Strictly private and confidential | |

| | |

Valuation Report to Ultrapar Participações

Ultrapar Participações S.A., Refinaria Petroleo Ipiranga S.A., Distribuidora de Produtos de Petroleo Ipiranga S.A., Companhia Brasileira de Petroleo Ipiranga

April 4, 2007

| n | These materials may only be used by Ultrapar Participações S.A. (“Ultrapar”) for the purposes defined in the engagement letter signed with Deutsche Bank Securities Inc. (“Deutsche Bank”). Neither Deutsche Bank nor any of its affiliates or any of its or their officers, directors, employees, affiliates, advisors, agents or representatives (collectively, “Deutsche Bank Representatives”) makes any express or implied representation or warranty as to the accuracy or completeness of any of the materials set forth herein or provides advice relating to tax, accounting, legal, antitrust, or other regulatory matters. Nothing contained in the accompanying materials is, or shall be relied upon as, a promise or representation as to the past or the future |

| n | In connection with Deutsche Bank’s role of “conducting a valuation analysis / preparing a valuation report” for Ultrapar, and in preparing its report as to the respective valuations of Companhia Brasileira de Petróleo Ipiranga (“CBPI”), Distribuidora de Produtos de Petróleo Ipiranga S.A. (“DPPI”) and Refinaria de Petróleo Ipiranga S.A. (“RIPI”) (collectively, “Ipiranga”, or the “Ipiranga Group”) and Ultrapar, Deutsche Bank has reviewed certain publicly available financial and other information concerning Ultrapar and the Ipiranga Group and certain internal analyses and other information furnished to it by Ultrapar and the Ipiranga Group. Deutsche Bank has also held discussions with members of the senior managements of Ultrapar and the Ipiranga Group, and with respect to certain assets, the senior management of Braskem, regarding the businesses and prospects of their respective companies and the operations of the combined company following the transactions described herein. In addition, Deutsche Bank has (i) reviewed the reported prices and trading activity for Ultrapar’s and the Ipiranga Group’s stock, (ii) compared certain financial and stock market information for Ultrapar and the Ipiranga Group with similar information for certain other companies whose securities are publicly traded, (iii) reviewed the financial terms of certain recent business combinations which it deemed comparable in whole or in part, (iv) reviewed the terms of the agreements governing the transaction, and (v) performed such other studies and analyses and considered such other factors as it deemed appropriate |

Disclaimer (continued)

| Deutsche Bank has not assumed responsibility for independent verification of, and has not independently verified, any information, whether publicly available or furnished to it, concerning Ultrapar or the Ipiranga Group, including, without limitation, any financial information, forecasts or projections considered in connection with the preparation of its report as to the respective valuations of Ultrapar and the Ipiranga Group. Accordingly, for purposes of its report, Deutsche Bank has assumed and relied upon the accuracy and completeness of all such information and Deutsche Bank has not conducted a physical inspection of any of the properties or assets, and has not prepared or obtained any independent evaluation or appraisal of any of the assets or liabilities, of Ultrapar or the Ipiranga Group. However, Deutsche Bank considers consistent the information used in this Report |

| It should be understood that any valuations, financial and other forecasts and/or estimates or projections and other assumptions contained in the accompanying materials (including, without limitation, regarding financial and operating performance), were prepared or derived from information (whether oral or in writing) supplied solely by the respective managements of Ultrapar, the Ipiranga Group and Braskem or derived from other public sources, without any independent verification by Deutsche Bank, and involve numerous and significant subjective determinations and assumptions by Ultrapar and the Ipiranga Group, which may not be correct. As a result, it is expected that there will be a difference between actual and estimated or projected results, and actual results may vary materially from those shown herein. In addition, with respect to any such information made available to Deutsche Bank and used in its analyses, Deutsche Bank has assumed that they have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the respective managements of Ultrapar and the Ipiranga Group as to the matters covered thereby. The Report observes the requirements imposed by Brazilian Securities Regulation, in particular Rule #361/02 of the Brazilian Securities Commission ("CVM") |

| Accordingly, in preparing its report as to the respective valuations of Ultrapar and the Ipiranga Group, neither Deutsche Bank nor any of the Deutsche Bank Representatives make any express or implied representation or warranty, or express any view, as to the accuracy, reasonableness, completeness or achievability of any such financial and other forecasts and/or estimates or projections, or as to the determinations or assumptions on which they are based. Deutsche Bank’s report is necessarily based upon economic, market and other conditions as in effect on, and the information made available to it as of, the date hereof |

Disclaimer (continued)

| Deutsche Bank has also assumed that all material governmental, regulatory or other approvals and consents required in connection with the consummation of the transaction will be obtained and that in connection with obtaining any necessary governmental, regulatory or other approvals and consents, or any amendments, modifications or waivers to any agreements, instruments or orders to which either Ultrapar or the Ipiranga Group is a party or is subject or by which it is bound, no limitations, restrictions or conditions will be imposed or amendments, modifications or waivers made that would have a material adverse effect on Ultrapar or the Ipiranga Group or materially reduce the contemplated benefits of the transaction to Ultrapar |

| This Report was based on the information available until today, and the views expressed are subject to change based upon a number of factors, including market conditions and Ultrapar’s and the Ipiranga Group’s business and prospects. Deutsche Bank does not undertake any obligation to update or otherwise revise these materials after the date hereof |

| This Report and its conclusions are not recommendations by Deutsche Bank as to whether Ipiranga shareholders should tender their shares in the mandatory tender offer, or to Ultrapar or Ipiranga shareholders as to the fairness to such shareholders, from a financial point of view, of the exchange ratio in the incorporation of RIPI, CBPI, DPPI shares in Ultrapar. Each shareholder must reach its own conclusions about the advisability of accepting the offer presented by Ultrapar and the incorporation of the shares of CBPI, DBPI and RIPI by Ultrapar |

| This valuation report incorporates the changes requested by the Brazilian Securities Exchange Commission (Comissão de Valores Mobiliários – CVM) detailed in the following documents: (i) OFICIO/CVM/SRE/GER-1/Nº 1017/2007, (ii) OFICIO/CVM/SRE/GER-1/Nº 1018/2007, (iii) OFICIO/CVM/SRE/GER-1/Nº 1019/2007, (iv) OFICIO/CVM/SRE/GER-1/Nº 1427/2007, (v) OFICIO/CVM/SRE/GER-1/Nº 1428/2007, (vi) OFICIO/CVM/SRE/GER-1/Nº 1429/2007 and (vii) OFICIO/CVM/SRE/GER-1/Nº 1703/2007. This revised book does not present a different assessment of value than the one presented by Deutsche Bank on the Valuation Report dated July 4th, 2007 |

Section | | |

| 1 | Executive summary | 1 |

| 2 | Valuation summary | 9 |

| | A | Ultrapar | 10 |

| | B | RIPI | 13 |

| | C | DPPI | 16 |

| | D | CBPI | 19 |

| 3 | Economic value of assets | 22 |

| | A | Ultrapar | 26 |

| | B | Ultrapar prior to the share merger | 37 |

| | C | Fuel distribution – CBPI | 39 |

| | D | | 45 |

| | E | Copesul | 50 |

| | F | IPQ | 55 |

| | G | Valuation of other assets based on multiples | 60 |

| 4 | Final considerations | 62 |

| 5 | Glossary | 64 |

| | | |

| | | |

Appendix | | |

| I | Share price evolution | 68 |

| II | Comparable multiples | 74 |

| III | Overview of the industries in which the assessed companies operate | 78 |

| IV | Calculation backup | 82 |

| V | Other relevant information | 91 |

Section 1

Executive summary

| 1 |

| This appraisal report (“Report” or “Valuation Report”) was prepared by Deutsche Bank as requested by Ultrapar |

| The Report observes the requirements imposed by Brazilian Securities Regulation, in particular Rule #361/02 of the Brazilian Securities Commission (“CVM”). Ultrapar requested this Report to be used in connection with (i) the mandatory tender offers related to the acquisition by Ultrapar of the control of Ipiranga Group, and (ii) the incorporation of CBPI, DPPI and RIPI shares in Ultrapar |

| The ranges for the respective valuations of Ultrapar, CBPI, DPPI and RIPI are limited to 10% due to a requirement imposed by Rule #361/02 of the CVM |

| 2 |

Scope of Deutsche Bank’s analysis

The objective of this Valuation Report is to present economic valuations of both Ultrapar and Ipiranga Group in accordance with the criteria defined as mandatory by the CVM

Under the CVM Rule #361/02, Deutsche Bank has conducted an analysis using the following methodologies and assumptions:

| | | Economic value based on discounted cash flow (“DCF”) analysis for the main operating companies and comparable multiples for some smaller operating subsidiaries |

| | – | Based on publicly available information and discussions with management of Ultrapar and Ipiranga |

| | | Market value based on average share prices weighted by traded volume |

| | | Average share price weighted by traded volume during the last twelve months ended March 16, 2007 (last trading day pre-announcement) |

| | | Based on Ultrapar and Ipiranga’s audited financial statements as of December 31,2006 |

Among the different valuation methodologies presented in this Valuation Report, Deutsche Bank believes that economic value based on DCF and comparable multiples is the most applicable methodology for valuing Ultrapar and Ipiranga

Economic value - methodologies for different business lines | | |

Discounted cash flow | | Codename | | WACC | | Public company comparables | | Codename |

| Companhia Brasileira de Petróleo Ipiranga | | CBPI | | 12.2% | | Ipiranga Química S.A. | | IQ |

| Distribuidora de Prod. de Petróleo Ipiranga | | DPPI | | 12.3% | | Empresa Carioca de Prod. Químicos S.A. | | EMCA |

| Copesul Central Química | | Copesul | | 11.2% | | Ipiranga Asfaltos | | IASA |

| Ipiranga Petroquímica S.A. | | IPQ | | 11.8% | | AM/PM Comestíveis | | AM/PM |

| Ultrapar Participações | | Ultrapar | | 10.6% | | Isa-Sul Administração e Part. Ltda | | Isa-sul |

| | | | | | | Refinaria Petróleo Ipiranga S.A. | | Refinery |

| 3 |

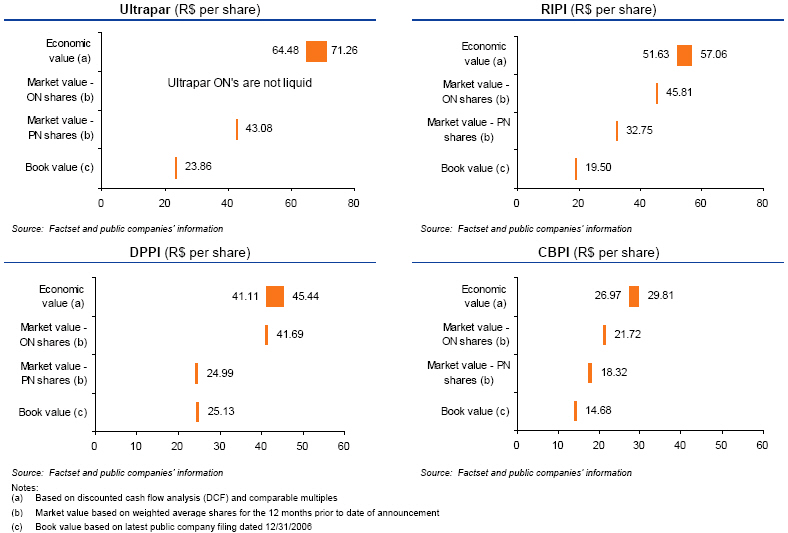

Valuation range - price per share |

(a) Based on discounted cash flow analysis (DCF) and comparable multiples

(b) Market value based on weighted average shares for the 12 months prior to

date of announcement (c) Book value based on latest public company filing dated

12/31/2006

|

| 4 |

Conducting the economic valuation

The three main economic valuation methodologies used were: Discounted Cash Flow (“DCF”), comparable public companies’ multiples and comparable precedent transaction multiples

| | | Discounted Cash Flow - DCF Analysis | | Comparable Public Company Analysis | | Comparable Precedent Transaction Analysis |

Methodology | | Un-levered projections of cash flow to the firm Terminal value calculation based on perpetuity growth (Gordon’s growth model) or exit multiple Cash flow and terminal value discounted by a discount rate that corresponds to the Company’s Weighted Average Cost of Capital (“WACC”)

| | Identification of listed companies that are comparable to the business being assessed Calculation of value (TEV or equity) as a multiple of value drivers (sales, Ebitda, earnings, etc.) Multiples of value are applied to the corresponding value driver of the Company being assessed

| | Identification of transactions involving companies with comparable activities Calculation of the implied multiples of value in those transactions Multiples of value are applied to the corresponding value driver of the Company being assessed

|

Potential advantages | | Estimates the intrinsic value of the Company Valuation takes into consideration the risk-return profile of the investment, and can be adjusted for the country risk Takes into consideration the company’s capital structure More flexibility to incorporate expected changes in the business profile such as change in product mix, capacity expansion, etc.

| | In efficient markets, it properly reflects the market consensus of value of a given industry Reflects historical performance and industry trends

| | |

Potential disadvantages | | | | Difficulty to identify companies that are comparable to the asset being assessed Does not reflect differences among the companies such as capital structure, profitability, management, etc Results can be affected by adverse situations not linked to valuation (macroeconomic, political, etc.)

