- BGC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

BGC (BGC) DEFA14AAdditional proxy soliciting materials

Filed: 30 May 07, 12:00am

Overview of the Proposed Combination of BGC Partners Inc. and eSpeed Inc. |

2 Disclosures Forward-Looking Statements The information in this release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You should carefully read the disclosure section entitled “Discussion of Forward- Looking Statements”, as well as other important information as contained in the Form 8-K filed by eSpeed Inc. with the U.S. Securities and Exchange Commission (the “SEC”) on May 30, 2007. Important Information In connection with the proposed merger, eSpeed intends to file a proxy statement and related materials with the SEC for the shareholders’ meeting to vote on the merger. Because those documents will contain important information, holders of eSpeed’s common stock are urged to read them carefully, if and when they become available. When filed with the SEC, the proxy statement and related materials will be available for free (along with any other documents and reports filed by eSpeed with the SEC) at the SEC’s website, www.sec.gov, and at eSpeed’s website, www.espeed.com. Participant Information eSpeed and its directors and executive officers may be deemed to be participants in the solicitation of proxies from eSpeed’s shareholders in connection with the proposed merger. Certain information regarding the participants and their interests in the solicitation are set forth in eSpeed’s Annual Report on Form 10-K for the year ended December 31, 2006, which was filed with the SEC on March 15, 2007, and will be set forth in the proxy statement for the meeting of shareholders to vote on the merger. shareholders may obtain additional information regarding the merger by reading the proxy statement and the related materials relating to the proposed merger, if and when they become available. |

3 On Today’s Call Howard Lutnick – Chairman and Co-CEO of Combined Company • Chairman, Chief Executive Officer and President of eSpeed since 1999 • President and CEO of Cantor Fitzgerald since 1991, Chairman since 1996. Lee Amaitis – Co-CEO of Combined Company • Chairman and Chief Executive Officer of BGC Partners since 2004 • Vice-Chairman of eSpeed since 2004 • Global Chief Operating Officer of eSpeed from 2001 to 2004 Shaun Lynn – President of Combined Company • President of the BGC Group since 2004 • Various senior management positions at Cantor since 1989 Robert West – CFO of Combined Company • Chief Financial Officer of BGC Partners since May 1, 2007 • CFO of Thomas Weisel Partners for 6 years Paul Saltzman – Executive MD, Electronic Trading Chief Operating Officer of eSpeed since 2004 • Executive Vice President and General Counsel for The Bond Market Association for 9 years |

4 Strategic Rationale for Transaction Shared vision for the future of voice, hybrid and electronic trading BGC’s enormous growth has been the significant revenue pipeline for eSpeed eSpeed’s technology is the fuel for BGC’s growth in hybrid and electronic trading Strengthens competitive market position for both firms Revenue growth will happen sooner and easier • Both companies will have shared objectives • Better coordination to introduce electronic trading to BGC’s global platform • Better cross sales and marketing |

5 Strategic Rationale for Major Stakeholders in eSpeed Customers benefit: Streamlines product development, sales, advances in technology, and superior service and execution Employees benefit: motivate and retain best people • Employees-owners will have a significant equity stake in the combined company eSpeed investors benefit: maximizes shareholder value • Significantly accretive • Shareholders own shares in larger and faster-growing company • Significant expected earnings and cash flow • Termination of Joint Services Agreement • Greater opportunities, advantages, and synergies |

6 Additional Benefits for eSpeed shareholders Strong underlying IDB industry fundamentals Leading inter-dealer broker in key products and geographies • Combined entity expected to have over $1.1B revenue in 2008 • Stronger balance sheet and resources Full scale global voice, hybrid, and electronic brokerage platform Accelerating momentum in new high growth product areas BGC’s track record of successful acquisitions and integration Ability to attract and retain key talent Experienced management team |

7 Transaction Summary Name: BGC Partners, Inc • NASDAQ: BGCP Structure of transaction Fully Diluted ESPD shares outstanding = 51.56 MM To acquire BGC eSpeed will issue in merger • An aggregate of 133.86 MM shares of common stock and rights to acquire shares of its common stock Based on the closing price of eSpeed's Class A common stock on May 29, 2007, BGC is valued at approximately $1.23 B In the transaction, eSpeed’s shares are being valued at $9.75 per share, a 6.09% premium to the closing price of eSpeed’s Class A common stock on May 29, 2007. |

eSpeed, Inc. (NASDAQ: eSpeed), a leader in electronic marketplaces and related trading technology for the global capital markets |

