016, we mailed to our stockholders of record as of March 7, 2016, a notice of the Annual Meeting and of the availability of the proxy materials on the Internet (“March 25 Notice”). That notice contains instructions on how to access the proxy materials and Annual Report, including requesting an emailed or paper copy, and how to cast your vote by Internet, phone or regular mail or in person at the meeting.

Your vote is important. You may vote by Internet or telephone, by sending a completed Proxy Card by regular mail or by submitting a ballot in person at the Annual Meeting. We encourage you to attend the Annual Meeting in person no matter how you decide to cast your vote. Please read the Proxy Statement and vote your shares as promptly as possible to ensure you are represented at the meeting.

ADVISORY VOTE ON EXECUTIVE COMPENSATION – Proposal 2

Since 2009, our stockholders have had the opportunity at each Annual Meeting to cast a non-binding, advisory vote on our executive compensation as disclosed in each proxy statement for those meetings. We are gratified that, each year, our stockholders have evidenced support of our executive compensation program by an overwhelming margin.

Stockholders have an opportunity to cast another non-binding, advisory vote on our executive compensation program disclosed in this Proxy Statement. We refer you to “Proposal 2 - Advisory (Non-Binding) Resolution to Approve Executive Compensation” on page 37.

In evaluating this say-on-pay proposal, we recommend that you review the disclosure of our executive compensation program, including our compensation program, philosophy and objectives and the level of compensation to our five named executive officers at “Executive Compensation” on pages 20 to 36. Our Board asks that you vote for the advisory resolution to approve executive compensation.

RATIFICATION OF BKD, LLP AS THE COMPANY’S INDEPENDENT AUDITOR – Proposal 3

The Audit/Compliance Committee has selected BKD, LLP as our audit firm for the 2016 fiscal year. The Board is asking the stockholders to ratify that appointment. Though the stockholder vote on ratification is not binding on the Audit/Compliance Committee, the Committee will consider the stockholders’ views on this matter when deciding whether to continue to retain BKD, LLP in the current or next fiscal year. In considering this matter, we refer you to “Proposal 3 – Ratification of Appointment of Independent Registered Public Accounting Firm” on pages 39 to 40 , including information regarding fees paid to BKD, LLP over the prior two fiscal years and the types of services provided by the firm. Our Board asks that you vote for the ratification of BKD, LLP as the Company’s audit firm for the 2016 fiscal year.

2017 ANNUAL MEETING

| · | Stockholder proposals for inclusion in our 2017 proxy statement under Securities and Exchange Commission (“SEC”) regulations must be received by us no later than November 25, 2016. |

| · | Stockholder proposals for presentation at our 2017 annual meeting, but not included in the proxy statement for that meeting, must be received by us no later than February 3, 2017, and no earlier than January 4, 2017, subject to adjustment based on the date of the 2017 annual meeting. See “Additional Information - Stockholder Proposals for 2017 annual meeting” on page 41. |

INFORMATION ABOUT THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will be asked to vote on the following proposals:

| Proposal 1. | The election of David W. Heeter, Edward C. Levy, Michael J. Marien and James R. Schrecongost as directors of the Company for a term of three years. |

| Proposal 2. | Adoption of an advisory (nonbinding) resolution to approve our executive compensation as disclosed in this Proxy Statement. |

| Proposal 3. | Ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016. |

The stockholders also will act on any other business that may properly come before the Annual Meeting. Members of our management team will be present at the Annual Meeting to respond to your questions.

Who is entitled to vote?

The record date for the Annual Meeting is March 7, 2016. Only stockholders of record at the close of business on that date are entitled to notice of and to vote at the Annual Meeting. The only class of stock entitled to be voted at the Annual Meeting is the Company’s common stock. Each outstanding share of common stock is entitled to one vote on each matter presented at the Annual Meeting. At the close of business on the record date, there were 7,448,543 shares of common stock outstanding.

Who may attend the Annual Meeting?

The Annual Meeting is open to all Company stockholders and their designated proxy holders. All attendees will be required to sign-in at the entrance to the meeting, and the Company reserves the right to request proof of stock ownership including brokerage statements for beneficial owners with shares held by their broker, proxy holder status (a valid proxy) or acceptable photo identification before granting entrance to the meeting. Everyone attending the Annual Meeting agrees to abide by the rules for the conduct of the proceedings. The use of cameras, recording devices and other electronic devices (including cell phones) is prohibited during the Annual Meeting, unless the attendee receives written authorization from the Company’s Secretary, who will be attending the Annual Meeting.

Where is the location of the Annual Meeting?

The Annual Meeting is being held at the main office of the Company and the Bank located at 110 E. Charles Street in Muncie, Indiana. The office is on the northwest corner of E. Charles Street and S. Mulberry Street (between S. Walnut and S. Madison Streets). Company and Bank personnel will be present to direct you to the location of the Annual Meeting in the main office building.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of the holders of at least one-third of the shares of common stock outstanding on the record date will constitute a quorum. Proxies received but marked as abstentions or broker non‑votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, the stockholders who are represented may adjourn the Annual Meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice of the adjourned meeting will be given, unless the adjourned meeting is held after June 30, 2016. An adjournment will have no effect on the business that may be conducted at the Annual Meeting.

How do I vote?

You may vote by internet. To vote by Internet, have in hand a copy of the Proxy Card and the 16 digit identification number assigned to you in a box marked by an arrow (® xxxx-xxxx-xxxx-xxxx) on the Proxy Card, go to www.proxyvote.com and follow the instructions for voting. The deadline for voting online is 11:59 p.m. Eastern Time on May 3, 2016. If your shares are held through a broker, bank or other nominee, check the voting form you received from the firm in order to determine whether, and how, you can vote online.

You may vote by phone. To vote by phone, have in hand a copy of the Proxy Card and the 16 digit identification number assigned to you in a box marked by an arrow (® xxxx-xxxx-xxxx-xxxx) on the Proxy Card, call the toll-free phone number 1-800-690-6903 and follow the instructions for voting. The deadline for voting by phone is 11:59 p.m. Eastern Time on May 3, 2016. If your shares are held through a broker, bank or other nominee, check the voting form you received from the firm in order to determine whether, and how, you can vote by phone.

You may vote by mail. To vote by mail, request a paper copy of the Proxy Card or all the proxy materials as noted in the response to the previous question. Then complete, sign and date the Proxy Card and return it in the postage-paid envelope provided or mail it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, in a timely manner. The mailed card must be received by the Company before the start of the Annual Meeting. If your shares are held through a broker, bank or other nominee, check the voting form you received from the firm in order to determine whether, and how, you can vote by mail.

You may vote in person at the annual meeting. If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the meeting. Note, however, that if your shares are held in the name of your broker, bank or other nominee, you will need to obtain a proxy from the record holder of your shares indicating that you were the beneficial owner of those shares at the close of business on March 7, 2016, the record date for voting at the Annual Meeting. You are encouraged to vote by proxy prior to the Annual Meeting, even if you plan to attend the meeting.