| | Difficulty to identify companies/ transactions that are comparable Characteristics of the transaction might affect valuation such as competitiveness of the sale process, estimated synergies of the potential buyer, defensive play, etc It does not reflect the differences among the companies’ potential returns Limited public information available

|

Considerations | | Maximum flexibility to incorporate in the valuation several value drivers such as discount rate (driven by capital structure, country risk, cost of equity), perpetuity growth and expected performance (as opposed to historical performance)

| | Limited sample in the local market requires evaluator to expand to different markets (normally with different characteristics) Does not incorporate specific nature of the company being assessed Based on historical performance, it incorporates market trend

| | |

| Notes: (1) TEV - Total Enterprise Value = Equity plus Net debt. | | |

| 5 |

Deutsche Bank credentials |

| Headquartered in Frankfurt am Main, Germany, Deutsche Bank is the largest bank in Germany, and one of the largest financial institutions in Europe and the world, as measured by total assets of € 1,126 billion as of December 31, 2006. As of that date, Deutsche Bank employed 68,849 people on a full-time equivalent basis, operating in 73 countries out of 1,717 facilities worldwide, of which 54 % were in Germany. Deutsche Bank offers a wide variety of investment, financial and related products and services to private individuals, corporate entities and institutional clients around the world (source: Deutsche Bank’s 2006 annual report) |

| Deutsche Bank and its affiliates’ expertise in assessing Brazilian publicly listed companies includes: the advisory to Ashmore Energy International on the acquisition of Prisma Energy International in 2006, and the fairness opinion valuation of Companhia Siderúrgica Belgo Mineira in 2005 |

| In addition to that, Deutsche Bank was responsible for the valuation report of Cia. Metalic Nordeste for Companhia Siderúrgica Nacional (“CSN”) in 2002 |

| Deutsche Bank or its affiliates also advised La Seda de Barcelona S.A. (“LSB”) on the acquisition of Eastman Chemical Iberica S.A. from Eastman Chemical Company in 2007, advised Linde AG on the sale of equipment business of BOC Edwards to CCMP Capital in 2007, advised Gazprom on the sale of a 10.7% stake to Rosneftegaz, advised ConocoPhillips on the divestment of selected European downstream assets (pending), advised Giant Industries on its sale to Western Refining Inc. and provided a fairness opinion valuation (pending), and is advising Valero on strategic alternatives for the Lima, Ohio refinery, among other assignments |

| Other selected transactions that involved valuation of public companies include: the advisory to Fairchild Semiconductor International in its acquisition of System General Corp, and the advisory to Healthcare REIT in its acquisition of Windrose Medical Properties Trust. Deutsche Bank also acted as advisor to International DisplayWorks Inc. when it was acquired by Flextronics International Ltd. and to US LEC Corp when it merged with Paetec Communications, Inc. All these transactions required a fairness opinion valuation |

| Deutsche Bank and its affiliates have a qualified team of professionals based in New York and São Paulo led by Mr. Ian Reid who was responsible for producing this Report |

| In delivering the Report, Deutsche Bank followed its internal policies applicable to the delivery of valuation reports, including forming an internal valuation committee to review and approve the report |

| – | The valuation committee is comprised of at least 3 senior bankers from the M&A department that had met at least twice as it is usual on the 2nd and 4th of April |

| 6 |

Additional considerations |

| The date of this Report is April 4, 2007 |

| This Report may be solely used in the context of the request made by Ultrapar to Deutsche Bank |

| Research reports prepared by different areas of Deutsche Bank may utilize different assumptions with respect to the future performance of Ultrapar and Ipiranga than those used in the Valuation Report, and thus potentially present significantly different conclusions with respect to valuation. Those different areas at Deutsche Bank are independent to the Corporate Finance and Mergers and Acquisitions department that was responsible for the elaboration of this Report. Those different areas have their own sources of information and a different assessment about what they make available to the public in the form of publications, and there is no communication between the professionals involved in the elaboration of this report and the professionals of those different areas. Deutsche Bank has strict internal policies regarding the segregation of public and private areas at the bank and monitoring the information flow between them in order to guarantee that both areas operate independently |

| In compliance with the resolution CVM #361/02, Deutsche Bank states that as of April 4, 2007: |

| | | There is no commercial or credit relationship that could impact this Report |

| | | There is no conflict of interest that compromises the independence necessary to prepare this Report |

| | | Deutsche Bank and its affiliates held 8,527 non-voting shares of Braskem and 171,000 ADRs of Braskem; 62,175 voting shares of Petrobras, and 500,540 ADRs of Petrobras; Deutsche Bank and its affiliates did not hold, directly or indirectly, any shares of CBPI, DBPI and RIPI, nor did they hold shares or ADRs of Ultrapar, Petrobras or Braskem other than the shares/ADRs mentioned above |

| | | Deutsche Bank is engaged in sales and trading transactions with Petrobras and Braskem, which includes, but is not limited to, derivatives |

| | | In May 2006, Deutsche Bank received R$2,673,760.50 net of taxes from Petrobras for the advisory and structuring services rendered in connection with the acquisition of ABB's stake in Termobahia. Deutsche Bank did not receive any other fees from Ultrapar, Braskem or Petrobras in connection with financial advisory, consulting or auditing services, or any other investment banking services over the past 12 months |

| | | Deutsche Bank will receive US$3,000,000 net of taxes as a fee for the delivery of this Report |

| | |

Ian Reid - Managing Director | |

| 7 |

Additional considerations (continued) |

| |

Ian Reid – Managing Director |

| n | Ian Reid, Managing Director for Corporate Finance and Mergers and Acquisitions for Latin America, was responsible for the preparation of this Valuation Report. Projects relevant in which Mr. Reid has been involved include the merger of Brahma and Antarctica to create Ambev, the unwinding of CSN’s controlling interest in CVRD (advisor to CVRD), acquisition of Bolivian refinery by Petrobras (advisor to Petrobras), the sale of Latasa by Bradesco, Alcoa, and JPMorgan to Rexam (advisor to the sellers), the acquisition of Panamco by Coca Cola FEMSA (advisor to Coca Cola FEMSA), the repurchase by FEMSA of Interbrew’s stake in Femsa Cerveza (advisor to FEMSA) |

| |

Jose Securato – Vice President |

| n | Jose Securato, Vice President for Corporate Finance and Mergers and Acquisitions for Latin America, also participated in the preparation of this Valuation Report. His experience includes, among others, advisory to Ashmore Energy International in its acquisition of Prisma Energy International in 2006 (which included valuation of Elektro), the valuation of Cia. Metalic Nordeste for Companhia Siderúrgica Nacional (“CSN”) in 2002, the sale of 40% of Indura in Chile in 2007, the sale of AGF Chile in 2004, the sale of Ática & Scipione in 2004, the acquisition of TCO/NBT in 2003 and Valuation Reports for the following companies or their businesses: Banco Itaú Argentina, Itausaga Corr. Seguros, Itaupromotora de Vendas, Intrag DTVM, BFB, FIBEMGE, BANERJ, CENF, LAJEADO, ROSAL, and MARTINÓPOLIS between 1998 and 1999 |

Also participating in the preparation of this Valuation Report:

| |

Steve Guberer – Associate |

| n | Steve Guberer, Associate for Corporate Finance and Mergers and Acquisitions for Latin America, joined Deutsche Bank one year ago. His experience includes advisory for Fortress Investment Group and Centerbridge Partners in their US$8.9 billion buyout of Penn National Gaming Inc., announced in June 2007. Steve worked at Deloitte & Touche from 2000 until 2004. Steve received his MBA from the University of Chicago and his bachelor’s degree in accounting from Rutgers University |

| n | Hunter Kushner, Analyst for Corporate Finance and Mergers and Acquisitions for Latin America, joined Deutsche Bank in June 2006. Hunter has worked on the IPO of Klabin Segall in addition to other projects. Hunter has worked in the Investment Management Division at JPMorgan and at Moore Capital Management. He received his Bachelor of Arts in Political Science from Yale University |

| n | Guilherme Gama, Analyst for Corporate Finance and Mergers and Acquisitions for Latin America, joined Deutsche Bank in 2005. His experience includes the initial public offering of Klabin Segall, the public offering of 2008 Notes by Sabesp, and the bond issuance of 10-year notes of US$140 million in value as well as the additional perpetual offering by Globo Comunicações. Prior to this, Guilherme was Financial Director and Junior Business Administrator for the Fundação Getulio Vargas, São Paulo, and in the period between 1999 and 2002, he was responsible for operations and technical and logistical assistance for Gran Coffee Com. Loc. Serv., a business in the sector of coffee serving systems |

| n | Other areas of the bank including the team for Mergers and Acquisitions, the group entitled Energy, Utilities, and Chemicals, and the group entitled Oil & Gas also contributed to this report |

| 8 |

Section 2

Valuation summary

| 9 |

Tab A

Ultrapar

| 10 |

| Valuation summary | Section 2 |

| | |

Ultrapar Participações S.A.

Source: Public Ultrapar information

Company description

Ultrapar is a holding company for 3 separate operating companies: Oxiteno, Ultragaz, and Ultracargo

Major subsidiaries

| ■ | | Ultragaz Participações LTDA |

| - | Ultragaz is the leading distributor of liquefied petroleum gas (LPG) in Brazil, and one of the largest distributors in the world by volume |

| | Distributes bottled and bulk LPG to residential, commercial, and industrial clients in Brazil |

| | 2006 revenue of US$1.4 billion, and volume sold of 1.5 million tons |

| | A second-generation producer of commodity & specialty petrochemicals |

| | Oxiteno is the largest producer of ethylene oxide and its main derivatives in Latin America |

| | 2006 revenue of US$707 million, and volume sold of 544,000 tons |

| ■ | | Ultracargo Oper. Logísticas e Participações LTDA |

| | Provides integrated logistics services for special products |

| | 2006 revenue of $103 million |

| | Storage capacity at 2006 year end of 240 thousand cubic meters. |

| | Traveled in 2006 approximately 43 million kilometers |

Source: Public Ultrapar information

| 11 |

| Valuation summary | Section 2 |

| | |

Ultrapar valuation

Prior to the share merger, Ultrapar’s share value ranges from R$64.48 to R$71.26 based on the economic value

Economic value (R$) | |

| | | | | | | | | | |

| Ultrapar TEV (before steps 1 and 2) | | | | | 5,879 | | | | |

| (+) net cash | | | | | | | 19 | | | | | |

| Ultrapar Equity value (before steps 1 and 2) | | | | | | | 5,898 | | | | | |

(+) assets acquired (a) | | | | | | | 497 | | | | | |

(-) price paid(b) | | | | | | | (876 | ) | | | | |

Ultrapar equity value (after steps 1 and 2) | | | | | | | 5,520 | | | | | |

| Total number of shares (million) | | | | | | | 81.3 | | | | | |

Price per share – R$ per share | | | 64.48 | | | | 67.87 | | | | 71.26 | |

| | | | | |

| | | -5% | | | | | | | +5% | |

Note: Figures in R$ million unless otherwise noted.

(a) refer to page 38 of the Valuation Report for more details

(b) Net value to be paid by Ultrapar for steps 1 and 2, net of the value received from

Dynamo for the sale of certain Ipiranga PN’s shares

Source: Ultrapar information and Deutsche Bank

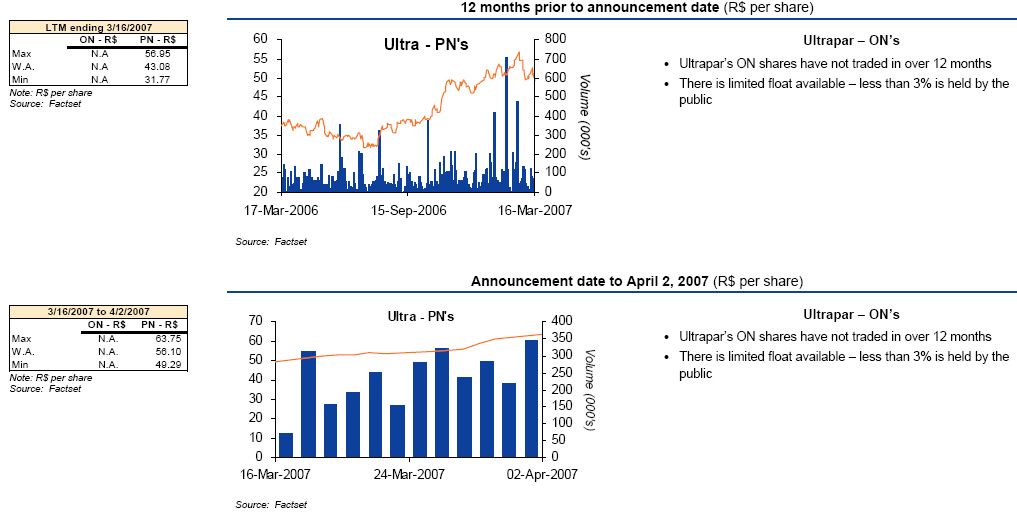

Weighted average share price LTM to announcement(a) | |

| | | ON | | | PN | |

| Total volume (000’s) | | | NA | | | | 17,108 | |

| W.A. share price (R$ per share) | | | NA | | | | 43.08 | |

(a) From 03/15/2006 to 03/16/2007

Note: Ultrapar’s ON shares have not traded for over 12 months.

Book value – Ultrapar | |

| | | 12/31/2006 | |

| Shareholder equity – (R$ million) | | | 1,940.7 | |

| Total number of shares (million) | | | 81.3 | |

| Book value per share (R$ per share) | | | 23.86 | |

Note: Book value based on operating company financials as of 12/31/2006

Source: Company’s filings

Weighted average share priceannouncement to April 2, 2007(a) | |

| | | ON | | | PN | |

| Total volume (000’s) | | | NA | | | | 2,822 | |

| W.A. share price (R$ per share) | | | NA | | | | 56.10 | |

(a) From 03/16/2007 to 04/02/2007

Source: FactSet

| 12 |

| Valuation summary | Section 2 |

| | |

Tab B

RIPI

| 13 |

| Valuation summary | Section 2 |

| | |

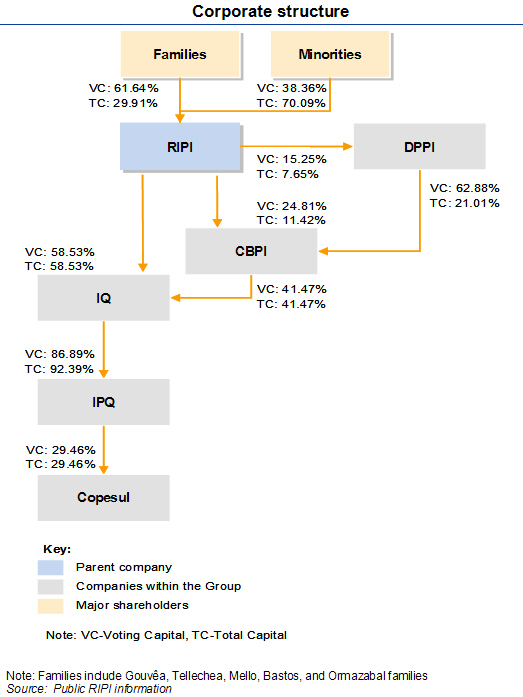

Refinaria Petroleo Ipiranga SA – RIPI

Company description

| ■ | RIPI is a holding company for certain Ipiranga investments and operates a refinery |