9 eSpeed’s Competitive Advantages eSpeed’s global securities marketplaces are among the world’s largest real- time, all the time, multiple buyer and seller trading venues eSpeed’s proprietary technology and priceless desktop real estate are built, paid for, and protected across multiple markets Massive infrastructure, technology, and continuous innovations extend into multiple markets Proprietary network connected to the world’s largest banks, investments banks, and other parts of the global financial community Concurrent, redundant, robust and global data centers, software, infrastructure, and hardware |

10 eSpeed’s Existing and Potential Revenue 1Q07 fully-electronic notional volume on eSpeed system, excluding new products: up 31.8% year-over-year • Overall fully electronic volume up 39.5% over same timeframe; total eSpeed volume up 29.4% Many asset classes traded on the eSpeed system have fully electronic volume • Primarily U.S. Treasuries • Also FX Options, Spot FX, European and Canadian Sovereigns, European CDS, Repos • Emerging Markets, IRDs, U.S. CDS expected to have fully electronic volume soon • Pipeline of revenue from existing BGC liquidity pools eSpeed is well positioned to benefit from growth of computer-based and algorithmic trading eSpeed’s evolving technology enables entry into new markets |

BGC Partners, Inc. (“BGC”), one of the largest and fastest growing inter-dealer brokers of financial instruments for wholesale market participants worldwide |

12 BGC : Global Leader in Voice And Electronic 1,180 brokers across 125 brokerage desks Leverage from strong broker relationships Proprietary network Product categories: Credit, Rates, FX, Equities, and Commodity Markets Top global banks and investment banks are key customers Voice/Hybrid Brokerage Real time data market data derived from BGC & eSpeed Broad array of distribution channels, including Bloomberg, CQG, Reuters and Thomson ILX Customized and advanced analytics tools for key customers Market Data $249 mm revenue Q1 2007 1,667 employees |

13 Building a Leading Inter-Dealer Broker BGC has experienced rapid growth since announcing separation from Cantor in October 2004 Expansion of global operations has provided scale, product depth and geographic footprint Since October 2004, BGC has grown from 483 brokers to 1,180 brokers as of March 31, 2007 • Expanded from 58 desks in October 2004 to 125 desks in March 2007 • Asian operations grew from 51 brokers as of January 2005 to 242 brokers as of March 31, 2007 • U.S. grew from 34 employees at the beginning of 2004 to 365 by March 31, 2007 |

14 Significantly Higher Growth Than Overall Industry Sources: BGC and eSpeed; overall industry data created by adding the combined full-year revenues as reported in the public filings made by the four other large, publicly traded pure-play Inter-Dealer Brokers: ICAP PLC, Compagnie Financière Tradition, Tullett Prebon, and GFI Group Inc using historically appropriate exchange rates. -10% 0% 10% 20% 30% 40% 50% 60% 2003 - 2006 2004 - 2006 2005 - 2006 |

15 Leading Hybrid Service and Execution Established voice relationships combined with innovative technologies Hybrid model provides a choice of voice managed and/or electronic trade execution Proprietary pre- and post-trade applications support price discovery and provide related price data BGC deploys a universal trading platform that handles multiple markets while facilitating user interaction through product specific front ends Established electronic connections to mainstream clearing houses and third party processing hubs |

eSpeed + BGC = a global leader in voice, hybrid, and fully electronic brokerage with cutting-edge technology, market data, and analytics solutions for the capital markets. + |