What if I return my executed Proxy Card without voting instructions?

Where properly executed proxies are returned to us without specific voting instructions, your shares will be voted by the proxy holders named on the Proxy Card “FOR” the election of management’s director nominees, “FOR” the advisory (non-binding) resolution to approve our executive compensation and “FOR” the ratification of the appointment of our independent registered public accounting firm.

What if other business is presented at the Annual Meeting?

Should any other matters be properly presented at the Annual Meeting for action, the proxy holders named on the Proxy Card and acting thereunder will have the discretion to vote on these matters in accordance with their best judgment. No other matters currently are expected by the Board of Directors to be properly presented at the Annual Meeting.

What if my shares are held in “street name” by a broker?

If your shares are held in “street name” by a broker, your broker is required to vote your shares in accordance with your instructions. If you do not give instructions to your broker, your broker will be entitled to vote your shares with respect to “discretionary” items. However, your broker will not be permitted to vote your shares

with respect to “non-discretionary” items, and your shares will be treated as “broker non-votes.” Whether an item is discretionary is determined by the exchange rules governing your broker. The election of directors and the advisory (non-binding) resolution regarding executive compensation are non-discretionary items. The ratification of our auditors is a discretionary item. Your broker will forward information to you indicating how you can forward voting instructions and whether you can forward them by Internet, mail or phone.

What if my shares are held in the Bank’s employee stock ownership plan (“ESOP”)?

If you are a participant in the Bank’s ESOP, the plan trustee is required to vote the shares allocated to your account under the plan in accordance with your instructions. If you do not instruct the trustee how to vote your allocated shares, the trustee may vote your allocated shares in its sole discretion.

What if my shares are held in the Company’s 401(k) plan?

If you are one of our employees who owns Company shares in our 401(k) plan, you will receive voting instructions with respect to all the MutualFirst shares allocated to your account. You are entitled to direct the trustee how to vote your shares. If you do not provide instructions, your shares will be voted by the trustee in its sole discretion.

Can I change my vote after I submit my proxy?

Yes, you may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting by:

| · | properly submitting a later-dated proxy by Internet or phone by 11:59 p.m. Eastern Time on May 3, 2016; |

| · | properly mailing a later-dated proxy that is received by the Company before the start of the Annual Meeting; |

| · | giving written notice of the revocation of your proxy to the Company’s Secretary prior to the Annual Meeting; or |

| · | voting in person by ballot at the Annual Meeting. |

Your proxy will not be automatically revoked just by your attendance at the Annual Meeting. You must actually vote at the meeting by submitting a ballot in order to revoke a prior proxy. If you have instructed a broker, bank or other nominee to vote your shares, you must follow directions received from your nominee to change your voting instructions to that nominee.

How will abstentions be treated?

If you abstain from voting, your shares will be included for purposes of determining whether a quorum is present. Because directors will be elected by a plurality of the votes cast, abstaining is not offered as a voting option for Proposal 1. If you abstain from voting on Proposals 2 or 3, your shares will not be included in the number of shares voting on the proposal and, consequently, your abstention will have no effect on whether the proposal is approved.

How will broker non-votes be treated?

Shares treated as broker non-votes on one or more proposals will be included for purposes of calculating the presence of a quorum but will not be counted as votes cast. Proposal 1 is a non-discretionary item that includes broker non-votes; however, because the directors are elected by a plurality of the votes cast, the broker non-votes will have no impact on the election results. If you do not instruct your broker, bank or nominee how to vote your shares on Proposal 2, your shares will not be included in the number of shares voting on the proposal and will have no effect on whether the proposal is approved. Proposal 3 is a discretionary item, so your broker is entitled to cast a vote without receiving instructions from you. If, however, your broker does not cast any votes absent your instructions, these broker non-votes will have no effect on whether the proposal is approved.

Vote required to approve Proposal 1: Election of four directors.

Directors are elected by a plurality of the votes cast, in person or by proxy, at the Annual Meeting by holders of MutualFirst common stock. Stockholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or withheld from each nominee. Votes that are withheld and broker non-votes will be excluded entirely from the vote and will have no effect on the election of directors.

What happens if a nominee is unable to stand for election?

If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the Board of Directors, as holder of your proxy, will vote your shares for the substitute nominee, unless you have withheld authority to vote for the nominee replaced.

Vote required to approve Proposal 2: Advisory resolution to approve our executive compensation.

The adoption of the advisory (non-binding) resolution to approve our executive compensation as disclosed in this Proxy Statement requires the affirmative vote of a majority of the votes cast, in person or by proxy, at the Annual Meeting.

Vote required to approve Proposal 3: Ratification of the appointment of our independent registered public accounting firm.

The ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of the majority of shares cast, in person or by proxy, at the Annual Meeting.

How does the Board of Directors recommend I vote on the proposals?

Your Board of Directors recommends that you vote:

| · | FOR the election of management’s four director nominees to the Board of Directors, for a three-year term; |

| · | FOR the adoption of an advisory (nonbinding) resolution to approve our executive compensation as disclosed in this Proxy Statement; and |

| · | FOR the ratification of the appointment of our independent registered public accounting firm for the year ending December 31, 2016. |

STOCK OWNERSHIP

Stock Ownership of Significant Stockholders, Directors and Executive Officers

The following table shows, as of March 7, 2016, the beneficial ownership of the Company’s common stock by:

| · | any persons or entities known by management to beneficially own more than 5% of the outstanding shares of Company common stock; |

| · | each director and director nominee of the Company; |

| · | each executive officer of the Company and the Bank named in the “2015 Summary Compensation Table” appearing below; and |

| · | all of the executive officers and directors of the Company and the Bank as a group. |

The address of each of the beneficial owners, except where otherwise indicated, is the Company’s address. As of March 7, 2016, there were 7,448,543 shares of Company common stock issued and outstanding.

Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to outstanding stock options beneficially owned and held by that person that are currently exercisable or exercisable within 60 days after March 7, 2016, are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

| | |

| Name of Beneficial Owner | | Beneficial Ownership | | | Percent of Common Stock Outstanding | |

| | | | | | | |

| Greater than 5% Stockholders | | | | | | |

MutualBank Employee Stock Ownership and 401(k) Plan 110 E. Charles Street, Muncie, Indiana 47305-2400 | | | 442,917 | (1) | | | 5.9 | |

| | | | | | | | | |

Dimensional Fund Advisors LP Palisades West, Building One, 6300 Bee Cave Road Austin, Texas 78746 | | | 374,869 | (2) | | | 5.0 | |

| | | | | | | | | |

PL Capital Group 47 E. Chicago Avenue, Suite 336 Naperville, IL 60540 | | | 703,973 | (3) | | | 9.4 | |

| | | | | | | | | |

Thomson Horstmann & Bryant, Inc. 501 Merritt 7 Norwalk, CT 06851 | | | 460,639 | (4) | | | 6.2 | |

| | | | | | | | | |

Ancora Advisors, LLC 6060 Parkland Blvd., Suite 200

Cleveland, OH 44124 | | | 387,629 | (5) | | | 5.2 | |

| | | | | | | | | |

| Directors and Executive Officers | | | | | | | | |

Wilbur R. Davis, Director and Chairman of the Board | | | 53,000 | (6) | | | * | |

David W. Heeter, Director, President and Chief Executive Officer | | | 122,585 | (7) | | | 1.6 | |

Patrick C. Botts, Director and Executive Vice President | | | 102,888 | (8) | | | 1.4 | |

Linn A. Crull, Director | | | 61,000 | (9) | | | * | |

William V. Hughes, Director | | | 34,501 | (10) | | | * | |

Jonathan E. Kintner, Director | | | 61,438 | (11) | | | * | |

Richard J. Lashley, Director | | | 705,973 | (12) | | | 9.5 | |

Edward C. Levy, Director | | | 31,931 | (13) | | | * | |

Michael J. Marien, Director | | | 88,024 | (14) | | | 1.2 | |

Jerry D. McVicker, Director | | | 50,745 | (15) | | | * | |

James D. Rosema, Director | | | 55,000 | (16) | | | * | |

James R. Schrecongost, Director | | | 11,500 | (17) | | | * | |

Charles J. Viater, Director and Senior Vice President | | | 278,652 | (18) | | | 3.7 | |

Christopher D. Cook, Chief Financial Officer | | | 63,111 | (19) | | | * | |

Christopher L. Caldwell, Senior Vice President - MutualBank | | | 17,229 | (20) | | | * | |

| | | | | | | | | |

| All executive officers and directors as a group (16 persons) | | | 1,759,502 | (21) | | | 22.7 | % |

* Less than 1% of outstanding shares.

________________________

Footnotes are on next page.

________________________

| (1) | Represents shares held by MutualBank Employee Stock Ownership and 401(k) Plan, including 25,069 shares in 401(k) accounts and 417,848 shares that were allocated to accounts of the participants in the ESOP as of December 31, 2015. First Bankers Trust Services, Inc., the trustee of the ESOP, may be deemed to beneficially own the shares held by the MutualBank Employee Stock Ownership and 401(k) Plan. MutualBank Employee Stock Ownership and 401(k) Plan filed a Schedule 13G amendment with the SEC on February 11, 2016. |

| (2) | Represents shares held by clients of Dimensional Fund Advisors LP, an investment advisor, which disclaims beneficial ownership of these shares. Dimensional Fund Advisors LP filed an amended Schedule 13G with the SEC on February 9, 2016. |

| (3) | According to filings under the Exchange Act, the PL Capital Group consists of the following persons and entities which share beneficial ownership of certain of the shares: Financial Edge Fund, L.P. (“Financial Edge Fund”); Financial Edge-Strategic Fund, LP (“Financial Edge Strategic”); PL Capital Focused Fund, L.P. (‘Focused Fund”), PL Capital, LLC (“PL Capital’), general partner of Financial Edge Fund, Financial Edge Strategic and Focused Fund; PL Capital Advisors, LLC (“PL Capital Advisors”), the investment advisor to Financial Edge Fund, Financial Edge Strategic, Focused Fund and Goodbody/PL LP; Goodbody /PL Capital LP (“Goodbody/PL LP”);Goodbody/PL Capital LLC(“Goodbody/PL LLC”), general partner of Goodbody/PL LP; John W. Palmer as managing member of PL Capital, PL Capital Advisors and Goodbody/PL LLC and individually; Richard Lashley, as managing member of PL Capital, PL Capital Advisors and Goodbody/PL LLC, and individually. Mr. Lashley is also a director of the Company. PL Capital Group has shared voting and dispositive power over 703,973 shares. |

| (4) | Represents shares held by Thomson Horstmann & Bryant, Inc. as filed on an amended Schedule 13-G with the SEC dated January 21, 2016. Thomson Horstmann & Bryant, Inc. reported shared voting power over 251,051 shares and sole dispositive power over 460,639 shares. |

| (5) | Represents shares held by Ancora Advisors, LLC, a registered investment advisor, as filed on Schedule 13-F on February 12, 2016. Ancora Advisors, LLC reported sole voting and dispositive power over 387,629 shares. |

| (6) | Includes options for 5,000 shares and 20,000 shares owned by Mr. Davis’ spouse. |

| (7) | Includes options for 65,515 shares, 13,640 shares allocated to Mr. Heeter in the ESOP and 20,000 shares pledged as security for debt. |

| (8) | Includes options for 66,646 shares, 1,360 shares owned by Mr. Botts’ spouse, 200 shares in a UTMA account for his son and 12,363 shares allocated to Mr. Botts in the ESOP. |

| (9) | Includes options for 5,000 shares, 20,000 shares owned by Mr. Crull’s spouse and 20,000 shares pledged as security for debt. |

| (10) | Includes options for 5,000 shares, 500 shares owned by Mr. Hughes’ spouse and 4,000 shares in an IRA account. |

| (11) | Includes options for 5,000 shares and 6,901 shares owned by Mr. Kintner’s spouse. |

| (12) | Of the shares reported as beneficially owned by Mr. Lashley 347,651 shares of common stock are held in the name of Financial Edge Fund, L.P.; 152,723 shares of common stock are held in the name of Financial Edge-Strategic Fund, L.P.; 66,186 shares of common stock are held in the name of PL Capital/Focused Fund, L.P.; 137,413 shares of common stock are held in the name of Goodbody/PL Capital, L.P.; and 2,000 shares of common stock are held in Mr. Lashley's IRA. With regard to the shares held by Financial Edge Fund, L.P., Financial Edge-Strategic Fund, L.P., PL Capital/Focused Fund, L.P., and Goodbody/PL Capital, L.P., Mr. Lashley reports beneficial ownership above because he has shared voting and dispositive power as a Managing Member of PL Capital, LLC and Goodbody/PL Capital, LLC, the general partners of the funds, and as a Managing Member of PL Capital Advisors, LLC, the investment advisor of the Funds. Mr. Lashley disclaims beneficial ownership of the reported securities except to the extent of his pecuniary interest therein. |

| (13) | Includes options for 5,000 shares. |

| (14) | Includes options for 5,000 shares, 2,932 shares owned by Mr. Marien’s spouse and 76,542 shares pledged as security for debt. |

| (15) | Includes 11,806 shares owned by Mr. McVicker’s spouse. |

| (16) | Includes 7,500 shares owned by Mr. Rosema’s spouse. |

| (17) | Includes options for 5,000 shares and 6,500 shares in an IRA account. |

| (18) | Includes options for 60,000 shares, 16,033 shares in Mr. Viater’s 401(k) account, 24,957 shares allocated to Mr. Viater in the ESOP and 100,280 shares pledged as security for debt. |