Major subsidiaries

| ■ | Companhia Brasileira de Petroleo Ipiranga (CBPI) |

| | A fuels distributor in Brazil, except in Rio Grande do Sul, Roraima and Amapá |

| | 2006 revenue of US$9.8 billion and volume sold of 12.2 billion cubic meters |

| ■ | Distrib. de Produtos de Petroleo Ipiranga (DPPI) |

| | A fuels distributor in Southern Brazil |

| | 2006 revenue of $1.6 billion and volume sold of 1.8 billion cubic meters |

| | A wholesale distributor of chemical products with over 5,000 clients in 50 different markets |

| | 2006 revenue of US$212.3 million and EBITDA of US$9.5 million |

| | Through its ownership in IQ, RIPI indirectly controls Copesul (with Braskem) and IPQ |

| ■ | Ipiranga Petroquímica (IPQ) |

| | A 2nd generation producer of high-end petrochemicals |

| | 2006 revenue of US$924.3 million and volume sold of 636,100 tons |

| | A naphtha-based cracker owned by Ipiranga & Braskem |

| | 2006 revenue of US$2.9 billion and volume of 2.962 million tons |

Note: Volume sold refers to total volume; Revenue figures not consolidated

Source: Public RIPI information

Note: Families include Gouvea, Tellechea, Mello, bastos, and Ormazabal families

Source: Public Ipiranga information

|

| 14 |

| Valuation summary | Section 2 |

| | |

RIPI valuation

RIPI’s share value ranges from R$51.63 to R$57.06 based on the economic value

Economic value | |

| | | 100% | | | Proportionate | | | | |

(R$ million) | | TEV | | | TEV | | | | |

| IQ SA | | | 3,051 | | | | 58.53 | % | | | 1,786 | | | | | |

| | | 4,029 | | | | 11.42 | % | | | 460 | | | | | |

| | | 1,552 | | | | 7.65 | % | | | 119 | | | | | |

RIPI Opco1 | | | 9 | | | | 100.0 | % | | | 9 | | | | | |

RIPI – Total Enterprise Value | | | | | | | | | | | 2,373 | | | | | |

| (-) net debt | | | | | | | | | | | (765 | ) | | | | |

| RIPI – Equity value | | | | | | | | | | | 1,609 | | | | | |

| Total number of shares (million) | | | | | | | | | | | 29.6 | | | | | |

Price per share – R$ per share | | | | | | | 51.63 | | | | 54.35 | | | | 57.06 | |

| | | | | | | | | |

| | | | | | | | -5 | % | | | | | | | +5 | % |

Note: Figures in R$ million unless otherwise noted. (1) Based on multiples detailed on pages 61 and 83 Source: RIPI information and Deutsche Bank | |

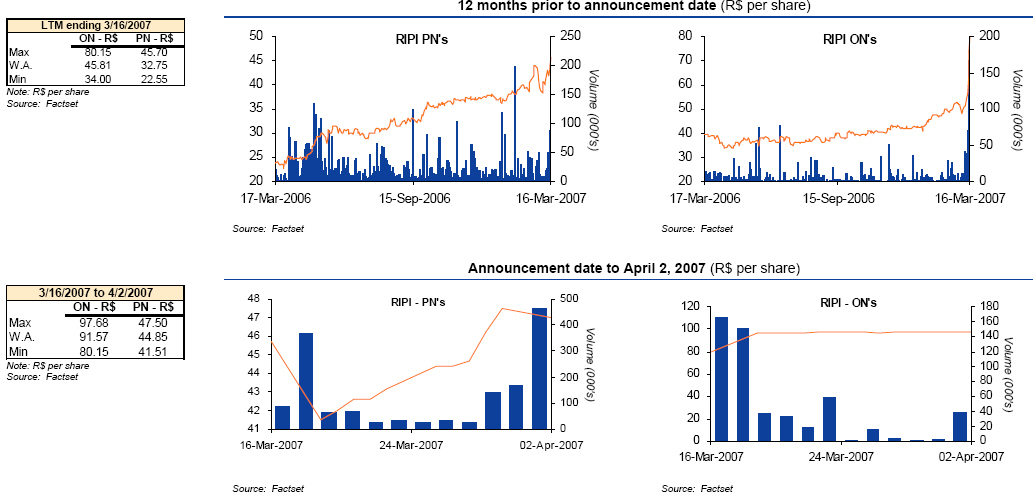

Weighted average share price LTM to announcement(a) | |

| | | ON | | | PN | |

| Total volume (000’s) | | 1,843 | | | 5,850 | |

| W.A. share price (R$ per share) | | 45.81 | | | 32.75 | |

| (a) From 03/15/2006 to 03/16/2007 | | | | | | | | |

Source: FactSet | | | | | | | | |

Book value – RIPI SA | |

| | | 12/31/2006 | |

| Shareholder equity – (R$ million) | | | 577.3 | |

| Total number of shares (million) | | | 29.6 | |

| Book value per share (R$ per share) | | | 19.50 | |

Note: Book value based on operating company financials as of 12/31/2006

Source: Company’s filings

Weighted average share price announcement to April 2, 2007(a) | |

| | | ON | | | PN | |

| Total volume (000’s) | | 528 | | | 1,495 | |

| W.A. share price (R$ per share) | | 91.57 | | | 44.85 | |

| (a) From 03/16/2007 to 04/02/2007 | | | | | | | | |

Source: FactSet | | | | | | | | |

| 15 |

| Valuation summary | Section 2 |

| | |

Tab C

DPPI

| 16 |

| Valuation summary | Section 2 |

| | |

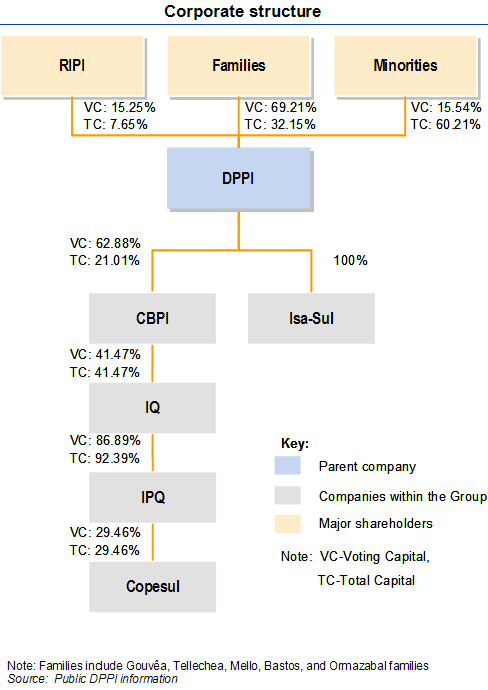

Distribuidora de Produtos de Petroleo Ipiranga SA – DPPI

Company description

| ■ | DPPI is a distributor of fuels in Southern Brazil |

| ■ | The Company delivers fuels to retail gas stations, industrial sites |

| ■ | Approximately 65% of volume is sold to retail gas stations |

| ■ | In 2006, core volume (gasoline, alcohol, and diesel fuels) was 1.8 billion cubic meters. Total volume (including GNV, lubricants, & others) was marginally higher |

| ■ | In 2006, the Company had 2.5% of the Brazilian market by volume sold |

Major subsidiaries

| ■ | | Isa-Sul Administração e Participações (Isa-Sul) |

| | Owns 152 of the gas stations in DPPI’s region |

| | 2006 revenue of US$8.7 million and EBITDA of US$7.5 million |

| ■ | | Companhia Brasileira de Petroleo Ipiranga (CBPI) |

| | A fuels distributor in Brazil, except in Rio Grande do Sul, Roraima and Amapá |

| | 2006 revenue of US$9.8 billion and volume sold of 12.2 billion cubic meters |

| | Through its ownership in CBPI, DPPI indirectly owns a minority stake in IQ, IPQ, and Copesul |

| | A wholesale distributor of chemical products with over 5,000 clients in 50 different markets |

| | 2006 revenue of US$212.3 million and EBITDA of US$9.5 million |

| ■ | | Ipiranga Petroquímica (IPQ) |

| | A 2nd generation producer of high-end petrochemicals |

| | 2006 revenue of US$924.3 million and volume sold of 636,100 tons |

| | A naphtha-based cracker owned by Ipiranga & Braskem |

| | 2006 revenue of US$2.9 billion and volume of 2.962 million tons |

Note: Volumes refer to volumes sold. Revenues are not consolidated

Source: Public DPPI information

Corporate structure

Note: Families include Gouvea, Tellechea, Mello, Bastos, and Ormazabal families

Source: Public Ipiranga information

|

| 17 |

| Valuation summary | Section 2 |

| | |

DPPI valuation

DPPI’s share value ranges from R$41.11 to R$45.44 based on the economic value

Economic value | |

| | | 100% | | | Proportionate | | | | |

(R$ million) | | TEV | | | TEV | | | | |

| CBPI | | | 4,029 | | | | 21.01 | % | | | 847 | | | | | |

| | | 706 | | | | 100.00 | % | | | 706 | | | | | |

DIPPI – Total Enterprise Value | | | | | | | | | | | 1,552 | | | | | |

| (-) net debt | | | | | | | | | | | (168 | ) | | | | |

| DPPI – Equity value | | | | | | | | | | | 1,385 | | | | | |

| Total number of shares (million) | | | | | | | | | | | 32.0 | | | | | |

Price per share – R$ per share | | | | | | | 41.11 | | | | 43.28 | | | | 45.44 | |

| | | | | | | | | |

| | | | | | | | -5 | % | | | | | | | +5 | % |

Note: Figures in R$ million, except unless otherwise noted (1) Further details on page 83 | |

| Source: DPPI information and Deutsche Bank | |

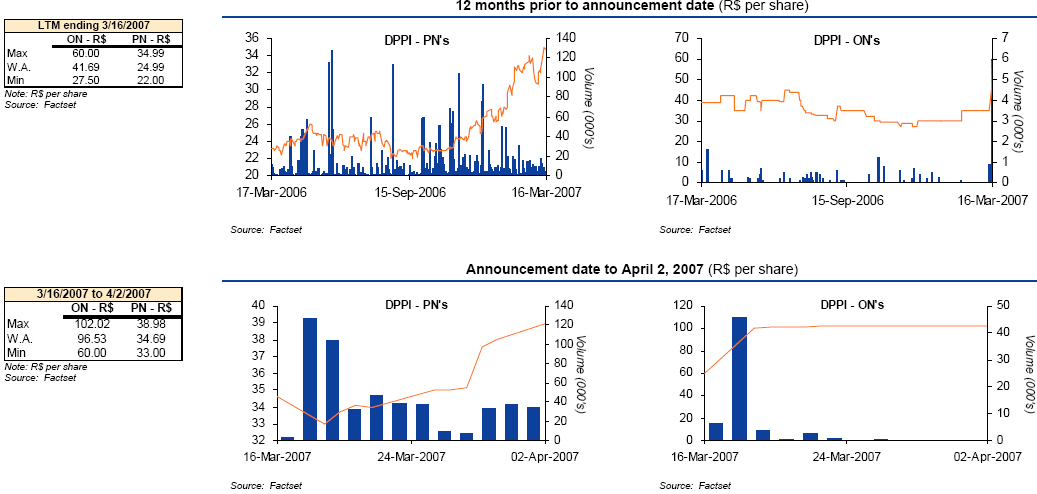

Weighted average share price LTM to announcement(a) | |

| | | ON | | | PN | |

| Total volume (000’s) | | | 24 | | | | 2,919 | |

| W.A. share price (R$ per share) | | | 41.69 | | | | 24.99 | |

| (a) From 03/15/2006 to 03/16/2007 | | | | | | | | |

Source: FactSet | | | | | | | | |

Book value – DPPI SA | |

| | | 12/31/2006 | |

| Shareholder equity – (R$ million) | | | 804.0 | |

| Total number of shares (million) | | | 32.0 | |

| Book value per share (R$ per share) | | | 25.13 | |

Note: Book value based on operating company financials as of 12/31/2006

Source: Company’s filings

Weighted average share price announcement to April 2, 2007(a) | |

| | | ON | | | PN | |

| Total volume (000’s) | | 61 | | | 514 | |

| W.A. share price (R$ per share) | | 96.53 | | | 34.69 | |

| (a) From 03/16/2007 to 04/02/2007 | | | | | | | | |

Source: FactSet | | | | | | | | |

| 18 |

| Valuation summary | Section 2 |

| | |

Tab D

CBPI

| Valuation summary | Section 2 |

| | |

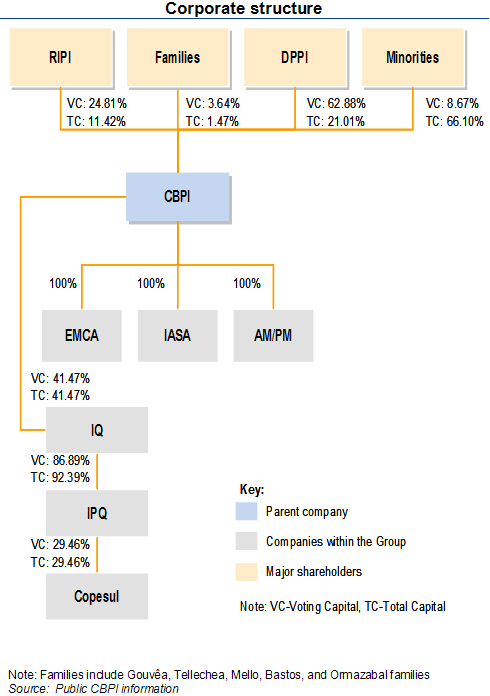

Companhia Brasileira de Petroleo Ipiranga – CBPI

Company description

| ■ | The largest company in the Ipiranga Group by revenue, CBPI is a distributor of fuels in Brazil, except in Rio Grande do Sul, Roraima and Amapá |

| ■ | The Company delivers fuels to retail gas stations, industrial sites |

| ■ | Approximately 65% of volume is sold to retail gas stations |

| ■ | In 2006, core volume (gasoline, alcohol, and diesel fuels) was 11.6 billion cubic meters. Total volume (including GNV, lubricants, & others) was 12.2 billion cubic meters |