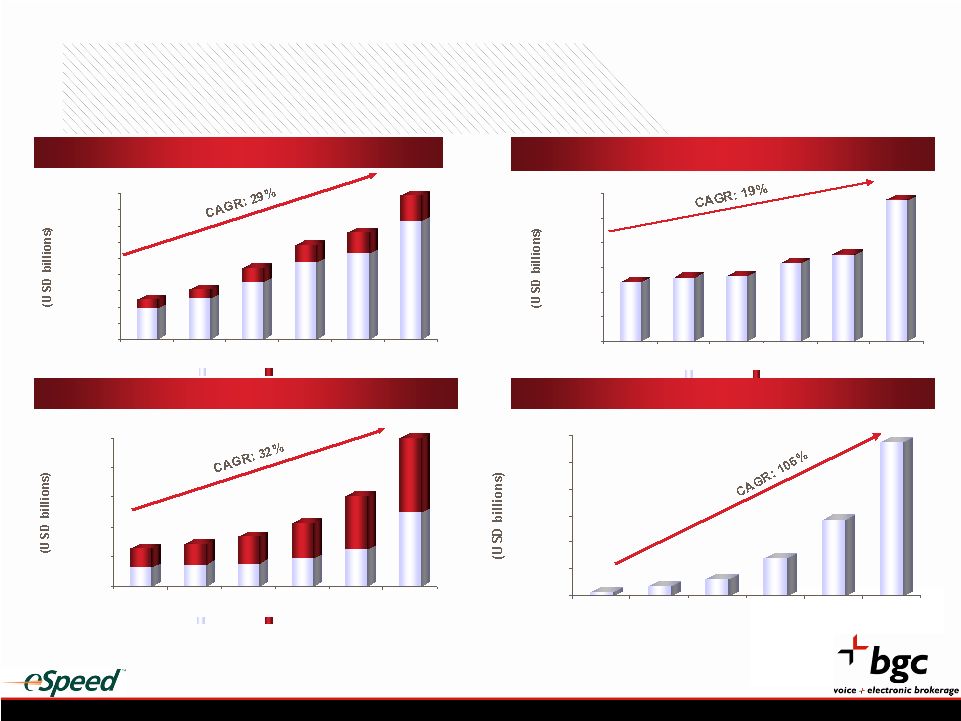

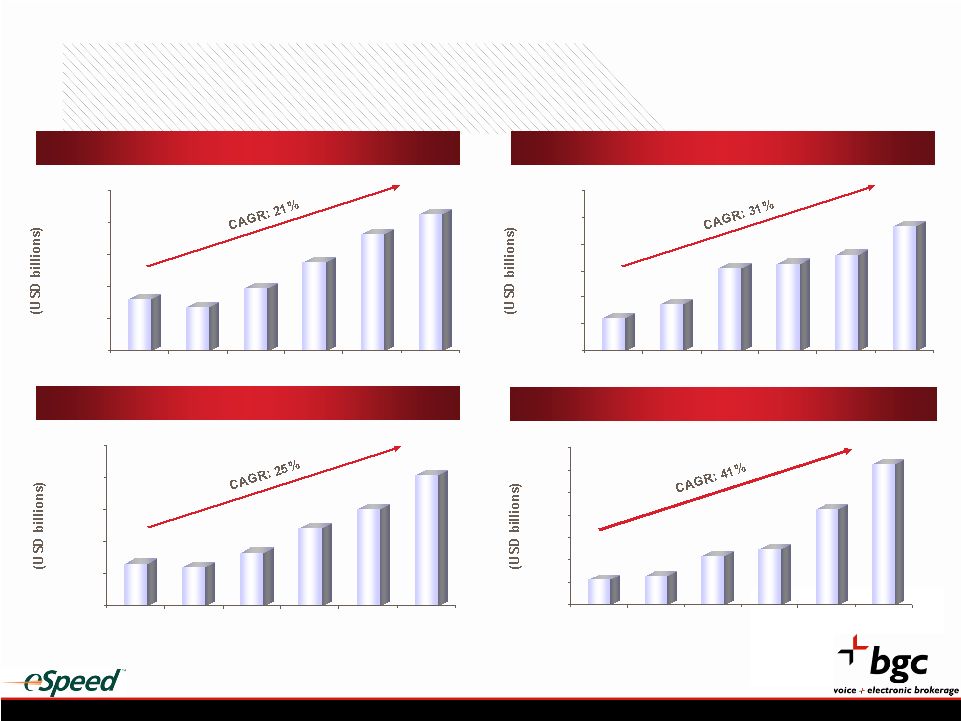

17 Strong Overall Industry Growth Trends Interest Rate Derivatives $0 $40,000 $80,000 $120,000 $160,000 $200,000 $240,000 $280,000 $320,000 $360,000 Dec 01 Dec 02 Dec 03 Dec 04 Dec 05 Dec 06 OTC Exchange Foreign Exchange Options Equity Linked Derivatives OTC Credit Derivative $0 $7,000 $14,000 $21,000 $28,000 $35,000 $42,000 Dec 01 Dec 02 Dec 03 Dec 04 Dec 05 Dec 06 OTC Exchange $0 $3,000 $6,000 $9,000 $12,000 $15,000 Dec 01 Dec 02 Dec 03 Dec 04 Dec 05 Dec 06 OTC Exchange Note: Figures are notional principal amounts of outstanding contracts. Source: ISDA for Credit Derivatives, Bank for International Settlements for all else $0 $6,000 $12,000 $18,000 $24,000 $30,000 $36,000 Dec 01 Dec 02 Dec 03 Dec 04 Dec 05 Dec 06 |

18 Full Range of Asset Classes and Services Trade Voice Screen / voice assisted Fully electronic Pre-Trade Price discovery Price streaming Pre-trade analytics Post Trade / Back Office Confirmation Clearing Settlement Equity derivatives Index futures Commodities and energy derivatives Equities, Commodities, & Other Asset Classes Credit derivatives Asset-backed Convertibles Corporate High yield Credit Foreign Exchange Options G10 Emerging Market Cross Exotic options FX Government debt Interest rate swaps Interest rate options Rates |

19 Ability to Attract and Retain Key Talent Partnership is a key tool in attracting and retaining key producers Significant number of key employees have sizable and restricted equity stakes Fundamental alignment of employees’ interests with shareholders Structure combines best aspect of private partnership with public ownership |

20 Executive Management of Combined Company 125+ Years of Experience Howard W. Lutnick Co-CEO, Chairman (24 years) Lee M. Amaitis Co-CEO (30 years ) Stephen Merkel EVP, General Counsel, Secretary (22 years) Shaun Lynn President (27 years) Bob West Chief Financial Officer (25 years) |