| (19) | Includes options for 33,000 shares, 4,861 shares allocated to Mr. Cook in the ESOP and 20,000 shares pledged as security for debt. |

| (20) | Includes options for 7,000 shares and 2,100 shares allocated to Mr. Caldwell in the ESOP. |

| (21) | This amount includes options for 267,161 shares held by directors and executive officers and 236,822 shares pledged as security for debt. This amount does not include the 223,831 shares owned by the MutualBank Charitable Foundation, Inc., which is an Indiana non-profit corporation and 501(c)(3) tax-exempt organization with no stock or stockholders. Two of the six directors and all the officers of the foundation also are directors or officers of the Company or the Bank. Pursuant to its charter and applicable federal regulations, these shares are required to be voted in any stockholder vote in the same ratio as the votes cast by all other stockholders of the Company. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors and executive officers, and persons who own more than 10 percent of the Company’s common stock, to report to the SEC their initial ownership of the Company’s common stock and any subsequent changes in that ownership. Specific due dates for these reports have been established by the SEC and the Company is required to disclose in this Proxy Statement any late filings or failures to file.

To the Company’s knowledge, based solely on its review of the Section 16 reports filed by its directors and executive officers and written representations from those directors and executive officers, all Section 16(a) filing requirements applicable to the Company’s executive officers and directors during the fiscal year ending December 31, 2015, were met with the exception of one report filed by Director Rosema covering 5,000 shares which was not filed timely due to a communication error.

PROPOSAL 1

ELECTION OF DIRECTORS

General

The Company’s Board of Directors consists of 13 directors, divided into three classes. Directors in each class generally are elected to serve for three-year terms that expire in successive years. The term of one of the classes of MutualFirst’s directors will expire at the Annual Meeting. Director Kintner is expected to retire from the boards of the Company and the Bank at the 2016 Annual Meeting pursuant to the Company’s mandatory retirement age requirement. Upon Mr. Kintner’s retirement, the Board of Directors will reduce the size of the Company’s Board to 12 members. The Board of Directors of the Bank intends to reduce the size of its Board as well.

Richard Lashley was appointed to the board of directors of the Company for a term commencing on February 26, 2015, and ending following the Annual Meeting to be held in 2017, pursuant to an agreement, dated February 26, 2015 with PL Capital Advisors, LLC and certain of its affiliates including Mr. Lashley (“the PL Capital Parties”).

Nominees and Directors

The Company’s Board of Directors, based on the recommendations of the Nominating Committee, has nominated David W. Heeter, Edward C. Levy, Michael J. Marien and James R. Schrecongost for election as

directors for three-year terms expiring at the Annual Meeting of Stockholders to be held in 2019. These four individuals currently serve as directors of the Company. All of the Company’s directors also serve as directors of the Bank.

| Name | | Age(1) | | Positions with the Company | | Director

Since(2) | | Term

Expires |

Nominees | | | | | | | | |

| David W. Heeter | | 54 | | President, Chief Executive Officer and Director | | 2003 | | 2019(3) |

| Edward C. Levy | | 67 | | Director | | 2008 | | 2019(3) |

| Michael J. Marien | | 68 | | Director | | 2008 | | 2019(3) |

| James R. Schrecongost | | 70 | | Director | | 2011 | | 2019(3) |

Other Directors | | | | | | | | |

| Linn A. Crull | | 60 | | Director | | 1997 | | 2017 |

| Wilbur R. Davis | | 61 | | Director | | 1991 | | 2017 |

Jonathan E. Kintner | | 72 | | Director | | 2008 | | 2017 |

| Richard J. Lashley | | 57 | | Director | | 2015 | | 2017 |

| Charles J. Viater | | 61 | | Senior Vice President and Director | | 2008 | | 2017 |

| Patrick C. Botts | | 52 | | Executive Vice President and Director | | 2003 | | 2018 |

| William V. Hughes | | 68 | | Director | | 1999 | | 2018 |

| Jerry D. McVicker | | 70 | | Director | | 2000 | | 2018 |

| James D. Rosema | | 69 | | Director | | 1998 | | 2018 |

___________________

(1) At March 7, 2016.

(2) Includes years of service on the Board of the Bank prior to the formation of the Company.

(3) If elected at the Annual Meeting.

The nominees have each consented to being named in this Proxy Statement and have agreed to serve if elected. If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the Board of Directors, as holder of your proxy, will vote your shares for the substitute nominee, unless you have withheld authority to vote for the nominee replaced.

The Company’s Board of Directors recommends that you vote “FOR” the election of each of the nominees.

Business Experience and Qualifications of Directors

The Board believes that the many years of service that our directors have at the Company, the Bank or other financial institutions acquired by the Company is one of their most important qualifications for continued service on our Board. This service has given them extensive knowledge of the banking business and our Company. Furthermore, their service on Board committees, especially in areas of audit, compliance, compensation and trust business is critical to their ability to oversee the management of the Company and the Bank by our executive officers. Service on the Board by three of our senior executive officers aids the outside directors’ understanding of the critical and complicated issues that are common in the banking business. Each outside director brings special skills, experience and expertise to the Board as a result of their other business activities and associations. The business experience for at least the past five years and the experience, qualifications, attributes, skills and areas of expertise of each director that further supports his service as a director are set forth below.

Patrick C. Botts. Mr. Botts has served as Executive Vice President of the Company and President and Chief Operating Officer of the Bank since November 2003. During the years prior to that appointment, he had served as the Executive Vice President, Vice President of Human Resources, Marketing and Administration and Vice President of Retail Lending for the Bank and has been employed by the Bank since 1986. Mr. Botts’ many years of service in all areas of the Bank’s operations and his duties as President of the Bank bring a special knowledge of the financial, economic and regulatory challenges the Company faces, and he is well suited to educating the Board on these matters.

Linn A. Crull. Mr. Crull is a Certified Public Accountant and has been a member and managing partner of the accounting firm of Whitinger & Company, LLC, Muncie, Indiana, since 1979. Mr. Crull has over 30 years of experience in public accounting, including conducting audits and preparing financial statements, and his knowledge of generally accepted accounting principles brings important technical expertise to the Board and was critical to his selection for service on the Board and the Audit/Compliance Committee. His years of providing business consulting services to a broad range of companies has provided him with knowledge of compensation issues that aids the Board and the Compensation Committee. His skills and experience as a member of a financial advisory firm provides insight into various investment vehicles that supports the Board and the Trust Committee.

Wilbur R. Davis. Mr. Davis currently serves as President of the Ball State Innovation Corporation. Since 2003, Mr. Davis has been the Chairman of Ontario Systems, LLC, a computer software company located in Muncie, Indiana, which he co-founded in 1980. Mr. Davis also served as President of Ontario Systems, LLC, from 1980 until July, 2008. He is the Chairman of the Board of Directors of the Company and the Bank. Mr. Davis brings management expertise, as well as information technology knowledge to the Board. His participation in our local business community for 30 years brings a knowledge of the local economy and business opportunities to the Bank.