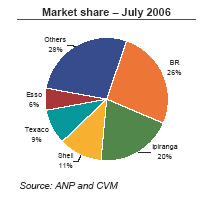

| ■ | In 2006, the Company had 16.9% share of the Brazilian market by volume |

Major subsidiaries

| ■ | Empresa Carioca de Produtos Químicos (EMCA) |

| | Produces specialty oils with applications in the pharmaceutical, food, cosmetic, and plastics industries |

| | 2006 revenue of US$42.5 million and EBITDA of US$1.4 million |

| ■ | Ipiranga Asfaltos (IASA) |

| | Produces asphalt and asphalt additives, and provides pavement services |

| | 2006 sales of US$114.3 million and EBITDA of US$6.1 million |

| | A chain of retail convenience stores attached to CBPI gas stations |

| | 2006 sales of US$8.4 million and EBITDA of US$14.7 million, which includes other operating income |

| ■ | Ipiranga Química SA (IQ) |

| | A wholesale distributor of chemical products with over 5,000 clients in 50 different markets |

| | 2006 revenue of US$212.3 million and EBITDA of US$9.5 million |

| | - | Through its ownership in IQ, CBPI, indirectly has a stake in IPQ and Copesul |

| ■ | Ipiranga Petroquímica (IPQ) |

| | A 2nd generation producer of high-end petrochemicals |

| | - | 2006 revenue of US$924.3 million and volume sold of 636,100 tons |

| | A naphtha-based cracker owned by Ipiranga & Braskem |

| | 2006 revenue of US$2.9 billion and volume of 2.962 million tons |

Source: Public CBPI information

Corporate structure

Note: Families include Gouvea, Tellechea, Mello, Bastos, and Ormazabal families

|

| Valuation summary | Section 2 |

| | |

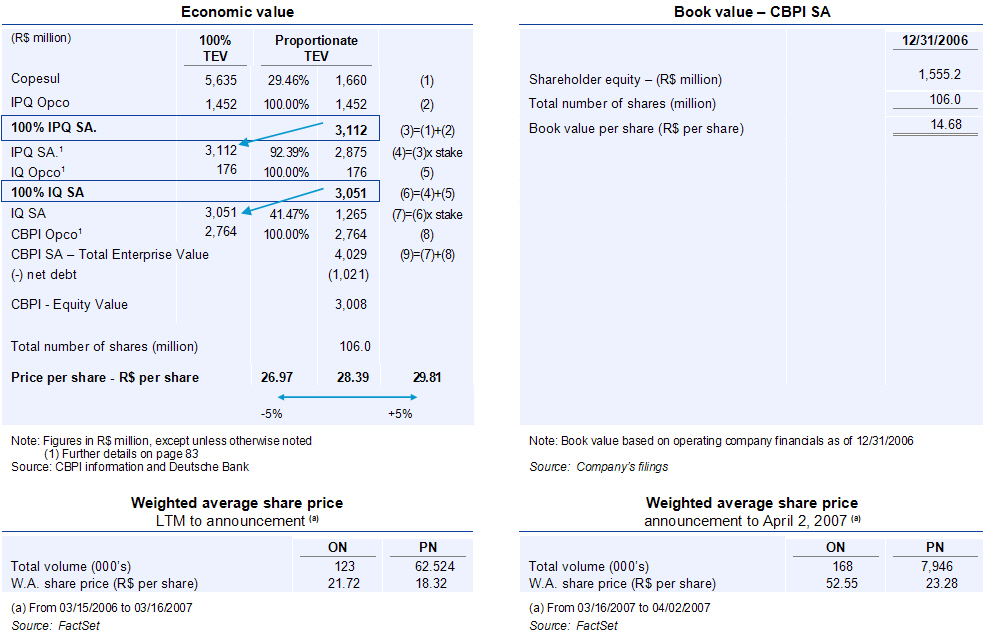

CBPI valuationCBPI’s share value ranges from R$26.97 to R$29.81 based on the economic value

Economic value Book value - CBPI

-------------- -----------------

(R$ million) 100% Proportionate 12/31/2006

TEV TEV ----------

Copesul 5,635 29.46% 1,660 (1) Shareholder equity - (R$ million) 1,555.2

IPQ Opco 1,452 100.00% 1,452 (2) Total number of shares (million) 106.0

100% IPQ SA. 3,112 (3)=(1)+(2) Book value per share (R$ per share) 14.68

IPQ SA. 3,112 92.39% 2,875 (4)=(3)x stake

IQ Opco 176 100.00% 176 (5)

100% IQ SA 3,051 (6)=(4)+(5)

IQ SA 3,051 41.47% 1,265 (7)=(6)x stake

CBPI Opco 2,764 100.00% 2,764 (8)

CBPI - Total Enterprise Value 4,029 (9)=(7)+(8)

(-) net debt (1,021)

CBPI - Equity Value 3,008

Total number of shares (million) 106.0

Price per share - R$ per share 26.97 28.39 29.81

-----------------

-5% +5%

Note: Figures in R$ million, except unless otherwise noted Note: Book value based on operating company financials

Source: Ipiranga information and Deutsche Bank as of 12/31/2006

Source: Company's filings

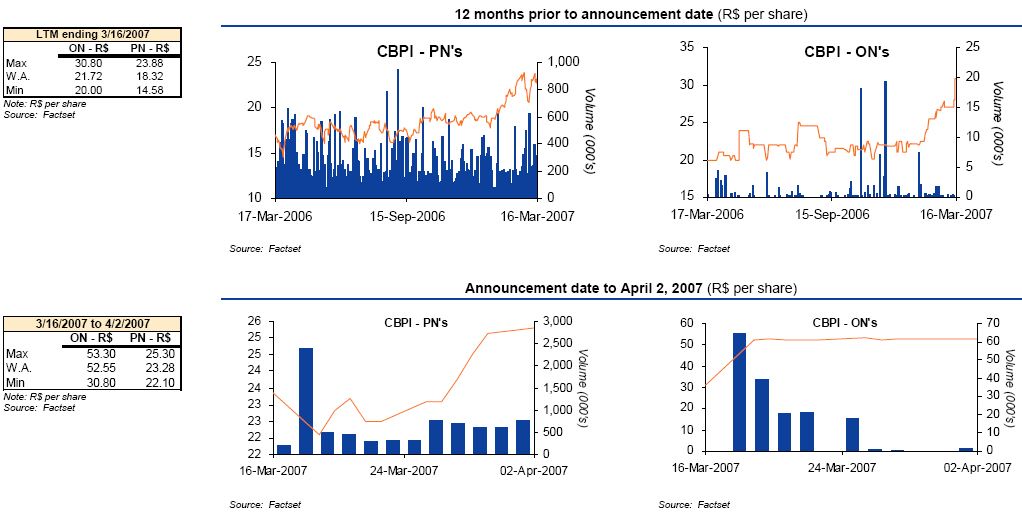

Weighted average share price Weighted average share price

LTM to announcement (a) announcement to April 2, 2007 (a)

- ----------------------------------------------------- ----------------------------------------------------

ON PN ON PN

======= ========= ======= =========

Total volume (000's) 123 62.524 Total volume (000's) 168 7,946

W.A. share price (R$ per share) 21.72 18.32 W.A. share price (R$ per share) 52.55 23.28

(a) From 03/15/2006 to 03/16/2007 (a) From 03/16/2007 to 04/02/2007

Source: FactSet Source: FactSet

|

| Economic value of assets | Section 3 |

| | |

Section 3

Economic value of assets

| 22 |

| Economic value of assets | Section 3 |

| | |

Valuation considerations

The companies were valued on a stand-alone basis

The valuation of each asset excludes any potential synergies that could be achieved as a result of the transaction

DCF |

| n | Basic assumptions |

| | – | 10-year projections |

| | – | Base date of DCF valuation is December 31, 2006 |

| | – | Exchange rate of 2.1385 R$/US$ as of 12/31/2006 |

| | – | Models projected in nominal Brazilian Reais; cash flows were converted to US Dollars based on average exchange rate for the year |

| | – | WACC in nominal US Dollars |

| | – | To discount the annual cash flow to the present value, it considers that cash flow is generated in the middle of the year (in June)1 |

| n | Perpetuity |

| | – | Calculated based on Gordon’s growth formula |

| | – | Adjustments to capex/ depreciation, tax rates, net operating working capital |

| | – | Petrochemical companies: perpetuity cash flow adjusted for mid-cycle |

| n | Equity value |

| | – | TEV minus net debt (as defined in the glossary) |

| | | |

DCF valuation |

| n | Companhia Brasileira de Petróleo Ipiranga |

| n | Distribuidora de Prod. de Petróleo Ipiranga |

| n | Ipiranga Petroquímica S.A. |

| Source: Ultrapar and Deutsche Bank |

Multiples |

| n | Basic assumptions |

| | – | Based on multiples of EBITDA |

| n | Precedent transactions |

| | – | Applied to LTM EBITDA |

| n | Trading comparables |

| | – | Applied to 2006 EBITDA except for petrochemicals, where an average of 3 - 5 years (normalized EBITDA) was used depending on the company |

| | | |

Multiple -based valuation |

| n | Ipiranga Química S.A. – precedent transactions |

| n | Empresa Carioca de Prod. Químicos S.A. – trading comps |

| n | Ipiranga Asfaltos – precedent transactions |

| n | AM/PM Comestíveis – trading comps |

| n | Isa-Sul Adm. e Part. Ltda – implied multiple from DPPI DCF |

| Source: Ultrapar and Deutsche Bank |

1 Assumes that the cash is generated evenly over the year, and for the purpose of discounting it to the net present value, it assumes the generation of cash occurs in the middle of the year (i.e. June), and not at the end of the year (i.e. December)

| 23 |

| Economic value of assets | Section 3 |

| | |

Weighted Average Cost of Capital and Cost of Equity

WACC and Ke

WACC definition

(US$ nominal)

| | | | Ipiranga companies |

| | Ultrapar | | CBPI | | DPPI | | Copesul | | IPQ |

| I. Beta calculation | | | | | | | | | |

1. Beta un-levered (a) | 0.64 | | 0.90 | | 0.90 | | 0.86 | | 0.86 |

| Long-term optimal debt (D)/cap (D+E) ratio | 35% (b) | | 40% (c) | | 40% (c) | | 50% (c) | | 50% (c) |

| Long-term optimal equity (E) /cap (D+E) ratio | 65% (b) | | 60% (c) | | 60% (c) | | 50% (c) | | 50% (c) |

Marginal tax rate (tax)(d) | 22% | | 26% | | 23% | | 33% | | 25% |

2. Re-levered equity beta (β) | 0.92 | | 1.35 | | 1.36 | | 1.44 | | 1.50 |

II. Calculation of Cost of Capital | | | | | | | | | |

US risk free rate (Rfr) (e) | 4.5% p.a. | | 4.5% p.a. | | 4.5% p.a. | | 4.5% p.a. | | 4.5% p.a. |

Local risk premium (CRP) (f) | 200 bps | | 200 bps | | 200 bps | | 200 bps | | 200 bps |

| Local long-term risk free rate | 6.5% p.a. | | 6.5% p.a. | | 6.5% p.a. | | 6.5% p.a. | | 6.5% p.a. |

US equity risk premium (ERP) (g) | 7.1% p.a. | | 7.1% p.a. | | 7.1% p.a. | | 7.1% p.a. | | 7.1% p.a. |

3. Cost of Equity (Ke) | 13.0% p.a. | | 16.1% p.a. | | 16.2% p.a. | | 16.7% p.a. | | 17.2 p.a.% |

| Local long-term risk free rate | 6.5% p.a. | | 6.5% p.a. | | 6.5% p.a. | | 6.5% p.a. | | 6.5% p.a. |

Long-term corporate risk spread (h) | 150 bps | | 200 bps | | 200 bps | | 200 bps | | 200 bps |

4. Cost of Debt (Kd) | 8.0% p.a. | | 8.50% p.a. | | 8.50% p.a. | | 8.50% p.a. | | 8.50% p.a. |

5. WACC | 10.6% p.a. | | 12.2% p.a. | | 12.3% p.a. | | 11.2% p.a. | | 11.8% p.a. |

| | | | | | | | | | |

| Note: | (a) Ultrapar’s beta is the observed and the betas for Grupo Ipiranga’s companies are the betas against the S&P 500 for the sample of companies that represent each industry. Based on 2 years of weekly betas. CBPI and DPPI’s betas were based on Pantry Inc, Casey’s General Stores, and Alimentacion Couche Tard Inc.2 Copesul and IPQ’s betas were based on Copesul, Braskem, Suzano Petroquímica, Petroquímica União, BASF and Nova Chemicals (source: Bloomberg as of February 18, 2007) |

| | (b) Based on a more conservative company risk profile than the optimal capital structure for the industry |

| | (c) Based on comparable public companies |

| | (d) Marginal tax rates as provided by the management of the companies. Refer to supporting material in Appendix IV |

| | (e) US risk free rate is the yield of the US Treasury (source: FactSet) |

| | (f) Local risk premium based on spread of the sovereign bond to the equivalent US Treasury (source: Bloomberg) |

| | (g) Equity risk premium from Ibbotson’s 2006 report |

| | (h) Long term corporate risk spreads are based on companies outstanding debt (source: the companies’ financials) |

Source: Bloomberg, Factset and the companies |

2 Pantry Inc., Casey’s General Stores, and Alimentation Couche Tard Inc. are businesses whose principal activities include the distribution of gasoline (77%, 71%, and 58% of 2006 sales respectively). The operation of convenience stores is a secondary activity totally dependent on the distribution of gasoline

| 24 |

| Economic value of assets | Section 3 |

| | |

Macroeconomic assumptions

US Economy | 2004A | 2005A | 2006A | 2007E | 2008E | 2009E | 2010E | 2011E | 2012E | 2013E | 2014E | 2015E | 2016E |

Inflation(1) | 1.6% | 2.6% | 2.3% | 2.0% | 2.0% | 2.0% | 2.0% | 2.0% | 2.0% | 2.0% | 2.0% | 2.0% | 2.0% |

US Treasury(1) | 4.1% | 4.1% | 4.7% | 4.5% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% |

Brazil Economy | 2004A | 2005A | 2006A | 2007E | 2008E | 2009E | 2010E | 2011E | 2012E | 2013E | 2014E | 2015E | 2016E |

GDP - real growth(2) | 4.9% | 2.3% | 2.9% | 3.5% | 3.7% | 3.6% | 3.4% | 3.3% | 3.1% | 3.0% | 3.0% | 3.0% | 3.0% |

| GDP - nominal growth | 12.8% | 9.7% | 6.1% | 7.4% | 7.8% | 7.2% | 7.0% | 6.9% | 6.7% | 6.6% | 6.6% | 6.6% | 6.6% |