21 Business Management - Another 290 + Years Danny LaVecchia Executive Managing Director for BGC North America Keith Reihl Chief Operating Officer for BGC North America Sal Trani Executive Managing Director for BGC North America Mark Webster Co-Executive Managing Director for BGC Asia- Pacific Mark Spring Co-Executive Managing Director for BGC Asia- Pacific Robin Clark Executive Managing Director for BGC Derivatives and Rates in the UK Nick Ruddell Senior Managing Director For BGC in the UK Jean Pierre Aubin Executive Managing Director for BGC Continental Europe and Listed Products U.K. Continental Europe Asia-Pacific (Industry experience: 22 years) (Industry experience: 22 years) (Industry experience: 24 years) (Industry experience: 17 years) Paul Saltzman Executive Managing Director of Electronic Trading (Industry Experience: 22 years) (Industry experience: 33 years) (Industry experience: 42 years) (Industry experience: 26 years) (Industry experience: 21 years) North America Sean Windeatt Executive Managing Director & Vice President (Industry experience: 10 years) Philip Norton Executive Managing Director for BGC e-Commerce Bernard Weinstein Executive Managing Director for BGC Market Data Yvette Tienery Chief Information Officer for BGC Global (Industry experience: 21 years) (Industry experience: 27 years) (Industry experience: 16 years) |

22 Track Record of Successful Expansion 325 brokers Principal offices in New York, London and Tokyo Reestablished strong U.S. operations Leadership in fixed income, money market and derivative products BGC acquires Maxcor/EuroBrokers (May 2005) BGC acquires ETC Pollak (September 2005) BGC’s Asia - Pacific Expansion Since 2005 BGC acquires Aurel Leven (November 2006) 72 brokers Based in Paris Establish presence in an attractive brokerage market Expertise in wide range of OTC and exchange traded products From 51 brokers in 1/2005 to 242 brokers as of 3/2007 Build out of operations in Hong Kong, Singapore, Seoul, Istanbul, and Tokyo Asia is emerging as a key growth region Substantially strengthened BGC platform 60 brokers Based in Paris Enhances presence in a key market Expertise in equity derivatives Description Strategic Rationale |