David W. Heeter. Mr. Heeter has served as President and Chief Executive Officer of the Company and Chief Executive Officer of the Bank since 2003. During the years prior to that appointment, he had served as Executive Vice President of the Company and the Bank and as Chief Operating Officer and Vice President of Human Resources, Marketing and Administration of the Bank. He has been employed by the Bank since 1986. Mr. Heeter’s many years of service in all areas of the Bank’s operations and his duties as Chief Executive Officer of the Bank bring a special knowledge of the financial, economic and regulatory challenges the Company faces, and he is well suited to educating the Board on these matters.

William V. Hughes. Mr. Hughes has served as a partner in the law firm of Beasley & Gilkison, LLP, Muncie, Indiana, since 1977. That law firm serves as general counsel to the Bank. Mr. Hughes brings extensive legal knowledge to the Board, particularly with respect to Indiana real property law, commercial transactions, trusts and estates and business litigation. His legal background also serves the Board as a resource for matters of corporate governance and director responsibility.

Jonathan E. Kintner, O.D. Dr. Kintner served as the managing partner of a private group optometry practice in Mishawaka, Indiana for 41 years before his retirement in 2009. He had served as a director of MFB Corp. and its banking subsidiary for 31 years prior to their acquisition by the Company in 2008. Dr. Kintner had chaired the Director’s Trust Committee of MFB Corp. prior to the acquisition in 2008. Since the acquisition, he has served as chairman of the Trust Committee that oversees the Bank’s trust business. Dr. Kintner has served as a trustee of the Mishawaka Housing Authority since 2008. He also brings general business knowledge to the Board from his optometry practice.

Richard J. Lashley. In 1996 Mr. Lashley became a co-founder and co-owner of PL Capital LLC, an investment management firm which specializes in the banking industry. In addition, Mr. Lashley has served on multiple bank and thrift boards. From June 2015 to February 2016, Mr. Lashley served as a director of Metro Bancorp, Inc. in Harrisburg, PA. From 2009 - 2013, Mr. Lashley served as a director of State Bancorp, Inc., in Jericho, New York. From 2011 - 2015, Mr. Lashley served as a director of BCSB Bancorp, Inc., in Baltimore, Maryland, and from 2008-2011, Mr. Lashley served as a director of Community FSB Holding Co., in Woodhaven, NY. He worked for KPMG Peat Marwick, LLP from 1984-1996 where he provided professional accounting and financial advisory services to bank and thrift clients nationwide. He is licensed as a CPA in New Jersey (status inactive).

Edward C. Levy. Mr. Levy has been an officer and owner of Freeman-Spicer Financial Services, Inc., a business finance and leasing company, and Freeman-Spicer Accounting Services, Inc., a small business accounting and computerization company for more than five years and is a 50% owner and managing partner in two real estate partnerships. During 2010, he became chairman of One-Touch Automation, Inc., a company engaged in home and business automation and security systems in Indiana. He is a partner in CVM Productions, Inc., a video production company specializing in corporate marketing and advertising videos and live sports broadcasting for network distribution. Mr. Levy is also president of Visible Electronics, Inc. a lighting and electronic company. The company has also developed lifts for the RV Industry. He had served as a director of MFB Corp. and its banking subsidiary for three years prior to their acquisition by the Company in 2008. Mr. Levy’s extensive knowledge of investments, insurance and these regulated industries supports the Board’s and Trust Committee’s knowledge in these areas. He also brings that understanding of regulations to the Audit/Compliance Committee. Mr. Levy’s background in finance, real estate and management is also important to his service on our Audit/Compliance Committee.

Michael J. Marien. Mr. Marien is employed by R. W. Baird, a registered broker/dealer and investment advisor firm. He has an active FINRA Series 7 License and Series 66 Indiana License. He retired in 2009 as Account Manager for IT/Signode Corp., a division of Illinois Tool Works (packaging of steel industry products and services, Glenview, Illinois), after 40 years of service. He had served as a director of MFB Corp. and its banking subsidiary for 21 years and was chairman of the board of MFB Corp. for five years prior to the acquisition by the Company in 2008. Mr. Marien brings his prior knowledge of the trust business of MFB Corp. to his service on our Trust Committee. His participation in our local business community for 30 years brings knowledge of the local economy and business opportunities to the Bank.

Jerry D. McVicker. Mr. McVicker retired in 2003. Prior to that, he had served as an Administrator, Chief Executive Officer and Chief Operating Officer for Marion Community Schools since 1996. He had served as a director of Marion Capital Holdings, Inc., prior to its acquisition by the Company in 2000. He is the Chairman of the Company’s Compensation Committee. Mr. McVicker has many years of extensive management and administrative experience. His participation in our local business community for over 30 years brings knowledge of the local economy and business opportunities to the Bank.

James D. Rosema. Mr. Rosema is the founder and was the President of Rosema Corporation, an interior finishing company located in Muncie, Fort Wayne, and South Bend, Indiana, from 1972 until his retirement in 2012. This successful business has had approximately $15 million in revenue each year and currently has 120 employees. Mr. Rosema brings to the Board over 40 years of management and administrative skills, extensive experience in real estate development and construction, especially in the communities we serve. He also has experience in sales, personnel management and human resource matters from his outside business experience.

James R. Schrecongost. Mr. Schrecongost is a retired bank executive with over 40 years of financial institution management experience. Since retiring in 2001, he has served as chairman and a director of the wealth management subsidiary of Old National Bancorp in Indiana until 2010. Old National Bancorp is a public company with securities registered with the SEC. Mr. Schrecongost was the vice chairman, president and chief executive officer of ANB Corporation, which owned and managed three banks and a trust company in Indiana before it was acquired by Old National Bancorp in 2000. Mr. Schrecongost’s extensive experience in the banking and trust company business and management, financial and analytical skills and knowledge of our market area are important to his service on the Board.

Charles J. Viater. Mr. Viater has served as Senior Vice President of the Company and Regional President of the Bank since July 2008. He had served as president, chief executive officer and a director of MFB Corp. and its banking subsidiary for 13 years prior to their acquisition by the Company in 2008. Prior to its acquisition by the Company, MFB Corp. had $500 million in assets and was operated under the leadership of Mr. Viater. Mr. Viater’s over 30-year background in bank operations and knowledge of the local communities we now serve after the MFB Corp. acquisition are important to the Board. He has training as a CPA.

Director Compensation

The Company uses a combination of cash and stock-based compensation to attract and retain qualified persons to serve as non-employee directors of the Company and the Bank. Each director of the Company also is a director of the Bank. Directors are not compensated separately for their service on the Company’s Board of Directors. In setting director compensation, the Board of Directors considers the significant amount of time and level of skill required for service on the Boards of the Company and the Bank, particularly due to the duties imposed on directors of public companies and financial institutions. The types and levels of director compensation are annually reviewed and set by the Compensation Committee and ratified by the full Board of Directors.