Brazilian population growth(3) | 1.5% | 1.4% | 1.4% | 1.4% | 1.3% | 1.3% | 1.3% | 1.2% | 1.2% | 1.2% | 1.1% | 1.1% | 1.1% |

Inflation (IPCA)(1) | 7.6% | 5.7% | 3.1% | 3.8% | 4.0% | 3.5% | 3.5% | 3.5% | 3.5% | 3.5% | 3.5% | 3.5% | 3.5% |

| | | | | | | | | | | | | | |

Selic (average)(4) | 16.2% | 19.0% | 15.1% | 12.2% | 11.1% | 10.0% | 9.5% | 9.5% | 9.5% | 9.5% | 9.5% | 9.5% | 9.5% |

CDI (Brazilian interbank rate)(1) | 16.2% | 19.0% | 15.0% | 12.7% | 11.6% | 10.5% | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% |

| | | | | | | | | | | | | | |

FX rate - eop(5) | 2.65 | 2.34 | 2.14 | 2.18 | 2.29 | 2.32 | 2.36 | 2.39 | 2.43 | 2.46 | 2.50 | 2.54 | 2.57 |

FX rate - avg(5) | 2.93 | 2.43 | 2.19 | 2.16 | 2.24 | 2.31 | 2.34 | 2.38 | 2.41 | 2.45 | 2.48 | 2.52 | 2.56 |

| Average R$ devaluation | | (20.3%) | (9.9%) | (1.5%) | 3.7% | 3.0% | 1.5% | 1.5% | 1.5% | 1.5% | 1.5% | 1.5% | 1.5% |

| (1) Based on estimates of the market and Deutsche Bank |

(2) Based on IBGE’s old methodology3. Source: IBGE for 2004 to 2006, and based on estimates of the market and Deutsche Bank for 2007 and onwards |

| (3) IBGE – Brazilian Institute of Geography and Statistics |

(4) Market consensus for 2007 and 2008 (source: BCB, February 2007) and based on estimates of the market and Deutsche Bank for 2009 and onwards |

(5) Market consensus for 2007 and 2008 (source: BCB, February 2007). Brazil – USA purchase power parity (PPP) for 2009 onwards |

3IBGE had recently published the parameters of a new methodology for the calculation of Brazilian GDP, however at the time of publication of the Report, projections based on the new methodology were not available. We therefore consider it most appropriate to use the old methodology, based on which projections were available.

| 25 |

| Economic value of assets | Section 3 |

| | |

Tab A

Ultrapar

| 26 |

| Economic value of assets | Section 3 |

| | |

Ultrapar consolidated - DCF valuation

Ultrapar consolidates: Ultragaz, the #1 LPG distributor in Brazil, Oxiteno, the main producer of Ethylene Oxide and its main derivatives in Latin America, and Ultracargo, a logistic company for special products

| | | 2007E | | 2008E | | 2009E | | 2010E | | 2011E | | 2012E | | 2013E | | 2014E | | 2015E | | 2016E | | Perp. |

1. EBIT | | 157 | | 163 | | 218 | | 239 | | 249 | | 251 | | 257 | | 286 | | 297 | | 347 | | 364 |

| annual growth | | n.a. | | 4.1% | | 33.2% | | 9.7% | | 4.4% | | 0.6% | | 2.4% | | 11.3% | | 3.9% | | 16.8% | | 5.0% |

| | | | | | | | | | | | | | | | | | | | | | | |

(-) tax | | (37) | | (38) | | (47) | | (51) | | (53) | | (54) | | (56) | | (64) | | (67) | | (77) | | (80) |

| effective tax rate | | (23.4%) | | (23.5%) | | (21.6%) | | (21.3%) | | (21.1%) | | (21.5%) | | (21.7%) | | (22.4%) | | (22.6%) | | (22.1%) | | (22.1%) |

| | | | | | | | | | | | | | | | | | | | | | | |

3. EBIT (-) tax | | 120 | | 125 | | 171 | | 188 | | 197 | | 197 | | 201 | | 222 | | 230 | | 270 | | 284 |

| (+) Depreciation & Amortization | | 93 | | 103 | | 111 | | 119 | | 127 | | 131 | | 134 | | 116 | | 119 | | 87 | | 87 |

| (-) Capex | | (253) | | (154) | | (103) | | (96) | | (99) | | (101) | | (104) | | (106) | | (100) | | (98) | | (87) |

| (-) Changes in net operating working capital | | (7) | | (19) | | (50) | | (21) | | (19) | | (17) | | (16) | | (13) | | (11) | | (11) | | (11) |

| | | | | | | | | | | | | | | | | | | | | | | |

4. Free cash flow to the Firm | | (47) | | 56 | | 129 | | 190 | | 206 | | 209 | | 215 | | 218 | | 238 | | 248 | | 272 |

| annual growth | | n.a | | n.m | | 130.4% | | 47.8% | | 8.3% | | 1.5% | | 3.0% | | 1.5% | | 9.0% | | 4.0% | | n.m |

Note: Annual free cash flow in US$ millions

Effective tax rate based on the effective tax rates of Ultragaz, Oxiteno, and Ultracargo

Perpetuity’s cash flow is based on long-term real growth of 3% corresponding to long-term expectations for GDP growth. These assumptions were evaluated in due diligence sessions confirmed by management of the businesses and are considered consistent with long-term growth expectations in each sector

Source: Company information and Ultrapar management guidance

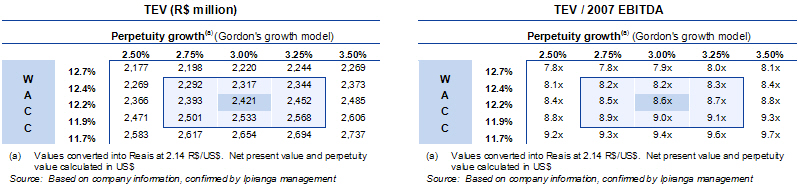

TEV (R$ million)

(R$ million) Perpetuity growth(a) (Gordon's growth model)

(a) Values converted into Reais at 2.14 R$/US$. Net present value and perpetuity

value calculated in US$

TEV/ 2007 EBITDA

(R$ million) Perpetuity growth(a) (Gordon's growth model)

(a) Values converted into Reais at 2.14 R$/US$. Net present value and perpetuity

value calculated in US$

|

| 27 |

| Economic value of assets | Section 3 |

| | |

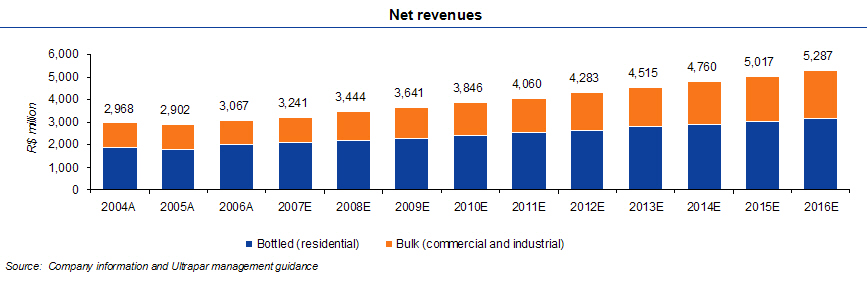

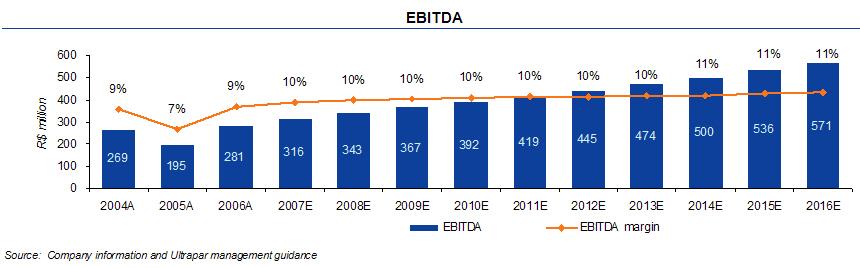

Assumptions - Ultragaz

Selected income statement drivers

Bottled LPG volumes are driven by population growth, while Bulk sales are driven by GDP growth

Cash gross margins per ton are constant in real terms adjusted for Brazilian inflation

Note: Excludes depreciation

Source: Company information and Ultrapar management guidance

|

| 28 |

| Economic value of assets | Section 3 |

| | |

Assumptions - Ultragaz (continued)

Selected income statement drivers

Revenues are driven by increasing volumes and are adjusted for inflation

Selling expenses are constant as a percentage of sales, while General and Administrative expenses are adjusted for inflation

| 29 |

| Economic value of assets | Section 3 |

| | |

Assumptions - Ultragaz (continued)

Selected balance sheet drivers

Capex/ton is based on sales volumes and adjusted for inflation

Based on property, plant and equipment depreciation schedule

Net operating working capital assumptions are in line with 2006

Change in net operating working capital |

| Net operating working capital (R$ million) | | 2005A | | 2006A | | 2007E | | 2008E | | 2009E | | 2010E | | 2011E | | 2012E | | 2013E | | 2014E | | 2015E | | 2016E |

| Net operating working capital | | 150.2 | | 126.4 | | 133.5 | | 141.9 | | 150.0 | | 158.5 | | 167.4 | | 176.6 | | 186.2 | | 196.3 | | 207.0 | | 218.2 |

| (+) current assets | | 216 | | 203 | | 215 | | 228 | | 241 | | 255 | | 269 | | 284 | | 299 | | 316 | | 333 | | 351 |

| (-) current liabilities | | (65) | | (77) | | (81) | | (87) | | (91) | | (97) | | (102) | | (107) | | (113) | | (119) | | (126) | | (132) |

| | | | | | | | | | | | | | | | | | | | | | | |

Change in net operating working capital | | | | | | | | | | | | | | | | | | | | | | |

| (Increase) / Decrease in net operating working capital | | (7) | | (8) | | (8) | | (8) | | (9) | | (9) | | (10) | | (10) | | (11) | | (11) |

Source: Company information and Ultrapar management guidance

| 30 |

| Economic value of assets | Section 3 |

| | |

Assumptions - Oxiteno

Selected income statement drivers

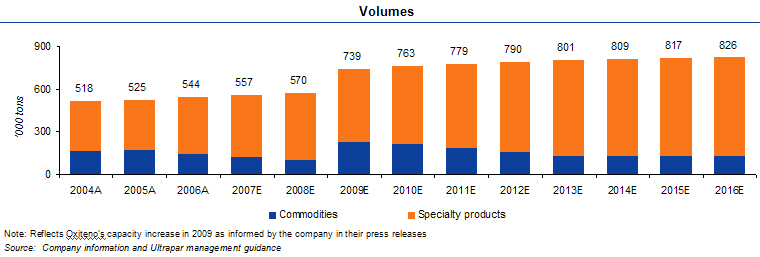

Oxiteno is currently in the process of increasing its capacity (expected to be fully operational in 2009)

Oxiteno’s strategy is to meet Brazil’s demand for specialties (expected to grow twice as fast as GDP)

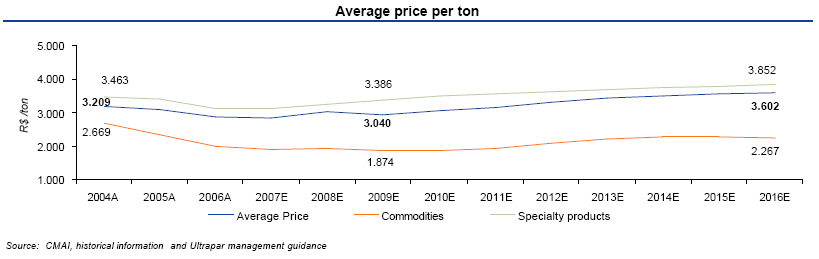

Specialties prices are constant in US Dollars and commodities prices are based on CMAI projections in US Dollars

| 31 |

| Economic value of assets | Section 3 |

| | |

Assumptions - Oxiteno (continued)

Selected income statement drivers

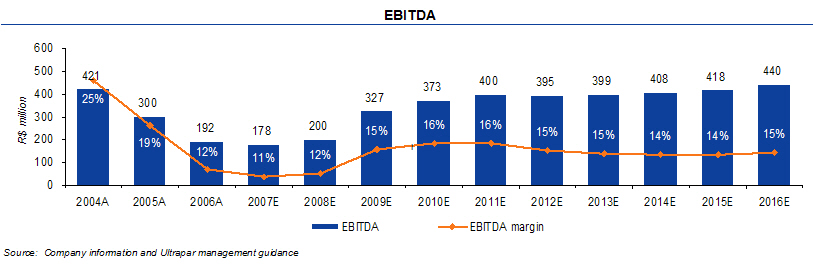

Revenue forecast reflects the capacity expansion and change in production mix

Sales are expected to shift over-time from commodities to specialties and from exports to the domestic market

The production shift to specialties diminishes the cyclicality of the EBITDA margin

| 32 |

| Economic value of assets | Section 3 |

| |

Assumptions - Oxiteno (continued)

Selected balance sheet drivers

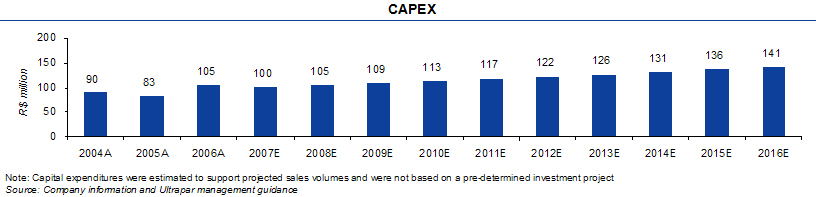

Capex is based on Ultrapar guidance relating to the capacity increase

Based on property, plant and equipment depreciation schedule

Net operating working capital assumptions are in line with 2006

Change in net operating working capital |

Net operating working capital (R$ million) | | | 2005A | | | 2006A | | | 2007E | | | 2008E | | | 2009E | | | 2010E | | | 2011E | | | 2012E | | | 2013E | | | 2014E | | | 2015E | | | 2016E | |

| Net operating working capital | | | 259.5 | | | 361.2 | | | 368.0 | | | 400.0 | | | 504.5 | | | 543.7 | | | 580.0 | | | 611.8 | | | 641.0 | | | 661.7 | | | 677.3 | | | 694.2 | |

| (+) current assets | | | 352 | | | 468 | | | 478 | | | 520 | | | 651 | | | 700 | | | 747 | | | 791 | | | 830 | | | 858 | | | 878 | | | 898 | |

| (-) current liabilities | | | (92 | ) | | (107 | ) | | (110 | ) | | (120 | ) | | (147 | ) | | (157 | ) | | (167 | ) | | (179 | ) | | (189 | ) | | (196 | ) | | (200 | ) | | (204 | ) |