eSpeed + BGC = Strong revenue growth, sound finances, scalable businesses + |

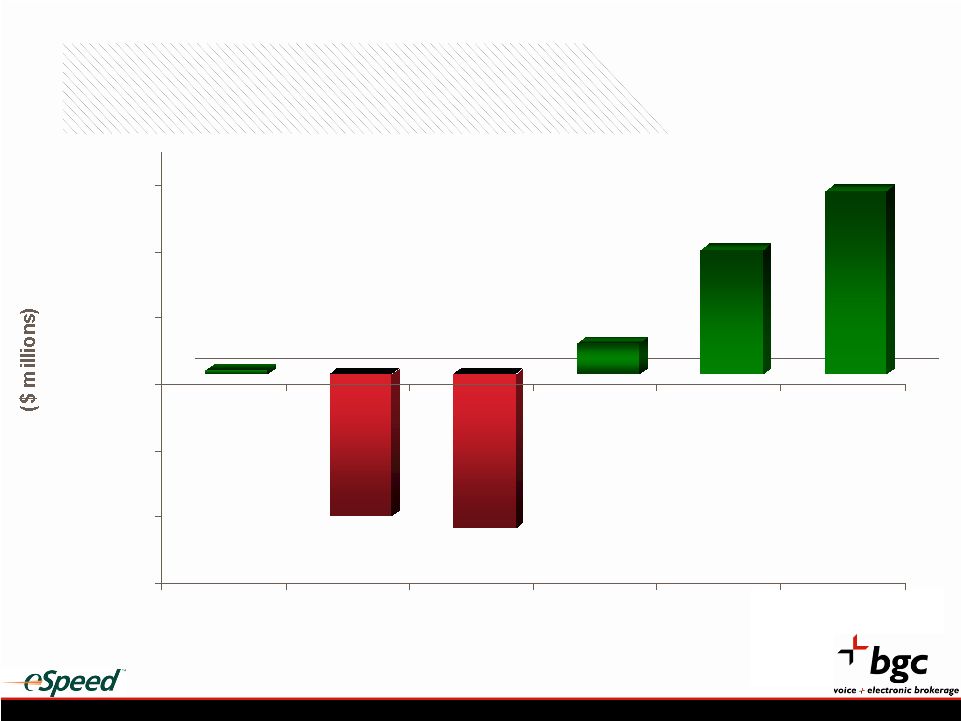

24 Solid Financial Results for BGC Stand-alone BGC had pre-tax profit in 1Q2007 of $24MM (a) BGC has strong momentum into 2Q2007, with projected full year pre-tax profit in excess of $93MM (a) Improvements in operating metrics Significant margin expansion expected (a) After the effects of the full formation and final separation from Cantor and excluding cost associated with the formation, separation and merger transactions |

25 BGC Stand-alone Pre-tax Profit Trend ($150) ($100) ($50) $0 $50 $100 $150 2004 2005 2006 1Q07 (a) 2007 (a) 2008 (a) (a) After the effects of the full formation and final separation from Cantor and excluding cost associated with the formation, separation and merger transactions |