For the fiscal year ending December 31, 2015, each director received an annual fee of $31,500 for serving on the Bank’s Board of Directors, except for Messrs. Heeter, Botts, and Viater, who were compensated as executive officers of the Bank and are not separately compensated as directors. Mr. Davis receives an additional $6,000 per year for serving as Chairman of the Board of Directors; Mr. Crull receives an additional $5,000 for serving as the Chairman of the Audit/Compliance Committee; Mr. McVicker receives an additional $3,000 for serving as Chairman of the Compensation Committee; and Mr. Kintner receives an additional $3,000 for serving as the Chairman of the Trust Management Committee. In addition, each director receives $200 per Board committee meeting attended. Our directors have been awarded restricted stock and stock options under the Company’s 2000 Recognition and Retention Plan and 2000 Stock Option and Incentive Plan. Messrs. Kintner, Levy and Marien received stock options from the Company in exchange for their outstanding options in connection with the acquisition of another financial institution by the Company in 2008. No stock options were granted to directors in 2015.

The Bank maintains deferred compensation arrangements with some directors, which allowed them to defer all or a portion of their Board fees earned before September 2008 and earn interest on deferred amounts at the rate of 10% per year, which rate was set at the inception of the plan in 1993 and was not an above-market rate at that time. Participants receive the deferred amounts as income when they are no longer serving as active directors. The participant may choose to receive the deferred payments in a lump sum or in annual installments for 15 years at age 70.

Mr. McVicker has a Director Shareholder Benefit Plan with the Company as a result of the Bank’s 2000 acquisition of another financial institution with which he was affiliated. This plan operates in the same fashion as MutualBank’s SERP, except that Director McVicker qualifies to receive the retirement benefits at the earlier of age 70 or the termination of his service as a director of MutualBank. During 2015, $43,382 was accrued under Mr. McVicker’s Director Shareholder Benefit Agreement. This plan provides for earlier payouts for disability, for continued payouts as death benefits and for immediate funding and payment upon a change in control of MutualBank that terminates his service as a director.

Messrs. Kintner, Levy and Marien were parties to director fee continuation agreements with the institution acquired in 2008, which were assumed by the Company. Those agreements provided that if the director retired after attaining age 72 and had served as a director for at least five years, he would be entitled to an annual retirement benefit for five years (or 10 years, if the director had more than 10 years of service) equal to 50% of the total fees paid to him during the last plan year before ending service. These agreements also provided that, in the event of a change in control followed within 24 months by a termination of service as a director prior to age 72, the director would be entitled to receive the present value of the normal retirement benefit (without regard to years of service) paid in a lump sum.

Director Compensation Table for 2015

The following table provides compensation information for each member of our Board of Directors during the year ending December 31, 2015 (except for Messrs. Heeter, Botts and Viater, whose compensation is reported as named executive officers). All prior stock options and restricted stock awards to non-officer directors were fully vested at December 31, 2015, and no stock option or restricted stock awards were granted to non-officer directors during 2015.

| Name | | Fees Earned or Paid in Cash | | Option Awards | | Change in Pension Value and Non Qualified Deferred Compensation Earnings(1) | | All Other

Compensation(2) | | Total |

Linn A. Crull(3) | | $40,500 | | --- | | $27,063 | | --- | | $67,563 |

Wilbur R. Davis(4) | | $39,300 | | --- | | $44,257 | | --- | | $83,557 |

William V. Hughes(5) | | $33,900 | | --- | | | | --- | | $33,100 |

Jonathan E. Kintner(6) | | $37,700 | | --- | | | | --- | | $37,700 |

Edward C. Levy(7) | | $34,700 | | --- | | | | --- | | $34,700 |

Richard J. Lashley(8) | | $29,075 | | --- | | | | | | $29,075 |

Michael J. Marien(9) | | $34,900 | | --- | | | | --- | | $34,900 |

Jerry D. McVicker(10) | | $36,300 | | --- | | | | $43,382 | | $79,682 |

James D. Rosema(11) | | $32,500 | | --- | | $54,895 | | --- | | $87,395 |

James R. Schrecongost(12) | | $34,500 | | --- | | --- | | --- | | $34,500 |

_______________________

| (1) | Amounts reported for Messrs. Crull, Davis and Rosema reflect only the above-market earnings on their deferred compensation accounts. |

| (2) | No director received personal benefits or perquisites exceeding $10,000 in the aggregate. The earnings on each director’s deferred compensation account, excluding the above-market earnings reported in the preceding column, are reported in the footnotes below. |

| (3) | Fees paid include $4,000 for committee meetings attended and $5,000 as audit committee chair. As of December 31, 2015, Mr. Crull owned exercisable options for 5,000 shares of Company stock. Mr. Crull’s other 2015 earnings on his deferred compensation account were $12,502. |

| (4) | Fees paid include $1,800 for committee meetings attended and $6,000 as chairman fee. As of December 31, 2015, Mr. Davis owned exercisable options for 5,000 shares of Company stock. Mr. Davis’ other 2015 earnings on his deferred compensation account were $20,446. |

| (5) | Fees paid include $2,400 for committee meetings attended. As of December 31, 2015, Mr. Hughes owned exercisable options for 5,000 shares of Company stock. |

| (6) | Fees paid include $3,200 for committee meetings attended. As of December 31, 2015, Mr. Kintner owned exercisable options for 5,000 shares of Company stock. |

| (7) | Fees paid include $3,200 for committee meetings attended. As of December 31, 2015, Mr. Levy owned exercisable options for 5,000 shares of Company stock. |

| (8) | Fees paid include $600 for committee meetings attended. |

| (9) | Fees paid include $3,400 for committee meetings attended. As of December 31, 2015, Mr. Marien owned exercisable options for 5,000 shares of Company stock. |

| (10) | Fees paid include $1,800 for committee meetings attended and $3,000 as Compensation Committee chair. This amount shown under “All Other Compensation” reflects the accrual under Mr. McVicker’s Director Shareholder Benefit Agreement. As of December 31, 2015, Mr. McVicker did not own exercisable options. |

| (11) | Fees paid include $1,000 for committee meetings attended. As of December 31, 2015, Mr. Rosema did not own exercisable options. Mr. Rosema’s other 2015 earnings on his deferred compensation account were $25,361. |

| (12) | Fees paid include $3,000 for committee meetings attended. As of December 31, 2015, Mr. Schrecongost owned exercisable options for 5,000 shares of Company stock. |

Business Relationships and Transactions with Executive Officers, Directors and Related Persons

The Company and the Bank may engage in transactions or series of transactions with our directors, executive officers and certain persons related to them. Except for loans by the Bank, which are governed by a separate policy, these transactions are considered “related party” transactions under applicable regulations of the SEC and are subject to review and approval of the Audit/Compliance Committee and ratification by the Board of Directors. All other transactions with executive officers, directors and related persons are approved by the Board of Directors. During 2015, the only transaction or series of transactions of this nature that exceeded $120,000 involved the law firm that has been retained as MutualBank’s general counsel for decades. Director Hughes is a 10% owner and partner in the law firm of Beasley & Gilkison LLP, which received a $72,000 retainer fee in 2015 to advise the Bank on certain contract, employment, trust, regulatory, real estate and certain litigation matters. It also received $148,846 in fees for the professional services rendered on an hourly basis on mortgage foreclosure, collection, estate claim, bankruptcy, loan service and other litigation matters during the year ending December 31, 2015. These fees were more than 5% of the total fees earned by the firm in 2015.