Change in net operating working capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Increase) / Decrease in net operating working capital | | | | | | | | | (7 | ) | | (32 | ) | | (105 | ) | | (39 | ) | | (36 | ) | | (32 | ) | | (29 | ) | | (21 | ) | | (16 | ) | | (17 | ) |

Source: Company information and Ultrapar management guidance

4 Relevant investment projects of the Oxiteno subsidiary are: expansion of the production capacity of ethylene oxide and specialty chemicals at Camaçari, Bahia; a new plant for fatty alcohols and derivatives at Camaçari, Bahia; and the expansion of production capacity of ethylene oxide and specialty chemicals at Mauá, São Paulo, as announced to the market through Ultrapar’s press releases dated August 17, 2006, and February 16, 2005

| 33 |

| Economic value of assets | Section 3 |

| |

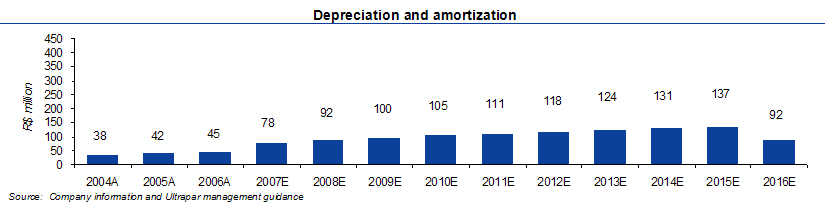

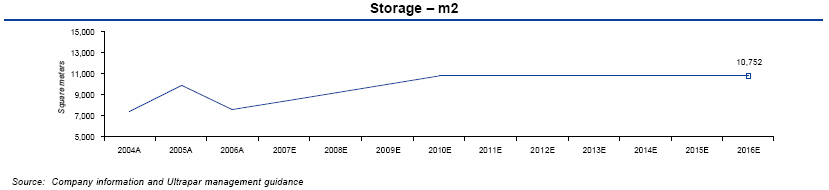

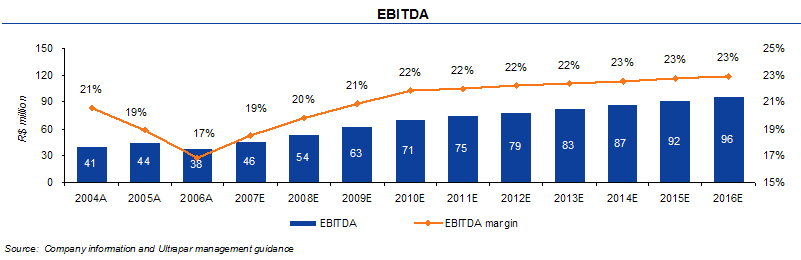

Assumptions - Ultracargo

Selected income statement drivers

Storage capacity utilized increasing from 78% as of 2007 to 95% as of 2010 based on Ultracargo guidance

Transportation capacity utilized increasing from 84% as of 2007 to 95% as of 2010

| 34 |

| Economic value of assets | Section 3 |

| |

Assumptions - Ultracargo (continued)

Selected income statement drivers

Revenues increase as a result of volume growth and price inflation

| 35 |

| Economic value of assets | Section 3 |

| |

Assumptions - Ultracargo (continued)Selected balance sheet drivers

Capacity increase between 2004 and 2006

Based on property, plant and equipment depreciation schedule

Net operating working capital assumptions are in line with 2006

Change in net operating working capital |

| Net operating working capital (R$ million) | | | 2005A | | | 2006A | | | 2007E | | | 2008E | | | 2009E | | | 2010E | | | 2011E | | | 2012E | | | 2013E | | | 2014E | | | 2015E | | | 2016E | |

| Net operating working capital | | | 14.0 | | | 16.1 | | | 17.7 | | | 19.4 | | | 21.1 | | | 22.9 | | | 23.9 | | | 24.9 | | | 26.0 | | | 27.1 | | | 28.2 | | | 29.5 | |

| (+) current assets | | | 33 | | | 35 | | | 38 | | | 42 | | | 46 | | | 50 | | | 52 | | | 54 | | | 57 | | | 59 | | | 62 | | | 64 | |

| (-) current liabilities | | | (19 | ) | | (19 | ) | | (20 | ) | | (23 | ) | | (25 | ) | | (27 | ) | | (28 | ) | | (29 | ) | | (31 | ) | | (32 | ) | | (33 | ) | | (35 | ) |

Change in net operating working capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Increase) / Decrease in net operating working capital | | | | | | | | | (2 | ) | | (2 | ) | | (2 | ) | | (2 | ) | | (1 | ) | | (1 | ) | | (1 | ) | | (1 | ) | | (1 | ) | | (1 | ) |

Source: Company information and Ultrapar management guidance

| 36 |

| Economic value of assets | Section 3 |

| |

Tab B

Ultrapar prior to the share merger

| 37 |

| Economic value of assets | Section 3 |

| |

Ultrapar prior to the share merger

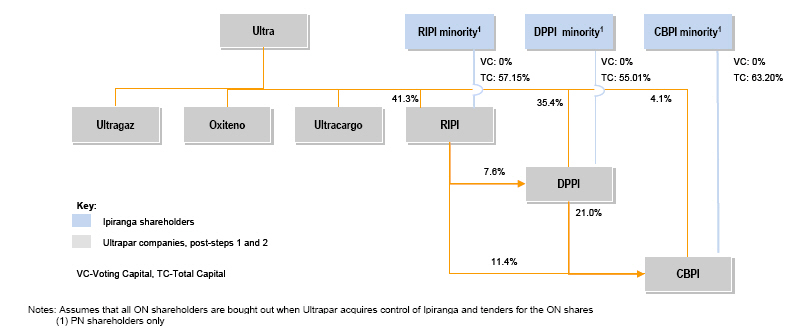

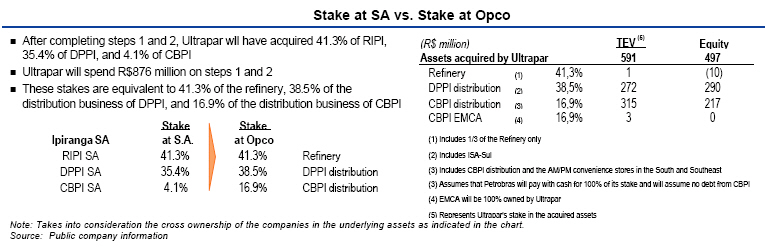

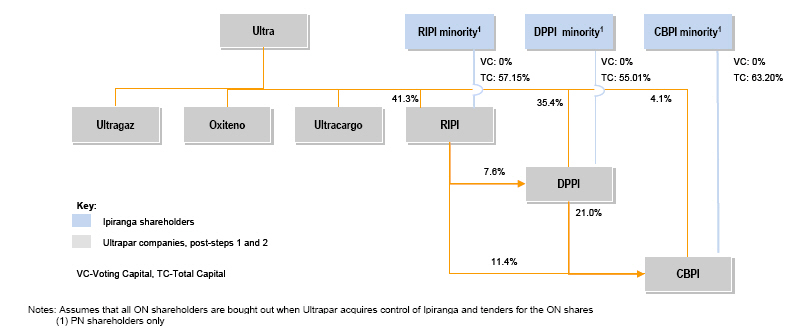

After completing the acquisition of the control block (step 1) and tendering for the other voting shareholders (step 2), Ultrapar will have acquired 41.3% of RIPI, 35.4% of DPPI, and 4.1% of CBPI

Ultrapar will spend R$876 million on steps 1 and 2

o After completing steps 1 and 2, Ultrapar will have acquired 41.3%

of RIPI, 35.4% of DPPI, and 4.1% of CBPI

o Ultrapar will spend R$876 million on steps 1 and 2

o These stakes are equivalent to 41.3% of the refinery, 38.5% of the

distribution business of DPPI, and 16.9% of the distribution

business of CBPI

Stake Stake

Ipiranga SA at S.A. at Opco

- ----------- ------- -------

RIPI SA 41.3% 41.3% Refinery

DPPI SA 35.4% 38.5% DPPI

distribution

CBPI

CBPI SA 4.1% 16.9% distribution

(R$ million) TEV (5) Equity

Assets acquired by Ultrapar 591 497

- ------------------------------------------------------

Refinery (1) 41,3% 1 (10)

DPPI 38,5% 272 290

distribution (2)

CBPI 16,9% 315 217

distribution (3)

CBPI EMCA (4) 16,9% 3 0

(1) Includes 1/3 of the Refinery only

(2) Includes ISA-Sul

(3) Includes CBPI distribution and the AM/PM

convenience stores in the South and Southeast

(3) Assumes that Petrobras will pay with cash for 100%

of its stake and will assume no debt from CBPI

(4) EMCA will be 100% owned by Ultrapar

(5) Represents Ultrapar's stake in the acquired assets

|

| 38 |

| Economic value of assets | Section 3 |

| |

Tab C

Fuel distribution - CBPI

| 39 |

| Economic value of assets | Section 3 |

| | |

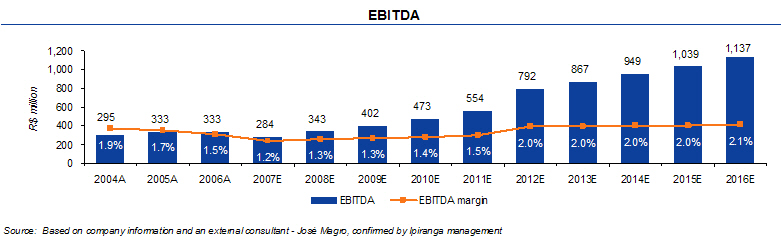

CBPI distribution – DCF valuation

CBPI: A fuel distributor operating in Brazil, except Rio Grande do Sul, Roraima and Amapa

In addition to the distribution business, CBPI also consolidates AM/PM, IASA, and EMCA totaling R$2.7 billion TEV (refer to page 61)

| | | 2007E | | | 2008E | | | 2009E | | | 2010E | | | 2011E | | | 2012E | | | 2013E | | | 2014E | | | 2015E | | | 2016E | | | Perp. | |

1. EBIT | | | 90 | | | | 106 | | | | 122 | | | | 142 | | | | 164 | | | | 251 | | | | 268 | | | | 298 | | | | 340 | | | | 361 | | | | 379 | |

| annual growth | | | n.a. | | | | 18.3 | % | | | 14.7 | % | | | 16.5 | % | | | 15.7 | % | | | 52.6 | % | | | 6.9 | % | | | 11.0 | % | | | 14.1 | % | | | 6.3 | % | | | 5.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(-) tax | | | (23 | ) | | | (27 | ) | | | (31 | ) | | | (36 | ) | | | (42 | ) | | | (64 | ) | | | (69 | ) | | | (76 | ) | | | (87 | ) | | | (93 | ) | | | (97 | ) |

| effective tax rate | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) | | | (25.6 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

3. EBIT (-) tax | | | 67 | | | | 79 | | | | 91 | | | | 106 | | | | 122 | | | | 187 | | | | 200 | | | | 222 | | | | 253 | | | | 269 | | | | 282 | |

| (+) Depreciation & Amortization | | | 41 | | | | 47 | | | | 52 | | | | 60 | | | | 69 | | | | 78 | | | | 86 | | | | 84 | | | | 73 | | | | 84 | | | | 83 | |

| (-) Capex, net of reimbursement | | | (74 | ) | | | (63 | ) | | | (91 | ) | | | (116 | ) | | | (134 | ) | | | (98 | ) | | | (105 | ) | | | (127 | ) | | | (144 | ) | | | (137 | ) | | | (130 | ) |

| (-) Changes in net operating working capital | | | (8 | ) | | | (46 | ) | | | (55 | ) | | | (58 | ) | | | (61 | ) | | | (37 | ) | | | (50 | ) | | | (51 | ) | | | (52 | ) | | | (59 | ) | | | (61 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

4. Free cash flow to the Firm | | | 27 | | | | 17 | | | | (3 | ) | | | (8 | ) | | | (4 | ) | | | 130 | | | | 131 | | | | 128 | | | | 130 | | | | 156 | | | | 174 | |

| annual growth | | | n.a. | | | | (37.9 | %) | | | (120.4 | %) | | | 125.6 | % | | | (43.1 | %) | | | n.a. | | | | 0.4 | % | | | (1.8 | %) | | | 1.1 | % | | | 20.1 | % | | | n.m. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Note: Annual free cash flow in US$ millions Cash flow in perpetuity reflects a 3% growth in sales volume compared to 2016 in line with GDP’s 3% long-term expected real growth. These assumptions were evaluated in due diligence sessions confirmed by management of the businesses and consistent with expectations of long-term growth in each sector |

| Source: Based on company information, confirmed by Ipiranga management | | | | | | | | | | | | | | | | | | | | | |

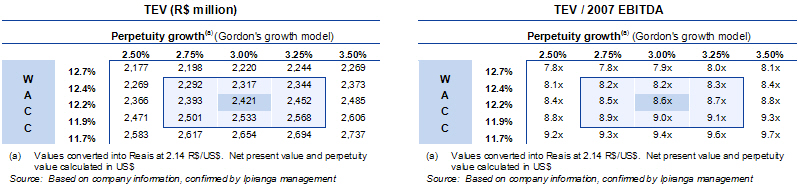

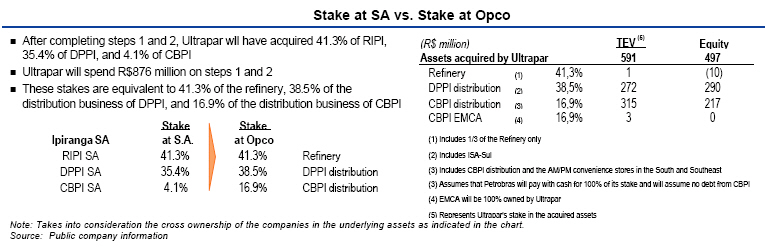

TEV (R$ million)

(R$ million) Perpetuity growth(a) (Gordon's growth model)