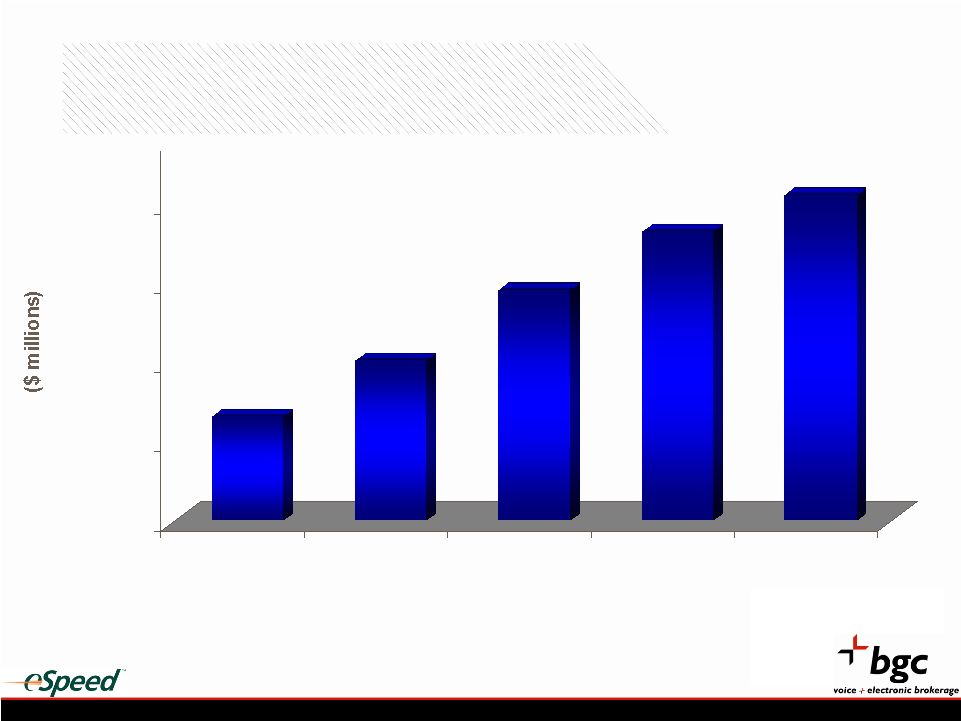

26 BGC Stand-alone Revenue Trend $0 $250 $500 $750 $1,000 2004 2005 2006 2007(a) 2008 (a) (a) After the effects of the full formation and final separation from Cantor and excluding cost associated with the formation, separation and merger transactions |

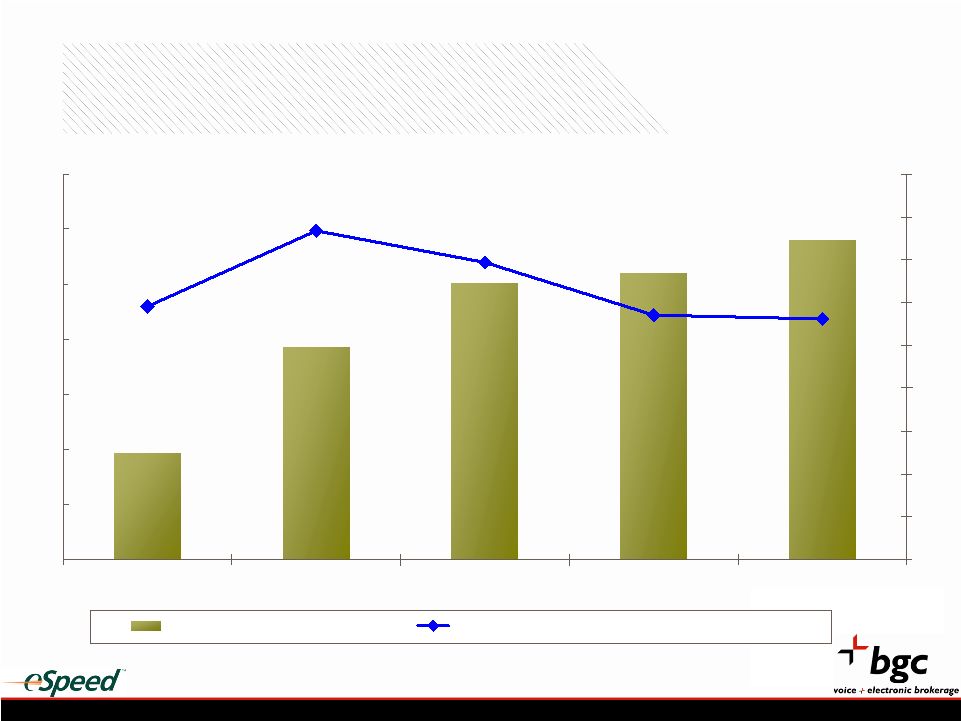

27 BGC Stand-alone Compensation Ratio 56% 57% 77% 59% 69% $0 $100 $200 $300 $400 $500 $600 $700 2004 2005 2006 2007 (a) 2008 (a) 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Total Compensation ($MM) Total Compensation Expense as a % of Total Revenues (a) After the effects of the full formation and final separation from Cantor and excluding cost associated with the formation, separation and merger transactions |