The Bank has a written policy of granting loans to officers and directors, which fully complies with all applicable federal regulations. Loans to directors and executive officers are made in the ordinary course of business and on substantially the same terms and conditions, including interest rates and collateral, as those of comparable transactions with non-insiders prevailing at the time (except as noted below), in accordance with the Bank’s underwriting guidelines, and do not involve more than the normal risk of collectability or present other unfavorable features. These loans to directors and executive officers are not made at preferential rates; however, certain closing fees are waived. No director, executive officer or any of their affiliates had aggregate indebtedness to the Bank at below-market interest rates exceeding $120,000 in the aggregate since December 31, 2014. Loans to all directors and executive officers and their associates totaled approximately $12.3 million at December 31, 2015, which was approximately 9.0% of the Company’s consolidated stockholders’ equity at that date. All loans to directors and executive officers were performing in accordance with their terms at December 31, 2015.

BOARD OF DIRECTORS’ MEETINGS AND COMMITTEES AND

CORPORATE GOVERNANCE MATTERS

Board Meetings, Independence and Ethics Code

Meetings of the Company’s Board of Directors are generally held on a monthly basis. The Company’s Board of Directors held 12 regular meetings during the fiscal year ending December 31, 2015. During 2015, each of the directors of the Company attended 75% or more of the aggregate of the total number of Board meetings and the total number of meetings of the Board committees on which the director served. The Company’s policy is for all directors to attend each annual meeting of stockholders, and all of our directors attended last year’s annual meeting.

The Board has determined that Directors Crull, Davis, Kintner, Lashley, Levy, Marien, McVicker, Rosema and Schrecongost, who constitute a majority of our Board members, are “independent directors,” as that term is defined in the NASDAQ listing standards. Among other things, when making this determination, the Board considers each director’s current or previous employment relationships and material transactions or relationships with the Company or the Bank, members of their immediate family and entities in which the director has a significant interest. The purpose of this review is to determine whether any relationships or transactions exist or have occurred that are inconsistent with a determination that the director is independent. Among other matters, in reaching its determination on independence, the Board considered the fact that certain of the directors or their affiliates have borrowed money from the Bank. See "Election of Directors - Business Relationships and Transactions with Executive Officers, Directors and Related Persons."

Stockholders may communicate directly with the Board of Directors by sending written communications to Wilbur R. Davis, Chairman of the Board, MutualFirst Financial, Inc., 110 E. Charles Street, Muncie, Indiana 47305-2400.

The Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all directors, officers and employees. You may obtain a copy of the Code free of charge by writing to the Corporate Secretary of the Company, 110 E. Charles Street, Muncie, Indiana 47305-2400 or by calling (765) 747-2800. In addition, the Code of Business Conduct and Ethics was filed with the SEC as Exhibit 14 to the Company’s Annual Report on Form 10-K for the year ending December 31, 2003, and is available at http://www.bankwithmutual.com/About us/Investor Relations/Governance Documents/Code-of-Ethics.

Board Leadership Structure and Risk Oversight

As noted above, the positions of Chairman of the Board of the Company and Chief Executive Officer and President of the Company are held by separate persons. This has been the case since the Company was formed. The Board believes this structure is appropriate for the Company and the Bank because it creates a clear line between management by the executive management and oversight of management by the Board of Directors, led by the Chairman.

Committees of the Board of Directors

The Board of Directors of the Company has standing Audit/Compliance, Compensation and Nominating Committees. The Board of Directors has adopted written charters for the Audit/Compliance Committee, the Compensation Committee and the Nominating Committee. Copies of the charters for the Audit/Compliance Committee, Compensation Committee and the Nominating Committee are available on our website at http://www.bankwithmutual.com/about-us/investor-relations/committee-charting/Audit Committee Charter; Compensation Committee Charter; Nominating Committee Charter, respectively. You also may obtain a copy of these committee charters free of charge by writing to the Corporate Secretary, MutualFirst Financial, Inc., 110 E. Charles Street, Muncie, Indiana 47305-2400 or by calling (765) 747-2800.

Audit/Compliance Committee

The Audit/Compliance Committee is comprised of Directors Crull (Chairman), Davis, Kintner, Lashley, Levy and McVicker, all of whom are “independent directors” under the NASDAQ listing standards. No member of the Audit/Compliance Committee had any relationship with the Company or the Bank requiring disclosure under Item 404 of SEC Regulation S-K, which requires the disclosure of certain related person transactions. The Board of Directors has determined that Directors Crull, Lashley, and Levy each is an “audit committee financial expert” as defined in Item 407(e) of Regulation S-K of the SEC and that all of the Audit/Compliance Committee members meet the independence and financial literacy requirements under the NASDAQ listing standards. In 2015, the Audit/Compliance Committee met four times.

The Audit/Compliance Committee is responsible for hiring, terminating and/or reappointing the Company’s independent auditor and for reviewing the annual audit report prepared by our independent registered public accounting firm. The functions of the Audit/Compliance Committee also include:

| · | approving non-audit and audit services to be performed by the independent registered public accounting firm; |

| · | reviewing and approving all related party transactions for potential conflict of interest situations; |

| · | reviewing and assessing the adequacy of the Audit/Compliance Committee Charter on an annual basis; |

| · | reviewing significant financial information for the purpose of giving added assurance that the information is accurate and timely and that it includes all appropriate financial statement disclosures; |

| · | ensuring the existence of effective accounting and internal control systems; and |

| · | overseeing the entire audit function of the Company, both internal and independent. |

Compensation Committee

The Compensation Committee is comprised of six independent directors, Directors McVicker (Chairman), Crull, Davis, Marien, Rosema and Schrecongost. No member of the Compensation Committee had any relationship with the Company or the Bank requiring disclosure under Item 404 of SEC Regulation S-K, which requires the disclosure of certain related person transactions. The Compensation Committee is responsible for:

| · | determining compensation to be paid to its officers and employees, which are based, in part, on the recommendations of Messrs. Heeter and Botts, except that compensation paid to Mr. Heeter is determined based on the recommendation of a majority of the independent directors, and neither Mr. Heeter nor Mr. Botts are present during voting or deliberations concerning their compensation; |

| · | overseeing the administration of the employee benefit plans covering employees generally; |

| · | administering the Company’s cash and equity compensation incentive plans; |

| · | setting Board and Board committee fees; and |

| · | reviewing our compensation policies and programs. |

The Company’s Compensation Committee met five times during the fiscal year ending December 31, 2015. The Compensation Committee does not delegate its authority to any one of its members or any other person. The Compensation Committee did not retain any compensation consultants in 2015 to determine or recommend the level or form of director or executive compensation. The Compensation Committee also reviews our incentive compensation plans to determine if they encourage undue or unnecessary risk or the manipulation of earnings.