(a) Values converted into Reais at 2.14 R$/US$. Net present value and perpetuity

value calculated in US$

TEV/ 2007 EBITDA

(R$ million) Perpetuity growth(a) (Gordon's growth model)

(a) Values converted into Reais at 2.14 R$/US$. Net present value and perpetuity

value calculated in US$

|

| Economic value of assets | Section 3 |

| | |

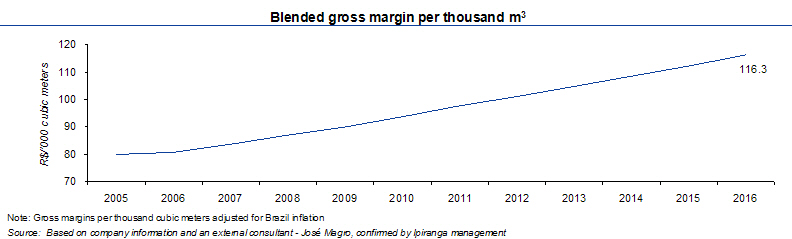

Assumptions – CBPI distribution

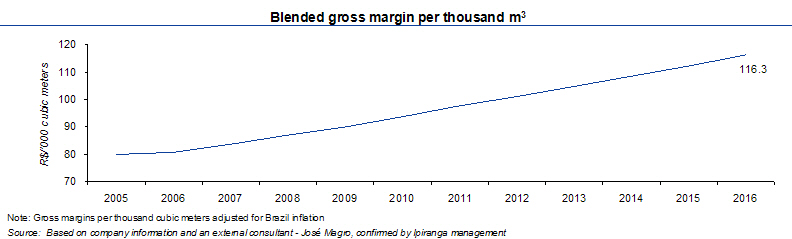

Selected income statement drivers

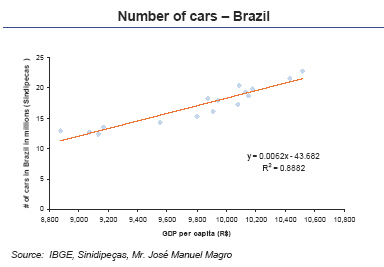

Gas and alcohol volumes in the Brazilian market were forecasted based on a regression on number of cars in Brazil as a function of GDP per capita, and consumption per car

Diesel volumes in the Brazilian market were projected as a result of a regression on diesel volumes in Brazil on GDP growth

Assumes the weighted average contribution margin of gasoline and ethanol is constant in

real Reais

5 CBPI has the objective of increasing its market share, which is deemed feasible by its management. This assumption was verified in a confirmatory due diligence session, and corroborated by the fact that CBPI gained 2 (two) percentage points of market share between 2001 and 2005, according to the National Petroleum Agency, ANP. However, the market consultant indicated that in order to gain 2 (two) percentage points market share in the coming years, it would demand stronger capex and higher marketing expenses to support this growth. It is expected that CBPI’s market share will stabilize at 18.9% after 2012, when CBPI sales will grow at the market pace, around 8% per year. A scenario in which sales would grow above this pace and therefore resulting in further market share increase would demand significant investments and is inconsistent with the expected increasing competition in the long term, considering a market dominated by 5 main players (which now control about 70% of the market) and numerous other players

| Economic value of assets | Section 3 |

| | |

Assumptions – CBPI distribution (continued)

Selected income statement drivers

Revenue increases driven by market share and gross margin per product increases

EBITDA margins in 2008-2011 are affected by selling expenses relating to market share growth, stabilized from 2012-2016

| Economic value of underlying assets | Section 3 |

| | |

Assumptions – CBPI distribution (continued)

Selected income statement drivers

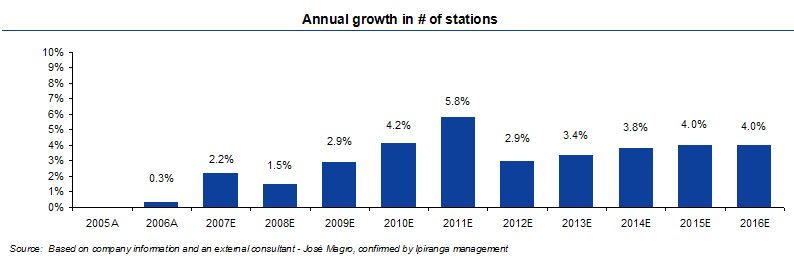

CBPI will increase the number of stations in its network by approximately 3.2% per year as a result of increased volumes of fuel and the increase in market share by 200 basis points

Selling expenses increase in 2007 through 2011 due to CBPI’s strategy to increase market share

| Economic value of underlying assets | Section 3 |

| | |

Assumptions – CBPI distribution (continued)

Selected balance sheet drivers

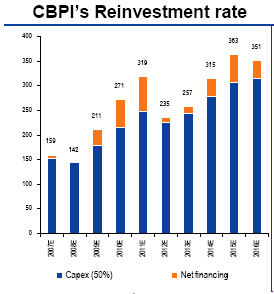

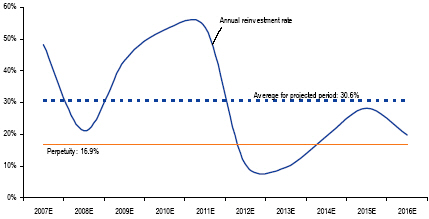

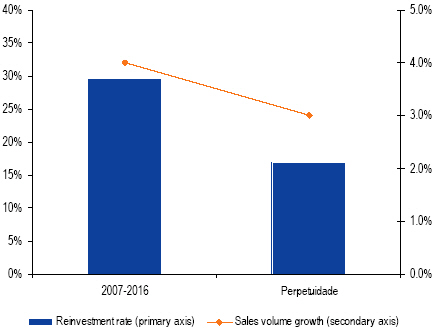

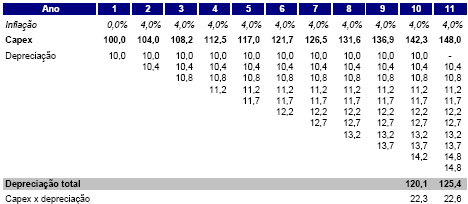

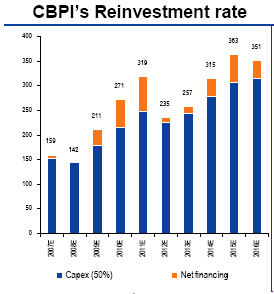

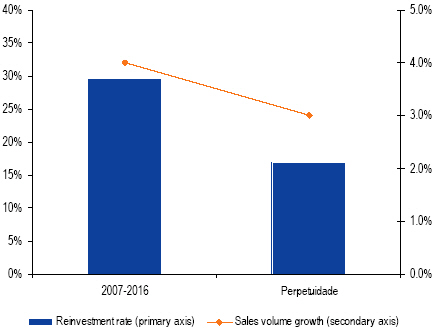

CAPEX based on number of new stores needed to increase market share as well as for renovating existing stations

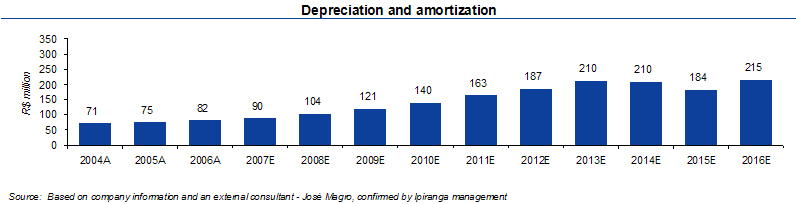

Based on property, plant and equipment depreciation schedule

Net operating working capital assumptions are in line with 2006

Change in net operating working capital | |

Net operating working capital (R$ million) | | | | | 2005A | | | 2006A | | | 2007E | | | 2008E | | | 2009E | | | 2010E | | | 2011E | | | 2012E | | | 2013E | | | 2014E | | | 2015E | | | 2016E | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating working capital | | | | 671 | | | | 872 | | | | 889 | | | | 992 | | | | 1,119 | | | | 1,253 | | | | 1,399 | | | | 1,487 | | | | 1,608 | | | | 1,734 | | | | 1,863 | | | | 2,015 | |

| (+) current assets | | | | 1,342 | | | | 1,491 | | | | 1,681 | | | | 1,882 | | | | 2,126 | | | | 2,386 | | | | 2,668 | | | | 2,888 | | | | 3,123 | | | | 3,377 | | | | 3,651 | | | | 3,947 | |

| (-) current liabilities | | | | 671 | | | | 618 | | | | 792 | | | | 890 | | | | 1,007 | | | | 1,133 | | | | 1,270 | | | | 1,401 | | | | 1,515 | | | | 1,644 | | | | 1,788 | | | | 1,931 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Change in net operating working capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Increase) / Decrease in net operating working capital | | | | | | | | | | | | (17 | ) | | | (103 | ) | | | (127 | ) | | | (135 | ) | | | (145 | ) | | | (88 | ) | | | (122 | ) | | | (125 | ) | | | (130 | ) | | | (152 | ) |

Source: Based on company information and an external consultant - José Magro, confirmed by Ipiranga management

| Economic value of assets | Section 3 |

| | |

Tab D

Fuel distribution - DPPI

| Economic value of assets | Section 3 |

| | |

DPPI distribution – DCF Valuation

DPPI: A fuel distributor operating in 2 states in the South of Brazil

Isa-Sul, a wholly owned subsidiary of DPPI, owns 152 gas stations in DPPI’s region. Isa-Sul is valued based on DPPI’s TEV multiple of 2006 EBITDA

Based on 2006 figures, Isa-Sul is valued at R$140 million (refer to pages 61 and 83)

DPPI opco including Isa-Sul is valued at R$706 million, or US$330 million (R$566 million related to DPPI ex-Isa Sul plus R$140 million related to Isa-Sul)

| | | 2007E | | | 2008E | | | 2009E | | | 2010E | | | 2011E | | | 2012E | | | 2013E | | | 2014E | | | 2015E | | | 2016E | | | Perp. | |

1. EBIT | | | 29 | | | | 34 | | | | 35 | | | | 37 | | | | 39 | | | | 41 | | | | 44 | | | | 48 | | | | 55 | | | | 58 | | | | 63 | |

| annual growth | | | n.a. | | | | 14.3 | % | | | 4.5 | % | | | 6.5 | % | | | 4.6 | % | | | 5.3 | % | | | 5.5 | % | | | 11.2 | % | | | 13.6 | % | | | 4.8 | % | | | 9.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(-) tax | | | (7 | ) | | | (8 | ) | | | (8 | ) | | | (9 | ) | | | (9 | ) | | | (9 | ) | | | (10 | ) | | | (11 | ) | | | (13 | ) | | | (13 | ) | | | (14 | ) |

| effective tax rate | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) | | | (22.8 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

3. EBIT (-) tax | | | 23 | | | | 26 | | | | 27 | | | | 29 | | | | 30 | | | | 32 | | | | 34 | | | | 37 | | | | 42 | | | | 44 | | | | 49 | |

| (+) Depreciation & Amortization | | | 8 | | | | 9 | | | | 10 | | | | 10 | | | | 11 | | | | 12 | | | | 13 | | | | 11 | | | | 8 | | | | 9 | | | | 19 | |

| (-) Capex | | | (15 | ) | | | (8 | ) | | | (6 | ) | | | (11 | ) | | | (8 | ) | | | (13 | ) | | | (12 | ) | | | (12 | ) | | | (12 | ) | | | (9 | ) | | | (19 | ) |

| (-) Changes in net operating working capital | | | (12 | ) | | | (13 | ) | | | (13 | ) | | | (12 | ) | | | (10 | ) | | | (11 | ) | | | (11 | ) | | | (12 | ) | | | (12 | ) | | | (13 | ) | | | (14 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

4. Free cash flow to the Firm | | | 5 | | | | 14 | | | | 18 | | | | 17 | | | | 23 | | | | 20 | | | | 23 | | | | 25 | | | | 27 | | | | 31 | | | | 35 | |

| annual growth | | | n.a. | | | | 199.4 | % | | | 28.0 | % | | | (6.2 | %) | | | 38.7 | % | | | (12.7 | %) | | | 14.0 | % | | | 6.4 | % | | | 7.7 | % | | | 18.4 | % | | | n.m. | |

Note: | Annual free cash flow in US$ millionsCash flow in perpetuity reflects a 3% growth in sales volume compared to 2016 in line with GDP’s 3% long-term expected real growth. These assumptions were evaluated in due diligence sessions confirmed by management of the businesses and consistent with expectations of long-term growth in each sector |

Source: | Based on company information, confirmed by Ipiranga management |

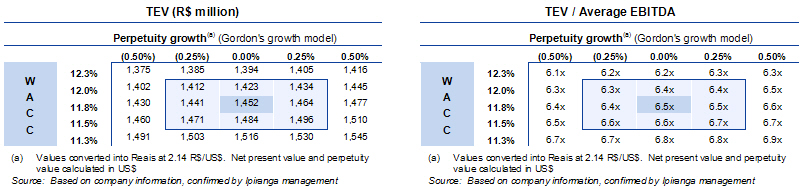

TEV (R$ million)

(R$ million) Perpetuity growth(a) (Gordon's growth model)

(a) Values converted into Reais at 2.14 R$/US$. Net present value and perpetuity

value calculated in US$

TEV/ 2007 EBITDA

(R$ million) Perpetuity growth(a) (Gordon's growth model)

(a) Values converted into Reais at 2.14 R$/US$. Net present value and perpetuity

value calculated in US$

|

| Economic value of assets | Section 3 |

| | |

Assumptions – DPPI distribution

Selected income statement drivers

Gas and alcohol volumes in the Brazilian market were forecasted based on a regression on number of cars in Brazil as a function of GDP per capita, and consumption per car

Diesel volumes in the Brazilian market were projected as a result of a regression on diesel volumes in Brazil on GDP growth

Given its leadership in the region, DPPI presents little market share fluctuation

DPPI’s market share remains approximately constant because DPPI is a leader in the region in which it operates – Rio Grande do Sul and Santa Catarina – with an already high 35% (thirty-five percent) market share. Nationally, DPPI reduced its market share from 2.9% in 2001 to 2.6% in 2005 according to the National Petroleum Agency – ANP. As per the recommendation of the market consultant, which was validated on confirmatory due diligence session with DPPI’s management, DPPI would tend to maintain its market share given DPPI’s dominant position in the region, or even lose some market participation to competition in line with the company’s recent performance.