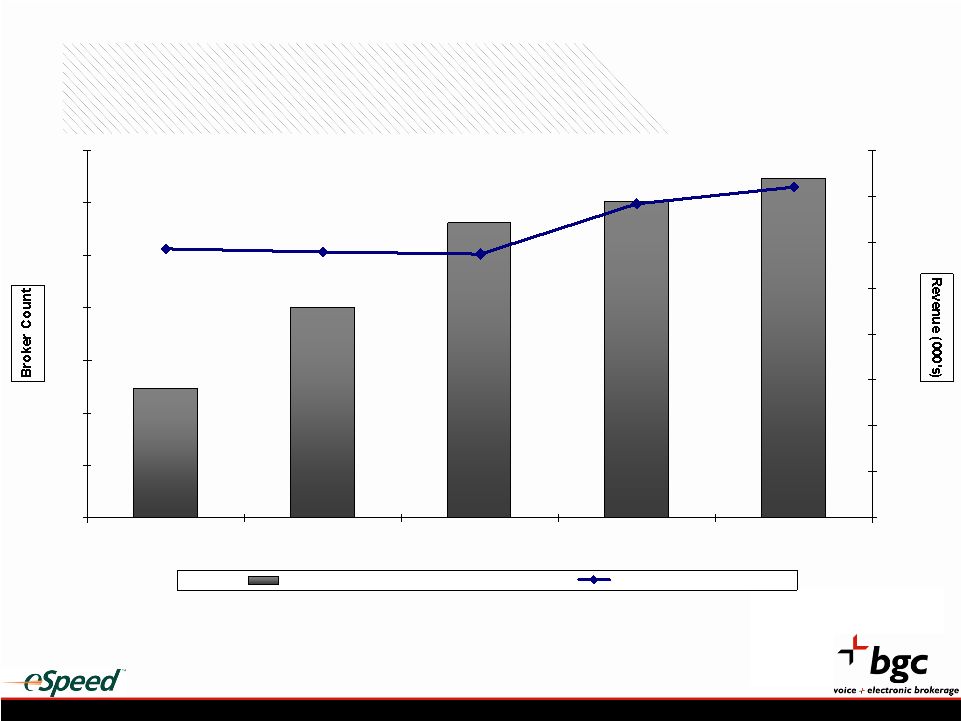

28 BGC Stand-alone Improving Broker Productivity 720 683 575 579 587 0 200 400 600 800 1000 1200 1400 2004 2005 2006 2007 (a) 2008 (a) $0 $100 $200 $300 $400 $500 $600 $700 $800 Average number of brokers Revenue per broker (a) After the effects of the full formation and final separation from Cantor and excluding cost associated with the formation, separation and merger transactions |

29 Strong Growth Outlook Projected Income Statement for 2008 on a Combined Basis (in millions) Target Margin 2008 2008 Revenues Fully electronic $95 + Voice brokerage 925 + Market data and software 40 + Corporate, interest income and other 40 + Total Revenues 1,100 + Expenses Compensation expenses 615 +/- 56% Non-compensation expenses 340 Total Expenses 955 +/- Pre-tax operating income 145 + 13% Income tax * 37 After-tax operating income $108 + 10% * Effective tax rate is projected to be 18% and 26% for 2007 and 2008, respectively. The effective tax rates include the effect of the NOL's. |

eSpeed + BGC – Conclusion + |

31 Strategic Rationale for Transaction Shared vision for the future of voice, hybrid and electronic trading Strengthens market position for both firms eSpeed investors gain: maximizes long term shareholder value Customers gain: streamlines product development, advances in technology, and superior service and execution Employees gain: motivate and retain best people |

Q&A |

Appendix: Additional Information for Analysts and Investors |

34 Strong Combined Company Balance Sheet Pro Forma Balance Sheet at Transaction Close (in millions) Combined Company Cash and cash equivalents $250 Debt $150 Stockholders equity* $400 * ignores the effect of minority interest holders and assumes full consolidation of underlying limited partnerships. |

35 Combined Company Ownership Public Investors 16% BGC Founding Partners (a) 19% Cantor Fitzgerald, L.P. (b) 65% Total 100% Cantor Fitzgerald, L.P. Expected Distribution (over next 2-3 years) BGC Founding Partners (c) -3% Distribution to Cantor Partners (c) -17% Cantor Fitzgerald, L.P. (b) 45% (a) Partnership interests (b) Exchangeable partnership interests (c) Common stock Note: Excludes Stock Options |

36 Structure Intent: Employee Retention and Lower Effective Tax Rate Public shareholders Cantor Fitzgerald, L.P. • Class A common stock • Class A & B common stock BGC Partners, Inc. • Limited Partnership Interests • General Partner Interests (controlling interest) • Special Voting Limited Partnership Interest • Limited Partnership Interests BGC Holdings, L.P. Founding Partners U.S Opco Global Opco • General Partner Interest (controlling interest) • Special Voting Limited Partnership Interest • Limited Partnership Interests * • General Partner Interest (controlling interest) • Special Voting Limited Partnership Interest • Limited Partnership Interests * • Limited Partnership Interests • Exchangeable Limited Partnership Interests • Exchangeable Limited Partnership Interests *Note: These units are held by a corporation wholly owned by BGC Partners, Inc. |

37 Multiple Product Offerings 12% 29% 6% 4% 5% 44% Credit Rates FX Other Asset Classes Market Data/Software Corporate 1Q 2007 ESPD Revenue 2% 3% 8% 51% 14% 22% Credit Rates FX Other Asset Classes Market Data/Software Corporate 1Q 2007 BGC Revenue 3 12% 4% 19% 12% 50% Credit Rates FX Other Asset Classes Market Data/Software Corporate 1Q 2007 Combined Revenue |

38 Strong Industry Growth Trends – Geographies Europe $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Dec 01 Dec 02 Dec 03 Dec 04 Dec 05 Dec 06 Other (a) $0 $100 $200 $300 $400 $500 $600 $700 Dec 01 Dec 02 Dec 03 Dec 04 Dec 05 Jun 06 Note: Outstanding notional principal amounts of futures/options traded on exchanges. (a) All markets except North America, Europe and Asia/ Pacific. Source: Bank of International Settlements. Asia and Pacific $0 $1,000 $2,000 $3,000 $4,000 $5,000 Dec 01 Dec 02 Dec 03 Dec 04 Dec 05 Dec 06 North America $0 $10,000 $20,000 $30,000 $40,000 $50,000 Dec 01 Dec 02 Dec 03 Dec 04 Dec 05 Dec 06 |

39 A Leading Provider of Market Data and Analytics BGC Market Data develops and markets real-time, indicative and historical Fixed Income, Foreign Exchange and Derivative market data services based on price data from eSpeed and BGC. The G3 product provides a real-time, 3D graphical view of the US Treasury cash and futures market Distribution channels include Bloomberg, CQG, DTN, eSignal, eSpeed, Quick Financial, Reuters, and Thomson ILX in addition to direct distribution Packaged data solutions to meet specific clients’ needs Interest Rate Swaps Options U.S. Treasuries European Government Bond FX Interest Rate Current Products Interest Options CDS FX Spot Derivatives Emerging Markets Bonds Emerging Markets Derivatives Potential New Products |

40 Los Angeles Chicago Toronto New York Mexico City London Paris Copenhagen Milan Nyon Turkey Hong Kong Singapore Tokyo Sydney Beijing Melbourne South Korea Global Presence and Revenue Contribution 66% 3% 31% 1Q 2007 ESPD Revenue 54% 16% 30% 1Q 2007 BGC Revenue 36% 14% 50% 1Q 2007 Combined Revenue US EUROPE ROW |

41 Recognized Market Leader in Multiple Products Market recognized leadership in several products: • 16 1st places in IR category (Risk ‘05) • Top 2 spots in currency categories • Joint first in euro/yen cross currency swaps • First in US dollar/yen vanilla options Recent Asia Risk survey showed: • BGC came 1st in 45 products within the interest rate swaps, currency derivatives, equity derivatives and credit derivatives categories • BGC came in 2nd within 12 products and • 3rd within 14 products #1 broker in Asian credit derivatives • 30 1 st place positions |