Nominating Committee

The Nominating Committee is comprised of Directors Davis (Chairman), Crull, Kintner, Marien, and Schrecongost. The Nominating Committee is primarily responsible for selecting nominees for election to the Board. The Nominating Committee generally meets once per year to make nominations. The Nominating Committee will consider nominees recommended by stockholders in accordance with the procedures in the Company’s bylaws, but the Nominating Committee has not actively solicited such nominations. The Nominating Committee has the following responsibilities under its charter:

| · | recommend to the Board the appropriate size of the Board and assist in identifying, interviewing and recruiting candidates for the Board; |

| · | recommend candidates (including incumbents) for election and appointment to the Board of Directors, subject to the provisions set forth in the Company’s charter and bylaws relating to the nomination or appointment of directors, based on the following criteria: business experience, education, integrity and reputation, independence, conflicts of interest, diversity, age, number of other directorships and commitments (including charitable obligations), tenure on the Board, attendance at Board and committee meetings, stock ownership, specialized knowledge (such as an understanding of banking, accounting, marketing, finance, regulation and public policy) and a commitment to the Company’s communities and shared values, as well as overall experience in the context of the needs of the Board as a whole; |

| · | review nominations submitted by stockholders, which have been addressed to the Corporate Secretary, and which comply with the requirements of the Company’s charter and bylaws; |

| · | consider and evaluate nominations from stockholders using the same criteria as all other nominations; |

| · | annually recommend to the Board committee assignments and committee chairs on all committees of the Board, and recommend committee members to fill vacancies on committees as necessary; and |

| · | perform any other duties or responsibilities expressly delegated to the Committee by the Board. |

As noted above, the Nominating Committee Charter provides for a number of criteria that are considered when selecting new members of the Board. Those criteria, as well as viewpoint, skill, race, gender and national origin, are considered by the Nominating Committee and the Board when seeking to fill a vacancy or a new seat on the Board in order to consider diversity on our Board of Directors.

Nominations, other than those made by the Nominating Committee, must be made pursuant to timely notice in writing to the Corporate Secretary as set forth in Article I, Section 1.09 of the Company’s bylaws. In general, to be timely, a stockholder’s notice must be received by the Company not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting; however, if less than 100 days’ notice of the date of the scheduled annual meeting is given by the Company, the stockholder has until the close of business on the tenth day following the day on which notice of the date of the scheduled annual meeting was made. The stockholder’s notice must include the information set forth in Article I, Section 1.09 of the Company’s bylaws, which includes the following:

| · | as to each person whom a stockholder proposes to nominate for election as a director: all information relating to the proposed nominee that is required to be disclosed in the solicitation of proxies for election as directors or is otherwise required pursuant to Regulation 14A under the Securities Exchange Act of 1934; and |

| · | as to the stockholder giving the notice: the name and address of the stockholder as they appear on the Company’s books and the number of shares of the Company’s common stock beneficially owned by the stockholder. |

This description is a summary of our nominating process. Any stockholder wishing to propose a director candidate to the Company should review and must comply in full with the procedures set forth in the Company’s charter and bylaws and in Maryland law. During the fiscal year ending December 31, 2015, the Nominating Committee was responsible for selecting director nominees and met one time with respect to the selection of director nominees.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

In this section, we provide an overview and analysis of our compensation programs, the material compensation policy decisions we have made under those programs, and the material factors that we have considered in making those decisions. Following this section, you will find a series of tables containing specific information about compensation paid or payable to the following individuals, whom we refer to as our “named executive officers.”

David W. Heeter – President and Chief Executive Officer

Christopher D. Cook – Chief Financial Officer

Patrick C. Botts – Executive Vice President

Charles J. Viater – Senior Vice President

Christopher L. Caldwell – Senior Vice President, MutualBank

The discussion below is intended to help you understand the detailed information provided in those tables and put that information into context within our overall compensation program.

Philosophy and Objectives of Compensation Program

The Compensation Committee has established a broad-based compensation program to address compensation for directors, executive officers and other employees. The overall goals of this compensation program help the Company and the Bank attract, motivate and retain talented and dedicated executives, orient its executives toward the achievement of business goals and link the compensation of its executives to the Company’s success. The Compensation Committee seeks to establish compensation levels that attract highly effective executives who work well as a team. Our compensation philosophy is based on established principles for all pay practices and aligns with our corporate values, which are to conduct our business with character, compassion, class and competition. We reflect these values in our compensation by ensuring competitive and fair practices. Our overriding principles in setting types and amounts of compensation are:

| · | Merit/Performance Based – Individual compensation is linked to the successful achievement of performance objectives. |

| · | Market Competition – Total compensation that attracts, retains and motivates our top performers at a competitive level in our market. |

| · | Stockholder Balance – Compensation components that align the interests of key management, especially the named executive officers, with those of our stockholders in furtherance of our goal to increase stockholder value. |

The Company implements this philosophy by using a combination of cash and stock-based compensation, benefits and perquisites to attract and retain qualified persons to serve as executive officers of the Company and the Bank. Our compensation program seeks to reach an appropriate balance between base salary (to provide competitive fixed compensation), incentive opportunities in performance-based cash bonuses (to provide rewards for meeting performance goals) and equity compensation (to align our executives’ interests with our stockholders’ interests).

The Compensation Committee and the Board have established a variable incentive compensation program that provides for cash incentive payments to designated executives of the Company, including the five named executive officers, based on Company performance, as reflected in basic earnings per share (“EPS”) for each fiscal year (see “- Non-Equity Incentive Plans”). In addition, in 2008, the stockholders approved a stock option plan that authorizes the Compensation Committee to award options to directors, officers and other employees (see “- Equity Incentive Plan”). Stock options encourage our executives to own and retain a meaningful stake in the Company’s common stock, thereby aligning their long-term interests with those of our stockholders. Both of these compensation programs encourage our executive officers to achieve the Company’s financial and other performance goals.

Each executive officer of the Company also is an executive officer of the Bank. Executive officers are not compensated separately for their service to the Company. The Compensation Committee considers the significant amount of time and level of skill required to perform the required duties of each executive’s position, taking into account the complexity of our business as a regulated public company and financial institution.