| Economic value of assets | Section 3 |

| | |

Assumptions – DPPI distribution (continued)

Selected income statement drivers

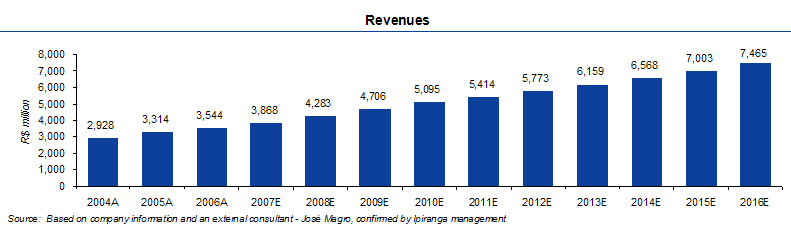

Revenues driven by volumes and contribution margin per product

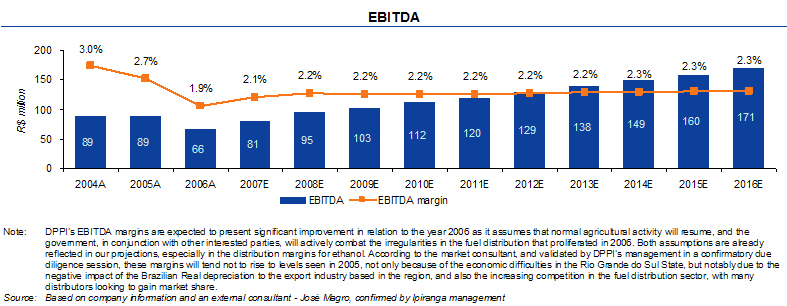

Projected EBITDA margin is expected to improve in relation to 2006

| Economic value of assets | Section 3 |

| | |

Assumptions – DPPI distribution

Selected balance sheet drivers

CAPEX based on the number of new stores needed to increase market share as well as for renovating existing stations

Based on propery, plant and equipment depreciation schedule

Net operating working capital assumptions are in line with 2006

Change in net operating working capital | |

Net operating working capital (R$ million) | | | 2005A | | | 2006A | | | 2007E | | | 2008E | | | 2009E | | | 2010E | | | 2011E | | | 2012E | | | 2013E | | | 2014E | | | 2015E | | | 2016E | |

| Net operating working capital | | | | 145 | | | | 255 | | | | 280 | | | | 310 | | | | 340 | | | | 368 | | | | 392 | | | | 417 | | | | 445 | | | | 475 | | | | 506 | | | | 539 | |

| (+) current assets | | | | 232 | | | | 310 | | | | 338 | | | | 375 | | | | 412 | | | | 446 | | | | 474 | | | | 505 | | | | 539 | | | | 575 | | | | 613 | | | | 653 | |

| (-) current liabilities | | | | 87 | | | | 55 | | | | 59 | | | | 65 | | | | 71 | | | | 77 | | | | 82 | | | | 88 | | | | 93 | | | | 100 | | | | 107 | | | | 114 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Change in net operating working capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Increase) / Decrease in net operating working capital | | | | | | | | | | | | (25 | ) | | | (30 | ) | | | (31 | ) | | | (28 | ) | | | (23 | ) | | | (26 | ) | | | (28 | ) | | | (29 | ) | | | (31 | ) | | | (33 | ) |

Source: | Based on company information and an external consultant - José Magro, confirmed by Ipiranga management | |

| Economic value of assets | Section 3 |

| | |

| Economic value of assets | Section 3 |

| | |

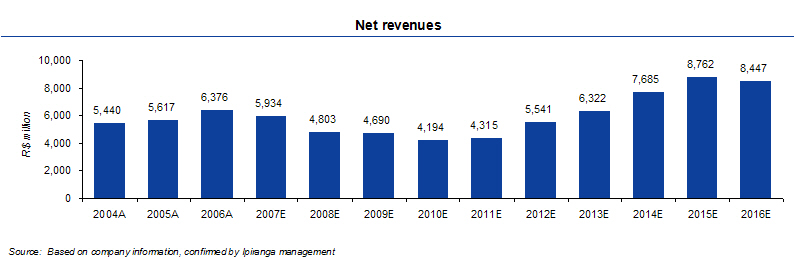

Copesul – DCF valuation

Copesul is a naphtha-based cracker jointly controlled by Ipiranga (29.5%) and Braskem (29.5%)

2006 production consisted of 39% ethylene, 20% propylene, 10% benzene, and 31% other by-products

| | | 2007E | | | 2008E | | | 2009E | | | 2010E | | | 2011E | | | 2012E | | | 2013E | | | 2014E | | | 2015E | | | 2016E | | | Perp. | |

1. EBIT | | | 402 | | | | 294 | | | | 273 | | | | 228 | | | | 231 | | | | 315 | | | | 365 | | | | 454 | | | | 521 | | | | 488 | | | | 374 | |

| annual growth | | | (3.6 | %) | | | (26.9 | %) | | | (6.9 | %) | | | (16.5 | %) | | | 1.1 | % | | | 36.6 | % | | | 15.6 | % | | | 24.6 | % | | | 14.6 | % | | | (6.4 | %) | | | 2.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(-) tax | | | (132 | ) | | | (96 | ) | | | (90 | ) | | | (75 | ) | | | (76 | ) | | | (103 | ) | | | (119 | ) | | | (149 | ) | | | (171 | ) | | | (160 | ) | | | (122 | ) |

| effective tax rate | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) | | | (32.8 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

3. EBIT (-) tax | | | 270 | | | | 198 | | | | 184 | | | | 154 | | | | 155 | | | | 212 | | | | 245 | | | | 306 | | | | 350 | | | | 328 | | | | 251 | |

| (+) Depreciation & Amortization | | | 109 | | | | 107 | | | | 105 | | | | 105 | | | | 45 | | | | 8 | | | | 9 | | | | 11 | | | | 12 | | | | 13 | | | | 31 | |

| (-) Capex | | | (26 | ) | | | (26 | ) | | | (27 | ) | | | (27 | ) | | | (28 | ) | | | (28 | ) | | | (29 | ) | | | (29 | ) | | | (30 | ) | | | (30 | ) | | | (31 | ) |

| (-) Changes in net operating working capital | | | 24 | | | | 41 | | | | 4 | | | | 17 | | | | (5 | ) | | | (42 | ) | | | (26 | ) | | | (45 | ) | | | (35 | ) | | | 10 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

4. Free cash flow to the Firm | | | 378 | | | | 319 | | | | 266 | | | | 248 | | | | 169 | | | | 150 | | | | 199 | | | | 242 | | | | 297 | | | | 321 | | | | 251 | |

| annual growth | | | n.a. | | | | (15.5 | %) | | | (16.6 | %) | | | (6.6 | %) | | | (32.2 | %) | | | (11.2 | %) | | | 33.1 | % | | | 21.3 | % | | | 23.0 | % | | | 7.9 | % | | | n.m. | |

Note: | Annual free cash flow in US$ millions |

Source: | Based on company information, confirmed by Ipiranga management |

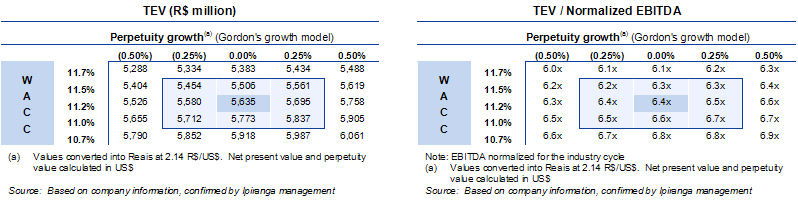

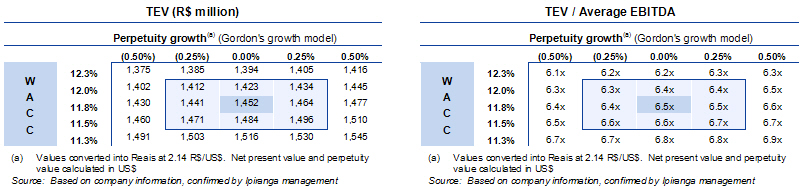

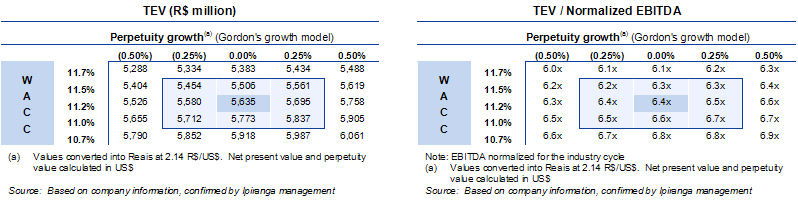

TEV (R$ million)

- ----------------

(a) Values converted into Reais at 2.14 R$/US$. Net present

value and perpetuity value calculated in US$

Source: Based on company information, confirmed by Ipiranga

management

TEV/Normalized EBITDA

- ---------------------

Note: EBITDA normalized for the industry cycle

(a) Values converted into Reais at 2.14 R$/US$. Net present

value and perpetuity value calculated in US$

Source: Based on company information, confirmed by Ipiranga

management

|

| Economic value of assets | Section 3 |

| | |

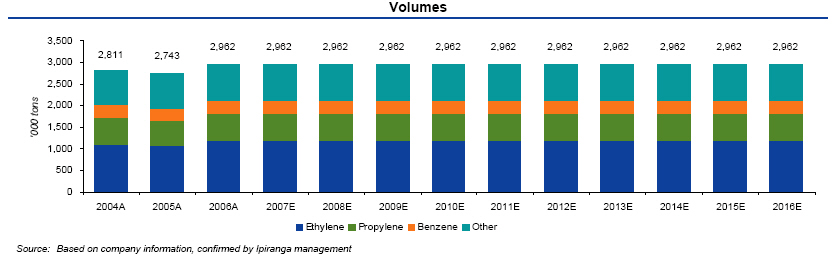

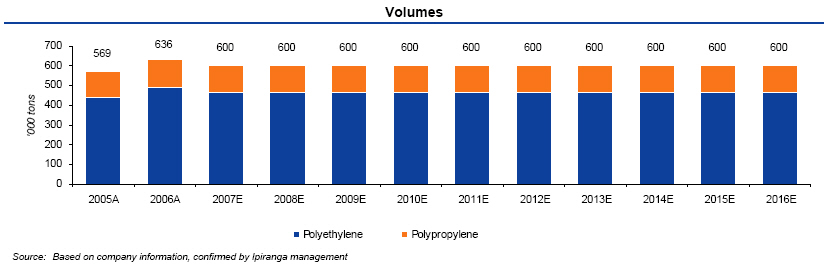

Assumptions – Copesul

Selected income statement drivers

Volumes remain constant at 2006 levels

Gross margin was driven by ethylene, propylene, and benzene cash spreads based on CMAI data adjusted for Brazil

| Economic value of assets | Section 3 |

| | |

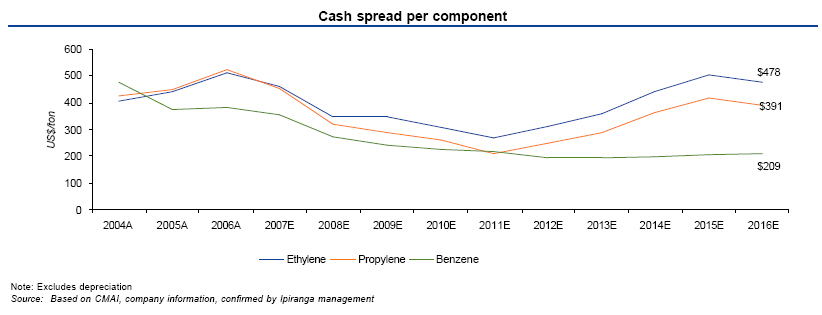

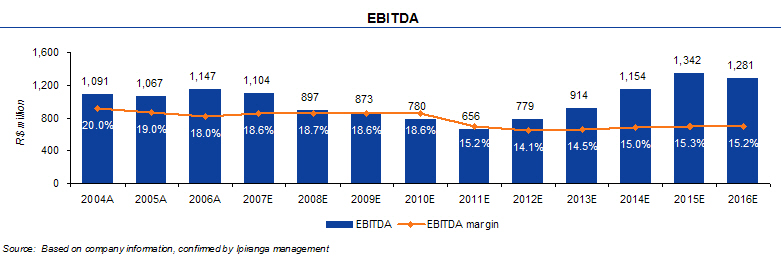

Assumptions – Copesul (continued)

Selected income statement drivers

Revenues projected as a constant spread to gross margin

EBITDA margins reflect the ethylene business cycle, based on CMAI data

| Economic value of assets | Section 3 |

| | |

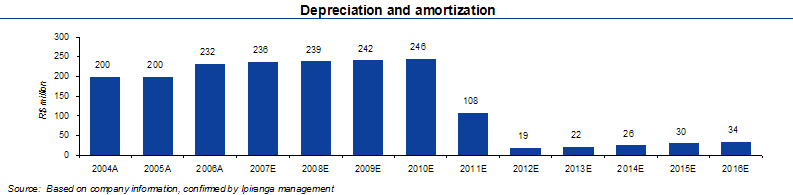

Assumptions – Copesul (continued)

Selected balance sheet drivers

Maintenance CAPEX projected based on company, information confirmed by management

Based on property, plant and equipment depreciation schedule

Net operating working capital assumptions are in line with 2006

Change in net operating working capital | |

| Net operating working capital (R$ million) | | | 2005A | | | 2006A | | | 2007E | | | 2008E | | | 2009E | | | 2010E | | | 2011E | | | 2012E | | | 2013E | | | 2014E | | | 2015E | | | 2016E | |

| Net operating working capital | | | | 459 | | | | 557 | | | | 506 | | | | 414 | | | | 406 | | | | 366 | | | | 377 | | | | 478 | | | | 543 | | | | 655 | | | | 744 | | | | 719 | |

(+) current assets | | | | 795 | | | | 1,061 | | | | 982 | | | | 795 | | | | 776 | | | | 694 | | | | 714 | | | | 917 | | | | 1,046 | | | | 1,272 | | | | 1,450 | | | | 1,398 | |

| (-) current liabilities | | | | 336 | | | | 504 | | | | 476 | | | | 380 | | | | 370 | | | | 328 | | | | 337 | | | | 439 | | | | 503 | | | | 617 | | | | 706 | | | | 678 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Change in net operating working capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |